INVESTOR PRESENTATION N O V E M B E R 2 0 1 7

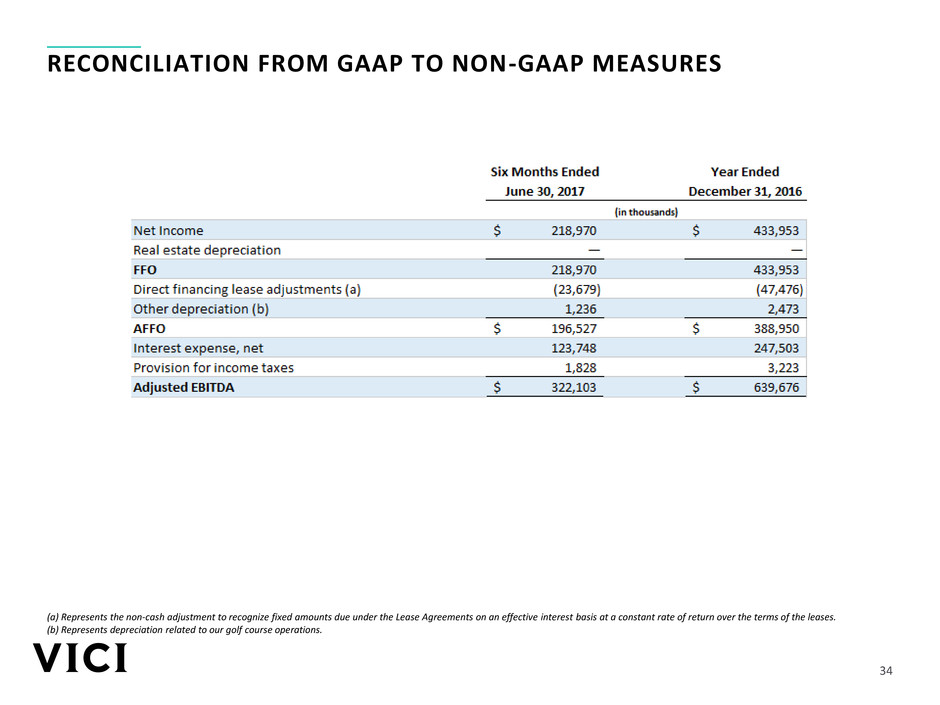

2 Forward-Looking Statements Certain statements in this presentation and discussed at investor meetings which this presentation accompanies that are not historical facts are “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on the Company’s current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as “expects”, “plans”, “opportunity” and similar words and variations thereof. These statements involve known and unknown risks, uncertainties and other factors including, among others, those set forth in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including its Registration Statement on Form 10 filed with the SEC on July 31, 2017 (as subsequently amended and became effective on September 29, 2017 and as further amended on October 23, 2017) and any future reports the Company files with the SEC, that may cause the Company’s actual results, performance and achievements to materially differ from any future results, performance and achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements included in this presentation. Except as otherwise required by the federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements after the date of this presentation, whether as a result of new information, future events, changed circumstances or any other reason. Market and Industry Data This presentation contains estimates and information concerning the Company’s industry, including market position, rent growth and rent coverage of the Company’s peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section of the Company’s public filings with the SEC. Non-GAAP Financial Measures This presentation includes reference to Adjusted Funds from Operations (“AFFO”) and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). The Company believes AFFO and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. The Company defines AFFO as net income (or loss) excluding gains (or losses) from sales of property plus real estate depreciation, adjusted for direct financing lease adjustments and other depreciation (which is comprised of the depreciation related to our golf course operations). The Company defines Adjusted EBITDA as AFFO adjusted for income taxes and interest expense, net. Because not all companies calculate AFFO and Adjusted EBITDA in the same way as the Company and other companies may not perform such calculations, those measures as used by other companies may not be consistent with the way the Company calculates such measures and should not be considered as alternative measures of operating profit or net income. The presentation of these measures does not replace the presentation of the Company’s financial results in accordance with GAAP. See Reconciliation from GAAP to Non-GAAP Measures. Not a Securities Offer or Recommendation This presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any security of VICI or any other person. Nothing in this presentation should be construed as a recommendation to buy, sell, or hold any investment in or security of VICI or any other person, nor is anything in this presentation intended to provide tax, legal or investment advice. DISCLAIMERS

3 TABLE OF CONTENTS WH O WE ARE1 P ORTFOLIO OV ERV IEW2 H IG H - QUALITY, BEST - IN -CLASS TENANT 3 F INANCIAL OV ERV IEW AND CAP ITAL STRUC TURE4 G OV ERNANCE QUALITY AND MANAG EMENT / BOARD V IG OR5

4 1WHO WE ARE

5 VICI IS THE NEXT GENERATION EXPERIENTIAL REAL ESTATE COMPANY MISSION TO BE AMER ICA’S M O S T DY N A M I C L E I S U R E & H O S P I TA L I T Y E X P E R I E N T I A L R E I T V IS ION W E W I L L B E T H E R E A L E S TAT E PA R T N E R O F C H O I C E F O R T H E WORLD ’S LEAD ING CREATORS & OPERATORS OF PLACE - B A S E D, S C A L E D L E I S U R E & H O S P I TA L I T Y E X P E R I E N C E S . O U R PA R T N E RS W I L L O W N M A R K E T - L E A D I N G RELAT IONSH IPS WITH TODAY ’S AND MOREOVER TOMORROW’S H IGHEST - VA LU E C O N S U M E RS O F L E I S U R E & H O S P I TA L I T Y. O U R DY N A M I C R E L AT I O N S H I P S W I T H O U R PA R T N E RS W I L L B E O U R E N G I N E O F G R O W T H

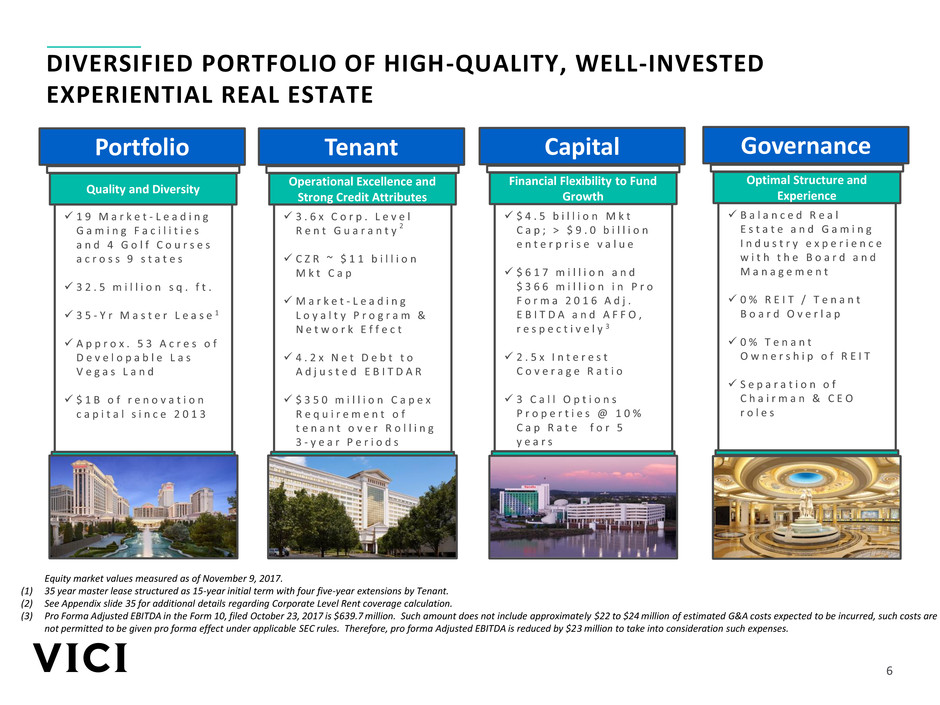

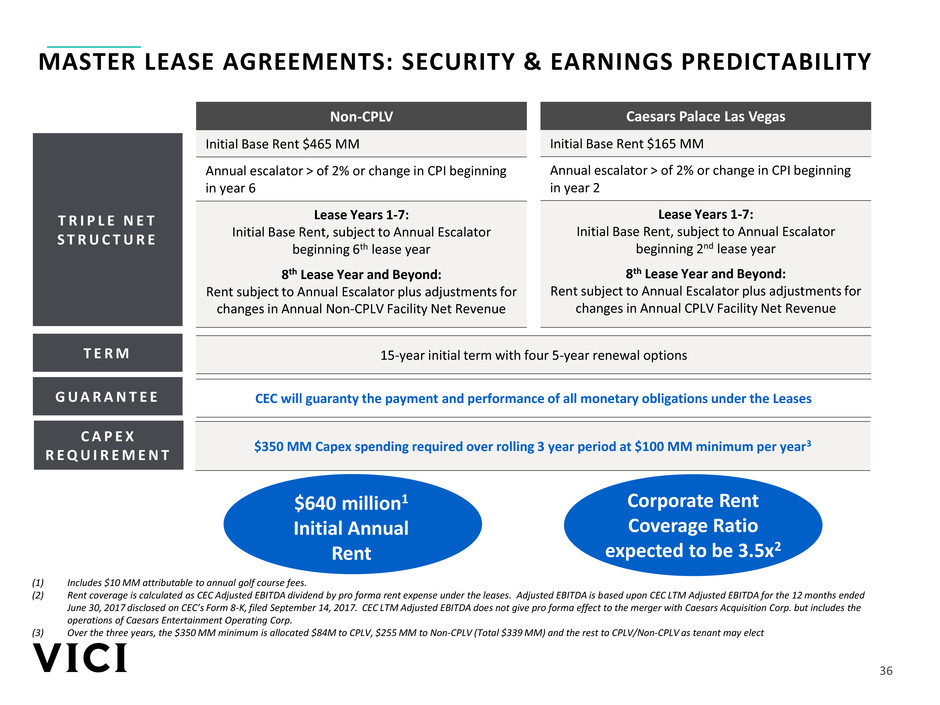

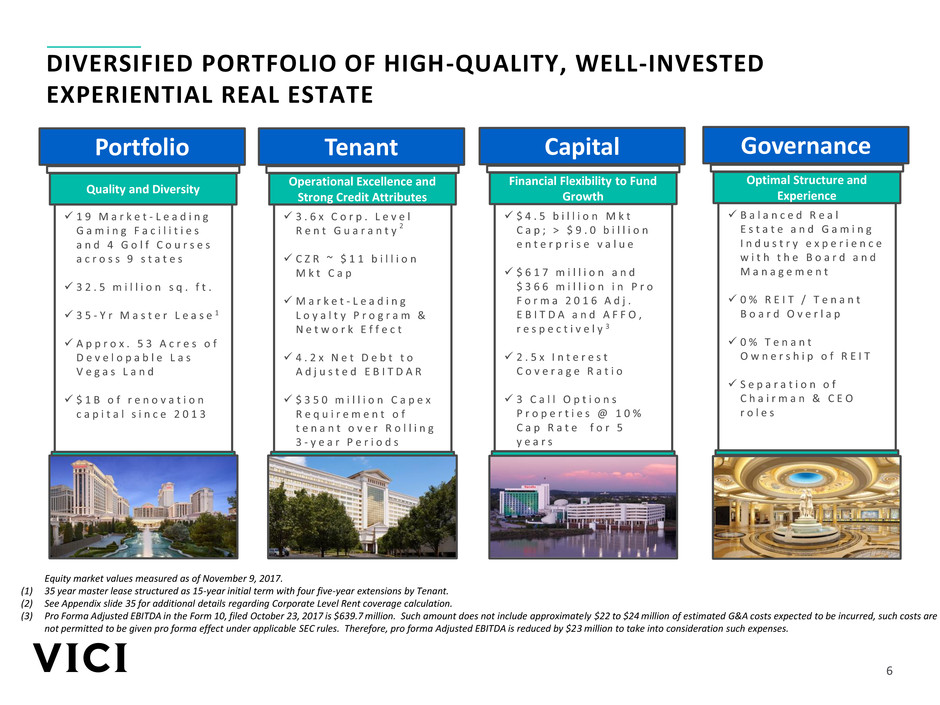

6 DIVERSIFIED PORTFOLIO OF HIGH-QUALITY, WELL-INVESTED EXPERIENTIAL REAL ESTATE Equity market values measured as of November 9, 2017. (1) 35 year master lease structured as 15-year initial term with four five-year extensions by Tenant. (2) See Appendix slide 35 for additional details regarding Corporate Level Rent coverage calculation. (3) Pro Forma Adjusted EBITDA in the Form 10, filed October 23, 2017 is $639.7 million. Such amount does not include approximately $22 to $24 million of estimated G&A costs expected to be incurred, such costs are not permitted to be given pro forma effect under applicable SEC rules. Therefore, pro forma Adjusted EBITDA is reduced by $23 million to take into consideration such expenses. Portfolio Quality and Diversity 1 9 M a r k e t - L e a d i n g G a m i n g F a c i l i t i e s a n d 4 G o l f C o u r s e s a c r o s s 9 s t a t e s 3 2 . 5 m i l l i o n s q . f t . 3 5 - Y r M a s t e r L e a s e 1 A p p r o x . 5 3 A c r e s o f D e v e l o p a b l e L a s V e g a s L a n d $ 1 B o f r e n o v a t i o n c a p i t a l s i n c e 2 0 1 3 Tenant Operational Excellence and Strong Credit Attributes 3 . 6 x C o r p . L e v e l R e n t G u a r a n t y 2 C Z R ~ $ 1 1 b i l l i o n M k t C a p M a r k e t - L e a d i n g L o y a l t y P r o g r a m & N e t w o r k E f f e c t 4 . 2 x N e t D e b t t o A d j u s t e d E B I T D A R $ 3 5 0 m i l l i o n C a p e x R e q u i r e m e n t o f t e n a n t o v e r R o l l i n g 3 - y e a r P e r i o d s Capital Financial Flexibility to Fund Growth $ 4 . 5 b i l l i o n M k t C a p ; > $ 9 . 0 b i l l i o n e n t e r p r i s e v a l u e $ 6 1 7 m i l l i o n a n d $ 3 6 6 m i l l i o n i n P r o F o r m a 2 0 1 6 A d j . E B I T D A a n d A F F O , r e s p e c t i v e l y 3 2 . 5 x I n t e r e s t C o v e r a g e R a t i o 3 C a l l O p t i o n s P r o p e r t i e s @ 1 0 % C a p R a t e f o r 5 y e a r s Governance Optimal Structure and Experience B a l a n c e d R e a l E s t a t e a n d G a m i n g I n d u s t r y e x p e r i e n c e w i t h t h e B o a r d a n d M a n a g e m e n t 0 % R E I T / T e n a n t B o a r d O v e r l a p 0 % T e n a n t O w n e r s h i p o f R E I T S e p a r a t i o n o f C h a i r m a n & C E O r o l e s

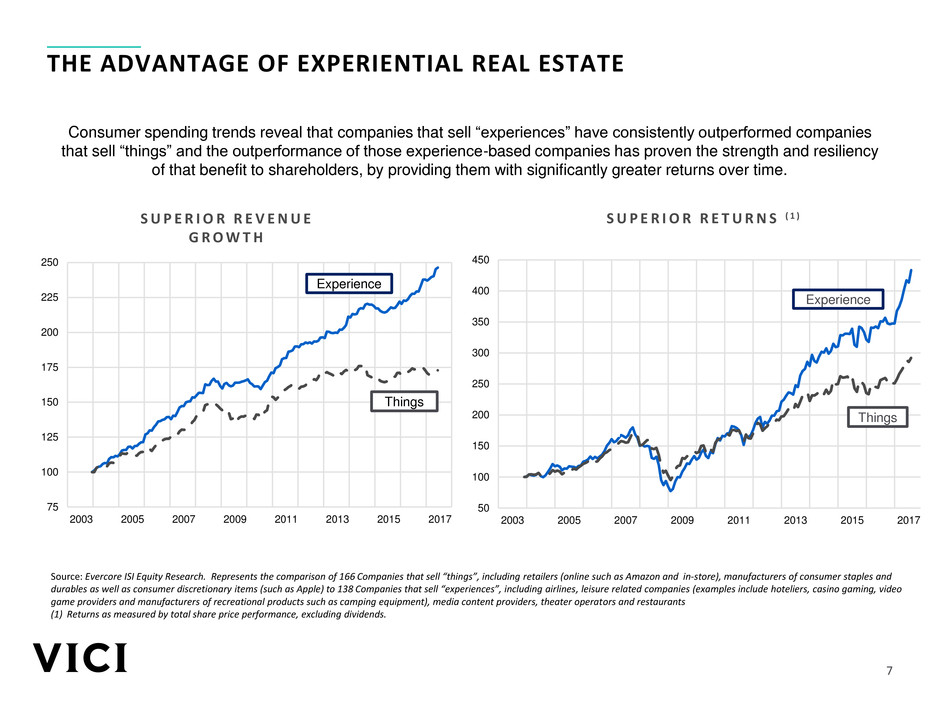

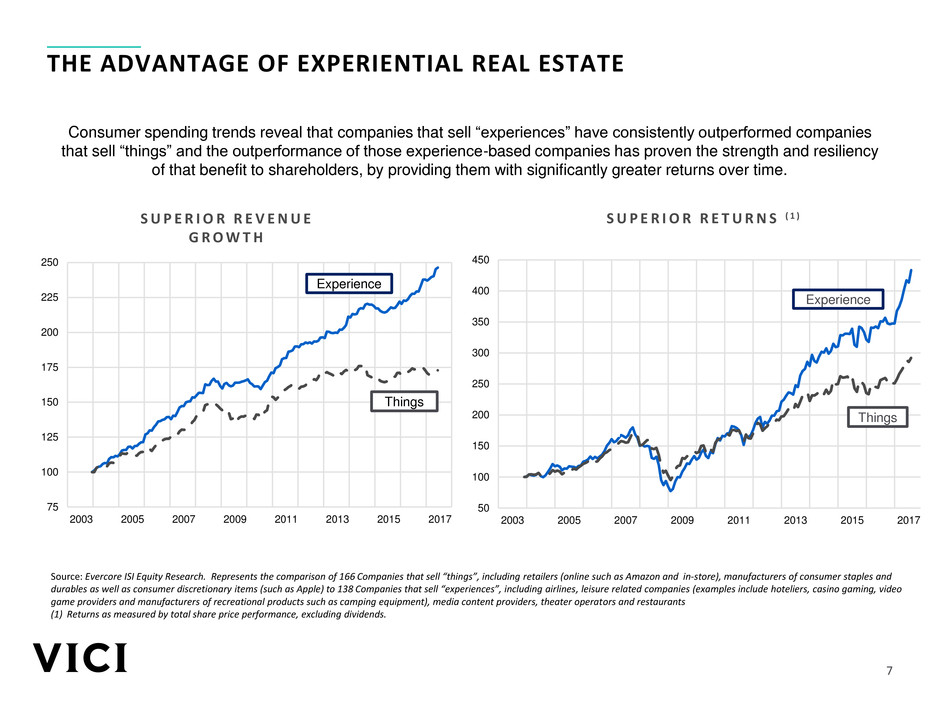

7 75 100 125 150 175 200 225 250 2003 2005 2007 2009 2011 2013 2015 2017 Experience Things Consumer spending trends reveal that companies that sell “experiences” have consistently outperformed companies that sell “things” and the outperformance of those experience-based companies has proven the strength and resiliency of that benefit to shareholders, by providing them with significantly greater returns over time. S U P E R I O R R E V E N U E G R O W T H S U P E R I O R R E T U R N S ( 1 ) 50 100 150 200 250 300 350 400 450 2003 2005 2007 2009 2011 2013 2015 2017 Experience Things Source: Evercore ISI Equity Research. Represents the comparison of 166 Companies that sell “things”, including retailers (online such as Amazon and in-store), manufacturers of consumer staples and durables as well as consumer discretionary items (such as Apple) to 138 Companies that sell “experiences”, including airlines, leisure related companies (examples include hoteliers, casino gaming, video game providers and manufacturers of recreational products such as camping equipment), media content providers, theater operators and restaurants (1) Returns as measured by total share price performance, excluding dividends. THE ADVANTAGE OF EXPERIENTIAL REAL ESTATE

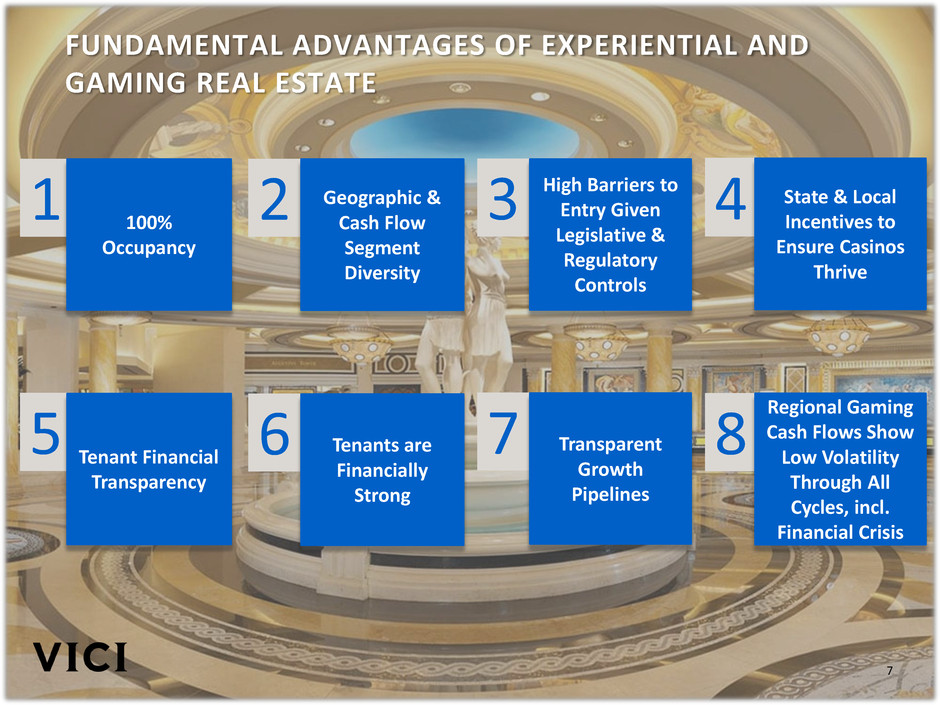

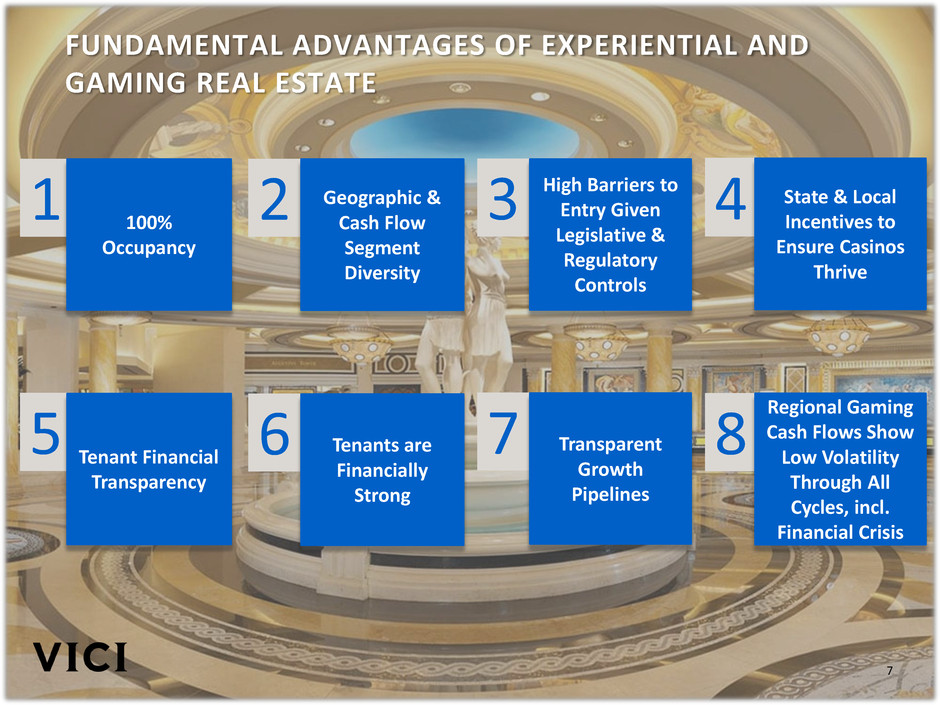

8 FUNDAMENTAL ADVANTAGES OF EXPERIENTIAL AND GAMING REAL ESTATE 2 Geographic & Cash Flow Segment Diversity 7 Transparent Growth Pipelines 6 Tenants are Financially Strong 1 100% Occupancy 5 Tenant Financial Transparency 3 High Barriers to Entry Given Legislative & Regulatory Controls 8 Regional Gaming Cash Flows Show Low Volatility Through All Cycles, incl. Financial Crisis 4 State & Local Incentives to Ensure Casinos Thrive 7

9 2PORTFOLIO OVERVIEW

10 HIGH QUALITY EXPERIENTIAL REAL ESTATE ANCHORED BY ICONIC ASSETS Harrah’s Metropolis Metropolis, IL (Southern IN / IL) Harrah’s Gulf Coast Biloxi, MS Harrah’s and Harvey’s Lake Tahoe Stateline, NV (Reno, NV) Caesars Atlantic City Atlantic City, NJ Horseshoe Bossier City Bossier City, LA (Bossier City / Shreveport) Horseshoe Tunica Robinsonville, MS (Memphis, TN) Harrah’s N. Kansas City North Kansas City, MO Horseshoe Southern Indiana Elizabeth, IN (Louisville, KY) Caesars Palace Las Vegas, NV Horseshoe Council Bluffs Council Bluffs, IA Note: Target market in parentheticals.

11 19 GAMING FACILITIES LOCATED IN DIVERSE LEADING MARKETS Atlantic CityKansas City Tunica Shreveport / Bossier City Las Vegas Reno / Lake Tahoe Council Bluffs Chicago Metropolis Louisville Caesars Palace Las Vegas Harrah’s Reno Harvey’s Lake Tahoe Harrah’s Lake Tahoe Harrah’s Council Bluffs Horseshoe Council Bluffs Harrah’s N. Kansas City Louisiana Downs Horseshoe Bossier City Harrah’s Metropolis Harrah’s Joliet Horseshoe Hammond Horseshoe Southern Indiana Bally’s Atlantic City Caesars Atlantic City Harrah’s Gulf Coast Horseshoe Tunica Tunica Roadhouse Hotel & Casino Paducah Bluegrass Downs New Orleans VICI Call Option Properties VICI Current Portfolio Laughlin

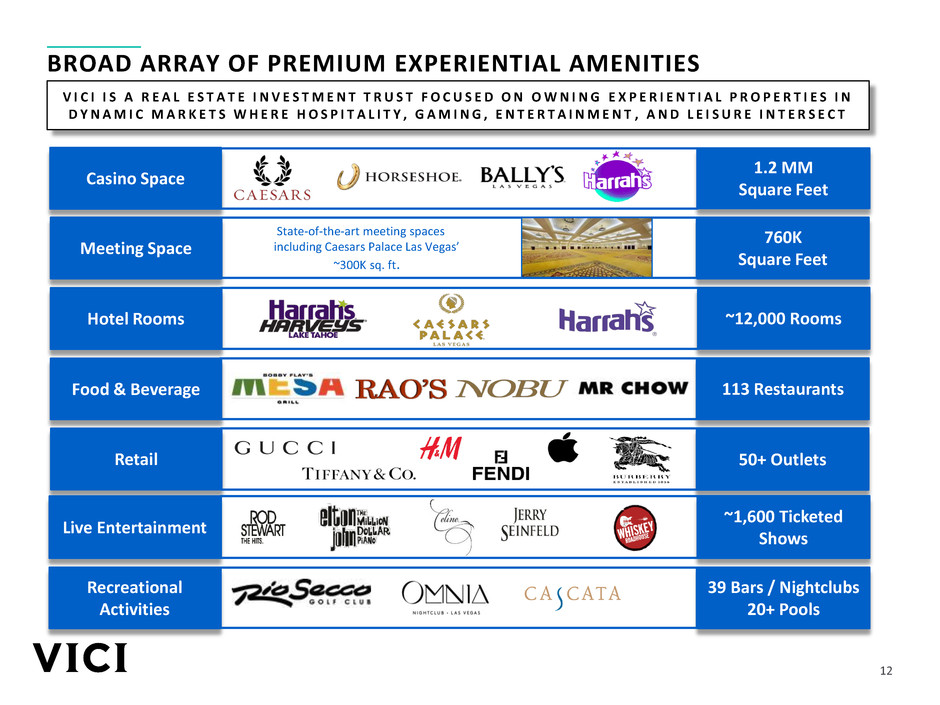

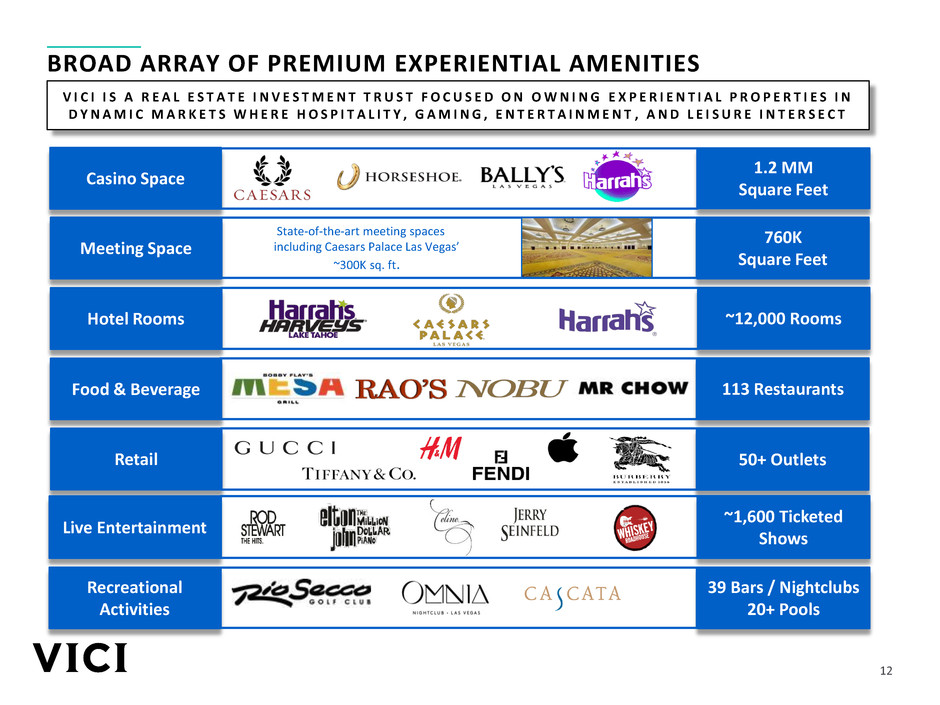

12 BROAD ARRAY OF PREMIUM EXPERIENTIAL AMENITIES Casino Space 1.2 MM Square Feet Hotel Rooms ~12,000 Rooms Food & Beverage 113 Restaurants Meeting Space 760K Square Feet Retail 50+ Outlets Live Entertainment ~1,600 Ticketed Shows Recreational Activities 39 Bars / Nightclubs 20+ Pools V I C I I S A R E A L E S T A T E I N V E S T M E N T T R U S T F O C U S E D O N O W N I N G E X P E R I E N T I A L P R O P E R T I E S I N D Y N A M I C M A R K E T S W H E R E H O S P I T A L I T Y , G A M I N G , E N T E R T A I N M E N T , A N D L E I S U R E I N T E R S E C T State-of-the-art meeting spaces including Caesars Palace Las Vegas’ ~300K sq. ft.

13 CAESARS PALACE: ICONIC ASSET IN PRIME LOCATION ON LAS VEGAS STRIP Over 27,000 daily visitors Home to The Forum Shops, a 680,000 sq. ft. shopping mall and 4th largest grossing retail shopping mall per sq. ft. Located on ~86 acres of land at the heart of the Las Vegas Strip 3,974 hotel rooms across 6 towers 40k+ sq. ft. Qua Baths & Spa, Color Salon, 8 swimming pools, fitness centers, and a business center 300,000+ sq. ft. of convention, meeting, and ballroom space 12 restaurants and 10 independent bars 81,300 sq. ft. Omnia Nightclub and the 4,300-seat Colosseum ~124,200 sq. ft. of casino space including over 1,400 slot and table gaming units 7 acres of developable land

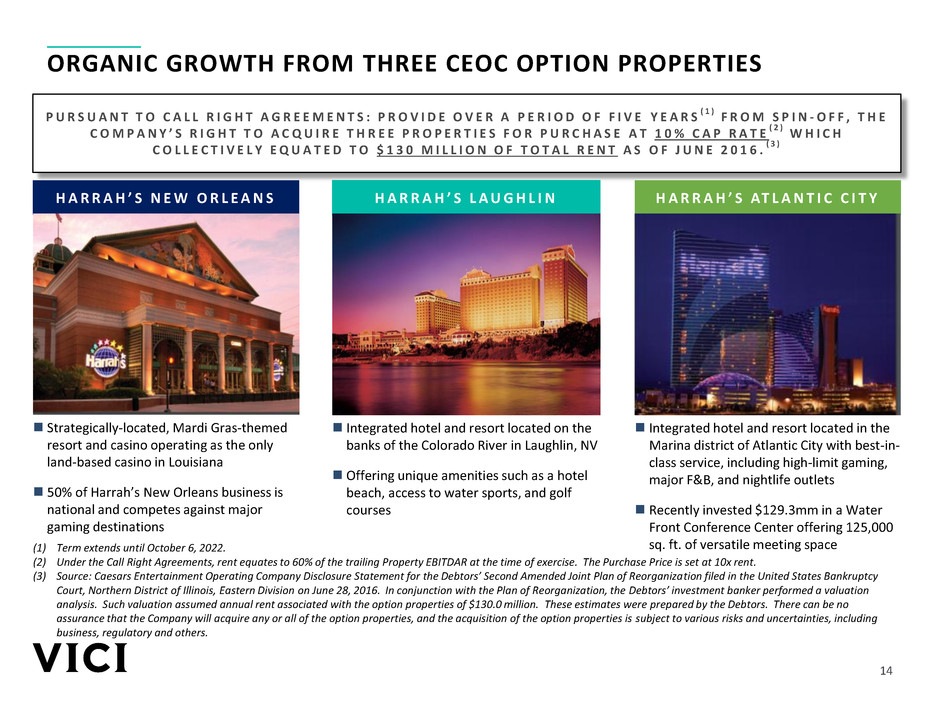

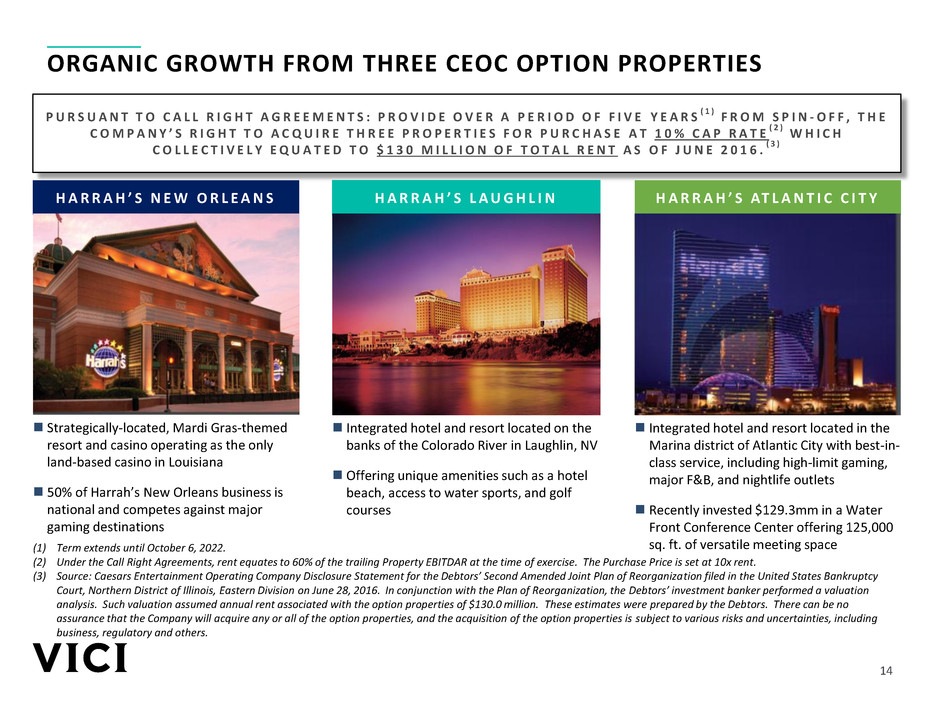

14 ORGANIC GROWTH FROM THREE CEOC OPTION PROPERTIES P U R S U A N T T O C A L L R I G H T A G R E E M E N T S : P R O V I D E O V E R A P E R I O D O F F I V E Y E A R S ( 1 ) F R O M S P I N - O F F , T H E C OMP AN Y ’ S R I G H T T O A C Q U I R E T H R E E P R O P E R T I E S F O R P U R C H A S E A T 1 0 % C A P R A T E ( 2 ) W H I C H C O L L E C T I V E L Y E Q U A T E D T O $ 1 3 0 M I L L I O N O F T O T A L R E N T A S O F J U N E 2 0 1 6 . ( 3 ) Strategically-located, Mardi Gras-themed resort and casino operating as the only land-based casino in Louisiana 50% of Harrah’s New Orleans business is national and competes against major gaming destinations HARRAH ’ S N EW O R L EAN S HARRAH ’ S L AUGH L I N HARRAH ’ S AT L AN T I C C I T Y Integrated hotel and resort located in the Marina district of Atlantic City with best-in- class service, including high-limit gaming, major F&B, and nightlife outlets Recently invested $129.3mm in a Water Front Conference Center offering 125,000 sq. ft. of versatile meeting space Integrated hotel and resort located on the banks of the Colorado River in Laughlin, NV Offering unique amenities such as a hotel beach, access to water sports, and golf courses (1) Term extends until October 6, 2022. (2) Under the Call Right Agreements, rent equates to 60% of the trailing Property EBITDAR at the time of exercise. The Purchase Price is set at 10x rent. (3) Source: Caesars Entertainment Operating Company Disclosure Statement for the Debtors’ Second Amended Joint Plan of Reorganization filed in the United States Bankruptcy Court, Northern District of Illinois, Eastern Division on June 28, 2016. In conjunction with the Plan of Reorganization, the Debtors’ investment banker performed a valuation analysis. Such valuation assumed annual rent associated with the option properties of $130.0 million. These estimates were prepared by the Debtors. There can be no assurance that the Company will acquire any or all of the option properties, and the acquisition of the option properties is subject to various risks and uncertainties, including business, regulatory and others.

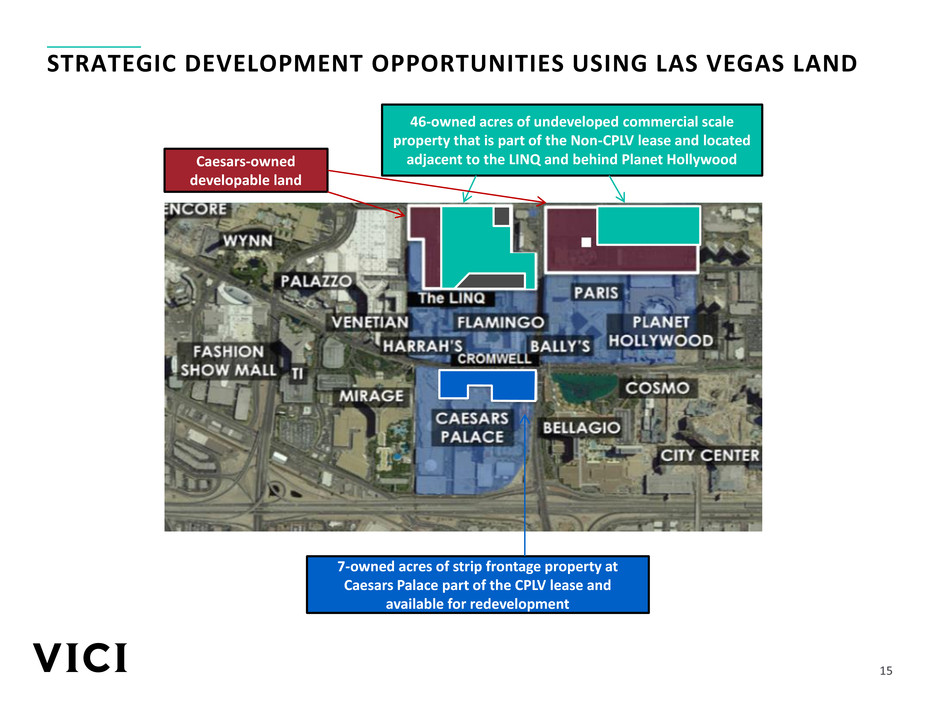

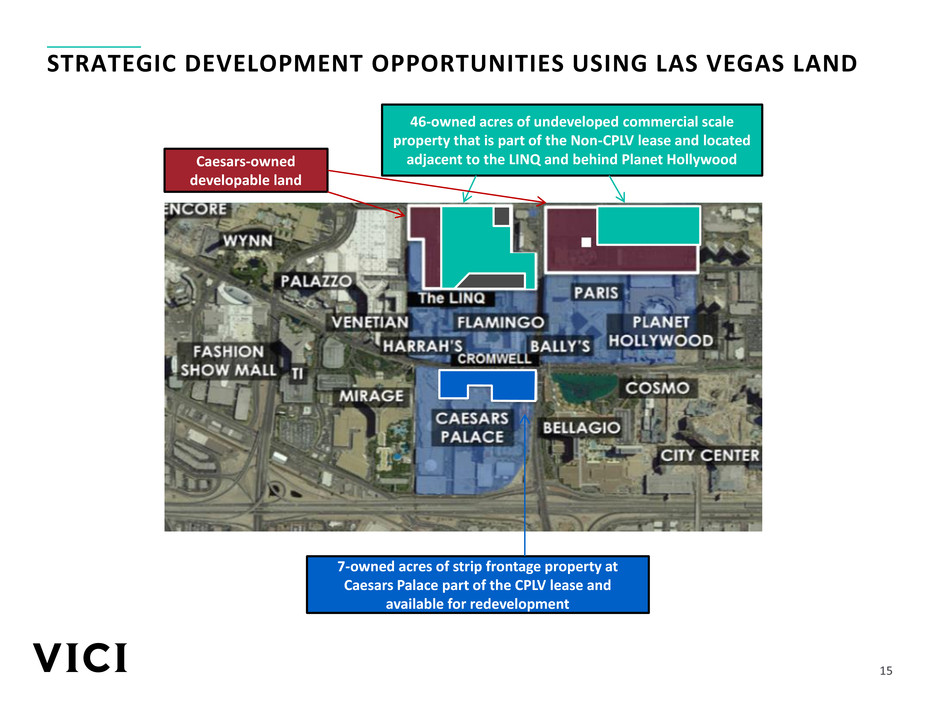

15 STRATEGIC DEVELOPMENT OPPORTUNITIES USING LAS VEGAS LAND 7-owned acres of strip frontage property at Caesars Palace part of the CPLV lease and available for redevelopment 46-owned acres of undeveloped commercial scale property that is part of the Non-CPLV lease and located adjacent to the LINQ and behind Planet HollywoodCaesars-owned developable land

16 CAESARS OWNED REAL ESTATE Octavius Tower Harrah’s Las Vegas Paris Las Vegas Bally’s Las Vegas The Cromwell Flamingo Las Vegas The LINQ Hotel & Casino Planet Hollywood Resort & Casino Rio All Suites Hotel and Casino Horseshoe Baltimore Harrah’s Philadelphia A TENANT PORTFOLIO WITH ADDITIONAL ACQUISITION AND DEVELOPMENT OPPORTUNITIES VALUE CREATION THROUGH COLLABORATION Right of First Refusal Agreement on Any Future Caesars Domestically Acquired Properties Outside of Clark County Prospect to Purchase Additional Properties Owned by Tenant Future Growth Interests Aligned with Tenant Partnership and Path to Growth should Tenant Need to Monetize Real Estate Value Note: Caesars is under no obligation to give VICI preferential treatment over competitors if multiple bids exist on any property.

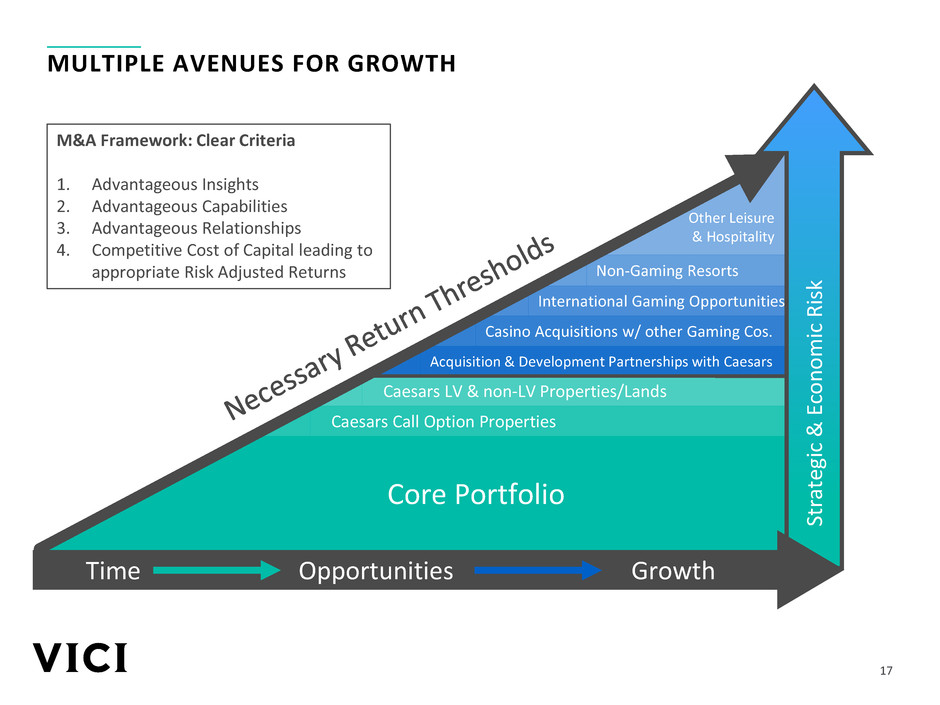

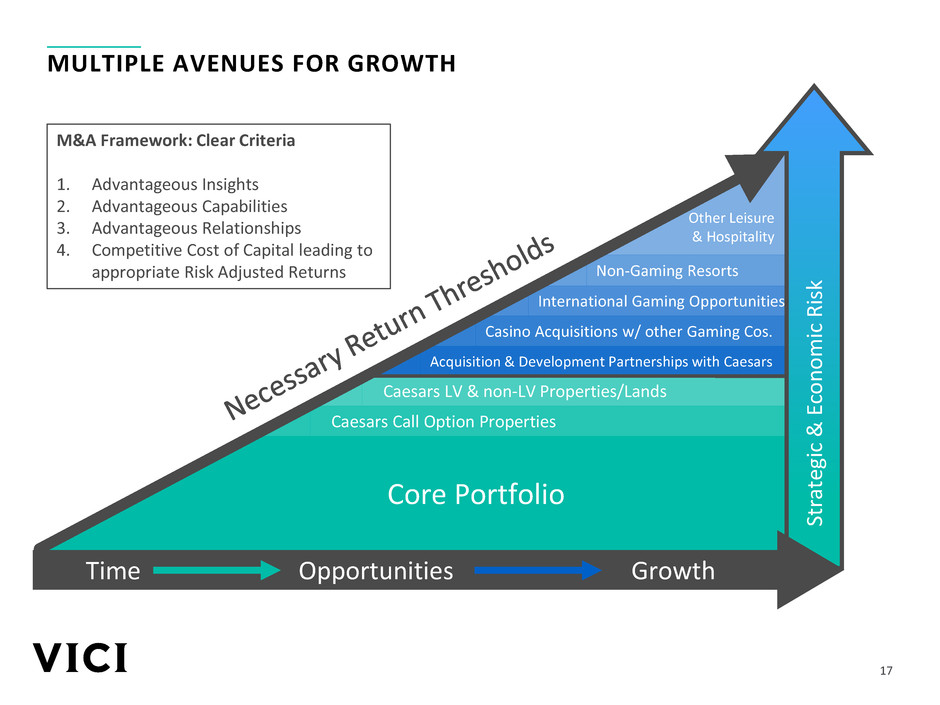

17 MULTIPLE AVENUES FOR GROWTH Core Portfolio Caesars Call Option Properties Caesars LV & non-LV Properties/Lands Acquisition & Development Partnerships with Caesars Casino Acquisitions w/ other Gaming Cos. International Gaming Opportunities Non-Gaming Resorts St rate gi c & E conomi c R is k Time Opportunities Growth Other Leisure & Hospitality M&A Framework: Clear Criteria 1. Advantageous Insights 2. Advantageous Capabilities 3. Advantageous Relationships 4. Competitive Cost of Capital leading to appropriate Risk Adjusted Returns

18 3BEST IN CLASS TENANT

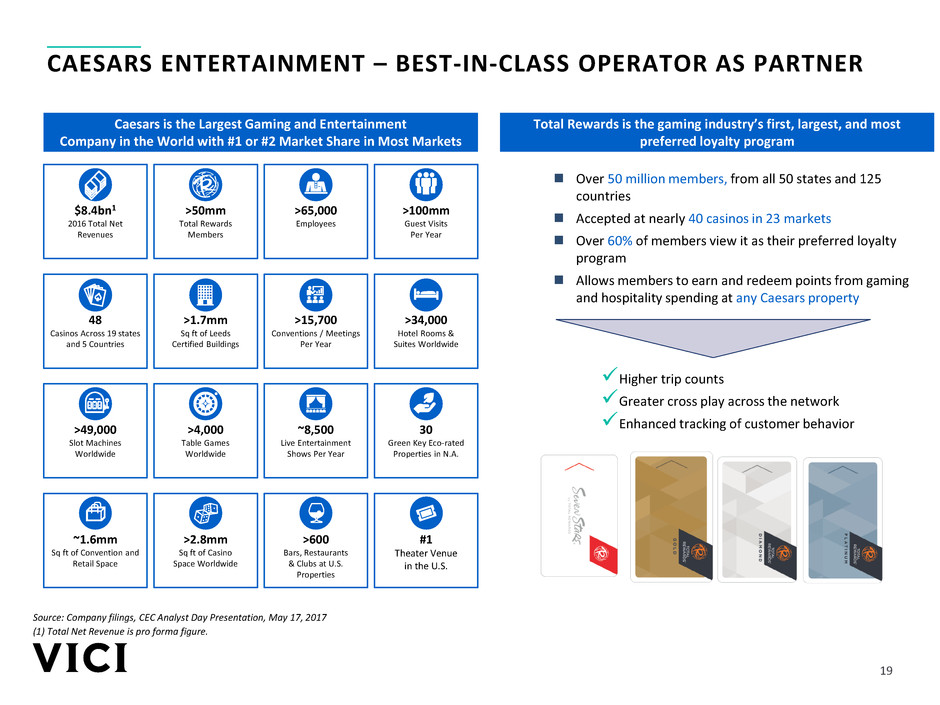

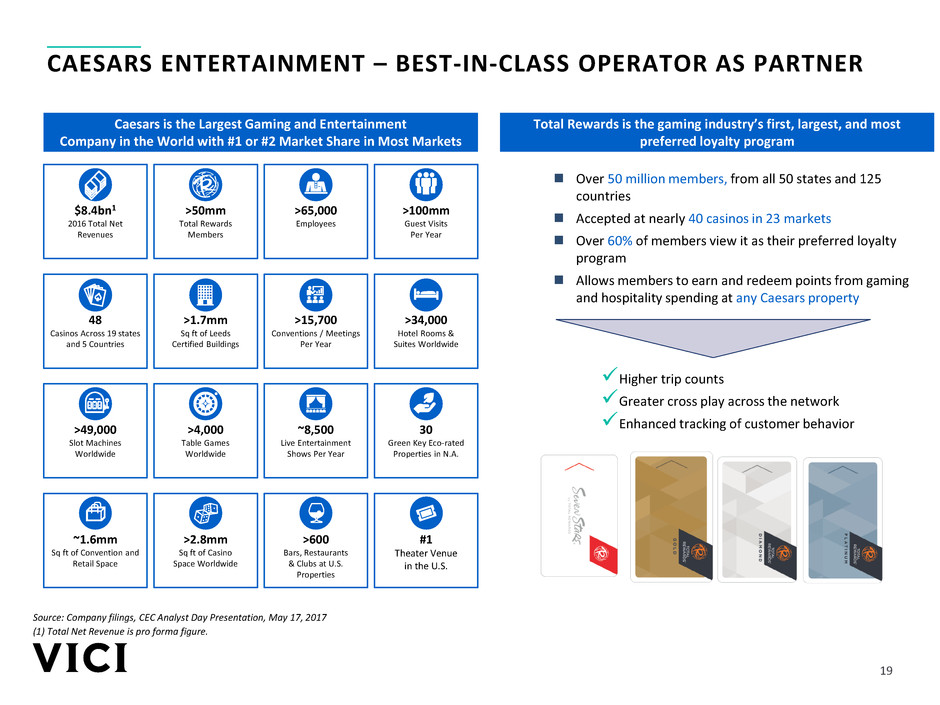

19 CAESARS ENTERTAINMENT – BEST-IN-CLASS OPERATOR AS PARTNER Caesars is the Largest Gaming and Entertainment Company in the World with #1 or #2 Market Share in Most Markets $8.4bn1 2016 Total Net Revenues >50mm Total Rewards Members >65,000 Employees >100mm Guest Visits Per Year 48 Casinos Across 19 states and 5 Countries >1.7mm Sq ft of Leeds Certified Buildings >15,700 Conventions / Meetings Per Year >34,000 Hotel Rooms & Suites Worldwide >49,000 Slot Machines Worldwide >4,000 Table Games Worldwide ~8,500 Live Entertainment Shows Per Year 30 Green Key Eco-rated Properties in N.A. ~1.6mm Sq ft of Convention and Retail Space >2.8mm Sq ft of Casino Space Worldwide >600 Bars, Restaurants & Clubs at U.S. Properties #1 Theater Venue in the U.S. Source: Company filings, CEC Analyst Day Presentation, May 17, 2017 (1) Total Net Revenue is pro forma figure. Over 50 million members, from all 50 states and 125 countries Accepted at nearly 40 casinos in 23 markets Over 60% of members view it as their preferred loyalty program Allows members to earn and redeem points from gaming and hospitality spending at any Caesars property Higher trip counts Greater cross play across the network Enhanced tracking of customer behavior Total Rewards is the gaming industry’s first, largest, and most preferred loyalty program

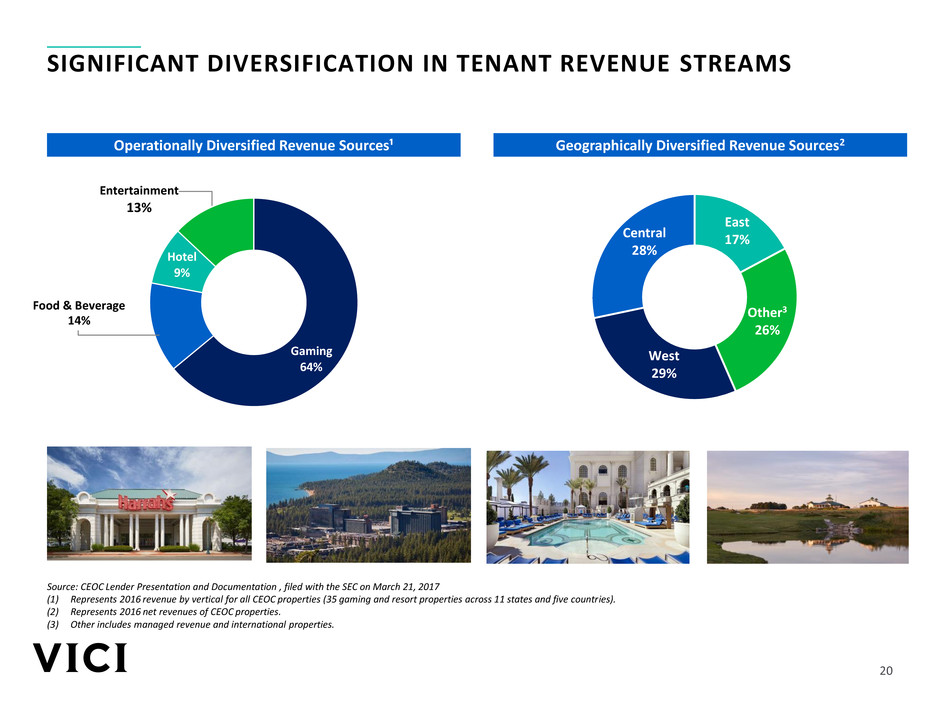

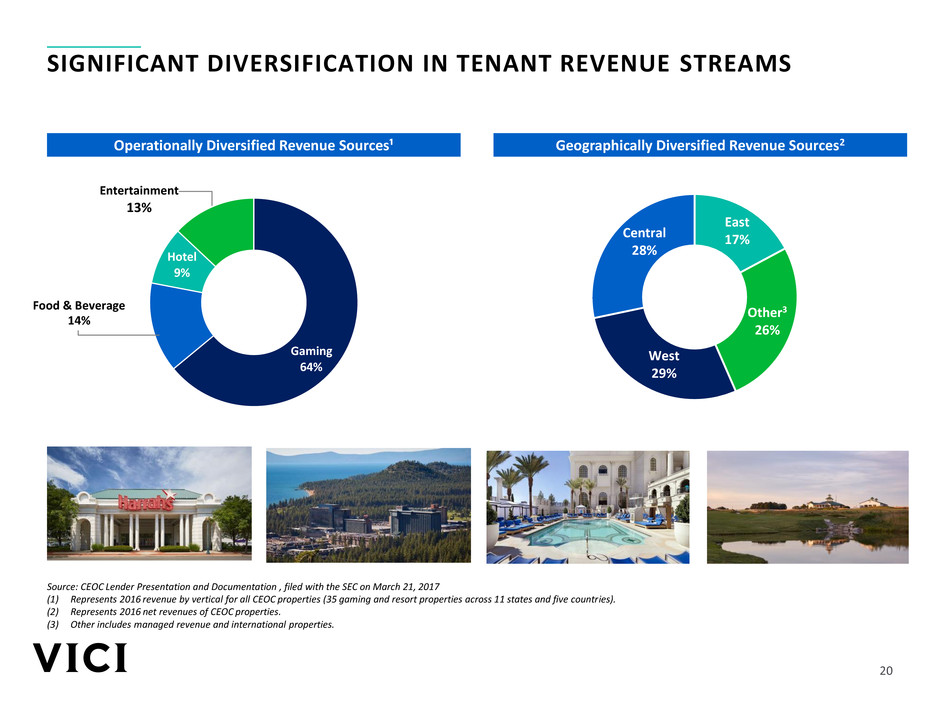

20 East 17% Other3 26% West 29% Central 28% SIGNIFICANT DIVERSIFICATION IN TENANT REVENUE STREAMS Operationally Diversified Revenue Sources¹ Geographically Diversified Revenue Sources2 Source: CEOC Lender Presentation and Documentation , filed with the SEC on March 21, 2017 (1) Represents 2016 revenue by vertical for all CEOC properties (35 gaming and resort properties across 11 states and five countries). (2) Represents 2016 net revenues of CEOC properties. (3) Other includes managed revenue and international properties. Gaming 64% Food & Beverage 14% Hotel 9% Entertainment 13%

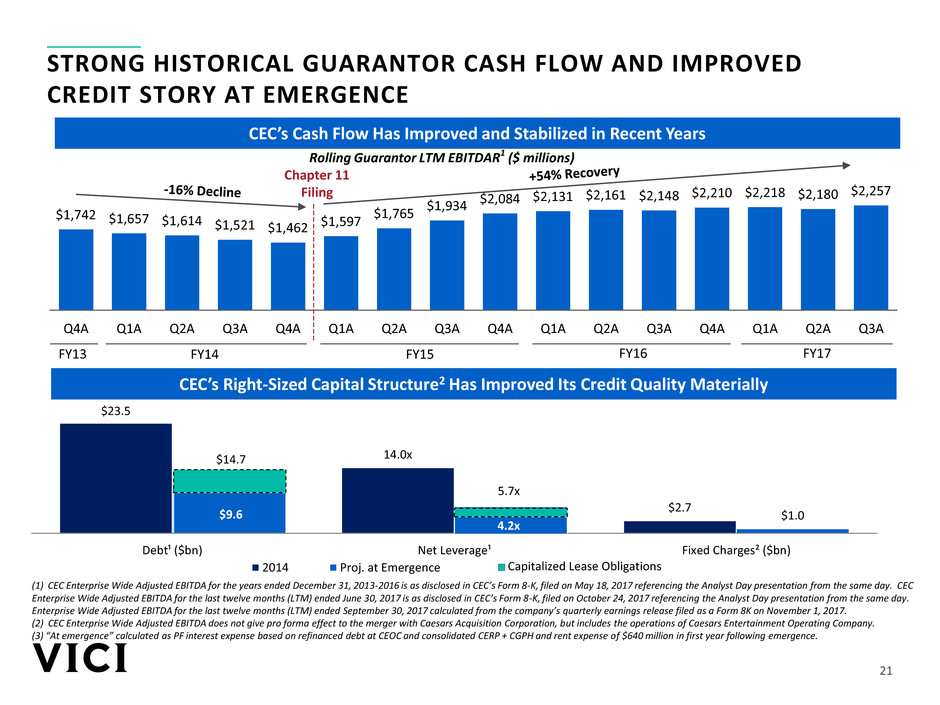

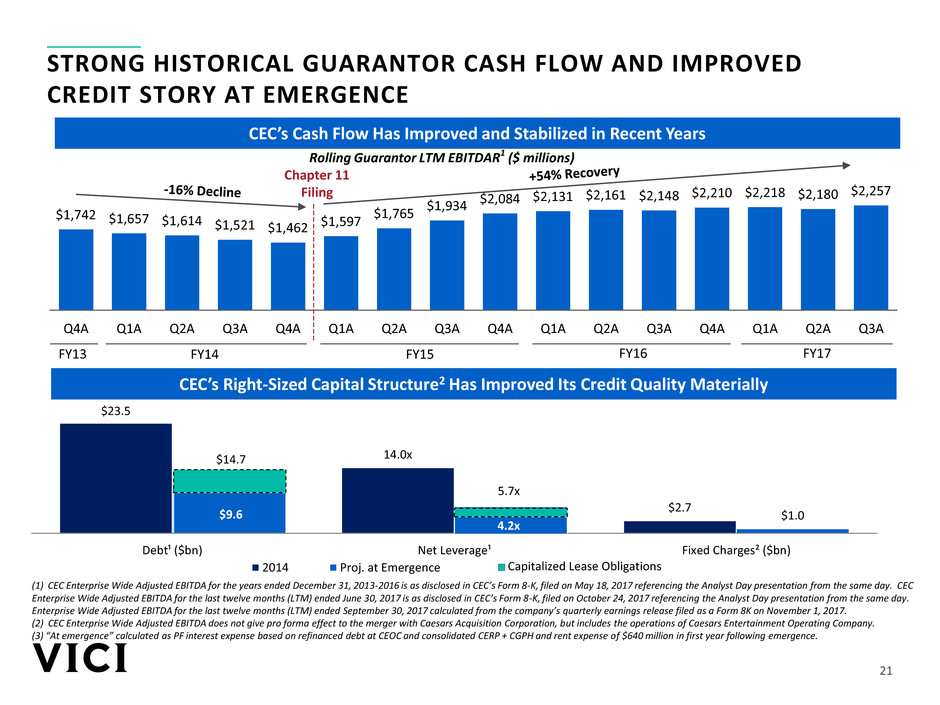

21 $23.5 14.0x $2.7 $9.6 $1.0 Debt¹ ($bn) Net Leverage¹ Fixed Charges² ($bn) 2014 Proj. at Emergence STRONG HISTORICAL GUARANTOR CASH FLOW AND IMPROVED CREDIT STORY AT EMERGENCE (1) CEC Enterprise Wide Adjusted EBITDA for the years ended December 31, 2013-2016 is as disclosed in CEC’s Form 8-K, filed on May 18, 2017 referencing the Analyst Day presentation from the same day. CEC Enterprise Wide Adjusted EBITDA for the last twelve months (LTM) ended June 30, 2017 is as disclosed in CEC’s Form 8-K, filed on October 24, 2017 referencing the Analyst Day presentation from the same day. Enterprise Wide Adjusted EBITDA for the last twelve months (LTM) ended September 30, 2017 calculated from the company’s quarterly earnings release filed as a Form 8K on November 1, 2017. (2) CEC Enterprise Wide Adjusted EBITDA does not give pro forma effect to the merger with Caesars Acquisition Corporation, but includes the operations of Caesars Entertainment Operating Company. (3) “At emergence” calculated as PF interest expense based on refinanced debt at CEOC and consolidated CERP + CGPH and rent expense of $640 million in first year following emergence. CEC’s Right-Sized Capital Structure2 Has Improved Its Credit Quality Materially CEC’s Cash Flow Has Improved and Stabilized in Recent Years Rolling Guarantor LTM EBITDAR1 ($ millions) $14.7 5.7x 3.7x 3.9x 3.9x $9.6 4.2x Capitalized Lease Obligations $1,742 $1,657 $1,614 $1,521 $1,462 $1,597 $1,765 $1,934 $2,084 $2,131 $2,161 $2,148 $2,210 $2,218 $2,180 $2,257 Q4A Q1A Q2A Q3A Q4A Q1A Q2A Q3A Q4A Q1A Q2A Q3A Q4A Q1A Q2A Q3A FY13 FY14 FY16FY15 FY17 Chapter 11 Filing

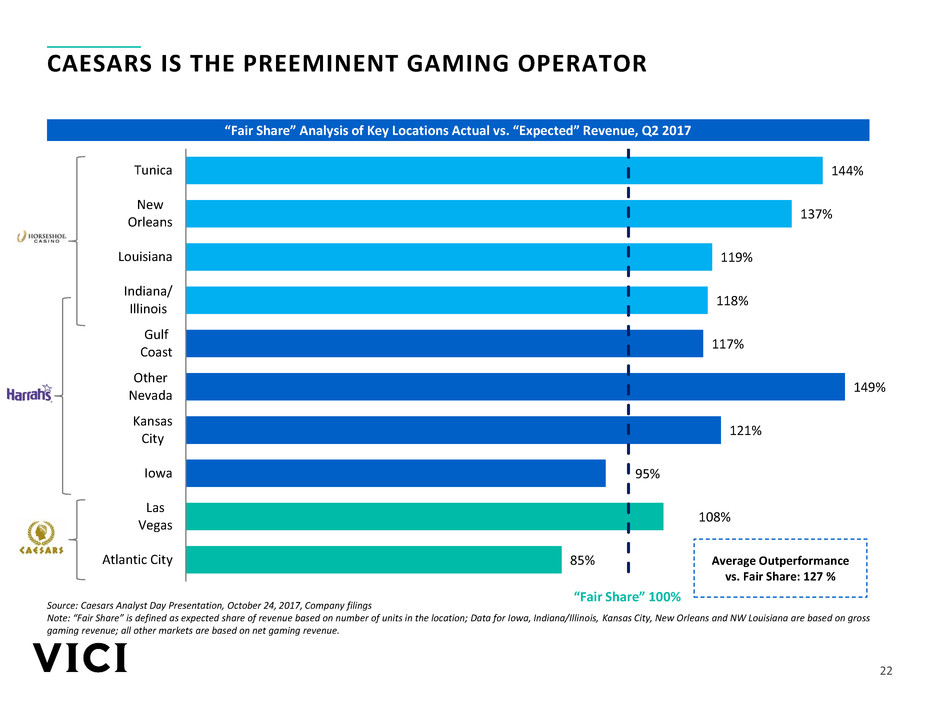

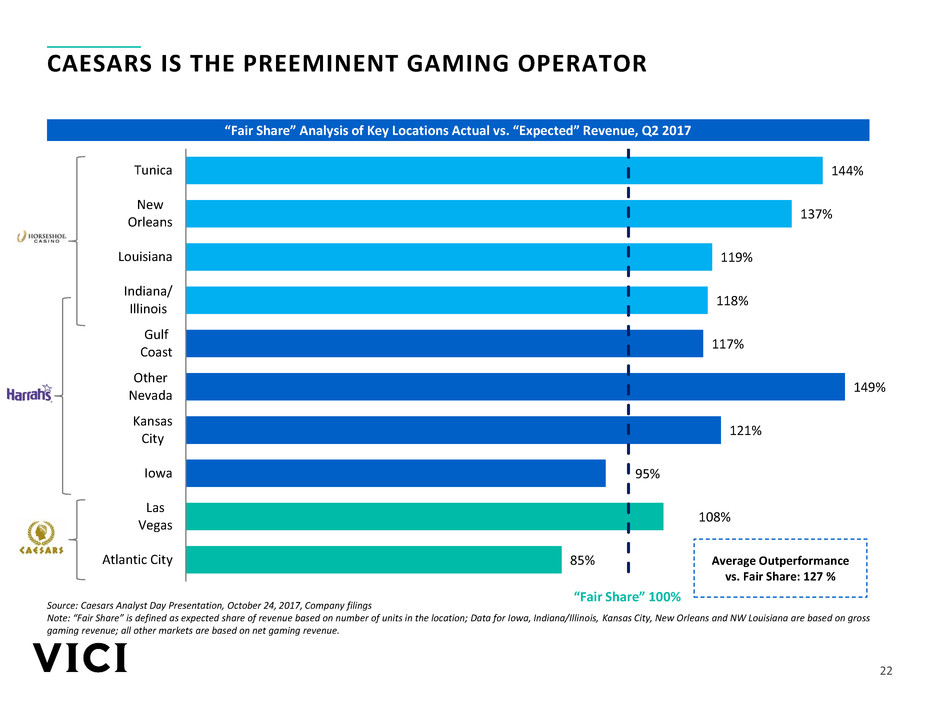

22 85% 108% 95% 121% 149% 117% 118% 119% 137% 144% Atlantic City Las Vegas Iowa Kansas City Other Nevada Gulf Coast Indiana/ Illinois Louisiana New Orleans Tunica CAESARS IS THE PREEMINENT GAMING OPERATOR Source: Caesars Analyst Day Presentation, October 24, 2017, Company filings Note: “Fair Share” is defined as expected share of revenue based on number of units in the location; Data for Iowa, Indiana/Illinois, Kansas City, New Orleans and NW Louisiana are based on gross gaming revenue; all other markets are based on net gaming revenue. “Fair Share” 100% Average Outperformance vs. Fair Share: 127 % “Fair Share” Analysis of Key Locations Actual vs. “Expected” Revenue, Q2 2017

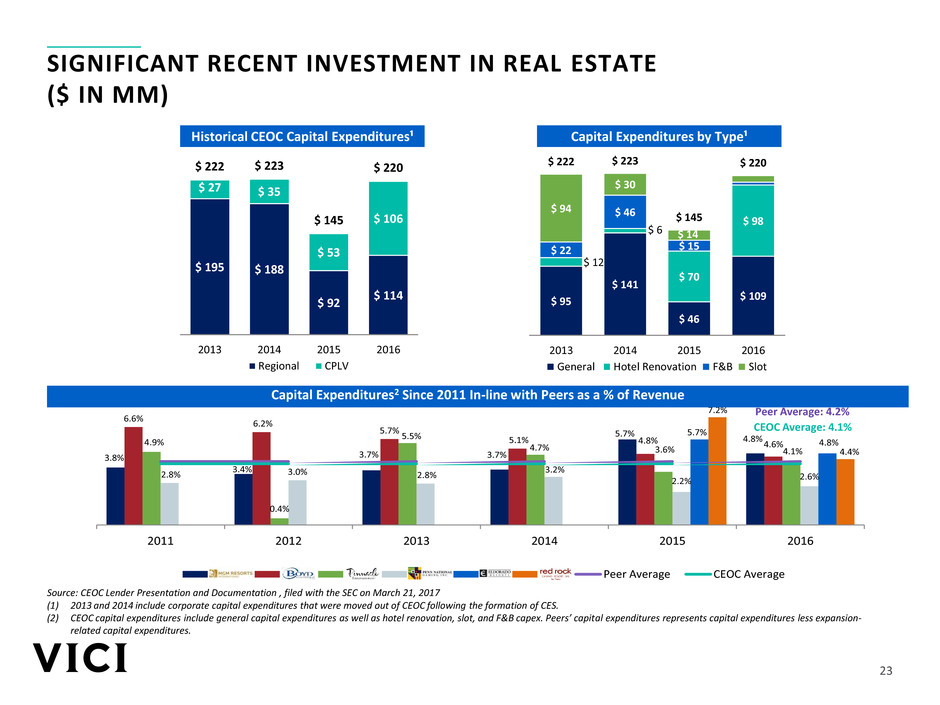

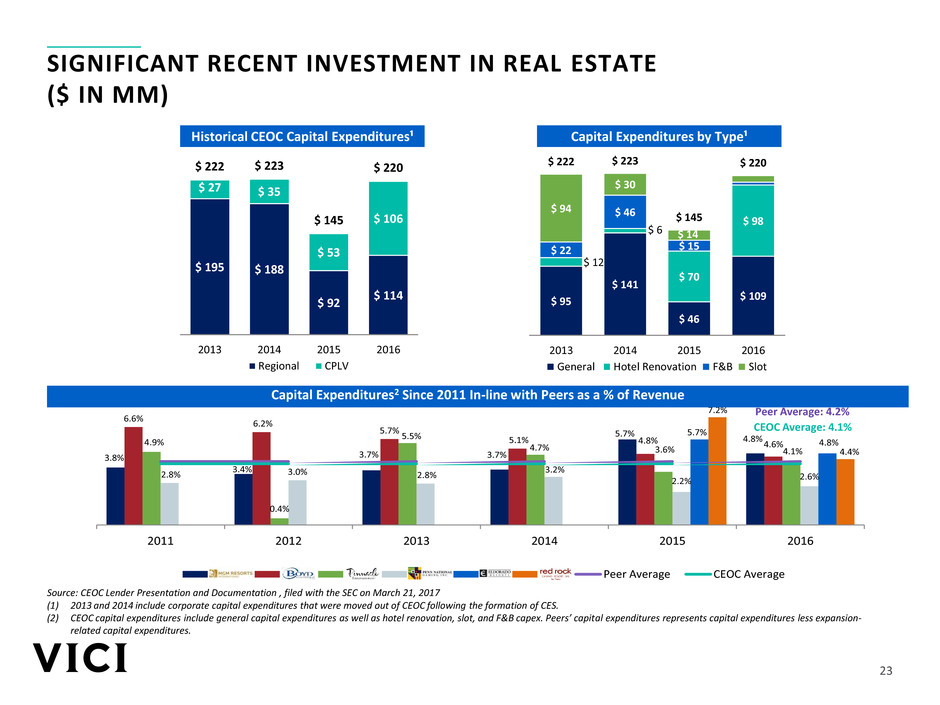

23 3.8% 3.4% 3.7% 3.7% 5.7% 4.8% 6.6% 6.2% 5.7% 5.1% 4.8% 4.6%4.9% 0.4% 5.5% 4.7% 3.6% 4.1% 2.8% 3.0% 2.8% 3.2% 2.2% 2.6% 5.7% 4.8% 7.2% 4.4% 2011 2012 2013 2014 2015 2016 MGM BYD PNK PENN ERI RRR Peer Average CEOC Average SIGNIFICANT RECENT INVESTMENT IN REAL ESTATE ($ IN MM) Source: CEOC Lender Presentation and Documentation , filed with the SEC on March 21, 2017 (1) 2013 and 2014 include corporate capital expenditures that were moved out of CEOC following the formation of CES. (2) CEOC capital expenditures include general capital expenditures as well as hotel renovation, slot, and F&B capex. Peers’ capital expenditures represents capital expenditures less expansion- related capital expenditures. Peer Average: 4.2% CEOC Average: 4.1% Historical CEOC Capital Expenditures¹ Capital Expenditures by Type¹ $ 95 $ 141 $ 46 $ 109 $ 12 $ 6 $ 70 $ 98 $ 22 $ 46 $ 15 $ 94 $ 30 $ 14 $ 222 $ 223 $ 145 $ 220 2013 2014 2015 2016 General Hotel Renovation F&B Slot $ 195 $ 188 $ 92 $ 114 $ 27 $ 35 $ 53 $ 106 $ 222 $ 223 $ 145 $ 220 2013 2014 2015 2016 Regional CPLV $ 195 $ 188 $ 92 $ 114 $ 27 $ 35 $ 53 $ 106 $ 222 $ 223 $ 145 $ 220 2013 2014 2015 2016 Capital Expenditures2 Since 2011 In-line with Peers as a % of Revenue

24 4FINANCIAL OVERVIEW AND CAPITAL STRUCTURE

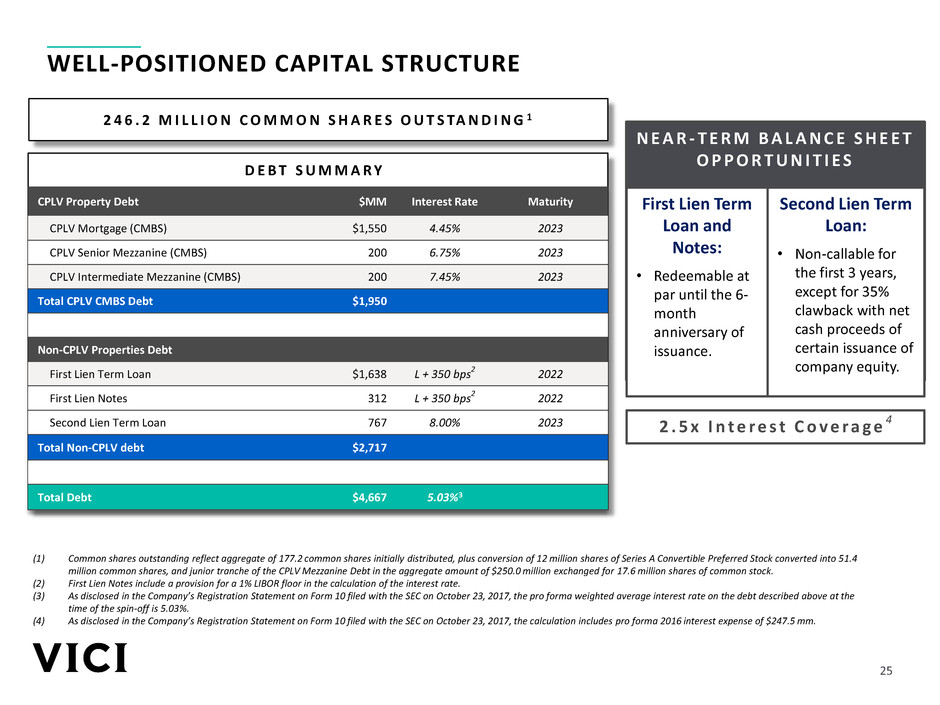

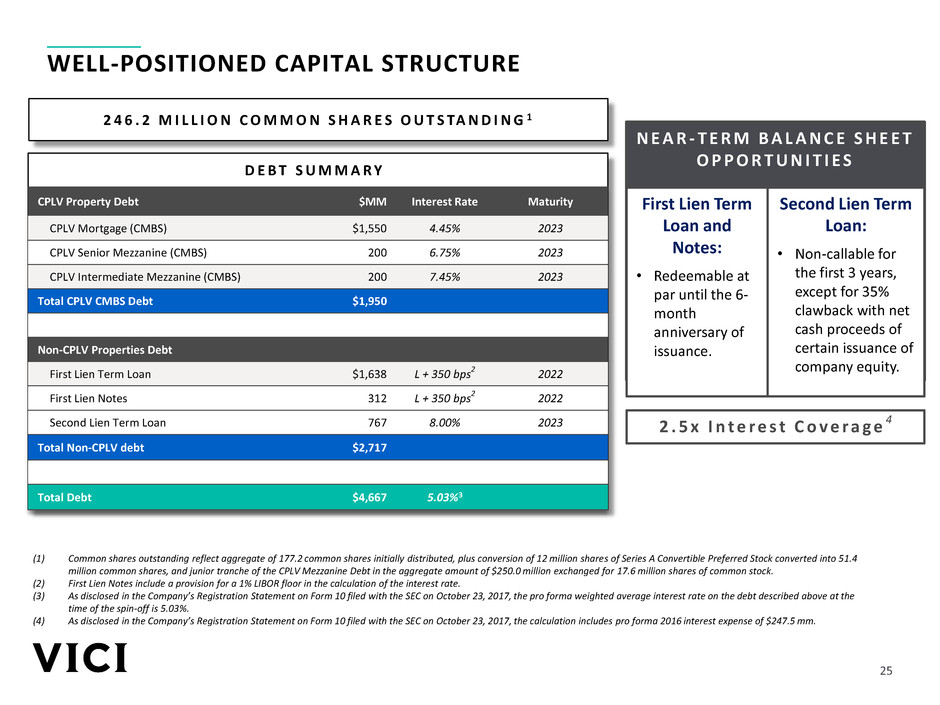

25 N E A R - T E R M B A L A N C E S H E E T O P P O R T U N I T I E S D E B T S U M M A R Y WELL-POSITIONED CAPITAL STRUCTURE CPLV Property Debt $MM Interest Rate Maturity CPLV Mortgage (CMBS) $1,550 4.45% 2023 CPLV Senior Mezzanine (CMBS) 200 6.75% 2023 CPLV Intermediate Mezzanine (CMBS) 200 7.45% 2023 Total CPLV CMBS Debt $1,950 Non-CPLV Properties Debt First Lien Term Loan $1,638 L + 350 bps 2 2022 First Lien Notes 312 L + 350 bps 2 2022 Second Lien Term Loan 767 8.00% 2023 Total Non-CPLV debt $2,717 Total Debt $4,667 5.03%3 (1) Common shares outstanding reflect aggregate of 177.2 common shares initially distributed, plus conversion of 12 million shares of Series A Convertible Preferred Stock converted into 51.4 million common shares, and junior tranche of the CPLV Mezzanine Debt in the aggregate amount of $250.0 million exchanged for 17.6 million shares of common stock. (2) First Lien Notes include a provision for a 1% LIBOR floor in the calculation of the interest rate. (3) As disclosed in the Company’s Registration Statement on Form 10 filed with the SEC on October 23, 2017, the pro forma weighted average interest rate on the debt described above at the time of the spin-off is 5.03%. (4) As disclosed in the Company’s Registration Statement on Form 10 filed with the SEC on October 23, 2017, the calculation includes pro forma 2016 interest expense of $247.5 mm. First Lien Term Loan and Notes: • Redeemable at par until the 6- month anniversary of issuance. Second Lien Term Loan: • Non-callable for the first 3 years, except for 35% clawback with net cash proceeds of certain issuance of company equity. 2 . 5 x I n t e r e s t C o v e r a g e 4 2 4 6 . 2 M I L L I O N C O M M O N S H A R E S O U T S TA N D I N G 1 D E B T S U M M A R Y

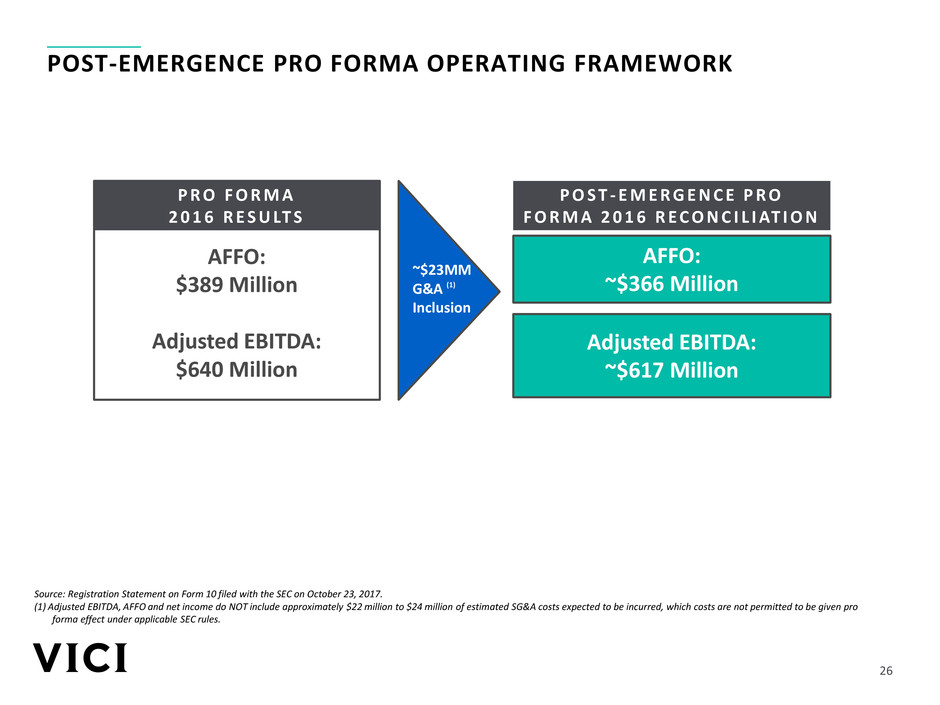

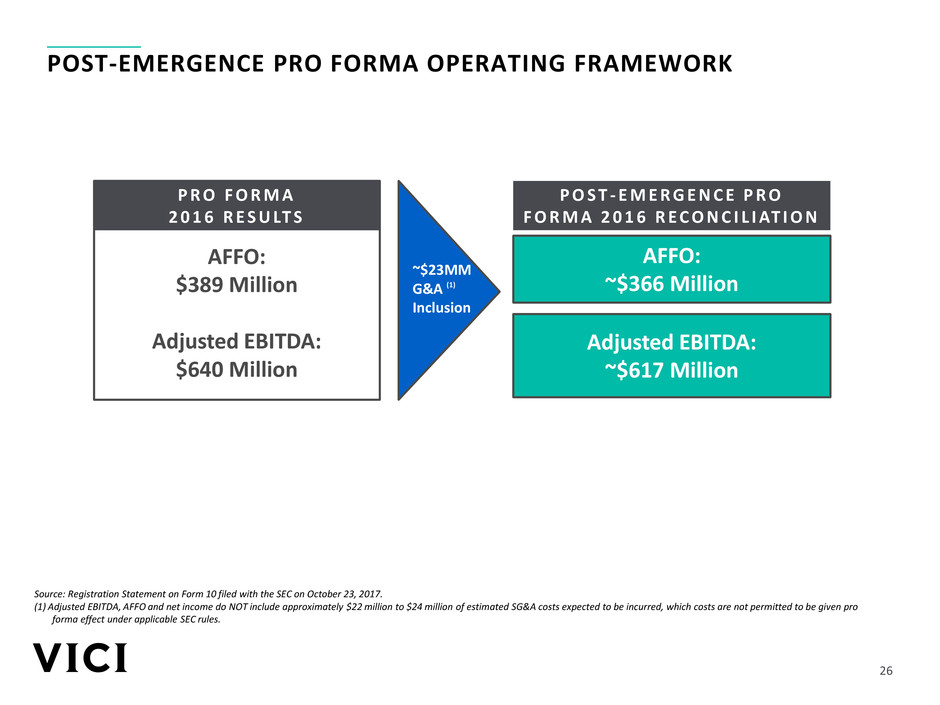

26 POST-EMERGENCE PRO FORMA OPERATING FRAMEWORK AFFO: $389 Million Adjusted EBITDA: $640 Million P R O F O R M A 2 0 1 6 R E S U LT S P O S T - E M E R G E N C E P R O F O R M A 2 0 1 6 R E C O N C I L I AT I O N ~$23MM G&A (1) Inclusion AFFO: ~$366 Million Adjusted EBITDA: ~$617 Million Source: Registration Statement on Form 10 filed with the SEC on October 23, 2017. (1) Adjusted EBITDA, AFFO and net income do NOT include approximately $22 million to $24 million of estimated SG&A costs expected to be incurred, which costs are not permitted to be given pro forma effect under applicable SEC rules.

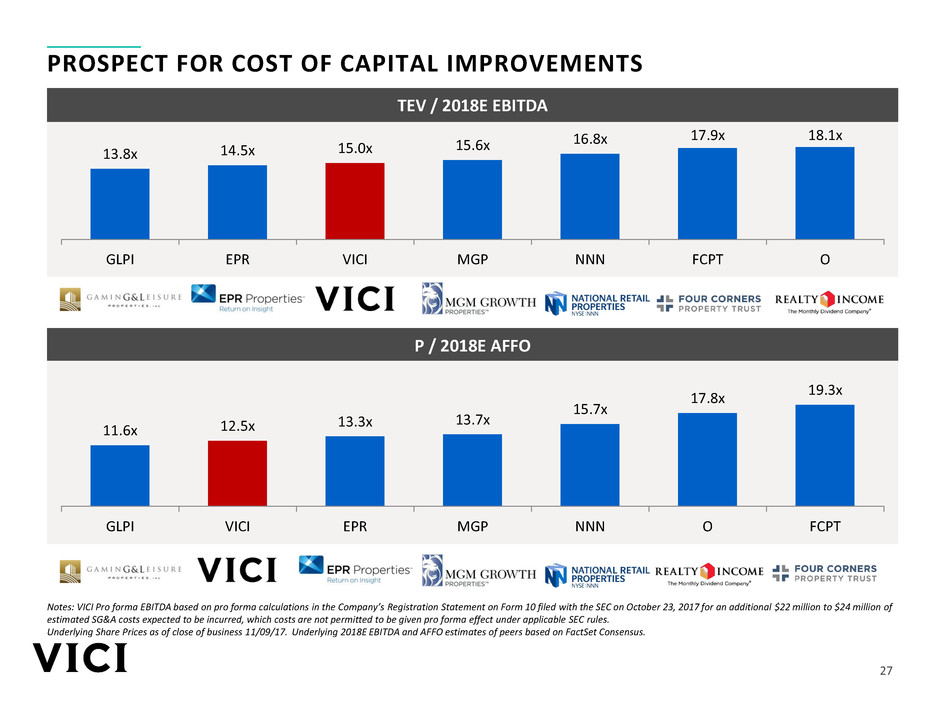

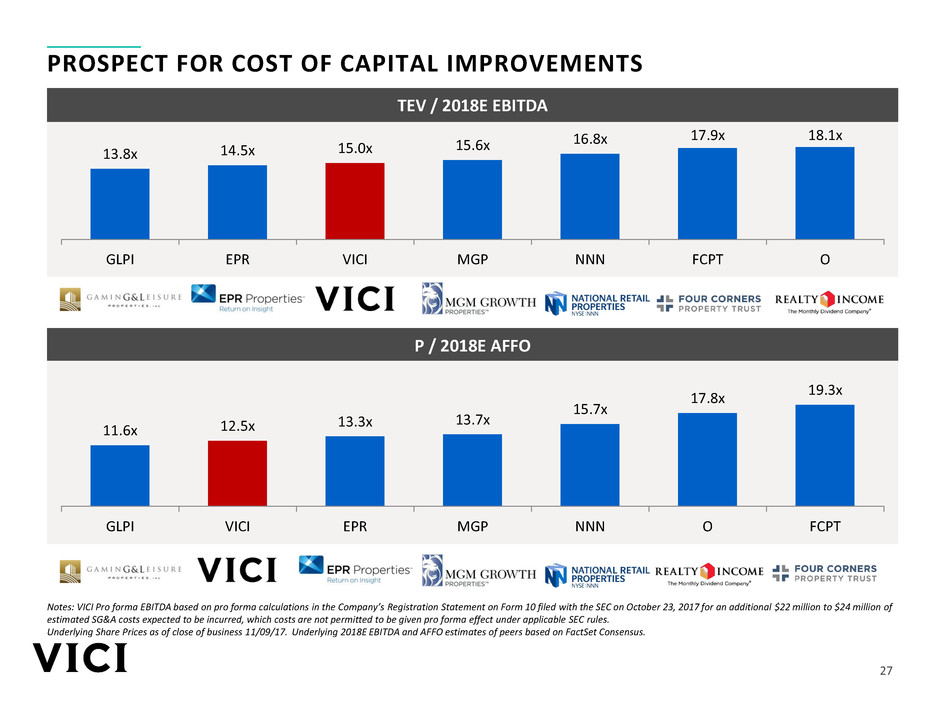

27 TEV / 2018E EBITDA Notes: VICI Pro forma EBITDA based on pro forma calculations in the Company’s Registration Statement on Form 10 filed with the SEC on October 23, 2017 for an additional $22 million to $24 million of estimated SG&A costs expected to be incurred, which costs are not permitted to be given pro forma effect under applicable SEC rules. Underlying Share Prices as of close of business 11/09/17. Underlying 2018E EBITDA and AFFO estimates of peers based on FactSet Consensus. PROSPECT FOR COST OF CAPITAL IMPROVEMENTS P / 2018E AFFO 13.8x 14.5x 15.0x 15.6x 16.8x 17.9x 18.1x GLPI EPR VICI MGP NNN FCPT O 11.6x 12.5x 13.3x 13.7x 15.7x 17.8x 19.3x GLPI VICI EPR MGP NNN O FCPT

28 5GOVERNANCE QUALITY AND MANAGEMENT / BOARD VIGOR

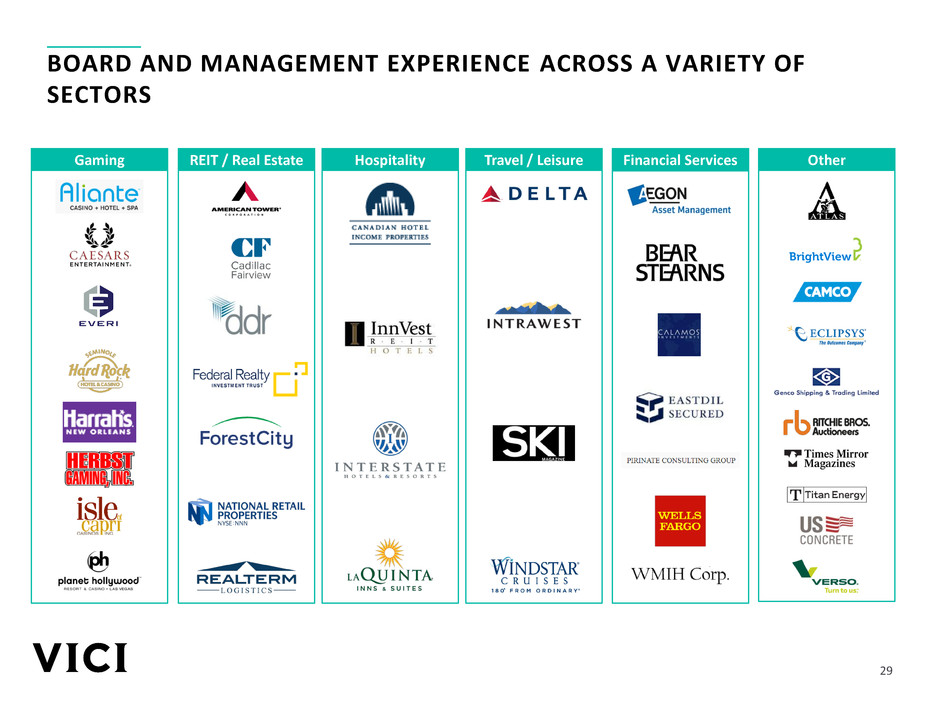

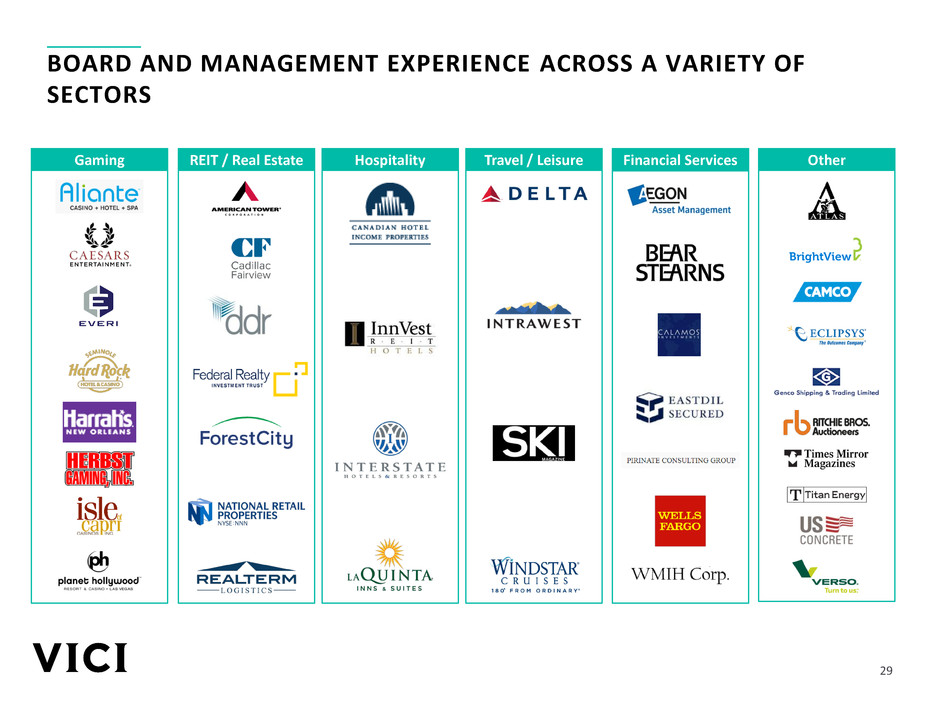

29 BOARD AND MANAGEMENT EXPERIENCE ACROSS A VARIETY OF SECTORS Hospitality Travel / LeisureREIT / Real EstateGaming OtherFinancial Services

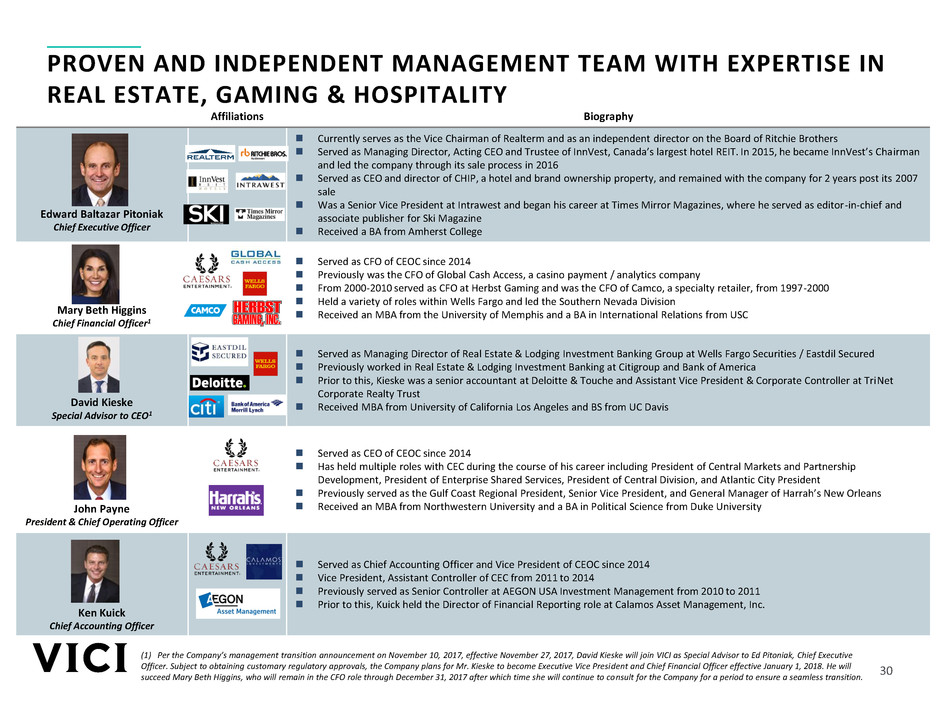

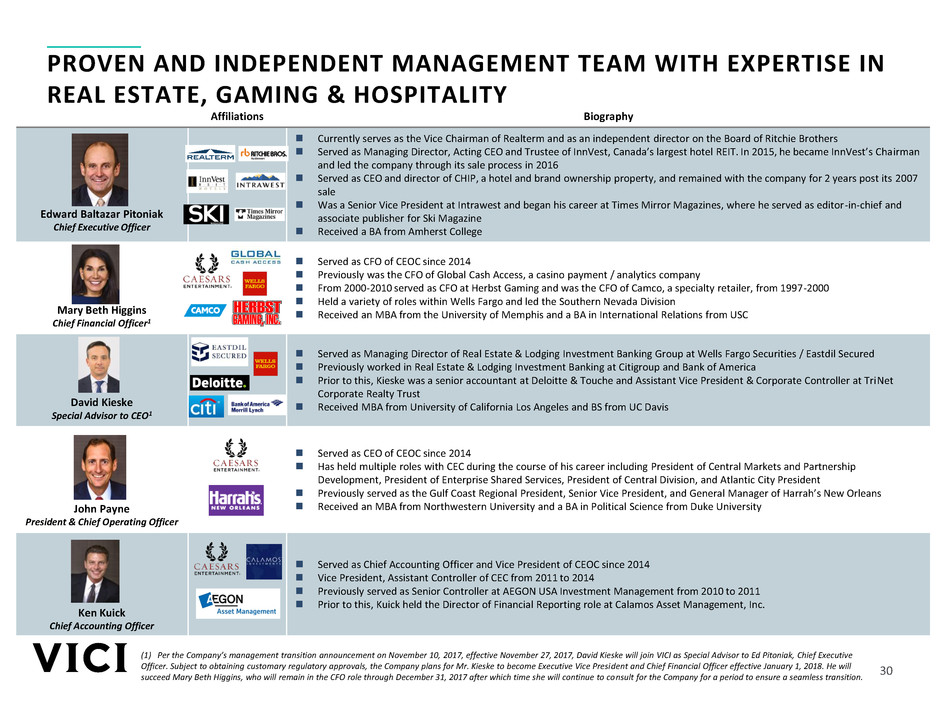

30 PROVEN AND INDEPENDENT MANAGEMENT TEAM WITH EXPERTISE IN REAL ESTATE, GAMING & HOSPITALITY Affiliations Biography Edward Baltazar Pitoniak Chief Executive Officer Currently serves as the Vice Chairman of Realterm and as an independent director on the Board of Ritchie Brothers Served as Managing Director, Acting CEO and Trustee of InnVest, Canada’s largest hotel REIT. In 2015, he became InnVest’s Chairman and led the company through its sale process in 2016 Served as CEO and director of CHIP, a hotel and brand ownership property, and remained with the company for 2 years post its 2007 sale Was a Senior Vice President at Intrawest and began his career at Times Mirror Magazines, where he served as editor-in-chief and associate publisher for Ski Magazine Received a BA from Amherst College Mary Beth Higgins Chief Financial Officer1 Served as CFO of CEOC since 2014 Previously was the CFO of Global Cash Access, a casino payment / analytics company From 2000-2010 served as CFO at Herbst Gaming and was the CFO of Camco, a specialty retailer, from 1997-2000 Held a variety of roles within Wells Fargo and led the Southern Nevada Division Received an MBA from the University of Memphis and a BA in International Relations from USC David Kieske Special Advisor to CEO1 Served as Managing Director of Real Estate & Lodging Investment Banking Group at Wells Fargo Securities / Eastdil Secured Previously worked in Real Estate & Lodging Investment Banking at Citigroup and Bank of America Prior to this, Kieske was a senior accountant at Deloitte & Touche and Assistant Vice President & Corporate Controller at TriNet Corporate Realty Trust Received MBA from University of California Los Angeles and BS from UC Davis John Payne President & Chief Operating Officer Served as CEO of CEOC since 2014 Has held multiple roles with CEC during the course of his career including President of Central Markets and Partnership Development, President of Enterprise Shared Services, President of Central Division, and Atlantic City President Previously served as the Gulf Coast Regional President, Senior Vice President, and General Manager of Harrah’s New Orleans Received an MBA from Northwestern University and a BA in Political Science from Duke University Ken Kuick Chief Accounting Officer Served as Chief Accounting Officer and Vice President of CEOC since 2014 Vice President, Assistant Controller of CEC from 2011 to 2014 Previously served as Senior Controller at AEGON USA Investment Management from 2010 to 2011 Prior to this, Kuick held the Director of Financial Reporting role at Calamos Asset Management, Inc. (1) Per the Company’s management transition announcement on November 10, 2017, effective November 27, 2017, David Kieske will join VICI as Special Advisor to Ed Pitoniak, Chief Executive Officer. Subject to obtaining customary regulatory approvals, the Company plans for Mr. Kieske to become Executive Vice President and Chief Financial Officer effective January 1, 2018. He will succeed Mary Beth Higgins, who will remain in the CFO role through December 31, 2017 after which time she will continue to consult for the Company for a period to ensure a seamless transition.

31 EXPERIENCED AND INDEPENDENT BOARD OF DIRECTORS Affiliations Biography James R. Abrahamson* Chairman of Interstate Hotels & Resorts Previously served as Interstate’s CEO from 2011 to March 2017 Serves as an independent director at La Quinta Holdings, Inc. and at BrightView Corporation Eugene I. Davis Founder and CEO of PIRINATE Consulting Group, LLC Serves as Chairman of the Board of Atlas Iron Limited, U.S. Concrete Inc.1 and WMIH corporation Serves as a director of Verso Corporation and Titan Energy Previously a director at Planet Hollywood, Delta Airlines, Windstar Cruise Line, Genco Shipping and Trading, and Aliante Eric Hausler CEO of Isle of Capri Casinos Previously served as ISLE’s CFO from 2014 to 2016 Served as an MD in Fixed Income Research, covering the gaming, lodging and leisure industries for Bear Stearns Elizabeth I. Holland3 CEO of Abbell Associates, LLC Currently serves as an independent director of Federal Realty Investment Trust Serves the Executive Board and the Board of Trustees of International Council of Shopping Centers Craig Macnab Held the position of Chairman and CEO of National Retail Properties, Inc. from 2008 to April 2017 Serves as an independent director of Forest City and American Tower Corporation Previously served as director of Eclipsys Corporation from 2008-2014 and DDR from 2013-2015 Edward Baltazar Pitoniak CEO of VICI Properties, Inc. Currently serves as Vice Chairman of Realterm Serves as an independent director of Ritchie Brother Auctioneers Served as Chairman of InnVest from 2015-2016 Michael D. Rumbolz President and CEO of Everi Holdings, Inc. Serves as an independent director of Seminole Hard Rock Entertainment, LLC. Previously served as Chairman and CEO of Cash Systems, Inc. from 2005-2008 * Denotes Chair of Board of Directors (1) Eugene I. Davis has decided not to stand for reelection at U.S. Concrete’s 2018 annual meeting. (2) Opted out of MUTA. (3) Appointed to the Board in November 2017, subject to the receipt of all applicable regulatory approvals. No Tenant/ Director Overlap 0% Parent/ Tenant Company Ownership Independent Chairman Separation of Chairman & CEO Role Board Not Staggered2

APPENDIX

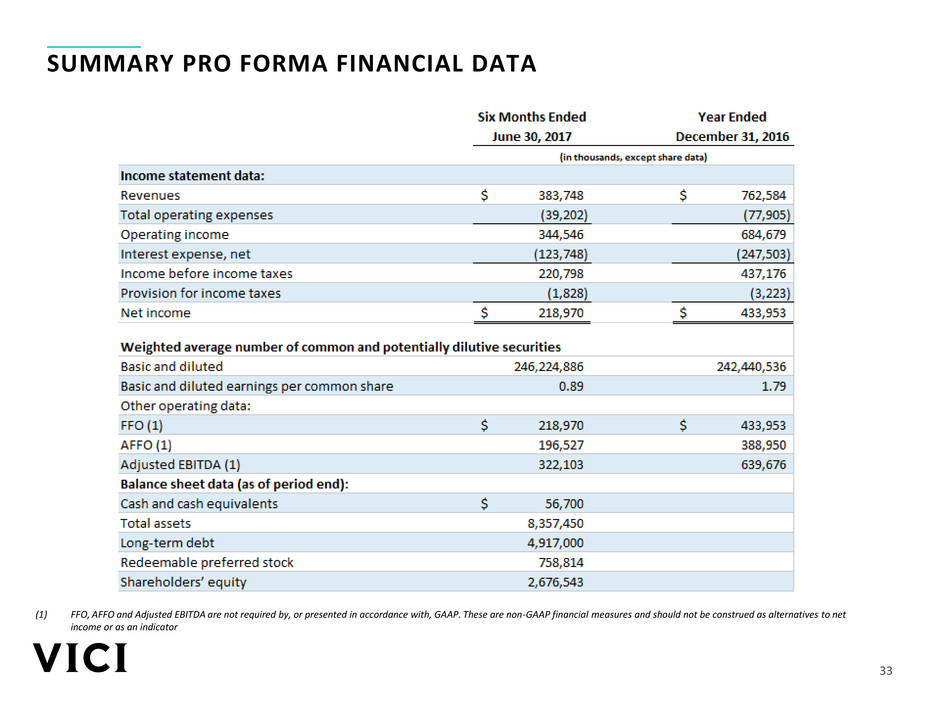

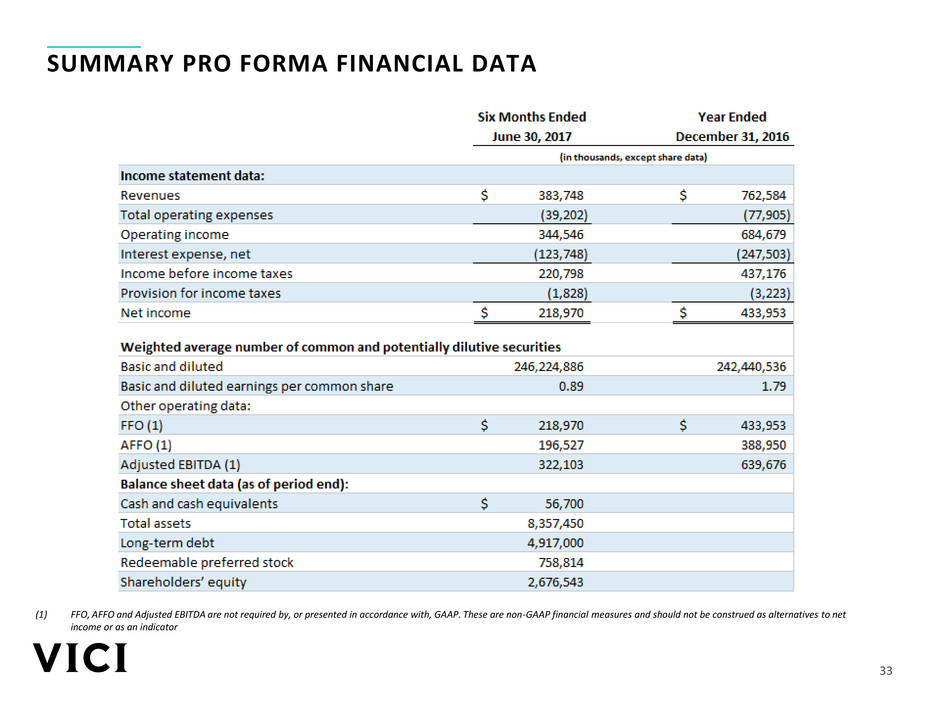

33 SUMMARY PRO FORMA FINANCIAL DATA (1) FFO, AFFO and Adjusted EBITDA are not required by, or presented in accordance with, GAAP. These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator

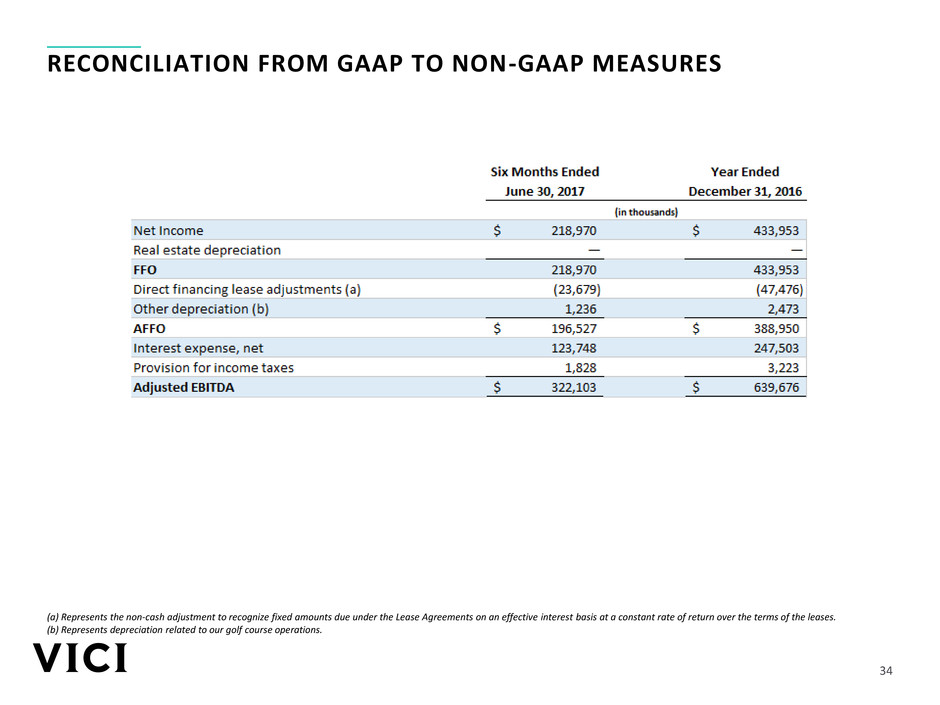

34 RECONCILIATION FROM GAAP TO NON-GAAP MEASURES (a) Represents the non-cash adjustment to recognize fixed amounts due under the Lease Agreements on an effective interest basis at a constant rate of return over the terms of the leases. (b) Represents depreciation related to our golf course operations.

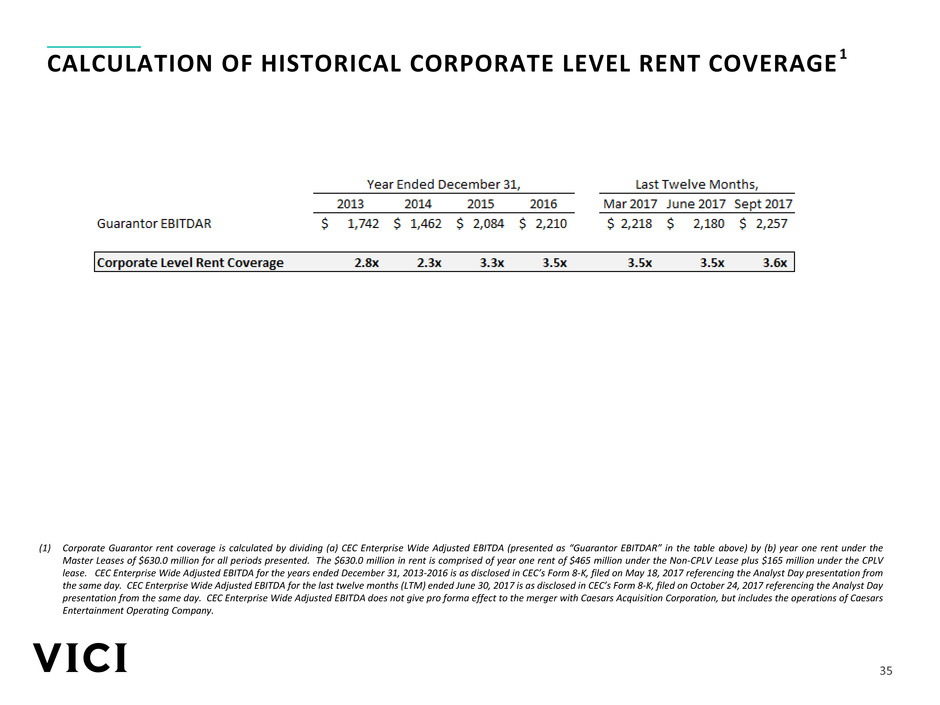

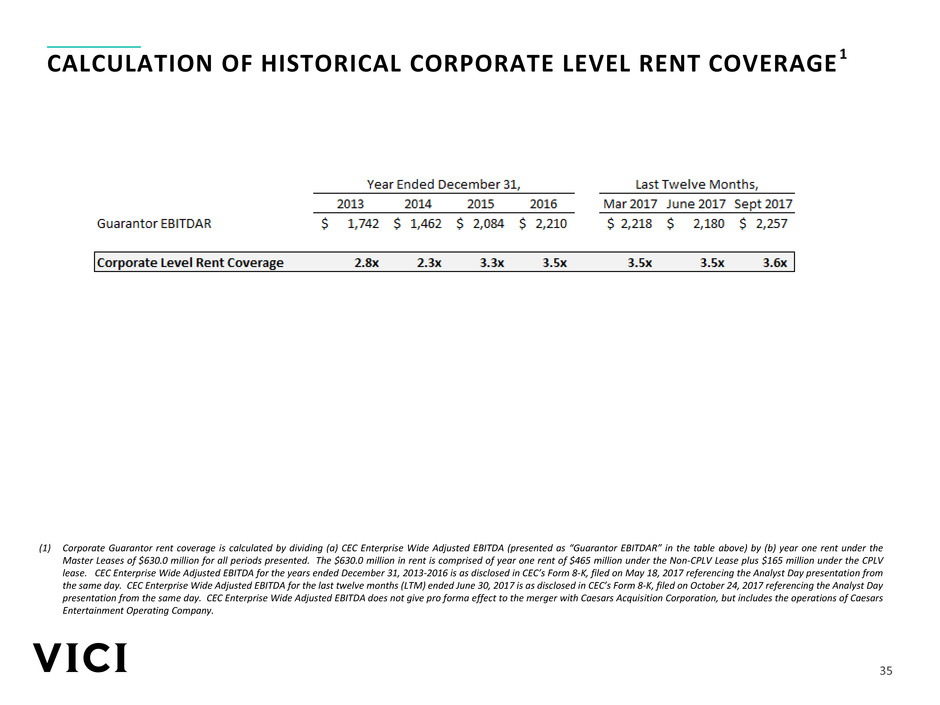

35 CALCULATION OF HISTORICAL CORPORATE LEVEL RENT COVERAGE 1 (1) Corporate Guarantor rent coverage is calculated by dividing (a) CEC Enterprise Wide Adjusted EBITDA (presented as “Guarantor EBITDAR” in the table above) by (b) year one rent under the Master Leases of $630.0 million for all periods presented. The $630.0 million in rent is comprised of year one rent of $465 million under the Non-CPLV Lease plus $165 million under the CPLV lease. CEC Enterprise Wide Adjusted EBITDA for the years ended December 31, 2013-2016 is as disclosed in CEC’s Form 8-K, filed on May 18, 2017 referencing the Analyst Day presentation from the same day. CEC Enterprise Wide Adjusted EBITDA for the last twelve months (LTM) ended June 30, 2017 is as disclosed in CEC’s Form 8-K, filed on October 24, 2017 referencing the Analyst Day presentation from the same day. CEC Enterprise Wide Adjusted EBITDA does not give pro forma effect to the merger with Caesars Acquisition Corporation, but includes the operations of Caesars Entertainment Operating Company.

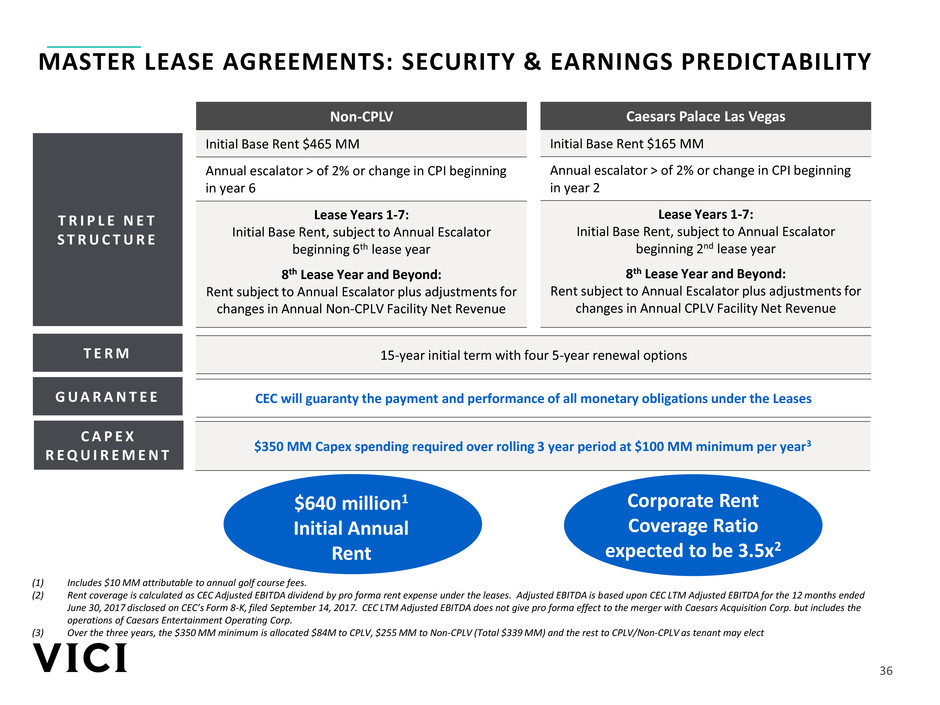

36 MASTER LEASE AGREEMENTS: SECURITY & EARNINGS PREDICTABILITY T E R M Non-CPLV Initial Base Rent $465 MM Annual escalator > of 2% or change in CPI beginning in year 6 Lease Years 1-7: Initial Base Rent, subject to Annual Escalator beginning 6th lease year 8th Lease Year and Beyond: Rent subject to Annual Escalator plus adjustments for changes in Annual Non-CPLV Facility Net Revenue T R I P L E N E T S T R U C T U R E Caesars Palace Las Vegas Initial Base Rent $165 MM Annual escalator > of 2% or change in CPI beginning in year 2 Lease Years 1-7: Initial Base Rent, subject to Annual Escalator beginning 2nd lease year 8th Lease Year and Beyond: Rent subject to Annual Escalator plus adjustments for changes in Annual CPLV Facility Net Revenue G U A R A N T E E 15-year initial term with four 5-year renewal options CEC will guaranty the payment and performance of all monetary obligations under the Leases $640 million1 Initial Annual Rent Corporate Rent Coverage Ratio expected to be 3.5x2 (1) Includes $10 MM attributable to annual golf course fees. (2) Rent coverage is calculated as CEC Adjusted EBITDA dividend by pro forma rent expense under the leases. Adjusted EBITDA is based upon CEC LTM Adjusted EBITDA for the 12 months ended June 30, 2017 disclosed on CEC’s Form 8-K, filed September 14, 2017. CEC LTM Adjusted EBITDA does not give pro forma effect to the merger with Caesars Acquisition Corp. but includes the operations of Caesars Entertainment Operating Corp. (3) Over the three years, the $350 MM minimum is allocated $84M to CPLV, $255 MM to Non-CPLV (Total $339 MM) and the rest to CPLV/Non-CPLV as tenant may elect C A P E X R E Q U I R E M E N T $350 MM Capex spending required over rolling 3 year period at $100 MM minimum per year3

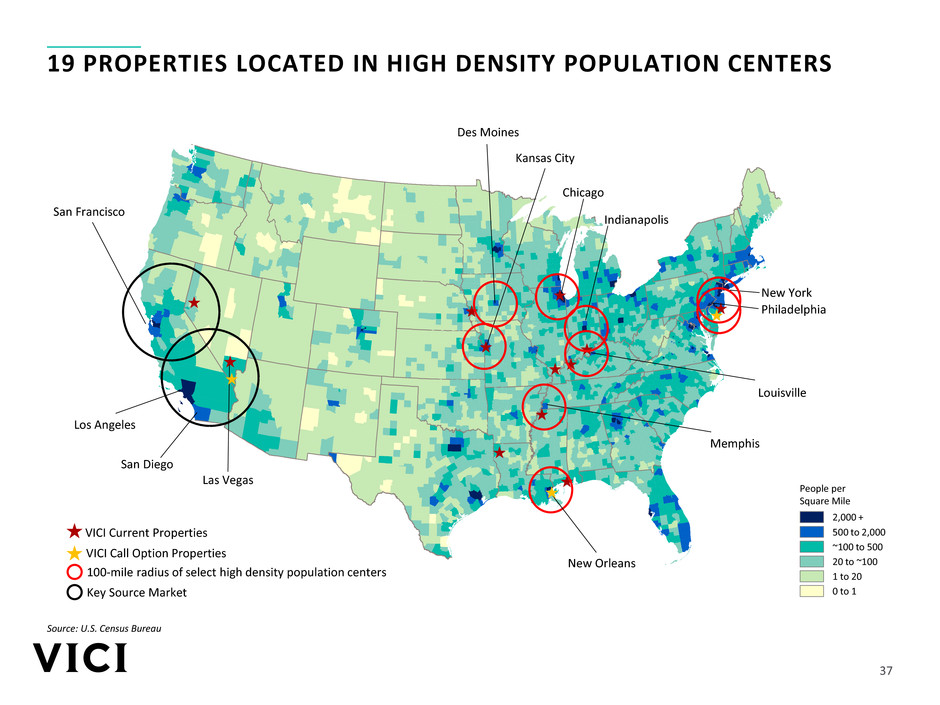

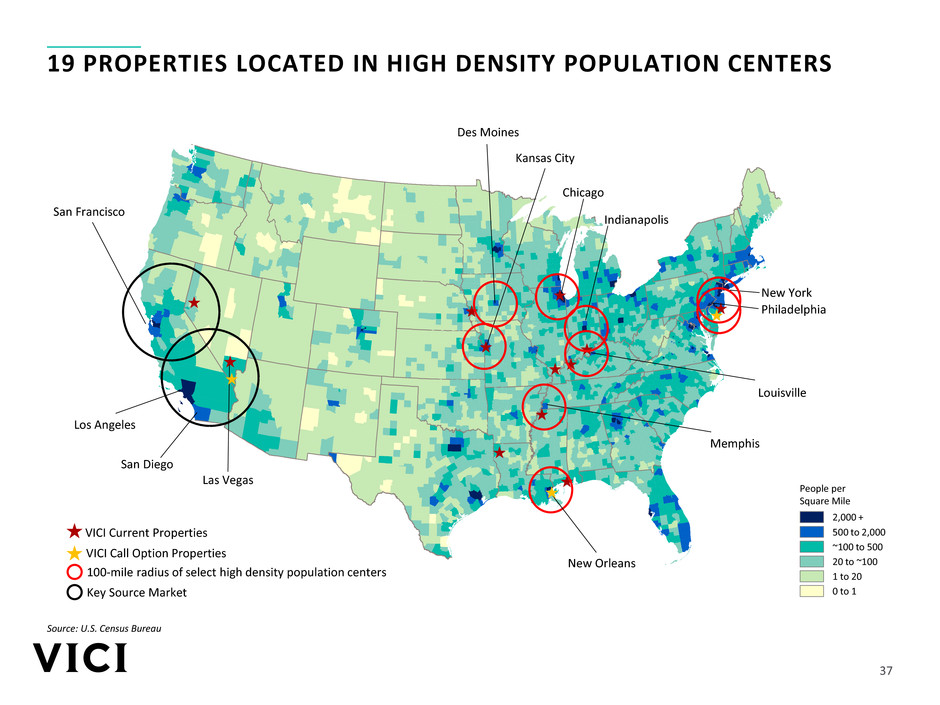

37 19 PROPERTIES LOCATED IN HIGH DENSITY POPULATION CENTERS Source: U.S. Census Bureau Kansas City Memphis Las Vegas Chicago VICI Current Properties 100-mile radius of select high density population centers San Francisco Philadelphia New York New Orleans Indianapolis Key Source Market San Diego Louisville Los Angeles People per Square Mile 2,000 + 500 to 2,000 ~100 to 500 1 to 20 0 to 1 20 to ~100 Des Moines VICI Call Option Properties