equivalents in excess of government provided insurance limits. We also minimize exposure to credit risk by dealing with a diversified group of major financial institutions.

On June 8, 2017, Navios Maritime Containers Inc. closed the initial private placement of 10,057,645 shares at a subscription price of $5.00 per share, resulting in gross proceeds of $50.3 million. Navios Partners invested $30.0 million and received 59.7% of the equity, and Navios Holdings invested $5.0 million and received 9.9% of our equity. Each of Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the equity, respectively.

On August 29, 2017, Navios Maritime Containers Inc. closed a follow-on private placement of 10,000,000 shares at a subscription price of $5.00 per share, resulting in gross proceeds of $50.0 million. Navios Partners invested $10.0 million and received 2,000,000 shares. Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the newly issued equity, respectively.

On November 9, 2017, Navios Maritime Containers Inc. closed a follow-on private placement of 9,090,909 shares at a subscription price of $5.50 per share, resulting in gross proceeds of $50.0 million. Navios Partners invested $10.0 million and received 1,818,182 shares. Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the newly issued equity, respectively.

On March 13, 2018, Navios Maritime Containers Inc. closed a follow-on private placement and issued 5,454,546 shares at a subscription price of $5.50 per share, resulting in gross proceeds of $30.0 million. Navios Partners invested $14.5 million and received 2,629,095 shares and Navios Holdings invested $0.5 million and received 90,909 shares. Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the newly issued equity, respectively, at an exercise price of $5.50 per share.

As of June 30, 2018, Navios Maritime Containers Inc. had a total of 34,603,100 shares of common stock outstanding and a total of 2,941,264 warrants outstanding. Navios Partners holds 12,447,277 common shares representing 36.0% of the equity and Navios Holdings holds 1,090,909 common shares representing 3.2% of our equity. Each of Navios Partners and Navios Holdings also holds warrants, with a five-year term, for 6.8% and 1.7% of our total equity, respectively.

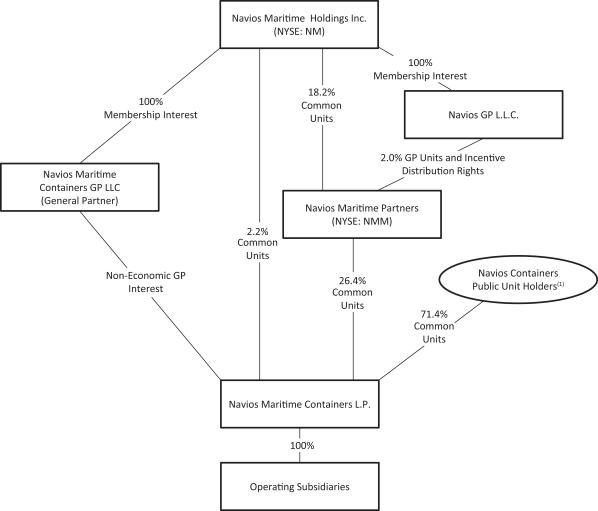

In connection with this offering, Navios Maritime Containers Inc. was converted into a limited partnership named Navios Maritime Containers L.P. Upon such conversion, all of the warrants described above issued to Navios Partners and Navios Holdings expired.

Cash flows for the Six Months Ended June 30, 2018 and for the period from April 28, 2017 (date of inception) to June 30, 2017:

The following table presents cash flow information for the six months ended June 30, 2018 and for the period from April 28, 2017 (date of inception) to June 30, 2017. This information was derived from our unaudited consolidated statement of cash flows for the respective periods.

| | | | | | | | |

| (in thousands of U.S. dollars) | | Six Months Ended

June 30, 2018 | | | Period from

April 28, 2017

(date of inception)

to June 30, 2017 | |

Net cash provided by/(used in) operating activities | | $ | 19,613 | | | $ | (1,491 | ) |

Net cash used in investing activities | | | (63,174 | ) | | | (44,567 | ) |

Net cash provided by financing activities | | | 70,160 | | | | 80,994 | |

Increase in cash and cash equivalents and restricted cash | | $ | 26,599 | | | $ | 34,936 | |

83