Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA February 2022 Prepared for: Alpha Metallurgical Resources, Inc. 340 Martin Luther King Jr. Blvd. Bristol, TN 37620 Prepared by: MARSHALL MILLER & ASSOCIATES, INC. 582 Industrial Park Road Bluefield, Virginia 24605 www.mma1.com Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 1 Statement of Use and Preparation This Technical Report Summary (TRS) was prepared for the sole use of Alpha Metallurgical Resources, Inc. (Alpha) and its affiliated and subsidiary companies and advisors. Copies or references to information in this report may not be used without the written permission of Alpha. The report provides a statement of coal resources and coal reserves for Alpha, as defined under the United States Securities and Exchange Commission (SEC). The statement is based on information provided by Alpha and reviewed by various professionals within Marshall Miller & Associates, Inc. (MM&A). MM&A professionals who contributed to the drafting of this report meet the definition of Qualified Persons (QPs), consistent with the requirements of the SEC. The information in this TRS related to coal resources and reserves is based on, and fairly represents, information compiled by the QPs. At the time of reporting, MM&A’s QPs have sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity they are undertaking to qualify as a QP as defined by the SEC. Each QP consents to the inclusion in this report of the matters based on their information in the form and context in which it appears. Certain information set forth in this report contains “forward-looking information”, including production, productivity, operating costs, capital costs, sales prices, and other assumptions. These statements are not guarantees of future performance and undue reliance should not be placed on them. The assumptions used to develop the forward-looking and the risks that could cause the actual results to differ materially are detailed in the body of this report. Marshall Miller & Associates, Inc. (MM&A) hereby consents (i) to the use of the information contained in this report dated December 31, 2021, relating to estimates of coal resources and coal reserves controlled by Alpha, (ii) to the use of MM&A’s name, any quotations from or summarizations of this TRS in Alpha’s SEC filings, and (iii) to the filing of this TRS as an exhibit to Alpha’s SEC filings. Qualified Person: /s/ Marshall Miller & Associates, Inc. Date: February 15, 2022

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 1 Table of Contents 1 Executive Summary .................................................................................................................... 1 1.1 Property Description ..................................................................................................... 1 1.2 Ownership ..................................................................................................................... 2 1.3 Ownership ..................................................................................................................... 2 1.4 Geology ......................................................................................................................... 2 1.5 Exploration Status ......................................................................................................... 3 1.6 Operations and Development ....................................................................................... 3 1.7 Mineral Resource .......................................................................................................... 4 1.8 Mineral Reserve ............................................................................................................ 5 1.9 Capital Summary ........................................................................................................... 6 1.10 Operating Costs ............................................................................................................. 7 1.11 Economic Evaluation ..................................................................................................... 9 1.11.1 Discounted Cash Flow Analysis ...................................................................... 11 1.11.2 Sensitivity Analysis ......................................................................................... 11 1.12 Permitting ................................................................................................................... 12 1.13 Conclusion and Recommendations .............................................................................. 12 2 Introduction ............................................................................................................................. 13 2.1 Registrant and Terms of Reference ............................................................................. 13 2.2 Information Sources .................................................................................................... 13 2.3 Personal Inspections ................................................................................................... 14 3 Property Description ................................................................................................................ 14 3.1 Location ...................................................................................................................... 14 3.2 Titles, Claims or Leases ................................................................................................ 14 3.3 Mineral Rights ............................................................................................................. 15 3.4 Encumbrances ............................................................................................................. 15 3.5 Other Risks .................................................................................................................. 15 4 Accessibility, Climate, Local Resources, Infrastructure and Physiography ............................... 15 4.1 Topography, elevation, and Vegetation ....................................................................... 15 4.2 Access and Transport .................................................................................................. 16 4.3 Proximity to Population Centers .................................................................................. 16 4.4 Climate and Length of Operating Season ..................................................................... 16 4.5 Infrastructure .............................................................................................................. 17 Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 2 5 History ...................................................................................................................................... 17 5.1 Previous Operation ..................................................................................................... 17 5.2 Previous Exploration ................................................................................................... 17 6 Geological Setting, Mineralization and Deposit ....................................................................... 18 6.1 Regional, Local and Property Geology ......................................................................... 18 6.2 Mineralization ............................................................................................................. 18 6.3 Deposits ...................................................................................................................... 20 7 Exploration ............................................................................................................................... 21 7.1 Nature and Extent of Exploration ................................................................................ 21 7.2 Drilling Procedures ...................................................................................................... 23 7.3 Hydrology .................................................................................................................... 23 7.4 Geotechnical Data ....................................................................................................... 24 8 Sample Preparation Analyses and Security .............................................................................. 24 8.1 Prior to Sending to the Lab .......................................................................................... 24 8.2 Lab Procedures............................................................................................................ 25 9 Data Verification ...................................................................................................................... 25 9.1 Procedures of Qualified Person ................................................................................... 25 9.2 Limitations .................................................................................................................. 26 9.3 Opinion of Qualified Person ........................................................................................ 26 10 Mineral Processing and Metallurgical Testing .......................................................................... 26 10.1 Testing Procedures ...................................................................................................... 26 10.2 Relationship of Tests to the Whole .............................................................................. 27 10.3 Lab Information ........................................................................................................... 27 10.4 Relevant Results .......................................................................................................... 27 11 Mineral Resource Estimates ..................................................................................................... 28 11.1 Assumptions, Parameters and Methodology ............................................................... 28 11.1.1 Geostatistical Analysis ................................................................................... 30 11.2 Resources Exclusive of Reserves .................................................................................. 33 11.2.1 Initial Economic Assessment .......................................................................... 34 11.3 Qualified Person’s Estimates ....................................................................................... 35 11.4 Qualified Person’s Opinion .......................................................................................... 36 12 Mineral Reserve Estimates ....................................................................................................... 37 12.1 Assumptions, Parameters and Methodology ............................................................... 37 12.2 Mineral Reserves ......................................................................................................... 38 12.2.1 Surface Reserves ............................................................................................ 39

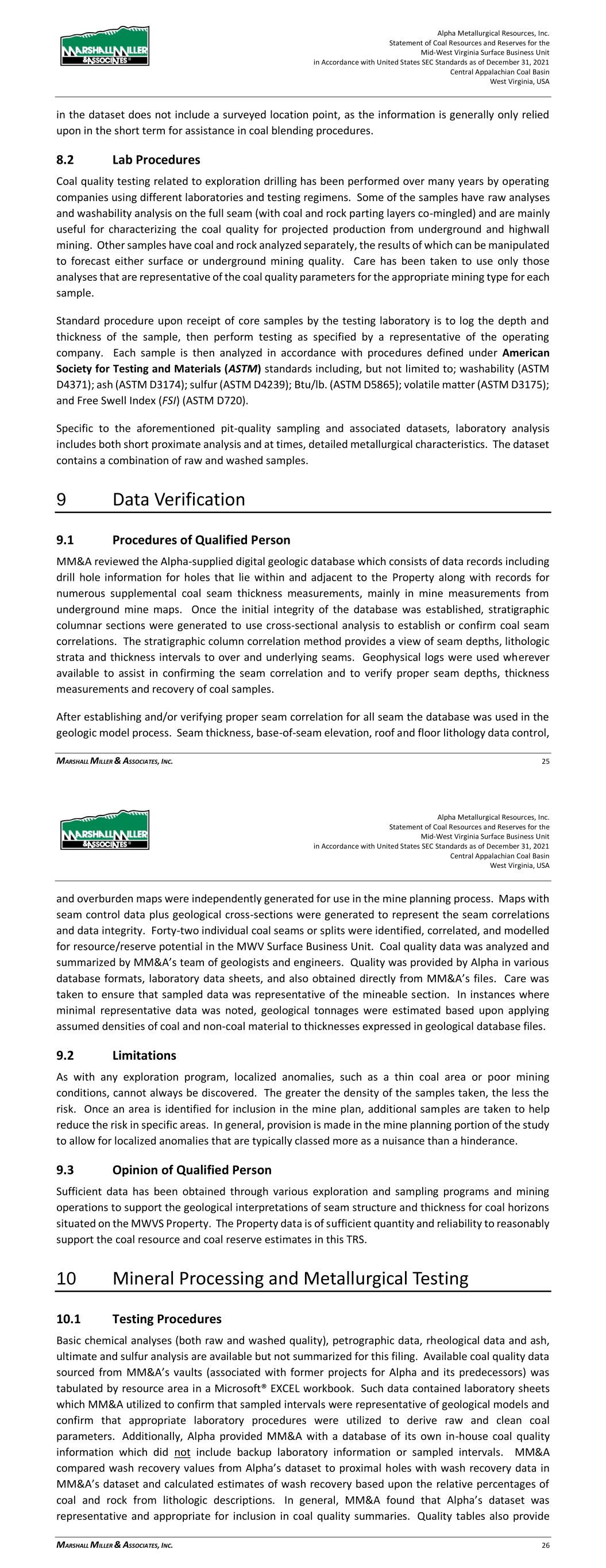

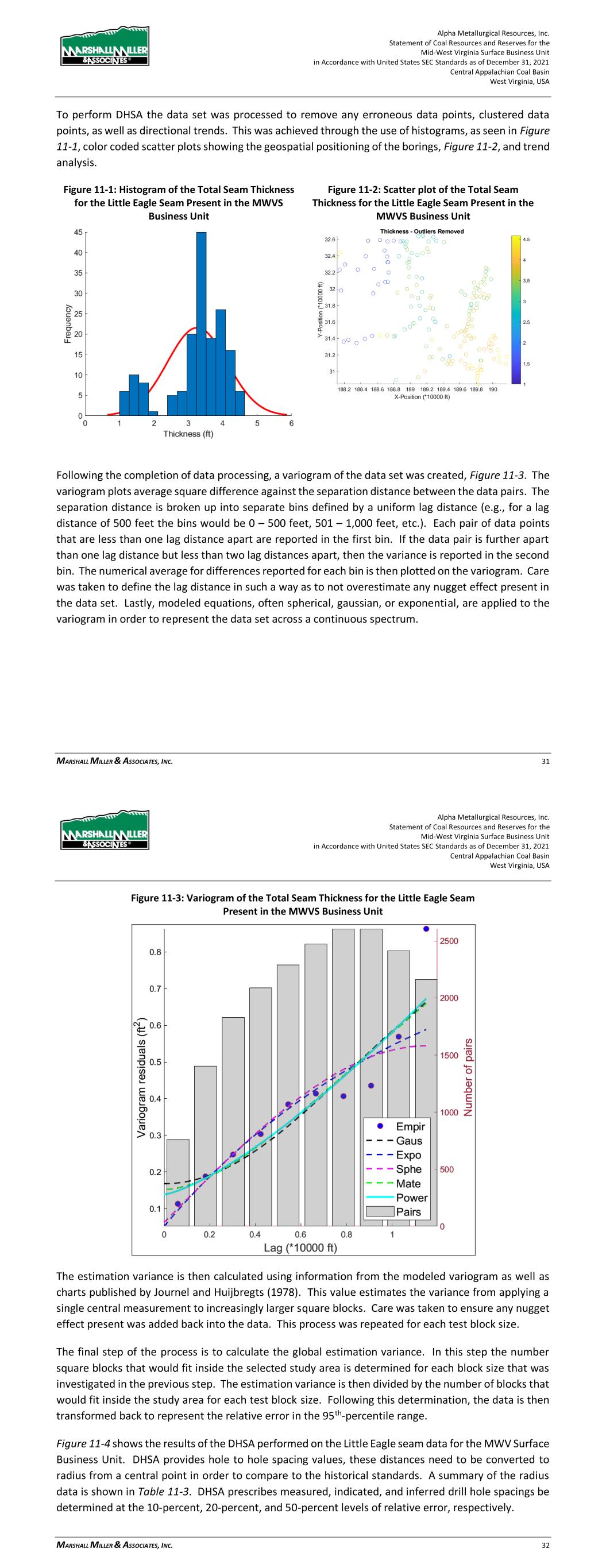

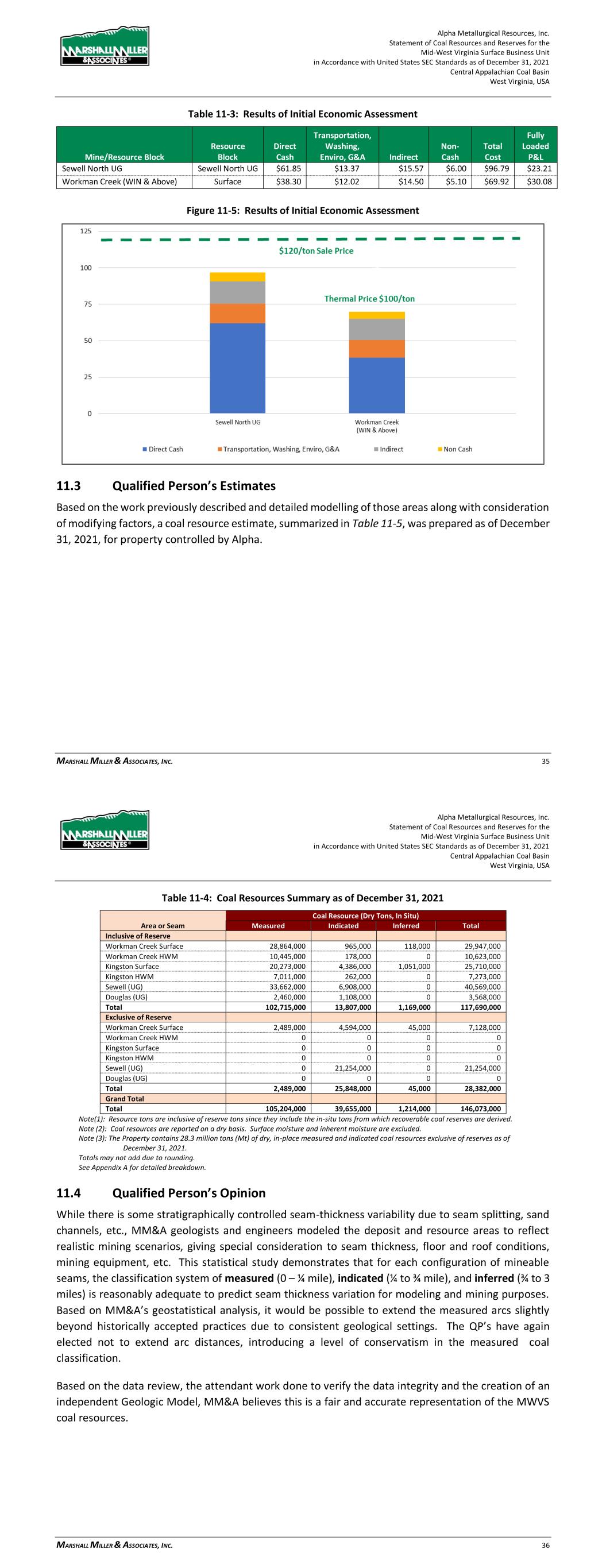

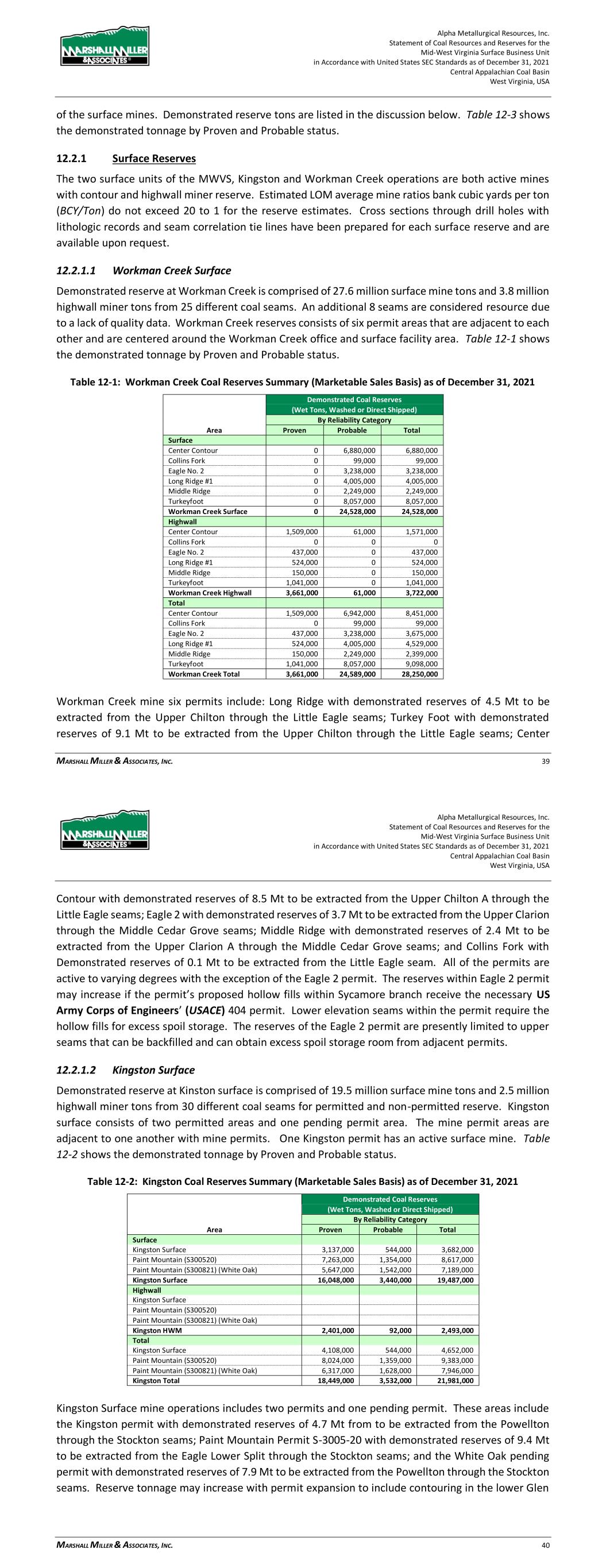

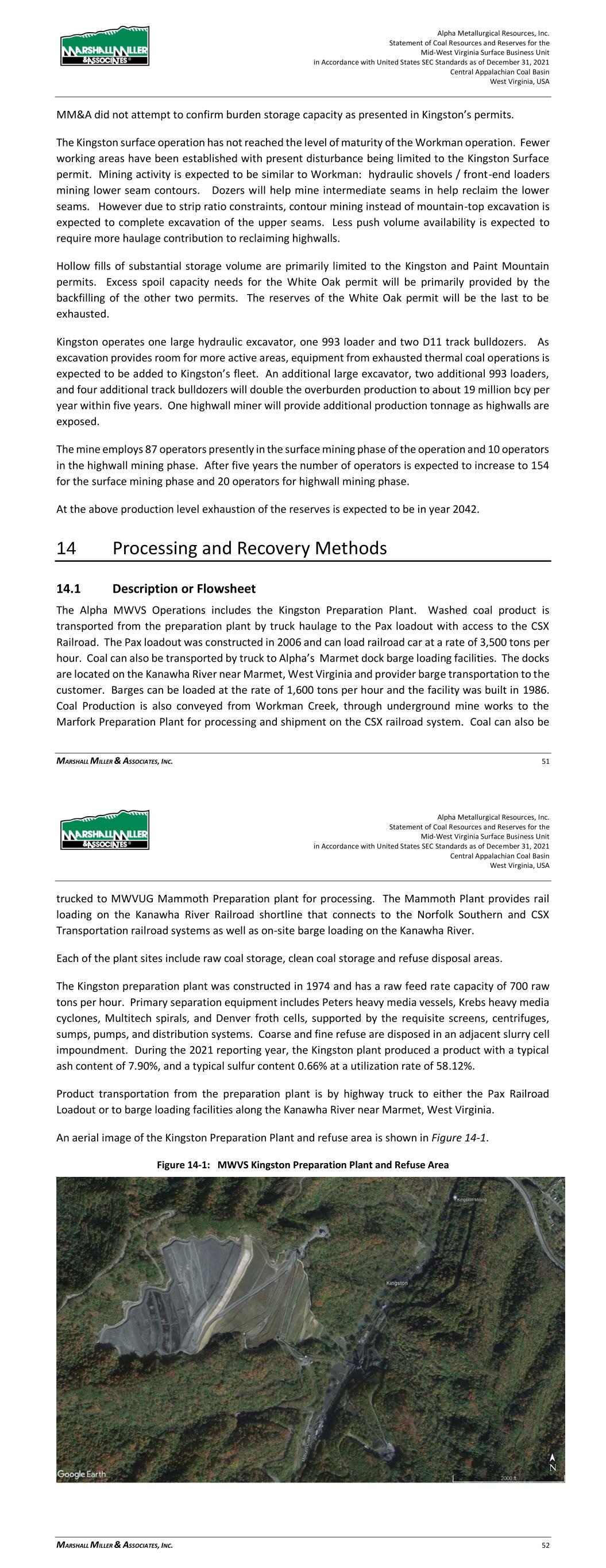

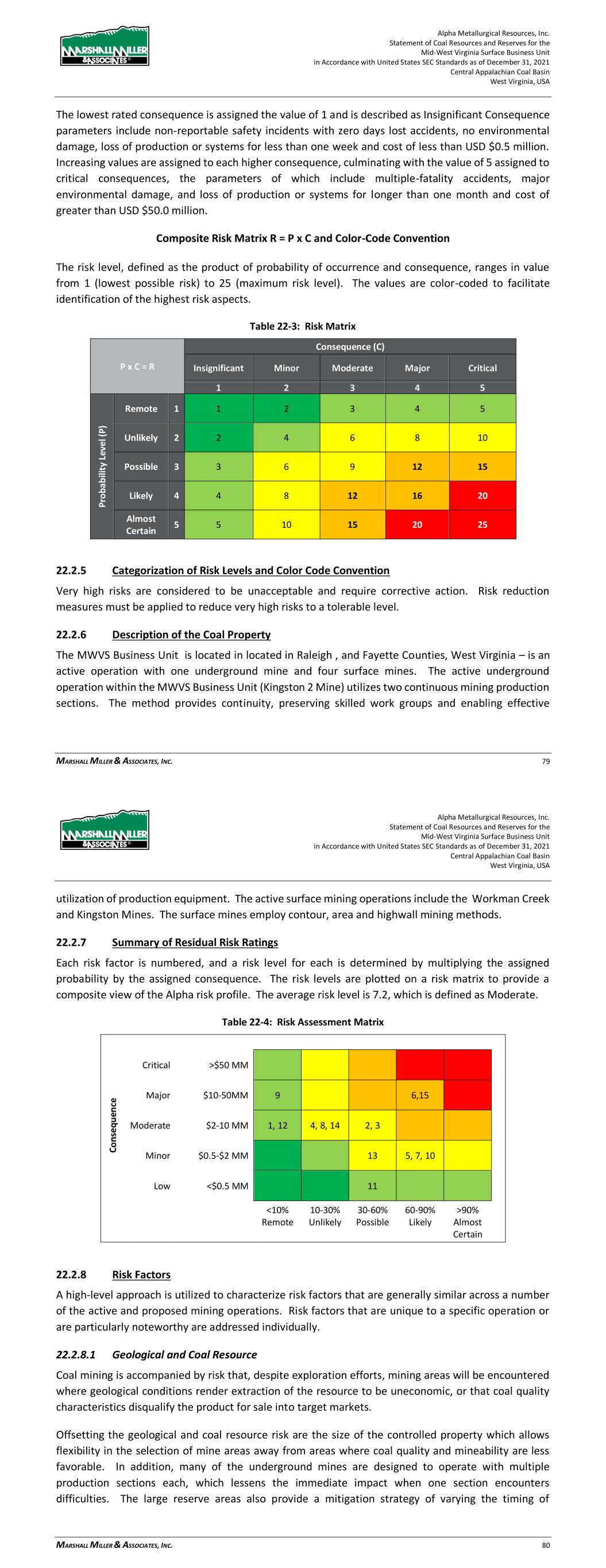

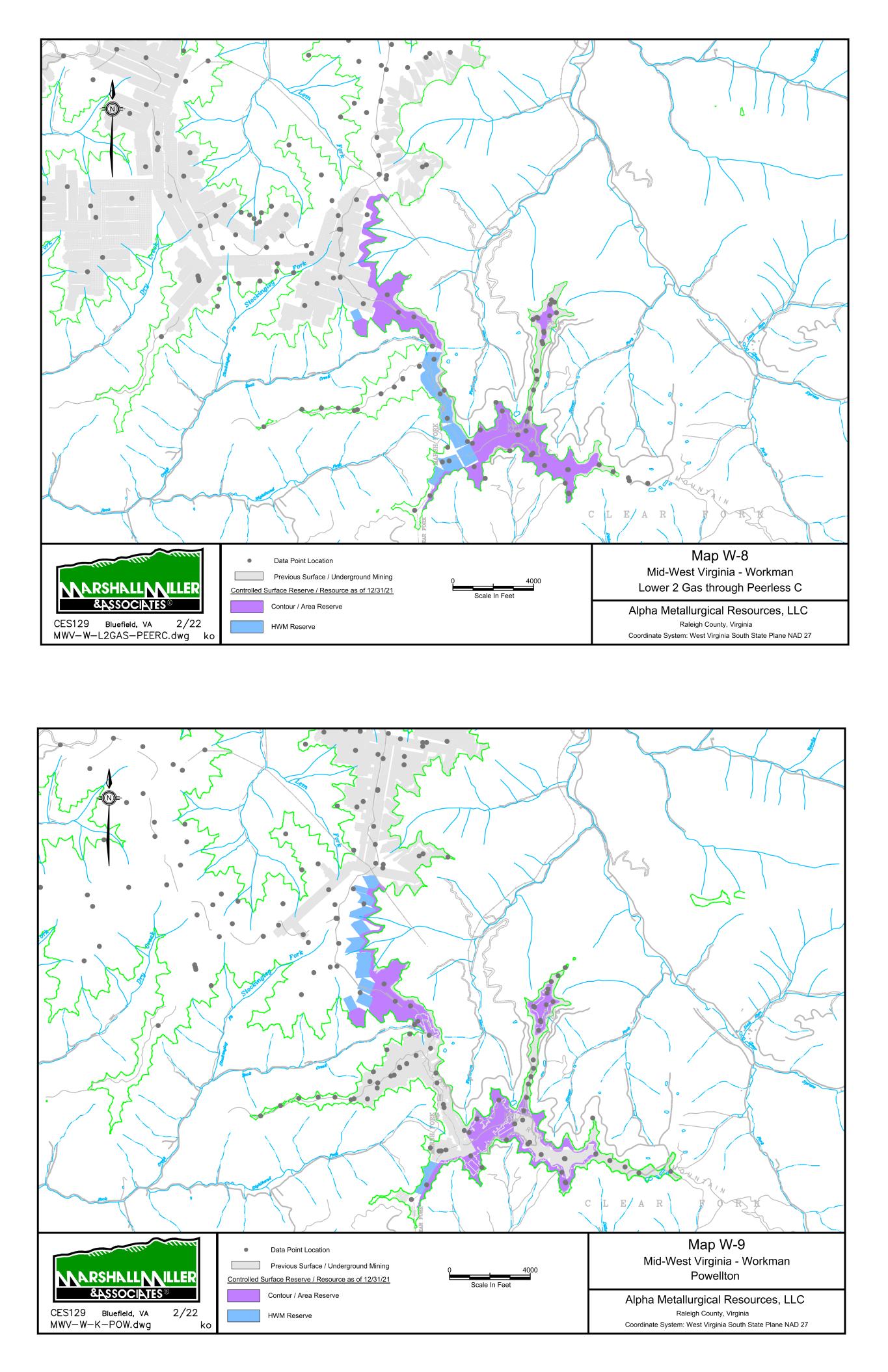

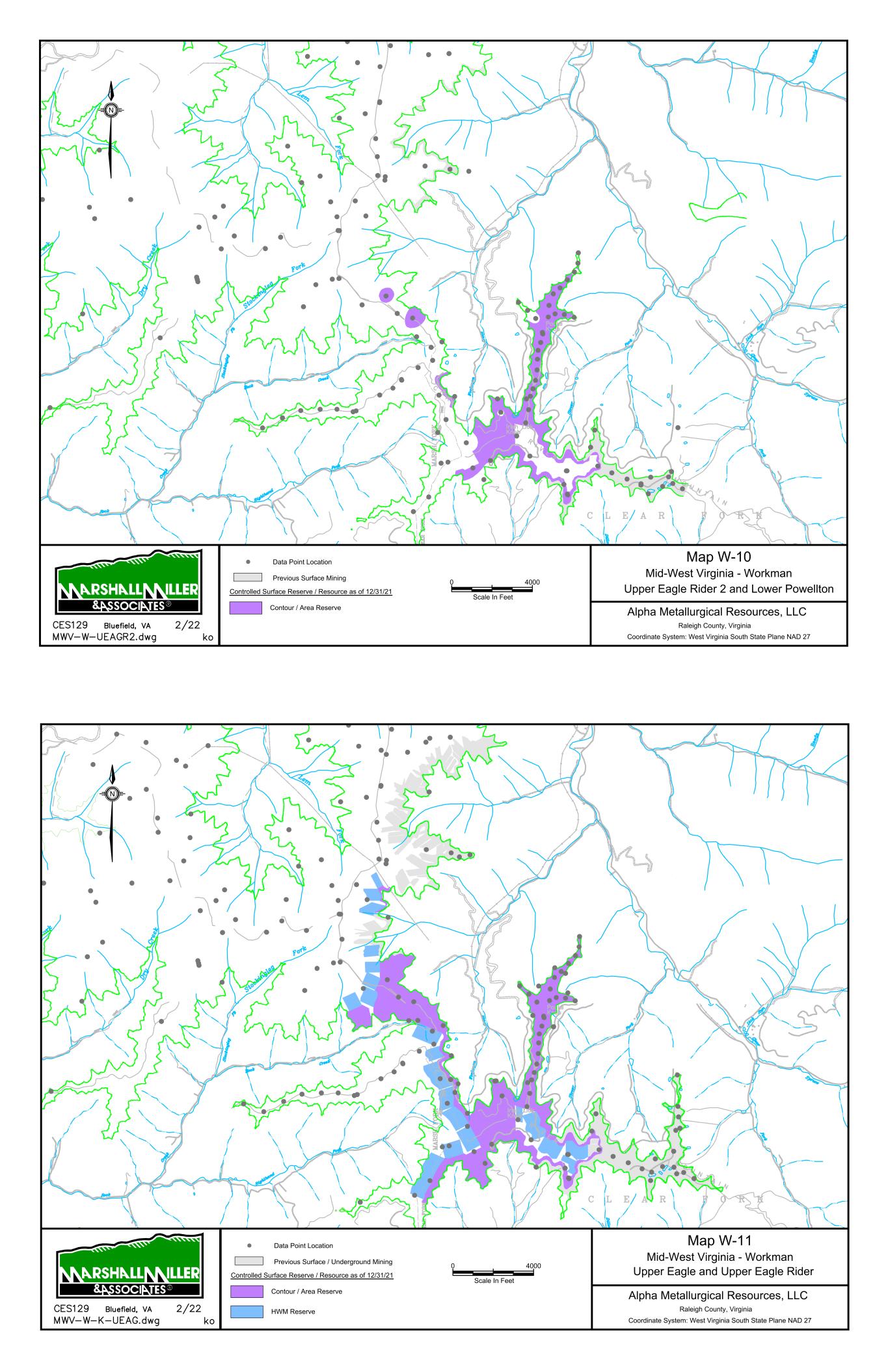

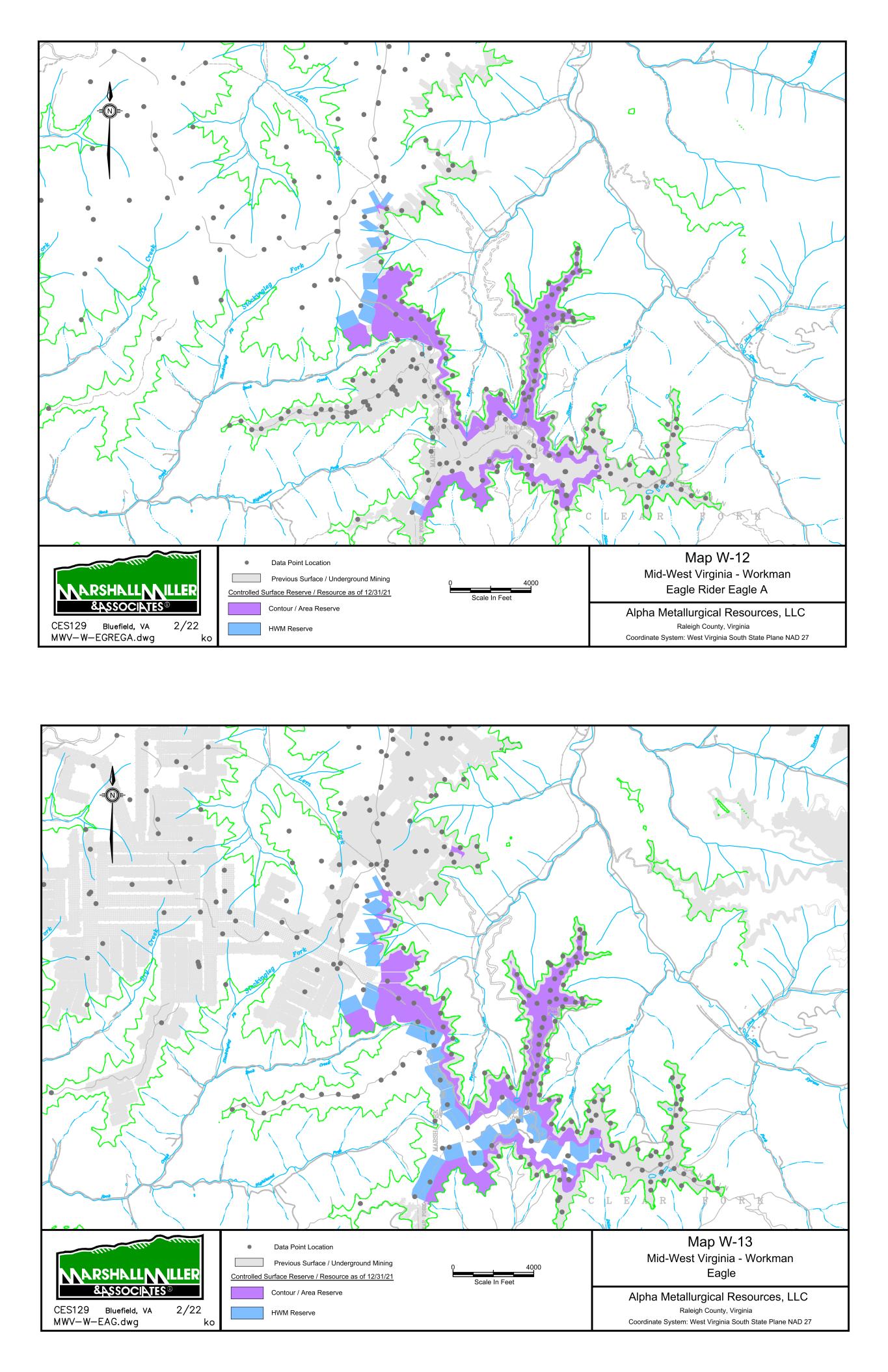

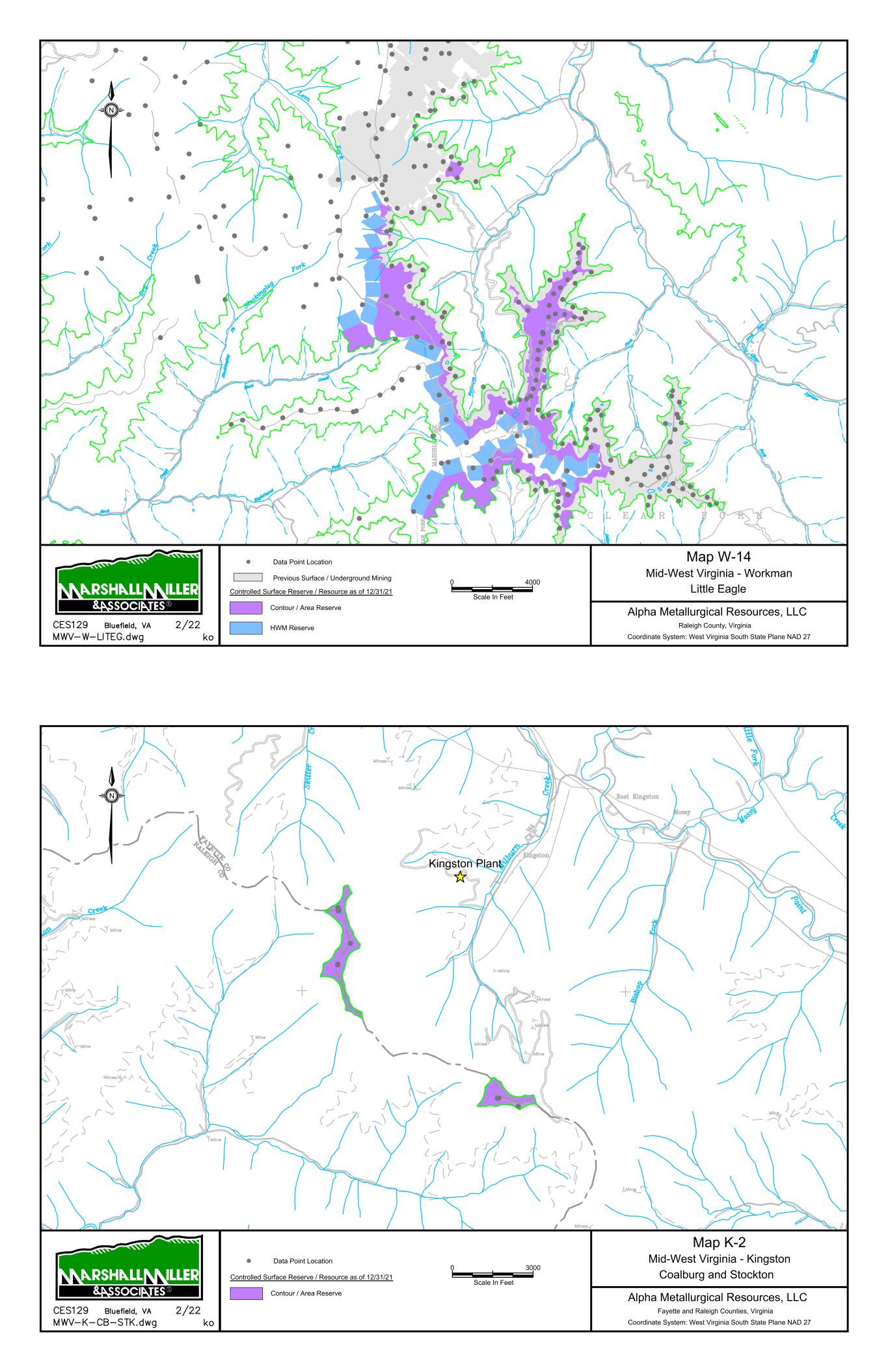

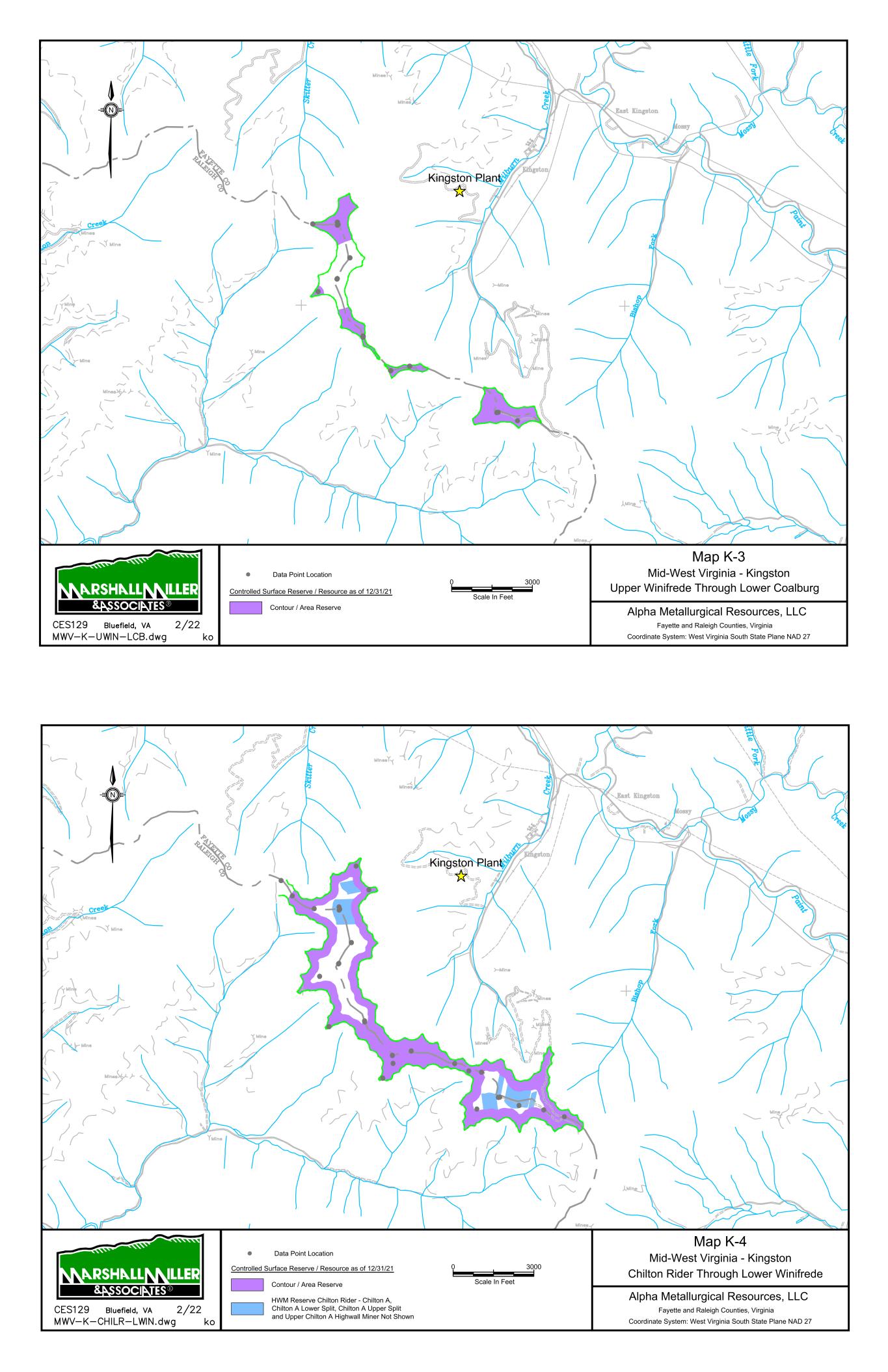

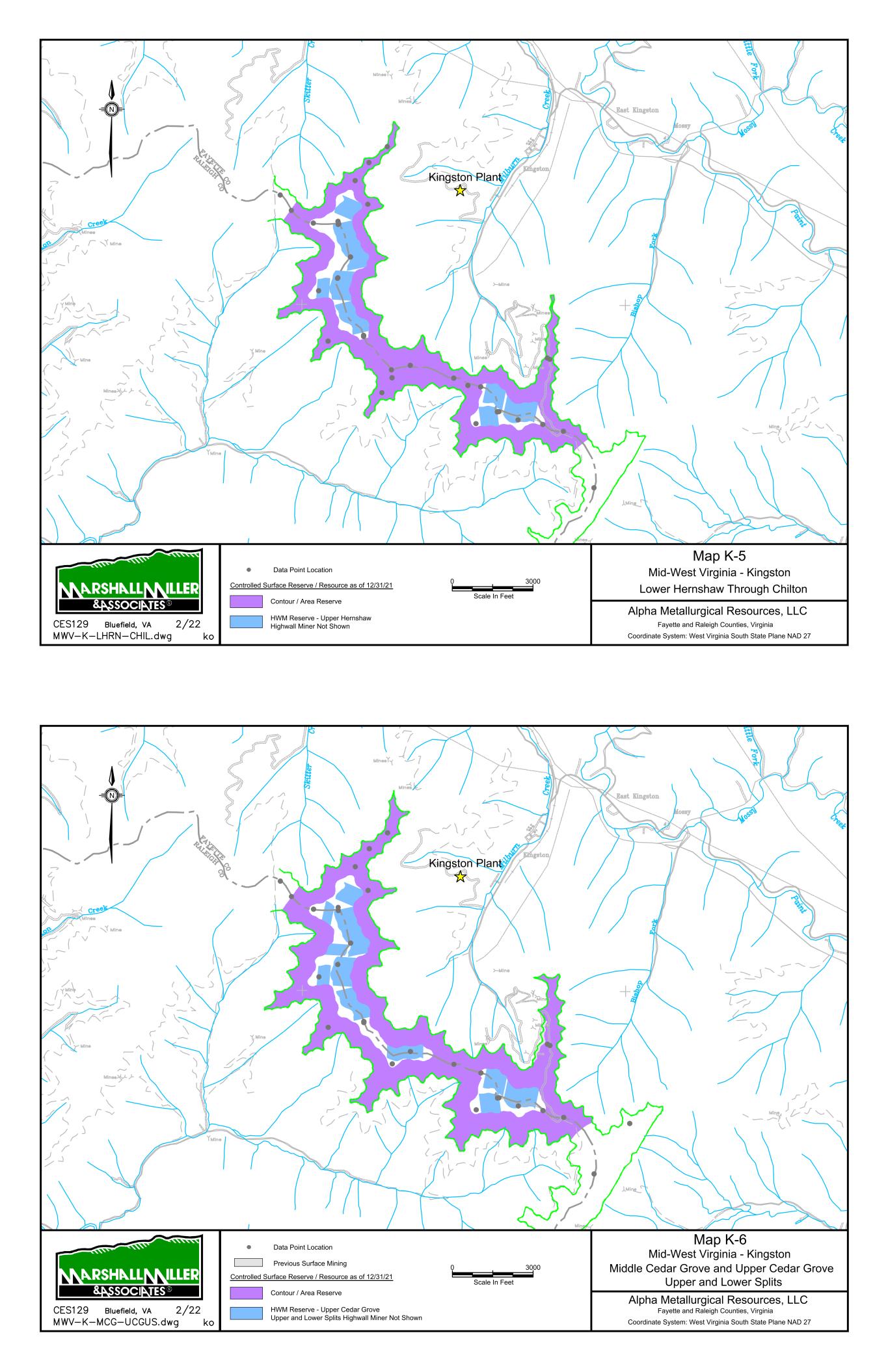

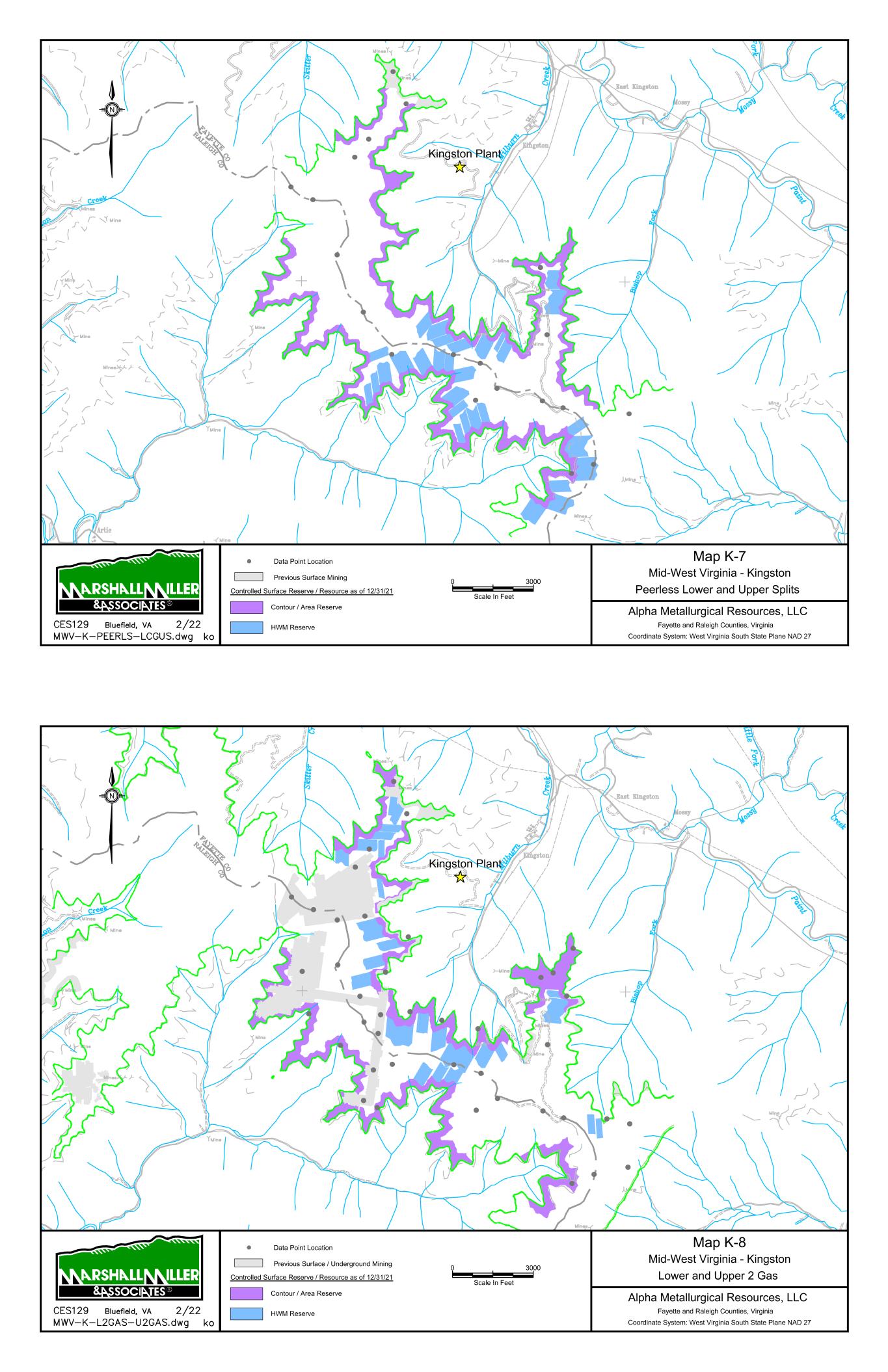

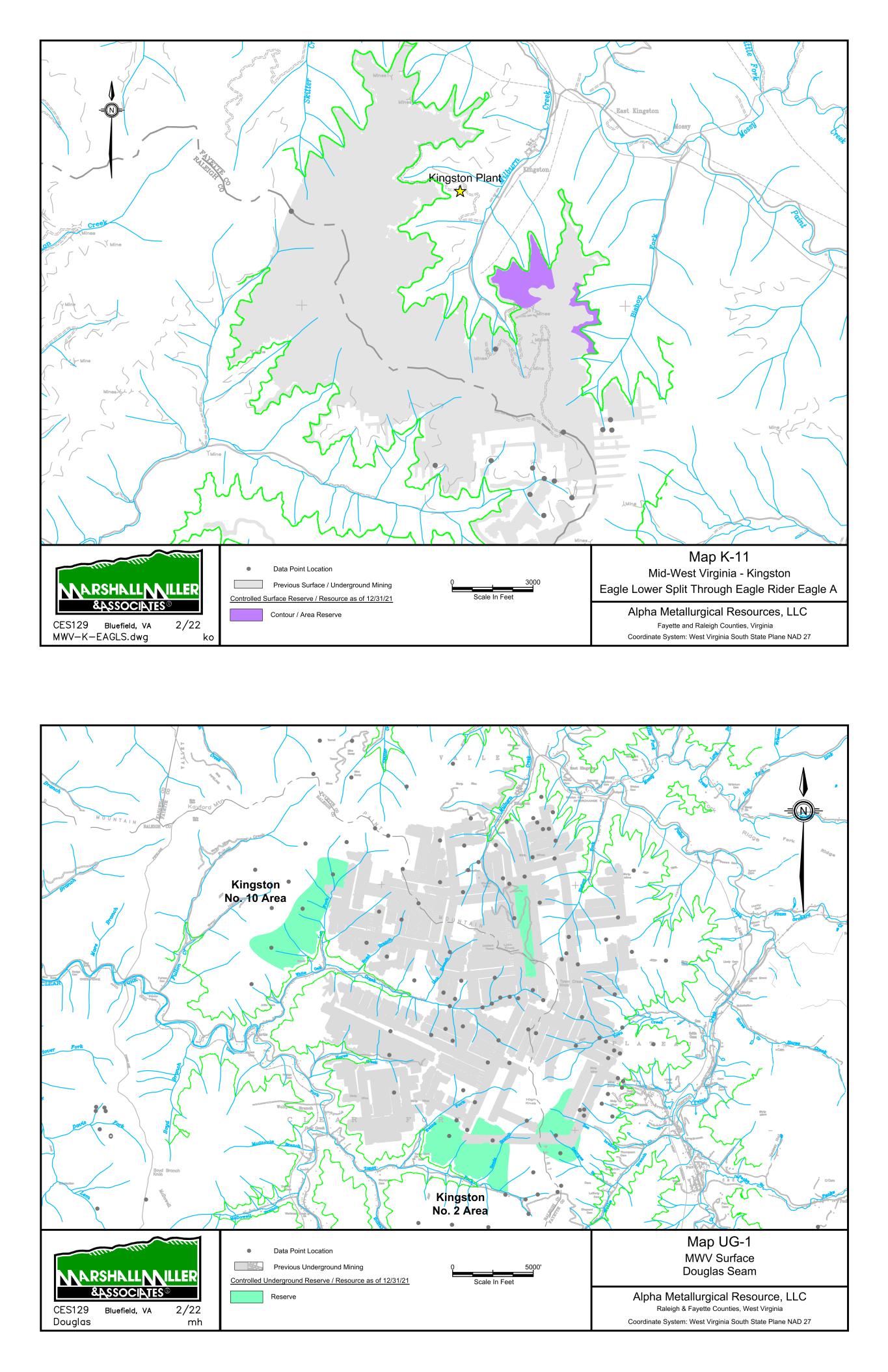

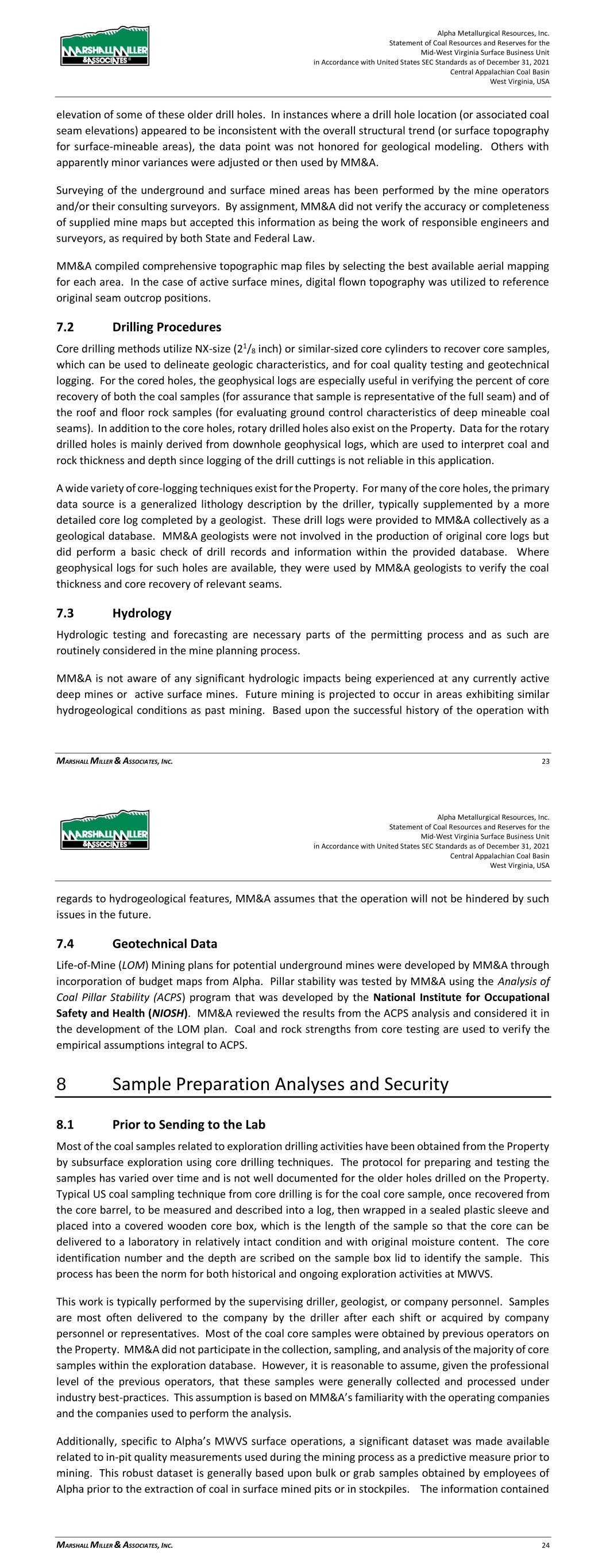

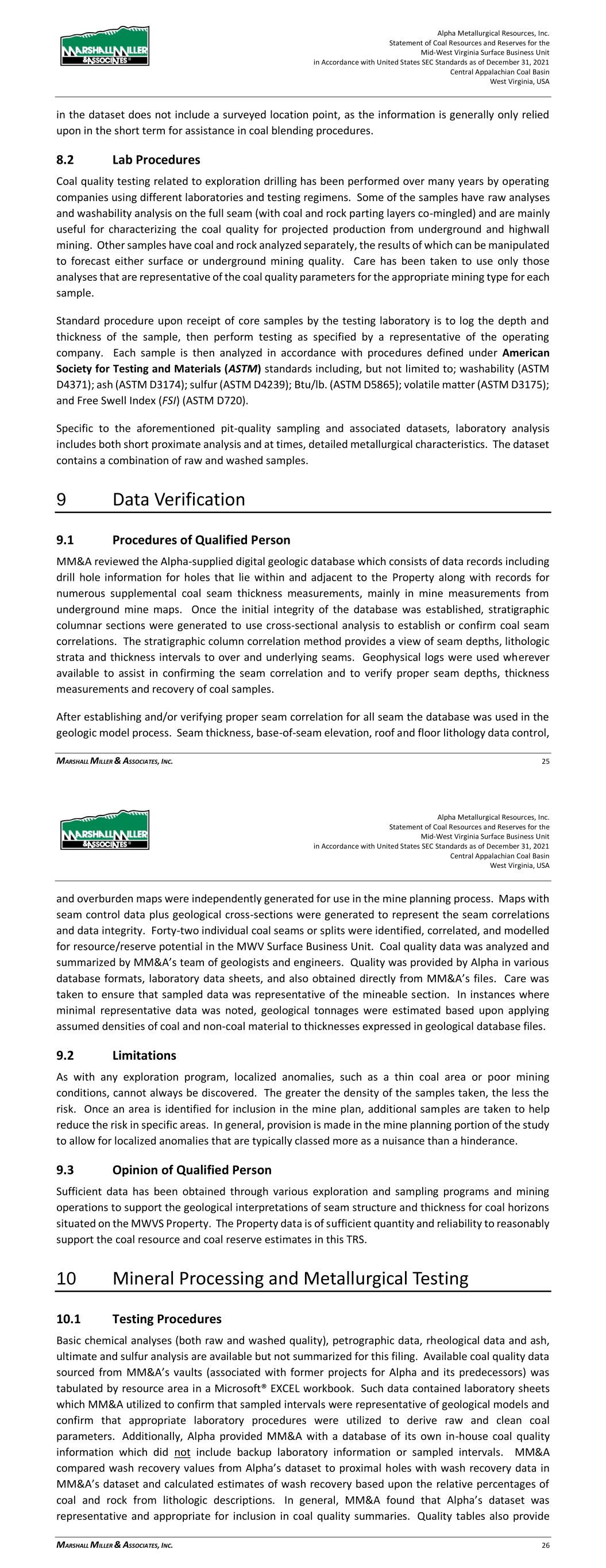

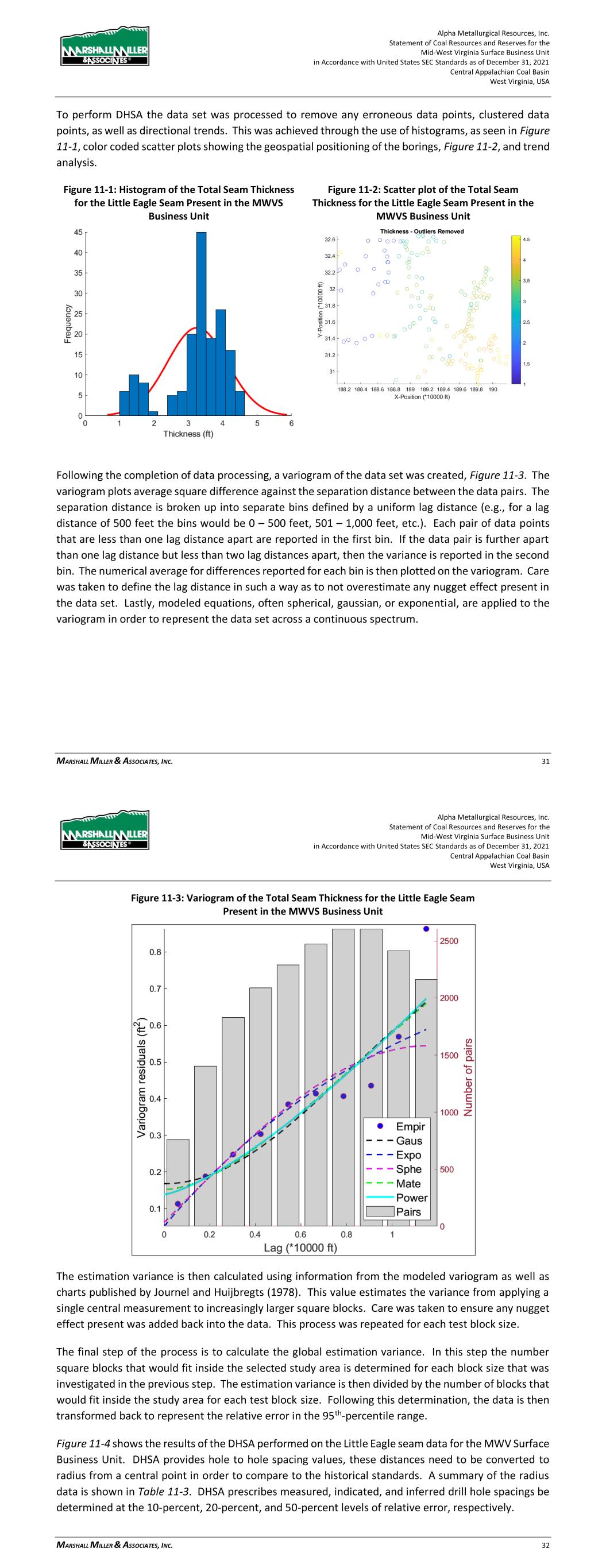

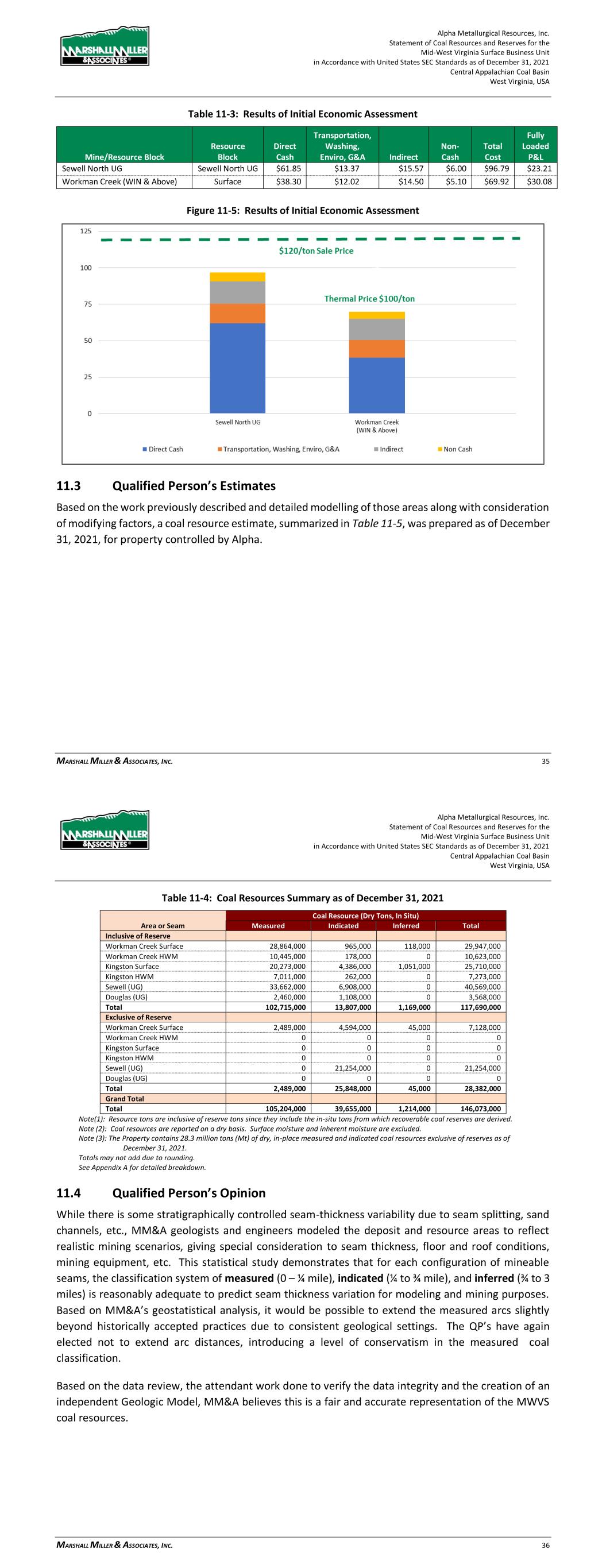

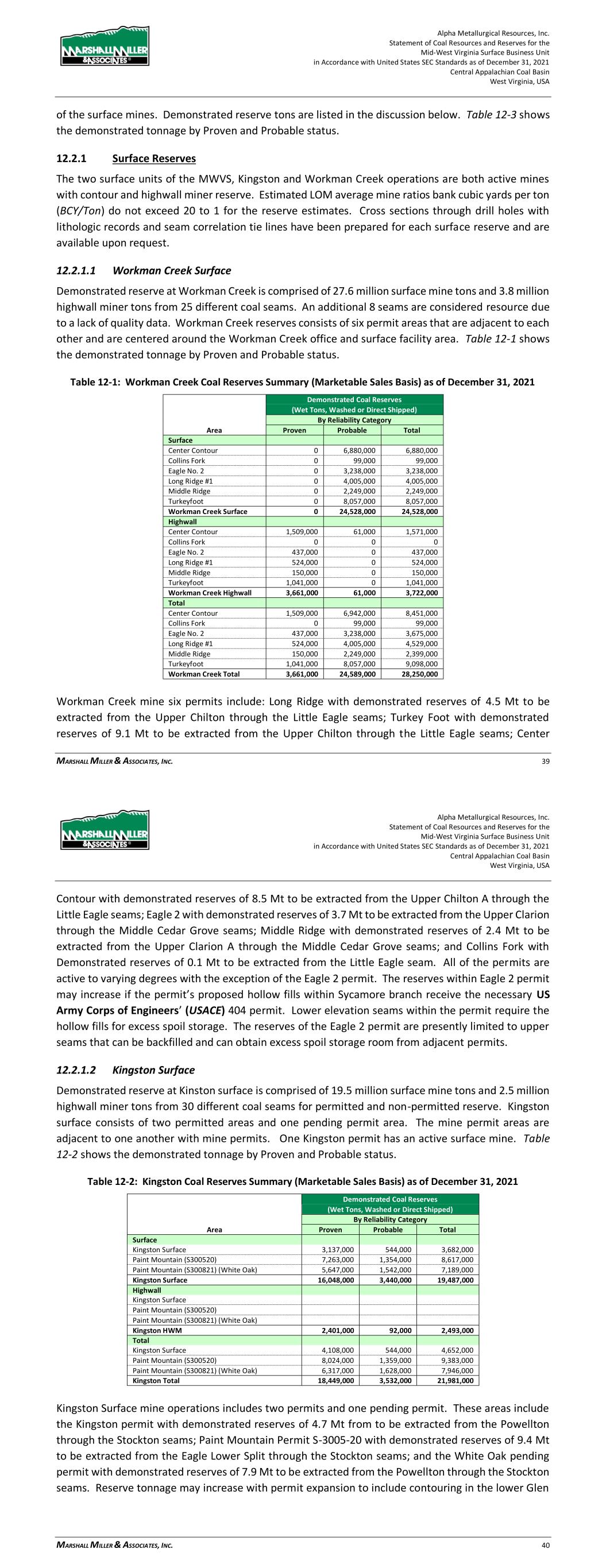

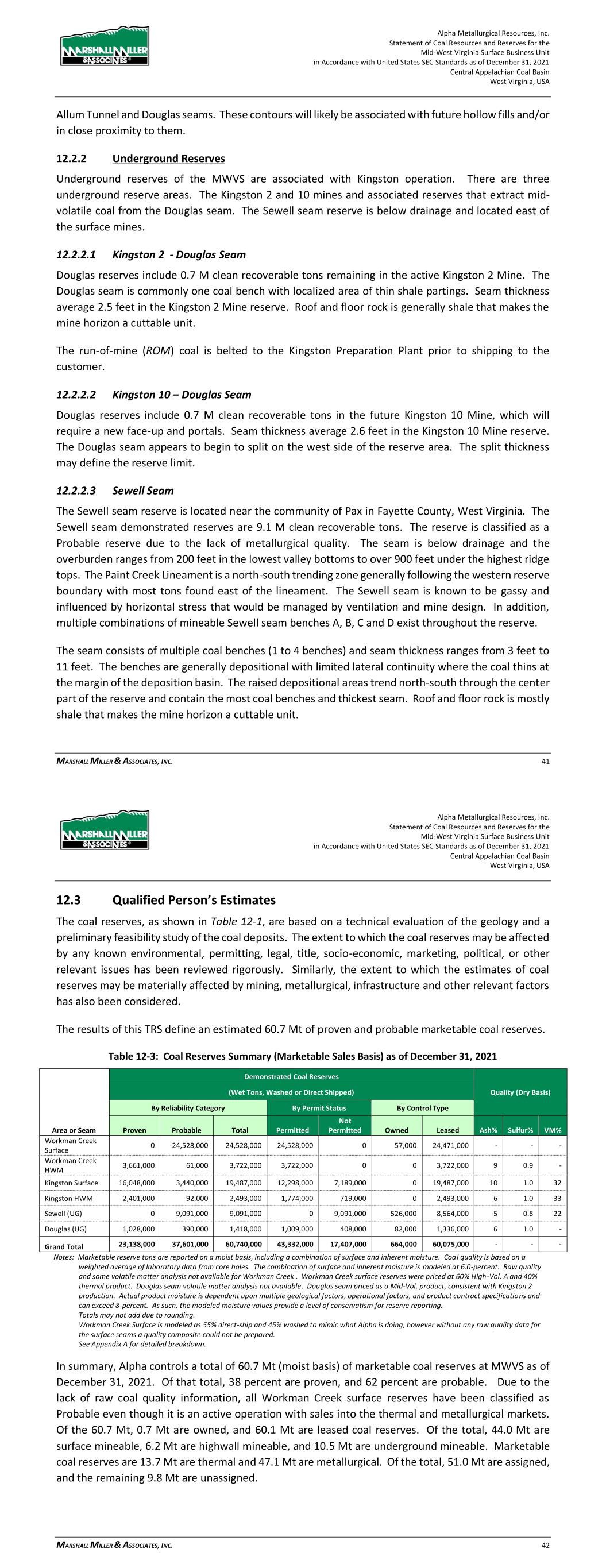

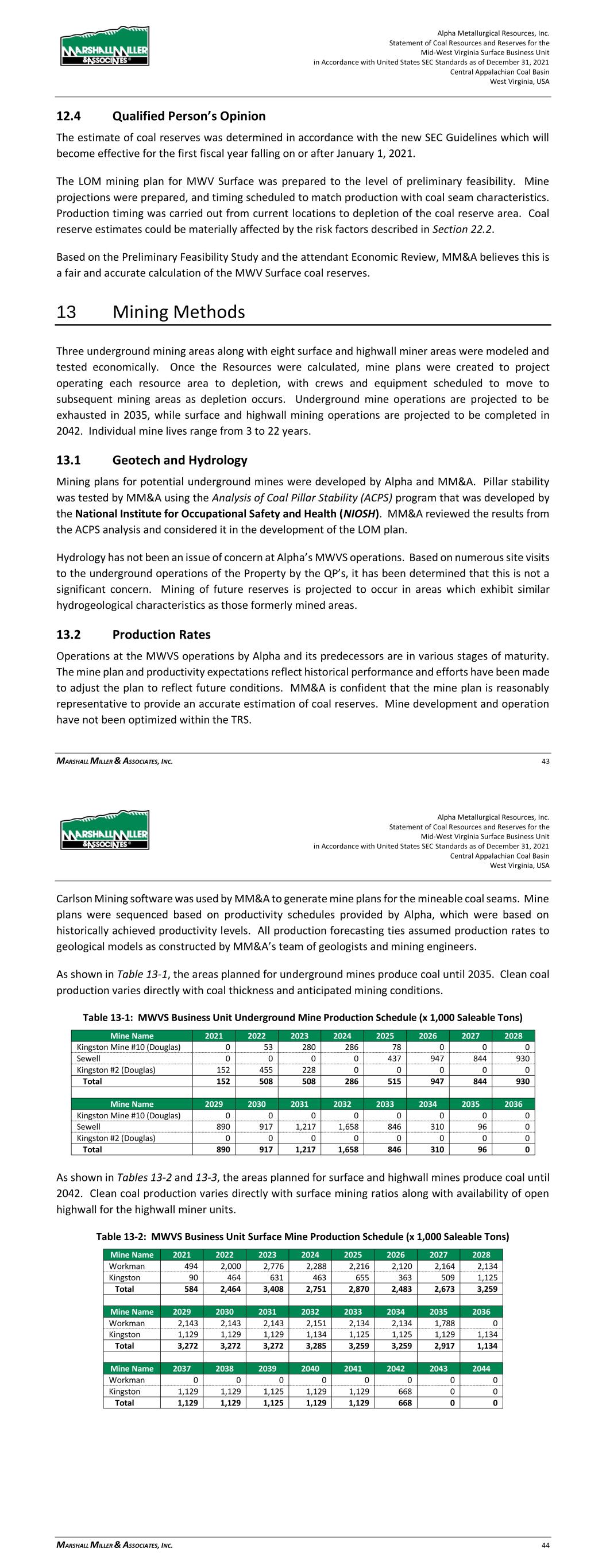

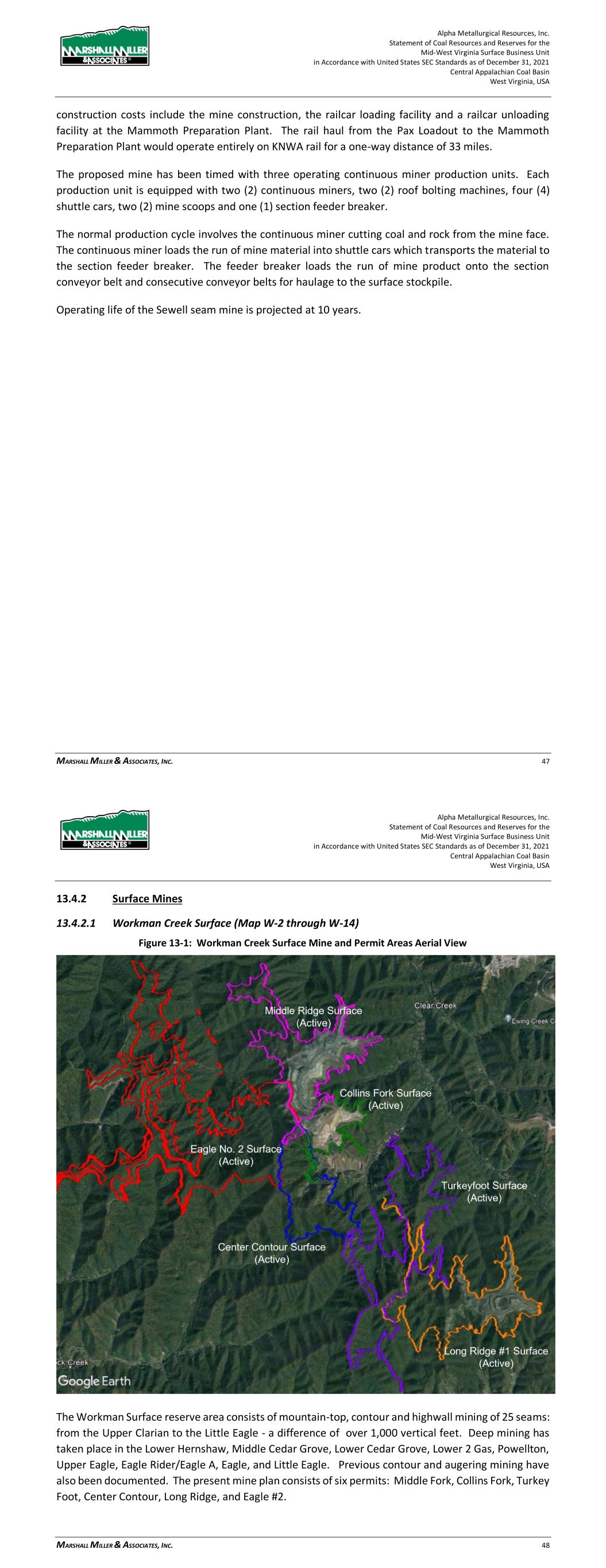

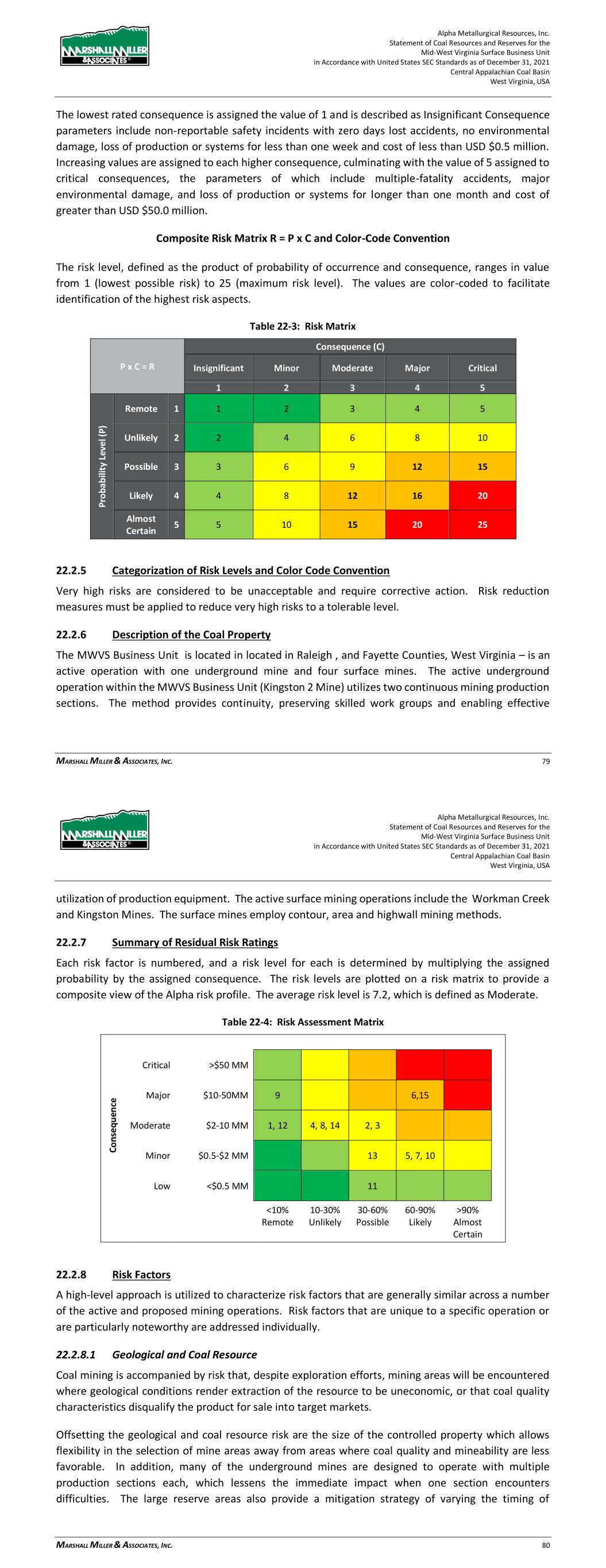

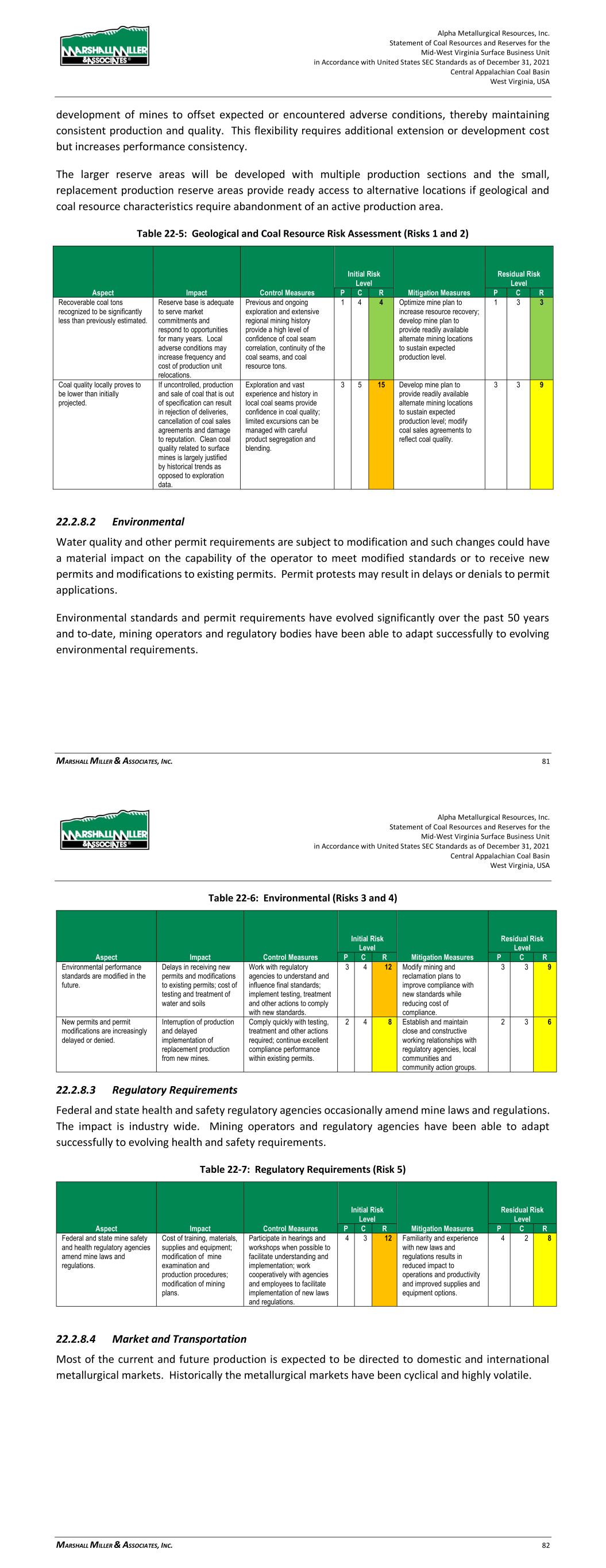

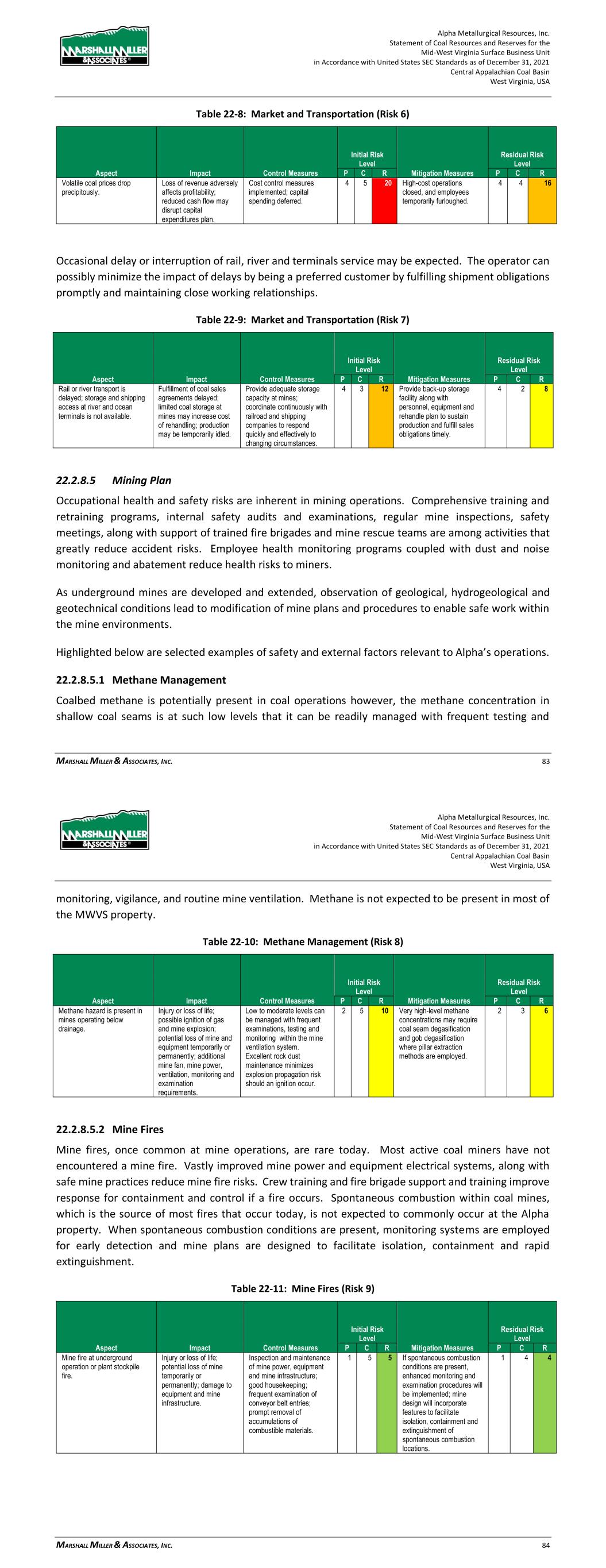

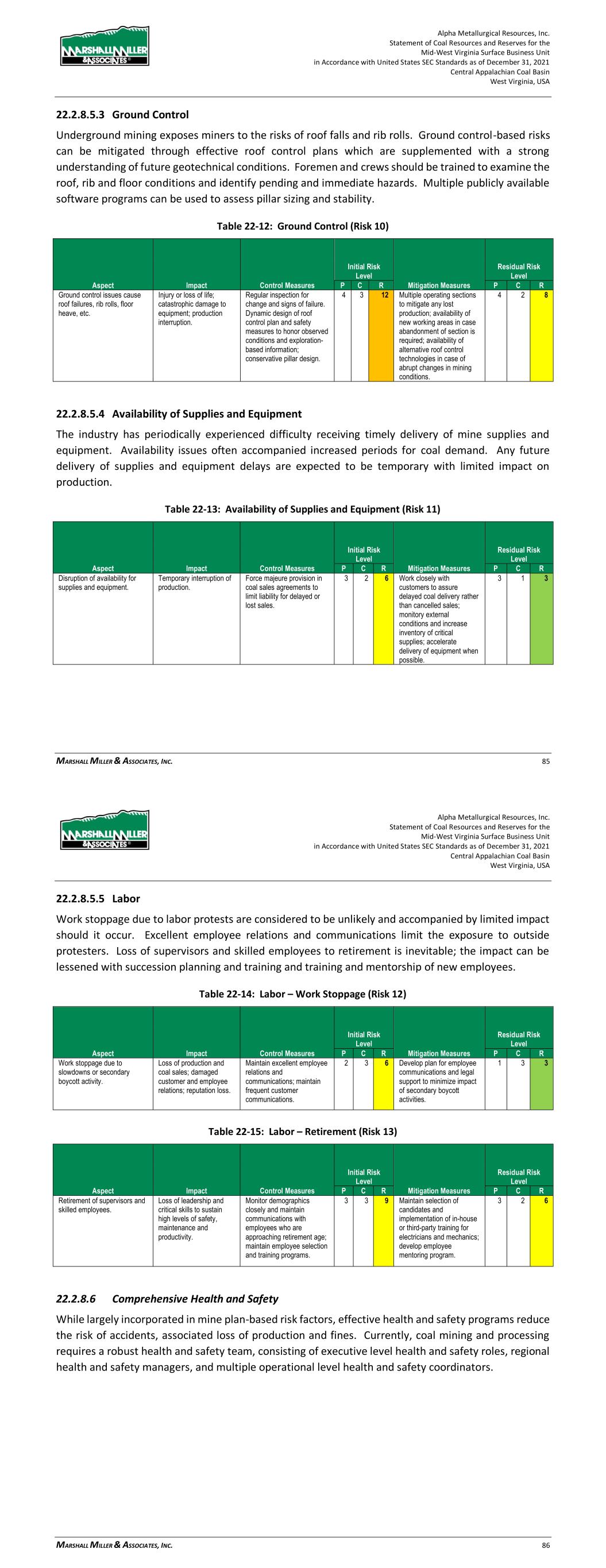

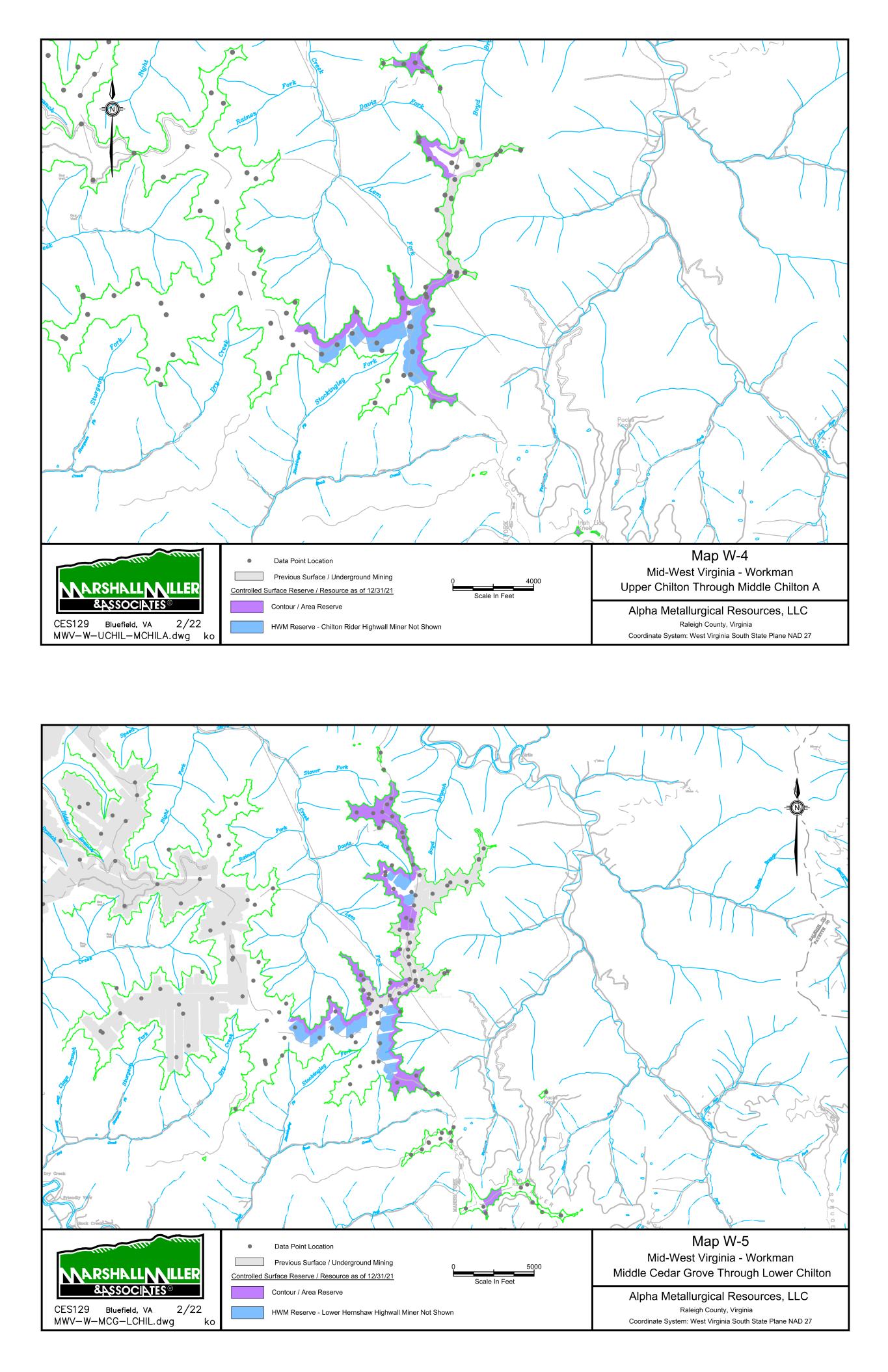

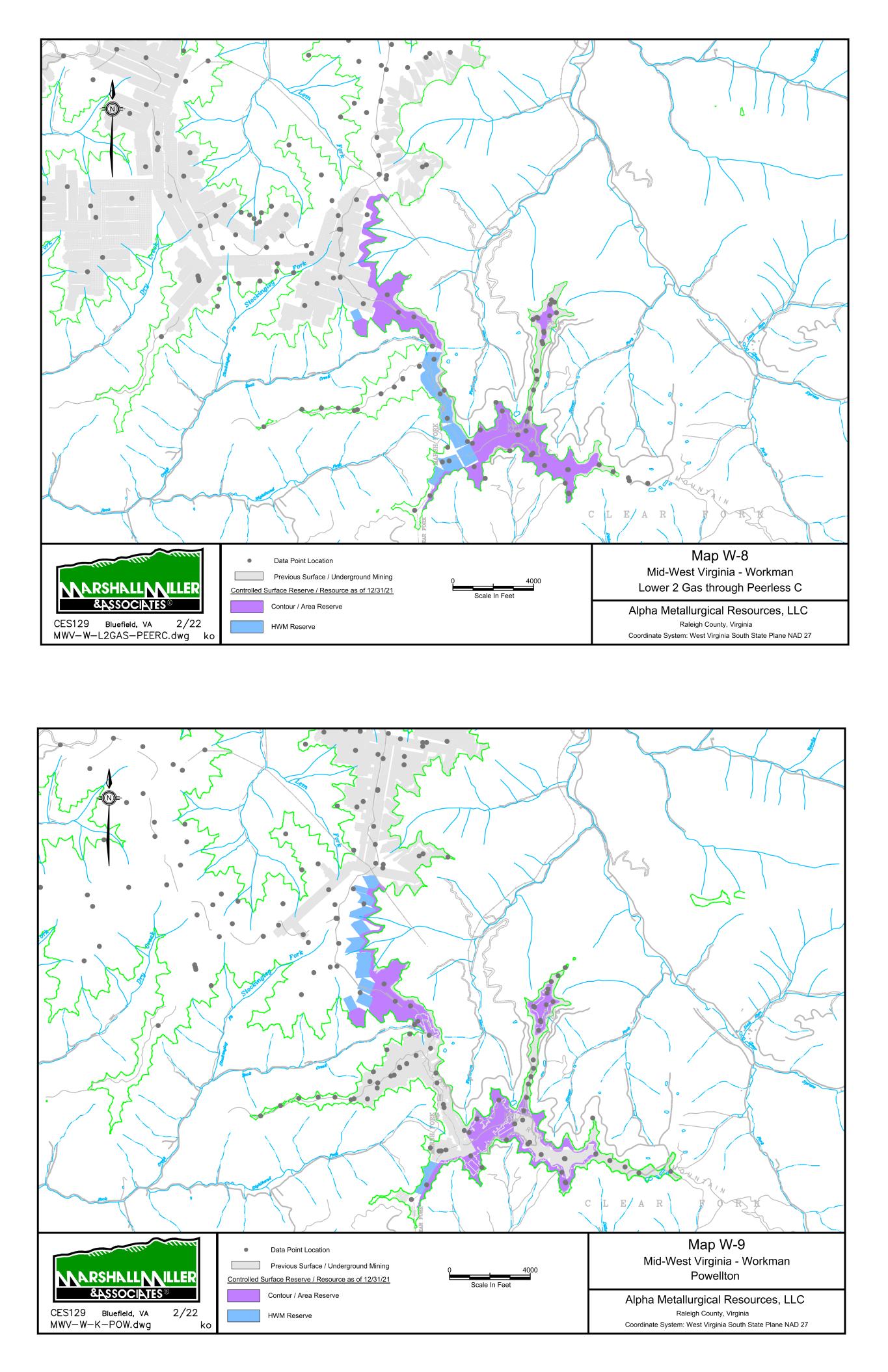

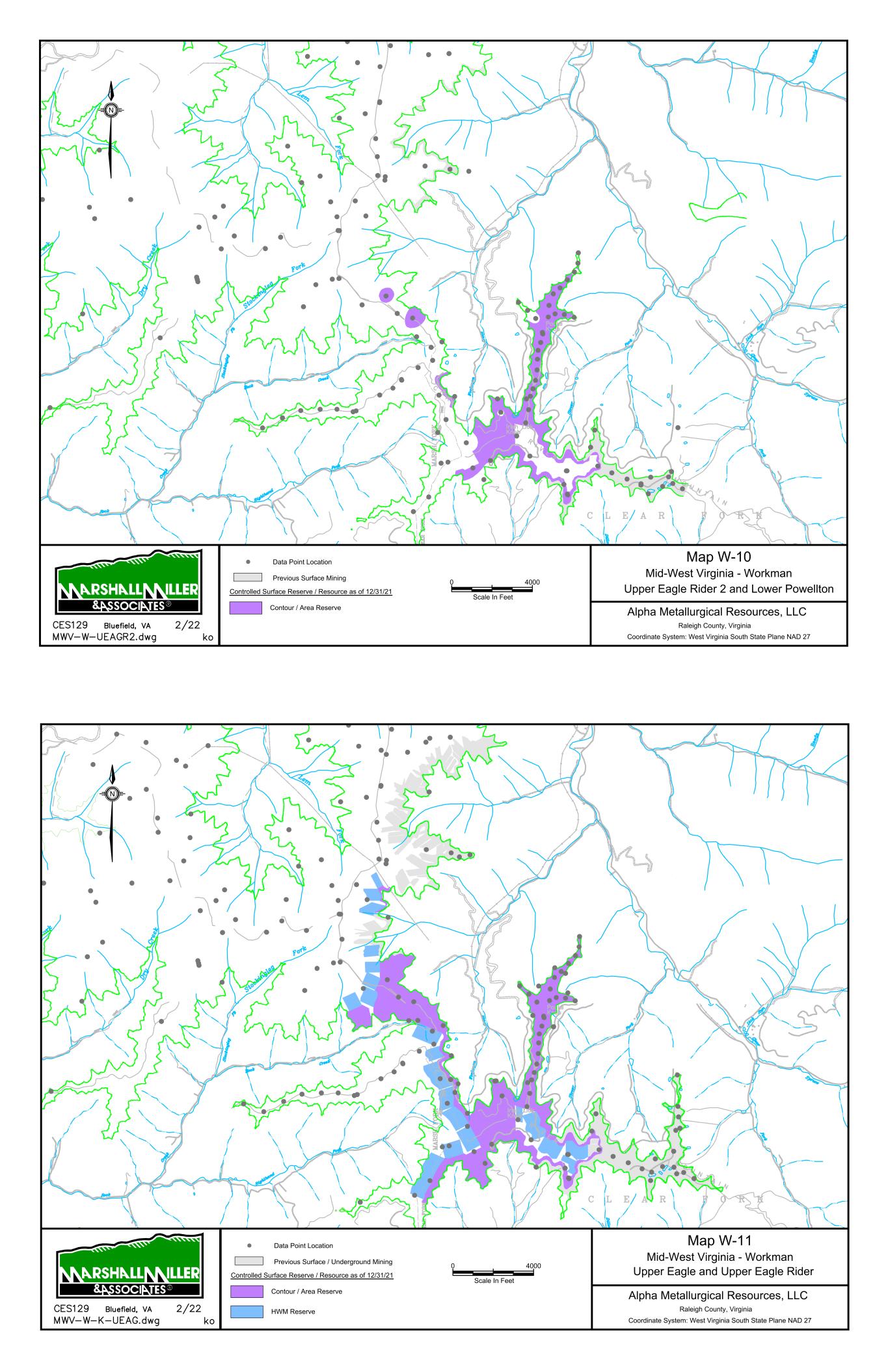

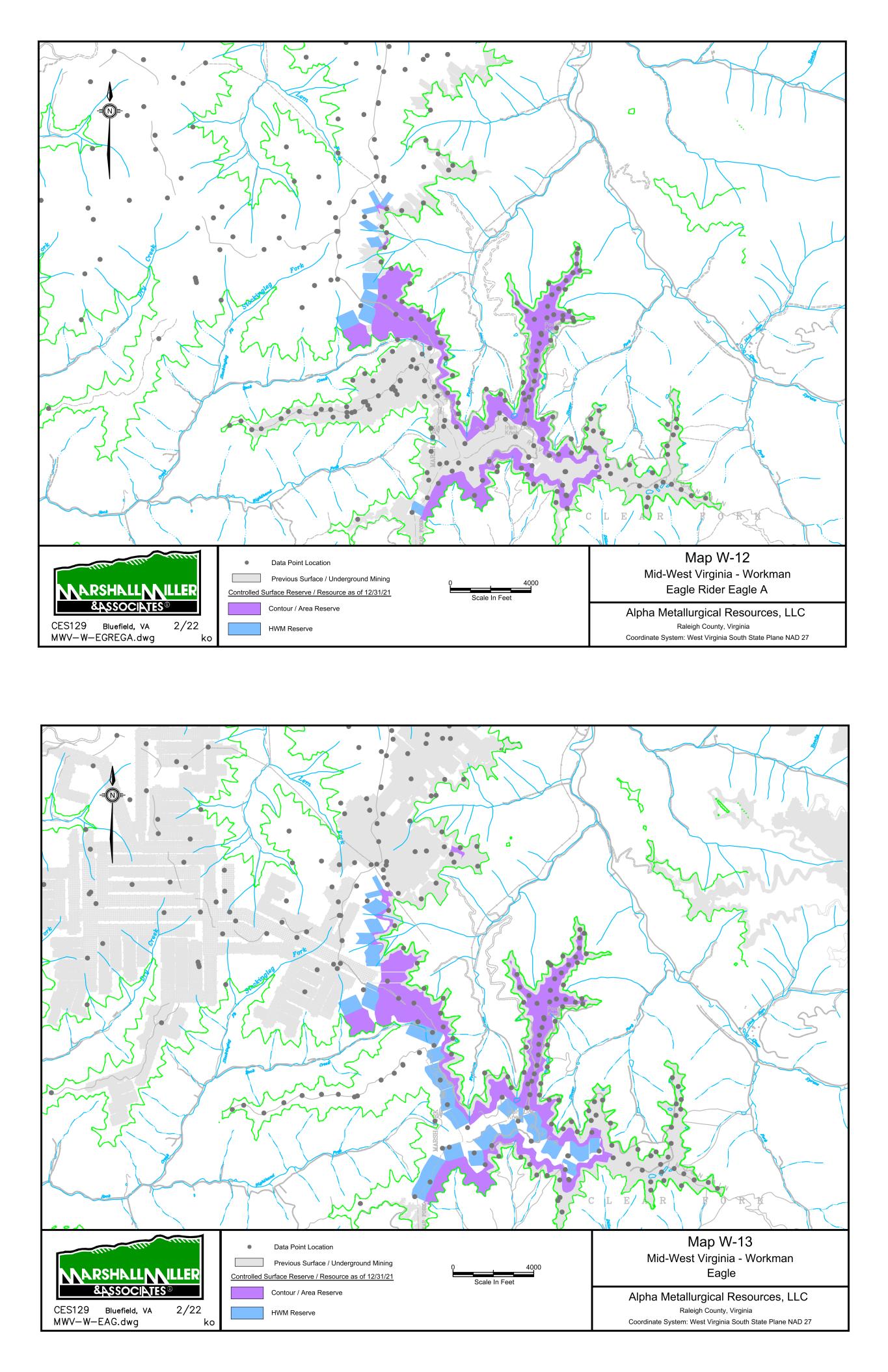

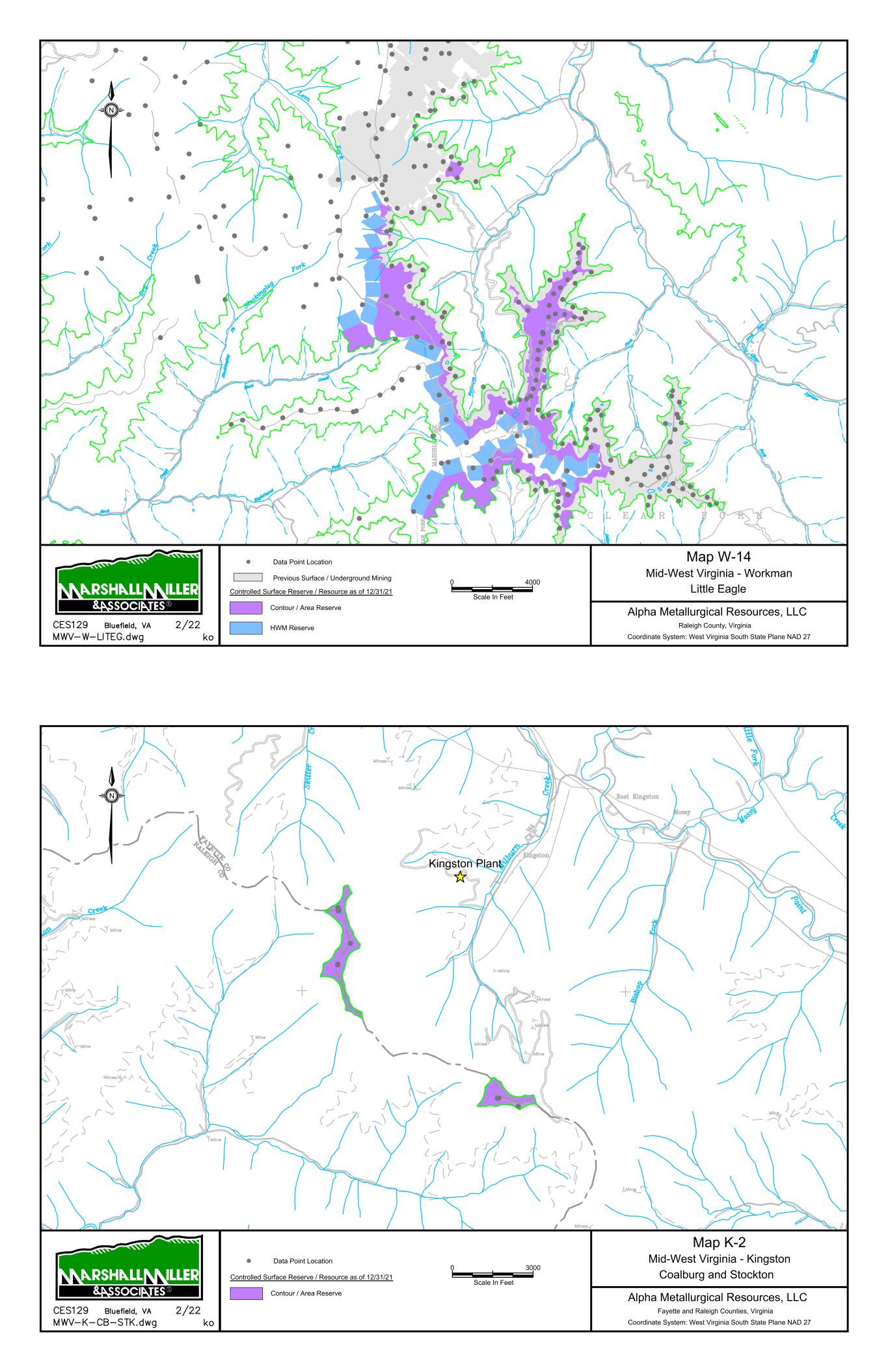

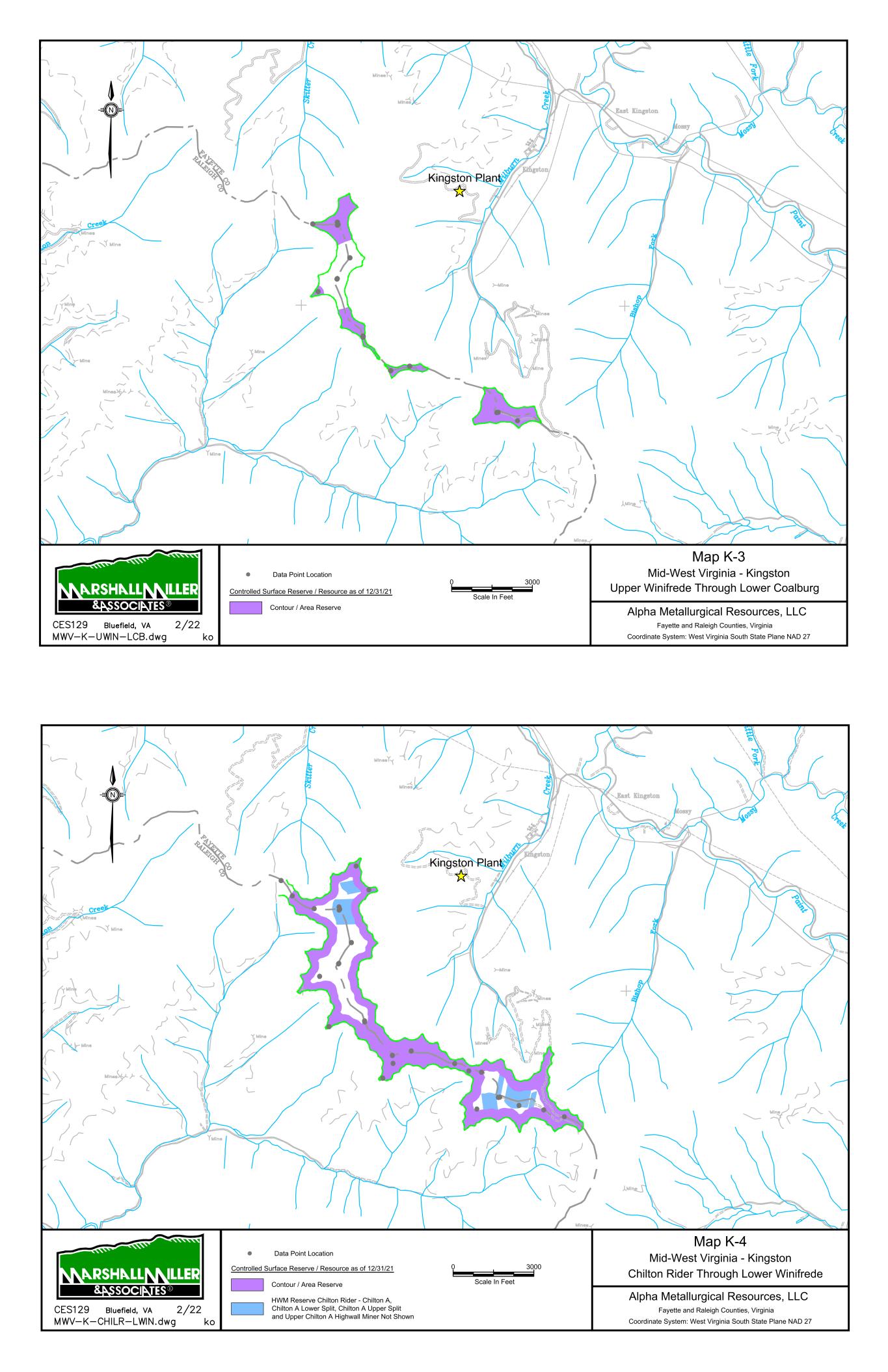

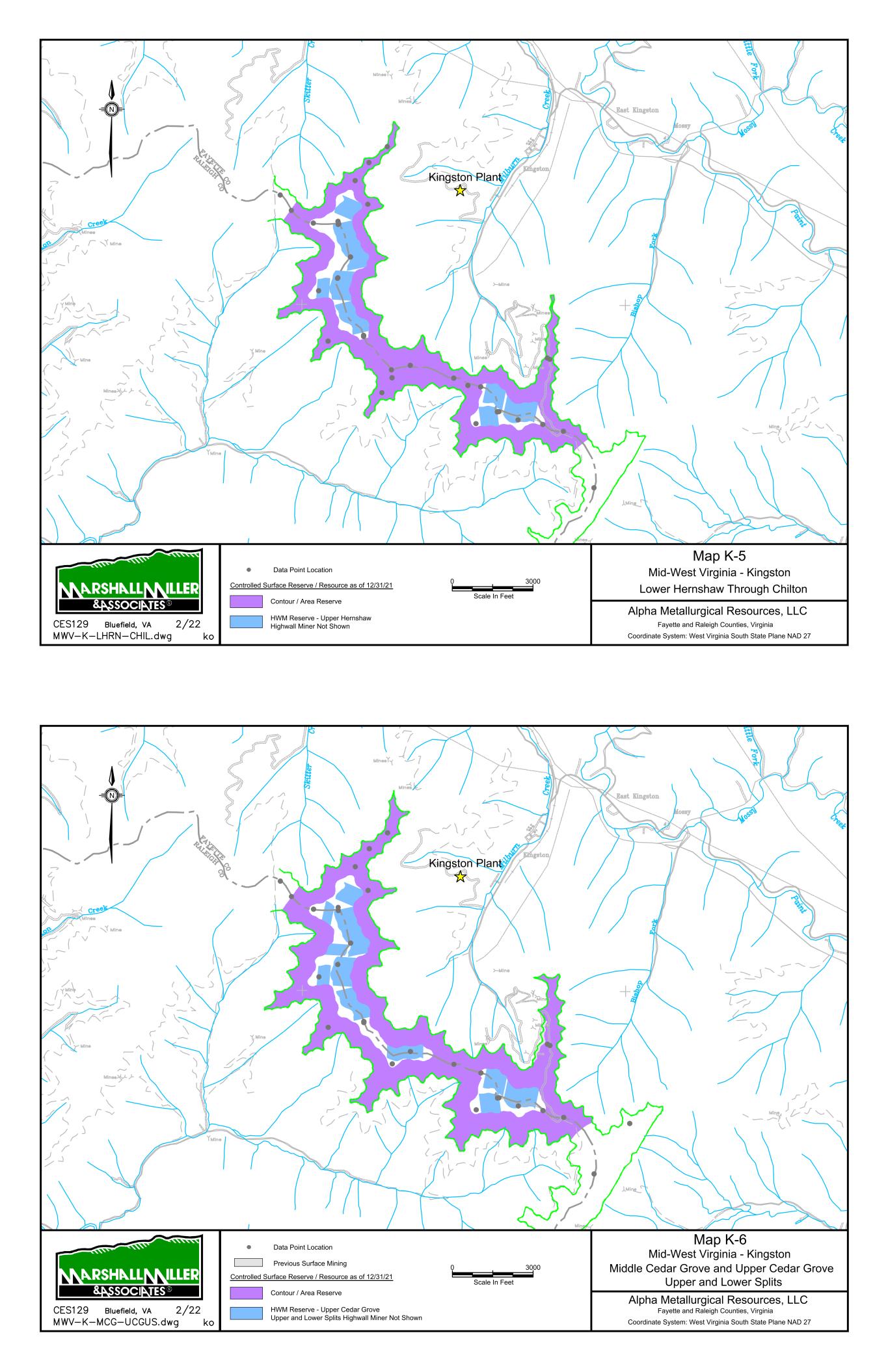

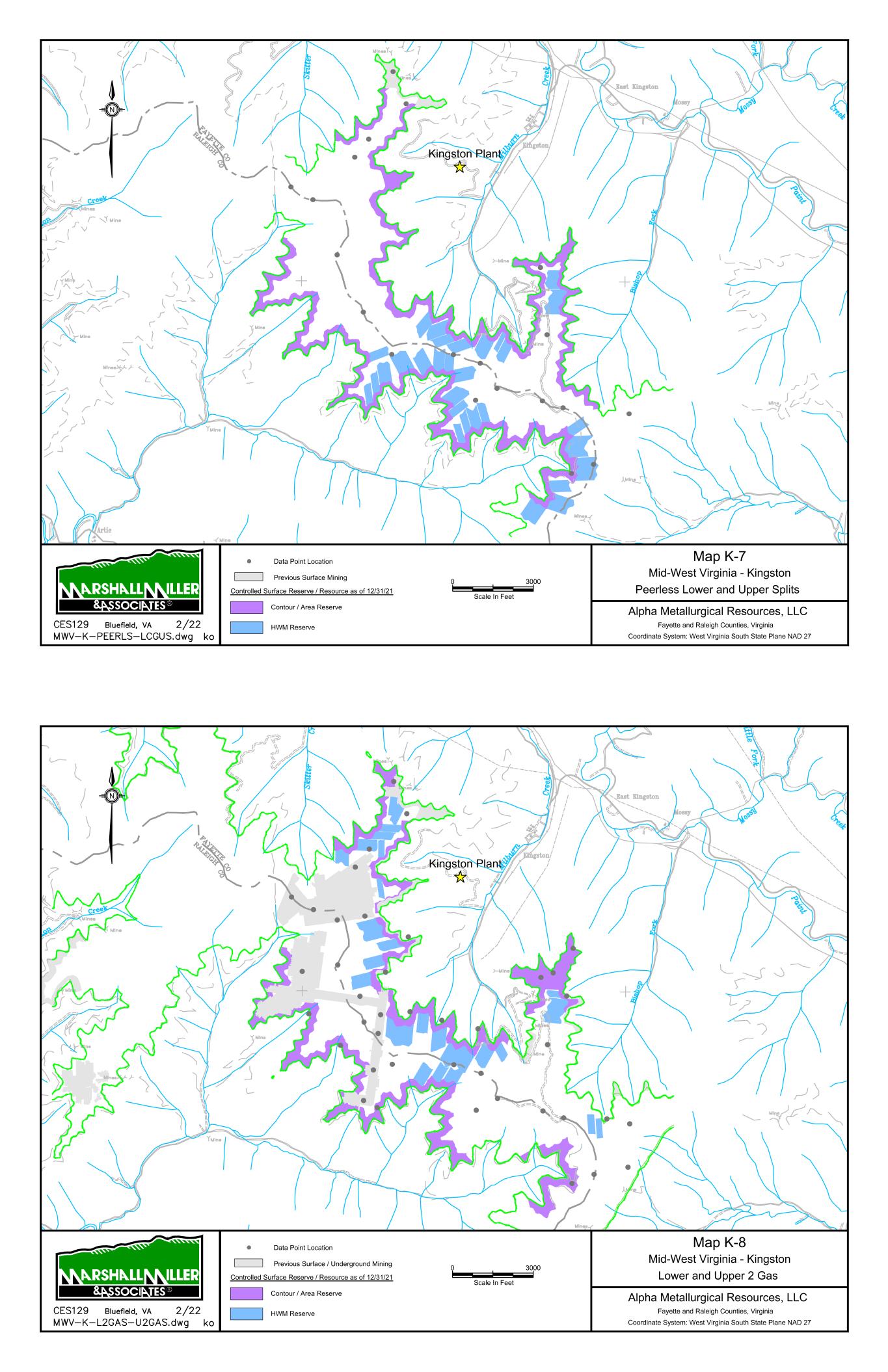

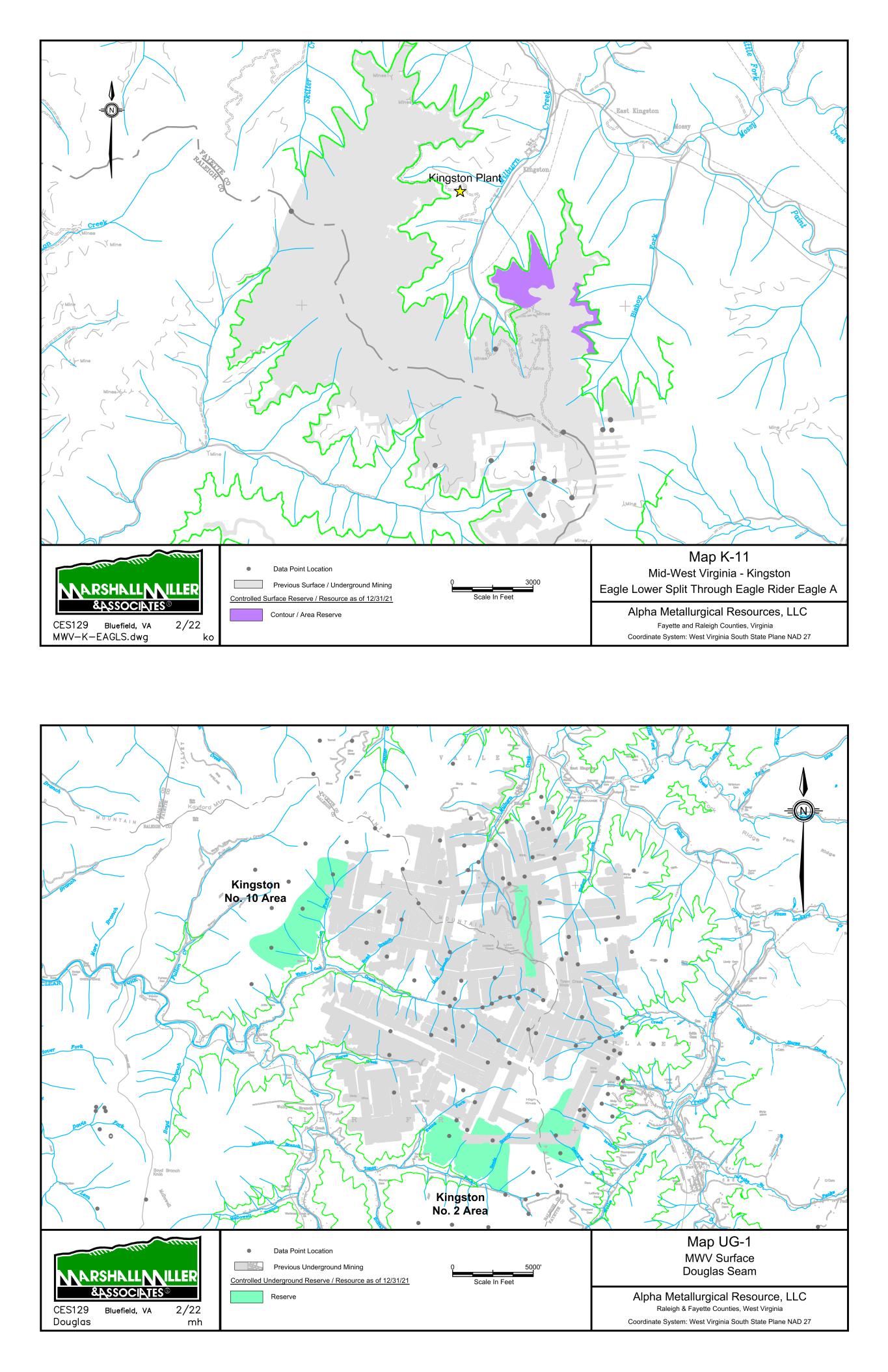

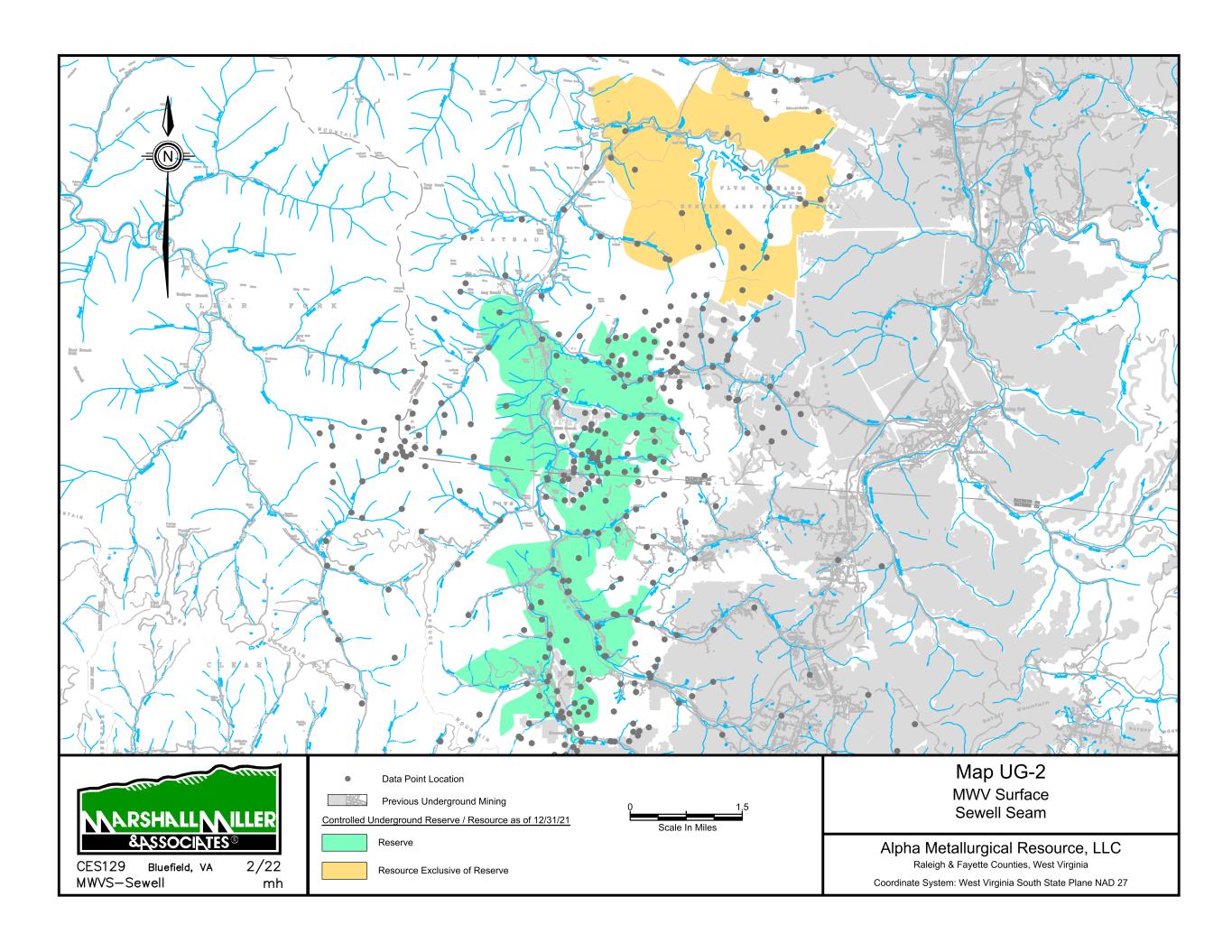

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 3 12.2.2 Underground Reserves .................................................................................. 41 12.3 Qualified Person’s Estimates ....................................................................................... 42 12.4 Qualified Person’s Opinion .......................................................................................... 43 13 Mining Methods ....................................................................................................................... 43 13.1 Geotech and Hydrology ............................................................................................... 43 13.2 Production Rates ......................................................................................................... 43 13.3 Mining Related Requirements ..................................................................................... 45 13.3.1 Underground ................................................................................................. 45 13.4 Required Equipment and Personnel ............................................................................ 45 13.4.1 Underground Mines ....................................................................................... 45 13.4.2 Surface Mines ................................................................................................ 48 14 Processing and Recovery Methods ........................................................................................... 51 14.1 Description or Flowsheet............................................................................................. 51 14.2 Requirements for Energy, Water, Material and Personnel ........................................... 53 15 Infrastructure ........................................................................................................................... 53 16 Market Studies ......................................................................................................................... 56 16.1 Market Description ..................................................................................................... 56 16.2 Price Forecasts ............................................................................................................ 57 16.3 Contract Requirements ............................................................................................... 57 17 Environmental Studies, Permitting and Plans, Negotiations or Agreements with Local Individuals ....................................................................................................................... 58 17.1 Results of Studies ........................................................................................................ 58 17.2 Requirements and Plans for Waste Disposal ................................................................ 58 17.3 Permit Requirements and Status ................................................................................. 59 17.4 Local Plans, Negotiations or Agreements ..................................................................... 62 17.5 Mine Closure Plans ...................................................................................................... 62 17.6 Qualified Person’s Opinion .......................................................................................... 62 18 Capital and Operating Costs ..................................................................................................... 62 18.1 Capital Cost Estimate................................................................................................... 62 18.2 Operating Cost Estimate .............................................................................................. 64 19 Economic Analysis .................................................................................................................... 66 19.1 Economic Evaluation ................................................................................................... 66 19.1.1 Introduction................................................................................................... 66 19.1.2 Cash Flow Summary ....................................................................................... 71 19.1.3 Discounted Cash Flow Analysis ...................................................................... 72 Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 4 19.1.4 Sensitivity Analysis ......................................................................................... 73 20 Adjacent Properties.................................................................................................................. 74 20.1 Information used ......................................................................................................... 74 21 Other Relevant Data and Information ...................................................................................... 74 22 Interpretation and Conclusions ................................................................................................ 74 22.1 Conclusion................................................................................................................... 74 22.2 Risk Factors ................................................................................................................. 74 22.2.1 Governing Assumptions ................................................................................. 75 22.2.2 Limitations ..................................................................................................... 76 22.2.3 Methodology ................................................................................................. 76 22.2.4 Development of the Risk Matrix .................................................................... 77 22.2.5 Categorization of Risk Levels and Color Code Convention .............................. 79 22.2.6 Description of the Coal Property .................................................................... 79 22.2.7 Summary of Residual Risk Ratings .................................................................. 80 22.2.8 Risk Factors .................................................................................................... 80 23 Recommendations ................................................................................................................... 87 24 References................................................................................................................................ 87 25 Reliance on Information Provided by Registrant ..................................................................... 88 FIGURES (IN REPORT) Figure 1-1: Alpha’s MWVS Business Unit Property Location Map ........................................................ 2 Figure 1-2: Projected Capital Expenditures – Consolidated MWVS Business Unit ................................ 7 Figure 1-3: MWVS Business Unit Operating Costs ................................................................................ 8 Figure 1-4: Sensitivity of NPV ............................................................................................................ 12 Figure 6-1: MWVS- Workman Creek Stratigraphic Column ............................................................... 19 Figure 6-2: MWVS-Kingston Stratigraphic Column ............................................................................ 20 Figure 7-1: MWVS Cross-Section ....................................................................................................... 22 Figure 11-1: Histogram of the Total Seam Thickness for the Little Eagle Seam Present in the MWVS Business Unit ................................................................................................................... 31 Figure 11-2: Scatter plot of the Total Seam Thickness for the Little Eagle Seam Present in the MWVS Business Unit ................................................................................................................... 31 Figure 11-3: Variogram of the Total Seam Thickness for the Little Eagle Seam Present in the MWVS Business Unit ................................................................................................................... 32 Figure 11-4: Result of DHSA for the Little Eagle Seam Present in the MWVS Business Unit ................ 33 Figure 11-5: Results of Initial Economic Assessment .......................................................................... 35 Figure 13-1: Workman Creek Surface Mine and Permit Areas Aerial View ......................................... 48 Figure 13-2: Kingston Surface Mine Permit Areas Aerial View ........................................................... 50 Figure 14-1: MWVS Kingston Preparation Plant and Refuse Area ..................................................... 52

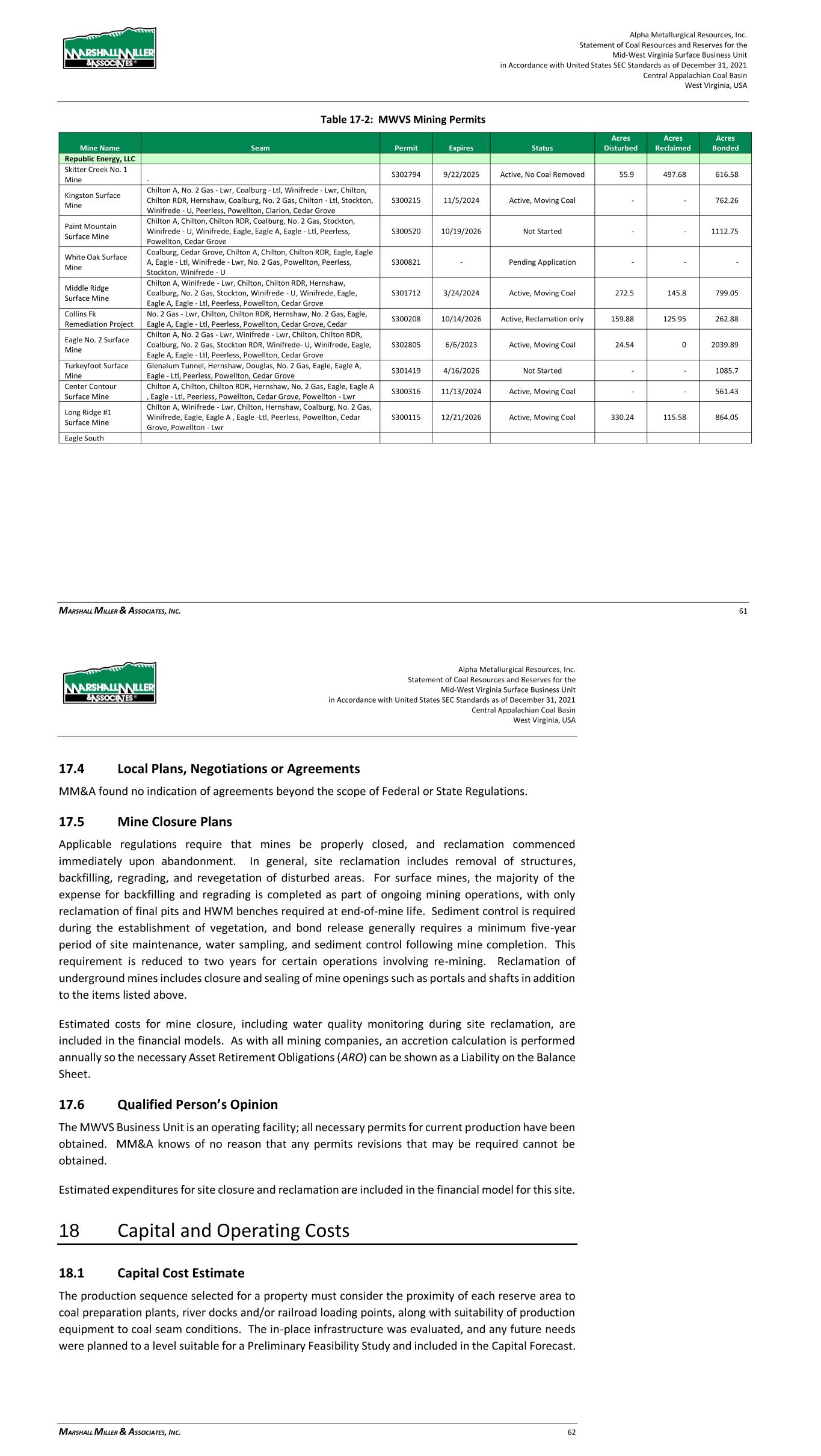

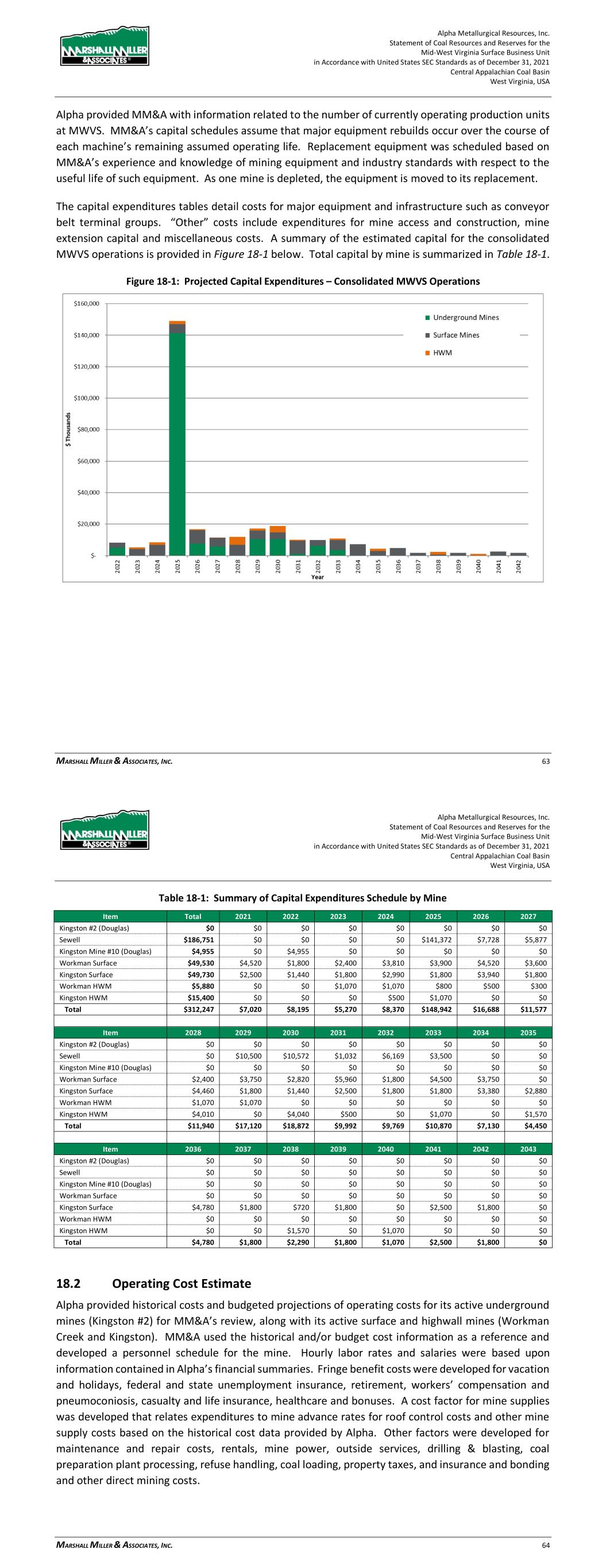

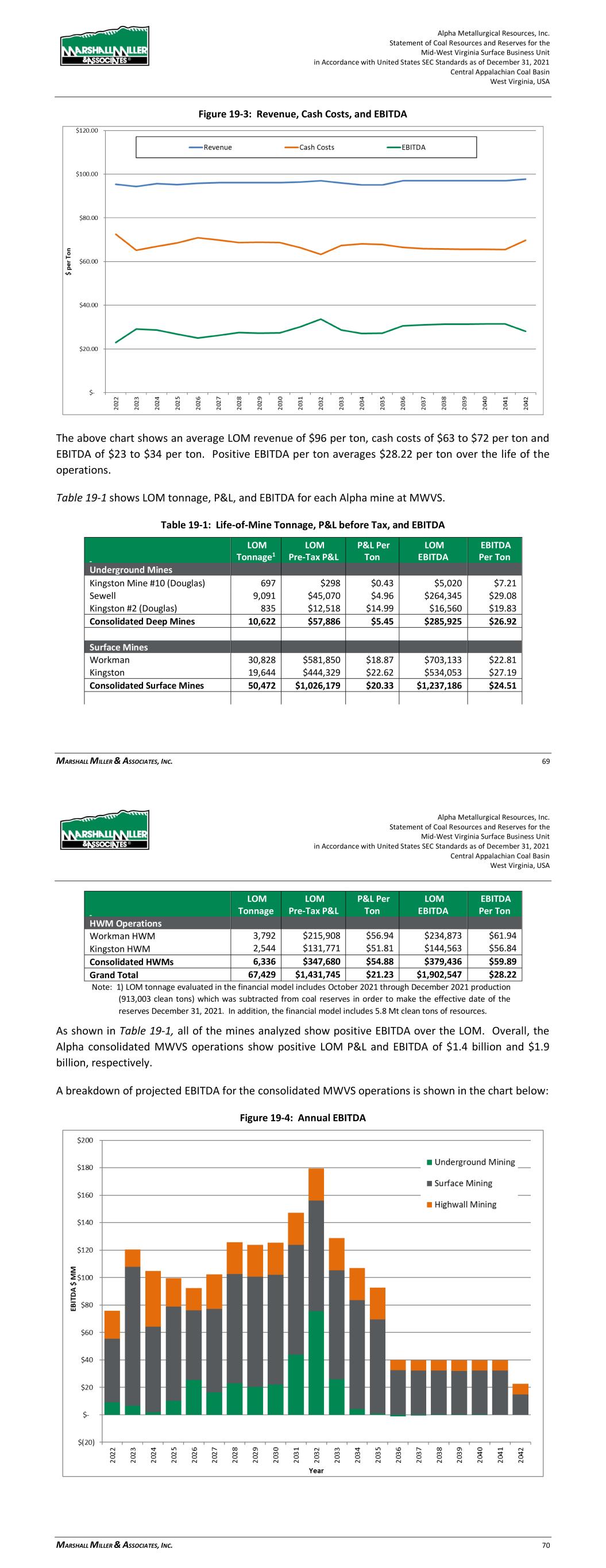

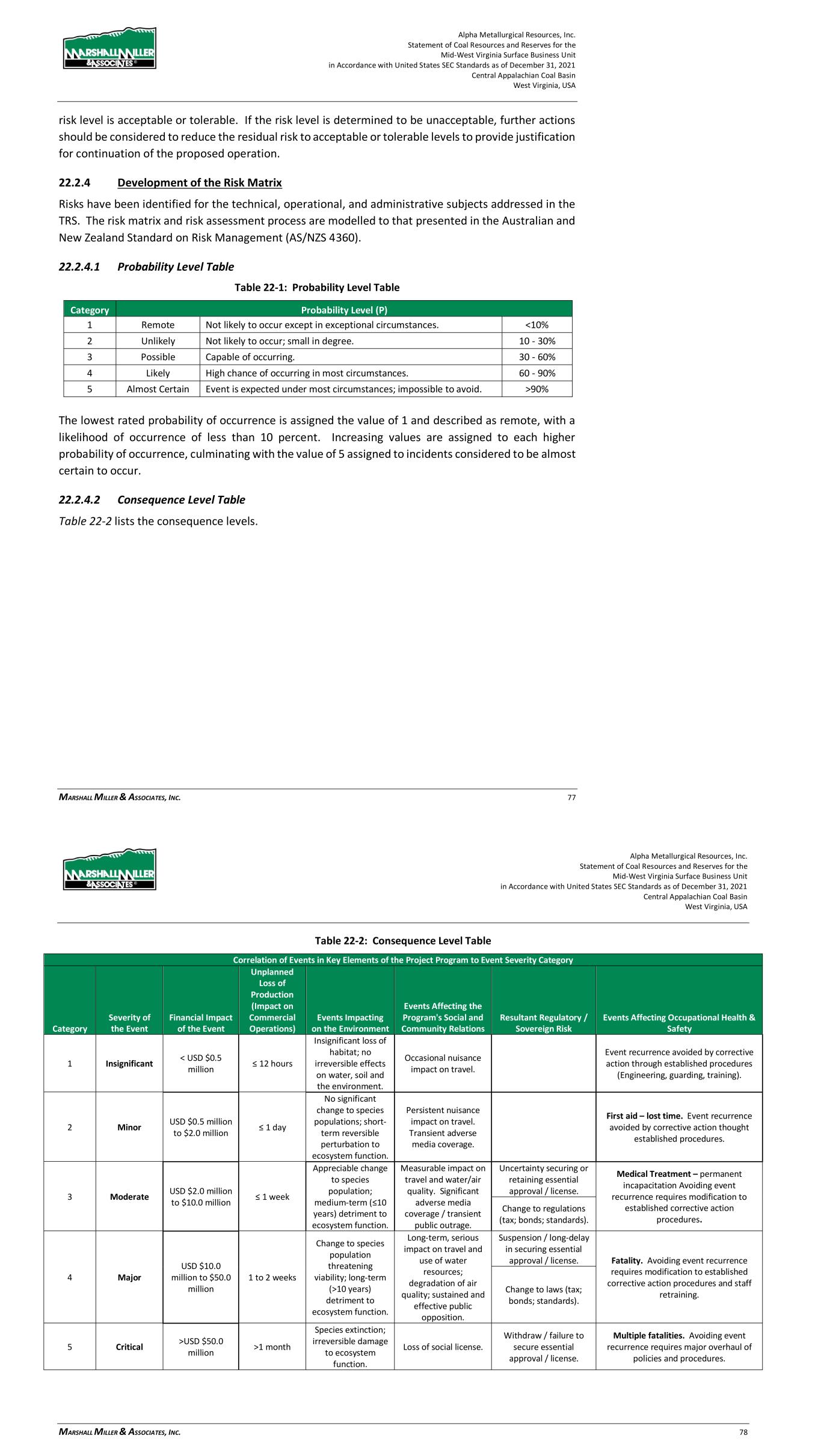

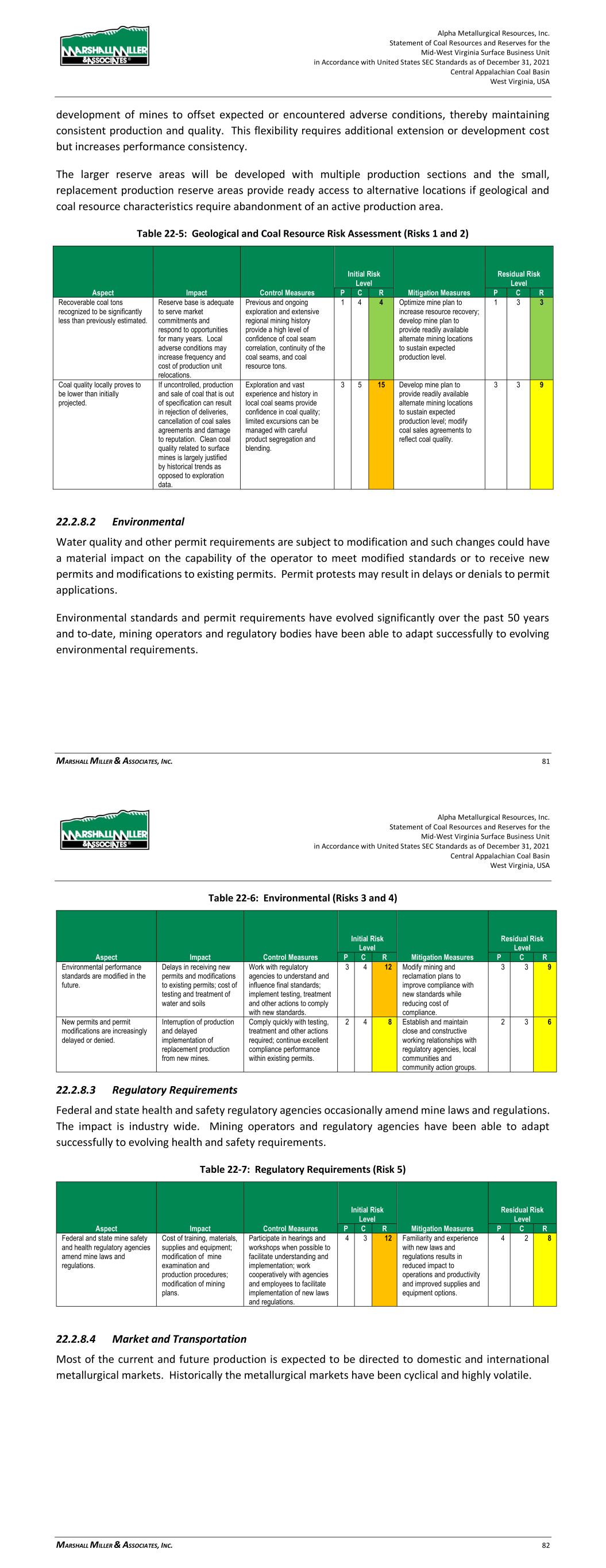

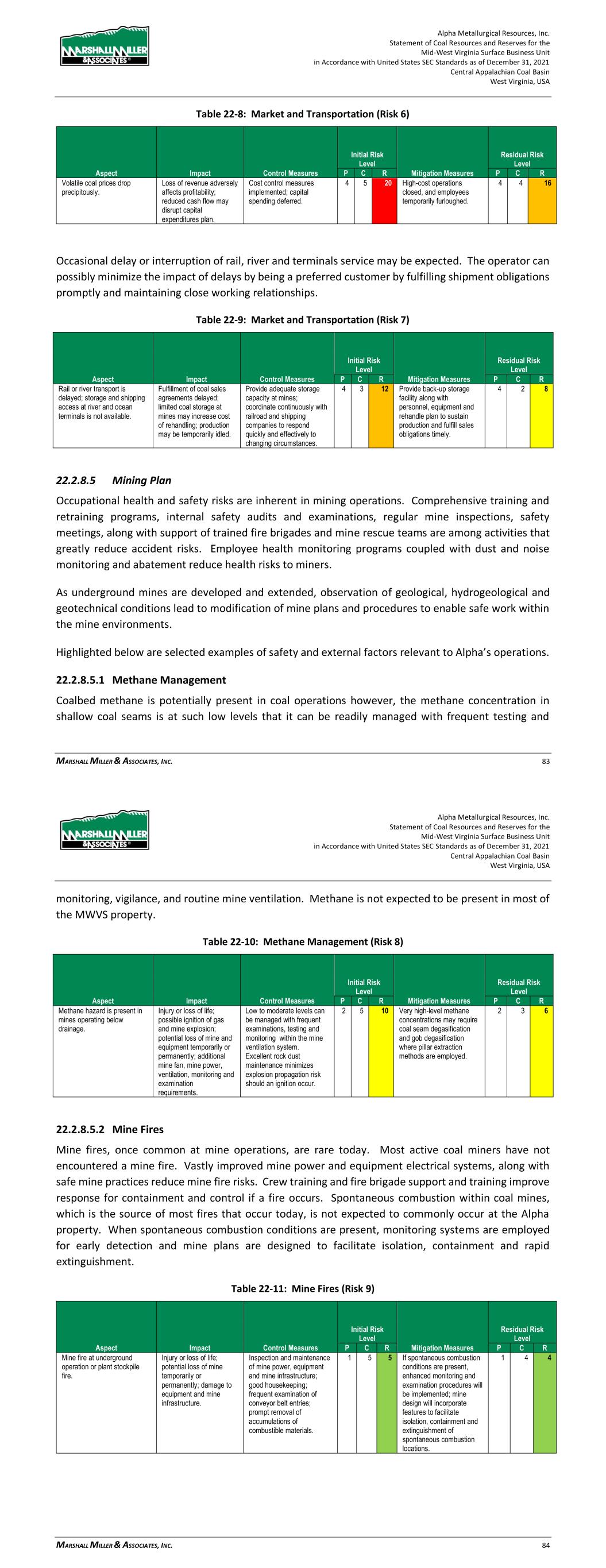

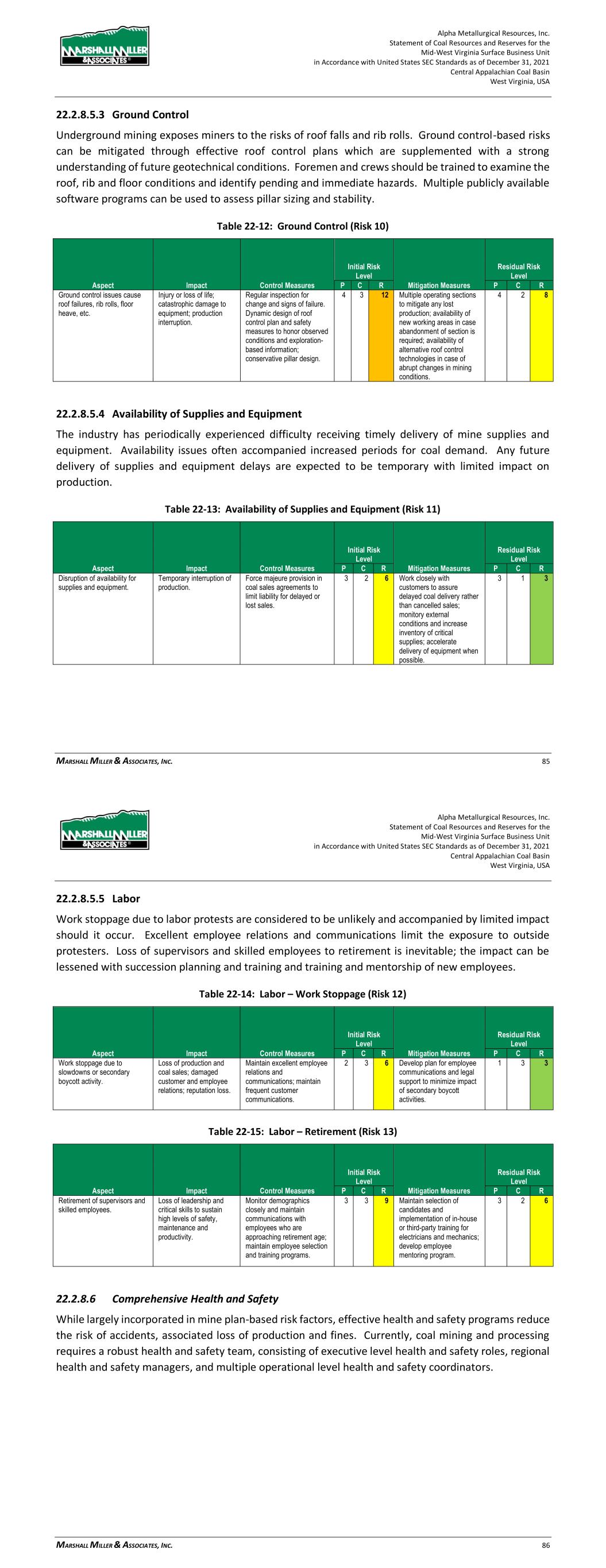

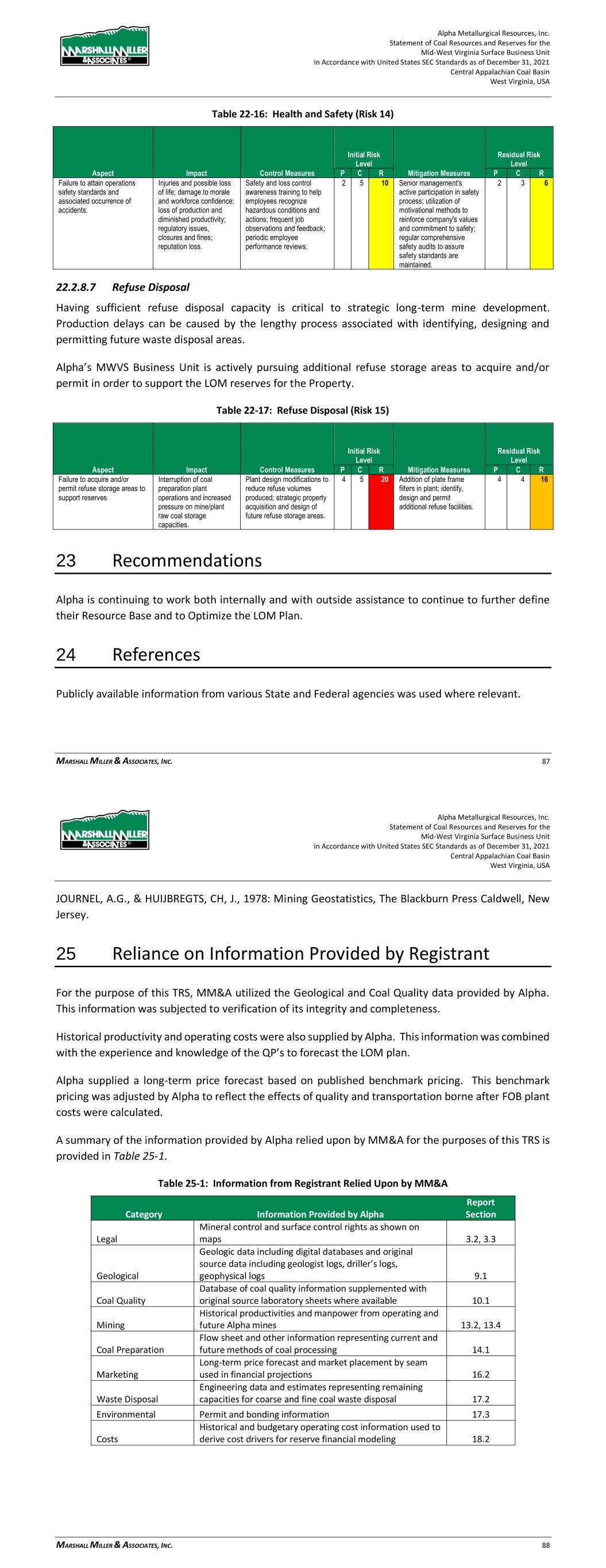

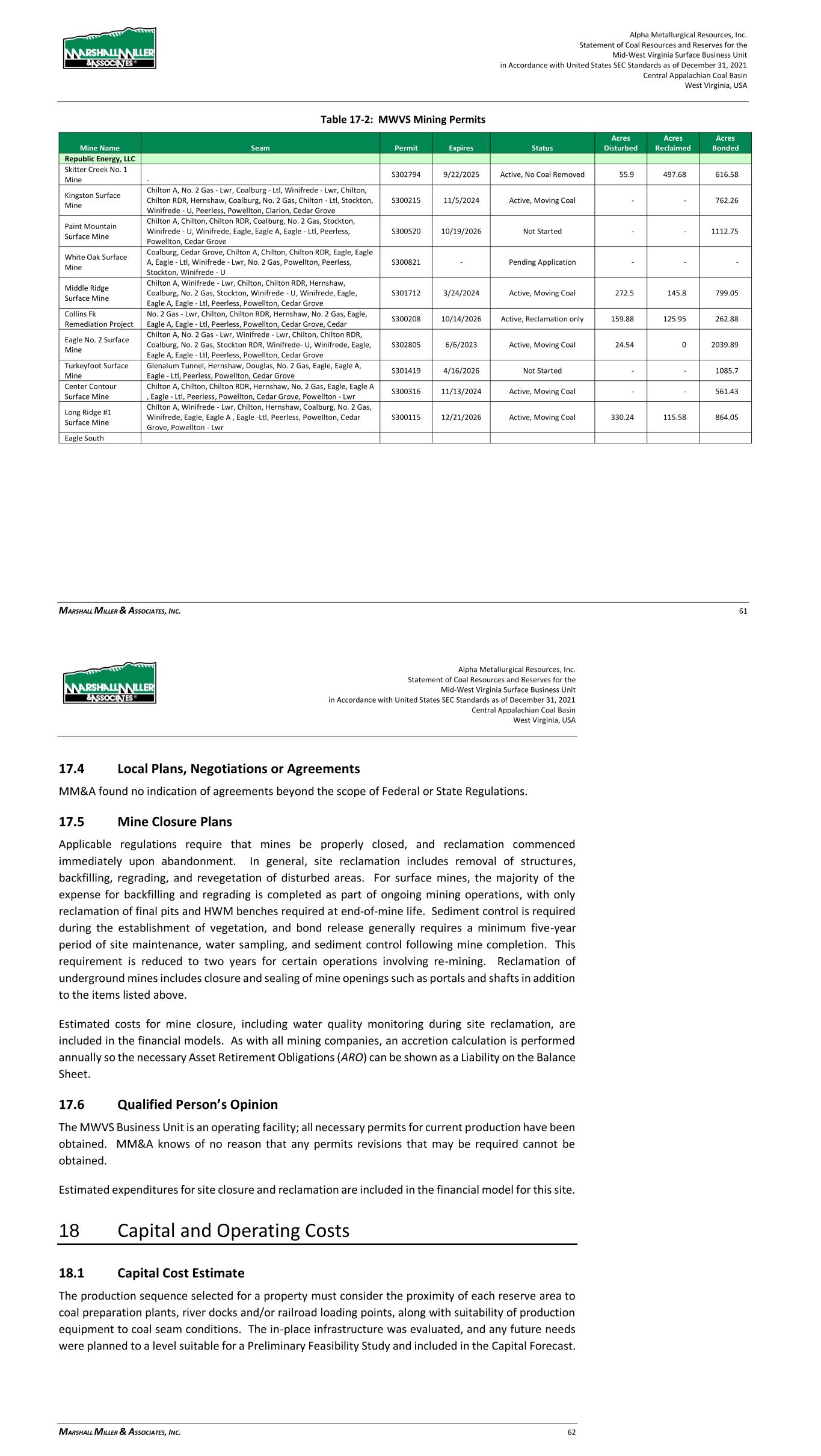

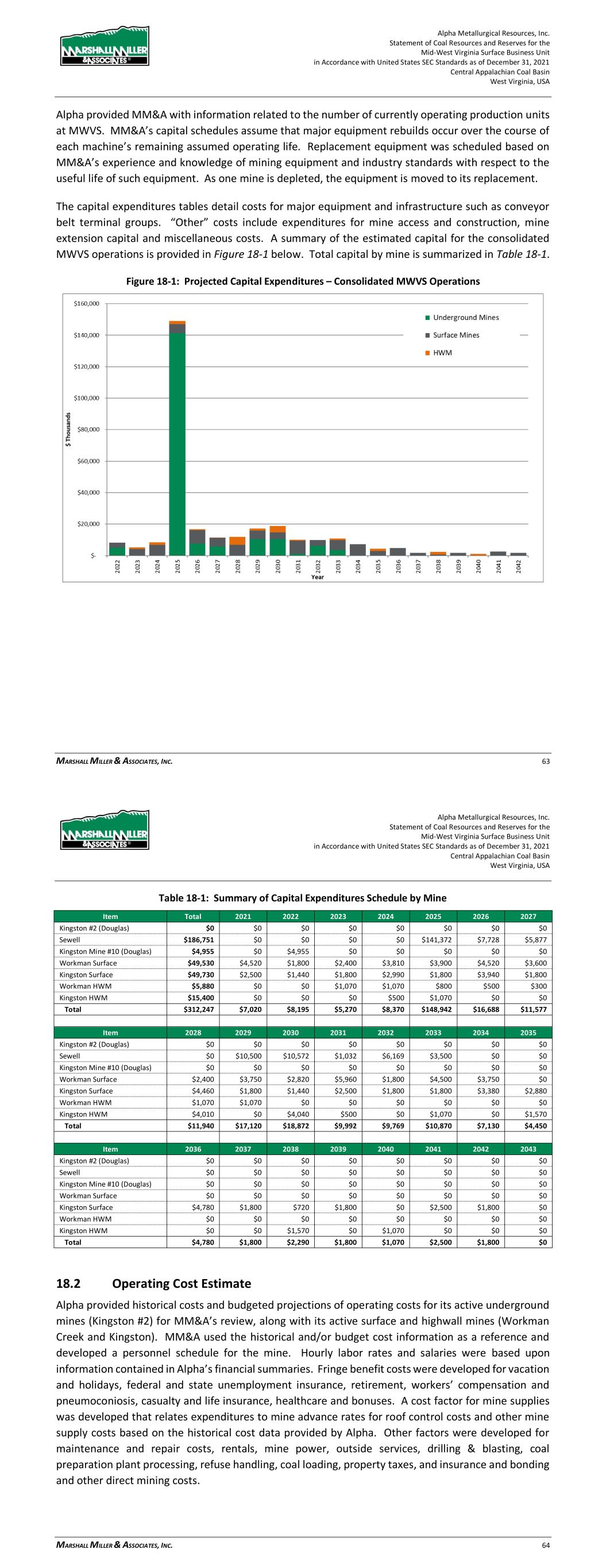

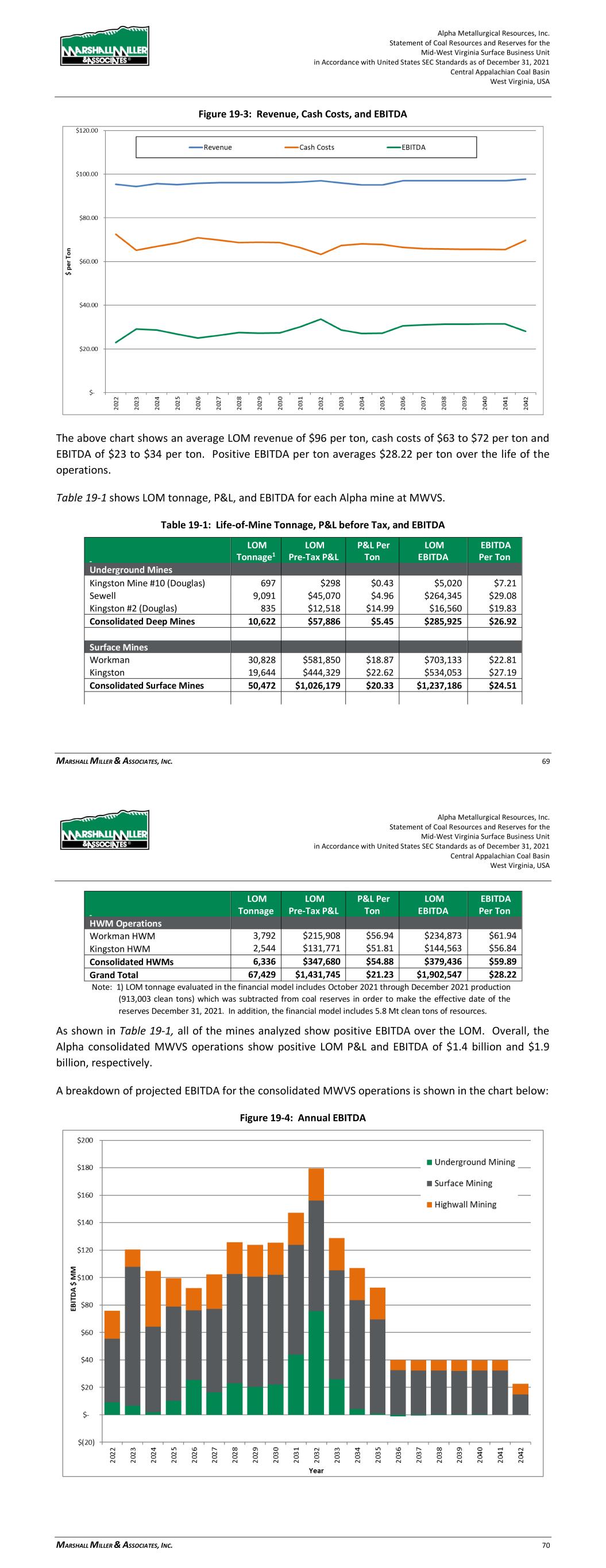

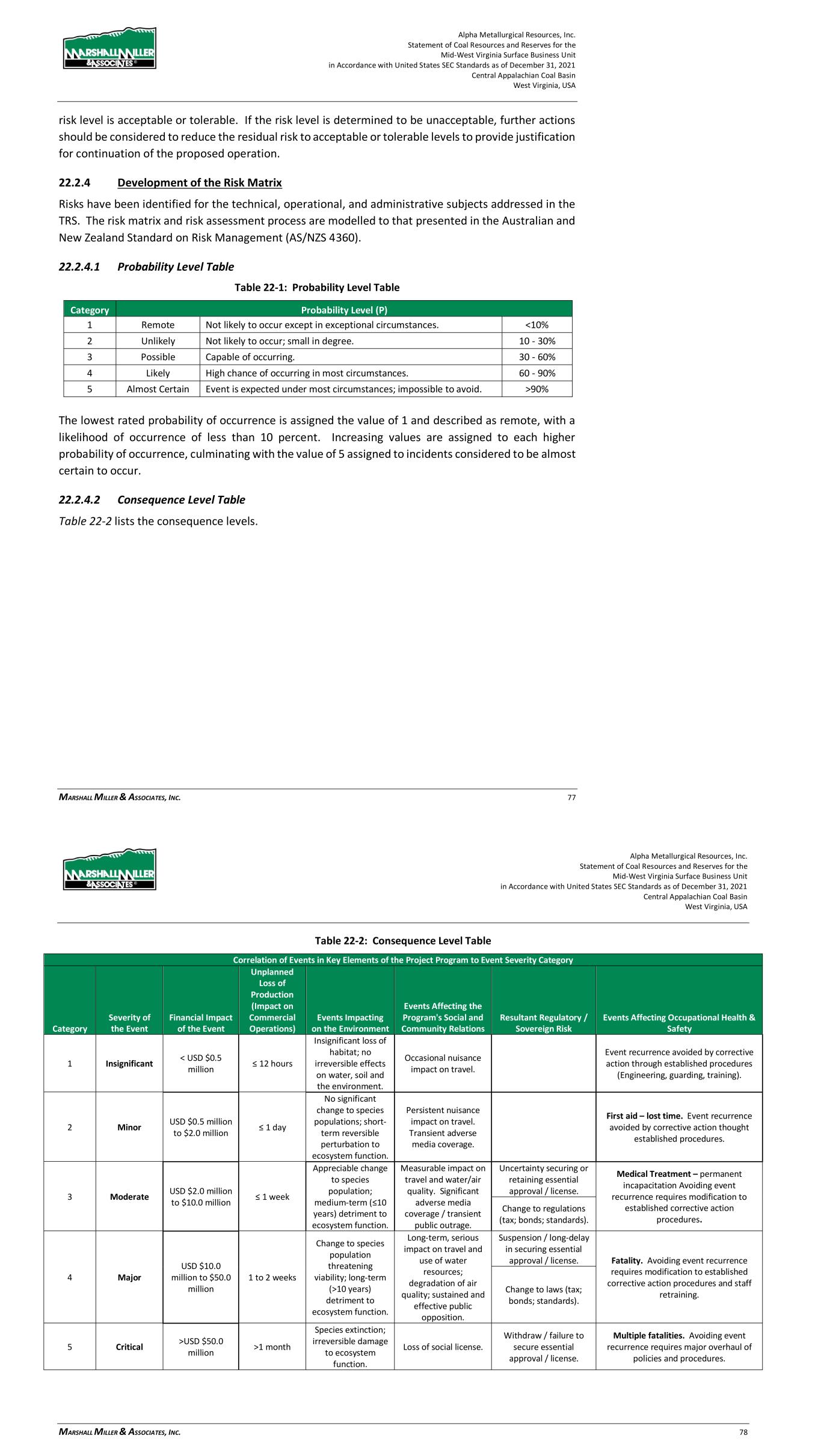

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 5 Figure 14-2: MWVS Kingston Preparation Plant and Refuse Area (Zoomed-In View) ........................ 53 Figure 15-1: MWVS Kingston Preparation Plant & Surface Facilities .................................................. 54 Figure 15-2: MWVS Pax Loadout Surface Facilities ........................................................................... 55 Figure 15-3: MWVS Workman Creek Surface Facilities ...................................................................... 55 Figure 15-4: Workman Creek Coal Handling Facility .......................................................................... 56 Figure 18-1: Projected Capital Expenditures – Consolidated MWVS Operations ................................ 63 Figure 18-2: MWVS Business Unit Operating Costs ............................................................................ 65 Figure 19-1: Projection of Sales Tons ................................................................................................. 67 Figure 19-2: Consolidated Annual Revenue ....................................................................................... 68 Figure 19-3: Revenue, Cash Costs, and EBITDA .................................................................................. 69 Figure 19-4: Annual EBITDA ............................................................................................................... 70 Figure 19-5: Net Cash Flow after Tax (Before Debt Service) ............................................................... 72 Figure 19-6: Sensitivity of NPV .......................................................................................................... 73 TABLES (IN REPORT) Table 1-1: Coal Resources Summary as of December 31, 2021 ............................................................ 4 Table 1-2: Coal Reserves Summary (Marketable Sales Basis) as of December 31, 2021 ....................... 5 Table 1-3: Life-of-Mine Tonnage, P&L before Tax, and EBITDA ............................................................ 9 Table 1-4: Project Cash Flow Summary (000) ..................................................................................... 10 Table 11-1: General Reserve & Resource Criteria .............................................................................. 29 Table 11-2: DHSA Results Summary for Radius from a Central Point ................................................. 33 Table 11-3: Results of Initial Economic Assessment ........................................................................... 35 Table 11-4: Coal Resources Summary as of December 31, 2021 ........................................................ 36 Table 12-1: Workman Creek Coal Reserves Summary (Marketable Sales Basis) as of December 31, 2021 ................................................................................................................................ 39 Table 12-2: Kingston Coal Reserves Summary (Marketable Sales Basis) as of December 31, 2021 ..... 40 Table 12-3: Coal Reserves Summary (Marketable Sales Basis) as of December 31, 2021 ................... 42 Table 13-1: MWVS Business Unit Underground Mine Production Schedule (x 1,000 Saleable Tons) .. 44 Table 13-2: MWVS Business Unit Surface Mine Production Schedule (x 1,000 Saleable Tons) ........... 44 Table 13-3: MWVS Business Unit Highwall Mine Production Schedule (x 1,000 Saleable Tons) ......... 45 Table 16-1: Quality Specifications...................................................................................................... 56 Table 16-2: Price Forecasts ................................................................................................................ 57 Table 17-1: MWVS Refuse Disposal Summary* .................................................................................. 59 Table 17-2: MWVS Mining Permits .................................................................................................... 61 Table 18-1: Summary of Capital Expenditures Schedule by Mine....................................................... 64 Table 18-2: Estimated Coal Production Taxes and Sales Costs ........................................................... 65 Table 19-1: Life-of-Mine Tonnage, P&L before Tax, and EBITDA ........................................................ 69 Table 19-2: Project Cash Flow Summary (000) ................................................................................... 71 Table 22-1: Probability Level Table .................................................................................................... 77 Table 22-2: Consequence Level Table ................................................................................................ 78 Table 22-3: Risk Matrix ...................................................................................................................... 79 Table 22-4: Risk Assessment Matrix .................................................................................................. 80 Table 22-5: Geological and Coal Resource Risk Assessment (Risks 1 and 2) ....................................... 81 Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 6 Table 22-6: Environmental (Risks 3 and 4) ......................................................................................... 82 Table 22-7: Regulatory Requirements (Risk 5) ................................................................................... 82 Table 22-8: Market and Transportation (Risk 6)................................................................................. 83 Table 22-9: Market and Transportation (Risk 7)................................................................................. 83 Table 22-10: Methane Management (Risk 8) ..................................................................................... 84 Table 22-11: Mine Fires (Risk 9)......................................................................................................... 84 Table 22-12: Ground Control (Risk 10) ............................................................................................... 85 Table 22-13: Availability of Supplies and Equipment (Risk 11) ........................................................... 85 Table 22-14: Labor – Work Stoppage (Risk 12) .................................................................................. 86 Table 22-15: Labor – Retirement (Risk 13) ......................................................................................... 86 Table 22-16: Health and Safety (Risk 14) ........................................................................................... 87 Table 22-17: Refuse Disposal (Risk 15) .............................................................................................. 87 Table 25-1: Information from Registrant Relied Upon by MM&A ...................................................... 88 Appendices A .................................................................................................................................. Summary Tables B ............................................................................. Financial Details – Resources Exclusive of Reserves C ................................................................................................................................................... Maps

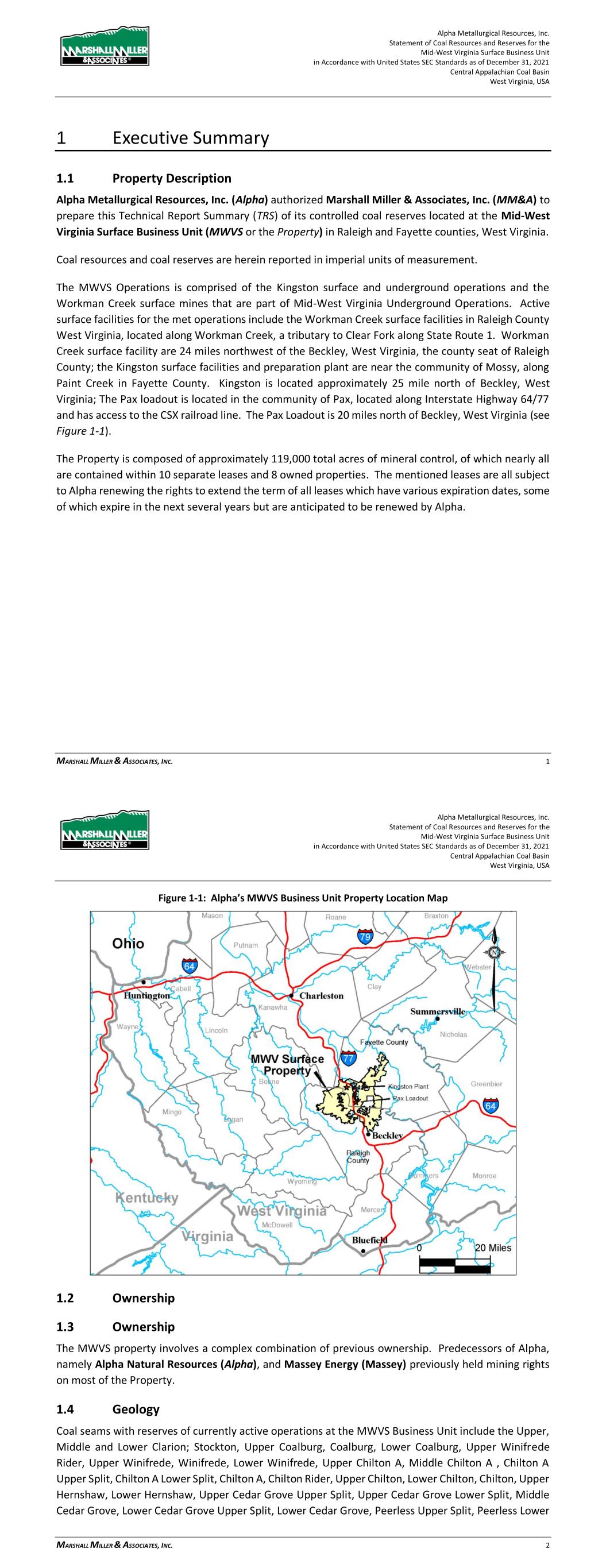

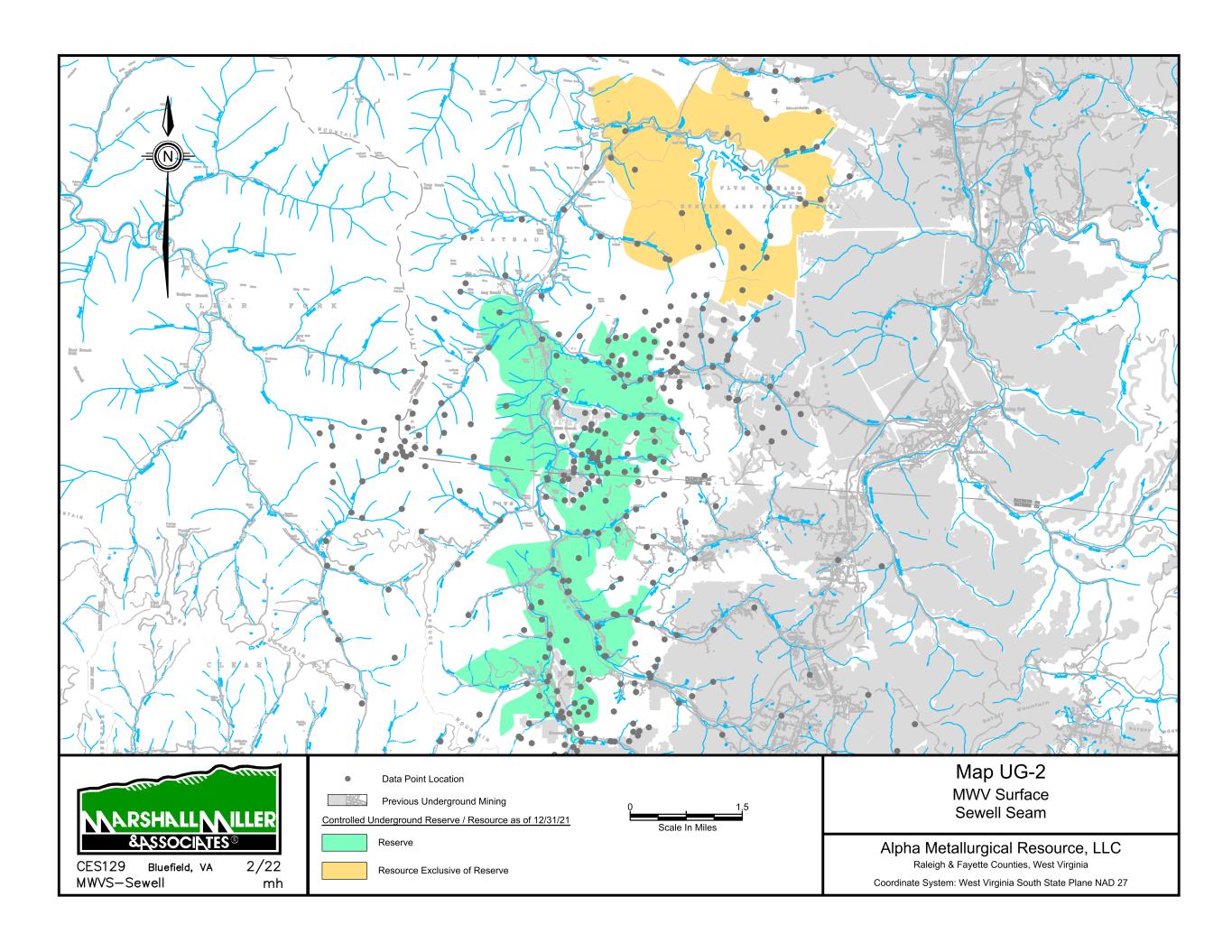

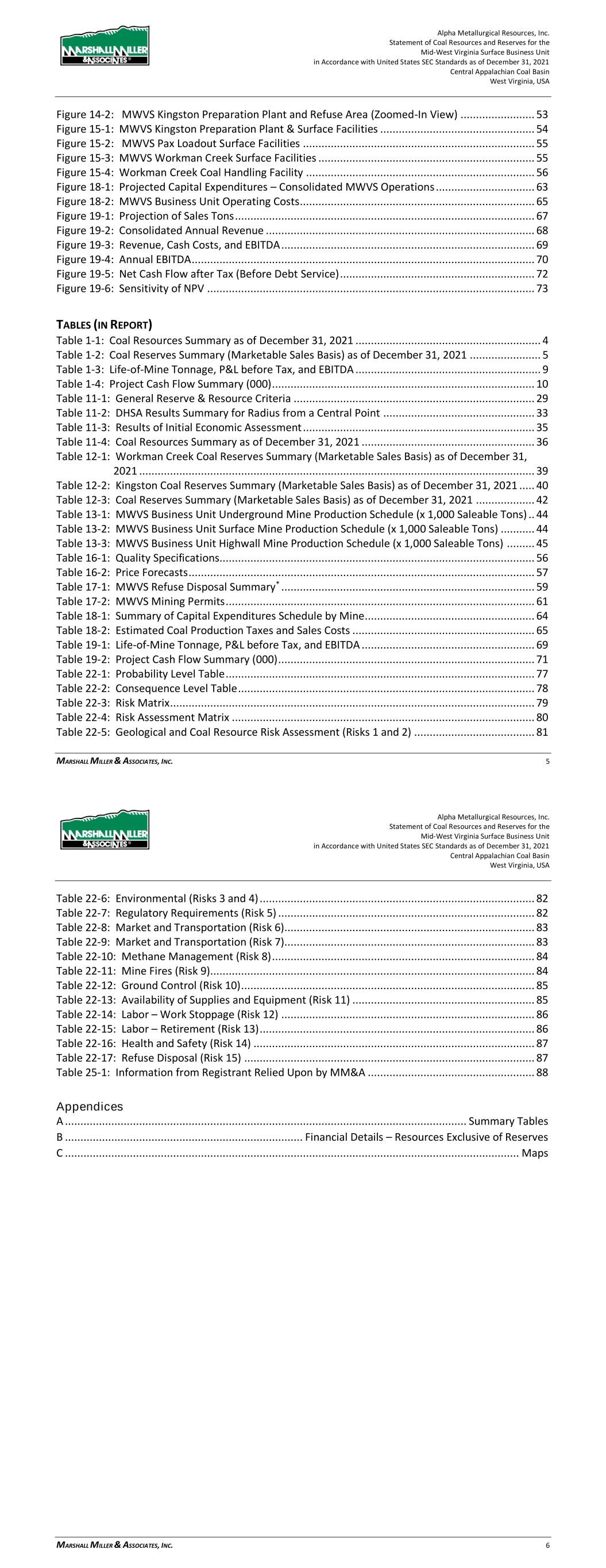

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 1 1 Executive Summary 1.1 Property Description Alpha Metallurgical Resources, Inc. (Alpha) authorized Marshall Miller & Associates, Inc. (MM&A) to prepare this Technical Report Summary (TRS) of its controlled coal reserves located at the Mid-West Virginia Surface Business Unit (MWVS or the Property) in Raleigh and Fayette counties, West Virginia. Coal resources and coal reserves are herein reported in imperial units of measurement. The MWVS Operations is comprised of the Kingston surface and underground operations and the Workman Creek surface mines that are part of Mid-West Virginia Underground Operations. Active surface facilities for the met operations include the Workman Creek surface facilities in Raleigh County West Virginia, located along Workman Creek, a tributary to Clear Fork along State Route 1. Workman Creek surface facility are 24 miles northwest of the Beckley, West Virginia, the county seat of Raleigh County; the Kingston surface facilities and preparation plant are near the community of Mossy, along Paint Creek in Fayette County. Kingston is located approximately 25 mile north of Beckley, West Virginia; The Pax loadout is located in the community of Pax, located along Interstate Highway 64/77 and has access to the CSX railroad line. The Pax Loadout is 20 miles north of Beckley, West Virginia (see Figure 1-1). The Property is composed of approximately 119,000 total acres of mineral control, of which nearly all are contained within 10 separate leases and 8 owned properties. The mentioned leases are all subject to Alpha renewing the rights to extend the term of all leases which have various expiration dates, some of which expire in the next several years but are anticipated to be renewed by Alpha. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 2 Figure 1-1: Alpha’s MWVS Business Unit Property Location Map 1.2 Ownership 1.3 Ownership The MWVS property involves a complex combination of previous ownership. Predecessors of Alpha, namely Alpha Natural Resources (Alpha), and Massey Energy (Massey) previously held mining rights on most of the Property. 1.4 Geology Coal seams with reserves of currently active operations at the MWVS Business Unit include the Upper, Middle and Lower Clarion; Stockton, Upper Coalburg, Coalburg, Lower Coalburg, Upper Winifrede Rider, Upper Winifrede, Winifrede, Lower Winifrede, Upper Chilton A, Middle Chilton A , Chilton A Upper Split, Chilton A Lower Split, Chilton A, Chilton Rider, Upper Chilton, Lower Chilton, Chilton, Upper Hernshaw, Lower Hernshaw, Upper Cedar Grove Upper Split, Upper Cedar Grove Lower Split, Middle Cedar Grove, Lower Cedar Grove Upper Split, Lower Cedar Grove, Peerless Upper Split, Peerless Lower

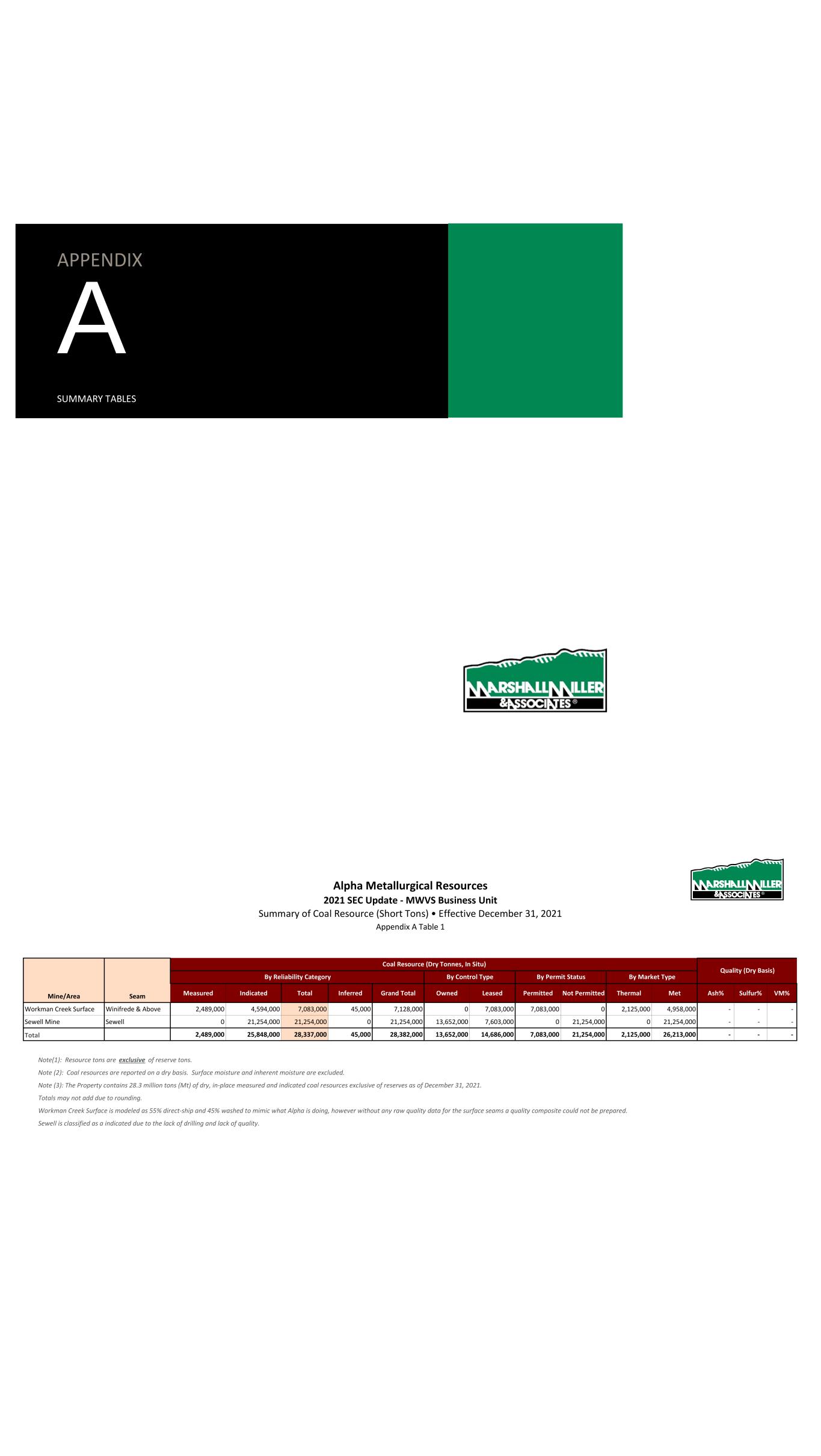

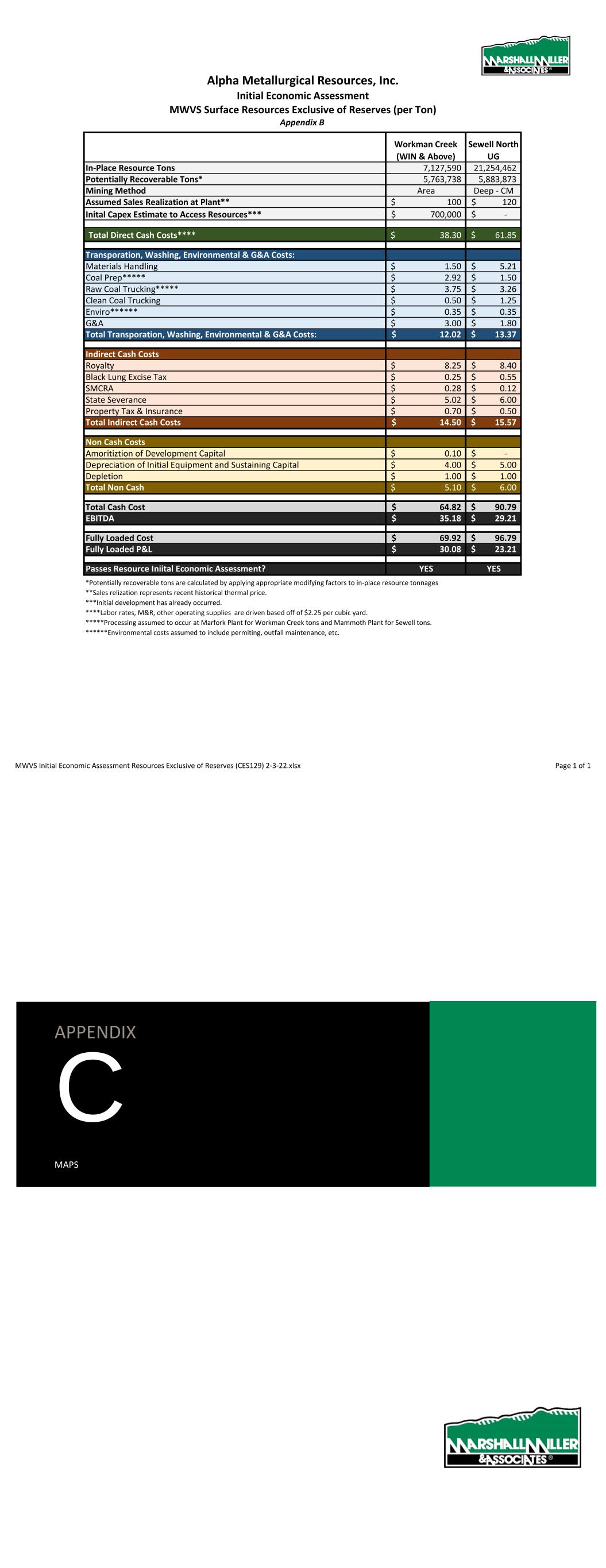

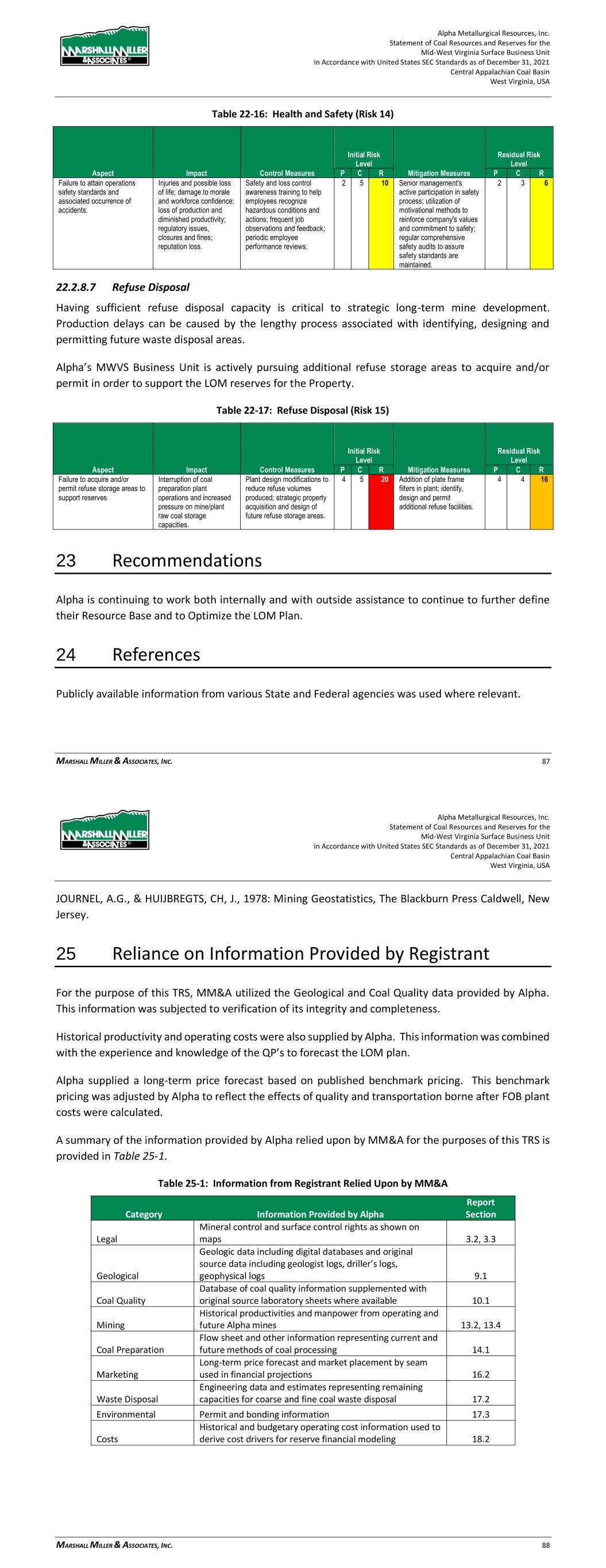

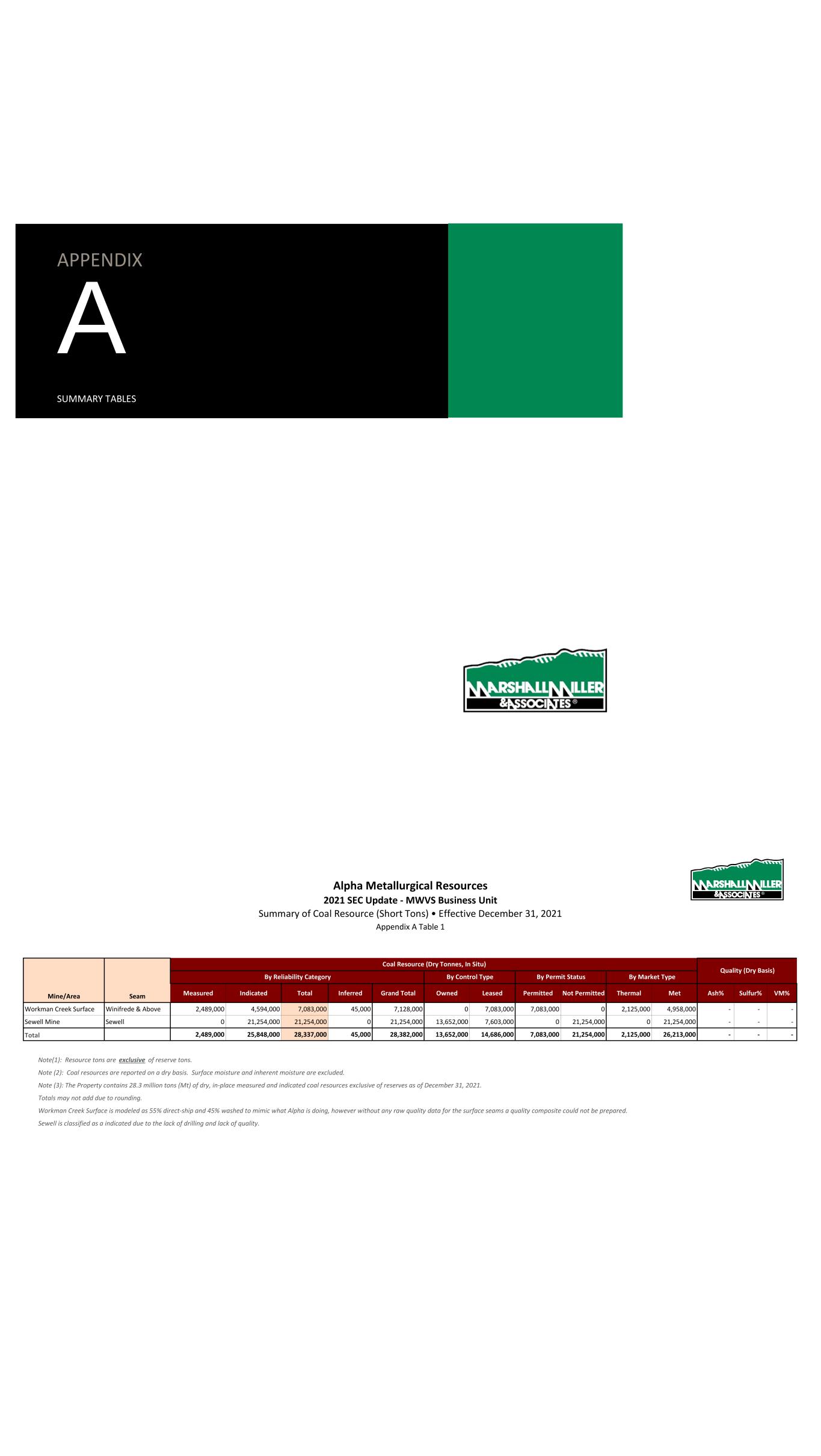

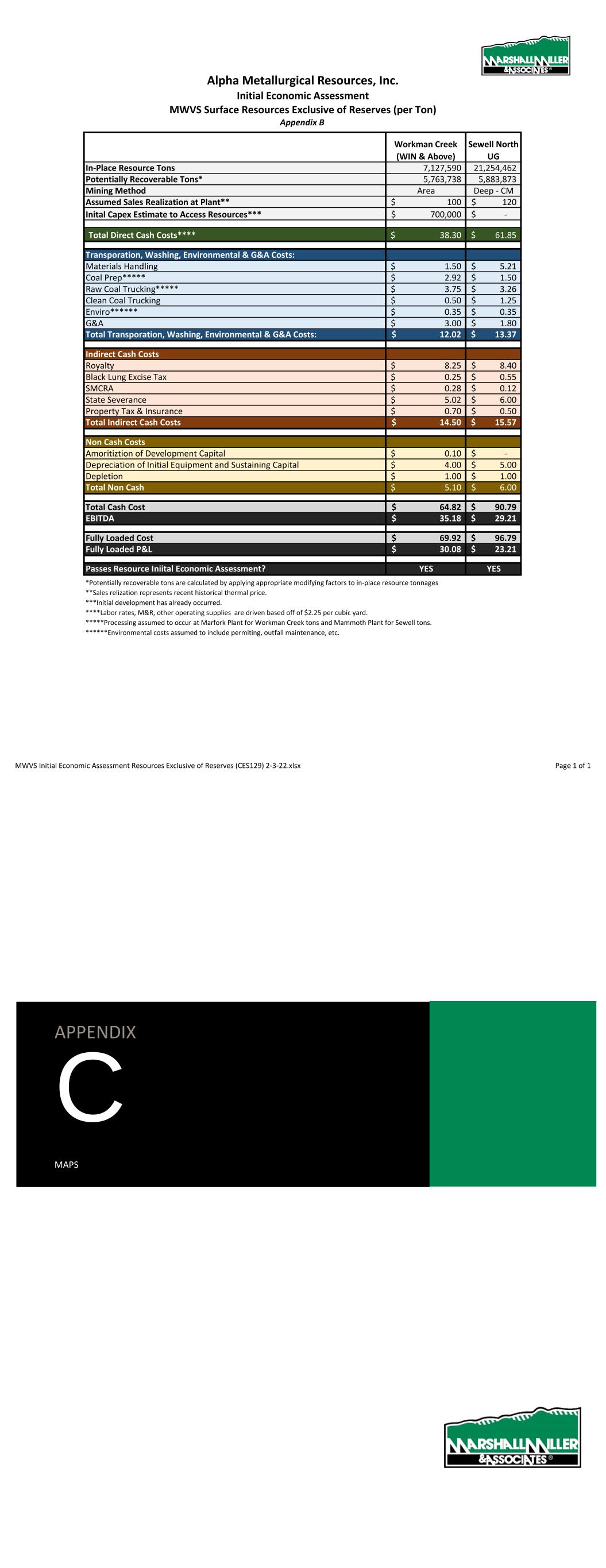

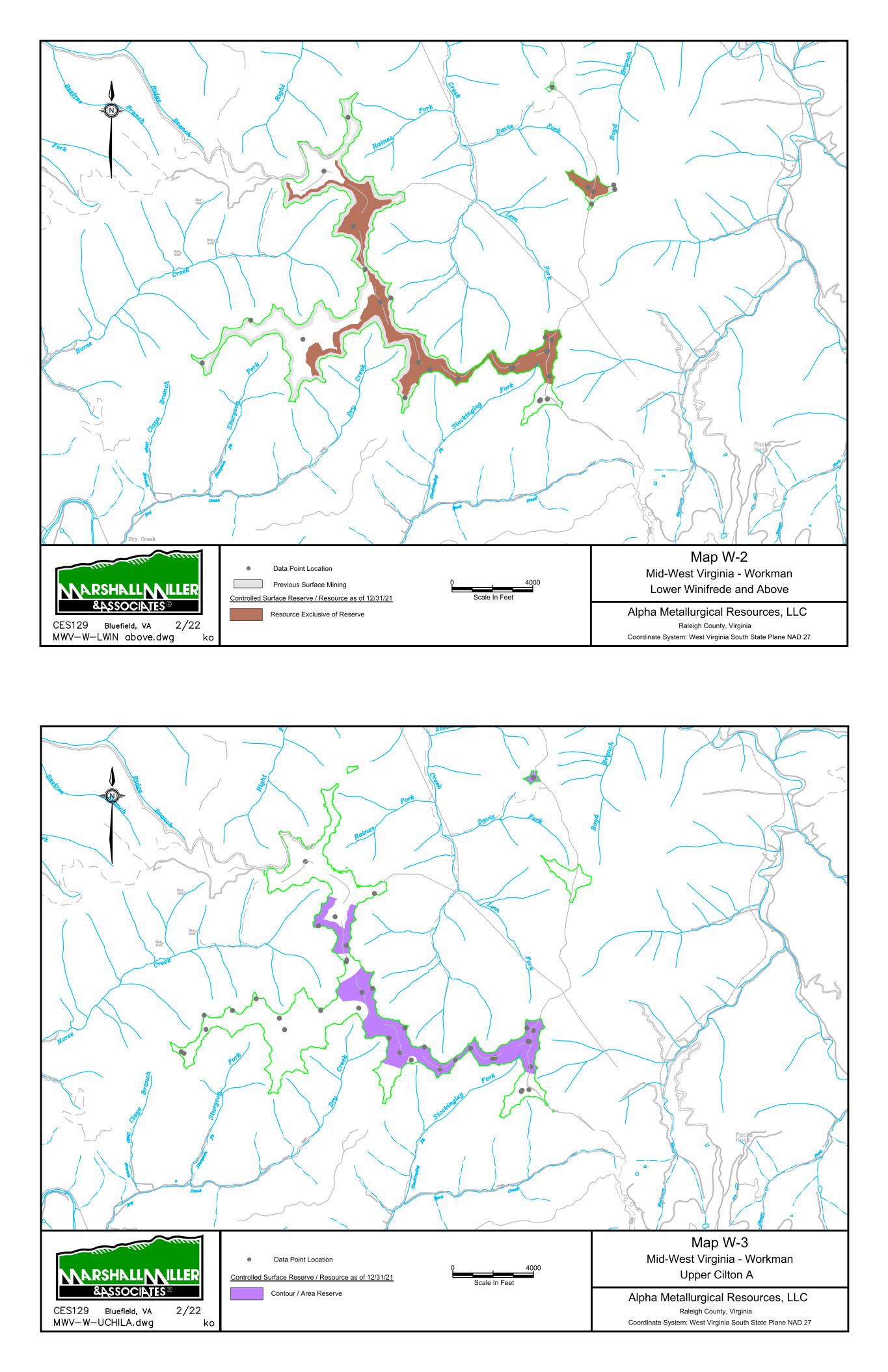

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 3 Split, Peerless C, Upper No. 2 Gas, Lower No. 2 Gas, Powellton, Lower Powellton, Powellton Lower Split, Powellton Lower Split Upper, Upper Eagle Rider 2, Powellton Lower Split Lower, Upper Eagle Rider, Upper Eagle, Eagle A, Eagle Upper Split, Eagle Lower Split, Eagle, Little Eagle, Little Eagle Lower Split, War Eagle, Glen Alum Tunnel Upper Split, Glen Alum Tunnel Douglas and Sewell seams. Coal seams below the Coalburg seam are all historically utilized as coking coal. Strata on the Property, among the active sites, are mostly of the Pennsylvanian-aged (approximately 290 to 330 million years ago) Kanawha Formation. The lower most Sewell coal seam is part of the New River Formation of the Pottsville Series. The rock formations between the coal seams are characterized by proportions of sandstone and shale units. In general, the coal seams reach the highest structural elevations along the southeastern margin of the Property, generally dipping toward the northwest. The area is generally stable with no major faulting and gentle dips. 1.5 Exploration Status The Property has been extensively explored, largely by drilling using continuous coring and rotary drilling methods but also by obtaining coal measurements at mine exposures, and by downhole geophysical methods. Most of the data was acquired or generated by previous owners of the Property. These sources comprise the primary data used in the evaluation of the coal resources and coal reserves on the Property. MM&A examined the data available for the evaluation and incorporated all pertinent information into this TRS. Where data appeared to be anomalous or not representative, that data was excluded from the digital databases and subsequent processing by MM&A. Ongoing exploration has been carried out by Alpha since acquiring the MWVS Business Unit. The Alpha acquired exploration data has been consistent with past drilling activities. 1.6 Operations and Development As of December 31, 2021, MWVS Business Unit is comprised of two surface operations, Kingston and Workman Creek. Active surface mine operations at Workman Creek, include the Long Ridge, Center Contour, Collins Fork and Middle Ridge permits. Active Surface mines and Kingston included the Kingston permit. The surface mines production is approximately 75% metallurgical coal product consisting of Mid-Vol, High-Vol A and Alt Met Coal product and 25% steam coal as a by-product from stripping. These surface mines are traditional contour strip mines that include supplemental highwall mining activity in major seams. MWVS underground mine operations were active at the Kingston 2 Mine, part of the Kingston unit. Kingston 2 produces Mid-Vol product from the Douglas coal seam. Based on the mine plans developed as part of this TRS, annual deep mine production peaks at 1.7 million tons in 2032. Underground reserves will be depleted in 2035. Annual surface production peaks at 3.4 million tons in 2023 and highwall mine production peaks at 0.6 million tons in 2024. Surface and highwall reserves are both depleted in 2042. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 4 In addition to the mines, the MWVS Business Unit includes the Kingston Preparation Plant and the Pax loadout facilities. The Kingston Preparation Plant has a design feed rate capacity of 700 raw tons per hour. Primary separation equipment includes heavy media vessels, heavy media cyclones, spirals, and flotation cells, supported by the requisite screens, centrifuges, sumps, pumps, and distribution systems. Coarse and fine refuse are disposed in an adjacent combined fill refuse area and impoundment. Coal Production is also conveyed from Workman Creek, through underground mine works to the Marfork preparation for processing and shipment on the CSX railway. Coal production can be trucked to Mammoth Preparation plant for processing and shipping on the Kanawha River. Shortline railroad connections to the CSX and Norfolk Southern railroads as well as on-site barge loading on the Kanawha River are also available. 1.7 Mineral Resource A coal resource estimate, summarized in Table 1-1 was prepared as of December 31, 2021, for property controlled by Alpha. Table 1-1: Coal Resources Summary as of December 31, 2021 Coal Resource (Dry Tons, In Situ) Area or Seam Measured Indicated Inferred Total Inclusive of Reserve Workman Creek Surface 28,864,000 965,000 118,000 29,947,000 Workman Creek HWM 10,445,000 178,000 0 10,623,000 Kingston Surface 20,273,000 4,386,000 1,051,000 25,710,000 Kingston HWM 7,011,000 262,000 0 7,273,000 Sewell (UG) 33,662,000 6,908,000 0 40,569,000 Douglas (UG) 2,460,000 1,108,000 0 3,568,000 Total 102,715,000 13,807,000 1,169,000 117,690,000 Exclusive of Reserve Workman Creek Surface 2,489,000 4,594,000 45,000 7,128,000 Workman Creek HWM 0 0 0 0 Kingston Surface 0 0 0 0 Kingston HWM 0 0 0 0 Sewell (UG) 0 21,254,000 0 21,254,000 Douglas (UG) 0 0 0 0 Total 2,489,000 25,848,000 45,000 28,382,000 Grand Total Total 105,204,000 39,655,000 1,214,000 146,073,000 Note(1): Resource tons are inclusive of reserve tons since they include the in-situ tons from which recoverable coal reserves are derived. Note (2): Coal resources are reported on a dry basis. Surface moisture and inherent moisture are excluded. Note (3): The Property contains 28.3 million tons (Mt) of dry, in-place measured and indicated coal resources exclusive of reserves as of December 31, 2021. Totals may not add due to rounding. See Appendix A for detailed breakdown.

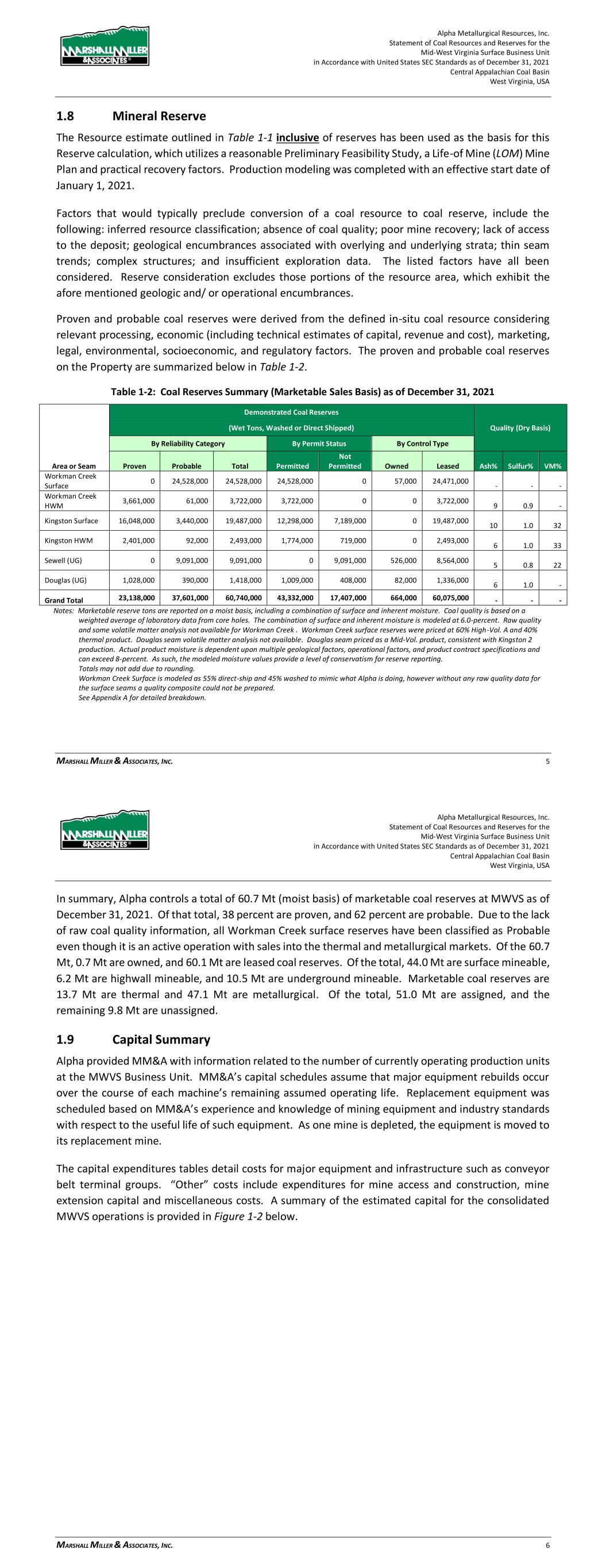

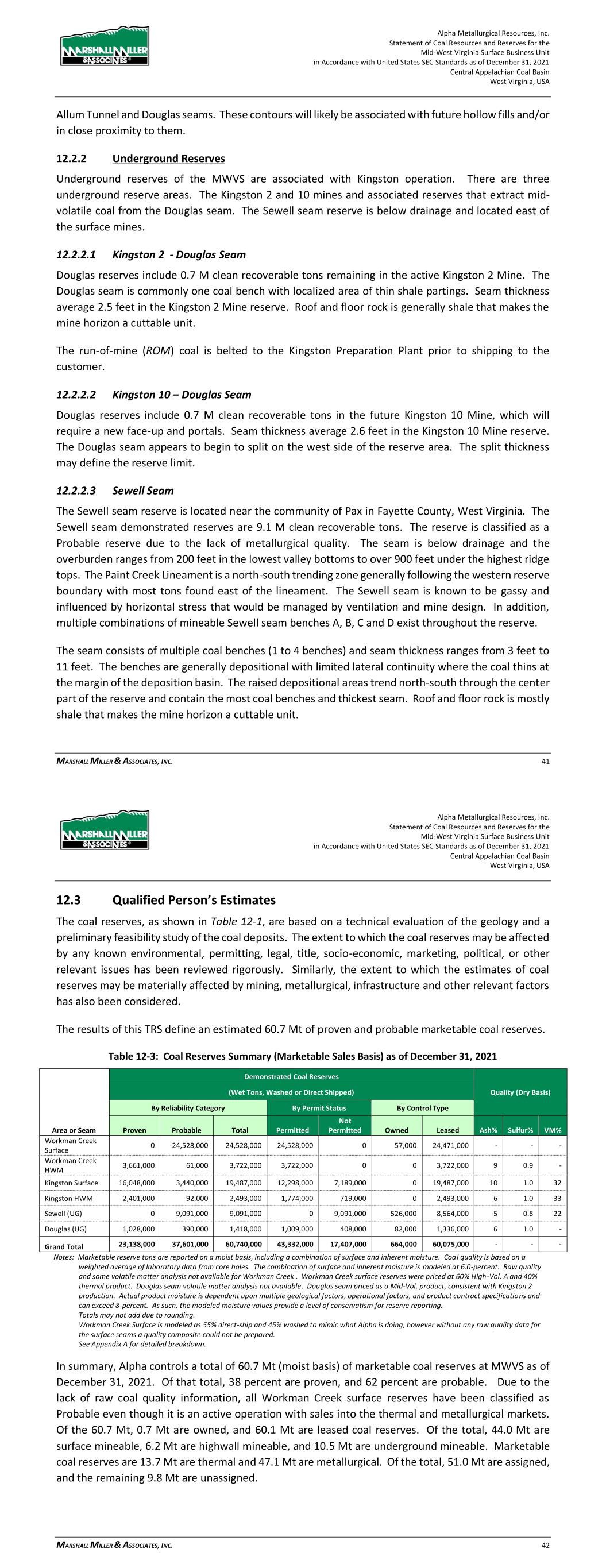

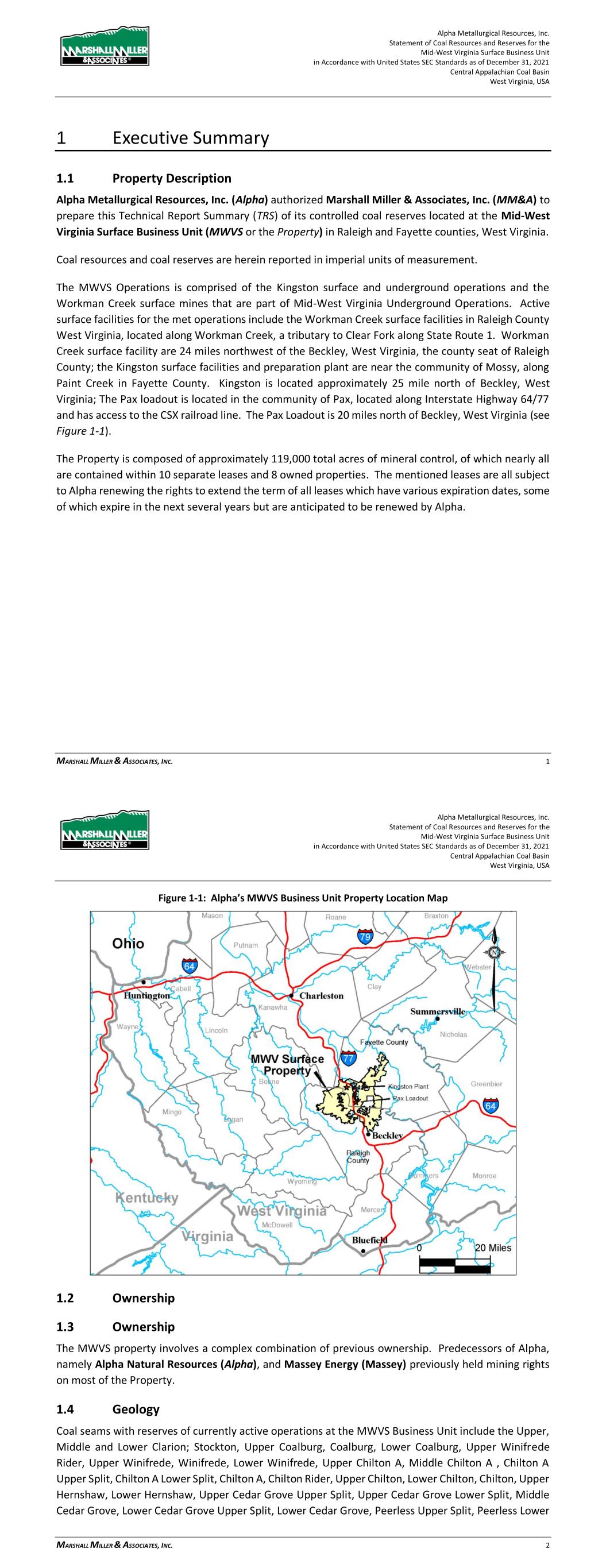

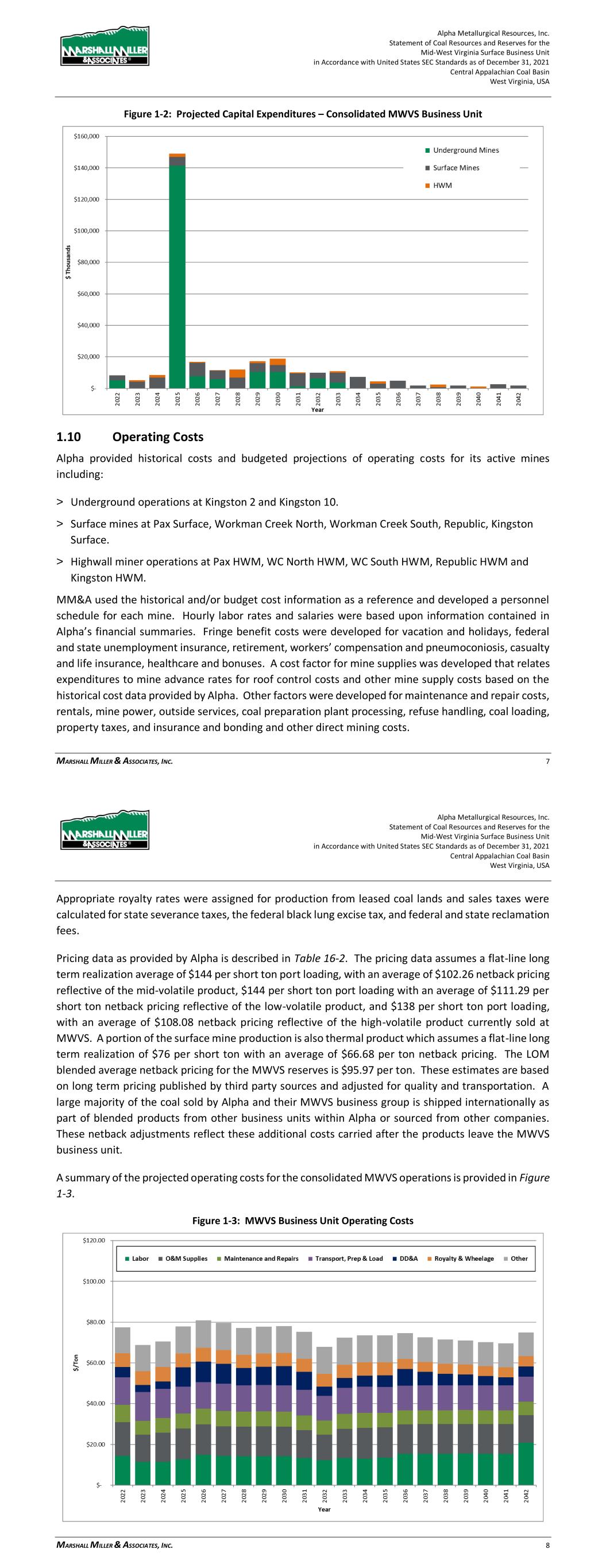

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 5 1.8 Mineral Reserve The Resource estimate outlined in Table 1-1 inclusive of reserves has been used as the basis for this Reserve calculation, which utilizes a reasonable Preliminary Feasibility Study, a Life-of Mine (LOM) Mine Plan and practical recovery factors. Production modeling was completed with an effective start date of January 1, 2021. Factors that would typically preclude conversion of a coal resource to coal reserve, include the following: inferred resource classification; absence of coal quality; poor mine recovery; lack of access to the deposit; geological encumbrances associated with overlying and underlying strata; thin seam trends; complex structures; and insufficient exploration data. The listed factors have all been considered. Reserve consideration excludes those portions of the resource area, which exhibit the afore mentioned geologic and/ or operational encumbrances. Proven and probable coal reserves were derived from the defined in-situ coal resource considering relevant processing, economic (including technical estimates of capital, revenue and cost), marketing, legal, environmental, socioeconomic, and regulatory factors. The proven and probable coal reserves on the Property are summarized below in Table 1-2. Table 1-2: Coal Reserves Summary (Marketable Sales Basis) as of December 31, 2021 Demonstrated Coal Reserves Quality (Dry Basis) (Wet Tons, Washed or Direct Shipped) By Reliability Category By Permit Status By Control Type Area or Seam Proven Probable Total Permitted Not Permitted Owned Leased Ash% Sulfur% VM% Workman Creek Surface 0 24,528,000 24,528,000 24,528,000 0 57,000 24,471,000 - - - Workman Creek HWM 3,661,000 61,000 3,722,000 3,722,000 0 0 3,722,000 9 0.9 - Kingston Surface 16,048,000 3,440,000 19,487,000 12,298,000 7,189,000 0 19,487,000 10 1.0 32 Kingston HWM 2,401,000 92,000 2,493,000 1,774,000 719,000 0 2,493,000 6 1.0 33 Sewell (UG) 0 9,091,000 9,091,000 0 9,091,000 526,000 8,564,000 5 0.8 22 Douglas (UG) 1,028,000 390,000 1,418,000 1,009,000 408,000 82,000 1,336,000 6 1.0 - Grand Total 23,138,000 37,601,000 60,740,000 43,332,000 17,407,000 664,000 60,075,000 - - - Notes: Marketable reserve tons are reported on a moist basis, including a combination of surface and inherent moisture. Coal quality is based on a weighted average of laboratory data from core holes. The combination of surface and inherent moisture is modeled at 6.0-percent. Raw quality and some volatile matter analysis not available for Workman Creek . Workman Creek surface reserves were priced at 60% High-Vol. A and 40% thermal product. Douglas seam volatile matter analysis not available. Douglas seam priced as a Mid-Vol. product, consistent with Kingston 2 production. Actual product moisture is dependent upon multiple geological factors, operational factors, and product contract specifications and can exceed 8-percent. As such, the modeled moisture values provide a level of conservatism for reserve reporting. Totals may not add due to rounding. Workman Creek Surface is modeled as 55% direct-ship and 45% washed to mimic what Alpha is doing, however without any raw quality data for the surface seams a quality composite could not be prepared. See Appendix A for detailed breakdown. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 6 In summary, Alpha controls a total of 60.7 Mt (moist basis) of marketable coal reserves at MWVS as of December 31, 2021. Of that total, 38 percent are proven, and 62 percent are probable. Due to the lack of raw coal quality information, all Workman Creek surface reserves have been classified as Probable even though it is an active operation with sales into the thermal and metallurgical markets. Of the 60.7 Mt, 0.7 Mt are owned, and 60.1 Mt are leased coal reserves. Of the total, 44.0 Mt are surface mineable, 6.2 Mt are highwall mineable, and 10.5 Mt are underground mineable. Marketable coal reserves are 13.7 Mt are thermal and 47.1 Mt are metallurgical. Of the total, 51.0 Mt are assigned, and the remaining 9.8 Mt are unassigned. 1.9 Capital Summary Alpha provided MM&A with information related to the number of currently operating production units at the MWVS Business Unit. MM&A’s capital schedules assume that major equipment rebuilds occur over the course of each machine’s remaining assumed operating life. Replacement equipment was scheduled based on MM&A’s experience and knowledge of mining equipment and industry standards with respect to the useful life of such equipment. As one mine is depleted, the equipment is moved to its replacement mine. The capital expenditures tables detail costs for major equipment and infrastructure such as conveyor belt terminal groups. “Other” costs include expenditures for mine access and construction, mine extension capital and miscellaneous costs. A summary of the estimated capital for the consolidated MWVS operations is provided in Figure 1-2 below.

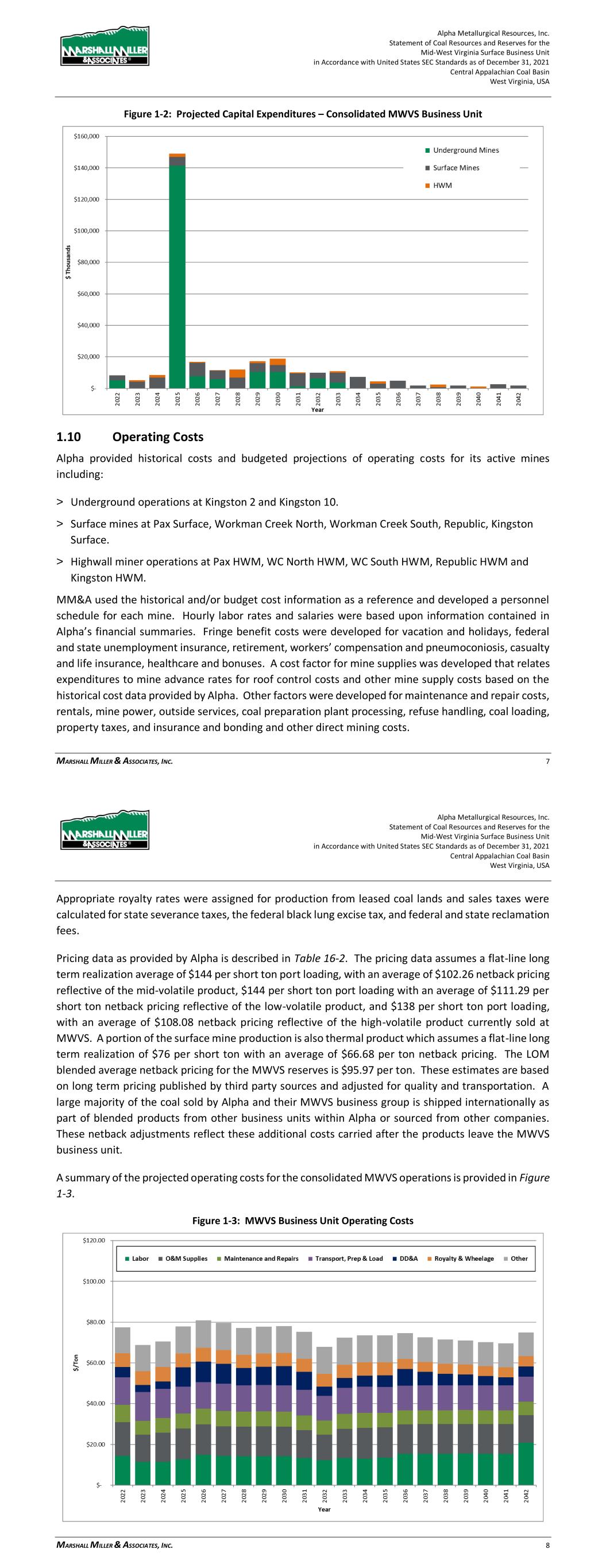

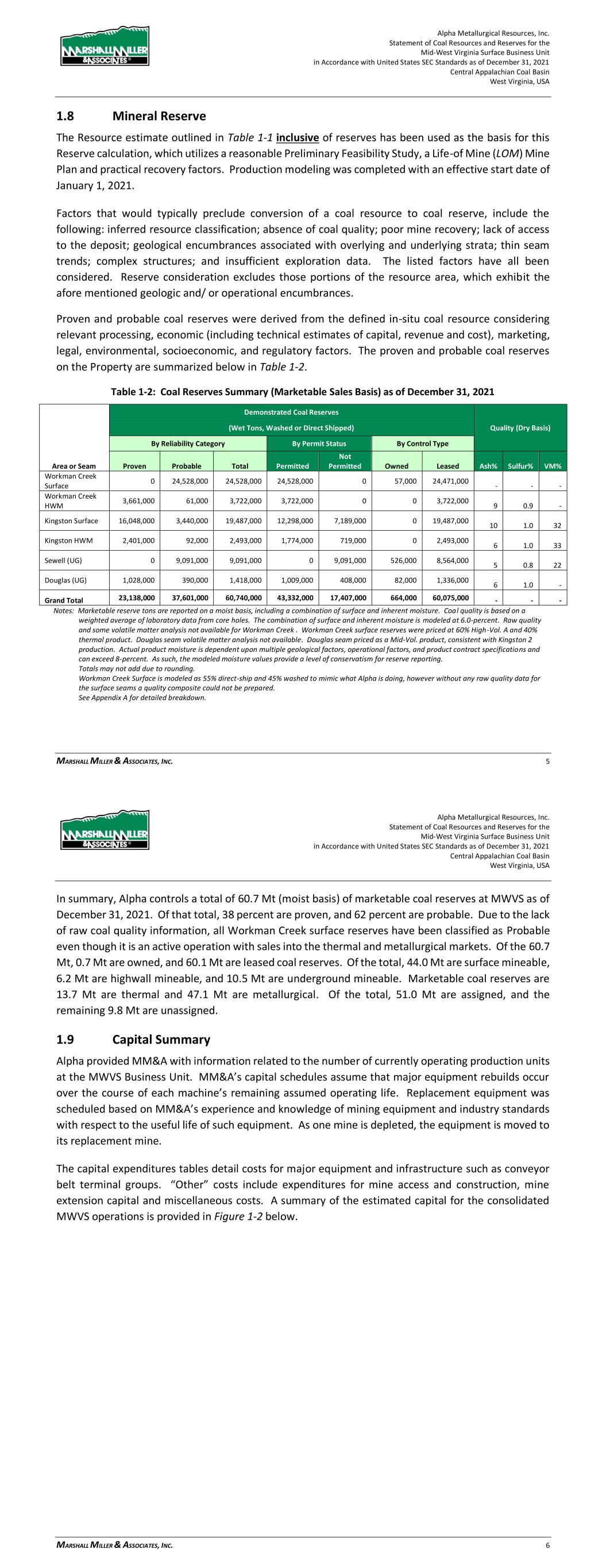

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 7 Figure 1-2: Projected Capital Expenditures – Consolidated MWVS Business Unit 1.10 Operating Costs Alpha provided historical costs and budgeted projections of operating costs for its active mines including: > Underground operations at Kingston 2 and Kingston 10. > Surface mines at Pax Surface, Workman Creek North, Workman Creek South, Republic, Kingston Surface. > Highwall miner operations at Pax HWM, WC North HWM, WC South HWM, Republic HWM and Kingston HWM. MM&A used the historical and/or budget cost information as a reference and developed a personnel schedule for each mine. Hourly labor rates and salaries were based upon information contained in Alpha’s financial summaries. Fringe benefit costs were developed for vacation and holidays, federal and state unemployment insurance, retirement, workers’ compensation and pneumoconiosis, casualty and life insurance, healthcare and bonuses. A cost factor for mine supplies was developed that relates expenditures to mine advance rates for roof control costs and other mine supply costs based on the historical cost data provided by Alpha. Other factors were developed for maintenance and repair costs, rentals, mine power, outside services, coal preparation plant processing, refuse handling, coal loading, property taxes, and insurance and bonding and other direct mining costs. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 8 Appropriate royalty rates were assigned for production from leased coal lands and sales taxes were calculated for state severance taxes, the federal black lung excise tax, and federal and state reclamation fees. Pricing data as provided by Alpha is described in Table 16-2. The pricing data assumes a flat-line long term realization average of $144 per short ton port loading, with an average of $102.26 netback pricing reflective of the mid-volatile product, $144 per short ton port loading with an average of $111.29 per short ton netback pricing reflective of the low-volatile product, and $138 per short ton port loading, with an average of $108.08 netback pricing reflective of the high-volatile product currently sold at MWVS. A portion of the surface mine production is also thermal product which assumes a flat-line long term realization of $76 per short ton with an average of $66.68 per ton netback pricing. The LOM blended average netback pricing for the MWVS reserves is $95.97 per ton. These estimates are based on long term pricing published by third party sources and adjusted for quality and transportation. A large majority of the coal sold by Alpha and their MWVS business group is shipped internationally as part of blended products from other business units within Alpha or sourced from other companies. These netback adjustments reflect these additional costs carried after the products leave the MWVS business unit. A summary of the projected operating costs for the consolidated MWVS operations is provided in Figure 1-3. Figure 1-3: MWVS Business Unit Operating Costs

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 9 1.11 Economic Evaluation The pre-feasibility financial model prepared for this TRS was developed to test the economic viability of each coal resource area. The results of this financial model are not intended to represent a bankable feasibility study, required for financing of any current or future mining operations contemplated for the Alpha properties, but are intended to establish the economic viability of the estimated coal reserves. Cash flows are simulated on an annual basis based on projected production from the coal reserves. The discounted cash flow analysis presented herein is based on an effective date of January 1, 2022. On an un-levered basis, the NPV of the project cash flow after taxes represents the Enterprise Value of the project. The project cash flow, excluding debt service, is calculated by subtracting direct and indirect operating expenses and capital expenditures from revenue. Direct costs include labor, operating supplies, maintenance and repairs, facilities cost for materials handling, coal preparation, refuse disposal, coal loading, reclamation, and general and administrative costs. Indirect costs include statutory and legally agreed upon fees related to direct extraction of the mineral. The indirect costs are the Federal black lung tax, Federal and State reclamation taxes, property taxes, coal production royalties, and income taxes. The Alpha mines’ historical costs provided a useful reference for MM&A’s cost estimates. Table 1-3 shows LOM tonnage, P&L, and EBITDA for each Alpha mine at MWVS. Table 1-3: Life-of-Mine Tonnage, P&L before Tax, and EBITDA LOM Tonnage1 LOM Pre-Tax P&L P&L Per Ton LOM EBITDA EBITDA Per Ton Underground Mines Kingston Mine #10 (Douglas) 697 $298 $0.43 $5,020 $7.21 Sewell 9,091 $45,070 $4.96 $264,345 $29.08 Kingston #2 (Douglas) 835 $12,518 $14.99 $16,560 $19.83 Consolidated Deep Mines 10,622 $57,886 $5.45 $285,925 $26.92 Surface Mines Workman 30,828 $581,850 $18.87 $703,133 $22.81 Kingston 19,644 $444,329 $22.62 $534,053 $27.19 Consolidated Surface Mines 50,472 $1,026,179 $20.33 $1,237,186 $24.51 HWM Operations Workman HWM 3,792 $215,908 $56.94 $234,873 $61.94 Kingston HWM 2,544 $131,771 $51.81 $144,563 $56.84 Consolidated HWMs 6,336 $347,680 $54.88 $379,436 $59.89 Grand Total 67,429 $1,431,745 $21.23 $1,902,547 $28.22 Note: 1) LOM tonnage evaluated in the financial model includes October 2021 through December 2021 production (913,003 clean tons) which was subtracted from coal reserves in order to make the effective date of the reserves December 31, 2021. In addition, the financial model includes 5.8 Mt clean tons of resources. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 10 As shown in Table 1-3, all of the mines analyzed show positive EBITDA over the LOM. Overall, the Alpha consolidated MWVS operations show positive LOM P&L and EBITDA of $1.4 billion and $1.9 billion, respectively. Alpha’s consolidated MWVS cash flow summary in constant dollars, excluding debt service, is shown in Table 1-4 below. Table 1-4: Project Cash Flow Summary (000) YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 Total 2021 2022 2023 2024 2025 2026 Production & Sales tons1 67,429 806 3,306 4,142 3,650 3,725 3,698 Total Revenue $6,471,321 $76,916 $315,487 $390,938 $349,204 $354,737 $354,585 EBITDA $1,902,547 $17,706 $75,845 $120,622 $104,818 $99,557 $92,318 Net Income $1,146,410 $989 $49,167 $85,262 $74,715 $46,469 $43,561 Net Cash Provided by Operating Activities $1,617,212 $14,075 $53,790 $93,210 $90,104 $84,150 $83,298 Purchases of Property, Plant, and Equipment ($312,247) ($7,020) ($8,195) ($5,270) ($8,370) ($148,942) ($16,688) Net Cash Flow $1,304,965 $7,055 $45,595 $87,940 $81,734 ($64,793) $66,610 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 2027 2028 2029 2030 2031 2032 2033 Production & Sales tons 3,915 4,580 4,553 4,581 4,880 5,334 4,497 Total Revenue $376,067 $440,318 $437,420 $440,275 $470,853 $517,175 $431,768 EBITDA $102,276 $125,806 $123,862 $125,485 $147,134 $179,469 $128,665 Net Income $53,290 $70,267 $65,830 $65,272 $81,751 $125,882 $83,944 Net Cash Provided by Operating Activities $91,678 $106,436 $109,408 $110,284 $123,849 $146,922 $118,462 Purchases of Property, Plant, and Equipment ($11,577) ($11,940) ($17,120) ($18,872) ($9,992) ($9,769) ($10,870) Net Cash Flow $80,101 $94,496 $92,288 $91,412 $113,857 $137,153 $107,592 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 2034 2035 2036 2037 2038 2039 2040 Production & Sales tons 3,960 3,405 1,270 1,265 1,265 1,261 1,265 Total Revenue $376,920 $323,799 $123,139 $122,710 $122,710 $122,282 $122,710 EBITDA $107,002 $92,743 $38,778 $39,324 $39,566 $39,492 $39,747 Net Income $67,840 $57,867 $26,428 $26,520 $26,717 $26,407 $27,294 Net Cash Provided by Operating Activities $96,106 $83,327 $33,645 $30,267 $31,840 $32,496 $32,323 Purchases of Property, Plant, and Equipment ($7,130) ($4,450) ($4,780) ($1,800) ($2,290) ($1,800) ($1,070) Net Cash Flow $88,976 $78,877 $28,865 $28,467 $29,550 $30,696 $31,253 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 YE 12/31 2041 2042 2043 2044 2045 2046 2047 Production & Sales tons 1,265 804 0 0 0 0 0 Total Revenue $122,710 $78,599 $0 $0 $0 $0 $0 EBITDA $39,811 $22,521 $0 $0 $0 $0 $0 Net Income $27,380 $14,531 ($557) ($221) ($111) ($56) ($29) Net Cash Provided by Operating Activities $33,109 $27,755 ($5,622) ($1,839) ($919) ($459) ($486) Purchases of Property, Plant, and Equipment ($2,500) ($1,800) $0 $0 $0 $0 $0 Net Cash Flow $30,609 $25,955 ($5,622) ($1,839) ($919) ($459) ($486) Note: 1) LOM tonnage evaluated in the financial model includes October 2021 through December 2021 production (913,003 clean tons) which was subtracted from coal reserves in order to make the effective date of the reserves December 31, 2021. In addition, the financial model includes 5.8 Mt clean tons of resources. Consolidated cash flows are driven by annual sales tonnage, which grows from 3.3 million tons in 2022 to a peak of 5.3 million tons in 2032. Between years 2033 and 2035, sales ranges from 3.4 million to

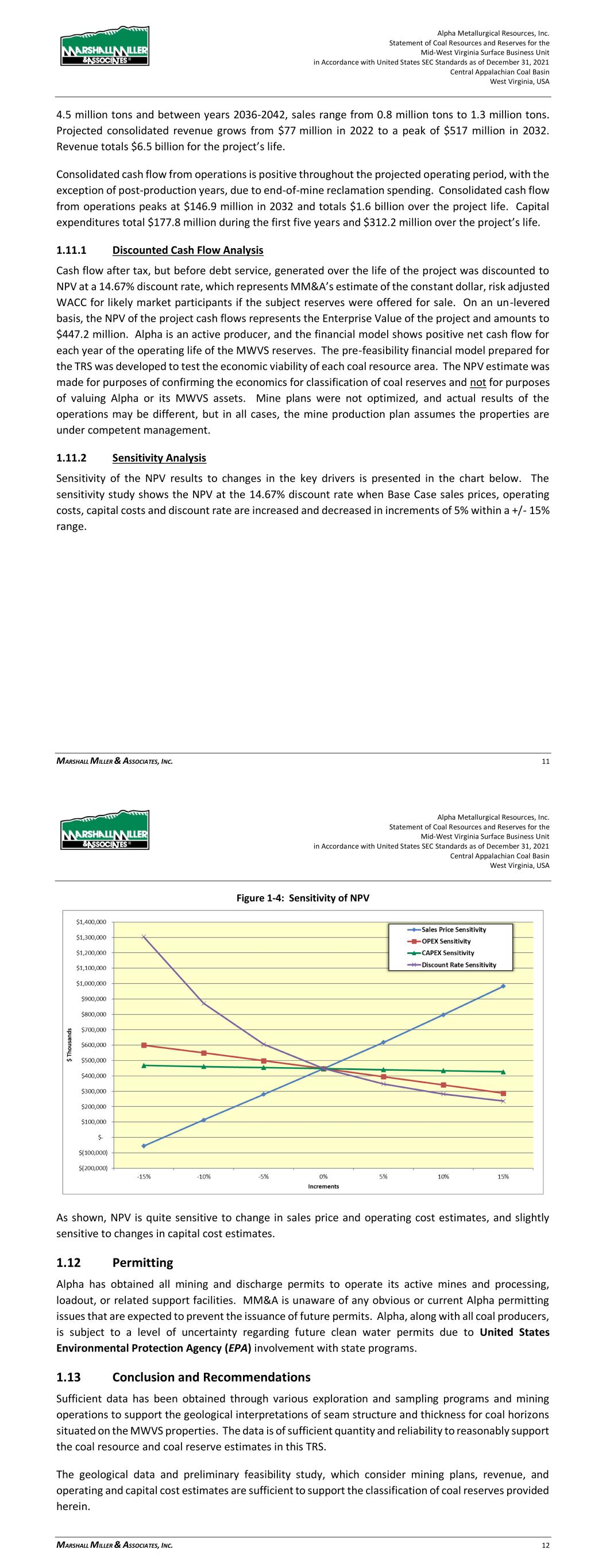

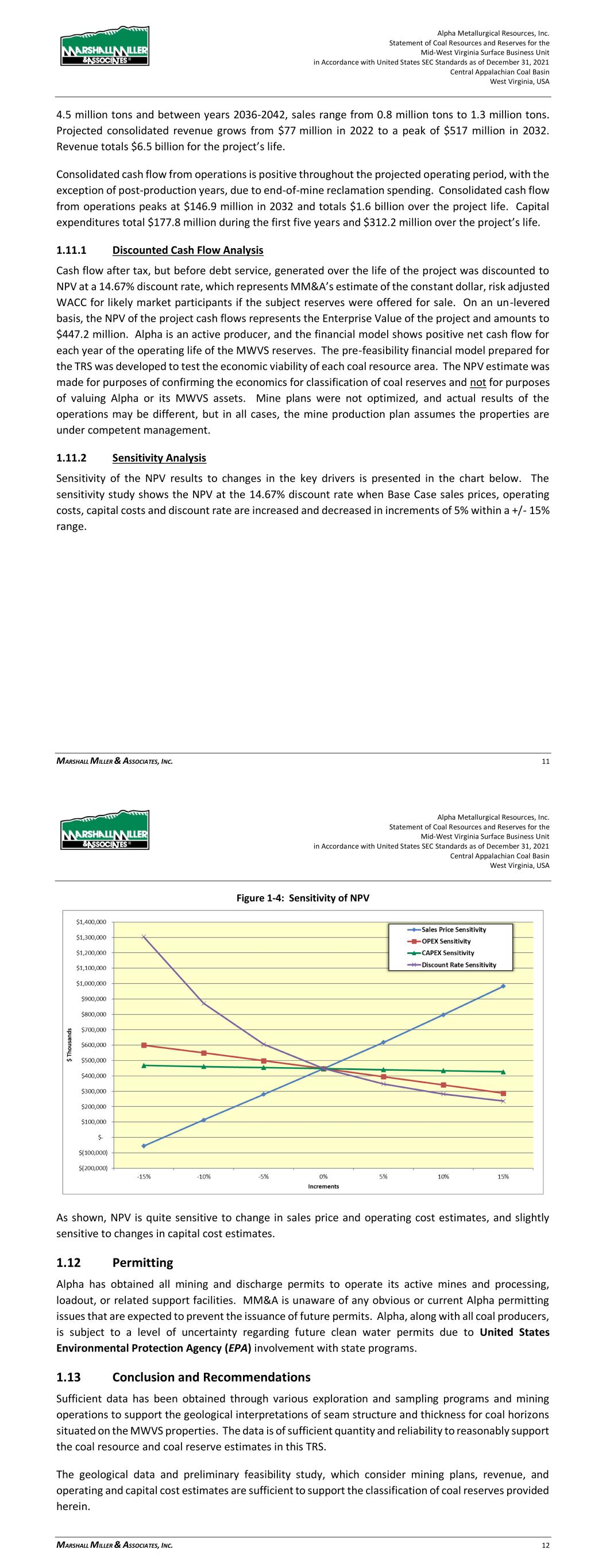

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 11 4.5 million tons and between years 2036-2042, sales range from 0.8 million tons to 1.3 million tons. Projected consolidated revenue grows from $77 million in 2022 to a peak of $517 million in 2032. Revenue totals $6.5 billion for the project’s life. Consolidated cash flow from operations is positive throughout the projected operating period, with the exception of post-production years, due to end-of-mine reclamation spending. Consolidated cash flow from operations peaks at $146.9 million in 2032 and totals $1.6 billion over the project life. Capital expenditures total $177.8 million during the first five years and $312.2 million over the project’s life. 1.11.1 Discounted Cash Flow Analysis Cash flow after tax, but before debt service, generated over the life of the project was discounted to NPV at a 14.67% discount rate, which represents MM&A’s estimate of the constant dollar, risk adjusted WACC for likely market participants if the subject reserves were offered for sale. On an un-levered basis, the NPV of the project cash flows represents the Enterprise Value of the project and amounts to $447.2 million. Alpha is an active producer, and the financial model shows positive net cash flow for each year of the operating life of the MWVS reserves. The pre-feasibility financial model prepared for the TRS was developed to test the economic viability of each coal resource area. The NPV estimate was made for purposes of confirming the economics for classification of coal reserves and not for purposes of valuing Alpha or its MWVS assets. Mine plans were not optimized, and actual results of the operations may be different, but in all cases, the mine production plan assumes the properties are under competent management. 1.11.2 Sensitivity Analysis Sensitivity of the NPV results to changes in the key drivers is presented in the chart below. The sensitivity study shows the NPV at the 14.67% discount rate when Base Case sales prices, operating costs, capital costs and discount rate are increased and decreased in increments of 5% within a +/- 15% range. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 12 Figure 1-4: Sensitivity of NPV As shown, NPV is quite sensitive to change in sales price and operating cost estimates, and slightly sensitive to changes in capital cost estimates. 1.12 Permitting Alpha has obtained all mining and discharge permits to operate its active mines and processing, loadout, or related support facilities. MM&A is unaware of any obvious or current Alpha permitting issues that are expected to prevent the issuance of future permits. Alpha, along with all coal producers, is subject to a level of uncertainty regarding future clean water permits due to United States Environmental Protection Agency (EPA) involvement with state programs. 1.13 Conclusion and Recommendations Sufficient data has been obtained through various exploration and sampling programs and mining operations to support the geological interpretations of seam structure and thickness for coal horizons situated on the MWVS properties. The data is of sufficient quantity and reliability to reasonably support the coal resource and coal reserve estimates in this TRS. The geological data and preliminary feasibility study, which consider mining plans, revenue, and operating and capital cost estimates are sufficient to support the classification of coal reserves provided herein.

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 13 This geologic evaluation conducted in conjunction with the preliminary feasibility study concludes that the 60.7 Mt of marketable underground and surface coal reserves identified on the Property are economically mineable under reasonable expectations of market prices for metallurgical coal products, estimated operation costs, and capital expenditures. 2 Introduction 2.1 Registrant and Terms of Reference This report was prepared for the sole use of Alpha Metallurgical Resources, Inc. (Alpha) and its affiliated and subsidiary companies and advisors. The report provides a statement of coal reserves for Alpha located at the Mid-West Virginia Surface Business Unit (MWVS) in Raleigh and Fayette Counties, West Virginia. Exploration results and Resource calculations were used as the basis for the mine planning and the preliminary feasibility study completed to determine the extent and viability of the reserve. Coal resources and coal reserves are herein reported in imperial units of measurement. 2.2 Information Sources The technical report is based on information provided by Alpha and reviewed by MM&A’s professionals, including geologists, mining engineers, civil engineers, and environmental scientists. MM&A’s professionals hold professional registrations and memberships which qualify them as Qualified Persons in accordance with SEC guidelines. Alpha engaged MM&A to conduct a coal reserve evaluation of the Alpha coal properties as of December 31, 2021. For the evaluation, the following tasks were to be completed: > Conduct site visits of the mines and mine infrastructure facilities. > Process the information supporting the estimation of coal resources and reserves into geological models. > Develop life-of-reserve mine (LOM) plans and financial models. > Hold discussions with Alpha company management; and > Prepare and issue a Technical Report Summary providing a statement of coal reserves which would include: - A description of the mines and facilities. - A description of the evaluation process. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 14 - An estimation of coal reserves with compliance elements as stated under the new SEC Guidelines which will become effective for the first fiscal year commencing on or after January 1, 2022. 2.3 Personal Inspections MM&A is very familiar with the MWVS properties, having provided a variety of services in recent years and QP’s involved in this TRS have conducted multiple site visits most recently November 2021. 3 Property Description 3.1 Location The MWV Surface Business Unit is in the Central Appalachian Basin in West Virginia (see Figure 1-1) north of Beckley, West Virginia, and south of Charleston, West Virginia. The Business Unit includes Workman Creek with six surface permits, Kingston with two issued and one pending surface permits and one deep mine located is in Raleigh and Fayette Counties. Surface facilities for the Workman Creek operation are located on Workman Creek, a tributary to Clear Fork along State Route 1 in Raleigh County. Kingston surface facilities are near the community of Mossy , along Paint Creek in Fayette County. The Pax loadout is located in the community of Pax, located along Interstate Highway 64/77 These facilities are all approximately 20 to 27 miles north of Beckley, WV, the county seat of Raleigh County. Numerous small communities are present throughout the Property. The nearest major population centers are Charleston, West Virginia (45 miles north), Bristol, Virginia (160 miles south), Roanoke, Virginia (140 miles east), and Morgantown, West Virginia (170 miles north), and Lexington, KY (220 miles west). The Property is located on the following United States Geological Survey (USGS) Quadrangles: Dorothy, Pax, Arnett, and Eccles. The coordinate system and datum used for the model of the MWV Surface Business Unit, and the subsequent maps were produced in the West Virginia State Plane South system, NAD 27. 3.2 Titles, Claims or Leases The Property is composed of over 119,000 total acres of mineral control, nearly all of which is owned and leased. Alpha’s control is comprised of over 10 separate leases with varying expiration dates and 8 owned properties. Some leases expire over the next several years, but Alpha does not anticipate any challenges related to lease renewal. MM&A has not carried out a separate title verification for the coal properties and has not verified leases, deeds, surveys, or other property control instruments pertinent to the subject resources. Alpha has represented to MM&A that it controls the mining rights to the reserves as shown on its property maps, and MM&A has accepted these as being a true and accurate depiction of the mineral rights controlled by Alpha. The TRS assumes the Property is developed under responsible and experienced management.

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 15 3.3 Mineral Rights Alpha supplied property control maps to MM&A related to properties for which mineral and/or surface property are controlled by Alpha. While MM&A accepted these representations as being true and accurate, MM&A has no knowledge of past property boundary disputes or other concerns, through past knowledge of the Property, that would signal concern over future mining operations or development potential. Property control in Appalachia can be intricate. Coal mining properties are typically composed of numerous property tracts which are owned and/or leased from both land holding companies and private individuals or companies. It is common to encounter severed ownership, with different entities or individuals controlling the surface and mineral rights. Mineral control in the region is typically characterized by leases or ownership of larger tracts of land, with surface control generally comprised of smaller tracts, particularly in developed areas. Control of the surface property is necessary to conduct surface mining but is not necessary to conduct underground mining aside from relatively limited areas required for seam access or ventilation infrastructure. Alpha’s executive management team has a history of mining in Central Appalachia and has conveyed to MM&A that it has been successful in acquiring surface rights where needed for past operations. 3.4 Encumbrances No Title Encumbrances are known. By assignment, MM&A did not complete a query related to Title Encumbrances. 3.5 Other Risks There is always risk involved in property control. As is common practice, Alpha, and its predecessors, have had their legal teams examine the deeds and title control to minimize this risk. Historically, property control has not posed any significant challenges related to MWVS’s operations. 4 Accessibility, Climate, Local Resources, Infrastructure and Physiography 4.1 Topography, elevation, and Vegetation Much of topography of the area encompassed by the MWVS Business Unit is typical of the Central Appalachian Plateau’s physiographic province, being rugged deeply dissected by V-shaped river valleys, flanked by steep-sided upland regions. Terrain slopes in the area are mostly steep to very steep with some gently sloping with relatively narrow ridges. Surface elevations near the mine operations range Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 16 from approximately 1,200 feet above sea level at streams to approximately 3,000 feet at ridge tops. The area is heavily vegetated and has a significant amount of hardwood forests. The Property is not situated near any major urban centers. 4.2 Access and Transport There is general access to the MWV Surface property via a well-developed network of primary, secondary, and unimproved roads from U.S. interstates highways. Interstate 81 to the south and 77 to the east are the primary roads coming into the business unit region. Interstate 81 connects with Bristol, Virginia to the southwest and Roanoke, Virginia to the east. Interstate 77 connects with Charleston, West Virginia to the north and via interstate 64 with Lexington, Kentucky, to the northwest. Numerous secondary and unimproved roads provide direct access to the mine property, some being federal, state, and town maintained. Interstate 64/77 is located near the eastern side of the Property and is the primary throughfare in the area connecting the Property to Beckley, Charleston, and Huntington, West Virginia, to the West and Lexington, Virginia, to the East. Numerous secondary and unimproved roads provide direct access to the mine property, some being federal-, state-, and town- maintained. These include State Route 1 that runs through the Property holdings and provides direct access to Workman Creek surface office. These roads typically stay open throughout the year. Within the Property, unimproved roads are utilized to access surface based deep mine infrastructure. The primary transport means of processed coal is CSX Railroad which services the Marfork preparation plant and the Pax Loadout. Additionally, coal is transported by over-the-road-truck to the Kanawha River for barge transportation at the Marmet dock and also for processing at the Mammoth preparation plant with access to barge and the Kanawha River Railroad shortline that connects to the Norfolk Southern and CSX Transportation railroads. 4.3 Proximity to Population Centers The MWV Surface Business Unit is located near the City of Beckley and is primarily in Raleigh and Fayette Counties, West Virginia, with small portions falling in Kanawha County. There are no large population centers in close proximity to mine operations. The nearest major population centers are Charleston, West Virginia (45 miles north), Bristol, Virginia (160 miles south), Roanoke, Virginia (140 miles east), and Morgantown, West Virginia (170 miles north), and Lexington, KY (220 miles west). As of the 2020 census, Raleigh County had just over 73,300 residents and Fayette County had 40,488 residents. 4.4 Climate and Length of Operating Season The climate of the region is classified as humid continental with four distinct seasons: warm summers, cold winters, and moderate fall and spring seasons. Precipitation in the region is consistent throughout the year, approximately 3 to 5 inches per month, with the most rain falling in spring and the early months of summer. Average yearly precipitation is 40 inches. Summer months typically begin in late

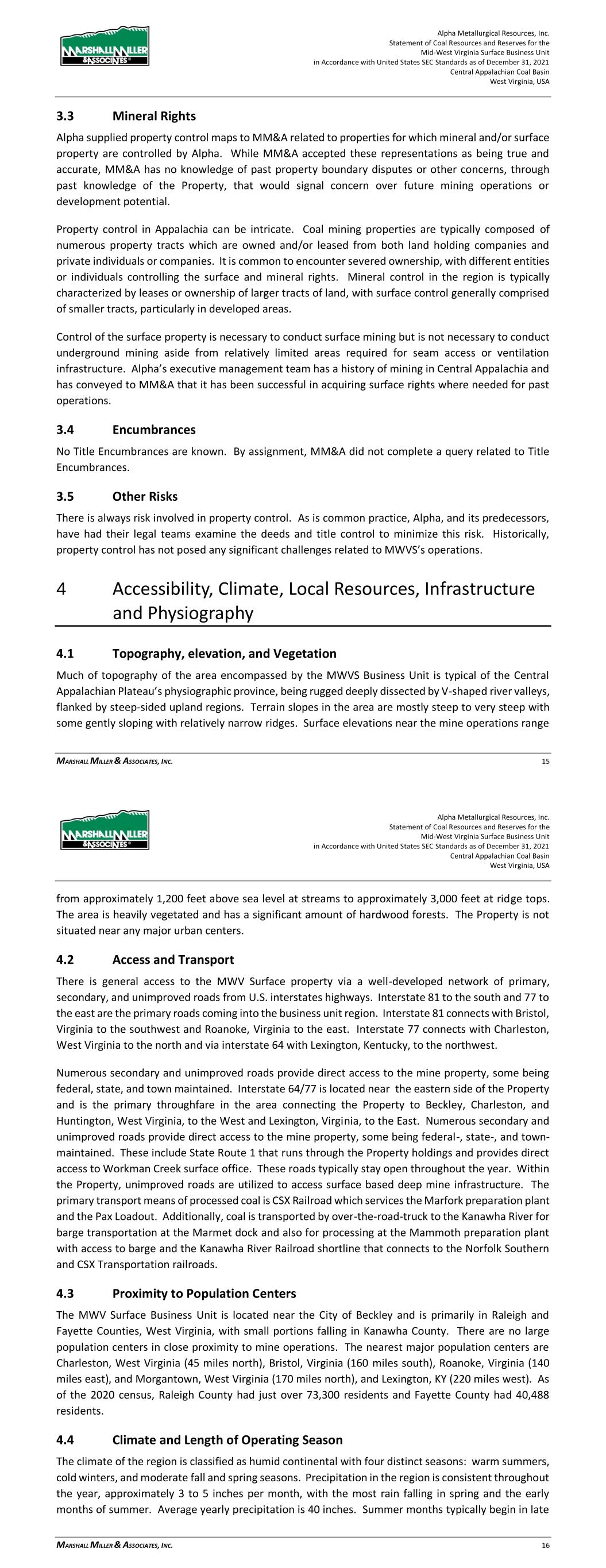

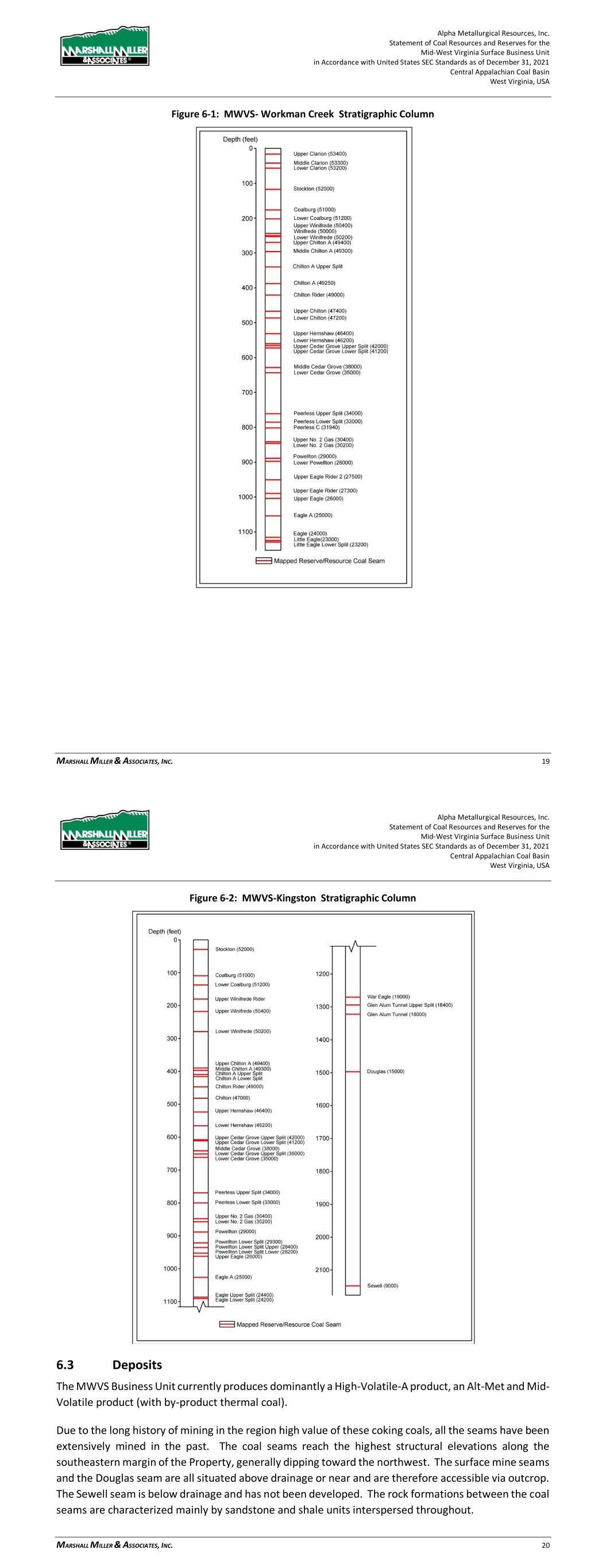

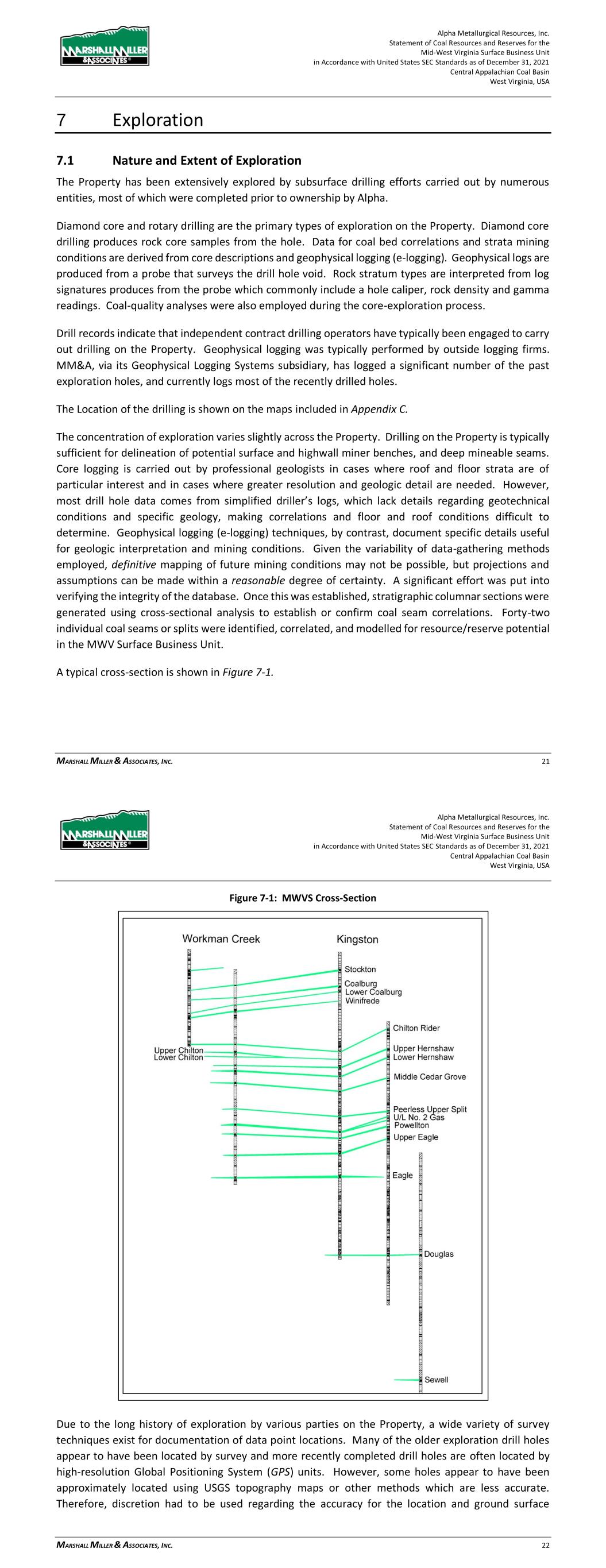

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 17 May and end in early September and range in average temperature from 46 to 78 degrees Fahrenheit. Winters typically begin in mid to late November and run until mid to late March with average temperatures ranging from 19 to 52 degrees Fahrenheit. Precipitation in the winter typically comes in the form of snowfall or as a wintery mix (sleet and snow) with severe snowfall events occurring occasionally. Seasonal variations in climate typically do not affect underground mining in West Virginia. However, weather events could potentially negatively impact efficiency of surface and preparation plant operations on a very limited basis and lasting less than a few days. 4.5 Infrastructure The MWV Surface Business Unit has sources of water, power, personnel, and supplies readily available for use. Personnel have historically been sourced from the surrounding communities in Raleigh, Fayette and surrounding Counties, and have proven to be adequate in number to conduct mining operations. As mining is common in the surrounding areas, the workforce is generally familiar with mining practices, and many are experienced miners. Water is sourced locally from public water sources or rivers, and electricity is sourced from Appalachian Power, a subsidiary of American Electric Power (AEP). The service industry in the areas surrounding the mine operations has historically provided supplies, equipment repairs and fabrication, etc. The Kingston Preparation Plant processes MWVS coal and is capable to shipping through the Pax Loadout or by barge on the Kanawha River. Pax Loadout services consumers with raw and washed coal via the CSX railroad. Alpha’s Marfork Preparation Plant processes some MWVS coal and services consumers with washed coal, which is transported via the adjacent CSX rail line at the loadout. Haul roads, primary roads, and conveyor belt systems account for transport from the various mine sites to both surface plant facilities. 5 History 5.1 Previous Operation The MWV Surface property involves a complex combination of previous ownership. Coal mining in the area occurred for nearly a century. Predecessors of Alpha, namely Alpha Natural Resources (Alpha) and Massey Energy (Massey) previously held mining rights on much of the Property. 5.2 Previous Exploration Extensive exploration in the form of subsurface drill efforts has been carried out on the property by numerous entities, most of which efforts were completed prior to the inception of Alpha. Diamond core and rotary drilling are the primary types of exploration on the Property. Data for correlation and mining conditions are derived from core descriptions and geophysical logs (e-logging). Coal sample, quality analyses were also employed during the core-exploration process. Development of this report included an assessment of over 1,500 locations of coal measurements, largely comprised of exploration drill holes which often include several coal intercepts. In mine data measurements are included also. Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 18 Drill records indicate that independent contract drilling operators have typically been engaged to carry out drilling on the Property. Geophysical logging was typically performed by outside logging firms. MM&A, via its Geophysical Logging Systems subsidiary, has logged a significant number of the past exploration holes, and currently logs most of the recent drilled holes. 6 Geological Setting, Mineralization and Deposit 6.1 Regional, Local and Property Geology The Property lies in the Central Appalachian Coal basin in the Appalachian Plateau physiographic province. The coal deposits in the eastern U.S. are the oldest and most extensively developed coal deposits in the country. The coal deposits on the Property are Carboniferous in age, being of the Pennsylvanian system. Overall, these Carboniferous coals contain two-fifths of the US’s bituminous coal deposits and extend over 900 miles from northern Alabama to Pennsylvania and are part of what is known as the Appalachian Basin. The Appalachian Basin is more than 250 miles wide and, in some portions, contains over 60 coal seams of varying economic significance. Strata on the Property are mostly of the Pennsylvanian-age Kanawha Formation and the older, lower Sewell seam is part of the New River Formation of the Pottsville Series. The rock formations between the coal seams are characterized by large proportions of sandstone interspersed with shale units. Coal seams with remaining reserve or resource potential evaluated within this TRS include, in descending stratigraphic order the: Upper, Middle and Lower Clarion; Stockton, Upper Coalburg, Coalburg, Lower Coalburg, Upper Winifrede Rider, Upper Winifrede, Winifrede, Lower Winifrede, Upper Chilton A, Middle Chilton A , Chilton A Upper Split, Chilton A Lower Split, Chilton A, Chilton Rider, Upper Chilton, Lower Chilton, Chilton, Upper Hernshaw, Lower Hernshaw, Upper Cedar Grove Upper Split, Upper Cedar Grove Lower Split, Middle Cedar Grove, Lower Cedar Grove Upper Split, Lower Cedar Grove, Peerless Upper Split, Peerless Lower Split, Peerless C, Upper No. 2 Gas, Lower No. 2 Gas, Powellton, Lower Powellton, Powellton Lower Split, Powellton Lower Split Upper, Upper Eagle Rider 2, Powellton Lower Split Lower, Upper Eagle Rider, Upper Eagle, Eagle A, Eagle Upper Split, Eagle Lower Split, Eagle, Little Eagle, Little Eagle Lower Split, War Eagle, Glen Alum Tunnel Upper Split, Glen Alum Tunnel Douglas and Sewell seams. 6.2 Mineralization The generalized stratigraphic columnar section in Figure 6-1 and Figure 6-2 demonstrates the vertical relationship of the principal coal seams and rock formations on the Workman Creek and Kingston Properties.

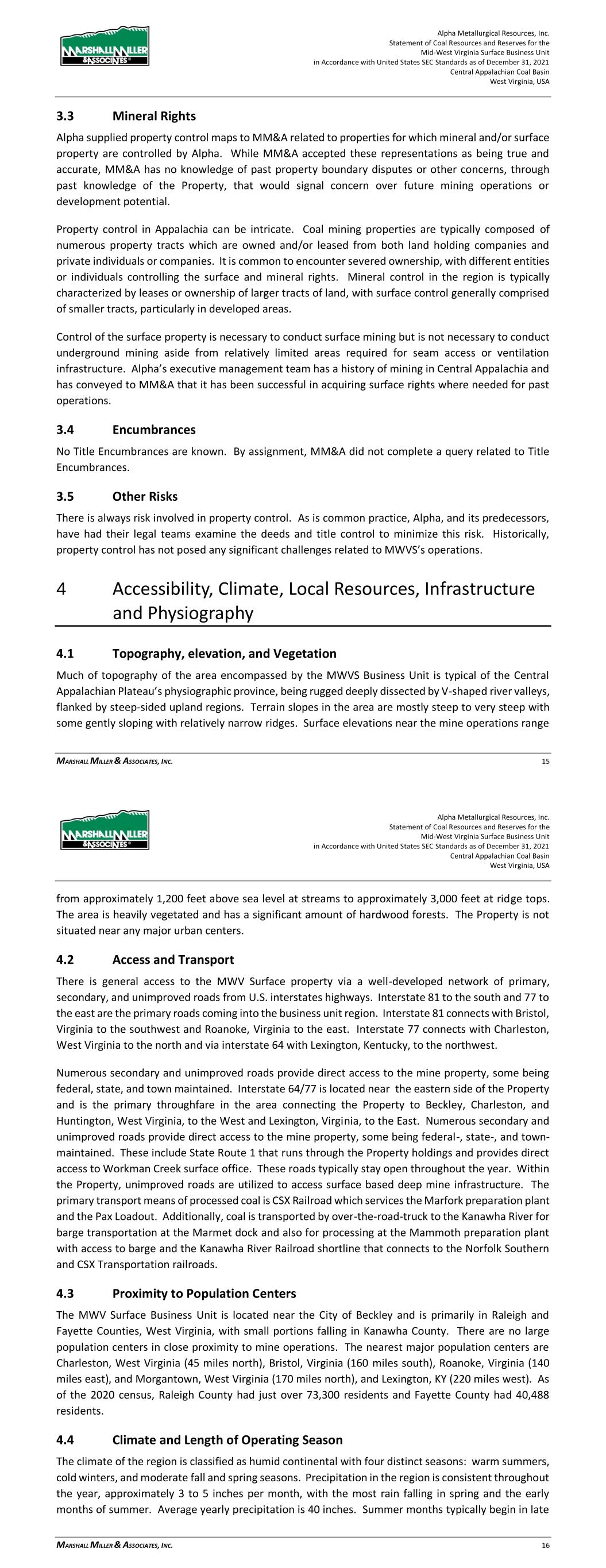

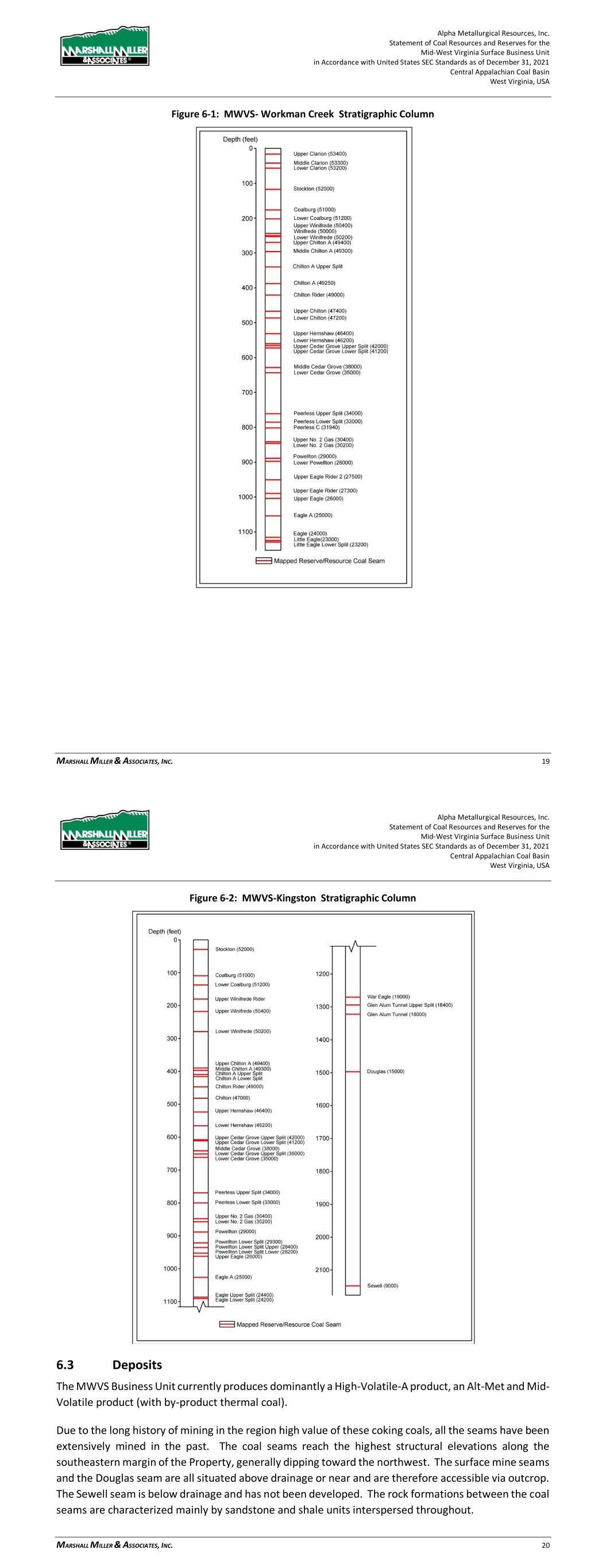

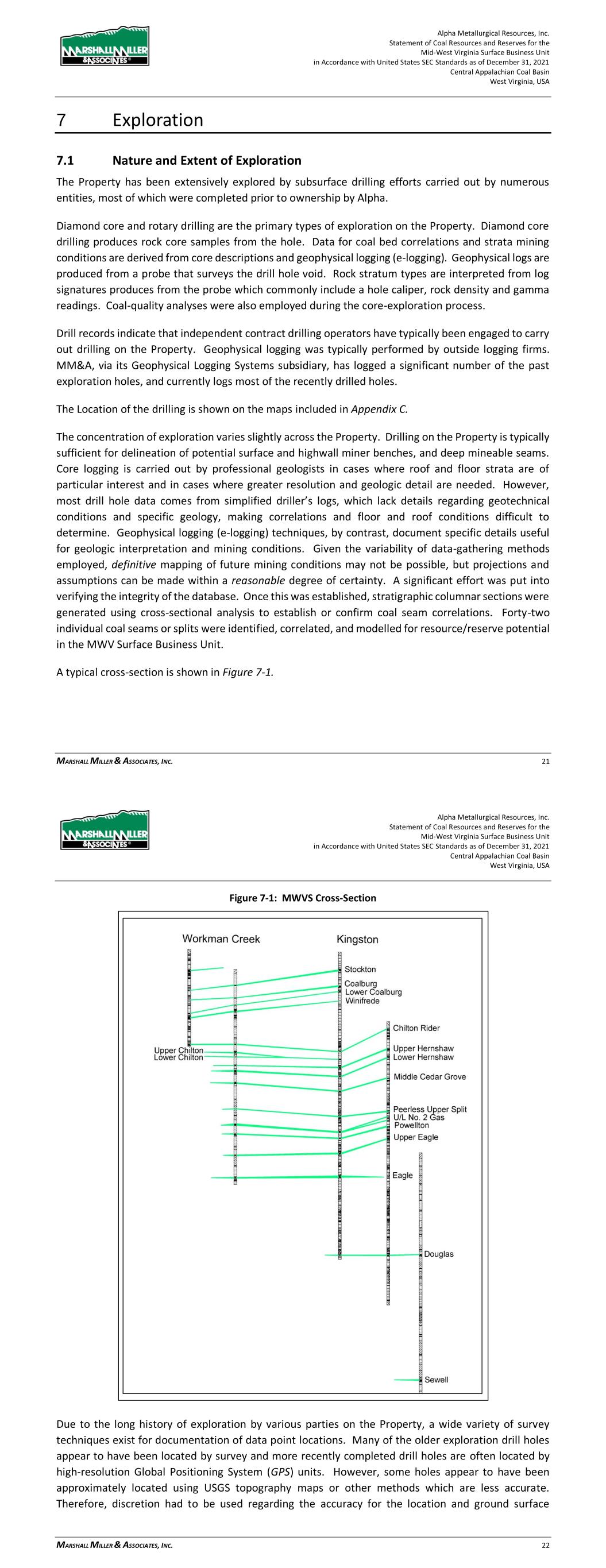

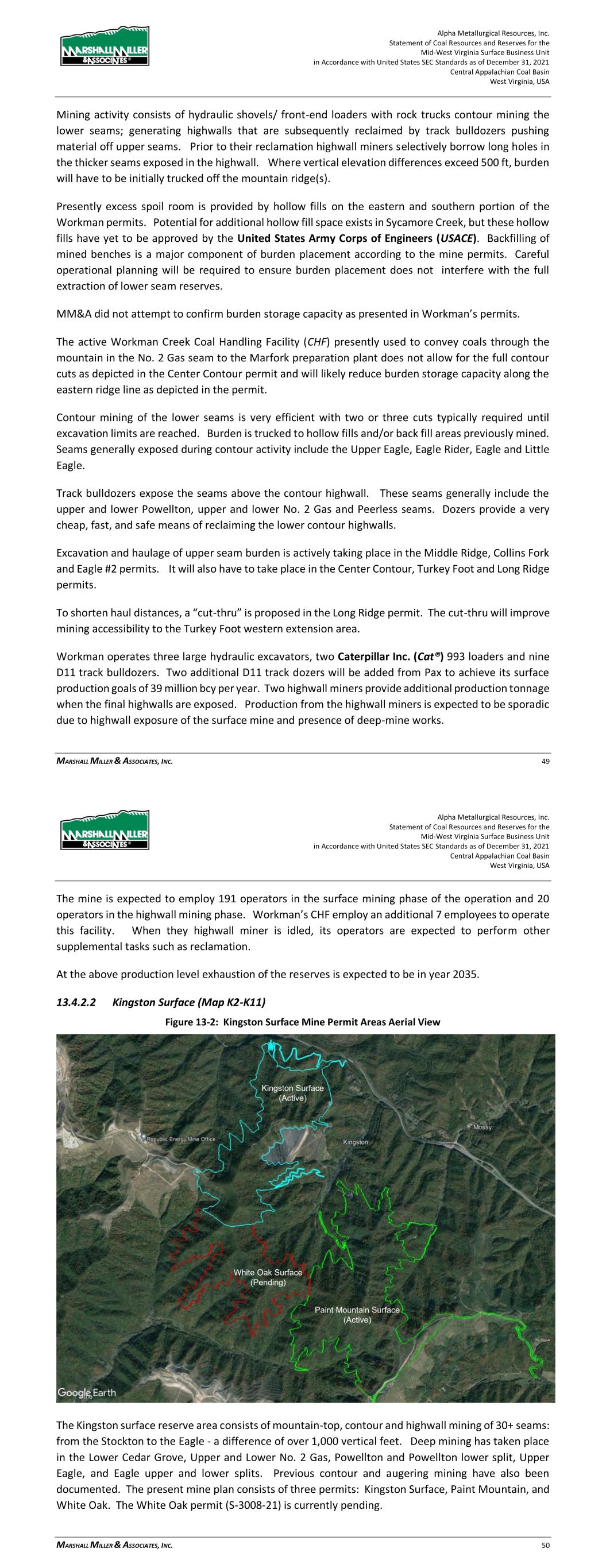

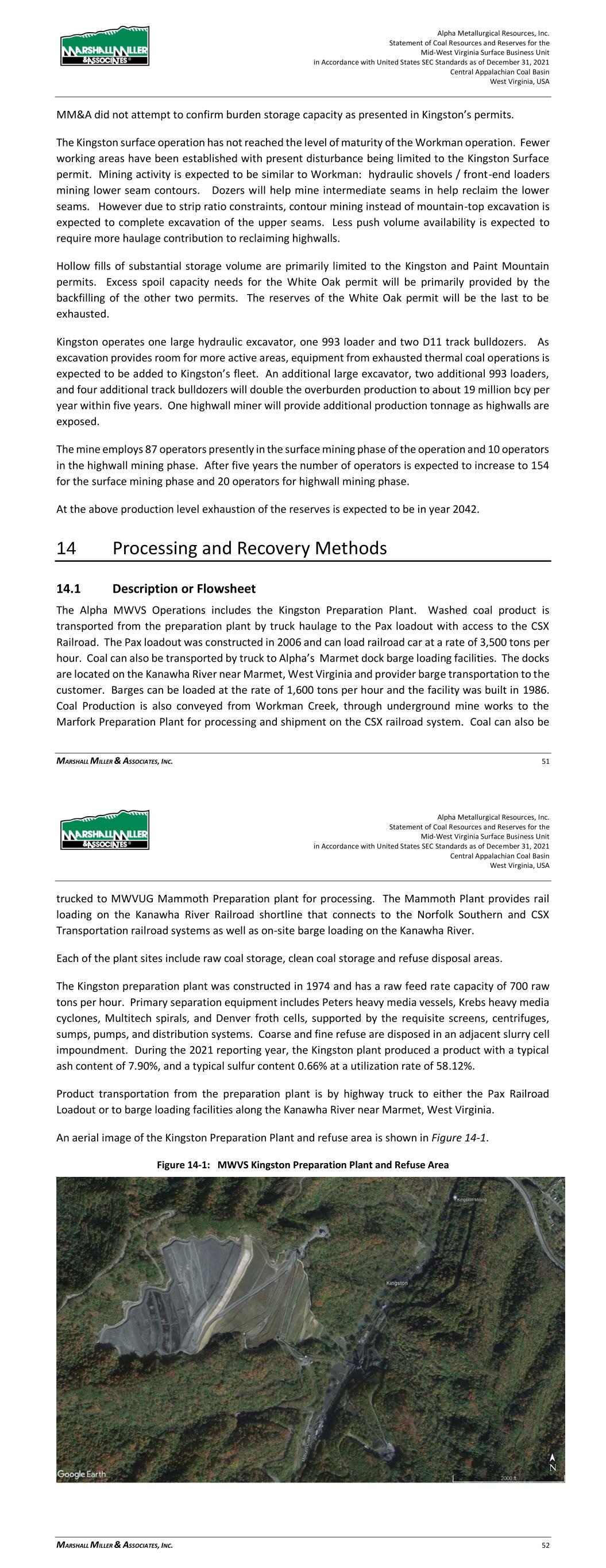

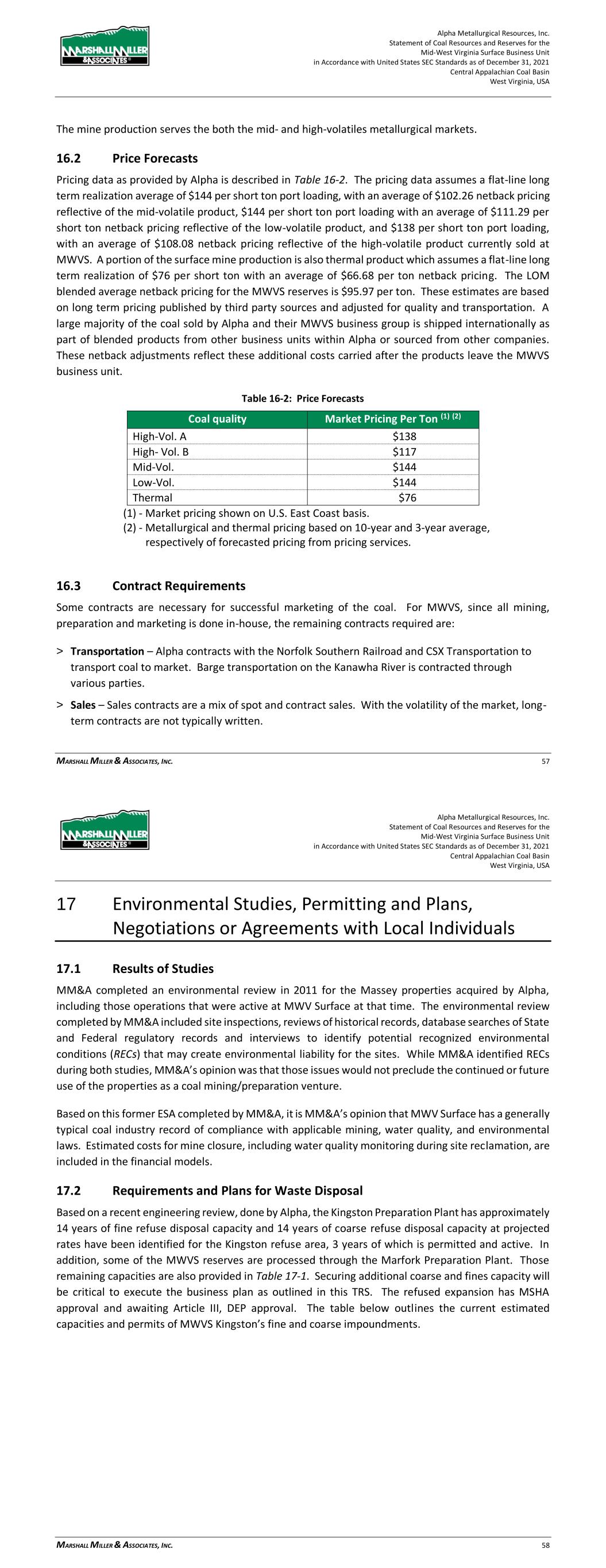

Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 19 Figure 6-1: MWVS- Workman Creek Stratigraphic Column Alpha Metallurgical Resources, Inc. Statement of Coal Resources and Reserves for the Mid-West Virginia Surface Business Unit in Accordance with United States SEC Standards as of December 31, 2021 Central Appalachian Coal Basin West Virginia, USA MARSHALL MILLER & ASSOCIATES, INC. 20 Figure 6-2: MWVS-Kingston Stratigraphic Column 6.3 Deposits The MWVS Business Unit currently produces dominantly a High-Volatile-A product, an Alt-Met and Mid- Volatile product (with by-product thermal coal). Due to the long history of mining in the region high value of these coking coals, all the seams have been extensively mined in the past. The coal seams reach the highest structural elevations along the southeastern margin of the Property, generally dipping toward the northwest. The surface mine seams and the Douglas seam are all situated above drainage or near and are therefore accessible via outcrop. The Sewell seam is below drainage and has not been developed. The rock formations between the coal seams are characterized mainly by sandstone and shale units interspersed throughout.