Exhibit 99.1

Compensation Discussion and Analysis

The following discussion and analysis of compensation programs should be read with the compensation tables and related disclosures that follow. This discussion contains forward-looking statements that are based on our current plans and expectations regarding future compensation programs. Actual compensation programs that we adopt may differ materially from the programs summarized in this discussion. The following discussion may also contain statements regarding corporate performance targets and goals. These targets and goals are disclosed in the limited context of our compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts.

In this compensation discussion and analysis, we provide an overview of our approach to compensating our named executive officers in 2016, including the objectives of our compensation programs and the principles upon which our compensation programs and decisions are based. Our named executive officers, and their titles, in 2016 were:

· Raymond R. Quirk, our Chief Executive Officer;

· Michael J. Nolan, our President;

· Brent B. Bickett, our Executive Vice President, Corporate Strategy;

· Roger Jewkes, our Chief Operating Officer;

· Anthony J. Park, our Executive Vice President and Chief Financial Officer;

· William P. Foley, II, our Chairman of the Board (Executive Chairman through January 8, 2016).

Effective January 8, 2016, Mr. Foley transitioned from Executive Chairman of the Board to Chairman of the Board, a non-executive position. Although Mr. Foley only served as an executive officer of FNF for eight days during 2016, Securities and Exchange Commission rules require that we discuss and disclose his compensation for fiscal 2016 in this section of the proxy, rather than in the director compensation section, since he served as an executive officer at some point during fiscal 2016.

EXECUTIVE SUMMARY

Financial Highlights

FNF has performed well for our shareholders over the past several years. In 2016, we generated approximately $9.6 billion in total revenue (a 5% increase from 2015), and approximately $1.1 billion in pre-tax earnings from continuing operations (a 24% increase from 2015). As reflected in the charts below, from 2014 through 2016, we have delivered strong growth in total revenue and pre-tax earnings from continuing operations, as well as title revenue.

During this three year period from January 1, 2014 through December 31, 2016, we delivered a total return to our shareholders of 31.9%, compared to S&P 500 total return of 28.1% during the same period. This includes a return of approximately $240 million to our shareholders in the form of cash dividends and approximately $206 million and $62 million, respectively, to our shareholders in the form of FNF Group and FNFV Group share repurchases in 2016. Total shareholder return is based on stock price changes (including FNFV group common stock since it began trading in July 2014), the Remy and J. Alexander’s spin-offs (assuming that the underlying shares were sold on their closing dates on December 31, 2014 and September 28, 2015, respectively) and cash dividends paid.

Pay for Performance

The primary goal of our executive compensation programs in 2016 was to drive continued growth and successful execution of our strategic business objectives. We believe our programs achieve this goal by:

· tying material portions of our named executive officers’ compensation to the performance of our core title operations and the FNFV companies and investments;

· structuring our performance-based programs to focus our named executive officers on attaining pre-established, objectively-determinable key performance goals that are aligned with and support our key strategic business objectives in our various operations, which, in turn, are aimed at growing long-term shareholder value for both our FNF Group and FNFV Group shareholders;

· recognizing our executives’ leadership abilities, scope of responsibilities, experience, effectiveness, and individual performance achievements; and

· attracting, motivating, and retaining a highly qualified and effective management team that can deliver superior performance and build shareholder value over the long term.

As in past years, in 2016, there was a direct correlation between our named executive officers’ pay and our performance. Here are a few highlights:

· In our title segment at FNF, we far exceeded both our adjusted title revenue and adjusted title pre-tax profit margin goals as set by our compensation committee under our annual incentive plan. We refer to these measures as adjusted title revenue and adjusted pre-tax title margin. Consistent with this strong performance, our named executive officers other than Mr. Foley earned an annual incentive equal to 192.4% of their respective target annual incentive opportunities. As non-executive Chairman of FNF, Mr. Foley was not eligible to earn an annual incentive from FNF in 2016. See the “FNF Annual Incentive Performance Measures and Results” section below.

· We have created individual bonus performance criteria tied to each of the core FNF and FNFV businesses and incented (and paid) our executives based on their estimated time in each such FNF and FNFV business; thereby creating a direct and objective link between pay and performance.

* Note that the financial measures used as performance targets for our named executive officers described in this discussion are non-GAAP measures and differ from the comparable GAAP measures reported in our financial statements. The measures are adjusted to exclude the impact of certain non-recurring and other items. We explain how we calculate these measures in the “Analysis of Compensation Components” section below.

Changes to our Chairman’s Duties and Compensation in 2016

On January 8, 2016, Mr. Foley transitioned from Executive Chairman to Chairman, a non-executive position, of the Boards of FNF and our majority-owned subsidiary ServiceLink Holdings, LLC, or ServiceLink. In connection with these changes, Mr. Foley’s employment agreement with FNF was replaced with a non-executive director services agreement, and his employment agreement with ServiceLink was terminated. Mr. Foley remains the Executive Chairman of Black Knight Financial Services, Inc.’s, or Black Knight’s, a majority-owned subsidiary

2

of FNF, Board of Directors. The compensation paid by Black Knight to Mr. Foley for his service as Executive Chairman of Black Knight is included in these discussions and the tables that follow because FNF owns a majority of Black Knight’s outstanding stock. However, as previously announced, our board has approved a tax-free plan whereby it intends to distribute all shares of Black Knight’s stock currently owned by FNF to our shareholders in 2017.

As shown in the tables below, which reflect the compensation earned by Mr. Foley as Executive Chairman (during the first eight days of 2016) and non-executive Chairman of FNF (for the remainder of 2016), and as Executive Chairman of Black Knight, only approximately 19% of Mr. Foley’s compensation disclosed in the discussion and tables that follow was earned as Executive Chairman and non-executive Chairman of FNF. The remainder was earned for his services as Executive Chairman of Black Knight and was paid by Black Knight. Details relating to the compensation Mr. Foley earned as Executive Chairman of Black Knight can be found in Black Knight’s Annual Proxy Statement for its 2017 annual meeting of shareholders.

Summary of Compensation Earned at FNF |

| | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Fiscal

Year | | Salary

($)(1) | | Bonus

($) | | Stock

Awards

($)(2) | | Option

Awards

($) | | Non-Equity

Incentive

Plan

Compensation

($)(3) | | All Other

Compensation

($)(4) | | Total

($) | |

William P. Foley, II | | 2016 | | 31,470 | | — | | 599,998 | | — | | 1,014,000 | | 1,156,986 | | 2,802,454 | |

Non-executive Chairman of the Board | | | | | | | | | | | | | | | | | |

(1) Reflects Mr. Foley’s salary for service as Executive Chairman through January 8, 2016. Mr. Foley did not receive a salary from FNF for the remainder of 2016. In addition Mr. Foley did not participate in FNF’s annual incentive plan in 2016, and Mr. Foley no longer receives cash compensation or benefits for his services as Chairman of ServiceLink.

(2) Reflects the equity award Mr. Foley received for service as a director and non-executive Chairman of FNF, which consisted of 17,351 restricted shares of FNF Group stock. The grant date fair value of this equity incentive award was less than one-half of the grant date fair value of our other named executive officers’ 2016 equity incentive awards and 92% lower than the grant date fair value of Mr. Foley’s 2015 FNF equity incentive awards.

(3) Reflects the amount earned by Mr. Foley pursuant to the Investment Success Incentive Program, a cash incentive award relating to the FNFV companies and investments granted in 2014.

(4) Includes, among other things, an annual board retainer of $780,000 for Mr. Foley’s board duties relating to FNF and FNFV, and meeting fees consistent with those paid to our other non-executive directors. See the footnotes to the “All Other Compensation” column in the “Summary Compensation Table” for details.

Summary of Compensation Earned at Black Knight |

| | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Fiscal

Year | | Salary

($)(1) | | Bonus

($) | | Stock

Awards

($)(2) | | Option

Awards

($) | | Non-Equity

Incentive

Plan

Compensation

($)(3) | | All Other

Compensation

($)(4) | | Total

($) | |

William P. Foley, II | | 2016 | | 592,568 | | — | | 6,999,993 | | — | | 3,861,000 | | 185,036 | | 11,638,597 | |

Executive Chairman of the Board | | | | | | | | | | | | | | | | | |

(1) Reflects salary paid by Black Knight for service as Executive Chairman of the Black Knight Board of Directors.

(2) Reflects the grant date fair value of a Black Knight restricted stock award.

3

(3) Reflects the amount earned under Black Knight’s annual incentive plan.

(4) See the footnotes to the “All Other Compensation” column in the “Summary Compensation Table” for details.

2016 SHAREHOLDER VOTE ON EXECUTIVE COMPENSATION

At our 2016 annual meeting of shareholders, we held a non-binding advisory vote, also called a “say on pay” vote, on the compensation of our named executive officers as disclosed in the 2016 proxy statement. A majority of our shareholders approved our “say on pay” proposal, with 54% of the votes cast in favor of the proposal and 46% of the votes cast against the proposal.

SHAREHOLDER OUTREACH AND CHANGES TO OUR COMPENSATION PROGRAMS IN 2016

Our compensation committee is committed to listening and responding to the views of our shareholders in creating and tailoring our executive compensation programs. Following the 2016 annual meeting of shareholders and the 2015 “say on pay” shareholder vote, our President, Executive Vice President, Chief Financial Officer, and Treasurer met with our investors in break-out sessions at investor conferences, as well as in independent one-on-one investor meetings, to discuss our business and stock price performance, as well as discuss and receive feedback on our compensation programs. In this regard, we met with investors at more than 20 investor conferences and numerous one-on-one meetings. The investors with whom we met in 2016 represented 12 of our top 15 FNF Group shareholders and seven of our top ten FNFV Group shareholders, who collectively owned more than 40% of our shares (including both FNF Group and FNFV Group shares) as of December 31, 2016.

Overall, we believe that we have been highly responsive to our shareholders’ concerns, and have created and continued compensation programs that achieved our strategic corporate objectives, focused our executives on achieving superior operating results and shareholder returns, balanced short-term and long-term incentives, and maintained a strong correlation between pay and performance.

IMPROVEMENTS TO OUR COMPENSATION PROGRAMS

Our compensation committee is committed to listening and responding to the views of our shareholders in creating and tailoring our executive compensation programs. As in prior years, following our 2016 annual meeting of shareholders and the “say on pay” shareholder vote, we reached out to our shareholders to discuss our business and stock price performance, as well as discuss and receive feedback on our compensation programs. We also considered the analysis of our compensation programs by proxy advisory firms.

We have made a number of improvements to our compensation programs over the last three years to address concerns raised by our shareholders and proxy advisory firms. Following are highlights of the key changes, demonstrating the responsiveness of our compensation committee:

Areas of

Improvement | | Improvements |

Mr. Foley’s Pay Continues to Decline and is Now Largely Allocable to BKFS Service | | Following a significant reduction in Mr. Foley’s total compensation in 2015, his compensation was further reduced in 2016. As disclosed in the “Summary Compensation Table,” Mr. Foley’s total compensation in 2016 was $14.4 million, 8% lower than his 2015 total compensation of $15.7 million, and 82% lower than his 2014 total compensation of $80.3 million. Moreover, Mr. Foley’s total compensation for 2016 paid by FNF for his services as non-executive Chairman of FNF and FNFV was $2.7 million, 36% of our CEO’s total compensation for 2016. |

4

Areas of

Improvement | | Improvements |

Pay Programs Have Been Simplified | | We also simplified our compensation programs. In 2016, our named executive officers earned base salary, an annual performance-based cash incentive, restricted stock awards and standard employee benefits. For Mr. Foley, his compensation by FNF is connected with his service as our non-executive Chairman and included a Chairman retainer, meeting fees and a restricted stock award, as well as a payment under the Investment Success Plan relating to a release from escrow of amounts relating to the 2014 purchase of Comdata by Fleetcor. Further, in 2016, our named executive officers’ long-term equity awards consisted only of restricted stock awards, rather than a combination of options, restricted stock and profits interests, and, except for one-time time-based grants made to Messrs. Jewkes and Nolan in connection with their execution of new employment agreements relating to their new roles and agreement to a non-compete, all of the restricted stock awards had performance-based vesting conditions. |

2017 Actions that will Further Simplify Our Pay Programs | | When we distribute the shares of Black Knight common stock that we currently own to our shareholders and redeem outstanding FNFV tracking shares, as announced on December 7, 2016, FNF, FNFV and Black Knight will each be independent, publicly-traded companies, with FNF and FNFV no longer being tracking stocks. The separation of these businesses and the elimination of our tracking stock will further simplify our compensation programs (and the discussion of our named executive officers’ compensation) going forward, as we will be able to focus solely on the compensation we provide to our named executive officers and we will no longer have to distinguish between our core and non-core businesses and we will be able to eliminate the discussion of Black Knight’s executive compensation programs. |

Eliminated Discretion Inherent in Incentive Program | | Based on feedback we received in our shareholder outreach program, we terminated our prior Long Term Incentive Program at the end of 2014. The plan measured annual increases in the value of certain of our FNFV companies. Some constituents felt the plan provided us with too much discretion regarding payout amounts and that it should not provide for annual payout opportunities. To address these concerns, we replaced that plan with our Investment Success Incentive Program, a plan that only pays out based on liquidity, monetization and similar events relating to the FNFV companies where the returns can be objectively determined. |

5

Areas of

Improvement | | Improvements |

Annual Incentive Plan Performance Goals are Rigorously Set, Despite Volatile and Unpredictable Economic Environment | | The adjusted title revenue and adjusted pre-tax title margin performance targets under our 2016 annual incentive plan were approximately 6% and 12% higher than the targets under our 2015 plan, respectively. Our annual incentive plan targets correlate with our annual strategic financial plans, which are based on our forecasted originations for the year and the relative mix of purchase versus refinance originations. These expectations are based on forecasts provided by the Mortgage Bankers Association (MBA), Fannie Mae, Freddie Mac, anticipated changes in interest rates and recent and expected industry and company trends. We prepare a base plan as well as upside and downside scenarios, which, taken together, form the strategic financial plan and the basis of the performance targets. |

GOVERNANCE AND COMPENSATION BEST PRACTICES

We periodically review our compensation programs and make adjustments that are believed to be in the best interests of our company and our shareholders. As part of this process, we review compensation trends and consider current best practices, and make changes in our compensation programs when we deem it appropriate, all with the goal of continually improving our approach to executive compensation.

Some of the improvements made and actions taken in recent years by our compensation committee or full board of directors include the following:

· amending our Certificate of Incorporation to permit shareholder action by written consent;

· amending our Certificate of Incorporation to eliminate all supermajority voting provisions;

· amending our bylaws to permit “proxy access”;

· amending our bylaws to implement majority voting in uncontested director elections beginning with the 2017 annual meeting of shareholders;

· decreasing the number and amount of perquisites provided to our named executive officers;

· setting a high ratio of performance-based compensation to total compensation, and a low ratio for fixed benefits/perquisites (non-performance-based compensation);

6

· eliminating modified single-trigger severance provisions that provide for payments upon a voluntary termination of employment following a change in control in each of our named executive officers’ employment agreements;

· eliminating excise tax gross ups;

· adopting a policy to clawback any overpayments of incentive-based or share-based compensation attributable to restated financial results;

· adding a performance-based vesting provision in restricted stock grants to our officers, including our named executive officers;

· providing enhanced transparency in our executive compensation disclosure;

· using a thorough methodology for comparing our executive compensation to market practices;

· requiring that any dividends or dividend equivalents on FNF Group restricted stock and other awards that are subject to performance based vesting conditions be subject to the same underlying vesting requirements applicable to the awards—that is, no payment of dividends or dividend equivalents are made unless and until the award vests;

· adopting a policy that annual grants of restricted stock (including FNFV Group restricted stock) will utilize a vesting schedule of not less than three years;

· separating the positions of Chief Executive Officer and Chairman and transitioning our Chairman to a non-executive Chairman role;

· appointing an independent lead director to help manage the affairs of our board of directors;

· using an independent compensation consultant who reports solely to our compensation committee, and who does not provide our compensation committee services other than executive compensation consulting;

· implementing stock ownership guidelines that require significant ownership in our company, for example, the multiple for our Chairman is ten times his annual retainer and the multiple for our Chief Executive Officer is five times base salary;

· prohibiting the repricing or cash buy-out of stock options and SARs under our equity incentive plan; and

· adopting a policy prohibiting hedging and pledging transactions involving FNF Group and FNFV Group securities.

As part of our compensation governance program, we also observe the following practices:

· employment agreements with our named executive officers do not contain multi-year guarantees for salary increases, non-performance based bonuses or guaranteed equity compensation;

· we do not provide income tax reimbursements on executive perquisites or other payments;

· all of our cash and equity incentive plans are capped;

· we use non-discretionary, pre-established, objectively determinable performance goals in our incentive plans; and

7

· the change in control provisions in our compensation programs trigger upon consummation of mergers, consolidations and other corporate transactions, not upon shareholder approval or other pre-consummation events.

COMPONENTS OF TOTAL COMPENSATION AND PAY MIX

We compensate our executive officers primarily through a mix of base salary, annual cash incentives and long-term equity-based incentives tied to each of our tracking stocks, as well as through investment or business-specific incentives such as the Investment Success Incentive Program. We also provide our executive officers with the same retirement and employee benefit plans that are offered to our other employees, as well as limited other benefits, although these items are not significant components of our compensation programs. The following table provides information regarding the elements of compensation provided to our named executive officers in 2016:

Category of

Compensation | | Type of Compensation | | Purpose of the Compensation |

Cash Compensation: | | Salary* | | Salary provides a level of assured, regularly-paid, cash compensation that is competitive and helps attract and retain key employees. |

| | | | |

Short-term Performance-based Cash Incentives: | | Annual Cash Incentive Relating to Our Core Operations** | | Cash incentives under the FNF annual incentive plan are designed to motivate our employees to work towards achieving our key annual adjusted title revenue and adjusted pre-tax title margin goals. |

| | | | |

Long-term Equity Incentives: | | Performance-Based FNF Group Restricted Stock | | These are awards of our FNF Group common stock. Performance-based restricted stock helps to tie our named executive officers’ long-term financial interests to our adjusted pre-tax title margin and to the long-term financial interests of FNF Group shareholders, as well as to retain key executives through a three-year vesting period and maintain a market competitive position for total compensation. |

| | | | |

Investment/Business Specific Incentives: | | Investment Success Incentive Program | | Our Investment Success Incentive Program is designed to help us maximize our return on investment in the FNFV companies and investments by aligning a significant portion of the executive’s long-term incentive compensation with our return related to the investments. The purpose of the programs is to retain and incentivize executives to identify and execute on monetization and liquidity opportunities that will maximize returns. |

8

Benefits & Other: | | ESPP, 401(k) Plan, health insurance and other benefits | | Our named executive officers’ benefits generally mirror our company-wide employee benefit programs. For security reasons and to make travel more efficient and productive for our named executive officers, they are eligible to travel on our corporate aircraft. We require that Mr. Foley travel on our corporate aircraft. |

* Mr. Foley received an annual retainer and board meeting fees consistent with those paid to our other non-executive directors, not a salary, for his service as non-executive Chairman of the FNF Board of Directors in 2016. He received a salary from Black Knight for his services as Executive Chairman of the Black Knight Board of Directors in 2016.

** In 2016, Mr. Foley participated in Black Knight’s annual cash incentive plan, but he did not participate in FNF’s annual cash incentive plan.

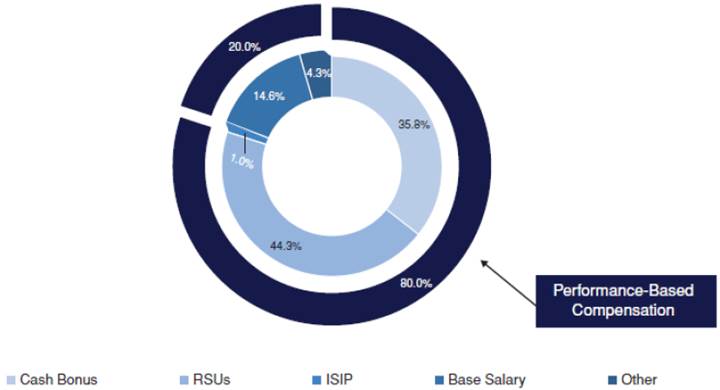

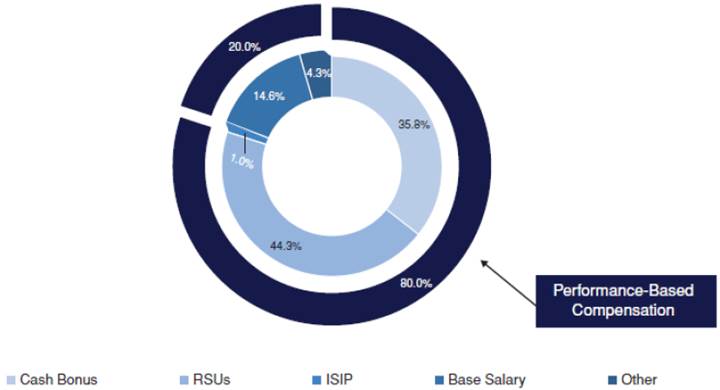

Allocation of Total Compensation for 2016

The following chart and table show the allocation of 2016 Total Compensation reported in the Summary Compensation Table except for Mr. Foley who only served as an executive officer of FNF for eight days, among the components of our compensation programs:

Named Executive Officers’

2016 Compensation Mix

9

2016 Compensation Mix

| | Salary | | Annual

Cash

Incentives

(FNF) | | Performance-

Based

Restricted

Stock

(FNF) | | Time-Based

Restricted

(FNF) | | FNFV

Companies

and

Investments

Incentive

Programs

(FNFV) | | Benefits

and

Other | | Total

Compensation | | Performance

Based

Compensation | |

Raymond R. Quirk | | 10.8 | % | 31.0 | % | 55.2 | % | 0.0 | % | 0.0 | % | 3.0 | % | 100 | % | 86.2 | % |

Anthony J. Park | | 18.0 | % | 35.5 | % | 40.9 | % | 0.0 | % | 1.2 | % | 4.4 | % | 100 | % | 77.6 | % |

Michael J. Nolan | | 14.7 | % | 36.1 | % | 44.8 | % | 2.8 | % | 0.0 | % | 1.6 | % | 100 | % | 80.9 | % |

Brent B. Bickett | | 13.7 | % | 39.0 | % | 37.8 | % | 0.0 | % | 3.9 | % | 5.6 | % | 100 | % | 80.7 | % |

Roger Jewkes | | 15.6 | % | 37.6 | % | 37.3 | % | 2.6 | % | 0.0 | % | 6.9 | % | 100 | % | 74.9 | % |

As illustrated above, a significant portion of each named executive officer’s total compensation is based on performance-based cash and equity incentives that are tied to our financial performance, stock and equity price and, in the cases of Messrs. Bickett and Park, the performance of the FNFV companies and investments. Combined, performance-based forms of compensation comprised between 74.9% and 86.2% of our named executive officers’ total compensation in 2016.

Our compensation committee believes this emphasis on performance-based incentive compensation is an effective way to use compensation to help us achieve our business objectives while directly aligning our executive officers’ interests with the interests of our shareholders.

Analysis of Compensation Components

Base Salary/Board Retainer and Meeting Fees

Our compensation committee typically reviews salary levels annually as part of our performance review process, as well as in the event of promotions or other changes in our named executive officers’ positions or responsibilities. When establishing base salary levels, our compensation committee considers the peer compensation data provided by its external independent compensation consultant, Strategic Compensation Group, LLC, or SCG, and, beginning on August 1, 2016, Mercer, as well as a number of qualitative factors, including each named executive officer’s experience, knowledge, skills, level of responsibility and performance. Mr. Quirk, Mr. Nolan, and Mr. Park received increases in their base salaries in 2016 to reflect their excellent performance and added responsibilities, which include Mr. Foley transitioning to non-executive Chairman and Mr. Quirk becoming our highest ranking officer.

In connection with the change from Executive Chairman to Chairman of FNF’s Board, Mr. Foley’s base salary was eliminated and he received an annual retainer of $780,000 and board meeting fees consistent with those paid to our other non-executive directors from FNF for his services as Chairman of the FNF Board of Directors. The retainer is allocated evenly between FNF and FNFV, reflecting the relative allocation of his responsibilities among FNF and FNFV. We believe the retainer is appropriate given Mr. Foley’s knowledge of, and history and experience in, our industry and our organization, the key role he plays in developing and implementing our business strategies and the importance of retaining his services and continued focus and dedication. While this retainer exceeds the compensation provided to our other non-executive directors, we believe that the cost is outweighed by the immediate and long-term benefits we and our shareholders stand to gain by having Mr. Foley dedicated, focused and materially aligned financially with our success. Mr. Foley’s ServiceLink base salary was eliminated and his Black Knight base salary was increased from $212,500 to $600,000. These changes to Mr. Foley’s base pay reflect the reallocation of his responsibilities among FNF and FNFV, ServiceLink and Black Knight.

Annual Performance-Based Cash Incentives

We award annual cash incentives based upon the achievement of pre-defined business and financial objectives relating to our core operations, which are specified in the first quarter of the year. Annual incentives play an important role in our approach to total compensation, as they motivate participants to achieve key fiscal year objectives by conditioning the payment of incentives on the achievement of defined, objectively determinable financial performance goals.

10

In the first quarter of 2016, our compensation committee approved the fiscal year FNF business performance objectives and a target incentive opportunity for each participant, as well as the potential incentive opportunity range for maximum and threshold performance. No annual incentive payments are payable to a named executive officer if the pre-established, minimum performance levels are not met, and payments are capped at a maximum performance payout level. The financial performance results are derived from our annual financial statements (and reported in our Annual Report on Form 10-K filed with the SEC), which are subject to an audit by our independent registered public accounting firm, KPMG LLP. However, as discussed below, we use financial measures as performance targets for our named executive officers that differ from the comparable GAAP measures reported in our financial statements. The incentive award target opportunities are expressed as a percentage of the individual’s base salary. Our named executive officers’ 2016 target percentages were the same as their 2015 target percentages, except that Mr. Jewkes’ and Mr. Nolan’s target percentages were increased from 100% to 125% to reflect their added responsibilities and excellent performance.

The amount of the annual incentives actually paid depends on the level of achievement of the pre-established goals as follows:

· If threshold performance is not achieved, no incentive will be paid.

· If threshold performance is achieved, the incentive payout will equal 50% of the executive’s target incentive opportunity.

· If target performance is achieved, the incentive payout will equal 100% of the executive’s target incentive opportunity.

· If maximum performance is achieved, the incentive payout will equal 200% of the executive’s target incentive opportunity.

· Between these levels, the payout is prorated.

An important tenet of our pay for performance philosophy is to utilize our compensation programs to motivate our executives to achieve performance levels that reach beyond what is expected of us as a company. The performance targets for the FNF incentive plan are approved by our compensation committee and are based on discussions between management and our compensation committee. Target performance levels are intended to be difficult to achieve, but not unrealistic. Maximum performance levels are established to limit short-term incentive awards so as to avoid excessive compensation while encouraging executives to reach for performance beyond the target levels.

In setting 2016 performance targets under our annual incentive plans, our compensation committee considered the following factors, which are discussed in more detail below:

· the Mortgage Bankers Association’s projection that mortgage originations would decline;

· our 2016 business plan;

· 2016 performance targets as compared to 2015 performance targets and 2015 actual performance;

· alignment of the 2016 performance targets with the investment community’s published projections for us and our publicly-traded title company competitors; and

· the effect that reaching performance targets would have on our growth and margins.

FNF Annual Incentive Performance Measures and Results. The 2016 performance goals under the FNF incentive plan were based on adjusted title revenue and adjusted pre-tax title margin relating to our title segment. We believe that these performance measures are among the most important measures of the financial performance of our core business, and they can have a significant impact on long-term stock price and the investing community’s

11

expectations. When combined with the strong focus on long-term shareholder return created by our equity-based incentives and our named executive officers’ significant stock ownership, and the focus on maximizing return for our FNFV companies and investments created by our Investment Success Incentive Program, these two annual performance measures provide a degree of checks and balances, requiring our named executive officers to consider both short-term and long-term performance of our businesses and investments. The annual incentive performance targets are synchronized with shareholder expectations, desired increase in our stock price, our annual budget, our long-term financial plan, and our board of directors’ expectations. Further, both measures are measures that executives can directly affect.

In the following table, we explain how we calculate the performance measures and why we use them.

Performance

Measure | | How Calculated | | Reason for Use |

Adjusted Title Revenue | | Adjusted title revenue is based on GAAP revenue from our title segment as reported in our annual financial statements, excluding realized gains and losses. | | Adjusted title revenue is an important measure of our growth, our ability to satisfy our clients and gain new clients and the effectiveness of our services and solutions. Adjusted title revenue is widely followed by investors. |

Adjusted Pre-Tax Title Margin | | Adjusted pre-tax title margin is determined by dividing the earnings before income taxes and non-controlling interests from our title segment, excluding realized gains and losses, purchase accounting amortization and other unusual items, by total revenues of the title segment excluding realized gains and losses. | | We selected adjusted pre-tax title margin as a measure for the short-term incentives because it is a financial measure that is significantly influenced by the performance of our executives, and it aligns the executives’ short-term incentive opportunity with one of our key corporate growth objectives and is commonly used within the title industry. |

The title insurance business is directly impacted by managements’ effectiveness in executing on our business strategy, and macro-economic factors such as mortgage interest rates, credit availability, job markets, economic growth, and changing demographics. Due to the year-to-year changes in these key economic factors, we do not think comparisons of financial and business goals and performance from one year to another are meaningful indicators of the rigor of our performance goals or managements’ performance in a given year. Instead, we think our performance goals and managements’ performance relative to those goals should be assessed in light of the economic environment within which the goals were established and management operated. In setting the threshold, target and maximum goals relating to the performance measures under the FNF incentive plan, the committee considered management’s expectations for 2016 with respect to forecasted originations and the relative mix of purchase versus refinance originations. These expectations are based on forecasts available in March 2016 provided by the Mortgage Bankers Association (MBA), Fannie Mae, Freddie Mac, anticipated changes in interest rates and recent and expected industry and company trends as reflected in our 2016 strategic financial plan. We prepare a base plan as well as upside and downside scenarios, which, taken together, form the strategic financial plan and the basis of the performance measure targets. To establish threshold and maximum goals, percentage adjustments were applied to the target goals. The pre-tax title margin threshold and maximum goals were set at 2.5% below and 2.5% above the target, respectively, and title revenue threshold and maximum goals were set at 7.5% below and 7.5% above the target, respectively. Target performance levels are intended to be difficult to achieve, but not unrealistic. Maximum performance levels are established to limit short-term incentive awards so as to avoid excessive compensation while encouraging executives to reach for performance beyond the target levels. All of the goals are subject to review and approval by our compensation committee.

Our 2016 results exceeded target thresholds due to strong performance by our executive officers and numerous factors, including a 15% increase in agency title insurance premiums driven by our active management of our agent portfolio to maximize profitability and minimize claims risk, and enhancements to our underwriting

12

processes which have resulted in lower policy year loss ratios compared to older years that, in turn, allowed us to reduce our provision for claim losses in the fourth quarter of 2016. Our results in 2016 also reflect a stronger than projected origination market, largely driven by a stronger than expected refinance market.

Set forth below are the 2016 weightings of the threshold, target and maximum performance levels (which include ServiceLink and exclude Black Knight), and 2016 performance results under the FNF incentive plan. Dollar amounts are in millions.

Performance

Metric | | Weight | | Threshold | | Target | | Maximum | | Results | |

Adjusted Title Revenue (Title Segment) | | 25 | % | $ | 5,790.5 | | $ | 6,260.0 | | $ | 6,729.5 | | $ | 6,978.3 | |

Adjusted Pre-Tax Title Margin (Title Segment) | | 75 | % | 10.0 | % | 12.5 | % | 15.0 | % | 14.75 | % |

| | | | | | | | | | | | | | | |

The table below shows each named executive officer’s target percentage under our annual incentive plan, the calculation of their 2016 incentive awards based on the 2016 performance multiplier from the results shown in the tables above, and the amounts earned under the annual incentive plans.

Name | | 2016

Base

Salary | | 2016

Annual

Incentive

Target

(%) | | 2016

Annual

Incentive

Target

($) | | 2016

Performance

Multiplier | | 2016

Total

Incentive

Earned | |

Raymond R. Quirk | | $ | 850,000 | | 150 | % | $ | 1,275,000 | | 192.4 | % | $ | 2,452,977 | |

Anthony J. Park | | $ | 500,000 | | 100 | % | $ | 500,000 | | 192.4 | % | $ | 961,952 | |

Michael J. Nolan | | $ | 575,000 | | 125 | % | $ | 718,750 | | 192.4 | % | $ | 1,382,806 | |

Roger Jewkes | | $ | 630,000 | | 125 | % | $ | 787,500 | | 192.4 | % | $ | 1,515,074 | |

Brent B. Bickett | | $ | 550,500 | | 150 | % | $ | 825,750 | | 192.4 | % | $ | 1,588,663 | |

Black Knight Annual Incentive Plan. In 2016, Mr. Foley received an annual incentive under Black Knight’s annual incentive plan. He did not participate in FNF’s annual incentive plan. The Black Knight plan was approved by its compensation committee, and the plan’s structure is similar to the FNF annual incentive plan. The Black Knight plan ties the payment of incentives to the achievement of adjusted revenue (weighted 40%) and adjusted EBITDA (weighted 60%) goals at Black Knight. Mr. Foley’s target percentage opportunity (expressed as a percentage of his annual base salary at Black Knight) was increased in accordance with his amended and restated employment agreement from 225% to 250%, reflecting his increased focus on Black Knight’s business. Black Knight achieved, on a combined basis, 178.7% of their targeted goals, and Mr. Foley earned a $3,861,000 annual incentive from Black Knight. Further details of Black Knight’s annual incentive plan can be found in the Compensation Discussion & Analysis section of Black Knight’s Annual Proxy Statement for its 2017 annual meeting of shareholders. All amounts under the FNF and Black Knight annual incentive plans are subject to our clawback policy.

Long-Term Equity Incentives

In December 2016, we granted performance-based FNF Group restricted stock to each of our named executive officers, and time-based FNF Group restricted stock to Messrs. Jewkes and Nolan in connection with their execution of new employment agreements, which relate to their new roles with us and include non-competition and other restrictive covenants.

We do not attempt to time the granting of awards to any internal or external events. Our general practice has been for our compensation committee to grant our FNF equity awards during the fourth quarter of each year following the release of our financial results for the third quarter. We also may grant awards in connection with significant new hires, promotions or changes in duties. We granted performance-based FNF Group restricted stock to our named executive officers in December 2016.

Our compensation committee’s determinations are not formulaic; rather, our compensation committee determines the share amounts on a subjective basis in its discretion and may differ among individual executive officers in any given year. Following is a brief discussion regarding the awards made in 2016.

13

Performance-Based FNF Group Restricted Stock. In 2016, we increased from 70% to 100% the proportion of the FNF equity awards consisting of performance-based FNF Group restricted stock and did not grant FNF Group stock options to our executive officers because our high levels of existing employee stock ownership were leading to higher dilution attributable to our low Black-Scholes option value.

The FNF Group restricted stock awards vest over three years, provided we achieve pre-tax title margin in our title segment of 8% in at least two of the six quarters beginning January 1, 2017. We considered various alternative measures but selected adjusted pre-tax title margin because it is one of the most important and impactful measures in evaluating the performance of our core operations, as well as the performance of our executives as it is a measure that executives can directly affect. Adjusted pre-tax title margin measures our achievements in operating efficiency, profitability and capital management. It is also a key measure used by investors and has a significant impact on long-term stock price. We reduced the adjusted pre-tax margin performance metric from 8.5% to 8% in 2016 because of anticipated increases in interest rates and recent and expected industry and company trends, including MBA’s forecast of decreased residential mortgage originations in 2017 and the Urban Land Institute’s forecast of a softer commercial real estate market in 2017. We increased the performance period to six quarters from five given the seasonality inherent in the title business, with the first quarter typically much weaker than the remaining quarters due to weather conditions and holidays impacting opened order activity in November and December resulting in fewer closings in the first quarter.

Adjusted pre-tax title margin is determined by dividing the earnings before income taxes and non-controlling interests from our title segment, excluding realized gains and losses, purchase accounting amortization and other unusual items, by total revenues of the title segment excluding realized gains and losses.

Time-Based FNF Group Restricted Stock. Mr. Jewkes and Mr. Nolan each received a one-time FNF Group restricted stock grant in March 2016 in connection with signing a new employment agreement including a non-compete, which they have not previously been subject to, following their assumption of their new roles and duties within the Company. These restricted stock awards vest in equal installments over a period of three years on each of the first three anniversaries of the date of grant.

Black Knight Performance-Based Restricted Stock. Reflecting the reallocation of Mr. Foley’s responsibilities and his increased focus on Black Knight, on February 3, 2016, Black Knight granted Mr. Foley a performance-based restricted stock award with a grant date value of approximately $7,000,000, which represented the bulk of Mr. Foley’s total equity-based long-term incentives in 2016. The performance-based restricted stock awards granted by Black Knight to Mr. Foley vest over three years based on continued employment, subject to Black Knight’s achievement of a performance target of Adjusted EBITDA of $413 million for the period of January 1, 2016 to December 31, 2016, which they achieved in 2016. The Adjusted EBITDA goal of $413 million was consistent with Black Knight’s 2015 actual Adjusted EBITDA. Further details relating to this award can be found in the Compensation Discussion & Analysis section of Black Knight’s Annual Proxy Statement for its 2017 annual meeting of shareholders.

With respect to all restricted stock awards, credit is provided for dividends paid on unvested shares, but payment of those dividends is subject to the same vesting requirements as the underlying shares—in other words, if the underlying shares do not vest, the dividends are forfeited.

Business/Investment Specific Incentives

The FNFV Companies and the Investment Success Incentive Program. FNF has diversified its business operations over the past several years, and its businesses are now organized into two discreet and separate groups: our core operations and our FNFV group, which includes the FNFV companies and investments. The businesses comprising our FNFV group, which had a book value of approximately $916 million as of December 31, 2016, have made a substantial contribution to the overall success of FNF and our shareholder returns. In connection with the split off of FNFV and redemption of FNFV tracking shares, FNFV will assume the Investment Success Incentive Program and we will no longer have any obligations under the program.

14

The Investment Success Incentive Program is a performance-based cash incentive program that our compensation committee established in 2014 to help us maximize the returns on our investments in ABRH, Ceridian, Comdata and Digital Insurance. Under the program, amounts are earned upon liquidity events that result in a positive return on our investment. For this purpose, return is determined relative to the value of our investment in the respective FNFV company or investment as of July 1, 2014, which were as follows: ABRH $314,300,000; Ceridian $329,800,000; Comdata $160,200,000; and Digital Insurance: $70,800,000. Upon a liquidity event, 10% of any incremental value is contributed to an incentive pool and payments are made to participants based on their allocated percentages of the pool, which are as follows: Mr. Park 2%; Mr. Bickett 10%; and Mr. Foley 65%. Since Messrs. Quirk, Jewkes and Nolan focus on our core title business and not our FNFV businesses, they do not participate in this program.

No liquidity events occurred in 2016. The only amounts earned under the Investment Success Incentive Program in 2016 related to a release of escrowed funds from a transaction that occurred in 2014, which is described below.

Release of Escrowed Comdata Sale Proceeds. In the sale by Ceridian of Comdata to FleetCor in 2014, the sale consideration was paid in shares of FleetCor common stock, with approximately 25% held in escrow to cover any potential indemnity claims, and any remaining escrowed funds payable to Ceridian in annual 1/3 installments over three years. As a result of the sale, we indirectly acquired (through our approximately 32% ownership interest in Ceridian) approximately 2.39 million shares of FleetCor common stock, with 25% of those shares held back in the indemnity escrow. The sale resulted in payments being made under the Investment Success Incentive Program in 2014; however, our compensation committee exercised discretion reserved under the Investment Success Incentive Program and reduced the incentives payable in 2014 by 25%, which we refer to as the Holdback Amount. In accordance with the Investment Success Incentive Program terms, our compensation committee reserved the right to decide whether the Holdback Amount (or a portion of it) would be forfeited or whether it would be paid to the participants at a future date. This authority under the program to hold back proceeds attributable to contingent sale proceeds, coupled with the compensation committee’s general authority to reduce or eliminate incentives otherwise payable under the program’s incentive formula provides the compensation committee with a mechanism to “wait and see” whether contingent sale proceeds are received before paying the related incentive amounts. This discretionary authority also enhances the retention component of the program as the right to any such held-back incentives is conditioned on the participants remaining employed through the payment date. In November 2016, approximately 50% of the remaining escrow holdback was released from escrow and we distributed approximately 50% of the Holdback Amount remaining after the November 2016 release in 2017. As noted above, any remaining obligations under the program, including any remaining portion of the Holdback Amount that becomes payable, will be the responsibility of FNFV following the FNFV split off.

The following table shows the payments made to our named executive officers in connection with the release of the Holdback Amount.

Name | | Percentage of

Incentive

Pool | | Total

Incentive

Paid | |

William P. Foley, II | | 65% | | $ | 1,014,000 | |

Brent B. Bickett | | 10% | | $ | 156,000 | |

Anthony J. Park | | 2% | | $ | 31,000 | |

All amounts payable under the Investment Success Incentive Program are subject to our clawback policy, which is described below. Additionally, the Investment Success Incentive Plan gives our compensation committee discretion to reduce or eliminate amounts that otherwise would be earned under the program’s incentive formula.

Benefit Plans

We provide retirement and other benefits to our U.S. employees under a number of compensation programs. Our named executive officers generally participate in the same compensation programs as our other executives and employees. All employees in the United States, including our named executive officers, are eligible to participate in our 401(k) plan and our employee stock purchase plan, or ESPP. In addition, our named executive officers are eligible to participate in broad-based health and welfare plans. We do not offer pensions or supplemental executive retirement plans for our named executive officers.

15

401(k) Plan. We sponsor a defined contribution savings plan that is intended to be qualified under Section 401(a) of the Internal Revenue Code. The plan contains a cash or deferred arrangement under Section 401(k) of the Internal Revenue Code. Participating employees may contribute up to 40% of their eligible compensation, but not more than statutory limits, which were generally $18,000 in 2016. Vesting in matching contributions, if any, occurs proportionally each year over three years based on continued employment with us.

Deferred Compensation Plan. We provide our named executive officers, as well as other key employees, with the opportunity to defer receipt of their compensation under a nonqualified deferred compensation plan. None of our named executive officers, elected to defer 2016 compensation into the plan. A description of the plan and information regarding our named executive officers’ interests under the plan can be found in the Nonqualified Deferred Compensation table and accompanying narrative.

Employee Stock Purchase Plan. We maintain an ESPP through which our executives and employees can purchase shares of our FNF Group common stock through payroll deductions and through matching employer contributions. At the end of each calendar quarter, we make a matching contribution to the account of each participant who has been continuously employed by us or a participating subsidiary for the last four calendar quarters. For officers, including our named executive officers, matching contributions are equal to 1/2 of the amount contributed during the quarter that is one year earlier than the quarter in which the matching contribution was made. The matching contributions, together with the employee deferrals, are used to purchase shares of our common stock on the open market. For information regarding the matching contributions made to our named executive officers in 2016 see “—Summary Compensation Table.”

Health and Welfare Benefits. We sponsor various broad-based health and welfare benefit plans for our employees. Certain executives, including our named executive officers, are provided with additional life insurance. The taxable portion of the premiums on this additional life insurance is reflected in the “Summary Compensation Table” under the column “All Other Compensation” and related footnote.

Other Benefits. We continue to provide a few additional benefits to our executives. In general, the additional benefits provided are intended to help our named executive officers be more productive and efficient and to protect us and our executives from certain business risks and potential threats. For example, in 2016, certain of our named executive officers received personal use of the corporate aircraft. For security reasons, our board requires that Mr. Foley travel on our corporate aircraft. Our compensation committee regularly reviews the additional benefits provided to our executive officers and believes they are minimal. Further detail regarding other benefits in 2016 can be found in the “Summary Compensation Table” under the column “All Other Compensation” and related footnote.

Employment Agreements and Post-Termination Compensation and Benefits

We have entered into employment agreements with each of our named executive officers. These agreements provide us and the executives with certain rights and obligations following a termination of employment, and in some instances, following a change in control. We believe these agreements are necessary to protect our legitimate business interests, as well as to protect the executives in the event of certain termination events. For a discussion of the material terms of the agreements, see the narrative following “—Grants of Plan-Based Awards” and “—Potential Payments Upon Termination or Change in Control,” below.

ROLE OF COMPENSATION COMMITTEE, COMPENSATION CONSULTANT AND EXECUTIVE OFFICERS

Our compensation committee is responsible for reviewing, approving and monitoring all compensation programs for our named executive officers. Our compensation committee is also responsible for administering the Fidelity National Financial, Inc. Annual Incentive Plan, or our annual incentive plan, the Fidelity National Financial, Inc. Amended and Restated 2005 Omnibus Incentive Plan, or our omnibus incentive plan, administering programs that are implemented under the omnibus incentive plan, including the FNFV Investment Success Incentive Program described above, and approving individual grants and awards under those plans for our executive officers. Black Knight’s compensation committee is responsible for reviewing, approving and monitoring all compensation programs for Mr. Foley with respect to his compensation as an executive of Black Knight and Richard N. Massey is the chair of both FNF’s and Black Knight’s compensation committee.

16

During the first portion of 2016, our compensation committee engaged SCG, an independent compensation consultant, to conduct an annual review of our compensation programs for our named executive officers and other key executives and our board of directors. Beginning on August 1, 2016, Mercer replaced SCG as our independent compensation consultant. The compensation committee determined to engage Mercer in order to get a fresh perspective on our compensation programs. Both SCG and Mercer (together, the compensation consultants) were selected, and their fees and terms of engagement were approved, by our compensation committee. Both SCG and Mercer reported directly to the compensation committee, received compensation only for services related to executive compensation issues, and neither it nor any affiliated company provided any other services to us. In March 2017, the compensation committee reviewed the independence of Mercer in accordance with the rules of the New York Stock Exchange regarding the independence of consultants to the compensation committee, and affirmed the consultant’s independence and that no conflicts of interest existed.

The compensation consultants provided our compensation committee with relevant market data on compensation, including annual salary, annual incentives, long-term incentives, other benefits, total compensation and pay mix, and alternatives to consider when making compensation decisions. Mercer also assists our compensation committee in its annual review of a compensation risk assessment.

Our Chairman, Mr. Foley, participated in the 2016 executive compensation process by making recommendations with respect to the compensation of our Chief Executive Officer, Mr. Quirk, and his direct reports. Our Chief Executive Officer made recommendations with respect to the compensation of his direct reports, as discussed further below. In addition, Mr. Gravelle, our Executive Vice President, General Counsel and Corporate Secretary, coordinated with our compensation committee members, the compensation consultants in preparing the committee’s meeting agendas and, at the direction of the compensation committee, assisted the compensation consultants in gathering financial information about FNF and stock ownership information for our executives for inclusion in the consultant’s reports to our compensation committee. Our executive officers do not make recommendations to our compensation committee with respect to their own compensation.

While our compensation committee carefully considers the information provided by, and the recommendations of, Mercer and the individuals who participate in the compensation process, our compensation committee retains complete discretion to accept, reject or modify any recommended compensation decisions.

Establishing Executive Compensation Levels

Our compensation committee considers a number of important qualitative and quantitative factors when determining the overall compensation of our named executive officers in 2016, including:

· the executive officer’s experience, knowledge, skills, level of responsibility and potential to influence our company’s performance;

· the executive officer’s prior salary levels, annual incentive awards, annual incentive award targets and long-term equity incentive awards;

· the business environment and our business objectives and strategy;

· our financial performance in the prior year;

· the need to retain and motivate executives (even in the current business cycle, it is critical that we not lose key people and long term incentives help to retain key people);

· corporate governance and regulatory factors related to executive compensation;

· marketplace compensation levels and practices;

· our focus on the performance of the FNFV companies and investments; and

· compensation provided by our affiliates and various business units, including FNFV.

In evaluating the compensation of our named executive officers (other than Mr. Foley), our compensation committee also considers the recommendations of our Chairman. Our compensation committee also considers our Chief Executive Officer’s recommendations with respect to the compensation of his direct reports. In making their recommendations, our Chairman and Chief Executive Officer review the performance of the other named executive officers, job responsibilities, importance to our overall business strategy, and our compensation philosophy. Neither our Chairman nor our Chief Executive Officer make a recommendation to our compensation committee regarding

17

his own compensation. The compensation decisions are not formulaic, and the members of our compensation committee did not assign precise weights to the factors listed above. Our compensation committee utilized their individual and collective business judgment to review, assess, and approve compensation for our named executive officers.

To assist our compensation committee, the compensation consultants conducted marketplace reviews of the compensation we pay to our executive officers. They gathered marketplace compensation data on total compensation, which consists of annual salary, annual incentives, long-term incentives, executive benefits, executive ownership levels, overhang and dilution from our omnibus incentive plan, compensation levels as a percent of revenue, pay mix and other key statistics. This data is collected and analyzed twice during the year, once in the first quarter and again in the fourth quarter. The marketplace compensation data provides a point of reference for our compensation committee, but our compensation committee ultimately makes subjective compensation decisions based on all of the factors described above.

For 2016, SCG used two marketplace data sources: (1) a general executive compensation survey of over 3,000 companies with a specific focus on companies with revenues of between $6 billion and $12 billion, and (2) compensation information for a group of 19 companies, or the FNF peer group. The FNF peer group was based on a revenue range of 1/2 to 2 times the projected 2016 revenue for FNF (which at the time was estimated to be $9 billion), industry focus (generally the insurance industry based on Global Industry Classification Standard (GICS) Code), nature and complexity of operations, and because they compete with us for business and/or executive talent. The 2016 peer group was consistent with the peer group used by the compensation committee in 2015, except that Chubb Corporation was deleted because it exceeded the revenue range requirement, PartnerRe Ltd. was deleted because it was acquired, Leucadia was deleted because of industry focus, and Alleghany Corporation and Reinsurance Group of American Inc. were added. When defining the peer group, our compensation committee, working with the compensation consultants, attempted to apply the standards used by ISS for identifying peer groups for public companies. The 2016 peer group consisted of:

· Alleghany Corporation | · Genworth Financial, Inc. |

· American Financial Group | · W.R. Berkley Corporation |

· Aon plc | · Lincoln National Corp. |

· Assurant Inc. | · Loews Corporation |

· Automatic Data Processing, Inc. | · Marsh & McLennan Companies, Inc. |

· CNA Financial Corporation | · Principal Financial Group |

· Computer Sciences Corporation | · Reinsurance Group of American Inc. |

· Discover Financial Services | · Unum Group |

· Everest Re Group Ltd. | · XL Group Ltd |

· First American Financial Corporation | |

The revenue range of these companies at that time was between $5.3 billion and $13.6 billion, with median revenue of approximately $10 billion. This compares to the FNF 2016 revenue estimate at that time of approximately $9 billion.

In addition to the compensation surveys, the compensation consultants gathered compensation program data from independent sources such as ISS and Glass Lewis. That data is helpful to the compensation committee when reviewing the executive compensation programs used by FNF.

The compensation committee primarily focused on the 50th percentile of the data when considering our named executive officers’ 2016 base salaries, annual performance-based cash incentives and long-term equity incentives.

While the compensation decisions of our compensation committee ultimately were subjective judgments, our compensation committee also considered the following factors in making compensation decisions for our named executive officers. In determining the total compensation for Mr. Foley, our compensation committee considered his ongoing role as non-executive Chairman for developing and implementing FNF’s long-term strategy with respect to both our title operations and our FNFV companies and investments, particularly in light of his substantial knowledge of our operations as our founder and a long-time executive. In determining the total compensation for Mr. Quirk, our compensation committee considered his 32 years of experience with FNF working in the title business and his

18

importance to the continued successful operation of FNF’s title business. In determining the total compensation for Mr. Park, our compensation committee considered his role and responsibility for accounting and financial reporting matters, as well as his 26 years of experience with FNF. In determining the total compensation for Mr. Bickett, our compensation committee considered his contribution to corporate finance matters, corporate development and mergers and acquisitions, as well as his 18 years of experience with FNF. In determining the total compensation for Mr. Jewkes, our compensation committee considered his role and responsibility for oversight of our day-to-day title operations, as well as his 30 years of experience with FNF and its predecessor companies. In determining the total compensation for Mr. Nolan, our compensation committee considered his role and responsibility for oversight of our title operations, his involvement in our investor relations, as well as his 34 years of experience with FNF. For Messrs. Park and Bickett, the committee also considered their respective contributions to the success of the FNFV companies and investments.

The marketplace compensation information in this discussion is not deemed filed or a part of this compensation discussion and analysis for certification purposes.

OUR NAMED EXECUTIVE OFFICERS HAVE SIGNIFICANT OWNERSHIP STAKES

Our named executive officers and our board of directors maintain significant long-term investments in our company. Collectively, as reported in the table “Security Ownership of Management and Directors,” they beneficially own an aggregate of 14,833,603 shares of our FNF Group and FNFV Group common stock and options to acquire an additional 3,683,337 shares of our FNF Group common stock, which in total is equal to 5.5% of FNF’s shares (including FNF Group and FNFV Group shares) entitled to vote. The fact that our executives and directors hold such a large investment in our shares is part of our company culture and our compensation philosophy. Management’s sizable investment in our shares aligns their economic interests directly with the interests of our shareholders, and their wealth will rise and fall as our share price rises and falls. This promotes teamwork among our management team and strengthens the team’s focus on achieving long term results and increasing shareholder return.

We have formal stock ownership guidelines for all corporate officers, including our named executive officers, and members of our board of directors. The guidelines were established to encourage such individuals to hold a multiple of their base salary (or annual retainer) in our common stock and, thereby, align a significant portion of their own economic interests with those of our shareholders.

The guidelines call for the executive to reach the ownership multiple within four years. Shares of restricted stock and gain on stock options count toward meeting the guidelines. The guidelines, including those applicable to members of our board of directors, are as follows:

Position | | Minimum Aggregate Value |

Chairman of the Board | | 10 × annual cash retainer |

Chief Executive Officer | | 5 × base salary |

Other Officers | | 2 × base salary |

Members of the Board | | 5 × annual cash retainer |

Each of our named executive officers and non-employee directors met these stock ownership guidelines as of December 31, 2016. Further, the award agreements for our 2016 FNF Group restricted stock awards provide that our executives who do not hold shares of FNF Group stock with a value sufficient to satisfy the applicable stock ownership guidelines must retain 50% of the shares acquired as a result of the lapse of vesting restrictions until the executive satisfies the applicable stock ownership guideline. The ownership levels are shown in the “Security Ownership of Management and Directors” table above.

HEDGING AND PLEDGING POLICY

In order to more closely align the interests of our directors and executive officers with those of our shareholders and to protect against inappropriate risk taking, we maintain a hedging and pledging policy, which prohibits our executive officers and directors from engaging in hedging or monetization transactions with respect to our securities, engaging in short-term or speculative transactions in our securities that could create heightened legal risk and/or the appearance of improper or inappropriate conduct or holding FNF securities in margin accounts or pledging them as collateral for loans without our approval.

19

CLAWBACK POLICY

In December 2010, our compensation committee adopted a policy to recover any incentive-based compensation from our executive officers if we are required to prepare an accounting restatement due to material noncompliance with financial reporting requirements, and the incentive-based compensation paid during the preceding three-year period would have been lower had the compensation been based on the restated financial results.

TAX AND ACCOUNTING CONSIDERATIONS

Our compensation committee considers the impact of tax and accounting treatment when determining executive compensation.

Section 162(m) of the Internal Revenue Code places a limit of $1,000,000 on the amount that can be deducted in any one year for compensation paid to certain executive officers. There is, however, an exception for certain performance-based compensation. Our compensation committee takes the deduction limitation under Section 162(m) into account when structuring and approving awards under our annual incentive plan and our omnibus plan. However, our compensation committee may approve compensation that will not meet these requirements. There are also uncertainties as to the application of Section 162(m). Consequently, it is possible that a deduction relating to amounts intended to qualify as performance-based compensation may be challenged or disallowed.

Our compensation committee also considers the accounting impact when structuring and approving awards. We account for share-based payments, including stock option grants, in accordance with ASC Topic 718, which governs the appropriate accounting treatment of share-based payments under generally accepted accounting principles.

COMPENSATION COMMITTEE REPORT

The compensation committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management, and the compensation committee recommended to the board that the Compensation Discussion and Analysis be included in this proxy statement.

THE COMPENSATION COMMITTEE

Richard N. Massey

Daniel D. (Ron) Lane

Cary H. Thompson

Executive Compensation

The following table contains information concerning the cash and non-cash compensation awarded to or earned by our named executive officers for the years indicated.

Summary Compensation Table

Name and Principal

Position | | Fiscal

Year | | Salary

($)(1) | | Bonus

($) | | Stock

Awards

($)(2) | | Option

Awards

($) | | Non-Equity

Incentive

Plan

Compensation

($)(3) | | All Other

Compensation

($)(4) | | Total

($) | |

Raymond R. Quirk | | 2016 | | 831,692 | | — | | 4,249,986 | | — | | 2,382,977 | | 233,402 | | 7,698,057 | |

Chief Executive Officer | | 2015 | | 780,000 | | — | | 2,613,000 | | 1,150,600 | | 2,298,016 | | 258,161 | | 7,099,777 | |

| | 2014 | | 769,133 | | — | | 3,870,015 | | 821,559 | | 3,308,148 | | 292,465 | | 9,061,320 | |

Anthony J. Park | | 2016 | | 483,000 | | — | | 1,099,990 | | — | | 984,952 | | 122,161 | | 2,690,103 | |

Executive Vice President and | | 2015 | | 435,000 | | — | | 731,640 | | 261,500 | | 913,666 | | 146,139 | | 2,487,945 | |

Chief Financial Officer | | 2014 | | 435,069 | | — | | 1,546,195 | | 102,695 | | 3,005,351 | | 146,569 | | 5,235,879 | |

Michael J. Nolan | | 2016 | | 557,308 | | — | | 1,805,263 | | — | | 1,369,806 | | 64,726 | | 3,797,103 | |

President | | | | | | | | | | | | | | | | | |

Roger Jewkes | | 2016 | | 630,000 | | — | | 1,604,167 | | — | | 1,515,074 | | 278,616 | | 4,027,857 | |

Chief Operating Officer | | | | | | | | | | | | | | | | | |

Brent B. Bickett | | 2016 | | 550,500 | | — | | 1,515,538 | | — | | 1,719,663 | | 220,727 | | 4,006,428 | |

Executive Vice President, | | 2015 | | 550,500 | | — | | 1,045,200 | | 470,700 | | 1,918,046 | | 349,363 | | 4,333,809 | |

Corporate Strategy | | 2014 | | 550,558 | | — | | 3,498,680 | | 235,402 | | 5,100,491 | | 223,533 | | 9,608,664 | |

William P. Foley, II | | 2016 | | 624,038 | | — | | 7,599,991 | | — | | 4,875,000 | | 1,342,022 | | 14,441,051 | |

Chairman of the Board(5) | | 2015 | | 850,000 | | — | | 5,226,000 | | 2,301,200 | | 6,446,075 | | 844,838 | | 15,668,113 | |

| | 2014 | | 850,030 | | — | | 35,151,870 | | 866,581 | | 42,665,398 | | 791,434 | | 80,325,313 | |

20

(1) Amounts shown are not reduced to reflect the named executive officers’ elections, if any, to defer receipt of salary into our 401(k) plan, ESPP, or deferred compensation plans. The amount for Mr. Foley for 2016 includes salary of $31,470 for his services as Chairman of the FNF Board of Directors and $592,568 in salary paid by Black Knight for his service as Executive Chairman of the Black Knight Board of Directors.

(2) Represents the grant date fair value of FNF Group restricted stock awards granted in 2016 computed in accordance with ASC Topic 718, excluding forfeiture assumptions. See the Grants of Plan-Based Awards table for details regarding each award. Assumptions used in the calculation of these amounts are included in Note O to our audited financial statements for the fiscal year ended December 31, 2016 included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 27, 2017. The FNF Group restricted stock awards are performance-based except that Mr. Jewkes and Mr. Nolan also received a time-based restricted stock grant on March 4, 2016 and March 3, 2016 respectively. For Mr. Foley, the amount shown also reflects the grant date fair value of Black Knight restricted stock awards granted in 2016 computed in accordance with ASC Topic 718, excluding forfeiture assumptions. See the Grants of Plan-Based Awards table for details regarding each award. Assumptions used in the calculation of these amounts are included in Note O to Black Knight’s audited financial statements for the fiscal year ended December 31, 2016 included in their Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 24, 2017. The grant date fair value of Mr. Foley’s 2016 FNF Group restricted stock award was $599,998, and the grant date fair value of Mr. Foley’s 2016 Black Knight restricted stock award was $6,999,993.

(3) Represents performance-based compensation earned in 2016 under the FNF annual incentive plan by each executive other than Mr. Foley, and the Investment Success Incentive Program by Messrs. Park, Bickett and Foley. For Mr. Foley, the amount reflects the amount earned under Black Knight’s annual incentive plan.

(4) Amounts shown for 2016 include matching contributions to our ESPP; dividends paid on restricted stock that vested in 2016; life insurance premiums paid by us; health insurance fees paid by us under the executive medical plan; personal use of a company airplane; automobile allowance; matching contributions to our 401(k) plan; and, for Mr. Foley, FNF director meeting fees consistent with those paid to our other non-executive directors, a board retainer fee for services to both the FNF and FNFV businesses, and matching contributions under the Black Knight ESPP.

| | Quirk

($) | | Park

($) | | Nolan

($) | | Bickett

($) | | Jewkes

($) | | Foley

($) | |

ESPP Matching Contributions—FNF | | 40,500 | | 33,880 | | 12,981 | | 42,875 | | 49,067 | | 63,137 | |

ESPP Matching Contributions—Black Knight | | — | | — | | — | | — | | — | | 3,065 | |

Restricted Stock Dividends* | | 143,093 | | 28,513 | | 45,395 | | 58,157 | | 55,870 | | — | |

Life Insurance Premiums | | 1,854 | | 207 | | 387 | | 207 | | 387 | | 321 | |

Personal Airplane Use—FNF | | 4,475 | | — | | — | | 59,927 | | 107,731 | | 294,679 | |

Personal Airplane Use—Black Knight | | — | | — | | — | | — | | — | | 147,340 | |

Executive Medical | | 37,517 | | 53,598 | | — | | 53,598 | | 53,598 | | 37,517 | |

Company match—401(k) | | 5,963 | | 5,963 | | 5,963 | | 5,963 | | 5,963 | | 5,963 | |

Automobile Allowance | | — | | — | | — | | — | | 6,000 | | — | |

FNF Board Meeting Fees | | — | | — | | — | | — | | — | | 10,000 | |

FNF and FNFV Board Retainer | | — | | — | | — | | — | | — | | 780,000 | |

* Dividends are subject to the same underlying performance-based vesting requirements applicable to the restricted stock awards.