Exhibit 99.1 D R I V I N G T R A I T & B R E E D I N G I N N O VAT I O N™ Company Introduction F e b r u a r y 2 0 2 3

“Investing in seed innovation is one of the best ways to ensure food security.” - Bill Gates 2 2

Key Management Team Rory Riggs Greg Gocal, PhD Peter Beetham, PhD CHIEF EXECUTIVE CHIEF SCIENTIFIC OFFICER CHIEF OPERATING OFFICER EXECUTIVE VICE PRESIDENT OFFICER PRESIDENT CO-FOUNDER CHAIRMAN CO-FOUNDER CO-FOUNDER Noel Sauer, PhD Wade King, MD Rosa Cheuk Kim, JD SENIOR VICE PRESIDENT CHIEF FINANCIAL SENIOR VICE PRESIDENT HEAD OF R&D OFFICER LEGAL 3 3 3

is in The Trait Business Background FOUNDED EMPLOYEES 2001 ~200 Products HEADQUARTERS Productivity traits Plant traits that improve yields San Diego, CA and/or lower costs such as chemicals Sustainable ingredients Major oil crops Customers Seed Companies SOYBEAN CANOLA Farmers pay for Seed Co’s Traits - Seed Co’s pay Trait Royalties to Trait Co’s for Trait IP Major grain crops Consumer, Pharma, Energy Co’s Renewable Low-Carbon Inputs CORN RICE Technology Gene Editing WHEAT Proprietary Gene Editing Technology OVER 400 ISSUED OR PENDING PATENTS 4 4

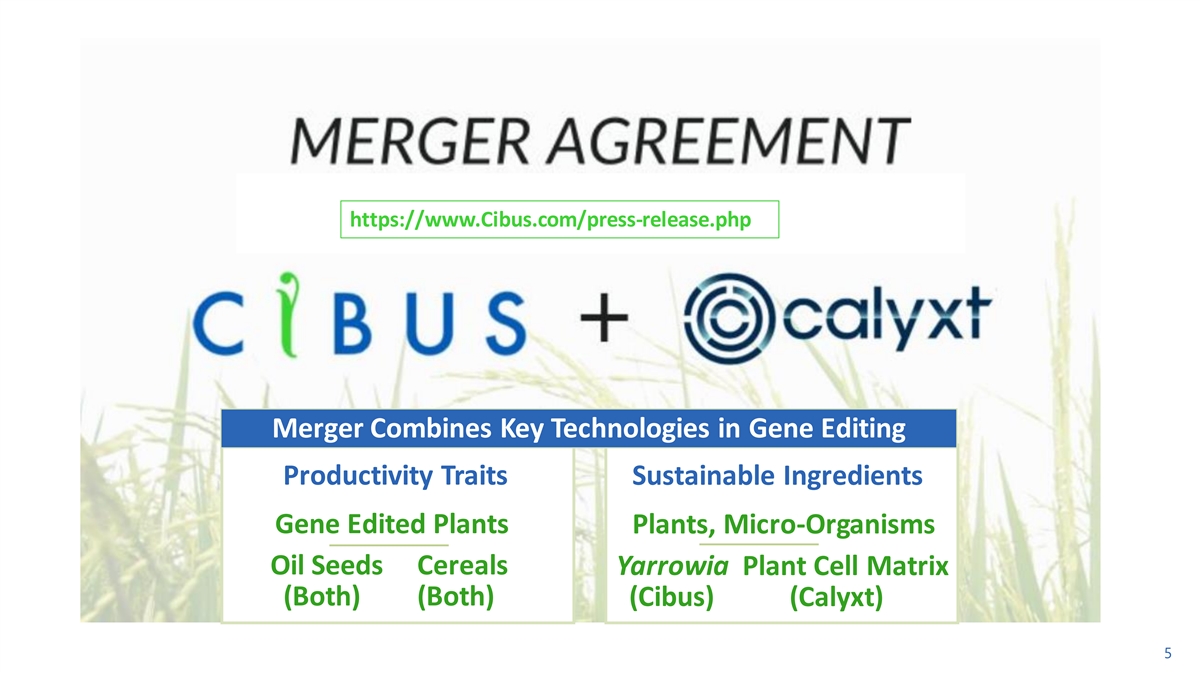

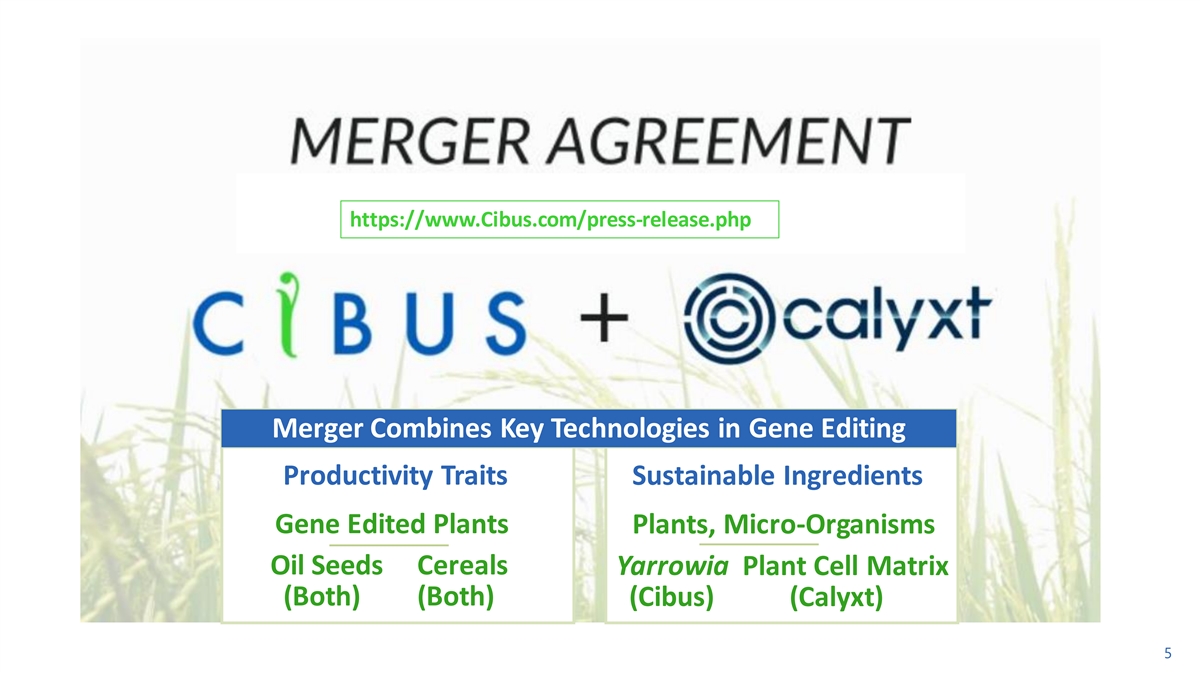

See: Cibus.com for Announcement & Details https://www.Cibus.com/press-release.php Merger Combines Key Technologies in Gene Editing Productivity Traits Sustainable Ingredients Gene Edited Plants Plants, Micro-Organisms Oil Seeds Cereals Yarrowia Plant Cell Matrix (Both) (Both) (Cibus) (Calyxt) 5

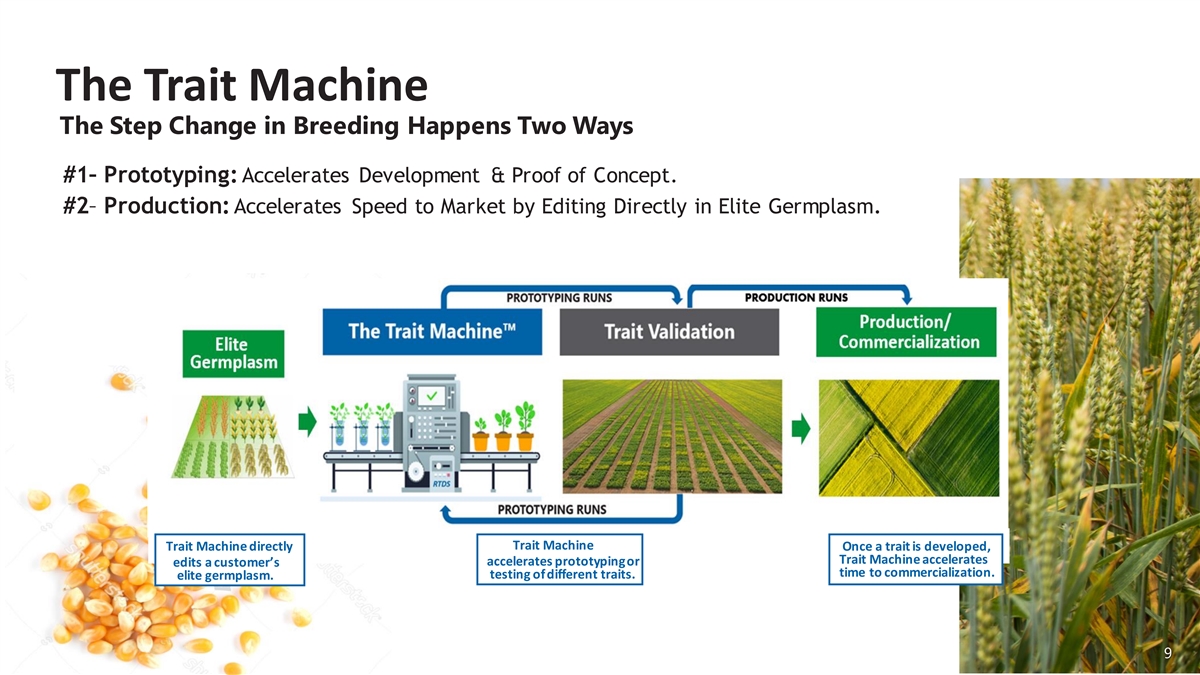

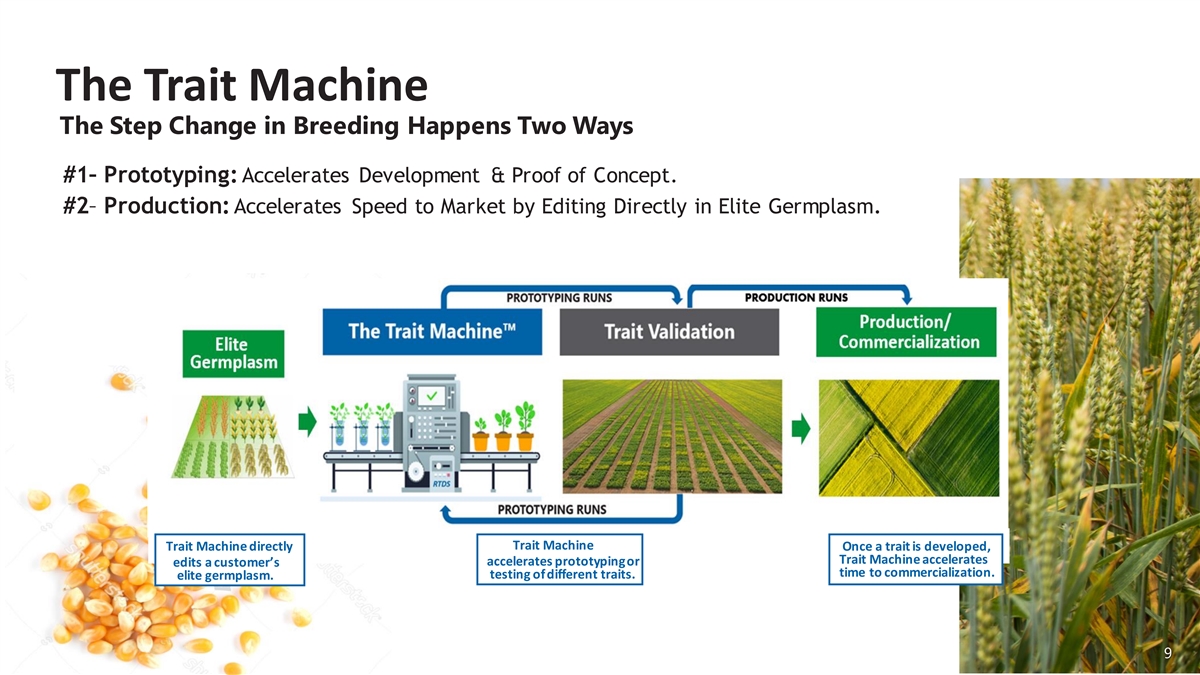

Technology & Business The Trait Machine™ Cibus’ Patented Gene Editing Platform ➢ Changes the Scale, Speed & Accuracy of breeding ➢ Scale materially shortens timelines to develop & commercialize Traits ➢ Changes the Opportunity Set 6

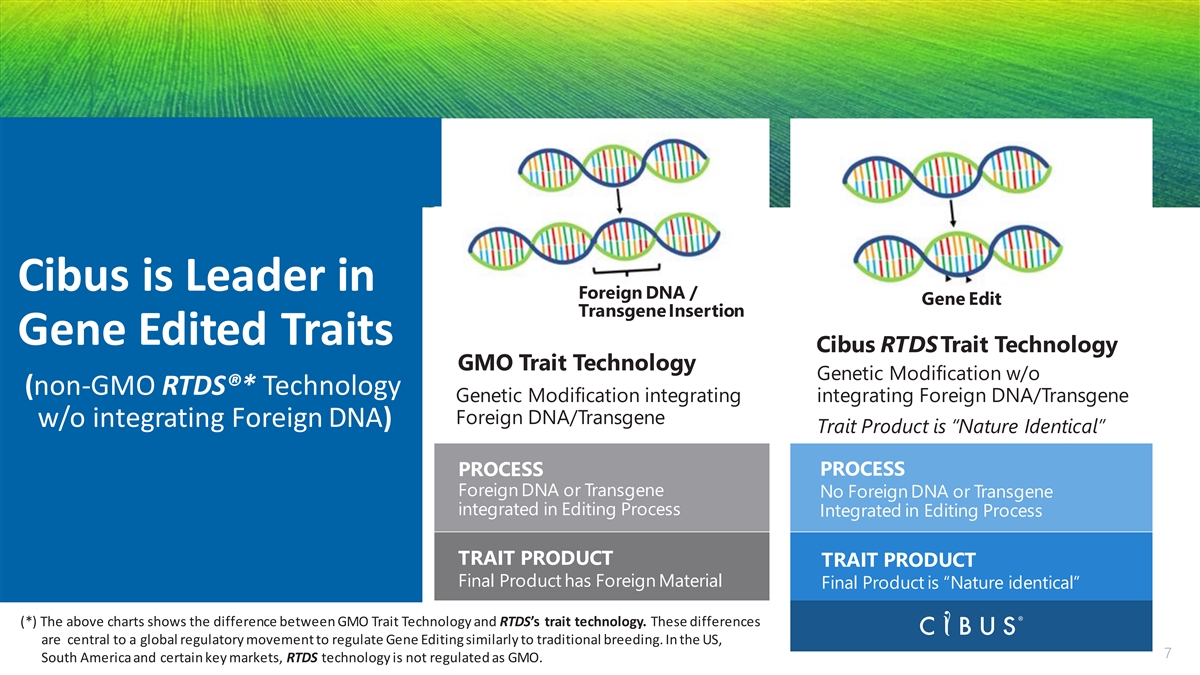

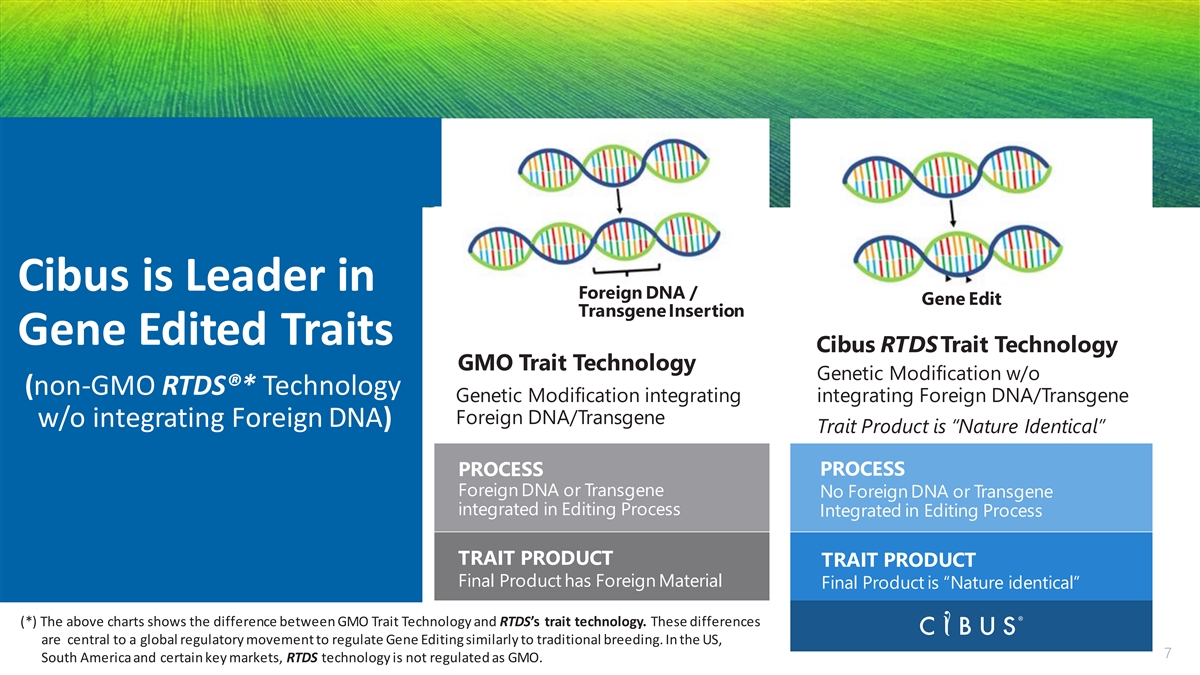

Cibus is Leader in Foreign DNA / Gene Edit Transgene Insertion Gene Edited Traits CibusRTDSTrait Technology GMO Trait Technology Genetic Modification w/o (non-GMO RTDS®* Technology Genetic Modification integrating integrating Foreign DNA/Transgene Foreign DNA/Transgene w/o integrating Foreign DNA) Trait Product is “Nature Identical” PROCESS PROCESS Foreign DNA or Transgene No Foreign DNA or Transgene integrated in Editing Process Integrated in Editing Process TRAIT PRODUCT TRAIT PRODUCT Final Product has Foreign Material Final Product is “Nature identical” (*) The above charts shows the difference between GMO Trait Technology and RTDS’s trait technology. These differences are central to a global regulatory movement to regulate Gene Editing similarly to traditional breeding. In the US, 7 South America and certain key markets, RTDS technology is not regulated as GMO.

RTDS Enables the Trait Machine An Industrial Scale End-to-End Semi-Automated Gene Editing (Breeding) Process “Nature Identical” Traits Traits from the Trait Machine “Step Change in Breeding” are indistinguishable from nature (or, breeding). Bio-Mfg. Standards Pharma Standard Quality Control & Assurance. RTDS 8

The Trait Machine The Step Change in Breeding Happens Two Ways #1– Prototyping: Accelerates Development & Proof of Concept. #2– Production: Accelerates Speed to Market by Editing Directly in Elite Germplasm. Trait Machine Trait Machine directly Once a trait is developed, Trait Machine accelerates edits a customer’s accelerates prototyping or time to commercialization. testing of different traits. elite germplasm. 9

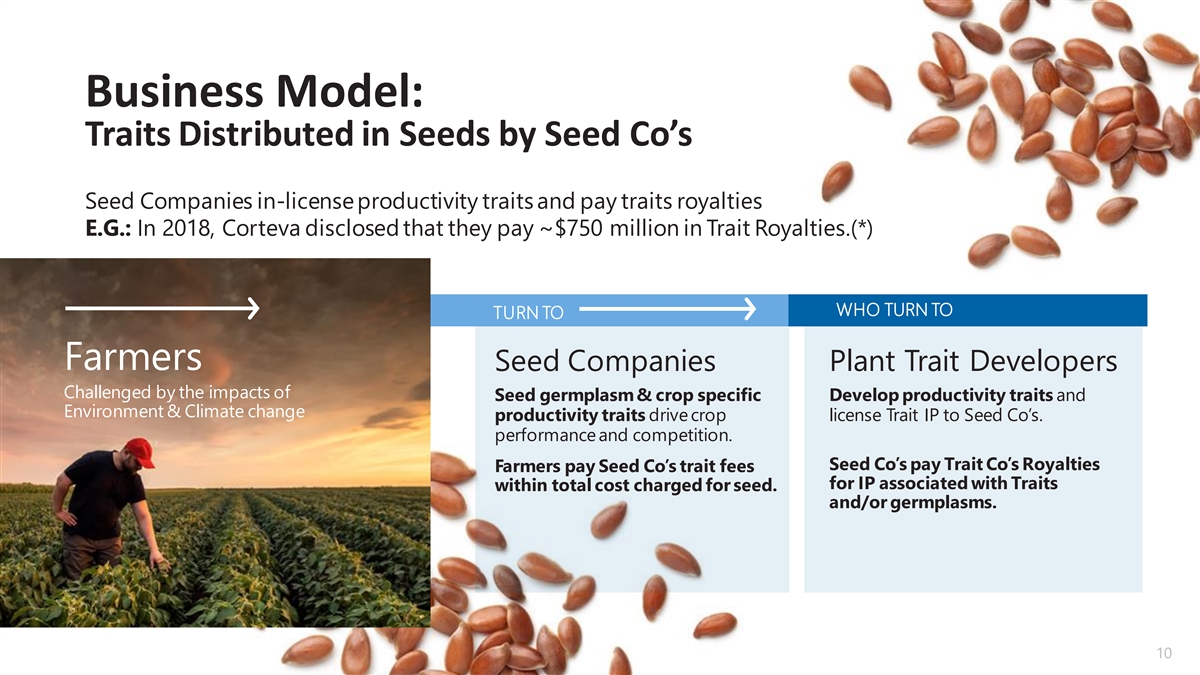

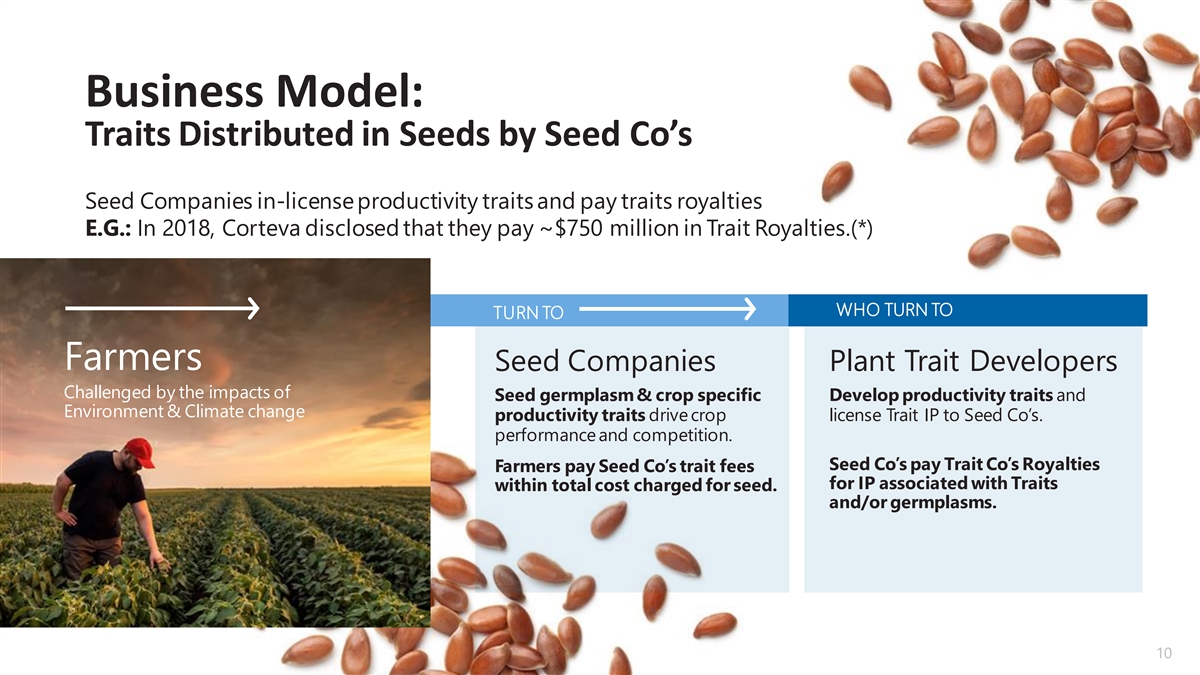

Business Model: Traits Distributed in Seeds by Seed Co’s Seed Companies in-license productivity traits and pay traits royalties E.G.: In 2018, Corteva disclosed that they pay ~$750 million in Trait Royalties.(*) WHO TURN TO TURN TO Farmers Seed Companies Plant Trait Developers Challenged by the impacts of Seed germplasm & crop specific Develop productivity traits and Environment & Climate change productivity traits drive crop license Trait IP to Seed Co’s. performance and competition. Seed Co’s pay Trait Co’s Royalties Farmers pay Seed Co’s trait fees for IP associated with Traits within total cost charged for seed. and/or germplasms. 10 10

Economics*: Farmers Pay Seed Co’s Fees for Productivity Traits Seed Co’s Pay Trait Co’s Royalties for Trait IP Major Crops (NA&SA) Trait Fees ~ 400 MILLION ACRES The Trait Business $2.1B Soybean ➢ Accessible Acres ~400 MM $1.0B Cotton ➢ Trait Fee Acres > 300 MM Est. 2020 $0.4B TRAIT FEES ➢ Avg. Trait Fee/Acre Canola by Crop $10-$15/Acre (Weeds & Insects) ~$8 B $0.2B ➢ Est. 2020 Trait Fees Other > $8 Billion $4.1B Corn (1) Source: Company estimates, BCG, FDA.gov., AgbioInvestor 2021. (2) 2020 Traits fees are predominantly for GMO-based traits in North & South America * See slide 21 regarding data assumptions in this presentation. 11 11 Trait Fee Pricing is based on Trait Specific Economics 11

Productivity Impacted Scale Solutions Limited for FOOD SUPPLY CHALLENGE a Problem > 1B Acres by Climate Change The Sustainable Supply Heat & Humidity of the Major Crops ORGANIC FARMING Impacting: Low productivity, no scale These 5 crops: Corn, Wheat, VERTICAL/INDOOR FARMING Drought Rice, Soybean & Canola provide Impractical for Major Crops Diseases of our SOIL MGMT. TECHNOLOGIES 90% proteins and Important but selective & customized Pests of our 70% vegetable oils GENE EDITING Weeds Productivity Traits: The 5 Crops are grown on Applicable to multiple crops, Fertilizer Supply change economics at scale over 1 billion acres 12

The Plan: Address Major Challenges at Scale Many areas like disease resistance & climate traits are now real targets. As a Multi-crop platform, Cibus can launch in multiple crops simultaneously. Resistance Traits Efficiency Traits DISEASE RESISTANCE NUTRIENT PROCESSING Able to resist or fight disease Able to better process available pathogens. Reduces fungicide use. nutrients. Reduces fertilizer needs. INSECT RESISTANCE AGRONOMY Able to resist specific pests or insects. Physiological traits that improve Reduces pesticide use. yields and farmability 13 13

The Plan: Collaborate with Partners to Develop New Traits Goal: To be an Extension of Partner’s Breeding Program Soybean Canola Rice MM MM MM TAM TAM TAM 190 ACRES ACRES 11 ACRES 46 Leading Rice Seed Co. NOTE: TAM - Total Addressable Market includes just hybrid crops in North America, South America and Europe. Across the three crops, 14 there are 35 million European acres included above. These acres are dependent on the proposed change in EU legislation.

Product Review Six Unique Traits that are Developed or Advanced 3 Traits beginning commercialization Pod Shatter HT3 HT1 Reduction Rice Rice Canola 3 Traits in advanced development Sclerotinia Nutrient Use HT2 White Mold Efficiency Canola Rice Canola Pipeline Disease Pests Climate 15

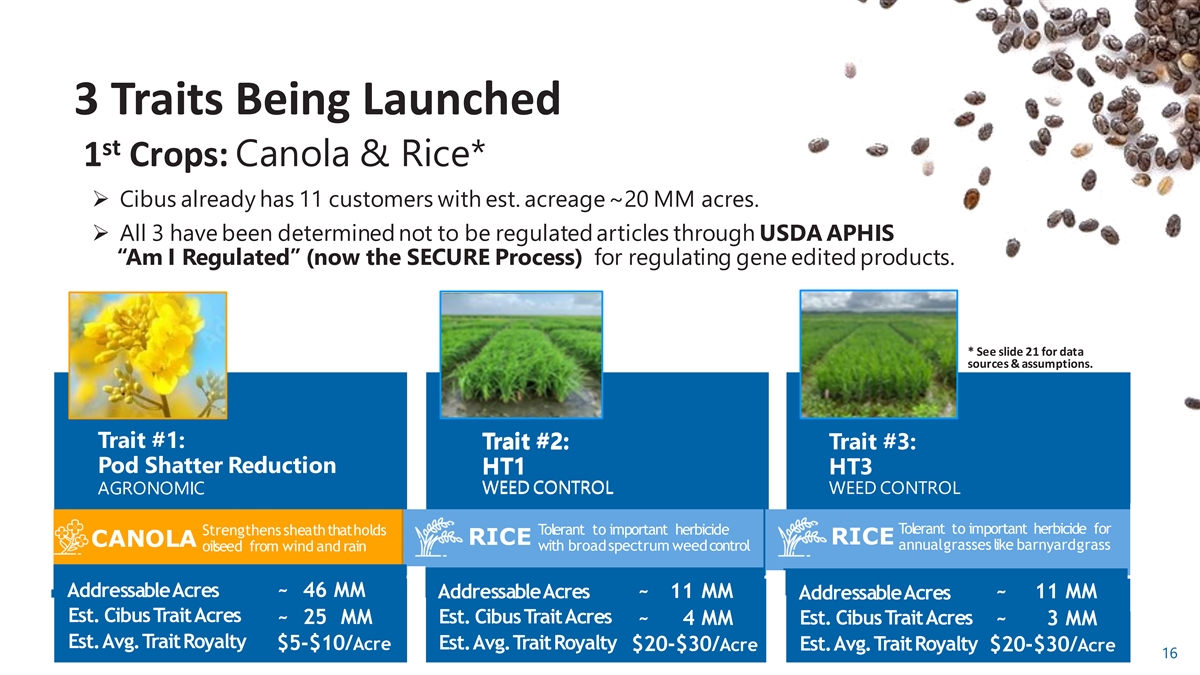

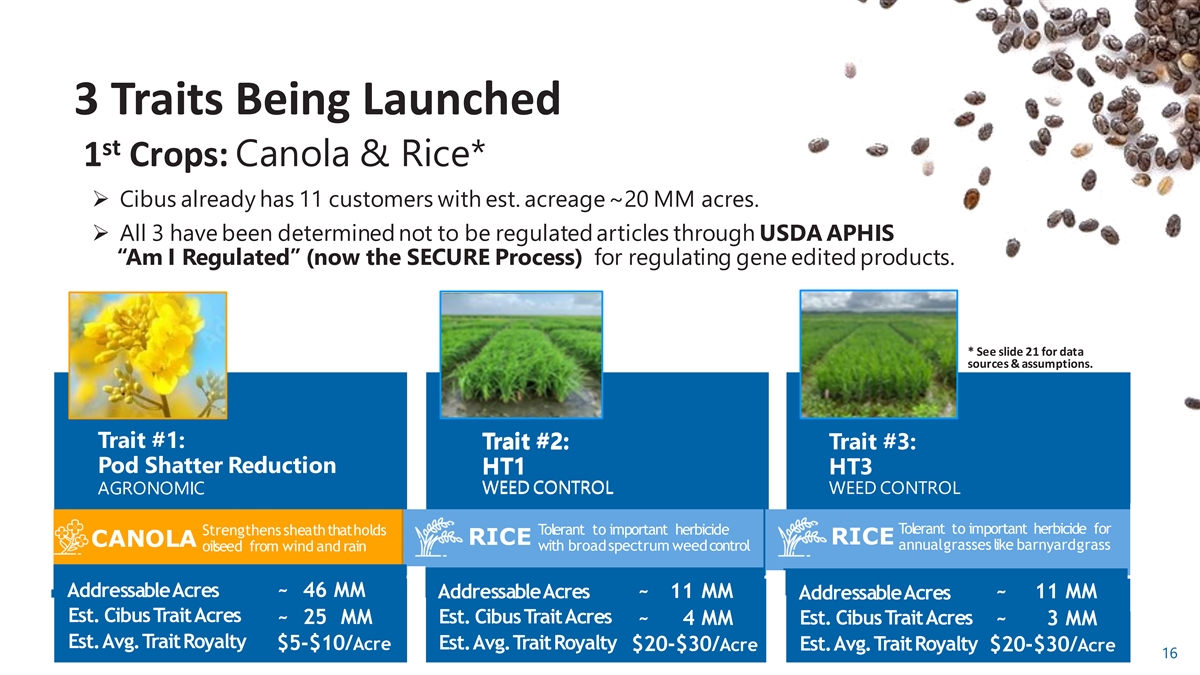

3 Traits Being Launched st 1 Crops: Canola & Rice* ➢ Cibus already has 11 customers with est. acreage ~20 MM acres. ➢ All 3 have been determined not to be regulated articles through USDA APHIS “Am I Regulated” (now the SECURE Process) for regulating gene edited products. * See slide 21 for data sources & assumptions. Trait #1: Trait #2: Trait #2: Trait #3: Pod Shatter Reduction HT1 HT1 HT3 W WE EE ED D C CO ON NT TR RO OL L WEED CONTROL AGRONOMIC Tolerant to important herbicide for Strengthenssheaththatholds Tolerant to important herbicide RICE RICE CANOLA annualgrasseslike barnyardgrass oilseed from wind and rain with broadspectrum weedcontrol Addressable Acres ~ 46 MM Addressable Acres ~ 11 MM ~ 11 MM Addressable Acres Est. Cibus Trait Acres ~ 25 MM Est. Cibus Trait Acres ~ 4 MM Est. Cibus Trait Acres ~ 3 MM Est. Avg. Trait Royalty $5-$10/Acre Est. Avg. Trait Royalty $20-$30/Acre Est. Avg. Trait Royalty $20-$30/Acre 16

Lead Trait: PSR Pod Shatter Reduction (PSR) - Canola/WOSR Quantifiable Savings & Pricing, Recently Issued Product Patent* Commercial Progress: POD Shatter Reduction The PSR Market Developed & Transferring Canola/WOSR sheaths (pods) Accessible Acres shatter in rain/high winds, causing Initial Seed yield losses of 10% or more. 10 Co. Customers ~46 MM . Est. Initial Est. Trait Fee Acres ~20 MM PSR reduces pod shatter Customer Acres and associated seed losses ~25 MM ~ Est. Transfer Est. Trait Royalty 2023 36Mx Est. Commercial ~$5-$10/Acre Strengthens sheath 2025 Launch PSR: That holds oil seeds. Est. Trait Fees Photo credit to the Canola Council of Canada * See slide 22 for data sources & assumptions. $175 MM 17 17

Crop Strategy: Multi-Trait Crops Strategy: Within a Crop, Build a Pipeline of Stacked Traits Available to Each Customer Multiple Traits Increases Trait Specific Acres for the Specific Crop Cibus has a Multi-Trait Pipeline for Canola Est. Cibus Est. Trait Royalty* Trait Acres* Pod Shatter (PSR) 25 MM $5-$10/Acre SclerotiniaResistance 30 MM $5-$10/Acre Herbicide Tolerance #2 20 MM $5-$10/Acre Canola Herbicide Tolerance #1 15 MM $5-$10/Acre OSR ~46 MM Acres Nutrient Use Efficiency 46 MM $10-$15/Acre $797 $1302 Sclerotinia, HT#2, HT#1 & NUE ~$30-$55/Acre ~140 MM (in dark gray) are Multi-Crop Traits Potential Cibus Trait Fee Acres Royalty per Customer • Trait Fee Pricing is based on Trait Specific Economics. Photo credit to the Canola Council of Canada 18 See slide 21 for additional data sourcing & assumptions. 18 18

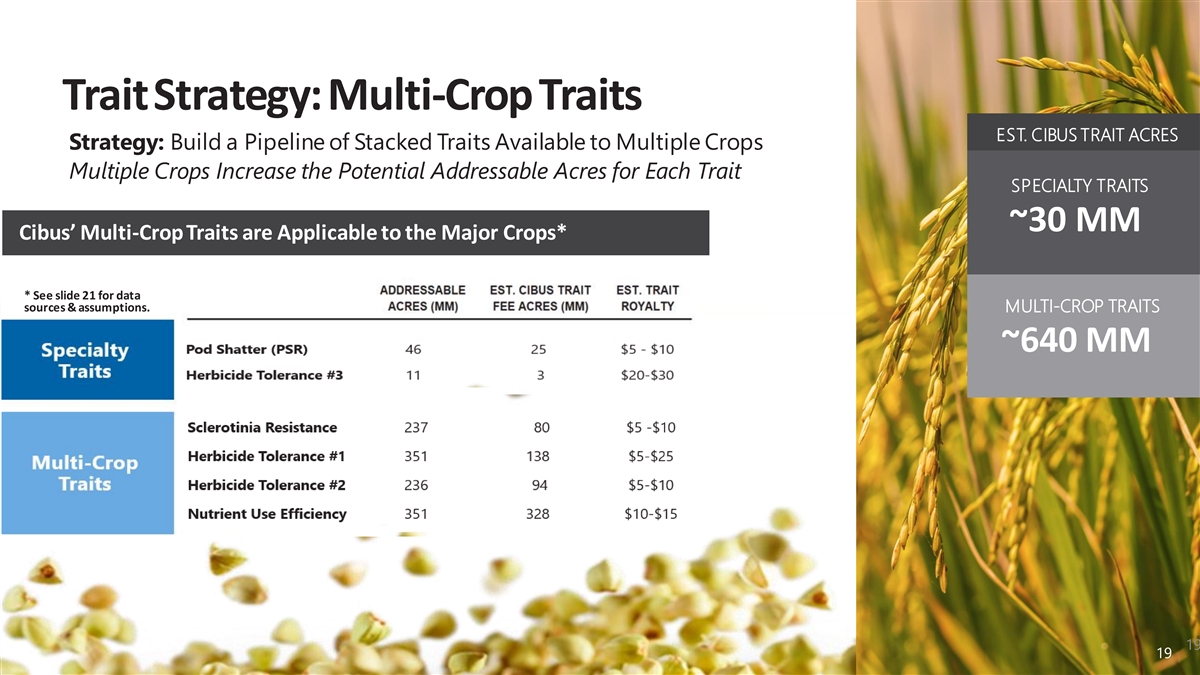

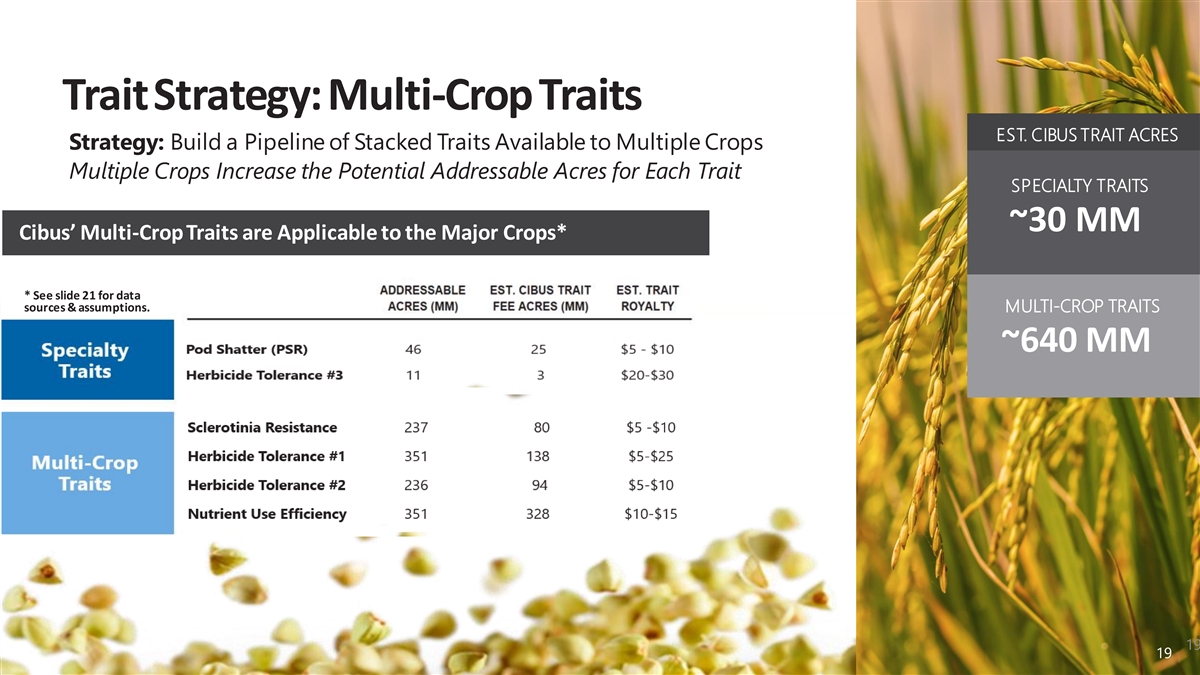

Trait Strategy: Multi-Crop Traits EST. CIBUS TRAIT ACRES Strategy: Build a Pipeline of Stacked Traits Available to Multiple Crops Multiple Crops Increase the Potential Addressable Acres for Each Trait SPECIALTY TRAITS ~30 MM Cibus’ Multi-Crop Traits are Applicable to the Major Crops* * See slide 21 for data sources & assumptions. MULTI-CROP TRAITS ~640 MM 19 19 19

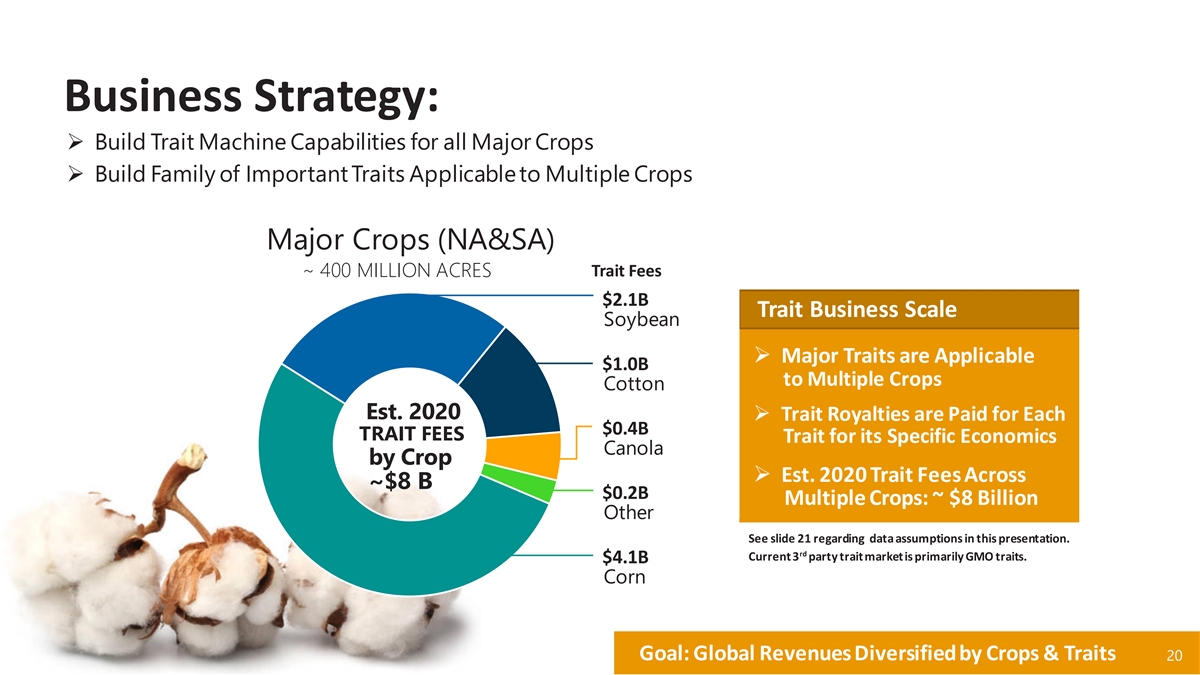

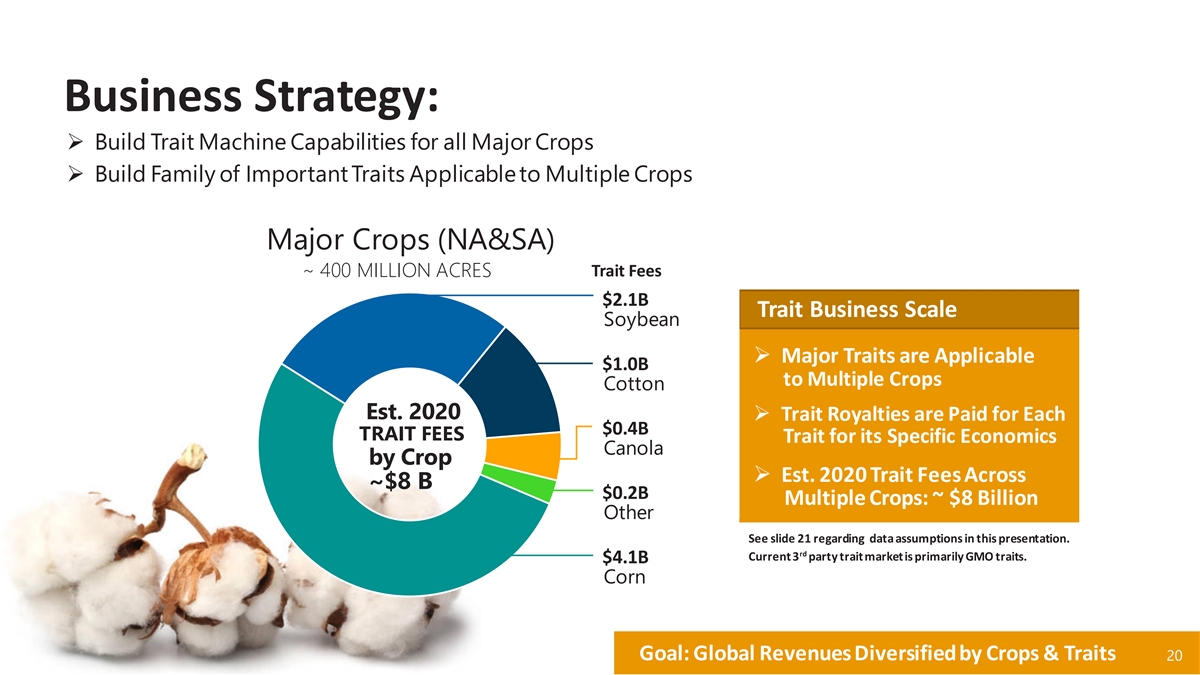

Business Strategy: ➢ Build Trait Machine Capabilities for all Major Crops ➢ Build Family of Important Traits Applicable to Multiple Crops Major Crops (NA&SA) Trait Fees ~ 400 MILLION ACRES $2.1B Trait Business Scale Soybean ➢ Major Traits are Applicable $1.0B to Multiple Crops Cotton Est. 2020 ➢ Trait Royalties are Paid for Each $0.4B TRAIT FEES Trait for its Specific Economics Canola by Crop ➢ Est. 2020 Trait Fees Across ~$8 B $0.2B Multiple Crops: ~ $8 Billion Other See slide 21 regarding data assumptions in this presentation. rd Current 3 party trait market is primarily GMO traits. $4.1B Corn 20 20 Goal: Global Revenues Diversified by Crops & Traits 20

Disclaimer Securities Law Matters Acreage Data This presentation shall not constitute an offer, nor a solicitation of an offer, of the sale or This presentation has 2 available acreage calculations: TAM-Total Accessible Acres and Trait purchase of securities, nor shall any securities of the Company be offered or sold, in any Fees Acres. These are based on the company’s estimate of total hybrid acres available in: jurisdiction in which such an offer, solicitation or sale would be unlawful. Neither the North America, South America & Europe for each crop. European acres are not currently Securities and Exchange Commission nor any state securities commission has approved or accessible. These acres depend on a favorable outcome of the current EU Parliamentary disapproved of the transactions contemplated hereby or determined if this presentation is process. They are shown to show the potential increase in available acres if the EU were to truthful or complete. Any representation to the contrary is a criminal offense. pass the proposed legislation. The EU is expected to address these changes in 2023. Forward Looking Statements Intellectual Property This presentation contains forward-looking statements that involve risks and uncertainties. “Cibus,” “RTDS,” “Rapid Trait Development System,” “FALCO,” “SU Canola,” “Nucelis,” “ASAP,” These forward-looking statements relate to, among other things, the expected timetable for “A Different Breed,” “Trait Machine,” “Inspired by Nature,” “Driving Sustainable Agriculture,” development of certain crop traits and our future financial performance, including our “Reshaping Crop Protection,” “Reinventing Trait Development”, “Timebound & Predictable”, operations, economic performance, financial condition, prospects and other future events. “Driving Trait & Breeding Innovation”, the Cibus logo and other trademarks or service marks These forward-looking statements are only predictions and are largely based on our current of Cibus appearing in this presentation are the property of Cibus. Trade names, trademarks expectations. These forward-looking statements appear in a number of places in this and service marks of other companies that appear are the property of their respective holders Presentation. In addition, a number of known and unknown risks, uncertainties and other and do not imply a relationship with, or endorsement or sponsorship of us, by these other factors could affect the accuracy of these statements. These risks may cause our actual results, companies. Solely for convenience, trademarks and trade names in this presentation appear levels of performance or achievements to differ materially from any future results, levels of without the ™ and ® symbols, but any such failure to appear should not be construed as activity, performance or achievements expressed or implied by these forward- looking indicating that their respective owners will not assert their rights with respect thereto. statements. Company Data & Projections Industry and Market Data Information about market and industry statistics contained in this presentation is included 1. Developed means validated field trials (Canola PSR, rice HT1, HT3); Advanced development based on information available to the Company that it believes is accurate in all material means editing process underway with known edit targets. Launching means sending or respects. It is generally based on academic and other publications that are not produced for preparing to send to customers (Canola PSR) purposes of securities offerings or economic analysis. The Company has not reviewed or 2. TAM, 2032 & Est. Peak Sales are company estimates. There can be no assurance future included data from all sources, and the Company cannot assure potential investors of the projections can be achieved. accuracy or completeness of the data included in this presentation. Forecasts and other forward-looking information obtained from these sources, including estimates of future rd 3 Party Data market size, revenue and market acceptance of products and services, are subject to the same qualifications and the additional uncertainties accompanying any forward-looking statements. 1. Trait Fee information are 2020 estimates based on data from Agbioinvestor, US Gov., BCG and 3rd party consultants. Traits are predominantly GMO traits. 2. Corteva, Nutrien, Royalty Pharma are 2021 operating income from Company filings with SEC. 21 21