The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, nor does it seek an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated May 21, 2018

Prospectus

14,000,000 shares

EVO Payments, Inc.

Class A common stock

This is the initial public offering of EVO Payments, Inc. We are offering 13,333,333 shares of our Class A common stock and the selling stockholder identified in this prospectus is offering 666,667 shares of our Class A common stock. We will not receive any of the proceeds from the sale of shares by the selling stockholder in this offering. We expect that the initial public offering price will be between $14.00 and $16.00 per share.

Prior to this offering, there has been no public market for our Class A common stock.

We have applied to list our Class A common stock on The Nasdaq Global Select Market, or Nasdaq, under the symbol “EVOP.”

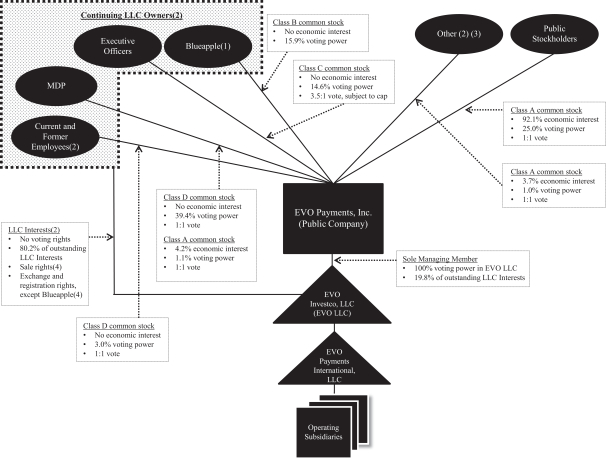

We will have four classes of common stock outstanding after this offering: Class A common stock offered hereby, Class B common stock, Class C common stock and Class D common stock. The holders of our Class A common stock and our Class D common stock will be entitled to one vote per share, and, subject to aggregate voting power limitations and certain sunset provisions described herein, the holders of our Class C common stock will be entitled to 3.5 votes per share in all matters presented to our stockholders generally, including the election of our board of directors. Subject to certain sunset provisions described herein, our Class B common stock will be entitled to 15.9% of the combined voting power in all matters presented to our stockholder generally, including the election of our board of directors. All of our Class B common stock will be held by Blueapple, Inc., all of our Class C common stock will be held by our executive officers, and all of our Class D common stock will be held by entities controlled by Madison Dearborn Partners, LLC and by certain of our current and former employees. We refer to the holders of our Class B common stock, Class C common stock and Class D common stock as of the date of this prospectus as the Continuing LLC Owners. We will also issue 1,200,558 shares of our Class A common stock, based on an assumed initial public offering price of $15.00 per share, which is themid-point of the price range set forth on the cover page of this prospectus, to members of our management, certain of our current and former employees, affiliates of Madison Dearborn Partners, LLC and the sellers of a business we acquired. Immediately following this offering, the holders of our Class A common stock, including the investors in this offering, will collectively hold 100% of the economic interests in us. The investors in this offering, through their ownership of Class A common stock will hold 25.0% of the combined voting power in us, and the Continuing LLC Owners, through their ownership of our Class A common stock, Class B common stock, Class C common stock and Class D common stock, as applicable, will hold 74.0% of the combined voting power in us. Our Class B common stock, Class C common stock and Class D common stock will not have any economic rights. Current and former employees and the sellers of a business we acquired, through their ownership of Class A common stock, will hold 1.0% of the combined voting power in us.

We will be a holding company, and, upon consummation of this offering and the application of proceeds therefrom, our principal asset will be common units of EVO Investco, LLC, which we refer to as EVO LLC, representing a 19.8% economic interest in EVO LLC (or 22.0% if the underwriters exercise their option to purchase additional shares of Class A common stock in full). The remaining 80.2% economic interest (or 78.0% if the underwriters exercise their option to purchase additional shares of Class A common stock in full) in EVO LLC will be owned by the Continuing LLC Owners through ownership of common units of EVO LLC. Although we will have a minority economic interest in EVO LLC, because we will be the sole managing member of EVO LLC, we will operate and control all of the business and affairs of EVO LLC and, through EVO LLC and its subsidiaries, conduct our business. See “Organizational structure.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus summary—Implications of being an emerging growth company.”

Investing in our Class A common stock involves risks. See “Risk factors” beginning on page 26.

| | | | | | | | |

| | | Per share | | | Total | |

| | |

Initial public offering price | | $ | | | | $ | | |

| | |

Underwriting discounts and commissions(1) | | $ | | | | $ | | |

| | |

Proceeds to EVO Payments, Inc., before expenses | | $ | | | | $ | | |

| (1) | | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting.” |

We have granted the underwriters an option to purchase up to 2,100,000 additional shares of Class A common stock from us. The underwriters can exercise this right at any time within 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on or about , 2018.

| | | | | | | | |

| J.P. Morgan | | BofA Merrill Lynch | | Citigroup | | Deutsche Bank Securities | | SunTrust Robinson Humphrey |

| | | | | | | | | | |

| Barclays | | Cowen and Company | | Goldman Sachs & Co. LLC | | PKO BP Securities | | Regions Securities LLC | | William Blair |

, 2018