Exhibit 99.2 SUPPLEMENTAL FINANCIAL & OPERATING DATA F I R S T Q U A R T E R ENDE D M A R C H 3 1 , 2020

Disclaimers Forward Looking Statements Certain statements in this presentation and that may be made in meetings are forward‐looking statements. Forward‐looking statements are based on VICI Properties Inc.’s (“VICI or the “Company”) current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as "expects", "plans", "opportunities" and similar words and variations thereof. Although the Company believes that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, its results, performance and achievements could differ materially from those expressed in or by the forward‐looking statements and may be affected by a variety of risks and other factors including, among others: the impact of changes in general economic conditions, including low consumer confidence, unemployment levels, and depressed real estate prices resulting from the severity and duration of any downturn in the U.S. or global economy (including stemming from the COVID-19 pandemic and changes in economic conditions as a result of the COVID-19 pandemic); risks that the pending purchase of three Harrah’s-branded casinos (the “MTA Properties”) pursuant to the transactions described in the Master Transaction Agreement entered into by the Company and Eldorado Resorts, Inc. (“Eldorado”) (the “Eldorado Transaction”) may not be consummated on the terms or timeframe described herein, or at all; the ability of the parties to satisfy the conditions set forth in the definitive transaction documents for the pending transactions, including the ability to receive, or delays in obtaining, the regulatory and other approvals and/or consents required to consummate the transactions; the terms on which the Company finances the pending transactions, including the source of funds used to finance such transactions; disruptions to the real property and operations of the MTA Properties during the pendency of the closings; risks that the Company may not achieve the benefits contemplated by our pending and recently completed acquisitions of real estate assets (including any expected accretion or the amount of any future rent payments); risks that not all potential risks and liabilities have been identified in the due diligence for our pending and recently completed transactions; the Company's dependence on affiliates of Caesars Entertainment Corporation (“Caesars”), Penn National Gaming, Inc. (“Penn”), Seminole Hard Rock Entertainment, Inc. (“Hard Rock”), Century Casinos, Inc. (“Century”) and JACK Ohio LLC (“JACK Entertainment”) (and, following the completion of our pending transactions, Combined Eldorado/Caesars, Penn, Hard Rock, Century and JACK Entertainment respectively) as tenants of all of its properties and Caesars, Penn, Hard Rock, Century and JACK Entertainment (and, following the completion of our pending transactions, Combined Eldorado/Caesars, Penn, Hard Rock, Century and JACK Entertainment) or their affiliates as guarantors of the relevant lease payments, and the consequences of any material adverse effect on their respective businesses could have on the Company; the Company's dependence on the gaming industry; the Company's ability to pursue its business and growth strategies may be limited by its substantial debt service requirements and by the requirement that the Company distribute 90% of its real estate investment trust (“REIT”) taxable income in order to qualify for taxation as a REIT and that the Company distribute 100% of its REIT taxable income in order to avoid current entity level U.S. Federal income taxes; the impact of extensive regulation from gaming and other regulatory authorities; the ability of the Company's tenants to obtain and maintain regulatory approvals in connection with the operation of the Company's properties; the possibility that the Company’s tenants may choose not to renew their lease agreements with the Company following the initial or subsequent terms of the leases; restrictions on the Company's ability to sell its properties subject to the lease agreements; the Company's indebtedness and ability to service and refinance such indebtedness; the Company's historical and pro forma financial information may not be reliable indicators of its future results of operations and financial condition; limits on the Company's operational and financial flexibility imposed by its debt agreements; and the possibility the Company's separation from Caesars Entertainment Operating Company, Inc. fails to qualify as a tax‐free spin‐off, which could subject the Company to significant tax liabilities. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the impact of the COVID-19 pandemic on the financial condition, results of operations, cash flows and performance of the Company, its tenants and its pending transactions. The extent to which the COVID-19 pandemic impacts the Company and its tenants will largely depend on future developments that are highly uncertain and cannot be predicted with confidence, including the impact of the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures on our tenants, including various state governments and/or regulatory authorities issuing directives, mandates, orders or similar actions restricting freedom of movement and business operations, such as travel restrictions, border closures, business closures, limitations on public gatherings, quarantines and “shelter-at-home” orders resulting in the closure of our tenants' operations at our properties. Each of the foregoing could have a material adverse effect on our tenants' ability to satisfy their obligations under their leases with us, including their continued ability to pay rent in a timely manner, or at all, and/or to fund capital expenditures or make other payments required under their leases. In addition, changes and instability in global, national and regional economic activity and financial markets as a result of the COVID-19 pandemic could negatively impact consumer discretionary spending and travel, which could have a material adverse effect on our tenants' businesses. Investors are cautioned to interpret many of the risks identified here and under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019 as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2019, Quarterly Reports on Form 10‐Q and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”). The Company does not undertake any obligation to update or revise any forward‐looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Caesars, Eldorado, Penn, Hard Rock, Century and JACK Entertainment Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars, Eldorado, Penn, Hard Rock, Century and JACK Entertainment included in this presentation. The historical audited and unaudited financial statements of Caesars, as the parent and guarantor of CEOC, LLC (“CEOC”), the Company's significant lessee, have been filed with the SEC. Certain financial and other information for Caesars, Eldorado, Penn, Hard Rock, Century and JACK Entertainment included in this presentation have been derived from their respective filings, if and as applicable, and other publicly available presentations and press releases. While we believe this information to be reliable, we have not independently investigated or verified such data. Market and Industry Data This presentation contains estimates and information concerning the Company's industry, including market position, rent growth and rent coverage of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”), AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of March 31, 2020 unless otherwise indicated. VICI Q1 2020 Supplemental Financial & Operating Data 2

Corporate Overview About VICI Properties (NYSE: VICI) VICI Properties Inc. (“VICI Properties” or the “Company”) is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including the world-renowned Caesars Palace. VICI Properties’ national, geographically diverse portfolio consists of 28 gaming facilities comprising over 40 million square feet and features approximately 15,600 hotel rooms and more than 180 restaurants, bars and nightclubs. Its properties are leased to industry leading gaming and hospitality operators, including Caesars Entertainment Corporation, Century Casinos Inc., Hard Rock International, JACK Entertainment and Penn National Gaming. VICI Properties also owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip. VICI Properties’ strategy is to create the nation’s highest quality and most productive experiential real estate portfolio. For additional information, please visit www.viciproperties.com. Senior Management Board of Directors Titles Independent Edward Pitoniak Chief Executive Officer & Director James Abrahamson Director, Chairman of the Board ✓ John Payne President & Chief Operating Officer Diana Cantor Director, Chair of the Audit Committee ✓ David Kieske EVP, Chief Financial Officer Monica Douglas Director ✓ Samantha Gallagher EVP, General Counsel & Secretary Elizabeth Holland Director ✓ Gabriel Wasserman Chief Accounting Officer Craig Macnab Director, Chair of the Compensation Committee ✓ Edward Pitoniak Chief Executive Officer & Director Michael Rumbolz Director, Chair of the Nominating & Governance Committee ✓ Contact Information Covering Equity Analysts Corporate Headquarters Transfer Agent VICI Properties Inc. Computershare Firm Analyst Phone Email 535 Madison Ave., 20th Fl 2335 Alaska Avenue Barclays Felicia Hendrix (212) 526‐5562 Felicia.Hendrix@barclays.com New York, NY 10022 El Segundo, CA 90245 BofA Merrill Lynch Shaun Kelley (646) 855‐1005 Shaun.Kelley@baml.com (646) 949‐4631 (800) 962‐4284 Citi Smedes Rose (212) 816-6243 Smedes.Rose@citi.com www.computershare.com Credit Suisse Ben Combes (212) 538-2383 Ben.Combes@credit-Suisse.com Investor Relations Deutsche Bank Carlo Santarelli (212) 250‐5815 Carlo.Santarelli@db.com investors@viciproperties.com Public Markets Detail Evercore ISI Rich Hightower (212) 752-0886 Rich.Hightower@evercoreisi.com Goldman Sachs Stephen Grambling (212) 902‐7832 Stephen.Grambling@gs.com Public Relations Ticker: VICI Green Street Advisors Spenser Allaway (949) 640-8780 Sallaway@greenstreetadvisors.com pr@viciproperties.com Exchange: NYSE Jefferies David Katz (212) 323-3355 Dkatz@jefferies.com Unsecured Credit Ratings Ladenburg Thalmann & Co. John Massocca (212) 409-2543 Jmassoca@ladenburg.com Morgan Stanley Thomas Allen (212) 761‐3356 Thomas.Allen@morganstanley.com Firm Rating Nomura l Instinet Daniel Adam (212) 310-5407 Daniel.Adam@instinet.com Moody's Ba3 Robert W. Baird RJ Milligan (813) 273-8252 Rjmilligan@rwbaird.com Standard & Poor’s BB SMBC Nikko Securities Richard Anderson (646) 521-2351 Randerson@smbcnikko-si.com Fitch BB Stifel Nicolaus Simon Yarmak (443) 224‐1345 Yarmaks@stifel.com Sun Trust Robinson Humphrey Barry Jonas (212) 590-0998 Barry.Jonas@suntrust.com Union Gaming John DeCree (702) 691‐3213 John.Decree@uniongaming.com Wells Fargo Todd Stender (562) 637-1371 Todd.Stender@wellsfargo.com Covering High Yield Analysts Firm Analyst Phone Email BofA Merrill Lynch James Kayler (646) 855‐9223 James.F.Kayler@baml.com Deutsche Bank Luis Chinchilla (212) 250-9980 Luis.Chinchilla@db.com Komal.Patel@gs.com VICI Q1 2020 Supplemental Financial & Operating Data Goldman Sachs Komal Patel (212) 357‐9774 J.P. Morgan Michael Pace (212) 270‐6530 Michael.Pace@jpmorgan.com 3

Table of Contents Portfolio & Financial Overview 5 Consolidated Balance Sheets 6-7 Consolidated Statements of Operations 8-9 Revenue Breakdown 10-11 Non‐GAAP Financial Measures 12-13 Capitalization 14 Property Overview 15 Properties Breakdown 16-17 Summary of Current Lease Terms 18-19 Recent Activity 20-21 Right of First Refusal / Put-Call Assets 22 Definitions of Non-GAAP Financial Measures 23 VICI Q1 2020 Supplemental Financial & Operating Data 4

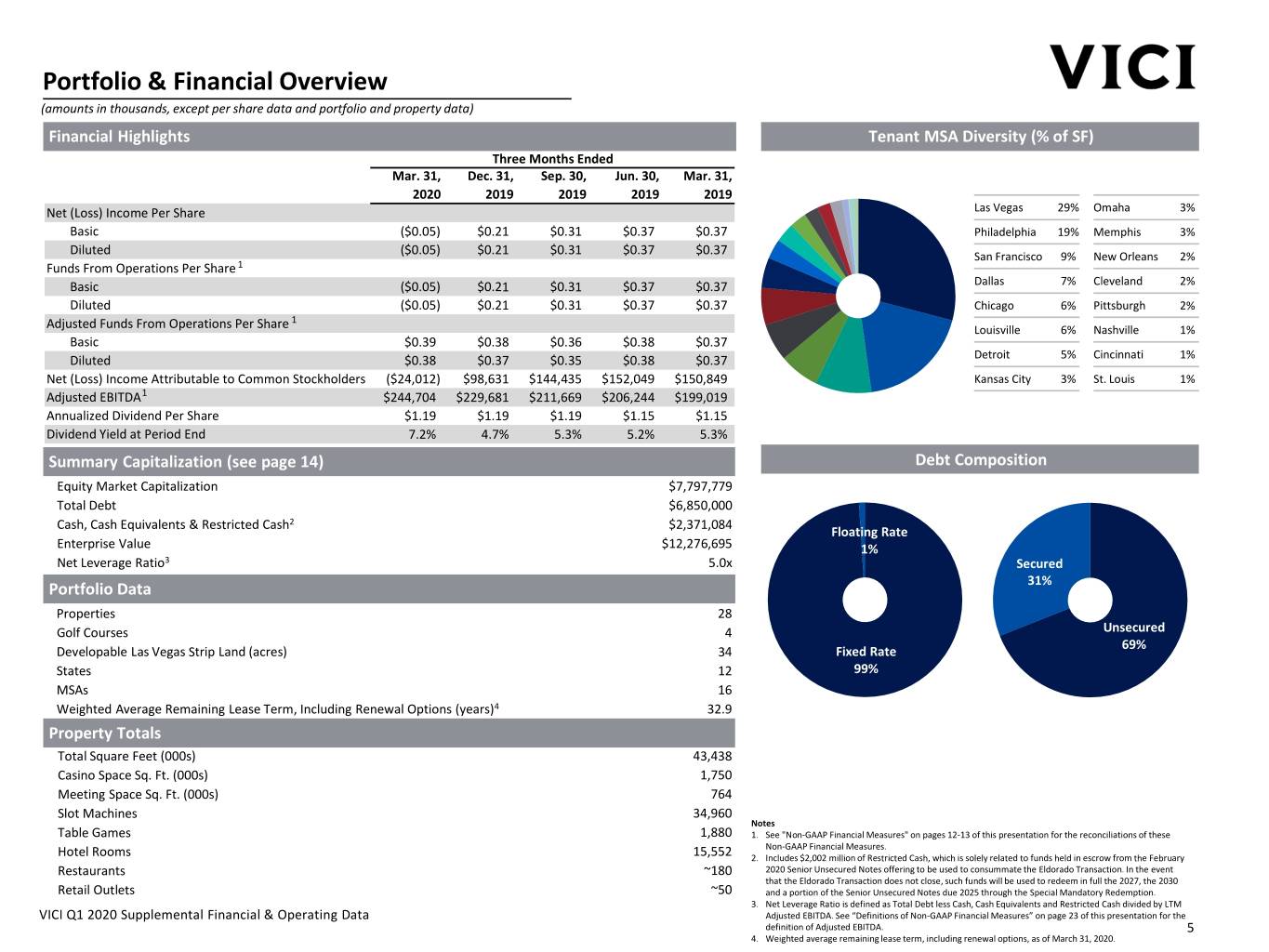

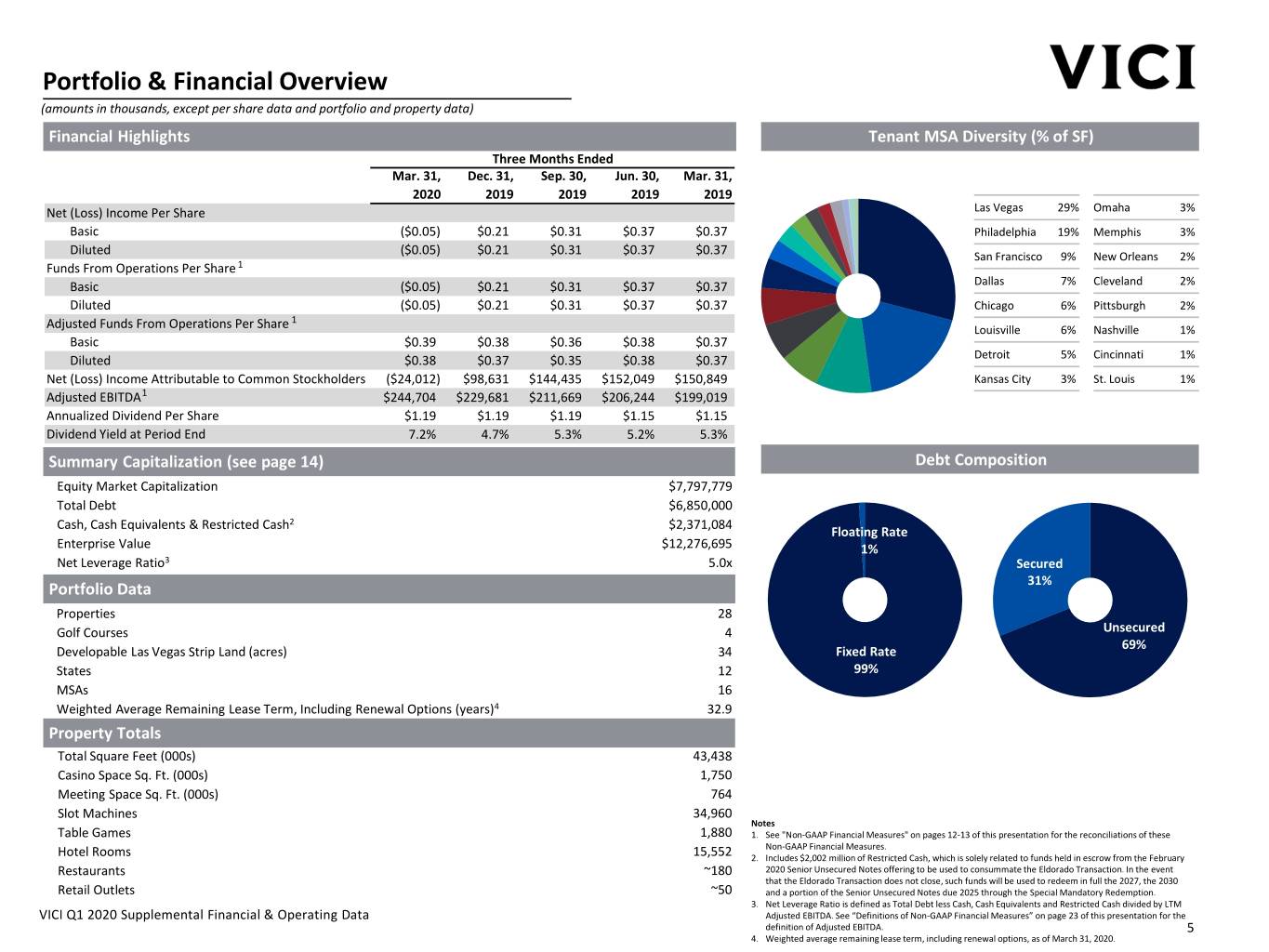

Portfolio & Financial Overview (amounts in thousands, except per share data and portfolio and property data) Financial Highlights Tenant MSA Diversity (% of SF) Three Months Ended Mar. 31, Dec. 31, Sep. 30, Jun. 30, Mar. 31, 2020 2019 2019 2019 2019 Net (Loss) Income Per Share Las Vegas 29% Omaha 3% Basic ($0.05) $0.21 $0.31 $0.37 $0.37 Philadelphia 19% Memphis 3% Diluted ($0.05) $0.21 $0.31 $0.37 $0.37 San Francisco 9% New Orleans 2% Funds From Operations Per Share 1 Basic ($0.05) $0.21 $0.31 $0.37 $0.37 Dallas 7% Cleveland 2% Diluted ($0.05) $0.21 $0.31 $0.37 $0.37 Chicago 6% Pittsburgh 2% 1 Adjusted Funds From Operations Per Share Louisville 6% Nashville 1% Basic $0.39 $0.38 $0.36 $0.38 $0.37 Diluted $0.38 $0.37 $0.35 $0.38 $0.37 Detroit 5% Cincinnati 1% Net (Loss) Income Attributable to Common Stockholders ($24,012) $98,631 $144,435 $152,049 $150,849 Kansas City 3% St. Louis 1% Adjusted EBITDA1 $244,704 $229,681 $211,669 $206,244 $199,019 Annualized Dividend Per Share $1.19 $1.19 $1.19 $1.15 $1.15 Dividend Yield at Period End 7.2% 4.7% 5.3% 5.2% 5.3% Summary Capitalization (see page 14) Debt Composition Equity Market Capitalization $7,797,779 Total Debt $6,850,000 Cash, Cash Equivalents & Restricted Cash2 $2,371,084 Floating Rate Enterprise Value $12,276,695 1% Net Leverage Ratio3 5.0x Secured 31% Portfolio Data Properties 28 Golf Courses 4 Unsecured 69% Developable Las Vegas Strip Land (acres) 34 Fixed Rate States 12 99% MSAs 16 Weighted Average Remaining Lease Term, Including Renewal Options (years)4 32.9 Property Totals Total Square Feet (000s) 43,438 Casino Space Sq. Ft. (000s) 1,750 Meeting Space Sq. Ft. (000s) 764 Slot Machines 34,960 Notes Table Games 1,880 1. See "Non‐GAAP Financial Measures" on pages 12-13 of this presentation for the reconciliations of these Non‐GAAP Financial Measures. Hotel Rooms 15,552 2. Includes $2,002 million of Restricted Cash, which is solely related to funds held in escrow from the February Restaurants ~180 2020 Senior Unsecured Notes offering to be used to consummate the Eldorado Transaction. In the event that the Eldorado Transaction does not close, such funds will be used to redeem in full the 2027, the 2030 Retail Outlets ~50 and a portion of the Senior Unsecured Notes due 2025 through the Special Mandatory Redemption. 3. Net Leverage Ratio is defined as Total Debt less Cash, Cash Equivalents and Restricted Cash divided by LTM VICI Q1 2020 Supplemental Financial & Operating Data Adjusted EBITDA. See “Definitions of Non-GAAP Financial Measures” on page 23 of this presentation for the definition of Adjusted EBITDA. 5 4. Weighted average remaining lease term, including renewal options, as of March 31, 2020.

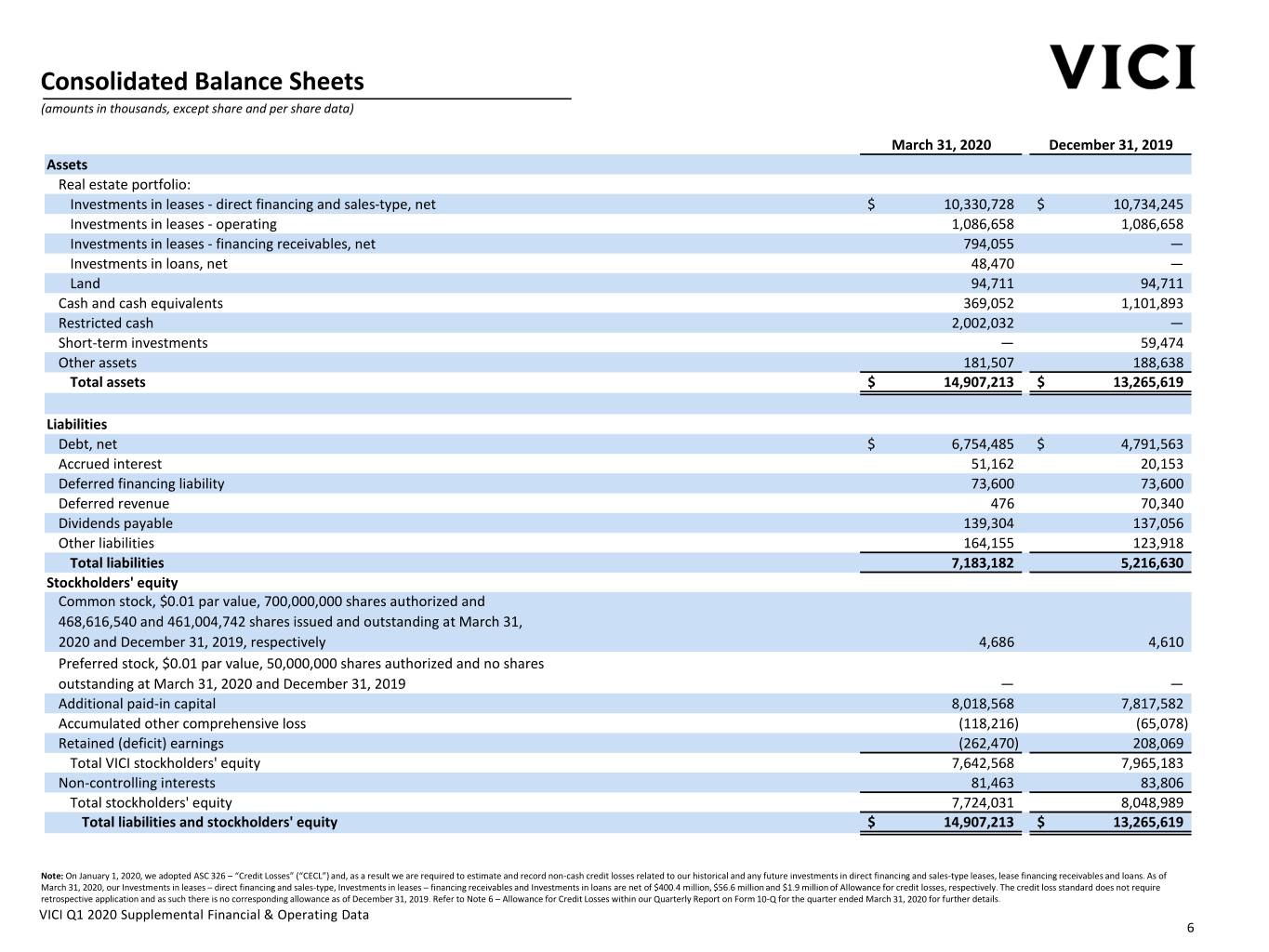

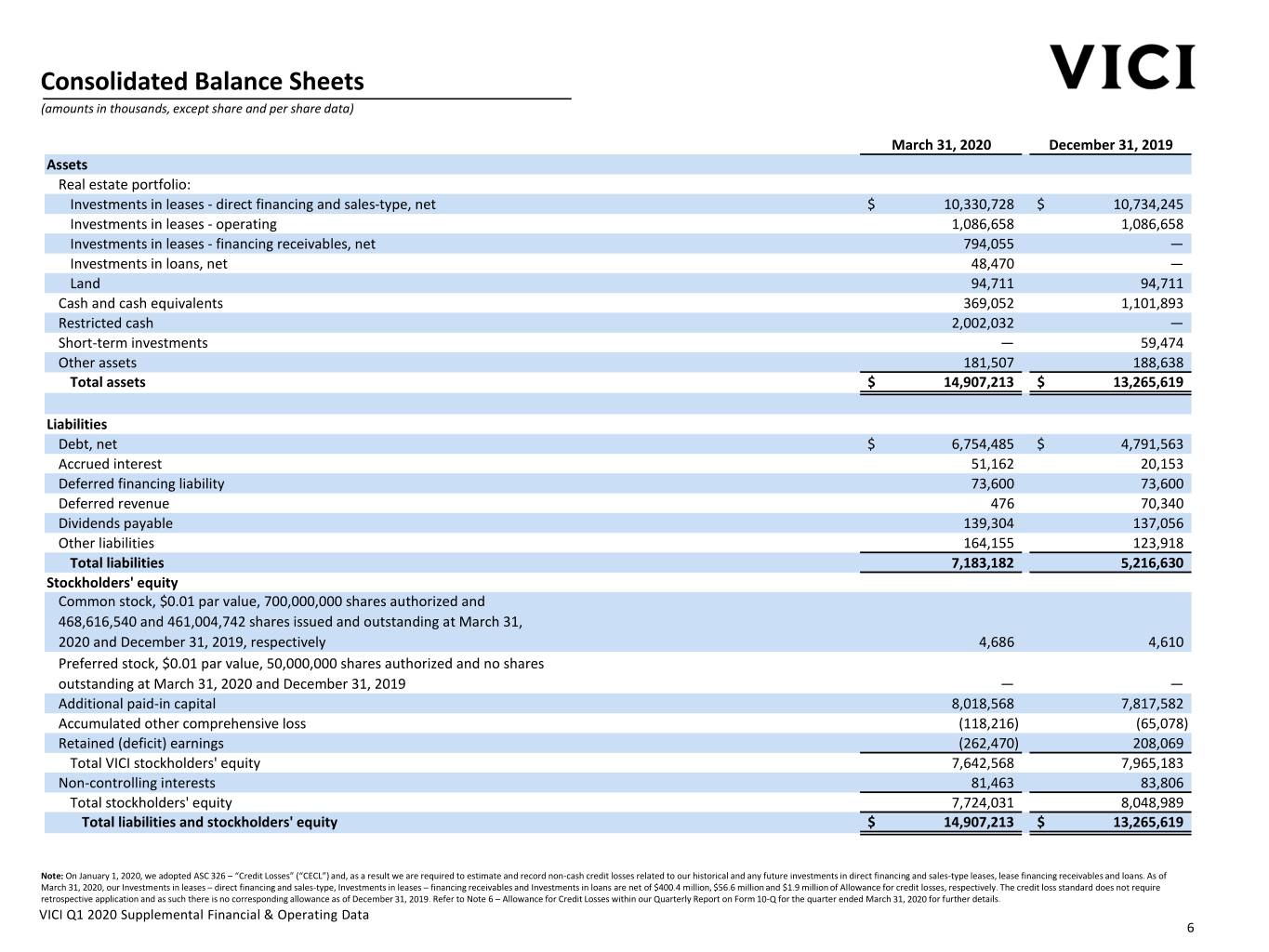

Consolidated Balance Sheets (amounts in thousands, except share and per share data) March 31, 2020 December 31, 2019 Assets Real estate portfolio: Investments in leases - direct financing and sales-type, net $ 10,330,728 $ 10,734,245 Investments in leases - operating 1,086,658 1,086,658 Investments in leases - financing receivables, net 794,055 — Investments in loans, net 48,470 — Land 94,711 94,711 Cash and cash equivalents 369,052 1,101,893 Restricted cash 2,002,032 — Short-term investments — 59,474 Other assets 181,507 188,638 Total assets $ 14,907,213 $ 13,265,619 Liabilities Debt, net $ 6,754,485 $ 4,791,563 Accrued interest 51,162 20,153 Deferred financing liability 73,600 73,600 Deferred revenue 476 70,340 Dividends payable 139,304 137,056 Other liabilities 164,155 123,918 Total liabilities 7,183,182 5,216,630 Stockholders' equity Common stock, $0.01 par value, 700,000,000 shares authorized and 468,616,540 and 461,004,742 shares issued and outstanding at March 31, 2020 and December 31, 2019, respectively 4,686 4,610 Preferred stock, $0.01 par value, 50,000,000 shares authorized and no shares outstanding at March 31, 2020 and December 31, 2019 — — Additional paid-in capital 8,018,568 7,817,582 Accumulated other comprehensive loss (118,216) (65,078) Retained (deficit) earnings (262,470) 208,069 Total VICI stockholders' equity 7,642,568 7,965,183 Non-controlling interests 81,463 83,806 Total stockholders' equity 7,724,031 8,048,989 Total liabilities and stockholders' equity $ 14,907,213 $ 13,265,619 Note: On January 1, 2020, we adopted ASC 326 – “Credit Losses” (“CECL”) and, as a result we are required to estimate and record non-cash credit losses related to our historical and any future investments in direct financing and sales-type leases, lease financing receivables and loans. As of March 31, 2020, our Investments in leases – direct financing and sales-type, Investments in leases – financing receivables and Investments in loans are net of $400.4 million, $56.6 million and $1.9 million of Allowance for credit losses, respectively. The credit loss standard does not require retrospective application and as such there is no corresponding allowance as of December 31, 2019. Refer to Note 6 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for further details. VICI Q1 2020 Supplemental Financial & Operating Data 6

Consolidated Balance Sheets – Quarterly (amounts in thousands, except share and per share data) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 Assets Real estate portfolio: Investments in leases - direct financing and sales-type, net $ 10,330,728 $ 10,734,245 $ 10,455,900 $ 9,897,031 Investments in leases - operating 1,086,658 1,086,658 1,086,658 1,086,658 Investments in leases - financing receivables, net 794,055 — — — Investments in loans, net 48,470 — — — Land 94,711 94,711 94,711 94,711 Cash and cash equivalents 369,052 1,101,893 431,423 1,205,335 Restricted cash 2,002,032 — 32,087 28,217 Short-term investments — 59,474 342,767 97,586 Other assets 181,507 188,638 137,920 112,508 Total assets $ 14,907,213 $ 13,265,619 $ 12,581,466 $ 12,522,046 Liabilities Debt, net $ 6,754,485 $ 4,791,563 $ 4,125,473 $ 4,124,448 Accrued interest 51,162 20,153 23,945 13,965 Deferred financing liability 73,600 73,600 73,600 73,600 Deferred revenue 476 70,340 250 5 Dividends payable 139,304 137,056 137,048 132,441 Other liabilities 164,155 123,918 147,081 105,164 Total liabilities 7,183,182 5,216,630 4,507,397 4,449,623 Stockholders' equity Common stock 4,686 4,610 4,610 4,610 Preferred stock — — — — Additional paid-in capital 8,018,568 7,817,582 7,816,233 7,814,829 Accumulated other comprehensive loss (118,216) (65,078) (77,116) (70,003) Retained (deficit) earnings (262,470) 208,069 246,587 239,301 Total VICI stockholders' equity 7,642,568 7,965,183 7,990,314 7,988,737 Non-controlling interests 81,463 83,806 83,755 83,686 Total stockholders' equity 7,724,031 8,048,989 8,074,069 8,072,423 Total liabilities and stockholders' equity $ 14,907,213 $ 13,265,619 $ 12,581,466 $ 12,522,046 Note: As of March 31, 2020, our Investments in leases – direct financing and sales-type, Investments in leases – financing receivables and Investments in loans are net of $400.4 million, $56.6 million and $1.9 million of Allowance for credit losses, respectively. The credit loss standard does not require retrospective application and as such there is no corresponding allowance as of December 31, 2019, September 30, 2019 or June 30, 2019. Refer to Note 6 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for further details. VICI Q1 2020 Supplemental Financial & Operating Data 7

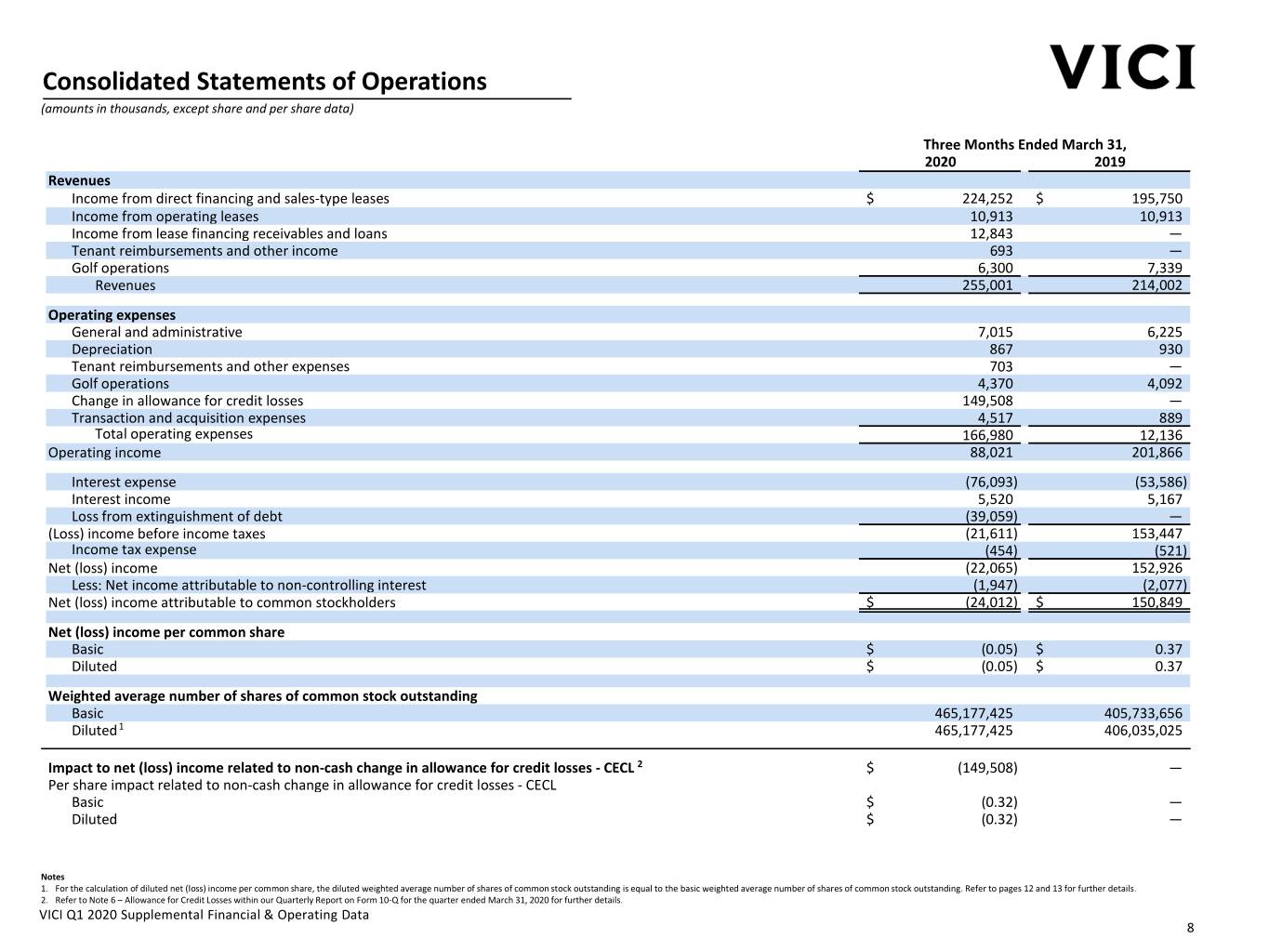

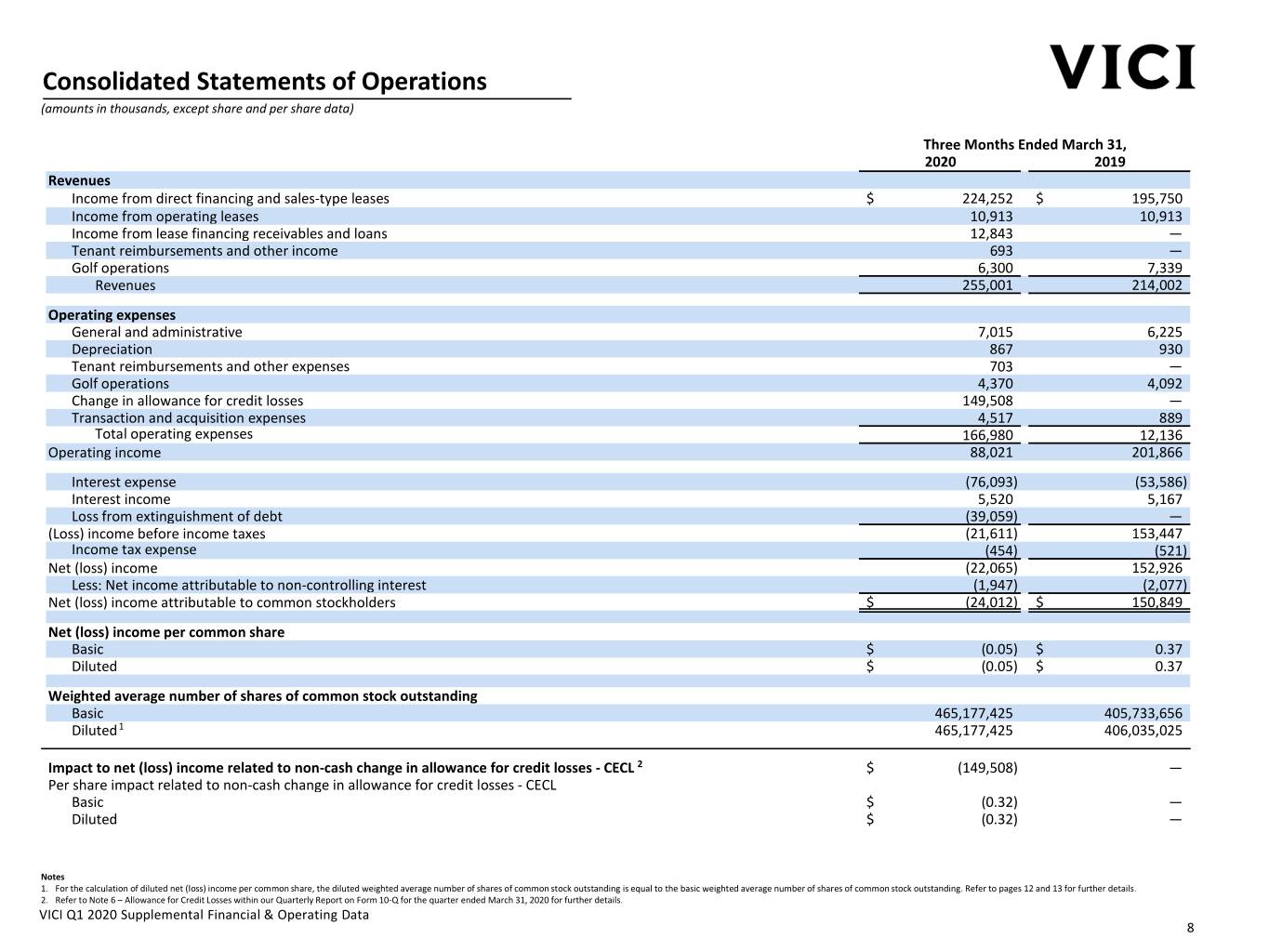

Consolidated Statements of Operations (amounts in thousands, except share and per share data) Three Months Ended March 31, 2020 2019 Revenues Income from direct financing and sales-type leases $ 224,252 $ 195,750 Income from operating leases 10,913 10,913 Income from lease financing receivables and loans 12,843 — Tenant reimbursements and other income 693 — Golf operations 6,300 7,339 Revenues 255,001 214,002 Operating expenses General and administrative 7,015 6,225 Depreciation 867 930 Tenant reimbursements and other expenses 703 — Golf operations 4,370 4,092 Change in allowance for credit losses 149,508 — Transaction and acquisition expenses 4,517 889 Total operating expenses 166,980 12,136 Operating income 88,021 201,866 Interest expense (76,093) (53,586) Interest income 5,520 5,167 Loss from extinguishment of debt (39,059) — (Loss) income before income taxes (21,611) 153,447 Income tax expense (454) (521) Net (loss) income (22,065) 152,926 Less: Net income attributable to non-controlling interest (1,947) (2,077) Net (loss) income attributable to common stockholders $ (24,012) $ 150,849 Net (loss) income per common share Basic $ (0.05) $ 0.37 Diluted $ (0.05) $ 0.37 Weighted average number of shares of common stock outstanding Basic 465,177,425 405,733,656 Diluted1 465,177,425 406,035,025 Impact to net (loss) income related to non-cash change in allowance for credit losses - CECL 2 $ (149,508) — Per share impact related to non-cash change in allowance for credit losses - CECL Basic $ (0.32) — Diluted $ (0.32) — Notes 1. For the calculation of diluted net (loss) income per common share, the diluted weighted average number of shares of common stock outstanding is equal to the basic weighted average number of shares of common stock outstanding. Refer to pages 12 and 13 for further details. 2. Refer to Note 6 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for further details. VICI Q1 2020 Supplemental Financial & Operating Data 8

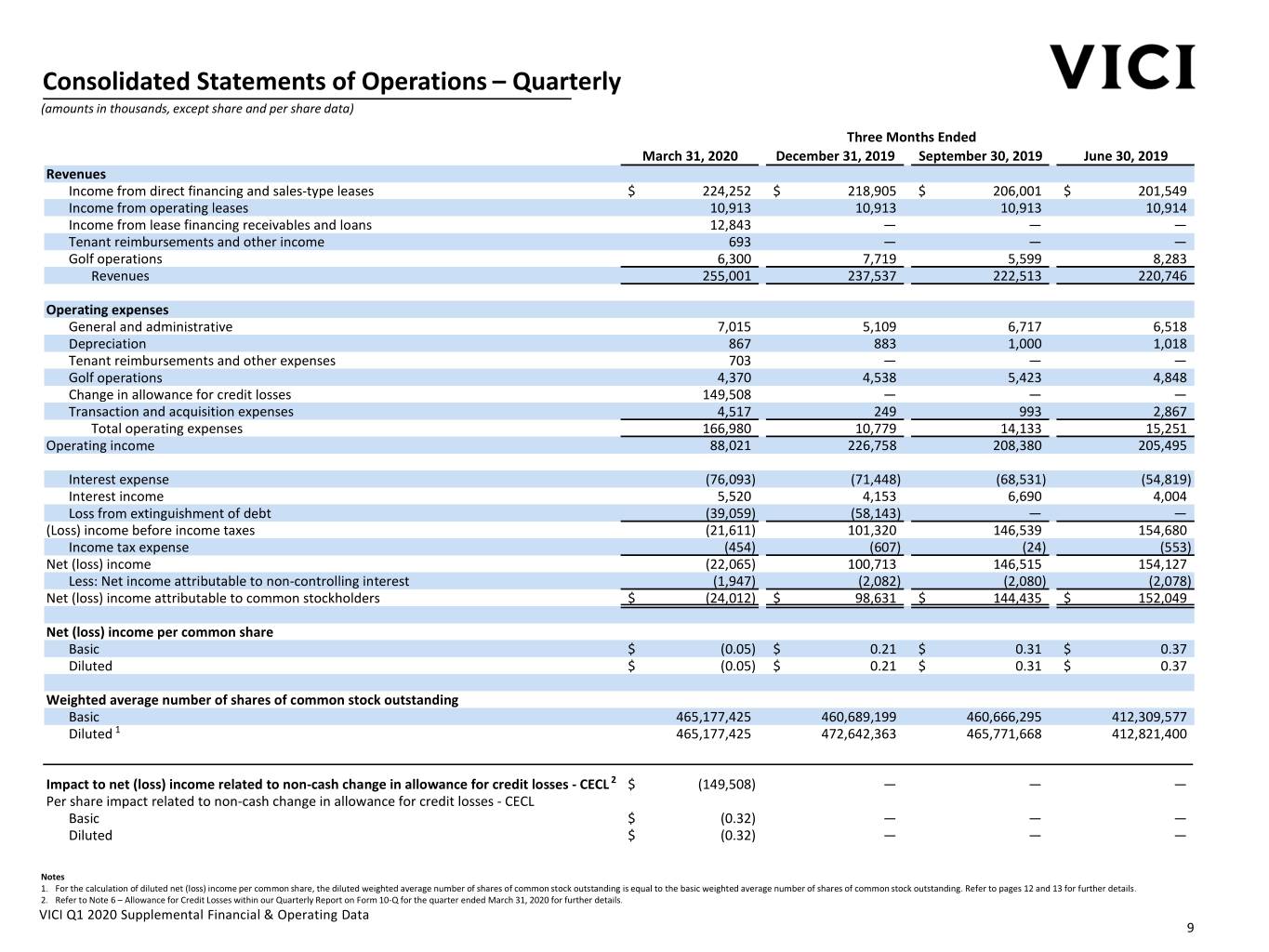

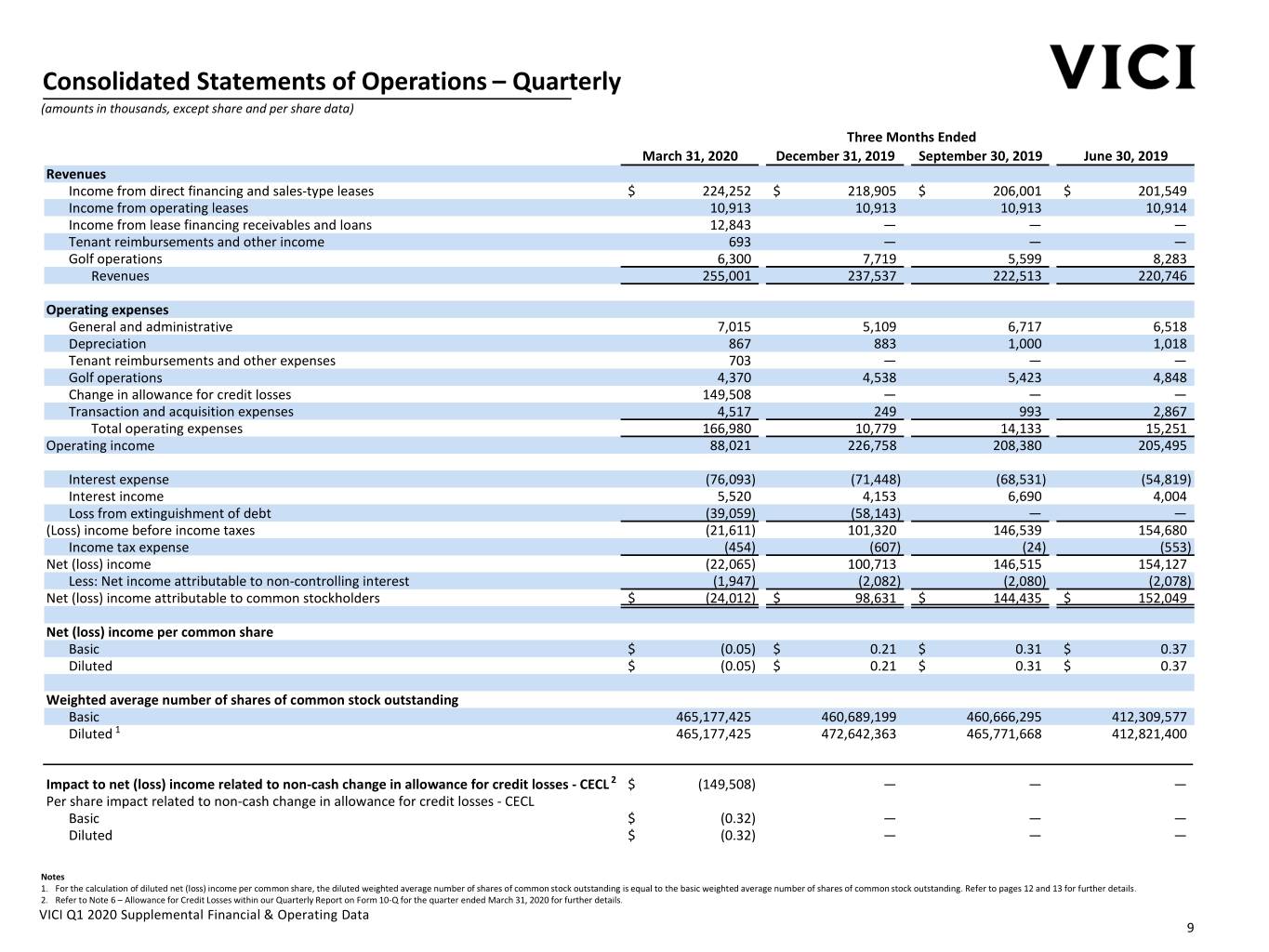

Consolidated Statements of Operations – Quarterly (amounts in thousands, except share and per share data) Three Months Ended March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 Revenues Income from direct financing and sales-type leases $ 224,252 $ 218,905 $ 206,001 $ 201,549 Income from operating leases 10,913 10,913 10,913 10,914 Income from lease financing receivables and loans 12,843 — — — Tenant reimbursements and other income 693 — — — Golf operations 6,300 7,719 5,599 8,283 Revenues 255,001 237,537 222,513 220,746 Operating expenses General and administrative 7,015 5,109 6,717 6,518 Depreciation 867 883 1,000 1,018 Tenant reimbursements and other expenses 703 — — — Golf operations 4,370 4,538 5,423 4,848 Change in allowance for credit losses 149,508 — — — Transaction and acquisition expenses 4,517 249 993 2,867 Total operating expenses 166,980 10,779 14,133 15,251 Operating income 88,021 226,758 208,380 205,495 Interest expense (76,093) (71,448) (68,531) (54,819) Interest income 5,520 4,153 6,690 4,004 Loss from extinguishment of debt (39,059) (58,143) — — (Loss) income before income taxes (21,611) 101,320 146,539 154,680 Income tax expense (454) (607) (24) (553) Net (loss) income (22,065) 100,713 146,515 154,127 Less: Net income attributable to non-controlling interest (1,947) (2,082) (2,080) (2,078) Net (loss) income attributable to common stockholders $ (24,012) $ 98,631 $ 144,435 $ 152,049 Net (loss) income per common share Basic $ (0.05) $ 0.21 $ 0.31 $ 0.37 Diluted $ (0.05) $ 0.21 $ 0.31 $ 0.37 Weighted average number of shares of common stock outstanding Basic 465,177,425 460,689,199 460,666,295 412,309,577 Diluted 1 465,177,425 472,642,363 465,771,668 412,821,400 Impact to net (loss) income related to non-cash change in allowance for credit losses - CECL 2 $ (149,508) — — — Per share impact related to non-cash change in allowance for credit losses - CECL Basic $ (0.32) — — — Diluted $ (0.32) — — — Notes 1. For the calculation of diluted net (loss) income per common share, the diluted weighted average number of shares of common stock outstanding is equal to the basic weighted average number of shares of common stock outstanding. Refer to pages 12 and 13 for further details. 2. Refer to Note 6 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for further details. VICI Q1 2020 Supplemental Financial & Operating Data 9

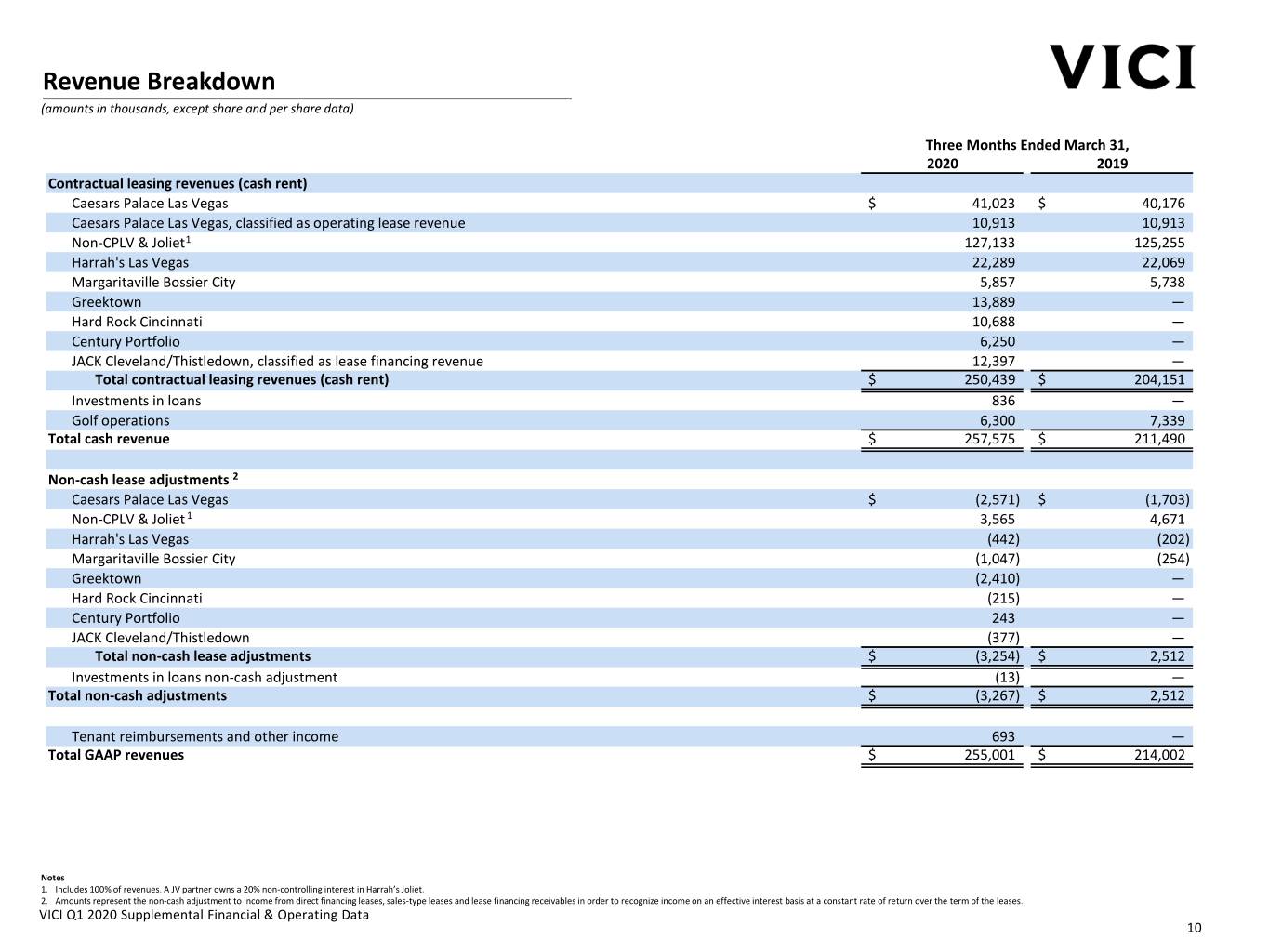

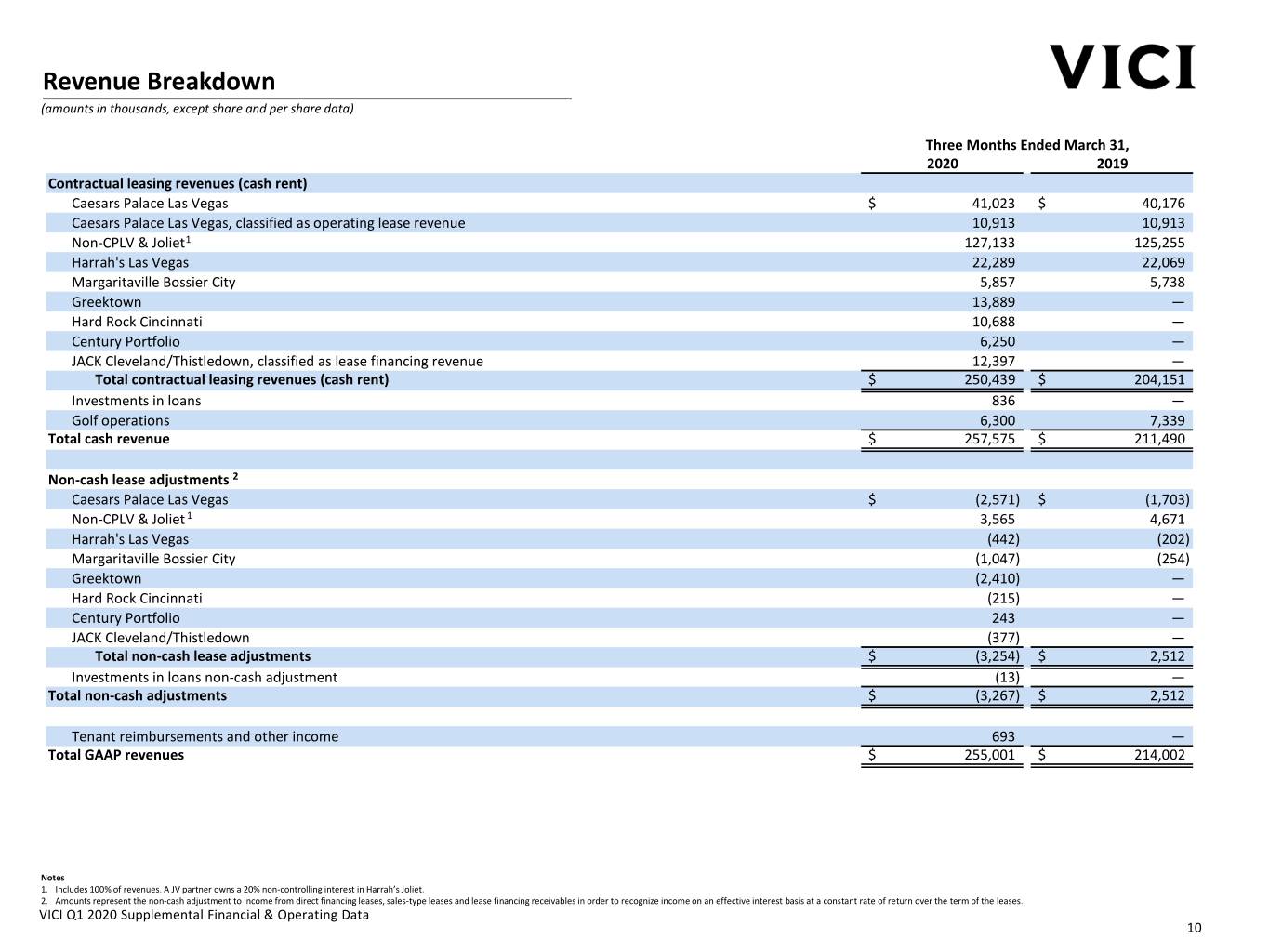

Revenue Breakdown (amounts in thousands, except share and per share data) Three Months Ended March 31, 2020 2019 Contractual leasing revenues (cash rent) Caesars Palace Las Vegas $ 41,023 $ 40,176 Caesars Palace Las Vegas, classified as operating lease revenue 10,913 10,913 Non-CPLV & Joliet 1 127,133 125,255 Harrah's Las Vegas 22,289 22,069 Margaritaville Bossier City 5,857 5,738 Greektown 13,889 — Hard Rock Cincinnati 10,688 — Century Portfolio 6,250 — JACK Cleveland/Thistledown, classified as lease financing revenue 12,397 — Total contractual leasing revenues (cash rent) $ 250,439 $ 204,151 Investments in loans 836 — Golf operations 6,300 7,339 Total cash revenue $ 257,575 $ 211,490 Non-cash lease adjustments 2 Caesars Palace Las Vegas $ (2,571) $ (1,703) Non-CPLV & Joliet 1 3,565 4,671 Harrah's Las Vegas (442) (202) Margaritaville Bossier City (1,047) (254) Greektown (2,410) — Hard Rock Cincinnati (215) — Century Portfolio 243 — JACK Cleveland/Thistledown (377) — Total non-cash lease adjustments $ (3,254) $ 2,512 Investments in loans non-cash adjustment (13) — Total non-cash adjustments $ (3,267) $ 2,512 Tenant reimbursements and other income 693 — Total GAAP revenues $ 255,001 $ 214,002 Notes 1. Includes 100% of revenues. A JV partner owns a 20% non-controlling interest in Harrah’s Joliet. 2. Amounts represent the non-cash adjustment to income from direct financing leases, sales-type leases and lease financing receivables in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases. VICI Q1 2020 Supplemental Financial & Operating Data 10

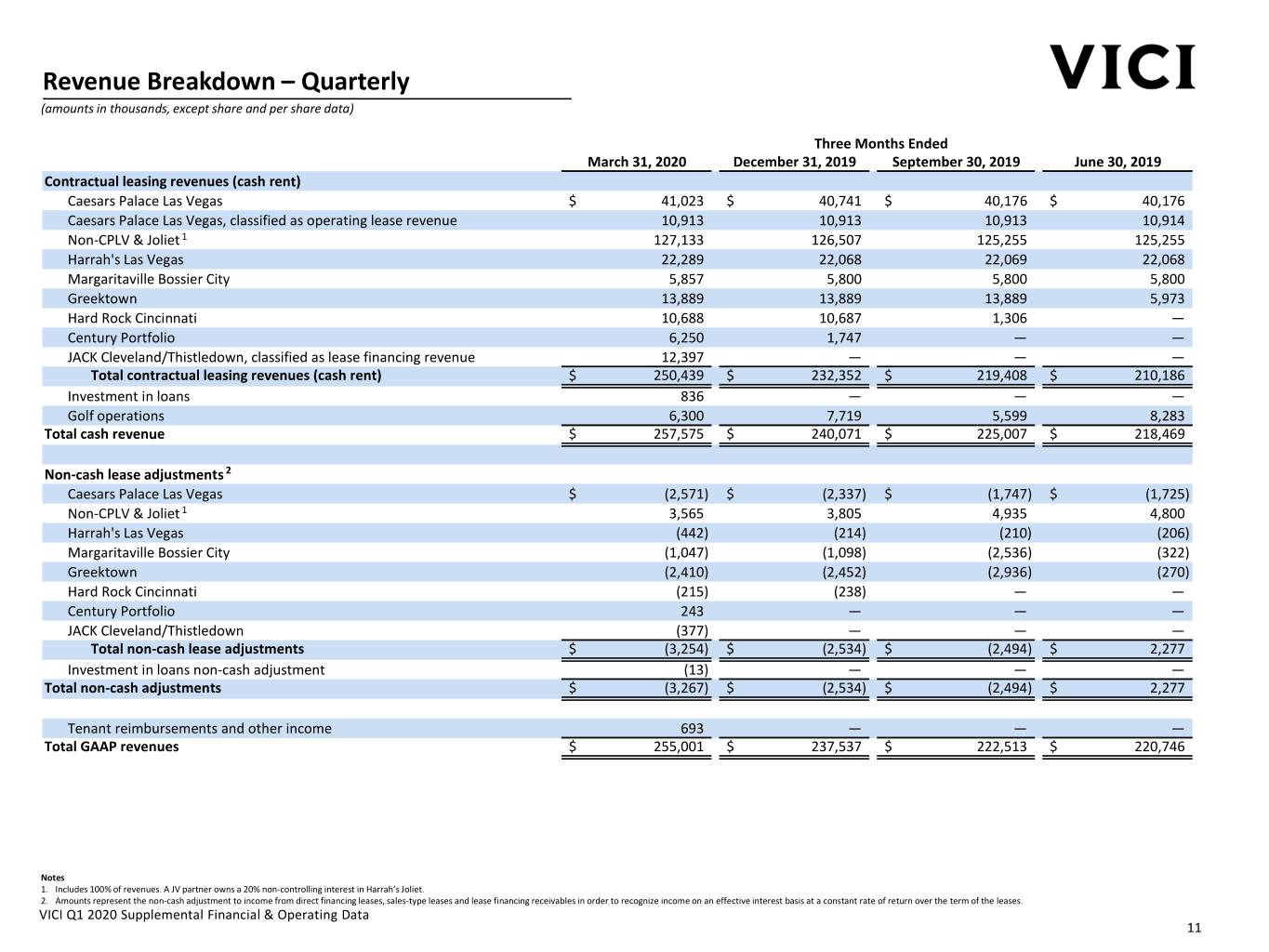

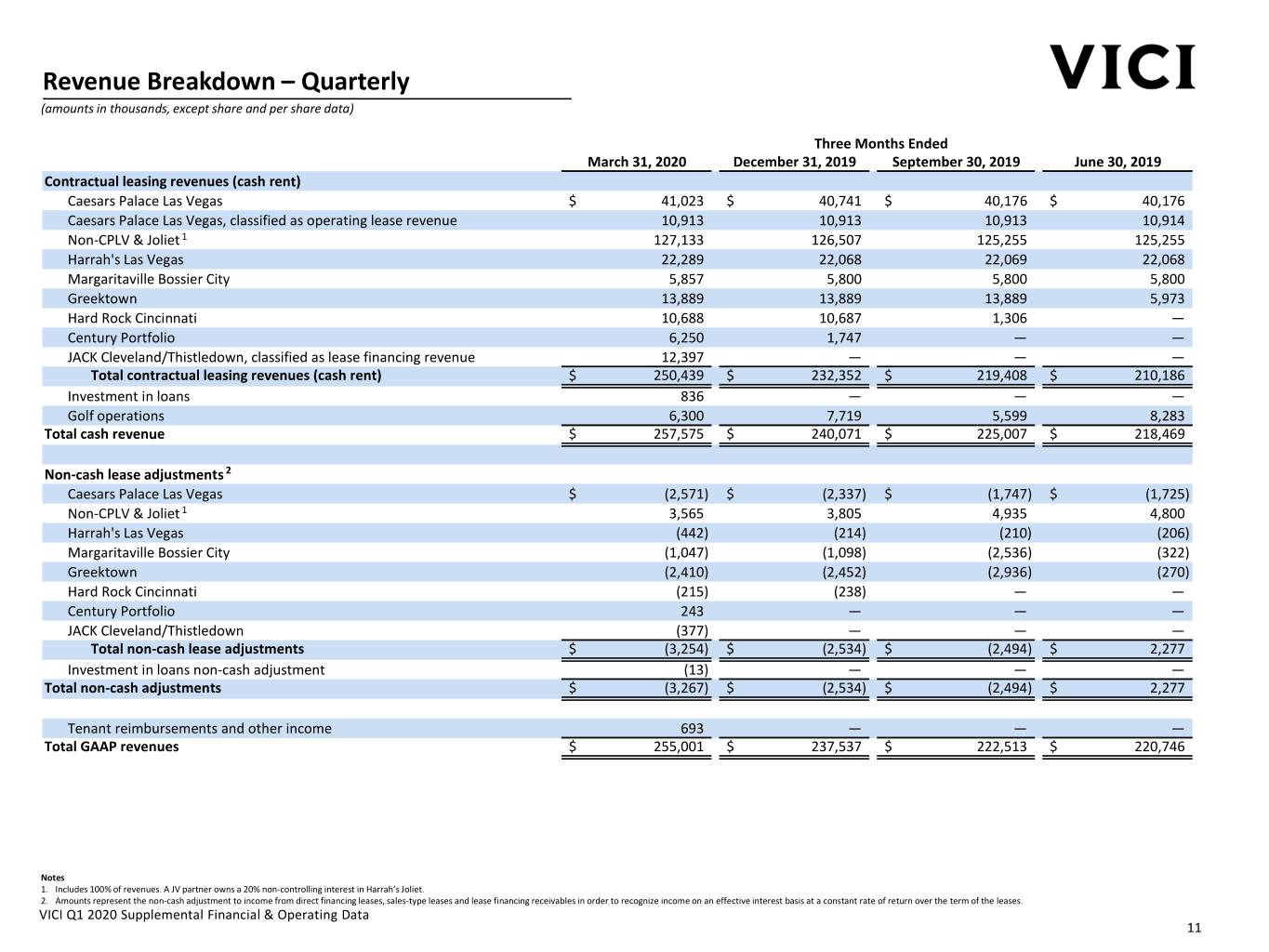

Revenue Breakdown – Quarterly (amounts in thousands, except share and per share data) Three Months Ended March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 Contractual leasing revenues (cash rent) Caesars Palace Las Vegas $ 41,023 $ 40,741 $ 40,176 $ 40,176 Caesars Palace Las Vegas, classified as operating lease revenue 10,913 10,913 10,913 10,914 Non-CPLV & Joliet 1 127,133 126,507 125,255 125,255 Harrah's Las Vegas 22,289 22,068 22,069 22,068 Margaritaville Bossier City 5,857 5,800 5,800 5,800 Greektown 13,889 13,889 13,889 5,973 Hard Rock Cincinnati 10,688 10,687 1,306 — Century Portfolio 6,250 1,747 — — JACK Cleveland/Thistledown, classified as lease financing revenue 12,397 — — — Total contractual leasing revenues (cash rent) $ 250,439 $ 232,352 $ 219,408 $ 210,186 Investment in loans 836 — — — Golf operations 6,300 7,719 5,599 8,283 Total cash revenue $ 257,575 $ 240,071 $ 225,007 $ 218,469 Non-cash lease adjustments 2 Caesars Palace Las Vegas $ (2,571) $ (2,337) $ (1,747) $ (1,725) Non-CPLV & Joliet 1 3,565 3,805 4,935 4,800 Harrah's Las Vegas (442) (214) (210) (206) Margaritaville Bossier City (1,047) (1,098) (2,536) (322) Greektown (2,410) (2,452) (2,936) (270) Hard Rock Cincinnati (215) (238) — — Century Portfolio 243 — — — JACK Cleveland/Thistledown (377) — — — Total non-cash lease adjustments $ (3,254) $ (2,534) $ (2,494) $ 2,277 Investment in loans non-cash adjustment (13) — — — Total non-cash adjustments $ (3,267) $ (2,534) $ (2,494) $ 2,277 Tenant reimbursements and other income 693 — — — Total GAAP revenues $ 255,001 $ 237,537 $ 222,513 $ 220,746 Notes 1. Includes 100% of revenues. A JV partner owns a 20% non-controlling interest in Harrah’s Joliet. 2. Amounts represent the non-cash adjustment to income from direct financing leases, sales-type leases and lease financing receivables in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases. VICI Q1 2020 Supplemental Financial & Operating Data 11

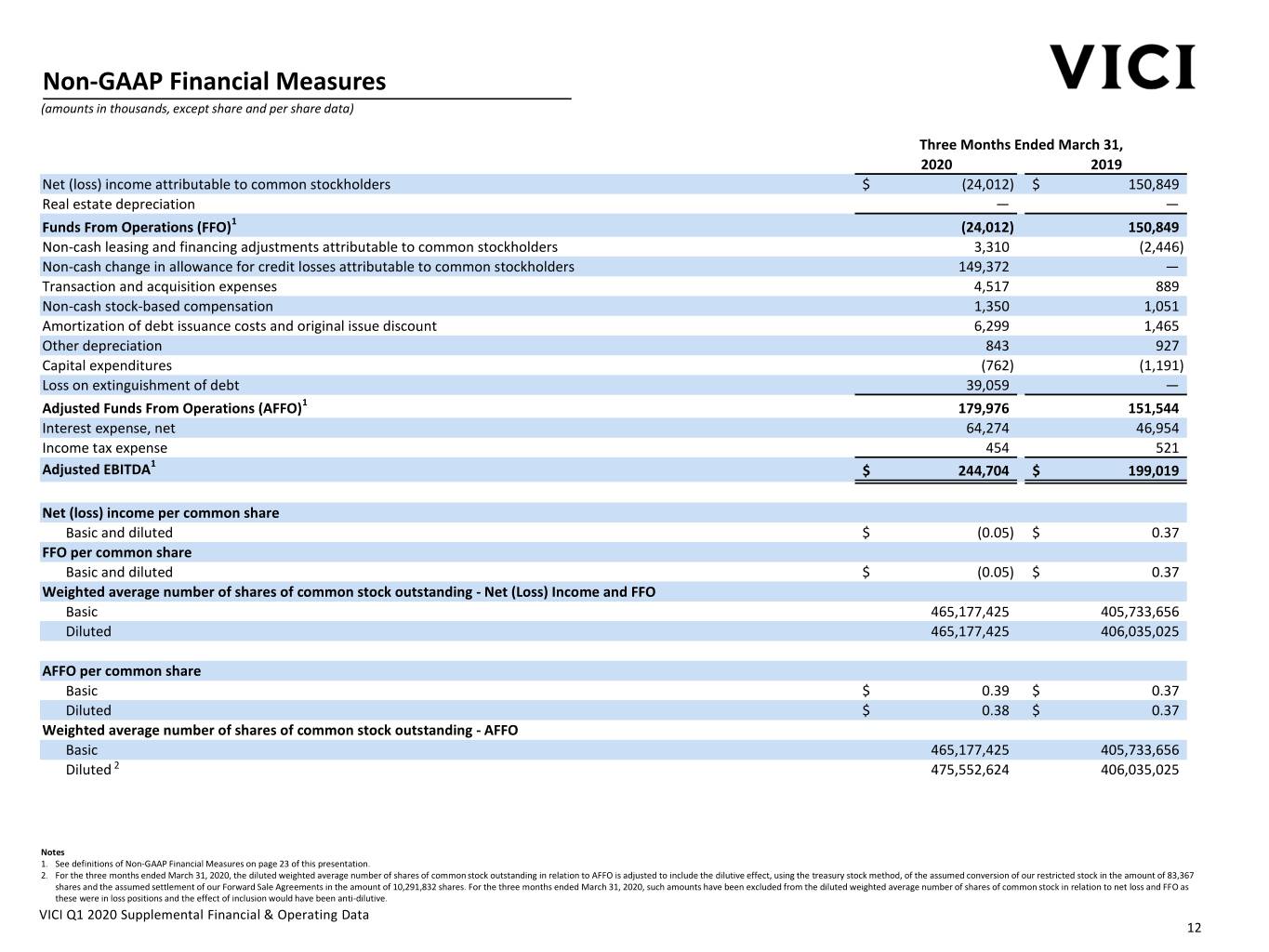

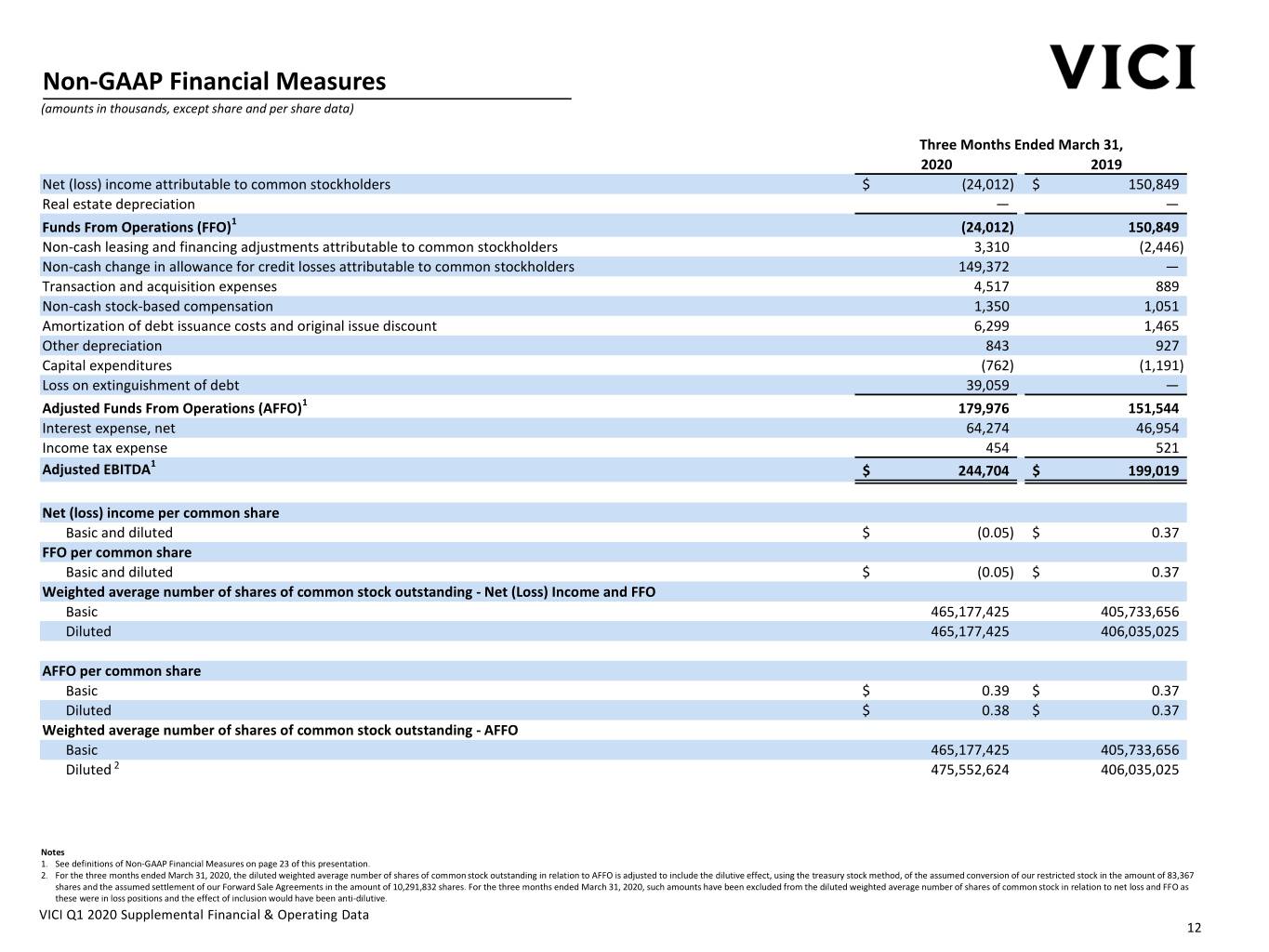

Non‐GAAP Financial Measures (amounts in thousands, except share and per share data) Three Months Ended March 31, 2020 2019 Net (loss) income attributable to common stockholders $ (24,012) $ 150,849 Real estate depreciation — — Funds From Operations (FFO)1 (24,012) 150,849 Non-cash leasing and financing adjustments attributable to common stockholders 3,310 (2,446) Non-cash change in allowance for credit losses attributable to common stockholders 149,372 — Transaction and acquisition expenses 4,517 889 Non-cash stock-based compensation 1,350 1,051 Amortization of debt issuance costs and original issue discount 6,299 1,465 Other depreciation 843 927 Capital expenditures (762) (1,191) Loss on extinguishment of debt 39,059 — Adjusted Funds From Operations (AFFO)1 179,976 151,544 Interest expense, net 64,274 46,954 Income tax expense 454 521 Adjusted EBITDA1 $ 244,704 $ 199,019 Net (loss) income per common share Basic and diluted $ (0.05) $ 0.37 FFO per common share Basic and diluted $ (0.05) $ 0.37 Weighted average number of shares of common stock outstanding - Net (Loss) Income and FFO Basic 465,177,425 405,733,656 Diluted 465,177,425 406,035,025 AFFO per common share Basic $ 0.39 $ 0.37 Diluted $ 0.38 $ 0.37 Weighted average number of shares of common stock outstanding - AFFO Basic 465,177,425 405,733,656 Diluted 2 475,552,624 406,035,025 Notes 1. See definitions of Non-GAAP Financial Measures on page 23 of this presentation. 2. For the three months ended March 31, 2020, the diluted weighted average number of shares of common stock outstanding in relation to AFFO is adjusted to include the dilutive effect, using the treasury stock method, of the assumed conversion of our restricted stock in the amount of 83,367 shares and the assumed settlement of our Forward Sale Agreements in the amount of 10,291,832 shares. For the three months ended March 31, 2020, such amounts have been excluded from the diluted weighted average number of shares of common stock in relation to net loss and FFO as these were in loss positions and the effect of inclusion would have been anti-dilutive. VICI Q1 2020 Supplemental Financial & Operating Data 12

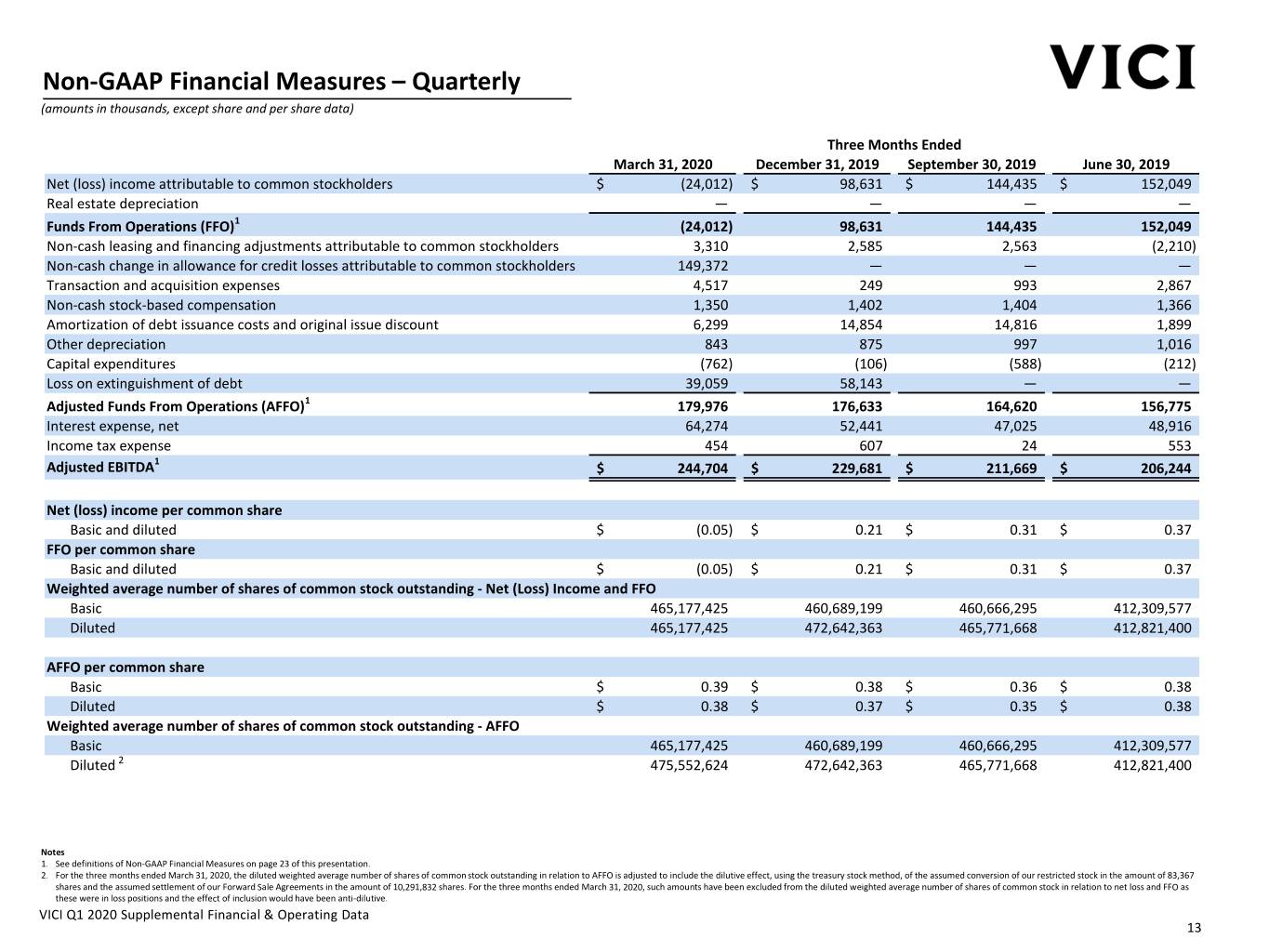

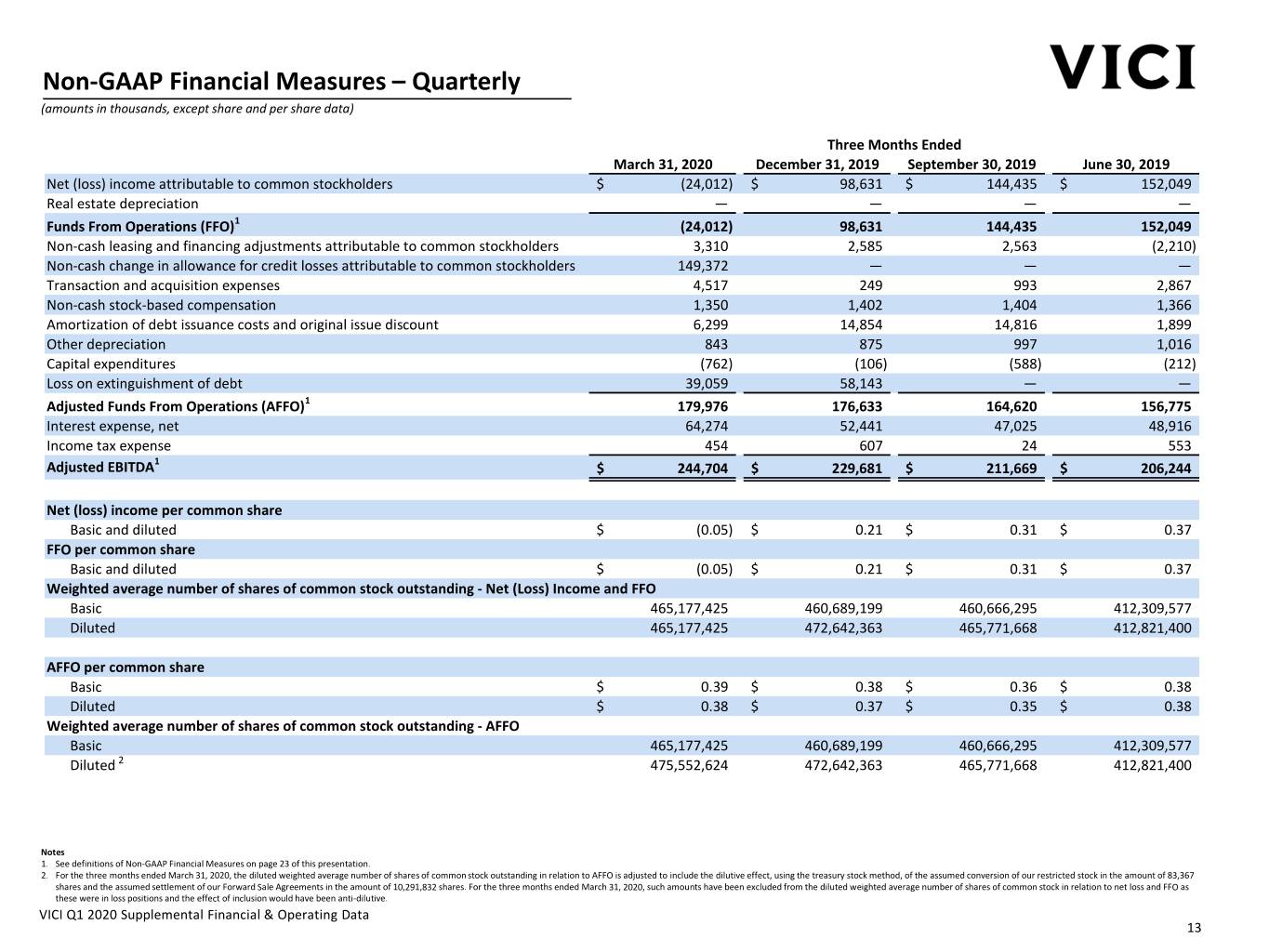

Non‐GAAP Financial Measures – Quarterly (amounts in thousands, except share and per share data) Three Months Ended March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 Net (loss) income attributable to common stockholders $ (24,012) $ 98,631 $ 144,435 $ 152,049 Real estate depreciation — — — — Funds From Operations (FFO)1 (24,012) 98,631 144,435 152,049 Non-cash leasing and financing adjustments attributable to common stockholders 3,310 2,585 2,563 (2,210) Non-cash change in allowance for credit losses attributable to common stockholders 149,372 — — — Transaction and acquisition expenses 4,517 249 993 2,867 Non-cash stock-based compensation 1,350 1,402 1,404 1,366 Amortization of debt issuance costs and original issue discount 6,299 14,854 14,816 1,899 Other depreciation 843 875 997 1,016 Capital expenditures (762) (106) (588) (212) Loss on extinguishment of debt 39,059 58,143 — — Adjusted Funds From Operations (AFFO)1 179,976 176,633 164,620 156,775 Interest expense, net 64,274 52,441 47,025 48,916 Income tax expense 454 607 24 553 Adjusted EBITDA1 $ 244,704 $ 229,681 $ 211,669 $ 206,244 Net (loss) income per common share Basic and diluted $ (0.05) $ 0.21 $ 0.31 $ 0.37 FFO per common share Basic and diluted $ (0.05) $ 0.21 $ 0.31 $ 0.37 Weighted average number of shares of common stock outstanding - Net (Loss) Income and FFO Basic 465,177,425 460,689,199 460,666,295 412,309,577 Diluted 465,177,425 472,642,363 465,771,668 412,821,400 AFFO per common share Basic $ 0.39 $ 0.38 $ 0.36 $ 0.38 Diluted $ 0.38 $ 0.37 $ 0.35 $ 0.38 Weighted average number of shares of common stock outstanding - AFFO Basic 465,177,425 460,689,199 460,666,295 412,309,577 Diluted 2 475,552,624 472,642,363 465,771,668 412,821,400 Notes 1. See definitions of Non-GAAP Financial Measures on page 23 of this presentation. 2. For the three months ended March 31, 2020, the diluted weighted average number of shares of common stock outstanding in relation to AFFO is adjusted to include the dilutive effect, using the treasury stock method, of the assumed conversion of our restricted stock in the amount of 83,367 shares and the assumed settlement of our Forward Sale Agreements in the amount of 10,291,832 shares. For the three months ended March 31, 2020, such amounts have been excluded from the diluted weighted average number of shares of common stock in relation to net loss and FFO as these were in loss positions and the effect of inclusion would have been anti-dilutive. VICI Q1 2020 Supplemental Financial & Operating Data 13

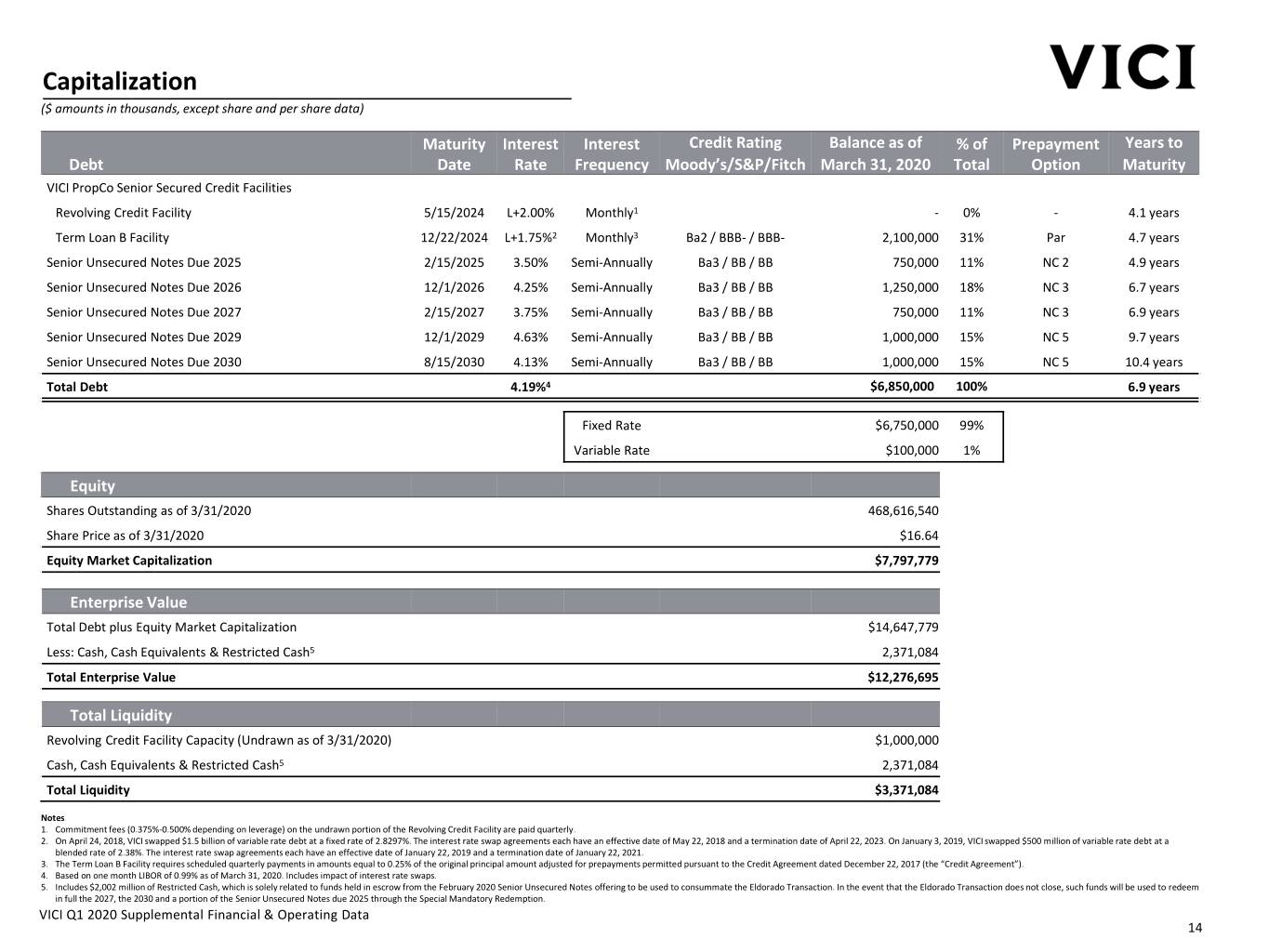

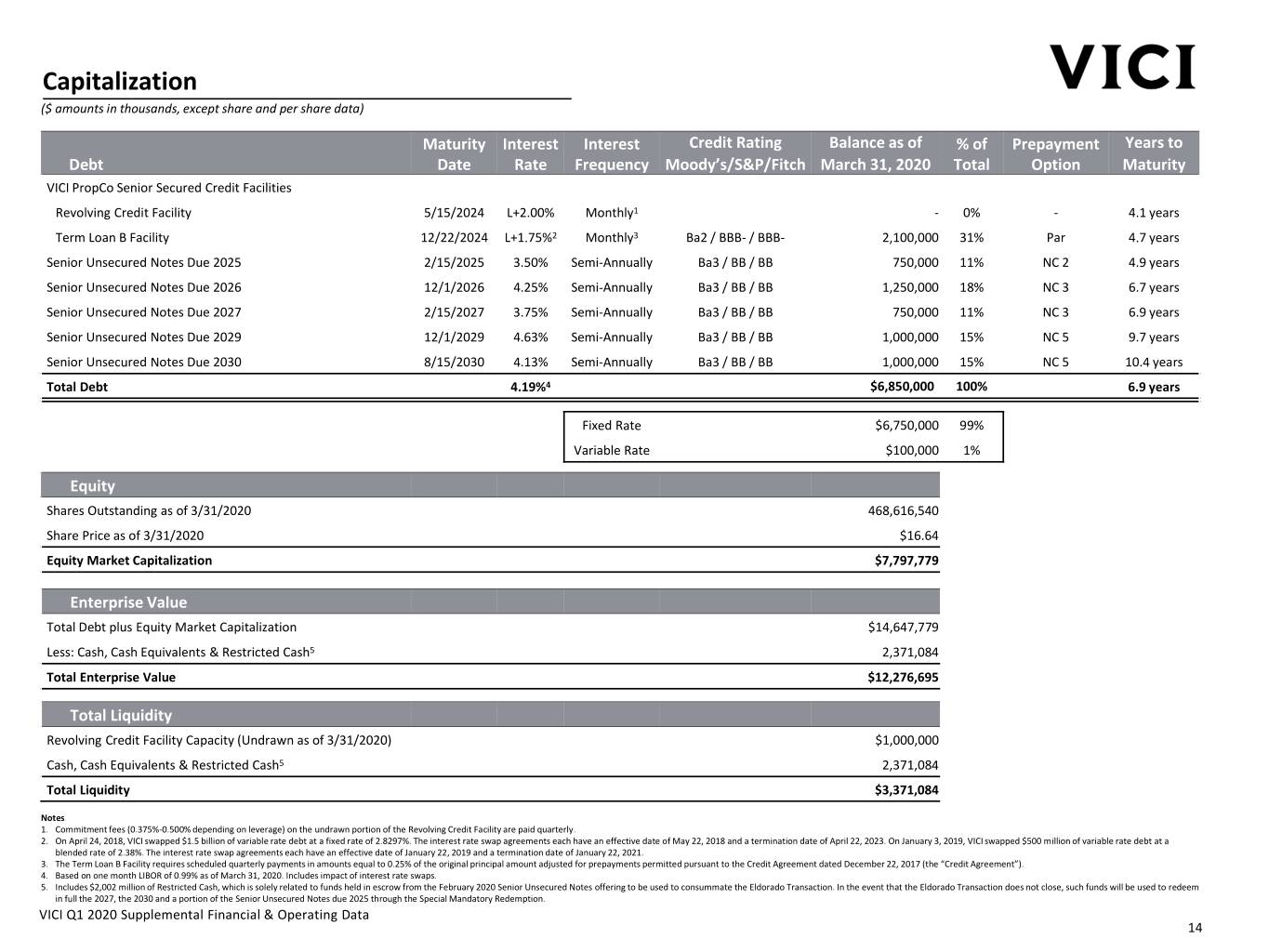

Capitalization ($ amounts in thousands, except share and per share data) Maturity Interest Interest Credit Rating Balance as of % of Prepayment Years to Debt Date Rate Frequency Moody’s/S&P/Fitch March 31, 2020 Total Option Maturity VICI PropCo Senior Secured Credit Facilities Revolving Credit Facility 5/15/2024 L+2.00% Monthly1 - 0% ‐ 4.1 years Term Loan B Facility 12/22/2024 L+1.75%2 Monthly3 Ba2 / BBB- / BBB- 2,100,000 31% Par 4.7 years Senior Unsecured Notes Due 2025 2/15/2025 3.50% Semi-Annually Ba3 / BB / BB 750,000 11% NC 2 4.9 years Senior Unsecured Notes Due 2026 12/1/2026 4.25% Semi‐Annually Ba3 / BB / BB 1,250,000 18% NC 3 6.7 years Senior Unsecured Notes Due 2027 2/15/2027 3.75% Semi-Annually Ba3 / BB / BB 750,000 11% NC 3 6.9 years Senior Unsecured Notes Due 2029 12/1/2029 4.63% Semi‐Annually Ba3 / BB / BB 1,000,000 15% NC 5 9.7 years Senior Unsecured Notes Due 2030 8/15/2030 4.13% Semi-Annually Ba3 / BB / BB 1,000,000 15% NC 5 10.4 years Total Debt 4.19%4 $6,850,000 100% 6.9 years Fixed Rate $6,750,000 99% Variable Rate $100,000 1% Equity Shares Outstanding as of 3/31/2020 468,616,540 Share Price as of 3/31/2020 $16.64 Equity Market Capitalization $7,797,779 Enterprise Value Total Debt plus Equity Market Capitalization $14,647,779 Less: Cash, Cash Equivalents & Restricted Cash5 2,371,084 Total Enterprise Value $12,276,695 Total Liquidity Revolving Credit Facility Capacity (Undrawn as of 3/31/2020) $1,000,000 Cash, Cash Equivalents & Restricted Cash5 2,371,084 Total Liquidity $3,371,084 Notes 1. Commitment fees (0.375%-0.500% depending on leverage) on the undrawn portion of the Revolving Credit Facility are paid quarterly. 2. On April 24, 2018, VICI swapped $1.5 billion of variable rate debt at a fixed rate of 2.8297%. The interest rate swap agreements each have an effective date of May 22, 2018 and a termination date of April 22, 2023. On January 3, 2019, VICI swapped $500 million of variable rate debt at a blended rate of 2.38%. The interest rate swap agreements each have an effective date of January 22, 2019 and a termination date of January 22, 2021. 3. The Term Loan B Facility requires scheduled quarterly payments in amounts equal to 0.25% of the original principal amount adjusted for prepayments permitted pursuant to the Credit Agreement dated December 22, 2017 (the “Credit Agreement”). 4. Based on one month LIBOR of 0.99% as of March 31, 2020. Includes impact of interest rate swaps. 5. Includes $2,002 million of Restricted Cash, which is solely related to funds held in escrow from the February 2020 Senior Unsecured Notes offering to be used to consummate the Eldorado Transaction. In the event that the Eldorado Transaction does not close, such funds will be used to redeem in full the 2027, the 2030 and a portion of the Senior Unsecured Notes due 2025 through the Special Mandatory Redemption. VICI Q1 2020 Supplemental Financial & Operating Data 14

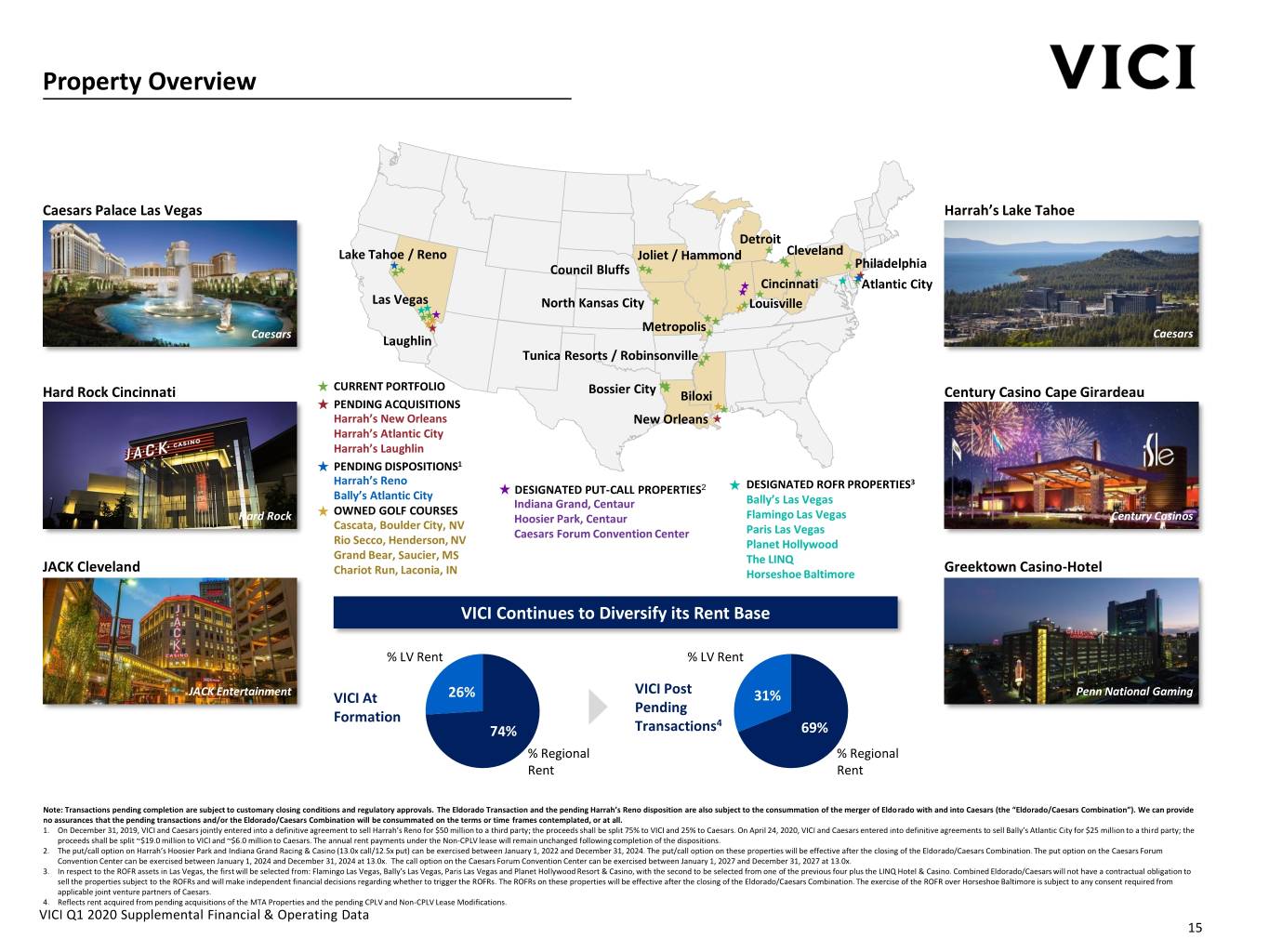

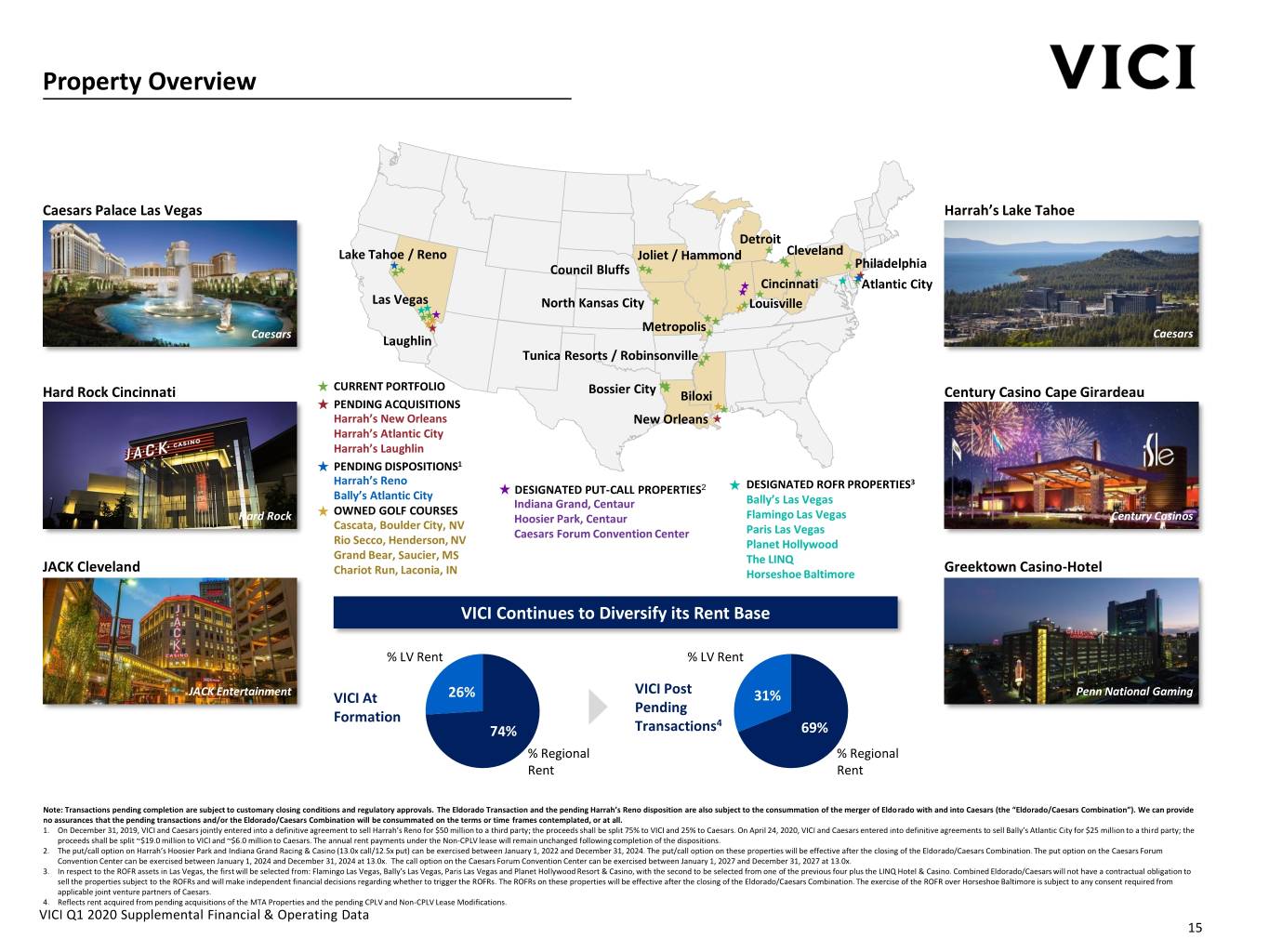

Property Overview Caesars Palace Las Vegas Harrah’s Lake Tahoe Detroit Lake Tahoe / Reno Joliet / Hammond Cleveland Council Bluffs Philadelphia Cincinnati Atlantic City Las Vegas North Kansas City Louisville Metropolis Caesars Caesars Laughlin Tunica Resorts / Robinsonville CURRENT PORTFOLIO Bossier City Hard Rock Cincinnati Biloxi Century Casino Cape Girardeau PENDING ACQUISITIONS Harrah’s New Orleans New Orleans Harrah’s Atlantic City Harrah’s Laughlin PENDING DISPOSITIONS1 Harrah’s Reno 3 2 DESIGNATED ROFR PROPERTIES Bally’s Atlantic City DESIGNATED PUT-CALL PROPERTIES Indiana Grand, Centaur Bally’s Las Vegas OWNED GOLF COURSES Hard Rock Hoosier Park, Centaur Flamingo Las Vegas Century Casinos Cascata, Boulder City, NV Caesars Forum Convention Center Paris Las Vegas Rio Secco, Henderson, NV Planet Hollywood Grand Bear, Saucier, MS The LINQ JACK Cleveland Chariot Run, Laconia, IN Horseshoe Baltimore Greektown Casino-Hotel VICI Continues to Diversify its Rent Base % LV Rent % LV Rent VICI Post JACK Entertainment VICI At 26% 31% Penn National Gaming Pending Formation 4 74% Transactions 69% % Regional % Regional Rent Rent Note: Transactions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction and the pending Harrah’s Reno disposition are also subject to the consummation of the merger of Eldorado with and into Caesars (the “Eldorado/Caesars Combination”). We can provide no assurances that the pending transactions and/or the Eldorado/Caesars Combination will be consummated on the terms or time frames contemplated, or at all. 1. On December 31, 2019, VICI and Caesars jointly entered into a definitive agreement to sell Harrah’s Reno for $50 million to a third party; the proceeds shall be split 75% to VICI and 25% to Caesars. On April 24, 2020, VICI and Caesars entered into definitive agreements to sell Bally’s Atlantic City for $25 million to a third party; the proceeds shall be split ~$19.0 million to VICI and ~$6.0 million to Caesars. The annual rent payments under the Non-CPLV lease will remain unchanged following completion of the dispositions. 2. The put/call option on Harrah’s Hoosier Park and Indiana Grand Racing & Casino (13.0x call/12.5x put) can be exercised between January 1, 2022 and December 31, 2024. The put/call option on these properties will be effective after the closing of the Eldorado/Caesars Combination. The put option on the Caesars Forum Convention Center can be exercised between January 1, 2024 and December 31, 2024 at 13.0x. The call option on the Caesars Forum Convention Center can be exercised between January 1, 2027 and December 31, 2027 at 13.0x. 3. In respect to the ROFR assets in Las Vegas, the first will be selected from: Flamingo Las Vegas, Bally’s Las Vegas, Paris Las Vegas and Planet Hollywood Resort & Casino, with the second to be selected from one of the previous four plus the LINQ Hotel & Casino. Combined Eldorado/Caesars will not have a contractual obligation to sell the properties subject to the ROFRs and will make independent financial decisions regarding whether to trigger the ROFRs. The ROFRs on these properties will be effective after the closing of the Eldorado/Caesars Combination. The exercise of the ROFR over Horseshoe Baltimore is subject to any consent required from applicable joint venture partners of Caesars. 4. Reflects rent acquired from pending acquisitions of the MTA Properties and the pending CPLV and Non-CPLV Lease Modifications. VICI Q1 2020 Supplemental Financial & Operating Data 15

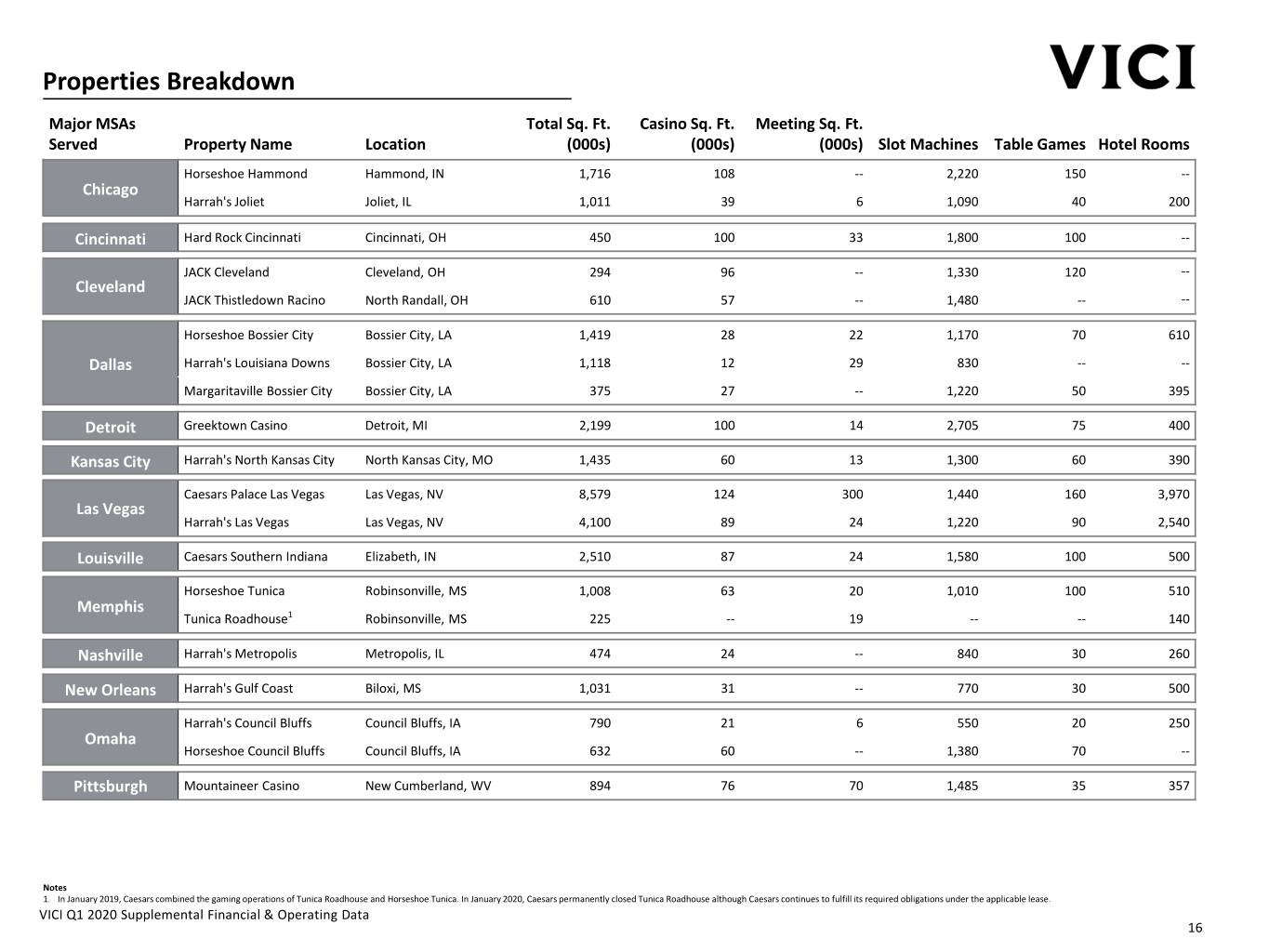

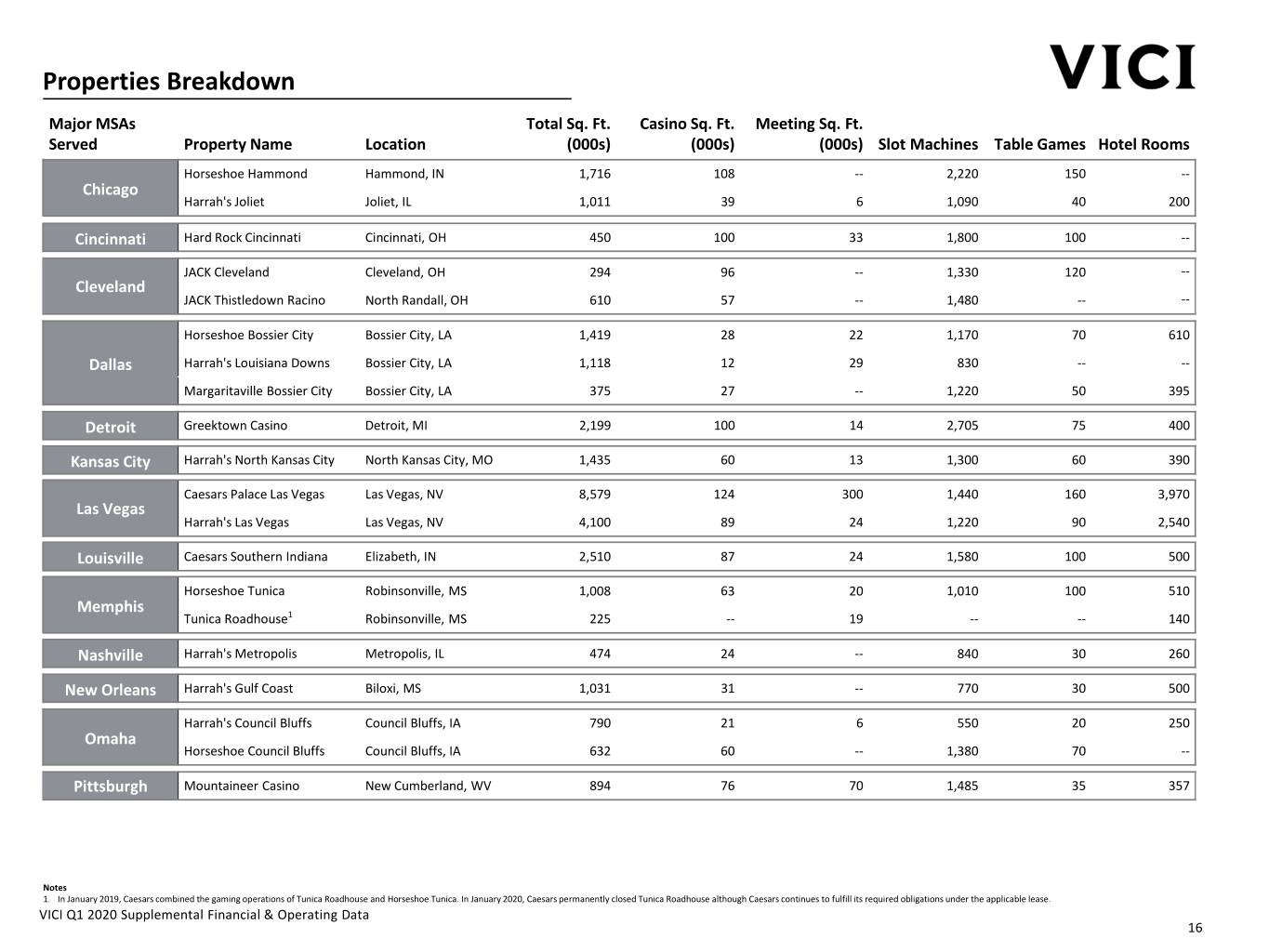

Properties Breakdown Major MSAs Total Sq. Ft. Casino Sq. Ft. Meeting Sq. Ft. Served Property Name Location (000s) (000s) (000s) Slot Machines Table Games Hotel Rooms Horseshoe Hammond Hammond, IN 1,716 108 -- 2,220 150 -- Chicago Harrah's Joliet Joliet, IL 1,011 39 6 1,090 40 200 Cincinnati Hard Rock Cincinnati Cincinnati, OH 450 100 33 1,800 100 -- JACK Cleveland Cleveland, OH 294 96 -- 1,330 120 -- Cleveland JACK Thistledown Racino North Randall, OH 610 57 -- 1,480 -- -- Horseshoe Bossier City Bossier City, LA 1,419 28 22 1,170 70 610 Dallas Harrah's Louisiana Downs Bossier City, LA 1,118 12 29 830 -- -- Margaritaville Bossier City Bossier City, LA 375 27 -- 1,220 50 395 Detroit Greektown Casino Detroit, MI 2,199 100 14 2,705 75 400 Kansas City Harrah's North Kansas City North Kansas City, MO 1,435 60 13 1,300 60 390 Caesars Palace Las Vegas Las Vegas, NV 8,579 124 300 1,440 160 3,970 Las Vegas Harrah's Las Vegas Las Vegas, NV 4,100 89 24 1,220 90 2,540 Louisville Caesars Southern Indiana Elizabeth, IN 2,510 87 24 1,580 100 500 Horseshoe Tunica Robinsonville, MS 1,008 63 20 1,010 100 510 Memphis Tunica Roadhouse1 Robinsonville, MS 225 -- 19 -- -- 140 Nashville Harrah's Metropolis Metropolis, IL 474 24 -- 840 30 260 New Orleans Harrah's Gulf Coast Biloxi, MS 1,031 31 -- 770 30 500 Harrah's Council Bluffs Council Bluffs, IA 790 21 6 550 20 250 Omaha Horseshoe Council Bluffs Council Bluffs, IA 632 60 -- 1,380 70 -- Pittsburgh Mountaineer Casino New Cumberland, WV 894 76 70 1,485 35 357 Notes 1. In January 2019, Caesars combined the gaming operations of Tunica Roadhouse and Horseshoe Tunica. In January 2020, Caesars permanently closed Tunica Roadhouse although Caesars continues to fulfill its required obligations under the applicable lease. VICI Q1 2020 Supplemental Financial & Operating Data 16

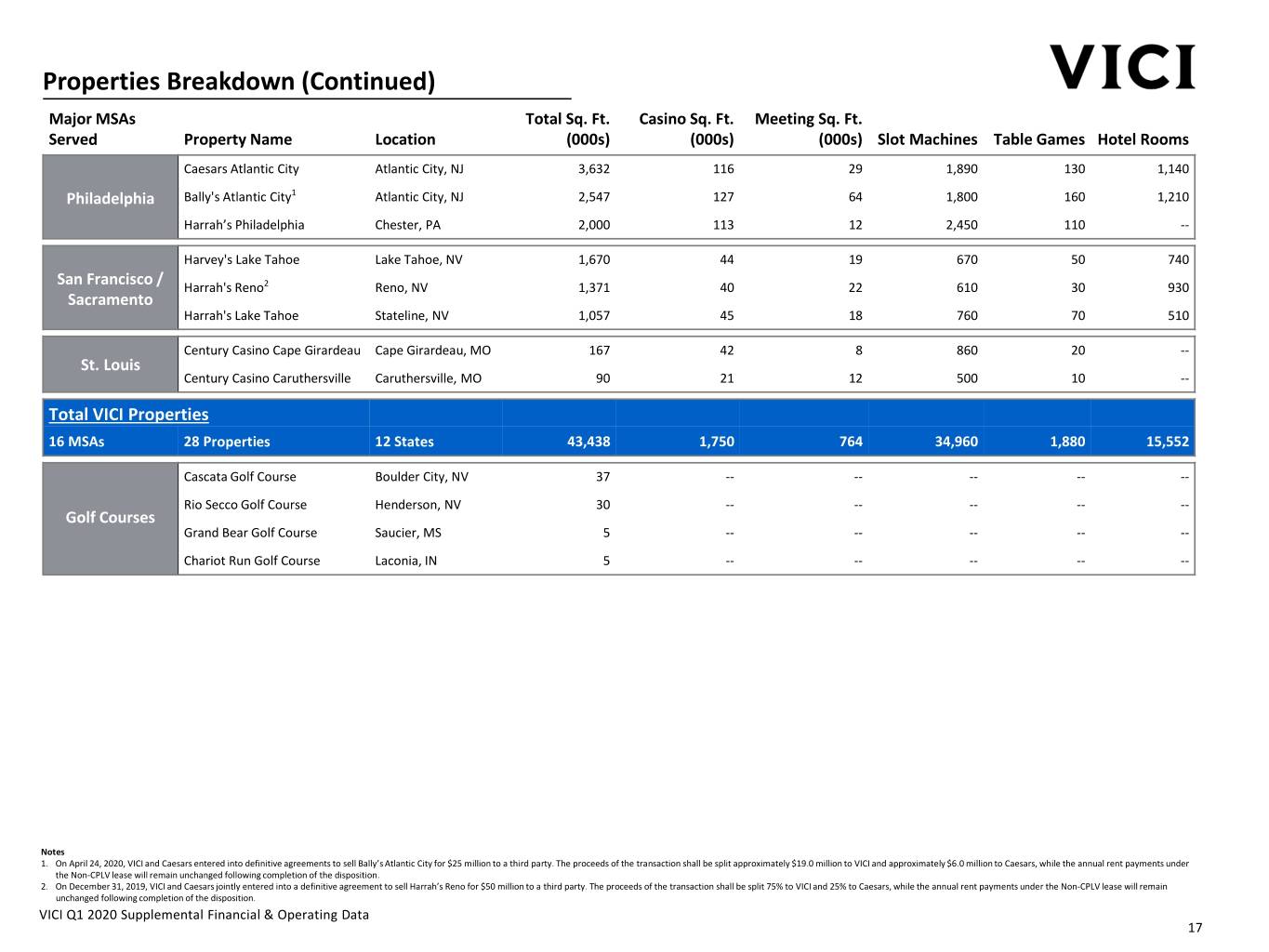

Properties Breakdown (Continued) Major MSAs Total Sq. Ft. Casino Sq. Ft. Meeting Sq. Ft. Served Property Name Location (000s) (000s) (000s) Slot Machines Table Games Hotel Rooms Caesars Atlantic City Atlantic City, NJ 3,632 116 29 1,890 130 1,140 Philadelphia Bally's Atlantic City1 Atlantic City, NJ 2,547 127 64 1,800 160 1,210 Harrah’s Philadelphia Chester, PA 2,000 113 12 2,450 110 -- Harvey's Lake Tahoe Lake Tahoe, NV 1,670 44 19 670 50 740 San Francisco / Harrah's Reno2 Reno, NV 1,371 40 22 610 30 930 Sacramento Harrah's Lake Tahoe Stateline, NV 1,057 45 18 760 70 510 Century Casino Cape Girardeau Cape Girardeau, MO 167 42 8 860 20 -- St. Louis Century Casino Caruthersville Caruthersville, MO 90 21 12 500 10 -- Total VICI Properties 16 MSAs 28 Properties 12 States 43,438 1,750 764 34,960 1,880 15,552 Cascata Golf Course Boulder City, NV 37 -- -- -- -- -- Rio Secco Golf Course Henderson, NV 30 -- -- -- -- -- Golf Courses Grand Bear Golf Course Saucier, MS 5 -- -- -- -- -- Chariot Run Golf Course Laconia, IN 5 -- -- -- -- -- Notes 1. On April 24, 2020, VICI and Caesars entered into definitive agreements to sell Bally’s Atlantic City for $25 million to a third party. The proceeds of the transaction shall be split approximately $19.0 million to VICI and approximately $6.0 million to Caesars, while the annual rent payments under the Non-CPLV lease will remain unchanged following completion of the disposition. 2. On December 31, 2019, VICI and Caesars jointly entered into a definitive agreement to sell Harrah’s Reno for $50 million to a third party. The proceeds of the transaction shall be split 75% to VICI and 25% to Caesars, while the annual rent payments under the Non-CPLV lease will remain unchanged following completion of the disposition. VICI Q1 2020 Supplemental Financial & Operating Data 17

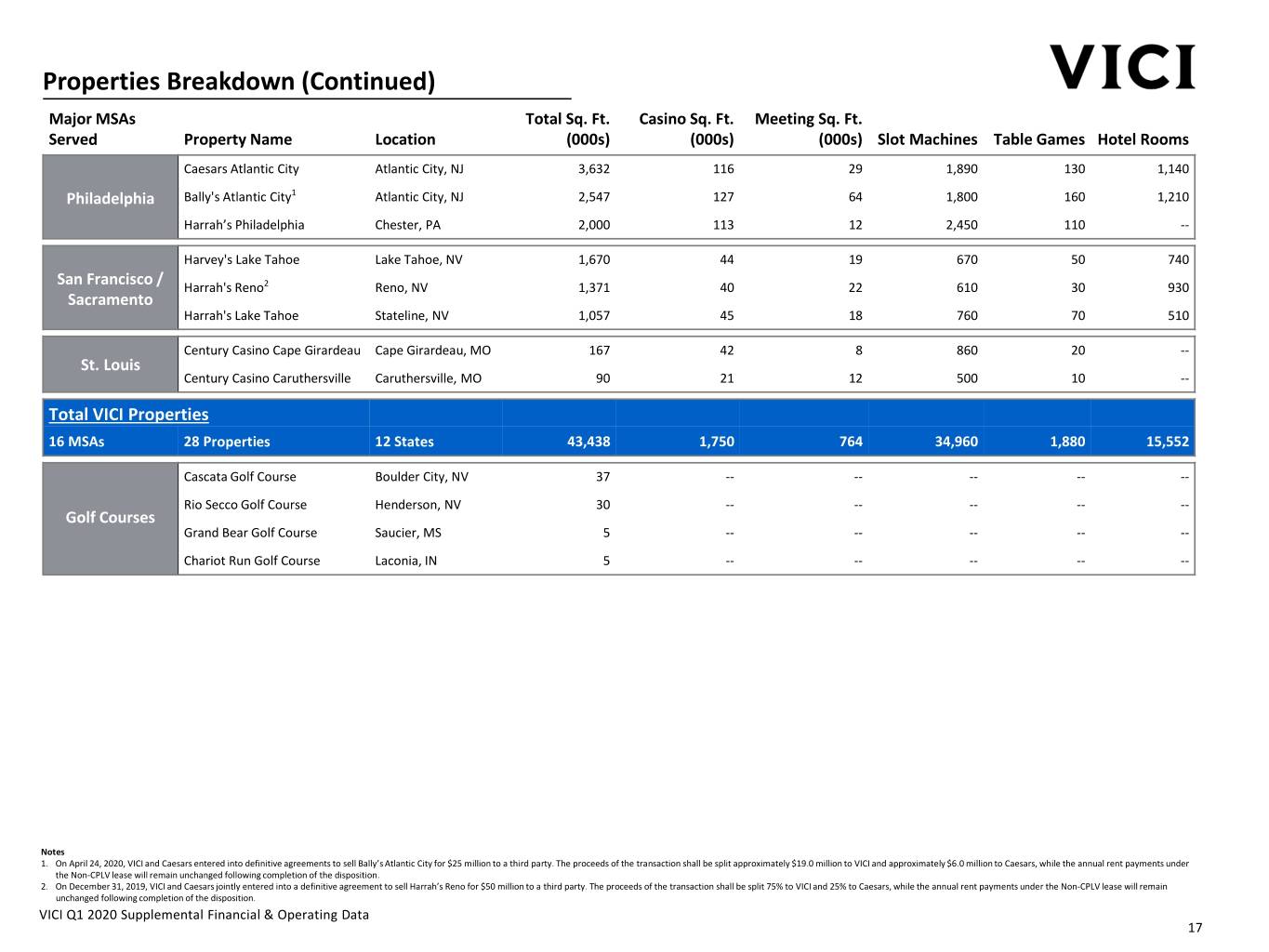

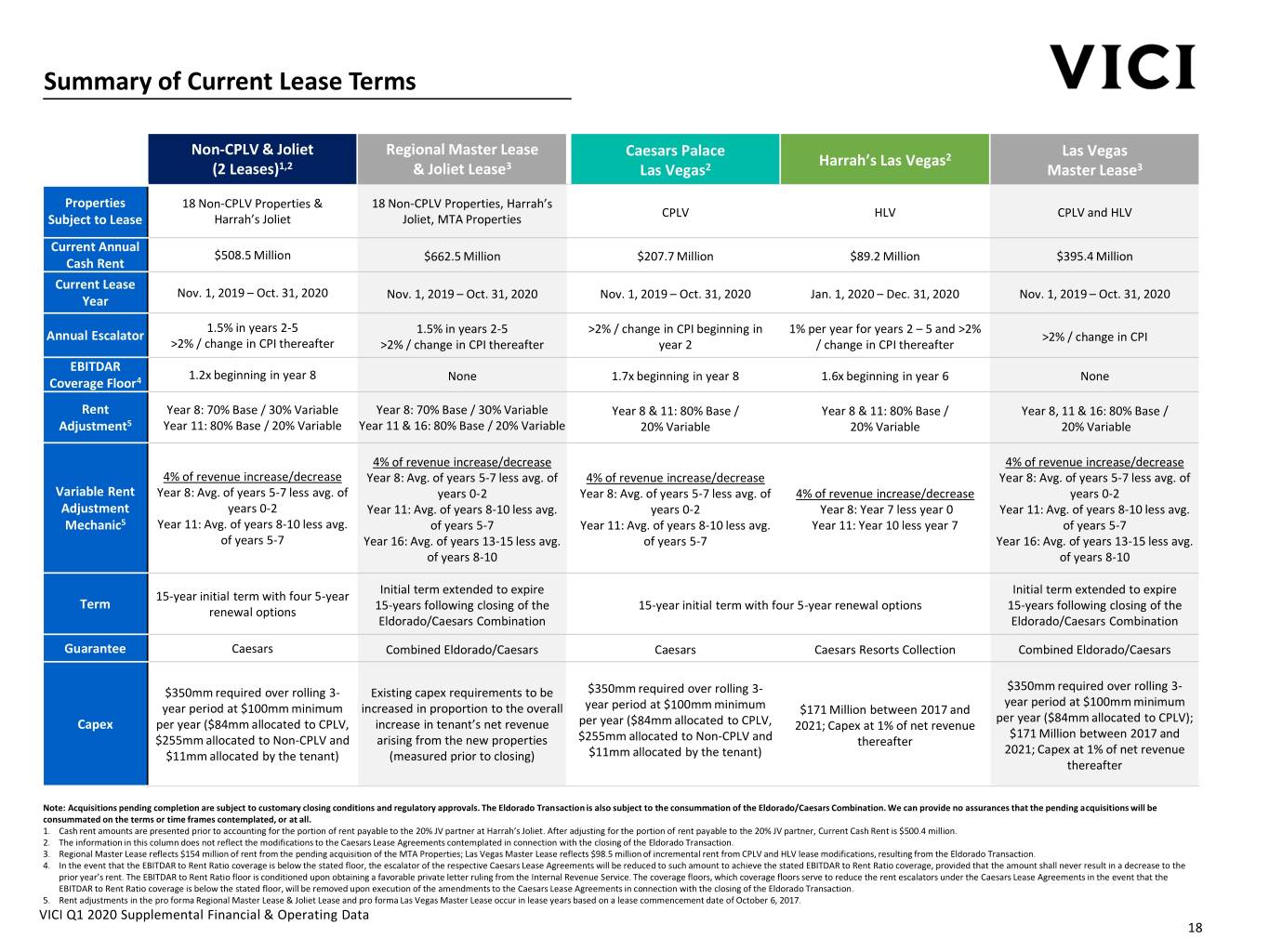

Summary of Current Lease Terms Non-CPLV & Joliet Regional Master Lease Caesars Palace Las Vegas Harrah’s Las Vegas2 (2 Leases)1,2 & Joliet Lease3 Las Vegas2 Master Lease3 Properties 18 Non-CPLV Properties & 18 Non-CPLV Properties, Harrah’s CPLV HLV CPLV and HLV Subject to Lease Harrah’s Joliet Joliet, MTA Properties Current Annual $508.5 Million $662.5 Million $207.7 Million $89.2 Million $395.4 Million Cash Rent Current Lease Nov. 1, 2019 – Oct. 31, 2020 Nov. 1, 2019 – Oct. 31, 2020 Nov. 1, 2019 – Oct. 31, 2020 Jan. 1, 2020 – Dec. 31, 2020 Nov. 1, 2019 – Oct. 31, 2020 Year 1.5% in years 2-5 1.5% in years 2-5 >2% / change in CPI beginning in 1% per year for years 2 – 5 and >2% Annual Escalator >2% / change in CPI >2% / change in CPI thereafter >2% / change in CPI thereafter year 2 / change in CPI thereafter EBITDAR 1.2x beginning in year 8 None 1.7x beginning in year 8 1.6x beginning in year 6 None Coverage Floor4 Rent Year 8: 70% Base / 30% Variable Year 8: 70% Base / 30% Variable Year 8 & 11: 80% Base / Year 8 & 11: 80% Base / Year 8, 11 & 16: 80% Base / Adjustment5 Year 11: 80% Base / 20% Variable Year 11 & 16: 80% Base / 20% Variable 20% Variable 20% Variable 20% Variable 4% of revenue increase/decrease 4% of revenue increase/decrease 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of Variable Rent Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 8: Avg. of years 5-7 less avg. of 4% of revenue increase/decrease years 0-2 Adjustment years 0-2 Year 11: Avg. of years 8-10 less avg. years 0-2 Year 8: Year 7 less year 0 Year 11: Avg. of years 8-10 less avg. Mechanic5 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 11: Avg. of years 8-10 less avg. Year 11: Year 10 less year 7 of years 5-7 of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 of years 8-10 Initial term extended to expire Initial term extended to expire 15-year initial term with four 5-year Term 15‐years following closing of the 15-year initial term with four 5-year renewal options 15‐years following closing of the renewal options Eldorado/Caesars Combination Eldorado/Caesars Combination Guarantee Caesars Combined Eldorado/Caesars Caesars Caesars Resorts Collection Combined Eldorado/Caesars $350mm required over rolling 3- $350mm required over rolling 3- Existing capex requirements to be $350mm required over rolling 3- year period at $100mm minimum year period at $100mm minimum increased in proportion to the overall year period at $100mm minimum $171 Million between 2017 and per year ($84mm allocated to CPLV); Capex per year ($84mm allocated to CPLV, increase in tenant’s net revenue per year ($84mm allocated to CPLV, 2021; Capex at 1% of net revenue $171 Million between 2017 and $255mm allocated to Non-CPLV and arising from the new properties $255mm allocated to Non-CPLV and thereafter 2021; Capex at 1% of net revenue $11mm allocated by the tenant) (measured prior to closing) $11mm allocated by the tenant) thereafter Note: Acquisitions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction is also subject to the consummation of the Eldorado/Caesars Combination. We can provide no assurances that the pending acquisitions will be consummated on the terms or time frames contemplated, or at all. 1. Cash rent amounts are presented prior to accounting for the portion of rent payable to the 20% JV partner at Harrah’s Joliet. After adjusting for the portion of rent payable to the 20% JV partner, Current Cash Rent is $500.4 million. 2. The information in this column does not reflect the modifications to the Caesars Lease Agreements contemplated in connection with the closing of the Eldorado Transaction. 3. Regional Master Lease reflects $154 million of rent from the pending acquisition of the MTA Properties; Las Vegas Master Lease reflects $98.5 million of incremental rent from CPLV and HLV lease modifications, resulting from the Eldorado Transaction. 4. In the event that the EBITDAR to Rent Ratio coverage is below the stated floor, the escalator of the respective Caesars Lease Agreements will be reduced to such amount to achieve the stated EBITDAR to Rent Ratio coverage, provided that the amount shall never result in a decrease to the prior year’s rent. The EBITDAR to Rent Ratio floor is conditioned upon obtaining a favorable private letter ruling from the Internal Revenue Service. The coverage floors, which coverage floors serve to reduce the rent escalators under the Caesars Lease Agreements in the event that the EBITDAR to Rent Ratio coverage is below the stated floor, will be removed upon execution of the amendments to the Caesars Lease Agreements in connection with the closing of the Eldorado Transaction. 5. Rent adjustments in the pro forma Regional Master Lease & Joliet Lease and pro forma Las Vegas Master Lease occur in lease years based on a lease commencement date of October 6, 2017. VICI Q1 2020 Supplemental Financial & Operating Data 18

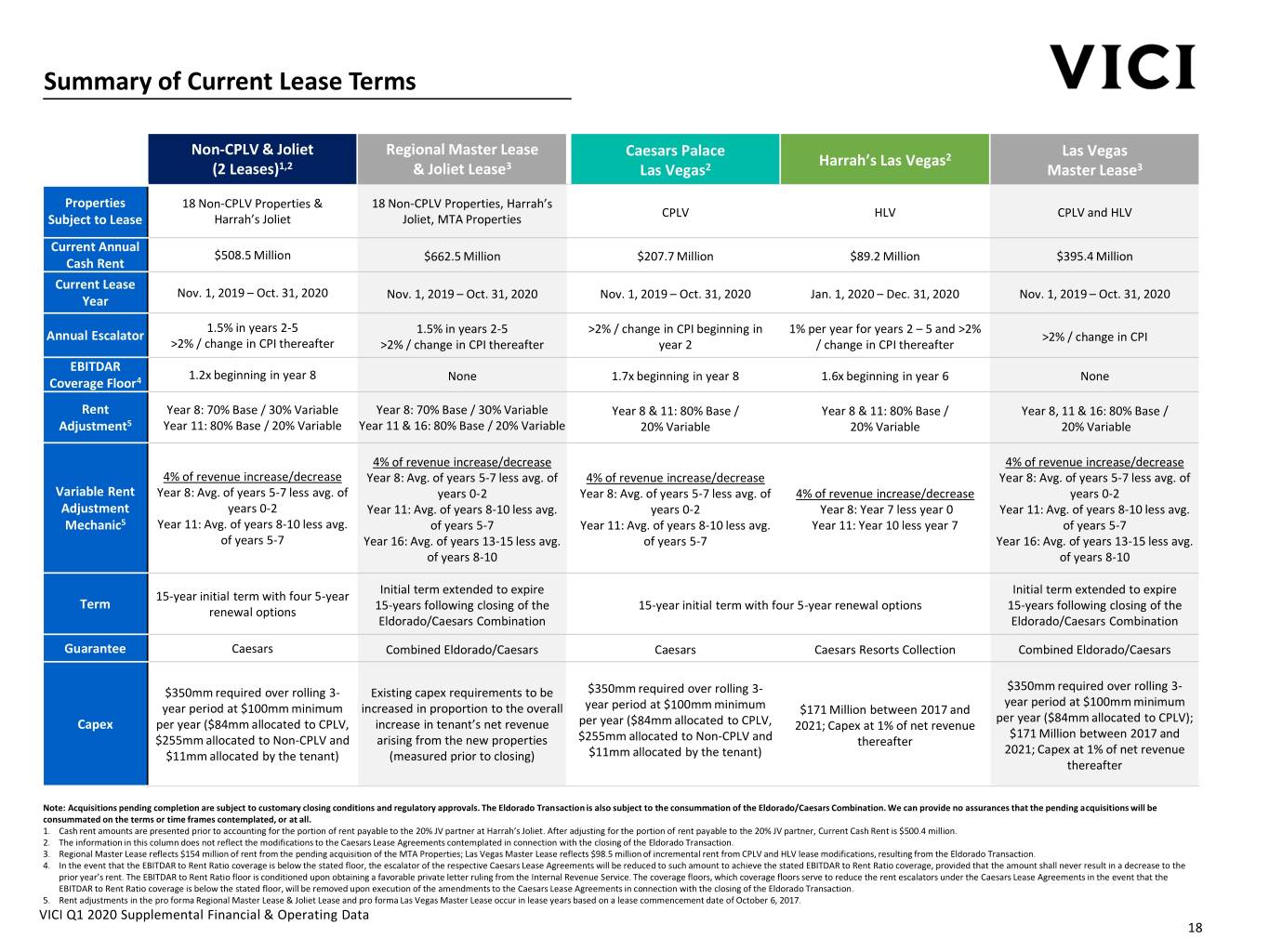

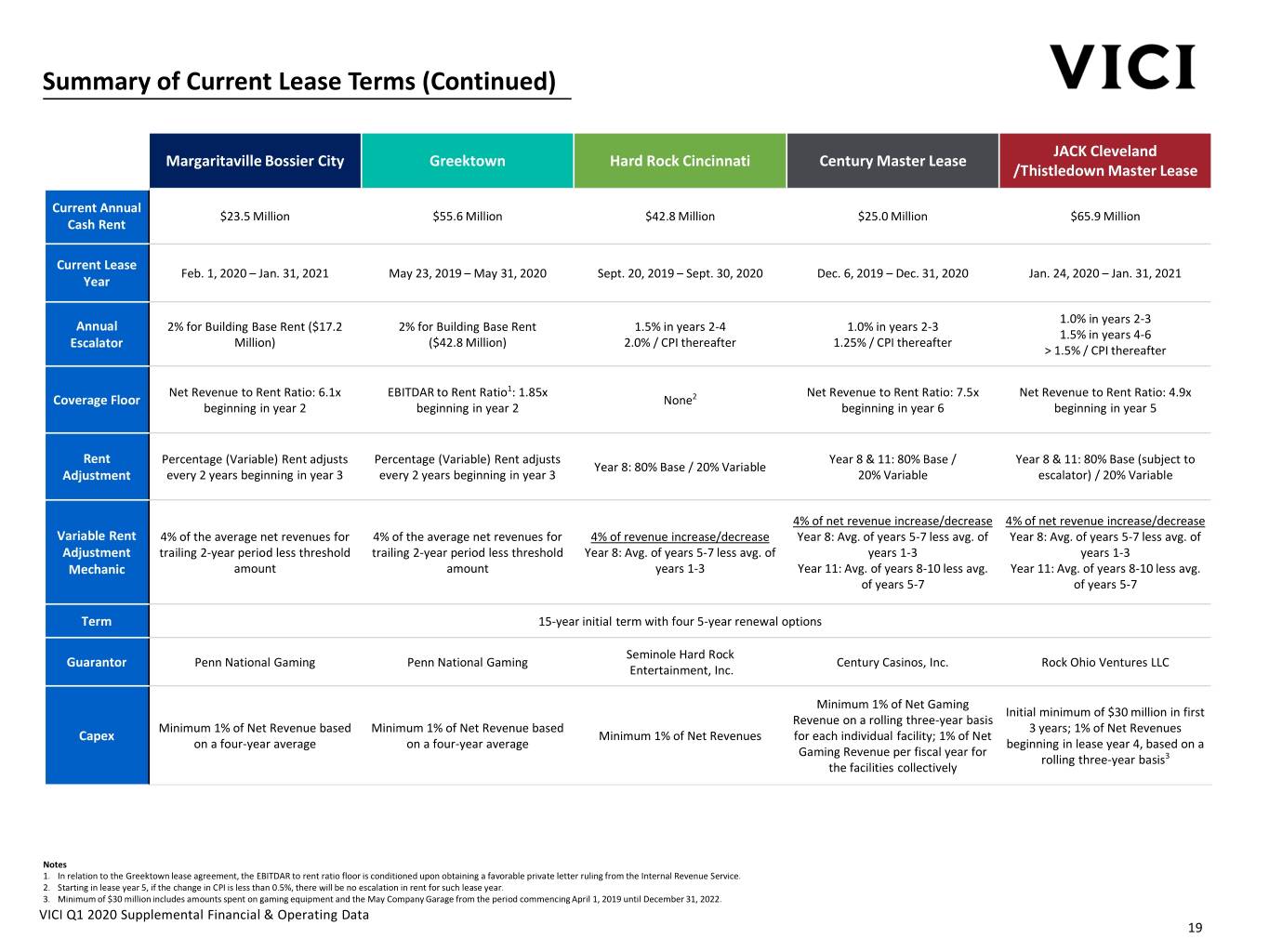

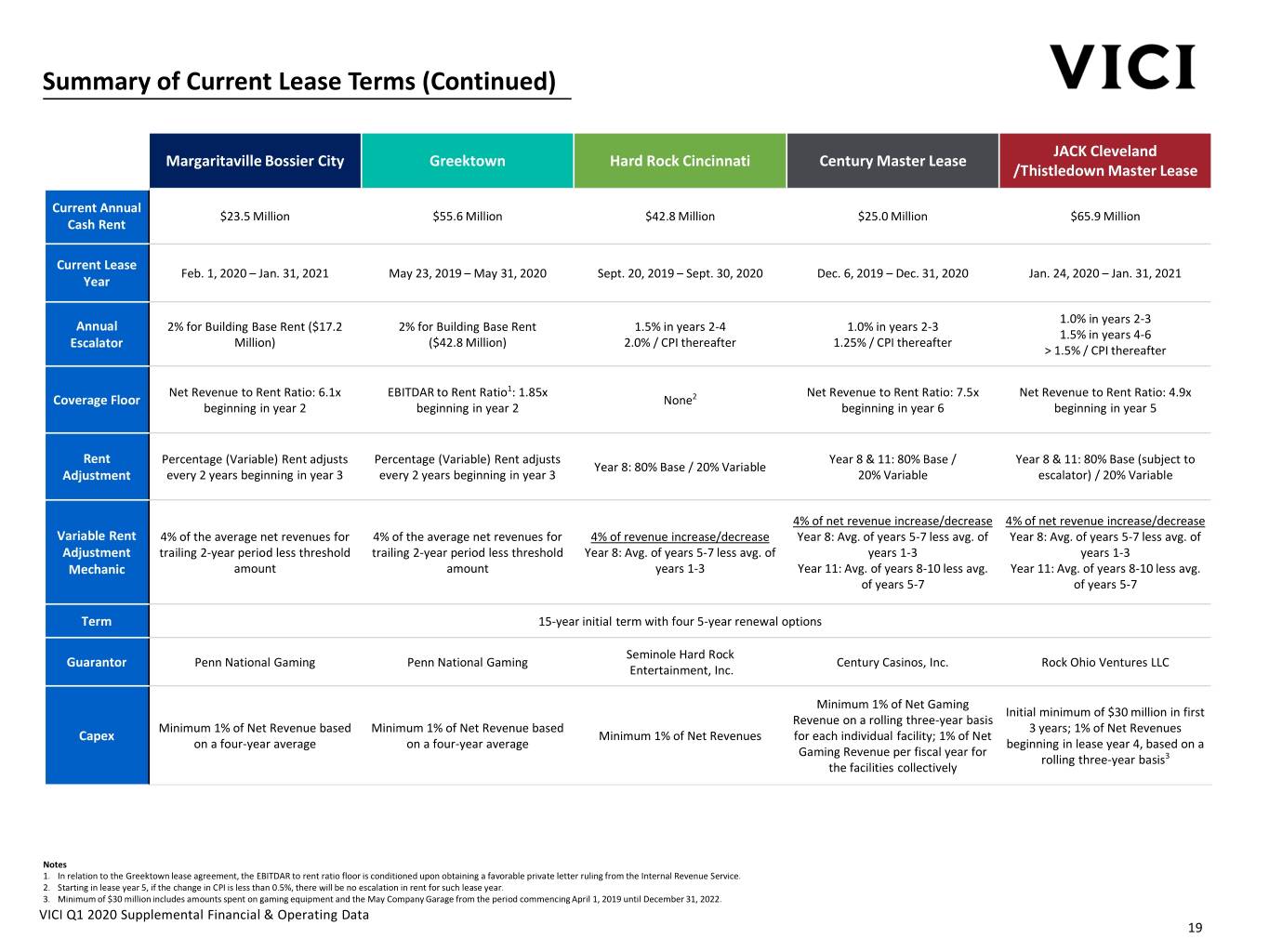

Summary of Current Lease Terms (Continued) JACK Cleveland Margaritaville Bossier City Greektown Hard Rock Cincinnati Century Master Lease /Thistledown Master Lease Current Annual $23.5 Million $55.6 Million $42.8 Million $25.0 Million $65.9 Million Cash Rent Current Lease Feb. 1, 2020 – Jan. 31, 2021 May 23, 2019 – May 31, 2020 Sept. 20, 2019 – Sept. 30, 2020 Dec. 6, 2019 – Dec. 31, 2020 Jan. 24, 2020 – Jan. 31, 2021 Year 1.0% in years 2-3 Annual 2% for Building Base Rent ($17.2 2% for Building Base Rent 1.5% in years 2-4 1.0% in years 2-3 1.5% in years 4-6 Escalator Million) ($42.8 Million) 2.0% / CPI thereafter 1.25% / CPI thereafter > 1.5% / CPI thereafter Net Revenue to Rent Ratio: 6.1x EBITDAR to Rent Ratio1: 1.85x Net Revenue to Rent Ratio: 7.5x Net Revenue to Rent Ratio: 4.9x Coverage Floor None2 beginning in year 2 beginning in year 2 beginning in year 6 beginning in year 5 Rent Percentage (Variable) Rent adjusts Percentage (Variable) Rent adjusts Year 8 & 11: 80% Base / Year 8 & 11: 80% Base (subject to Year 8: 80% Base / 20% Variable Adjustment every 2 years beginning in year 3 every 2 years beginning in year 3 20% Variable escalator) / 20% Variable 4% of net revenue increase/decrease 4% of net revenue increase/decrease Variable Rent 4% of the average net revenues for 4% of the average net revenues for 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of Year 8: Avg. of years 5-7 less avg. of Adjustment trailing 2-year period less threshold trailing 2-year period less threshold Year 8: Avg. of years 5-7 less avg. of years 1-3 years 1-3 Mechanic amount amount years 1-3 Year 11: Avg. of years 8-10 less avg. Year 11: Avg. of years 8-10 less avg. of years 5-7 of years 5-7 Term 15-year initial term with four 5-year renewal options Seminole Hard Rock Guarantor Penn National Gaming Penn National Gaming Century Casinos, Inc. Rock Ohio Ventures LLC Entertainment, Inc. Minimum 1% of Net Gaming Initial minimum of $30 million in first Revenue on a rolling three-year basis Minimum 1% of Net Revenue based Minimum 1% of Net Revenue based 3 years; 1% of Net Revenues Capex Minimum 1% of Net Revenues for each individual facility; 1% of Net on a four-year average on a four-year average beginning in lease year 4, based on a Gaming Revenue per fiscal year for rolling three-year basis3 the facilities collectively Notes 1. In relation to the Greektown lease agreement, the EBITDAR to rent ratio floor is conditioned upon obtaining a favorable private letter ruling from the Internal Revenue Service. 2. Starting in lease year 5, if the change in CPI is less than 0.5%, there will be no escalation in rent for such lease year. 3. Minimum of $30 million includes amounts spent on gaming equipment and the May Company Garage from the period commencing April 1, 2019 until December 31, 2022. VICI Q1 2020 Supplemental Financial & Operating Data 19

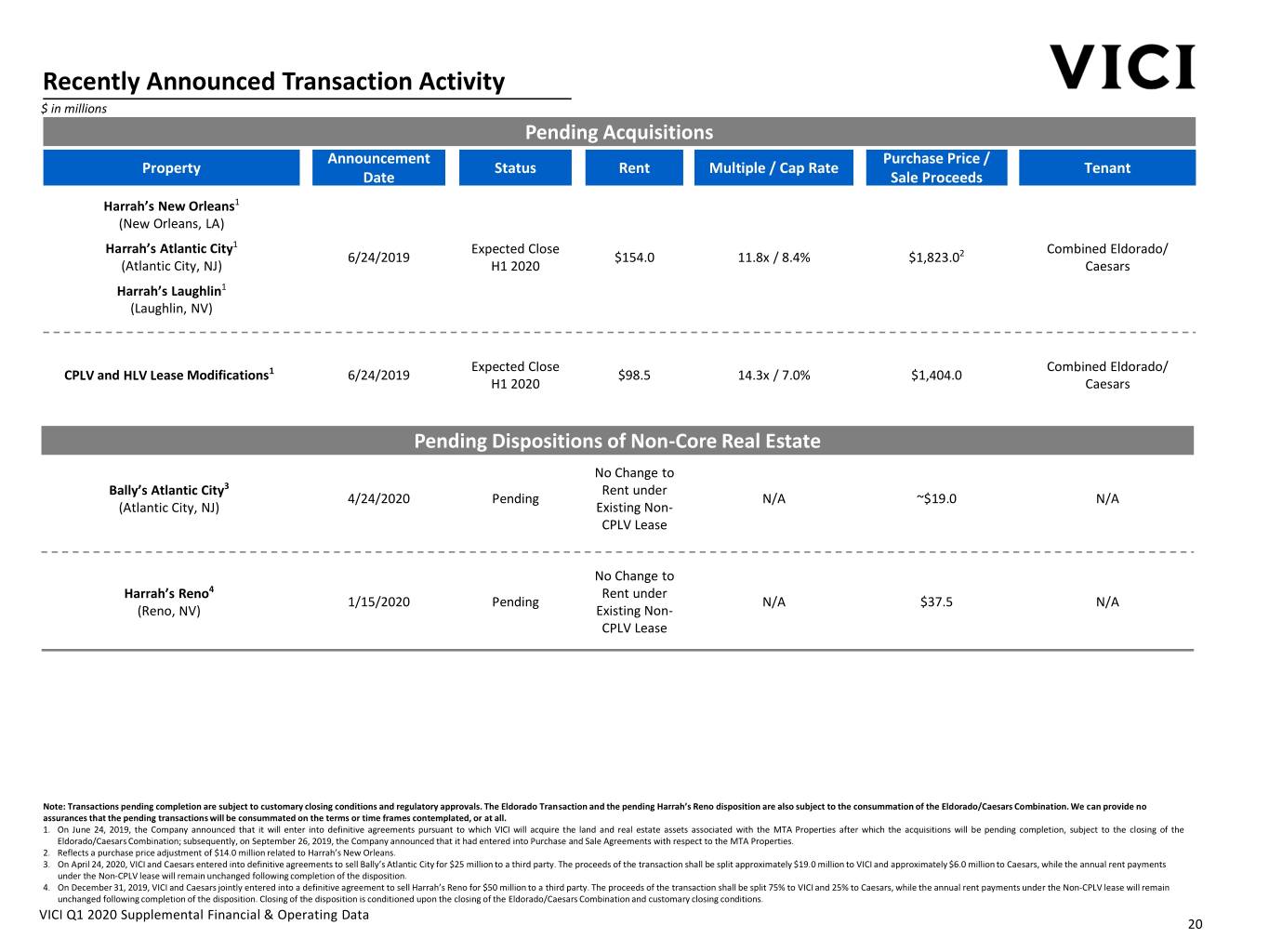

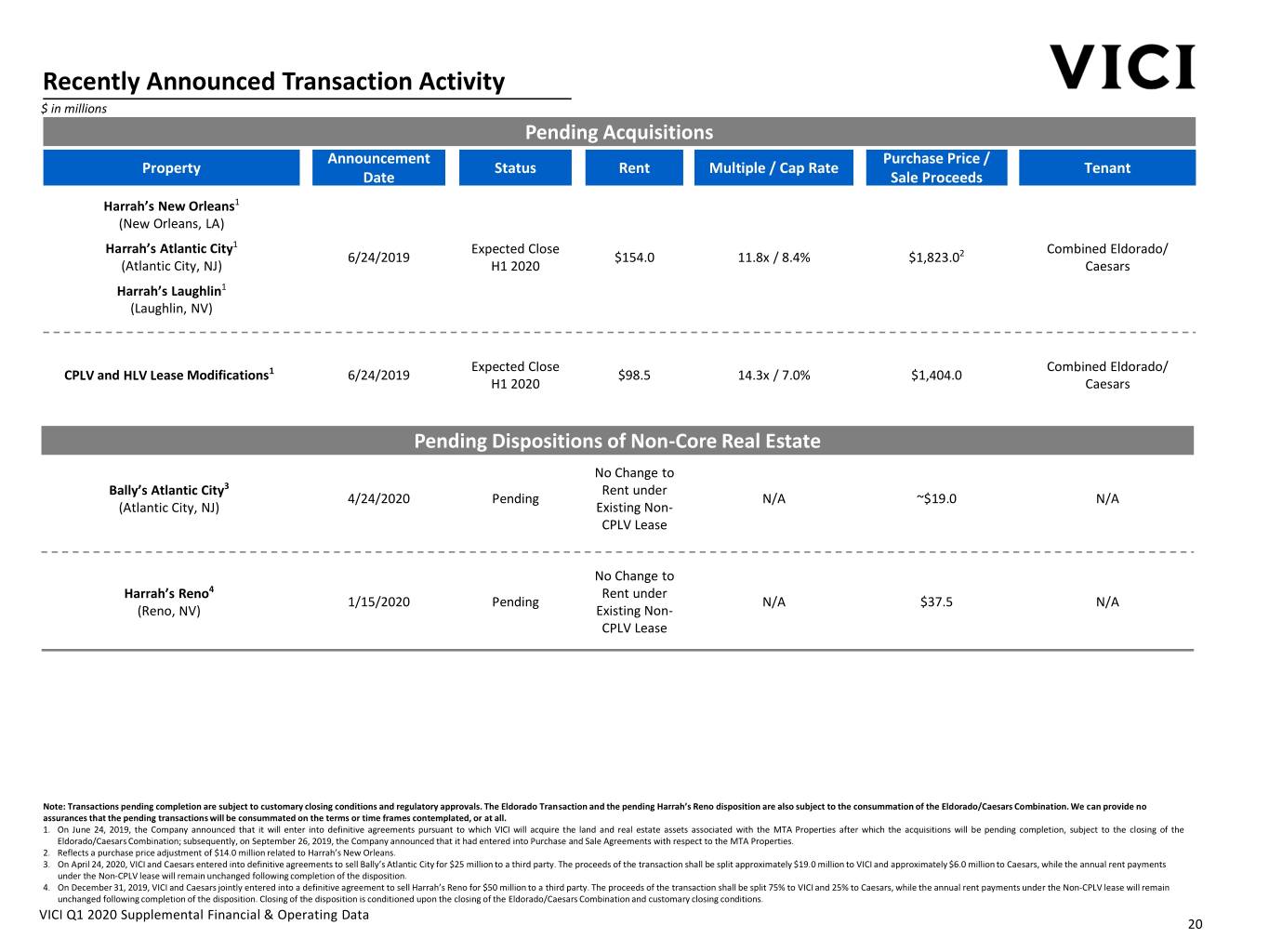

Recently Announced Transaction Activity $ in millions Pending Acquisitions Announcement Purchase Price / Property Status Rent Multiple / Cap Rate Tenant Date Sale Proceeds Harrah’s New Orleans1 (New Orleans, LA) Harrah’s Atlantic City1 Expected Close Combined Eldorado/ 6/24/2019 $154.0 11.8x / 8.4% $1,823.02 (Atlantic City, NJ) H1 2020 Caesars Harrah’s Laughlin1 (Laughlin, NV) Expected Close Combined Eldorado/ CPLV and HLV Lease Modifications1 6/24/2019 $98.5 14.3x / 7.0% $1,404.0 H1 2020 Caesars Pending Dispositions of Non-Core Real Estate No Change to Bally’s Atlantic City3 Rent under 4/24/2020 Pending N/A ~$19.0 N/A (Atlantic City, NJ) Existing Non- CPLV Lease No Change to Harrah’s Reno4 Rent under 1/15/2020 Pending N/A $37.5 N/A (Reno, NV) Existing Non- CPLV Lease Note: Transactions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction and the pending Harrah’s Reno disposition are also subject to the consummation of the Eldorado/Caesars Combination. We can provide no assurances that the pending transactions will be consummated on the terms or time frames contemplated, or at all. 1. On June 24, 2019, the Company announced that it will enter into definitive agreements pursuant to which VICI will acquire the land and real estate assets associated with the MTA Properties after which the acquisitions will be pending completion, subject to the closing of the Eldorado/Caesars Combination; subsequently, on September 26, 2019, the Company announced that it had entered into Purchase and Sale Agreements with respect to the MTA Properties. 2. Reflects a purchase price adjustment of $14.0 million related to Harrah’s New Orleans. 3. On April 24, 2020, VICI and Caesars entered into definitive agreements to sell Bally’s Atlantic City for $25 million to a third party. The proceeds of the transaction shall be split approximately $19.0 million to VICI and approximately $6.0 million to Caesars, while the annual rent payments under the Non-CPLV lease will remain unchanged following completion of the disposition. 4. On December 31, 2019, VICI and Caesars jointly entered into a definitive agreement to sell Harrah’s Reno for $50 million to a third party. The proceeds of the transaction shall be split 75% to VICI and 25% to Caesars, while the annual rent payments under the Non-CPLV lease will remain unchanged following completion of the disposition. Closing of the disposition is conditioned upon the closing of the Eldorado/Caesars Combination and customary closing conditions. VICI Q1 2020 Supplemental Financial & Operating Data 20

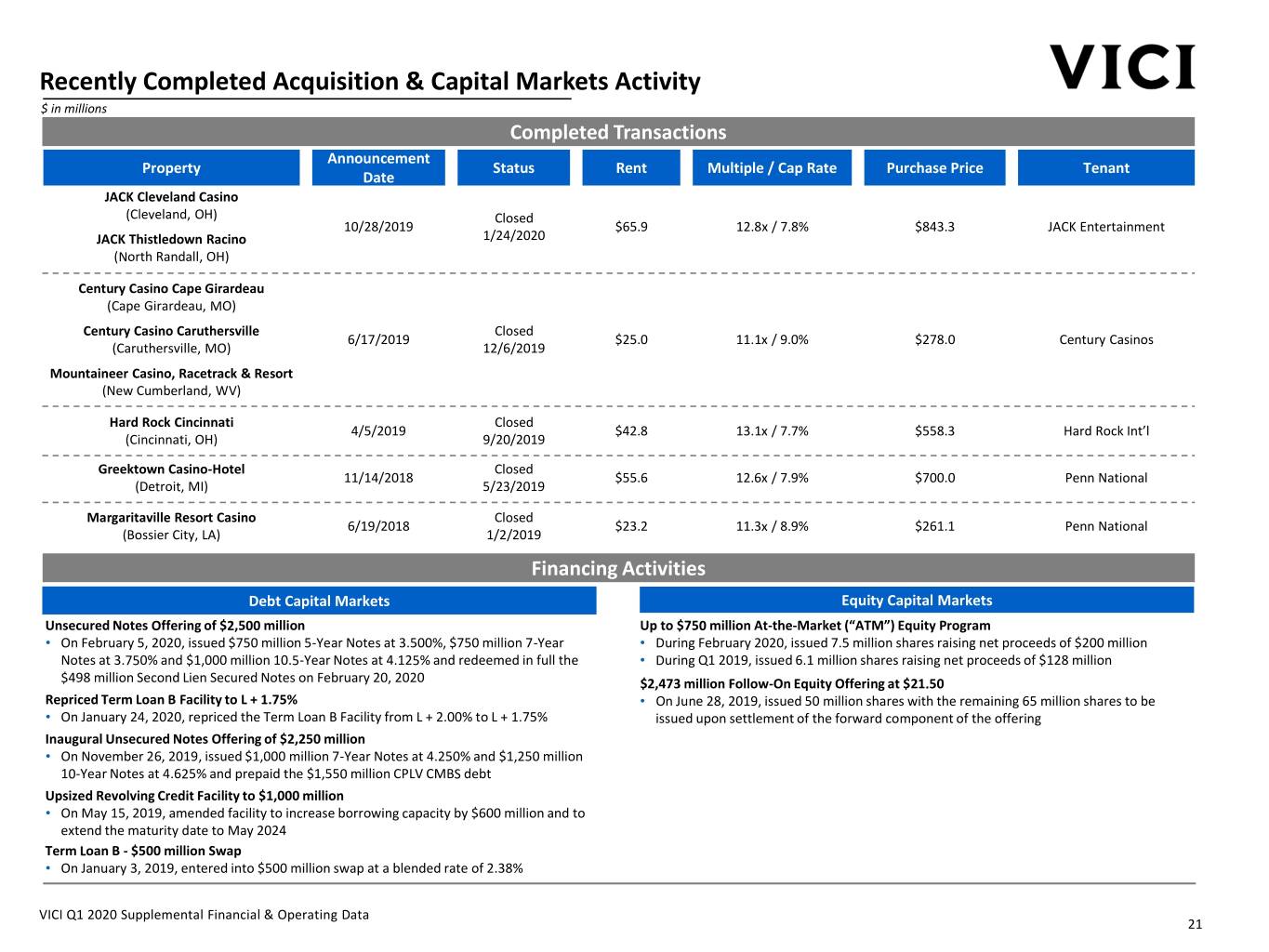

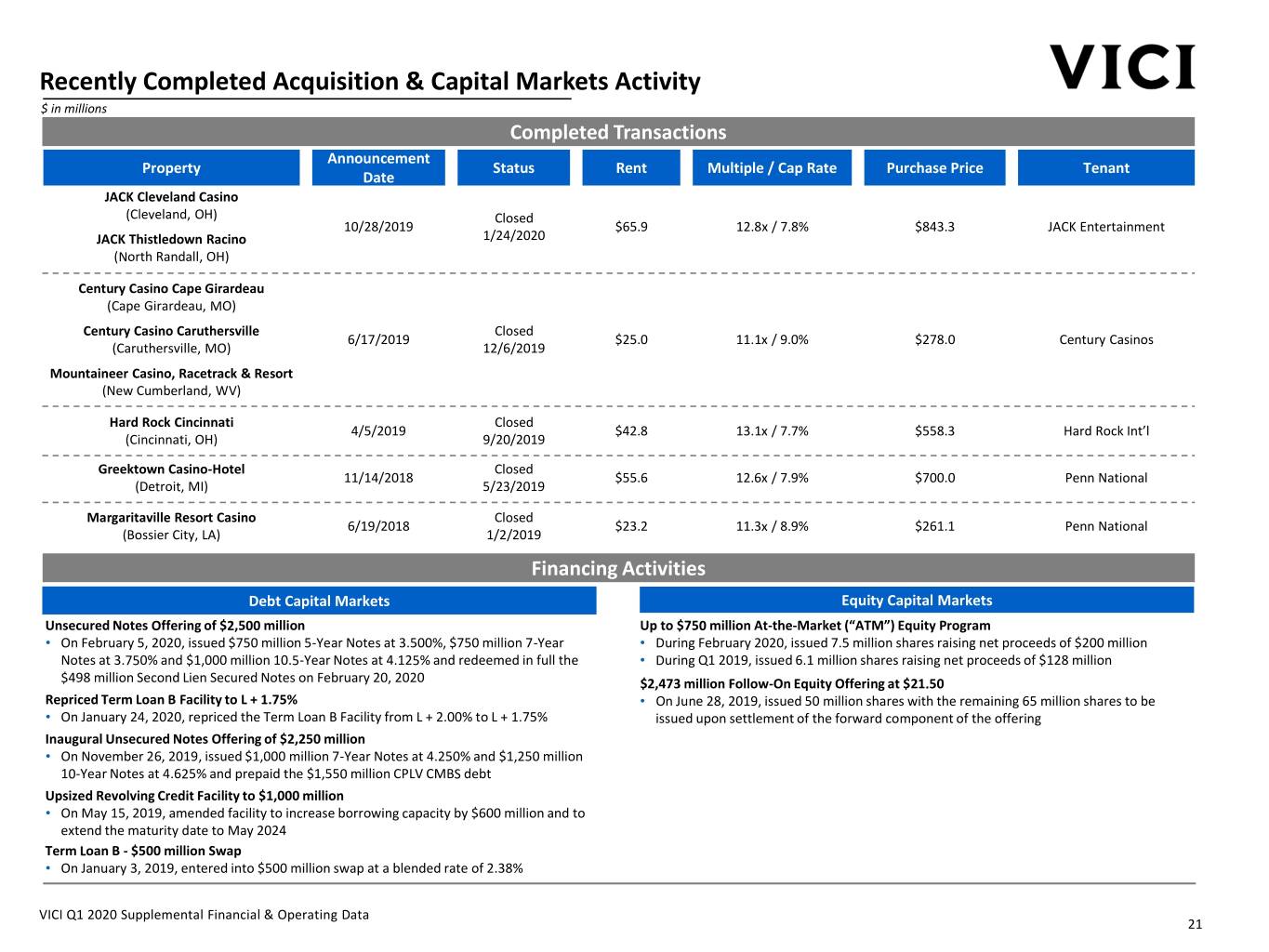

Recently Completed Acquisition & Capital Markets Activity $ in millions Completed Transactions Announcement Property Status Rent Multiple / Cap Rate Purchase Price Tenant Date JACK Cleveland Casino (Cleveland, OH) Closed 10/28/2019 $65.9 12.8x / 7.8% $843.3 JACK Entertainment JACK Thistledown Racino 1/24/2020 (North Randall, OH) Century Casino Cape Girardeau (Cape Girardeau, MO) Century Casino Caruthersville Closed 6/17/2019 $25.0 11.1x / 9.0% $278.0 Century Casinos (Caruthersville, MO) 12/6/2019 Mountaineer Casino, Racetrack & Resort (New Cumberland, WV) Hard Rock Cincinnati Closed 4/5/2019 $42.8 13.1x / 7.7% $558.3 Hard Rock Int’l (Cincinnati, OH) 9/20/2019 Greektown Casino-Hotel Closed 11/14/2018 $55.6 12.6x / 7.9% $700.0 Penn National (Detroit, MI) 5/23/2019 Margaritaville Resort Casino Closed 6/19/2018 $23.2 11.3x / 8.9% $261.1 Penn National (Bossier City, LA) 1/2/2019 Financing Activities Debt Capital Markets Equity Capital Markets Unsecured Notes Offering of $2,500 million Up to $750 million At-the-Market (“ATM”) Equity Program • On February 5, 2020, issued $750 million 5-Year Notes at 3.500%, $750 million 7-Year • During February 2020, issued 7.5 million shares raising net proceeds of $200 million Notes at 3.750% and $1,000 million 10.5-Year Notes at 4.125% and redeemed in full the • During Q1 2019, issued 6.1 million shares raising net proceeds of $128 million $498 million Second Lien Secured Notes on February 20, 2020 $2,473 million Follow-On Equity Offering at $21.50 Repriced Term Loan B Facility to L + 1.75% • On June 28, 2019, issued 50 million shares with the remaining 65 million shares to be • On January 24, 2020, repriced the Term Loan B Facility from L + 2.00% to L + 1.75% issued upon settlement of the forward component of the offering Inaugural Unsecured Notes Offering of $2,250 million • On November 26, 2019, issued $1,000 million 7-Year Notes at 4.250% and $1,250 million 10-Year Notes at 4.625% and prepaid the $1,550 million CPLV CMBS debt Upsized Revolving Credit Facility to $1,000 million • On May 15, 2019, amended facility to increase borrowing capacity by $600 million and to extend the maturity date to May 2024 Term Loan B - $500 million Swap • On January 3, 2019, entered into $500 million swap at a blended rate of 2.38% VICI Q1 2020 Supplemental Financial & Operating Data 21

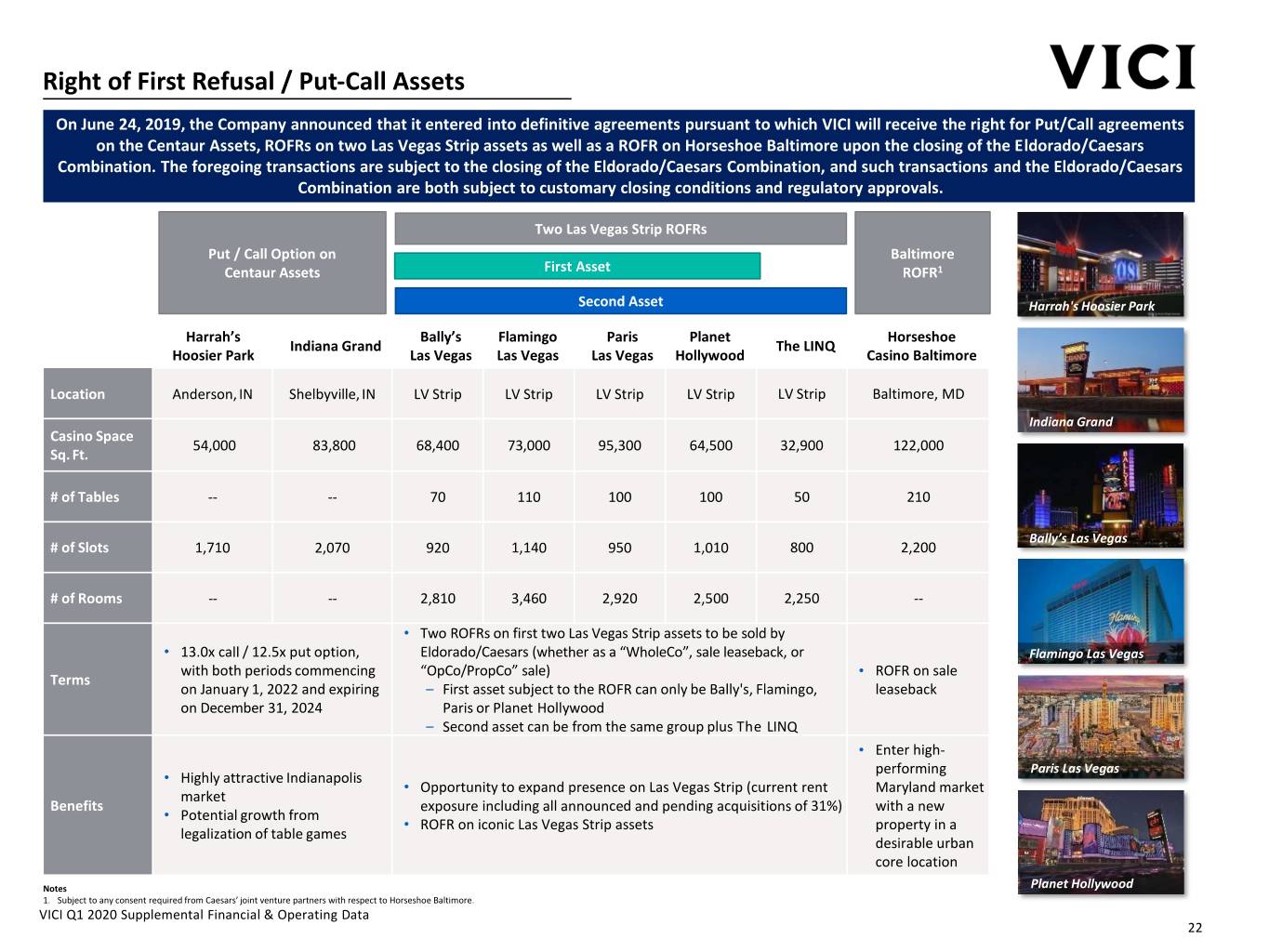

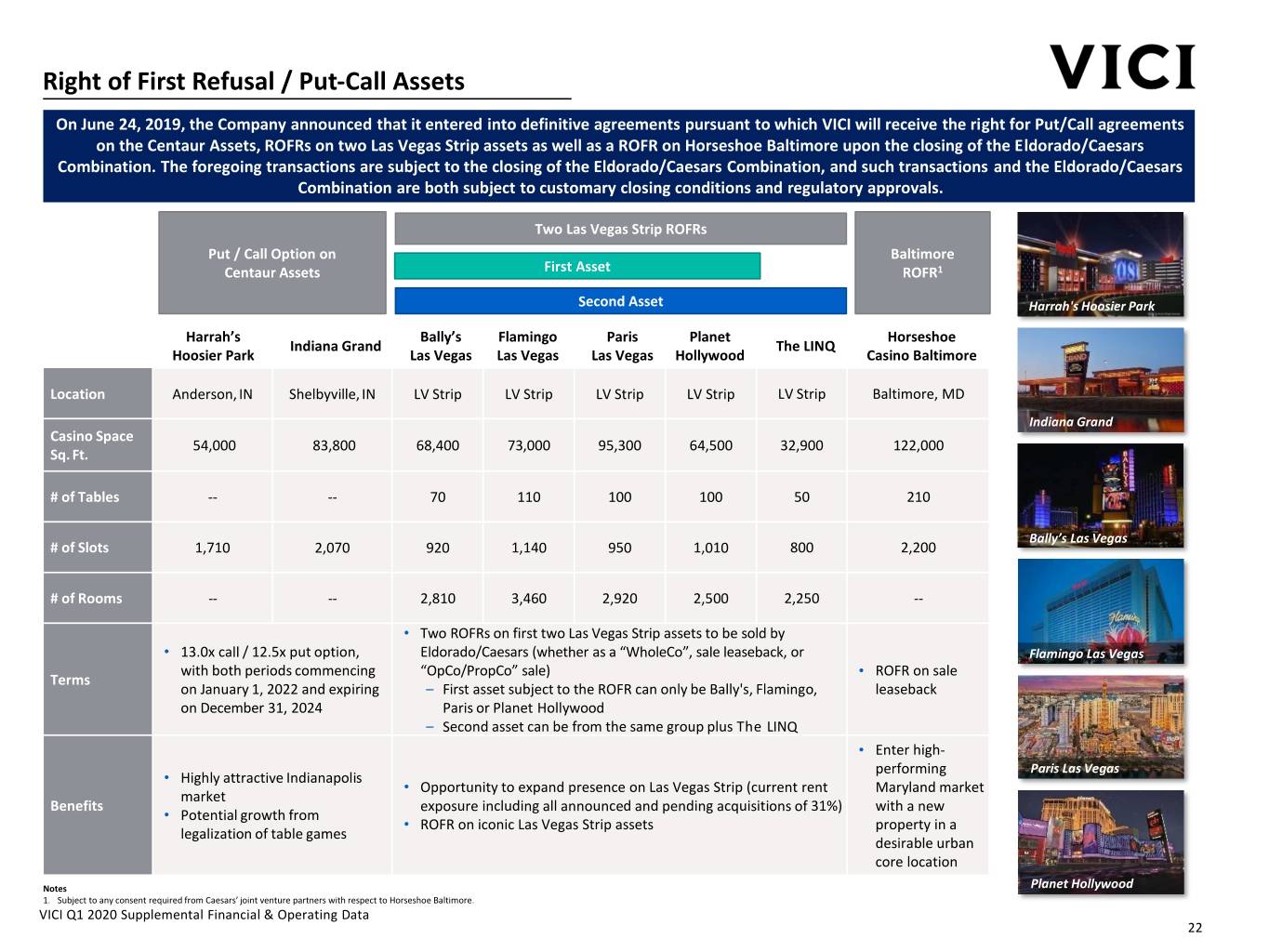

Right of First Refusal / Put‐Call Assets On June 24, 2019, the Company announced that it entered into definitive agreements pursuant to which VICI will receive the right for Put/Call agreements on the Centaur Assets, ROFRs on two Las Vegas Strip assets as well as a ROFR on Horseshoe Baltimore upon the closing of the Eldorado/Caesars Combination. The foregoing transactions are subject to the closing of the Eldorado/Caesars Combination, and such transactions and the Eldorado/Caesars Combination are both subject to customary closing conditions and regulatory approvals. Two Las Vegas Strip ROFRs Put / Call Option on Baltimore Centaur Assets First Asset ROFR1 Second Asset Harrah's Hoosier Park Harrah’s Bally’s Flamingo Paris Planet Horseshoe Indiana Grand The LINQ Hoosier Park Las Vegas Las Vegas Las Vegas Hollywood Casino Baltimore Location Anderson,IN Shelbyville,IN LV Strip LV Strip LV Strip LV Strip LV Strip Baltimore, MD Indiana Grand Casino Space 54,000 83,800 68,400 73,000 95,300 64,500 32,900 122,000 Sq. Ft. # of Tables -- -- 70 110 100 100 50 210 Bally’s Las Vegas # of Slots 1,710 2,070 920 1,140 950 1,010 800 2,200 # of Rooms -- -- 2,810 3,460 2,920 2,500 2,250 -- • Two ROFRs on first two Las Vegas Strip assets to be sold by • 13.0x call / 12.5x put option, Eldorado/Caesars (whether as a “WholeCo”, sale leaseback, or Flamingo Las Vegas with both periods commencing “OpCo/PropCo” sale) • ROFR on sale Terms on January 1, 2022 and expiring – First asset subject to the ROFR can only be Bally's, Flamingo, leaseback on December 31, 2024 Paris or Planet Hollywood – Second asset can be from the same group plus The LINQ • Enter high- performing Paris Las Vegas • Highly attractive Indianapolis • Opportunity to expand presence on Las Vegas Strip (current rent Maryland market market Benefits exposure including all announced and pending acquisitions of 31%) with a new • Potential growth from • ROFR on iconic Las Vegas Strip assets property in a legalization of table games desirable urban core location Notes Planet Hollywood 1. Subject to any consent required from Caesars’ joint venture partners with respect to Horseshoe Baltimore. VICI Q1 2020 Supplemental Financial & Operating Data 22

Definitions of Non-GAAP Financial Measures FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by The National Association of Real Estate Investment Trusts (“NAREIT”), we define FFO as net income (or loss) (computed in accordance with GAAP) excluding (i) gains (or losses) from sales of certain real estate assets, (ii) depreciation and amortization related to real estate, (iii) gains and losses from change in control and (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. AFFO is a non-GAAP financial measure that we use as a supplemental operating measure to evaluate our performance. We calculate AFFO by adding or subtracting from FFO non-cash leasing and financing adjustments attributable to common stockholders, non-cash change in allowance for credit losses attributable to common stockholders, transaction costs incurred in connection with the acquisition of real estate investments, non-cash stock-based compensation expense, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges related to non-depreciable real estate and gains (or losses) on debt extinguishment. The non-cash change in allowance for credit losses attributable to common stockholders consists of estimated credit loss for our investments in leases - direct financing and sales-type, investments in leases - financing receivables and investments in loans as a result of our adoption of ASU No. 2016-13 - Financial Instruments-Credit Losses (Topic 326). No similar adjustments are reflected in prior periods because the accounting standard was adopted effective January 1, 2020 and does not require retrospective application. Please see Note 6 - Allowance for Credit Losses in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for further information. We calculate Adjusted EBITDA by adding or subtracting from AFFO interest expense and interest income (collectively, interest expense, net) and income tax expense. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs, due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP. VICI Q1 2020 Supplemental Financial & Operating Data 23

VICI Q1 2020 Supplemental Financial & Operating Data VICI Q4 2018 Supplemental Financial & Operating Data