Confidentially submitted to the Securities and Exchange Commission on May 13, 2022.

This draft registration statement has not been publicly filed with the Securities and

Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

__________________________________________

Form S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

__________________________________________

ev Transportation Services, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

Delaware | 3711 | 814109808 | ||

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

__________________________________________

ev Transportation Services, Inc.

1309 Beacon Street — Suite 300

Brookline, MA 02446

Tel: (202) 347-3359

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

__________________________________________

David Solomont

President & Chief Executive Officer

ev Transportation Services, Inc.

1309 Beacon Street — Suite 300

Brookline, MA 02446

Tel: (617) 800-0212

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Edwin L. Miller Jr. | Alexander R. McClean |

__________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | |

Non-accelerated filer ☐ | Smaller reporting company ☒ | |

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED MAY 13, 2022 |

ev Transportation Services, Inc.

[•] Shares

Common Stock

This is the initial public offering of ev Transportation Services, Inc. No public market currently exists for our common stock. We are offering, on a firm commitment basis, [•] shares of our common stock and anticipate the initial public offering price will be between $[•] and $[•] per share.

We intend to list the common stock on the NASDAQ Capital Market, or NASDAQ, under the symbol “EVTS.” No assurance can be given that our application will be approved. If our application is not approved or we otherwise determine that we will not be able to secure the listing of our common stock on NASDAQ, we will not complete this offering.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced reporting requirements for this prospectus and future filings. See “Prospectus Summary — Emerging Growth Company Status.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our securities is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page 5 of this prospectus before purchasing shares of our common stock.

Per Share | Total | |||||

Public Offering Price | $ | $ | ||||

Underwriting Discounts and Commissions(1) | $ | $ | ||||

Proceeds to us, before expenses | $ | $ | ||||

____________

(1) Does not include warrants that are issuable by us to the representative of the underwriters for 8% of the shares of common stock sold in the offering at a price per share equal to 110% of the initial public offering price or certain out-of-pocket expenses of the underwriters that are reimbursable by us. See “Underwriting” for a description of the compensation payable to the underwriters.

We have granted the representative of the underwriters a 45-day option to purchase from us, up to an additional [•] shares of common stock at the public offering price of $ per share, less the underwriting discounts and commissions, to cover over-allotments, if any. If the representative of the underwriters exercises the option in full, the total underwriting discounts and commissions payable will be $ , and the total proceeds to us, before expenses, will be $ . Delivery of the shares is expected to be made on or about , 2022.

Sole Book-Running Manager

Maxim Group LLC

The date of this prospectus is , 2022.

Page | ||

1 | ||

5 | ||

Cautionary Note Regarding Forward-Looking Statements and Industry Data | 21 | |

23 | ||

24 | ||

25 | ||

27 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 29 | |

39 | ||

54 | ||

59 | ||

65 | ||

67 | ||

68 | ||

72 | ||

74 | ||

78 | ||

78 | ||

78 | ||

F-1 |

Neither we nor the underwriters have authorized anyone to provide you with any information other than that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the® and™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

i

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes thereto and the information set forth in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Unless the context otherwise requires, we use the terms “Company,” “we,” “us” and “our” in this prospectus to refer to ev Transportation Services, Inc.

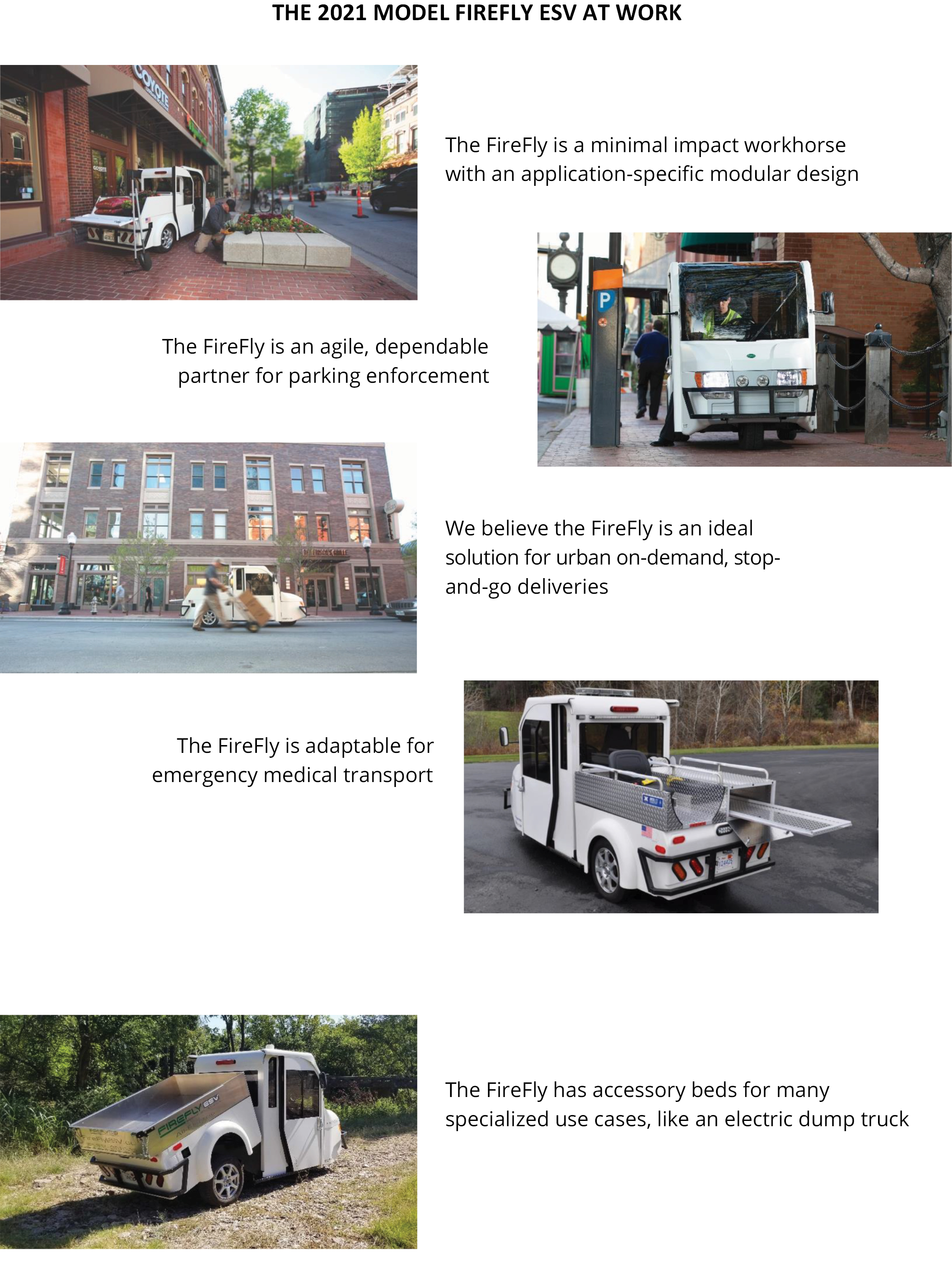

We are an early stage manufacturer of all-electric, lightweight commercial utility vehicles. Our first vehicle is the “FireFly”, which is used in the essential services and on-demand “last mile” urban e-delivery markets. We have completed the design of the vehicle, have assembled a core team, and have begun to manufacture it in limited quantities. With the proceeds of this offering, we plan to significantly scale operations.

Our vehicles provide an application-flexible platform. Our vehicles are easily configurable for a wide variety of applications, including parking management, security and perimeter patrol, parks and sidewalk maintenance, utility meter reading, property and building management, university and corporate campuses, as well as last mile urban small package and food delivery. Our Connected Vehicle Solution, evTS Connect™ is a cloud-connected electronics and software package that can be used for vehicle performance monitoring and remote diagnostics, vehicle and fleet management, and vehicle tracking and routing. In addition, the FireFly use a lithium iron phosphate battery with enhanced safety features, not a lithium ion battery. According to the U.S. Government (GAO and GSA) and Company research and interviews, the size of the replacement market for utility vehicles for public fleets (federal/state/municipal) is $2.4 billion. According to publicly available data on existing fleet size (by company) and publicly announced commitments for new vehicle purchases within the delivery industry, the size of the “Last Mile Delivery Market” (small to medium-size packages), which is growing quickly, is $4.4 billion for replacement and new sales to private delivery fleets.

We are currently focused on the essential services and urban e-mobility transportation markets. According to a Bureau of Transportation Statistics study dated April 21, 2021, the market share of electric light duty vehicles has increased year by year since 2011. Accordingly, we believe that businesses using pickup trucks or gasoline-powered light passenger vehicles in dense urban environments for specific applications are increasingly purchasing all-electric vehicles, such as the FireFly, that are designed with functionality for these applications. Our vehicles:

• Operate within 100+ mile range on a full charge • Travel from site to site at speeds exceeding 50 mph • Carry up to 1,100 lbs. payload • Are light weight, agile and maneuverable in dense urban environments • Have superior stability and handling | • Seat one or two passengers with multiple driver position options • Have real-time two-way vehicle communications with remote performance monitoring, diagnostics, and tracking and routing capabilities • Use lithium iron phosphate battery, not lithium ion battery |

The original FireFly® vehicle was designed between January 2009 and December 2015 by Fort Worth, Texas-based eFleets Corporation with total estimated development costs of nearly $14,000,000. eFleets began shipping vehicles in 2012. As of December 31, 2021, the FireFly vehicle has been delivered to a total of 23 different cities. We estimate that the 73 vehicles delivered since inception have amassed in excess of 500,000 user miles. We acquired the intellectual property and assets of eFleets Corporation in August of 2020. From our formation until the present, we have recruited our management team, set up operations in three locations, developed our evTS Connect offering, established our initial distributor network and completed design and development of our 2022 model year FireFly.

Corporate Information

We were organized under the laws of the State of Delaware on May 8, 2015. Our principal executive offices are located at 1309 Beacon Street, Suite 300, Brookline, MA 02446, and our telephone number is (202) 347-3359. Our website address is www.evts.com. The information contained on our website is not, and should not be interpreted to be, incorporated into this prospectus.

1

Listing on the Nasdaq Capital Market

There is currently no public trading market for our shares of common stock. In connection with this offering, we have applied to list our common stock on the NASDAQ Capital Market under the symbol “EVTS.” If our listing application is approved, we expect to list our common stock on NASDAQ upon consummation of the offering. No assurance can be given that our listing application will be approved. This offering will occur only if NASDAQ approves the listing of our common stock.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. As a result, we may take advantage of reduced reporting requirements that are otherwise applicable to public companies, including delaying auditor attestation of internal control over financial reporting, providing only two years of audited financial statements and related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus and reduced executive compensation disclosures.

We may remain an emerging growth company for up to five years from the date of the first sale in this offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenue exceeds $1.07 billion, or we issue more than $1 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation related information that would be required if we were not an emerging growth company. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests. In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have elected not to “opt out” of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we can adopt the new or revised standard at the time private companies adopt the new or revised standard and may do so until such time that we either (1) irrevocably elect to “opt out” of such extended transition period or (2) no longer qualify as an emerging growth company.

Finally, we are a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

2

THE OFFERING

Common stock offered by us | [•] shares | |

Option to purchase additional shares | We have granted the underwriters an option for a period of 45 days from the closing of this offering to purchase up to [•] additional shares of our common stock. | |

Common stock to be outstanding immediately following this offering | [•] shares ([•] shares if the underwriters exercise their option to purchase additional shares of our common stock in full). See Note 1. | |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately $[•] million, or approximately $[•] million if the underwriters exercise in full their option to purchase up to [•] additional shares of our common stock, based on an assumed initial public offering price of $[•] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. | |

We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents, to continue the commercialization of our business. See “Use of Proceeds.” | ||

Proposed NASDAQ trading symbol | We have applied to list our common stock on the NASDAQ Capital Market under the symbol “EVTS.” We will not proceed with this offering in the event our common stock is not approved for listing on NASDAQ. | |

Lock-up | We and our directors, officers and holders of 1% or more of our outstanding shares of common stock as of the effective date of the registration statement related to this offering (including all holders of securities exercisable for or convertible into shares of common stock) shall enter into customary “lock-up” agreements pursuant to which such persons and entities shall agree not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 180 days after the effective date of this registration statement. | |

Risk factors | The securities offered by this prospectus are speculative and involve a high degree of risk. Investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 5. _________________ |

Note 1. The number of shares of our common stock to be outstanding immediately following this offering is based on 13,720,000 shares of our common stock issued and outstanding as of March 31, 2022. This includes shares of our common stock issuable upon the mandatory conversion of all outstanding shares of our preferred stock into common stock on a one-for-one basis. Separately, the principal and accrued interest, as of March 31, 2022, on substantially all of our outstanding convertible notes ($6,394,528) will be automatically converted into shares of our common stock at a conversion price of $[•]. At the closing of the offering, the number of shares of common stock will increase to reflect the interest accrued from March 31, 2022 through the closing based on the conversion price of $[•].

3

The number of shares of our common stock to be outstanding immediately following this offering excludes 3,500,000 shares of our common stock that will become available for future issuance under our 2022 Stock Incentive Plan, which will become effective immediately prior to the effectiveness of the registration statement of which this prospectus is a part.

Unless otherwise indicated, all information in this prospectus reflects and assumes the following:

• no exercise by the underwriters of their option to purchase additional shares of our common stock;

• the automatic conversion of all outstanding shares of our preferred stock and the conversion of substantially all of our convertible notes into an aggregate of [•] shares of our common stock upon the closing of this offering; and

• the filing and effectiveness of our restated certificate of incorporation and the adoption of our amended and restated bylaws each upon the closing of this offering.

4

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and the related notes appearing elsewhere in this prospectus, before deciding to invest in our common stock. The risks described below are not the only risks we face. The occurrence of any of the following risks, or of additional risks and uncertainties not presently known to us or that we currently believe to be immaterial, could cause our business, prospects, results of operations and financial condition to suffer materially. In such event, the trading price of our common stock could decline, and you might lose all or part of your investment.

Risks Related to Our Business, Financial Condition and Industry

We are an early stage manufacturer of electric utility vehicles with limited operations to date and a history of losses, and we expect to incur significant expenses and continuing losses for an indefinite period.

We were organized in May 2015 and have had only limited operations. Since inception, we have incurred an accumulated deficit of approximately $12.7 million through December 31, 2021. We believe that we will continue to incur operating and net losses each quarter until at least the time that we have established large scale manufacturing and sales efforts and begin wider scale deliveries of our EVs, which are not expected to begin for several years, and may occur later or not at all. In addition, as an early stage company with a limited operating history, our business is subject to all of the risks inherent in a new business enterprise, including (i) a product without a significant history in the market, (ii) reliance on one product, (iii) limited experience with manufacturing and (iv) a lack of established distribution channels.

We expect the rate at which we will incur losses to be significantly higher in future periods as we:

• continue to design, develop, manufacture and market our EVs;

• continue to utilize our third-party suppliers of component parts;

• expand our production capabilities, including costs associated with the manufacture and assembly of our EVs;

• build up inventories of parts and components for our EVs;

• create an inventory of our EVs;

• expand our design, development, and servicing capabilities;

• increase our sales and marketing activities and develop our distribution infrastructure; and

• increase our general and administrative functions to support our growing operations.

We have not achieved positive operating cash flow and our ability to generate positive cash flow is uncertain.

We have manufactured only a small number of vehicles. We have had negative cash flow from operating activities of approximately $1.3 million during the year ended December 31, 2020 and $3.9 million during the year ended December 31, 2021. We may have negative cash flow for at least several years from operating and investing activities because we expect to incur research and development, sales and marketing, and general and administrative expenses and make capital expenditures in our efforts to increase sales, engage in development work and ramp up operations. If negative cash flow from operations extends indefinitely, an inability to generate positive cash flow may adversely affect our ability to raise needed capital for our business on reasonable terms, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may decrease our viability. There can be no assurance that we will achieve positive cash flow. Because of the numerous risks and uncertainties associated with vehicle development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, maintain our product development efforts, diversify our pipeline of product offerings or even continue our operations.

5

If our vehicles do not gain market acceptance, prospects for our sales revenue and profit will be unfavorable.

To date we have received a limited number of sales orders for our 2022 model year FireFly ESV vehicles. In order to generate market demand, we are delivering a limited number of pre-production 2022 model year FireFly ESV vehicles for use as demonstration vehicles to certain dealers and key customer accounts during the first quarter of 2022. As a “sight unseen” new model year, potential customers for our vehicles may be reluctant to immediately place large orders for our vehicles until they are released and in the marketplace in significant volumes. Obstacles to widespread adoption of our vehicles also include inability to achieve market penetration due to sales of currently available competitive vehicles, budget cycle purchasing windows of potential customers and our ability to supply an adequate number of FireFly ESVs to meet demand. For more information related to this risk, see the section titled “Competitive Position” under “Business” below.

Our future operating results are unpredictable and are likely to fluctuate.

As a result of our limited operating history, we are unable to forecast our revenues to a degree of relative certainty. To date, our gross revenue has been inconsistent due to fluctuations in vehicle sales, and we have been unable to achieve positive operating cash flow. In the future, we may not be able to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenues in relation to our planned expenditures will have an adverse effect on our business, prospects, financial condition and results of operations. Further, as a strategic response to changes in the competitive environment, we may from time to time make certain pricing, service or marketing decisions that could have a material adverse effect on our business, prospects, financial condition and results of operations.

Our future capital needs will likely require us to sell additional equity or debt securities that will dilute our stockholders’ ownership interest or introduce covenants that may restrict our operations.

We have historically relied on borrowings and equity financing to conduct our business and may need to seek equity or debt financing to finance a portion of our capital expenditures and operations. Such financing might not be available to us in a timely manner, on terms that are acceptable, or at all.

Our ability to obtain the necessary financing to carry out our business plan is subject to a number of factors, including general market conditions and investor acceptance of our business model. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities or substantially change our corporate structure. We might not be able to obtain any funding, and we might not have sufficient resources to conduct our business as expected, both of which could mean we would be forced to curtail or discontinue our operations.

In addition, our future capital needs and other business reasons could require us to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity or equity-linked securities would dilute the ownership interest of our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations.

We are dependent on third-party suppliers to provide parts for our EVs.

We rely on third-party suppliers to provide us the parts and sub-assembly necessary for producing our EVs. As of the date of this prospectus, we do not have agreements in place with any suppliers. All of our parts are ordered on a just-in-time basis through purchase orders. Our ability to timely assemble and deliver vehicles to our customers will be compromised if:

• these companies terminate our purchase orders without adequate notice,

• these companies fail to accept our purchase orders,

• our suppliers fail to provide the required capacity and quality of sub-assembly parts on a timely basis,

• our suppliers fail to support our scale of growth,

• our suppliers experience supply shortages, long lead times, or supply changes,

6

• our suppliers become economically distressed or go bankrupt, or

• the parts are delayed in route to us or we face other logistical problems.

If our vendor manufacturers fail to meet our requirements for quality, quantity, price and timeliness, our business growth will be harmed.

As of the date of this prospectus, we do not have agreements in place with any suppliers. All of our parts are ordered on a just-in-time basis through purchase orders. If these companies fail to accept or terminate our purchase orders without adequate notice, or if they fail to provide the required capacity and quality of sub-assembly parts on a timely basis, our ability to timely assemble and deliver vehicles to our customers will be compromised.

Our success will depend on our ability to economically assemble our EVs at scale to meet our customers’ needs, and our ability to develop and assemble EVs of sufficient quality and appeal to customers on schedule and at scale is unproven.

Our future business depends in large part on our ability to execute our plans to develop, assemble, market and sell our EVs at sufficient capacity to meet the transportation demands of our business customers. Our continued development of our EVs is and will be subject to risks, including with respect to:

• our ability to secure necessary funding;

• the equipment we plan to use being able to accurately manufacture the vehicles within specified design tolerances;

• compliance with environmental, workplace safety and similar regulations;

• securing necessary components on acceptable terms and in a timely manner;

• delays in delivery of final component designs to our suppliers;

• our ability to attract, recruit, hire and train skilled employees;

• quality controls, particularly as we plan to increase manufacturing;

• delays or disruptions in our supply chain; and

• other delays and cost overruns.

We have no experience to date in high volume assembly of our EVs. We do not know whether we will be able to develop efficient, automated, low-cost assembly capabilities and processes, and reliable sources of parts and sub-assembly supply, that will enable us to meet the quality, price, engineering, design and production standards, as well as the production volumes, required to successfully mass market our EVs. Even if we are successful in developing our high volume assembly capability and processes and reliably source our parts supply, we do not know whether we will be able to do so in a manner that avoids significant delays and cost overruns, including as a result of factors beyond our control such as problems with suppliers and vendors, or in time to meet our vehicle commercialization schedules or to satisfy the requirements of customers. Any failure to develop such manufacturing processes and capabilities within our projected costs and timelines could have a material adverse effect on our business, prospects, operating results and financial condition.

Our vehicles could contain defects, certain parts may malfunction, or they may be operated incorrectly, which could reduce sales of those vehicles due to adverse publicity and reputational harm or result in significant litigation against us.

Our vehicles may have or develop defects. As a result, our customers could lose confidence in our vehicles and in us if they unexpectedly use defective vehicles or tend to use our vehicles improperly. This could result in loss of revenue, loss of profit margin, and loss of market share in addition to reputational harm and potentially significant litigation being brought against us. Further, electric vehicles have a number of distinguishing characteristics from traditional, internal combustion vehicles, including the relatively reduced noise produced by the operation of an electric vehicle. There have been reports of electric vehicle incidents resulting from operators or pedestrians being

7

unable to hear an approaching vehicle. If we were found responsible for major defects or other incidents resulting from the operation of our vehicles, it could cause us to incur liability which could interrupt or even cause us to terminate some or all of our operations. A product could be found to have a material defect causing a recall of that vehicle which as a result could negatively impact our operations, financial condition, and ultimately our continued operations.

Our success depends, in part, on establishing and maintaining good relationships with our network of distributors.

Our success depends, in part, on our establishing and maintaining satisfactory relationships with our distribution partners. We currently have a network of four vehicle distributors and, as of the date of this prospectus, we are in active negotiation with an additional four. If we are not successful in establishing an adequate distributor network, our results of operations, financial condition and continued operations will be negatively impacted.

In the past, we have identified conditions and events that raise substantial doubt about our ability to continue as a going concern and it is possible that conditions and events in the future may negatively impact our ability to continue as a going concern.

Our report from our independent registered public accounting firm for the years ended December 31, 2020 and 2021 includes an explanatory paragraph stating that our recurring losses from operations and cash outflows from operating activities raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result if we are unable to continue as a going concern. If we are unable to continue as a going concern, holders of our securities might lose their entire investment. Although we plan to attempt to raise additional capital through one or more private placements or public offerings, the doubts raised relating to our ability to continue as a going concern may make our shares an unattractive investment for potential investors. These factors, among others, may make it difficult to raise any additional capital and may cause us to be unable to continue to operate our business. If we are unable to continue as a going concern, it is likely that investors would lose a substantial part or all of their investment.

Targeted customers may be reluctant to acquire a vehicle from a new and unproven manufacturer.

Municipal customers and fleet owners value safety and reliability as important factors in choosing a vehicle and may be reluctant to acquire a vehicle from a new and unproven manufacturer. In addition, our novel technology and design may not align with current target market preferences. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

From time to time, our EVs may be evaluated and reviewed by third parties. Any negative reviews or reviews which compare us unfavorably to competitors could adversely affect targeted customer perception about our EVs. We may have fewer resources than our competitors to effectively market our EVs compared to such competitors’ EVs, which may lead to an increase in unfavorable reviews of us compared to competitors or reduce the likelihood that we are able to attract new customers.

We will need to be successful with respect to a number of areas that will be necessary to expand our business, and may be unable to do so.

We expect our future expansion to include:

• expanding our management team;

• hiring and training new personnel;

• forecasting production and revenue;

• controlling expenses and investments in anticipation of expanded operations;

• establishing or expanding design, production, sales and service facilities;

• implementing and enhancing administrative infrastructure, systems and processes; and

• expanding into new markets.

8

We intend to hire a significant number of additional personnel, including software engineers, design and production personnel and service technicians for our EVs. Because our EVs are based on a different technology platform than traditional four-wheeled vehicles equipped with internal combustion engines, individuals with sufficient training in alternative fuel and EVs may not be available to hire, and as a result, we will need to expend significant time and expense training any newly hired employees. Competition for individuals with experience designing, producing and servicing EVs and their software is intense and increasing, particularly in the current labor market. We may not be able to attract, integrate, train, motivate or retain additional highly qualified personnel, particularly with respect to software engineers in the Fort Worth, Texas, or Boston, Massachusetts, areas. The failure to attract, integrate, train, motivate and retain these additional employees could seriously harm our business, prospects, financial condition and operating results.

Additionally, the availability and prices for materials needed for our EVs will fluctuate, which may impact our business, prospects, financial condition, and operating results.

The electric vehicle market is relatively new, and the availability of the personnel and components required to compete in this market is uncertain.

We and our suppliers use various materials in our businesses and products, including for example steel, and the availability and prices for these materials will fluctuate. Supply chain disruptions and access to materials have impacted our suppliers’ ability to delivery materials to us in a timely manner. If we are unable to timely obtain materials or if there are fluctuations in prices, it could adversely affect our operating results.

In addition, engineers and other personnel with experience in the electric vehicle industry are in demand, and we may be unable to compete successfully in attracting these personnel. If we are not successful in hiring and retaining highly qualified employees with experience in the electric vehicle industry, we may not be able to extend or maintain our industry expertise, and our future product development efforts could be adversely affected. The loss of members of our senior management could significantly delay or prevent the achievement of our strategic objectives, which could adversely affect our operating results.

Developments in alternative technology improvements in the internal combustion engine may adversely affect the demand for our EVs.

Significant developments in alternative technologies, such as advanced diesel, ethanol, hydrogen cells, or compressed natural gas or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. Other fuels or sources of energy may emerge as customers’ preferred alternative to our EVs. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced alternative fuel and electric vehicles, which could result in the loss of competitiveness of our EVs, decreased revenue and a loss of market share to competitors. Our research and development efforts may not be sufficient to adapt to changes in alternative fuel and electric vehicle technology.

We have no significant experience servicing our EVs. If we are unable to address the service requirements of our customers, our business will be materially and adversely affected.

We have no significant experience servicing or repairing our vehicles. Servicing alternative fuel and electric vehicles is different than servicing vehicles with internal combustion engines and requires specialized skills, including high voltage training and servicing techniques. We may decide to partner with a third party to perform some or all of the maintenance on our EVs, and there can be no assurance that we will be able to enter into an acceptable arrangement with any such third-party provider. If we are unable to successfully address the service requirements of our customers, our business and prospects will be materially and adversely affected.

In addition, the motor vehicle industry laws in many states require that service facilities be available to service vehicles physically sold from locations in the state. While we anticipate developing a service program that would satisfy regulators in these circumstances, the specifics of our service program are still in development, and at some point may need to be restructured to comply with state law, which may impact our business, financial condition, operating results and prospects.

9

Our workforce may undertake efforts to unionize, which may increase our operating costs and adversely affect the results of our operations.

While we believe our relations with our employees are good, we may see union organization campaigns by our workforce. We respect our workforce’s right to unionize or not to unionize; however, the unionization of a significant portion of our workforce could increase our overall operating costs and adversely affect our ability to run our business in the most efficient manner to remain competitive and could adversely affect our results of operations by increasing our labor costs or otherwise restricting our ability to maximize the efficiency of our operations.

If we lose key personnel or are unable to attract and retain personnel on a cost-effective basis, our business could be adversely affected.

Our performance is substantially dependent on the continued services and performance of our senior management and the rest of our employees. Key team members include President & Chief Executive Officer (“CEO”), David Solomont and Chief Technology Officer (“CTO”) Greg Horne, in particular. If we are not successful in hiring and retaining highly qualified employees, we may not be able to extend or maintain our industry expertise, and our future product development efforts could be adversely affected. The loss of members of our senior management could significantly delay or prevent the achievement of our strategic objectives, which could adversely affect our operating results.

In addition, engineers and other personnel with experience in the electric vehicle industry are in demand, and we may be unable to compete successfully in attracting these personnel.

We may have conflicts of interest with our affiliates and related parties, and in the past we have engaged in transactions and entered into agreements with affiliates that were not negotiated at arms’ length.

We have engaged, and may in the future engage, in transactions with affiliates and other related parties. These transactions may not have been, and may not be, on terms as favorable to us as they could have been if obtained from non-affiliated persons. While an effort has been made and will continue to be made to obtain services from affiliated persons and other related parties at rates and on terms as favorable as would be charged by others, there will always be an inherent conflict of interest between our interests and those of our affiliates and related parties. To date, our operations have been funded in part through advances from Nine Associates, LLC, an entity owned by an affiliate of our Chief Executive Officer. Mr. Solomont may economically benefit from our arrangements with related parties. If we engage in related party transactions on unfavorable terms, our operating results will be negatively impacted.

We may need to defend against intellectual property infringement claims or misappropriation claims, which may be time-consuming and expensive and, if adversely determined, could limit our ability to commercialize our EVs.

Companies, organizations or individuals, including our competitors, may own or obtain patents, trademarks or other proprietary rights that could prevent or limit our ability to make, use, develop or deploy our EVs. Although we have not in the past been subject to claims that any of our products infringe any patents or other proprietary rights of third parties, we could be subject to such claims in the future. There can be no assurance that claims that may arise in the future can be amicably disposed of, and it is possible that litigation could ensue. We do not know whether we will prevail in these proceedings given the complex technical issues and inherent uncertainties in intellectual property litigation.

Claims that our products or services infringe third-party intellectual property rights, regardless of their merit or resolution, could be costly to defend or settle and could divert the efforts and attention of our management. If any pending or future proceedings result in an adverse outcome, we could be required to:

• cease the manufacture, use or sale of the infringing products, services or technology;

• pay substantial damages for infringement;

• expend significant resources to develop non-infringing products, services or technology;

10

• license from the third-party claiming infringement, which license may not be available on commercially reasonable terms, or at all; or

• pay substantial damages to discontinue use of or to replace infringing intellectual property sold by us with non-infringing intellectual property.

Any of the foregoing results could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to protect our intellectual property rights, our competitive position could be harmed or we could be required to incur significant expenses to enforce our rights.

We depend on our ability to protect our proprietary technology. The Company does not have any issued patents, but has filed several patent applications and plans to file several additional patent applications.

We rely on trademarks, trade secrets and intellectual property laws and confidentiality agreements with employees and third parties, all of which offer only limited protection. In addition, some of our trademarks are not currently registered with the United States Patent and Trademark Office and we have yet to file trademark applications for certain of these marks, which may make protecting these unregistered trademarks more difficult. Despite our efforts, the steps we have taken to protect our proprietary rights may not be adequate to preclude misappropriation of our proprietary information or infringement of our intellectual property rights, and our ability to police such misappropriation or infringement is uncertain, particularly in countries outside of the United States. Protecting against the unauthorized use of our products, trademarks, and other proprietary rights is expensive, difficult and, in some cases, impossible. Litigation may be necessary in the future to enforce or defend our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others. Such litigation could result in substantial costs and diversion of management resources, either of which could harm our business. Furthermore, many of our current and potential competitors have the ability to dedicate substantially greater resources to enforce their intellectual property rights than we do. Accordingly, despite our efforts, we may not be able to prevent third parties from infringing upon or misappropriating our intellectual property.

Data is communicated electronically between our vehicles and our fleet management system, and may be subject to data breaches or data insecurity.

The data communicated between our vehicles and fleet management system is encrypted and transmitted wirelessly via a virtual private network (“VPN”), but subject to security risks associated with data communications such as data breaches, hacking, or other data security issues. If any of these were to occur, we may suffer financial and reputational harm that could materially and adversely affect our business and operations.

To date, we have not been subject to cyber-attacks or other cyber incidents which, individually or in the aggregate, resulted in a material impact to our operations or financial condition. However, hackers may attempt to gain unauthorized access to modify, alter and use such networks, EVs and systems to gain control of or to change our EVs’ functionality, user interface and performance characteristics, or to gain access to data stored in or generated by the EV. Future vulnerabilities could be identified and our efforts to remediate such vulnerabilities may not be successful. Any unauthorized access to or control of our EVs or their systems, or any loss of customer data, could result in legal claims or proceedings. In addition, regardless of their veracity, reports of unauthorized access to our EVs, systems or data, as well as other factors that may result in the perception that our EVs, systems or data are capable of being “hacked,” could negatively affect our brand and harm our business, prospects, financial condition and operating results.

Interruption or failure of our information technology and communications systems could impact our ability to effectively provide our services.

We plan to outfit our EVs with in-vehicle services and functionality that utilize data connectivity to monitor performance and timely capture opportunities for cost-saving preventative maintenance. The availability and effectiveness of our services depend on the continued operation of information technology and communications systems. Our systems will be vulnerable to damage or interruption from, among others, fire, terrorist attacks, natural

11

disasters, power loss, telecommunications failures, computer viruses, computer denial of service attacks or other attempts to harm our systems. Data centers we use could also be subject to break-ins, sabotage and intentional acts of vandalism causing potential disruptions. Some of our systems will not be fully redundant, and our disaster recovery planning cannot account for all eventualities. Any problems at data centers we use could result in lengthy interruptions in our service. In addition, our EVs are highly technical and complex and may contain errors or vulnerabilities, which could result in interruptions in our business or the failure of our systems.

We provide a 3-year bumper to bumper warranty for up to 24,000 miles and a 5-year frame warranty, which may result in us bearing the costs of warranty claims. Additionally, we may be subject to financial and reputational harm due to risks associated with components and materials in our EVs including product recalls, product liability claims, and class action litigation.

Our 3-year bumper to bumper warranty for up to 24,000 miles and 5-year frame warranty may result in our customers making claims under such warranties for losses or repairs, which amounts may exceed our expectations. As a result, there is a risk that we may not have provided sufficient reserve for warranty repairs.

We may be exposed to product recalls, product liability claims, or class action litigation if any other materials in our EVs fail. Any product recall, product liability claim, or class action claim seeking significant monetary damages could have a material adverse effect on our business and financial condition. A product recall, product liability claim, or class action claim could also generate substantial negative publicity about our EVs and our business.

We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or if we identify additional material weaknesses in the future or otherwise fail to establish and maintain an effective system of internal controls, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business.

In connection with the preparation and audit of our financial statements, material weaknesses were identified in our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of its annual or interim financial statements will not be prevented or detected on a timely basis. These material weaknesses are as follows:

• Insufficient control environment

• Lack of adequate accounting policies and procedures

• Lack of sufficient accounting resources

Until we complete this Offering or raise other funds, we are unable to begin to remediate these material weaknesses. As a result of these identified material weaknesses, and until such weaknesses are remediated, there can be no assurances that our financial statements will be free from error, or that we will not need to restate our financial statements in the future.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common stock.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, is designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In addition, any testing by us conducted in connection with Section 404, or any subsequent testing by our independent registered public accounting firm, may reveal deficiencies in our internal control over financial reporting that are deemed to be material weaknesses or that may require prospective or retroactive changes to our financial statements or identify other areas for further attention or improvement. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could harm our business and have a negative effect on the trading price of our stock.

12

We will be required to disclose changes made in our internal controls and procedures on a quarterly basis and our management will be required to assess the effectiveness of these controls annually. However, for as long as we are an EGC under the JOBS Act, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404. We could be an EGC for up to five years. Our assessment of internal controls and procedures may not detect material weaknesses in our internal control over financial reporting. Undetected material weaknesses in our internal control over financial reporting could lead to financial statement restatements and require us to incur the expense of remediation, which could have a negative effect on the trading price of our stock.

Our business could be adversely affected by changes in contract requirements and budgetary priorities of federal, state, and local governments.

We will target municipalities, governmental organizations, and other related entities. Changes in federal, state and local government budgetary priorities could directly affect our financial performance. A significant decline in government expenditures, a shift of expenditures away from programs which call for the types of services that we provide or a change in government contracting policies, could cause federal, state, or local governments to reduce their expenditures under contracts, to exercise their right to terminate contracts at any time without penalty, not to exercise options to renew contracts or to delay or not originate new contracts. Any of those actions could seriously harm our business, prospects, financial condition or operating results.

Additionally, changes in government programs or contract requirements, a decrease in the contracts reserved for small businesses, and changes in fiscal policies could negatively impact our business and our prospects.

Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud.

Upon completion of this offering, we will become subject to certain reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Our disclosure controls and procedures are designed to reasonably assure that information required to be disclosed by us in reports we file or submit under the Exchange Act is accumulated and communicated to management, recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the SEC. We believe that any disclosure controls and procedures or internal controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by an unauthorized override of the controls. Accordingly, because of the inherent limitations in our control system, misstatements or insufficient disclosures due to error or fraud may occur and not be detected.

We may be subject to significant exposure if one of our directors or officers is sued.

If a legal action is commenced against one of our directors or officers, including, but not limited to, an action alleging a violation of securities law, and such action exhausts our insurance coverage, we may incur the legal fees and costs associated with defending against the action under our bylaws or indemnification agreements, which may harm our business. In addition, a potential action could be time-consuming, resource-intensive, expensive, and uncertain.

Our operating results may be negatively impacted by the COVID-19 pandemic.

The COVID-19 pandemic has resulted, and is likely to continue to result, in significant economic disruption. It has already disrupted global travel and supply chains and adversely impacted global commercial activity. Considerable uncertainty still surrounds COVID-19 and its potential long-term economic effects, as well as the effectiveness of any responses taken by government authorities and businesses. The travel restrictions, limits on hours of operations and/or closures of non-essential businesses, and other efforts to curb the spread of COVID-19 has continued to disrupt business activity globally. New strains and variants of the coronavirus continue to spread around the world. The ongoing rollout of vaccines around the globe is encouraging, but their long-term impact on the political environment, business environment, and our business is still uncertain.

13

Risks Related to Other External Factors

Recent downturns in general economic and market conditions, including the economic effects of the COVID-19 pandemic, will materially and adversely affect our business.

A significant number of utility vehicle purchases are related to the budgets of, and purchases by, cities and municipalities. The COVID-19 pandemic has had a significant adverse effect on the resources of these potential buyers. Further, the budgets of these cities and municipalities are subject to the fluctuations of their local economies as well as of the national economy. Even post-pandemic, a reduction in budgets and expenditures by cities/airports/ports/colleges/universities will likely cause a reduction in the demand for our vehicles and could adversely impact our business.

We are subject to substantial regulation and unfavorable changes to, or failure by us to comply with, these regulations could substantially harm our business and operating results.

Our EVs, and the sale of motor vehicles in general, are subject to substantial regulation under international, federal, state, and local laws. We expect to incur significant costs in complying with these regulations. Regulations related to the electric vehicle industry are currently evolving. To the extent the laws change, our EVs may not comply with applicable international, federal, state or local laws, which would have an adverse effect on our business. Compliance with changing regulations could be burdensome, time consuming, and expensive. To the extent compliance with new regulations is cost prohibitive, our business, prospects, financial condition and operating results would be adversely affected.

Our operations and products are subject to environmental laws and regulations, including those related to vehicle emissions, that can significantly increase our cost and affect how we do business.

We are affected by environmental regulations that can increase costs related to the production of our vehicles, particularly regulations relating to emissions and other environmental impacts of our operations, including laws relating to the use, handling, storage, disposal and human exposure to hazardous materials. Failing to comply with these regulations is costly, and we anticipate that the number and extent of these environmental regulations may increase in the future. These laws can give rise to liability for administrative oversight costs, cleanup costs, property damage, bodily injury and fines and penalties. Capital and operating expenses needed to comply with environmental laws and regulations can be significant, and violations may result in substantial fines and penalties, third party damages, suspension of production or a cessation of our operations. These environmental regulations may significantly affect our operations and any failure to comply could have a material adverse effect on our operations and financial condition.

Contamination at properties we will own and operate, we formerly owned or operated or to which hazardous substances were sent by us, may result in liability for us under environmental laws and regulations, including, but not limited to the Comprehensive Environmental Response, Compensation and Liability Act, which can impose liability for the full amount of remediation-related costs without regard to fault, for the investigation and cleanup of contaminated soil and ground water, for building contamination and impacts to human health and for damages to natural resources. The costs of complying with environmental laws and regulations and any claims concerning noncompliance, or liability with respect to contamination in the future, could have a material adverse effect on our financial condition or operating results.

If critical manufacturing components become unavailable or our vendors delay their production, our business will be negatively impacted. The current supply chain crisis may have a material adverse effect on our business.

Stability of our component and sub-assembly supply chain is crucial to our manufacturing process. As some critical parts and components are supplied by certain third-party manufacturers, we may be unable to acquire necessary amounts of key components at competitive prices. If we are unable to obtain these components at competitive prices, or at all, we will be unable to produce our vehicles and may have to discontinue our business. It is not possible to state precisely what the impact of the current supply chain crisis will have on our business since our manufacturing operations are currently limited.

14

We have a plan to form a U.K. subsidiary, which will expose us to difficulties and risks presented by international economic, political, legal, accounting, and business factors.

We are forming a UK subsidiary in a collaboration with the Automotive Innovation Group, a UK-based automotive original equipment manufacturer. We may establish partnerships in other Western European countries as well.

Conducting business internationally subjects us to complicated U.S. and foreign governmental trade regulations. Compliance with such regulations is costly and exposes us to penalties for non-compliance. Other laws and regulations that can significantly impact us include anti-bribery laws, including the U.S. Foreign Corrupt Practices Act, laws restricting business with suspected terrorists, and anti-boycott laws. Any failure to comply with applicable legal and regulatory obligations could impact us in a variety of ways including criminal, civil, and administrative penalties, fines and penalties, and restrictions on certain business activities.

Other risks associated with conducting business internationally include:

• difficulties in managing and staffing international operations and the required infrastructure costs, including legal, tax, accounting, and information technology;

• the imposition of U.S. and/or international sanctions against a country, company, person, or entity with whom we do business with that would restrict or prohibit continued business with the sanctioned country, company, person, or entity;

• adverse currency exchange rate fluctuations;

• national and international conflicts, including foreign policy changes or terrorist acts;

• difficulties in enforcing or defending intellectual property rights; and

• multiple, changing, and often inconsistent enforcement of laws and regulations.

Our failure to effectively manage and mitigate these risks could adversely impact our business.

Risks Related to this Offering, Ownership of Our Common Stock and Our Status as a Public Company

An active trading market for our common stock may not develop.

Prior to this offering, there has been no public market for our common stock. The initial public offering price for our common stock was determined through negotiations with the underwriters. Although we have applied to have our common stock approved for listing on NASDAQ, an active trading market for our shares may never develop or be sustained following this offering. If an active market for our common stock does not develop, it may be difficult for you to sell shares you purchase in this offering without depressing the market price for the shares or at all.

If you purchase shares of common stock in this offering, you will suffer immediate dilution of your investment.

The initial public offering price of our common stock is substantially higher than the pro forma as adjusted net tangible book value per share of our common stock after this offering. Therefore, if you purchase shares of our common stock in this offering, you will pay a price per share that substantially exceeds our pro forma as adjusted net tangible book value per share after this offering. Based on an assumed initial public offering price of $[•] per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, you will experience immediate dilution of $[•] per share, representing the difference between our pro forma as adjusted net tangible book value per share as of December 31, 2021, after giving effect to this offering, and the initial public offering price. To the extent outstanding options are exercised, you will incur further dilution.

15

If securities analysts do not publish or cease publishing research or reports or publish misleading, inaccurate or unfavorable research about our business or if they publish negative evaluations of our stock, the price and trading volume of our stock could decline.

The trading market for our common stock will rely, in part, on the research and reports that industry or financial analysts publish about us or our business. We do not currently have, and may never obtain, research coverage by industry or financial analysts. If no, or few, analysts commence coverage of us, the trading price of our stock would likely decrease. Even if we do obtain analyst coverage, if one or more of the analysts covering our business downgrade their evaluations of our stock or publish inaccurate or unfavorable research about our business, or provide more favorable relative recommendations about our competitors, the price of our stock could decline. If one or more of these analysts cease to cover our stock, we could lose visibility in the market for our stock, which in turn could cause our stock price and trading volume to decline.

The price of our common stock may be volatile and fluctuate substantially, which could result in substantial losses for purchasers of our common stock in this offering.

Our stock price is likely to be volatile. The stock market, in general, and the market for smaller companies, in particular, have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may not be able to sell your common stock at or above the initial public offering price. The market price for our common stock may be influenced by many factors, including:

• our success in commercializing our products;

• developments with respect to competitive products or technologies;

• regulatory or legal developments in the United States and other countries;

• developments or disputes concerning patent applications, issued patents or other intellectual property or proprietary rights;

• the recruitment or departure of key personnel;

• actual or anticipated changes in estimates as to financial results, commercialization timelines or recommendations by securities analysts;

• variations in our financial results or the financial results of companies that are perceived to be similar to us;

• sales of common stock by us, our executive officers, directors or principal stockholders or others;

• general economic, industry and market conditions, such as the impact of the COVID-19 pandemic on our industry; the publication of unfavorable research reports and updates thereto by financial analysts; a

• the other factors described in this “Risk Factors” section.

In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted against that company. Any lawsuit to which we are a party, with or without merit, may result in an unfavorable judgment. We also may decide to settle lawsuits on unfavorable terms. Any such negative outcome could result in payments of substantial damages or fines, damage to our reputation or adverse changes to our offerings or business practices.

Such litigation may also cause us to incur other substantial costs to defend such claims and divert management’s attention and resources.

16

After this offering, our executive officers, directors, and principal stockholders, if they choose to act together, will continue to have the ability to significantly influence all matters submitted to stockholders for approval.

Upon the closing of this offering, based on the number of shares outstanding as of December 31, 2021, our executive officers and directors and our stockholders who owned more than 5% of our outstanding common stock before this offering will, in the aggregate, beneficially own shares representing approximately [•] of our common stock (excluding any shares purchased in this offering). As a result, if these stockholders were to choose to act together, they would be able to significantly influence all matters submitted to our stockholders for approval, as well as our management and affairs. For example, these stockholders, if they choose to act together, would significantly influence the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets.

This concentration of ownership control may:

• delay, defer or prevent a change in control;

• entrench our management and board of directors; or

• delay or prevent a merger, consolidation, takeover or other business combination involving us that other stockholders may desire.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that does not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our product candidates. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. As a result, capital appreciation, if any, of our common stock will be your sole source of gain for the foreseeable future.

A significant portion of our total outstanding shares are eligible to be sold into the market in the near future, which could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. After this offering, we will have [•] shares of common stock outstanding, based on the number of shares outstanding as of March 31, 2022 and after giving effect to the automatic conversion of all outstanding shares of our preferred stock and the conversion of substantially all convertible notes. Of the [•] shares to be outstanding immediately after this offering (based, with respect to our convertible notes, on the conversion price of $[•]), the [•] shares sold in this offering (assuming the underwriters do not exercise their option to purchase additional shares) may be resold in the public market immediately without restriction, unless purchased by our affiliates or existing stockholders that have signed lock-up agreements. Of the remaining [•] shares, [•] shares are currently restricted as a result of securities laws or lock-up agreements but will become eligible to be sold at various times after the offering as described in the section of this prospectus titled “Shares Eligible for Future Sale.” The representatives of the underwriters may release some or all of the shares of common stock subject to lock-up agreements at any time and without notice, which would allow for earlier sales of shares in the public market.

Once we register these shares, they can be freely sold in the public market upon issuance, subject to volume limitations applicable to affiliates and the lock-up agreements described in the “Shares Eligible for Future Sale” section of this prospectus.

17

We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.