Filed Pursuant to Rule 424(b)(5)

Registration No. 333-206535

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 21, 2017)

$125,000,000

Bristow Group Inc.

4.50% Convertible Senior Notes Due 2023

We are offering $125,000,000 aggregate principal amount of our 4.50% Convertible Senior Notes due 2023, or the “notes.” The notes will bear interest at a rate of 4.50% per year. Interest on the notes will be payable semi-annually in arrears on June 1 and December 1 of each year, beginning June 1, 2018. The notes will mature on June 1, 2023.

Holders may convert their notes into shares of our common stock, at their option, prior to the close of business on the second scheduled trading day immediately preceding December 1, 2022 only under the following circumstances: (1) during any fiscal quarter commencing after January 1, 2018, if the last reported sale price of our common stock for at least 20 trading days in the period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than 130% of the conversion price of the notes on such trading day; (2) during the fivebusiness-day period after any fivetrading-day period in which the trading price per $1,000 principal amount of notes for each trading day of such period was less than 98% of the product of the last reported sale price of our common stock for such trading day and the conversion rate; or (3) upon the occurrence of specified corporate events. On or after December 1, 2022 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their notes without regard to the foregoing circumstances. Upon conversion, we will pay or deliver, as the case may be, cash, shares of our common stock or a combination of cash and shares of our common stock, at our election, as described in this prospectus supplement.

The initial conversion rate for the notes will be 63.9488 shares of our common stock per $1,000 principal amount of notes, equivalent to an initial conversion price of approximately $15.64 per share of our common stock. The conversion rate will be subject to adjustment in certain events.

Following certain transactions, we will increase the conversion rate for a holder who elects to convert its notes in connection with those corporate transactions by a number of additional shares of common stock as described in this prospectus supplement.

If we undergo a fundamental change, as defined in this prospectus supplement, holders may require us to purchase all or a portion of their notes for cash at a price equal to 100% of the principal amount of the notes to be purchased plus accrued and unpaid interest.

The notes will be unsecured senior obligations, will rank equal in right of payment to any of our existing or future unsecured senior debt, and will rank senior to all of our subordinated debt. The notes will be unconditionally guaranteed on a senior basis by those of our subsidiaries that currently provide guarantees of our existing senior notes or our amended and restated revolving credit facility and term loan, as well as certain future subsidiaries. The notes will effectively rank junior to any of our secured debt to the extent of the value of the assets securing such indebtedness, and will be structurally subordinated to all debt and other liabilities of our subsidiaries that are not guarantors.

For a more detailed description of the notes, see “Description of the Notes” beginning on pageS-37.

Our common stock is listed on the New York Stock Exchange under the symbol “BRS.” On December 13, 2017, the last reported sale price of our common stock on the New York Stock Exchange was $12.51 per share.

We do not intend to apply for listing of the notes on any securities exchange or for inclusion of the notes in any automated quotation system.

Investing in the notes involves risks. See “Risk Factors” beginning on pageS-15 of this prospectus supplement.

| | | | | | |

| | | Price to Public(1) | | Underwriting Discounts and Commissions(2) | | Proceeds to Bristow Group |

Per Note | | 100.00% | | 2.25% | | 97.75% |

Total | | $125,000,000 | | $2,812,500 | | $122,187,500 |

| (1) | Plus accrued interest, if any, from December 18, 2017, if settlement occurs after that date. |

| (2) | See “Underwriting” on page S-74 of this prospectus supplement for a description of the compensation payable to the underwriters. |

The underwriters have the option to purchase within the13-day period beginning on, and including, the initial issue date of the notes a maximum of $18,750,000 additional principal amount of the notes to cover over-allotments.

Delivery of the notes will be made in book-entry form on or about December 18, 2017.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| | | | |

| Credit Suisse | | Barclays | | BofA Merrill Lynch |

Senior Co-Managers

| | | | |

| Citigroup | | J.P. Morgan | | SunTrust Robinson Humphrey |

The date of this prospectus supplement is December 13, 2017.

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained or incorporated by reference in this prospectus supplement or the accompanying prospectus or in any free writing prospectus made available by us. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters are making an offer to sell these notes or the guarantees in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on the front of this document or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since these dates.

We provide information to you about this offering of our notes in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering, and (2) the accompanying prospectus, which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

You should carefully read this prospectus supplement and the accompanying prospectus, including the information incorporated by reference in the prospectus, before you invest. These documents contain information you should consider when making your investment decision.

S-i

SUMMARY

This summary highlights certain information included or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information you should consider before deciding whether to participate in this offering. You should carefully read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference in their entirety, including “Risk Factors,” before deciding whether to participate in this offering. We use the pronouns “we,” “our” and “us” and the terms “Bristow Group” and the “company” to refer collectively to Bristow Group Inc. and its consolidated subsidiaries and affiliates, unless the context indicates otherwise. We also own interests in other entities that we do not consolidate for financial reporting purposes, which we refer to as unconsolidated affiliates, unless the context indicates otherwise. Bristow Group, its consolidated subsidiaries and affiliates and the unconsolidated affiliates are each separate corporations, limited liability companies or other legal entities, and our use of the terms “we,” “our” and “us” does not suggest that we have abandoned their separate identities or the legal protections given to them as separate legal entities. Our fiscal year ends March 31, and we refer to fiscal years based on the end of such period. Therefore, the fiscal year ended March 31, 2017 is referred to as “fiscal year 2017.”

Our Company

Overview

We are the leading global industrial aviation services provider based on the number of aircraft operated. We have a long history in industrial aviation services through Bristow Helicopters Ltd. (“Bristow Helicopters”) and Offshore Logistics, Inc., which were founded in 1955 and 1969, respectively. We have major transportation operations in the North Sea, Nigeria and the U.S. Gulf of Mexico, and in most of the other major offshore energy producing regions of the world, including Australia, Brazil, Canada, Russia and Trinidad. We provide private sector search and rescue (“SAR”) services in Australia, Canada, Norway, Russia, Trinidad and the United States. We provide public sector SAR services in the U.K. on behalf of the Maritime & Coastguard Agency. We also provide regional fixed wing scheduled and charter services in the U.K., Nigeria and Australia through our consolidated affiliates, Eastern Airways International Limited (“Eastern Airways”) and Capiteq Limited, operating under the name of Airnorth (“Airnorth”), respectively. These operations support our primary industrial aviation services operations in those markets, creating a more integrated logistics solution for our clients. Additionally, in March 2013, we were awarded a contract to provide public sector SAR services for all of the U.K.

We primarily provide industrial aviation services to a broad base of major integrated, national and independent offshore energy companies. Our clients charter our helicopters primarily to transport personnel between onshore bases and offshore production platforms, drilling rigs and other installations. To a lesser extent, our clients also charter our helicopters to transport time-sensitive equipment to these offshore locations. These clients’ operating expenditures in the production sector are the principal source of our revenue, while their exploration and development capital expenditures provide a lesser portion of our revenue. The clients for SAR services include both the oil and gas industry, where our revenue is primarily dependent on our clients’ operating expenditures, and governmental agencies, where our revenue is dependent on a country’s desire to privatize SAR and enter into long-term contracts.

In addition to our primary industrial aviation services operations, as of September 30, 2017, we also operated a training unit, Bristow Academy, Inc. (“Bristow Academy”), which we sold on November 1, 2017.

U.K. Search and Rescue (SAR)

In fiscal year 2013, Bristow Helicopters, our U.K. subsidiary, was awarded a contract with the U.K. Department for Transport to provide SAR services for all of the U.K. (the “U.K. SAR contract”). The U.K. SAR

S-1

contract has aphased-in transition period that began in April 2015 and continued to July 2017 and a contract length of approximately ten years. Under the terms of this contract, Bristow Helicopters has agreed to provide helicopters that will be located at ten bases across the U.K. with two aircraft operating at each base. We are currently operational at all ten bases. In addition to the ten bases with 20 aircraft, the contract provides for two fullySAR-equipped training aircraft that can be deployed to any base as needed.

Our Fleet

Medium and large helicopters, which can fly in a wider variety of operating conditions, over longer distances and at higher speeds and can carry larger payloads in comparison to small helicopters, are most commonly used for crew changes on large offshore production facilities and drilling rigs. With these enhanced capabilities, medium and large helicopters have historically been preferred in international markets, where the offshore facilities tend to be larger, the drilling locations tend to be more remote and located in harsh environments, and the onshore infrastructure tends to be more limited. Additionally, local governmental regulations in certain international markets require us to operate twin-engine medium and large aircraft in those markets. Global demand for medium and large helicopters is driven by drilling, development and production activity levels in deepwater locations throughout the world, as the medium and large aircraft are able to travel to these deepwater locations. Small helicopters are generally used for shorter routes and to reach production facilities that cannot accommodate medium and large helicopters and operate primarily over the shallow waters offshore in the U.S. Gulf of Mexico and Nigeria. Bristow Group is able to deploy its aircraft to the regions with the greatest demand, subject to the satisfaction of local governmental regulations.

As of September 30, 2017, we operated 344 aircraft in our consolidated fleet, of which 224 were owned and 120 were leased; 15 of the owned aircraft were held for sale, and our unconsolidated affiliates operated 116 aircraft in addition to those aircraft leased from us. Bristow Group’s consolidated fleet of 344 aircraft consisted of 124 large helicopters (66 owned), 100 medium helicopters (76 owned), 23 small helicopters (22 owned), 45 training aircraft (28 owned) and 52 fixed-wing aircraft (32 owned). The average age of our commercial helicopters fleet as of September 30, 2017 was about nine years, and the commercial helicopter fleet is comprised of the latest technology large and medium sized aircraft being utilized offshore.

The chart below presents (1) the percentage of operating revenue which each of our regions provided during the six months ended September 30, 2017; (2) the number of aircraft in our consolidated fleet and their distribution among the regions of our company as of September 30, 2017; and (3) the number of helicopters which we had on order or under option as of September 30, 2017.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Percentage of

Six Months Ended

September 30, 2017

Operating Revenue | | | Aircraft in Consolidated Fleet | |

| | | | Helicopters | | | | | | Fixed

Wing | | | Total | |

| | | | Small | | | Medium | | | Large | | | Training | | | |

Europe Caspian | | | 54 | % | | | — | | | | 16 | | | | 80 | | | | — | | | | 32 | | | | 128 | |

Africa | | | 14 | % | | | 9 | | | | 32 | | | | 5 | | | | — | | | | 5 | | | | 51 | |

Americas | | | 17 | % | | | 14 | | | | 42 | | | | 16 | | | | — | | | | — | | | | 72 | |

Asia Pacific | | | 15 | % | | | — | | | | 10 | | | | 23 | | | | — | | | | 14 | | | | 47 | |

Corporate and other(1) | | | — | % | | | — | | | | — | | | | — | | | | 45 | | | | 1 | | | | 46 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 100 | % | | | 23 | | | | 100 | | | | 124 | | | | 45 | | | | 52 | | | | 344 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Aircraft not currently in fleet: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

On order | | | | | | | — | | | | — | | | | 27 | | | | — | | | | — | | | | 27 | |

Under option | | | | | | | — | | | | — | | | | 4 | | | | — | | | | — | | | | 4 | |

| (1) | The aircraft presented for Corporate and other represent the aircraft operated by Bristow Academy as of September 30, 2017. On November 1, 2017, we sold Bristow Academy, including all of its aircraft. |

S-2

The additional helicopters on order are expected to provide incremental fleet capacity, with only a small number of our existing aircraft expected to be replaced with the new aircraft.

We expect to deploy our new SAR helicopters primarily to the U.K. in support of the U.K. SAR contract and our new oil and gas configured aircraft to markets with the strongest client demand.

Our Strengths

We believe that we possess a number of strengths, including:

| | • | | Leading Market Position and Differentiation Relative to Other Operators. Bristow Group is a market leader in the major offshore oil and gas regions of the North Sea, U.S., Nigeria, Australia, Brazil, Canada, Russia and Trinidad and is one of only two global helicopter service providers to the offshore energy industry. Our industry leading Target Zero safety culture and performance, as well as our size and scale, creates a competitive advantage relative to smaller, regional competitors in being able to provide aircraft and flight services in support of the global operations of our international oil and gas clients. The fixed element of ourtwo-tiered contract structure provides stability as it provides the majority of our revenue. Further, our U.K. SAR and fixed-wing businesses provide unique and complementary diversification. |

| | • | | World Class Fleet. Since the beginning of fiscal year 2008, we have invested in nearly $3.9 billion in capital expenditures to grow our business. This investment primarily in new technology and medium and large sized commercial helicopters to support client needs, particularly their deepwater activities, has resulted in a shift of the commercial helicopter fleet composition to approximately 91% medium and large aircraft as of September 30, 2017, and reduced the average age of the fleet to approximately nine years. As a result, we are well positioned to take advantage of commercial opportunities in any offshore market worldwide and have a strong balance sheet necessary to grow our business. |

| | • | | Focus on Cost Reduction Efforts Have Created a Positive Inflection Point. Since the beginning of fiscal year 2016, we have reduced direct and general and administrative cost across our business, including the benefit of the restructuring completed earlier in calendar year 2017. These efforts have created a positive inflection point in both EBITDA margin and revenue as we compete for over $2 billion in contracts over the next two years. |

| | • | | Industry-Leading Liquidity. Our liquidity of $496 million as of December 8, 2017, driven by original equipment manufacturer recoveries related to ongoing aircraft issues and deferral of payments of capital expenditures into future periods, has positioned us well to survive the ongoing offshore oil and gas downturn. We continue to focus on our key “STRIVE” priorities as discussed below and focus on portfolio and fleet optimization and revenue growth across our new hub structure. This allows us to be responsive to client needs, taking advantage of short-term work and longer-term contract renewals and wins. |

Our Strategy

Our goal is to strengthen our position as the leading industrial aviation services provider to the offshore energy industry and a leading industrial aviation services provider for civilian SAR and to pursue additional business opportunities that leverage our strengths in these markets. Our vision is to be a safe, financially strong, diversified global leader. To achieve this goal and vision, we intend to employ our “STRIVE” strategy as follows:

| | • | | Sustain Target Zero Safety Culture. Safety will always be our number one focus. The best approach to be Target Zero is to continuously improve our safety systems and processes to allow us to become even safer and to build confidence in our industry and among our regulators with respect to the safety of helicopter transportation globally. |

S-3

| | • | | Train and Develop Our People. We continue to invest in employee training to ensure that we have the best workforce in the industry. We believe that the skills, talent and dedication of our employees are our most important assets, and we plan to continue to invest in them, especially in entry level learning, the continued control and ownership of our training assets, and creation of leadership programming. |

| | • | | Renew Commercial Strategy and Operational Excellence. We are in the process of renewing both our commercial strategy to improve revenue productivity across our global markets and our operational strategy to serve our clients safely, reliably and efficiently. We believe that we need to renew these strategies in order to thrive in an economy that is undergoing long-term structural change. |

| | • | | Improve Balance Sheet and Return on Capital. We seek to continue to improve our balance sheet and liquidity and reduce our capital costs. In August 2017, we suspended our quarterly dividend as part of a broader plan of reducing costs and improving liquidity. By suspending our quarterly dividend, we will preserve approximately $10 million of cash annually. Please read “Price Range of Our Common Stock and Dividend Policy.” |

| | • | | Value Added Acquisitions and Divestitures. We intend to pursue value-added acquisitions that not only make us bigger but also better, and that improve our competitive posture to thrive in an economy that is undergoing long-term structural change. We may also divest portions of our business or assets to narrow our product lines and reduce our operational footprint in order to reduce leverage and improve return on capital. |

| | • | | Execute on Bristow Transformation. We intend to sustain our strategy and the effective transformation of our business by focusing on execution globally. |

Our Principal Executive Offices and Internet Address

Our principal executive offices are located at 2103 City West Boulevard, 4th floor, Houston, Texas 77042 and our telephone number is(713) 267-7600. Our website address iswww.bristowgroup.com. We make available our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the “SEC”) free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus supplement or the accompanying prospectus.

S-4

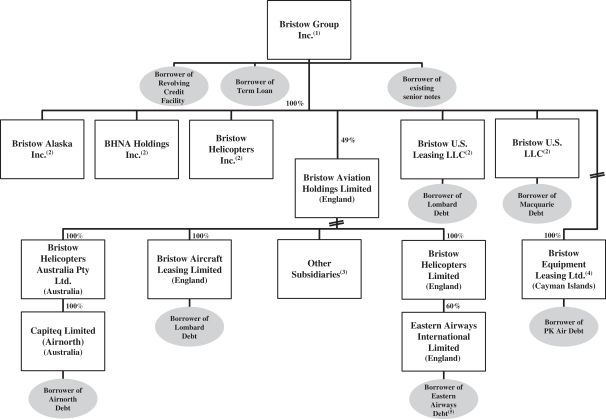

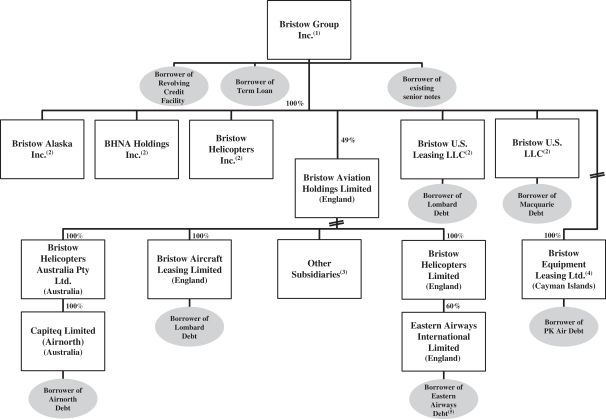

Organizational Structure

The following diagram illustrates our simplified organizational structure, as well as certain of our indebtedness, as of December 13, 2017.

| (1) | Bristow Group Inc. is a parent guarantor of the Lombard Debt, the Macquarie Debt, the PK Air Debt and the Eastern Airways Debt (each as defined under “Description of Indebtedness”). |

| (2) | Such entity is a subsidiary guarantor of the Revolving Credit Facility, the Term Loan (each as defined under “Description of Indebtedness”), our existing senior notes (as defined under “The Offering”) and the notes offered hereby. |

| (3) | Bristow Group Inc.’s percentage interests in such entities vary. |

| (4) | The direct owner of the interests in such entity has pledged such entity’s interests to secure the PK Air Debt. |

| (5) | Certain of Eastern Airways’ subsidiaries guarantee the Eastern Airways Debt. |

S-5

THE OFFERING

The following summary contains basic information about this offering and the notes and is not intended to be complete. This summary does not contain all of the information that may be important to you. For a more complete understanding of the terms and provisions of the notes, please refer to the section of this prospectus supplement entitled “Description of the Notes.” For purposes of the description of the notes included in this prospectus supplement, references to “the company,” “the issuer,” “us,” “we” and “our” refer only to Bristow Group Inc. and do not include any of its subsidiaries.

Issuer | Bristow Group Inc., a Delaware corporation. |

Securities | $125,000,000 aggregate principal amount of 4.50% Convertible Senior Notes due 2023, or the “notes.” We have also granted the underwriters a13-day option to purchase a maximum of $18,750,000 additional principal amount of the notes to cover over-allotments. |

Maturity | The notes will mature on June 1, 2023, subject to earlier repurchase or conversion. |

Subsidiary guarantors | The notes will be jointly and severally guaranteed on a senior unsecured basis by those of our U.S. subsidiaries that currently provide guarantees of our outstanding 6 1⁄4% Senior Notes due 2022 (the “existing senior notes”) or our amended and restated revolving credit facility and term loan, as well as certain future subsidiaries. |

Ranking and subordination | The notes will be our unsecured senior obligations. Accordingly, thenotes and the related subsidiary guarantees will: |

| | • | | rank equally in right of payment with our existing senior notes and any of our and the guarantors’ future unsecured senior indebtedness; |

| | • | | be effectively subordinated to all of our and the guarantors’ existing and future secured indebtedness to the extent of the value of the collateral securing such indebtedness, including indebtedness under our credit facilities; and |

| | • | | rank senior to all of our and the guarantors’ future subordinated indebtedness. |

| | As of September 30, 2017, as adjusted to give effect to this offering, we and the guarantors would have had $484.2 million of secured indebtedness. |

| | In addition, the notes and guarantees will be effectively junior to all debt and other liabilities, including trade payables, of ournon-guarantor subsidiaries. As of September 30, 2017, ournon-guarantor subsidiaries had approximately $639.3 million of total liabilities (including certain indebtedness under our credit facilities and trade payables but excluding intercompany liabilities and guarantees). Revenue related to ournon-guarantor subsidiaries |

S-6

| | constituted 87.2% of our gross revenue during the six months ended September 30, 2017 (excluding intercompany revenue), and ournon-guarantor subsidiaries held approximately 61.6% of our consolidated assets as of September 30, 2017. |

Interest | 4.50% per year on the principal amount from December 18, 2017, payable semi-annually in arrears on June 1 and December 1 of each year, beginning June 1, 2018. |

Conversion rights | Holders may convert their notes at their option prior to the close of business on the second scheduled trading day immediately preceding December 1, 2022, but only under the following circumstances: |

| | • | | with respect to any calendar quarter commencing after January 1, 2018, if the last reported sale price of our common stock for at least 20 trading days during the period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than 130% of the conversion price on such last trading day; |

| | • | | during the fivebusiness-day period following any five consecutivetrading-day period in which the trading price for $1,000 principal amount of notes was less than 98% of the product of the last reported sale price of our common stock and the conversion rate on such day; or |

| | • | | upon the occurrence of specified corporate transactions described under “Description of the Notes—Conversion Rights—Conversion upon Specified Corporate Transactions.” |

| | On or after December 1, 2022, notes may be converted until the close of business on the second scheduled trading day preceding maturity without regard to the foregoing conditions. |

| | The initial conversion rate for the notes will be 63.9488 shares of our common stock for each $1,000 principal amount of notes, equivalent to an initial conversion price of approximately $15.64 per share of our common stock. The conversion rates are subject to adjustment as described under “Description of the Notes—Conversion Rights—Conversion Rate Adjustments” and “Description of the Notes—Conversion Rights—Increase of Conversion Rate upon Conversion upon Make-Whole Fundamental Change.” |

Settlement upon conversion | We may elect to deliver to holders in full satisfaction of our conversion obligation: |

| | • | | solely shares of our common stock, together with cash in lieu of fractional shares, which we refer to as a “physical settlement”; |

| | • | | solely cash without any delivery of shares of our common stock, which we refer to as a “cash settlement”; or |

S-7

| | • | | a combination of cash and shares of our common stock, together with cash in lieu of fractional shares, which we refer to as a “combination settlement.” |

| | If we satisfy our conversion obligation with cash settlement or combination settlement, the amount of cash and shares of common stock, if any, due upon conversion will be based on a daily conversion value calculated on a proportionate basis on each trading day in a 40 trading day observation period. See “Description of the Notes—Conversion Rights—Settlement upon Conversion.” |

| | You will not receive any additional cash payment, including any accrued but unpaid interest, upon conversion of a note except in circumstances described in “Description of the Notes—Interest.” Instead, interest will be deemed paid by the delivery of the settlement amount to you upon conversion of a note. |

Increase of conversion rate upon certain fundamental changes |

If a make-whole fundamental change (as defined under “Description of the Notes—Conversion Rights—Increase of Conversion Rate upon Conversion upon Make-Whole Fundamental Change”) occurs, we may be required in certain circumstances to increase the conversion rate for any notes converted in connection with such fundamental change. A description of how the conversion rate will be increased and a table showing the increase in conversion rate that would apply at various stock prices and effective dates of the fundamental change are set forth under “Description of the Notes—Conversion Rights— Increase of Conversion Rate upon Conversion upon Make-Whole Fundamental Change.” |

No optional redemption | We will not have the right to redeem the notes at our option prior to maturity. |

Repurchase of notes upon a fundamental change | If we undergo a fundamental change (as defined under “Description of the Notes—Fundamental Change Permits Holders to Require Us to Purchase Notes”), you will have the option to require us to purchase all or any portion of your notes for cash. The fundamental change purchase price will be 100% of the principal amount of the notes to be purchased plus any accrued and unpaid interest to, but excluding, the fundamental change repurchase date. |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately $121.4 million (or approximately $139.8 million if the underwriters exercise their over-allotment option in full) after deducting underwriting discounts and commissions and estimated offering expenses. |

S-8

| | We expect to use approximately $89.6 million of the net proceeds from this offering to repay a portion of the indebtedness outstanding under our Term Loan and approximately $8.8 million of the net proceeds from this offering to pay the cost of the convertible note hedge transactions described herein (after such cost is partially offset by the proceeds to us of the warrant transactions), with the remainder of the net proceeds from this offering to be used for general corporate purposes. If the underwriters exercise their over-allotment option, we expect to sell additional warrants and use a portion of the net proceeds from the sale of the additional notes to enter into additional convertible note hedge transactions with the option counterparties, as well as use a portion of the net proceeds from the sale of such additional warrants and additional notes to make additional repayments of the indebtedness outstanding under our Term Loan and for general corporate purposes. |

Trustee, paying agent and conversion agent | U.S. Bank National Association. |

Governing law | The indenture and the notes provide that they will be governed by, and construed in accordance with, the laws of the State of New York. |

Book-entry form | The notes will be issued in book-entry form and will be represented by permanent global certificates deposited with, or on behalf of, The Depository Trust Company, which we refer to as “DTC,” and registered in the name of a nominee of DTC. Beneficial interests in any of the notes will be shown on, and transfers will be effected only through, records maintained by DTC or its nominee and any such interest may not be exchanged for certificated securities, except in limited circumstances. |

Absence of a public market for the notes | The notes are new securities, and there is currently no established market for the notes. The underwriters have advised us that they currently intend to make a market in the notes. However, they are not obligated to do so, and may discontinue any market making with respect to the notes without notice. We do not intend to apply for a listing of the notes on any national securities exchange or any automated dealer quotation system. Accordingly, we cannot assure you as to the development or liquidity of any market for the notes. Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “BRS.” |

Convertible note hedge and warrant transactions | In connection with the pricing of the notes, we entered into convertible note hedge transactions with certain of the underwriters or affiliates thereof, which we refer to as the option counterparties. The convertible note hedge transactions are expected generally to reduce potential dilution to our common stock and/or offset any cash payments we may be required to make in excess of the principal amount of the converted notes upon any conversion of notes, in each case, in the event that the market price per share of our |

S-9

| | common stock, as measured under the terms of the convertible note hedge transactions, is greater than the strike price of the convertible note hedge transactions (which initially corresponds to the initial conversion price of the notes and is subject to certain adjustments substantially similar to those contained in the notes). In addition, in order to partially offset the cost of the convertible note hedge transactions, we issued warrants to the option counterparties at a higher strike price than the strike price of the notes. The warrant transactions could separately have a dilutive effect to the extent that the market value per share of our common stock as measured over the applicable valuation period at the maturity of the warrants exceeds the applicable strike price of the warrants. If the underwriters exercise their over-allotment option, we expect to enter into additional convertible note hedge and warrant transactionswith the option counterparties. |

| | In connection with establishing their initial hedge of the convertible note hedge and warrant transactions, the option counterparties and/or their respective affiliates expect to enter into various derivative transactions with respect to our common stock concurrently with or shortly after the pricing of the notes. This activity could increase (or reduce the size of any decrease in) the market price of our common stock or the notes at that time. |

| | In addition, the option counterparties and/or their respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to our common stock and/or purchasing or selling our common stock or other securities of ours in secondary market transactions following the pricing of the notes and prior to the maturity of the notes (and are likely to do so during any observation period related to a conversion of notes). This activity could also cause or avoid an increase or a decrease in the market price of our common stock or the notes, which could affect your ability to convert the notes and, to the extent the activity occurs during any observation period related to a conversion of notes, it could affect the amount and value of the consideration that you will receive upon conversion of the notes. |

| | For a discussion of the potential impact of any market or other activity by the option counterparties or their respective affiliates in connection with these convertible note hedge and warrant transactions, see “Risk Factors—Risks Related to this Offering and the Notes—The convertible note hedge and warrant transactions may affect the value of the notes and our common stock” and “Underwriting—Convertible Note Hedge and Warrant Transactions.” |

Risk factors | An investment in the notes involves significant risks. You should carefully consider the information under the section titled “Risk Factors” and all other information included in this prospectus |

S-10

| | supplement and the accompanying prospectus and the documents incorporated by reference before investing in the notes. |

U.S. federal income tax consequences | For the U.S. federal income tax consequences of the holding, disposition and conversion of the notes, and the holding and disposition of shares of our common stock, see “Material U.S. Federal Income Tax Considerations.” |

S-11

SELECTED FINANCIAL DATA

The following financial data should be read in conjunction with the information included in our consolidated financial statements and related notes thereto included in our Annual Report on Form10-K for fiscal year 2017 (our “2017 Annual Report”) and our Quarterly Reports on Form10-Q for the three months ended June 30, 2017 and September 30, 2017, each filed with the SEC and incorporated by reference in this prospectus supplement and the accompanying prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve

Months

Ended

September 30,

2017 | | | Six Months Ended

September 30, | | | Fiscal Year Ended March 31, | |

| | | | 2017 | | | 2016 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (unaudited) | | | (unaudited) | | | | | | | | | | | | | | | | |

| | | (In thousands, except percentages, ratios and LACE data) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross revenue(1) | | $ | 1,399,422 | | | $ | 725,785 | | | $ | 726,865 | | | $ | 1,400,502 | | | $ | 1,715,513 | | | $ | 1,858,669 | | | $ | 1,699,582 | | | $ | 1,508,473 | |

Direct cost(1) | | | (1,155,138 | ) | | | (597,904 | ) | | | (597,063 | ) | | | (1,154,297 | ) | | | (1,309,365 | ) | | | (1,299,557 | ) | | | (1,186,132 | ) | | | (1,057,794 | ) |

Loss on impairment(2) | | | (9,898 | ) | | | (1,192 | ) | | | (7,572 | ) | | | (16,278 | ) | | | (55,104 | ) | | | (7,167 | ) | | | (12,669 | ) | | | — | |

Consolidated operating income (loss) | | | (76,131 | ) | | | (37,506 | ) | | | (53,117 | ) | | | (91,742 | ) | | | (40,845 | ) | | | 145,874 | | | | 186,977 | | | | 224,144 | |

Interest expense, net | | | (62,149 | ) | | | (34,584 | ) | | | (22,354 | ) | | | (49,919 | ) | | | (34,128 | ) | | | (29,354 | ) | | | (43,218 | ) | | | (41,658 | ) |

Extinguishment of debt(3) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2,591 | ) | | | — | | | | (14,932 | ) |

Gain on sale of unconsolidated affiliates(4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 3,921 | | | | 103,924 | | | | — | |

Other income (expense), net(5) | | | 1,458 | | | | 913 | | | | (3,186 | ) | | | (2,641 | ) | | | (4,258 | ) | | | (6,377 | ) | | | (2,692 | ) | | | (877 | ) |

Benefit (provision) for income taxes(6) | | | (56,031 | ) | | | (15,965 | ) | | | 7,478 | | | | (32,588 | ) | | | 2,082 | | | | (22,766 | ) | | | (57,212 | ) | | | (35,002 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (192,853 | ) | | $ | (87,142 | ) | | $ | (71,179 | ) | | $ | (176,890 | ) | | $ | (77,149 | ) | | $ | 88,707 | | | $ | 187,779 | | | $ | 131,675 | |

Noncontrolling interests | | | 6,402 | | | | 658 | | | | 610 | | | | 6,354 | | | | 4,707 | | | | (4,407 | ) | | | (1,042 | ) | | | (1,573 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to Bristow Group | | $ | (186,451 | ) | | $ | (86,484 | ) | | $ | (70,569 | ) | | $ | (170,536 | ) | | $ | (72,442 | ) | | $ | 84,300 | | | $ | 186,737 | | | $ | 130,102 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total cash and cash equivalents | | $ | 97,343 | | | $ | 97,343 | | | $ | 100,668 | | | $ | 96,656 | | | $ | 104,310 | | | $ | 104,146 | | | $ | 204,341 | | | $ | 215,623 | |

Working capital | | | 139,676 | | | | 139,676 | | | | 126,662 | | | | 91,517 | | | | 202,728 | | | | 202,845 | | | | 263,782 | | | | 435,933 | |

Total assets | | | 3,088,523 | | | | 3,088,523 | | | | 3,198,096 | | | | 3,113,847 | | | | 3,262,945 | | | | 3,230,720 | | | | 3,398,257 | | | | 2,950,692 | |

Total debt | | | 1,312,106 | | | | 1,312,106 | | | | 1,221,546 | | | | 1,282,019 | | | | 1,131,972 | | | | 864,422 | | | | 841,302 | | | | 787,269 | |

Stockholders’ investment | | | 1,233,028 | | | | 1,233,028 | | | | 1,416,201 | | | | 1,294,232 | | | | 1,509,892 | | | | 1,618,786 | | | | 1,756,586 | | | | 1,610,957 | |

Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | $ | (53,427 | ) | | $ | (35,334 | ) | | $ | 28,795 | | | $ | 10,702 | | | $ | 116,026 | | | $ | 253,226 | | | $ | 232,094 | | | $ | 266,764 | |

Net cash provided by (used in) investing activities | | | (8,375 | ) | | | 17,927 | | | | (90,047 | ) | | | (116,349 | ) | | | (316,750 | ) | | | (203,093 | ) | | | (266,302 | ) | | | (307,757 | ) |

Net cash provided by (used in) financing activities | | | 61,302 | | | | 10,157 | | | | 56,371 | | | | 107,516 | | | | 191,614 | | | | (128,297 | ) | | | 10,167 | | | | (13,043 | ) |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(7) | | $ | 74,186 | | | $ | 47,581 | | | $ | 44,479 | | | $ | 71,084 | | | $ | 205,523 | | | $ | 309,057 | | | $ | 327,888 | | | $ | 313,543 | |

Capital expenditures | | | 57,561 | | | | 24,317 | | | | 101,866 | | | | 135,110 | | | | 372,375 | | | | 601,834 | | | | 628,613 | | | | 571,425 | |

Ratio of Adjusted EBITDA to Adjusted Interest(8) | | | 1.2 | | | | 1.4 | | | | 1.7 | | | | 1.3 | | | | 4.8 | | | | 7.3 | | | | 7.5 | | | | 7.6 | |

Debt as a percentage of book capitalization(9) | | | 55.3 | % | | | 51.6 | % | | | 46.3 | % | | | 49.8 | % | | | 42.8 | % | | | 34.8 | % | | | 32.4 | % | | | 32.8 | % |

LACE(10) | | | 174 | | | | 174 | | | | 166 | | | | 174 | | | | 162 | | | | 166 | | | | 158 | | | | 158 | |

LACE rate (in millions)(10) | | $ | 6.51 | | | $ | 6.76 | | | $ | 7.28 | | | $ | 6.63 | | | $ | 8.85 | | | $ | 9.33 | | | $ | 9.34 | | | $ | 8.35 | |

| (1) | Gross revenue includes reimbursable revenue of $28.1 million and $27.0 million for the six months ended September 30, 2017 and 2016, respectively, and $52.7 million, $86.0 million, $131.7 million, $153.3 million and $164.5 million for fiscal years 2017, 2016, 2015, 2014 |

S-12

| | and 2013, respectively. Direct cost includes reimbursable expense of $27.6 million and $25.9 million for the six months ended September 30, 2017 and 2016, respectively, and $50.3 million, $81.8 million, $124.6 million, $144.6 million and $157.4 million for fiscal years 2017, 2016, 2015, 2014 and 2013, respectively. |

| (2) | During the six months ended September 30, 2017 and 2016, we recorded impairment charges of $1.2 million and $7.6 million, respectively, to write-down certain spare parts within inventories to market value. During fiscal years 2017, 2016, 2015 and 2014, we recorded impairment charges of $7.6 million, $5.4 million, $7.2 million and $12.7 million, respectively, to write-down certain spare parts within inventories to market value. During fiscal years 2017 and 2016, we recorded impairment charges of $8.7 million and $49.7 million, respectively, to write-down goodwill and intangibles. |

| (3) | Extinguishment of debt includes $2.6 million related to premiums paid for the repurchase of a portion of our existing senior notes during fiscal year 2015 and $14.9 million in redemption premium and fees paid for the early retirement of our 7 1/2% Senior Notes due 2017 during fiscal year 2013. |

| (4) | Gain on sale of unconsolidated affiliates includes $3.9 million related to the sale of Helideck Certification Agency (“HCA”) during fiscal year 2015 and $103.9 million inpre-tax gains related to the sale of FBS Limited, FB Heliservices Limited and FB Leasing Limited (collectively, the “FB Entities”) during fiscal year 2014. |

| (5) | Includes foreign currency transaction gains (losses) of $0.8 million and $(3.4) million for the six months ended September 30, 2017 and 2016, respectively, and $(2.9) million, $(4.3) million, $(6.5) million, $(3.7) million and $(1.1) million for fiscal years 2017, 2016, 2015, 2014 and 2013, respectively. Includes a gain of $1.1 million on the sale of intellectual property during fiscal year 2014. |

| (6) | The provision for income taxes includes $36.6 million of tax expense for the sale of the FB Entities in fiscal year 2014. |

| (7) | Adjusted EBITDA is calculated by taking our net income and adjusting for benefit (provision) for income taxes, interest expense, gain (loss) on disposal of assets, depreciation and amortization and any special items during the reported periods. Management believes that adjusted EBITDA provides relevant and useful information, which is widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and regional performance. Adjusted EBITDA provides us with an understanding of one aspect of earnings before the impact of investing and financing transactions and income taxes. Adjusted EBITDA should not be considered a measure of discretionary cash available to us for investing in the growth of our business. Adjusted EBITDA is not calculated or presented in accordance with generally accepted accounting principles (“GAAP”) and other companies in our industry may calculate adjusted EBITDA differently than we do. As a result, this financial measure has limitations as an analytical and comparative tool and you should not consider this measure in isolation, or as a substitute for analysis of our results as reported under GAAP. In calculating this financial measure, we make certain adjustments that are based on assumptions and estimates that may prove to be inaccurate. In addition, in evaluating this financial measure, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or special items. The following table reconciles net income to adjusted EBITDA for the periods presented: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months

Ended

September 30,

2017 | | | Six Months

Ended

September 30, | | | Fiscal Year Ended March 31, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | (in thousands) | |

Net income (loss) | | $ | (192,853 | ) | | $ | (87,142 | ) | | $ | (71,179 | ) | | $ | (176,890 | ) | | $ | (77,149 | ) | | $ | 88,707 | | | $ | 187,779 | | | $ | 131,675 | |

Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Provision (benefit) for income taxes | | | 56,031 | | | | 15,965 | | | | (7,478 | ) | | | 32,588 | | | | (2,082 | ) | | | 22,766 | | | | 57,212 | | | | 35,002 | |

Interest expense | | | 62,991 | | | | 34,952 | | | | 22,823 | | | | 50,862 | | | | 35,186 | | | | 30,310 | | | | 44,938 | | | | 42,446 | |

(Gains) losses on disposal of assets | | | 10,123 | | | | 7,827 | | | | 12,203 | | | | 14,499 | | | | 30,693 | | | | 35,849 | | | | 722 | | | | (8,068 | ) |

Depreciation and amortization | | | 117,899 | | | | 62,437 | | | | 63,286 | | | | 118,748 | | | | 136,812 | | | | 114,293 | | | | 95,977 | | | | 96,284 | |

Special items(i) | | | 19,995 | | | | 13,542 | | | | 24,824 | | | | 31,277 | | | | 82,063 | | | | 17,132 | | | | (58,740 | ) | | | 16,204 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 74,186 | | | $ | 47,581 | | | $ | 44,479 | | | $ | 71,084 | | | $ | 205,523 | | | $ | 309,057 | | | $ | 327,888 | | | $ | 313,543 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (i) | In fiscal year 2017, special items that impacted our results included organizational restructuring costs, goodwill impairment, impairment of inventories and reversal of contingent consideration related to the acquisition on January 29, 2015 of an 85% interest in Airnorth by our subsidiary Bristow Helicopters Australia Pty Ltd. for $24.0 million. In fiscal year 2016, special items that impacted our results included organizational restructuring costs, impairment of inventories and impairment of goodwill and intangible assets. In fiscal year 2015, special items that impacted our results included a gain on the sale of an unconsolidated affiliate, organizational restructuring costs, CEO succession costs, impairment of inventories, the repurchase of a portion of our existing senior notes (the repurchase premium and fees), accrued maintenance cost reversal, an accounting correction and Nigeria severance costs. In fiscal year 2014, special items that impacted our results included a gain on the sale of an unconsolidated affiliate, the impairment of inventories, restructuring items, Líder taxes, the fire one of our hangars experienced in Nigeria and the CEO succession costs and officer separation. In fiscal year 2013, special items that impacted our results included an additional inventory allowance, the correction of the calculation error related to Líder, severance costs in the Southern North Sea, the reversal of accrued maintenance cost for sale of AS332Ls that ultimately did not execute and the retirement of our 7 1/2% Senior Notes due 2017 (the redemption premium and fees). |

S-13

| (8) | Adjusted interest expense means interest expense adjusted to add capitalized interest and deduct amortization of deferred financing costs. Adjusted interest expense is not a measure of financial performance or liquidity under GAAP, but is used as a component of the conditions to debt incurrence, restricted payments and certain other events under the indenture governing the notes. Accordingly, it should not be considered as a substitute for interest expense or any other operating or liquidity measure prepared in accordance with GAAP. The following table reconciles adjusted interest expense to interest expense for the periods presented: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve

Months

Ended

September 30,

2017 | | | Six Months

Ended

September 30, | | | Fiscal Year Ended March 31, | |

| | | | 2017 | | | 2016 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (in thousands) | |

Interest expense | | $ | 62,991 | | | $ | 34,952 | | | $ | 22,823 | | | $ | 50,862 | | | $ | 35,186 | | | $ | 30,310 | | | $ | 44,938 | | | $ | 42,446 | |

Capitalized interest | | | 6,453 | | | | 1,956 | | | | 5,672 | | | | 10,169 | | | | 10,575 | | | | 14,559 | | | | 14,104 | | | | 6,594 | |

Amortization of deferred financing costs | | | (6,212 | ) | | | (2,940 | ) | | | (2,487 | ) | | | (5,759 | ) | | | (2,722 | ) | | | (2,712 | ) | | | (15,091 | ) | | | (7,604 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted interest expense | | $ | 63,232 | | | $ | 33,968 | | | $ | 26,008 | | | $ | 55,272 | | | $ | 43,039 | | | $ | 42,157 | | | $ | 43,951 | | | $ | 41,436 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (9) | Book capitalization includes total debt and stockholders’ investment. |

| (10) | The commercial aircraft in our consolidated fleet are our primary source of revenue. To normalize the consolidated operating revenue of our commercial helicopter fleet for the different revenue productivity and cost, we developed a common weighted factor that combines large, medium and small commercial helicopters into a combined standardized number of revenue producing commercial aircraft assets. We call this measure Large AirCraft Equivalent (“LACE”). Our commercial large, medium and small helicopters, including owned and leased helicopters, are weighted as 100%, 50%, and 25%, respectively, to arrive at a single LACE number, which excludes training aircraft, fixed wing aircraft, unconsolidated affiliate aircraft, aircraft held for sale and aircraft construction in process. We divide our operating revenue from commercial contracts relating to LACE aircraft, which excludes operating revenue from affiliates and reimbursable revenue, by LACE to develop a LACE rate, which is a standardized rate. |

S-14

RISK FACTORS

You should carefully consider the risks described below in addition to the remainder of this prospectus supplement and the factors discussed in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, including the information provided under the caption Item 1A. “Risk Factors” in our 2017 Annual Report, and subsequent periodic filings with the SEC, before making an investment decision. The risks and uncertainties described below and incorporated by reference into this prospectus supplement are not the only ones related to our business, the notes, our common stock or the offering. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business operations, results of operations, financial condition or prospects. The trading price of the notes and the shares of our common stock, if any, issuable upon conversion of the notes could decline due to the materialization of any of these risks, and you may lose all or part of your investment.

Risks Related to Our Level of Indebtedness

Our level of indebtedness could adversely affect our ability to obtain financing, impair our ability to fulfill our obligations under our indebtedness and limit our ability to adjust to changing market conditions.

We have, and following the completion of this offering, we will have, substantial debt and substantial debt service requirements. As of September 30, 2017, as adjusted to give effect to this offering, we would have had approximately $1.3 billion of outstanding indebtedness including long-term debt. In addition, we had $292.0 million of availability for borrowings under our Revolving Credit Facility as of September 30, 2017, subject to our maintenance of financial covenants and other conditions. Although the agreements governing certain of our credit facilities and the indenture governing our existing senior notes contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of qualifications and exceptions, and we could incur substantial additional indebtedness in the future.

Our level of indebtedness may have important consequences to our business, including:

| | • | | making it more difficult for us to satisfy our obligations with respect to the notes; |

| | • | | impairing our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or other general corporate purposes; |

| | • | | requiring us to dedicate a substantial portion of our cash flow to the payment of principal and interest on our indebtedness, which reduces the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes or to repurchase our notes upon a change of control; |

| | • | | subjecting us to the risk of increased sensitivity to interest rate increases on our indebtedness with variable interest rates, including borrowings under our credit facilities; |

| | • | | increasing the possibility of an event of default under the financial and other covenants contained in our debt agreements; and |

| | • | | limiting our ability to adjust to rapidly changing market conditions, reducing our ability to withstand competitive pressures and making us more vulnerable to a downturn in general economic conditions or our business than our competitors with less debt. |

If we are unable to generate sufficient cash flow from operations in the future to service our debt, we may be required to refinance all or a portion of our existing debt or obtain additional financing. There is no assurance that any such refinancing would be possible or that any additional financing could be obtained. Our inability to obtain such refinancing or financing may have a material adverse effect on us.

S-15

We may still incur substantially more debt or take other actions which would intensify the risks associated with our level of indebtedness.

We and our current or future subsidiaries may incur substantial additional debt in the future, subject to the restrictions contained in our future debt instruments, some of which may be secured debt. We will not be restricted under the terms of the indenture governing the notes from incurring additional debt, securing existing or future debt, recapitalizing our debt or taking a number of other actions that are not limited by the terms of the indenture governing the notes that could have the effect of diminishing our ability to make payments on the notes when due.

To service our indebtedness, including the notes, and lease obligations, we will continue to require a significant amount of cash, and our ability to generate cash depends on many factors beyond our control.

Our ability to make scheduled payments of principal or interest with respect to our indebtedness, including the notes, and lease obligations will depend on our ability to generate cash and on our financial results. Our ability to generate cash depends on the demand for our services, which is subject to levels of activity in offshore oil and gas exploration, development and production, general economic conditions, the ability of our affiliates to generate and distribute cash flows, and financial, competitive, regulatory and other factors affecting our operations, many of which are beyond our control. We cannot assure you that our operations will generate sufficient cash flow or that future borrowings will be available to us under our credit facilities or otherwise in an amount sufficient to enable us to pay our indebtedness, including the notes, or lease obligations or to fund our other liquidity needs.

Covenants in our debt agreements may restrict the manner in which we can operate our business.

Certain of our credit facilities and the indenture governing our existing senior notes limit, among other things, our ability and the ability of our restricted subsidiaries to:

| | • | | borrow money or issue guarantees; |

| | • | | pay dividends, redeem capital stock or make other restricted payments; |

| | • | | incur liens to secure indebtedness; |

| | • | | make certain investments; |

| | • | | enter into transactions with our affiliates; and |

| | • | | merge with another person or sell substantially all of our assets. |

If we fail to comply with these and other covenants, we would be in default under our credit facilities and the indenture governing our existing senior notes, and the principal and accrued interest on our outstanding indebtedness may become due and payable. See “Description of Indebtedness.” In addition, our credit facilities contain, and our future indebtedness agreements may contain, additional affirmative and negative covenants. As a result, our ability to respond to changes in business and economic conditions and to obtain additional financing, if needed, may be significantly restricted, and we may be prevented from engaging in transactions that might otherwise be considered beneficial to us.

Certain of our credit facilities also require us, and our future credit facilities may require us, to maintain specified financial ratios and satisfy certain financial condition tests. Our ability to meet these financial ratios and tests can be affected by events beyond our control, and we cannot assure you that we will meet those tests in the future. The breach of any of these covenants could result in a default under our credit facilities. Upon the occurrence of an event of default under our existing or future credit facilities, the lenders could elect to declare all amounts outstanding under such credit facilities, including accrued interest or other obligations, to be immediately due and payable. There can be no assurance that our assets would be sufficient to repay all of our indebtedness in full.

S-16

The agreements governing certain of our indebtedness, including our credit facilities and the indenture governing our existing senior notes, contain cross-default provisions. Under these provisions, a default under one agreement governing our indebtedness may constitute a default under our other agreements of indebtedness.

Risks Related to this Offering and the Notes

We are dependent on our subsidiaries and our unconsolidated affiliates for our cash flow.

We are a holding company with no material assets other than cash, our equity interests in our subsidiaries, our interests in our unconsolidated affiliates and our indebtedness from those subsidiaries and affiliates. Our subsidiaries and our unconsolidated affiliates conduct substantially all of our operations and directly own substantially all of our assets. Therefore, our operating cash flow and ability to meet our debt obligations, including the notes, will depend on the cash flow provided by our subsidiaries and our unconsolidated affiliates in the form of loans, dividends, aircraft leases, maintenance charges, reimbursable expenses or other payments to us as a shareholder, equity holder, service provider or lender. The ability of our subsidiaries and our unconsolidated affiliates to make such payments to us will depend on their earnings, tax considerations, legal restrictions and restrictions under their indebtedness. Ournon-guarantor subsidiaries are not obligated to make funds available for payment of the notes.

The notes will be structurally subordinated to all indebtedness of our subsidiaries that are not guarantors of the notes.

We derive substantially all of our revenue from our consolidated subsidiaries and our unconsolidated affiliates. While certain of our U.S. subsidiaries will guarantee the notes, ournon-U.S. subsidiaries, many of which are significant, will not guarantee the notes. You will not have any claim as a creditor against our subsidiaries that are not guarantors of the notes. Accordingly, all obligations of ournon-guarantor subsidiaries will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise, to us or a guarantor of the notes. As of September 30, 2017, ournon-guarantor subsidiaries had approximately $639.3 million of total liabilities (including certain indebtedness under our credit facilities and trade payables but excluding intercompany liabilities and guarantees). Revenue related to ournon-guarantor subsidiaries constituted 87.2% of our gross revenue during the six months ended September 30, 2017 (excluding intercompany revenue), and ournon-guarantor subsidiaries held approximately 61.6% of our consolidated assets as of September 30, 2017.

Similar to ournon-guarantor subsidiaries, you will not have any claim as a creditor against our unconsolidated affiliates. We own between 20% and 51% of the equity of our unconsolidated affiliates so that, in addition to the claims of creditors of those entities, the equity interests of our partners or other shareholders in any dividend or other distribution made by these entities would need to be satisfied on a proportionate basis with us. These unconsolidated affiliates and subsidiaries may also be subject to restrictions on their ability to distribute cash to us in their financing or other agreements, and as a result, we may not be able to access their cash flow to service our debt obligations, including the notes.

The notes and the subsidiary guarantees will be unsecured and effectively subordinated to our and our subsidiary guarantors’ secured indebtedness.

Holders of our secured debt will have claims that are effectively senior to your claims as holders of the notes to the extent of the value of the assets securing the secured debt. The notes will be effectively subordinated to all secured debt of us and our subsidiaries that guarantee the notes. If we become insolvent or are liquidated, or if payment under any secured debt is accelerated, the lender thereunder would be entitled to exercise the remedies available to a secured lender. Accordingly, the lender will have priority over any claim for payment under the notes or the guarantees to the extent of the assets that constitute their collateral. If this were to occur, it is possible that there would be no assets remaining from which claims of the holders of the notes could be

S-17

satisfied. Further, if any assets did remain after payment of these lenders, the remaining assets might be insufficient to satisfy the claims of the holders of the notes and holders of other unsecured debt that is deemed the same class as the notes, and potentially all other general creditors who would participate ratably with holders of the notes.

A court could subordinate or void the obligations under our subsidiaries’ guarantees.

Under the U.S. federal bankruptcy laws and comparable provisions of state fraudulent conveyance laws, a court could void obligations under the subsidiary guarantees, subordinate those obligations to other obligations of our subsidiary guarantors or require you to repay any payments made pursuant to the subsidiary guarantees, if:

(1) fair consideration or reasonably equivalent value was not received in exchange for the obligation; and

(2) at the time the obligation was incurred, the obligor:

| | • | | was insolvent or rendered insolvent by reason of the obligation; |

| | • | | was engaged in a business or transaction for which its remaining assets constituted unreasonably small capital; or |

| | • | | intended to incur, or believed that it would incur, debts beyond its ability to pay them as the debts matured. |

The measure of insolvency for these purposes will depend upon the law of the jurisdiction being applied. Generally, however, a company will be considered insolvent if:

| | • | | the sum of its debts, including contingent liabilities, is greater than the saleable value of all of its assets at a fair valuation; |

| | • | | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and matured; or |

| | • | | it could not pay its debts as they become due. |

Moreover, regardless of solvency, a court might void the guarantees, or subordinate the guarantees, if it determined that the transaction was made with intent to hinder, delay or defraud creditors.

Each subsidiary guarantee will contain a provision intended to limit the guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its subsidiary guarantee to be a fraudulent transfer. This provision, however, may not be effective to protect the subsidiary guarantees from attack under fraudulent transfer law.

The indenture requires that certain subsidiaries must guarantee the notes in the future. These considerations will also apply to these guarantees.

The notes currently have no established trading or other public market.

Prior to this offering, there has been no trading market for the notes. We do not intend to apply for a listing of the notes on any national securities exchange or any automated dealer quotation system. The underwriters have advised us that they currently intend to make a market in the notes after the offering is completed. However, they are not obligated to do so and may discontinue market making with respect to the notes without notice. In addition, the liquidity of the trading market in the notes, and the market price quoted for the notes, may be adversely affected by changes in the overall market for this type of security and by changes in our financial performance or prospects or in the prospects for companies in our industry generally. As a result, there can be no assurance that an active trading market will develop for the notes.

S-18

Recent and future regulatory actions and other events may adversely affect the trading price and liquidity of the notes.

We expect that many investors in, and potential purchasers of, the notes will employ, or seek to employ, a convertible arbitrage strategy with respect to the notes. Investors that employ a convertible arbitrage strategy with respect to convertible debt instruments typically implement that strategy by selling short the common stock underlying the convertible notes and dynamically adjusting their short position while they hold the notes. As a result, any specific rules regulating short selling of securities or other governmental action that interferes with the ability of market participants to effect short sales in our common stock could adversely affect the ability of investors in, or potential purchasers of, the notes to conduct the convertible arbitrage strategy that we believe they will employ, or seek to employ, with respect to the notes. This could, in turn, adversely affect the trading price and liquidity of the notes.

The SEC and other regulatory and self-regulatory authorities have implemented various rule changes and are expected to adopt additional rule changes in the future, and may take other actions, that may impact those engaging in short selling activity involving equity securities (including our common stock). Such rules and actions include Rule 201 of SEC Regulation SHO, the Financial Industry Regulatory Authority, Inc.’s “LimitUp-Limit Down” program, market-wide circuit breaker systems that halt trading of stock for certain periods following specific market declines, and rules stemming from the enactment and implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Past regulatory actions, including emergency actions or regulations, have had a significant impact on the trading prices and liquidity of equity-linked instruments. Any governmental action that similarly restricts the ability of investors in, or potential purchasers of, the notes to effect short sales of our common stock could similarly adversely affect the trading price and the liquidity of the notes.

Conversion of the notes or future sales or issuances of common stock may dilute the ownership interest of existing stockholders, including holders who have previously converted their notes. Such dilution may adversely affect the trading price of our common stock and the notes and the conversion rate of the notes may not be adjusted for all dilutive events.

We may issue equity securities in the future for a number of reasons, including to finance our operations and business strategy, to acquire assets or companies, to adjust our ratio of debt to equity, or in connection with our incentive and stock option plans. Any issuance of equity securities after this offering, including the issuance of shares, if any, upon conversion of the notes, could dilute the interests of our existing stockholders, including holders who have previously received shares upon conversion of their notes or exercise of the warrants, and could substantially affect the trading price of our common stock and the notes. In addition, the anticipated conversion of the notes into shares of our common stock could depress the price of our common stock.

The price of our common stock could also be affected by possible sales of our common stock by investors who view the notes as a more attractive means of equity participation in our company and by hedging or arbitrage trading activity that may develop involving our common stock. The hedging or arbitrage could, in turn, affect the trading price of the notes.

We may not be able to pay interest on the notes or settle conversions of the notes in cash or to repurchase the notes upon a fundamental change, and our future debt, if any, may contain limitations on our ability to pay cash upon conversion or repurchase of the notes.

Holders of notes have the right to require us to repurchase all or a portion of their notes for cash upon the occurrence of a fundamental change. In addition, upon conversion of the notes, unless we elect to deliver solely shares of our common stock to settle such conversion (other than paying cash in lieu of delivering any fractional share), we will be required to make cash payments in respect of the notes being converted. However, we may not have enough available cash or be able to obtain financing on favorable terms, if at all, at the time we are required

S-19

to make repurchases of notes surrendered therefor or pay cash with respect to the notes being converted. See “Description of the Notes—Interest,” “Description of the Notes—Conversion Rights—Settlement upon Conversion” and “Description of the Notes—Fundamental Change Permits Holders to Require Us to Purchase Notes.”

In addition, our ability to make the required repurchase upon a fundamental change may be limited by law or the terms of other debt agreements or securities. Our failure to pay interest on the notes or to make the required cash repurchase or cash payment, as the case may be, would constitute an event of default under the indenture governing the notes which, in turn, could constitute an event of default under other debt agreements or securities, thereby resulting in their acceleration and required prepayment and thereby further restricting our ability to make such interest payments and repurchases. Any inability on our part to pay for your notes that are tendered for repurchase or conversion could result in your receiving substantially less than the principal amount of the notes.

Your right to convert the notes is conditional, which could impair the value of the notes.

The notes are convertible only if specified conditions are met. If the specified conditions for conversion are not met, you will not be able to convert your notes, and you may not be able to receive the value of the cash and shares into which the notes would otherwise be convertible.

The accounting method for convertible debt securities that may be settled in cash, such as the notes, could have a material effect on our reported financial results.

Under Accounting Standards Codification (“ASC”)470-20,Debt with Conversion and Other Options, which we refer to as ASC470-20, an entity must separately account for the liability and equity components of the convertible debt instruments (such as the notes) that may be settled entirely or partially in cash upon conversion in a manner that reflects the issuer’s economic interest cost. The effect of ASC470-20 on the accounting for the notes is that the equity component is required to be included in the additionalpaid-in capital section of stockholders’ equity on our consolidated balance sheet, and the value of the equity component would be treated as original issue discount for purposes of accounting for the debt component of the notes. As a result, we will be required to record a greater amount ofnon-cash interest expense in current periods presented as a result of the amortization of the discounted carrying value of the notes to their face amount over the term of the notes. We will report lower net income in our financial results because ASC470-20 will require interest to include both the current period’s amortization of the debt discount and the instrument’s coupon interest, which could adversely affect our reported or future financial results, the trading price of our common stock and the trading price of the notes.

We may account for the notes utilizing the treasury stock method. The effect of this method is that the shares issuable upon conversion of convertible securities are not included in the calculation of diluted earnings per share except to the extent that the conversion value of such securities exceeds their principal amount. Under the treasury stock method, for diluted earnings per share purposes, the notes would be accounted for as if the number of shares of common stock that would be necessary to settle such excess, if we elected to settle such excess in shares, are issued.

However, we cannot be sure that the accounting standards in the future will continue to permit the use of the treasury stock method. If we are unable to use the treasury stock method in accounting for the shares issuable upon conversion of the notes, for whatever reason, then we would have to apply theif-converted method, the effect of which is that conversion will not be assumed for purposes of computing diluted earnings per share if the effect would be antidilutive. Under theif-converted method, for diluted earnings per share purposes, convertible debt is antidilutive whenever its interest, net of tax and nondiscretionary adjustments, per common share obtainable on conversion exceeds basic earnings per share. Dilutive securities that are issued during a period and dilutive convertible securities for which conversion options lapse, or for which related debt is extinguished

S-20