1A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r I NVESTOR P R ES ENTAT I ON F E B R U A R Y 2 0 2 5

2A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r F O R WA R D LO O K I N G S TAT E M E N T S This presentation includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements.” These statements, which involve risks and uncertainties, relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to our future prospects, developments and business strategies. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should” and similar terms and phrases, including references to assumptions, in this presentation to identify forward-looking statements, but these terms and phrases are not the exclusive means of identifying such statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those expressed in or implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our forward-looking statements: • depressed levels or declines in coal prices; • the financial performance of the company; • our liquidity, results of operations and financial condition; • our ability to generate sufficient cash or obtain financing to fund our business operations; • worldwide market demand for coal and steel, including demand for U.S. coal exports, and competition in coal markets; • railroad, barge, truck, port and other transportation availability, performance and costs; • steel and coke producers switching to alternative energy sources such as natural gas, renewables and coal from basins where we do not operate; • our ability to meet collateral requirements for, and fund, employee benefit obligations; • our ability to self-insure certain of our black lung obligations following a significant increase in required collateral; • our ability to obtain or renew surety bonds on acceptable terms or maintain our current bonding status; • the imposition or continuation of barriers to trade, such as tariffs; • attracting and retaining key personnel and other employee workforce factors, such as labor relations; • our ability to consummate financing or refinancing transactions, and other services, and the form and degree of these services available to us, which may be significantly limited by the lending, investment and similar policies of financial institutions and insurance companies regarding carbon energy producers, the environmental impacts of coal combustion or other factors; • our costs of complying with health and safety regulations, including but not limited to MSHA’s silica regulations; • changes in domestic or international environmental laws and regulations, and court decisions, including those directly affecting our coal mining and production and those affecting our customers’ coal usage, including potential climate change initiatives; • failures in performance, or non-performance, of services by third-party contractors, including contract mining and reclamation contractors; • disruptions in delivery or changes in pricing from third-party vendors of key equipment and materials that are necessary for our operations, such as diesel fuel, steel products, explosives, tires and purchased coal; • our production capabilities and costs; • inflationary pressures on supplies and labor and significant or rapid increases in commodity prices; • our indebtedness as we may incur it from time to time; • our ability to execute our share repurchase program; • cybersecurity attacks or failures, threats to physical security, extreme weather conditions or other natural disasters; • increased volatility and uncertainty regarding worldwide markets, seaborne transportation and our customers as a result of developments in and around Ukraine and the Middle East; • changes in, renewal or acquisition of, terms of and performance of customers under coal supply arrangements and the refusal by our customers to receive coal under agreed-upon contract terms; • reductions or increases in customer coal inventories and the timing of those changes; • our ability to obtain, maintain or renew any necessary permits or rights; • inherent risks of coal mining, including those that are beyond our control; • changes in, interpretations of, or implementations of domestic or international tax or other laws and regulations, including the Inflation Reduction Act of 2022 and its related regulations; • our relationships with, and other conditions affecting, our customers, including the inability to collect payments from our customers if their creditworthiness declines; • reclamation and mine closure obligations; • our assumptions concerning economically recoverable coal reserve estimates; and • other factors, including the other factors discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections included in our Annual Report on Form 10-K. The list of factors identified above is not exhaustive. We caution readers not to place undue reliance on any forward looking statements, which are based on information currently available to us and speak only as of the dates on which they are made. When considering these forward-looking statements, you should keep in mind the cautionary statements in this presentation. We do not undertake any responsibility to publicly revise these forward-looking statements to take into account events or circumstances that occur after the date of this presentation. Additionally, except as expressly required by federal securities laws, we do not undertake any responsibility to update or revise any forward-looking statements or update you on the occurrence of any unanticipated events, which may cause actual results to differ from those expressed or implied by the forward-looking statements contained in this presentation. See Appendix B for reconciliations of the differences between the financial measures in accordance with U.S. generally accepted accounting principles (“GAAP”) and non-GAAP financial measures used in this presentation.

3A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r BUSINESS OVERVIEW

4A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r A L P H A AT A G L A N C E Note: Metrics as of 12/31/24 unless otherwise noted. 1 For full-year 2024 shipments, by tonnage. 2 65% ownership in DTA Export Terminal. 3 Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of Net Income to Adjusted EBITDA is included in the Appendix. Current Sales Mix Sales by Shipment Mix1 Sales by Type1 WV VA 17.1 Million Tons of Coal Sold in 2024 $408 Million Adjusted EBITDA in 20243 #1 US Producer of Met Coal 4,040 Employees Asset Footprint 20 Mines 8 Preparation Plants 2 Standalone Loadouts 1 Dock 1 Export Terminal2 DTA Export Terminal2 Company Mines Processing and Shipping Facilities High Vol-A 37% High Vol-B 31% Mid Vol 19% Low Vol 13% Export 76% Domestic 24%

5A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r S A F E T Y, E N V I R O N M E N TA L AWA R E N E S S A N D A C O M M I T M E N T T O C O N T I N U O U S I M P R O V E M E N T – E S S E N T I A L C O M P O N E N T S O F B U S I N E S S E X C E L L E N C E Note: 1 See Appendix for additional detail on Alpha’s key safety statistics vs. the coal industry average. 2 Trees planted since 2016. ~26% Lower Total Reportable Incident Rate vs. Industry Avg.1 ~40% Lower Non-Fatal Days Lost vs. Industry Avg.1 37 2024 Safety & Mine Rescue Awards 5.3 Million Trees Planted2 25+ Environmental Compliance Awards 99.9%+ Water Quality Compliance Rate SAFE PRODUCTION We believe in operating safely and ethically. Every employee is empowered to eliminate at-risk behaviors. ENVIRONMENTAL STEWARDSHIP We conduct our mining business with a focus on environmental stewardship and a commitment to the protection of the environment.

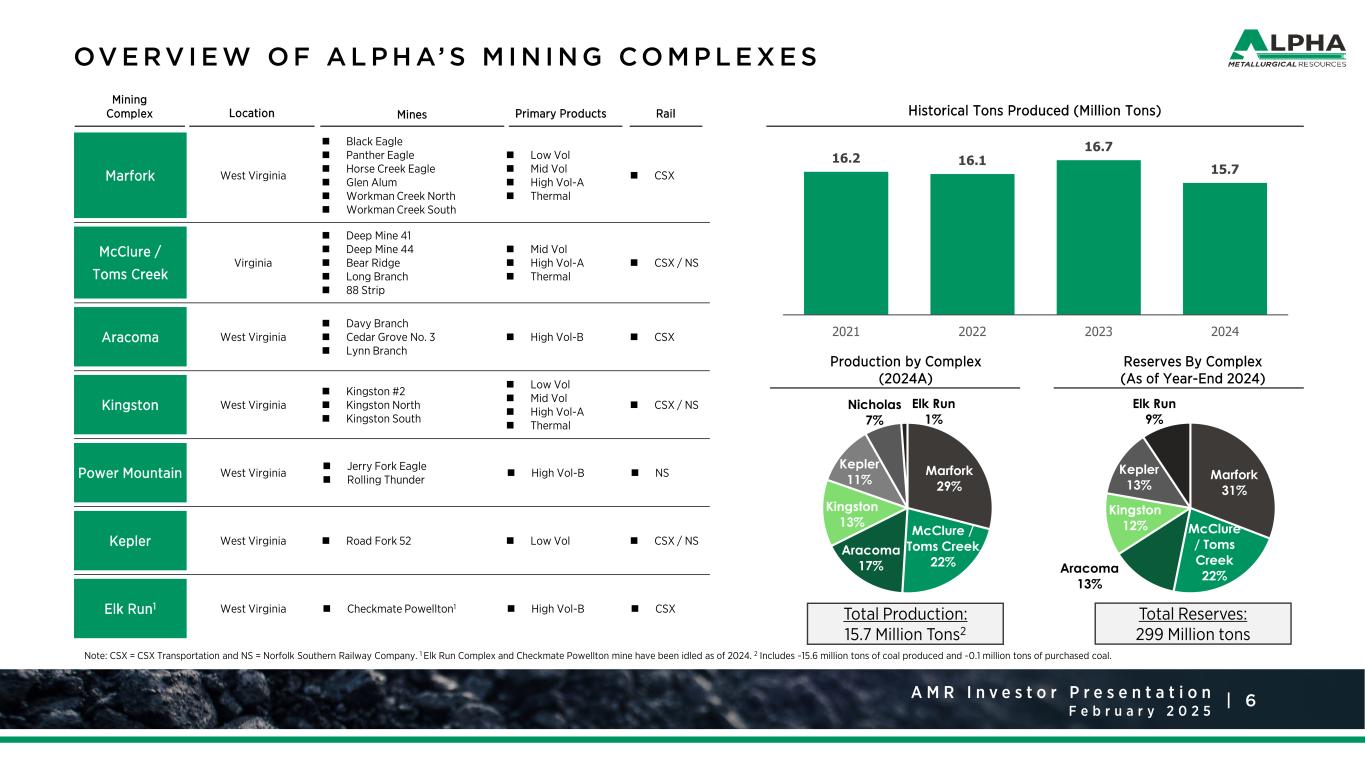

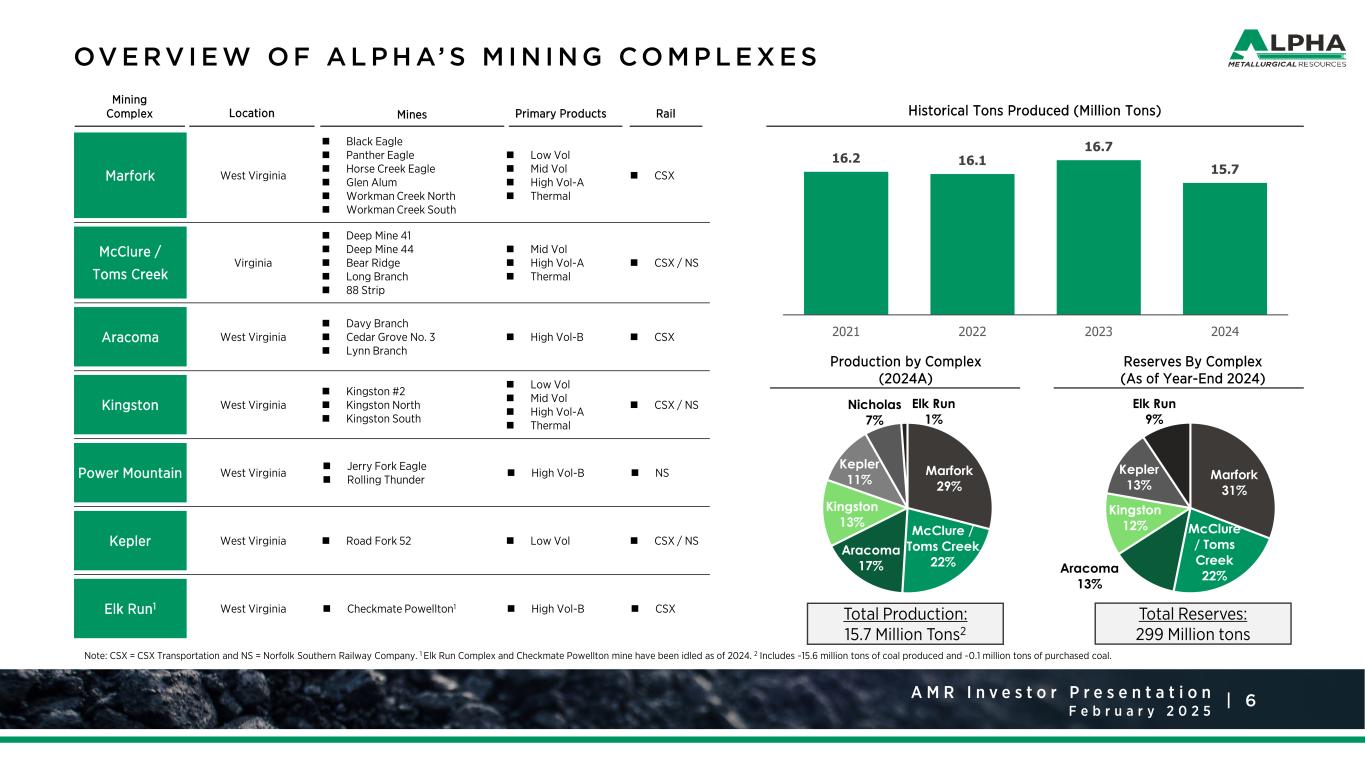

6A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r OV E RV I E W O F A L P H A’ S M I N I N G CO M P L E X E S Mining Complex Location Rail Marfork West Virginia Black Eagle Panther Eagle Horse Creek Eagle Glen Alum Workman Creek North Workman Creek South Low Vol Mid Vol High Vol-A Thermal CSX McClure / Toms Creek Virginia Deep Mine 41 Deep Mine 44 Bear Ridge Long Branch 88 Strip Mid Vol High Vol-A Thermal CSX / NS Aracoma West Virginia Davy Branch Cedar Grove No. 3 Lynn Branch High Vol-B CSX Kingston West Virginia Kingston #2 Kingston North Kingston South Low Vol Mid Vol High Vol-A Thermal CSX / NS Power Mountain West Virginia Jerry Fork Eagle Rolling Thunder High Vol-B NS Kepler West Virginia Road Fork 52 Low Vol CSX / NS Elk Run1 West Virginia Checkmate Powellton1 High Vol-B CSX Primary ProductsMines Note: CSX = CSX Transportation and NS = Norfolk Southern Railway Company. 1 Elk Run Complex and Checkmate Powellton mine have been idled as of 2024. 2 Includes ~15.6 million tons of coal produced and ~0.1 million tons of purchased coal. Historical Tons Produced (Million Tons) Reserves By Complex (As of Year-End 2024) Production by Complex (2024A) Total Reserves: 299 Million tons Total Production: 15.7 Million Tons2 Marfork 31% McClure / Toms Creek 22%Aracoma 13% Kingston 12% Power Mountain 0% Kepler 13% Elk Run 9% 16.2 16.1 16.7 15.7 2021 2022 2023 2024 Marfork 29% McClure / Toms Creek 22% Aracoma 17% Kingston 13% Kepler 11% Nicholas 7% Elk Run 1%

7A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r KEY INVESTMENT HIGHLIGHTS

8A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r K E Y I N V E S T M E N T H I G H L I G H T S Strategically Located Assets With Ability to Serve Both Domestic and Export Markets Experienced Management Team With Deep Industry Expertise and Familiarity With Alpha’s Asset Base Largest and Most Diverse Domestic Metallurgical Coal Supplier in the United States Outlook for Metallurgical Coal Remains Robust With Strong Long-Term Demand and Limited New Supply Flexible Cost Structure Enables Resilience Through the Commodity Price Cycle Strong Culture of Commitment to Safety, Environmental Stewardship, and Continuous Improvement Disciplined Capital Return Policy With Proven Ability to Adjust to Market Dynamics 4 1 2 3 5 6 7

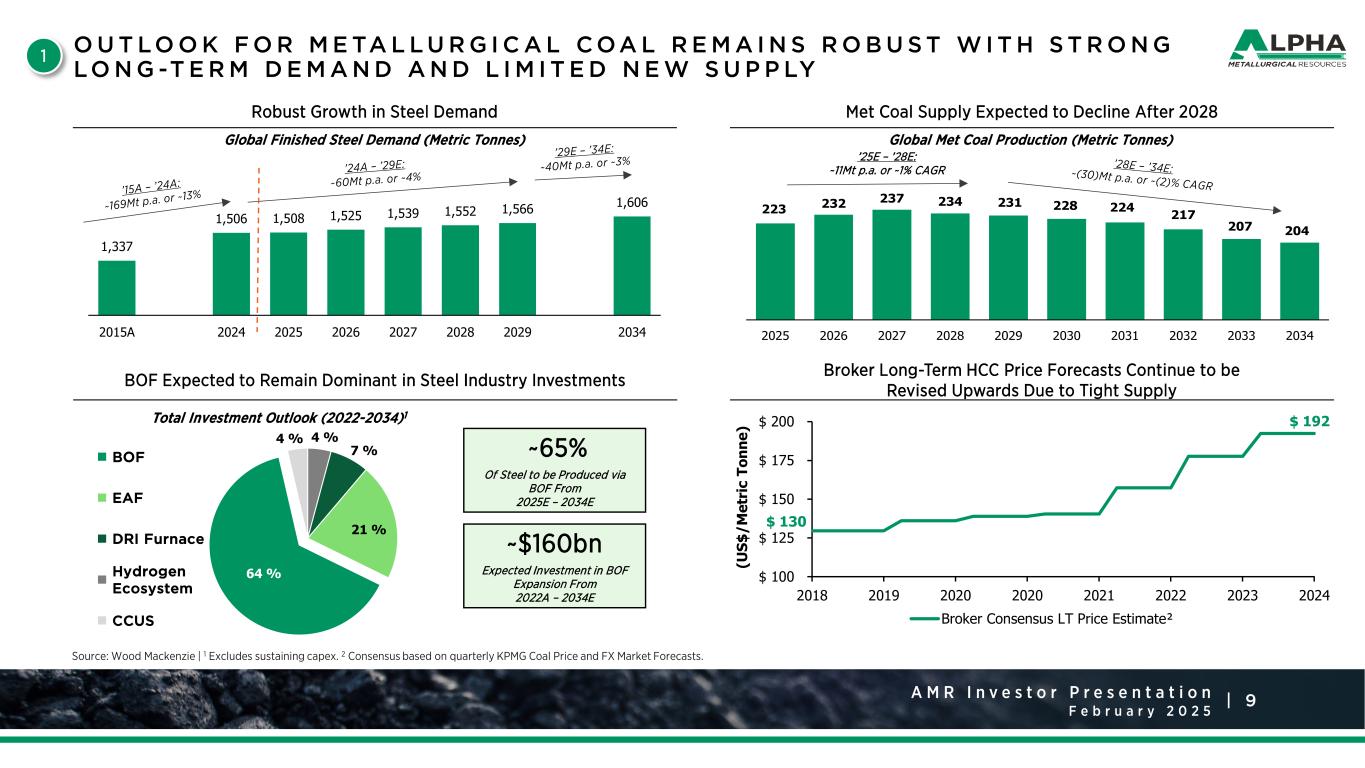

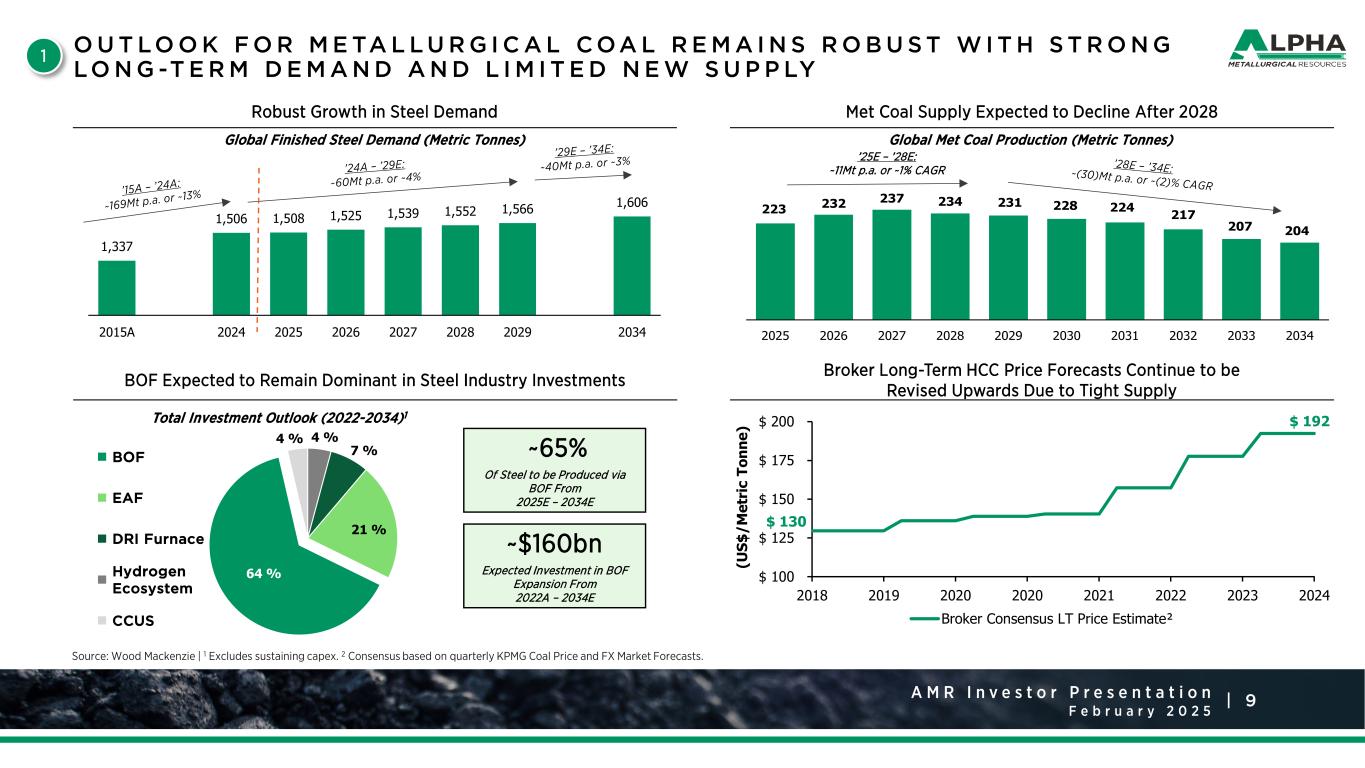

9A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r 223 232 237 234 231 228 224 217 207 204 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 1,337 1,506 1,508 1,525 1,539 1,552 1,566 1,606 2015A 2024 2025 2026 2027 2028 2029 2034 Source: Wood Mackenzie | 1 Excludes sustaining capex. 2 Consensus based on quarterly KPMG Coal Price and FX Market Forecasts. 1 Robust Growth in Steel Demand Global Finished Steel Demand (Metric Tonnes) BOF Expected to Remain Dominant in Steel Industry Investments Met Coal Supply Expected to Decline After 2028 ~65% Of Steel to be Produced via BOF From 2025E – 2034E ~$160bn Expected Investment in BOF Expansion From 2022A – 2034E Broker Long-Term HCC Price Forecasts Continue to be Revised Upwards Due to Tight Supply Total Investment Outlook (2022-2034)1 4 % 7 % 21 % 64 % 4 % ’25E – ’28E: ~11Mt p.a. or ~1% CAGR Global Met Coal Production (Metric Tonnes) $ 130 $ 192 $ 100 $ 125 $ 150 $ 175 $ 200 2018 2019 2020 2020 2021 2022 2023 2024 (U S$ /M et ri c To nn e) Broker Consensus LT Price Estimate² BOF EAF DRI Furnace Hydrogen Ecosystem CCUS O U T LO O K F O R M E TA L L U R G I C A L C OA L R E M A I N S R O B U S T W I T H S T R O N G LO N G -T E R M D E M A N D A N D L I M I T E D N E W S U P P LY

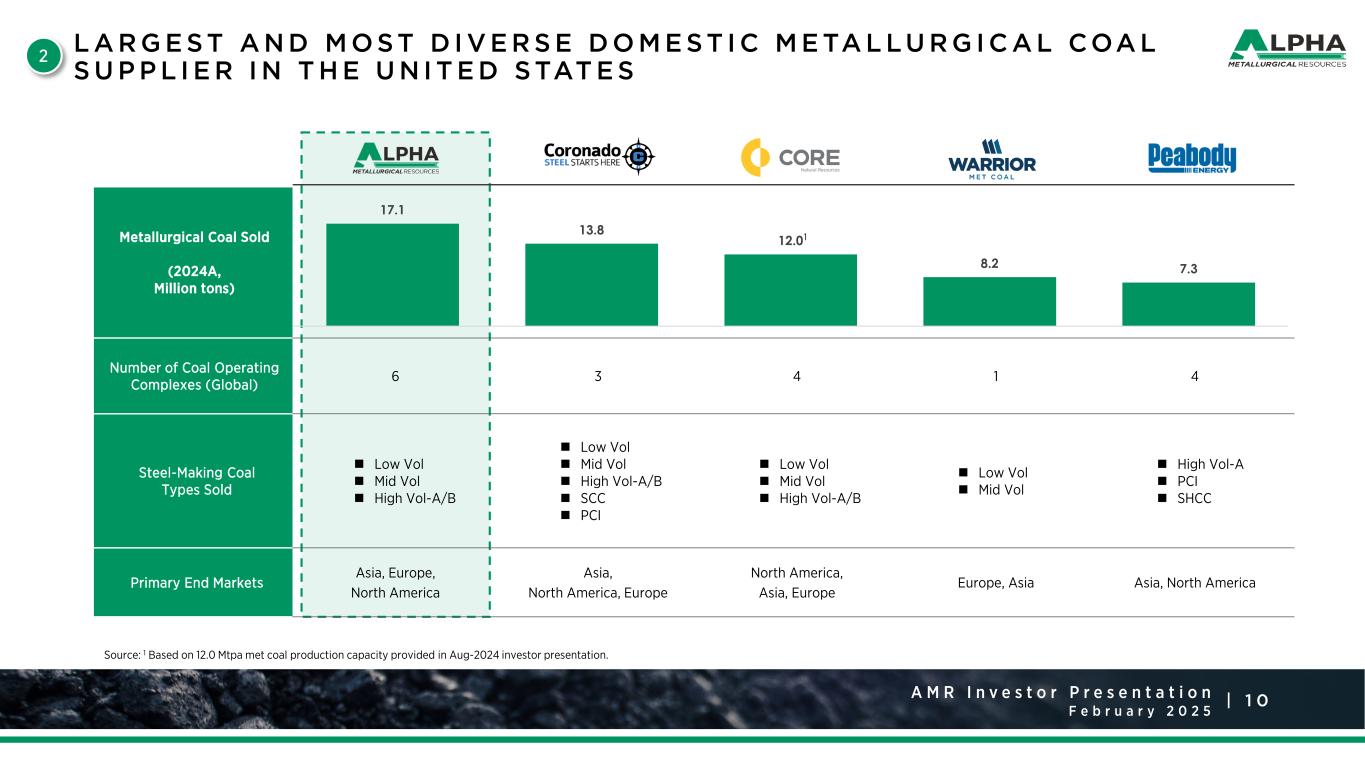

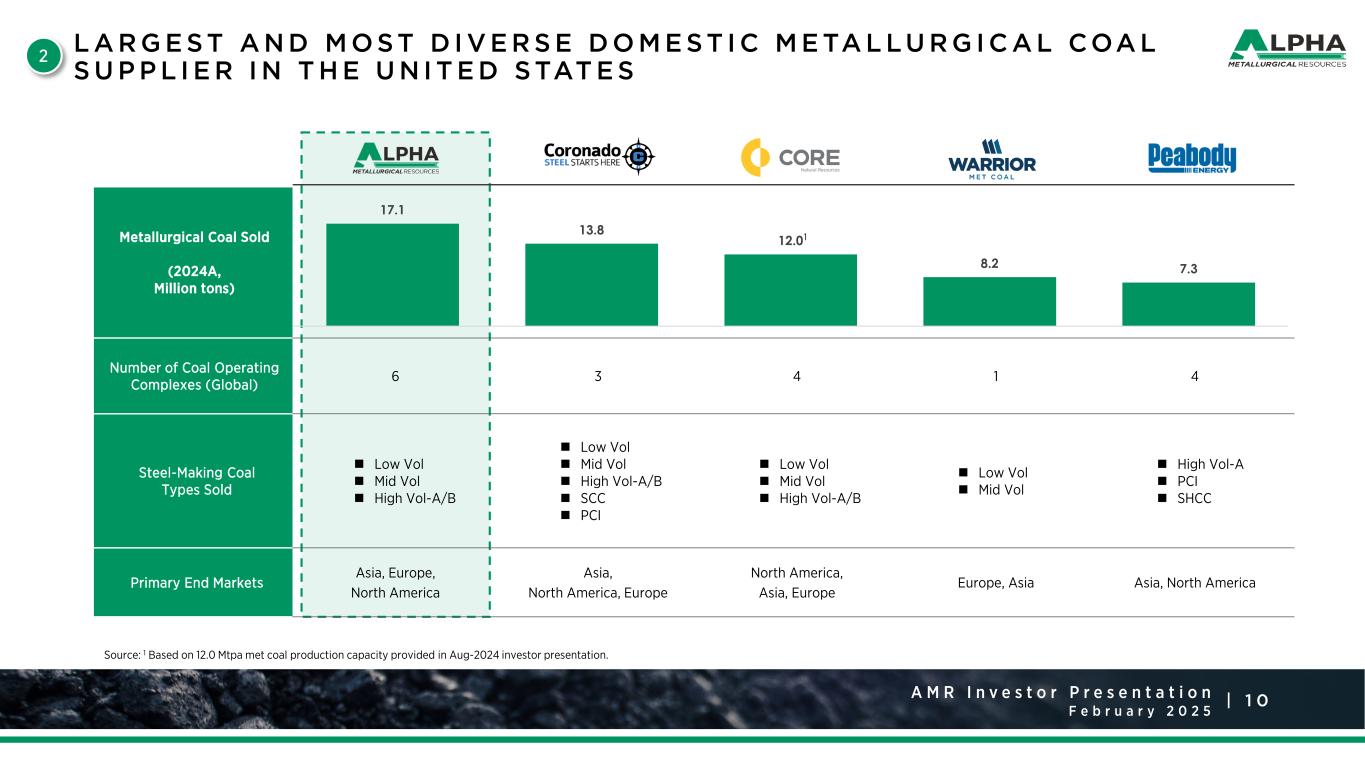

1 0A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Metallurgical Coal Sold (2024A, Million tons) Number of Coal Operating Complexes (Global) 6 3 4 1 4 Steel-Making Coal Types Sold Low Vol Mid Vol High Vol-A/B Low Vol Mid Vol High Vol-A/B SCC PCI Low Vol Mid Vol High Vol-A/B Low Vol Mid Vol High Vol-A PCI SHCC Primary End Markets Asia, Europe, North America Asia, North America, Europe North America, Asia, Europe Europe, Asia Asia, North America Source: 1 Based on 12.0 Mtpa met coal production capacity provided in Aug-2024 investor presentation. L A R G E S T A N D M O S T D I V E R S E D O M E S T I C M E TA L LU R G I C A L COA L S U P P L I E R I N T H E U N I T E D S TAT E S 2 1 17.1 13.8 12.0 8.2 7.3

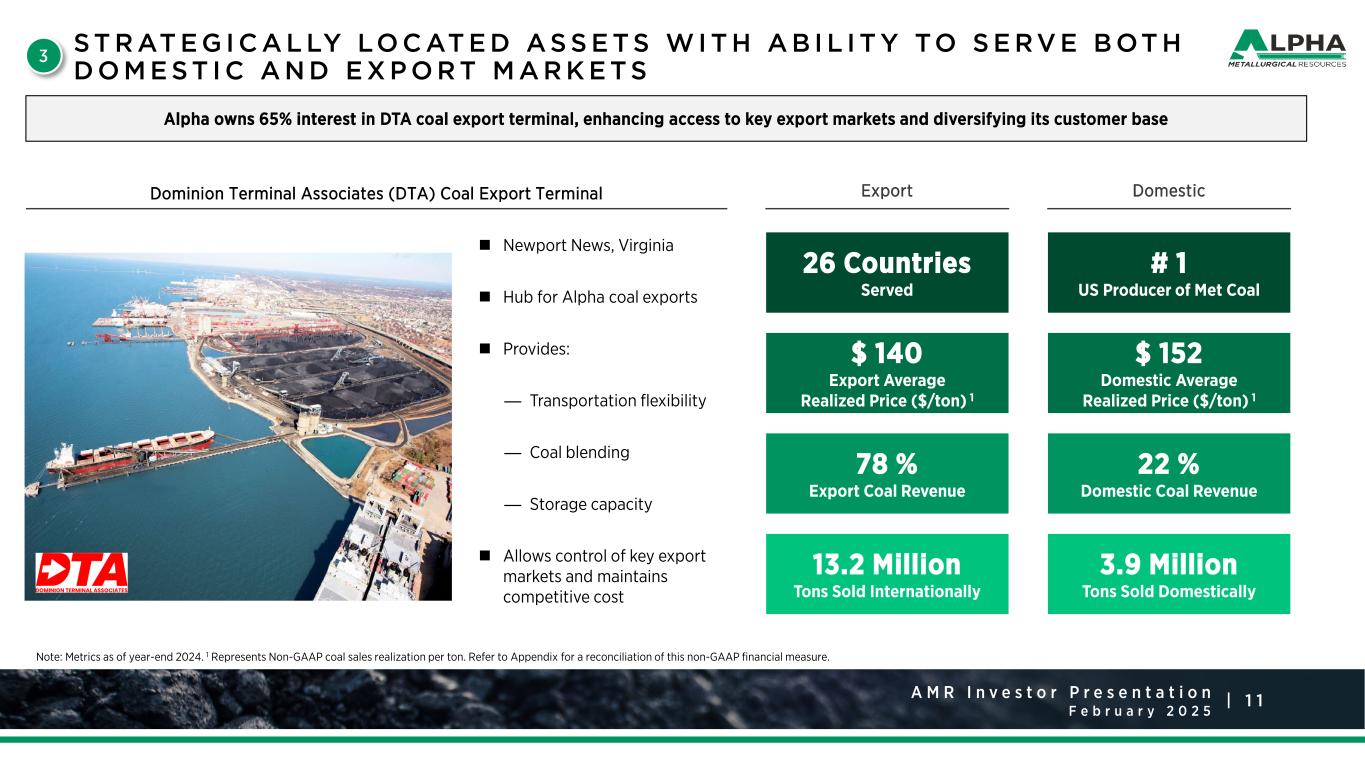

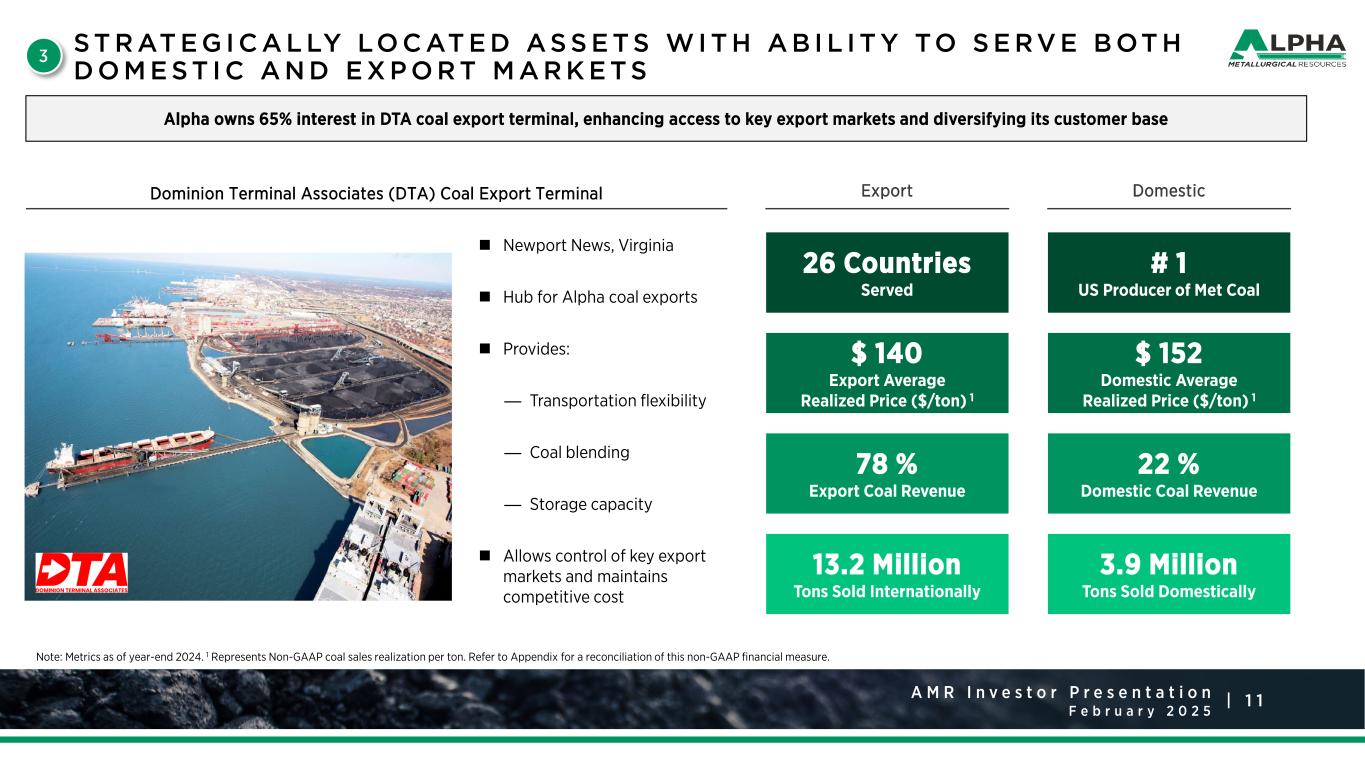

1 1A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r S T R AT E G I C A L LY LO C AT E D AS S E T S W I T H A B I L I T Y TO S E RV E B OT H D O M E S T I C A N D E X P O R T M A R K E T S 3 Note: Metrics as of year-end 2024. 1 Represents Non-GAAP coal sales realization per ton. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 22 % Domestic Coal Revenue 78 % Export Coal Revenue $ 152 Domestic Average Realized Price ($/ton) 1 $ 140 Export Average Realized Price ($/ton) 1 Dominion Terminal Associates (DTA) Coal Export Terminal Export Domestic # 1 US Producer of Met Coal 26 Countries Served 3.9 Million Tons Sold Domestically 13.2 Million Tons Sold Internationally Alpha owns 65% interest in DTA coal export terminal, enhancing access to key export markets and diversifying its customer base Newport News, Virginia Hub for Alpha coal exports Provides: — Transportation flexibility — Coal blending — Storage capacity Allows control of key export markets and maintains competitive cost

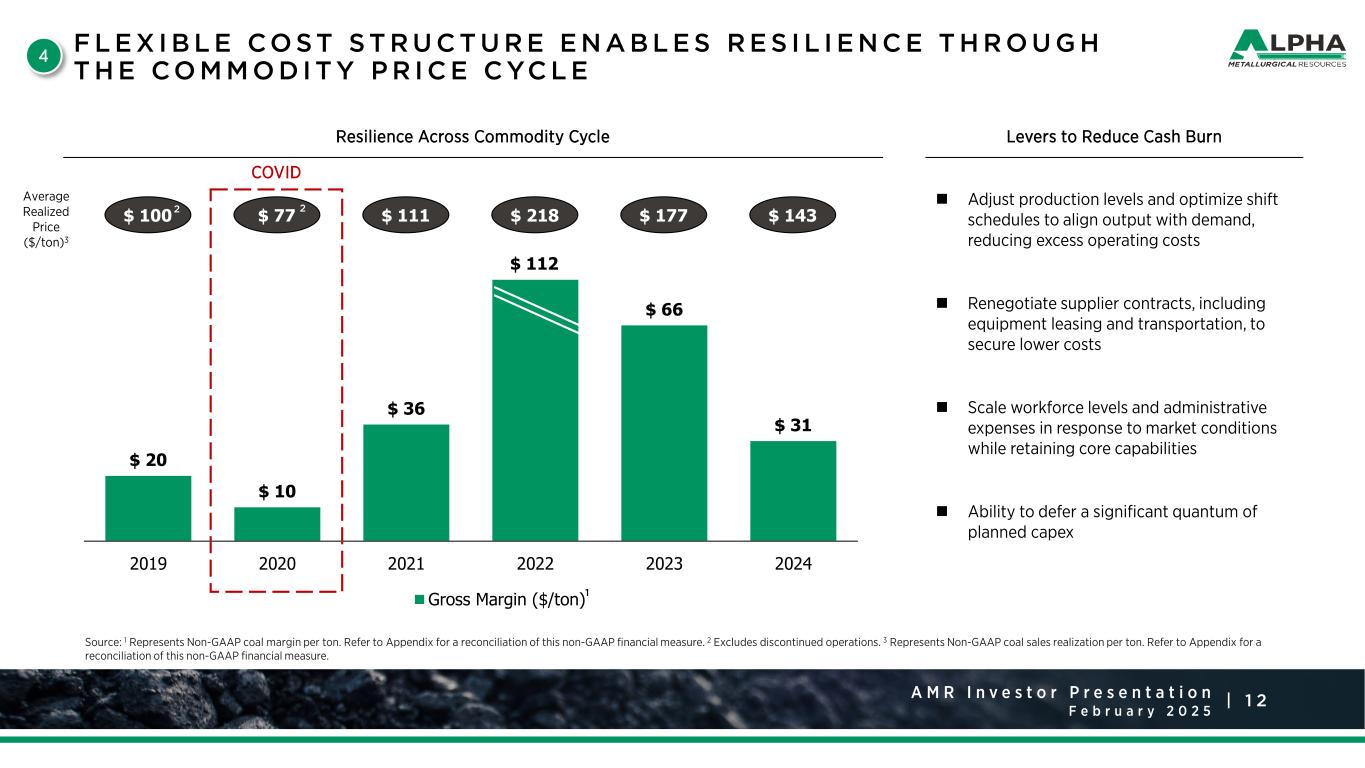

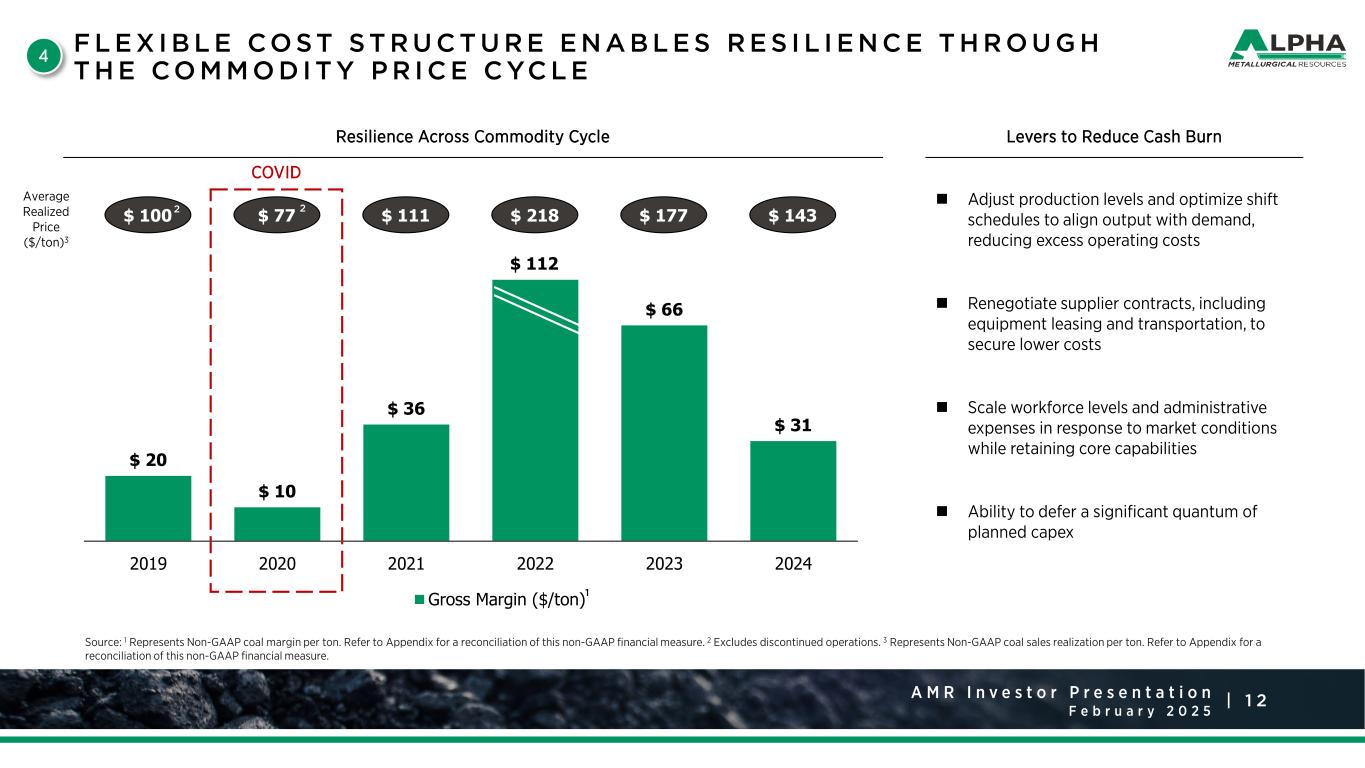

1 2A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Source: 1 Represents Non-GAAP coal margin per ton. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 2 Excludes discontinued operations. 3 Represents Non-GAAP coal sales realization per ton. Refer to Appendix for a reconciliation of this non-GAAP financial measure. F L E X I B L E CO S T S T R U C T U R E E N A B L E S R E S I L I E N C E T H R O U G H T H E CO M M O D I T Y P R I C E C YC L E 4 Resilience Across Commodity Cycle Levers to Reduce Cash Burn Average Realized Price ($/ton)3 COVID Adjust production levels and optimize shift schedules to align output with demand, reducing excess operating costs Renegotiate supplier contracts, including equipment leasing and transportation, to secure lower costs Scale workforce levels and administrative expenses in response to market conditions while retaining core capabilities Ability to defer a significant quantum of planned capex 2 1 $ 20 $ 10 $ 36 $ 66 $ 31 2019 2020 2021 2022 2023 2024 Gross Margin ($/ton) $ 100 $ 77 $ 111 $ 218 $ 177 $ 143 $ 112 22

1 3A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r D I S C I P L I N E D C A P I TA L R E T U R N P O L I C Y W I T H P R OV E N A B I L I T Y TO A DJ U S T TO M A R K E T DY N A M I C S 5 1 Represents Free Cash Flow. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 2 Represents Distributions. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 3 Represents Shareholder Return as a % of Excess Liquidity. Refer to Appendix for a reconciliation of this non-GAAP financial measure. Alpha has focused its shareholder returns on share repurchases, which has been highly accretive for shareholders Management has calibrated shareholder return with Company’s free cash flow generation Share repurchases are the most flexible form of capital return and can be adjusted based on free cash flow generation Going forward, management expects to continue to align shareholder returns and cash generation to maintain a healthy balance sheet Key TakeawaysCapital Return Aligned to Free Cash Flow Generation (U S$ in M ill io ns ) $ 85 $ 1,300 $ 575 $ 349 $ 1 $ 535 $ 653 $ 125 2021A 2022A 2023A 2024A Free Cash Flow¹ Distributions² Shareholder Return as a % of Excess Liquidity3 280 %NM 581 % 36 %

1 4A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r S T R O N G C U LT U R E O F C O M M I T M E N T T O S A F E T Y, E N V I R O N M E N TA L S T E WA R D S H I P, A N D C O N T I N U O U S I M P R O V E M E N T6 Environmental • Environmental Management Systems • Water Management Systems • Waste Management Systems • Biodiversity Control • “Beyond Compliance” Attitude Social • Safety and Health • Workforce and Operations • Community Involvement • Code of Ethics and Responsibility Governance • Rigorous reporting and documentation standards • Strategic shift away from thermal coal Environmental Awards & Recognition 2024 Best Reclaimed Underground Mine 2023 Exemplary Reclamation of Surface Mining 2023 Exemplary Reclamation of Underground Mining 2023 Best AML Dangerous Highwall Elimination 2022 Underground Reclamation Award 2022 Drainage Control award Outstanding Employee Relations Experienced Leadership Driving Growth Safety performance is ~40% better than industry average1 Competitive compensation and benefits package Equal opportunity employer Strict anti-harassment and anti-discrimination policies 85% workforce retention in 2024 Combined 100+ years of experience across the coal and financial industries 83% Board independence 33% Board gender diversity Average director age of 58 years Average board tenure of 3 years Note: 1 Represents 2022 – 2024YTD average Non-Fatal Days Lost for Alpha of 1.23 vs. 2.22 for the coal industry average.

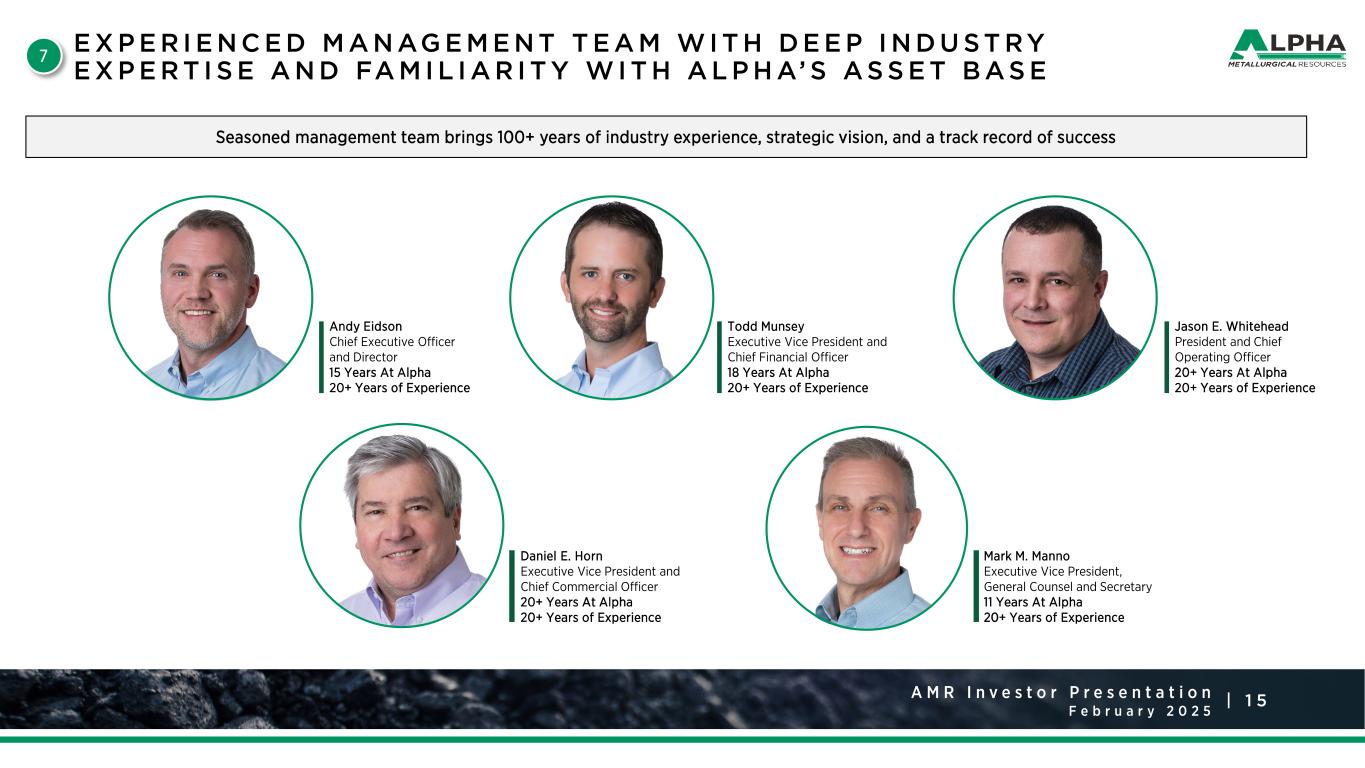

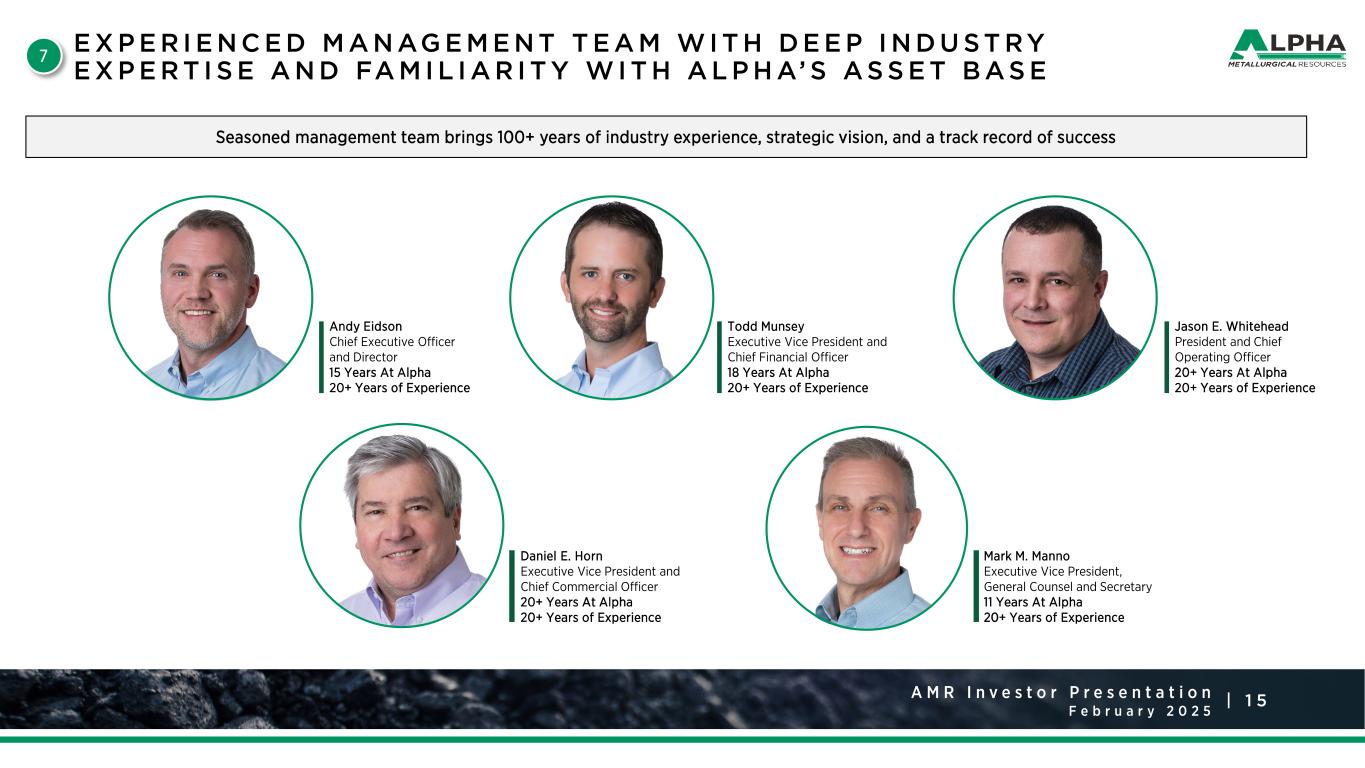

1 5A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r E X P E R I E N C E D M A N AG E M E N T T E A M W I T H D E E P I N D U S T RY E X P E R T I S E A N D FA M I L I A R I T Y W I T H A L P H A’ S AS S E T B AS E 7 Seasoned management team brings 100+ years of industry experience, strategic vision, and a track record of success Daniel E. Horn Executive Vice President and Chief Commercial Officer 20+ Years At Alpha 20+ Years of Experience Mark M. Manno Executive Vice President, General Counsel and Secretary 11 Years At Alpha 20+ Years of Experience Andy Eidson Chief Executive Officer and Director 15 Years At Alpha 20+ Years of Experience Todd Munsey Executive Vice President and Chief Financial Officer 18 Years At Alpha 20+ Years of Experience Jason E. Whitehead President and Chief Operating Officer 20+ Years At Alpha 20+ Years of Experience

1 6A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r FINANCIAL SUMMARY

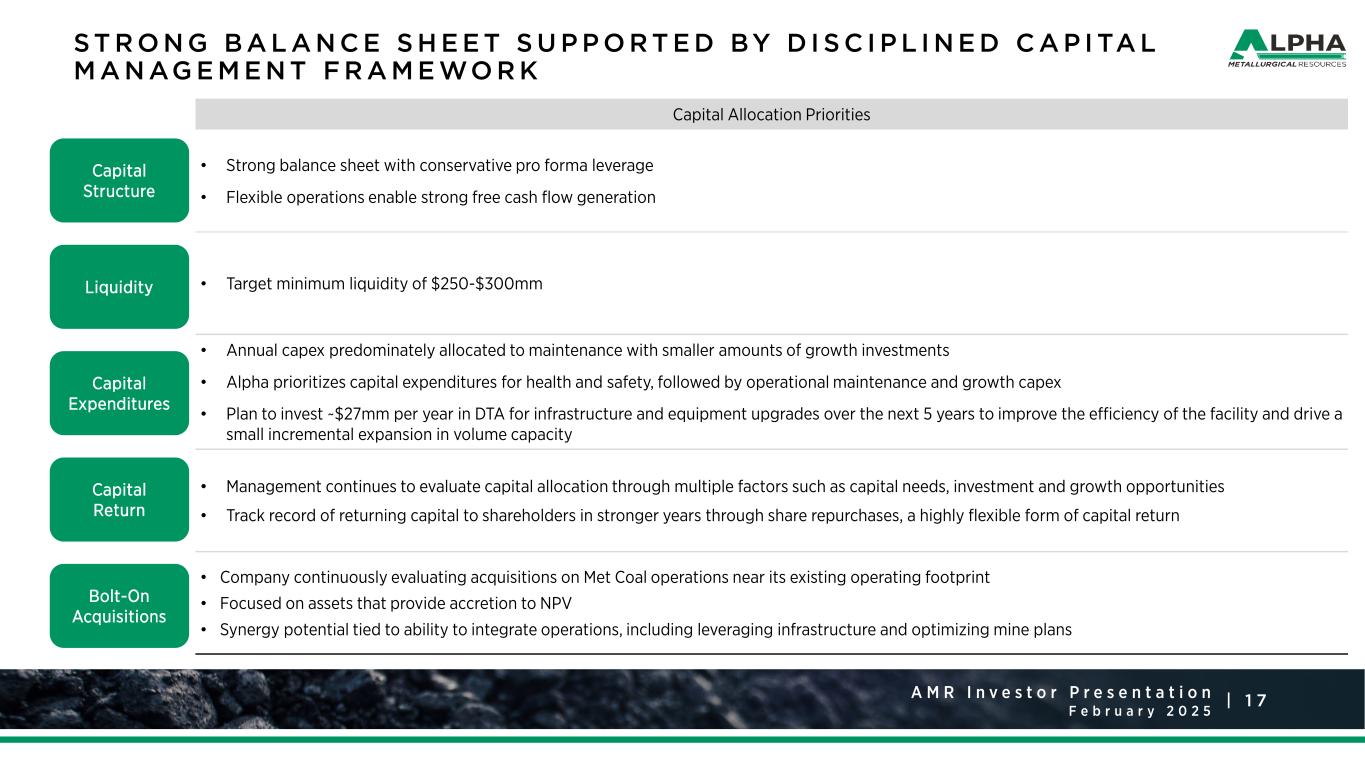

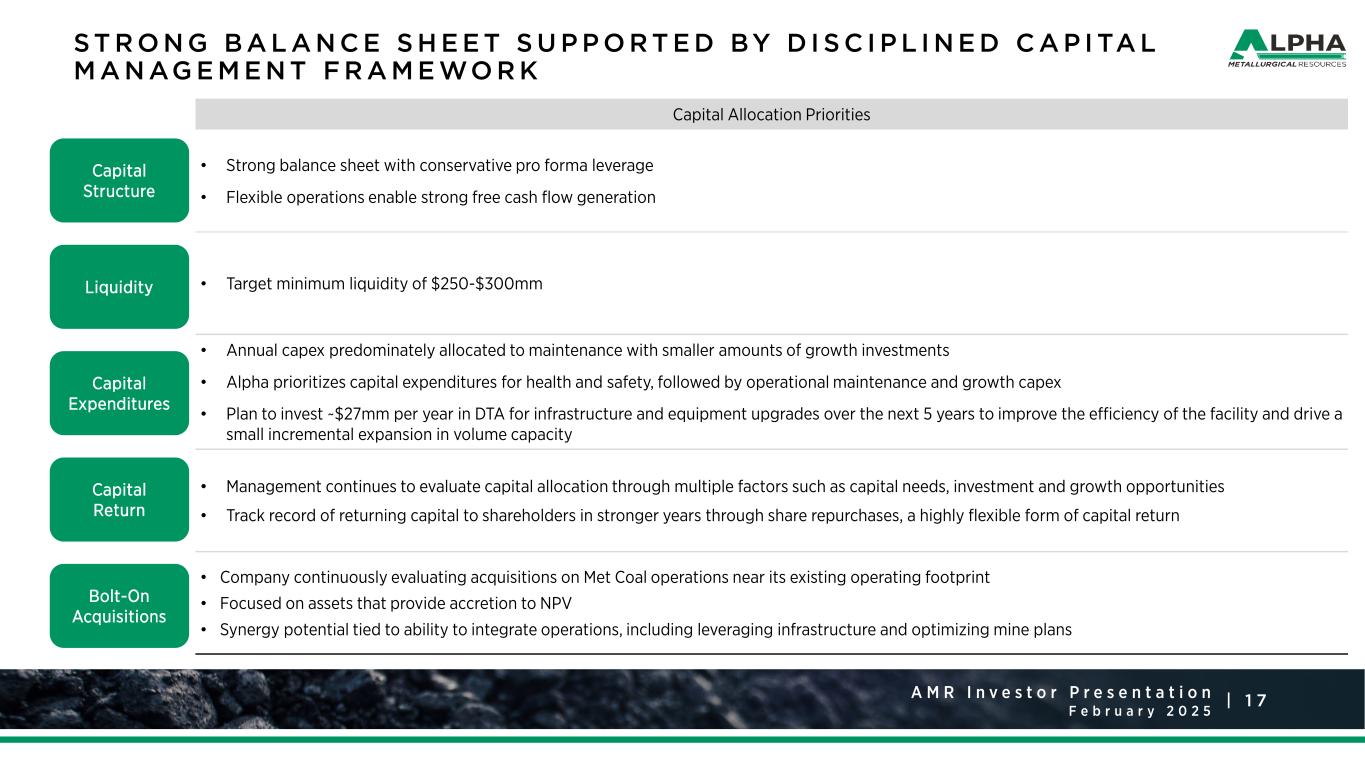

1 7A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Capital Allocation Priorities • Strong balance sheet with conservative pro forma leverage • Flexible operations enable strong free cash flow generation • Target minimum liquidity of $250-$300mm • Annual capex predominately allocated to maintenance with smaller amounts of growth investments • Alpha prioritizes capital expenditures for health and safety, followed by operational maintenance and growth capex • Plan to invest ~$27mm per year in DTA for infrastructure and equipment upgrades over the next 5 years to improve the efficiency of the facility and drive a small incremental expansion in volume capacity • Management continues to evaluate capital allocation through multiple factors such as capital needs, investment and growth opportunities • Track record of returning capital to shareholders in stronger years through share repurchases, a highly flexible form of capital return • Company continuously evaluating acquisitions on Met Coal operations near its existing operating footprint • Focused on assets that provide accretion to NPV • Synergy potential tied to ability to integrate operations, including leveraging infrastructure and optimizing mine plans S T R O N G B A L A N C E S H E E T S U P P O R T E D BY D I S C I P L I N E D C A P I TA L M A N AG E M E N T F R A M E WO R K Capital Structure Liquidity Capital Expenditures Capital Return Bolt-On Acquisitions

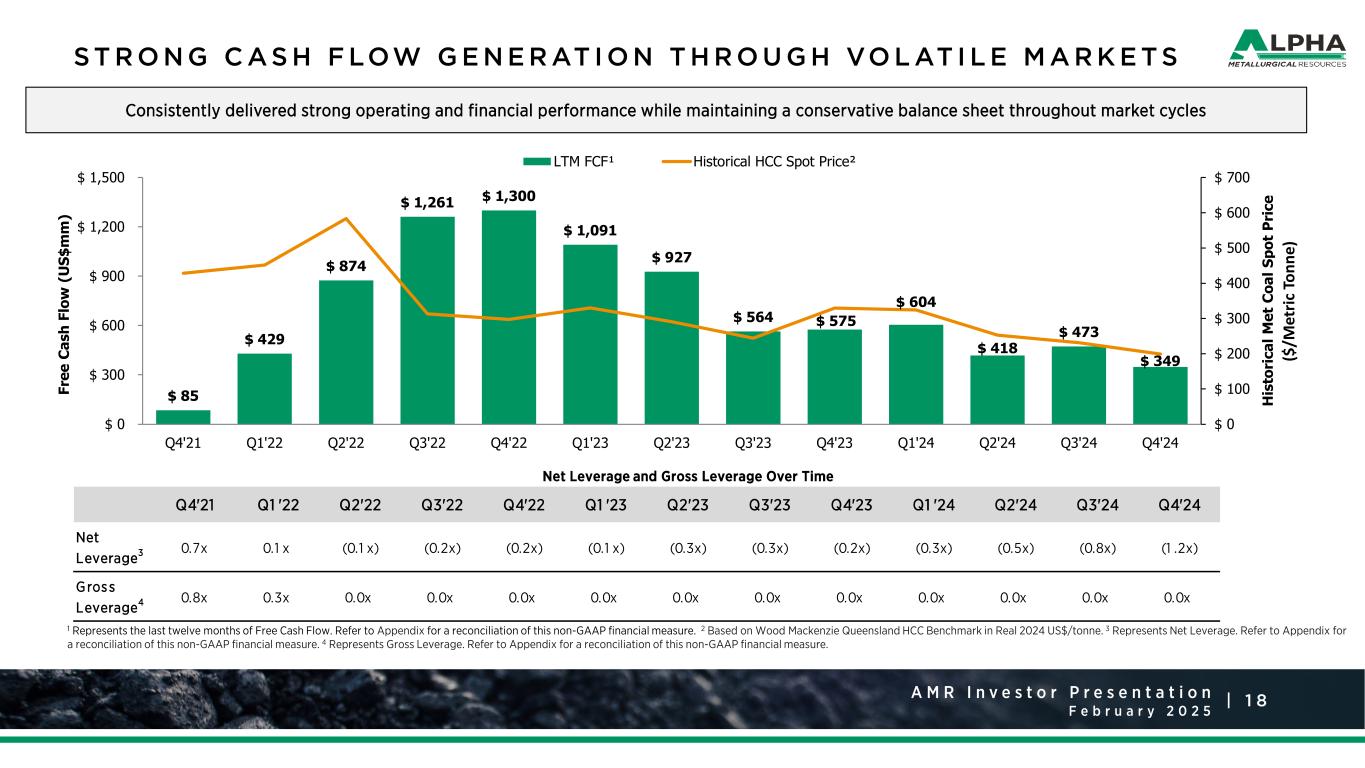

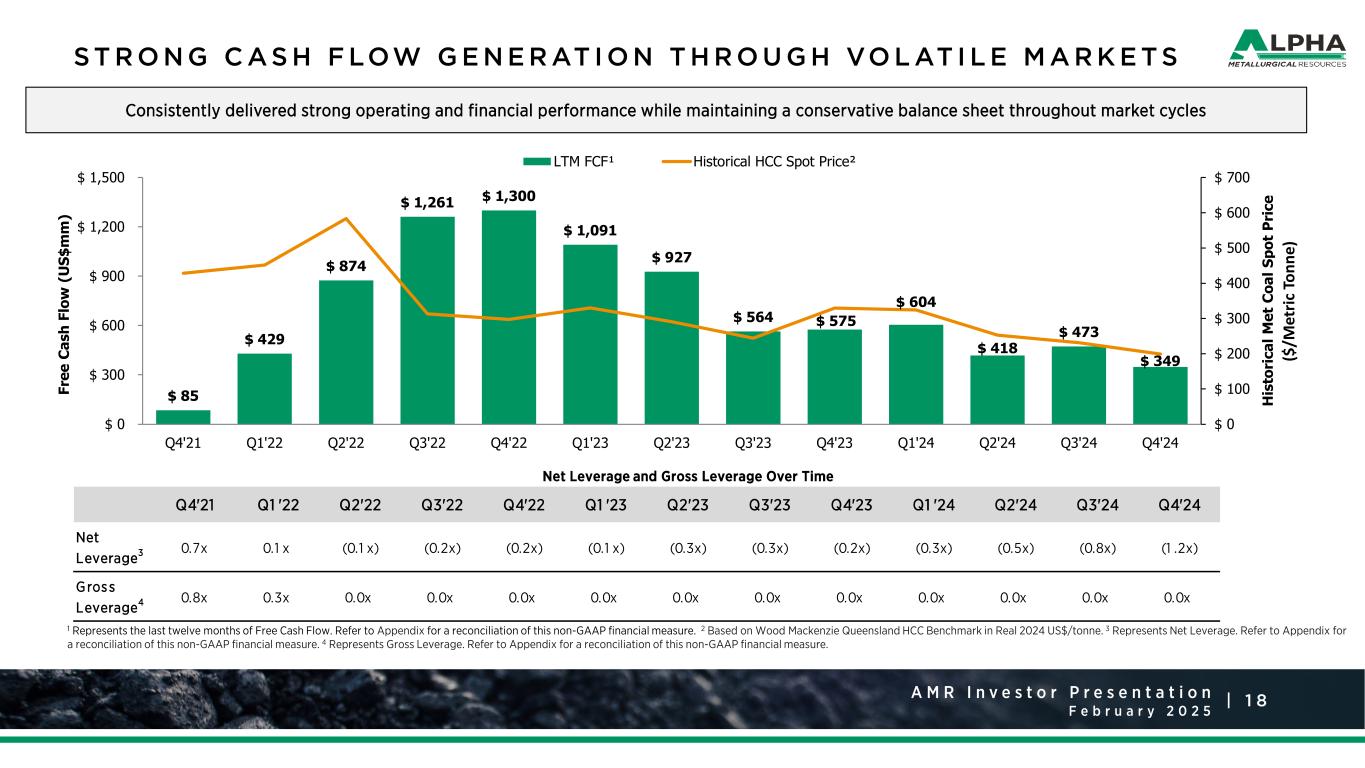

1 8A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r S T R O N G C AS H F LOW G E N E R AT I O N T H R O U G H VO L AT I L E M A R K E T S Net Leverage and Gross Leverage Over Time 1 Represents the last twelve months of Free Cash Flow. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 2 Based on Wood Mackenzie Queensland HCC Benchmark in Real 2024 US$/tonne. 3 Represents Net Leverage. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 4 Represents Gross Leverage. Refer to Appendix for a reconciliation of this non-GAAP financial measure. Consistently delivered strong operating and financial performance while maintaining a conservative balance sheet throughout market cycles $ 85 $ 429 $ 874 $ 1,261 $ 1,300 $ 1,091 $ 927 $ 564 $ 575 $ 604 $ 418 $ 473 $ 349 $ 0 $ 100 $ 200 $ 300 $ 400 $ 500 $ 600 $ 700 $ 0 $ 300 $ 600 $ 900 $ 1,200 $ 1,500 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 H is to ri ca l M et C oa l S po t P ri ce Fr ee C as h Fl ow ( U S$ m m ) LTM FCF¹ Historical HCC Spot Price² Q4'21 Q1 '22 Q2'22 Q3'22 Q4'22 Q1 '23 Q2'23 Q3'23 Q4'23 Q1 '24 Q2'24 Q3'24 Q4'24 Net Leverage3 0.7x 0.1 x (0.1 x) (0.2x) (0.2x) (0.1 x) (0.3x) (0.3x) (0.2x) (0.3x) (0.5x) (0.8x) (1 .2x) Gros s Leverage4 0.8x 0.3x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x ($ /M et ric To nn e)

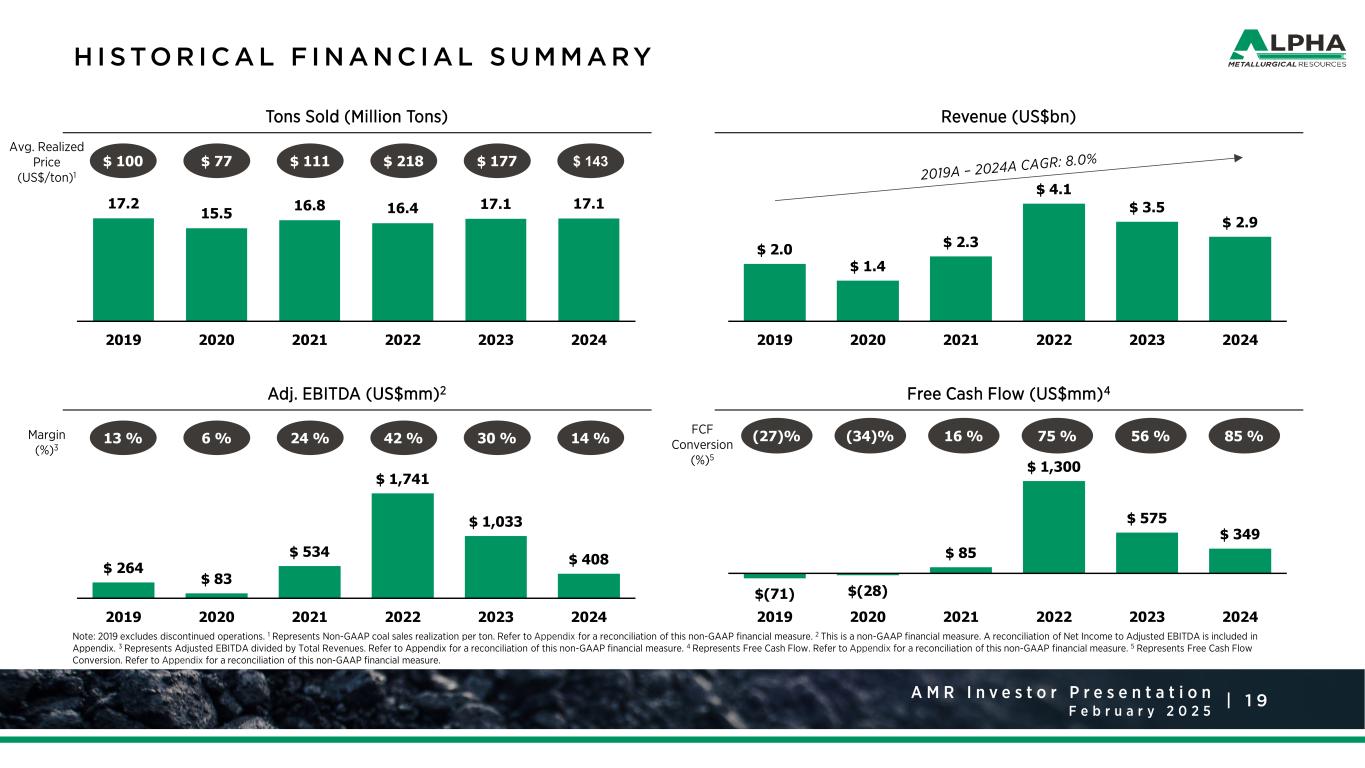

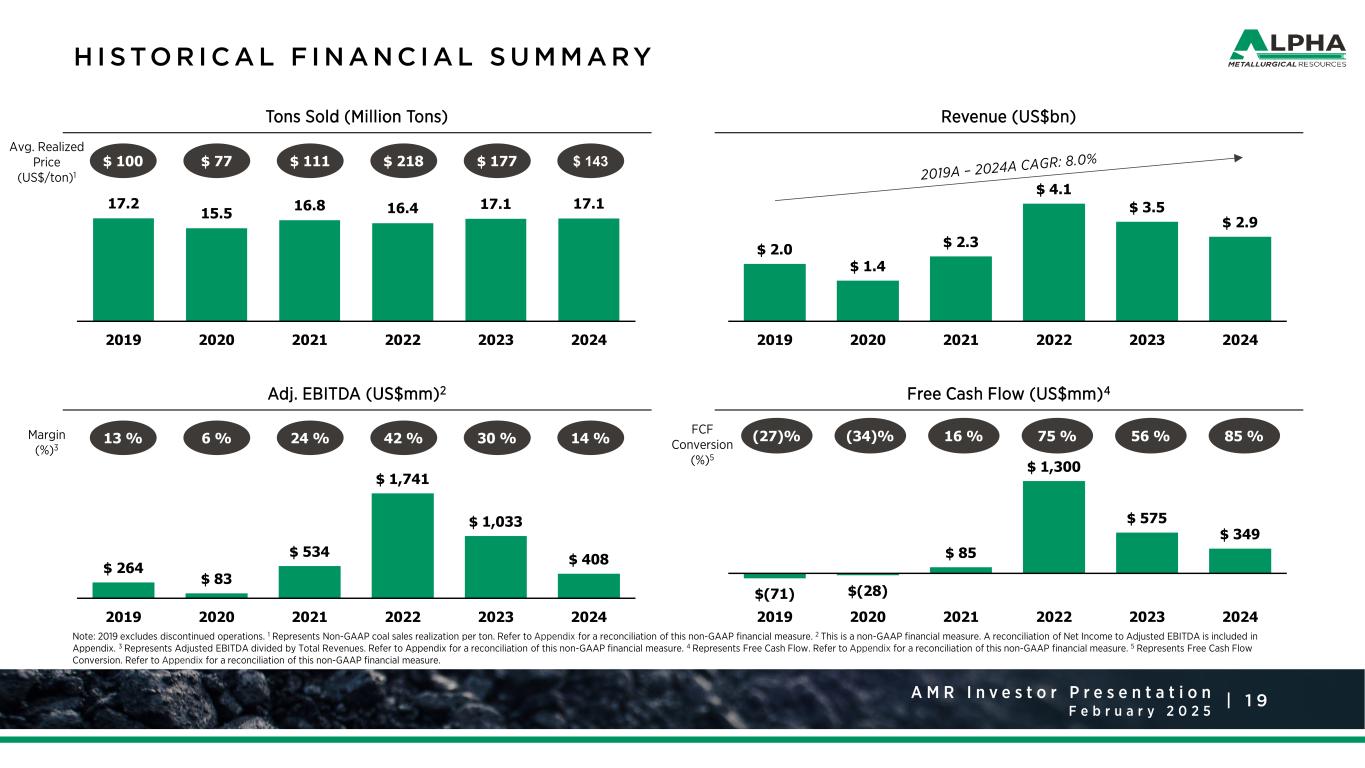

1 9A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r H I S TO R I C A L F I N A N C I A L S U M M A RY Tons Sold (Million Tons) Revenue (US$bn) Adj. EBITDA (US$mm)2 Free Cash Flow (US$mm)4 Avg. Realized Price (US$/ton)1 Note: 2019 excludes discontinued operations. 1 Represents Non-GAAP coal sales realization per ton. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 2 This is a non-GAAP financial measure. A reconciliation of Net Income to Adjusted EBITDA is included in Appendix. 3 Represents Adjusted EBITDA divided by Total Revenues. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 4 Represents Free Cash Flow. Refer to Appendix for a reconciliation of this non-GAAP financial measure. 5 Represents Free Cash Flow Conversion. Refer to Appendix for a reconciliation of this non-GAAP financial measure. Margin (%)3 FCF Conversion (%)5 17.2 15.5 16.8 16.4 17.1 17.1 2019 2020 2021 2022 2023 2024 $ 100 $ 177 $ 218 $ 111 $ 77 $ 143 $ 2.0 $ 1.4 $ 2.3 $ 4.1 $ 3.5 $ 2.9 2019 2020 2021 2022 2023 2024 $ 264 $ 83 $ 534 $ 1,741 $ 1,033 $ 408 2019 2020 2021 2022 2023 2024 13 % 30 %42 %24 %6 % 14 % $(71) $(28) $ 85 $ 1,300 $ 575 $ 349 2019 2020 2021 2022 2023 2024 (27)% 56 %75 %16 %(34)% 85 %

2 0A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r D I S C I P L I N E D C A P I TA L E X P E N D I T U R E S W I T H A B I L I T Y TO A DJ U S T TO M A R K E T N E E D S Alpha’s Capital Expenditures (US$mm) Alpha Capex Overview Alpha has shown the ability to adjust its capex spend based on market dynamics and reduce cash outlays in a downside pricing environment Currently developing Kingston Wildcat (previously named Kingston Sewell), a new underground mine in Fayette County, West Virginia — Mine is expected to produce a low- volatile product — Surface site development and slope excavation underway, with first production expected in late 2025 Note: 1 Midpoint of guidance. 2 Carryover reflects capex intended to be spent in 2024 that was delayed due to timing and availability of supplies and contract labor. Carryover2 $10 Million – 2025E¹ Maintenance Capex $117 Million – 2025E¹ Development Projects $40 Million – 2025E¹ $ 192 $ 154 $ 83 $ 164 $ 245 $ 199 $ 167 $ 0 $ 25 $ 50 $ 75 $ 100 $ 125 $ 150 $ 175 $ 200 $ 225 $ 250 $ 275 2019A 2020A 2021A 2022A 2023A 2024A 2025E¹ In m ill io ns

2 1A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b rAppendix A: Supplemental Materials

2 2A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r 3.09 3.04 3.02 2.37 2.21 2.22 2022 2023* 2024 YTD(1) Coal Industry Average Total Reportable Incident Rate (TRIR) 2.20 2.23 2.22 1.05 1.30 1.35 2022* 2023 2024 YTD(1) Non-Fatal Days Lost (NFDL) S A F E T Y D R I V E S O U R C U LT U R E A N D CO N T I N U O U S I M P R OV E M E N T Alpha (1) 2024 YTD data represents January – September, the most recent available timeframe from MSHA for coal industry averages.*AMR record

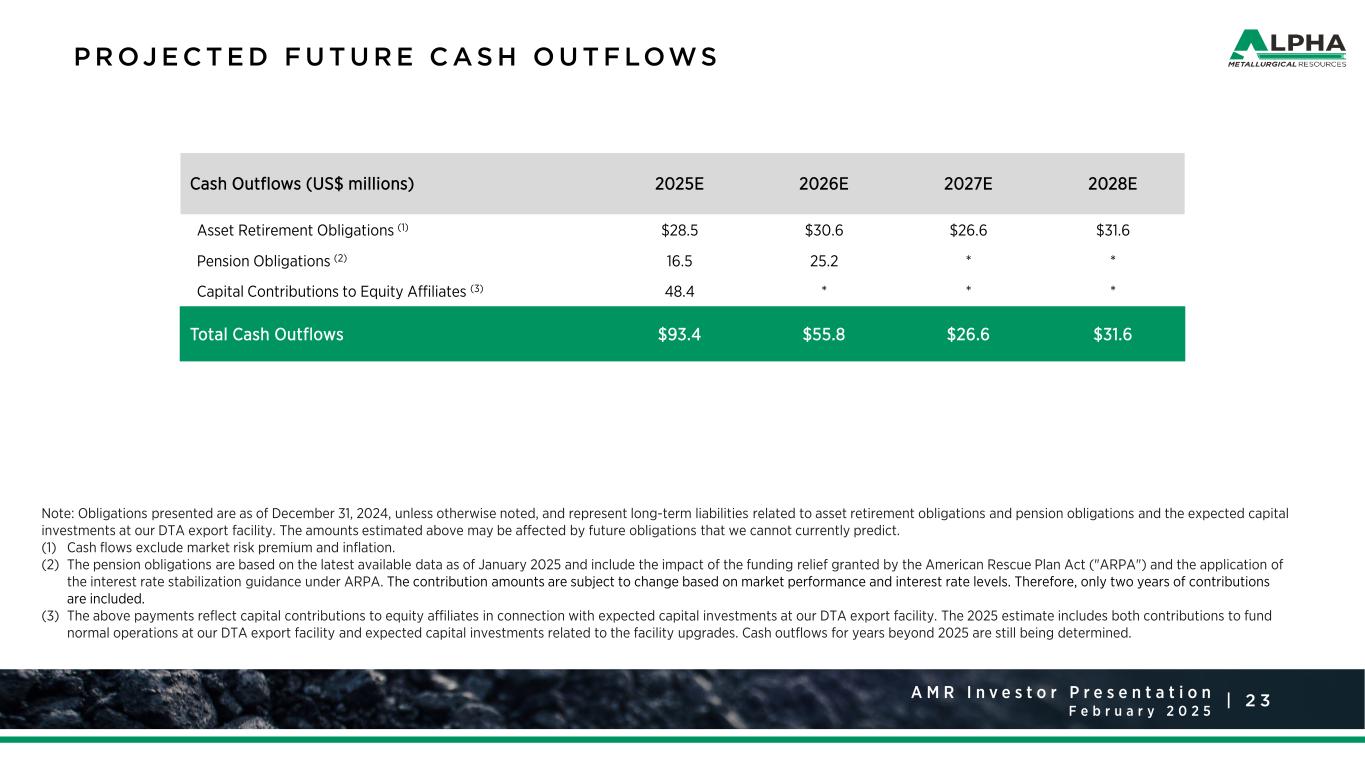

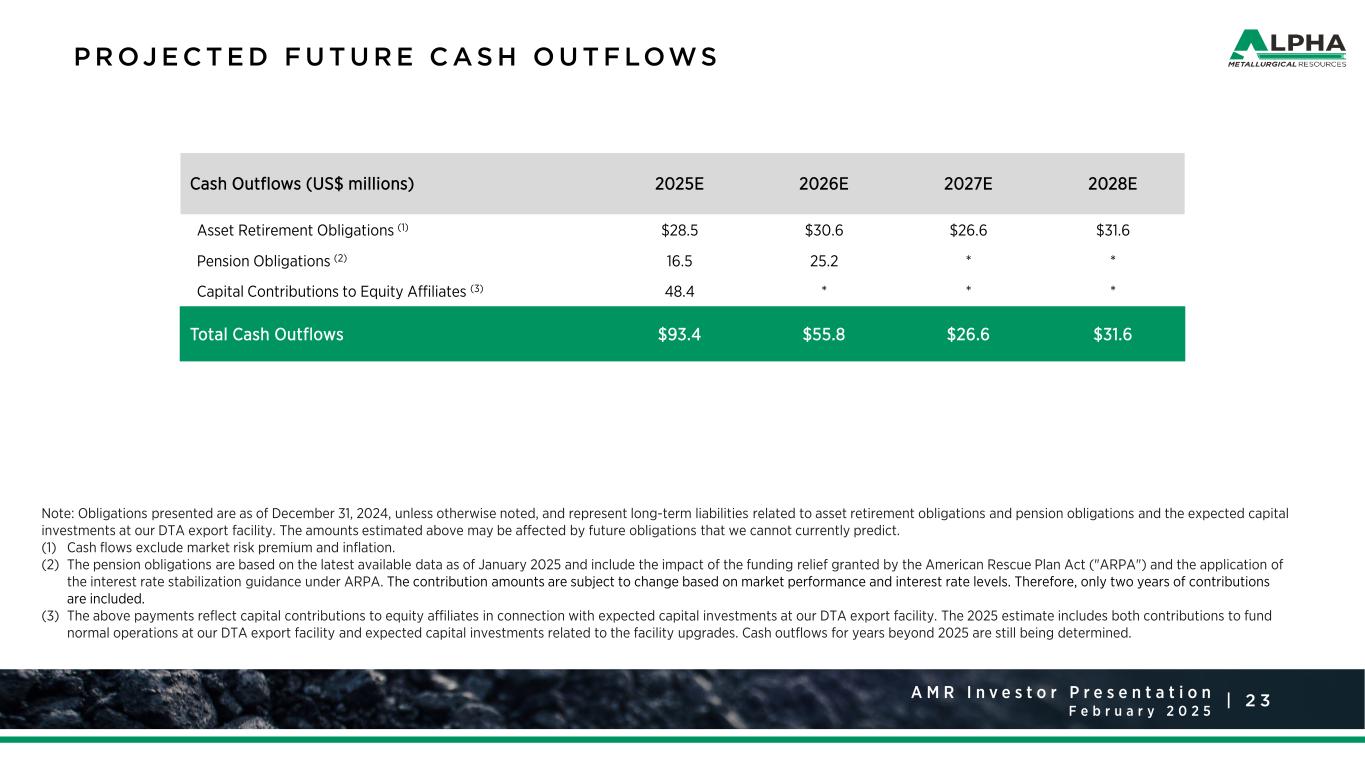

2 3A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r P R OJ E C T E D F U T U R E C AS H O U T F LOWS Note: Obligations presented are as of December 31, 2024, unless otherwise noted, and represent long-term liabilities related to asset retirement obligations and pension obligations and the expected capital investments at our DTA export facility. The amounts estimated above may be affected by future obligations that we cannot currently predict. (1) Cash flows exclude market risk premium and inflation. (2) The pension obligations are based on the latest available data as of January 2025 and include the impact of the funding relief granted by the American Rescue Plan Act ("ARPA") and the application of the interest rate stabilization guidance under ARPA. The contribution amounts are subject to change based on market performance and interest rate levels. Therefore, only two years of contributions are included. (3) The above payments reflect capital contributions to equity affiliates in connection with expected capital investments at our DTA export facility. The 2025 estimate includes both contributions to fund normal operations at our DTA export facility and expected capital investments related to the facility upgrades. Cash outflows for years beyond 2025 are still being determined. Cash Outflows (US$ millions) 2025E 2026E 2027E 2028E Asset Retirement Obligations (1) $28.5 $30.6 $26.6 $31.6 Pension Obligations (2) 16.5 25.2 * * Capital Contributions to Equity Affiliates (3) 48.4 * * * Total Cash Outflows $93.4 $55.8 $26.6 $31.6

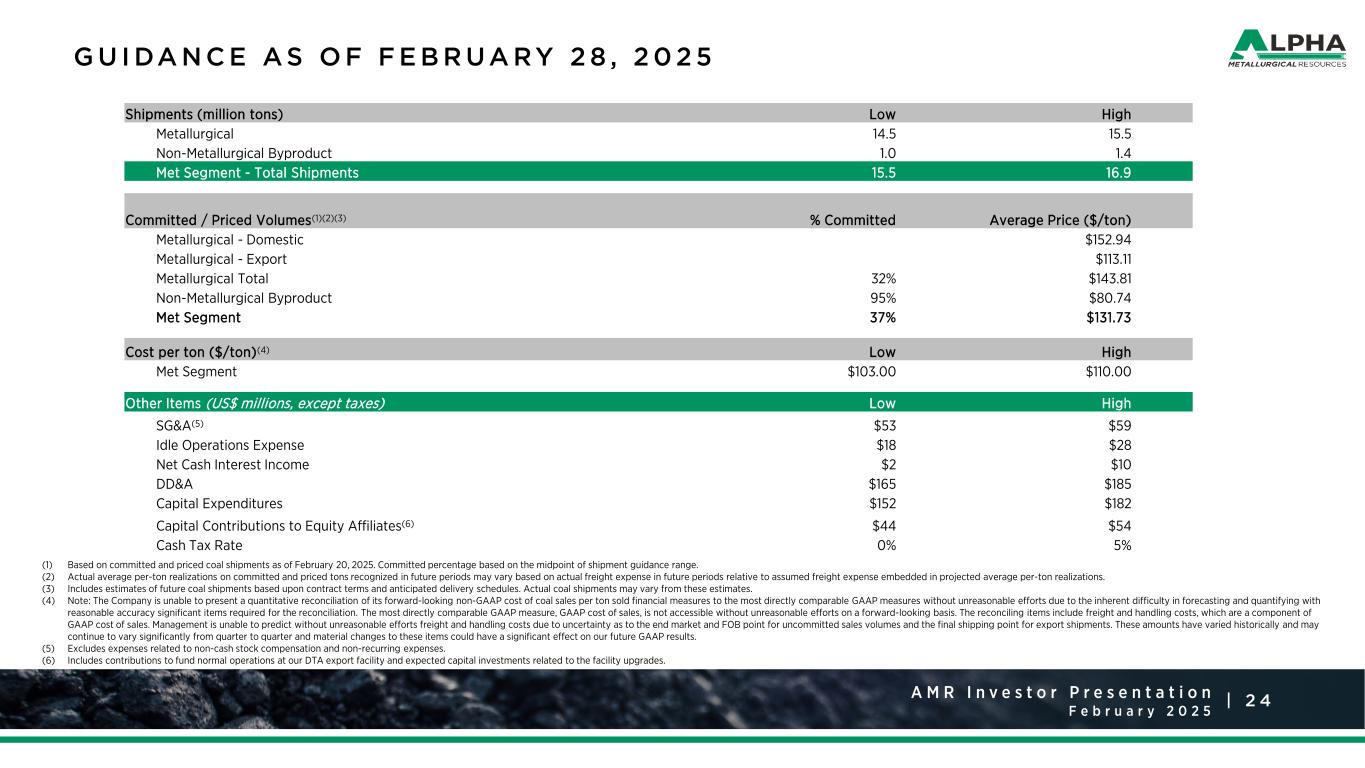

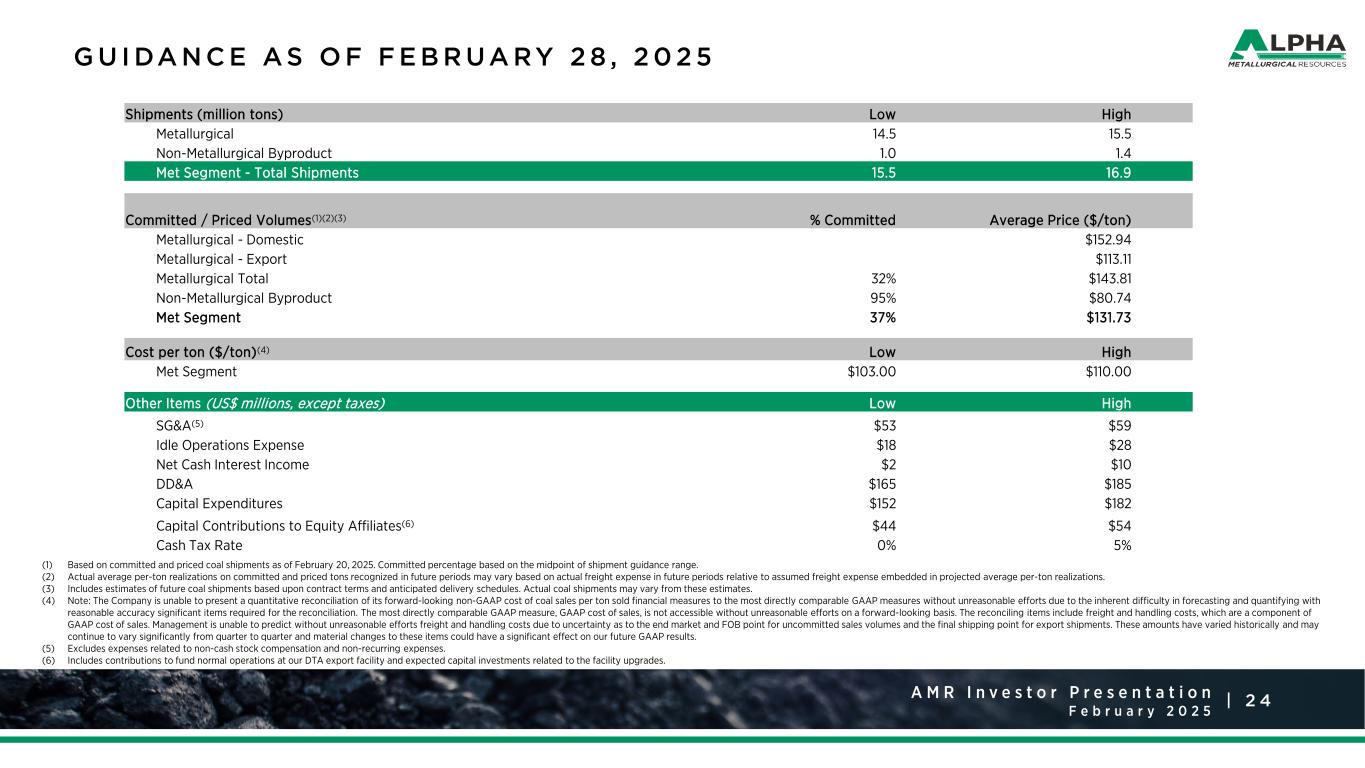

2 4A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r (1) Based on committed and priced coal shipments as of February 20, 2025. Committed percentage based on the midpoint of shipment guidance range. (2) Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations. (3) Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates. (4) Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have varied historically and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results. (5) Excludes expenses related to non-cash stock compensation and non-recurring expenses. (6) Includes contributions to fund normal operations at our DTA export facility and expected capital investments related to the facility upgrades. G U I DA N C E A S O F F E B R UA RY 2 8 , 2 0 2 5 Shipments (million tons) Low High Metallurgical 14.5 15.5 Non-Metallurgical Byproduct 1.0 1.4 Met Segment - Total Shipments 15.5 16.9 Committed / Priced Volumes(1)(2)(3) % Committed Average Price ($/ton) Metallurgical - Domestic $152.94 Metallurgical - Export $113.11 Metallurgical Total 32% $143.81 Non-Metallurgical Byproduct 95% $80.74 Met Segment 37% $131.73 Cost per ton ($/ton)(4) Low High Met Segment $103.00 $110.00 Other Items (US$ millions, except taxes) Low High SG&A(5) $53 $59 Idle Operations Expense $18 $28 Net Cash Interest Income $2 $10 DD&A $165 $185 Capital Expenditures $152 $182 Capital Contributions to Equity Affiliates(6) $44 $54 Cash Tax Rate 0% 5%

2 5A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b rAppendix B: Non-GAAP Financial Measures & Reconciliations

2 6A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Non-GAAP Financial Measures The Investor Presentation contains “non-GAAP financial measures.” These are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” “non-GAAP coal margin,” “Margin %,” “non-GAAP coal sales realization per ton,” “non-GAAP cost of coal sales per ton,” “Free Cash Flow,” “Free Cash Flow Conversion,” “Net Leverage,” “Gross Leverage,” “Total Distributions,” “Excess Liquidity,” and “Shareholder Return as a % of Excess Liquidity.” In addition to net income, we use Adjusted EBITDA to measure the operating performance of our reportable segment. Adjusted EBITDA does not purport to be an alternative to net income as a measure of operating performance or any other measure of operating results, financial performance, or liquidity presented in accordance with GAAP. Moreover, this measure is not calculated identically by all companies and therefore may not be comparable to similarly titled measures used by other companies. Adjusted EBITDA is presented because management believes it is a useful indicator of the financial performance of our coal operations. Margin % is calculated as Adjusted EBITDA divided by total revenues. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization - production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, and idled and closed mine costs. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. Free Cash Flow is calculated as cash flow from operations less capital expenditures and capital contributions to equity affiliates. Free Cash Flow Conversion is calculated as Free Cash Flow divided by Adjusted EBITDA. Net Leverage is calculated as the last twelve months of Adjusted EBITDA divided by net debt. Gross Leverage is calculated as the last twelve months of Adjusted EBITDA divided by gross debt. Total Distributions is calculated as dividend and dividend equivalents paid plus common stock repurchases and related expenses. Excess Liquidity is calculated as cash and cash equivalents, short-term investments and credit facility capacity less outstanding letters of credit and minimum liquidity. Shareholder Return as a % of Excess Liquidity is calculated as Total Distributions divided by Excess Liquidity. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, capital investments and other factors. Included on the following slides are reconciliations of non-GAAP financial measures to GAAP financial measures.

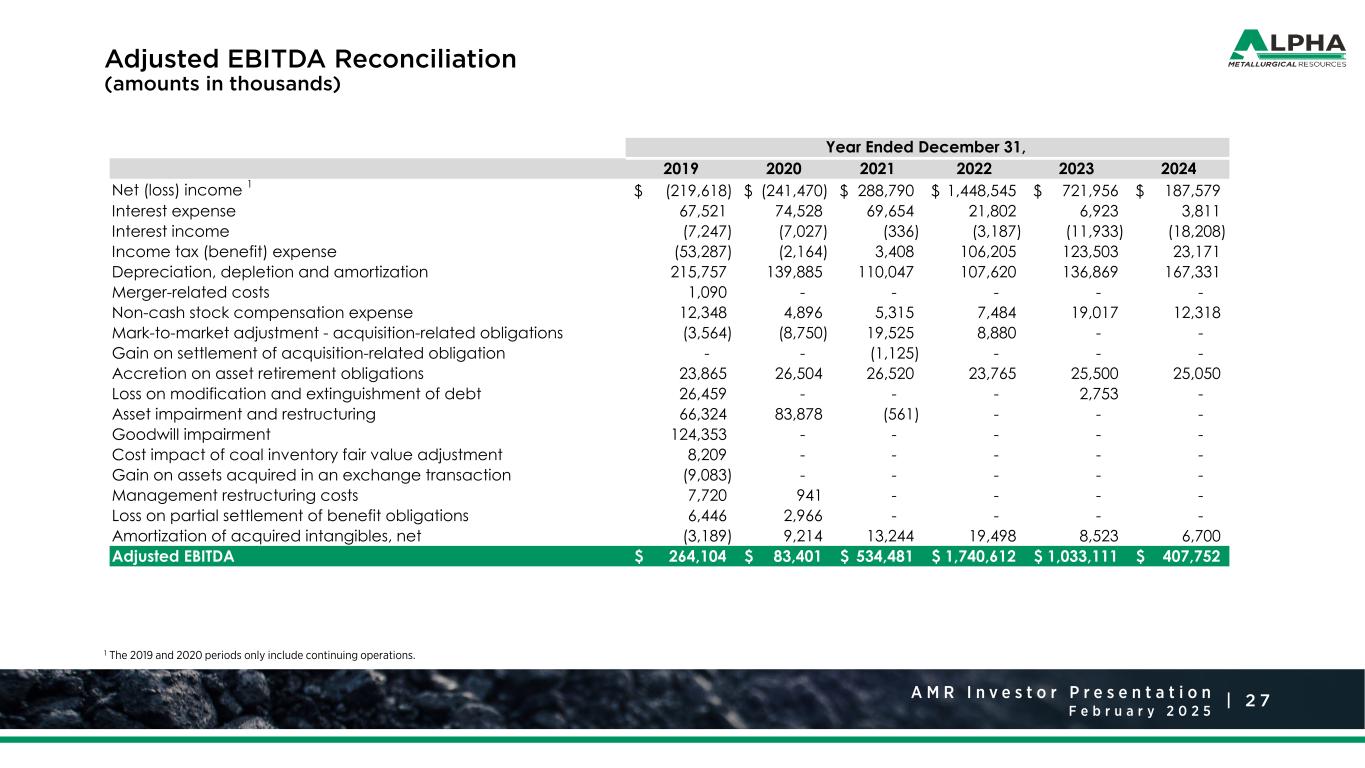

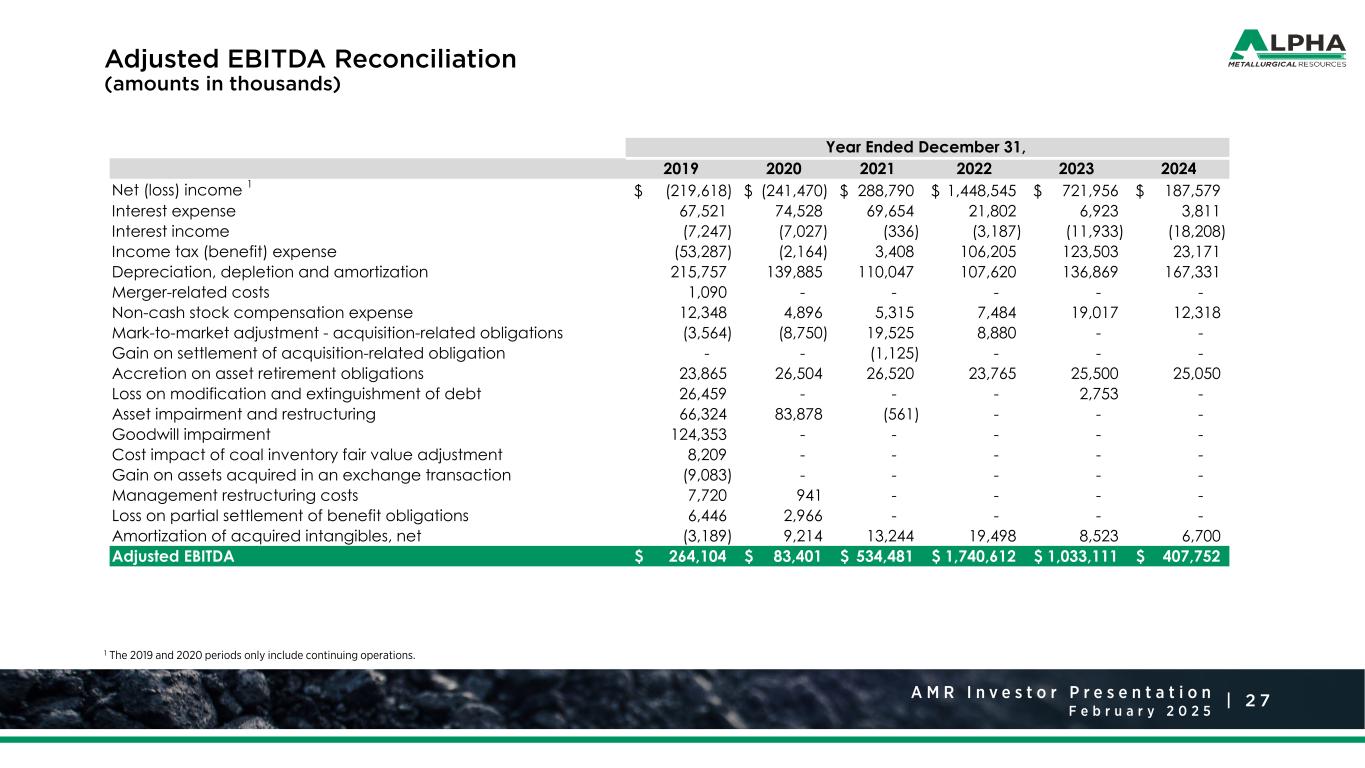

2 7A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Adjusted EBITDA Reconciliation (amounts in thousands) 1 The 2019 and 2020 periods only include continuing operations. 2019 2020 2021 2022 2023 2024 Net (loss) income 1 (219,618)$ (241,470)$ 288,790$ 1,448,545$ 721,956$ 187,579$ Interest expense 67,521 74,528 69,654 21,802 6,923 3,811 Interest income (7,247) (7,027) (336) (3,187) (11,933) (18,208) Income tax (benefit) expense (53,287) (2,164) 3,408 106,205 123,503 23,171 Depreciation, depletion and amortization 215,757 139,885 110,047 107,620 136,869 167,331 Merger-related costs 1,090 - - - - - Non-cash stock compensation expense 12,348 4,896 5,315 7,484 19,017 12,318 Mark-to-market adjustment - acquisition-related obligations (3,564) (8,750) 19,525 8,880 - - Gain on settlement of acquisition-related obligation - - (1,125) - - - Accretion on asset retirement obligations 23,865 26,504 26,520 23,765 25,500 25,050 Loss on modification and extinguishment of debt 26,459 - - - 2,753 - Asset impairment and restructuring 66,324 83,878 (561) - - - Goodwill impairment 124,353 - - - - - Cost impact of coal inventory fair value adjustment 8,209 - - - - - Gain on assets acquired in an exchange transaction (9,083) - - - - - Management restructuring costs 7,720 941 - - - - Loss on partial settlement of benefit obligations 6,446 2,966 - - - - Amortization of acquired intangibles, net (3,189) 9,214 13,244 19,498 8,523 6,700 Adjusted EBITDA 264,104$ 83,401$ 534,481$ 1,740,612$ 1,033,111$ 407,752$ Year Ended December 31,

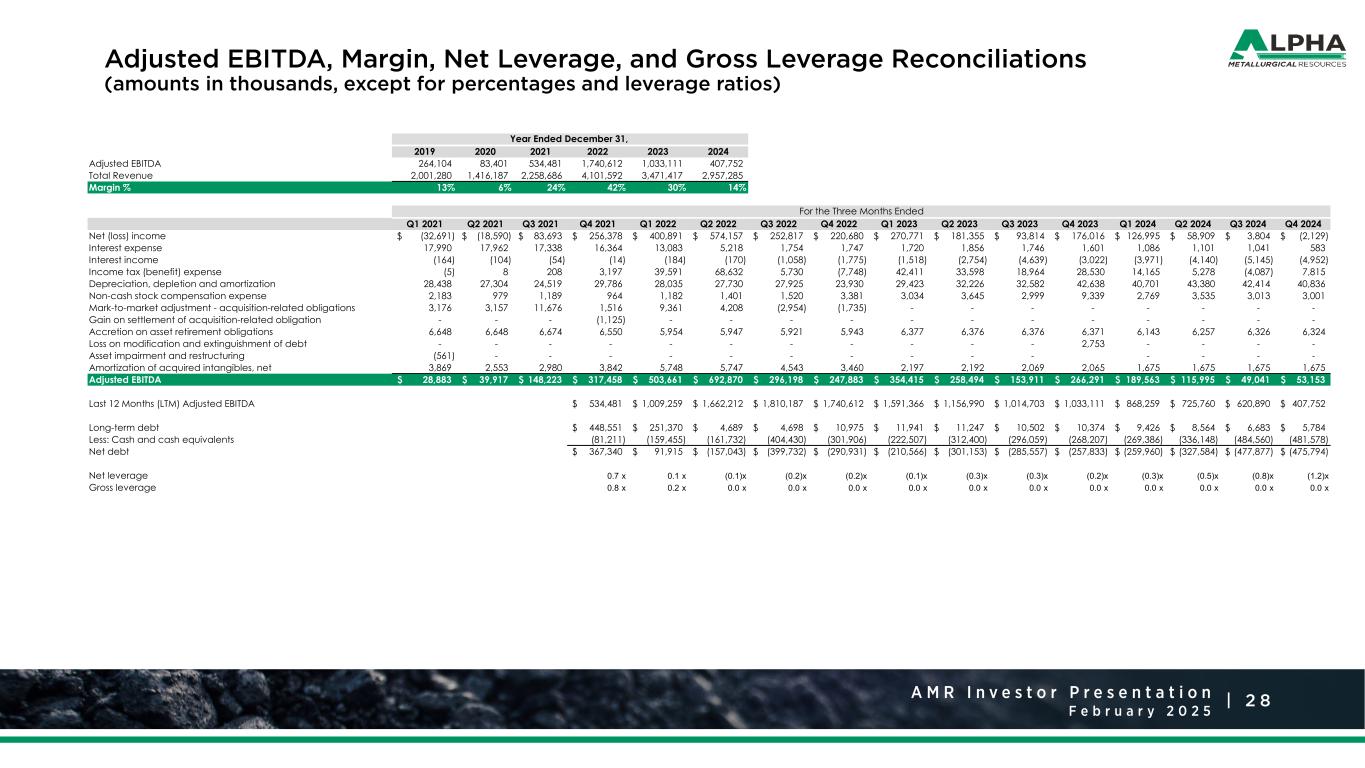

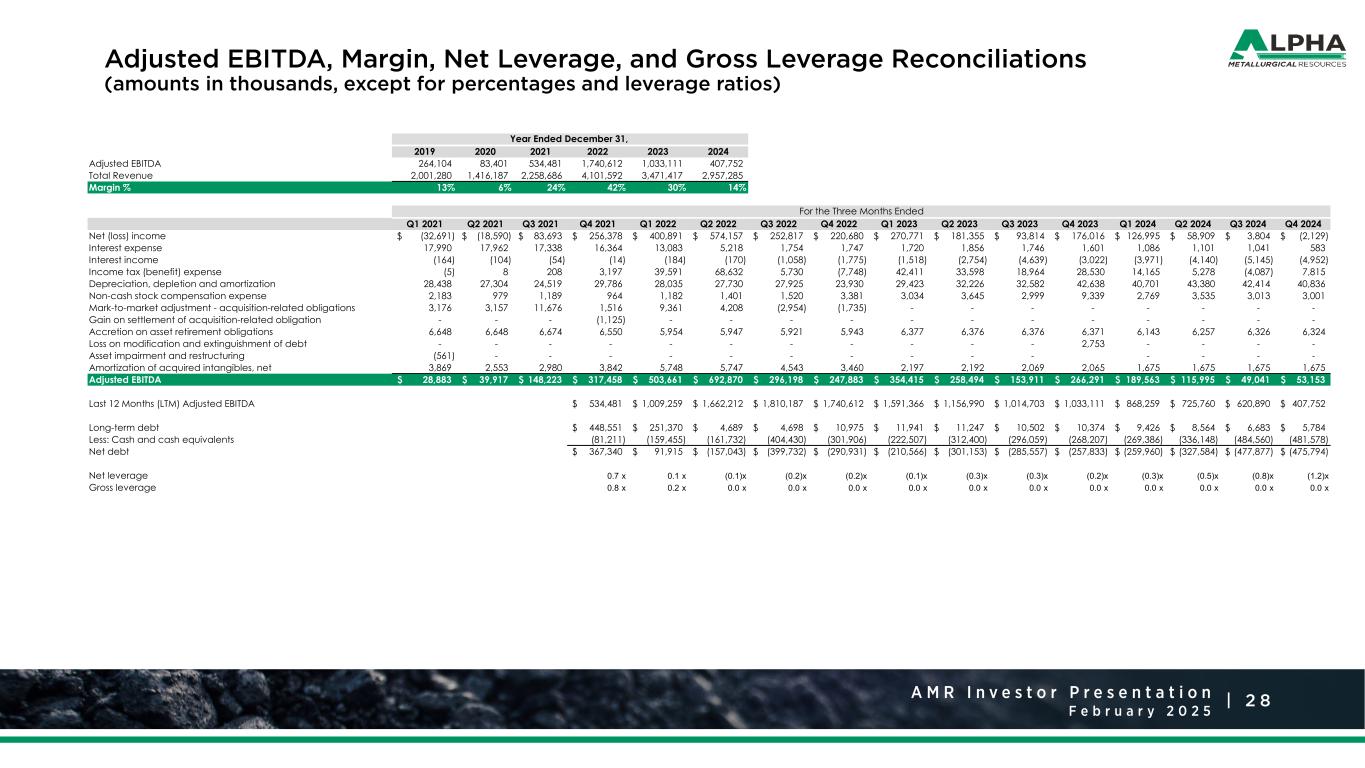

2 8A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Adjusted EBITDA, Margin, Net Leverage, and Gross Leverage Reconciliations (amounts in thousands, except for percentages and leverage ratios) 2019 2020 2021 2022 2023 2024 Adjusted EBITDA 264,104 83,401 534,481 1,740,612 1,033,111 407,752 Total Revenue 2,001,280 1,416,187 2,258,686 4,101,592 3,471,417 2,957,285 Margin % 13% 6% 24% 42% 30% 14% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Net (loss) income (32,691)$ (18,590)$ 83,693$ 256,378$ 400,891$ 574,157$ 252,817$ 220,680$ 270,771$ 181,355$ 93,814$ 176,016$ 126,995$ 58,909$ 3,804$ (2,129)$ Interest expense 17,990 17,962 17,338 16,364 13,083 5,218 1,754 1,747 1,720 1,856 1,746 1,601 1,086 1,101 1,041 583 Interest income (164) (104) (54) (14) (184) (170) (1,058) (1,775) (1,518) (2,754) (4,639) (3,022) (3,971) (4,140) (5,145) (4,952) Income tax (benefit) expense (5) 8 208 3,197 39,591 68,632 5,730 (7,748) 42,411 33,598 18,964 28,530 14,165 5,278 (4,087) 7,815 Depreciation, depletion and amortization 28,438 27,304 24,519 29,786 28,035 27,730 27,925 23,930 29,423 32,226 32,582 42,638 40,701 43,380 42,414 40,836 Non-cash stock compensation expense 2,183 979 1,189 964 1,182 1,401 1,520 3,381 3,034 3,645 2,999 9,339 2,769 3,535 3,013 3,001 Mark-to-market adjustment - acquisition-related obligations 3,176 3,157 11,676 1,516 9,361 4,208 (2,954) (1,735) - - - - - - - - Gain on settlement of acquisition-related obligation - - - (1,125) - - - - - - - - - - - - Accretion on asset retirement obligations 6,648 6,648 6,674 6,550 5,954 5,947 5,921 5,943 6,377 6,376 6,376 6,371 6,143 6,257 6,326 6,324 Loss on modification and extinguishment of debt - - - - - - - - - - - 2,753 - - - - Asset impairment and restructuring (561) - - - - - - - - - - - - - - Amortization of acquired intangibles, net 3,869 2,553 2,980 3,842 5,748 5,747 4,543 3,460 2,197 2,192 2,069 2,065 1,675 1,675 1,675 1,675 Adjusted EBITDA 28,883$ 39,917$ 148,223$ 317,458$ 503,661$ 692,870$ 296,198$ 247,883$ 354,415$ 258,494$ 153,911$ 266,291$ 189,563$ 115,995$ 49,041$ 53,153$ Last 12 Months (LTM) Adjusted EBITDA 534,481$ 1,009,259$ 1,662,212$ 1,810,187$ 1,740,612$ 1,591,366$ 1,156,990$ 1,014,703$ 1,033,111$ 868,259$ 725,760$ 620,890$ 407,752$ Long-term debt 448,551$ 251,370$ 4,689$ 4,698$ 10,975$ 11,941$ 11,247$ 10,502$ 10,374$ 9,426$ 8,564$ 6,683$ 5,784$ Less: Cash and cash equivalents (81,211) (159,455) (161,732) (404,430) (301,906) (222,507) (312,400) (296,059) (268,207) (269,386) (336,148) (484,560) (481,578) Net debt 367,340$ 91,915$ (157,043)$ (399,732)$ (290,931)$ (210,566)$ (301,153)$ (285,557)$ (257,833)$ (259,960)$ (327,584)$ (477,877)$ (475,794)$ Net leverage 0.7 x 0.1 x (0.1)x (0.2)x (0.2)x (0.1)x (0.3)x (0.3)x (0.2)x (0.3)x (0.5)x (0.8)x (1.2)x Gross leverage 0.8 x 0.2 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x 0.0 x For the Three Months Ended Year Ended December 31,

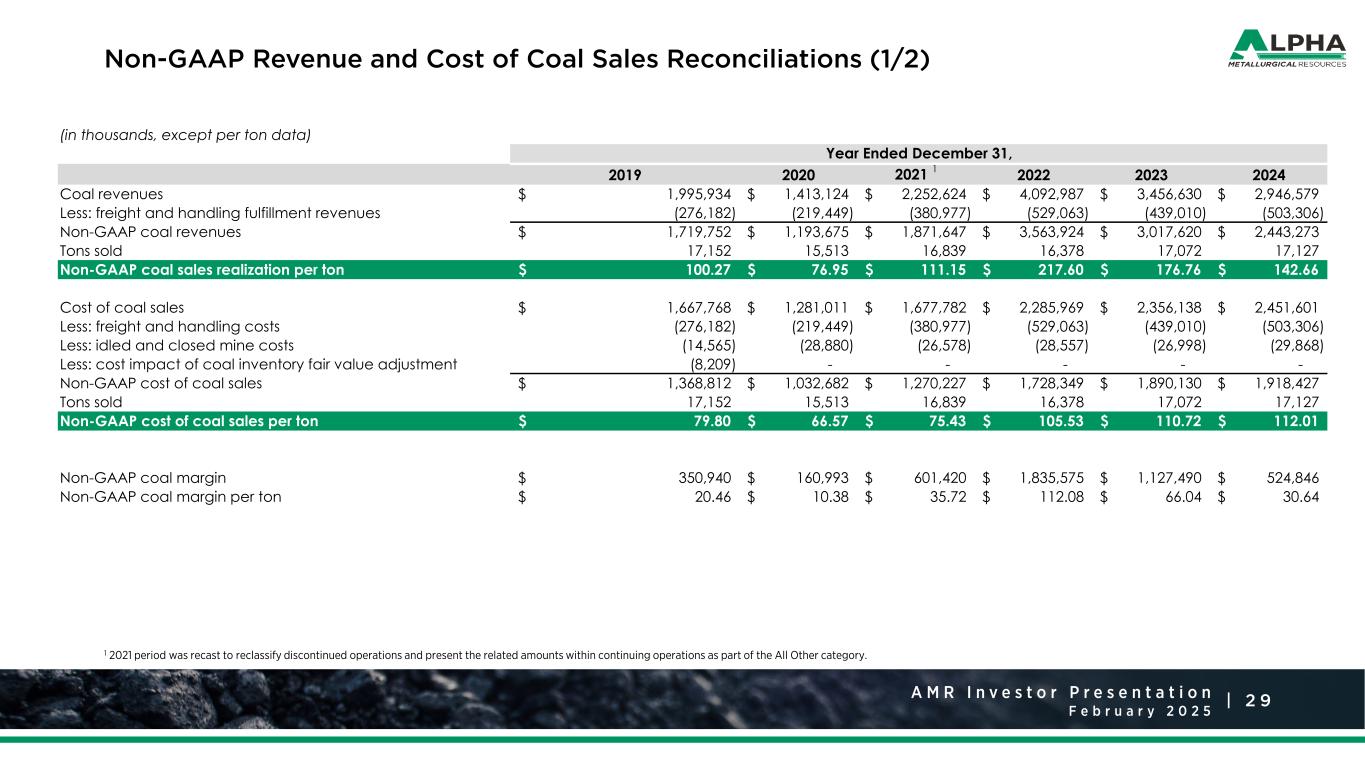

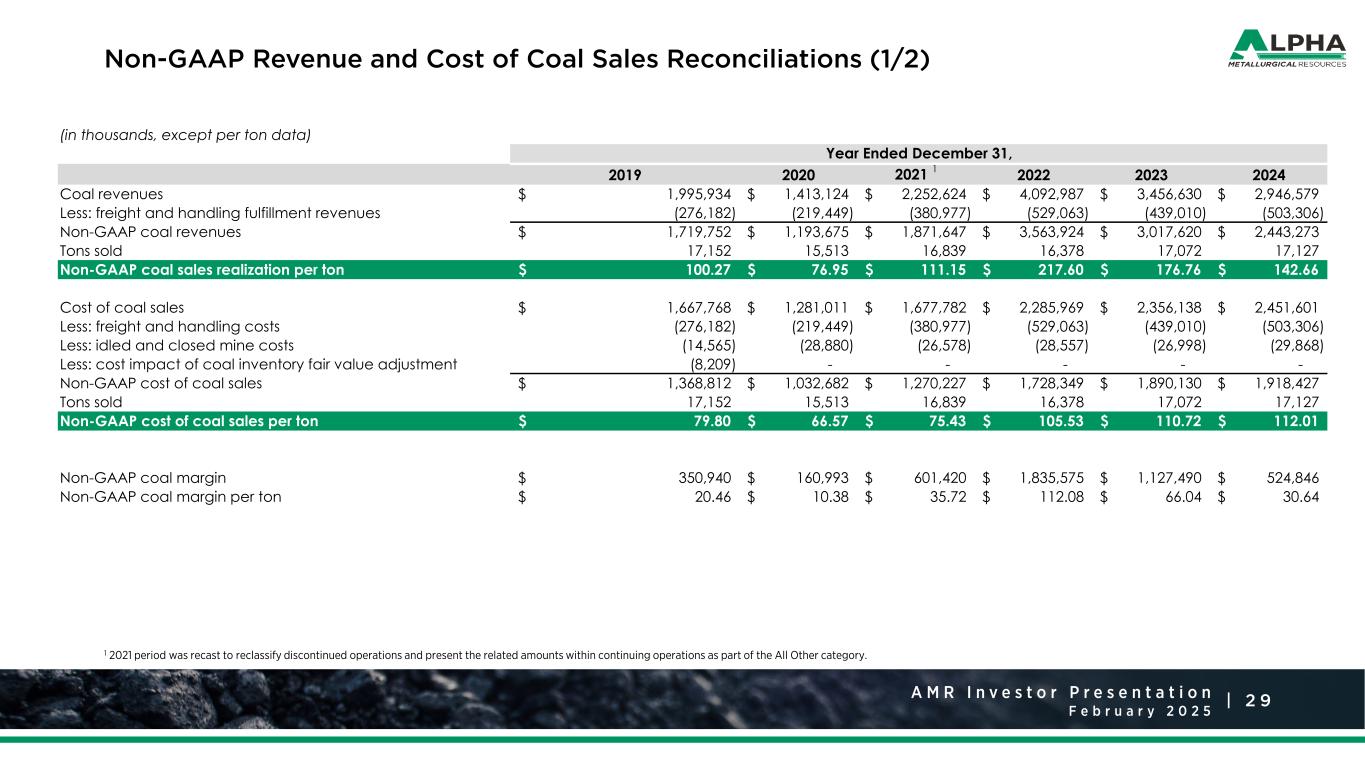

2 9A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Non-GAAP Revenue and Cost of Coal Sales Reconciliations (1/2) 1 2021 period was recast to reclassify discontinued operations and present the related amounts within continuing operations as part of the All Other category. (in thousands, except per ton data) 2019 2020 2021 1 2022 2023 2024 Coal revenues 1,995,934$ 1,413,124$ 2,252,624$ 4,092,987$ 3,456,630$ 2,946,579$ Less: freight and handling fulfillment revenues (276,182) (219,449) (380,977) (529,063) (439,010) (503,306) Non-GAAP coal revenues 1,719,752$ 1,193,675$ 1,871,647$ 3,563,924$ 3,017,620$ 2,443,273$ Tons sold 17,152 15,513 16,839 16,378 17,072 17,127 Non-GAAP coal sales realization per ton 100.27$ 76.95$ 111.15$ 217.60$ 176.76$ 142.66$ Cost of coal sales 1,667,768$ 1,281,011$ 1,677,782$ 2,285,969$ 2,356,138$ 2,451,601$ Less: freight and handling costs (276,182) (219,449) (380,977) (529,063) (439,010) (503,306) Less: idled and closed mine costs (14,565) (28,880) (26,578) (28,557) (26,998) (29,868) Less: cost impact of coal inventory fair value adjustment (8,209) - - - - - Non-GAAP cost of coal sales 1,368,812$ 1,032,682$ 1,270,227$ 1,728,349$ 1,890,130$ 1,918,427$ Tons sold 17,152 15,513 16,839 16,378 17,072 17,127 Non-GAAP cost of coal sales per ton 79.80$ 66.57$ 75.43$ 105.53$ 110.72$ 112.01$ Non-GAAP coal margin 350,940$ 160,993$ 601,420$ 1,835,575$ 1,127,490$ 524,846$ Non-GAAP coal margin per ton 20.46$ 10.38$ 35.72$ 112.08$ 66.04$ 30.64$ Year Ended December 31,

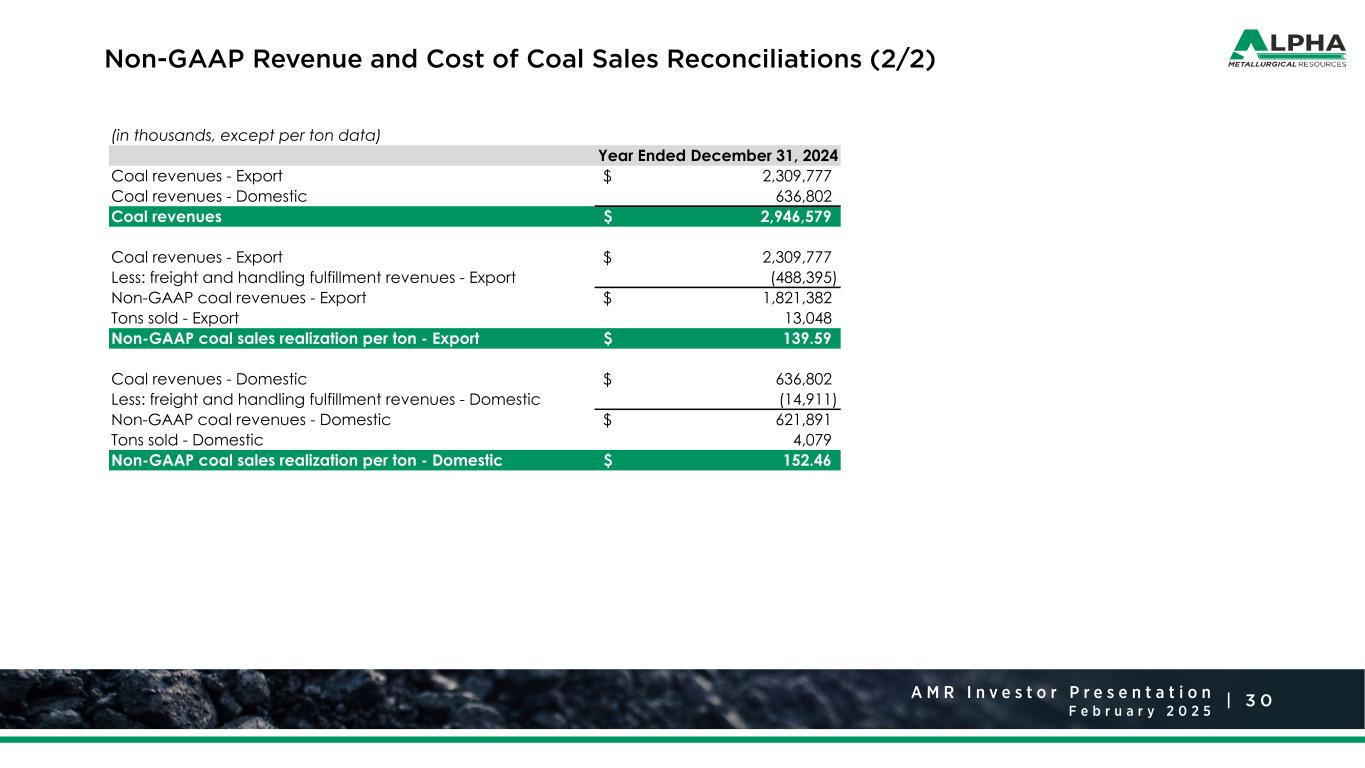

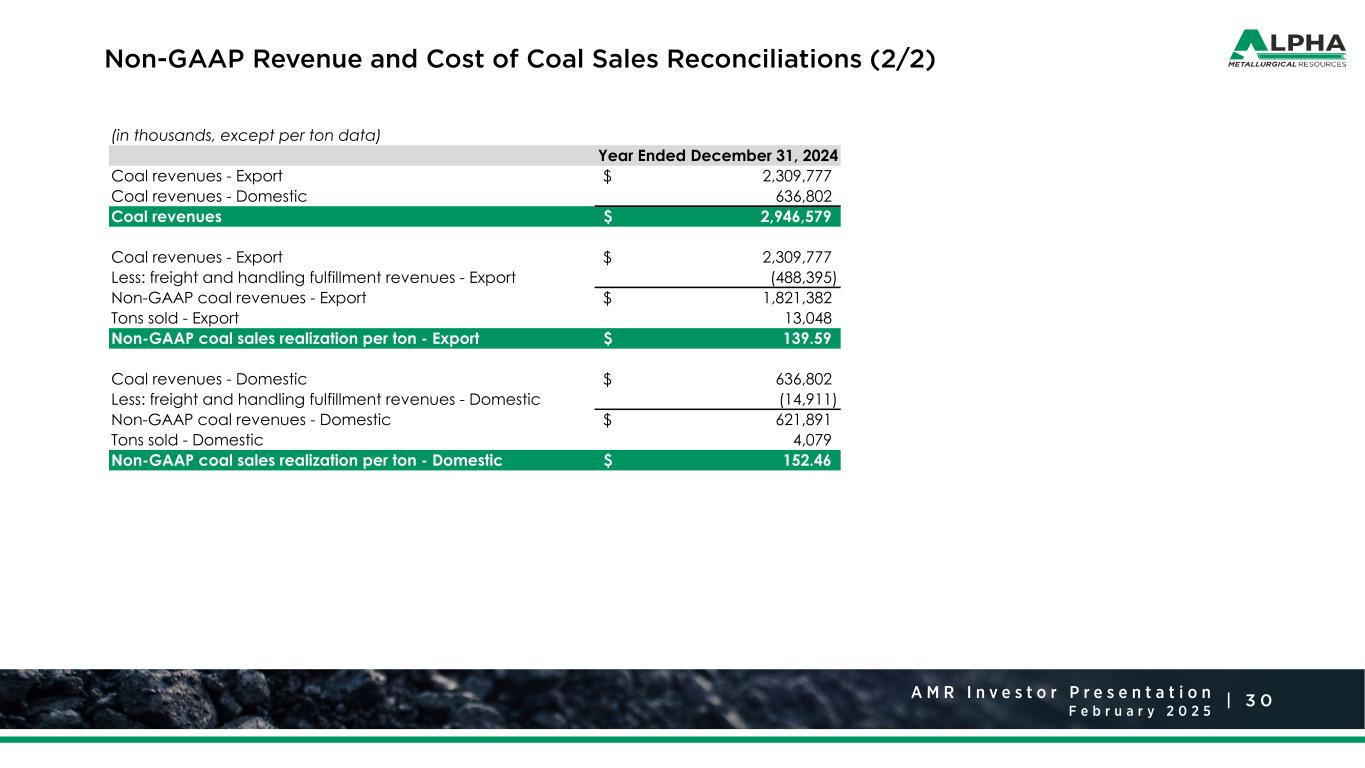

3 0A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Non-GAAP Revenue and Cost of Coal Sales Reconciliations (2/2) (in thousands, except per ton data) Year Ended December 31, 2024 Coal revenues - Export 2,309,777$ Coal revenues - Domestic 636,802 Coal revenues 2,946,579$ Coal revenues - Export 2,309,777$ Less: freight and handling fulfillment revenues - Export (488,395) Non-GAAP coal revenues - Export 1,821,382$ Tons sold - Export 13,048 Non-GAAP coal sales realization per ton - Export 139.59$ Coal revenues - Domestic 636,802$ Less: freight and handling fulfillment revenues - Domestic (14,911) Non-GAAP coal revenues - Domestic 621,891$ Tons sold - Domestic 4,079 Non-GAAP coal sales realization per ton - Domestic 152.46$

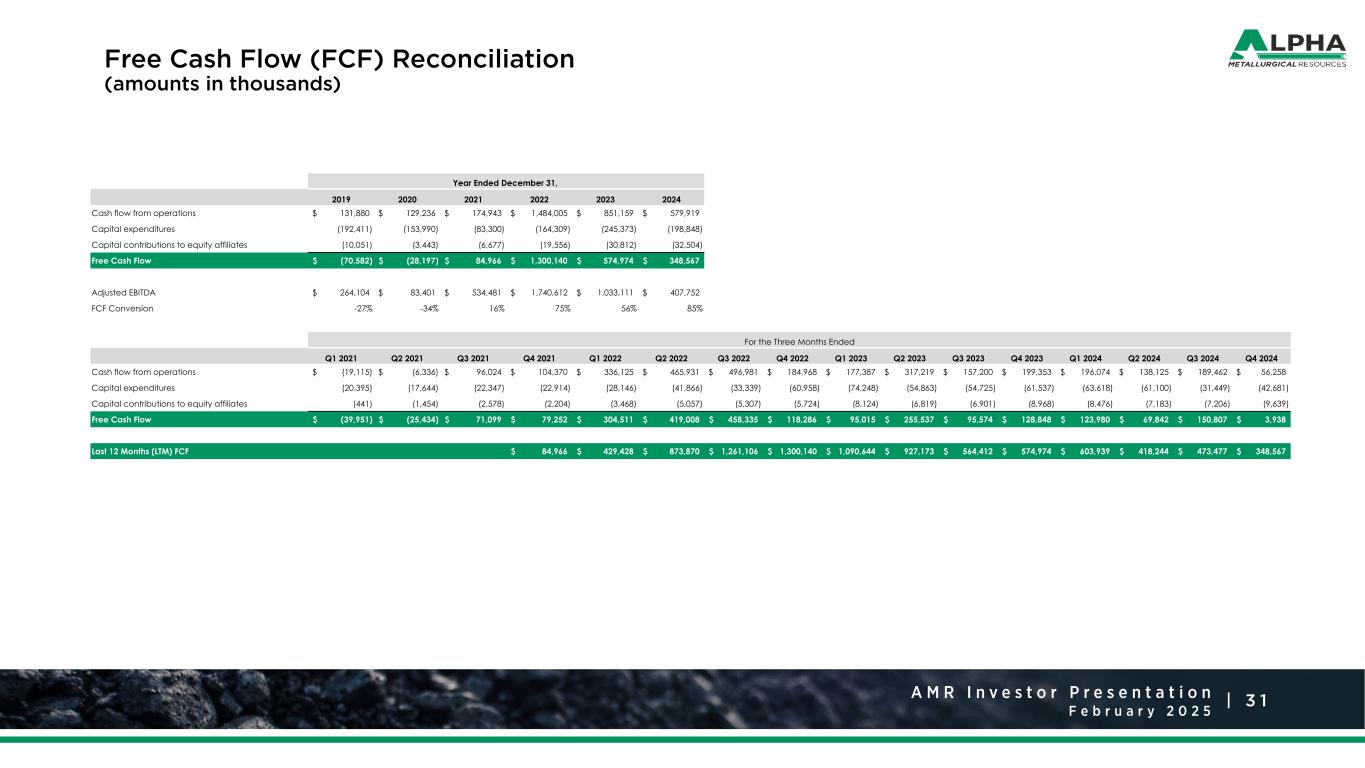

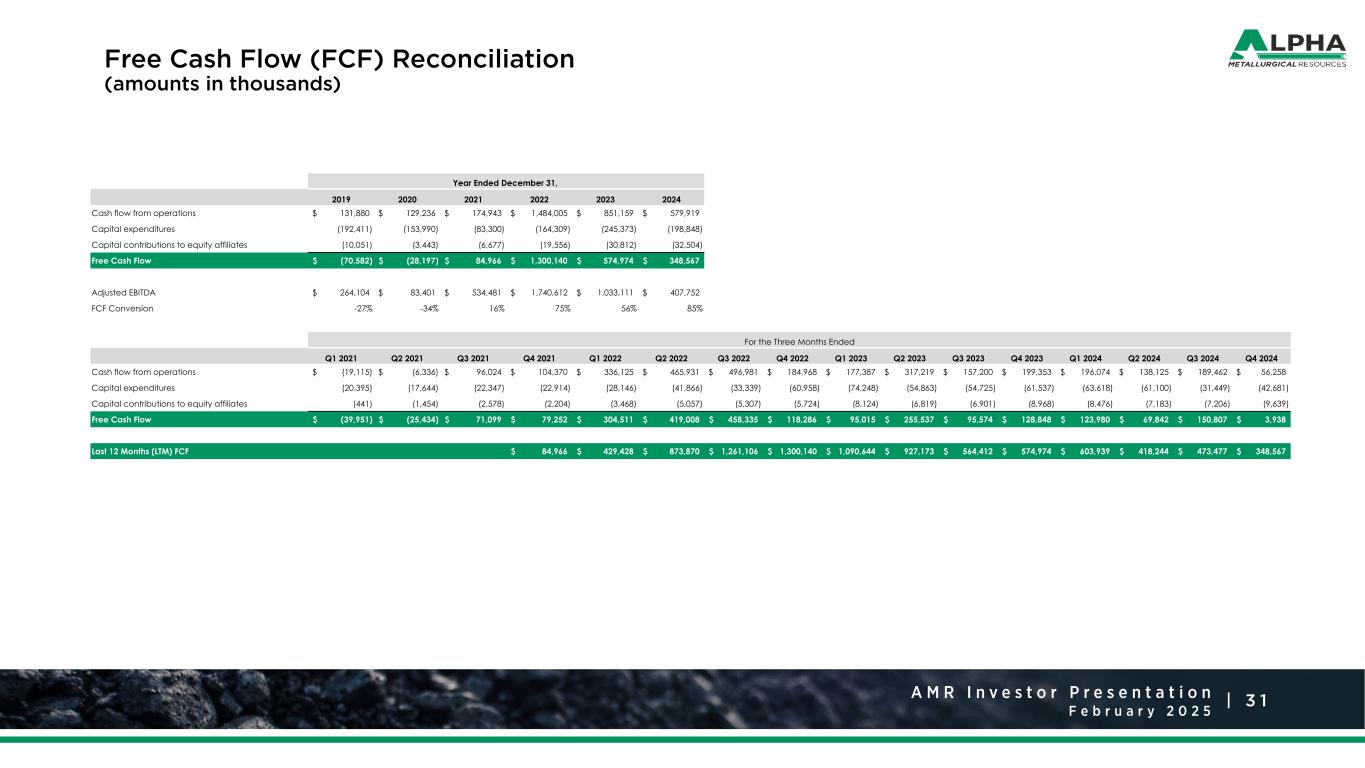

3 1A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Free Cash Flow (FCF) Reconciliation (amounts in thousands) 2019 2020 2021 2022 2023 2024 Cash flow from operations 131,880$ 129,236$ 174,943$ 1,484,005$ 851,159$ 579,919$ Capital expenditures (192,411) (153,990) (83,300) (164,309) (245,373) (198,848) Capital contributions to equity affiliates (10,051) (3,443) (6,677) (19,556) (30,812) (32,504) Free Cash Flow (70,582)$ (28,197)$ 84,966$ 1,300,140$ 574,974$ 348,567$ Adjusted EBITDA 264,104$ 83,401$ 534,481$ 1,740,612$ 1,033,111$ 407,752$ FCF Conversion -27% -34% 16% 75% 56% 85% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Cash flow from operations (19,115)$ (6,336)$ 96,024$ 104,370$ 336,125$ 465,931$ 496,981$ 184,968$ 177,387$ 317,219$ 157,200$ 199,353$ 196,074$ 138,125$ 189,462$ 56,258$ Capital expenditures (20,395) (17,644) (22,347) (22,914) (28,146) (41,866) (33,339) (60,958) (74,248) (54,863) (54,725) (61,537) (63,618) (61,100) (31,449) (42,681) Capital contributions to equity affiliates (441) (1,454) (2,578) (2,204) (3,468) (5,057) (5,307) (5,724) (8,124) (6,819) (6,901) (8,968) (8,476) (7,183) (7,206) (9,639) Free Cash Flow (39,951)$ (25,434)$ 71,099$ 79,252$ 304,511$ 419,008$ 458,335$ 118,286$ 95,015$ 255,537$ 95,574$ 128,848$ 123,980$ 69,842$ 150,807$ 3,938$ Last 12 Months (LTM) FCF 84,966$ 429,428$ 873,870$ 1,261,106$ 1,300,140$ 1,090,644$ 927,173$ 564,412$ 574,974$ 603,939$ 418,244$ 473,477$ 348,567$ Year Ended December 31, For the Three Months Ended

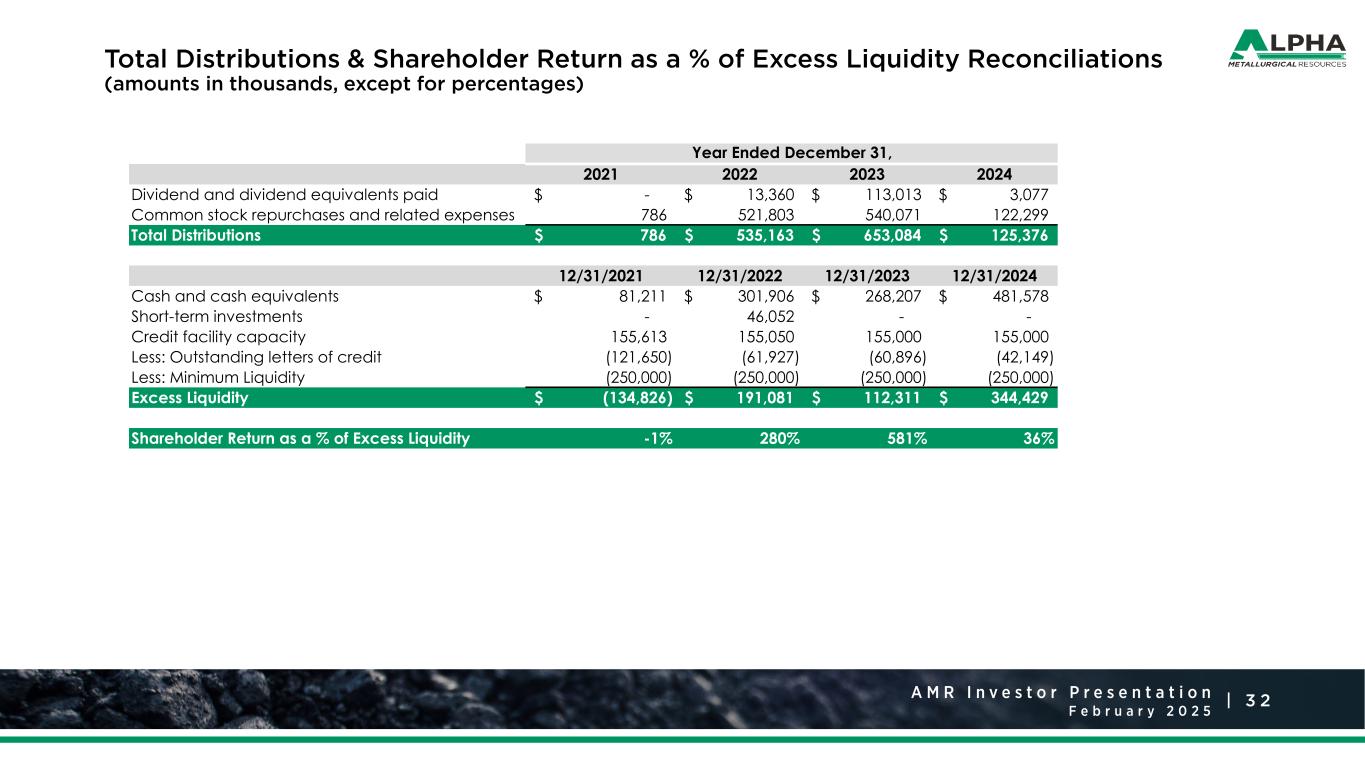

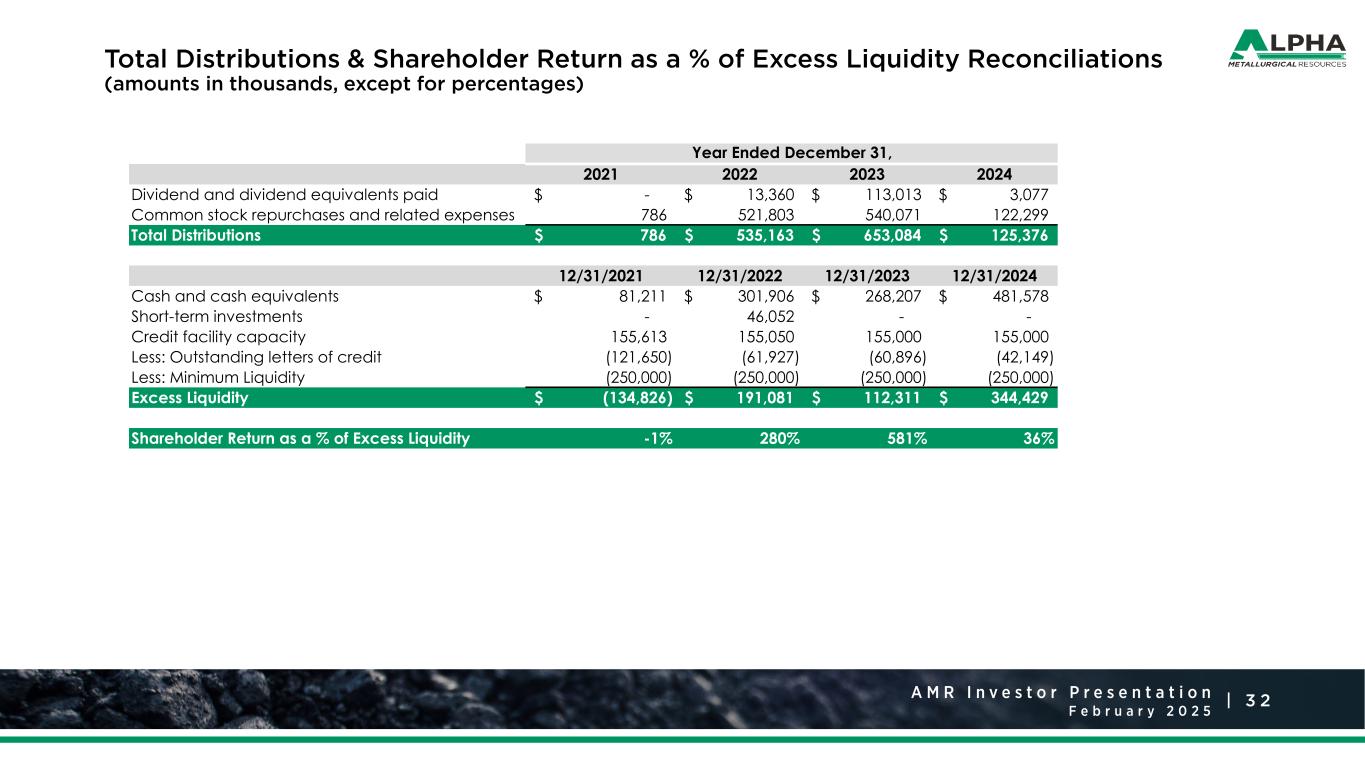

3 2A M R R a t i n g s A g e n c y P r e s e n t a t i o n J a n u a r y 2 0 2 5 |A M R I n v e s t o r F e b r Total Distributions & Shareholder Return as a % of Excess Liquidity Reconciliations (amounts in thousands, except for percentages) 2021 2022 2023 2024 Dividend and dividend equivalents paid -$ 13,360$ 113,013$ 3,077$ Common stock repurchases and related expenses 786 521,803 540,071 122,299 Total Distributions 786$ 535,163$ 653,084$ 125,376$ 12/31/2021 12/31/2022 12/31/2023 12/31/2024 Cash and cash equivalents 81,211$ 301,906$ 268,207$ 481,578$ Short-term investments - 46,052 - - Credit facility capacity 155,613 155,050 155,000 155,000 Less: Outstanding letters of credit (121,650) (61,927) (60,896) (42,149) Less: Minimum Liquidity (250,000) (250,000) (250,000) (250,000) Excess Liquidity (134,826)$ 191,081$ 112,311$ 344,429$ Shareholder Return as a % of Excess Liquidity -1% 280% 581% 36% Year Ended December 31,