SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant o

Filed by a Party other than the Registrant þ

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| þ | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

SilverBow Resources, Inc.

(Name of Registrant as Specified in Its Charter)

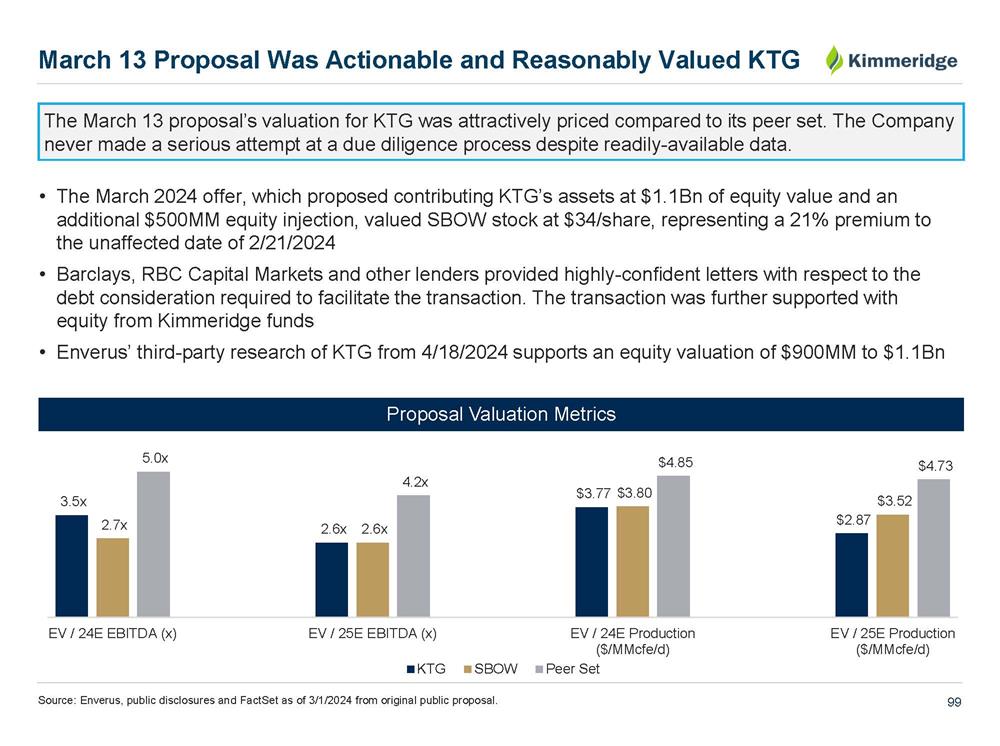

KEF Investments, LP

KEF Fund V Investments, LP

Kimmeridge Energy Management Company, LLC

Benjamin Dell

Alexander Inkster

Neda Jafar

Denis Laloy

Noam Lockshin

Henry Makansi

Neil McMahon

Douglas E. Brooks

Carrie M. Fox

Katherine L. Minyard

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SilverBow Resources: A Board in Need of Change

2 I. Executive Summary II. The Board’s Status Quo Approach III. SilverBow’s Paths to Maximize Long - Term Value for All Shareholders IV. Worst - in - Class Corporate Governance & Pay Policy V. The Serious Concerns Raised by the Board’s Stale, Incumbent Nominees VI. Our Independent Nominees Appendices • Kimmeridge Industry Experience and Sector Leadership • Setting the Record Straight • The March 13 Proposal Agenda

Executive Summary

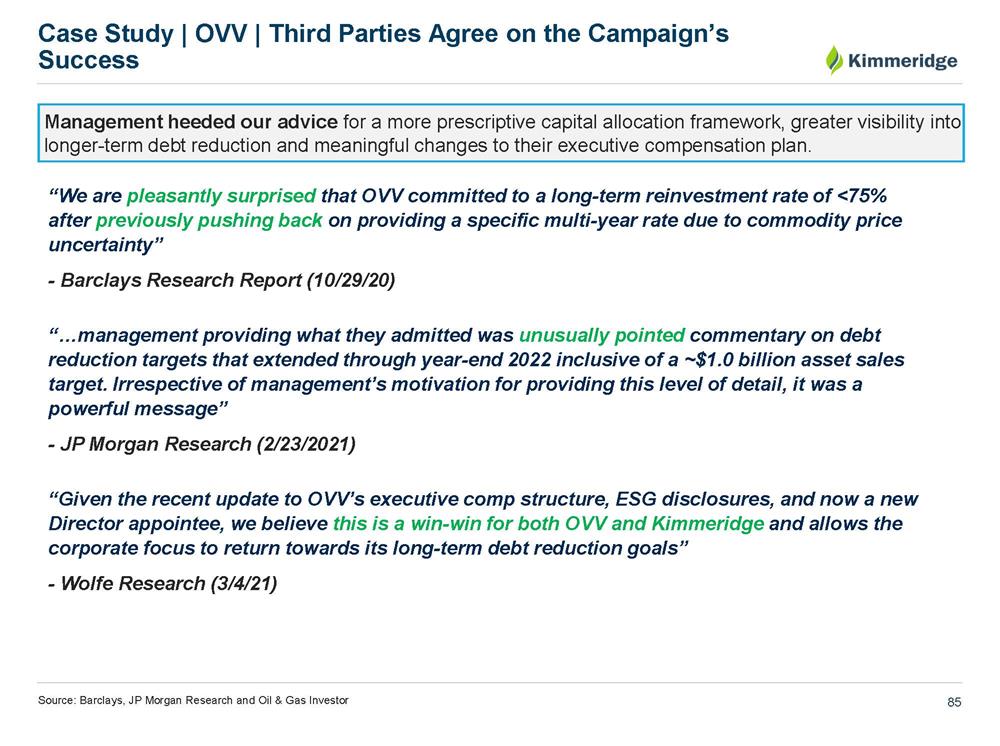

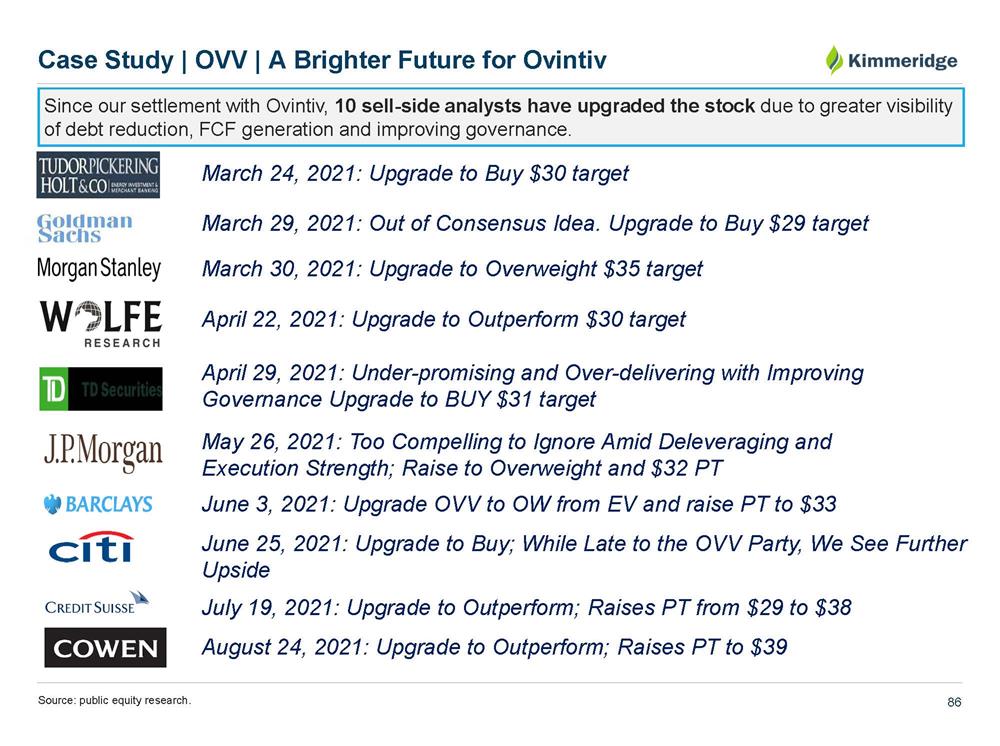

4 Company Mboe /d at Investment Kimmeridge Role Company Action Taken Oasis 75 Engaged Merged with Whiting to form Chord Enerplus 100 Engaged Merged with Chord Chesapeake 572 Engaged Merged with Southwestern Southwestern 767 Engaged Merged with Chesapeake California Resources 85 Engaged Announced strategic realignment and undertook sale of real estate PDC Energy 247 Engaged Sold to Chevron Ovintiv 555 Engaged Added 1 board member, changed CEO, revised capital allocation and ESG frameworks Resolute 35 Engaged Ran process and sold Carrizo 57 Engaged Improved capital allocation process and refreshed board Callon 100 Primary transaction Partnered with Kimmeridge on 2L, equity and royalty. Equity rose ~10x Civitas 70 Direct investment Transformed business model and merged with multiple companies Sitio 36 Direct investment Merged with Brigham to form a leading royalties company SilverBow 92 Largest shareholder Refused to engage Kimmeridge History at Public Companies & Sector Impact Source: Kimmeridge analysis, public filings. Since 2020, Kimmeridge has been actively involved in 13 public companies. These names represent almost 10% of all US oil and gas production (2.8 MMboe/d). 12 of the 1 3 have actively engaged, revised their business model, merged or refreshed their boards. SBOW stands alone as obstructing change.

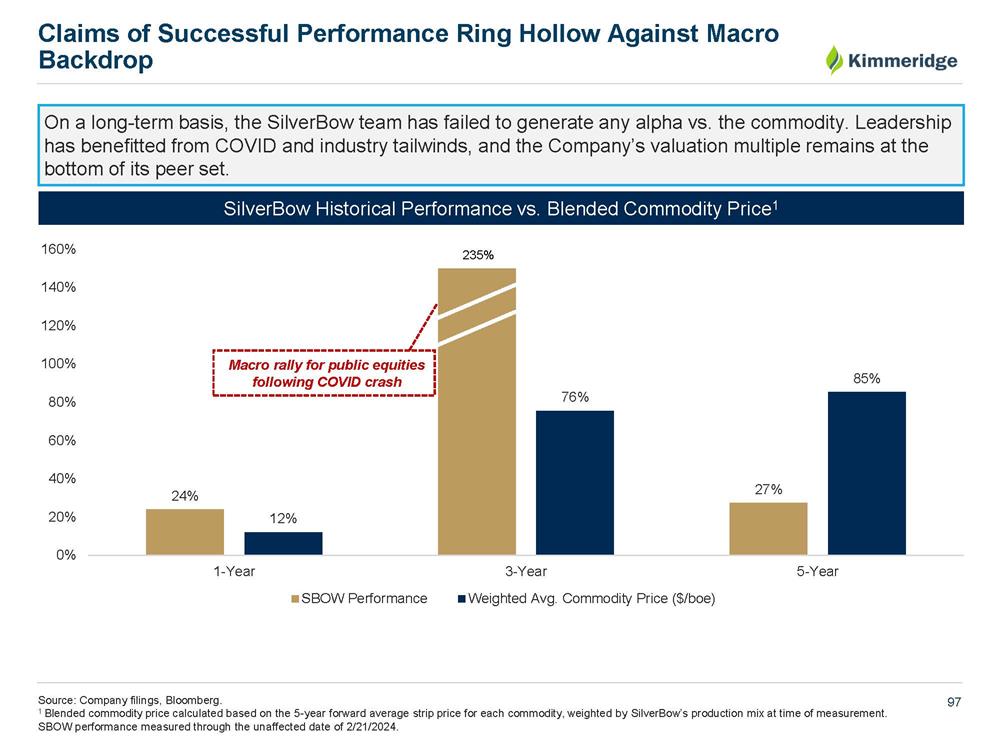

5 SBOW’s Claims 1 The Facts “Kimmeridge launched a proxy fight to facilitate a path to change control of the Company without paying a premium to SilverBow shareholders” • Kimmeridge has not bought an SBOW share in >650 days and remains below the poison pill threshold • Kimmeridge has engaged with SBOW for over 2 years , following the Board’s requested process . Kimmeridge’s proposals far surpassed upstream M&A premiums and were rejected • Following Kimmeridge’s February 2024 presentation of 8 strategic alternatives, the Board asked Kimmeridge to deliver a formal proposal to the Board for the combination of KTG and SBOW and an associated capital injection • SBOW ignored the proposal they specifically requested , undertook no serious due diligence and announced its dismissal via proxy solicitation materials. As a result, Kimmeridge withdrew the proposal on April 16 to focus on much - needed board refreshment Kimmeridge's directors are “conflicted nominees that can force a combination that would destroy SBOW shareholder value” • Our nominees are highly qualified, independent, industry leaders, that would immediately and materially enhance SilverBow’s Board • Our nominees have a track record of value creation, not value destruction like the incumbents • The Company ignores the fact that our nominees, if elected, would be a minority in the boardroom and have a fiduciary responsibility to act in the best interest of all shareholders “Our [SBOW’s] strategy has proven to be resilient through market cycles and has delivered significant shareholder value” • SBOW has generated a negative 4% TSR since CEO Sean Woolverton’s tenure and 2.6% annualized TSR over Ellisor and Wampler’s lengthy tenures • The Company trades at the lowest valuation multiple out of its peer set • On a 5 - year basis, SBOW’s stock has underperformed the blended commodity by 58% 2 , highlighting the lack of alpha generation from leadership An Honest Assessment of the SBOW Engagement 1 Quotes from SilverBow’s 4/22/2024 Letter to Shareholders. 2 See slide 97 for further detail on SBOW stock underperformance. SBOW’s existing Board insulates itself from shareholder accountability at all costs. Investors demand change See Appendix 2 for further detail

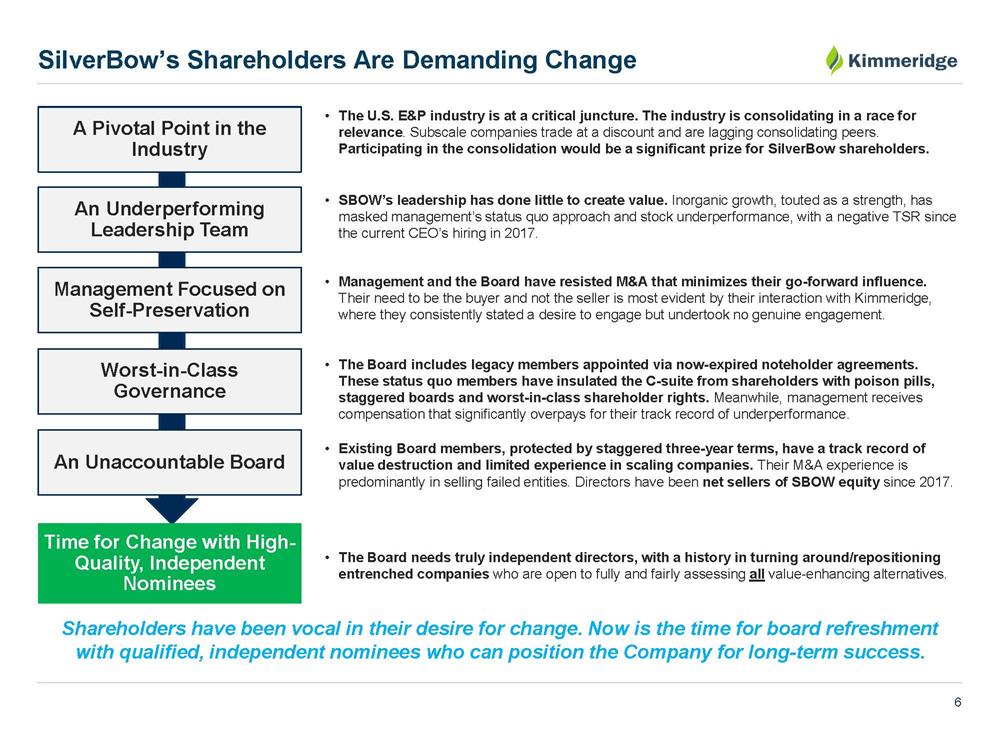

6 • The U.S. E&P industry is at a critical juncture. The industry is consolidating in a race for relevance . Subscale companies trade at a discount and are lagging consolidating peers. Participating in the consolidation would be a significant prize for SilverBow shareholders. • SBOW’s leadership has done little to create value. Inorganic growth, touted as a strength, has masked management’s status quo approach and stock underperformance, with a negative TSR since the current CEO’s hiring in 2017. • Management and the Board have resisted M&A that minimizes their go - forward influence. Their need to be the buyer and not the seller is most evident by their interaction with Kimmeridge, where they consistently stated a desire to engage but undertook no genuine engagement. • The Board includes legacy members appointed via now - expired noteholder agreements. These status quo members have insulated the C - suite from shareholders with poison pills, staggered boards and worst - in - class shareholder rights. Meanwhile, management receives compensation that significantly overpays for their track record of underperformance. • Existing Board members, protected by staggered three - year terms, have a track record of value destruction and limited experience in scaling companies. Their M&A experience is predominantly in selling failed entities. Directors have been net sellers of SBOW equity since 2017. • The Board needs truly independent directors, with a history in turning around/repositioning entrenched companies who are open to fully and fairly assessing all value - enhancing alternatives. SilverBow’s Shareholders Are Demanding Change Shareholders have been vocal in their desire for change. Now is the time for board refreshment with qualified, independent nominees who can position the Company for long - term success. A Pivotal Point in the Industry An U nderperforming Leadership T eam Management Focused on Self - Preservation Worst - in - Class Governance An Unaccountable Board Time for Change with High - Quality, Independent Nominees

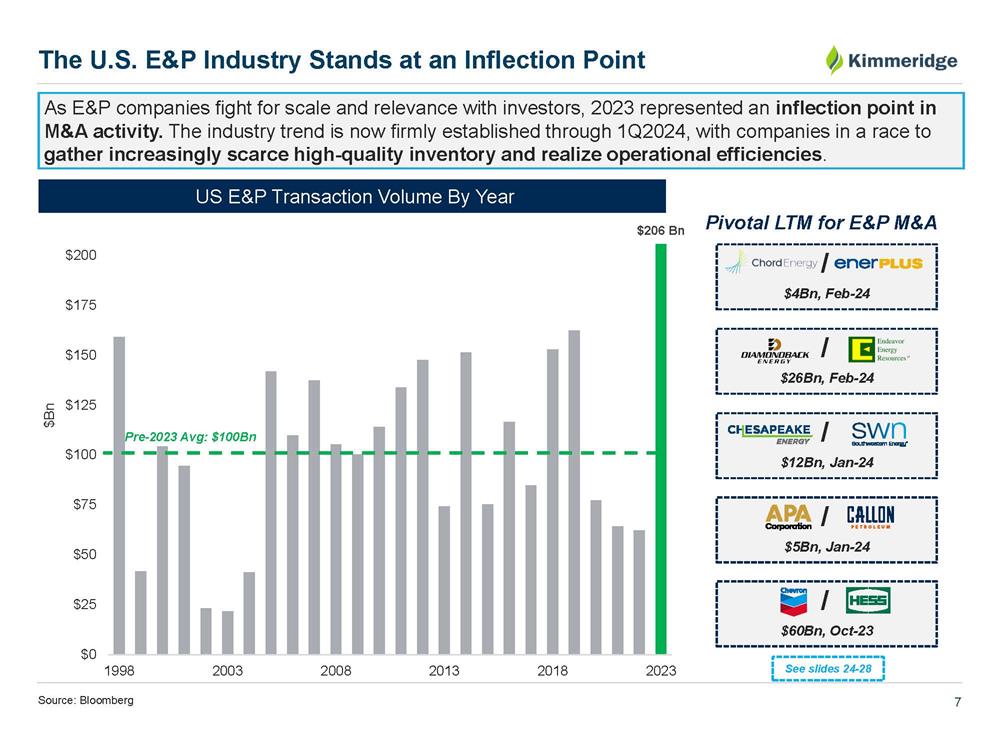

7 / $60Bn, Oct - 23 / $5Bn, Jan - 24 / $12Bn, Jan - 24 As E&P companies fight for scale and relevance with investors, 2023 represented an inflection point in M&A activity. The industry trend is now firmly established through 1Q2024, with companies in a race to gather increasingly scarce high - quality inventory and realize operational efficiencies . The U.S. E&P Industry Stands at an Inflection Point Source: Bloomberg $206 Bn $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 1998 2003 2008 2013 2018 2023 $Bn / $4Bn, Feb - 24 Pivotal LTM for E&P M&A / $26Bn, Feb - 24 Pre - 2023 Avg: $100Bn US E&P Transaction Volume By Year See slides 24 - 28

8 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x 9.0x 10.0x 300 600 1,200 2,400 4,800 9,600 EV/'24E EBITDA (x) 2024E Production (MMcfe/d) Among the companies in the XOP, scale has a high correlation with valuation multiple. SBOW is an outlier with the lowest EV / EBITDA of its peers , in part due to the Board and m anagement team’s failed strategy, worst - in - class governance and corresponding subscale status. E&Ps are in a Race for Relevance with Investors as Scale Drives Multiples Source: FactSet and market data as of 4/12/24. Note: Peer group shown on page includes APA, AR, CHK, CHRD, CIVI, CNX, COP, CRGY, CRK, CTRA, DVN, EOG, EQT, FANG, KOS, MGY, M NR, MRO, MTDR, MUR, NOG, OVV, OXY, PR, PXD, RRC, SM, TALO. Antero Resources Enterprise Value and EBITDA not reflective of equity method investment in Antero Midstream. 1 XOP defined as an index of 52 holdings representative of the S&P Oil & Gas Exploration & Production Industry . SBOW SBOW is in the bottom 10% of the XOP 1 in terms of market capitalization and lags its peers The status quo must change for the Company to realize its true potential and prevent being left further behind See slides 26 - 29

9 Kimmeridge Active Involvement Kimmeridge’s Annualized TSR 2 Track Record Proxy Performance Peer Status 1 • Filed for Chapter 11 • Acquired • Active • Filed for Chapter 11 / Re - emerged SilverBow in Danger of Being Left Behind Source: Public disclosure, FactSet. 1 Since SilverBow bankruptcy reemergence 5/3/2016. 2 As of the later of first trade after bankruptcy, initial public offering, or SilverBow bankruptcy reemergence 5/3/2016 through unaffected date of 2/21/ 2024. 6 9 19 2 36 Peers * * *Denotes Acquired Companies Active SBOW Proxy Performance Peers Companies with Kimmeridge involvement have averaged 28% TSR %$7/ 97/( &5*< 5(, $03< %5< 55& 6' $5 (47 6%2: 3'&( &75$ 60 299 &1; 5(3; &,9, &5. 0*< (5) *325 &+. &5& &+5' A look at SilverBow’s proxy peer set shows the significant risks faced by subscale E&P companies. It is imperative that the Board consider all paths to maximize value, without prioritizing personal outcomes . Kimmeridge has a track record of identifying companies with strong potential. We believe a key ingredient to these companies’ success has been independent, effective Board oversight. See slides 24 - 26 %DQNUXSW $FTXLUHG $FWLYH 5H HPHUJHG

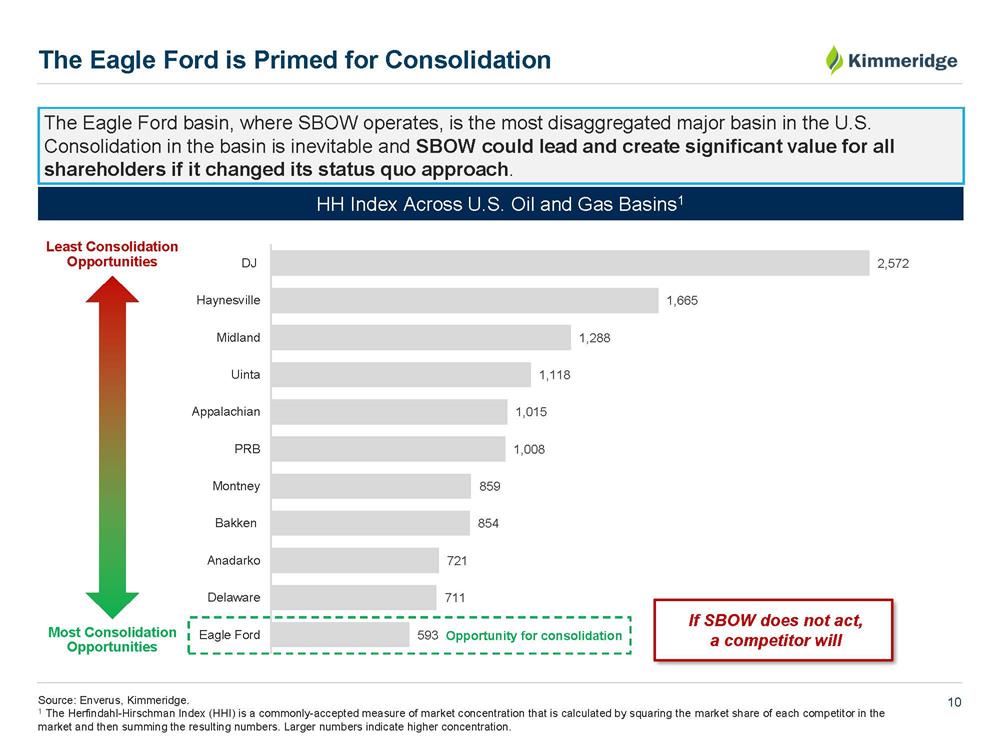

10 The Eagle Ford basin, where SBOW operates, is the most disaggregated major basin in the U.S. Consolidation in the basin is inevitable and SBOW could lead and create significant value for all shareholders if it changed its status quo approach . HH Index Across U.S. Oil and Gas Basins 1 593 711 721 854 859 1,008 1,015 1,118 1,288 1,665 2,572 Eagle Ford Delaware Anadarko Bakken Montney PRB Appalachian Uinta Midland Haynesville DJ The Eagle Ford is Primed for Consolidation Source: Enverus, Kimmeridge. 1 The Herfindahl - Hirschman Index (HHI) is a commonly - accepted measure of market concentration that is calculated by squaring the market share of each competitor in the market and then summing the resulting numbers. Larger numbers indicate higher concentration. Opportunity for consolidation Most Consolidation Opportunities Least Consolidation Opportunities If SBOW does not act, a competitor will

11 16% 25% (18%) (14%) (20%) (3%) (10%) 60 - day Share Price Performance vs. XOP SBOW’s M&A strategy has grown the Company, but the market has not reacted positively. This strategy has saddled SBOW with its subscale status and high leverage, foreclosing its ability to scale as a buyer . $5.4 $4.9 $4.1 $4.0 $2.6 $2.0 Enterprise Value ($Bn) Logical M&A Partners are Larger and Less Levered Market Reaction to SBOW Deals SBOW’s M&A Prioritizes Empire Building Over Value Creation Source: FactSet as of 4/12/2024 and respective company filings. $157,056 Aug - 21 Aug - 23 1.2 x 2.8x 1.1x 0.9x 1.5x 1.0x 1.6x $157.1 Current Leverage 2 nd Highest Leverage Among Potential Partners See slides 31 - 33

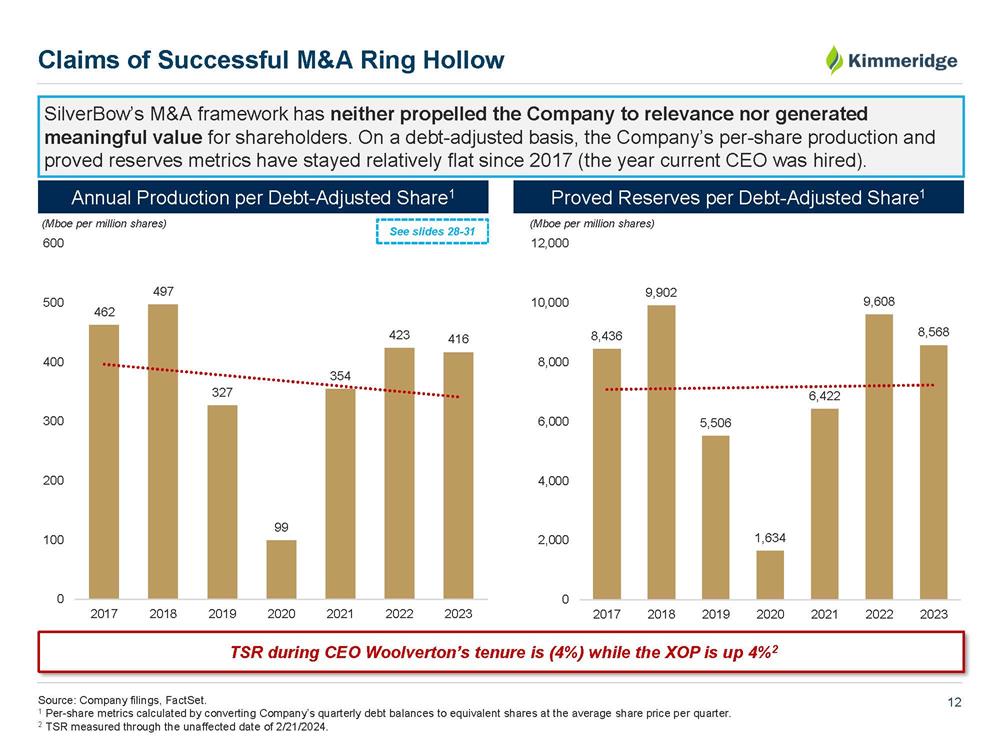

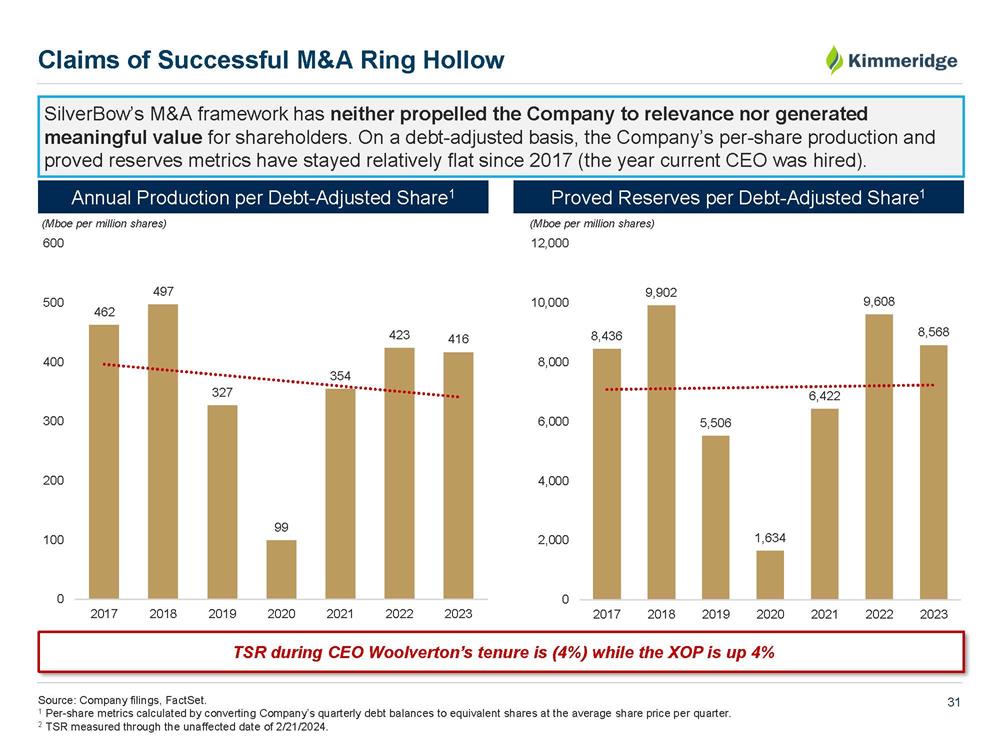

12 SilverBow’s M&A framework has neither propelled the Company to relevance nor generated meaningful value for shareholders. On a debt - adjusted basis, the Company’s per - share production and proved reserves metrics have stayed relatively flat since 2017 (the year current CEO was hired). Proved Reserves per Debt - Adjusted Share 1 Annual Production per Debt - Adjusted Share 1 462 497 327 99 354 423 416 0 100 200 300 400 500 600 2017 2018 2019 2020 2021 2022 2023 8,436 9,902 5,506 1,634 6,422 9,608 8,568 0 2,000 4,000 6,000 8,000 10,000 12,000 2017 2018 2019 2020 2021 2022 2023 Claims of Successful M&A Ring Hollow Source: Company filings, FactSet. 1 Per - share metrics calculated by converting Company’s quarterly debt balances to equivalent shares at the average share price pe r quarter. 2 TSR measured through the unaffected date of 2/21/2024. ( Mboe per million shares) ( Mboe per million shares) TSR during CEO Woolverton’s tenure i s ( 4%) while the XOP is up 4% 2 See slides 28 - 31

13 (100%) (80%) (60%) (40%) (20%) - 20% 40% 60% 80% 100% Feb-17 Aug-17 Feb-18 Aug-18 Feb-19 Aug-19 Feb-20 Aug-20 Feb-21 Aug-21 Feb-22 Aug-22 Feb-23 Aug-23 SBOW XOP Total Shareholder Return (%) Through the cycle, SBOW has underperformed the XOP and provided negative 4% total shareholder return. A holistic look at performance over time shows that SilverBow has delivered no real alpha for shareholders. SBOW Has Generated Negative TSR and Underperformed the XOP Since CEO Woolverton Was Hired Source: Bloomberg. Note: Performance shown through an unaffected date of 2/21/2024. CEO Woolverton’s hiring was announced on 2/28/2017. By self - selecting time periods, the Company claims to have delivered performance, when it has not SilverBow’s post - COVID rally driven by their beta to the commodity XOP: 4% SBOW: (4) % COVID - 19

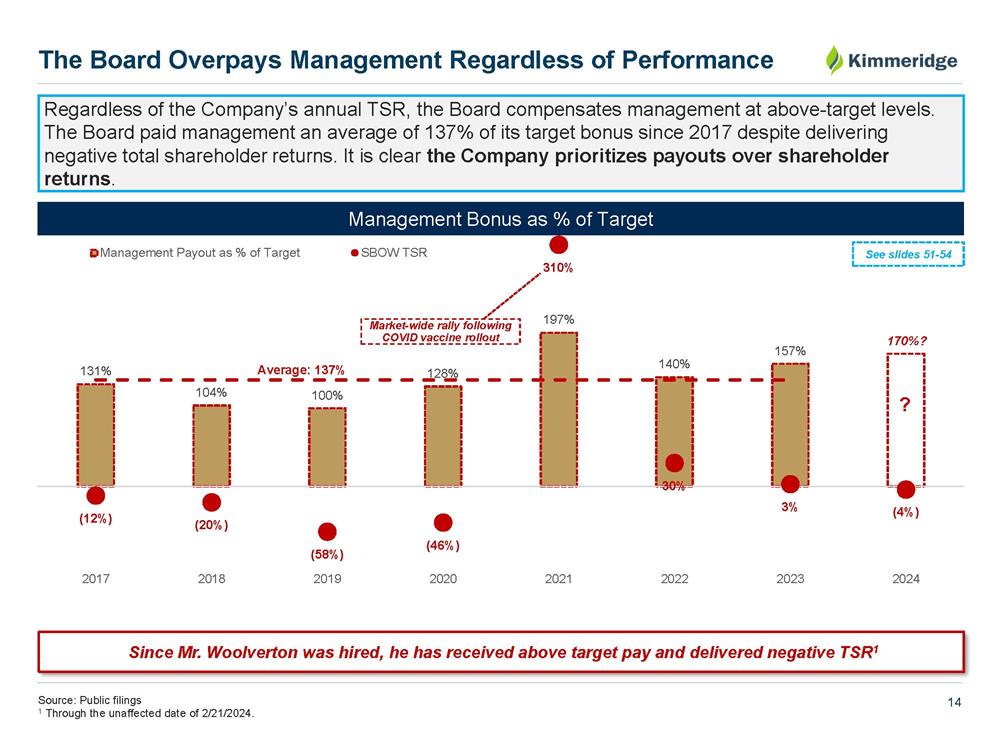

14 131% 104% 100% 128% 197% 140% 157% (12%) (20%) (58%) (46%) 310% 30% 3% (4%) 2017 2018 2019 2020 2021 2022 2023 2024 Management Payout as % of Target SBOW TSR Average: 137% Since Mr. Woolverton was hired, he has received above target pay and delivered negative TSR 1 Regardless of the Company’s annual TSR, the Board compensates management at above - target levels. The Board paid management an average of 137% of its target bonus since 2017 despite delivering negative total shareholder returns. It is clear the Company prioritizes payouts over shareholder returns . Management Bonus as % of Target The Board Overpays Management Regardless of Performance Source: Public filings 1 Through the unaffected date of 2/21/2024. Market - wide rally following COVID vaccine rollout 170%? ? See slides 51 - 54

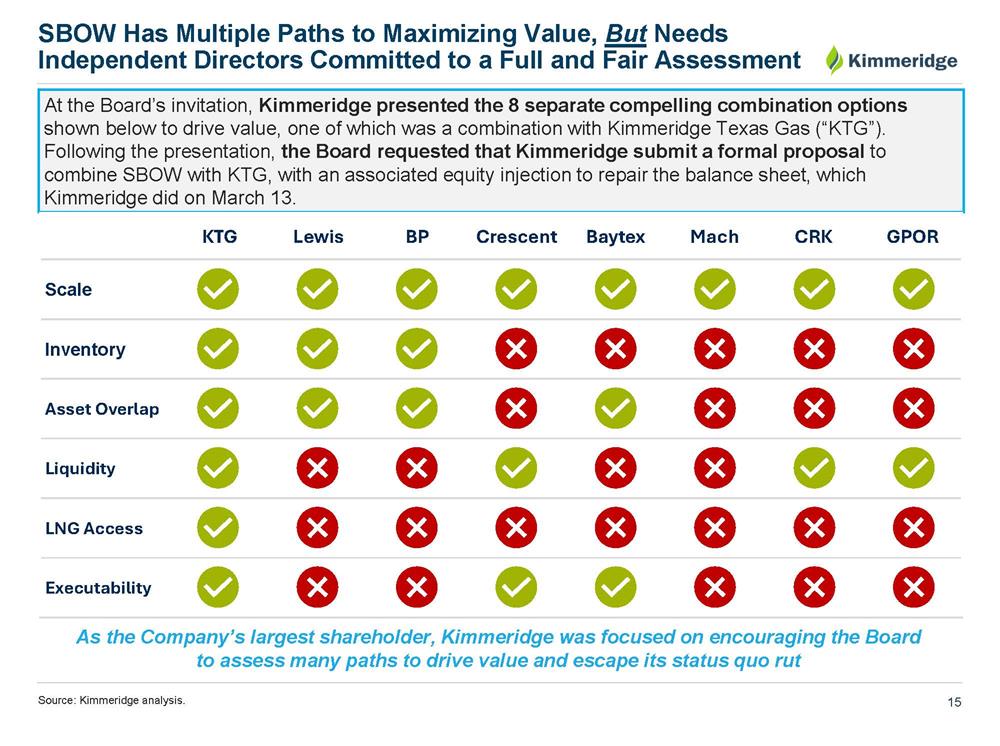

15 At the Board’s invitation, Kimmeridge presented the 8 separate compelling combination options shown below to drive value, one of which was a combination with Kimmeridge Texas Gas (“KTG”). Following the presentation, the Board requested that Kimmeridge submit a formal proposal to combine SBOW with KTG, with an associated equity injection to repair the balance sheet, which Kimmeridge did on March 13. KTG Lewis BP Crescent Baytex Mach CRK GPOR Scale Inventory Asset Overlap Liquidity LNG Access Executability SBOW Has Multiple Paths to Maximizing Value, But Needs Independent Directors Committed to a Full and Fair Assessment Source: Kimmeridge analysis. As the Company’s largest shareholder, Kimmeridge was focused on encouraging the Board to assess many paths to drive value and escape its status quo rut

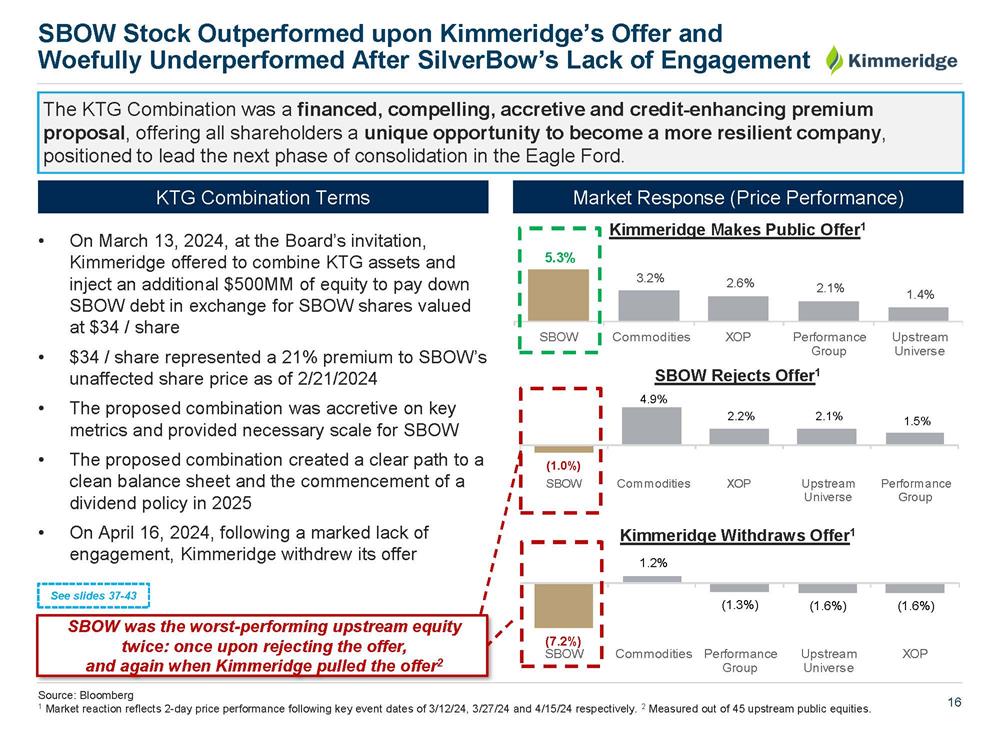

16 The KTG Combination was a financed, compelling, accretive and credit - enhancing premium proposal , offering all shareholders a unique opportunity to become a more resilient company , positioned to lead the next phase of consolidation in the Eagle Ford. Market Response (Price Performance) KTG Combination Terms • On March 13, 2024, at the Board’s invitation, Kimmeridge offered to combine KTG assets and inject an additional $500MM of equity to pay down SBOW debt in exchange for SBOW shares valued at $34 / share • $34 / share represented a 21% premium to SBOW’s unaffected share price as of 2/21/2024 • The proposed combination was accretive on key metrics and provided necessary scale for SBOW • The proposed combination created a clear path to a clean balance sheet and the commencement of a dividend policy in 2025 • On April 16, 2024, following a marked lack of engagement, Kimmeridge withdrew its offer SBOW Stock Outperformed upon Kimmeridge’s Offer and Woefully Underperformed After SilverBow’s Lack of Engagement Source: Bloomberg 1 Market reaction reflects 2 - day price performance following key event dates of 3/12/24, 3/27/24 and 4/15/24 respectively. 2 Measured out of 45 upstream public equities. Kimmeridge Makes Public Offer 1 Kimmeridge Withdraws Offer 1 6%2: &RPPRGLWLHV ;23 3HUIRUPDQFH *URXS 8SVWUHDP 8QLYHUVH 6%2: &RPPRGLWLHV ;23 8SVWUHDP 8QLYHUVH 3HUIRUPDQFH *URXS 6%2: &RPPRGLWLHV 3HUIRUPDQFH *URXS 8SVWUHDP 8QLYHUVH ;23 SBOW was the worst - performing upstream equity twice: once upon rejecting the offer, and again when Kimmeridge pulled the offer 2 SBOW Rejects Offer 1 See slides 37 - 43

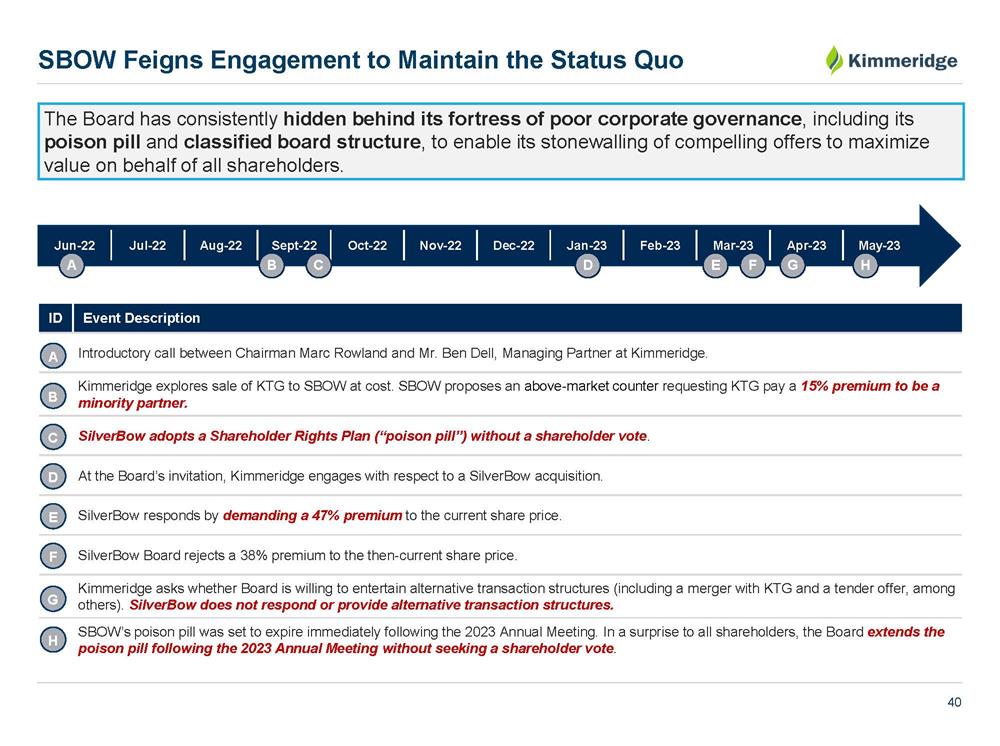

17 The Board has repeatedly feigned engagement , either through requesting significantly out - of - market share price premiums or flat - out rejecting above - market premiums. SBOW Feigns Engagement to Maintain the Status Quo Note: SBOW 2022 counter premium represents value over 30 - day VWAP; other shown premiums represent offer price vs. prior - day shar e price. 1 Reflects average 1 - day premium to closing stock prices of U.S. E&P acquisitions of greater than $500MM since August 2022. 2 Kimmeridge proposal represents 1 - day premium to closing price as of 2/21/2024; equity issuance premium represents benefit of not issuing additional public equity at an illustrative discount. % offer premium 2022 Engagement Summary | Kimmeridge Indication of Interest & SBOW Counter (% Premium) ± .LPPHULGJH ,QGLFDWLRQ 6%2: &RXQWHU .LPPHULGJH 3URSRVDO 6%2: &RXQWHU ± .LPPHULGJH 3URSRVDO 6%2: &RXQWHU ± .LPPHULGJH 3URSRVDO 6%2: &RXQWHU 2023 2023 2024 2 SBOW requests KTG pay 15% premium to be a minority partner SBOW counters with unreasonable premium SBOW flat - out r ejects without a counter SBOW specifically requests proposal from Kimmeridge in writing; upon receiving, does not engage ? ? Avg. precedent premium since 2022 1 We have seen how this Board has treated Kimmeridge, which leads us to question: How have they treated other proposals? 29% with equity issuance premium See slides 37 - 43

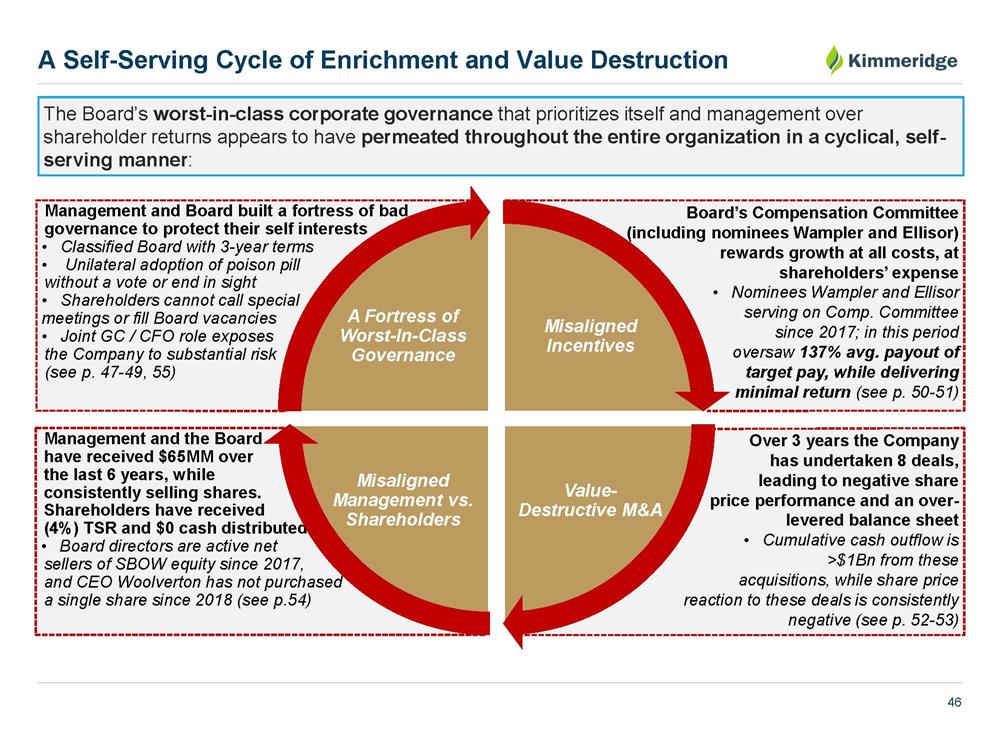

18 Management and the Board h ave received $65MM over the last 6 years, while consistently selling shares. Shareholders have received (4%) TSR and $0 cash distributed • Boar d directors are active net s ellers of SBOW equity since 2017, and CEO Woolverton has not purchased a single share since 2018 (see p.54) Over 3 years the Company has undertaken 8 deals, leading to negative share price performance and an over - levered balance sheet • Cumulative cash outflow is >$1Bn from these acquisitions, while share price reaction to these deals is consistently negative (see p. 52 - 53) Management and Board built a fortress of bad governance to protect their self interests • Classified Board with 3 - year terms • Unilateral adoption of poison pill without a vote or end in sight • Shareholders cannot call special meetings or fill Board vacancies • Joint GC / CFO role exposes the Company to substantial risk (see p. 47 - 49, 55) Board’s Compensation Committee (including nominees Wampler and Ellisor ) rewards growth at all costs, at shareholders’ expense • Nominees Wampler and Ellisor serving on Comp. Committee since 2017; in this period oversaw 137% avg. payout of target pay, while delivering minimal return (see p. 50 - 51) Misaligned Incentives Value - Destructive M&A Misaligned Management vs. Shareholders A Fortress of Worst - In - Class Governance A cir A Self - Serving Cycle of Enrichment and Value Destruction The Board’s worst - in - class corporate governance that prioritizes itself and management over shareholder returns appears to have permeated throughout the entire organization in a cyclical, self - serving manner :

19 See slides 46 - 56 The Company’s true mindset regarding shareholder accountability is best encapsulated in its worst - in - class governance structures . • No Board refreshment occurred in 7 years until Kimmeridge’s involvement • Long - tenured director did not step down until after we proposed his removal by shareholders • SBOW has a classified Board with 3 - year terms for directors • In the face of this proxy contest, SBOW will not de - classify the Board until 2027 SilverBow’s Fortress of Bad Governance Shareholders Restricted from Exercising Their Rights • Unilaterally adopted and extended its pill since September 2022 • Board did not even make a window - dressing attempt to seek shareholder approval of the pill at the 2024 Annual Meeting • Shareholders can only hold the Board to account at the Annual Meeting • Shareholders cannot call special meetings • SilverBow is the only domestically traded public company on the NYSE with a joint CFO / GC role • Only amidst this proxy context did SBOW propose to reverse its plurality director vote standard and its super - majority vote requirements to amend certain Charter provisions SilverBow’s Worst - in - Class Governance Classified Board Poison Pill No Special Meetings Defensive Refreshment Dual CFO / GC Role Super - Majority and Plurality Vote Standards

20 We have serious questions regarding the Company’s nominees’ lack of independence, a strategy - aligned skillset, respect for corporate governance and shareholder accountability. We believe they will perpetuate the same, tired status quo. Incumbent Nominees’ Questionable Track Record Source: Bloomberg. Gabriel Ellisor Charles Wampler Kathleen McAllister Representative for Shareholders? No Appointed to Board via expired 2016 Nomination Agreement with Senior Noteholders No Appointed to Board via expired 2016 Nomination Agreement with Senior Noteholders Yes Defensive appointment Transactional Expertise? No No No In interviews with our nominees, the participating Board members shared their belief that the only person on the Board with transaction experience is Chairman Rowland Commitment to Best - In - Class Corporate Governance? No No No SBOW TSR During Board Tenure 2.6% Annualized 2.6% Annualized 6.4% Annualized Buyer of SBOW Equity? No No No Seller of SBOW Equity? Yes Yes No Public Company C - Suite Experience? No No Yes Transocean’s TSR was negative 15% during her tenure See slides 58 - 65

21 Our nominees are E&P industry leaders who will undertake a fresh, deeply thoughtful, highly - informed and independent assessment of SBOW’s strategy and governance. Our Nominees Have the Skillsets Necessary to Ensure a Sustainable Future for SBOW Katherine Minyard Ms. Minyard has spent her whole career focused on capital markets in the U.S. and global oil & gas industry, with specific expertise in financial analysis, valuation and capital allocation through her positions as a leading sell - side analyst and investor. She understands both the shareholder mindset and the Board member mindset in this dynamic industry. Our nominees have the necessary skillsets to challenge the status quo: P Strategic Transformation Expertise P Capital Allocation Expertise P Established Shareholder Value Creation Record P Industry Experience P Operational Excellence P Best - In - Class Corporate Governance Commitment P Capital Markets Experience P Sustainability Commitment and Leadership Carrie Fox Ms. Fox is an oil & gas executive and public company Board member with extensive transactional, strategic leadership, asset management, and operational experience. Her team won the S&P Global Platts’ Global Energy Award “Corporate Deal of the Year” in 2018. Douglas Brooks Named one of America’s Top 100 D irectors by the NACD in 2022, Mr. Brooks is a highly respected, veteran public company CEO and independent board member with a track - record of being asked to lead oil & gas public companies as they navigate significant strategic challenges. He has served on all key public Board committees. See slides 68 - 78

22 Kimmeridge’s Expertise in Driving Positive Change Kimmeridge is a first - mover in diagnosing and capitalizing on the industry’s ailments – at scale. Over the past decade, our investments, engagement and thought leadership have delivered differentiated returns for our investors, attracted diverse, best - in - class talent to our organization and set the foundation for sustained growth. Driving Industry Consolidation Adopting an Improved Business Model Raising ESG Standards Building New Business Models Cultivating Industry Partnerships See Appendix 1

The Board’s Status Quo Approach How SBOW’s Subscale Market Position Drives Its Underperformance and Dooms It to Long - Term Irrelevance

24 • The U.S. Upstream Industry is rapidly consolidating in a race for relevance • As the capital pool available for upstream oil and gas has declined, the competition for capital has increased with investment increasingly concentrated in a few names • Investors have increasingly focused on companies that have: Scale : Minimum relevance $5Bn, but increasing multiple with scale and inventory Capital Efficiency : High recycle ratios, high - quality inventory, high cash margins, and low reinvestment rates A Strong Return - of - Capital Policy : Framework around dividends and potential buybacks Best - in - Class ESG It’s Clear to Everyone Except SBOW What Upstream Investors Want Source: PRNewswire, Bloomberg, Wall Street Journal. “We are particularly concerned that you [the Board] have adopted corporate governance practices prejudicial to the interests of your shareholders” June 2023 Members of the Board “have done everything within [their] power to deter potential acquirers of [SBOW] in the midst of an ongoing wave of logical consolidation” November 2023 “Repeatedly ignoring shareholders' interests has become somewhat standard practice for SilverBow , as management and the Board have pursued their own agenda at the expense of shareholders ” March 2024 Other SilverBow Shareholders Have Had Enough of the Status Quo | Excerpts From Riposte Capital “Producers with the largest scale tend to command the highest valuation” December 1, 2023 “’The most prudent thing for these companies to do is preserve their balance sheet’” December 11, 2023 “Even after a record $200 billion dealmaking frenzy last year, US oil and gas producers haven’t consolidated nearly enough” April 4, 2024

25 Consolidation offers SBOW a unique opportunity to become a more resilient company that is positioned to drive growth and lead the next phase in the Eagle Ford as the basin’s preeminent pure - play operator. SilverBow can build a peer - group - leading South Texas Champion that: 1) Drives the consolidation in the Eagle Ford and broader South Texas region, resulting in greater scale and an expanded multiple 2) Integrates gas sales into the international market through LNG, expanding returns and lowering price volatility 3) Has best - in - class inventory of 15 years or more 4) Sets the standard for capital efficiency, cash margins, returns and return of capital to investors 5) Delivers best - in - class corporate governance and environmental performance The Company could build a template from CIVI which built a dominant single - basin position (see slides 87 - 89) Key challenges created by the incumbent Board and management team’s status quo approach are: 1) A depressed multiple (driven by a lack of scale and bottom quartile corporate governance), which makes stock transactions unattractive 2) An over - leveraged balance sheet , with >50% of FCF allocated to interest expense 3) A lack of access to capital markets , which restricts available cash for transactions The Opportunity | Creating a South Texas Champion

26 The Eagle Ford basin, where SBOW operates, is the most disaggregated major basin in the U.S. Consolidation in the basin is inevitable and SBOW could be positioned to lead and create significant value for all shareholders if it changed its status quo approach. If SBOW does not act, a competitor will. HH Index Across U.S. Oil and Gas Basins 1 593 711 721 854 859 1,008 1,015 1,118 1,288 1,665 2,572 Eagle Ford Delaware Anadarko Bakken Montney PRB Appalachian Uinta Midland Haynesville DJ The Eagle Ford is Primed for Consolidation Source: Enverus, Kimmeridge. 1 The Herfindahl - Hirschman Index (HHI) is a commonly - accepted measure of market concentration that is calculated by squaring the market share of each competitor in the market and then summing the resulting numbers. Larger numbers indicate higher concentration. Opportunity for consolidation Most Consolidation Opportunities Least Consolidation Opportunities If SBOW does not act, a competitor will

27 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x 9.0x 10.0x 300 600 1,200 2,400 4,800 9,600 EV/'24E EBITDA (x) 2024E Production (MMcfe/d) Among the companies in the XOP, scale has a high correlation with valuation multiple. SBOW is an outlier with the lowest EV / EBITDA of its peers , in part due to the Board and m anagement team’s failed strategy, worst - in - class governance and corresponding subscale status. E&Ps are in a Race for Relevance with Investors as Scale Drives Multiples Source: FactSet and market data as of 4/12/24. Note: Peer group shown on page includes APA, AR, CHK, CHRD, CIVI, CNX, COP, CRGY, CRK, CTRA, DVN, EOG, EQT, FANG, KOS, MGY, M NR, MRO, MTDR, MUR, NOG, OVV, OXY, PR, PXD, RRC, SM, TALO. Antero Resources Enterprise Value and EBITDA not reflective of equity method investment in Antero Midstream. 1 XOP defined as an index of 52 holdings representative of the S&P Oil & Gas Exploration & Production Industry . SBOW SBOW is in the bottom 10% of the XOP 1 in terms of market capitalization and lags its peers The status quo must change for the Company to realize its true potential and prevent being left further behind

28 SilverBow’s EV / NTM EBITDA multiple discount has widened since January 2021 from 1.5x to 2.0x in February 2024. The subscale nature of the Company makes it difficult to execute M&A effectively , but M&A is required to scale and narrow the widening valuation gap. 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 5.0x 5.5x Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 Jan-23 Apr-23 Jul-23 Oct-23 Jan-24 SilverBow Has Underperformed Peers Since 2021 Source: Public disclosure, FactSet data through the unaffected date of 2/21/2024. 1 Valuation gap based on EV / NTM EBITDA metric. 2 Active performance peers include AMPY, AR, BRY, CHK, CIVI, CNX, CPE, CRC, CRGY, CRK, CTRA, EQT, GPOR, MGY, REI, REPX, RRC, SM, VTLE. SD & BATL not included in graph as no research forward looking estimates per FactSet. Avg. Active Performance Peers 2 SilverBow Valuation Gap 1 Between SBOW and Its Peers Has Widened Since January 2021 Announced Sundance Acquisition (2.0x) 2.4x 4.4x 3.1x 4.6x (1.5x) Announced CHK STX Acquisition See slides 30 - 31 for further information on the Company’s value - destructive M&A history EV / NTM EBITDA (x)

29 SBOW publicly touts its performance since January 2021, conveniently leaving out that the TSR prior to that date was negative 82%. In other words, the stock lost $24 /share in value before regaining $23/share . (200%) (150%) (100%) (50%) - 50% 100% 150% 200% Feb-17 Aug-17 Feb-18 Aug-18 Feb-19 Aug-19 Feb-20 Aug-20 Feb-21 Aug-21 Feb-22 Aug-22 Feb-23 Aug-23 Total Shareholder Return (%) [] SBOW’s Communication About Its Shareholder Return Metrics Insults the Intelligence of Its Shareholders Source: Bloomberg Note: Performance shown through an unaffected date of 2/21/2024. CEO Woolverton’s hiring announced on 2/28/2017. SBOW Selective Lookback From its Materials The SBOW Board and management team’s self - congratulatory stance for almost returning to shareholders the value that was lost is indicative of the need for change at SBOW.

30 (5%) (4%) 18% 18% (5%) (29%) (9%) (29%) (33%) 10% 4% 3% 8% (5%) (8%) Sep-2016: Marc Rowland Hired as Board Chairman Feb-2017: Sean Woolverton Hired as CEO Aug-2021: SBOW Acquires San Isidro Aug-2021: SBOW Acquires Assets from Post Oak Oct-2021: SBOW Acquires Teal Apr-2022: SBOW Acquires Sandpoint and Sundance Sep-2022: SBOW Implements Poison Pill Aug-2023: SBOW Acquires CHK STX Rich Asset Sep-2023: SBOW Issues Equity to Fund CHK Deal SBOW XOP SBOW’s core leadership team – Sean Woolverton (CEO), Marc Rowland (Chair), and former noteholder appointees and incumbent Director nominees Gabriel Ellisor and Charles Wampler – are responsible for destroying shareholder value over all relevant timeframes . A Track Record of Destroying Value Source: Bloomberg, public company filings 1 Performance represents total shareholder return from announcement date of key event through the unaffected date of 2/21/2024. (15%) v. XOP (8%) v. XOP (22%) v. XOP (45%) v. XOP (32%) v. XOP (17%) v. XOP (24%) v. XOP (25%) v. XOP SBOW vs. XOP Total Shareholder Return From Key Event to Present 1 Total Shareholder Return (%) 45% 79% 40% 57% (34%) v. XOP 79% Key Events

31 SilverBow’s M&A framework has neither propelled the Company to relevance nor generated meaningful value for shareholders. On a debt - adjusted basis, the Company’s per - share production and proved reserves metrics have stayed relatively flat since 2017 (the year current CEO was hired). Proved Reserves per Debt - Adjusted Share 1 Annual Production per Debt - Adjusted Share 1 462 497 327 99 354 423 416 0 100 200 300 400 500 600 2017 2018 2019 2020 2021 2022 2023 8,436 9,902 5,506 1,634 6,422 9,608 8,568 0 2,000 4,000 6,000 8,000 10,000 12,000 2017 2018 2019 2020 2021 2022 2023 Claims of Successful M&A Ring Hollow Source: Company filings, FactSet. 1 Per - share metrics calculated by converting Company’s quarterly debt balances to equivalent shares at the average share price pe r quarter. 2 TSR measured through the unaffected date of 2/21/2024. ( Mboe per million shares) ( Mboe per million shares) TSR during CEO Woolverton’s tenure i s ( 4%) while the XOP is up 4%

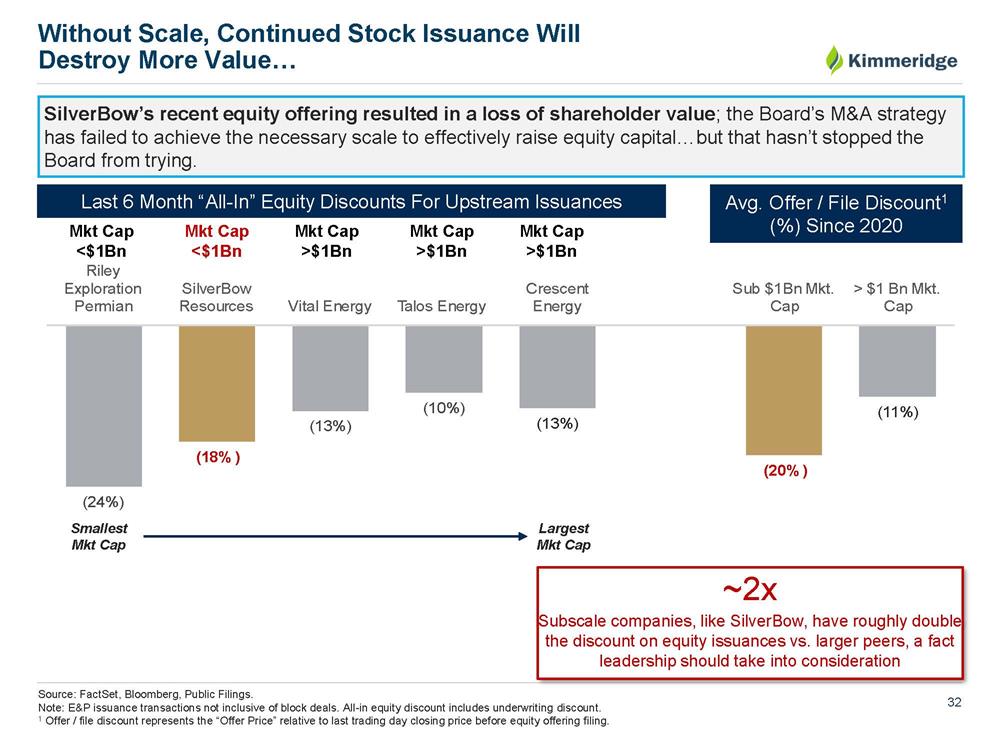

32 5LOH\ ([SORUDWLRQ 3HUPLDQ 6LOYHU%RZ 5HVRXUFHV 9LWDO(QHUJ\ 7DORV(QHUJ\ &UHVFHQW (QHUJ\ 6XE %Q0NW &DS ! %Q0NW &DS SilverBow’s recent equity offering resulted in a loss of shareholder value ; the Board’s M&A strategy has failed to achieve the necessary scale to effectively raise equity capital…but that hasn’t stopped the Board from trying. Last 6 Month “All - In” Equity Discounts For Upstream Issuances Without Scale, Continued Stock Issuance Will Destroy More Value… Source: FactSet, Bloomberg, Public Filings. Note: E&P issuance transactions not inclusive of block deals. All - in equity discount includes underwriting discount. 1 Offer / file discount represents the “Offer Price” relative to last trading day closing price before equity offering filing. Avg. Offer / File Discount 1 (%) Since 2020 ~2x Subscale companies, like SilverBow , have roughly double the discount on equity issuances vs. larger peers, a fact leadership should take into consideration Mkt Cap <$1Bn Mkt Cap >$1Bn Mkt Cap <$1Bn Mkt Cap >$1Bn Mkt Cap >$1Bn Smallest Mkt Cap Largest Mkt Cap

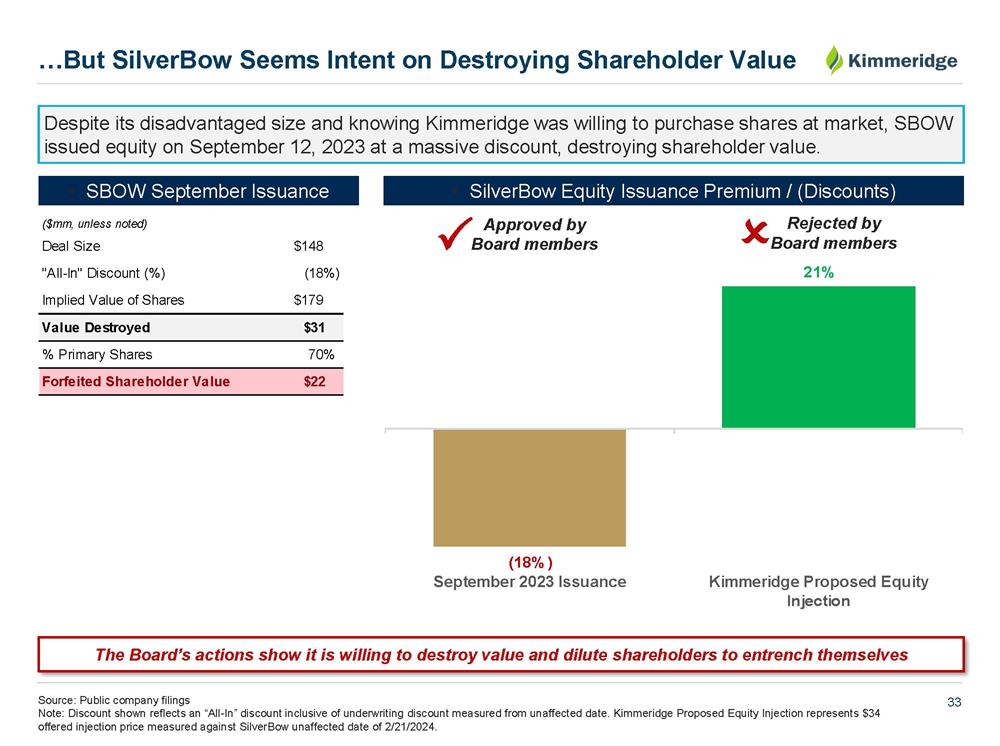

33 The Board’s actions show it is willing to destroy value and dilute shareholders to entrench themselves Despite its disadvantaged size and knowing Kimmeridge was willing to purchase shares at market, SBOW issued equity on September 12, 2023 at a massive discount, destroying shareholder value. …But SilverBow Seems Intent on Destroying Shareholder Value Source: Public company filings Note: Discount shown reflects an “All - In” discount inclusive of underwriting discount measured from unaffected date. Kimmeridge Proposed Equity Injection represents $34 offered injection price measured against SilverBow unaffected date of 2/21/2024. 6HSWHPEHU ,VVXDQFH .LPPHULGJH3URSRVHG(TXLW\ ,QMHFWLRQ • SilverBow Equity Issuance Premium / (Discounts) ($mm, unless noted) Deal Size $148 "All-In" Discount (%) (18%) Implied Value of Shares $179 Value Destroyed $31 % Primary Shares 70% Forfeited Shareholder Value $22 • SBOW September Issuance Rejected by Board members O Approved by Board members P

34 Consolidation offers SBOW a unique opportunity to become a more resilient Company as the preeminent pure - play Eagle Ford shale operator, where SBOW operates • The Eagle Ford basin is the most disaggregated in the U.S. If SBOW does not act, a competitor will Meanwhile, recent M&A has neither propelled SBOW to relevance nor generated meaningful value creation • The Company’s debt - adjusted per - share production and proved reserves metrics have stayed roughly flat since CEO’s hiring • The Company raises equity capital at a steep discount due to its subscale nature , despite knowing Kimmeridge was willing to purchase shares at market Among its peers, SBOW’s valuation is an underperforming outlier with the lowest EV / EBITDA, in large part due to the Board and m anagement team’s failed strategy, balance sheet destruction, and corresponding subscale status • SilverBow’s EV / NTM EBITDA multiple discount from performance peers has widened in recent years • Effective M&A is required to scale and narrow the widening valuation gap, but we believe SBOW’s subscale nature and entrenched leadership makes this difficult to execute While failing to perform at a critical juncture, the Board takes a self - congratulatory stance for poor performance • SBOW’s core leadership team – Sean Woolverton (CEO), Marc Rowland (Chair), and former noteholder appointees Gabriel Ellisor , Charles Wampler, and Michael Duginski (recently stepped down) – are responsible for overseeing the destruction of shareholder value over all relevant timeframes • SBOW’s publicly - touted TSR metrics neglect to mention that TSR prior to their cherry - picked date was (82%) 1 Summary | Inorganic Growth Masks Leadership’s Underperformance and Status Quo Approach At this pivotal moment for the U.S. E&P industry, SilverBow is in danger of being left behind . The Company’s poor M&A framework has failed to generate value for shareholders , and all the while, leadership continues its deceptive, self - congratulatory tone . Source: Bloomberg. 1 TSR shown from CEO Woolverton’s hiring to unaffected date of 2/21/2024. 1 2 3 4

SilverBow’s Paths to Maximize Long - Term Value for All Shareholders And How the Board has Blocked Changes to the Status Quo at Every Turn

36 At the Board’s invitation, Kimmeridge presented the 8 separate compelling combination options shown below to drive value, one of which was a combination with KTG. Following the presentation, the Board requested that Kimmeridge submit a formal proposal to combine SBOW with KTG, with an associated equity injection to repair the balance sheet, which Kimmeridge did on March 13. KTG Lewis BP Crescent Baytex Mach CRK GPOR Scale Inventory Asset Overlap Liquidity LNG Access Executability SBOW Has Multiple Paths to Maximizing Value, But Needs Independent Directors Committed to a Full and Fair Assessment Source: Kimmeridge analysis. As the Company’s largest shareholder, Kimmeridge was focused on encouraging the Board to assess many paths to drive value and escape its status quo rut

37 The KTG Combination was a financed, compelling, accretive and credit - enhancing premium proposal , offering all shareholders a unique opportunity to become a more resilient company , positioned to lead the next phase of consolidation in the Eagle Ford. Market Response (Price Performance) KTG Combination Terms • On March 13, 2024, at the Board’s invitation, Kimmeridge offered to combine KTG assets and inject an additional $500MM of equity to pay down SBOW debt in exchange for SBOW shares valued at $34 / share • $34 / share represented a 21% premium to SBOW’s unaffected share price as of 2/21/2024 • The proposed combination was accretive on key metrics and provided necessary scale for SBOW • The proposed combination created a clear path to a clean balance sheet and the commencement of a dividend policy in 2025 • On April 16, 2024, following a marked lack of engagement, Kimmeridge withdrew its offer SBOW Stock Outperformed upon Kimmeridge’s Offer and Woefully Underperformed After SilverBow’s Lack of Engagement Source: Bloomberg 1 Market reaction reflects 2 - day price performance following key event dates of 3/12/24, 3/27/24 and 4/15/24 respectively. 2 Measured out of 45 upstream public equities. Kimmeridge Makes Public Offer 1 Kimmeridge Withdraws Offer 1 6%2: &RPPRGLWLHV ;23 3HUIRUPDQFH *URXS 8SVWUHDP 8QLYHUVH 6%2: &RPPRGLWLHV ;23 8SVWUHDP 8QLYHUVH 3HUIRUPDQFH *URXS 6%2: &RPPRGLWLHV 3HUIRUPDQFH *URXS 8SVWUHDP 8QLYHUVH ;23 SBOW was the worst performing upstream equity twice: once upon rejecting the offer, and again when Kimmeridge pulled the offer 2 SBOW Rejects Offer 1

38 The Board has repeatedly feigned engagement , either through requesting significantly out - of - market share price premiums or flat - out rejecting above - market premiums. SBOW Feigns Engagement to Maintain the Status Quo Note: SBOW 2022 counter premium represents value over 30 - day VWAP; other shown premiums represent offer price vs. prior - day shar e price. 1 Reflects average 1 - day premium to closing stock prices of U.S. E&P acquisitions of greater than $500MM since August 2022. 2 Kimmeridge proposal represents 1 - day premium to closing price as of 2/21/2024; equity issuance premium represents benefit of not issuing additional public equity at an illustrative discount. % offer premium 2022 Engagement Summary | Kimmeridge Indication of Interest & SBOW Counter (% Premium) ± .LPPHULGJH ,QGLFDWLRQ 6%2: &RXQWHU .LPPHULGJH 3URSRVDO 6%2: &RXQWHU ± .LPPHULGJH 3URSRVDO 6%2: &RXQWHU ± .LPPHULGJH 3URSRVDO 6%2: &RXQWHU 2023 2023 2024 2 SBOW requests KTG pay 15% premium to be a minority partner SBOW counters with unreasonable premium SBOW flat - out r ejects without a counter SBOW specifically requests proposal from Kimmeridge in writing; upon receiving, does not engage ? ? Avg. precedent premium since 2022 1 We have seen how this Board has treated Kimmeridge, which leads us to question: How have they treated other proposals? 29% with equity issuance premium See slides 37 - 43

39 Acquirer Target Date 2/28/23 5/22/23 7/13/23 8/21/23 10/11/23 10/23/23 1/4/24 1/11/24 2/21/24 Kimmeridge Far Surpassed Upstream M&A Premiums Source: FactSet and respective company filings. Note: Transactions include U.S. domiciled corporate E&P transactions with an enterprise value over $500mm since August 2022. 1 Chesapeake / Southwestern premiums as of unaffected date of 1/4/2024 due to press release released trading hours on 1/5/2024 (1 - day premium as of actual announcement date of 1/11/2024 is (2.9%)). Premiums for Selected U.S. Upstream Acquisitions (>$500MM since August 2022) 7.4% 10.6% 1.9% 14.8% 17.8% 4.9% 13.9% 4.5% 14.8% 0% 5% 10% 15% 20% 25% 30% 35% 40% Premium of Indication of Interest to Unaffected Share Price Average Premium: 10% Kimmeridge 2023 Amended Premium: 38% Kimmeridge 2023 Initial Premium: 24% Kimmeridge 2024 Premium: 21%

40 The Board has consistently hidden behind its fortress of poor corporate governance , including its poison pill and classified board structure , to enable its stonewalling of compelling offers to maximize value on behalf of all shareholders. SBOW Feigns Engagement to Maintain the Status Quo ID Event Description A Introductory call between Chairman Marc Rowland and Mr. Ben Dell, Managing Partner at Kimmeridge. B Kimmeridge explores sale of KTG to SBOW at cost. SBOW proposes an above - market counter requesting KTG pay a 15% premium to be a minority partner. C SilverBow adopts a Shareholder Rights Plan (“poison pill”) without a shareholder vote . D At the Board’s invitation, Kimmeridge engages with respect to a SilverBow acquisition. E SilverBow responds by demanding a 47% premium to the current share price. F SilverBow Board rejects a 38% premium to the then - current share price. G Kimmeridge asks whether Board is willing to entertain alternative transaction structures (including a merger with KTG and a t end er offer, among others). SilverBow does not respond or provide alternative transaction structures. H SBOW’s poison pill was set to expire immediately following the 2023 Annual Meeting. In a surprise to all shareholders, the Bo ard extends the poison pill following the 2023 Annual Meeting without seeking a shareholder vote . Jun - 22 Jul - 22 Aug - 22 Sept - 22 Oct - 22 Nov - 22 Dec - 22 Jan - 23 Feb - 23 Mar - 23 Apr - 23 May - 23 A B C D E F G H A B C D E F G H

41 ID Event Description Mr. Rowland informs Mr. Dell of an upcoming block sale and asks if Kimmeridge would be interested in purchasing the block. Mr . D ell reminds him that this would not be possible, as the poison pill was still in place. Mr. Dell meets with CEO Woolverton to discuss strategic paths to create value, including, but not limited to, a potential combination with KTG. Concerned about the Company’s track record of stonewalling and prioritizing the value - destructive status quo, Kimmeridge nominates three independent, highly - qualified nominees to the Board. Mr. Dell is invited to meet with the Board. Kimmeridge presents multiple ideas to unlock value , including 8 alternative industry transactions. Mr. Woolverton calls Mr. Dell and informs him of the Board’s interest in receiving a formal proposal for the contemplated KTG merger and equity injection. SilverBow publishes its misleading 8 - K about Kimmeridge, mischaracterizing discussions and failing to mention its days - old request for a formal proposal . At the Board’s request, Kimmeridge submits its premium, compelling offer to combine KTG with SilverBow and associated $500MM equity investment. The Company is silent for 2 weeks. SilverBow rejects the offer but also requests more information to diligence the offer. Kimmeridge provides requested information and releases data to the public domain. SBOW does not reply for weeks. SilverBow publicly requests additional data, most of which was either already provided or irrelevant to the transaction. Kimmeridge promptly provides requested information and releases data to the public domain. Kimmeridge notes all data requested has been prepared in a data room with which the Company did not engage or diligence . Kimmeridge asks for an initial view on relative value. SilverBow does not engage or respond . Kimmeridge withdraws its offer to focus on Board refreshment to position the Company for success. Through Present Day, SBOW Prioritizes Self - Preservation at the Expense of All Shareholders Jun - 23 Jul - 23 Aug - 23 Sept - 23 Oct - 23 Nov - 23 Dec - 23 Jan - 24 Feb - 24 Mar - 24 Apr - 24 May - 24 I J K L M N O P I Q R N O S T P Q R S T J K L M Most recently, the Company refused to discuss Kimmeridge’s financed, premium proposal, never engaging in good faith negotiations, undertaking a real due diligence process, or delivering a counterproposal. We learned of their rejections only through their public proxy solicitation materials.

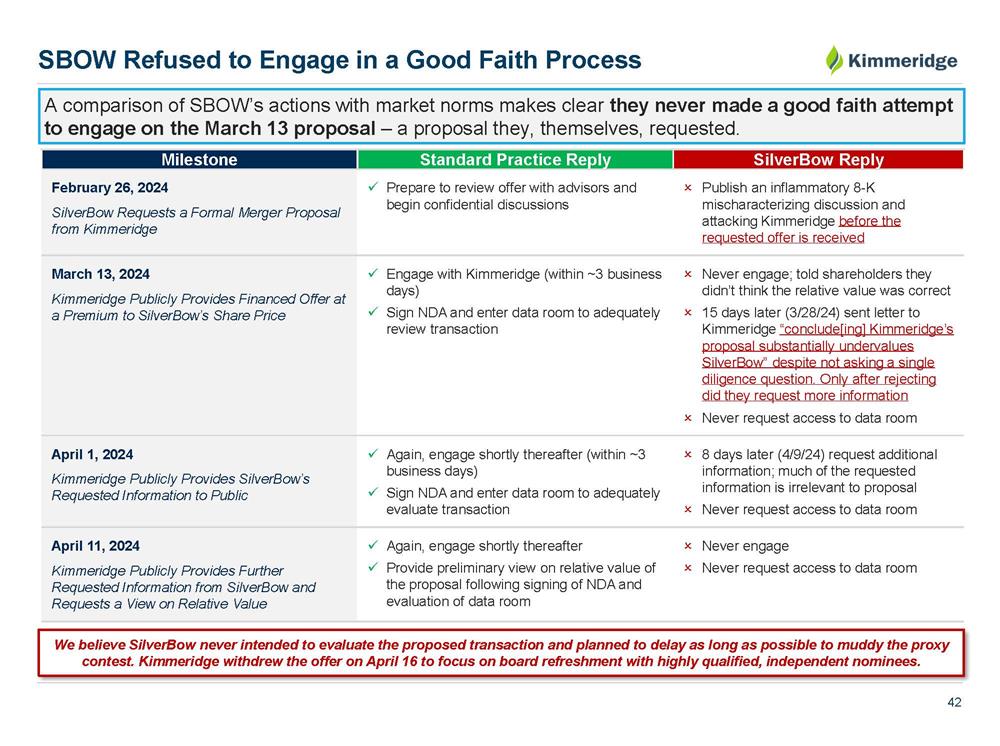

42 A comparison of SBOW’s actions with market norms makes clear they never made a good faith attempt to engage on the March 13 proposal – a proposal they, themselves, requested. SBOW Refused to Engage in a Good Faith Process Milestone Standard Practice Reply SilverBow Reply February 26, 2024 SilverBow Requests a Formal Merger Proposal from Kimmeridge x Prepare to review offer with advisors and begin confidential discussions Publish an inflammatory 8 - K mischaracterizing discussion and attacking Kimmeridge before the requested offer is received March 13, 2024 Kimmeridge Publicly Provides Financed Offer at a Premium to SilverBow’s Share Price x Engage with Kimmeridge (within ~3 business days) x Sign NDA and enter data room to adequately review transaction Never engage; told shareholders they didn’t think the relative value was correct 15 days later (3/28/24) sent letter to Kimmeridge “conclude[ ing ] Kimmeridge’s proposal substantially undervalues SilverBow ” despite not asking a single diligence question. Only after rejecting did they request more information Never request access to data room April 1, 2024 Kimmeridge Publicly Provides SilverBow’s Requested Information to Public x Again, engage shortly thereafter (within ~3 business days) x Sign NDA and enter data room to adequately evaluate transaction 8 days later (4/9/24) request additional information; much of the requested information is irrelevant to proposal Never request access to data room April 11, 2024 Kimmeridge Publicly Provides Further Requested Information from SilverBow and Requests a View on Relative Value x Again, engage shortly thereafter x Provide preliminary view on relative value of the proposal following signing of NDA and evaluation of data room Never engage Never request access to data room We believe SilverBow never intended to evaluate the proposed transaction and planned to delay as long as possible to muddy the proxy contest. Kimmeridge withdrew the offer on April 16 to focus on board refreshment with highly qualified, independent nominees.

43 SBOW and XOP Share Price Performance Since Most Recent Engagements in 2024 1 The Market Has Spoken: Shareholders Hoped for Meaningful Engagement, and Were Let Down When the Board Failed Them Source: FactSet, public disclosure, and market data as of 4/17/2024. 1 Market reaction reflects 2 - day price performance following key event dates of 3/12/24, 3/27/24 and 4/15/24 respectively. March 28 th SilverBow “rejects” transaction and requests information to diligence the transaction April 9 th SilverBow requests additional public disclosure of KTG assets March 1 st SilverBow releases 8 - K attacking Kimmeridge April 11 th Kimmeridge files Definitive Proxy and releases additional KTG data; asks the Company to counter with relative value by April 15 April 16 th Kimmeridge withdraws offer SilverBow XOP February 21 st Kimmeridge makes director nominees and proxy contest public via Schedule 13D amendment March 13 th As requested by the Board, Kimmeridge makes public proposal to inject $500mm of equity and merge KTG with SBOW April 1 st Kimmeridge provides and makes public requested data to SilverBow 5% (7%) %) Since Kimmeridge’s re - engagement with SilverBow became public, SilverBow outperformed the XOP by as much as 10%. After it became clear the Company never intended to constructively engage, Kimmeridge rescinded its March 13 proposal on April 16, 2024. Since then, the stock has dropped 7% and has significantly underperformed the XOP. Reflecting the market’s hopes for engagement, SBOW outperformed the XOP on recent Kimmeridge news. Once the Board’s status quo, self - serving approach was made publicly clear, the stock continued its underperforming trajectory.

44 The Board has repeatedly feigned engagement, either requesting significantly out - of - market share price premiums or rejecting above - market premiums • Kimmeridge has attempted to engage in good faith, with an offer that far surpassed average M&A premiums Most recently, the Company refused to discuss Kimmeridge’s financed, premium proposal, never engaging in good faith negotiations, undertaking a bona fide due diligence process, or delivering a counterproposal – despite asking Kimmeridge to submit the proposal • The Company stonewalls at every turn, and we learned of their rejections only through their public press releases and proxy solicitation materials • The Company continues to misrepresent past events; see Appendix 2 for further detail On the news of Kimmeridge’s most recent engagement with the Company, SBOW’s stock outperformed the XOP, only to plummet when the market learned of the Board’s failure to engage • We’ve seen how the Company has neglected Kimmeridge’s attempts to create value, which leads us to question: How can this Board be trusted to engage with other counterparties in any effort to maximize long - term value? Summary | Kimmeridge Has Long Believed in SBOW’s Value Potential, Which Our Nominees Will Help Unlock As the Company’s largest shareholder, Kimmeridge has always focused on encouraging the Board to assess many paths to escape its status quo rut. We believe a refreshed Board with our highly qualified, independent nominees is the only way to prevent stonewalling and position SBOW for long - term success. Like all shareholders, we seek to achieve the long - term potential of the Company, and believe that our three i ndependent , high ly - qualified nominees can help effect much - needed change 1 2 3

Worst - in - Class Corporate Governance & Pay Policy The Board’s Last - Minute, Window - Dressing, Attempts Cannot Hide its Retrenchment

46 Management and the Board h ave received $65MM over the last 6 years, while consistently selling shares. Shareholders have received (4%) TSR and $0 cash distributed • Boar d directors are active net s ellers of SBOW equity since 2017, and CEO Woolverton has not purchased a single share since 2018 (see p.54) Over 3 years the Company has undertaken 8 deals, leading to negative share price performance and an over - levered balance sheet • Cumulative cash outflow is >$1Bn from these acquisitions, while share price reaction to these deals is consistently negative (see p. 52 - 53) Management and Board built a fortress of bad governance to protect their self interests • Classified Board with 3 - year terms • Unilateral adoption of poison pill without a vote or end in sight • Shareholders cannot call special meetings or fill Board vacancies • Joint GC / CFO role exposes the Company to substantial risk (see p. 47 - 49, 55) Board’s Compensation Committee (including nominees Wampler and Ellisor ) rewards growth at all costs, at shareholders’ expense • Nominees Wampler and Ellisor serving on Comp. Committee since 2017; in this period oversaw 137% avg. payout of target pay, while delivering minimal return (see p. 50 - 51) Misaligned Incentives Value - Destructive M&A Misaligned Management vs. Shareholders A Fortress of Worst - In - Class Governance A cir A Self - Serving Cycle of Enrichment and Value Destruction The Board’s worst - in - class corporate governance that prioritizes itself and management over shareholder returns appears to have permeated throughout the entire organization in a cyclical, self - serving manner :

47 The Company’s true mindset regarding shareholder accountability is best encapsulated in its worst - in - class governance structures . • No Board refreshment occurred in 7 years until Kimmeridge’s involvement • Long - tenured director did not step down until after we proposed his removal by shareholders • SBOW has a classified Board with 3 - year terms for directors • In the face of this proxy contest, SBOW will not de - classify the Board until 2027 SBOW’s Worst - in - Class Governance Enabled It to Avoid Shareholder Accountability for Years… Shareholders Restricted from Exercising Their Rights • Unilaterally adopted and extended its pill since September 2022 • Board did not even make a window - dressing attempt to seek shareholder approval of the pill at the 2024 Annual Meeting • Shareholders can only hold the Board to account at the Annual Meeting • Shareholders cannot call special meetings • SilverBow is the only domestically traded public company on the NYSE with a joint CFO / GC role • Only amidst this proxy context did SBOW propose to reverse its plurality director vote standard and its super - majority vote requirements to amend certain Charter provisions SilverBow’s Fortress of Bad Governance Classified Board Poison Pill No Special Meetings Defensive Refreshment Dual CFO / GC Role Super - Majority and Plurality Vote Standards

48 But…What About the Poison Pill? The Board’s silence on its retention of a two - years - and - counting poison pill is deafening. A Board that was at least trying to pretend to care about shareholder accountability would have put the poison pill to a shareholder ratification vote at the 2024 AGM. …And Nothing Has Changed, Despite Its Desperate, Last - Minute Window Dressing In Advance of the Annual Meeting 1 Source: SilverBow proxy statement. SBOW’s Window Dressing 1 Pulling Back the Shades to Reality “Declassify the Board and provide for the annual election of all directors” SBOW fails to mention that the Board will not be declassified until 2027 “With the recent ownership changes, the Board took significant steps to refresh its membership…” Shareholders are not so naive as to believe that this refreshment would ever have occurred if directors’ seats were not at risk at the AGM. Not a single director was brought on to the Board in the past 7 years up until January 9, 2023. Since then, and in the midst of negotiations with Kimmeridge, including the possibility of this proxy contest, the Board: Expanded its size by 2 directors Removed one of its long - standing noteholder - appointed directors Appointed 4 new directors Shareholders understand that the new appointees, hand - selected by incumbents, cannot be relied on to be a robust advocate for challenging the status quo in the boardroom “Adopt a majority voting standard in uncontested elections of directors” It speaks volumes that it took a proxy fight for the Board to consider changing these two worst - in - class governance mechanisms so they meet the bare - minimum of what is acceptable to today’s shareholders “Eliminate the supermajority vote requirements for shareholders to amend certain provisions” Investors will not be assuaged by the Company’s disingenuous efforts to hide its worst - in - class governance in the face of this pending proxy contest.

49 The facts clearly show one of the most blatantly obvious examples of a defensive Board refreshment in recent corporate histor y: The “Mid - Negotiation Board Stacking” Not a single new director was brought on to the Board in the past 7 years up until January 9, 2023 In the midst of negotiations with Kimmeridge regarding a potential combination, including related Board composition, on Jan 9 , 2 023 the Board expanded its size from 7 to 9 directors, appointing Jennifer M. Grigsby and Kathleen McAllister The “Writing on the Wall ” Retirement Faced with our director removal proposal (since withdrawn), Christoph O. Majeske , a long - tenured director, who was 1 of 4 holdovers from the Company’s expired noteholder agreements finally stepped down The “Avoid Proxy Advisory Firm Scrutiny” Refreshment The Board failed to welcome ethnic diversity into its stale boardroom until ~8 weeks before this year’s Annual Meeting when t he Company knew it was facing significant hurdles from the proxy advisory firms’ vote policies and shareholder pushback This, despite having the opportunity to introduce this important perspective when it recently seated 3 other directors to the Bo ard (Mmes. Grigsby, McAllister & DeSanctis) The “Sham Interview Process” The Company waited approximately 3 weeks to request interviews with our nominees and were only interviewed, in a process led by the CEO (as opposed to the “independent” directors) 3 days prior to the announcement of Mr. Jourdan In one interview, after sharing that SBOW was interviewing three directors separate from Kimmeridge’s nominees, an SBOW direc tor intimated to our nominee that the Board was planning to take the campaign all the way to the annual meeting, rather than reach a resolu tio n in the best interests of shareholders We were shocked, but not surprised, that the Board members would say the quiet part out loud – namely, that these interviews wer e a check - the - box window - dressing exercise devoid of substance or good faith The Company’s Obviously Self - Serving and Defensive Approach to Board Refreshment We know SBOW shareholders can see the forest for its trees. SBOW’s long - tenured incumbent directors’ defensive refreshment process is disingenuous. The Company has taken multiple, reactionary steps to manipulate its Board composition to shelter incumbent directors from accountability in the face of this proxy contest.

50 131% 104% 100% 128% 197% 140% 157% (12%) (20%) (58%) (46%) 310% 30% 3% (4%) 2017 2018 2019 2020 2021 2022 2023 2024 Management Payout as % of Target SBOW TSR Average: 137% Since Mr. Woolverton was hired, he has received above target pay and delivered negative TSR 1 Regardless of the Company’s annual TSR, the Board compensates management at above - target levels. The Board paid management an average of 137% of its target bonus since 2017 despite delivering negative total shareholder returns. It is clear the Company prioritizes payouts over shareholder returns . Management Bonus as % of Target The Board Overpays Management Regardless of Performance Source: Public filings 1 Through the unaffected date of 2/21/2024. Market - wide rally following COVID vaccine rollout 170%? ? See slides 51 - 54

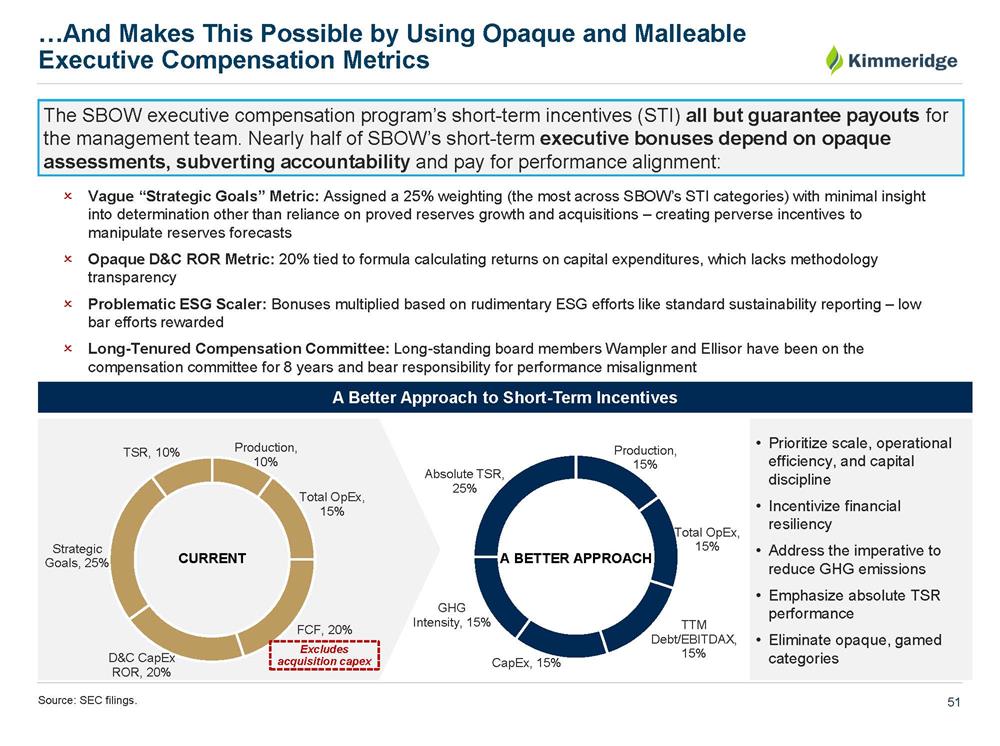

51 Vague “Strategic Goals” Metric: Assigned a 25% weighting (the most across SBOW’s STI categories) with minimal insight into determination other than reliance on proved reserves growth and acquisitions – creating perverse incentives to manipulate reserves forecasts Opaque D&C ROR Metric: 20% tied to formula calculating returns on capital expenditures, which lacks methodology transparency Problematic ESG Scaler: Bonuses multiplied based on rudimentary ESG efforts like standard sustainability reporting – low bar efforts rewarded Long - Tenured Compensation Committee: Long - standing board members Wampler and Ellisor have been on the compensation committee for 8 years and bear responsibility for performance misalignment …And Makes This Possible by Using Opaque and Malleable Executive Compensation Metrics Source: SEC filings. A Better Approach to Short - Term Incentives Production , 10% Total OpEx , 15% FCF , 20% D&C CapEx ROR , 20% Strategic Goals , 25% TSR , 10% Production , 15% Total OpEx , 15% TTM Debt/EBITDAX , 15% CapEx , 15% GHG Intensity , 15% Absolute TSR , 25% • Prioritize scale, operational efficiency, and capital discipline • Incentivize financial resiliency • Address the imperative to reduce GHG emissions • Emphasize absolute TSR performance • Eliminate opaque, gamed categories CURRENT A BETTER APPROACH The SBOW executive compensation program’s short - term incentives (STI) all but guarantee payouts for the management team. Nearly half of SBOW’s short - term executive bonuses depend on opaque assessments, subverting accountability and pay for performance alignment: Excludes acquisition capex

52 Focusing on a single metric, the STI’s ‘Strategic Goals’, showcases how the Board has failed to select metrics that properly incentivize management. • Per SBOW’s proxy, 2023 Strategic Goals “also included balance sheet optimization for the Company to enhance liquidity ” A similar phrase was used in 2021 and curiously omitted in 2022 when SBOW’s liquidity decreased • Concerns about this methodology: Liquidity DOES NOT equate to balance sheet optimization (see below) The Board can retroactively include metrics based on results Opaque and Shifting Executive Compensation Metrics Enable Overpayment for Underperformance (Cont.) Source: Company website and filings. Aggregate MVC Costs and NTM Interest Cost per SilverBow’s 10 - K’s. Strategic Goal Commentary Omitted Metrics When Considering Balance Sheet Optimization | 2021 to 2023 ($MM unless noted) [ [ <( <( /70/HYHUDJH [ <( <( 170,QWHUHVW&RVW Annual Liquidity Increase / (Decrease) <( <( 7RWDO'HEW <( <( $JJUHJDWH09& 2EOLJDWLRQV Included in Strategic Goals Excluded from Strategic Goals Included in Strategic Goals Compensation Committee awarded management 2x the target for Strategic G oals including ‘balance sheet optimization’ ($MM unless noted) Liquidity Decreased YoY

53 The Board Consistently Rewards Management for Bad Deals …Combined With High Pay for “Strategic Goals” Value - Destructive M&A Deals… 180% 200% 200% 0% 50% 100% 150% 200% 2021 2022 2023 “Strategic Goals” Payout vs. Target Target Source: FactSet and respective company filings. Note: XOP returns exclude gross dividends. The Board has overseen an M&A strategy that resulted in consistently negative share price reactions to announced deals. Meanwhile, the Board continued to reward the management team lavishly. Aug - 21 Aug - 23 16% 25% (18%) (14%) (20%) (3%) (10%) 60 - day Share Price Performance vs. XOP

54 (100%) (80%) (60%) (40%) (20%) 0% 20% 40% 60% Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 May-22 Jul-22 Sep-22 Nov-22 Jan-23 Mar-23 May-23 Jul-23 Sep-23 Nov-23 Jan-24 Mar-24 SBOW Indexed Price Performance 2 3 20 1 2 10 8 (2) (13) (1) (12) (3) (6) (25) (17) (17) (32) (40) (41) (2) (8) (3) (11) SBOW Management / Board Members Are Net Sellers Through Time Incumbent Board & Management Are Net Sellers of SBOW Stock Source: FactSet, Public Filings. Note: Insider buy/sell position not inclusive of RSUs or PSUs. Buy (000s) Sell (000s) Management (213) (112) Shares Bought Shares Sold Net Buy / (Sell) ~46k ~559k ~(513k) Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 SBOW Nominated Board Member Board Member CEO Woolverton has not bought a single share of SBOW since 2018 With a strongly net sell position , SBOW Board Members are active sellers of SBOW stock since 2017.

55 Joint CFO/GC Role Is “Unique” Among Public Companies Source: Public filings. 2,271 Companies on the NYSE have a separate CFO and G eneral C ounsel SBOW Combined CFO / GC Note: Plotted size is to scale by area. Among the 2,272 listed companies on the New York Stock Exchange, SilverBow is the only domestic company with a joint CFO / GC role . This exposes the Company to substantial risk s.

56 The Company’s true mindset regarding shareholder accountability is best encapsulated in its worst - in - class governance structures, including: Classified Board with 3 - year terms Unilateral adoption of a poison pill without a vote or end in sight Joint GC / CFO role, which we believe exposes the Company to substantial risk The SBOW executive compensation program’s short - term incentives are rigged for management, with opaque assessments that subvert accountability and pay - for - performance alignment: The Board paid management an average of 137% of its target bonus since 2017 despite delivering negative total shareholder return. It is clear the Company prioritizes management payouts over shareholder returns The Board has overseen an M&A policy that has consistently destroyed shareholder value. Still, the Board continued to reward the management team lavishly. Meanwhile, leadership stands unaccountable. With a strongly net sell position, SBOW Board Directors are active sellers of SBOW stock since 2017 In the same period, shareholders have received (4%) TSR and $0 cash distributed Summary | SBOW’s Self - Serving Cycle of Entrenchment and Value Destruction SilverBow’s entrenched corporate governance has perpetuated its lack of shareholder accountability for years. Despite desperate, last - minute attempts at window dressing in advance of this proxy contest, the evidence of a stale, deeply entrenched, unaccountable Board is overwhelming. Cycle Repeats

The Serious Concerns Raised by the Board’s Stale, Incumbent Nominees

58 The Company’s three incumbent nominees fail to have the independence , capital allocation and transactional expertise necessary to fully and fairly assess all paths forward for SBOW. The Company’s Nominees Raise Serious Questions Regarding Independence and Will Perpetuate the Same, Tired, Status Quo Source: Company website and filings. Mr. Ellisor Mr. Wampler Ms. McAllister Circumstances Regarding Board Appointment Appointed to Board via expired 2016 Nomination Agreement by Consenting Noteholders Appointed to Board via expired 2016 Nomination Agreement by Consenting Noteholders 1 of 2 Directors appointed to Board as “Mid - Negotiation Board Stacking” defensive refreshment Transactional Expertise No No No In interviews with our nominees, the participating Board members shared their belief that the only person on the Board with transaction experience is Mr. Rowland Commitment to Best - In - Class Corporate Governance No No No TSR During SBOW Tenure 2.6% Annualized 2.6% Annualized 6.4% Annualized Buyer of SBOW stock? No Has only sold shares of SBOW No Has only sold shares of SBOW No Mr. Wampler gets a checkmark for “Corporate Governance” in the 2024 proxy skillset matrix. Curiously, that box was not checked in 2023.

59 SBOW’s Critiques Apply to Their Own Nominees Mr. Ellisor Mr. Wampler Ms. McAllister “Mixed track record, overseeing shareholder value destruction during director and executive tenures” N/A – has not served more than a 12 - month tenure outside of SilverBow Wampler TSR at other tenures: EGC: (70%) McAllister TSR at other tenures: TMC: (25%) BKH: (20%) Maersk: (31%) RIGP: (15%) “No Company C - Suite Experience” Never employed as a Public C - Suite Executive Never employed as a Public C - Suite Executive Served as C - Suite Executive in in an MLP subsidiary to a parent company for total of 2 years, retiring in 2016 The company’s TSR was negative 15% during her tenure “Only public director experience serving as director alongside Ben Dell” Limited public company director service, having served total of 14 months as a public director at outside companies, split across 2 Boards, the most recent of which ended in 2018 Only public director experience at an outside company was serving alongside Mr. Ellisor (and our nominee Mr. Brooks), for a 2 - year term, ending in 2018 3 boards at outside companies Source: Company website and filings. Note: TSR calculations from Bloomberg data. TSR measured through 2/21/2024 for currently held directorships. The Board’s lack of self - awareness is evident when their critiques are applied to their own nominees.

60 SBOW shareholders deserve better than Mr. Ellisor’s long - standing commitment to insulating the Board from accountability while over - paying management for its failure to chart a course for the long - term success of SBOW. Mr. Ellisor Is Responsible for Executive Compensation That Drives Overpayment for Value - Destructive M&A • Past - His - Expiration Date Noteholder Appointee: Appointed to the Board via an expired 2016 Nomination Agreement with senior noteholders • Lacks Necessary Skillset to Save SBOW from Irrelevance: No history of successfully transitioning a subscale public company into a market leader in the E&P industry Claims “financial expertise, especially in capital raising” but oversaw meaningfully dilutive equity issuances and punitive Second Liens No public company C - Suite experience Only served for about 6 months on the Energy XXI Board, where Mr. Brooks served Resigned from the only other public company Board on which he served (Royale Energy Inc.) within weeks of being elected Skillset is Duplicative of Similarly - Stale Mr. Wampler • According to SBOW’s own skillset matrix, Mr. Ellisor lacks key skillsets that each of our nominees holds, including: Strategic Planning Risk Management Operational Experience

61 SBOW shareholders deserve better than Mr. Ellisor’s long - standing commitment to insulating the Board from accountability while over - paying management for its failure to chart a course for the long - term success of SBOW. Mr. Ellisor Is Responsible for Executive Compensation That Drives Overpayment for Value - Destructive M&A (Cont.) • Responsible For SBOW’s Worst - In - Class Governance: Crafted and perpetuated SBOW’s fortress governance since the Company’s emergence from bankruptcy, including classified Board, unilaterally adopted and extended poison pill and troubling lack of shareholder rights to ensure Board accountability • Member of Compensation Committee Marked by Lack of Pay For Performance Record: Member of the Compensation Committee, on which he has sat since his tenure began, he is responsible for the Board’s track - record of over - payment for under - performance Shareholders roundly expressed their lack of support for Say On Pay last year, with a low 76% level of support • A Heavy Seller of SBOW Stock: Mr. Ellisor sold 27,474 shares from May - 2021 to Nov - 2023 for a total of $869k gain. Mr. Ellisor’s holdings of SBOW consist entirely of shares awarded to him. He has purchased no shares over his tenure • Has never purchased a single share of SBOW

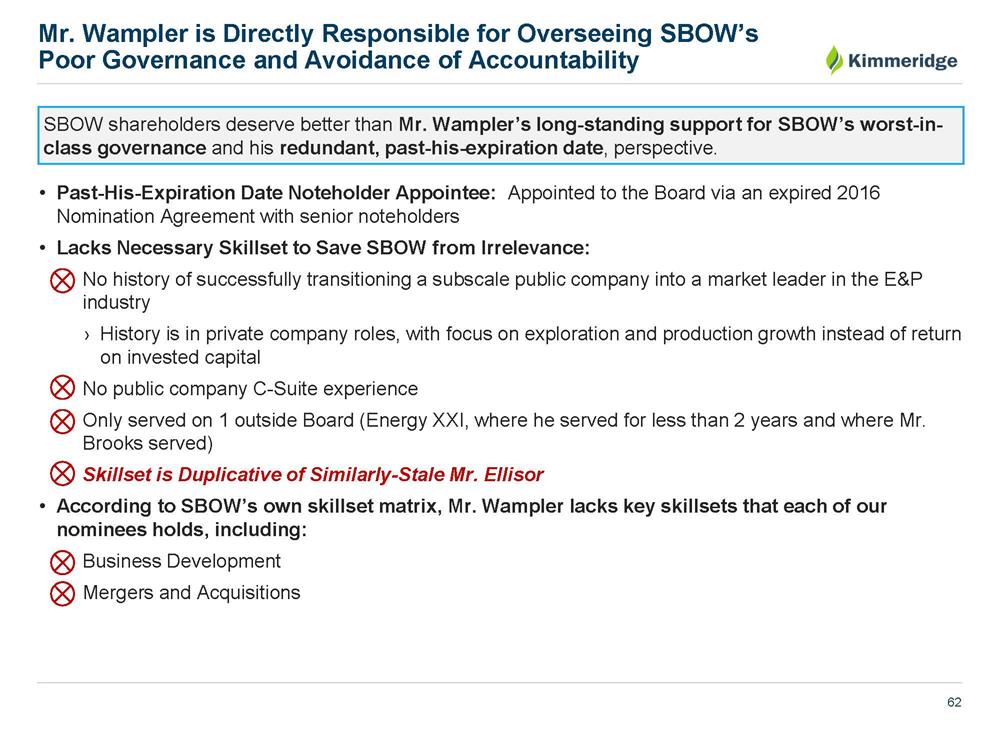

62 • Past - His - Expiration Date Noteholder Appointee: Appointed to the Board via an expired 2016 Nomination Agreement with senior noteholders • Lacks Necessary Skillset to Save SBOW from Irrelevance: No history of successfully transitioning a subscale public company into a market leader in the E&P industry › History is in private company roles, with focus on exploration and production growth instead of return on invested capital No public company C - Suite experience Only served on 1 outside Board (Energy XXI, where he served for less than 2 years and where Mr. Brooks served) Skillset is Duplicative of Similarly - Stale Mr. Ellisor • According to SBOW’s own skillset matrix, Mr. Wampler lacks key skillsets that each of our nominees holds, including: Business Development Mergers and Acquisitions Mr. Wampler is Directly Responsible for Overseeing SBOW’s Poor Governance and Avoidance of Accountability SBOW shareholders deserve better than Mr. Wampler’s long - standing support for SBOW’s worst - in - class governance and his redundant, past - his - expiration date , perspective.

63 • Responsible For Overseeing SBOW’s Worst - In - Class Governance: Allowed and perpetuated SBOW’s fortress governance since the Company’s emergence from bankruptcy, including a classified board, unilaterally adopted and extended poison pill and troubling lack of shareholder rights to ensure Board accountability We agree with SBOW’s 2023 proxy’s skillset matrix, which indicated Mr. Wampler has no Corporate Governance experience. The 2024 proxy was curiously changed to give him credit for this skill • Over - Pays Management for Under - Performance : A member of the Compensation Committee since SBOW’s emergence from bankruptcy, he is responsible for the Board’s track - record of over - payment for under - performance Shareholders roundly expressed their lack of support for Say On Pay last year, with a low 76% level of support • A Heavy Seller of SBOW Stock: Mr. Wampler sold 20,000 shares from May - 2021 to Aug - 2022 for a total of $606k gain. Mr. Wampler’s holdings of SBOW consist entirely of shares awarded to him. He has purchased no shares over his tenure. • Approved Highly “Unusual” Joint CFO/GC Role: As a member of both the Audit Committee and the Nominating and Strategy Committee, he has approved the joint role and is responsible for the risk it presents • Has never purchased a single share of SBOW Mr. Wampler is Directly Responsible for Overseeing SBOW’s Poor Governance and Avoidance of Accountability (Cont.) SBOW shareholders deserve better than Mr. Wampler’s long - standing support for SBOW’s worst - in - class governance and his redundant, past - his - expiration date , perspective.

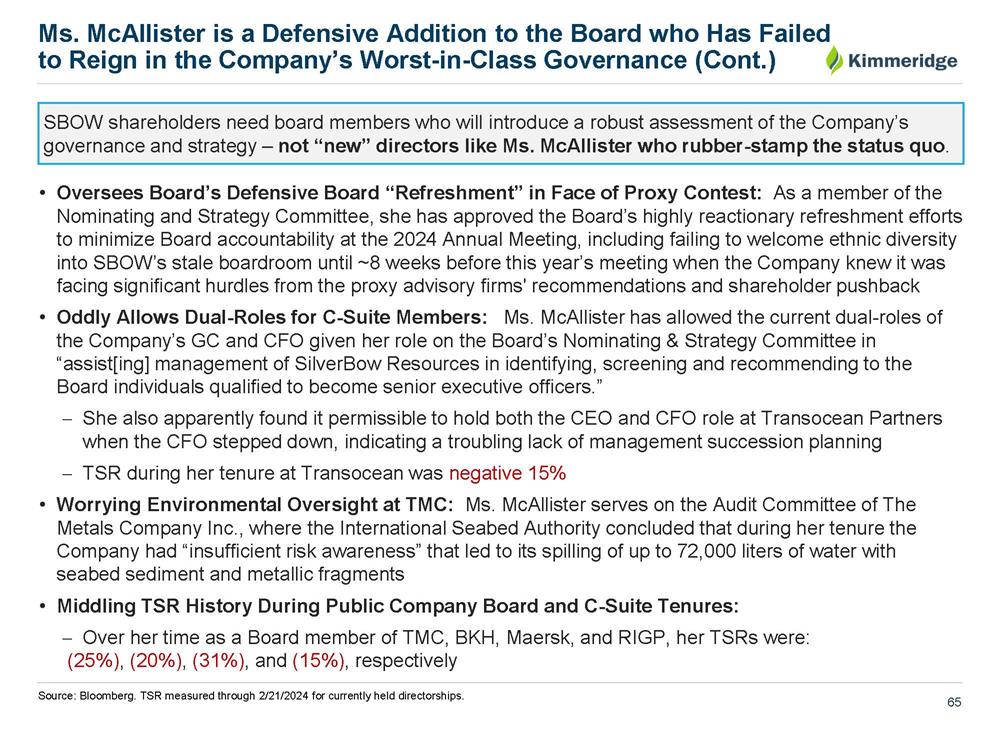

64 SBOW shareholders need board members who will introduce a robust assessment of the Company’s governance and strategy – not “new” directors like Ms. McAllister who rubber - stamp the status quo . • Significant Concerns Regarding her 2 Years as a Public Company CEO Led Transocean Partners as CEO in an MLP subsidiary to a parent company during a 2 - year period of negative 15% return • Lacks Necessary Skillset to Save SBOW from Irrelevance No history of successfully transitioning a subscale public company into a market leader in the E&P industry No E&P Industry experience No Eagle Ford experience • Even as a Brand New Director, Shareholders Expressed Their Strongly Negative Opinion: Received only 76% support at 2023 Annual Meeting – despite being a first - time nominee and without a single proxy advisory firm recommendation against her • Rubber - Stamps SBOW's Fortress Governance: Failed to use her position as a new director in 2023 to declassify the Board until 2027 and failing to remove the long - term poison pill without even providing shareholders an option to vote on this entrenchment device • Troubling Appointment: Appointed to the Board in the “Mid - Negotiating Board Stacking” defensive refreshment whereby the Board expanded its size from 7 to 9 directors after Kimmeridge engaged • Has never purchased a single share of SBOW Ms. McAllister is a Defensive Addition to the Board who Has Failed to Reign in the Company’s Worst - in - Class Governance

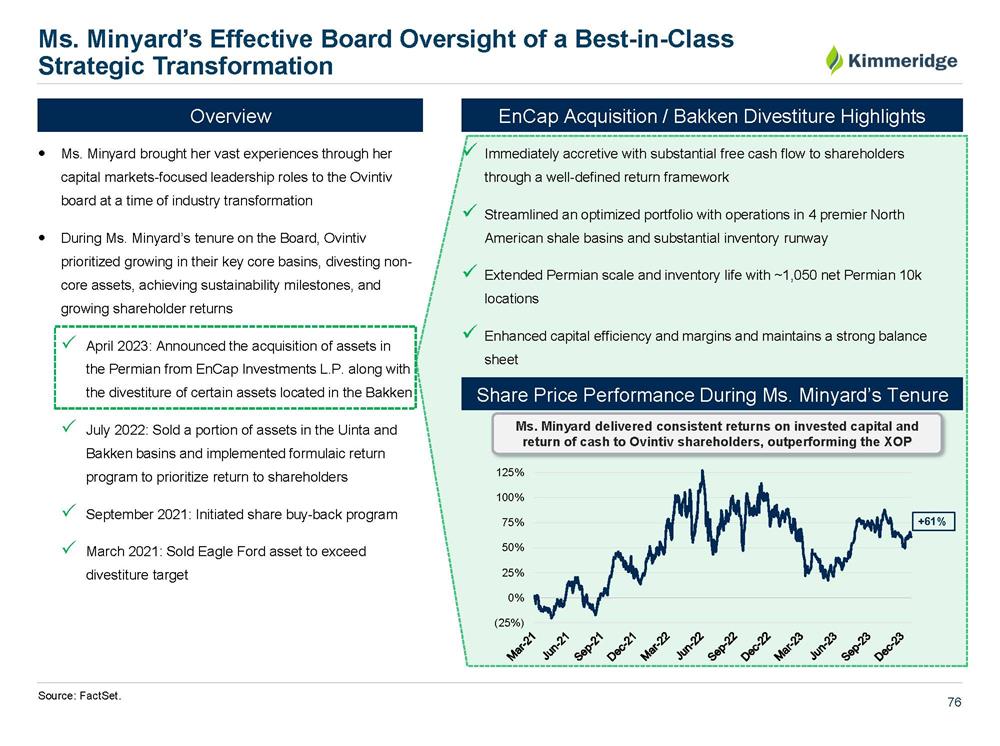

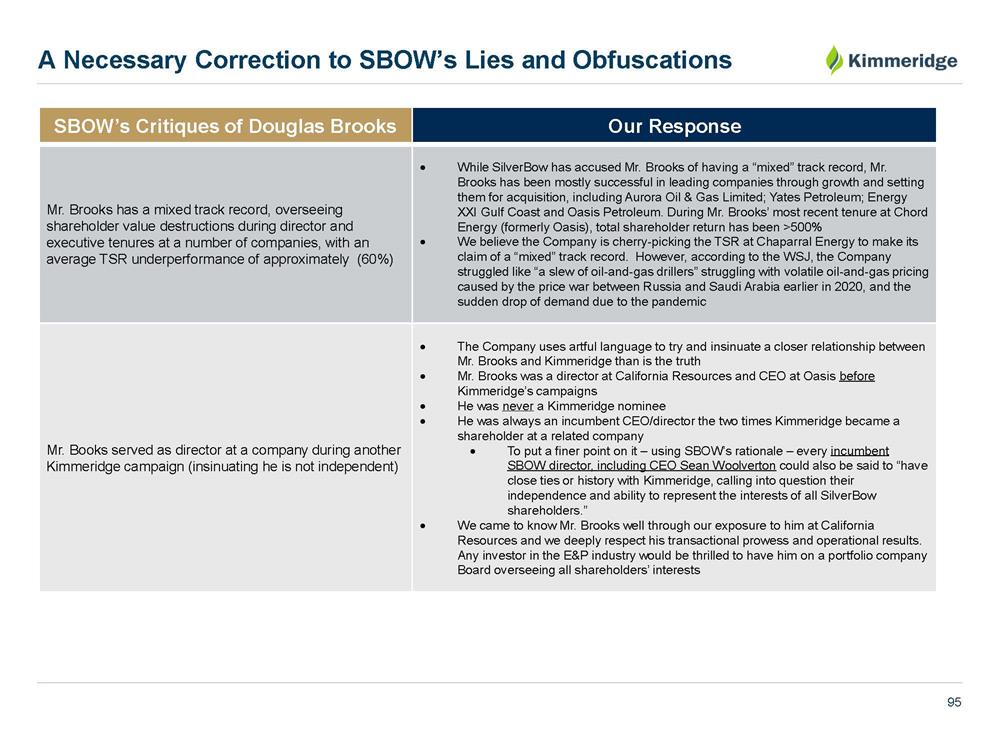

65 • Oversees Board’s Defensive Board “Refreshment” in Face of Proxy Contest: As a member of the Nominating and Strategy Committee, she has approved the Board’s highly reactionary refreshment efforts to minimize Board accountability at the 2024 Annual Meeting, including failing to welcome ethnic diversity into SBOW’s stale boardroom until ~8 weeks before this year’s meeting when the Company knew it was facing significant hurdles from the proxy advisory firms' recommendations and shareholder pushback • Oddly Allows Dual - Roles for C - Suite Members: Ms. McAllister has allowed the current dual - roles of the Company’s GC and CFO given her role on the Board’s Nominating & Strategy Committee in “assist[ ing ] management of SilverBow Resources in identifying, screening and recommending to the Board individuals qualified to become senior executive officers.” She also apparently found it permissible to hold both the CEO and CFO role at Transocean Partners when the CFO stepped down, indicating a troubling lack of management succession planning TSR during her tenure at Transocean was negative 15% • Worrying Environmental Oversight at TMC: Ms. McAllister serves on the Audit Committee of The Metals Company Inc., where the International Seabed Authority concluded that during her tenure the Company had “insufficient risk awareness” that led to its spilling of up to 72,000 liters of water with seabed sediment and metallic fragments • Middling TSR History During Public Company Board and C - Suite Tenures: Over her time as a Board member of TMC, BKH, Maersk, and RIGP, her TSRs were: (25%) , (20%) , (31%) , and (15%) , respectively Ms. McAllister is a Defensive Addition to the Board who Has Failed to Reign in the Company’s Worst - in - Class Governance (Cont.) SBOW shareholders need board members who will introduce a robust assessment of the Company’s governance and strategy – not “new” directors like Ms. McAllister who rubber - stamp the status quo . Source: Bloomberg. TSR measured through 2/21/2024 for currently held directorships.