UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material Pursuant to §240.14a-12 |

DELPHI TECHNOLOGIES PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

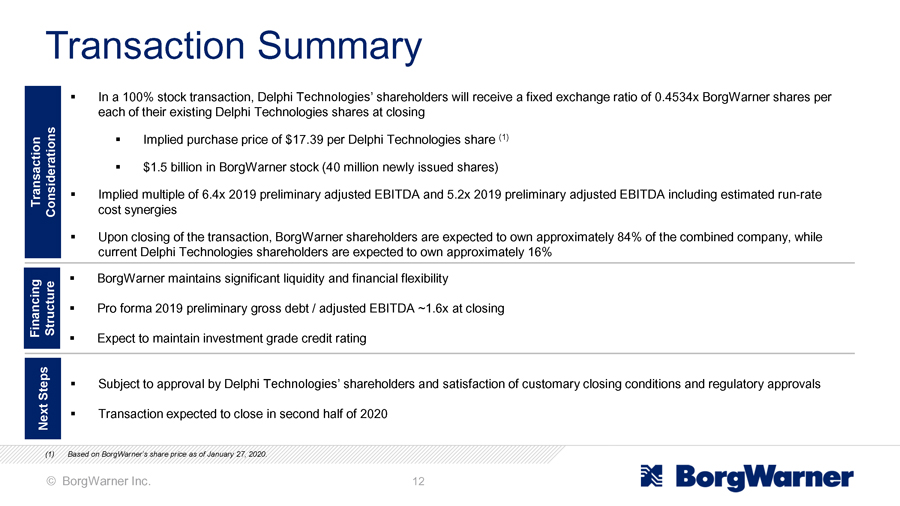

This Schedule 14A filing consists of the following communications relating to the proposed acquisition of Delphi Technologies PLC (“Delphi” or the “Company”) by BorgWarner Inc., a Delaware corporation (“Buyer”), pursuant to the terms of a Transaction Agreement, dated January 28, 2020, by and between the Company and Buyer:

(i) Transcript of Video Presentation by Richard F. Dauch, Chief Executive Officer of the Company, presented on January 28, 2020.

(ii) Employee Letter from Richard F. Dauch, Chief Executive Officer of the Company, dated January 28, 2020.

(iii) Employee Questions and Answers, dated January 28, 2020.

(iv) Social Media Posts, dated January 28, 2020.

(v) Investor Presentation, dated January 28, 2020.

(vi) Transcript of Investor Conference Call held on January 28, 2020.

Exhibit 99.1

Hello

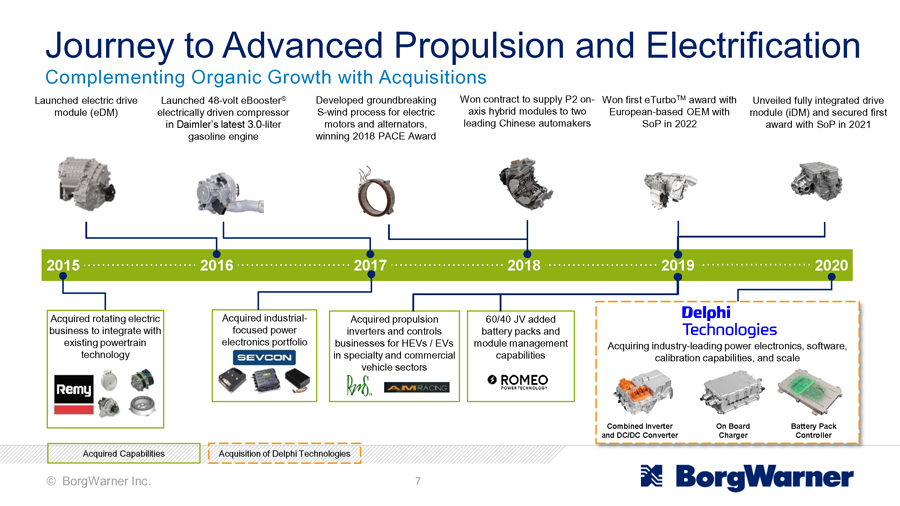

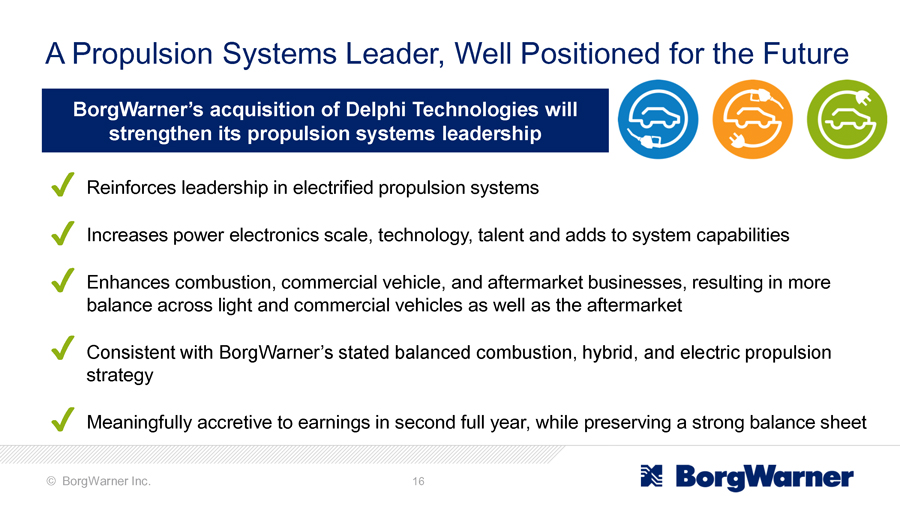

As you will have seen and heard by now, today we announced that Delphi Technologies has entered into an agreement with BorgWarner under which the two companies will come together to create a pioneering propulsion technologies leader.

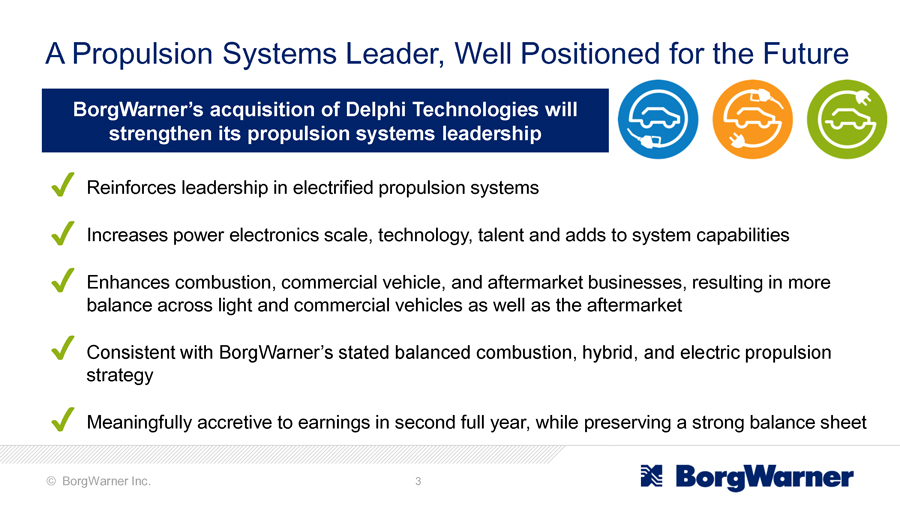

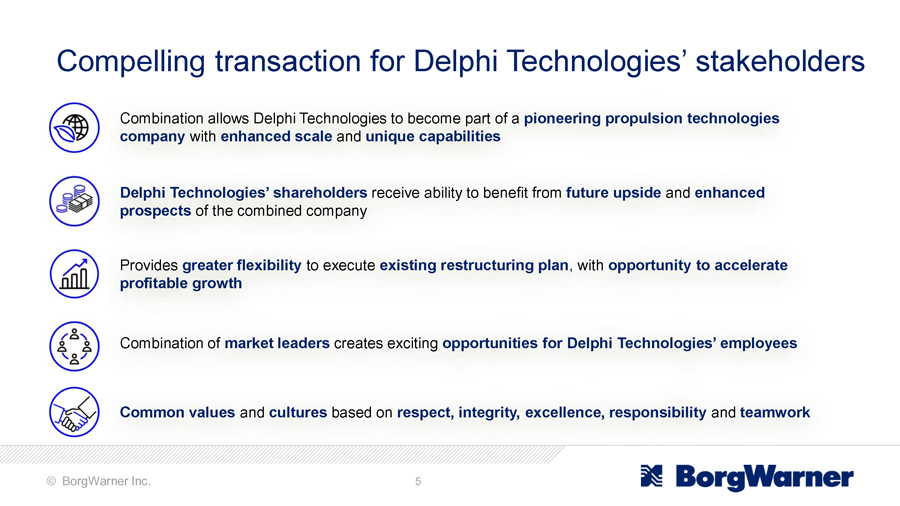

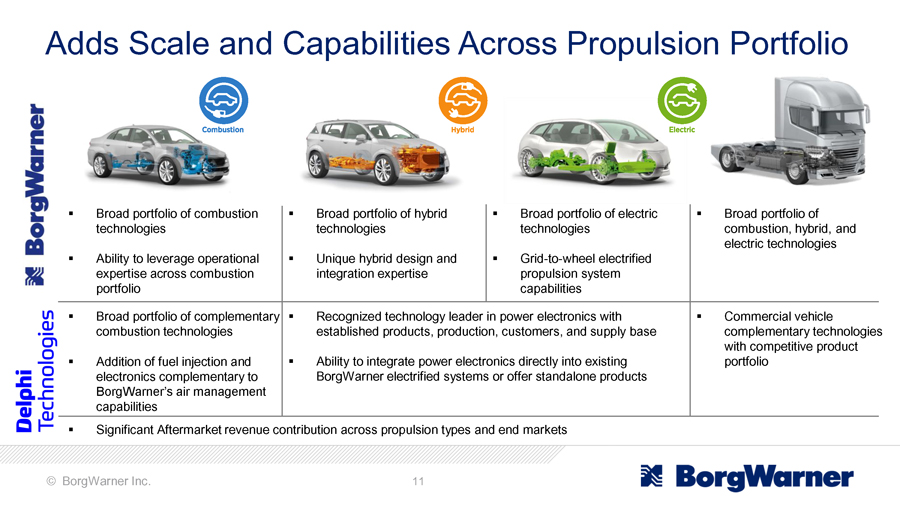

This combination presents an exciting opportunity for our two companies to evolve together to meet our customers’ current and future propulsion technology needs.

I know this will be an unexpected development for many of you, particularly given our recently announced restructuring initiatives.

Delphi Technologies’ Board and Executive Leadership Team considered the offer at great length and from all angles….before deciding that this was the best path forward for the company, our people...and all of our stakeholders.

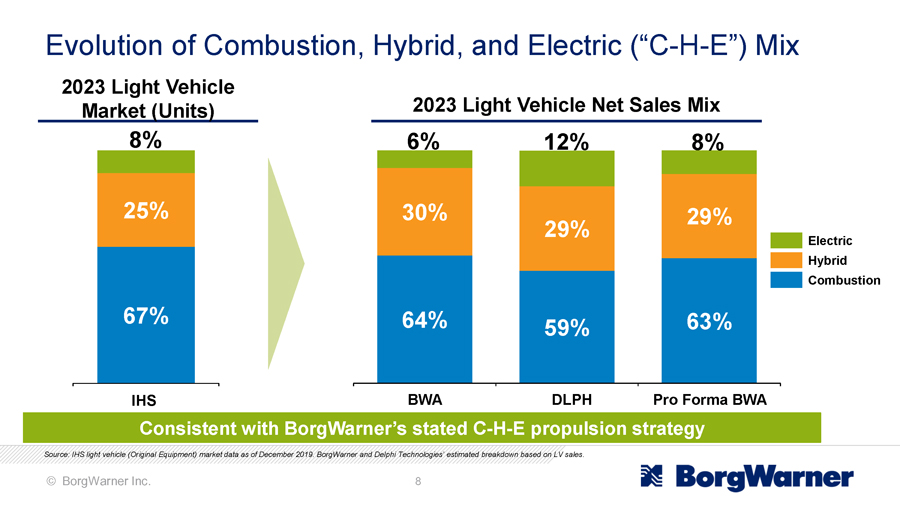

As you look at BorgWarner and Delphi Technologies we share similar visions and common values.

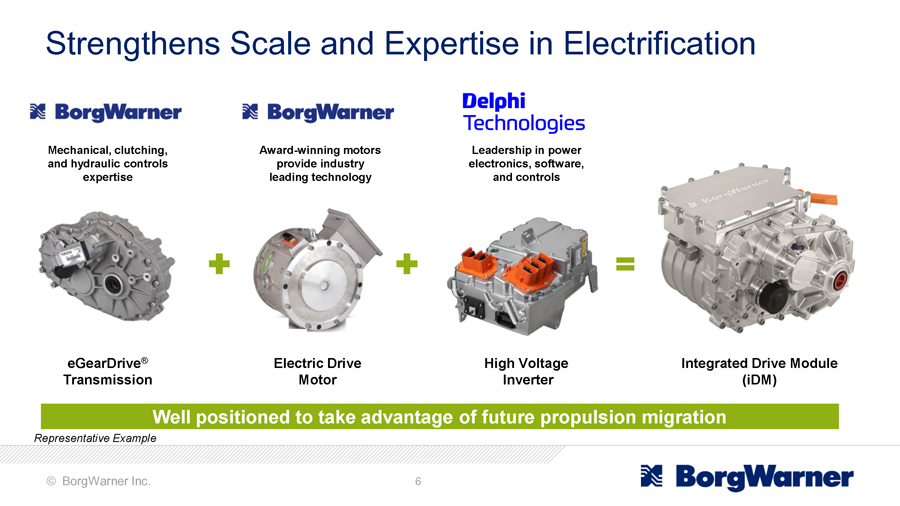

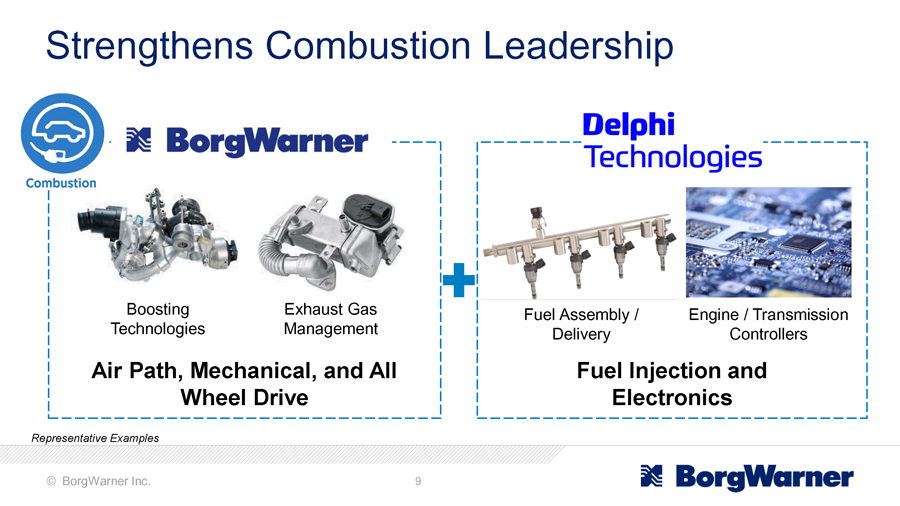

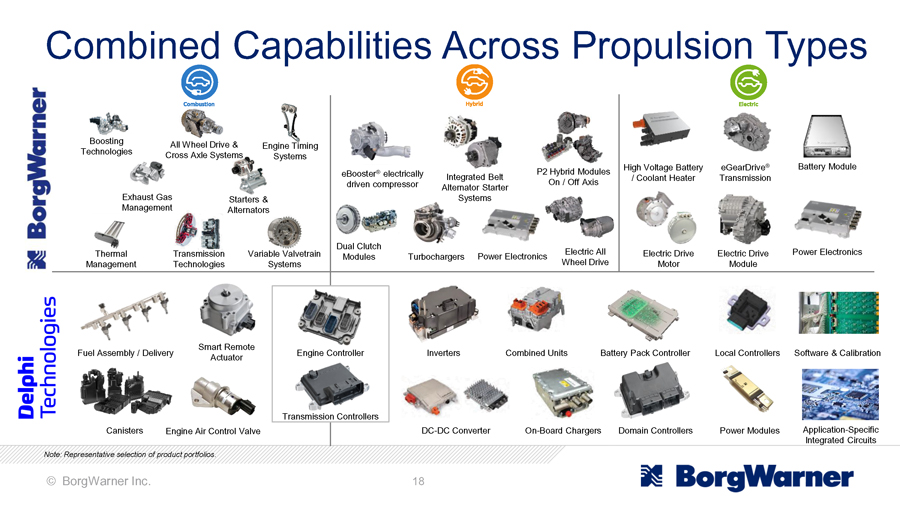

The two companies are also a great strategic fit. Our combined product portfolios fit together like a hand and a glove.

BorgWarner’s leadership team shares our focus on addressing the technological challenges and transitions underway in our industry today.

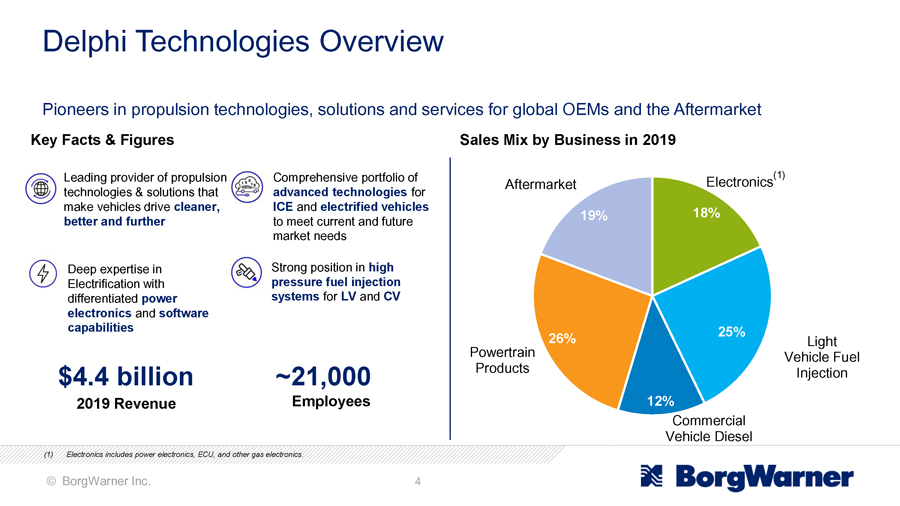

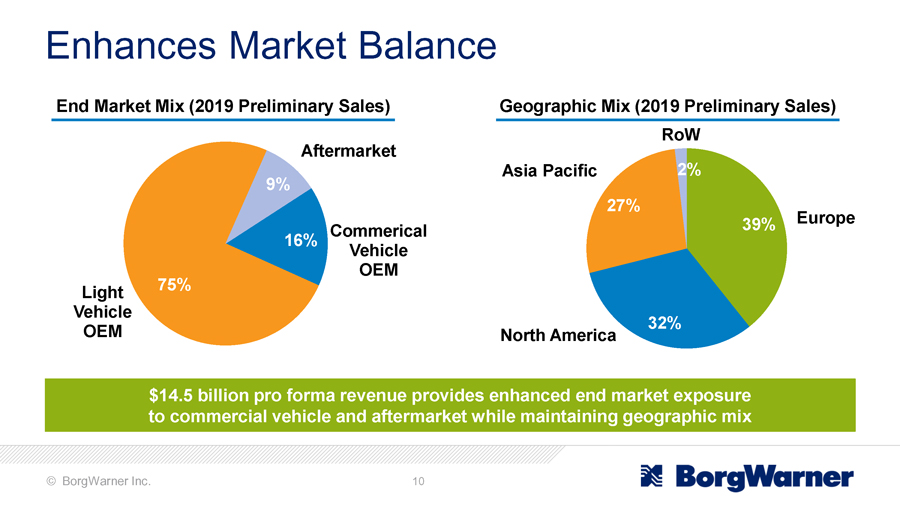

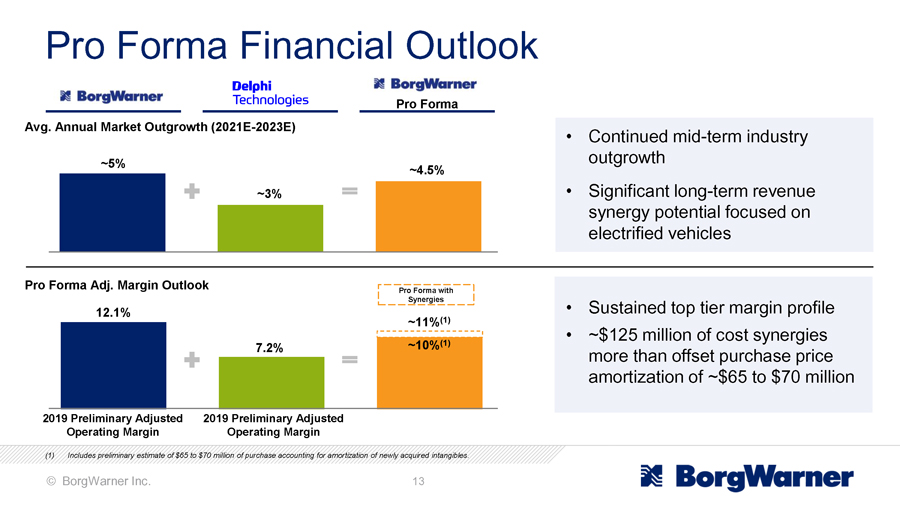

Together we will have greater scale ....the new company will have combined revenues of more than $14bn annually.

The combined company will operate under the name BorgWarner. Together we will be uniquely positioned to serve OEMs and Aftermarket customers around the world… as the demand grows for cleaner and more efficient vehicles. We will be one of the leading pure-play propulsion companies in the automotive industry. For our teams around the world, there will be new and increased opportunities to advance your careers. Other benefits include:

| | • | | Greater revenue balance between light and commercial vehicle segments......and from a customer and regional standpoint. |

| | • | | our Aftermarket business will nearly double in size. |

| | • | | we will have a stronger, investment grade balance sheet ....that can support future investments in our people, new product and process technologies and in our operating sites around the world. |

| | • | | And finally it creates a significant shareholder value both today and in the future. |

So what happens next…?

The transaction is expected to close by the second half of 2020, subject to approval by Delphi Technologies shareholders ....and the completion of various conditions and regulatory approvals.

Tomorrow we will hold a leadership call at 1pm London time to review further details. Over the coming days, ELT members and site managers will also be holding Skype briefings and town halls – please look out for details and contact your manager or ELT member if you do not receive an invitation to one of those meetings.

Questions can also be submitted via a SharePoint site and details on how to do that will also be made available.

In the meantime, we have a business to run….it is very important that we continue to operate safely and deliver on our commitments to our customers and to each other.

So please stay focused on your job and deliver on our operational and financial commitments to the company.

Together, BorgWarner and Delphi Technologies can and will …create a true pioneering propulsion technologies leader in the automotive industry.

Thanks for your continued support and...

Be the Best!

Corrected Transcript

Corrected Transcript