SCHEDULE 14A INFORMATION

(Rule 14a-101) PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ | |

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material under §240.14a-12

Amesite Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

AMESITE INC.

205 EAST WASHINGTON STREET, SUITE B

ANN ARBOR, MI 48104

NOTICE OF 2018 ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

Dear Stockholder:

The annual meeting of stockholders of Amesite Inc. (“Amesite”, “Amesite OpCo”, “the Company”, “we”, “us” and “our”) will be held viaa virtual meeting on Wednesday, December 12, 2018, at 1:00 p.m. Eastern Time (the “Annual Meeting”). You may attend the Annual Meeting, vote and submit a question during the Annual Meeting by visiting www.virtualshareholdermeeting.com/Amesite2018. If you plan to attend the Annual Meeting, please follow the voting and registration instructions as outlined in this Proxy Statement.

The Annual Meeting will be held for the following purposes:

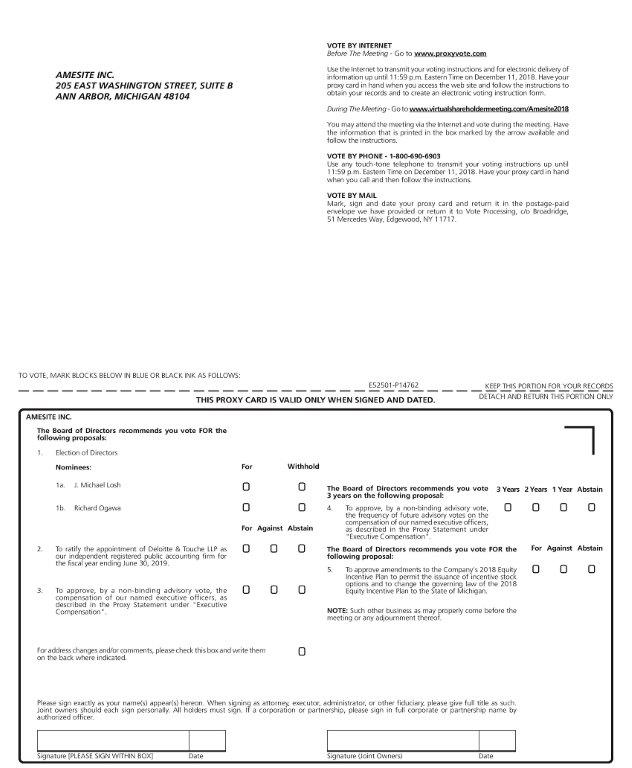

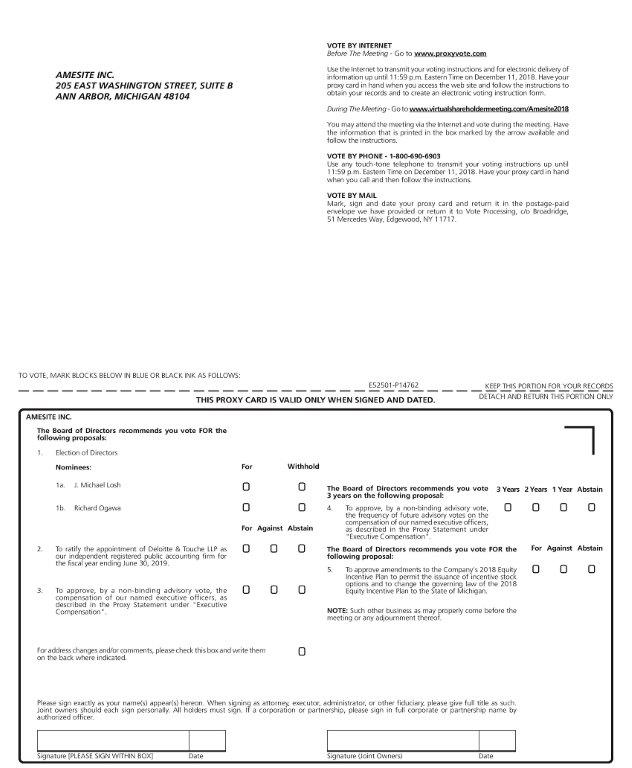

| 1. | To elect two Class I directors for a three-year term to expire at the 2021 annual meeting of stockholders. |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019. |

| 3. | To approve, by a non-binding advisory vote, the compensation of our named executive officers, as described in the Proxy Statement under “Executive Compensation”. |

| 4. | To approve, by a non-binding advisory vote, the frequency of future advisory votes on the compensation of our named executive officers, as described in the Proxy Statement under “Executive Compensation”. |

| 5. | To approve amendments to the Company’s 2018 Equity Incentive Plan to permit the issuance of incentive stock options and to change the governing law of the 2018 Equity Incentive Plan to the State of Michigan. |

| 6. | To transact any other business that may properly come before our annual meeting or any adjournment or postponement thereof. |

Information concerning the matters to be voted upon at the Annual Meeting is set forth in the enclosed Proxy Statement.This Proxy Statement is furnished to holders of our common stock as of the record date as part of the solicitation of proxies by our Board of Directors (the “Board”) in connection with the proposals to be presented at the Annual Meeting. Our Board has set October 19, 2018, as the record date for the Annual Meeting (the “Record Date”). Only holders of our common stock as of the close of business on October 19, 2018, are entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 13,490,586 shares of our common stock outstanding.

All stockholders are cordially invited to attend the annual meeting.Whether or not you expect to attend the annual meeting, please vote by mail, Internet or telephone as described in the enclosed proxy materials.If you plan to attend the annual meeting and wish to vote your shares personally, you may do so at any time before the proxy is voted.

| | By Order of the Board of Directors, |

| | |

| | /s/ ANN MARIE SASTRY, Ph.D. |

| | Ann Marie Sastry |

| | Chief Executive Officer & Chair of the Board |

Ann Arbor, Michigan

November 9, 2018

TABLE OF CONTENTS

205 EAST WASHINGTON STREET, SUITE B

ANN ARBOR, MI 48104

PROXY STATEMENT FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, DECEMBER 12, 2018

The Board of Directors of Amesite Inc. is soliciting the enclosed proxy for use at the Annual Meeting of stockholders to be held on Wednesday, December 12, 2018, at 1:00 p.m., Eastern Time, via avirtual meeting. You may attend the Annual Meeting, vote and submit a question during the Annual Meeting by visiting www.virtualshareholdermeeting.com/Amesite2018. If you plan to attend the Annual Meeting, please follow the voting and registration instructions as outlined in this Proxy Statement.

This Proxy Statement is furnished to holders of our common stock as of the Record Date as part of the solicitation of proxies by our Board in connection with the proposals to be presented at the Annual Meeting. Our Board has set October 19, 2018, as the Record Date. Only holders of our common stock as of the close of business on October 19, 2018, are entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 13,490,586 shares of our common stock outstanding.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

What am I voting on?

There are five proposals scheduled for a vote:

Proposal 1: To elect two Class I directors for a three-year term to expire at the 2021 annual meeting of stockholders:

| | ● | J. Michael Losh; and |

| | | |

| | ● | Richard Ogawa. |

Proposal 2: Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2019.

Proposal 3: To adopt, on an advisory basis, a non-binding resolution approving the compensation of our named executive officers, as described in the Proxy Statement under “Executive Compensation”.

Proposal 4: To adopt, on an advisory basis, on the frequency of the advisory vote to approve the compensation of our named executive officers.

Proposal 5: To approve amendments to our 2018 Equity Incentive Plan to permit the issuance of incentive stock options and to change the governing law of the 201Equity Incentive Plan to the State of Michigan.

Who is entitled to vote at the meeting?

The Board has set October 19, 2018 as the Record Date for the annual meeting. If you were a stockholder of record of our common stock at the close of business on October 19, 2018, you are entitled to vote at the meeting.

How many votes do I have?

Each share of our common stock that you own as of October 19, 2018, entitles you to one vote.

How may I attend the meeting?

The annual meeting will be conducted completely as a virtual meeting via the internet. Stockholders may attend the meeting, vote their shares electronically during the meeting via the live audiocast, and may submit questions in advance of the meeting, by visiting www.proxyvote.com. We believe that holding our meeting completely online will enable greater participation and improved communication. Stockholders will need the digit control number included on their proxy card to enter the meeting and vote their shares at the meeting.

How many shares must be present to hold the meeting?

In accordance with our amended and restated bylaws, shares equal to a majority of all of the shares of the outstanding common stock as of the Record Date must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum. Your shares are counted as present at the meeting if:

| ● | you are present and vote at the meeting; or |

| ● | you have properly submitted a proxy card by mail, telephone or internet. |

Therefore, in order for a quorum to be present, there must be a total of 6,745,294 shares of common stock present or represented by proxy and entitled to vote at the annual meeting on at least one of the proposals.

How do I give a proxy to vote my shares?

If you are a stockholder of record of our common stock as of the Record Date, you can give a proxy to be voted at the meeting in any of the following ways:

| ● | over the telephone by calling a toll-free number; |

| ● | electronically, via the internet; or |

| ● | by completing, signing and mailing the enclosed proxy card. |

The telephone and internet procedures have been set up for your convenience. We encourage you to save corporate expense by submitting your vote by telephone or internet. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. If you are a stockholder of record and you would like to submit your proxy by telephone or internet, please refer to the specific instructions provided on the enclosed proxy card. If you wish to submit your proxy by mail, please return your signed proxy card to our transfer agent before the annual meeting.

If you hold your shares in “street name,” you must vote your shares in the manner prescribed by your broker or other nominee. Your broker or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares, and telephone and internet voting is also encouraged for stockholders who hold their shares in street name.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the method described above.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit your proxy vote by telephone or internet, vote once for each proxy card you receive.

Can I vote my shares at the meeting?

If you are a stockholder of record of our common stock, you may vote your shares at the meeting by going to www.proxyvote.com and using your digit control number included on your proxy card. Even if you currently plan to attend the meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting. If you are a street name holder, you must vote your shares in the manner prescribed by your broker, bank, trust or other nominee.

How can I submit questions for the annual meeting?

You may submit questions prior to the meeting at www.proxyvote.com. Questions pertinent to matters to be acted upon at the annual meeting as well as appropriate questions regarding the business and operations of the company will be answered during the annual meeting, subject to time constraints. In the interests of time and efficiency, we reserve the right to group questions of a similar nature together to facilitate the question and answer portion of the meeting. We may not be able to answer all questions submitted in the allotted time.

What vote is required for a proposal to be approved?

Directors are elected by a plurality of the votes cast. A plurality means that the nominees with the greatest number of votes are elected as directors up to the maximum number of directors to be chosen at the meeting. The advisory vote of the frequency of the say on pay vote is also determined by a plurality of the votes cast. Each other matter that may be acted upon at the meeting will be determined by the affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy at the meeting and entitled to vote on that matter.

How are votes counted?

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the Board of Directors. You may vote “3 YEARS”, “2 YEARS”, “1 YEAR” or “ABSTAIN for the frequency of the advisory vote to approve the compensation of our named executive officers. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the other proposals. If you submit your proxy but abstain from voting or withhold authority to vote on one or more matters, your shares will be counted as present at the meeting for the purpose of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the vote on the particular matter with respect to which you abstained from voting or withheld authority to vote.

If you abstain from voting on a proposal other than the frequency of the advisory vote to approve the compensation of our named executive officers, your abstention has the same effect as a vote against that proposal. Withholding authority to vote for one or more of the directors up for re-election will have no effect on the voting for the election of any director who is among the two nominees receiving the highest number of votes FOR his or her election.

If you hold your shares in street name with a brokerage firm that exercises discretionary proxy authority and do not provide voting instructions to your broker or other nominee, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker or other nominee does not have discretionary authority to vote (a “Non-Discretionary Proposal”). Shares that constitute broker non-votes will be counted as present at the meeting for the purpose of determining a quorum, but will not be considered entitled to vote on any Non-Discretionary Proposal. Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending June 30, 2019 is considered a routine matter on which a broker or other nominee has discretionary authority to vote.

How will the proxies vote on any other business brought up at the meeting?

By submitting your proxy card, you authorize the proxies to use their judgment to determine how to vote on any other matter brought before the meeting. We do not know of any other business to be considered at the meeting.

The proxies’ authority to vote according to their judgment applies only to shares you own as the stockholder of record.

Who will count the vote?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes.

How does the Board of Directors recommend that I vote?

You will vote on the following management proposals:

| 1. | FORthe election of two Class I directors for a three-year term to expire at the 2021 annual meeting of stockholders. |

| 2. | FORthe ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019. |

| 3. | FORthe approval, on an advisory basis, of a non-binding resolution approving the compensation of our named executive officers, as described in the Proxy Statement under “Executive Compensation”. |

| 4. | THREE YEARS for the frequency of future advisory votes on the compensation of our named executive officers, as described in the Proxy Statement under “Executive Compensation”. |

| 5. | FORthe approval of amendments to the 2018 Equity Incentive Plan to permit the issuance of incentive stock options and to change the governing law of the 2018 Equity Incentive Plan to the State of Michigan. |

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the annual meeting. If you are a stockholder of record, you may revoke your proxy and change your vote by submitting a later-dated proxy by telephone, internet or mail, or by voting at the meeting.

To request an additional proxy card, or if you have any questions about the annual meeting or how to vote or revoke your proxy, you should contact:

Broadridge Financial Solutions, Inc.

51 Mercedes Way, Edgewood, New York 11717

Call toll free: (855) 325-6676

Where and when will I be able to find the results of the voting?

Preliminary results will be announced at the meeting. We will publish the final results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission no later than four business days after the date of our annual meeting.

What is the deadline to submit stockholder proposals for the 2019 Annual Meeting?

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), some stockholder proposals may be eligible for inclusion in our 2019 proxy statement. Any such proposal must be submitted in writing to us at 205 East Washington Street, Suite B Ann Arbor, MI 48104. If we change the date of our 2019 annual meeting by more than thirty days from the date of this Annual Meeting, the deadline shall be a reasonable time before we begin to print and send our proxy materials. Stockholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of the applicable securities laws and our amended and restated bylaws. The submission of a stockholder proposal does not guarantee that it will be included in our proxy statement.

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that if you wish to submit a proposal that is not to be included in next year’s proxy statement or nominate a director, a timely written notice of a stockholder proposal must be delivered to, or mailed and received by 205 East Washington Street, Suite B Ann Arbor, MI 48104, no earlier than August 12, 2019 and no later than the close of business on September 14, 2019, which notice must contain the information specified in our amended and restated bylaws. If we change the date of our 2019 Annual Meeting of Stockholders by more than thirty days before, or more than sixty days after, the one-year anniversary of the 2018 Annual Meeting of Stockholders, then the written notice of a stockholder proposal that is not intended to be included in our proxy statement must be delivered, or mailed and received, not later than the ninetieth day prior to our 2019 Annual Meeting of Stockholders or, if later, the tenth day following the day on which certain public disclosure as described in our amended and restated bylaws of the meeting date is made. The public announcement of an adjournment or postponement of the 2019 annual meeting does not commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described in this proxy statement. You are advised to review our amended and restated bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominees.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks or other nominees for forwarding proxy materials to street name holders. We are soliciting proxies primarily by mail. In addition, our directors, officers and regular employees may solicit proxies by telephone, facsimile or personally. These individuals will receive no additional compensation for their services other than their regular salaries and/or director fees.

PROPOSAL 1:

ELECTION OF DIRECTORS

Our amended and restated bylaws currently specify that the number of directors shall be determined from time to time by resolution of our Board of Directors. Our amended and restated certificate of incorporation and our amended and restated bylaws provide for the classification of our Board of Directors into three classes, as nearly equal in number as possible and with staggered terms of office, and provide that upon the expiration of the term of office for a class of directors, nominees for such class shall be elected for a term of three years or until their successors are duly elected and qualified, provided that the term of each director shall continue until the election and qualification of a successor and be subject to such director’s earlier death, resignation or removal. At the Annual Meeting, two nominees for director are to be elected as Class I directors for a three-year term expiring at our 2021 annual meeting of stockholders and until such individual’s successor is elected and qualified. The nominees, who were recommended for nomination by the Board, are J. Michael Losh and Richard Ogawa.The Class II and Class III directors have one year and two years, respectively, remaining on their terms of office.

If no contrary indication is made, proxies in the accompanying form are to be voted for Mr. Losh or Mr. Ogawa or, in the event that any of Mr. Losh or Mr. Ogawa is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our Board of Directors to fill the vacancy. Mr. Losh and Mr. Ogawa are currently members of our Board of Directors.

All of our directors bring to our Board of Directors significant leadership experience derived from their professional experience and service as executives or board members of other companies. The process undertaken by the Board in recommending qualified director candidates is described below under “Director Nominations Process.” Certain individual qualifications and skills of our directors that contribute to the effectiveness of our Board of Directors as a whole are described in the following paragraphs.

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

For a Three-Year Term Expiring at the

2021 Annual Meeting of Stockholders (Class I)

| Name | | Age | | Present Position with Amesite Inc. |

| J. Michael Losh | | 72 | | Director |

| Richard Ogawa | | 55 | | Director |

J. Michael Losh.Mr. Losh is currently a member of the Board of Amesite and was appointed to the Board in April 2018. Mr. Losh served as the Chief Financial Officer at Cardinal Health from July 2004 to May 2005. Mr. Losh was with General Motors from 1964 to 2000. He served as the Chief Financial Officer and Executive Vice President of General Motors Corp., the world's largest vehicle manufacturer, from July 1994 to August 2000. He is the Chairman of the Board of Masco Corp. (2015-present), and Director at Aon PLC (2003-present), HB Fuller Co (2001-present), and Prologis, Inc. (2012-present). Mr. Losh has served as a director of AMB Corp., Cardinal Health Inc., Care Fusion Inc., Electronic Data Systems Corp., Delphi Automotive Systems Corp., Hughes Electronics, Quaker Oats Company, and TRW Automotive Inc. He served as Chairman of the boards of GMAC and Metaldyne Corp. Mr. Losh holds a B.S. in Mechanical Engineering from Kettering University and an M.B.A. from Harvard University. We believe that Mr. Losh’s public company experience qualifies him to serve on our Board.

Richard Ogawa, JD.Mr. Ogawa is currently a member of the Board of Amesite and was appointed to the Board in April 2018. Mr. Richard T. Ogawa has been General Counsel at Inphi Corporation, responsible for overseeing legal matters as well as corporate, intellectual property, and government affairs. Mr. Ogawa is a Registered United States Patent Attorney and a Member of the California State Bar with more than 25 years of experience specializing in technology companies. Prior to Inphi, he was a Partner at Townsend and Townsend, a law firm focused on intellectual property. He is the founder and owner of Ogawa Professional Corporation, his own law firm, focusing on venture backed startup companies. He is General Counsel for Soraa Laser Diode, Inc., a venture funded company by Khosla Ventures, and is General Counsel for MCube, Inc. a venture funded company by Kleiner Perkins Caufield & Byers. He has also held a variety of engineering and management positions at NEC Electronics. He is a Charter Member of the Indus Entrepreneur Group (TIE) and had been a member of the boards of the Asian Law Alliance, American Intellectual Property Law Association, and others. Mr. Ogawa also served as a Partner Member for Technology Group 2800 of the United States Patent and Trademark Office. He received a B.S. in Chemical Engineering from the University of California, Davis in 1984, and a J.D. from McGeorge School of Law, University of Pacific in 1991. We believe that Mr. Ogawa’s experience as an attorney and his patent expertise qualifies him to serve on our Board.

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Term Expiring at the

2019 Annual Meeting of Stockholders (Class II)

| Name | | Age | | Present Position with Amesite Inc. |

| Dr. Ann Maries Sastry | | 51 | | Chairman of the Board and Chief Executive Officer |

Ann Marie Sastry, Ph.D. Dr. Sastry currently serves as the Chairman of the Board of Amesite and was appointed in April 2018. Dr. Sastry is President and Chief Executive Officer of Amesite, since its incorporation in November 2017. From April 2008 to October 2015, Dr. Sastry served as the President, Chief Executive Officer, member of the board of directors and co-founder of Sakti3, recognized as one of the Massachusetts Institute of Technology’s 50 Smartest Companies in 2015 and as a Crain’s Detroit Business Cool Places to Work winner in 2017. Backed by a global team of venture capitalists Sakit3 was sold to Dyson Ltd. in 2015 for $90 million. Dr. Sastry was invited to the White House in 2015 to be recognized for her technology entrepreneurship, and meet with President Barack Obama. Her technology and business work have been featured in the WSJ, Fortune, Forbes, the Economist, USA Today, the New York Times and on the cover of Inc.

Prior to starting her companies, Dr. Sastry was a professor of engineering at the University of Michigan, which is ranked among top 5 public universities in the nation. Dr. Sastry was named an Arthur F. Thurnau Professor (UM’s highest teaching honor) in 2008. Tenured and promoted early, Sastry was recognized with some of the highest honors in her scientific fields over her 17 year academic career, including the ASME Frank Kreith Energy Award (2011) and NSF's Presidential Early Career Award for Scientists and Engineers (1997). She founded two academic research centers in intracellular signaling (Keck Foundation) and advanced automotive batteries (GM / Department of Energy), and a global graduate program in Energy Systems Engineering. She has co-authored over 100 publications and 100 patents and filings, and has delivered over 100 invited lectures and seminars globally on a range of scientific and technology topics, spanning mathematics, physics, bioscience and battery technology. Sastry is active in philanthropy and business mentorship, with a focus on education and poverty alleviation. She holds PhD and MS degrees from Cornell University, and a BS from the University of Delaware, all in mechanical engineering.

We believe that Dr. Sastry’s experience working with successful companies and her experience in education qualifies her to serve on our Board.

Term Expiring at the

2020 Annual Meeting of Stockholders (Class III)

| Name | | Age | | Present Position with Amesite Inc. |

| Dr. Edward H. Frank | | 61 | | Director |

| Anthony M. Barkett | | 52 | | Director |

Edward H. Frank, Ph.D.Dr. Frank is currently a member of the Board of Amesite and was appointed to the Board in April 2018. Dr. Frank is presently co-founder and CEO of Brilliant Lime, Inc., a very early-stage technology development startup. Previously, he was co-founder and CEO of Cloud Parity Inc., a voice-of-the-customer startup in the San Francisco Bay Area, founded in late 2013. From 2009 through 2013, he was Vice President of Macintosh Hardware Systems Engineering at Apple, Inc. where he led the development of four generations of Macintosh laptop and desktop computers. Before joining Apple, he was Corporate Vice President of Research and Development at Broadcom, where he was responsible for Broadcom's overall engineering execution and played a key role in corporate business and IP strategy. Prior to becoming Corporate VP of Research and Development, Dr. Frank co-founded and led the engineering group for Broadcom's Wireless LAN business, which is now one of Broadcom's largest business units. Dr. Frank joined Broadcom in May 1999 following its acquisition of Epigram, Inc., where he was the founding CEO and Executive Vice President. From 1993 to 1996, he was a co-founder and Vice President of Engineering of NeTpower, Inc., a computer workstation manufacturer. From 1988 to 1993, Dr. Frank was a Distinguished Engineer at Sun Microsystems, Inc., where he co-architected several generations of Sun's SPARCstations and was a principal member of Sun's Green Project, which developed the precursor to the Java cross-platform web programming language. Dr. Frank holds over 50 issued patents. He presently serves on the boards of directors of Analog Devices (ADI), Cavium (CAVM), Quantenna (QTNA), and eASIC, and is an advisor to several Bay Area venture capital firms and startups. Dr. Frank holds BSEE and MSEE degrees from Stanford University. He received a Ph.D. in computer science from Carnegie Mellon University, where he was a Hertz Foundation Fellow. In 2018, he was elected to the National Academy of Engineering for his contributions to the development and commercialization of wireless systems. Dr. Frank has been a Trustee of Carnegie Mellon University since 2000 and is currently a Vice-Chairman of its Board of Trustees. Dr. Frank is also the Executive Director (pro bono) of Metallica’s All Within My Hands Foundation, and is the founder and vintner of Compass Vineyards, in Napa California, a boutique producer of 100% estate grown Cabernet Sauvignon. We believe that Dr. Frank’s public company experience qualifies him to serve on our Board.

Anthony Barkett, JD. Mr. Barkett is currently a member of the Board of Amesite and was appointed to the Board in April 2018. Mr. Barkett is a California- based real estate developer. He holds Bachelor of Arts degrees in Economics and Political Science from the University of California at Los Angeles, as well as a Juris Doctor degree from the University of the Pacific McGeorge School of Law. Mr. Barkett practiced law from 94-2003 specializing in land use, affordable housing and government relations. He is currently the managing member of several LLC's which developed and now own and manage commercial real estate in CA, Arizona and Hawaii. He is the managing member of Oliveto, LLC which farms and manages olive and walnut orchards in Linden, CA. He is the CEO of Trinity Solar and managing member of Affordable Energy Partners, LLC which built and still owns and manages solar systems throughout CA. In 2013 he was appointed by Governor Jerry Brown to the California Citizens Compensation Commission, a State commission that sets compensation for the legislature. He is a board member and has been for 17 years of the Downtown Stockton Alliance which is a property owner based 501c 3 organized to promote and restore downtown Stockton, He is a political consultant for Stockton East Water District and has held this position for 20 years. In 2016, He was a co-founder of Ready to Work a 501 c3 corporation formed to help homeless and previously incarcerated men get paid work, job training and permanent housing. We believe that Mr. Barkett’s non-profit experience qualifies him to serve on our Board.

Board Independence

Our securities are not listed on a national securities exchange or on any inter-dealer quotation system, which has a requirement that a majority of directors be independent. We evaluate independence by the standards for director independence set forth in the NASDAQ Marketplace Rules and the rules and regulations of the SEC. Under such rules, our Board has determined that other than Dr. Sastry and Mr. Ogawa, the other members of the Board are independent directors. In making such independence determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. In considering the independence of the directors listed above, our Board considered the association of our directors with the holders of more than 5% of our common stock. We expect to transition the composition and functioning of our Board and each of our committees to comply with all applicable requirements of the NASDAQ Capital Market and the rules and regulations of the SEC within applicable transition periods. There are no family relationships among any of our directors or executive officers.

Board Leadership Structure

Amesite does not have a formal policy regarding the separation of its Chair and Chief Executive Officer (principal executive officer) positions. Our Board is responsible for the control and direction of the Company. The Board represents the Company’s stockholders, and its primary purpose is to build long-term stockholder value. Dr. Sastry serves as Chair of the Board and Chief Executive Officer of the Company. The Board believes that Dr. Sastry is best situated to serve as Chair because she is the director most familiar with the Company’s business and industry and is also the person most capable of effectively identifying strategic priorities and leading the discussion and execution of corporate strategy. In this combined role, Dr. Sastry is able to foster clear accountability and effective decision making. The Board believes that the combined role of Chair and Chief Executive Officer strengthens the communication between the Board and management and provides a clear roadmap for stockholder communications. Further, as the individual with primary responsibility for managing day-to-day operations, Dr. Sastry is best positioned to chair regular Board meetings and ensure that key business issues and risks are brought to the attention of our Board and committees. We therefore believe that the creation of a lead independent director position is not necessary at this time.

The Board’s Role in Risk Oversight

Our Board of Directors is responsible for oversight of risks facing our Company, while our management is responsible for day-to-day management of risk. Our Board of Directors, as a whole, directly administers its risk oversight function. In addition, the risk oversight function is also administered through the standing committees of our Board of Directors, which oversee risks inherent in their respective areas of responsibility, reporting to our Board of Directors regularly and involving the Board as necessary. For example, the Audit Committee oversees our financial exposure and financial reporting related risks, the Compensation and Committee (the “Compensation Committee”) oversees risks related to our compensation programs and practices and our Nomination and Governance Committee (which the entire Board serves) oversees risks related to corporate governance and certain compliance matters. Our Board of Directors, as a whole, directly oversees our strategic and business risk, including financial risk, through regular interactions with our management and, from time to time, input from independent advisors. We believe our leadership structure of our Board of Directors supports its role in risk oversight, with our executive officers responsible for assessing and managing risks facing our Company on a day-to-day basis and the chairman of the Board and other independent members of our Board of Directors providing oversight of such risk management.

Board of Directors Meetings

Our Board of Directors holds regularly scheduled meetings per year and additional special meetings as necessary. Each director is expected to prepare for and attend all regularly scheduled and special meetings of the Board and all committees on which the director sits (including separate meetings of independent directors), unless unusual circumstances make attendance impractical. The Board of Directors may also take action from time to time by written or electronic consent.

For fiscal year 2018, our Board of Directors held 4 meetings; the Audit Committee held 2 meetings; the Compensation Committee held 2 meetings; and the Nominating and Governance Committee held 2 meetings. Each of the directors who served during the past year attended at least 75% of the aggregate of the total number of meetings of our Board of Directors and meetings of committees on which they served.

Standing Committees of the Board of Directors

We have three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The current members of the committees are identified in the following table.

| Director | | Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

| Ann Marie Sastry, Ph.D. | | — | | — | | X |

| J. Michael Losh | | X* | | — | | X |

| Edward Frank, Ph.D. | | X | | X | | X |

| Richard Ogawa | | | | X* | | X |

| Anthony Barkett | | X | | X | | X |

| * | Indicates chair of the committee. |

Audit Committee

The Audit Committee of our Board of Directors currently consists of Mr. Losh, Dr. Frank and Mr. Barkett. Mr. Losh serves as chair of the committee. All members of our Audit Committee meet the requirements for financial literacy under applicable SEC and NASDAQ rules. Our Board of Directors has determined that Mr. Losh qualifies as an “audit committee financial expert” under applicable SEC rules and has the financial sophistication required under applicable NASDAQ rules. Our Board of Directors also determined that all members of the Audit Committee are independent directors under applicable SEC and NASDAQ rules, including Section 10A of the Exchange Act. The Audit Committee operates under a charter. The purpose of the Audit Committee is to oversee our accounting and financial reporting processes and the audits of our financial statements. This committee’s responsibilities include, among other things:

| | ● | appointing our independent registered public accounting firm; |

| | | |

| | ● | reviewing the qualifications, independence and quality control procedures of our independent auditor and the experience and qualifications of the independent auditor’s senior personnel; |

| | | |

| | ● | evaluating the performance of our independent registered public accounting firm; |

| | | |

| | ● | approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

| | | |

| | ● | establishing procedures for the receipt, retention and treatment of complaints we receive regarding accounting, internal accounting controls or auditing matters; |

| | | |

| | ● | discussing with management and the independent registered public accounting firm the results of our annual audit and the review of our quarterly unaudited financial statements; |

| | | |

| | ● | determining, based upon review of the annual audit and review of our annual financial statements, whether to recommend to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year subject to the audit; |

| | | |

| | ● | reviewing, overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| | | |

| | ● | discussing with our internal counsel or outside counsel any legal matters brought to the attention of the Audit Committee that could reasonably be expected to have a material impact of our financial statements; |

| | | |

| | ● | preparing the report with respect to our audited financial statements that the SEC requires for inclusion in each of our annual proxy statements; |

| | | |

| | ● | reviewing and approving any related party transactions on an ongoing basis; |

| | | |

| | ● | reviewing and reassessing, at least annually, our Audit Committee charter and submitting any recommended changes to the Board of Directors for its consideration; and |

| | | |

| | ● | reviewing and evaluating, at least annually, the performance of the Audit Committee and its members including compliance of the audit committee with its charter. |

Report of the Audit Committee of the Board of Directors

This report of the Audit Committee is required by the SEC and, in accordance with the SEC’s rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed “soliciting material” or “filed” under either the Securities Act or the Exchange Act.

Our management is responsible for the preparation, presentation and integrity of our financial statements; for the appropriateness of the accounting principles and reporting policies that we use; and for establishing and maintaining adequate internal control over financial reporting. Deloitte & Touche LLP, our independent registered public accounting firm for 2018, was responsible for performing an independent audit of our financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles.

The Audit Committee reviewed and discussed with management our audited financial statements included in our Transition Report on Form 10-K for the transition period of January 1, 2018 to June 30, 2018, that was filed with the SEC on August 17, 2018 (the “Form 10-K”). The Audit Committee also reviewed and discussed the audited financial statements in the Form 10-K with Deloitte & Touche LLP. In addition, the Audit Committee discussed with Deloitte & Touche LLP those matters required to be discussed by Auditing Standard No. 61, as amended, as adopted by the Public Company Accounting Oversight Board (the “PCAOB”) in Rule 3200T. Additionally, Deloitte & Touche LLP provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the PCAOB regarding Deloitte & Touche LLP’s communications with the Audit Committee concerning independence. The Audit Committee also discussed with Deloitte & Touche LLP its independence from the Company.

In reliance on the reviews and discussions described above, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Form 10-K and filed with the SEC. The Audit Committee and the Company’s Board of Directors have also recommended, subject to stockholder approval, the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2019.

The foregoing report has been furnished by the Audit Committee of our Board of Directors.

Respectfully submitted,

J. Michael Losh, Chair

Edward Frank

Anthony Barkett

Compensation Committee

The Compensation Committee of our Board of Directors currently consists of Mr. Ogawa, Dr. Frank and Mr. Barkett. Mr. Barkett serves as chair of the committee. Our Board of Directors has determined that all members of the Compensation Committee, other than Mr. Ogawa, are independent directors under applicable NASDAQ rules. The purpose of the Compensation Committee is to discharge the responsibilities of our Board of Directors relating to compensation of our executives. Pursuant to the Compensation Committee’s charter, it may delegate any of its responsibilities, along with the authority to take action related to the delegated responsibilities, to a subcommittee consisting of at least one member of the Compensation Committee. However, any delegation by the Compensation Committee may only be to the extent that it is consistent with the Internal Revenue Code, as amended (the “Code”), and with applicable laws, regulations and NASDAQ listing rules. The committee’s responsibilities include, among other things:

| | ● | reviewing, at least annually, the overall compensation strategy, philosophy and practices of the Company; |

| | | |

| | ● | reviewing and approving the corporate goals and objectives relating to the compensation of our chief executive officer, evaluating the performance of the chief executive officer in light of these goals, and determining and approving the compensation of the chief executive officer based on such evaluation; |

| | | |

| | ● | reviewing and approving, at least annually, all elements of compensation of all other officers and directors, and certain other employees; |

| | | |

| | ● | managing, reviewing and approving all annual bonus, long-term incentive compensation, stock option, employee pension, health and welfare benefit plans; |

| | | |

| | ● | determining our policy with respect to change of control and “parachute” payments; |

| | | |

| | ● | reviewing and approving, at least annually, the risk assessment of our compensation policies and practices; |

| | ● | reviewing and reassessing, at least annually, our Compensation Committee charter and submitting any recommended changes to the Board of Directors for its consideration, and |

| | | |

| | ● | evaluating the performance of the Compensation Committee and its members, including the compliance with its charter. |

Nominating and Governance Committee

Due to the size and structure of the Company, we do not have a designated nominating and corporate governance committee. The entire Board is responsible for:

| | ● | identifying individuals qualified to become members of the board of directors; |

| | | |

| | ● | developing criteria for membership on the board of directors and committees; |

| | ● | recommending persons to be nominated for election as directors and to each committee of the board of directors; |

| | ● | annually reviewing our corporate governance guidelines; and |

| | ● | monitoring and evaluating the performance of the board of directors and leading the board in an annual self-assessment of its practices and effectiveness. |

Director Nomination Process

Director Qualifications

Our goal is to assemble a group of directors that collectively provide an appropriate balance of experience, skills and characteristics that enable our Board of Directors to fulfill its responsibilities. In evaluating director nominees, the Nominating and Governance Committee consider, among others, the following factors:

| | ● | fundamental qualities of intelligence, honesty, sound judgment, high ethics and standards of integrity, fairness and responsibility; |

| | | |

| | ● | experience in corporate management, such as serving as an officer or former officer of a publicly held company and a background in the medical device, healthcare, technology and/or manufacturing industries; |

| | | |

| | ● | general understanding of marketing, finance, legal or regulatory compliance knowledge and audit or risk assessment expertise and other elements relevant to the success of a publicly traded company in today’s business environment; |

| | | |

| | ● | familiarity with the Company and its business and products; |

| | | |

| | ● | experience as a board member or executive officer of other companies; and |

| | | |

| | ● | ability to make independent analytical inquiries. |

Other than consideration of the foregoing and other similar factors, there are no stated minimum criteria for director nominees, although the Nominating and Governance Committee may also consider such other factors as it may deem to be in the best interests of our Company and stockholders, including the number of other boards of directors on which an individual serves, the composition of the Board and other skills or experiences. The Nominating and Governance Committee does, however, believe it appropriate for at least one, and preferably, more than one, member of our Board of Directors to meet the criteria for an “audit committee financial expert” under applicable SEC rules, and for a majority of the members of our Board of Directors to be “independent” under applicable NASDAQ rules.

Identification and Evaluation of Nominees for Directors

The Nominating and Governance Committee identifies nominees for director by first evaluating the current members of our Board of Directors willing to continue in service. Current members who possess qualifications and skills that are consistent with the Nominating and Governance Committee’s criteria for service on the Board and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our Board of Directors with that of obtaining a new perspective or expertise. Before nominating a sitting director for reelection, the Nominating and Governance Committee will also consider the director’s performance on, participation in and contributions to the activities of our Board of Directors and the director’s past attendance at meeting.

If any member of our Board of Directors does not wish to continue in service or if our Board of Directors decides not to re-nominate a member for re-election, the Nominating and Governance Committee may identify the desired skills and experience of a new nominee in light of the criteria above. The Nominating and Governance Committee will take into account the advice and recommendations of other members of the Board, the chief executive officer and other members of the Company’s senior leadership team, and, in its discretion, may seek third-party resources to assist in the selection and/or evaluation process. The Nominating and Governance Committee may also review the composition and qualification of the boards of directors of our competitors, and may seek input from industry experts or analysts. The Nominating and Governance Committee reviews the qualifications, diversity of experience and background of the candidates. In making its determinations, the Nominating and Governance Committee evaluates each individual in the context of our Board of Directors as a whole, with the objective of assembling a group that can best position our Company for success and represent stockholder interests through the exercise of sound business judgment. After review and deliberation of all feedback and data, the Nominating and Governance Committee makes its recommendation to our Board of Directors.

The Nominating and Governance Committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees. To date, we have not received director candidate recommendations from our stockholders. In the event that we do receive a director candidate recommendation from a stockholder, the Nominating and Governance Committee will conduct an initial evaluation of the proposed nominee and, if it determines the proposed nominee may be a qualified candidate, it will, along with one or more members of the Company’s management team, interview the proposed nominee to determine whether he or she might be suitable to serve as a director. If, based on the criteria set forth above and the Board’s specific needs at such time, the Nominating and Governance Committee determines the proposed nominee would be a valuable addition to our Board of Directors, it will recommend to our Board of Directors such proposed nominee’s nomination. We do not intend to treat stockholder recommendations in any manner different from other recommendations.

Stockholders wishing to suggest a candidate for director should write to us and provide such information about the stockholder and the proposed candidate as is set forth in our amended and restated bylaws and as would be required by SEC rules to be included in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination.

Compensation Committee Interlocks and Insider Participation

For the transition period ended June 30, 2018, none of the members of our Compensation Committee has at any time been an officer or employee of the Company. None of the members of our Compensation Committee has had any relationship with us of the type that is required to be disclosed as a related party transaction under Item 404 of Regulation S-K, except as otherwise disclosed in this Proxy Statement. In addition, none of our executive officers serves or has served as a member of the Board of Directors, Compensation Committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Merger

On April 27, 2018, Lola One, Lola One Acquisition Sub, Inc., and Amesite OpCo entered into a Merger Agreement (“Merger Agreement”). Pursuant to the terms of the Merger Agreement, on April 27, 2018, Lola One Acquisition Sub, Inc. merged with and into Amesite OpCo, which was the surviving corporation and thus became our wholly-owned subsidiary. At the effective time of the Merger, all of the issued and outstanding shares of Amesite OpCo’s Class B common stock were converted into shares of our common stock. As a result, an aggregate of 5,833,333 shares of our common stock were issued to the holders of Amesite OpCo’s capital stock after adjustments due to rounding for fractional shares.

Following the consummation of the Merger, Amesite OpCo changed its name to “Amesite Operating Company” and we adopted Amesite OpCo’s former company name, “Amesite Inc.”, as our company name.

Director Compensation

On March 28, 2018, Amesite OpCo granted (i) 50,000 options (which were converted into 72,917 options of Amesite following the consummation of the Merger) to Anthony Barkett, (ii) 50,000 options (which were converted into 72,917 options of Amesite following the consummation of the Merger) to Edward Frank, (iii) 75,000 options (which were converted into109,375 options of Amesite following the consummation of the Merger) to Michael Losh, and (iv) 75,000 options (which were converted into 109,375 options of Amesite following the consummation of the Merger) to Richard Ogawa. 50% of the options vest one year from the date of grant with the remainder vesting at a rate of 1/24 each month thereafter. These options were automatically converted into options of Amesite Inc. at the closing of the Merger. We have entered into a board service agreement with each of its non-employee directors regarding director compensation and covering reimbursement of expenses incurred by such directors in attending meetings of our board of directors and committees thereof, and in carrying out such director’s duties as a director or as a member of any committee of its board of directors. These agreements, which may be amended from time to time, will remain in place.

Employment and Change in Control Arrangements

We generally execute an offer of employment or employment agreement before an executive joins the company. This offer describes the basic terms of the executive’s employment, including his or her start date, starting salary, bonus target and any equity awards.

Executive Compensation

Ann Marie Sastry, Chief Executive Officer

Dr. Sastry’s base salary is reviewed periodically by our Board and adjustments may be made upon the recommendations of the Compensation Committee. Before the effective date of the Merger, our Board appointed her as our Chief Executive Officer and set her annual base salary at $350,000. She is eligible to receive a bonus up to 60% of her annual base salary for achievement of mutually agreed upon milestones approved by our Board.

Base salaries for our named executive officers other than our Chief Executive Officer are reviewed annually in connection with their performance reviews.

Benjamin Williams, Chief Financial Officer

In connection with the appointment of Mr. Williams as Chief Financial Officer, the Company and Mr. Williams entered into a consulting agreement, effective August 20, 2018 (the “Consulting Agreement”), pursuant to which Mr. Williams will receive a flat rate of $5,000 per month for his services. Under the terms of the Consulting Agreement, the Company will engage Mr. Williams as an independent contractor to perform certain services, including but not limited to, serving as the Company’s Chief Financial Officer and performing services normally provided by a chief financial officer. The engagement of Mr. Williams pursuant to the Consulting Agreement will continue until the earlier of (i) the final completion of his Services (as such term is defined in the Consulting Agreement), or (ii) the termination of the Consulting Agreement as provided in the Consulting Agreement. Each party to the Consulting Agreement may terminate such agreement upon providing 21 days’ prior written notice of such termination to the other party. In addition, the Company may terminate the Consulting Agreement immediately and without prior notice under certain circumstances.

Outstanding Equity Awards at June 30, 2018

There were no outstanding equity awards issued to our principal executive officer or next two highest paid executive officers at June 30, 2018.

Equity Incentive Plans

The following summary provides more detailed information concerning our equity compensation plan. This summary is qualified in its entirety by the full text of the compensation plan and related form of award agreement, each of which has been filed as an exhibit to this prospectus.

2017 Equity Incentive Plan

On November 14, 2017 and November 15, 2017, respectively, the Amesite OpCo board of directors adopted and its stockholders approved the Amesite Inc. 2017 Equity Incentive Plan, or the 2017 Plan. The material terms of the 2017 Plan are as follows:

Eligible participants. All officers, directors, employees, consultants, agents and independent contractors, and persons expected to become officers, directors, employees, consultants, agents and independent contractors of our Company or any of our subsidiaries are eligible to receive awards under the 2017 Plan.

Shares authorized. The maximum plan pool size is 1,000,000 shares of Amesite OpCo’s common stock.

Award Types. Awards include options, stock appreciation rights, restricted stock, or restricted stock units.

2018 Equity Incentive Plan

On April 26, 2018, the Board adopted and the Company’s stockholders approved the Amesite, Inc. 2018 Equity Incentive Plan, or the 2018 Plan. The 2018 Plan is intended to align the interests of our stockholders and the recipients of awards under the 2018 Plan, and to advance our interests by attracting and retaining directors, officers, employees and other service providers and motivating them to act in our long-term best interests. The material terms of the 2018 Plan are as follows:

Plan term. The 2018 Plan became effective on July 23, 2018 and terminates on the tenth anniversary of its effective date, unless terminated earlier by our Board.

Eligible participants. All officers, directors, employees, consultants, agents and independent contractors, and persons expected to become officers, directors, employees, consultants, agents and independent contractors of our Company or any of our subsidiaries are eligible to receive awards under the 2018 Plan. The Compensation Committee of our board will determine the participants under the 2018 Plan.

Shares authorized. 2,529,000 shares of common stock will be available for awards granted under the 2018 Plan, inclusive of 1,288,195 shares subject to options originally granted under the 2017 Plan and assumed in connection with the Merger, subject to adjustment for stock splits and other similar changes in capitalization. The number of available shares will be reduced by the aggregate number of shares that become subject to outstanding awards granted under the 2018 Plan. As of the first day of each calendar year beginning on or after January 1, 2021, the number of shares available for all awards under the 2018 Plan, other than incentive stock options, will automatically increase by a number equal to the least of (i) five percent (5%) of the number of shares of the Company’s common stock that are issued and outstanding as of that date, or (ii) a lesser number of shares of the Company’s common stock as determined by the Compensation Committee. To the extent that shares of common stock subject to an outstanding award granted under the 2018 Plan are not issued or delivered by reason of the expiration, termination, cancellation or forfeiture of such award or by reason of the settlement of an award in cash, then those shares of common stock will again be available under the 2018 Plan. In addition, any shares covered by an award that have been surrendered in connection with the payment of the award exercise or purchase price or in satisfaction of tax withholding obligations incident to the grant, exercise, vesting or settlement of an award will be deemed not to have been issued for purposes of determining the maximum number of shares of common stock which may be issued pursuant to all awards under the 2018 Plan.

Award types. Awards include non-qualified and incentive stock options, stock appreciation rights, bonus shares, restricted stock, restricted stock units, performance units and cash-based awards.

Administration. The Compensation Committee will interpret and administer the 2018 Plan. The Compensation Committee’s interpretation, construction and administration of the 2018 Plan and all of its determinations thereunder will be conclusive and binding on all persons.

The Compensation Committee shall have the authority to determine the participants in the 2018 Plan, the form, amount and timing of any awards, the performance goals, if any, and all other terms and conditions pertaining to any award. The Compensation Committee may take any action such that (i) any outstanding options and stock appreciation rights become exercisable in part or in full, (ii) all or any portion of a restriction period on any restricted stock or restricted stock units will lapse, (iii) all or a portion of any performance period applicable to any performance-based award will lapse, and (iv) any performance measures applicable to any outstanding award will be deemed satisfied at the target level or any other level. Subject to the terms of the 2018 Plan relating to grants to our executive officers and directors, the Compensation Committee may delegate some or all of its powers and authority to the Chief Executive Officer and President or other executive officer as the Compensation Committee deems appropriate.

Stock options and stock appreciation rights. The 2018 Plan provides for the grant of stock options and stock appreciation rights. Stock options may be either tax-qualified incentive stock options or non-qualified stock options. The Compensation Committee will determine the terms and conditions to the exercisability of each option and stock appreciation right.

The period for the exercise of a non-qualified stock option or stock appreciation right will be determined by the Compensation Committee provided that no option may be exercised later than ten years after its date of grant. The exercise price of a non-qualified stock option and the base price of a stock appreciation right will not be less than 100% of the fair market value of a share of our common stock on the date of grant, provided that the base price of a stock appreciation right granted in tandem with an option will be the exercise price of the related option. A stock appreciation right entitles the holder to receive upon exercise, subject to tax withholding in respect of an employee, shares of our common stock, which may be restricted stock, with a value equal to the difference between the fair market value of our common stock on the exercise date and the base price of the stock appreciation right.

Each incentive stock option will be exercisable for not more than 10 years after its date of grant, unless the optionee owns greater than 10% of the voting power of all shares of our capital stock, or a “ten percent holder”, in which case the option will be exercisable for not more than five years after its date of grant. The exercise price of an incentive stock option will not be less than the fair market value of a share of our common stock on its date of grant, unless the optionee is a ten percent holder, in which case the option exercise price will be the price required by the Code, currently 110% of fair market value.

Upon exercise, the option exercise price may be paid in cash, by the delivery of previously owned shares of our common stock, share withholding or through a cashless exercise arrangement, as permitted by the applicable award agreement. All of the terms relating to the exercise, cancellation or other disposition of an option or stock appreciation right upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Compensation Committee.

The Compensation Committee, without stockholder approval, may (i) reduce the exercise price of any previously granted option or the base appreciation amount of any previously granted stock appreciation right, or (ii) cancel any previously granted option or stock appreciation right at a time when its exercise price or base appreciation amount (as applicable) exceeds the fair market value of the underlying shares, in exchange for another option, stock appreciation right or other award or for cash.

Stock awards. The 2018 Plan provides for the grant of stock awards. The Compensation Committee may grant a stock award as a bonus stock award, a restricted stock award or a restricted stock unit award and, in the case of a restricted stock award or restricted stock unit award, the Compensation Committee may determine that such award will be subject to the attainment of performance measures over an established performance period. All of the terms relating to the satisfaction of performance measures and the termination of a restriction period, or the forfeiture and cancellation of a stock award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Compensation Committee.

The agreement awarding restricted stock units will specify whether such award may be settled in shares of our common stock, cash or a combination thereof and whether the holder will be entitled to receive dividend equivalents, on a current or deferred basis, with respect to such award. Prior to settlement of a restricted stock unit in shares of our common stock, the holder of a restricted stock unit will have no rights as our stockholder.

Unless otherwise set forth in a restricted stock award agreement, the holder of shares of restricted stock will have rights as our stockholder, including the right to vote and receive dividends with respect to the shares of restricted stock, except that distributions other than regular cash dividends and regular cash dividends with respect to shares of restricted stock subject to performance-based vesting conditions will be held by us and will be subject to the same restrictions as the restricted stock.

Performance unit awards. The 2018 Plan provides for the grant of performance unit awards. Each performance unit is a right, contingent upon the attainment of performance measures within a specified performance period, to receive a specified cash amount, shares of our common stock or a combination thereof which may be restricted stock, having a fair market value equal to such cash amount. Prior to the settlement of a performance unit award in shares of our common stock, the holder of such award will have no rights as our stockholder with respect to such shares. Performance units will be non-transferable and subject to forfeiture if the specified performance measures are not attained during the specified performance period. All of the terms relating to the satisfaction of performance measures and the termination of a performance period, or the forfeiture and cancellation of a performance unit award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Compensation Committee.

Cash-based awards. The 2018 Plan also provides for the grant of cash-based awards. Each cash-based award is an award denominated in cash that may be settled in cash and/or shares, which may be subject to restrictions, as established by the Compensation Committee.

Performance goals. Under the 2018 Plan, the vesting or payment of performance-based awards will be subject to the satisfaction of certain performance goals. The performance goals applicable to a particular award will be determined by the Compensation Committee at the time of grant. The performance goals may be one or more of the following corporate-wide or subsidiary, division, operating unit or individual measures, stated in either absolute terms or relative terms.

Individual Limits.

With respect to non-employee directors, the maximum grant date fair value of shares that may be granted to an individual non-employee director during any fiscal year of the Company is $150,000. In connection with a non-employee director’s commencement of service with the Company, the per person limit set forth in the previous sentence will be $150,000.

Amendment or termination of the 2018 Plan. The board may amend or terminate the 2018 Plan as it deems advisable, subject to any requirement of stockholder approval required by law, rule or regulation.

Change of control. In the event of a change of control, our Board may, in its discretion, (1) provide that (A) some or all outstanding options and stock appreciation rights will immediately become exercisable in full or in part, (B) the restriction period applicable to some or all outstanding stock awards will lapse in full or in part, (C) the performance period applicable to some or all outstanding awards will lapse in full or in part, and (D) the performance measures applicable to some or all outstanding awards will be deemed to be satisfied at the target or any other level, (2) provide that some or all outstanding awards will terminate without consideration as of the date of the change of control, (3) require that shares of stock of the corporation resulting from such change of control, or a parent corporation thereof, be substituted for some or all of our shares subject to an outstanding award, and/or (4) require outstanding awards, in whole or in part, to be surrendered by the holder, and to be immediately canceled, and to provide for the holder to receive (A) a cash payment in an amount equal to (i) in the case of an option or stock appreciation right, the number of our shares then subject to the portion of such option or stock appreciation right surrendered, whether vested or unvested, multiplied by the excess, if any, of the fair market value of a share of our common stock as of the date of the change of control, over the purchase price or base price per share of our common stock subject to such option or stock appreciation right, (ii) in the case of a stock award, the number of shares of our common stock then subject to the portion of such award surrendered, whether vested or unvested, multiplied by the fair market value of a share of our common stock as of the date of the change of control, and (iii) in the case of a performance unit award, the value of the performance units then subject to the portion of such award surrendered; (B) shares of capital stock of the corporation resulting from such change of control, or a parent corporation thereof, having a fair market value not less than the amount determined under clause (A) above; or (C) a combination of the payment of cash pursuant to clause (A) above and the issuance of shares pursuant to clause (B) above.

Under the 2018 Plan, a change of control will occur upon: (i) a person’s or entity’s acquisition, other than from us, of beneficial ownership of 50% or more of either our then outstanding shares or the combined voting power of our then outstanding voting securities, but excluding certain acquisitions by the company, its subsidiaries or employee benefit plans, or by a corporation in which our stockholders hold a majority interest; (ii) a reorganization, merger or consolidation of the company if our stockholders do not thereafter beneficially own more than 50% of the outstanding shares or combined voting power of the resulting company, (iii) certain changes to the incumbent directors of our Company, or (iv) a complete liquidation or dissolution of the company or of the sale or other disposition of all or substantially all of our assets; but excluding, in any case, the initial public offering or any bona fide primary or secondary public offering following the occurrence of the initial public offering.

New plan benefits. The benefits that might be received by officers, employees and non-employee directors cannot be determined at this time. All officers, employees and non-employee directors are eligible for consideration to participate in the 2018 Plan.

Equity Compensation Plan Information

The following table summarizes securities available under our equity compensation plans as of June 30, 2018.

| | | | | | | | | Number of | |

| | | | | | | | | securities | |

| | | | | | | | | available for | |

| | | Number of | | | | | | future | |

| | | securities | | | Weighted | | | issuance | |

| | | to be issued | | | average | | | under equity | |

| | | upon | | | exercise | | | compensation | |

| | | exercise of | | | price of | | | plans | |

| | | outstanding | | | outstanding | | | (excluding | |

| | | options, | | | options, | | | securities | |

| | | warrants | | | warrants | | | reflected in | |

| | | and rights | | | and rights | | | column (a)) | |

Equity compensation plans approved by security holders: | | | | | | | | | |

| 2018 Plan(1) | | | 947,917 | | | $ | 1.50 | | | | 1,581,083 | |

| Equity compensation plans not approved by security holders: | | | | | | | | | | | | |

| — | | | — | | | $ | — | | | | — | |

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our Board of Directors at the Annual Meeting, we encourage all of our directors to attend.

Communications with our Board of Directors

Our stockholders wishing to address questions regarding the business affairs of the Company directly to our Board of Directors, or any individual director, should submit the inquiry in writing to:

Amesite Inc.

Attn: Chair of the Board

205 East Washington Street, Suite B

Ann Arbor, Michigan 48104

Stockholders should indicate that they are a stockholder of the Company. Depending on the subject matter, investor relations will (alone or in concert with other personnel of the Company, as appropriate): (1) forward the inquiry to the chair of our Board of Directors or the lead independent director, as appropriate, who may forward the inquiry to a particular director if the inquiry is directed towards a particular director; (2) forward the inquiry to the appropriate personnel within the Company; for instance, if it is primarily commercial in nature; (3) attempt to handle the inquiry directly; for instance, if it is a request for information about the Company or a stock-related matter; or (4) not forward the inquiry, if it relates to an improper or inappropriate topic or is otherwise irrelevant.

Vote Required; Recommendation of the Board of Directors

If a quorum is present at the Annual Meeting, the two nominees receiving the highest number of votes will each be elected to our Board of Directors. Votes withheld from any nominee, abstentions and broker non-votes will be counted only for purposes of determining a quorum. Broker non-votes will have no effect on this proposal as brokers or other nominees are not entitled to vote on such proposal in the absence of voting instructions from the beneficial owner.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information relating to the beneficial ownership of our common stock as of October 29, 2018, by:

| | ● | each person, or group of affiliated persons, known by us to beneficially own more than five percent of the outstanding shares of our common stock; |

| | ● | each of our named executive officers; and |

| | ● | all directors and executive officers as a group. |