VICI Q1 2022 Supplemental Financial & Operating Data SUP P L EMENTAL F I NANCI AL & OP ERAT I NG DATA F I R S T Q U A R T E R E N D E D M A R C H 3 1 , 2 0 2 2 Exhibit 99.2

VICI Q1 2022 Supplemental Financial & Operating Data 2 Disclaimers Forward Looking Statements Certain statements in this presentation are forward-looking statements within the meaning of the federal securities laws. Forward‐looking statements are based on VICI Properties Inc.’s (“VICI” or the “Company”) current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate strictly to historical facts and by the use of words such as “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects,” and similar expressions that do not relate to historical matters. All statements other than statements of historical fact are forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors which are, in some cases, beyond the Company’s control and could materially affect actual results, performance or achievements. Among those risks, uncertainties and other factors are: risks associated with the MGP Transactions (as defined herein), including our ability or failure to realize the anticipated benefits of the acquisition of MGM Growth Properties LLC and related transactions (the "MGP Transactions"); the impact of changes in general economic conditions and market developments, including inflation, low consumer confidence, supply chain disruptions, unemployment levels and depressed real estate prices resulting from the severity and duration of any downturn in the U.S. or global economy; our dependence on subsidiaries of Caesars Entertainment, Inc. (“Caesars”), Penn National Gaming, Inc. (“Penn National”), Seminole Hard Rock Entertainment, Inc. (“Hard Rock”), Century Casinos, Inc. (“Century Casinos”), Rock Ohio Ventures LLC (“JACK Entertainment”), the Eastern Band of Cherokee Indians (“EBCI”), an affiliate of certain funds managed by affiliates of Apollo Global Management, Inc. (“Venetian Las Vegas Tenant”), and MGM Resorts International (“MGM”) as tenants of our properties and Caesars, Penn National, Hard Rock, Century Casinos, JACK Entertainment, EBCI and MGM or certain of their respective subsidiaries as guarantors of the lease payments and the negative consequences any material adverse effect on their respective businesses could have on us; the ability of our tenants to obtain and maintain regulatory approvals in connection with the operation of our properties and the completion of pending transactions on a timely basis, or at all, or the imposition of conditions to such regulatory approvals; our tenants historical results may not be a reliable indicator of their future results; our substantial amount of indebtedness, including indebtedness assumed and incurred by us in connection with the MGP Transactions, and ability to service, refinance and otherwise fulfill our obligations under such indebtedness; our historical financial information may not be reliable indicators of our future results of operations, financial condition and cash flows; the possibility that we identify significant environmental, tax, legal or other issues that materially and adversely impact the value of assets acquired or secured as collateral (or other benefits we expect to receive) in any of our recently completed transactions; the effects of our recently completed transactions on us, including the future impact on our financial condition, financial and operating results, cash flows, strategy and plans; the impact and outcome of previous and potential future litigation relating to the MGP Transactions; the possibility of adverse tax consequences as a result of our recently completed transactions; increased volatility in our stock price as a result of our recently completed transactions; our reliance on distributions received from VICI Properties L.P., and, subsequent to the consummation of the MGP Transactions, VICI Properties OP LLC, our operating partnership, to make distributions to our stockholders; our ability to continue to make distributions to holders of our common stock or maintain anticipated levels of distributions over time; and competition for transaction opportunities, including from other REITs, investment companies, private equity firms and hedge funds, sovereign funds, lenders, gaming companies and other investors that may have greater resources and access to capital and a lower cost of capital or different investment parameters than us. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the impact of the COVID-19 pandemic on our and our tenants' financial condition, results of operations, cash flows and performance. The extent to which the COVID-19 pandemic continues to adversely affect our tenants, and ultimately impacts our business and financial condition, depends on future developments which cannot be predicted with confidence, including the impact of the actions taken to contain the pandemic or mitigate its impact, including the availability, distribution, public acceptance and efficacy of approved vaccines, new or mutated variants of COVID-19 (including vaccine-resistant variants) or a similar virus, the direct and indirect economic effects of the pandemic and containment measures on our tenants, the ability of our tenants to successfully operate their businesses, including the costs of complying with regulatory requirements necessary to keep their respective facilities open, such as reduced capacity requirements, the need to close any of the facilities as a result of the COVID-19 pandemic, and the effects of the negotiated capital expenditure reductions and other amendments to our lease agreements that we agreed to with certain of our tenants in response to the COVID-19 pandemic. Each of the foregoing could have a material adverse effect on our tenants' ability to satisfy their obligations under their Lease Agreements with us, including their continued ability to pay rent in a timely manner, or at all, and/or to fund capital expenditures or make other payments required under their leases. Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Caesars, Century Casinos, EBCI, Hard Rock, JACK Entertainment, MGM, Penn and Venetian Las Vegas Tenant Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars, Century Casinos, EBCI, Hard Rock, JACK Entertainment, MGM, Penn and Venetian Las Vegas Tenant included in this presentation. The historical audited and unaudited financial statements of Caesars, as the parent and guarantor of CEOC, LLC and MGM, as the parent and guarantor of MGM Lessee, LLC, the Company's significant lessees, have been filed with the Securities and Exchange Commission (“SEC”). Certain financial and other information for Caesars, Century Casinos, EBCI, Hard Rock, JACK Entertainment, MGM, Penn and Venetian Las Vegas Tenant included in this presentation have been derived from their respective filings, if and as applicable, and other publicly available presentations and press releases. While we believe this information to be reliable, we have not independently investigated or verified such data. Market and Industry Data This presentation contains estimates and information concerning the Company's industry, including market position, rent growth and rent coverage of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”), AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of March 31, 2022 unless otherwise indicated.

VICI Q1 2022 Supplemental Financial & Operating Data Corporate Overview About VICI Properties (NYSE: VICI) Senior Management Edward Pitoniak John Payne David Kieske Samantha Gallagher Gabriel Wasserman Chief Executive Officer & Director President & Chief Operating Officer EVP, Chief Financial Officer EVP, General Counsel & Secretary Chief Accounting Officer VICI Properties Inc. is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip. Following the closing of the acquisition of MGM Growth Properties LLC on April 29, 2022, VICI Properties’ national, geographically diverse portfolio consists of 43 gaming facilities comprising over 122 million square feet and features approximately 58,700 hotel rooms and more than 450 restaurants, bars, nightclubs and sportsbooks. Its properties are leased to industry leading gaming and hospitality operators, including Caesars Entertainment, Inc., Century Casinos, Inc., the Eastern Band of Cherokee Indians, Hard Rock International Inc., JACK Entertainment LLC, MGM Resorts International, Penn National Gaming, Inc., and The Venetian Las Vegas. VICI Properties also has an investment in the Chelsea Piers, New York facility and owns four championship golf courses and 34 acres of undeveloped and underdeveloped land adjacent to the Las Vegas Strip. VICI Properties’ strategy is to create the nation’s highest quality and most productive experiential real estate portfolio. Covering Equity Analysts Covering Fixed Income Analysts Firm BofA Merrill Lynch Deutsche Bank Goldman Sachs J.P. Morgan Analyst James Kayler Luis Chinchilla Komal Patel Michael Pace Phone (646) 855‐9223 (212) 250-9980 (212) 357-9774 (212) 270‐6530 Email James.f.kayler@baml.com Luis.chinchilla@db.com Komal.patel@gs.com Michael.pace@jpmorgan.com Firm Berenberg BofA Merrill Lynch Capital One Securities CBRE Citi Deutsche Bank Goldman Sachs Green Street Advisors Jefferies J.P. Morgan Keybanc Ladenburg Thalmann & Co. Loop Capital Macquarie Capital Morgan Stanley Raymond James Robert W. Baird Scotiabank SMBC Nikko Securities Stifel Nicolaus Truist Securities Wolfe Research Analyst Keegan Carl Shaun Kelley Neil Malkin John DeCree Smedes Rose Carlo Santarelli Stephen Grambling Spenser Allaway David Katz Anthony Paolone Todd Thomas John Massocca Daniel Adam Chad Beynon Thomas Allen RJ Milligan Wesley Golladay Greg McGinniss Richard Anderson Simon Yarmak Barry Jonas Andrew Rosivach Email Keegan.carl@berenberg-us.com Shaun.kelley@baml.com Neil.malkin@capitalone.com John.decree@cbre.com Smedes.rose@citi.com Carlo.santarelli@db.com Stephen.grambling@gs.com Sallaway@greenstreetadvisors.com Dkatz@jefferies.com Anthony.paolone@jpmorgan.com Tthomas@key.com Jmassocca@ladenburg.com Daniel.adam@loopcapital.com chad.beynon@macquarie.com Thomas.allen@morganstanley.com Rjmilligan@raymondjames.com Wgolladay@rwbaird.com Greg.mcginniss@scotiabank.com Randerson@smbcnikko-si.com Yarmaks@stifel.com Barry.jonas@truist.com Arosivach@wolferesearch.com Phone (646) 949-9052 (646) 855‐1005 (571) 633-8191 (702) 691-3213 (212) 816-6243 (212) 250‐5815 (212) 902‐7832 (949) 640-8780 (212) 323-3355 (212) 622-6682 (917) 368-2286 (212) 409-2543 (212) 823-1312 (212) 231-2634 (212) 761‐3356 (727) 567-2585 (216) 737-7510 (212) 225-6906 (646) 521-2351 (443) 224‐1345 (212) 590-0998 (646) 582-9250 Contact Information Board of Directors Independent James Abrahamson Diana Cantor Monica Douglas Elizabeth Holland Craig Macnab Edward Pitoniak Michael Rumbolz Director, Chairman of the Board Director, Audit Committee Chair Director Director, Nominating & Governance Committee Chair Director, Compensation Committee Chair Chief Executive Officer & Director Director 3 Corporate Headquarters VICI Properties Inc. 535 Madison Ave., 20th Fl New York, NY 10022 (646) 949‐4631 Transfer Agent Computershare 7530 Lucerne Drive, Suite 305 Cleveland, OH 44130 (800) 962‐4284 www.computershare.com Investor Relations investors@viciproperties.com Public Markets Detail Ticker: VICI Exchange: NYSE Public Relations pr@viciproperties.com Website www.viciproperties.com ✓ ✓ ✓ ✓ ✓ ✓

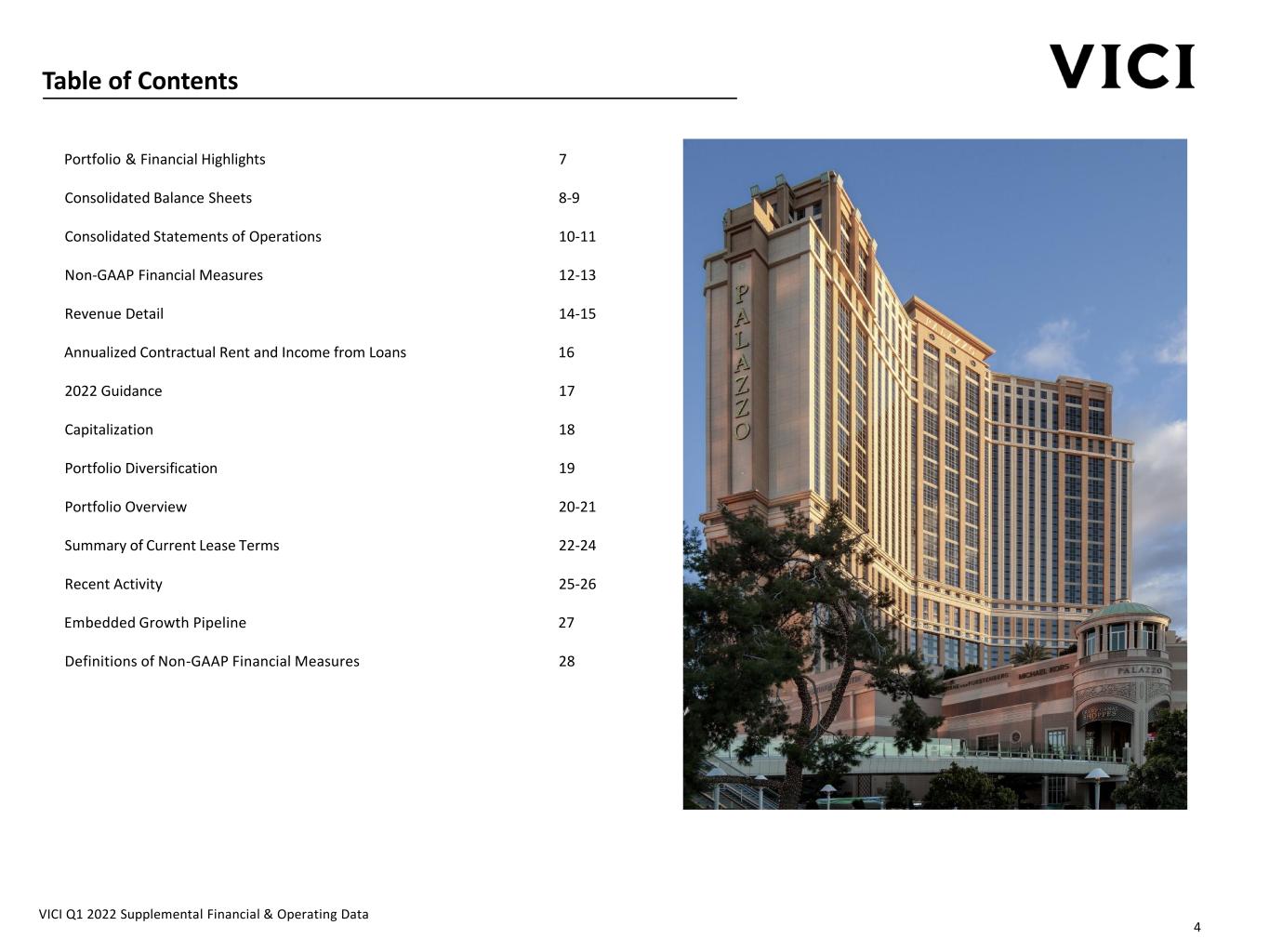

VICI Q1 2022 Supplemental Financial & Operating Data Table of Contents Consolidated Balance Sheets 8-9 Consolidated Statements of Operations 10-11 Non‐GAAP Financial Measures 12-13 2022 Guidance 17 Portfolio Overview 20-21 Summary of Current Lease Terms 22-24 Recent Activity 25-26 Definitions of Non-GAAP Financial Measures 28 7 Portfolio Diversification 19 4 Revenue Detail 14-15 Portfolio & Financial Highlights Capitalization 18 Embedded Growth Pipeline 27 Annualized Contractual Rent and Income from Loans 16

VICI Q1 2022 Supplemental Financial & Operating Data Park MGM New York-New York The Mirage Luxor MGM Grand Excalibur Mandalay Bay On April 29, 2022, VICI closed on its $17.2bn transformative acquisition of MGM Growth Properties, enhancing VICI’s portfolio quality with 7 premier Las Vegas resorts… 5

VICI Q1 2022 Supplemental Financial & Operating Data Borgata MGM Grand DetroitBeau RivageMGM Springfield Empire City MGM Northfield Park Gold StrikeMGM National Harbor …and a market-leading regional portfolio of 8 assets for ~$1.0 billion of incremental annual rent 6

VICI Q1 2022 Supplemental Financial & Operating Data Three Months Ended Mar. 31, 2022 Dec. 31, 2021 Sep. 30, 2021 Jun. 30, 2021 Mar. 31, 2021 Net Income Per Share Basic $0.35 $0.45 $0.29 $0.56 $0.50 Diluted $0.35 $0.44 $0.28 $0.54 $0.50 Funds From Operations Per Share Basic $0.35 $0.45 $0.29 $0.56 $0.50 Diluted $0.35 $0.44 $0.28 $0.54 $0.50 Adjusted Funds From Operations Per Share Basic $0.45 $0.44 $0.46 $0.48 $0.48 Diluted $0.44 $0.44 $0.45 $0.46 $0.47 Net Income Attributable to Common Stockholders $240,383 $281,479 $161,862 $300,709 $269,801 Adjusted EBITDA $357,967 $329,300 $324,544 $327,225 $325,834 Annualized Dividend Per Share $1.44 $1.44 $1.44 $1.32 $1.32 Dividend Yield at Period End 5.1% 4.8% 5.1% 4.3% 4.7% Portfolio & Financial Highlights (amounts in thousands, except per share, portfolio and property data) Properties 43 Golf Courses 4 Developable Las Vegas Strip Land 34 acres States 15 Metropolitan Statistical Areas ("MSAs") 20 Weighted Average Remaining Lease Term, Including Renewal Options (as of 3/31/2022) 43.0 years Occupancy Rate 100% Financial Highlights as of March 31, 2022 1. See "Non‐GAAP Financial Measures" on pages 12-13 of this presentation for the reconciliations and "Definitions of Non-GAAP Financial Measures" on page 28 of this presentation for the definitions of these Non‐GAAP Financial Measures. 2. Based on 748,413,311 shares outstanding and closing share price of $28.46 on March 31, 2022. 3. Net Leverage Ratio is defined as Total Debt less Cash & Cash Equivalents divided by Adjusted EBITDA for the last twelve months ended March 31, 2022. See "Non-GAAP Financial Measures" on page 13 of this presentation for the reconciliation of Adjusted EBITDA for the periods presented. 4. Metrics include the impact of the MGM Growth Properties LLC ("MGP") acquisition, which closed subsequent to quarter end on April 29, 2022. 5. Based on annualized contractual rent as of May 2022. Pro forma for MGM’s pending sale of the operations of the Mirage Hotel & Casino (the “Mirage”) to Hard Rock, which is subject to customary closing conditions and regulatory approvals. Please refer to page 25 for additional details. Portfolio Highlights – Pro Forma for MGP Acquisition4 Las Vegas 55% Philadelphia 13% New Orleans 5% Detroit 4% Washington D.C. 3% San Francisco 2% Chicago 2% Cleveland 2% Louisville 2% Memphis 2% Boston 2% Dallas 1% Cincinnati 1% Kansas City 1% Omaha 1% Laughlin 1% Pittsburgh 1% New York 0.4% Nashville 0.4% St. Louis 0.2% % of Total SF 1 7 1 Portfolio Summary Geographic Diversity Tenant Diversity 81% Public Tenants / 19% Private Tenants (By % of Rent)545% Las Vegas / 55% Regional (By % of Rent)5 Caesars 42% MGM 36% Venetian 10% Hard Rock 5% JACK 3% Penn 3% EBCI 1% CNTY 1% % of Rent5 Equity Market Capitalization2 $21,299,843 Total Debt $5,350,000 Cash & Cash Equivalents $568,702 Enterprise Value $26,081,141 LTM Net Leverage Ratio3 3.6x Summary Capitalization 1

VICI Q1 2022 Supplemental Financial & Operating Data March 31, 2022 December 31, 2021 Assets Real estate portfolio: Investments in leases - sales-type, net 17,113,699$ 13,136,664$ Investments in leases - financing receivables, net 2,650,633 2,644,824 Investments in loans, net 513,128 498,002 Land 153,576 153,576 Cash and cash equivalents 568,702 739,614 Other assets 741,583 424,693 Total assets 21,741,321$ 17,597,373$ Liabilities Debt, net 5,297,014$ 4,694,523$ Accrued expenses and deferred revenue 99,062 113,530 Dividends payable 269,276 226,309 Other liabilities 592,183 375,837 Total liabilities 6,257,535 5,410,199 Stockholders' equity 7,484 6,289 — — Additional paid-in capital 14,971,890 11,755,069 Accumulated other comprehensive income 109,495 884 Retained earnings 315,809 346,026 Total VICI stockholders' equity 15,404,678 12,108,268 Non-controlling interest 79,108 78,906 Total stockholders' equity 15,483,786 12,187,174 Total liabilities and stockholders' equity 21,741,321$ 17,597,373$ Common stock, $0.01 par value, 1,350,000,000 shares authorized and 748,413,311 and 628,942,092 shares issued and outstanding at March 31, 2022 and December 31, 2021, respectively Preferred stock, $0.01 par value, 50,000,000 shares authorized and no shares outstanding at December 31, 2021 and December 31, 2020 Consolidated Balance Sheets (amounts in thousands, except share and per share data) 8

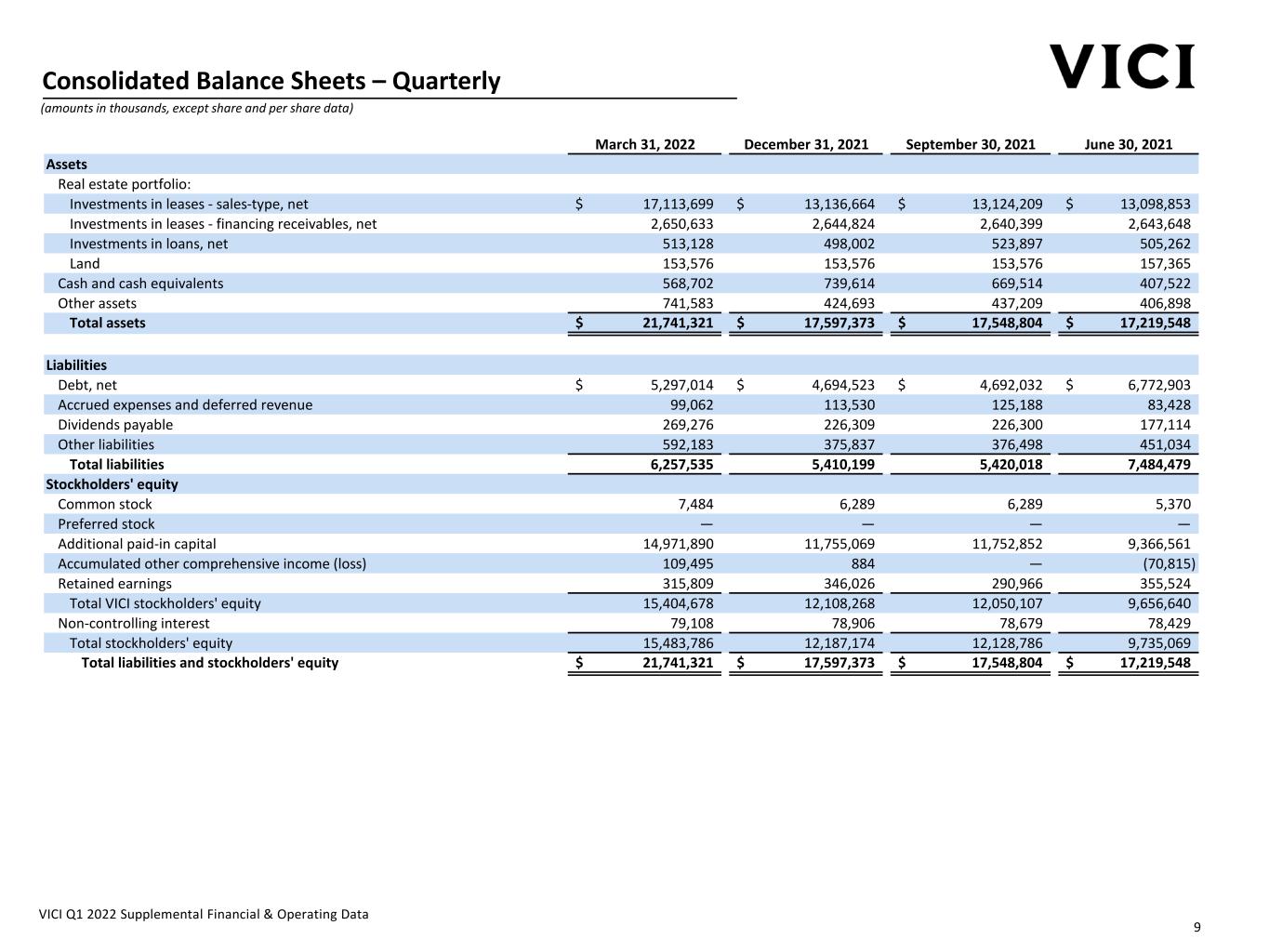

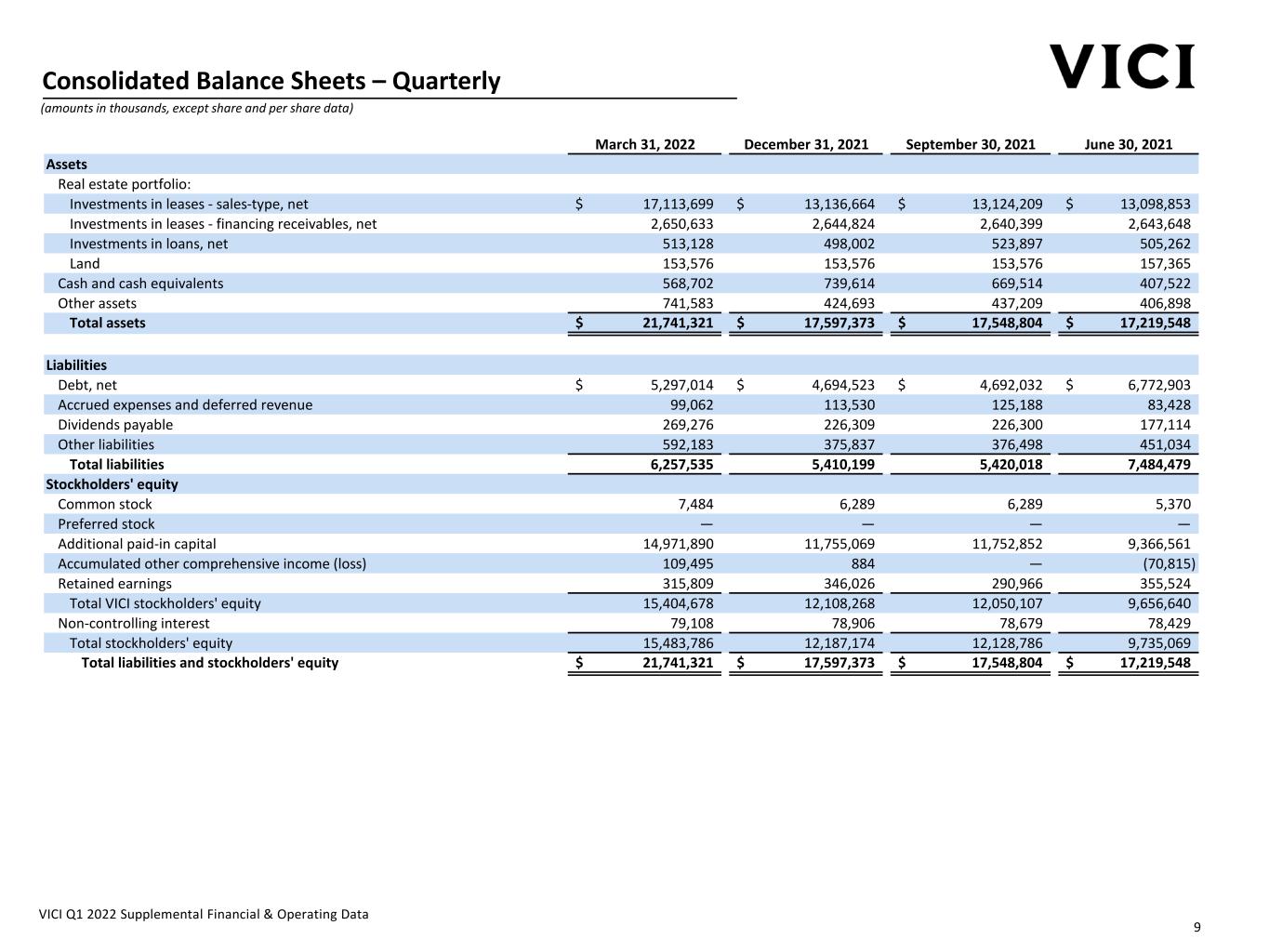

VICI Q1 2022 Supplemental Financial & Operating Data March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Assets Real estate portfolio: Investments in leases - sales-type, net 17,113,699$ 13,136,664$ 13,124,209$ 13,098,853$ Investments in leases - financing receivables, net 2,650,633 2,644,824 2,640,399 2,643,648 Investments in loans, net 513,128 498,002 523,897 505,262 Land 153,576 153,576 153,576 157,365 Cash and cash equivalents 568,702 739,614 669,514 407,522 Other assets 741,583 424,693 437,209 406,898 Total assets 21,741,321$ 17,597,373$ 17,548,804$ 17,219,548$ Liabilities Debt, net 5,297,014$ 4,694,523$ 4,692,032$ 6,772,903$ Accrued expenses and deferred revenue 99,062 113,530 125,188 83,428 Dividends payable 269,276 226,309 226,300 177,114 Other liabilities 592,183 375,837 376,498 451,034 Total liabilities 6,257,535 5,410,199 5,420,018 7,484,479 Stockholders' equity Common stock 7,484 6,289 6,289 5,370 Preferred stock — — — — Additional paid-in capital 14,971,890 11,755,069 11,752,852 9,366,561 Accumulated other comprehensive income (loss) 109,495 884 — (70,815) Retained earnings 315,809 346,026 290,966 355,524 Total VICI stockholders' equity 15,404,678 12,108,268 12,050,107 9,656,640 Non-controlling interest 79,108 78,906 78,679 78,429 Total stockholders' equity 15,483,786 12,187,174 12,128,786 9,735,069 Total liabilities and stockholders' equity 21,741,321$ 17,597,373$ 17,548,804$ 17,219,548$ Consolidated Balance Sheets – Quarterly (amounts in thousands, except share and per share data) 9

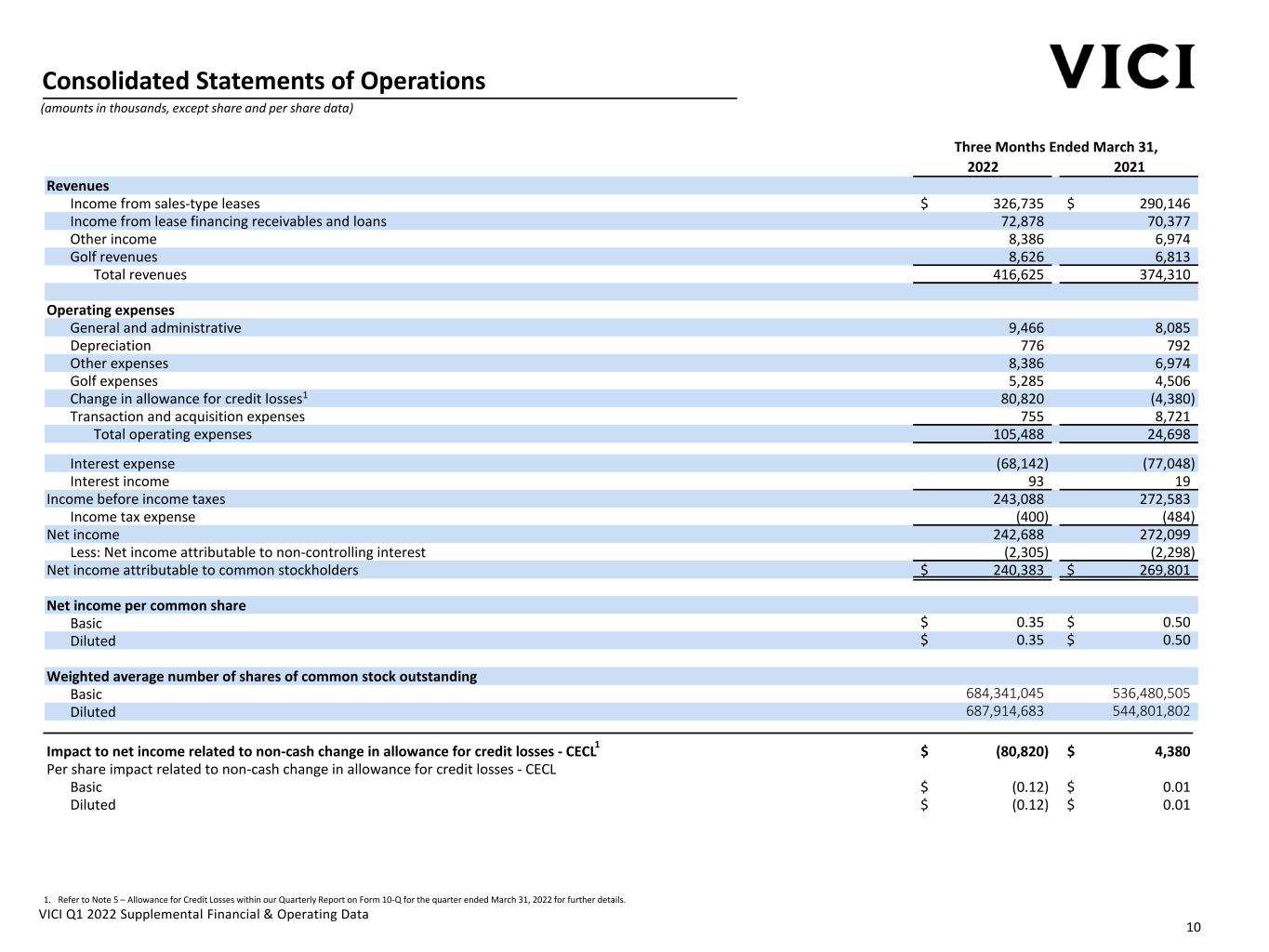

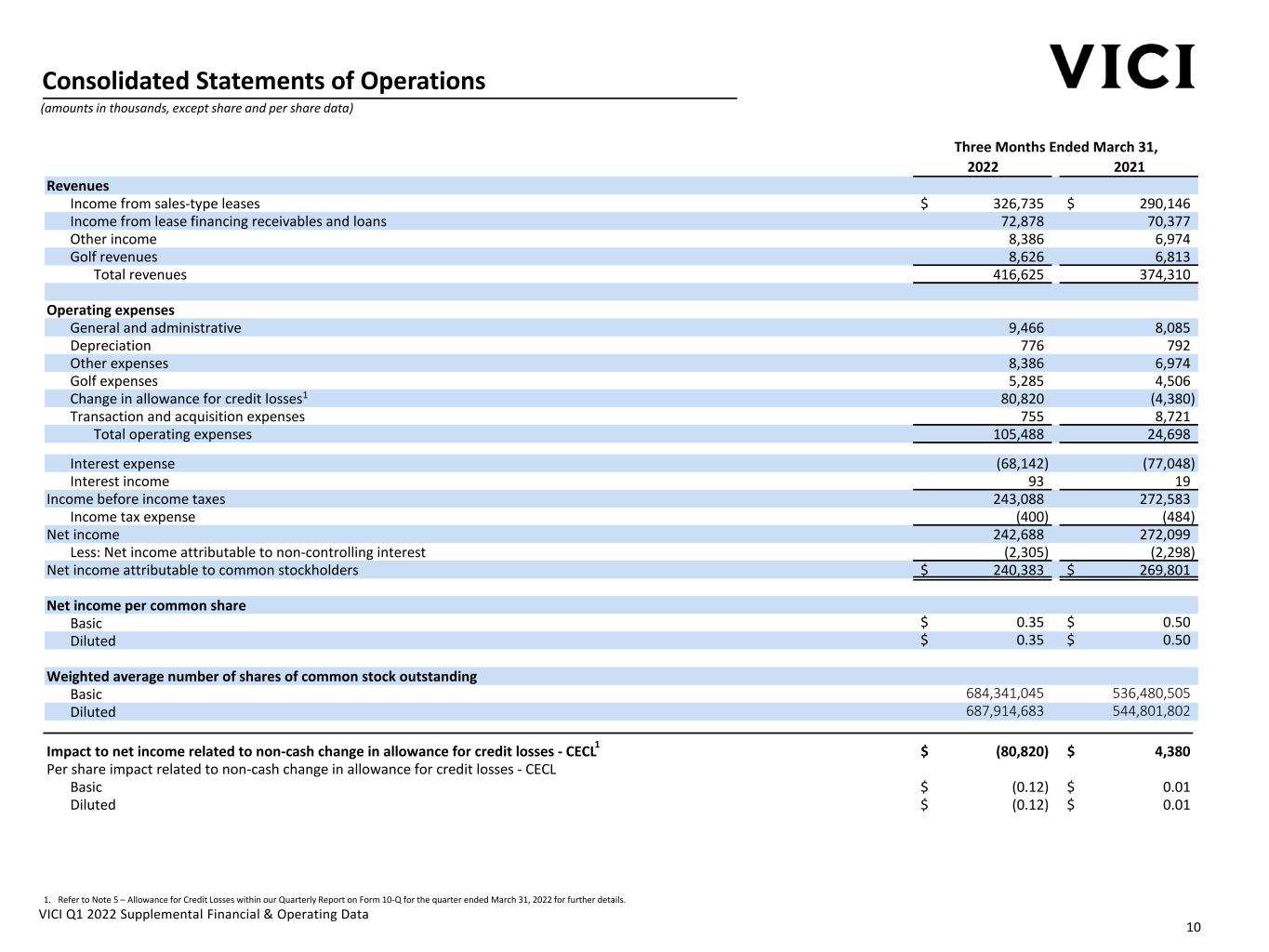

VICI Q1 2022 Supplemental Financial & Operating Data Three Months Ended March 31, 2022 2021 Revenues Income from sales-type leases 326,735$ 290,146$ Income from lease financing receivables and loans 72,878 70,377 Other income 8,386 6,974 Golf revenues 8,626 6,813 Total revenues 416,625 374,310 Operating expenses General and administrative 9,466 8,085 Depreciation 776 792 Other expenses 8,386 6,974 Golf expenses 5,285 4,506 Change in allowance for credit losses 80,820 (4,380) Transaction and acquisition expenses 755 8,721 Total operating expenses 105,488 24,698 Interest expense (68,142) (77,048) Interest income 93 19 Income before income taxes 243,088 272,583 Income tax expense (400) (484) Net income 242,688 272,099 Less: Net income attributable to non-controlling interest (2,305) (2,298) Net income attributable to common stockholders 240,383$ 269,801$ Net income per common share Basic 0.35$ 0.50$ Diluted 0.35$ 0.50$ Weighted average number of shares of common stock outstanding Basic 684,341,045 536,480,505 Diluted 687,914,683 544,801,802 Consolidated Statements of Operations (amounts in thousands, except share and per share data) 10 1 1 Impact to net income related to non-cash change in allowance for credit losses - CECL (80,820)$ 4,380$ Per share impact related to non-cash change in allowance for credit losses - CECL Basic (0.12)$ 0.01$ Diluted (0.12)$ 0.01$ 1. Refer to Note 5 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 for further details.

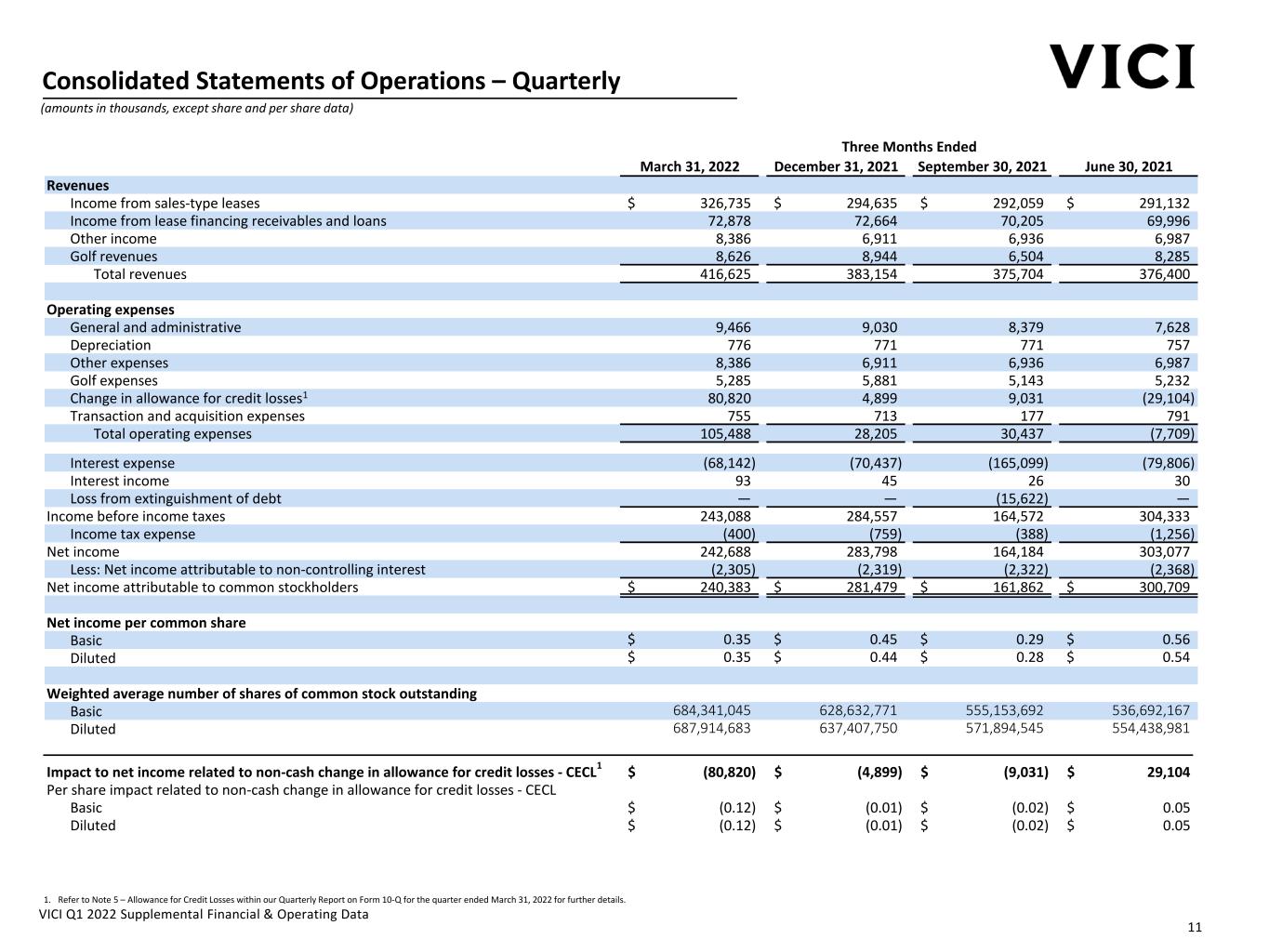

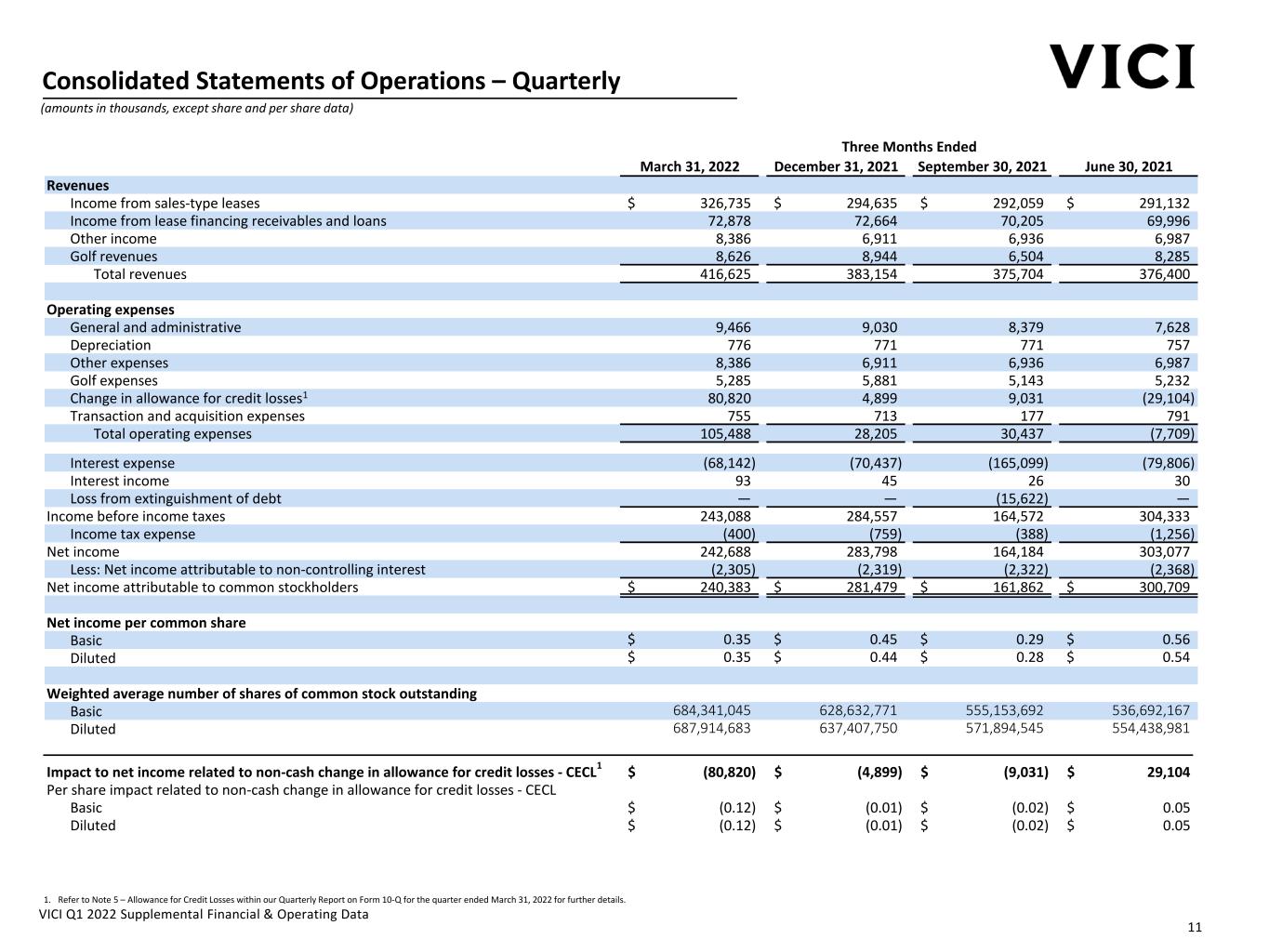

VICI Q1 2022 Supplemental Financial & Operating Data Three Months Ended March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Revenues Income from sales-type leases 326,735$ 294,635$ 292,059$ 291,132$ Income from lease financing receivables and loans 72,878 72,664 70,205 69,996 Other income 8,386 6,911 6,936 6,987 Golf revenues 8,626 8,944 6,504 8,285 Total revenues 416,625 383,154 375,704 376,400 Operating expenses General and administrative 9,466 9,030 8,379 7,628 Depreciation 776 771 771 757 Other expenses 8,386 6,911 6,936 6,987 Golf expenses 5,285 5,881 5,143 5,232 Change in allowance for credit losses 80,820 4,899 9,031 (29,104) Transaction and acquisition expenses 755 713 177 791 Total operating expenses 105,488 28,205 30,437 (7,709) Interest expense (68,142) (70,437) (165,099) (79,806) Interest income 93 45 26 30 Loss from extinguishment of debt — — (15,622) — Income before income taxes 243,088 284,557 164,572 304,333 Income tax expense (400) (759) (388) (1,256) Net income 242,688 283,798 164,184 303,077 Less: Net income attributable to non-controlling interest (2,305) (2,319) (2,322) (2,368) Net income attributable to common stockholders 240,383$ 281,479$ 161,862$ 300,709$ Net income per common share Basic 0.35$ 0.45$ 0.29$ 0.56$ Diluted 0.35$ 0.44$ 0.28$ 0.54$ Weighted average number of shares of common stock outstanding Basic 684,341,045 628,632,771 555,153,692 536,692,167 Diluted 687,914,683 637,407,750 571,894,545 554,438,981 Consolidated Statements of Operations – Quarterly (amounts in thousands, except share and per share data) 1. Refer to Note 5 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 for further details. 11 1 Impact to net income related to non-cash change in allowance for credit losses - CECL (80,820)$ (4,899)$ (9,031)$ 29,104$ Per share impact related to non-cash change in allowance for credit losses - CECL Basic (0.12)$ (0.01)$ (0.02)$ 0.05$ Diluted (0.12)$ (0.01)$ (0.02)$ 0.05$ 1

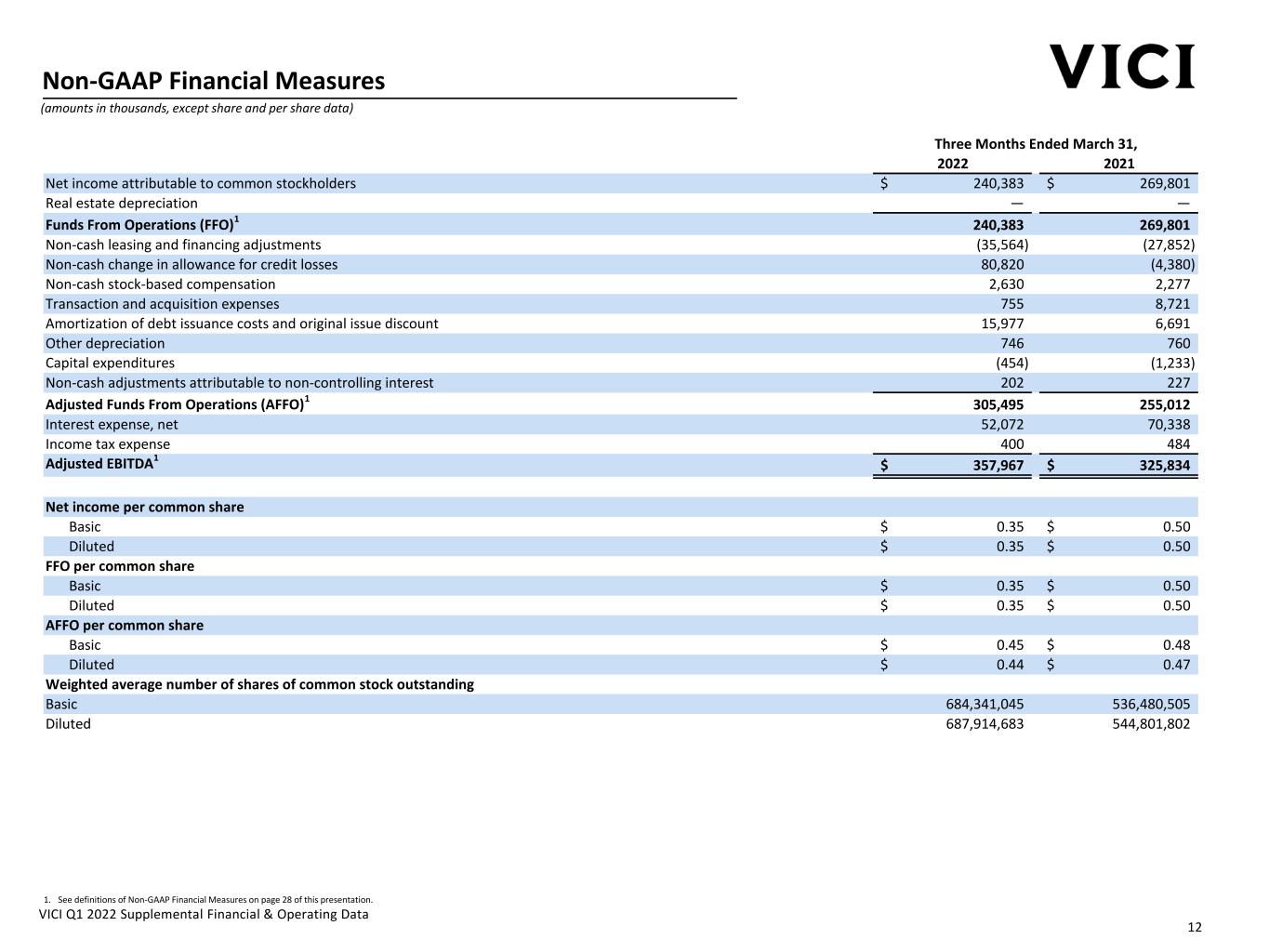

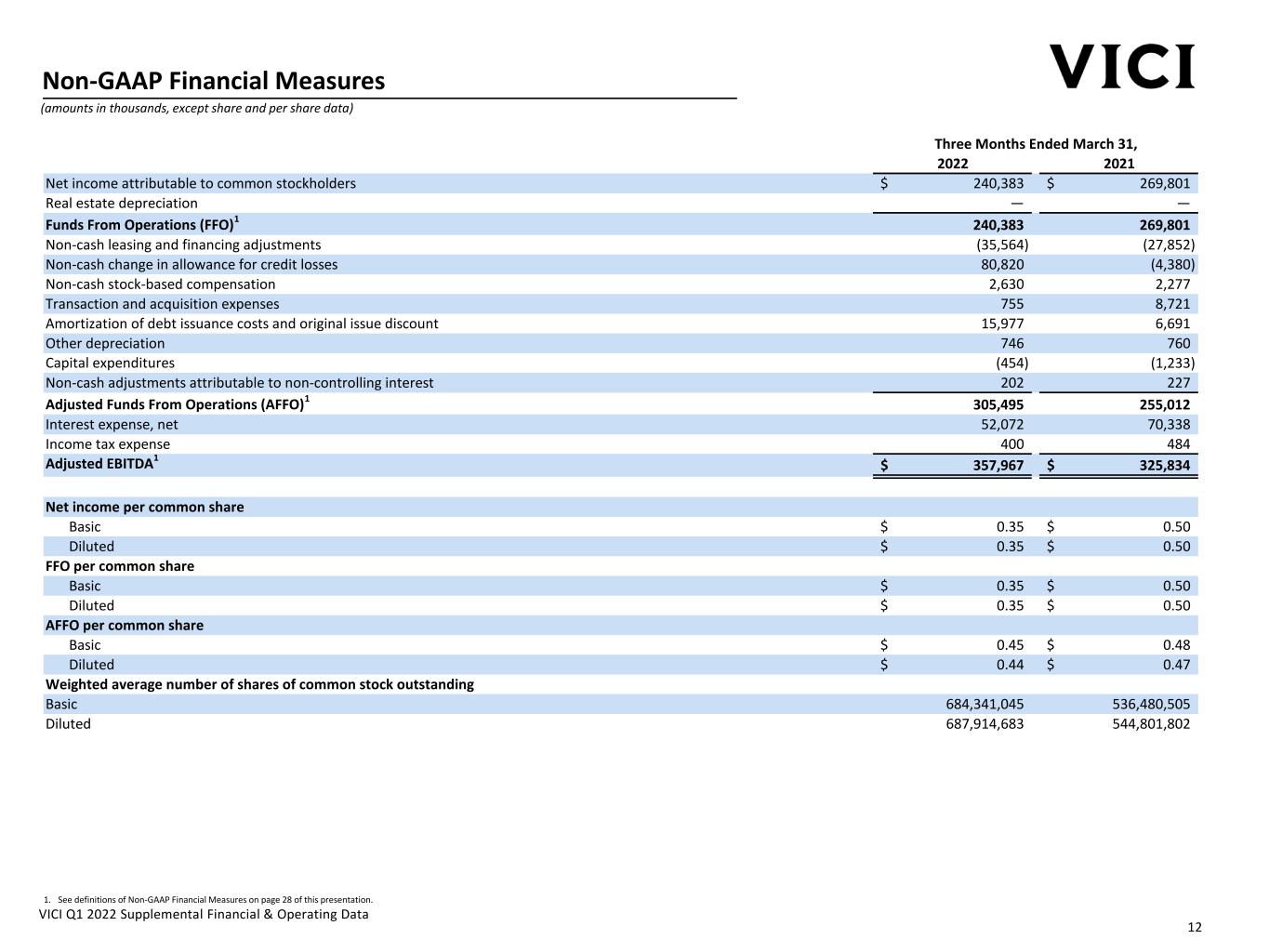

VICI Q1 2022 Supplemental Financial & Operating Data Non‐GAAP Financial Measures (amounts in thousands, except share and per share data) 12 2022 2021 Net income attributable to common stockholders 240,383$ 269,801$ Real estate depreciation — — Funds From Operations (FFO)1 240,383 269,801 Non-cash leasing and financing adjustments (35,564) (27,852) Non-cash change in allowance for credit losses 80,820 (4,380) Non-cash stock-based compensation 2,630 2,277 Transaction and acquisition expenses 755 8,721 Amortization of debt issuance costs and original issue discount 15,977 6,691 Other depreciation 746 760 Capital expenditures (454) (1,233) Non-cash adjustments attributable to non-controlling interest 202 227 Adjusted Funds From Operations (AFFO)1 305,495 255,012 Interest expense, net 52,072 70,338 Income tax expense 400 484 Adjusted EBITDA1 357,967$ 325,834$ Net income per common share Basic 0.35$ 0.50$ Diluted 0.35$ 0.50$ FFO per common share Basic 0.35$ 0.50$ Diluted 0.35$ 0.50$ AFFO per common share Basic 0.45$ 0.48$ Diluted 0.44$ 0.47$ Weighted average number of shares of common stock outstanding Basic 684,341,045 536,480,505 Diluted 687,914,683 544,801,802 Three Months Ended March 31, 1. See definitions of Non-GAAP Financial Measures on page 28 of this presentation.

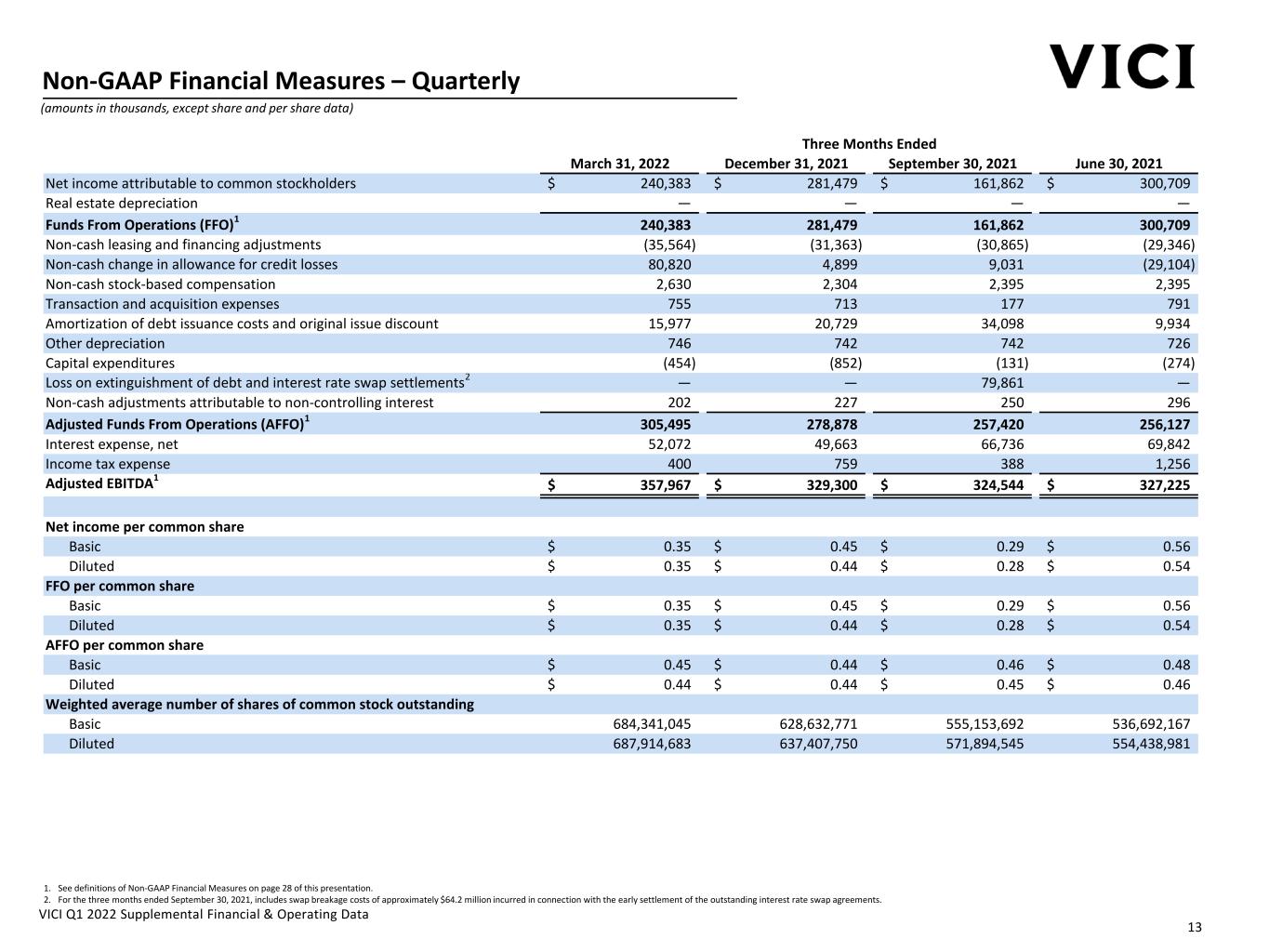

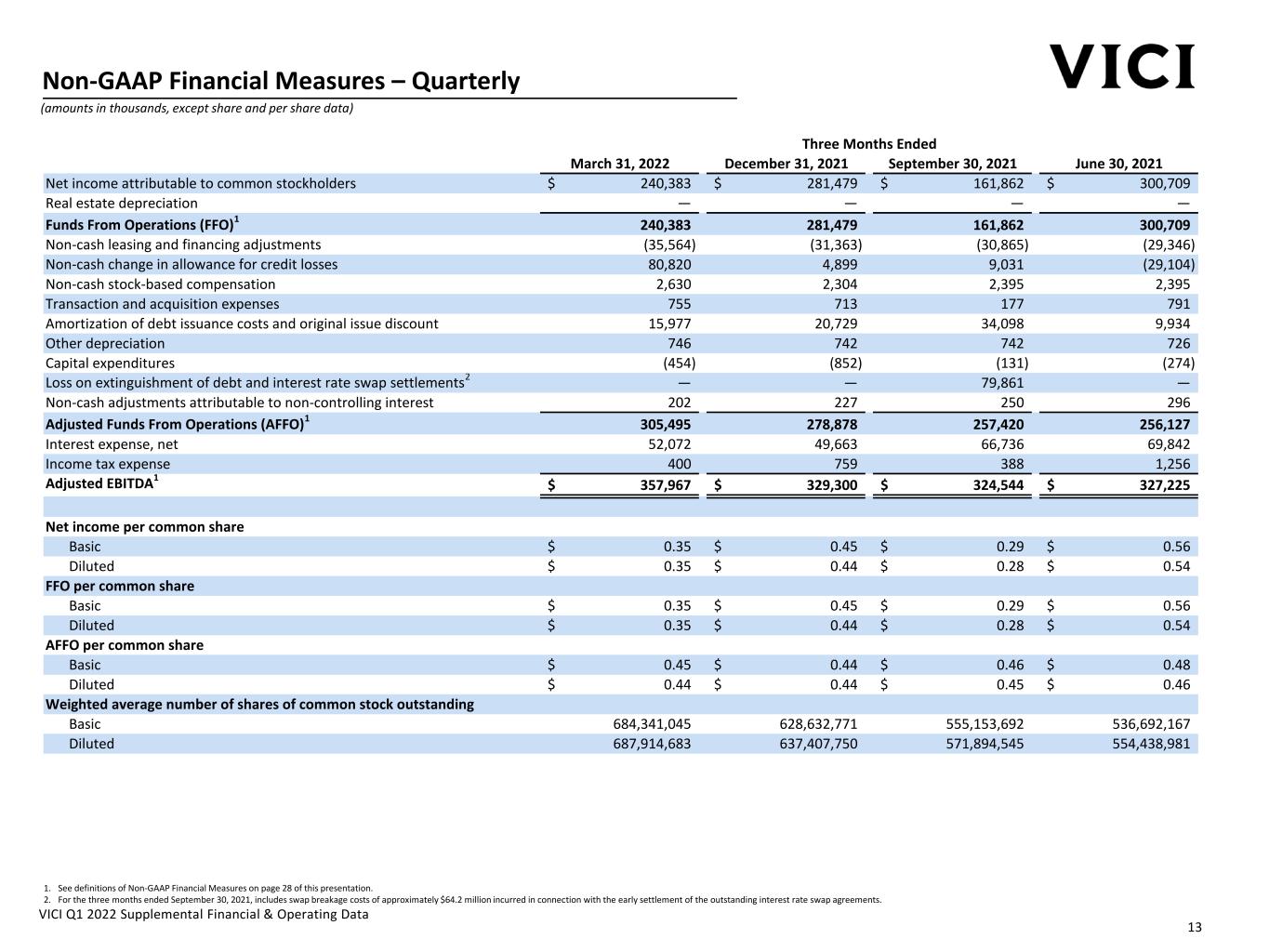

VICI Q1 2022 Supplemental Financial & Operating Data Non‐GAAP Financial Measures – Quarterly (amounts in thousands, except share and per share data) 13 Three Months Ended March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Net income attributable to common stockholders 240,383$ 281,479$ 161,862$ 300,709$ Real estate depreciation — — — — Funds From Operations (FFO)1 240,383 281,479 161,862 300,709 Non-cash leasing and financing adjustments (35,564) (31,363) (30,865) (29,346) Non-cash change in allowance for credit losses 80,820 4,899 9,031 (29,104) Non-cash stock-based compensation 2,630 2,304 2,395 2,395 Transaction and acquisition expenses 755 713 177 791 Amortization of debt issuance costs and original issue discount 15,977 20,729 34,098 9,934 Other depreciation 746 742 742 726 Capital expenditures (454) (852) (131) (274) Loss on extinguishment of debt and interest rate swap settlements2 — — 79,861 — Non-cash adjustments attributable to non-controlling interest 202 227 250 296 Adjusted Funds From Operations (AFFO)1 305,495 278,878 257,420 256,127 Interest expense, net 52,072 49,663 66,736 69,842 Income tax expense 400 759 388 1,256 Adjusted EBITDA1 357,967$ 329,300$ 324,544$ 327,225$ Net income per common share Basic 0.35$ 0.45$ 0.29$ 0.56$ Diluted 0.35$ 0.44$ 0.28$ 0.54$ FFO per common share Basic 0.35$ 0.45$ 0.29$ 0.56$ Diluted 0.35$ 0.44$ 0.28$ 0.54$ AFFO per common share Basic 0.45$ 0.44$ 0.46$ 0.48$ Diluted 0.44$ 0.44$ 0.45$ 0.46$ Weighted average number of shares of common stock outstanding Basic 684,341,045 628,632,771 555,153,692 536,692,167 Diluted 687,914,683 637,407,750 571,894,545 554,438,981 1. See definitions of Non-GAAP Financial Measures on page 28 of this presentation. 2. For the three months ended September 30, 2021, includes swap breakage costs of approximately $64.2 million incurred in connection with the early settlement of the outstanding interest rate swap agreements.

VICI Q1 2022 Supplemental Financial & Operating Data 2022 2021 Contractual revenue from sales-type leases 122,729$ 129,040$ Caesars Las Vegas Master Lease 105,556 100,652 The Venetian Resort Las Vegas Lease 25,298 — Greektown Lease 12,830 13,889 Hard Rock Lease 11,010 10,848 Caesars Southern Indiana Lease 8,125 — Century Master Lease 6,376 6,313 Margaritaville Lease 5,924 5,872 Income from sales-type leases non-cash adjustment 28,887 23,532 Income from sales-type leases 326,735 290,146 Contractual revenue from lease financing receivables Harrah's NOLA, AC, and Laughlin 39,663 39,077 JACK Entertainment Master Lease 16,690 16,470 Income from lease financing receivables non-cash adjustment 6,666 4,345 Income from lease financing receivables 63,019 59,892 Contractual interest income JACK Entertainment Loan - 1,633 Caesars Forum Convention Center Loan 7,854 7,700 Chelsea Piers Loan 1,176 1,176 Great Wolf Mezzanine Loan 818 — Income from loans non-cash adjustment 11 (24) Income from loans 9,859 10,485 Income from lease financing receivables and loans 72,878 70,377 Other income 8,386 6,974 Golf revenues 8,626 6,813 Total revenues 416,625$ 374,310$ Three Months Ended March 31, Caesars Regional Master Lease (excluding Harrah's NOLA, AC, and Laughlin) & Joliet Lease Revenue Detail 1. On September 3, 2021, in connection with EBCI’s acquisition of the operations of Caesars Southern Indiana, VICI entered into a triple-net lease agreement with EBCI, and the annual base rent payment under the Caesars Regional Master Lease was reduced by $32.5 million. 2. Amounts represent non-cash adjustments to recognize revenue on an effective interest basis in accordance with GAAP. (amounts in thousands, except share and per share data) 14 2 2 2 1

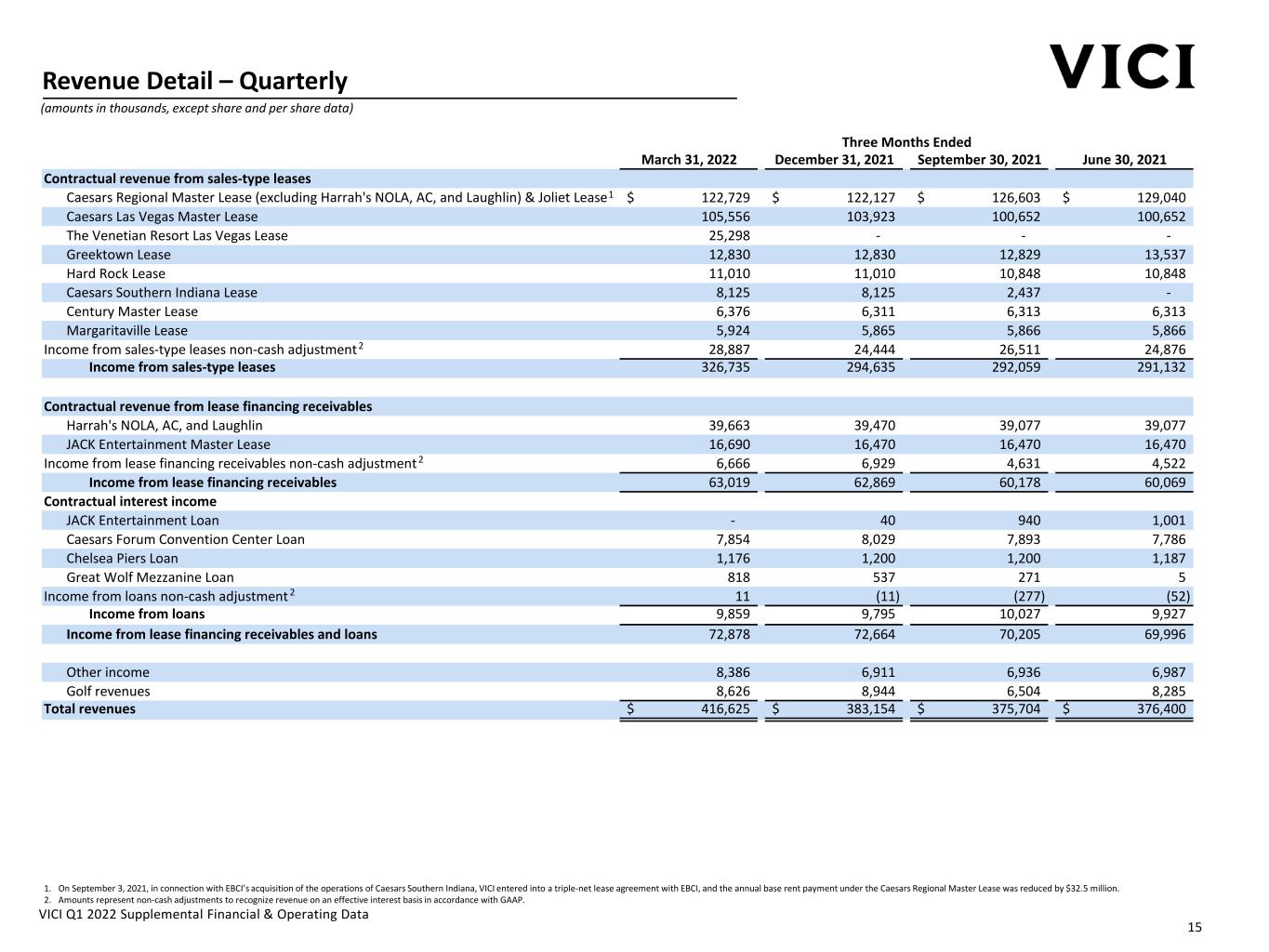

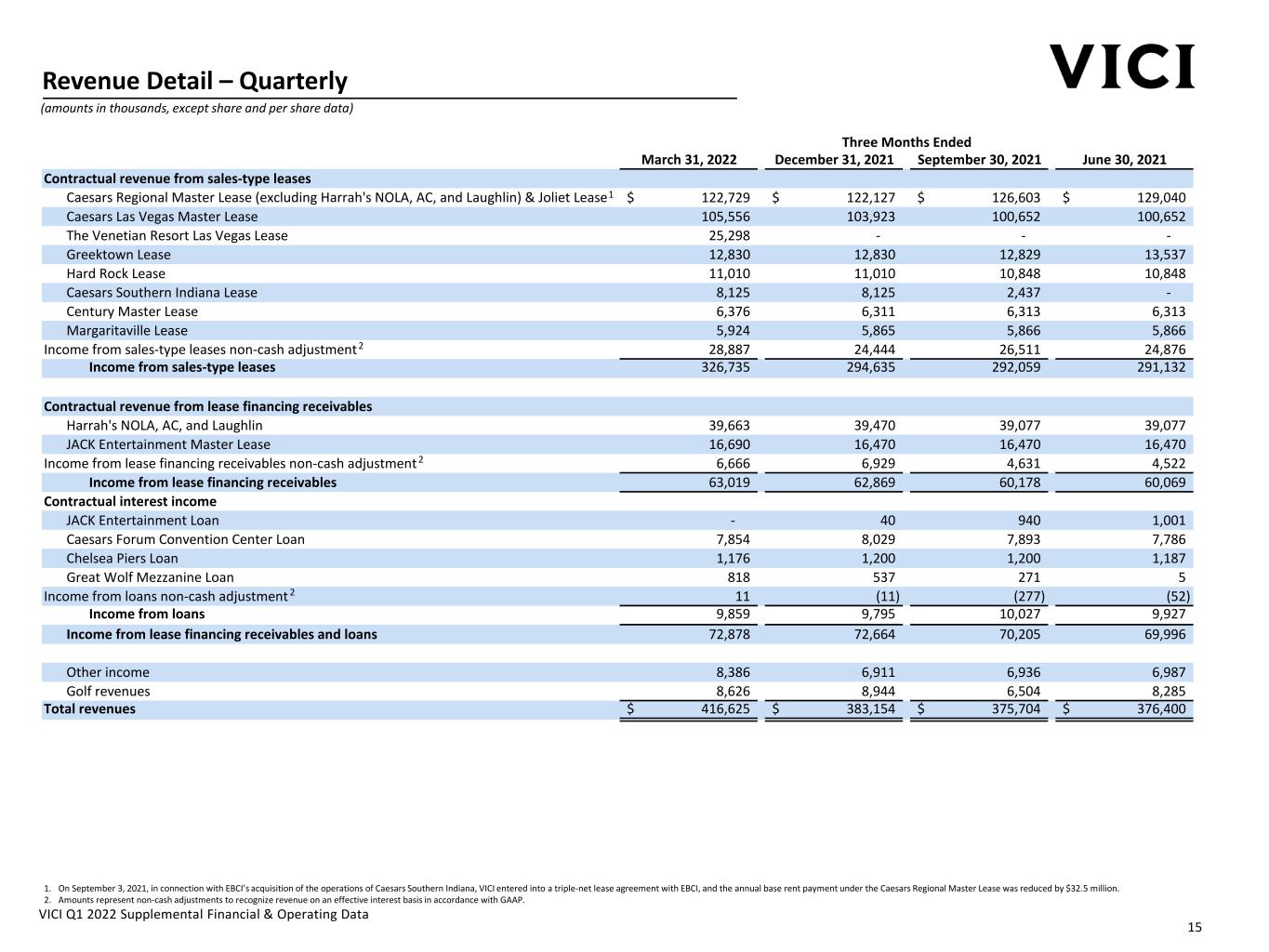

VICI Q1 2022 Supplemental Financial & Operating Data Three Months Ended March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Contractual revenue from sales-type leases Caesars Regional Master Lease (excluding Harrah's NOLA, AC, and Laughlin) & Joliet Lease 122,729$ 122,127$ 126,603$ 129,040$ Caesars Las Vegas Master Lease 105,556 103,923 100,652 100,652 The Venetian Resort Las Vegas Lease 25,298 - - - Greektown Lease 12,830 12,830 12,829 13,537 Hard Rock Lease 11,010 11,010 10,848 10,848 Caesars Southern Indiana Lease 8,125 8,125 2,437 - Century Master Lease 6,376 6,311 6,313 6,313 Margaritaville Lease 5,924 5,865 5,866 5,866 Income from sales-type leases non-cash adjustment 28,887 24,444 26,511 24,876 Income from sales-type leases 326,735 294,635 292,059 291,132 Contractual revenue from lease financing receivables Harrah's NOLA, AC, and Laughlin 39,663 39,470 39,077 39,077 JACK Entertainment Master Lease 16,690 16,470 16,470 16,470 Income from lease financing receivables non-cash adjustment 6,666 6,929 4,631 4,522 Income from lease financing receivables 63,019 62,869 60,178 60,069 Contractual interest income JACK Entertainment Loan - 40 940 1,001 Caesars Forum Convention Center Loan 7,854 8,029 7,893 7,786 Chelsea Piers Loan 1,176 1,200 1,200 1,187 Great Wolf Mezzanine Loan 818 537 271 5 Income from loans non-cash adjustment 11 (11) (277) (52) Income from loans 9,859 9,795 10,027 9,927 Income from lease financing receivables and loans 72,878 72,664 70,205 69,996 Other income 8,386 6,911 6,936 6,987 Golf revenues 8,626 8,944 6,504 8,285 Total revenues 416,625$ 383,154$ 375,704$ 376,400$ Revenue Detail – Quarterly (amounts in thousands, except share and per share data) 1. On September 3, 2021, in connection with EBCI’s acquisition of the operations of Caesars Southern Indiana, VICI entered into a triple-net lease agreement with EBCI, and the annual base rent payment under the Caesars Regional Master Lease was reduced by $32.5 million. 2. Amounts represent non-cash adjustments to recognize revenue on an effective interest basis in accordance with GAAP. 15 2 2 2 1

VICI Q1 2022 Supplemental Financial & Operating Data Assets Per Lease Locations Annualized Rent Annualized Contractual Rent MGM Master Lease 13 Las Vegas / Regional $860.0 Caesars Regional Master Lease & Joliet Lease 16 Regional 649.6 Caesars Las Vegas Master Lease 2 Las Vegas 422.2 The Venetian Resort Las Vegas Lease 1 Las Vegas 250.0 Pro Rata Share of MGM Grand / Mandalay Bay BREIT JV Master Lease 2 Las Vegas 152.2 JACK Entertainment Master Lease 2 Regional 69.0 Greektown Lease 1 Regional 51.3 Hard Rock Cincinnati Lease 1 Regional 44.0 Caesars Southern Indiana Lease 1 Regional 32.5 Century Master Lease 3 Regional 25.5 Margaritaville Lease 1 Regional 23.8 Total Annualized Contractual Rent 43 $2,580.2 Borrower Principal Balance Interest Rate Final Maturity Date Annualized Income from Loans Annualized Contractual Income from Loans Caesars Forum Convention Center Loan Caesars Entertainment $400.0 7.9% 9/18/2025 $31.4 Chelsea Piers Loan Chelsea Piers New York 65.0 7.0% 8/31/2027 4.6 Great Wolf Mezzanine Loan Great Wolf Resorts 49.2 8.0% 7/9/2026 3.9 BigShots Golf Loan BigShots Golf - 10.0% 4/11/2027 - Total Annualized Contractual Income from Loans $514.2 $39.9 Total Annualized Contractual Rent and Income from Loans $2,620.1 Annualized Contractual Rent and Income from Loans ($ in millions, as of May 2022) 1. On April 29, 2022, the Company completed the acquisition of MGP. On December 13, 2021, in connection with MGM’s agreement to sell the operations of the Mirage to Hard Rock, VICI has agreed to enter into a separate lease with Hard Rock related to the land and real estate assets of the Mirage, subject to customary closing conditions and regulatory approvals. Upon closing of the transaction, the MGM Master Lease will be amended to reflect the removal of the Mirage and initial annual rent payments will be reduced by $90.0 million. 2. MGM Grand and Mandalay Bay are owned by a joint venture with Blackstone Real Estate Income Trust, Inc. (“BREIT”), in which the Company owns a 50.1% interest following the acquisition of MGP. 3. Final maturity assumes all extension options are exercised; however, the loans may be repaid, subject to certain conditions, prior to such date. 4. The interest rate of the Caesars Forum Convention Center Mortgage Loan is subject to 2.0% annual escalation. 5. Subsequent to quarter end, on April 7, 2022, the Company entered into an up to $80.0 million mortgage with BigShots Golf. 16 4 3 1 2 5

VICI Q1 2022 Supplemental Financial & Operating Data 2022 Guidance The Company is updating AFFO guidance for the full year 2022. The Company’s updated guidance incorporates the expected impact on operating results of the recently announced completion of the MGP Transactions, including the issuance of approximately 214.5 million shares of common stock to former stockholders of MGP, and the issuance of $5.0 billion of senior notes in April 2022. The Company's guidance does not include the impact on operating results from any possible future acquisitions or dispositions, capital markets activity, or other non-recurring transactions. The Company estimates AFFO for the year ending December 31, 2022 will be between $1,660.0 million and $1,690.0 million, or between $1.89 and $1.92 per diluted share. The following is a summary of the Company’s updated full-year 2022 guidance: In determining AFFO, the Company adjusts for certain items that are otherwise included in determining net income attributable to common stockholders, the most comparable GAAP financial measure. For more information, see “Non-GAAP Financial Measures.” The Company is unable to provide a reconciliation of its stated AFFO guidance to net income attributable to common stockholders because it is unable to predict with reasonable certainty the amount of the change in non-cash allowance for credit losses under ASU No. 2016-13 - Financial Instruments—Credit Losses (Topic 326) (“ASC 326”) for a future period. The non-cash change in allowance for credit losses under ASC 326 with respect to a future period is dependent upon future events that are entirely outside of the Company's control and may not be reliably predicted, including its tenants’ respective financial performance, fluctuations in the trading price of their common stock, credit ratings and outlook (each to the extent applicable), as well as broader macroeconomic performance. Based on past results, the impact of these adjustments could be material, individually or in the aggregate, to the Company's reported GAAP results. The estimates set forth above reflect management’s view of current and future market conditions, including assumptions with respect to the earnings impact of the events referenced in this presentation. The estimates set forth above may be subject to fluctuations as a result of several factors and there can be no assurance that the Company’s actual results will not differ materially from the estimates set forth above. ($ in millions, except per share data) 17 2022 Guidance Updated Guidance Prior Guidance For the Year Ending December 31, 2022: Low High Low High Estimated Adjusted Funds From Operations (AFFO) $1,660.0 $1,690.0 $1,317.0 $1,347.0 Estimated Adjusted Funds From Operations (AFFO) per diluted share $1.89 $1.92 $1.80 $1.84 Estimated Weighted Average Share Count at Year End (in millions) 878.6 878.6 733.7 733.7

VICI Q1 2022 Supplemental Financial & Operating Data Debt1 Maturity Date Interest Rate Interest Frequency Balance as of March 31, 2022 Balance as of May 3, 20222 Senior Unsecured Debt $2.5Bn Revolving Credit Facility 3/31/20273 SOFR+1.05%4 Monthly 600,000 - $1.0Bn Delayed Draw Term Loan 3/31/20273 SOFR+1.20%4 Monthly - - 3.500% Notes due 2025 2/15/2025 3.500% Semi-Annually 750,000 750,000 4.250% Notes due 2026 12/1/2026 4.250% Semi‐Annually 1,250,000 1,250,000 3.750% Notes due 2027 2/15/2027 3.750% Semi-Annually 750,000 750,000 4.625% Notes due 2029 12/1/2029 4.625% Semi‐Annually 1,000,000 1,000,000 4.125% Notes due 2030 8/15/2030 4.125% Semi-Annually 1,000,000 1,000,000 5.625% Notes due 20245 5/1/2024 5.625% Semi-Annually - 1,050,000 4.625% Notes due 20255 6/15/2025 4.625% Semi-Annually - 800,000 4.500% Notes due 20265 9/1/2026 4.500% Semi-Annually - 500,000 5.750% Notes due 20275 2/1/2027 5.750% Semi-Annually - 750,000 4.500% Notes due 20285 1/15/2028 4.500% Semi-Annually - 350,000 3.875% Notes due 20295 2/15/2029 3.875% Semi-Annually - 750,000 4.375% Notes due 2025 5/15/2025 4.375% Semi-Annually - 500,000 4.750% Notes due 2028 2/15/2028 4.750% Semi-Annually - 1,250,000 4.950% Notes due 2030 2/15/2030 4.950% Semi-Annually - 1,000,000 5.125% Notes due 2032 5/15/2032 5.125% Semi-Annually - 1,500,000 5.625% Notes due 2052 5/15/2052 5.625% Semi-Annually - 750,000 Total Unsecured Debt - - - $5,350,000 $13,950,000 50.1% Pro Rata Share of BREIT JV Debt 3/5/2032 3.308% Monthly - 1,503,000 Total Debt $5,350,000 $15,453,000 Weighted Average Interest Rate (Coupon / Coupon Including Impact of Hedges) 3.84%6 / - 4.54% / 4.38%7 Unsecured Debt 100% 90% Fixed Rate Debt 89% 100% 1. The Senior Unsecured Notes benefit from a limited pledge of the equity of VICI Properties L.P. Refer to Note 7 - Debt within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 for further details. 2. Reflects debt assumed and incurred in connection with the acquisition of MGP and use of proceeds therefrom. 3. Maturity date shown inclusive of applicable extension options. 4. Facility fees (0.15%-0.375% depending on VICI LP’s ratings) on total commitments; reflects Ba1 / BBB- / BBB- credit ratings as of April 18, 2022. 5. Issued in exchange for senior notes originally issued by MGP OP pursuant to the related exchange offers, which settled on April 29, 2022 in connection with the closing of the MGP acquisition. Principal amounts listed include unexchanged MGP OP notes which remain outstanding, totaling $90.0 million in the aggregate. 6. Based on one-month SOFR of 0.30% as of March 31, 2022; reflects Ba3 / BB / BB credit ratings as of March 31, 2022. 7. Reflects impact of $3.0bn notional amount of forward starting swaps and treasury locks entered into between December 2021 – April 2022, which were settled in connection with the April 2022 $5.0 billion senior notes offering. Refer to page 26 of this presentation and Note 8 – Derivatives within our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 for further details. 8. On April 29, 2022, VICI issued approximately 214.5 million shares of common stock to former stockholders of MGP in connection with the closing of the MGP acquisition. In addition, following the closing of the MGP acquisition, MGM holds approximately 1% of the limited liability company interests in VICI Properties OP LLC, which may be redeemed for cash or, at VICI's election, shares of common stock. Capitalization ($ in thousands, except share and per share data) 18 VICI Issuer Credit Ratings Moody’s: Ba1 / Stable Outlook S&P: BBB- / Stable Outlook Fitch: BBB- / Stable Outlook Equity As of March 31, 2022 As of May 3, 2022 Shares Outstanding 748,413,311 963,002,1138 Third-Party OP Units Outstanding - 12,231,3738 Share Price $28.46 $29.93 Equity Market Capitalization $21,299,843 $29,188,738

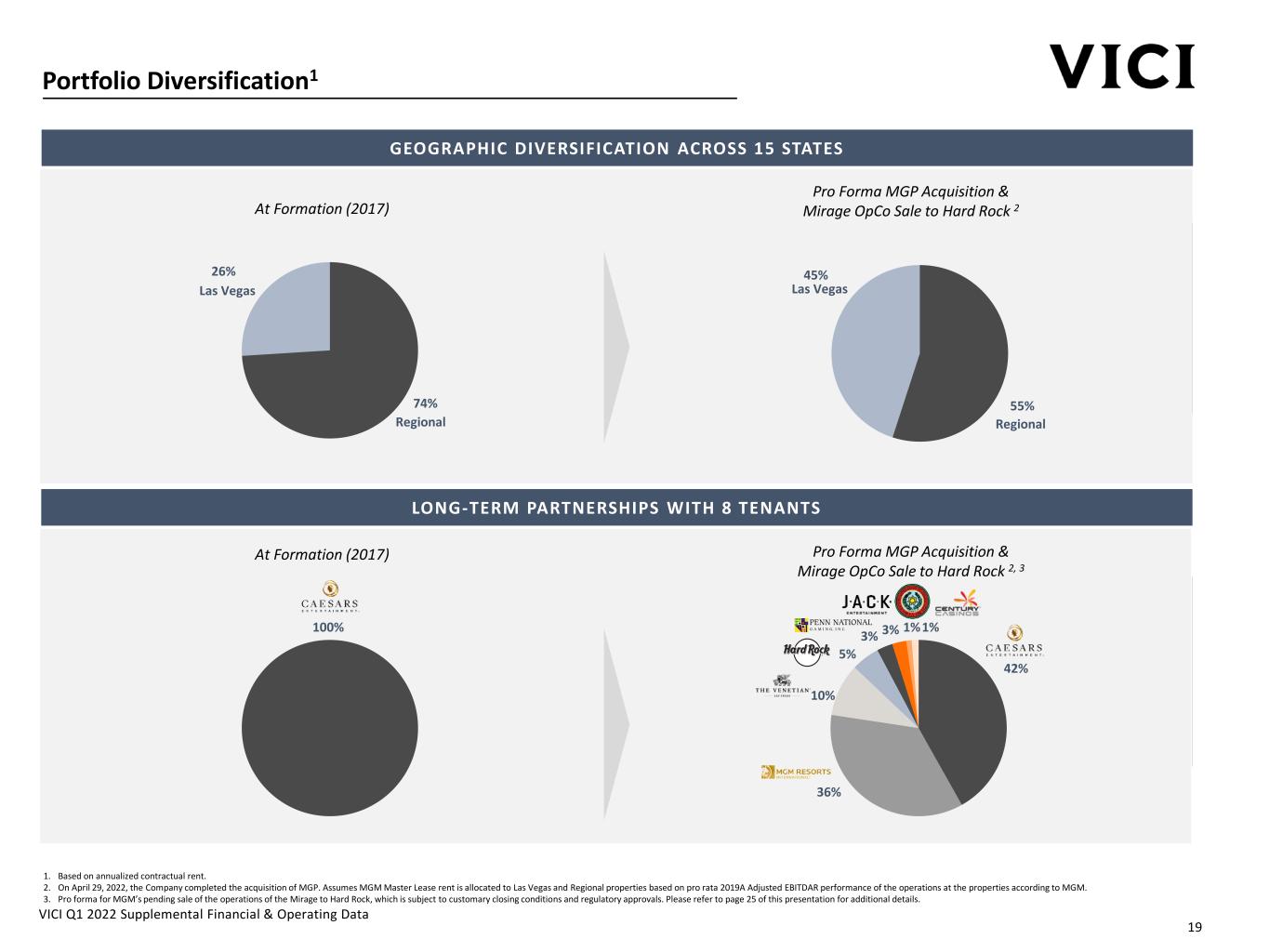

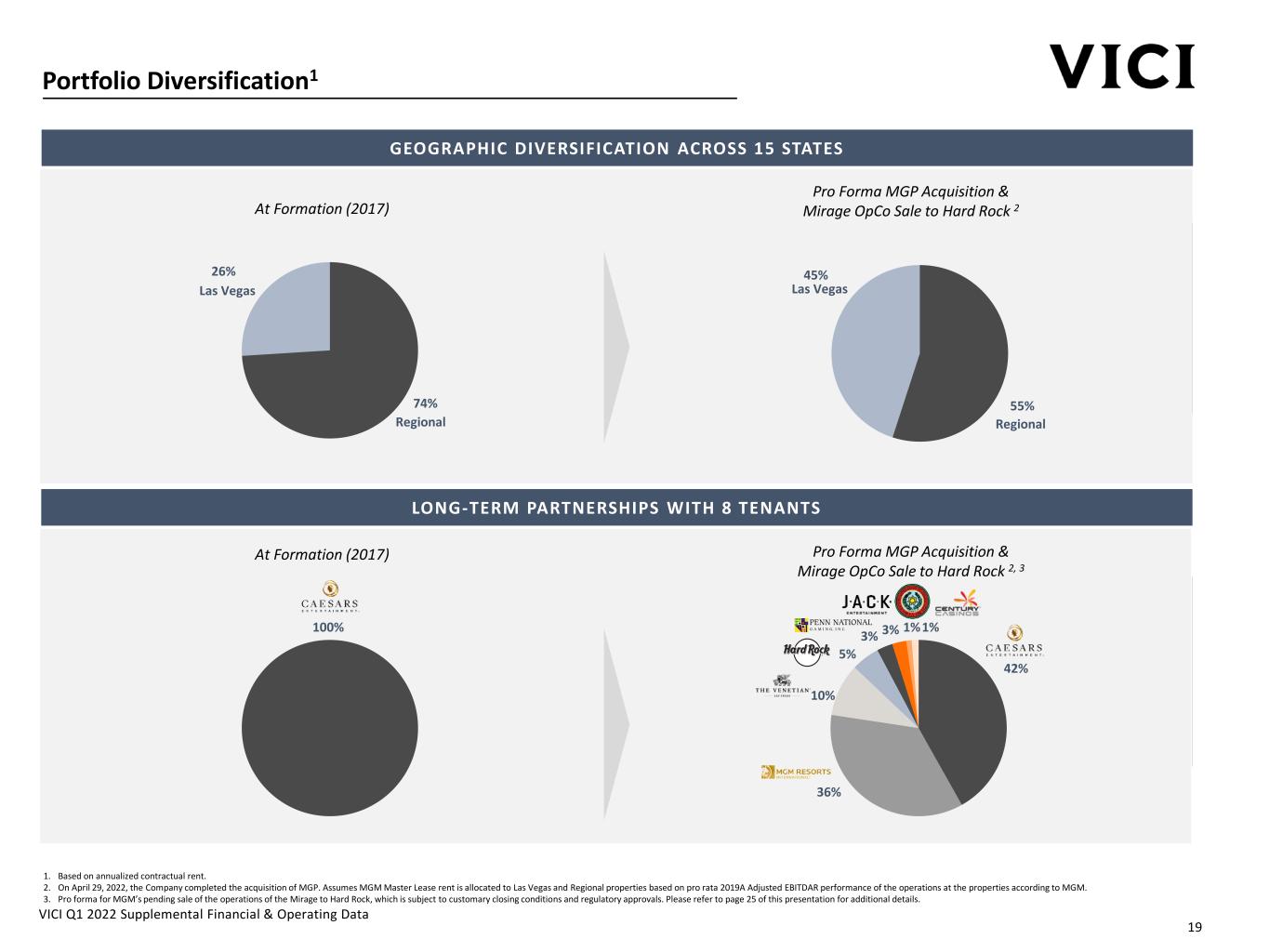

VICI Q1 2022 Supplemental Financial & Operating Data Portfolio Diversification1 1. Based on annualized contractual rent. 2. On April 29, 2022, the Company completed the acquisition of MGP. Assumes MGM Master Lease rent is allocated to Las Vegas and Regional properties based on pro rata 2019A Adjusted EBITDAR performance of the operations at the properties according to MGM. 3. Pro forma for MGM’s pending sale of the operations of the Mirage to Hard Rock, which is subject to customary closing conditions and regulatory approvals. Please refer to page 25 of this presentation for additional details. 19 GEOGRAPHIC DIVERSIFICATION ACROSS 15 STATES At Formation (2017) 74% 26% Regional Las Vegas Pro Forma MGP Acquisition & Mirage OpCo Sale to Hard Rock 2 55% 45% Regional Las Vegas LONG-TERM PARTNERSHIPS WITH 8 TENANTS 100% At Formation (2017) 42% 36% 10% 5% 3% 3% 1%1% Pro Forma MGP Acquisition & Mirage OpCo Sale to Hard Rock 2, 3

VICI Q1 2022 Supplemental Financial & Operating Data Portfolio Overview 20 1. On April 29, 2022, the Company acquired this property in connection with the closing of the acquisition of MGP. 2. Owned by Harrah's Joliet Landco LLC, a joint venture of which a subsidiary of VICI is the 80% owner and managing member. 3. MGM Grand and Mandalay Bay are owned by a joint venture with BREIT, in which the Company owns a 50.1% interest following the acquisition of MGP. (Square footage shown in thousands) Major MSAs Total Casino Meeting Slot Table Hotel Served Property Location Sq. Ft. Sq. Ft. Sq. Ft. Machines Games Rooms Boston MGM Springfield1 Springfield, MA 2,000 106 34 1,571 52 240 Horseshoe Hammond Hammond, IN 1,716 117 -- 1,970 120 -- Harrah's Joliet2 Joliet, IL 1,011 39 6 880 20 200 Cincinnati Hard Rock Cincinnati Cincinnati, OH 1,482 100 33 1,800 100 -- JACK Cleveland Cleveland, OH 844 96 -- 1,330 120 -- JACK Thistledown North Randall, OH 1,004 57 -- 1,480 -- -- MGM Northfield Park1 Northfield, OH 724 73 -- 1,669 -- -- Horseshoe Bossier City Bossier City, LA 1,419 28 22 1,060 60 600 Margaritaville Bossier City Bossier City, LA 380 30 -- 986 50 395 Hollywood Casino at Greektown Detroit, MI 2,200 100 14 2,155 64 400 MGM Grand Detroit1 Detroit, MI 3,220 147 30 2,817 140 400 Kansas City Harrah's North Kansas City North Kansas City, MO 1,435 60 13 960 60 390 Caesars Palace Las Vegas Las Vegas, NV 8,579 124 300 1,400 180 3,970 Excalibur1 Las Vegas, NV 2,860 93 25 894 42 3,981 Harrah's Las Vegas Las Vegas, NV 4,100 89 24 1,070 60 2,540 Luxor1 Las Vegas, NV 3,398 101 35 819 45 4,397 Mandalay Bay1,3 Las Vegas, NV 9,581 152 2,121 990 69 4,750 MGM Grand Las Vegas1,3 Las Vegas, NV 9,068 169 850 1,245 122 6,071 The Mirage1 Las Vegas, NV 4,795 94 170 835 71 3,044 New York - New York & The Park1 Las Vegas, NV 2,765 81 31 893 54 2,024 Park MGM1 Las Vegas, NV 5,099 66 77 745 65 2,898 The Venetian Resort Las Vegas Las Vegas, NV 16,970 225 2,300 1,480 210 7,100 Laughlin Harrah's Laughlin Laughlin, NV 1,413 58 7 760 40 1,510 Louisville Caesars Southern Indiana Elizabeth, IN 2,510 74 24 1,100 90 500 Gold Strike Tunica1 Tunica, MS 1,460 57 17 1,082 61 1,109 Horseshoe Tunica Robinsonville, MS 1,008 63 20 970 100 510 Chicago Cleveland Dallas Detroit Las Vegas Memphis

VICI Q1 2022 Supplemental Financial & Operating Data Portfolio Overview (Continued) 21 1. On April 29, 2022, the Company acquired this property in connection with the closing of the acquisition of MGP. (Square footage shown in thousands) Major MSAs Total Casino Meeting Slot Table Hotel Served Property Location Sq. Ft. Sq. Ft. Sq. Ft. Machines Games Rooms Nashville Harrah's Metropolis Metropolis, IL 474 24 -- 650 20 210 Beau Rivage1 Biloxi, MS 3,633 85 50 1,516 75 1,740 Harrah's Gulf Coast Biloxi, MS 1,031 32 -- 600 30 500 Harrah's New Orleans New Orleans, LA 1,180 104 47 1,260 120 450 New York Empire City1 Yonkers, NY 549 137 0 4,696 0 0 Harrah's Council Bluffs Council Bluffs, IA 790 23 6 510 20 250 Horseshoe Council Bluffs Council Bluffs, IA 632 55 -- 1,330 60 150 Pittsburgh Mountaineer Casino New Cumberland, WV 890 72 70 1,110 35 357 Borgata1 Atlantic City, NJ 5,673 213 106 2,816 163 2,767 Caesars Atlantic City Atlantic City, NJ 3,816 113 29 1,900 130 1,150 Harrah's Atlantic City Atlantic City, NJ 4,470 150 125 1,860 130 2,590 Harrah’s Philadelphia Chester, PA 2,000 100 12 1,700 70 -- Harvey's Lake Tahoe Lake Tahoe, NV 1,670 51 19 600 30 740 Harrah's Lake Tahoe Stateline, NV 1,057 54 18 720 60 510 Century Casino Cape Girardeau Cape Girardeau, MO 170 42 8 839 23 -- Century Casino Caruthersville Caruthersville, MO 90 21 12 525 9 -- Washington D.C. MGM National Harbor1 Prince George's County, MD 3,349 150 50 2,123 158 308 Total VICI Properties 20 MSAs 43 Properties 15 States 122,516 3,825 6,705 57,716 3,128 58,751 Cascata Golf Course Boulder City, NV 37 -- -- -- -- -- Rio Secco Golf Course Henderson, NV 30 -- -- -- -- -- Grand Bear Golf Course Saucier, MS 5 -- -- -- -- -- Chariot Run Golf Course Laconia, IN 5 -- -- -- -- -- Golf Course New Orleans Omaha Philadelphia San Francisco /Sacramento St. Louis

VICI Q1 2022 Supplemental Financial & Operating Data Summary of Current Lease Terms MGM Master Lease1 Caesars Regional Master Lease and Joliet Lease2 Caesars Las Vegas Master Lease2 Venetian Resort Las Vegas Lease Tenant MGM Resorts International Caesars Entertainment Caesars Entertainment Affiliate of funds managed by affiliates of Apollo Global Management, Inc. Annual Cash Rent as of May 2022 $860.0 million $649.6 million3 $422.2 million $250.0 million Current Lease Year Apr. 29, 2022 – Apr. 30, 2023 Lease Year 1 Nov. 1, 2021 – Oct. 31, 2022 Lease Year 5 Nov. 1, 2021 – Oct. 31, 2022 Lease Year 5 Feb. 23, 2022 – Feb. 28, 20234 Lease Year 1 Annual Escalator 2% in years 2-10 >2% / change in CPI thereafter (capped at 3%) 1.5% in years 2-5 >2% / change in CPI thereafter, subject to 2% floor >2% / change in CPI, subject to 2% floor >2% / change in CPI (capped at 3%), beginning in year 2 Coverage Floor None None None None Rent Adjustment5 None Year 8: 70% Base / 30% Variable Year 11 & 16: 80% Base / 20% Variable Year 8, 11 & 16: 80% Base / 20% Variable None Variable Rent Adjustment Mechanic5 None 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 None Term 25-year initial term with three 10-year renewal options 18-year initial term with four 5-year renewal options6 30-year initial term with two 10-year renewal options Guarantor MGM Resorts International Caesars Entertainment, Inc. Caesars Entertainment, Inc. Las Vegas Sands Corp. provides contingent lease payment support through 2023, which will terminate after (i) 2022 if 2022 EBITDAR ≥ $550mm or (ii) a change of control occurs Capex 1% of Net Revenues Minimum of 1% of Net Revenue annually, with rolling three-year minimum (allocated among CPLV and regional properties) Minimum of 1% of Net Revenue annually, with rolling three-year minimum (allocated among CPLV and HLV) 2.0% of Net Revenues annually (exclusive of gaming equipment) on a rolling three- year basis with ramp up 22 1. On April 29, 2022, the Company completed the acquisition of MGP. 2. Regional Master Lease consists of 16 Caesars properties leased from VICI and the Las Vegas Master Lease consists of Caesars Palace Las Vegas and Harrah’s Las Vegas. 3. Cash rent amounts are presented prior to accounting for the portion of rent payable to the 20% JV partner at Harrah’s Joliet. After adjusting for the portion of rent payable to the 20% JV partner, Current Annual Cash Rent is $641.2 million. 4. Lease year 1 ends on the earlier of (i) February 28, 2024 and (ii) the first day of the first month following the month in which the net revenue of the Venetian Resort Las Vegas for the trailing 12 months equals or exceeds 2019 net revenue. 5. Rent adjustments in the Caesars Regional Master Lease and Caesars Las Vegas Master Lease occur in lease years based on a lease commencement date of October 6, 2017. 6. Upon the consummation of the Eldorado Transaction, the Caesars Lease Agreements were extended such that each lease has a full 15-year initial lease term from the date of consummation.

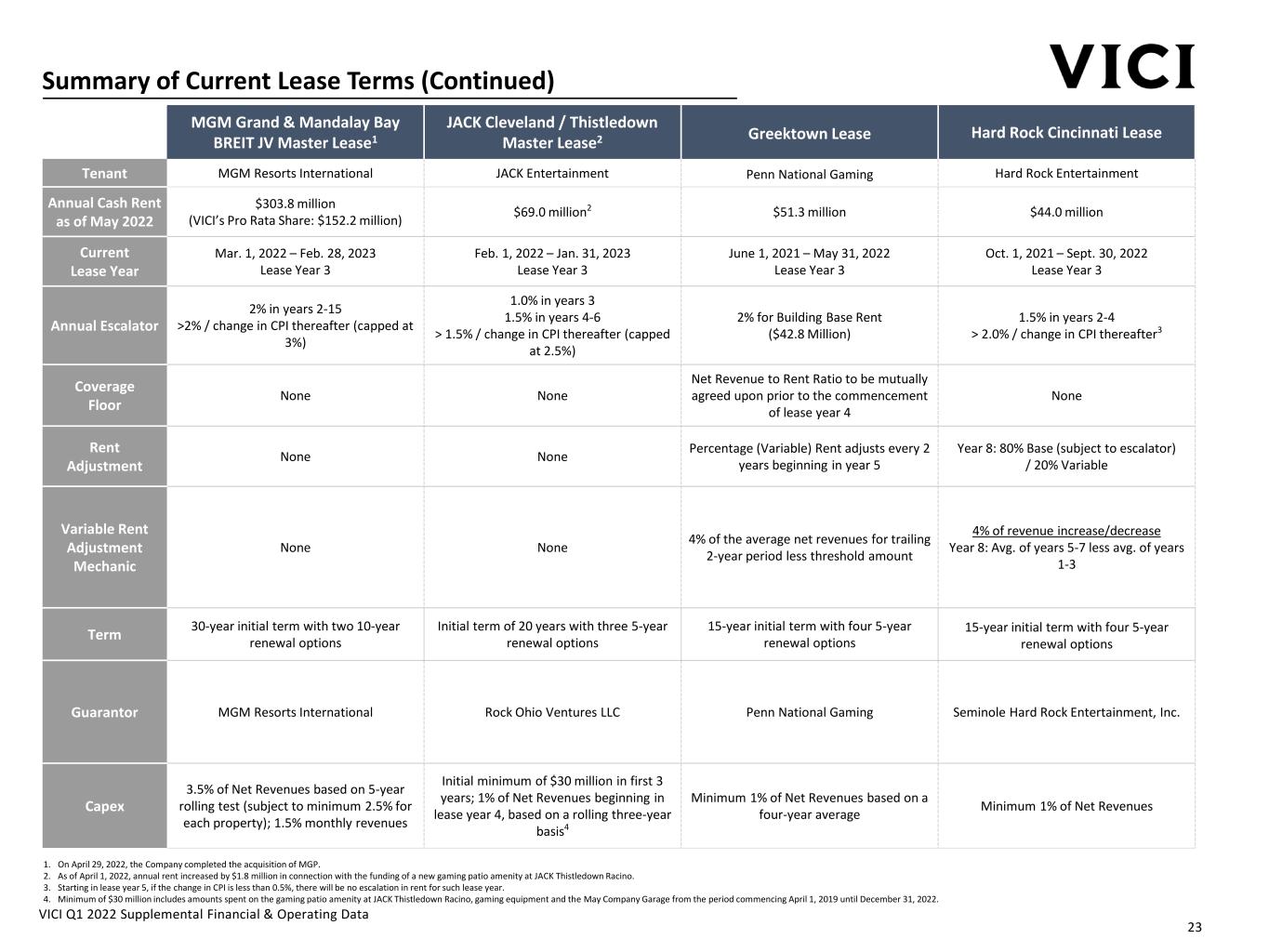

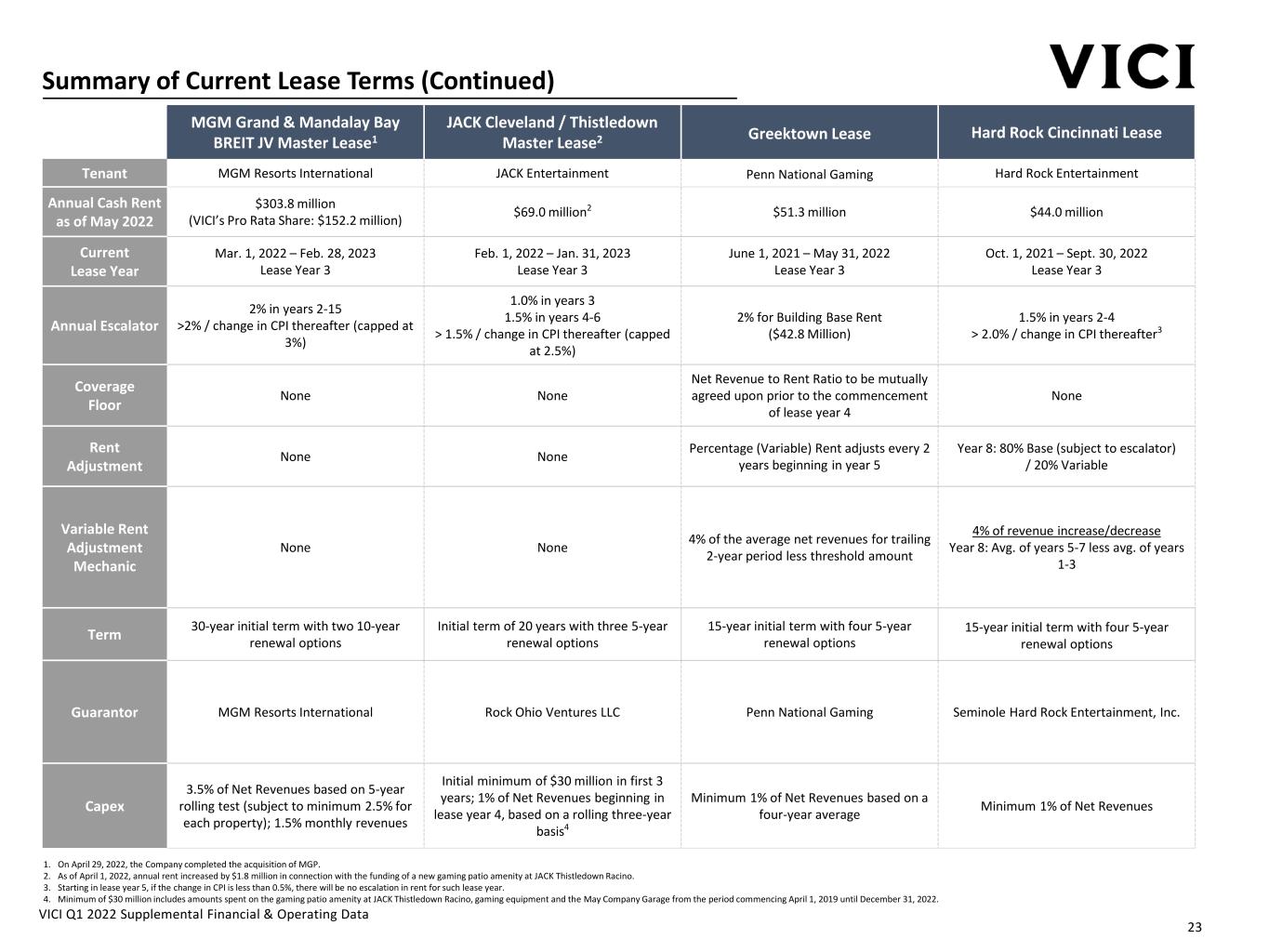

VICI Q1 2022 Supplemental Financial & Operating Data Summary of Current Lease Terms (Continued) 23 MGM Grand & Mandalay Bay BREIT JV Master Lease1 JACK Cleveland / Thistledown Master Lease2 Greektown Lease Hard Rock Cincinnati Lease Tenant MGM Resorts International JACK Entertainment Penn National Gaming Hard Rock Entertainment Annual Cash Rent as of May 2022 $303.8 million (VICI’s Pro Rata Share: $152.2 million) $69.0 million2 $51.3 million $44.0 million Current Lease Year Mar. 1, 2022 – Feb. 28, 2023 Lease Year 3 Feb. 1, 2022 – Jan. 31, 2023 Lease Year 3 June 1, 2021 – May 31, 2022 Lease Year 3 Oct. 1, 2021 – Sept. 30, 2022 Lease Year 3 Annual Escalator 2% in years 2-15 >2% / change in CPI thereafter (capped at 3%) 1.0% in years 3 1.5% in years 4-6 > 1.5% / change in CPI thereafter (capped at 2.5%) 2% for Building Base Rent ($42.8 Million) 1.5% in years 2-4 > 2.0% / change in CPI thereafter3 Coverage Floor None None Net Revenue to Rent Ratio to be mutually agreed upon prior to the commencement of lease year 4 None Rent Adjustment None None Percentage (Variable) Rent adjusts every 2 years beginning in year 5 Year 8: 80% Base (subject to escalator) / 20% Variable Variable Rent Adjustment Mechanic None None 4% of the average net revenues for trailing 2-year period less threshold amount 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 1-3 Term 30-year initial term with two 10-year renewal options Initial term of 20 years with three 5-year renewal options 15-year initial term with four 5-year renewal options 15-year initial term with four 5-year renewal options Guarantor MGM Resorts International Rock Ohio Ventures LLC Penn National Gaming Seminole Hard Rock Entertainment, Inc. Capex 3.5% of Net Revenues based on 5-year rolling test (subject to minimum 2.5% for each property); 1.5% monthly revenues Initial minimum of $30 million in first 3 years; 1% of Net Revenues beginning in lease year 4, based on a rolling three-year basis4 Minimum 1% of Net Revenues based on a four-year average Minimum 1% of Net Revenues 1. On April 29, 2022, the Company completed the acquisition of MGP. 2. As of April 1, 2022, annual rent increased by $1.8 million in connection with the funding of a new gaming patio amenity at JACK Thistledown Racino. 3. Starting in lease year 5, if the change in CPI is less than 0.5%, there will be no escalation in rent for such lease year. 4. Minimum of $30 million includes amounts spent on the gaming patio amenity at JACK Thistledown Racino, gaming equipment and the May Company Garage from the period commencing April 1, 2019 until December 31, 2022.

VICI Q1 2022 Supplemental Financial & Operating Data Summary of Current Lease Terms (Continued) 24 Caesars Southern Indiana Lease Century Master Lease Margaritaville Bossier City Lease Tenant Eastern Band of Cherokee Indians Century Casinos Penn National Gaming Annual Cash Rent as of May 2022 $32.5 million $25.5 million $23.8 million Current Lease Year Sept. 3, 2021 – Aug. 31, 2022 Lease Year 1 Jan. 1, 2022 – Dec. 31, 2022 Lease Year 3 Feb. 1, 2022 – Jan. 31, 2023 Lease Year 4 Annual Escalator 1.5% in years 2-5 >2% / change in CPI thereafter 1.0% in years 2-3 > 1.25% / change in CPI thereafter 2% for Building Base Rent ($17.2 Million) Coverage Floor None Net Revenue to Rent Ratio: 7.5x beginning in year 6 Net Revenue to Rent Ratio: 6.1x beginning in year 2 Rent Adjustment Year 8 & 11: 80% Base (subject to escalator) / 20% Variable Year 8 & 11: 80% Base (subject to escalator) / 20% Variable Percentage (Variable) Rent adjusts every 2 years beginning in year 3 Variable Rent Adjustment Mechanic 4% of net revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-21 Year 11: Avg. of years 8-10 less avg. of years 5-7 4% of net revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 1-3 Year 11: Avg. of years 8-10 less avg. of years 5-7 4% of the average net revenues for trailing 2-year period less threshold amount Term 15-year initial term with four 5-year renewal options 15-year initial term with four 5-year renewal options 15-year initial term with four 5-year renewal options Guarantor Eastern Band of Cherokee Indians Century Casinos, Inc. Penn National Gaming Capex 1% of annual Net Revenues Minimum 1% of Net Revenues on a rolling three-year basis for each individual facility; 1% of Net Gaming Revenue per fiscal year for the facilities collectively Minimum 1% of Net Revenues based on a four-year average 1. With respect to lease year 0, for the period Caesars Southern Indiana was closed in 2020 due to COVID-19, the Caesars Southern Indiana Lease will provide for the use of 2019 net revenues, pro rated for the period of such closure.

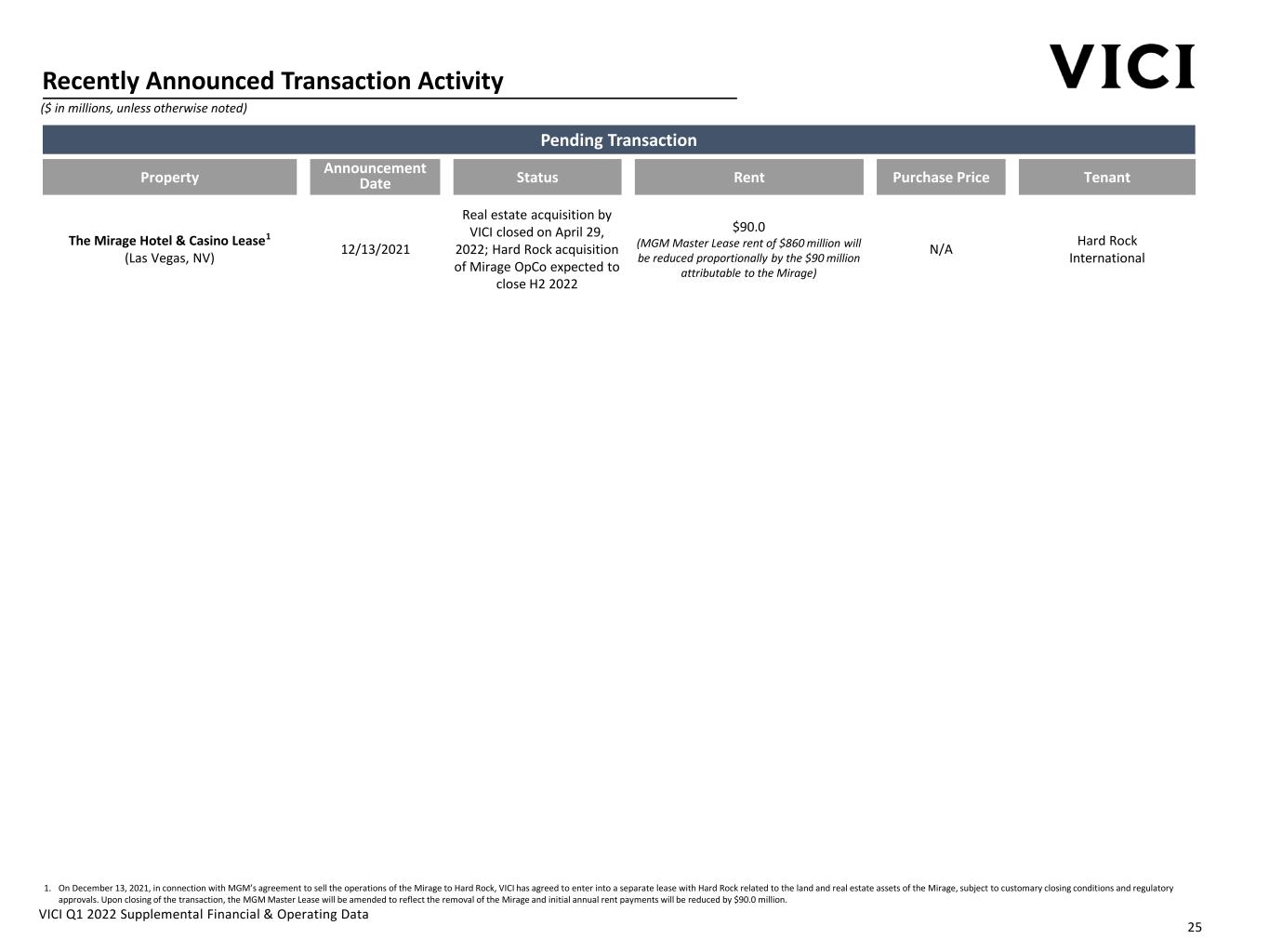

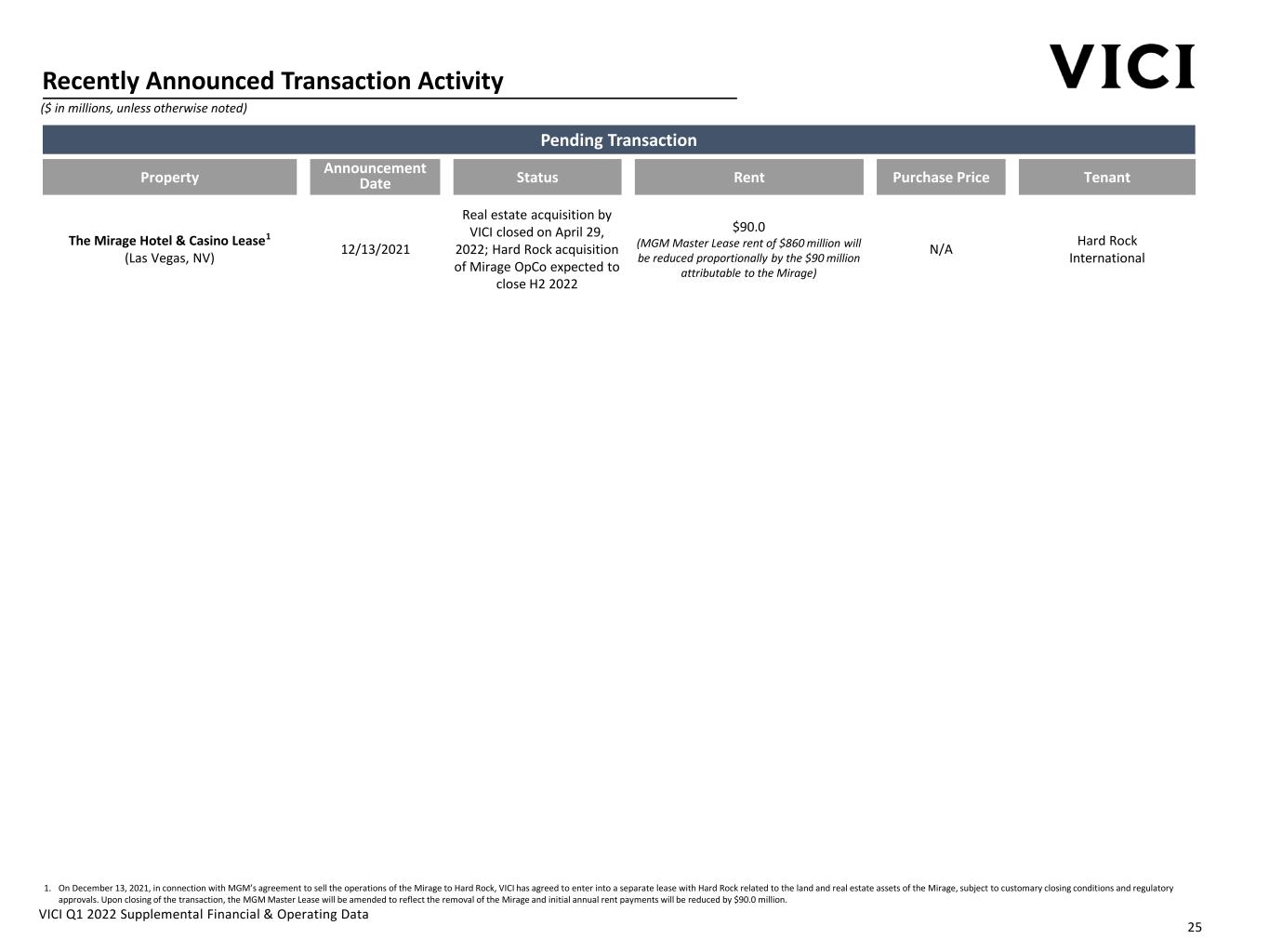

VICI Q1 2022 Supplemental Financial & Operating Data Recently Announced Transaction Activity 1. On December 13, 2021, in connection with MGM’s agreement to sell the operations of the Mirage to Hard Rock, VICI has agreed to enter into a separate lease with Hard Rock related to the land and real estate assets of the Mirage, subject to customary closing conditions and regulatory approvals. Upon closing of the transaction, the MGM Master Lease will be amended to reflect the removal of the Mirage and initial annual rent payments will be reduced by $90.0 million. ($ in millions, unless otherwise noted) Property Announcement Date Status Rent Purchase Price Tenant Pending Transaction The Mirage Hotel & Casino Lease1 (Las Vegas, NV) $90.0 (MGM Master Lease rent of $860 million will be reduced proportionally by the $90 million attributable to the Mirage) N/A Real estate acquisition by VICI closed on April 29, 2022; Hard Rock acquisition of Mirage OpCo expected to close H2 2022 Hard Rock International 25 12/13/2021

VICI Q1 2022 Supplemental Financial & Operating Data Investment & Capital Markets Activities ($ in millions, unless otherwise noted) Financing Activities Inaugural Investment Grade Unsecured Notes Offering of $5.0 billion • On April 29, 2022, issued $500 million 3-Year Notes at 4.375%, $1.25 billion 5-Year Notes at 4.750%, $1.0 billion 7-Year Notes at 4.950%, $1.5 billion 10-Year Notes at 5.125% and $750 million 30-Year Notes at 5.625% Entered into New $3.5 billion Unsecured Credit Facility • On February 8, 2022, entered into a new $2.5 billion unsecured revolving credit facility and $1.0 billion unsecured delayed draw term loan facility and concurrently terminated the secured $1.0 billion revolving credit facility • On February 18, 2022, drew $600.0 million on our revolving credit facility in connection with the closing of the Venetian acquisition. On April 29, 2022, utilized funds from the April 2022 notes offering and cash on hand to pay down the outstanding balance Interest Rate Swap and Treasury Lock Agreements • From December 2021 to April 2022, entered into forward-starting interest rate swaps and U.S. Treasury rate locks with a notional amount of $3.0 billion to hedge against changes in future cash flows resulting from changes in interest rates • In connection with the April 2022 notes offering, settled the above swaps and treasury locks for total proceeds of $206.8 million to be amortized into interest expense in future periods Repaid $2.1 billion Secured Term Loan B Facility • On September 15, 2021, repaid in full the $2.1 billion secured Term Loan B facility and terminated related swap agreements $3.4 billion Follow-On Equity Offering at $29.50 per share • On September 14, 2021, issued 65.0 million shares with the remaining 50.0 million shares to be issued upon settlement of the forward sale agreements $2.0 billion Follow-On Equity Offering at $29.00 per share • On March 3, 2021, offered 69.0 million shares to be issued upon settlement of the forward sale agreements Forward Sale Agreement Settlements • On February 18, 2022, settled 50.0 million shares from the September 2021 forward sale agreements and 69.0 million shares from the March 2021 forward sale agreements • On September 9, 2021, settled the remaining 26.9 million shares from the June 2020 forward sale agreement Debt Capital Markets Equity Capital Markets Great Wolf Mezzanine Loan 7/20/2021 6/16/2021 $2.72 8.0% $79.52 Great Wolf Resorts Caesars Southern Indiana 12/24/2020 $32.51 N/A N/A9/3/2021 Eastern Band of Cherokee Indians Property / Loan Announcement Date Closing Date Rent / Income Cap Rate / Yield Price / Loan Size Tenant / Borrower Recently Completed Transactions (By Closing Date) 26 The Venetian Resort Las Vegas 8/4/2021 $1,012.2 N/A ~$17.2 billion4/29/2022 MGM Resorts International 1. Annual rent payment under the Regional Master Lease with Caesars was commensurately reduced by $32.5 million upon the consummation of the sale of the operations of Caesars Southern Indiana to the Eastern Band of Cherokee Indians. 2. Expect to fund the entire $79.5 million commitment by mid-2022. As of March 31, 2022, $49.2 million has been disbursed. MGM Growth Properties’ Portfolio 3/3/2021 $250.0 6.25% $4,000.02/23/2022 Affiliate of Apollo Global Management, Inc. BigShots Golf Loan 9/15/2021 N/A 10.0% $80.04/7/2022 BigShots Golf, a subsidiary of ClubCorp Holdings, Inc.

VICI Q1 2022 Supplemental Financial & Operating Data Embedded Growth Pipeline Location / Jurisdiction Las Vegas Strip Anderson, IN Shelbyville, IN LV Strip Baltimore, MD New York, NY Danville, VA Casino Space Sq.Ft. 68,400 72,300 95,300 64,500 32,900 55,300 105,100 -- 122,000 -- -- # of Tables 70 110 100 110 60 28 61 -- 210 -- -- # of Slots 940 1,120 980 1,070 780 1,710 2,070 -- 2,200 -- -- # of Rooms 2,810 3,450 2,920 2,520 2,250 -- -- -- -- -- -- Highlights • Opportunity to expand presence on Las Vegas Strip and potential to diversify tenant base • Highly attractive Indianapolis market with the potential for growth from table games • Bolsters Las Vegas asset base with newly built, world class convention center • Furthers geographic diversification with urban core real estate • Iconic experiential asset with diverse revenue streams expands VICI’s investment universe • Geographical diversification with a new asset in a recently legalized state with limited casino licenses Terms • Two ROFRs on Las Vegas Strip assets to be sold by Caesars (whether as a “WholeCo” or “OpCo/PropCo” sale) – First asset can only be Bally's, Flamingo, Paris or Planet Hollywood – Second asset can be from the same group plus The LINQ • 13.0x call / 12.5x put3, commencing on Jan. 1, 2022 and expiring on Dec. 31, 2024 • 13.0x put3 from Jan. 1, 2024 to Dec. 31, 2024 • 13.0x call3 from Sept. 18, 2025 to Dec. 31, 2026 • ROFR on a sale leaseback of the real estate related to Horseshoe Baltimore • Agreement with Chelsea Piers for the life of the loan, subject to a minimum of 5 years, that could lead to a longer- term financing partnership in the future • ROFR on a sale leaseback of the real estate related to the development of a new casino resort in Danville, VA Put / Call Agreements Two Las Vegas Strip ROFRs1 Horseshoe Baltimore ROFR1,2 First Asset Second Asset 1. Caesars does not have a contractual obligation to sell the properties subject to the ROFR agreements and will make an independent financial decision regarding whether to trigger the ROFR agreements, and VICI will make an independent financial decision whether to purchase the properties. 2. Subject to any consent required from Caesars’ applicable joint venture partners. 3. Multiples based on initial annual rent. Chelsea Piers New York Caesars Virginia ROFR1,2 27

VICI Q1 2022 Supplemental Financial & Operating Data 28 Definitions of Non-GAAP Financial Measures FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by the National Association of Real Estate Investment Trusts (Nareit), we define FFO as net income (or loss) attributable to common stockholders (computed in accordance with GAAP) excluding (i) gains (or losses) from sales of certain real estate assets, (ii) depreciation and amortization related to real estate, (iii) gains and losses from change in control and (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. AFFO is a non-GAAP financial measure that we use as a supplemental operating measure to evaluate our performance. We calculate AFFO by adding or subtracting from FFO non-cash leasing and financing adjustments, non-cash change in allowance for credit losses, non-cash stock-based compensation expense, transaction costs incurred in connection with the acquisition of real estate investments, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges related to non-depreciable real estate, gains (or losses) on debt extinguishment and interest rate swap settlements, other nonrecurring non-cash transactions and non-cash adjustments attributable to noncontrolling interest with respect to certain of the foregoing. We calculate Adjusted EBITDA by adding or subtracting from AFFO contractual interest expense and interest income (collectively, interest expense, net) and income tax expense. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs, due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP.