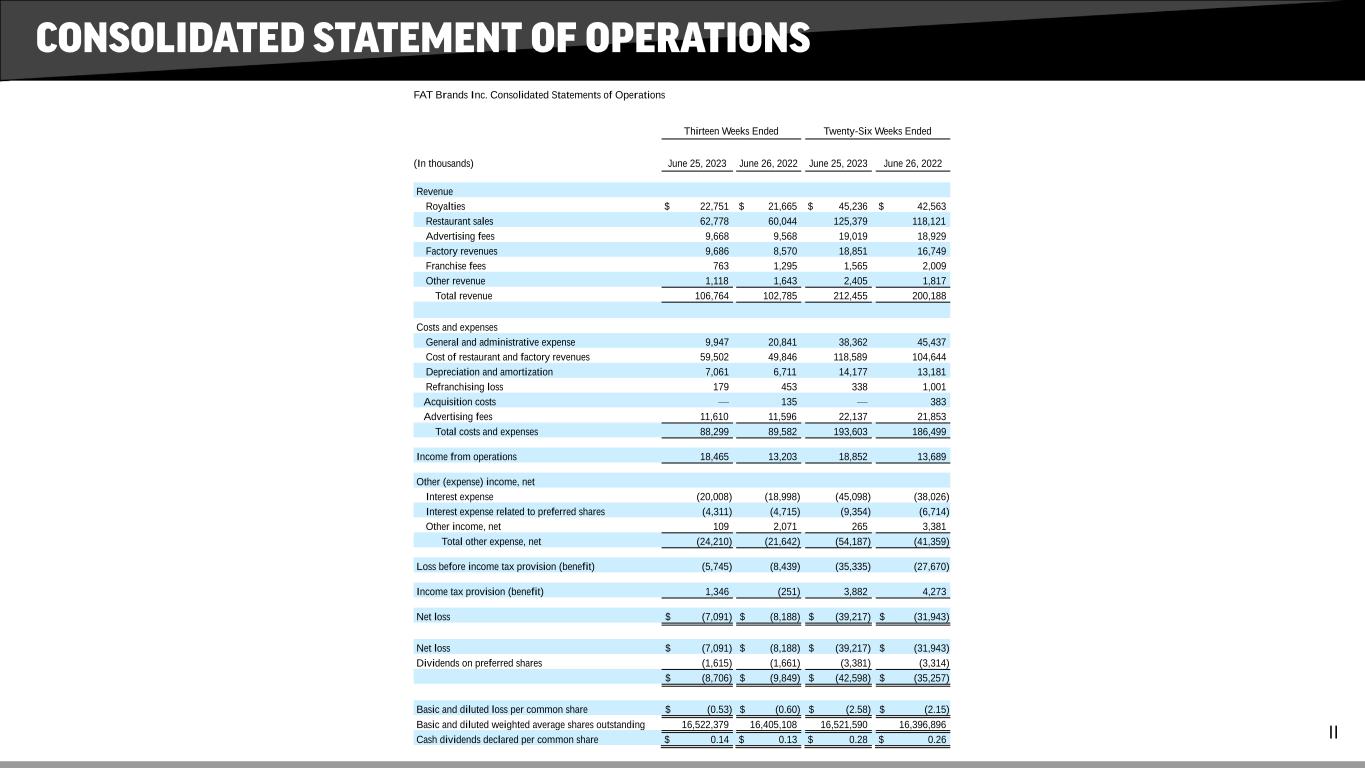

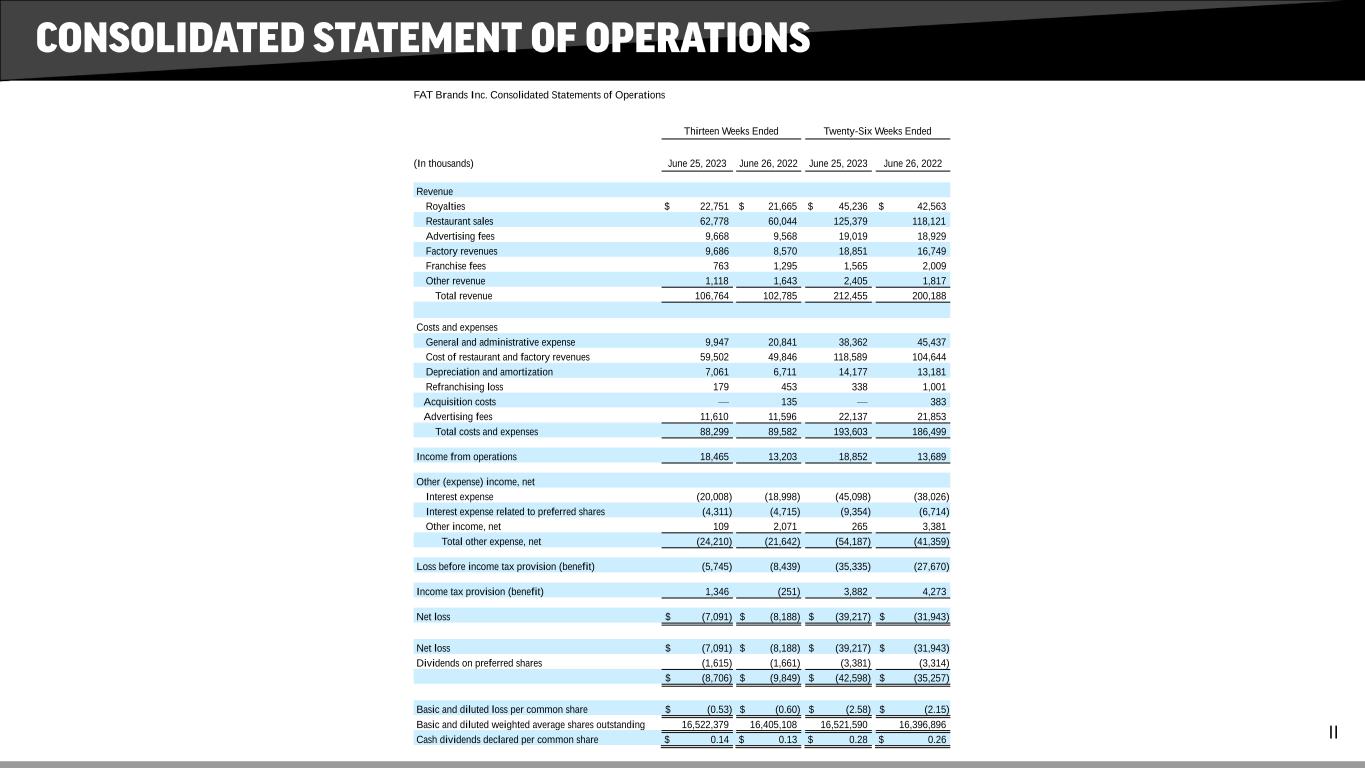

FAT Brands Inc. Consolidated Statements of Operations Thirteen Weeks Ended Twenty-Six Weeks Ended (In thousands) June 25, 2023 June 26, 2022 June 25, 2023 June 26, 2022 Revenue Royalties $ 22,751 $ 21,665 $ 45,236 $ 42,563 Restaurant sales 62,778 60,044 125,379 118,121 Advertising fees 9,668 9,568 19,019 18,929 Factory revenues 9,686 8,570 18,851 16,749 Franchise fees 763 1,295 1,565 2,009 Other revenue 1,118 1,643 2,405 1,817 Total revenue 106,764 102,785 212,455 200,188 Costs and expenses General and administrative expense 9,947 20,841 38,362 45,437 Cost of restaurant and factory revenues 59,502 49,846 118,589 104,644 Depreciation and amortization 7,061 6,711 14,177 13,181 Refranchising loss 179 453 338 1,001 Acquisition costs — 135 — 383 Advertising fees 11,610 11,596 22,137 21,853 Total costs and expenses 88,299 89,582 193,603 186,499 Income from operations 18,465 13,203 18,852 13,689 Other (expense) income, net Interest expense (20,008) (18,998) (45,098) (38,026) Interest expense related to preferred shares (4,311) (4,715) (9,354) (6,714) Other income, net 109 2,071 265 3,381 Total other expense, net (24,210) (21,642) (54,187) (41,359) Loss before income tax provision (benefit) (5,745) (8,439) (35,335) (27,670) Income tax provision (benefit) 1,346 (251) 3,882 4,273 Net loss $ (7,091) $ (8,188) $ (39,217) $ (31,943) Net loss $ (7,091) $ (8,188) $ (39,217) $ (31,943) Dividends on preferred shares (1,615) (1,661) (3,381) (3,314) $ (8,706) $ (9,849) $ (42,598) $ (35,257) Basic and diluted loss per common share $ (0.53) $ (0.60) $ (2.58) $ (2.15) Basic and diluted weighted average shares outstanding 16,522,379 16,405,108 16,521,590 16,396,896 Cash dividends declared per common share $ 0.14 $ 0.13 $ 0.28 $ 0.26

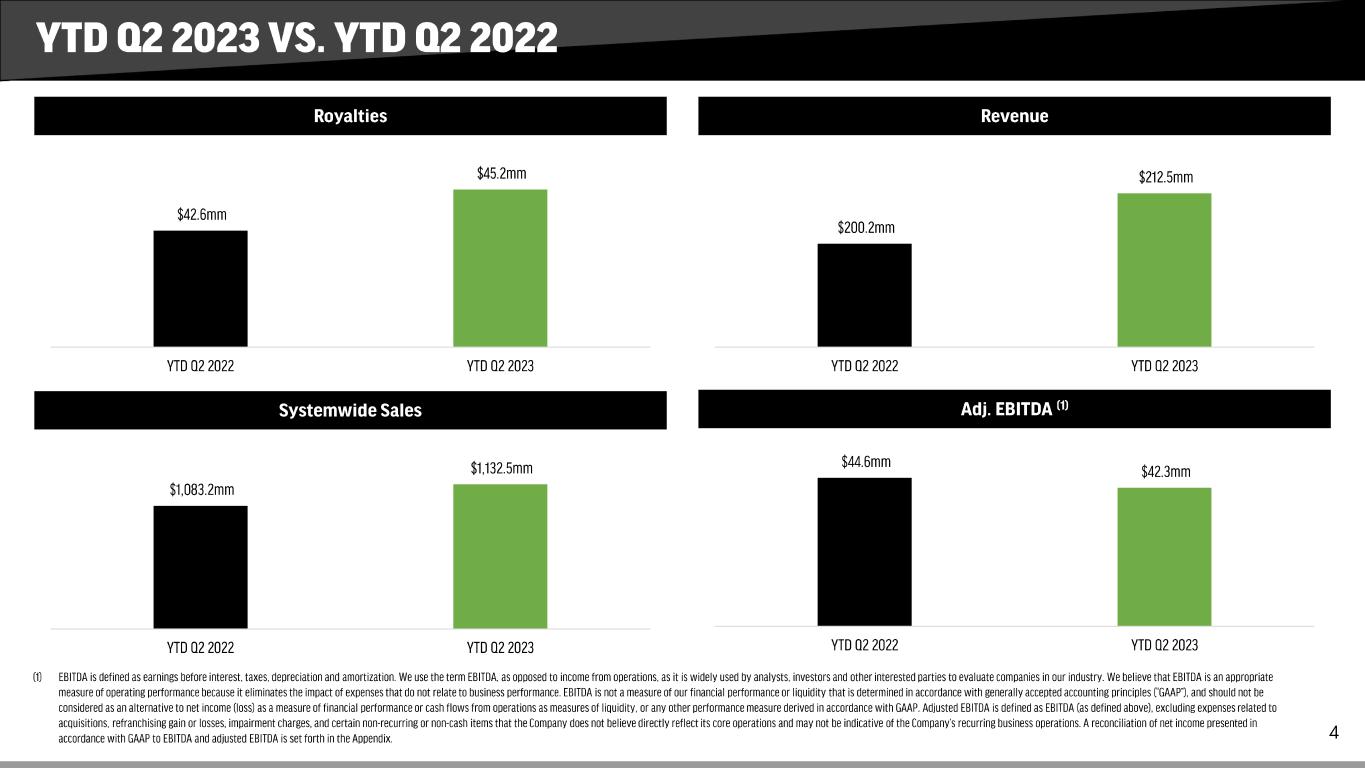

FAT Brands Inc. Consolidated EBITDA and Adjusted EBITDA Reconciliation Thirteen Weeks Ended Twenty-Six Weeks Ended (In thousands) June 25, 2023 June 26, 2022 June 25, 2023 June 26, 2022 Net loss $ (7,091) $ (8,188) $ (39,217) $ (31,943) Interest expense, net 24,319 23,713 54,452 44,740 Income tax provision (benefit) 1,346 (251) 3,882 4,273 Depreciation and amortization 7,061 6,711 14,177 13,181 EBITDA 25,635 21,985 33,294 30,251 Bad debt expense (13,106) 239 (12,071) 423 Share-based compensation expenses 477 1,934 1,572 4,046 Non-cash lease expenses 293 457 674 741 Acquisition costs — 134 — 383 Refranchising loss 179 453 338 1,001 Litigation costs 6,924 4,308 14,668 7,264 Severance 1,036 — 1,036 526 Net loss related to advertising fund deficit 1,688 — 2,773 10 Pre-opening expenses 11 — 40 — Adjusted EBITDA $ 23,137 $ 29,510 $ 42,325 $ 44,645

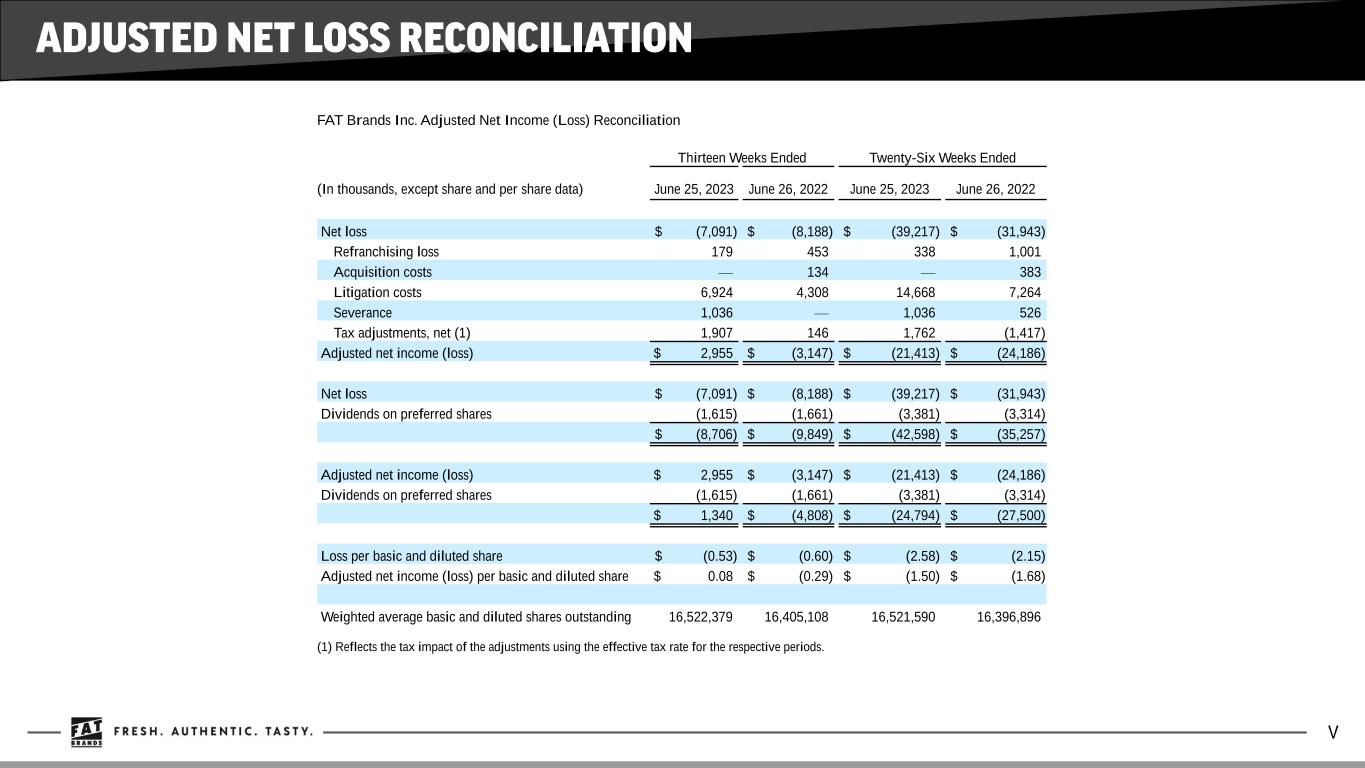

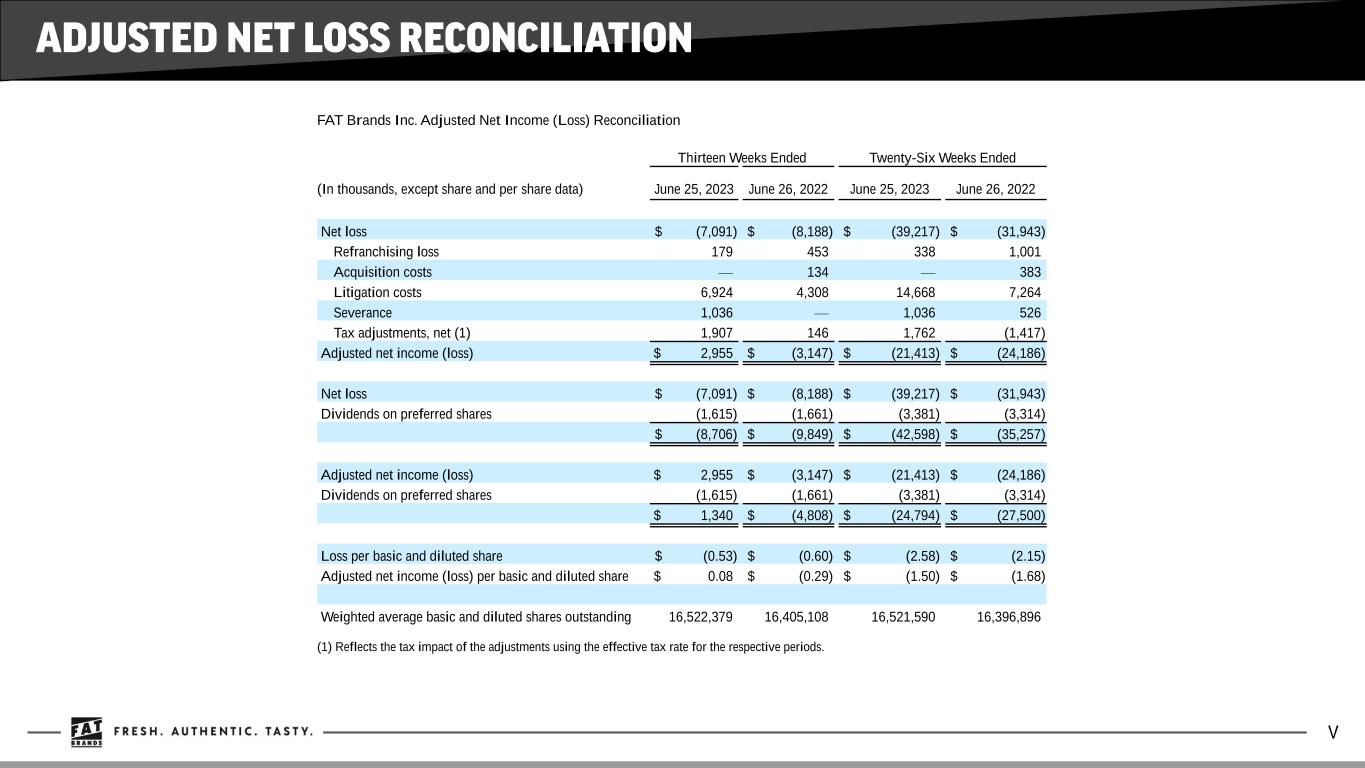

FAT Brands Inc. Adjusted Net Income (Loss) Reconciliation Thirteen Weeks Ended Twenty-Six Weeks Ended (In thousands, except share and per share data) June 25, 2023 June 26, 2022 June 25, 2023 June 26, 2022 Net loss $ (7,091) $ (8,188) $ (39,217) $ (31,943) Refranchising loss 179 453 338 1,001 Acquisition costs — 134 — 383 Litigation costs 6,924 4,308 14,668 7,264 Severance 1,036 — 1,036 526 Tax adjustments, net (1) 1,907 146 1,762 (1,417) Adjusted net income (loss) $ 2,955 $ (3,147) $ (21,413) $ (24,186) Net loss $ (7,091) $ (8,188) $ (39,217) $ (31,943) Dividends on preferred shares (1,615) (1,661) (3,381) (3,314) $ (8,706) $ (9,849) $ (42,598) $ (35,257) Adjusted net income (loss) $ 2,955 $ (3,147) $ (21,413) $ (24,186) Dividends on preferred shares (1,615) (1,661) (3,381) (3,314) $ 1,340 $ (4,808) $ (24,794) $ (27,500) Loss per basic and diluted share $ (0.53) $ (0.60) $ (2.58) $ (2.15) Adjusted net income (loss) per basic and diluted share $ 0.08 $ (0.29) $ (1.50) $ (1.68) Weighted average basic and diluted shares outstanding 16,522,379 16,405,108 16,521,590 16,396,896 (1) Reflects the tax impact of the adjustments using the effective tax rate for the respective periods.