Q4 2022 EARNINGS SUPPLEMENT FEBRUARY 22, 2023

LEGAL DISCLAIMER

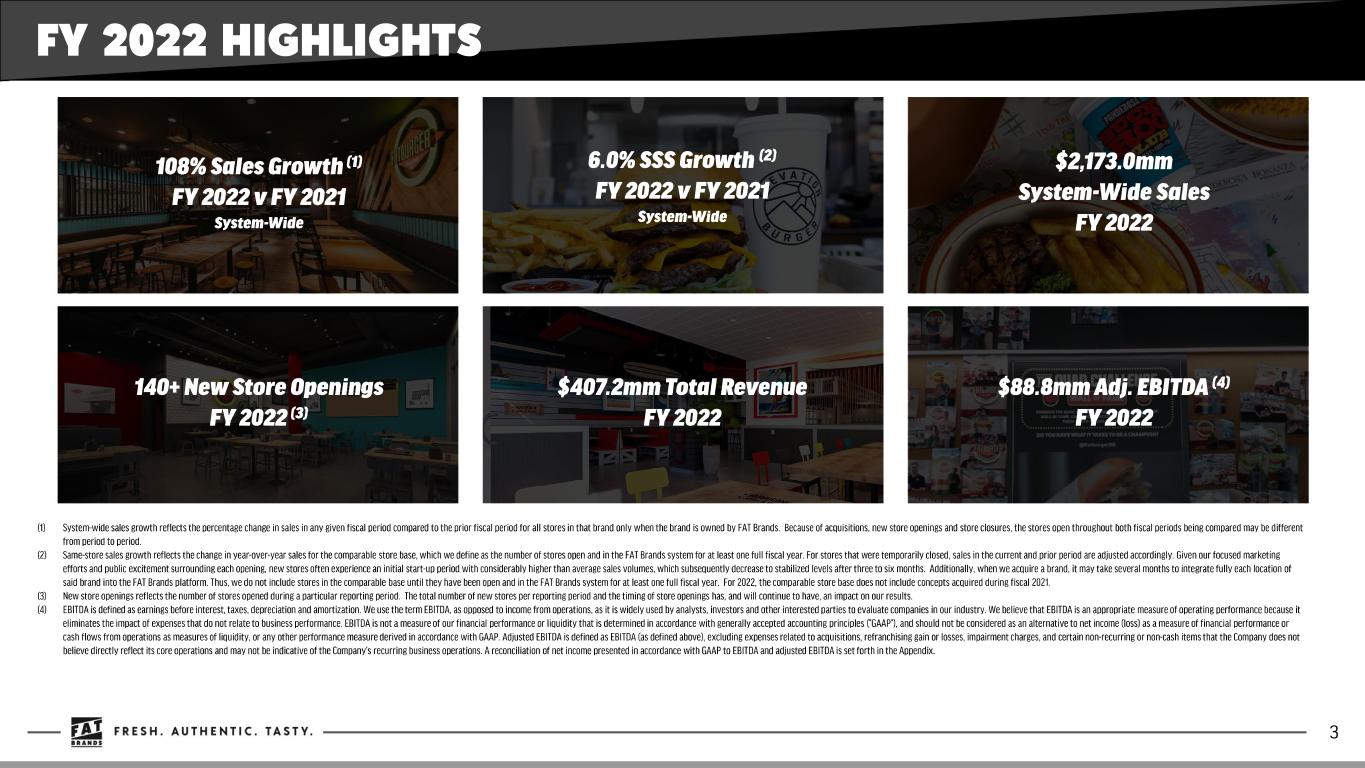

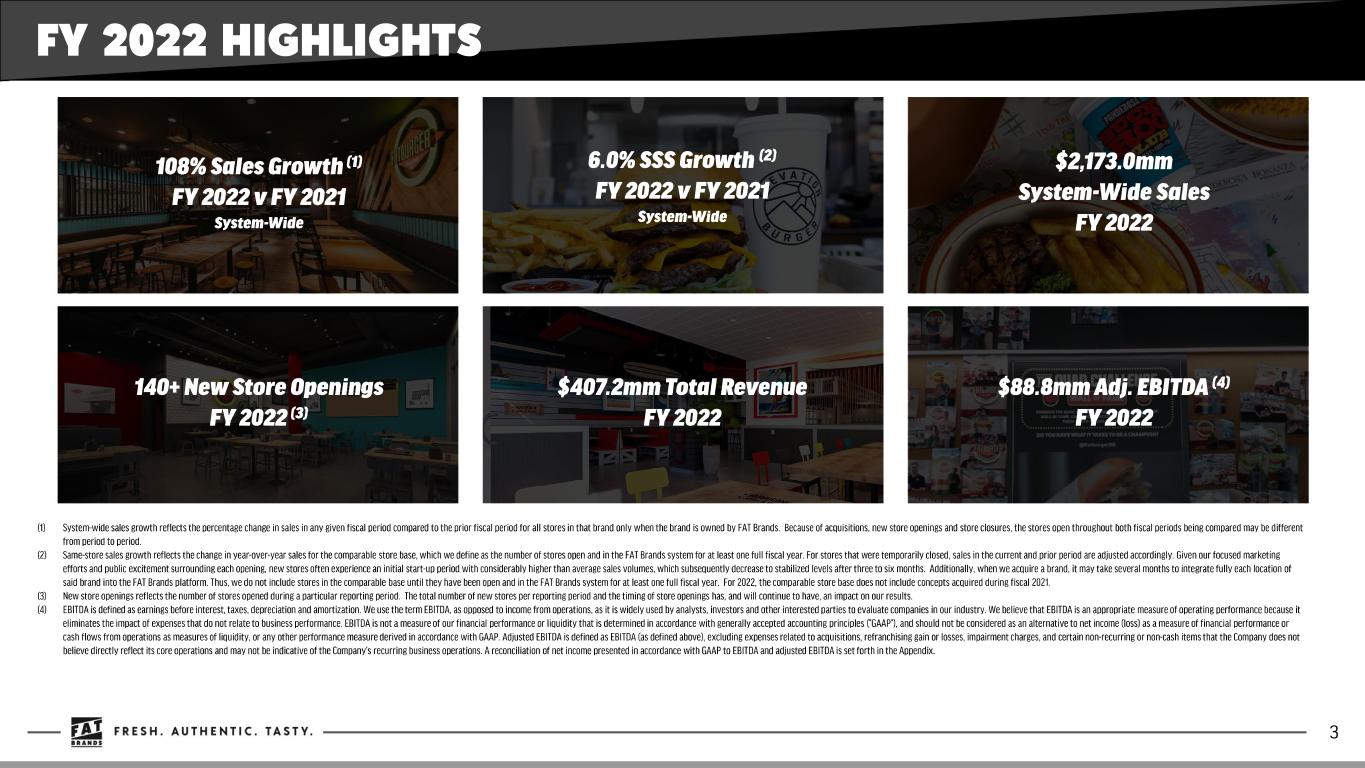

FY 2022 HIGHLIGHTS

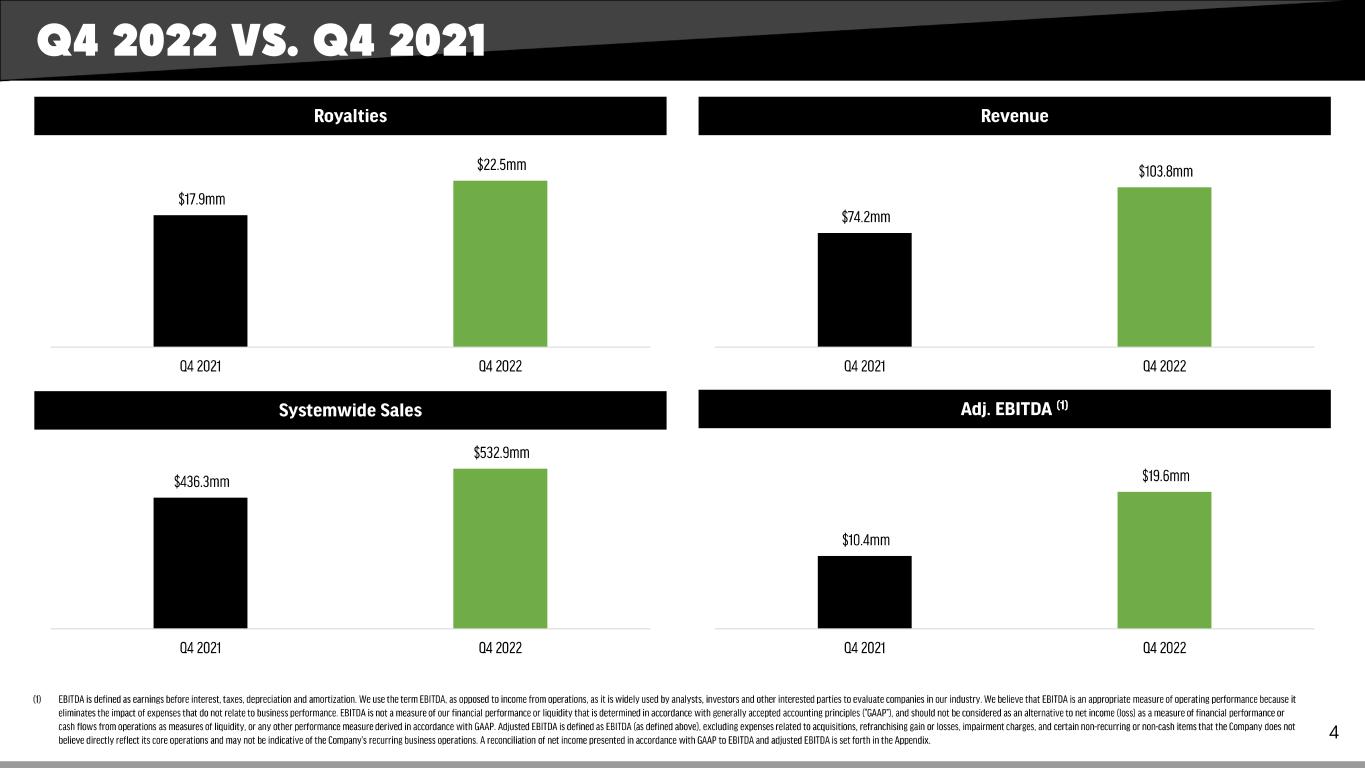

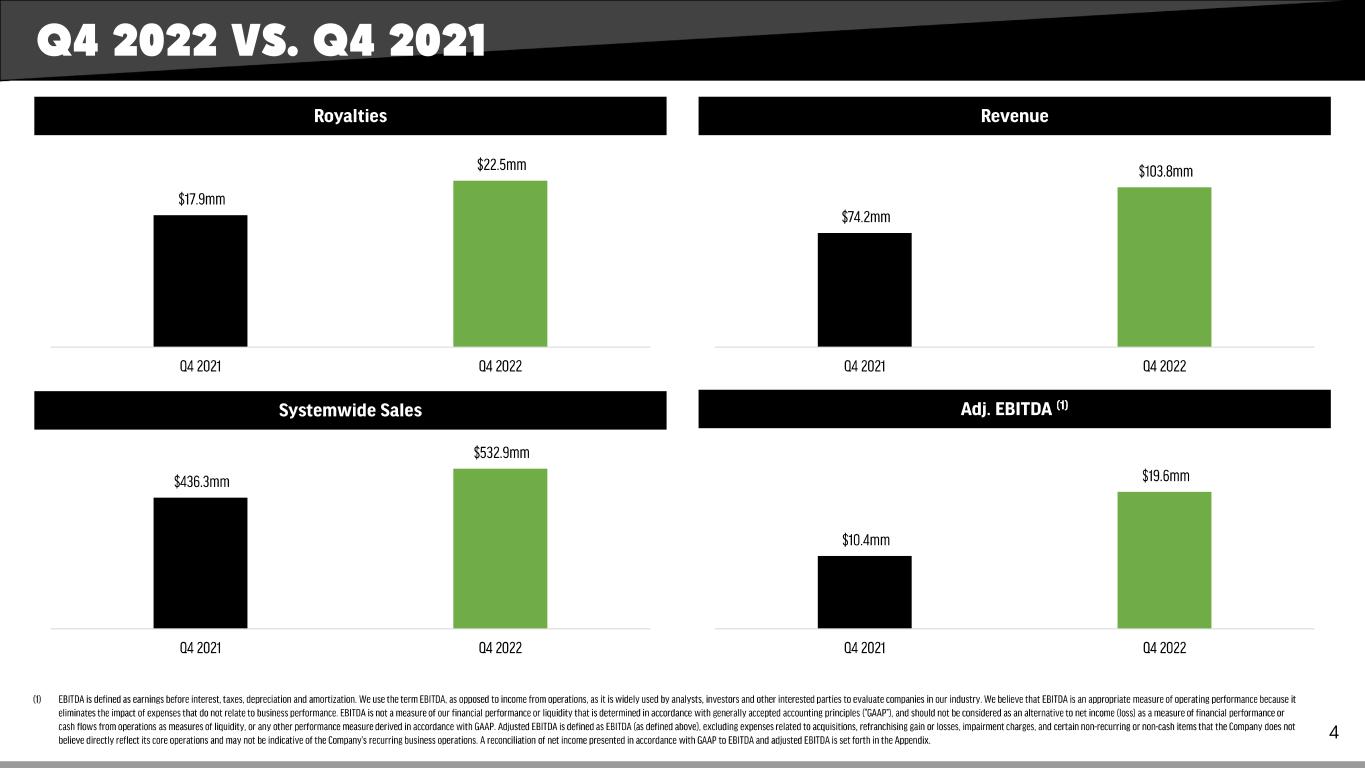

Q4 2022 VS. Q4 2021

FY 2022 VS. FY 2021

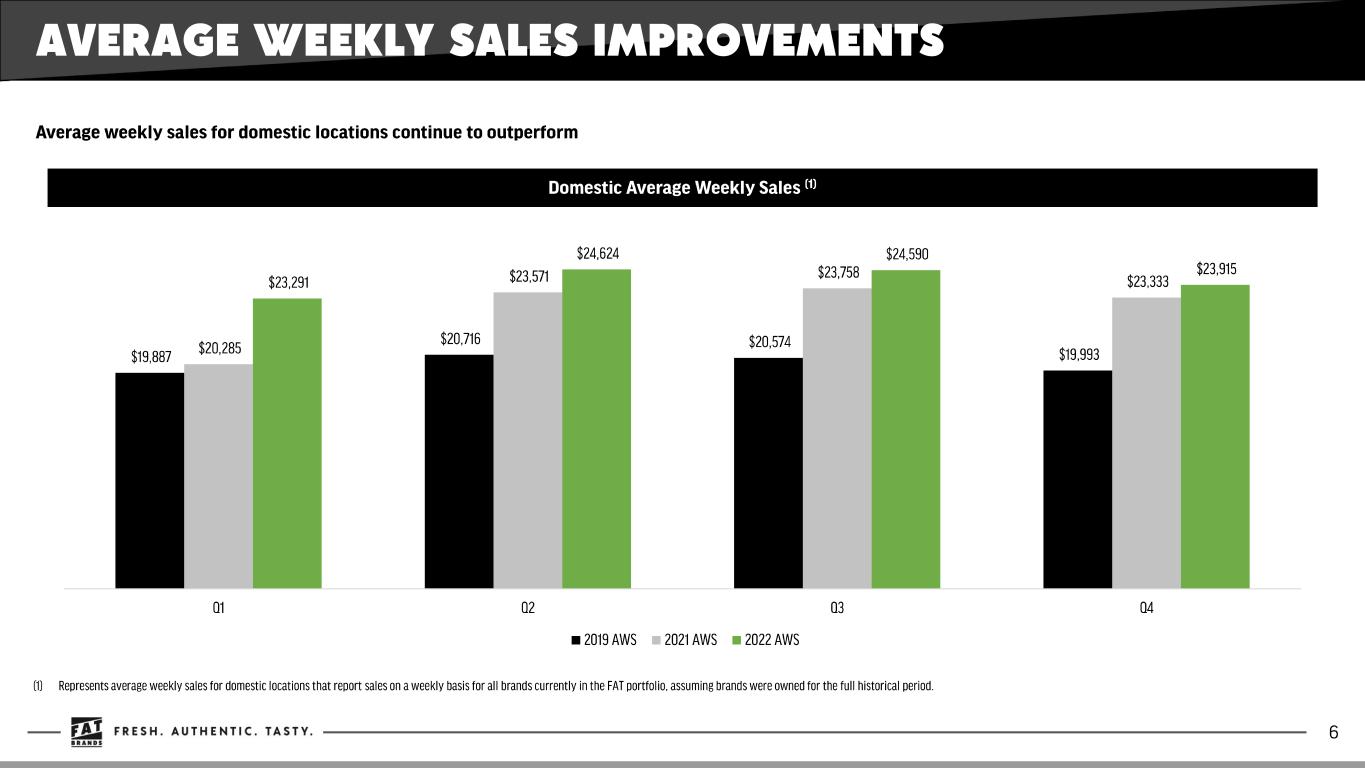

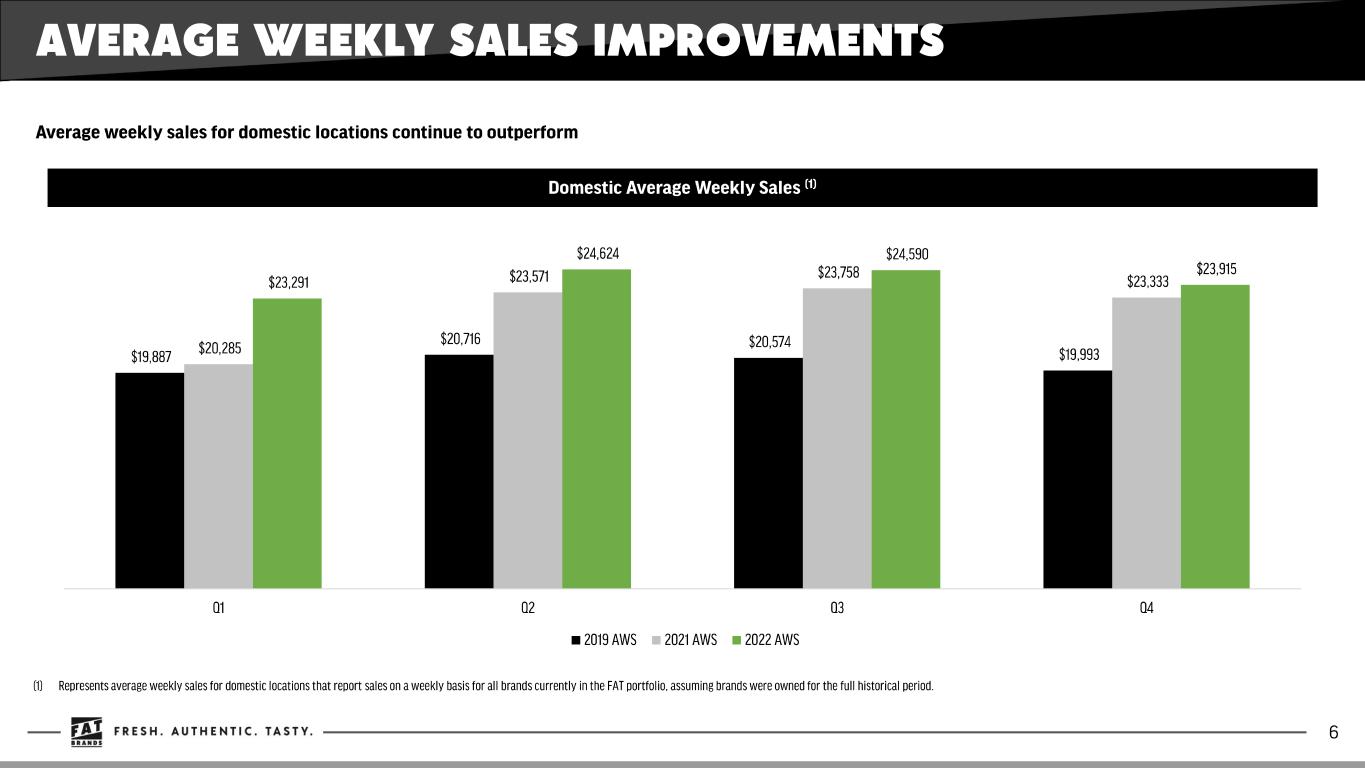

AVERAGE WEEKLY SALES IMPROVEMENTS

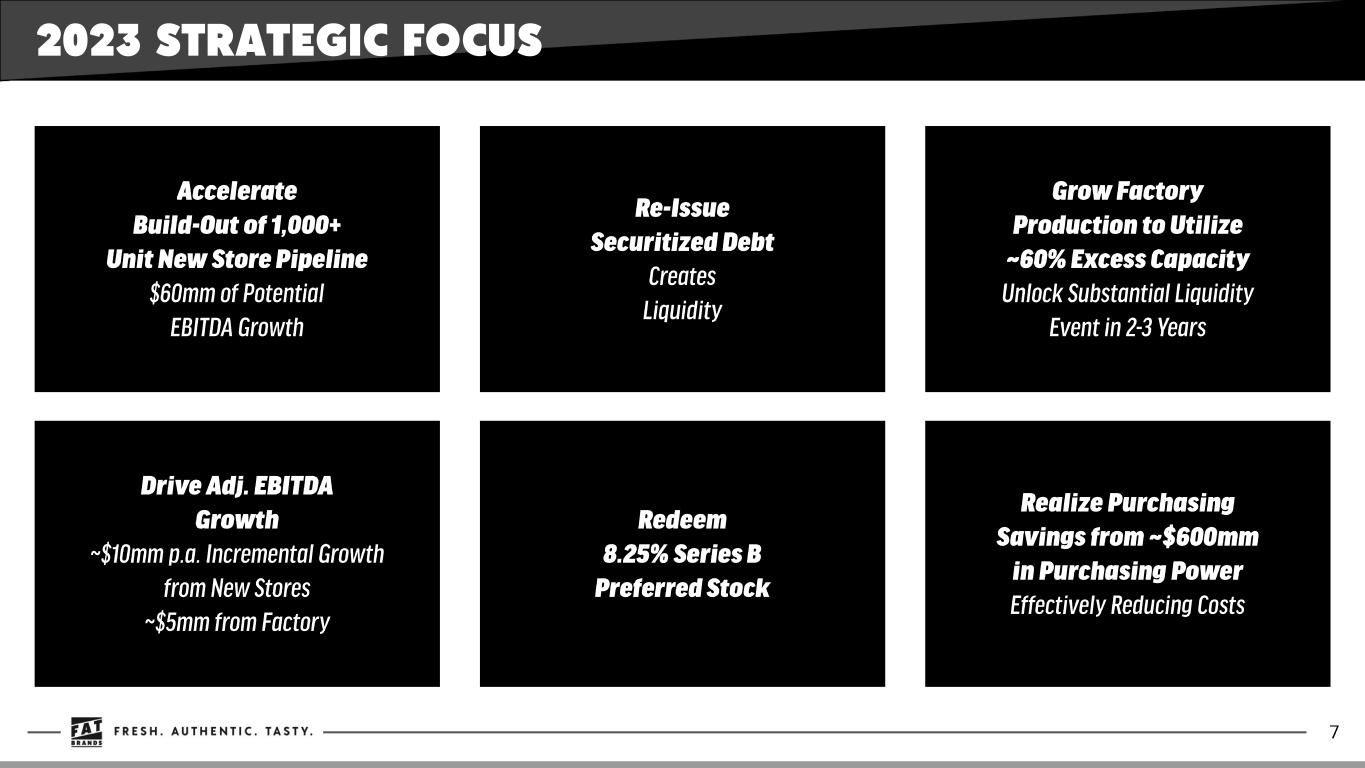

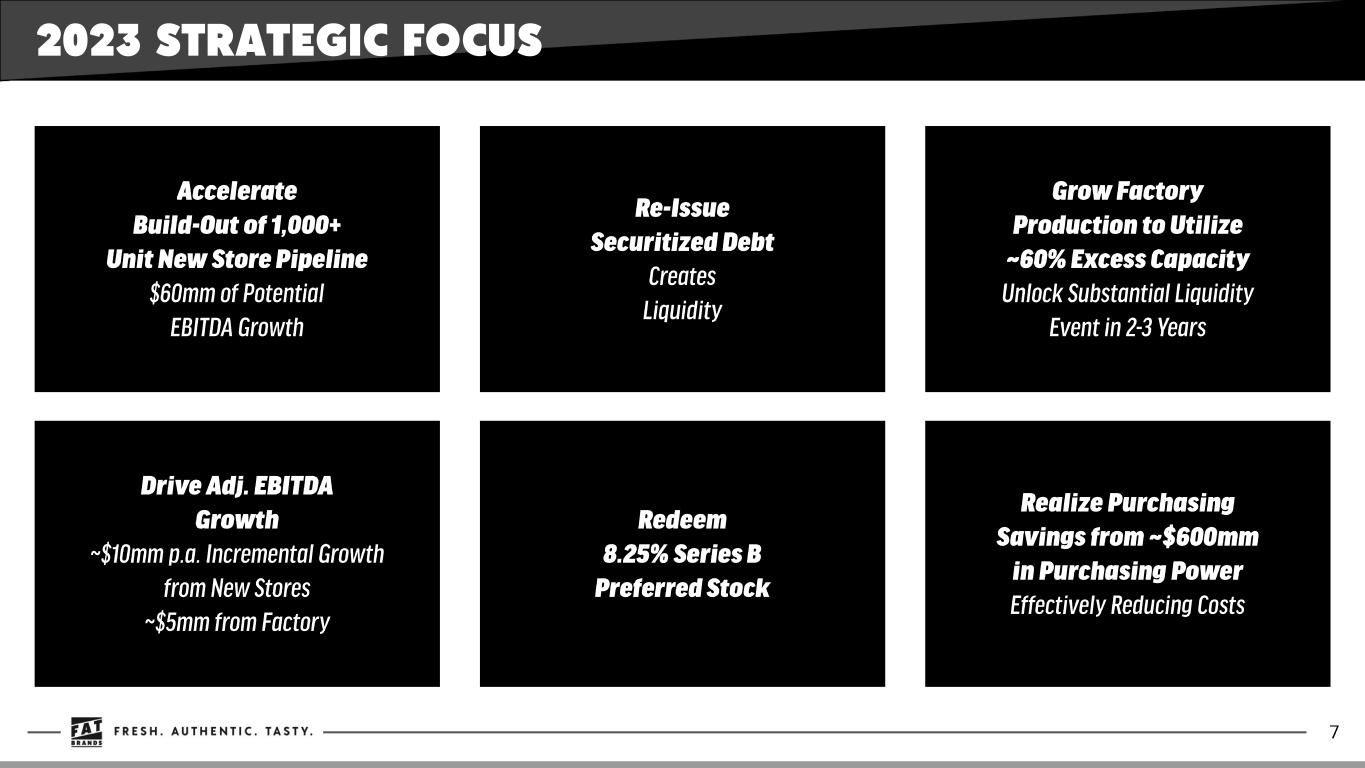

2023 STRATEGIC FOCUS

APPENDIX

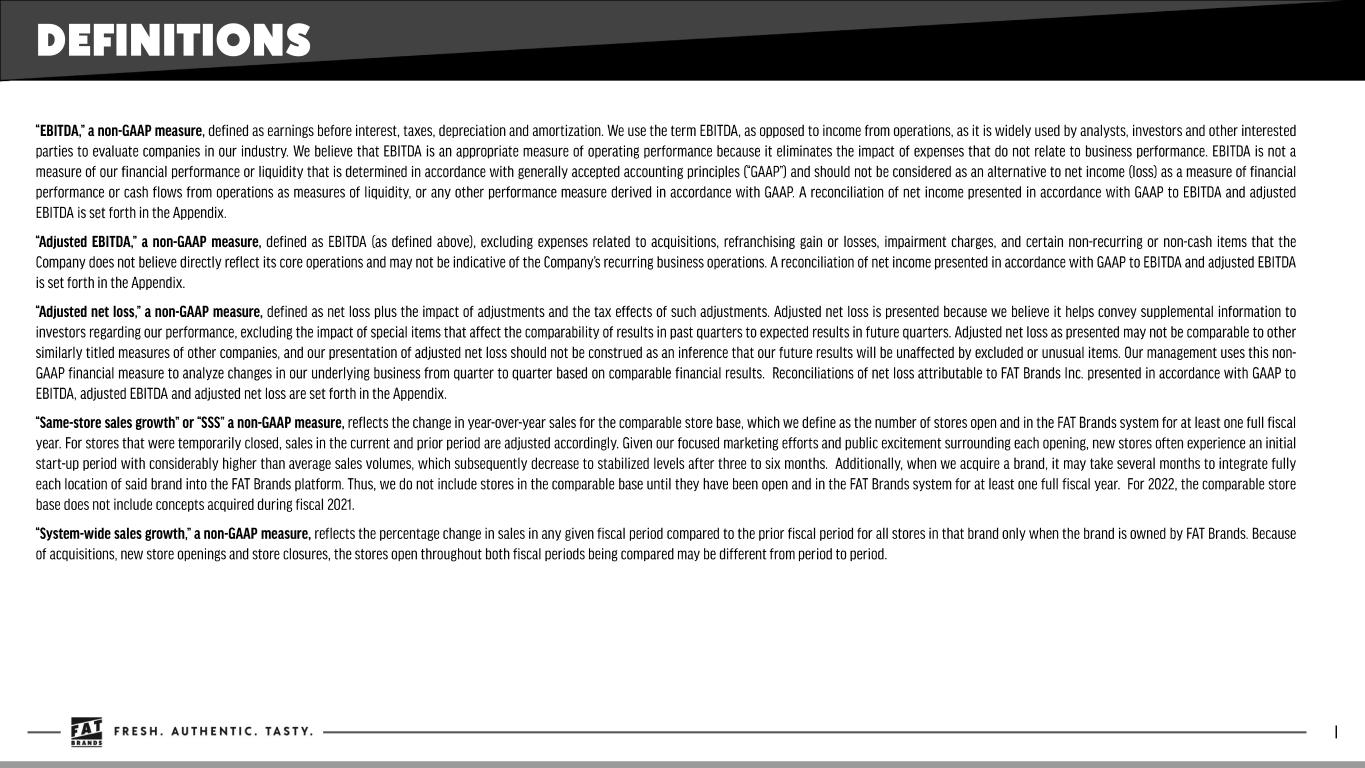

DEFINITIONS

CONSOLIDATED STATEMENT OF OPERATIONS FAT Brands Inc. Consolidated Statements of Operations Thirteen Weeks Ended Fifty-Two Weeks Ended (In thousands) December 25, 2022 December 26, 2021 December 25, 2022 December 26, 2021 Revenue Royalties $ 22,525 $ 17,858 $ 87,921 $ 42,658 Restaurant sales 61,528 37,451 241,001 41,563 Advertising fees 9,589 8,685 37,997 16,728 Factory revenues 8,916 7,990 33,504 13,470 Franchise fees 943 1,914 3,706 4,023 Management fees and other income 313 291 3,095 439 Total revenue 103,814 74,189 407,224 118,881 Costs and expenses General and administrative expense 39,125 21,563 113,313 41,775 Cost of restaurant and factory revenues 61,726 36,865 221,627 44,242 Depreciation and amortization 6,939 5,313 27,015 8,474 Impairment of goodwill and other intangible assets 14,000 1,037 14,000 1,037 Refranchising loss 3,055 992 4,178 314 Acquisition costs — 1,257 383 4,242 Advertising fees 11,574 9,930 44,612 17,973 Total costs and expenses 136,419 76,957 425,128 118,057 Income from operations (32,605) (2,768) (17,904) 824 Other (expense) income, net Interest expense (20,947) (14,925) (78,477) (26,864) Interest expense related to preferred shares (4,691) (1,468) (16,372) (2,193) Net loss on extinguishment of debt — (1,219) — (7,637) Other income, net 1,456 543 5,375 750 Total other expense, net (24,182) (17,069) (89,474) (35,944) Loss before income tax (56,787) (19,837) (107,378) (35,120) Income tax provision (benefit) 14,021 (234) 18,810 (3,537) Net loss $ (70,808) $ (19,603) $ (126,188) $ (31,583) Basic and diluted loss per common share $ (4.29) $ (1.38) $ (7.66) $ (2.15) Basic and diluted weighted average shares outstanding 16,530,934 14,203,887 16,476,090 14,656,880 Cash dividends declared per common share $ 0.14 $ 0.13 $ 0.54 $ 0.52

CONSOLIDATED EBITDA & ADJ. EBITDA RECONCILIATION FAT Brands Inc. Consolidated EBITDA and Adjusted EBITDA Reconciliation Thirteen Weeks Ended Fifty-Two Weeks Ended (In thousands) December 25, 2022 December 26, 2021 December 25, 2022 December 26, 2021 Net loss $ (70,808) $ (19,603) $ (126,188) $ (31,583) Interest expense, net 25,638 16,393 94,849 29,057 Income tax provision (benefit) 14,021 (234) 18,810 (3,537) Depreciation and amortization 6,939 5,313 27,015 8,474 EBITDA (24,210) 1,869 14,486 2,411 Bad debt expense 17,793 1,340 23,736 1,565 Share-based compensation expenses 1,584 1,154 7,665 1,642 Non-cash lease expenses 808 201 2,478 640 Acquisition costs — 974 383 4,242 Refranchising loss 3,055 992 4,178 314 Litigation costs 4,788 394 18,958 394 Severance — — 526 — Net loss related to advertising fund deficit 1,038 1,245 1,041 1,245 Net loss on extinguishment of debt — 1,219 — 7,637 Impairment losses 14,454 1,037 14,454 1,037 Pre-opening expenses 298 — 900 — Adjusted EBITDA $ 19,608 $ 10,425 $ 88,805 $ 21,127

ADJUSTED NET LOSS RECONCILIATION FAT Brands Inc. Adjusted Net Loss Reconciliation Thirteen Weeks Ended Fifty-Two Weeks Ended (In thousands, except share and per share data) December 25, 2022 December 26, 2021 December 25, 2022 December 26, 2021 Net loss $ (70,808) $ (19,603) $ (126,188) $ (31,583) Refranchising loss 3,055 992 4,178 314 Acquisition costs — 974 383 4,242 Net loss on extinguishment of debt — 1,219 — 7,637 Impairment losses 14,454 — 14,454 — Litigation costs 4,788 — 18,958 — Severance — — 526 — Tax adjustments, net (1) 5,505 (38) 6,744 (1,228) Adjusted net loss $ (43,006) $ (16,456) $ (80,945) $ (20,618) Loss per basic and diluted share $ (4.29) $ (1.38) $ (7.66) $ (2.15) Adjusted loss per basic and diluted share $ (2.60) $ (1.16) $ (4.91) $ (1.41) Weighted average basic and diluted shares outstanding 16,530,934 14,203,887 16,476,090 14,656,880 (1) Reflects the tax impact of the adjustments using the effective tax rate for the respective periods.

CONTACT INVESTOR RELATIONS: MEDIA RELATIONS: