As of September 30, 2018 and December 31, 2017, our current liabilities included $47.0 million and $42.5 million, respectively, related to installments due under our credit facilities and the financial liability under the sale and leaseback transactions. In May 2018, we entered into a sale and leaseback transaction for an amount of $119.0 million to refinance our outstanding credit facilities on 18 vessels maturing in the fourth quarter of 2019, with a combined balance of $92.4 million outstanding on March 31, 2018. On June 29, 2018, we completed the sale and leaseback of the first six vessels for approximately $37.5 million and, on July 27, 2018 and August 29, 2018, we completed the sale and leaseback of four additional vessels for approximately $26.0 million. We expect to be in a position to meet our loan obligations in part through our contracted revenue of $135.20 million as of October 31, 2018. Generally, our long-term sources of funds derive from cash from operations, long-term bank borrowings and other debt or equity financings to fund acquisitions and expansion and investment capital expenditures, including opportunities we may pursue under the Omnibus Agreement. We cannot assure you that we will be able to raise the size of our credit facilities or obtaining additional funds on favorable terms.

Cash deposits and cash equivalents in excess of amounts covered by government provided insurance are exposed to loss in the event ofnon-performance by financial institutions. We maintain cash deposits and equivalents in excess of government provided insurance limits. We also minimize exposure to credit risk by dealing with a diversified group of major financial institutions.

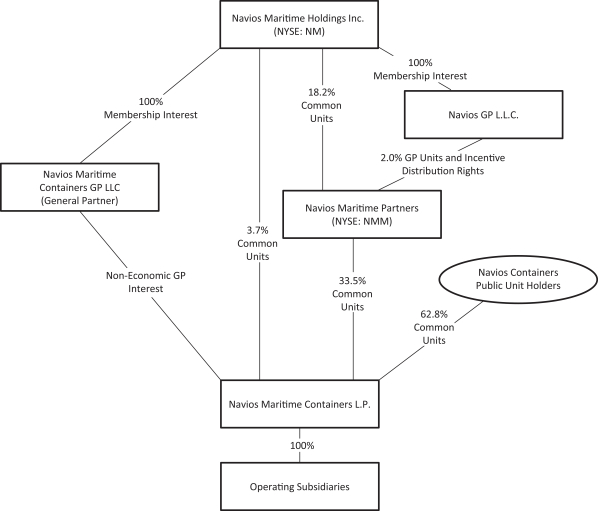

On June 8, 2017, Navios Maritime Containers Inc. closed the initial private placement of 10,057,645 shares at a subscription price of $5.00 per share, resulting in gross proceeds of $50.3 million. Navios Partners invested $30.0 million and received 59.7% of the equity, and Navios Holdings invested $5.0 million and received 9.9% of our equity. Each of Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the equity, respectively.

On August 29, 2017, Navios Maritime Containers Inc. closed afollow-on private placement of 10,000,000 shares at a subscription price of $5.00 per share, resulting in gross proceeds of $50.0 million. Navios Partners invested $10.0 million and received 2,000,000 shares. Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the newly issued equity, respectively.

On November 9, 2017, Navios Maritime Containers Inc. closed afollow-on private placement of 9,090,909 shares at a subscription price of $5.50 per share, resulting in gross proceeds of $50.0 million. Navios Partners invested $10.0 million and received 1,818,182 shares. Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the newly issued equity, respectively.

On March 13, 2018, Navios Maritime Containers Inc. closed a follow-on private placement and issued 5,454,546 shares at a subscription price of $5.50 per share, resulting in gross proceeds of $30.0 million. Navios Partners invested $14.5 million and received 2,629,095 shares and Navios Holdings invested $0.5 million and received 90,909 shares. Navios Partners and Navios Holdings also received warrants, with a five-year term, for 6.8% and 1.7% of the newly issued equity, respectively, at an exercise price of $5.50 per share.

As of September 30, 2018, Navios Maritime Containers Inc. had a total of 34,603,100 common shares outstanding and a total of 2,941,264 warrants outstanding. Navios Partners holds 12,447,277 common shares representing 36.0% of the equity and Navios Holdings holds 1,090,909 common shares representing 3.2% of our equity. Each of Navios Partners and Navios Holdings also holds warrants, with a five-year term, for 6.8% and 1.7% of our total equity, respectively.

After giving effect to the Distribution, Navios Partners will own 11,592,227 common units, or approximately 33.5% of the equity and Navios Holding will hold 1,263,287 common units, or approximately 3.7% of the equity. In addition, prior to the Distribution, Navios Maritime Containers Inc. will convert into a limited partnership named Navios Maritime Containers L.P. Upon such conversion, all of the warrants described above issued to Navios Partners and Navios Holdings will expire.

90