Exhibit 99.1 The Future of Breeding™ D r i v i n g S u s t a i n a b l e A g r i c u l t u re™ A p r i l 2 0 2 3

“Investing in seed innovation is one of the best ways to ensure food security.” - Bill Gates 2 2

The Past & the Present The Oldest Industry without a Technological Moment Breeding is Still a Lengthy and Random Process 3

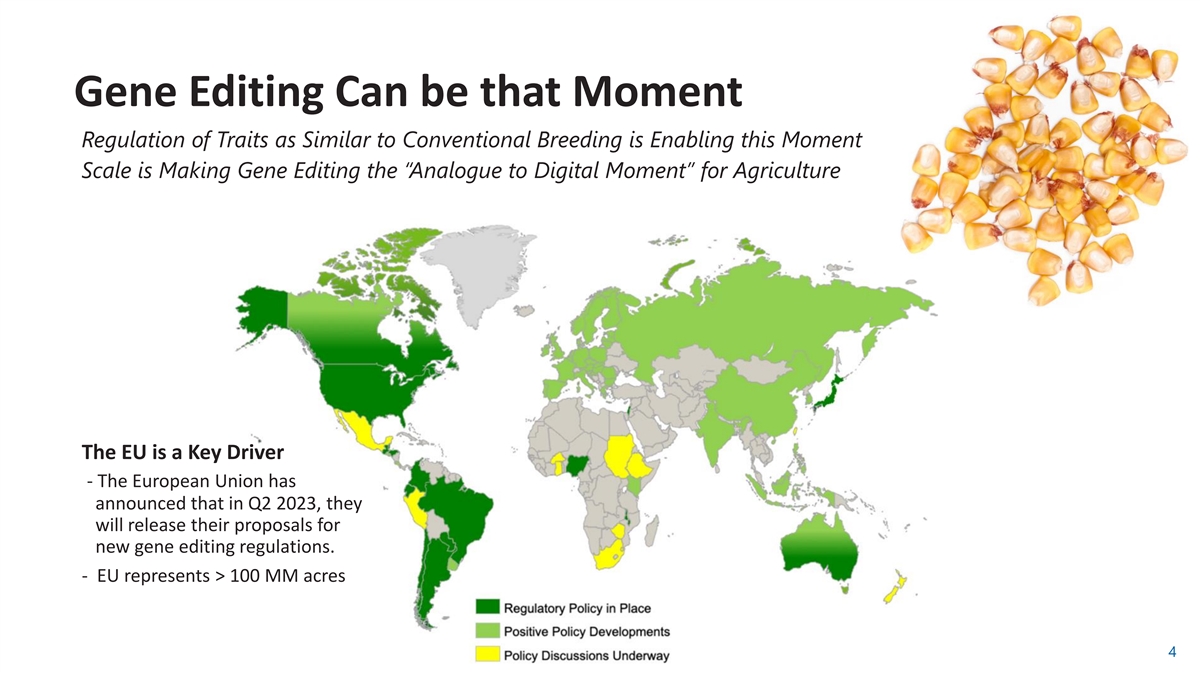

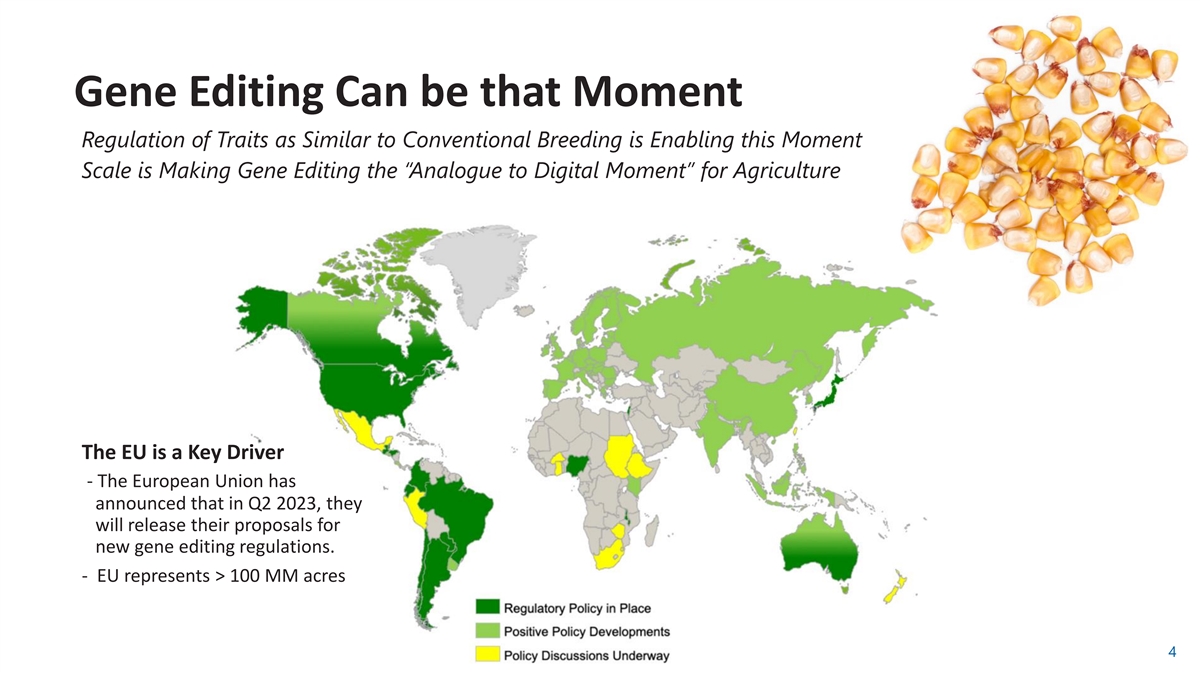

Gene Editing Can be that Moment Regulation of Traits as Similar to Conventional Breeding is Enabling this Moment Scale is Making Gene Editing the “Analogue to Digital Moment” for Agriculture The EU is a Key Driver - The European Union has announced that in Q2 2023, they will release their proposals for new gene editing regulations. - EU represents > 100 MM acres 4

Gene Editing Transforms Breeding Trait Development in a Scale Semi-Automated “End-to-End” Process Enables a “Timebound & Predictable” System to Develop Traits “Nature Identical” Traits Traits from Trait Machine that are conventional breeding like. Bio-Mfg. Standards Pharma Standard Quality Control & Assurance. RTDS 5

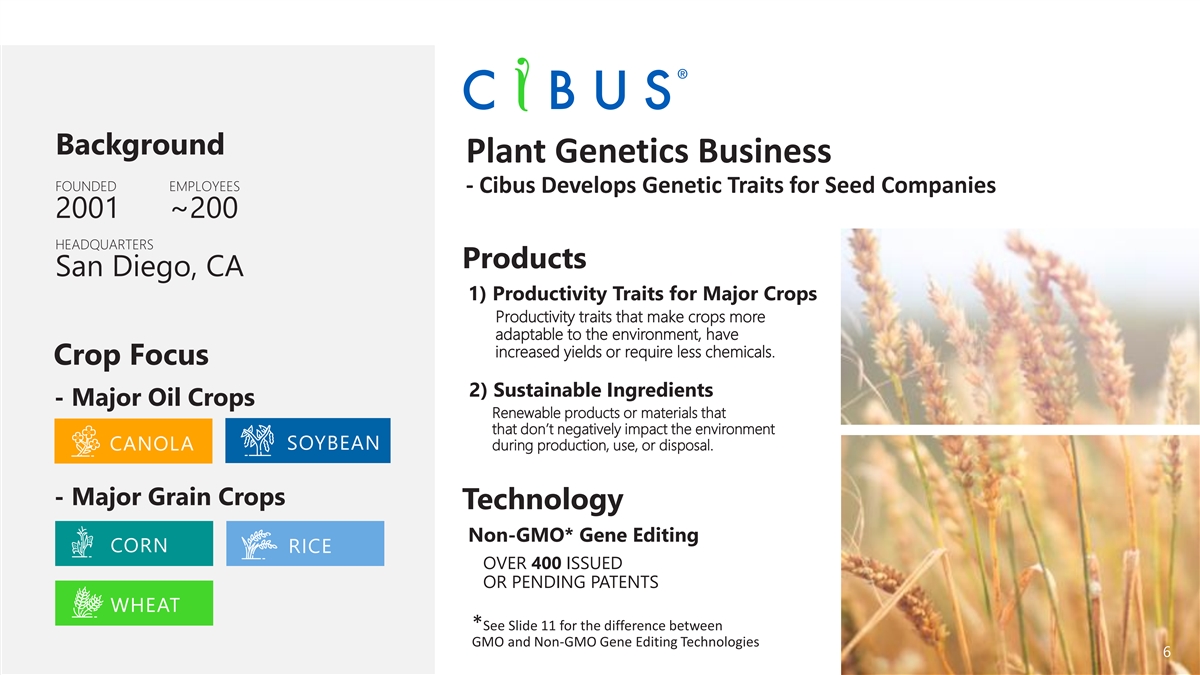

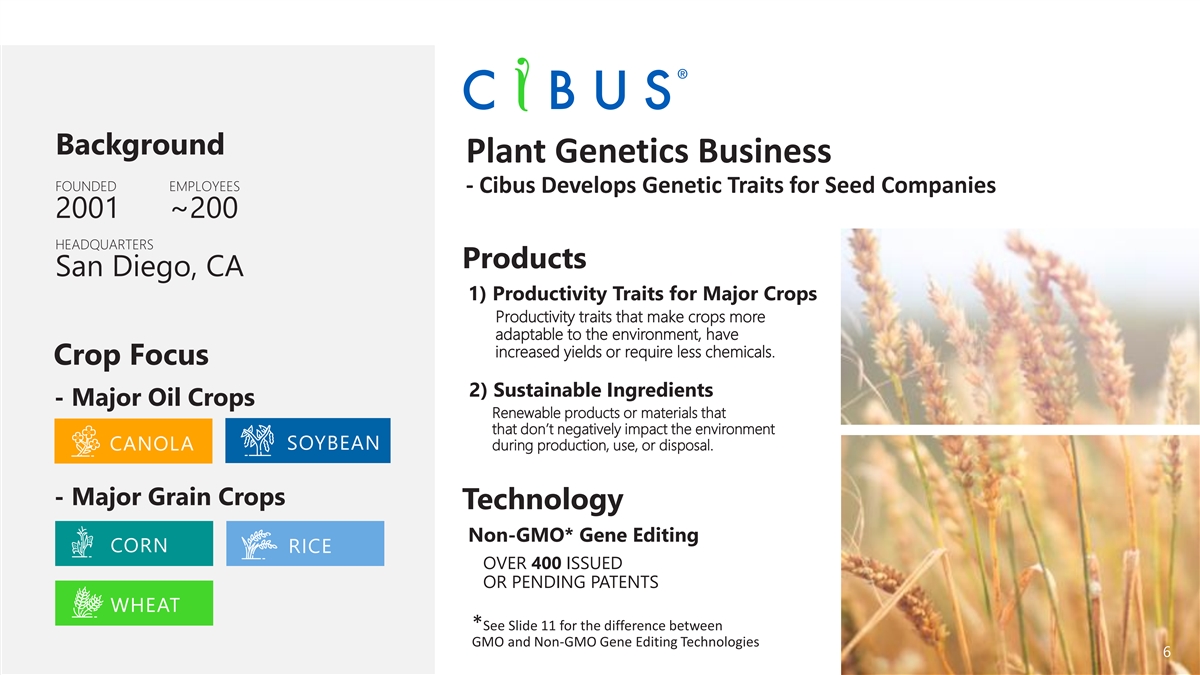

Background Plant Genetics Business FOUNDED EMPLOYEES - Cibus Develops Genetic Traits for Seed Companies 2001 ~200 HEADQUARTERS Products San Diego, CA 1) Productivity Traits for Major Crops Productivity traits that make crops more adaptable to the environment, have increased yields or require less chemicals. Crop Focus 2) Sustainable Ingredients - Major Oil Crops Renewable products or materials that that don’t negatively impact the environment SOYBEAN during production, use, or disposal. CANOLA - Major Grain Crops Technology Non-GMO* Gene Editing CORN RICE OVER 400 ISSUED OR PENDING PATENTS WHEAT *See Slide 11 for the difference between GMO and Non-GMO Gene Editing Technologies 6 6

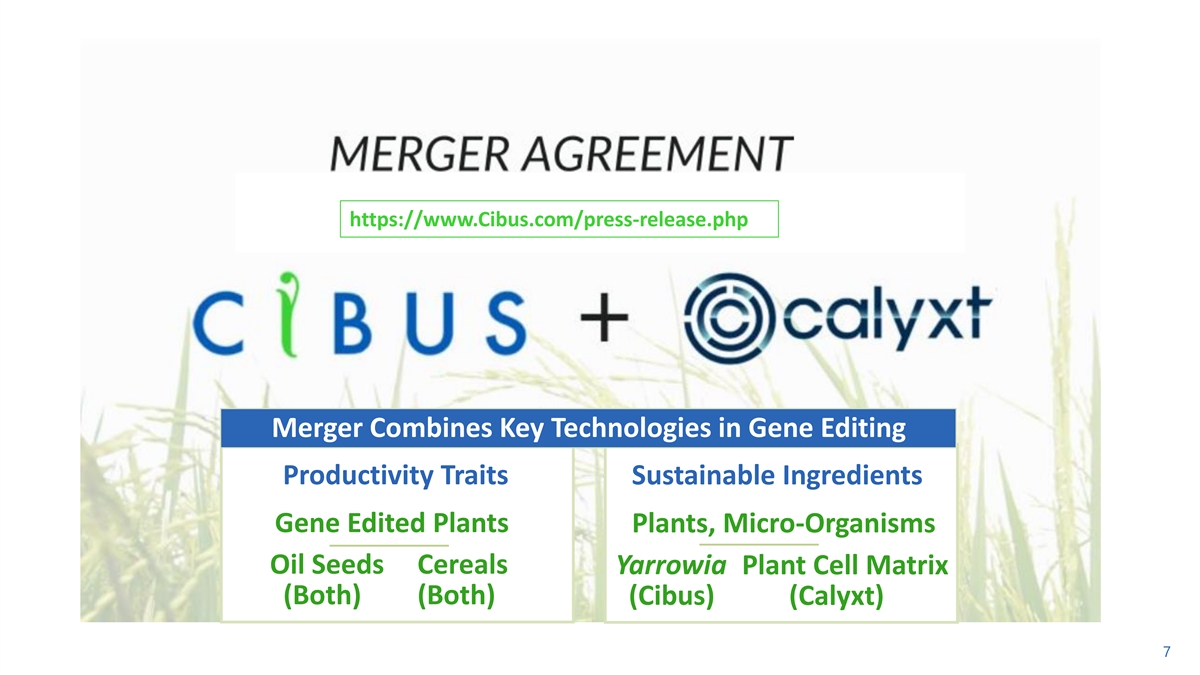

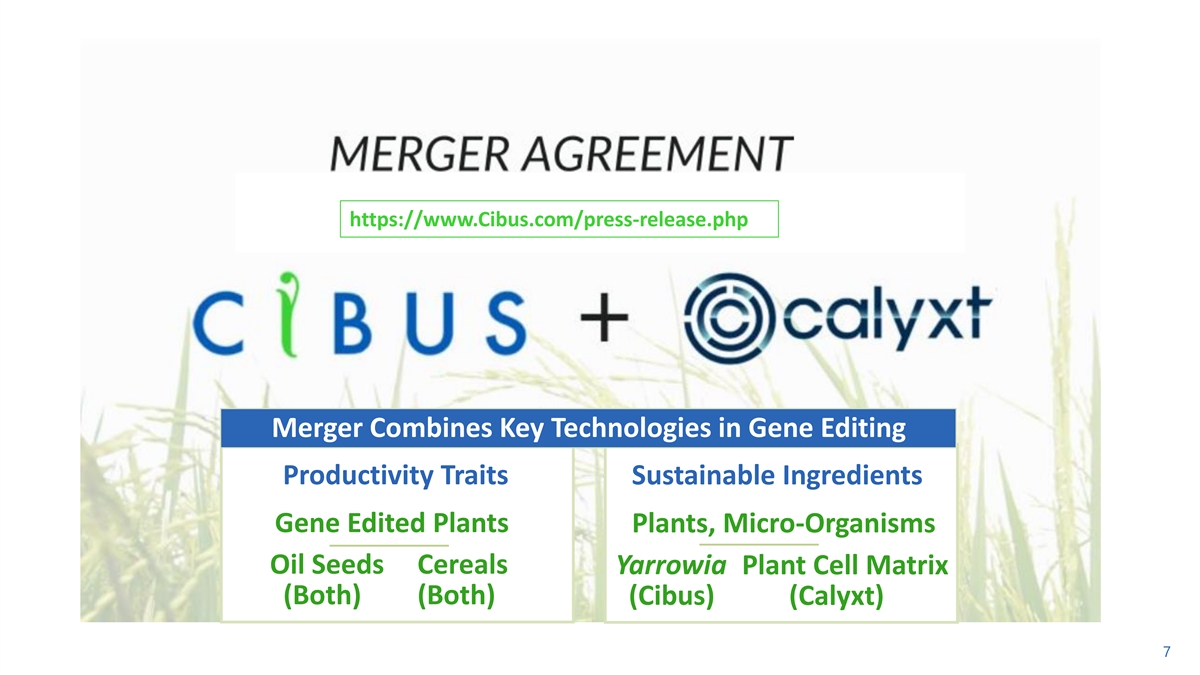

See: Cibus.com for Announcement & Details https://www.Cibus.com/press-release.php Merger Combines Key Technologies in Gene Editing Productivity Traits Sustainable Ingredients Gene Edited Plants Plants, Micro-Organisms Oil Seeds Cereals Yarrowia Plant Cell Matrix (Both) (Both) (Cibus) (Calyxt) 7

Technology & Business RTDS®/Trait Machine™ - Revolutionary Breeding Platform 1- Changes Scale, Speed & Accuracy 2- Changes Opportunity Set - Disease, Nitrogen Use, Climate Change 8

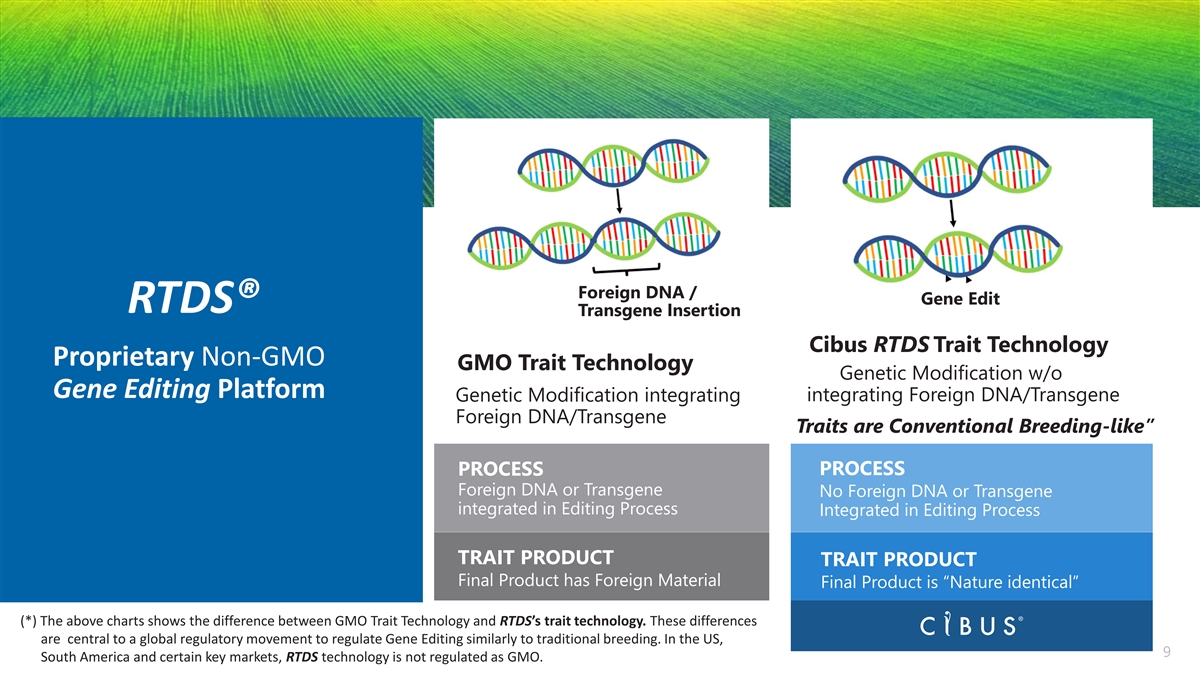

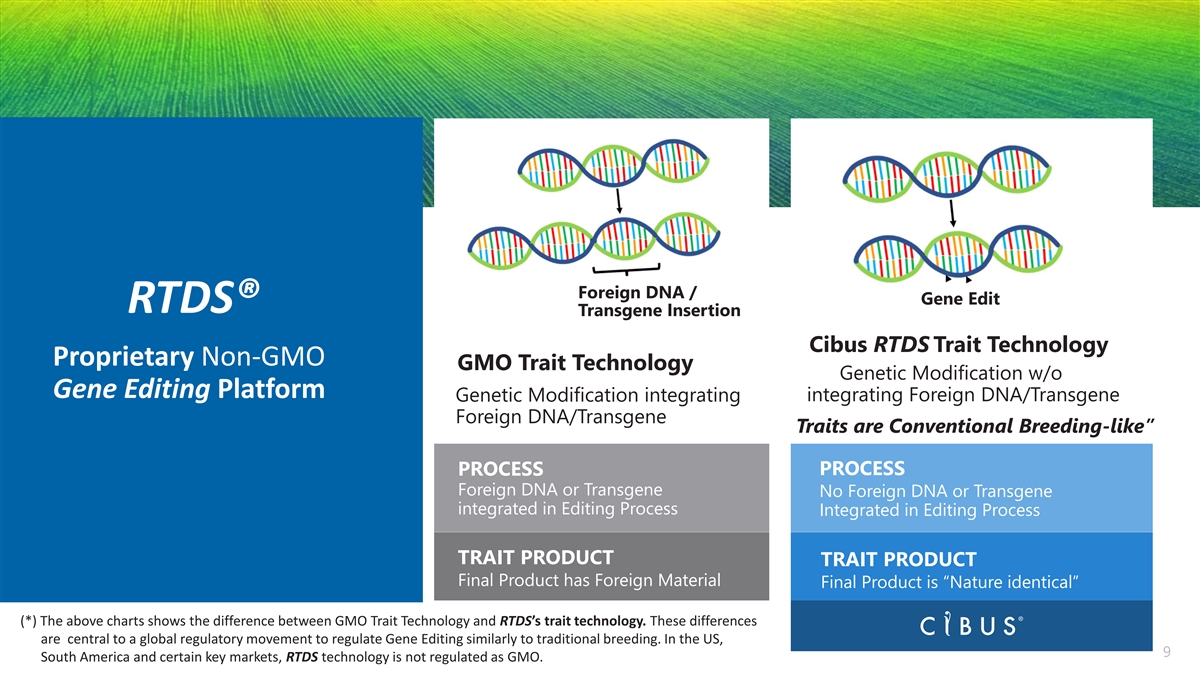

Foreign DNA / Gene Edit RTDS® Transgene Insertion Cibus RTDS Trait Technology Proprietary Non-GMO GMO Trait Technology Genetic Modification w/o Gene Editing Platform Genetic Modification integrating integrating Foreign DNA/Transgene Foreign DNA/Transgene Traits are Conventional Breeding-like” PROCESS PROCESS Foreign DNA or Transgene No Foreign DNA or Transgene integrated in Editing Process Integrated in Editing Process TRAIT PRODUCT TRAIT PRODUCT Final Product has Foreign Material Final Product is “Nature identical” (*) The above charts shows the difference between GMO Trait Technology and RTDS’s trait technology. These differences are central to a global regulatory movement to regulate Gene Editing similarly to traditional breeding. In the US, 9 South America and certain key markets, RTDS technology is not regulated as GMO.

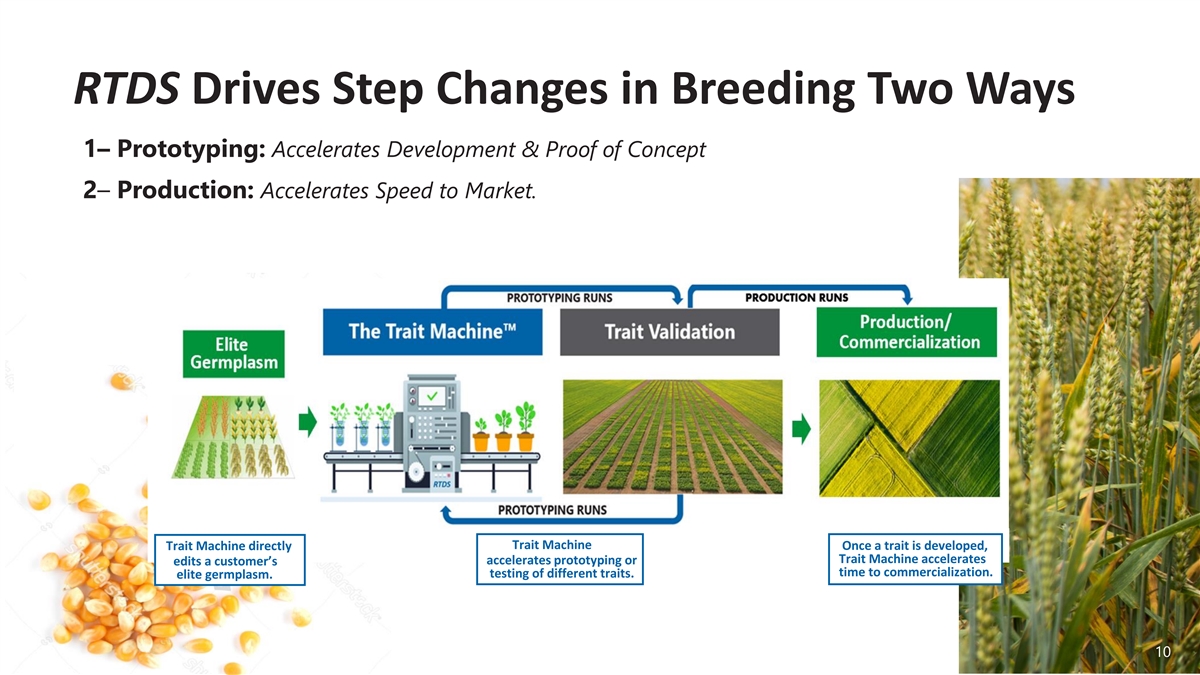

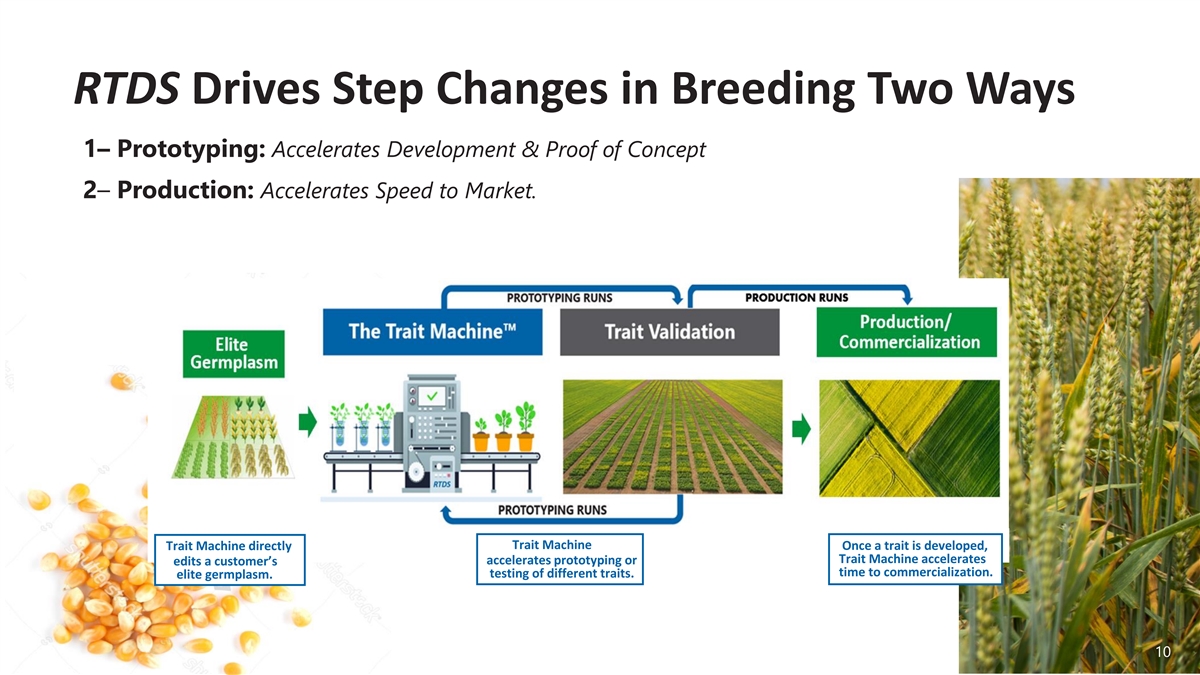

RTDS Drives Step Changes in Breeding Two Ways 1– Prototyping: Accelerates Development & Proof of Concept 2– Production: Accelerates Speed to Market. Trait Machine Trait Machine directly Once a trait is developed, Trait Machine accelerates accelerates prototyping or edits a customer’s time to commercialization. testing of different traits. elite germplasm. 10

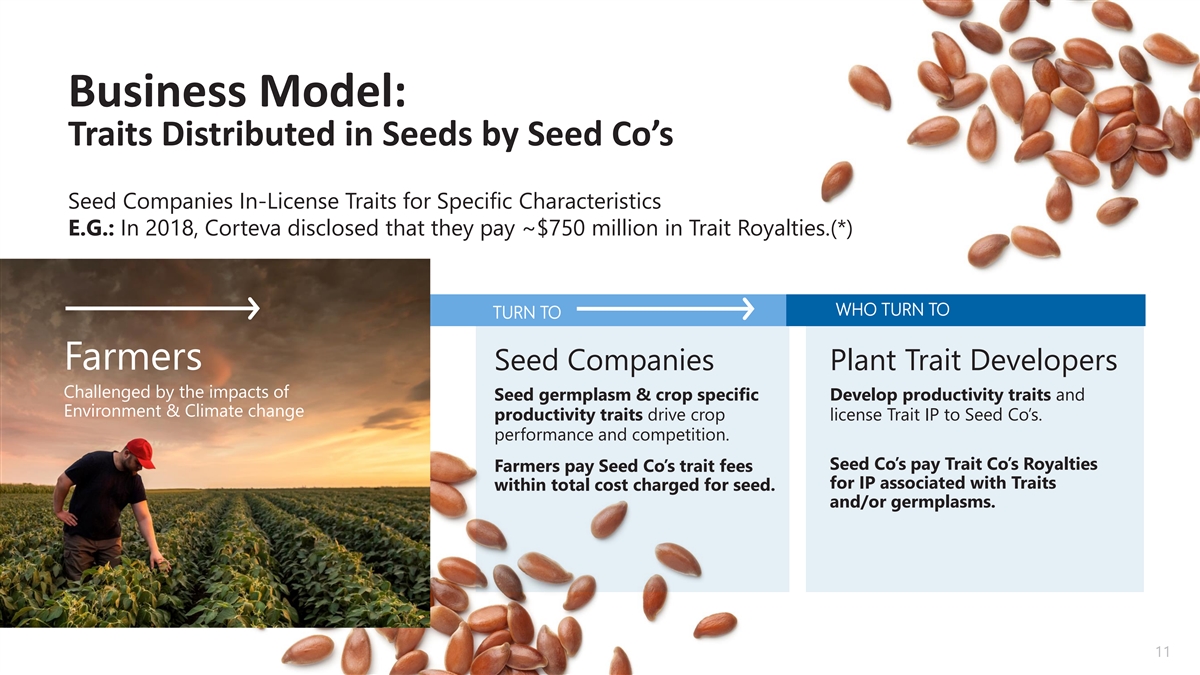

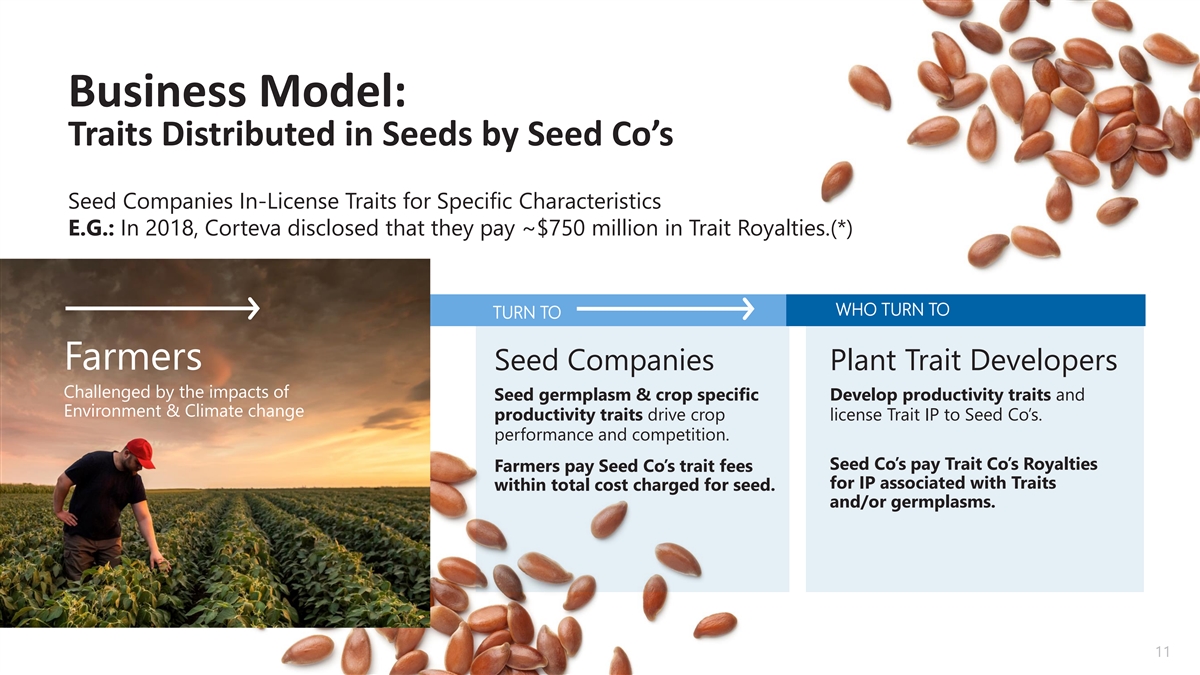

Business Model: Traits Distributed in Seeds by Seed Co’s Seed Companies In-License Traits for Specific Characteristics E.G.: In 2018, Corteva disclosed that they pay ~$750 million in Trait Royalties.(*) WHO TURN TO TURN TO Farmers Seed Companies Plant Trait Developers Challenged by the impacts of Seed germplasm & crop specific Develop productivity traits and Environment & Climate change productivity traits drive crop license Trait IP to Seed Co’s. performance and competition. Seed Co’s pay Trait Co’s Royalties Farmers pay Seed Co’s trait fees for IP associated with Traits within total cost charged for seed. and/or germplasms. 11 11

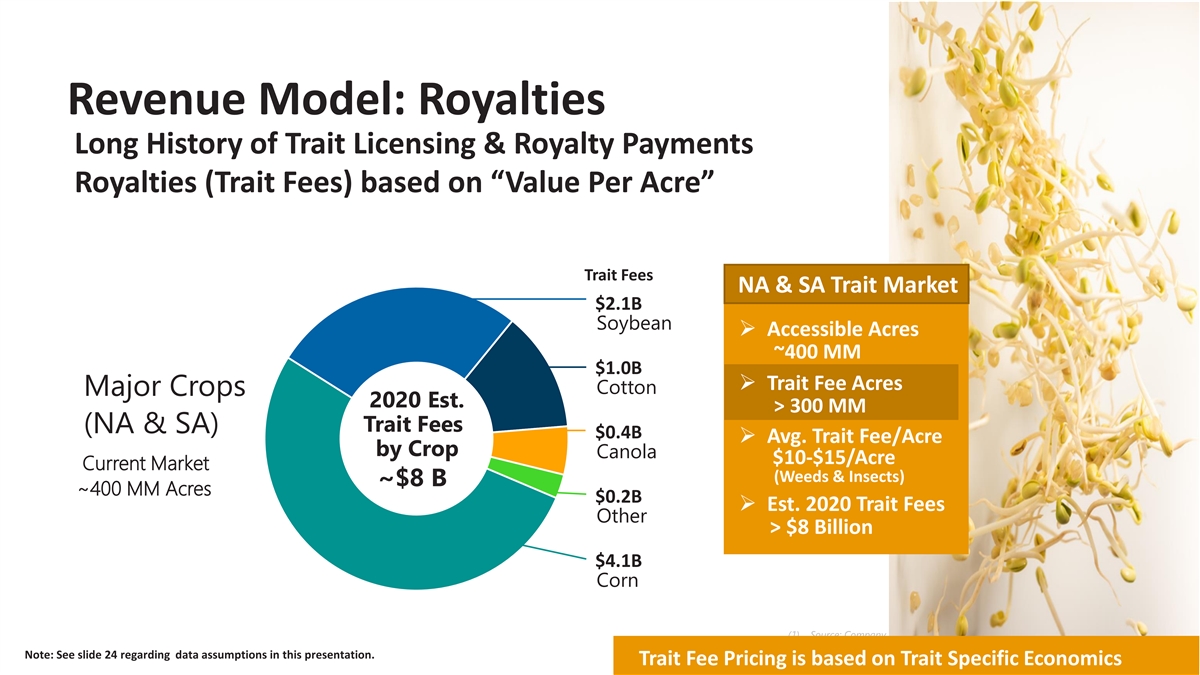

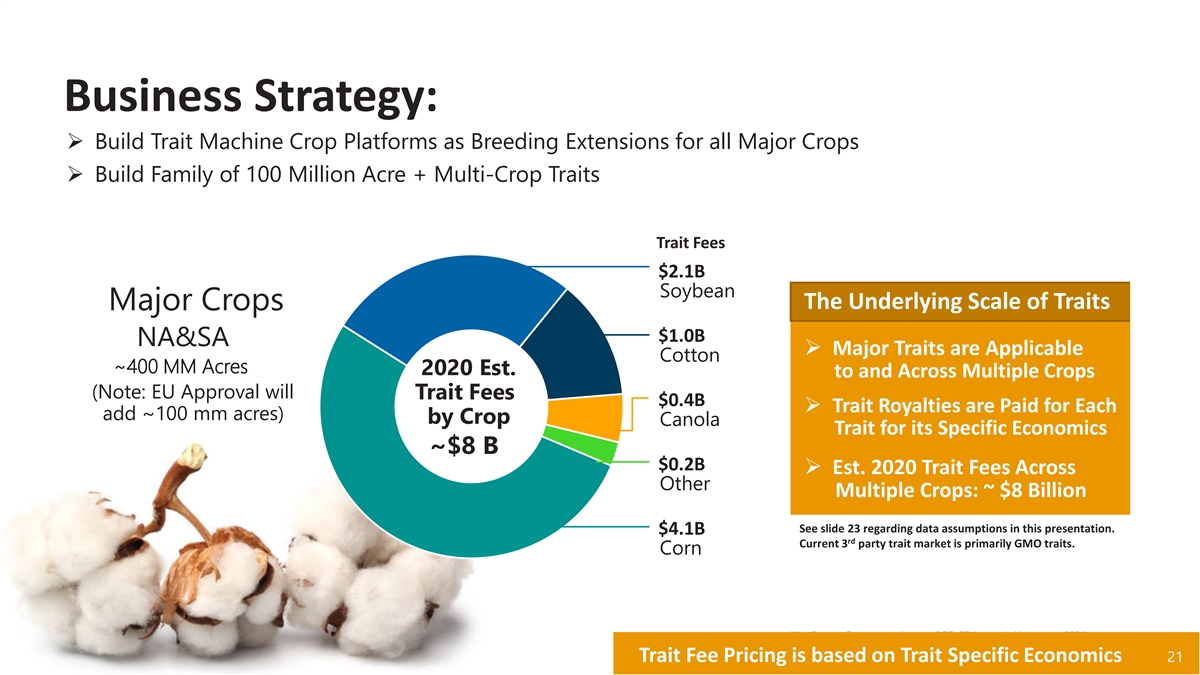

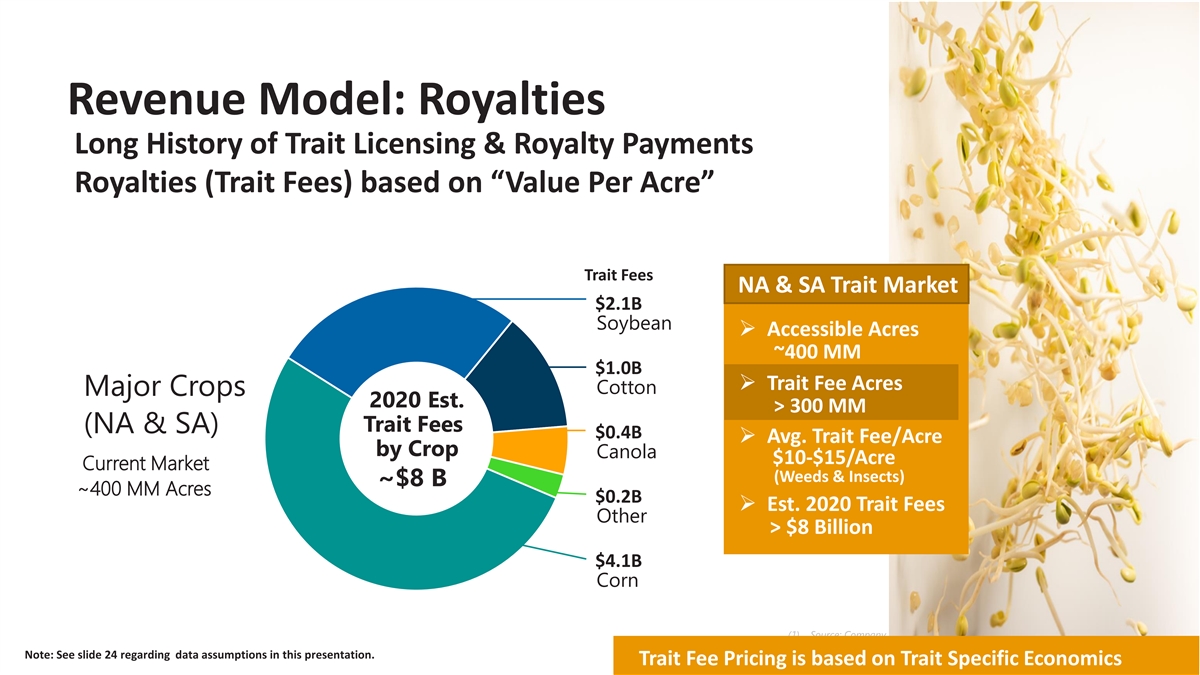

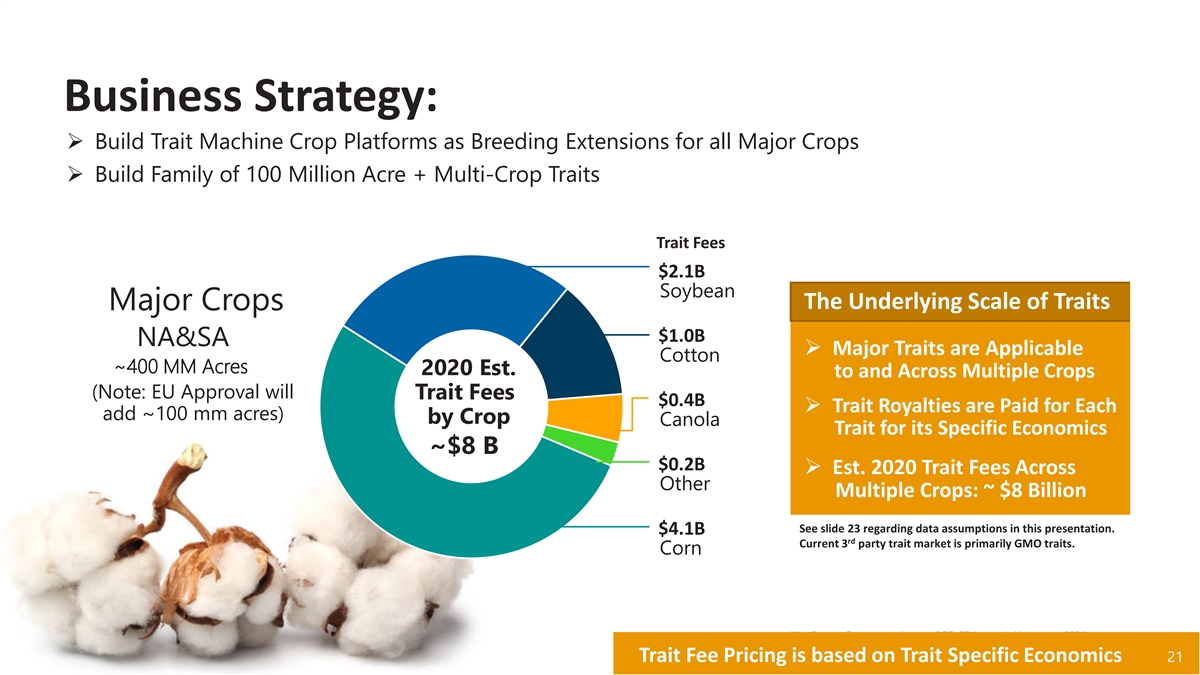

Revenue Model: Royalties Long History of Trait Licensing & Royalty Payments Royalties (Trait Fees) based on “Value Per Acre” Trait Fees NA & SA Trait Market $2.1B Soybean ➢ Accessible Acres ~400 MM $1.0B ➢ Trait Fee Acres Cotton Major Crops 2020 Est. > 300 MM Trait Fees (NA & SA) $0.4B ➢ Avg. Trait Fee/Acre by Crop Canola $10-$15/Acre Current Market (Weeds & Insects) ~$8 B ~400 MM Acres $0.2B ➢ Est. 2020 Trait Fees Other > $8 Billion $4.1B Corn (1) Source: Company estimates, BCG, FDA.gov., AgbioInvestor 2021. (2) 2020 Traits fees are predominantly for GMO-based traits in North & South America 12 12 Note: See slide 24 regarding data assumptions in this presentation. 12 Trait Fee Pricing is based on Trait Specific Economics

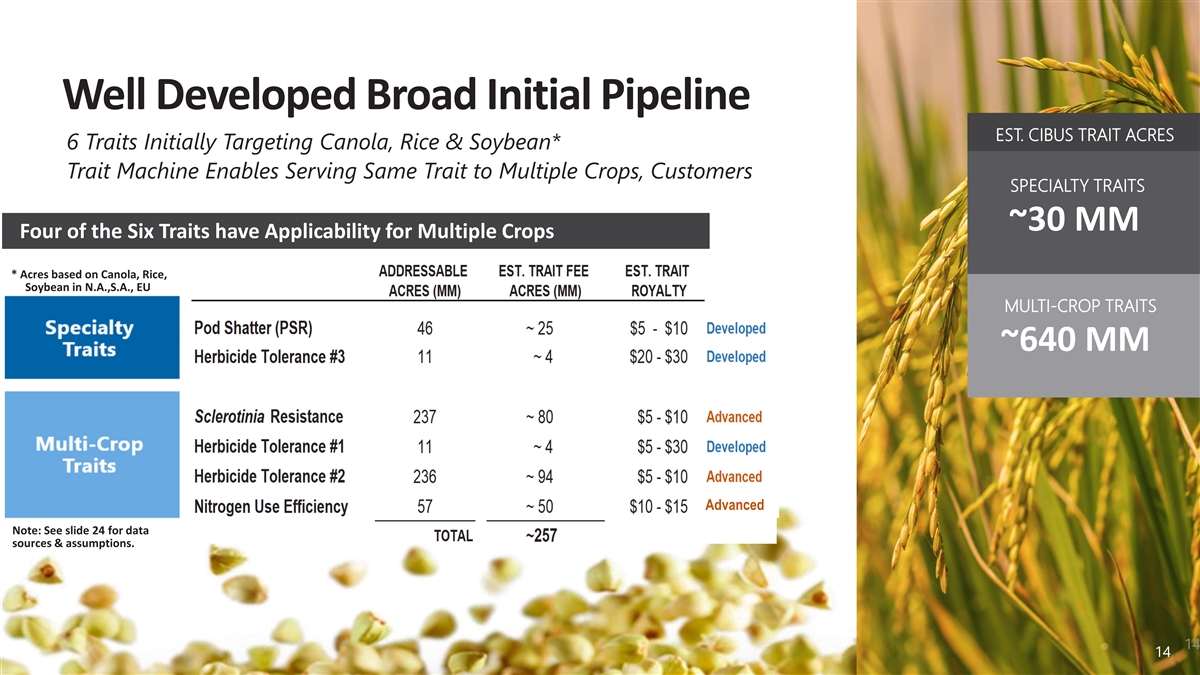

Product Review Pipeline 3- Developed Products 3- Advanced Products 13

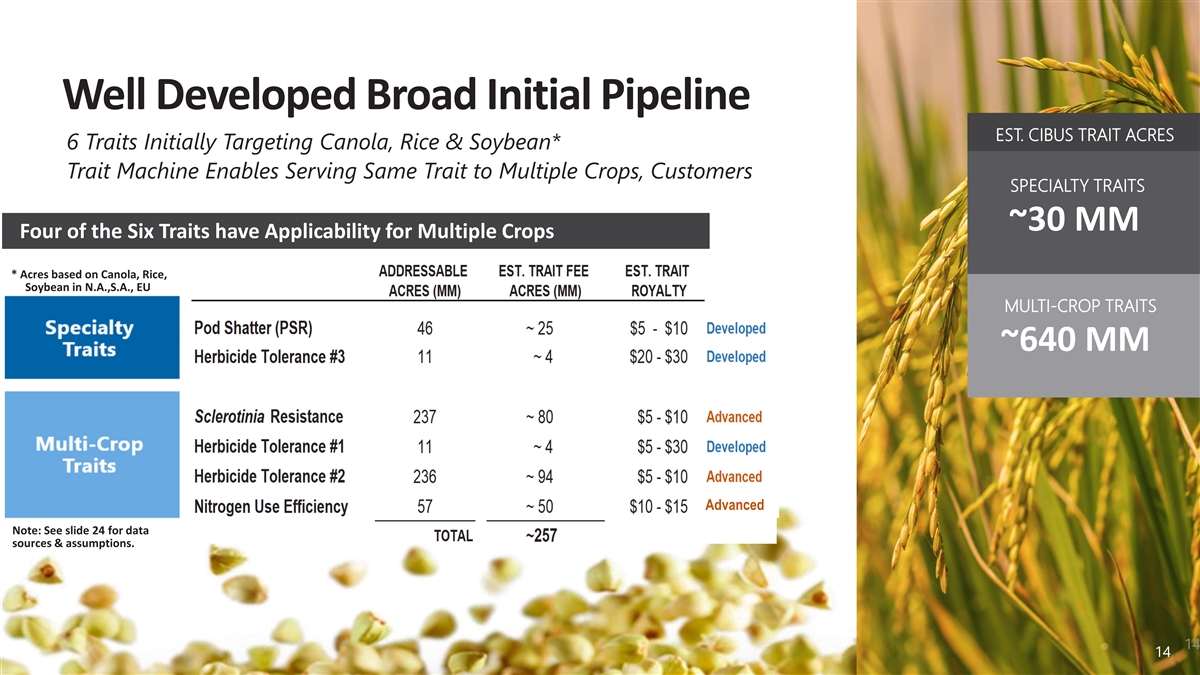

Well Developed Broad Initial Pipeline EST. CIBUS TRAIT ACRES 6 Traits Initially Targeting Canola, Rice & Soybean* Trait Machine Enables Serving Same Trait to Multiple Crops, Customers SPECIALTY TRAITS ~30 MM Four of the Six Traits have Applicability for Multiple Crops * Acres based on Canola, Rice, Soybean in N.A.,S.A., EU MULTI-CROP TRAITS ~640 MM Advanced Note: See slide 24 for data sources & assumptions. 14 14 14

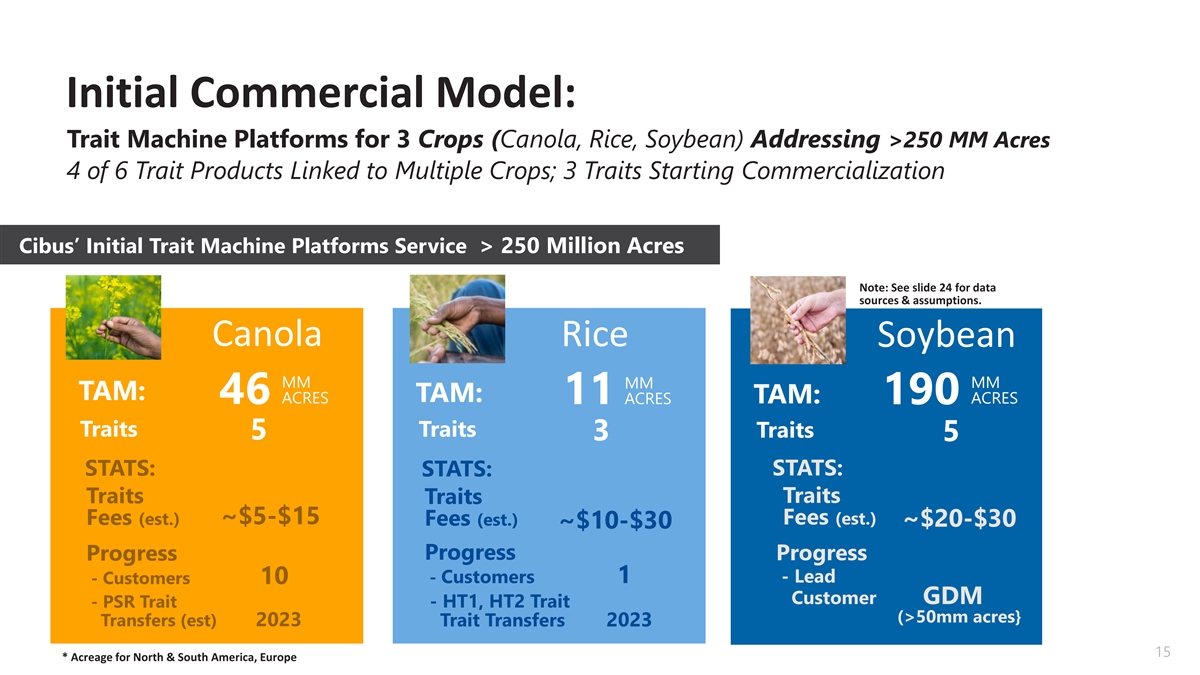

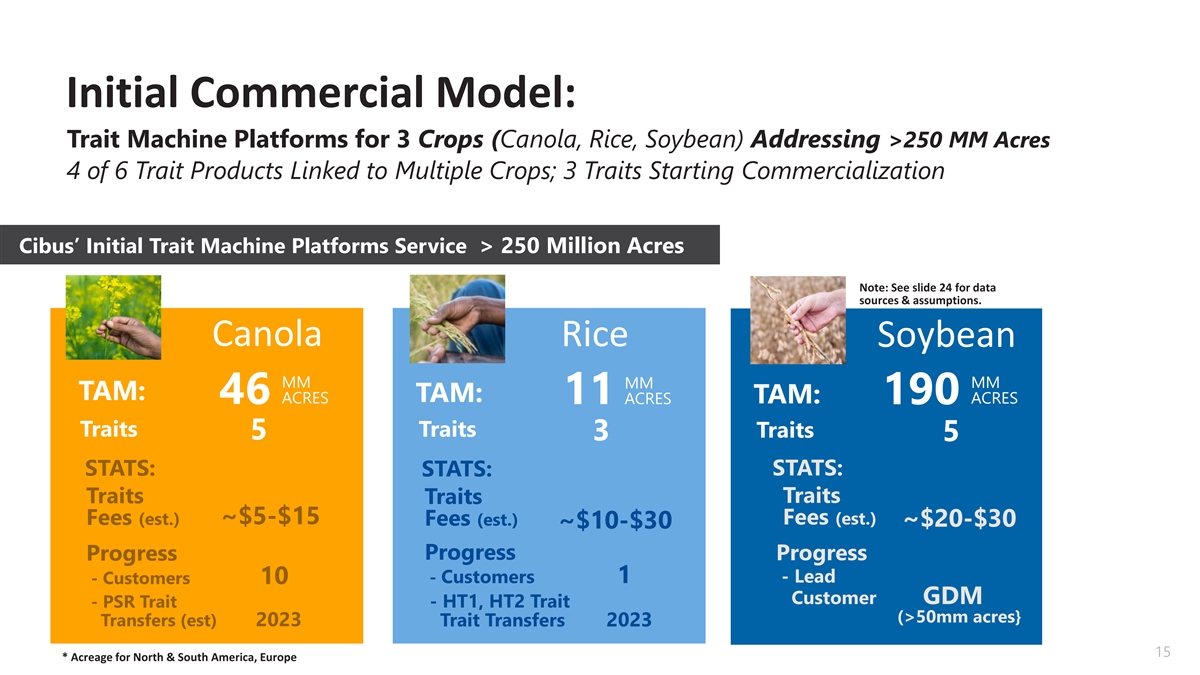

Initial Commercial Model: Trait Machine Platforms for 3 Crops (Canola, Rice, Soybean) Addressing >250 MM Acres 4 of 6 Trait Products Linked to Multiple Crops; 3 Traits Starting Commercialization Cibus’ Initial Trait Machine Platforms Service > 250 Million Acres Acres * Mkt. Note: See slide 24 for data sources & assumptions. Canola Rice Soybean MM MM MM TAM: TAM: 46 ACRES 11 ACRES TAM: ACRES 190 Soybean Traits Traits Traits 5 3 5 STATS: STATS: STATS: Traits Traits Traits Fees (est.) ~$5-$15 Fees (est.) Fees (est.) ~$20-$30 ~$10-$30 Progress Progress Progress - Lead - Customers 10 - Customers 1 Customer GDM - PSR Trait - HT1, HT2 Trait (>50mm acres} Transfers (est) 2023 Trait Transfers 2023 15 * Acreage for North & South America, Europe

Lead Developed Trait: PSR: Pod Shatter Reduction - Canola/WOSR Quantifiable Savings & Pricing, Recently Issued Product Patent*, Initial Trait Acres ~15 MM Commercial Progress: POD Shatter Reduction Developed & Transferring Sheaths or pods shatter in rain/high winds, causing yield Collaborations. losses of 10% or more. 10 Transfers have started PSR reduces pod shatter . Est. Acres for ~15 MM and associated seed losses Initial Customers 1st Transfer 2023 Est. Commercial Strengthens sheath 2025 Launch PSR: That holds oil seeds. Photo credit to the Canola Council of Canada * See slide 24 for data sources & assumptions. 16 16

Lead Advanced Trait Sclerotinia White Mold Resistance The First Disease Trait, Major Need in Canola & Soybean, Est. Trait Fees Acres ~80 MM Sclerotinia Resistance Major Crops Canola/ Soybean Sclerotinia WOSR Builds plant’s defense mechanisms Resistance to prevent Sclerotinia from infecting Est. Trait and colonizing a Soybean, Canola or ~30 MM ~50 MM Fee Acres Winter Oilseed Rape plants. . Est. Trait Fee ~$5-$10 ~$5-$10 Direct benefit from improved yields, reducing fungicide cost and their applications. Molecular Confirmation Yes Yes Green House Confirmation NA 2023 * See slide 23 for data sources & assumptions. NA Field Validation (Est.) 2024 17 17

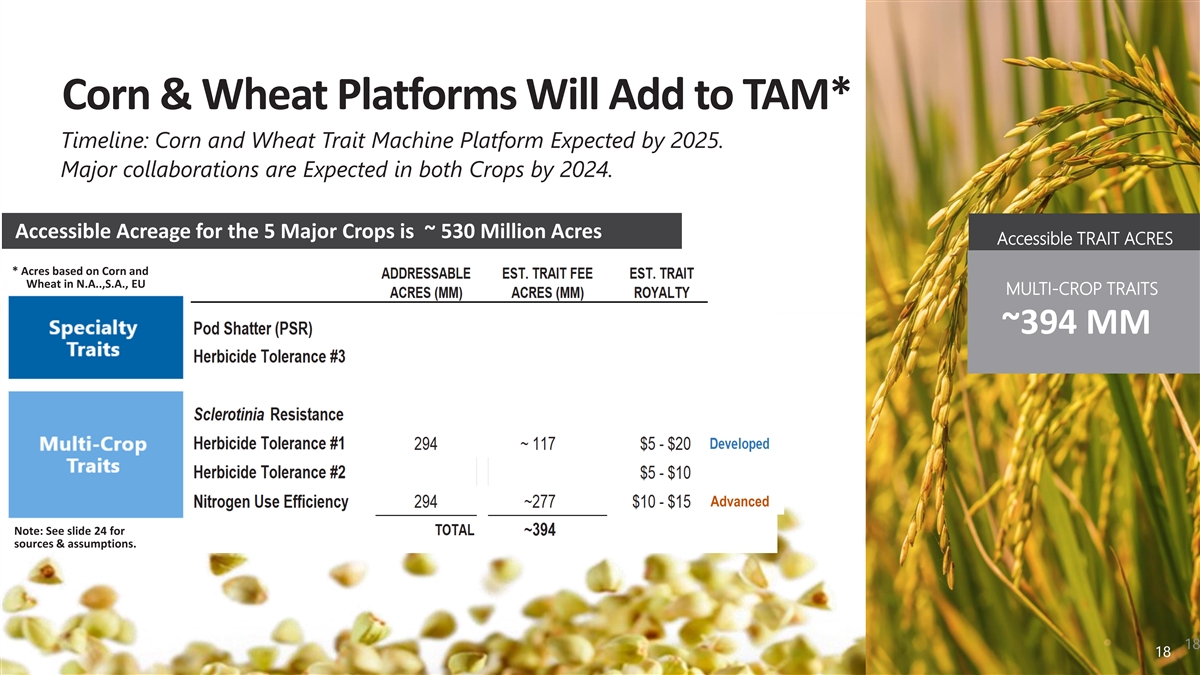

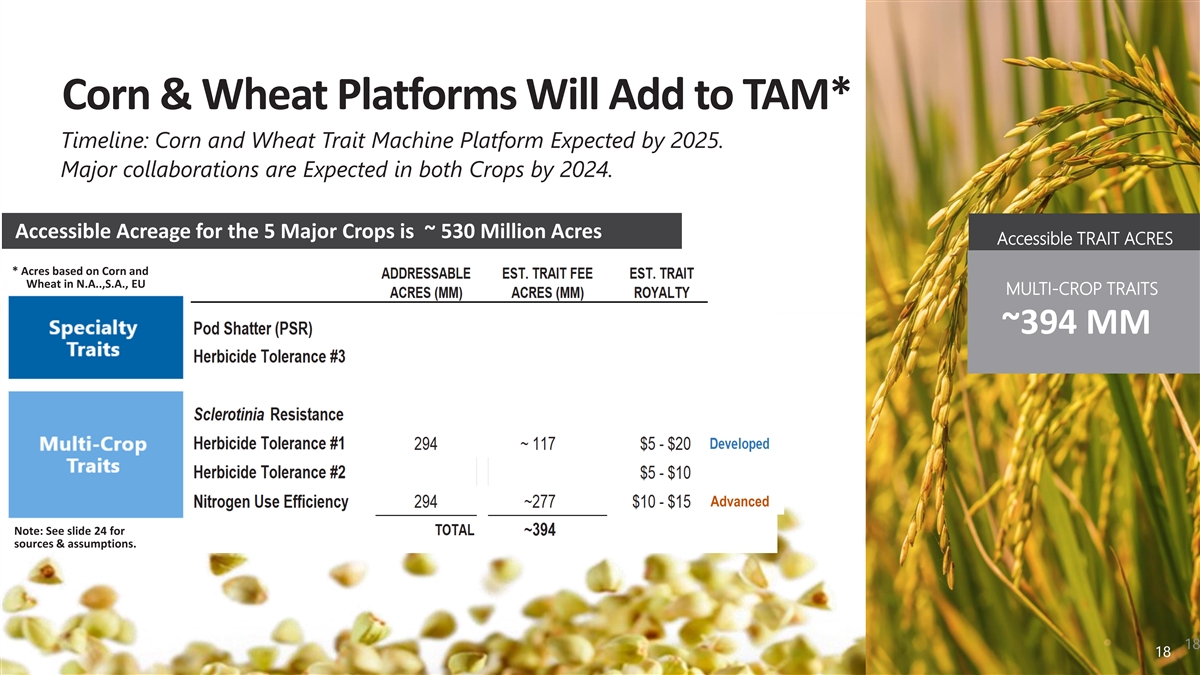

Corn & Wheat Platforms Will Add to TAM* Timeline: Corn and Wheat Trait Machine Platform Expected by 2025. Major collaborations are Expected in both Crops by 2024. Accessible Acreage for the 5 Major Crops is ~ 530 Million Acres Accessible TRAIT ACRES * Acres based on Corn and Wheat in N.A..,S.A., EU MULTI-CROP TRAITS ~394 MM Advanced Note: See slide 24 for sources & assumptions. 18 18 18

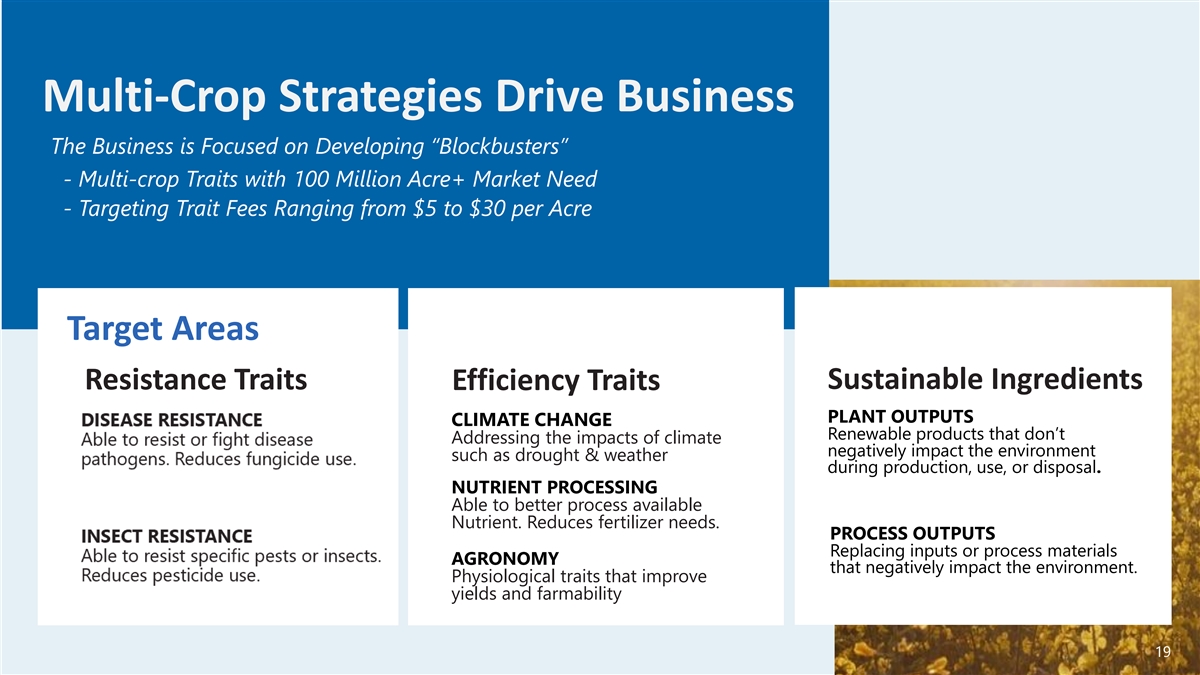

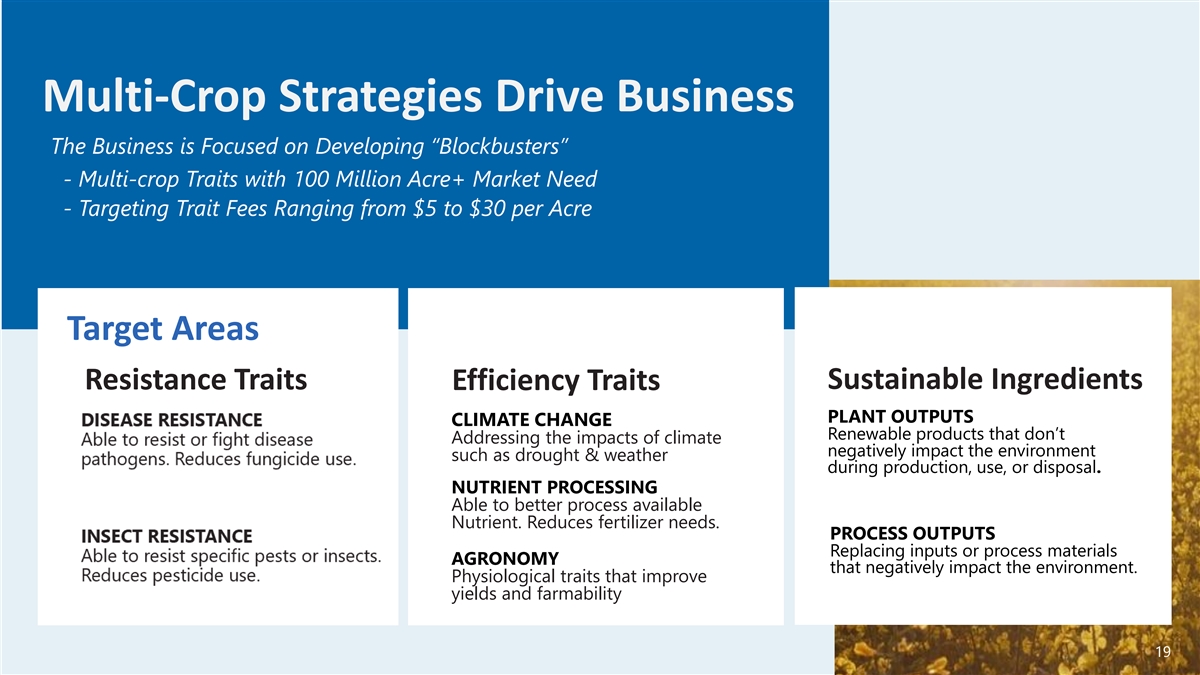

Multi-Crop Strategies Drive Business The Business is Focused on Developing “Blockbusters” - Multi-crop Traits with 100 Million Acre+ Market Need - Targeting Trait Fees Ranging from $5 to $30 per Acre Target Areas Sustainable Ingredients Resistance Traits Efficiency Traits PLANT OUTPUTS CLIMATE CHANGE Renewable products that don’t Addressing the impacts of climate negatively impact the environment such as drought & weather during production, use, or disposal. NUTRIENT PROCESSING Able to better process available Nutrient. Reduces fertilizer needs. PROCESS OUTPUTS Replacing inputs or process materials AGRONOMY that negatively impact the environment. Physiological traits that improve yields and farmability 19 19

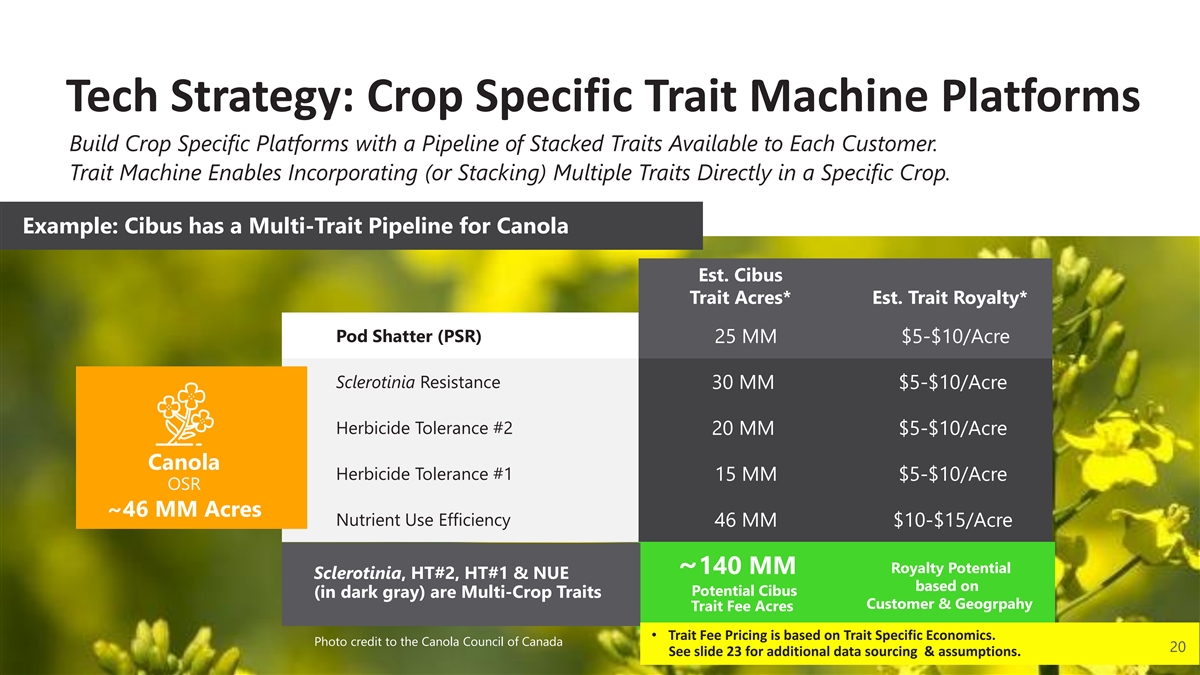

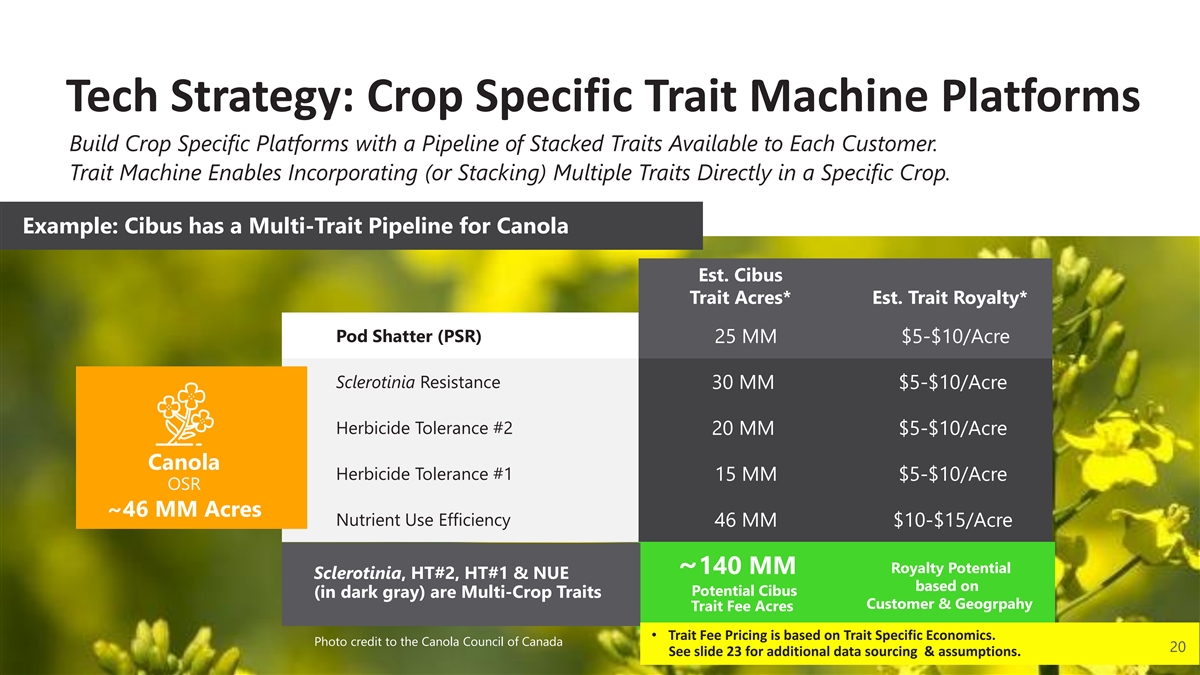

Tech Strategy: Crop Specific Trait Machine Platforms Build Crop Specific Platforms with a Pipeline of Stacked Traits Available to Each Customer. Trait Machine Enables Incorporating (or Stacking) Multiple Traits Directly in a Specific Crop. Example: Cibus has a Multi-Trait Pipeline for Canola Est. Cibus Trait Acres* Est. Trait Royalty* Pod Shatter (PSR) 25 MM $5-$10/Acre Sclerotinia Resistance 30 MM $5-$10/Acre Herbicide Tolerance #2 20 MM $5-$10/Acre Canola Herbicide Tolerance #1 15 MM $5-$10/Acre OSR ~46 MM Acres Nutrient Use Efficiency 46 MM $10-$15/Acre ~140 MM Royalty Potential Sclerotinia, HT#2, HT#1 & NUE based on Potential Cibus (in dark gray) are Multi-Crop Traits Customer & Geogrpahy Trait Fee Acres • Trait Fee Pricing is based on Trait Specific Economics. Photo credit to the Canola Council of Canada 20 See slide 23 for additional data sourcing & assumptions. 20 20

Business Strategy: ➢ Build Trait Machine Crop Platforms as Breeding Extensions for all Major Crops ➢ Build Family of 100 Million Acre + Multi-Crop Traits Trait Fees $2.1B Soybean The Underlying Scale of Traits Major Crops $1.0B NA&SA ➢ Major Traits are Applicable Cotton ~400 MM Acres 2020 Est. to and Across Multiple Crops (Note: EU Approval will Trait Fees $0.4B ➢ Trait Royalties are Paid for Each add ~100 mm acres) by Crop Canola Trait for its Specific Economics ~$8 B $0.2B ➢ Est. 2020 Trait Fees Across Other Multiple Crops: ~ $8 Billion See slide 23 regarding data assumptions in this presentation. $4.1B rd Current 3 party trait market is primarily GMO traits. Corn (1) Source: Company estimates, BCG, FDA.gov., AgbioInvestor 2021. (2) 2020 Traits fees are predominantly for GMO-based traits in North & South America * See slide 21 regarding data assumptions in this presentation. 21 21 Trait Fee Pricing is based on Trait Specific Economics 21

Disclaimer Securities Law Matters Acreage Data This presentation has been prepared by Cibus Global, LLC (the Company ), and the Company This presentation has 2 available acreage calculations: TAM-Total Accessible Acres and Trait is responsible for its contents. It shall not constitute an offer, nor a solicitation of an offer, of Fees Acres. These are based on the company’s estimate of total hybrid acres available in: the sale or purchase of securities, nor shall any securities of the Company be offered or sold, North America, South America & Europe for each crop. European acres are not currently in any jurisdiction in which such an offer, solicitation or sale would be unlawful. Neither the accessible. These acres depend on a favorable outcome of the current EU Parliamentary Securities and Exchange Commission nor any state securities commission has approved or process. They are shown to show the potential increase in available acres if the EU were to disapproved of the transactions contemplated hereby or determined if this presentation is pass the proposed legislation. The EU is expected to address these changes in 2023. truthful or complete. Any representation to the contrary is a criminal offense. Intellectual Property “Cibus,” “RTDS,” “Rapid Trait Development System,” “FALCO,” “SU Canola,” “Nucelis,” “ASAP,” Forward Looking Statements “A Different Breed,” “Trait Machine,” “Inspired by Nature,” “Driving Sustainable Agriculture,” This presentation contains forward-looking statements that involve risks and uncertainties. “Reshaping Crop Protection,” “Reinventing Trait Development”, “Timebound & Predictable”, These forward-looking statements relate to, among other things, the expected timetable for “Driving Trait & Breeding Innovation”, “Future of Breeding”, the Cibus logo and other development of certain crop traits and our future financial performance, including our trademarks or service marks of Cibus appearing in this presentation are the property of Cibus. operations, economic performance, financial condition, prospects and other future events. Trade names, trademarks and service marks of other companies that appear are the property These forward-looking statements are only predictions and are largely based on our current of their respective holders and do not imply a relationship with, or endorsement or expectations. These forward-looking statements appear in a number of places in this sponsorship of us, by these other companies. Solely for convenience, trademarks and trade Presentation. In addition, a number of known and unknown risks, uncertainties and other names in this presentation appear without the ™ and ® symbols, but any such failure to factors could affect the accuracy of these statements. These risks may cause our actual results, appear should not be construed as indicating that their respective owners will not assert their levels of performance or achievements to differ materially from any future results, levels of rights with respect thereto. activity, performance or achievements expressed or implied by these forward- looking statements. Company Data & Projections 1. Developed means validated field trials (Canola PSR, rice HT1, HT3); Advanced development Industry and Market Data means editing process underway with known edit targets. Beginning Development means Information about market and industry statistics contained in this presentation is included early stage of initial edits. based on information available to the Company that it believes is accurate in all material 2. TAM, Addressable Markets and Trait Fee Acres company estimates based on industry sources. respects. It is generally based on academic and other publications that are not produced for There can be no assurance that Trait Fee Acres can be achieved. purposes of securities offerings or economic analysis. The Company has not reviewed or 3. Trait Machine Platforms are operational in canola and rice. Soybean is expected to be included data from all sources, and the Company cannot assure potential investors of the operational in Q2 2023. accuracy or completeness of the data included in this presentation. Forecasts and other forward-looking information obtained from these sources, including estimates of future rd 3 Party Data market size, revenue and market acceptance of products and services, are subject to the same 1. Trait Fee information are 2020 estimates based on data from Agbioinvestor, US Gov., BCG qualifications and the additional uncertainties accompanying any forward-looking statements. and 3rd party consultants. Traits are predominantly GMO traits. 2. Corteva, 2018 Trait Royalties are from Corteva public disclosure. 22 22