(xxxix) “New Buyer Shares” means the new shares of Buyer Common Stock to be issued and credited as fully paid to Company Shareholders pursuant to the Transaction.

(xl) “Order” means any charge, order, writ, injunction, judgment, decree, ruling, determination, directive, award or settlement, whether civil, criminal or administrative.

(xli) “Release” means any release, spill, emission, discharge, leaking, pumping, injection, deposit, disposal, or leaching of Hazardous Materials into the environment (including ambient air, surface water, groundwater and surface or subsurface strata).

(xlii) “Relevant Authority” means the United States Department of Justice, the U.S. Federal Trade Commission, and any United States, foreign or supranational, federal, state or local governmental commission, board, body, bureau, or other regulatory authority, agency, including courts and other judicial bodies, or any competition, antitrust or supervisory body, central bank or other governmental, trade or regulatory agency or body, securities exchange or any self-regulatory body or authority.

(xliii) “Restructuring Plan” means the current restructuring activities of Company related to the realignment of existing manufacturing capacity and closure of facilities and other exit or disposal activities as detailed inSection 8.16(b) of the Company Disclosure Schedule.

(xliv) “Rights” means rights granted in accordance with a Rights Plan.

(xlv) “Rights Plan” means a shareholder rights plan that could be put in place by Company using the relevant provisions of article 2 of the Company Articles of Association.

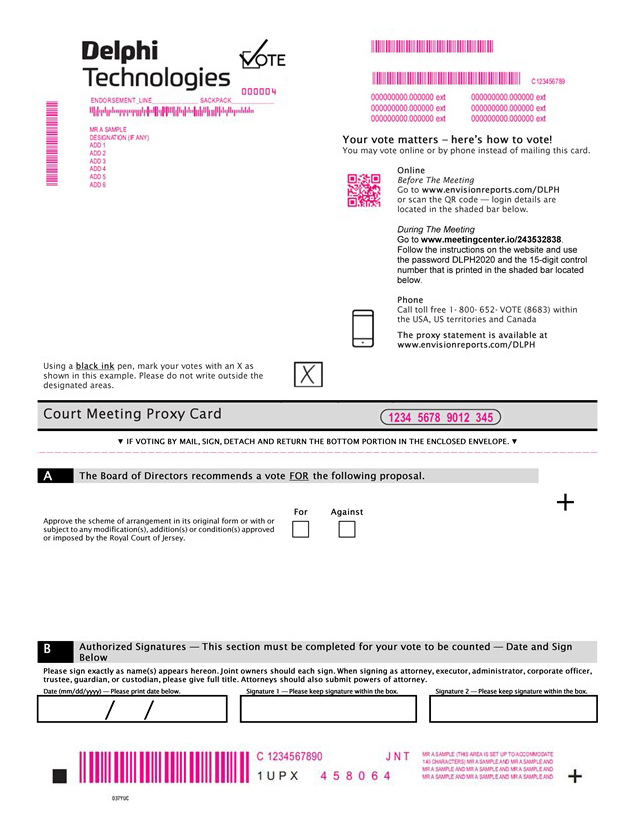

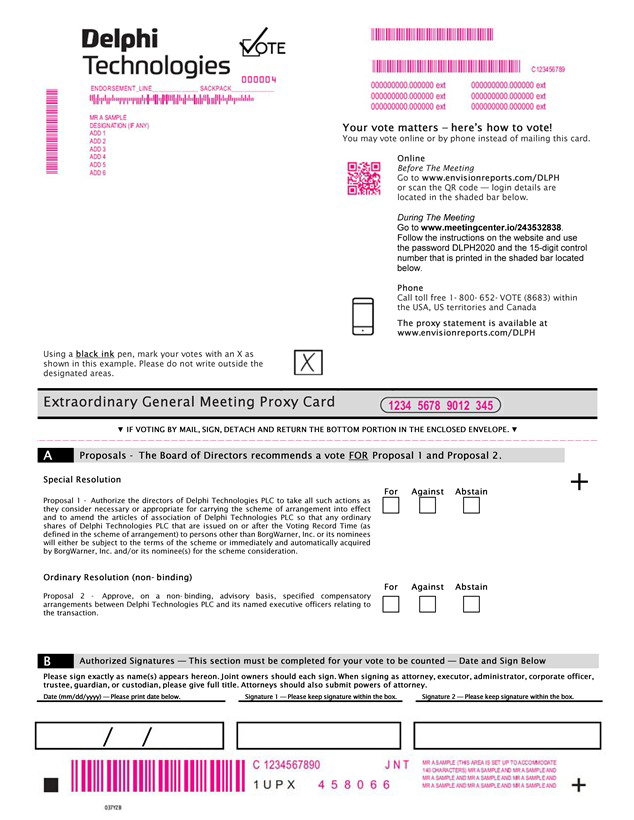

(xlvi) “Scheme Meeting” means such meeting(s) of the Company Shareholders as the Court may direct in relation to the Scheme of Arrangement.

(xlvii) “Scheme of Arrangement” means the proposed scheme of arrangement of Company under Part 18A of the Companies Law to effect the Transaction pursuant to this Agreement, in all material respects in the form set out inAnnex II subject to any amendment thereof that the Parties agree in accordance withSection 5.7(b).

(xlviii) “Spin-Off Date” means December 4, 2017.

(xlix) “Tax” or “Taxes” means any and all federal, state, local or foreign taxes, imposts, levies, duties, fees or other assessments, including all net income, gross receipts, capital, sales, use, ad valorem, value added, transfer, franchise, profits, inventory, capital stock, license, withholding, payroll, employment, social security, unemployment, excise, severance, stamp, occupation, property and estimated taxes, customs duties, and other taxes of any kind whatsoever, including any and all interest, penalties, additions to tax or additional amounts imposed by any Governmental Entity with respect thereto, whether disputed or not.

(l) “Tax Return” means any return, report or similar filing (including any attached schedules, supplements and additional or supporting material) filed or required to be filed with respect to Taxes, including any information return, claim for refund, or declaration of estimated Taxes (and including any amendments with respect thereto).

(li) “Trade Sanctions” means economic or trade sanctions administered by OFAC, the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury, or similar Governmental Entities.

(lii) “Treasury Regulations” means the regulations (including temporary regulations) promulgated by the U.S. Department of Treasury with respect to the Code.

(liii) “Willful Breach” means a breach that is a consequence of an act or omission undertaken by the breaching Party with the knowledge that the taking of, or failure to take, such act would, or would reasonably be expected to, cause or constitute a material breach of this Agreement (and which results in

A-77