Exhibit 99.2 Strategic Update: Acquisition of AavantiBio and $75M PIPE September 30, 2022 © 2022 Solid Biosciences 1

Forward-Looking Statements and Industry and Market Data This presentation and various remarks we make during this presentation contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding: future expectations, plans and prospects for Solid Biosciences Inc. (the “Company” or “Solid”), AavantiBio, Inc. (“AavantiBio”) and the combined company following the anticipated consummation of the proposed merger transaction between the Company and AavantiBio (the “Merger”) and the anticipated consummation of the proposed concurrent private placement (the “PIPE”); the anticipated timing of the Merger and the PIPE; the expected ownership percentages in the combined company; the anticipated implied shares outstanding and anticipated market capitalization of the combined company following the closing; the anticipated benefits of the Merger; the anticipated milestones, key inflection points and pipeline of the combined company; the expected cash and investments of the combined company at closing of the Merger and PIPE and the anticipated cash runway of the combined company; the anticipated use of proceeds from the PIPE; the expected management team and board of directors of the combined company; the Company’s SGT-003 program, including expectations for filing an IND and initiating dosing; AavantiBio’s AVB-202 program, including expectations for filing an IND; and other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” “working” and similar expressions. Any forward-looking statements are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in, or implied by, such forward-looking statements. These risks and uncertainties include, but are not limited to, risks and uncertainties associated with: completion of the proposed Merger and concurrent PIPE in a timely manner or on the anticipated terms or at all; the satisfaction (or waiver) of closing conditions to the consummation of the Merger, including with respect to the approval of the Company’s stockholders; risks related to Solid’s and AavantiBio’s ability to estimate their respective operating expenses and expenses associated with the transaction, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement; the effect of the announcement or pendency of the Merger on Company’s or AavantiBio’s business relationships, operating results and business generally; the ability of the combined company to timely and successfully achieve or recognize the anticipated benefits of the Merger; the outcome of any legal proceedings that may be instituted against the Company or AavantiBio following any announcement of the proposed Merger and related transactions; the ability to obtain or maintain the listing of the common stock of the combined company on the Nasdaq Stock Market following the proposed Merger; costs related to the proposed Merger, including unexpected costs, charges or expenses resulting from the Merger; changes in applicable laws or regulation; the possibility that the Company or AavantiBio may be adversely affected by other economic, business and/or competitive factors; competitive responses to the transactions; risks related to the Company’s continued listing on the Nasdaq Global Select Market, including the Company’s ability to regain compliance with Nasdaq’s minimum bid price requirement; the Company’s ability to advance its SGT-003 program on the timelines expected or at all, obtain and maintain necessary approvals from the FDA and other regulatory authorities; following the consummation of the Merger, the Company’s ability to advance the AVB-202 program and other future product candidates on the timelines expected or at all, obtain and maintain necessary approvals from the FDA and other regulatory authorities; obtaining and maintaining the necessary approvals from investigational review boards at clinical trial sites and independent data safety monitoring board; replicating in clinical trials positive results found in preclinical studies and early-stage clinical trials of the Company’s product candidates; whether the methodologies, assumptions and applications the Company utilizes to assess particular safety or efficacy parameters will yield meaningful statistical results; advancing the development of the Company’s product candidates under the timelines it anticipates in current and future clinical trials; successfully transitioning, optimizing and scaling the Company’s manufacturing process; obtaining, maintaining or protecting intellectual property rights related to the Company’s product candidates; competing successfully with other companies that are seeking to develop Duchenne treatments and gene therapies; managing expenses; and raising the substantial additional capital needed, on the timeline necessary, to continue development of SGT-003 and other product candidates; achieving the Company’s other business objectives and continuing as a going concern. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the Company’s actual results to differ from those contained in the forward-looking statements, see the “Risk Factors” section, as well as discussions of potential risks, uncertainties and other important factors, in the Company’s most recent filings with the Securities and Exchange Commission. Furthermore, our combined pro forma information, including projected pro forma cash and investments as of the closing of the Merger and PIPE, has not been audited or reviewed by our accountants and has not been prepared in accordance with Regulation S-X. The pro formas are subject to a number of adjustments and assumptions including the anticipated timeline of the Merger, the consummation of the PIPE, change of control payments, severance fees, transaction fees payable to advisors, and others, including preparation of Article 11 of Regulation S-X compliant financials, and is not necessarily indicative of what the Company’s financial information actually would have been had the Merger and PIPE been completed on the dates described herein. These assumptions may prove to be inaccurate and as a result our pro forma amounts could vary significantly from what is disclosed herein. In addition, the forward- looking statements included in this presentation represent the Company’s views as of the date hereof and should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. Industry and Market Data This presentation contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. © 2022 Solid Biosciences 2

Additional Information about the Transactions No Offer or Solicitation This presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Important Additional Information Will Be Filed with the SEC In connection with the Merger and the PIPE, the Company intends to file with the SEC preliminary and definitive proxy statements relating to the Merger and the PIPE and other relevant documents. The definitive proxy statement will be mailed to the Company’s stockholders as of a record date to be established for voting on the shares to be issued in the Merger and the PIPE and any other matters to be voted on at the special meeting. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS, ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR THE PIPE OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, AAVANTIBIO, THE MERGER AND THE PIPE. Investors and security holders may obtain free copies of these documents (when they become available) on the SEC’s website at www.sec.gov, on the Company’s website at www.solidbio.com or by contacting the Company’s Investor Relations via email at clowie@solidbio.com or by telephone at 607-423-3219. Participants in the Solicitation The Company, AavantiBio and their respective directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of the Company in connection with the issuance of shares in Merger and the PIPE and any other matters to be voted on at the special meeting. Information about the Company’s directors and executive officers is included in the Company’s most recent definitive proxy statement filed with the SEC on April 28, 2022. Additional information regarding the names, affiliations and interests of the Company's and AavantiBio's directors and executive officers will be included in the preliminary and definitive proxy statements (when filed with the SEC). © 2022 Solid Biosciences 3

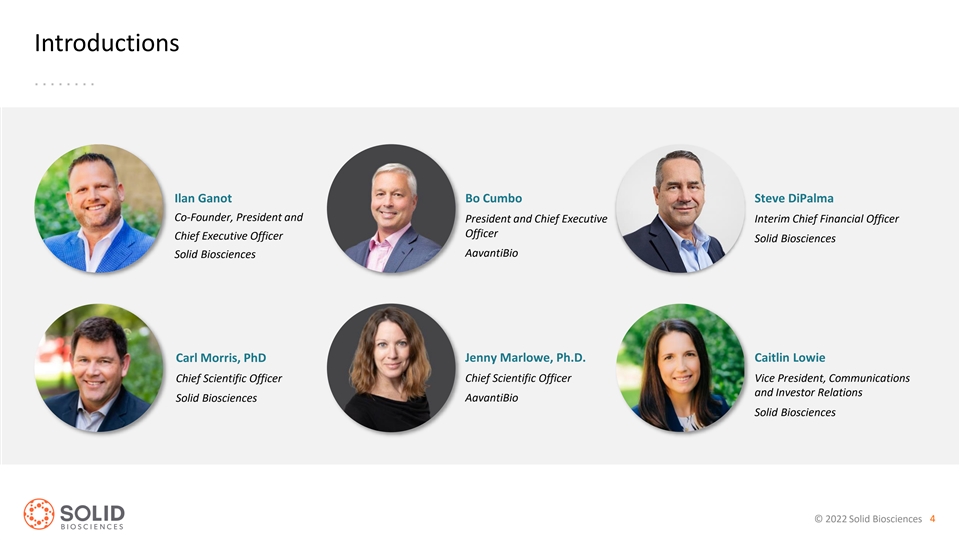

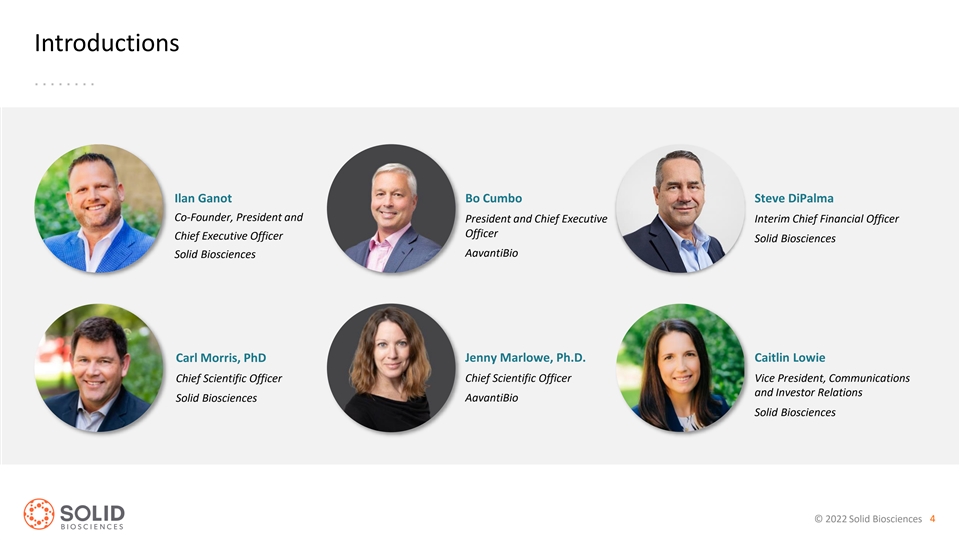

Introductions Ilan Ganot Bo Cumbo Steve DiPalma Co-Founder, President and President and Chief Executive Interim Chief Financial Officer Officer Chief Executive Officer Solid Biosciences AavantiBio Solid Biosciences Jenny Marlowe, Ph.D. Caitlin Lowie Carl Morris, PhD Chief Scientific Officer Chief Scientific Officer Vice President, Communications and Investor Relations AavantiBio Solid Biosciences Solid Biosciences © 2022 Solid Biosciences 4

• Definitive Agreement to Acquire AavantiBio AGENDA • Strategic Path Forward for Solid Biosciences • Q&A © 2022 Solid Biosciences 5

STRATEGIC UPDATE: Diversify Solid’s business through the strategic merger with AavantiBio, supported by PIPE investment expected to extend Solid’s runway into 2025 © 2022 Solid Biosciences 6

DEFINITIVE AGREEMENT TO ACQUIRE AAVANTIBIO © 2022 Solid Biosciences 7

Solid Strengthens Pipeline and Organizational Capacity through Strategic Acquisition of AavantiBio Addition of AavantiBio’s Friedreich’s ataxia and cardiac programs presents an opportunity for Solid to become a leading gene therapy company within neuromuscular and cardiac medicine Strategic Rationale People Pipeline Process Combined company to be led by Lead candidates, SGT-003 and Scalable manufacturing experienced team with deep AVB-202, both in the neuromuscular methodology across all programs expertise across gene therapy, space with high unmet need utilizing Transient Transfection CMC, clinical and regulatory with the goal of delivering Shared commitment to developing consistent drug product with next generation delivery vehicles desired quality attributes Goal is to have multiple INDs and clinical programs in the coming years, led by an IND submission for SGT-003 anticipated in mid-2023 © 2022 Solid Biosciences 8

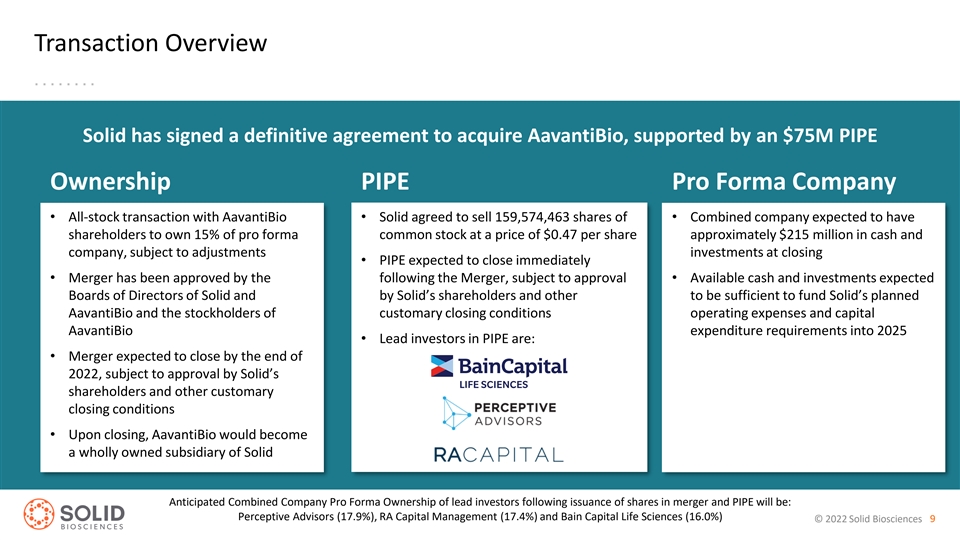

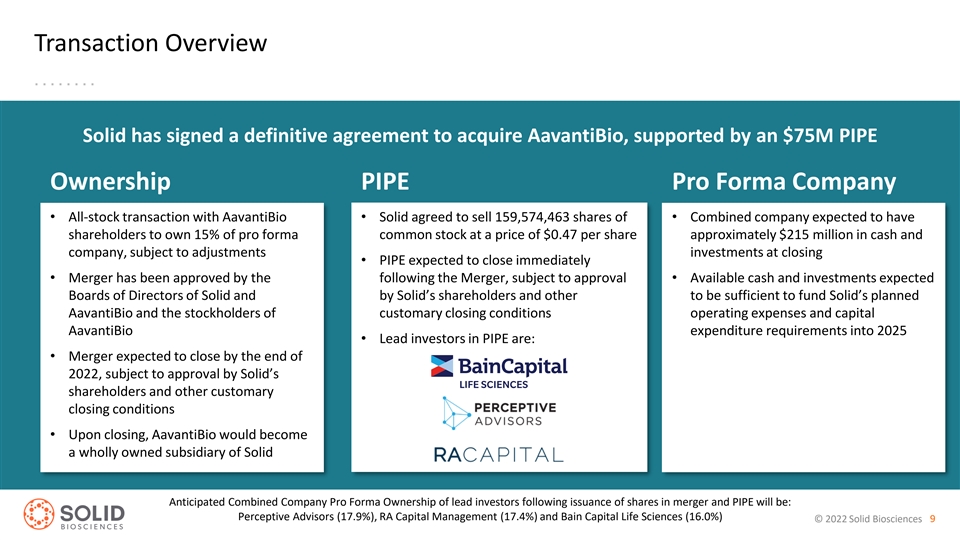

Transaction Overview Solid has signed a definitive agreement to acquire AavantiBio, supported by an $75M PIPE Ownership PIPE Pro Forma Company • All-stock transaction with AavantiBio • Solid agreed to sell 159,574,463 shares of • Combined company expected to have shareholders to own 15% of pro forma common stock at a price of $0.47 per share approximately $215 million in cash and company, subject to adjustments investments at closing • PIPE expected to close immediately • Merger has been approved by the following the Merger, subject to approval • Available cash and investments expected Boards of Directors of Solid and by Solid’s shareholders and other to be sufficient to fund Solid’s planned AavantiBio and the stockholders of customary closing conditions operating expenses and capital AavantiBio expenditure requirements into 2025 • Lead investors in PIPE are: • Merger expected to close by the end of 2022, subject to approval by Solid’s shareholders and other customary closing conditions • Upon closing, AavantiBio would become a wholly owned subsidiary of Solid Anticipated Combined Company Pro Forma Ownership of lead investors following issuance of shares in merger and PIPE will be: Perceptive Advisors (17.9%), RA Capital Management (17.4%) and Bain Capital Life Sciences (16.0%) © 2022 Solid Biosciences 9

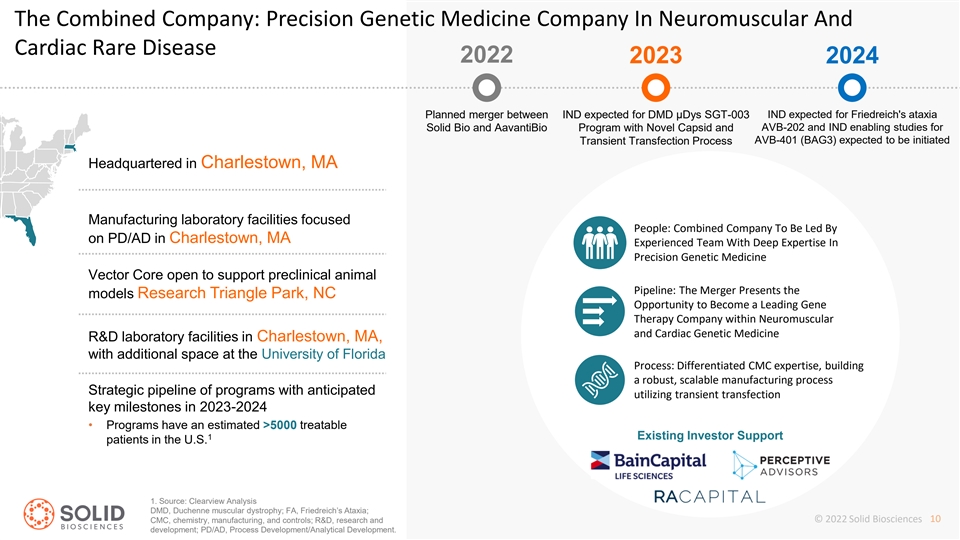

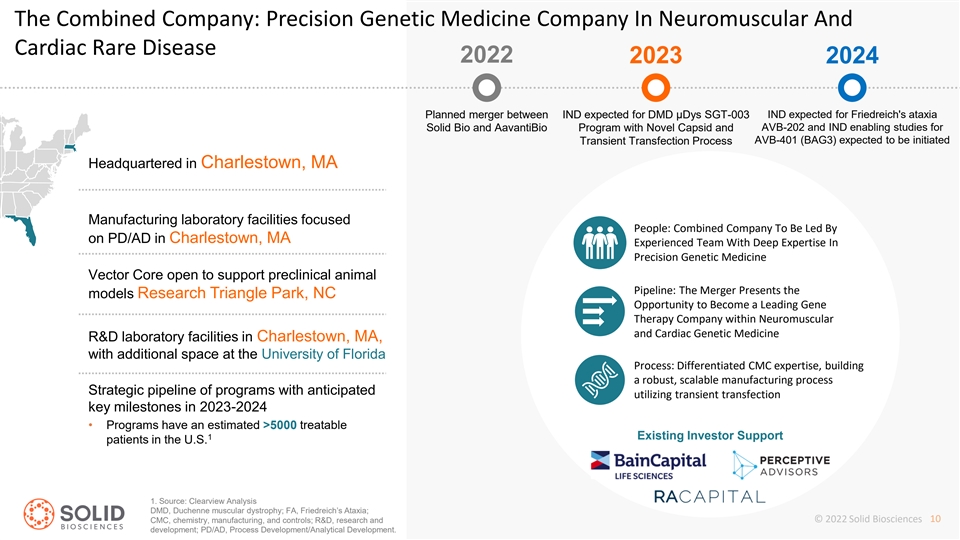

The Combined Company: Precision Genetic Medicine Company In Neuromuscular And Cardiac Rare Disease 2022 2023 2024 Planned merger between IND expected for DMD µDys SGT-003 IND expected for Friedreich's ataxia AVB-202 and IND enabling studies for Solid Bio and AavantiBio Program with Novel Capsid and AVB-401 (BAG3) expected to be initiated Transient Transfection Process Headquartered in Charlestown, MA Manufacturing laboratory facilities focused People: Combined Company To Be Led By on PD/AD in Charlestown, MA Experienced Team With Deep Expertise In Precision Genetic Medicine Vector Core open to support preclinical animal Pipeline: The Merger Presents the models Research Triangle Park, NC Opportunity to Become a Leading Gene Therapy Company within Neuromuscular and Cardiac Genetic Medicine R&D laboratory facilities in Charlestown, MA, with additional space at the University of Florida Process: Differentiated CMC expertise, building a robust, scalable manufacturing process Strategic pipeline of programs with anticipated utilizing transient transfection key milestones in 2023-2024 • Programs have an estimated >5000 treatable 1 Existing Investor Support patients in the U.S. 1. Source: Clearview Analysis DMD, Duchenne muscular dystrophy; FA, Friedreich’s Ataxia; CMC, chemistry, manufacturing, and controls; R&D, research and © 2022 Solid Biosciences 10 development; PD/AD, Process Development/Analytical Development.

Combined Company To Be Led By Experienced Team With Deep Expertise In Precision Genetic Medicine With >100 Combined Years of Relevant Experience Bo Cumbo Stephen DiPalma Carl Morris, PhD Jenny Marlowe, PhD Chief Scientific Officer Chief Scientific Officer President and CEO Interim Chief Friedreich’s Ataxia & Financial Officer Neuromuscular Cardiac Pipeline Jessie Hanrahan, PhD Ty Howton Paul Herzich Roxana Donisa Chief Regulatory Officer Dreghici, M.D. Chief Administrative Chief Technology Officer Officer Head of Clinical Development Board of Directors of the combined company to include Solid’s current board members and, effective as of the closing of the transactions, Solid will add Bo Cumbo and Adam Koppel, M.D., Ph.D., managing director at Bain Capital Life Sciences. © 2022 Solid Biosciences 11

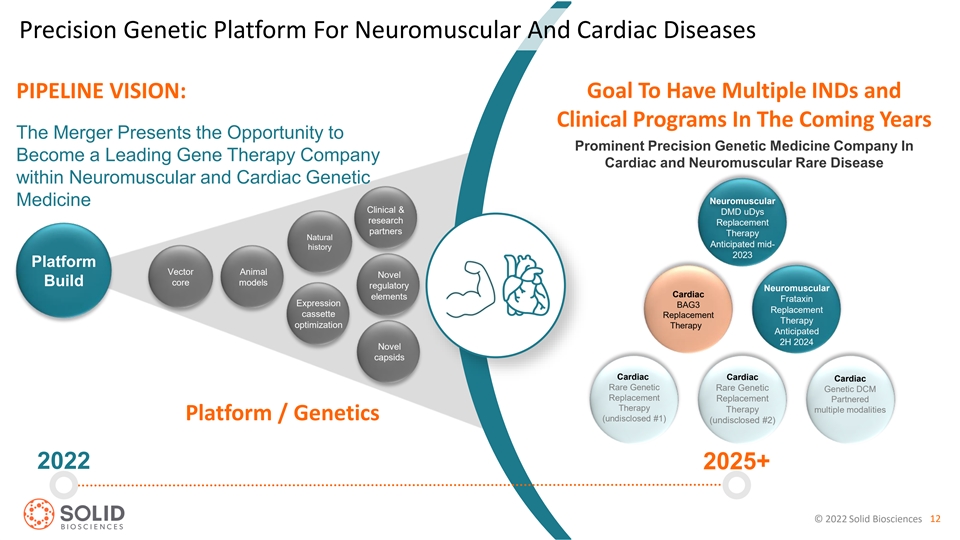

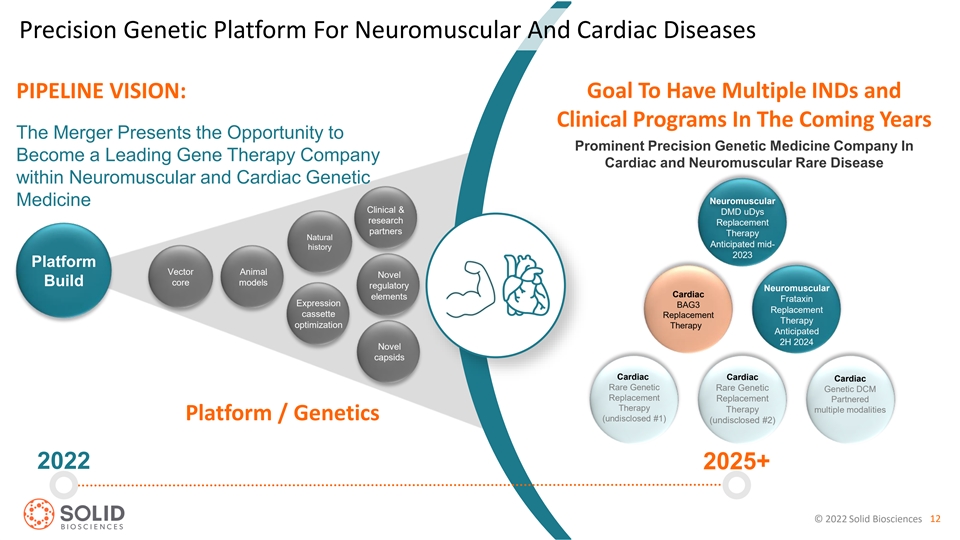

Precision Genetic Platform For Neuromuscular And Cardiac Diseases PIPELINE VISION: Goal To Have Multiple INDs and Clinical Programs In The Coming Years The Merger Presents the Opportunity to Prominent Precision Genetic Medicine Company In Become a Leading Gene Therapy Company Cardiac and Neuromuscular Rare Disease within Neuromuscular and Cardiac Genetic Neuromuscular Medicine Clinical & DMD uDys research Replacement partners Therapy Natural Anticipated mid- history 2023 Platform Vector Animal Novel core models Build regulatory Neuromuscular Cardiac elements Frataxin Expression BAG3 Replacement cassette Replacement Therapy optimization Therapy Anticipated 2H 2024 Novel capsids Cardiac Cardiac Cardiac Rare Genetic Rare Genetic Genetic DCM Replacement Replacement Partnered Therapy Therapy multiple modalities Platform / Genetics (undisclosed #1) (undisclosed #2) 2022 2025+ © 2022 Solid Biosciences 12

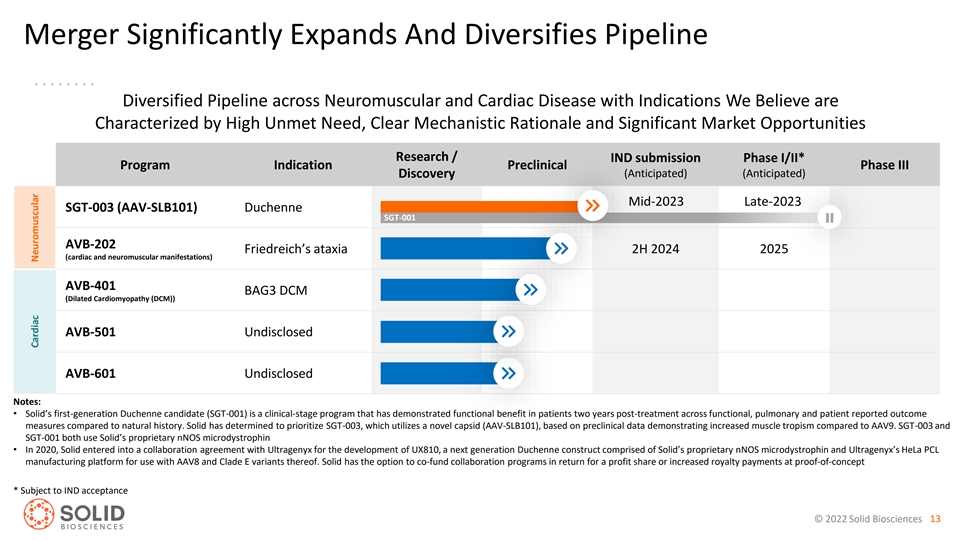

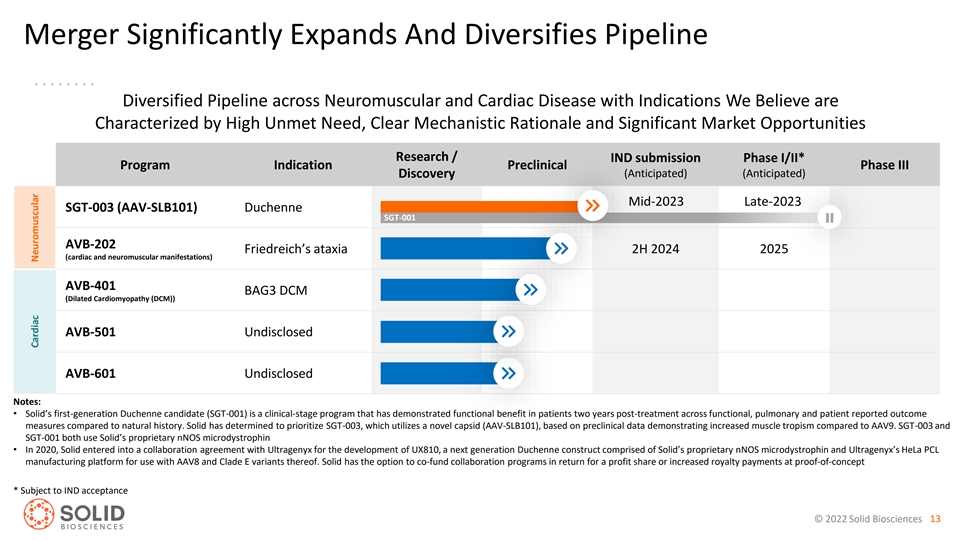

Merger Significantly Expands And Diversifies Pipeline Diversified Pipeline across Neuromuscular and Cardiac Disease with Indications We Believe are Characterized by High Unmet Need, Clear Mechanistic Rationale and Significant Market Opportunities Research / IND submission Phase I/II* Program Indication Preclinical Phase III Discovery (Anticipated) (Anticipated) Mid-2023 Late-2023 SGT-003 (AAV-SLB101) Duchenne SGT-001 AVB-202 Friedreich’s ataxia 2H 2024 2025 (cardiac and neuromuscular manifestations) AVB-401 BAG3 DCM (Dilated Cardiomyopathy (DCM)) AVB-501 Undisclosed AVB-601 Undisclosed Notes: • Solid’s first-generation Duchenne candidate (SGT-001) is a clinical-stage program that has demonstrated functional benefit in patients two years post-treatment across functional, pulmonary and patient reported outcome measures compared to natural history. Solid has determined to prioritize SGT-003, which utilizes a novel capsid (AAV-SLB101), based on preclinical data demonstrating increased muscle tropism compared to AAV9. SGT-003 and SGT-001 both use Solid’s proprietary nNOS microdystrophin • In 2020, Solid entered into a collaboration agreement with Ultragenyx for the development of UX810, a next generation Duchenne construct comprised of Solid’s proprietary nNOS microdystrophin and Ultragenyx’s HeLa PCL manufacturing platform for use with AAV8 and Clade E variants thereof. Solid has the option to co-fund collaboration programs in return for a profit share or increased royalty payments at proof-of-concept * Subject to IND acceptance © 2022 Solid Biosciences 13 Cardiac Neuromuscular

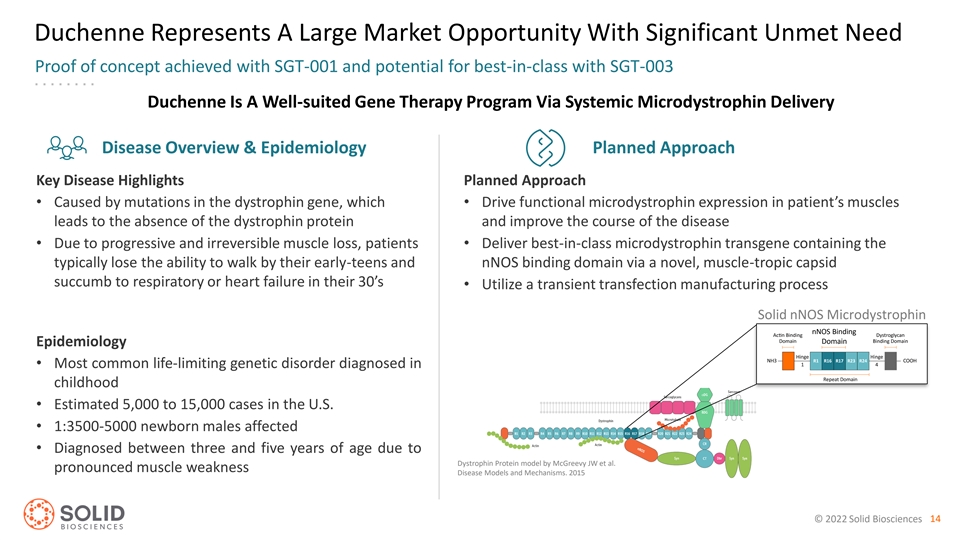

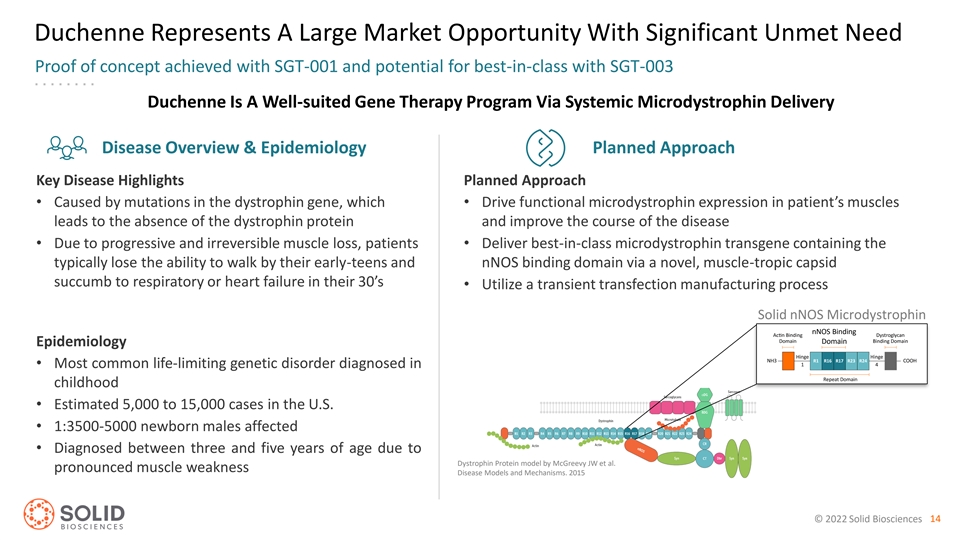

Duchenne Represents A Large Market Opportunity With Significant Unmet Need Proof of concept achieved with SGT-001 and potential for best-in-class with SGT-003 Duchenne Is A Well-suited Gene Therapy Program Via Systemic Microdystrophin Delivery Disease Overview & Epidemiology Planned Approach Key Disease Highlights Planned Approach • Caused by mutations in the dystrophin gene, which • Drive functional microdystrophin expression in patient’s muscles leads to the absence of the dystrophin protein and improve the course of the disease • Due to progressive and irreversible muscle loss, patients • Deliver best-in-class microdystrophin transgene containing the typically lose the ability to walk by their early-teens and nNOS binding domain via a novel, muscle-tropic capsid succumb to respiratory or heart failure in their 30’s • Utilize a transient transfection manufacturing process Solid nNOS Microdystrophin nNOS Binding Domain Epidemiology • Most common life-limiting genetic disorder diagnosed in childhood • Estimated 5,000 to 15,000 cases in the U.S. • 1:3500-5000 newborn males affected • Diagnosed between three and five years of age due to Dystrophin Protein model by McGreevy JW et al. pronounced muscle weakness Disease Models and Mechanisms. 2015 © 2022 Solid Biosciences 14

Clinical Proof Of Concept For SGT-001 (HSV) Suggests SGT-003 (TT) Could Provide Higher Transduction And Lower Viral Loads SGT-001 HSV SGT-001 TT SGT-003 AAV-SLB101 Capsid AAV9 AAV9 (Novel, muscle tropic capsid) Promoter CK8 CK8 CK8 Transgene Protein nNOS Microdystrophin nNOS Microdystrophin nNOS Microdystrophin 2E14 vg/kg subject to <2E14 vg/kg subject to Target Dosage 2E14 vg/kg ++ dose-finding studies dose-finding studies Manufacturing Platform HSV Transient Transfection Transient Transfection ++ ++ Plasmid Design First Generation Optimized for Productivity Optimized for Productivity ++ ++ Transgene Expression in vivo compared to AAV9 >10X ++ Muscle Biodistribution in vivo compared to AAV9 >2X ++ Liver Biodistribution in vivo compared to AAV9 ~0.5X ++ Target SGT-003 IND For Mid-2023 and First Dosing Late-2023 subject to IND approval © 2022 Solid Biosciences 15 Preclinical Data Manufacturing GTx Construct

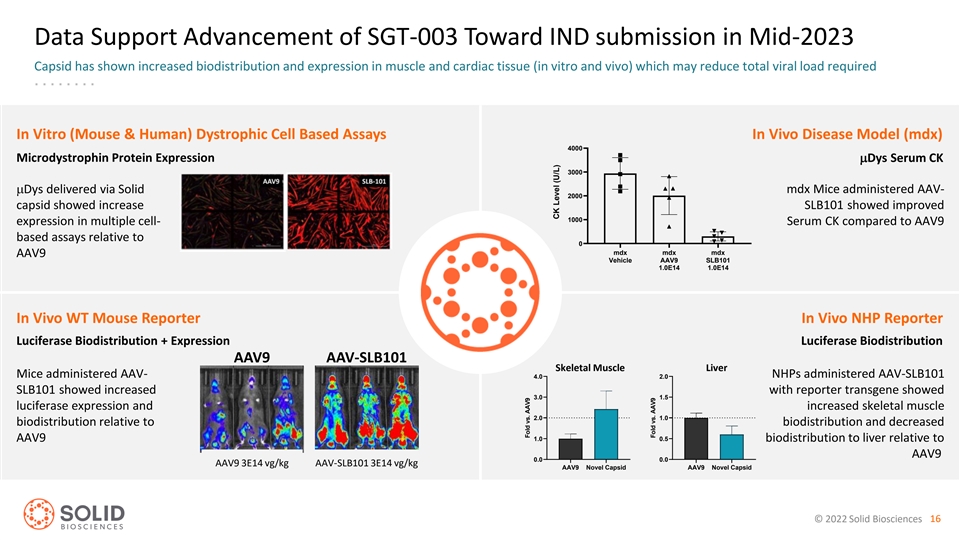

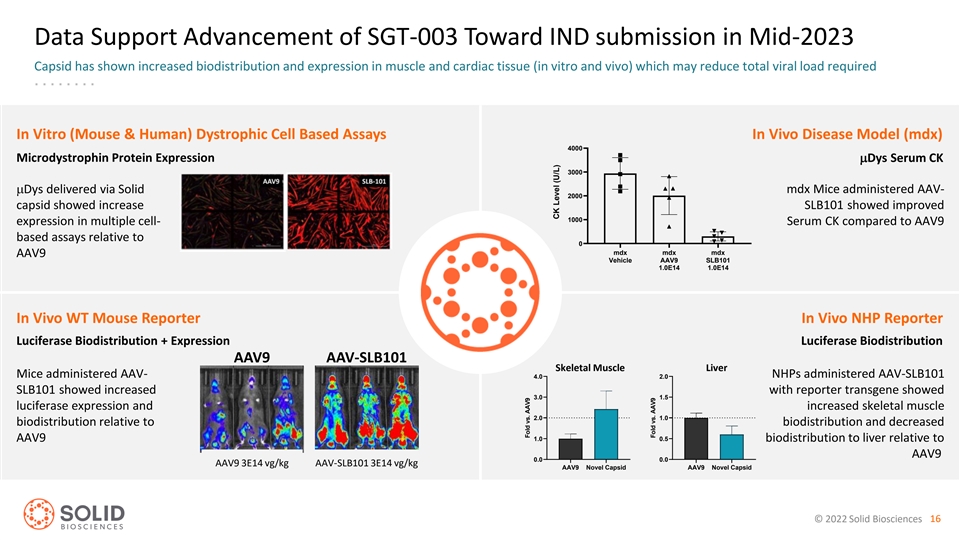

Data Support Advancement of SGT-003 Toward IND submission in Mid-2023 Capsid has shown increased biodistribution and expression in muscle and cardiac tissue (in vitro and vivo) which may reduce total viral load required Serum CK Day 29 Post-Treatment In Vitro (Mouse & Human) Dystrophic Cell Based Assays In Vivo Disease Model (mdx) 4000 Microdystrophin Protein ExpressionmDys Serum CK 3000 mDys delivered via Solid mdx Mice administered AAV- 2000 capsid showed increase SLB101 showed improved 1000 expression in multiple cell- Serum CK compared to AAV9 based assays relative to 0 mdx mdx mdx AAV9 Vehicle AAV9 SLB101 1.0E14 1.0E14 In Vivo WT Mouse Reporter In Vivo NHP Reporter Luciferase Biodistribution + Expression Luciferase Biodistribution AAV9 AAV-SLB101 Skeletal Muscle Liver Skeletal Muscle Liver Mice administered AAV- 4.0 2.0 NHPs administered AAV-SLB101 SLB101 showed increased with reporter transgene showed 3.0 1.5 luciferase expression and increased skeletal muscle 2.0 1.0 biodistribution relative to biodistribution and decreased 1.0 0.5 AAV9 biodistribution to liver relative to AAV9 0.0 0.0 AAV9 3E14 vg/kg AAV-SLB101 3E14 vg/kg AAV9 Novel Capsid AAV9 Novel Capsid © 2022 Solid Biosciences 16 Fold vs. AAV9 CK Level (U/L) Fold vs. AAV9

Solid’s Path Forward for SGT-003 Manufacturing Regulatory Engagement Clinical scale process development complete; Solid completing preclinical requirements and Solid to initiate GMP manufacturing to enable clinical protocol to support IND submission patient dosing in late-2023, pending IND package acceptance Target date for submission is mid-2023 Solid expects to initiate dosing patients in late-2023, pending IND acceptance © 2022 Solid Biosciences 17

Friedreich’s Ataxia Represents A Large Market Opportunity With Significant Unmet Need And No Approved Therapies FA Is A Well-suited Gene Therapy Program Via Frataxin Replacement Strategy Disease Overview & Epidemiology Planned Approach and Current Status Key Disease Highlights Planned Approach: IND Targeted For 2H 2024 • FA is a monogenic disease caused by loss of frataxin • Address both neurological and cardiac manifestations of the with both neurological and cardiac manifestations diseases via dual IV and IT routes of administration, as well as affecting muscle control and coordination with possible applying an immunosuppression strategy to optimize for safety loss of vision and hearing, and slurred speech • Utilize a transient transfection manufacturing process • Primary cause of death is cardiac complications Vector Promoter Transgene • There is a substantial unmet need with no disease- CBA ITR human FXN-3’ UTR ITR 1 modifying standard of care for the broad population Poly A AAV9 Frataxin Epidemiology Current Status of AVB-202 Preclinical Studies 2,3 • 1 in every 40,000 to 50,000 people • Frataxin expression observed in target tissues in multiple animal models • Carrier rate between 1:60 and 1:100 • Treatment of frataxin-deficient mice led to dose-dependent rescue of mitochondrial SDH in the heart compared to vehicle control • Average age of diagnosis is in the early-teens which 1 leads to many undiagnosed patients • Improved survival and cardiac function in preclinical cardiac mouse models compared to vehicle control 1. FARA 2. Durr et al, 1996 (SDH, succinate dehydrogenase) © 2022 Solid Biosciences 18 3. NORD

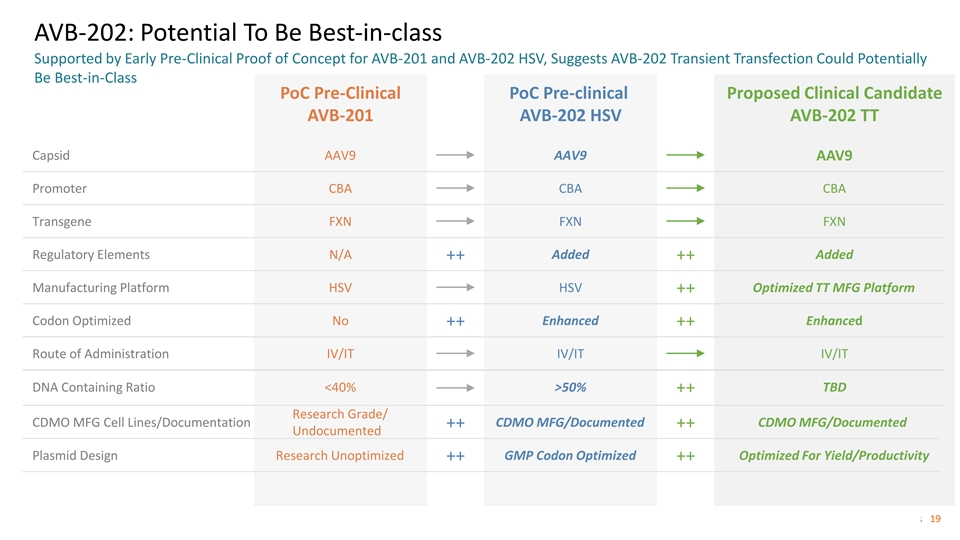

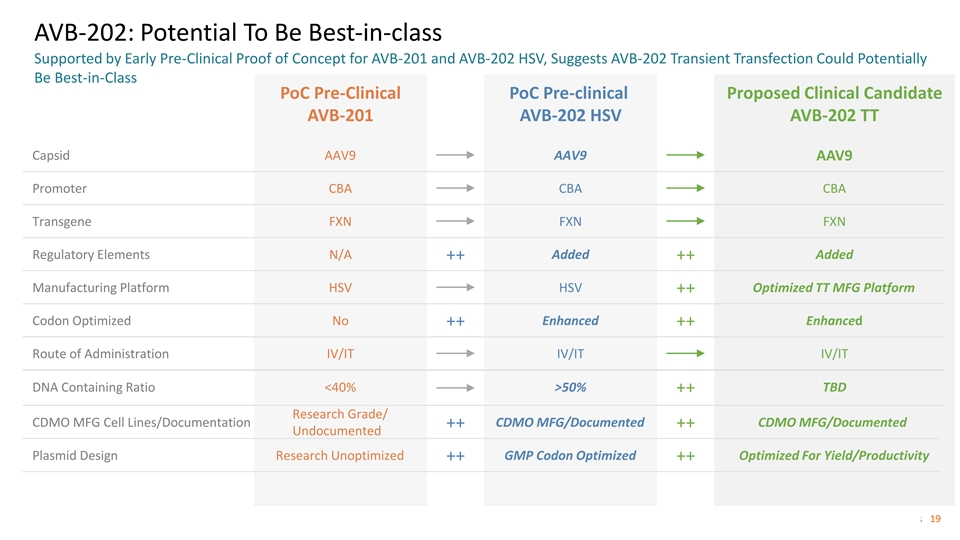

AVB-202: Potential To Be Best-in-class Supported by Early Pre-Clinical Proof of Concept for AVB-201 and AVB-202 HSV, Suggests AVB-202 Transient Transfection Could Potentially Be Best-in-Class PoC Pre-Clinical PoC Pre-clinical Proposed Clinical Candidate AVB-201 AVB-202 HSV AVB-202 TT Capsid AAV9 AAV9 AAV9 Promoter CBA CBA CBA Transgene FXN FXN FXN Regulatory Elements N/A Added Added ++ ++ Manufacturing Platform HSV HSV Optimized TT MFG Platform ++ Codon Optimized No Enhanced Enhanced ++ ++ Route of Administration IV/IT IV/IT IV/IT DNA Containing Ratio <40% >50% TBD ++ Research Grade/ CDMO MFG Cell Lines/Documentation CDMO MFG/Documented CDMO MFG/Documented ++ ++ Undocumented Plasmid Design Research Unoptimized GMP Codon Optimized Optimized For Yield/Productivity ++ ++ © 2022 Solid Biosciences 19

FA Proof Of Concept Achieved Pre-clinically Program Supported by Multiple Key Preclinical Models of Cardiac Manifestations of FA AVB-202 Extended Survival And Improved Cardiac Function In Cardiac Frataxin (FXN) KO Mice Survival Ejection Fraction Pre-symptomatic FXN KO model Survival Ejection Fraction Post-symptomatic FXN KO model © 2022 Solid Biosciences 20 Animals dosed at onset of Animals dosed at P1 cardiac symptoms

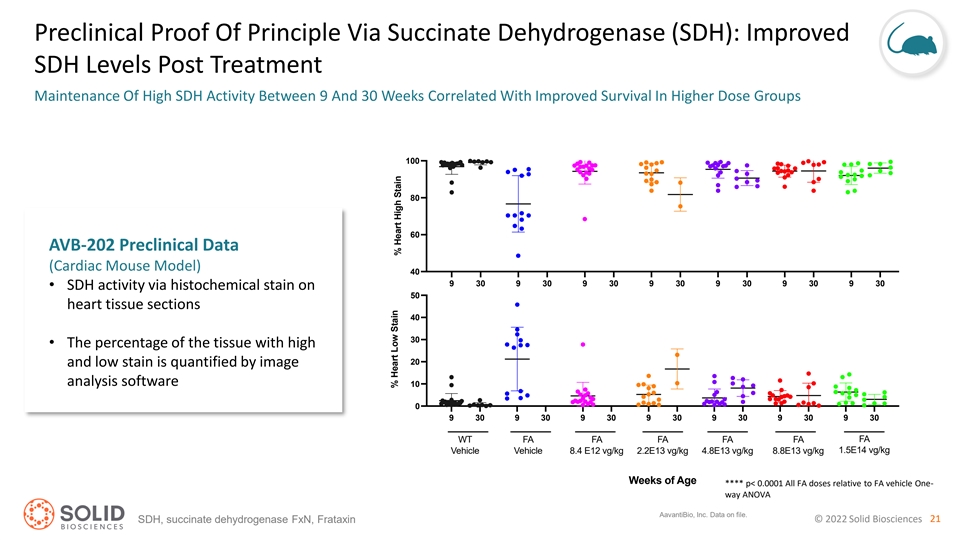

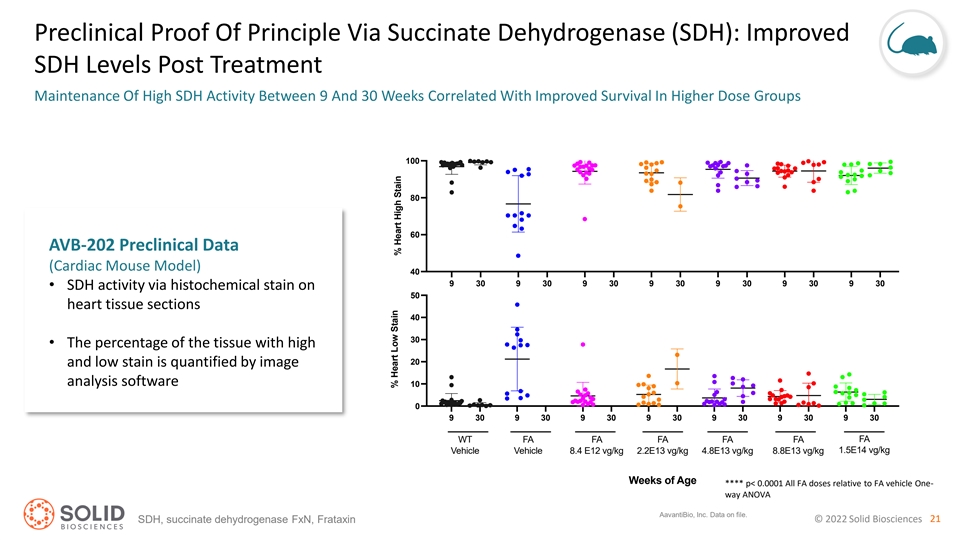

Preclinical Proof Of Principle Via Succinate Dehydrogenase (SDH): Improved SDH Levels Post Treatment Maintenance Of High SDH Activity Between 9 And 30 Weeks Correlated With Improved Survival In Higher Dose Groups 100 80 60 AVB-202 Preclinical Data (Cardiac Mouse Model) 40 9 30 9 30 9 30 9 30 9 30 9 30 9 30 • SDH activity via histochemical stain on 50 heart tissue sections 40 30 • The percentage of the tissue with high 20 and low stain is quantified by image analysis software 10 0 9 30 9 30 9 30 9 30 9 30 9 30 9 30 WT FA FA FA FA FA FA 1.5E14 vg/kg Vehicle Vehicle 8.4 E12 vg/kg 2.2E13 vg/kg 4.8E13 vg/kg 8.8E13 vg/kg Weeks of Age **** p< 0.0001 All FA doses relative to FA vehicle One- way ANOVA AavantiBio, Inc. Data on file. © 2022 Solid Biosciences 21 SDH, succinate dehydrogenase FxN, Frataxin % Heart Low Stain % Heart High Stain

Dilated Cardiomyopathy (BAG3) Is The First Program From The Cardiac Pipeline Attractive Indication with Clear Mechanistic Rationale, High Unmet Need and Significant Market Opportunity BAG3 DCM is Well-suited to Gene Therapy via BAG3 Replacement Disease Overview & Epidemiology Patient Experience and Planned Approach Key Disease Highlights Patient Experience • The BAG3 gene codes for the BCL-2-associated athanogene • Most common presentation is dyspnea but can range from 3 protein dyspnea to sudden death • Sufficient levels of functional BAG3 are required for healthy • Activities of daily life are severely impacted cardiac function • Eventually heart failure sets in and death ensues • BAG3 mutations lead to reduced BAG3 levels and dilated • No approved therapies address the underlying cause of 4 cardiomyopathy (DCM) disease. Symptomatic treatment is standard of care • Postulated mechanism: Decreased BAG3 leads to heat shock protein dysfunction, and a build-up of dysfunctional Planned Approach hBAG3 proteins in the sarcomere, causing myofilament damage, • AAVrh74-delivered optimized poor contraction and heart failure BAG3 transgene with cardiac- specific promoter for safe and Epidemiology specific expression 1, 2, 3 • ~29,000 active patients in the US • Optimized transient 1. Dominguez et al, 2018 transfection manufacturing 2. Virani et al, 2021 process 3. Clearview Analysis 4. Shaw et al, 2018 © 2022 Solid Biosciences 22 5. Bozkurt et al, 2007

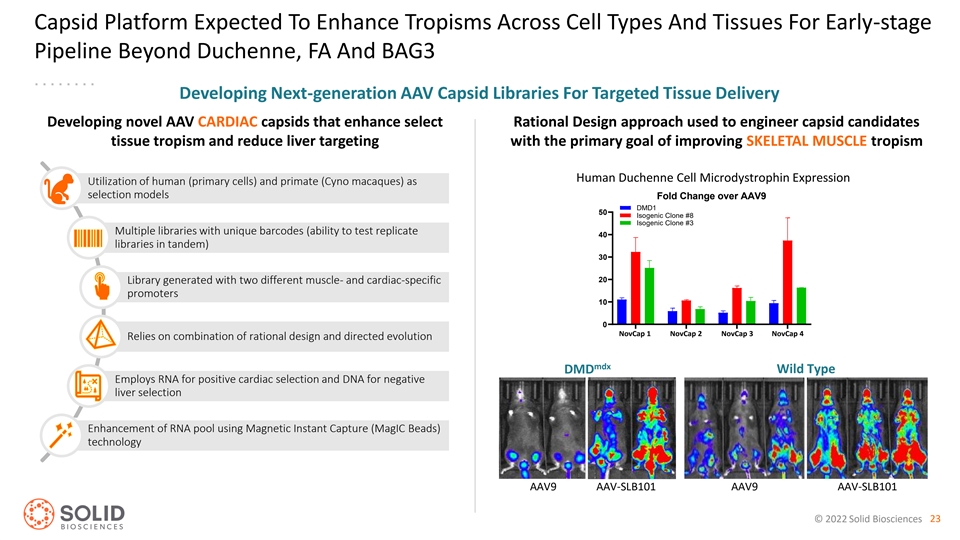

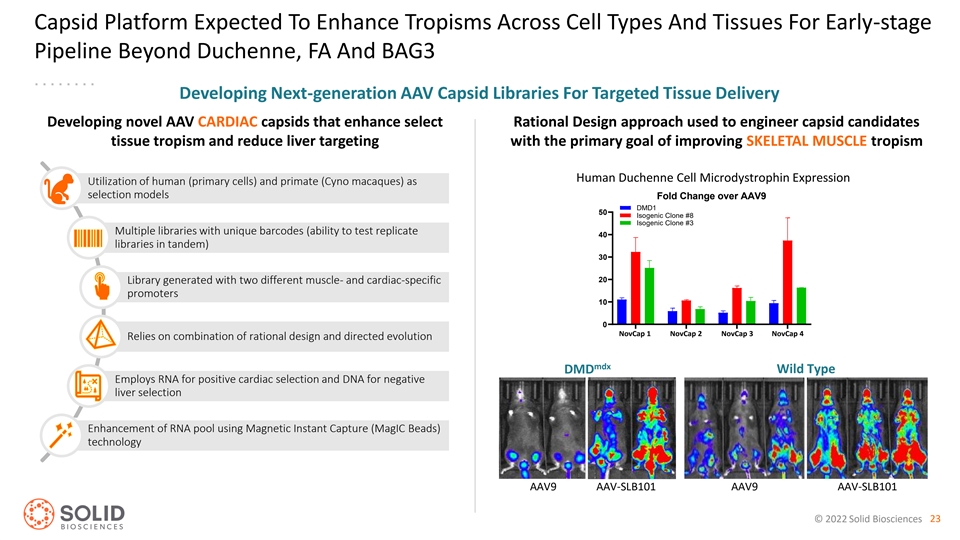

Capsid Platform Expected To Enhance Tropisms Across Cell Types And Tissues For Early-stage Pipeline Beyond Duchenne, FA And BAG3 Developing Next-generation AAV Capsid Libraries For Targeted Tissue Delivery Developing novel AAV CARDIAC capsids that enhance select Rational Design approach used to engineer capsid candidates tissue tropism and reduce liver targeting with the primary goal of improving SKELETAL MUSCLE tropism Human Duchenne Cell Microdystrophin Expression Utilization of human (primary cells) and primate (Cyno macaques) as selection models Fold Change over AAV9 DMD1 50 Isogenic Clone #8 Isogenic Clone #3 Multiple libraries with unique barcodes (ability to test replicate 40 libraries in tandem) 30 20 Library generated with two different muscle- and cardiac-specific promoters 10 0 NovCap 1 NovCap 2 NovCap 3 NovCap 4 SLB101 SLB102 SLB113 SLB114 Relies on combination of rational design and directed evolution mdx DMD Wild Type Employs RNA for positive cardiac selection and DNA for negative liver selection Enhancement of RNA pool using Magnetic Instant Capture (MagIC Beads) technology AAV9 AAV-SLB101 AAV9 AAV-SLB101 © 2022 Solid Biosciences 23

Single Manufacturing Approach Across All Programs Utilizing Transient Transfection Combined Company Will Have Fully Integrated CMC Regulatory Teams Supporting PD/AD/QA/QC* Established commercially scalable process with a known regulatory pathway that we believe can be leveraged to move programs quickly towards commercialization Highly potent drug product demonstrating high levels of in vitro and in vivo transgene expression High quality product with desired quality attributes supported by robust analytical data Consistent product supply with ability to dynamically leverage synergized supply chain Platform process to inform and expedite the transition of novel capsids into clinical studies * Process Development (PD), Analytical Development (AD), Quality Assurance (QA), Quality Control (QC) © 2022 Solid Biosciences 24

In Vivo Comparison Study Supports Use of TT Process and SGT-003 Capsid Process and capsid changes yielded a 2.3x improved expression for SGT-003 TT compared to SGT-001 HSV Microdystrophin Expression (WB) at 1E14 vg/kg in mdx mice ~ 2.3x 400 ~1.7x 350 Process change (HSV to TT) and AAV-SLB101 capsid combined to increase µDys by 2.3x vs SGT-001 HSV 251% 300 • Product with desired quality attributes supported by analytical data 250 ~1.4x with TT process 200 149% • Product demonstrated high levels of in vitro and in vivo transgene 108% expression vs HSV material 150 • In vivo expression increased by 1.4-2.0x in multiple mdx studies 100 • SGT-003 provided an additional increase of microdystrophin expression vs SGT-001 TT material in mdx mice 50 0 HSV TT TT SGT-001 SGT-003 28-day in vivo mdx mouse study. Microdystrophin expression measured in the quadriceps muscle using Western Blot (WB). Mean data are shown +/- SD relative a Reference of SGT-001 produced by the HSV process. n=5 per group. © 2022 Solid Biosciences 25 % of Reference

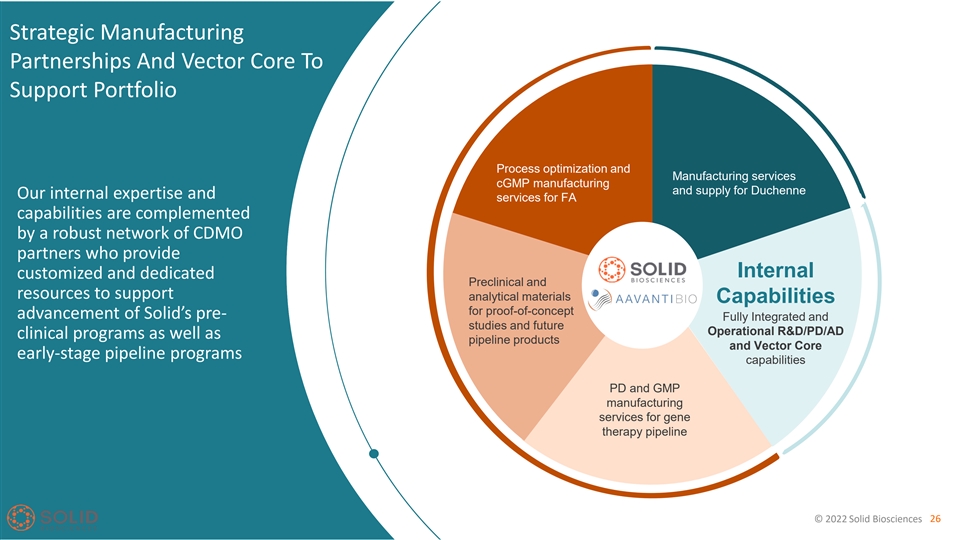

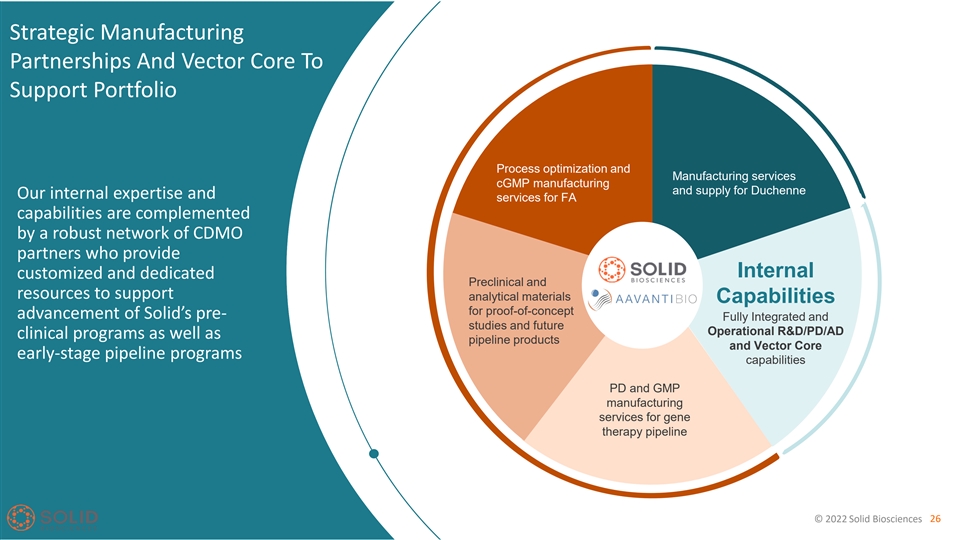

Strategic Manufacturing Partnerships And Vector Core To Support Portfolio Process optimization and Manufacturing services cGMP manufacturing and supply for Duchenne Our internal expertise and services for FA capabilities are complemented by a robust network of CDMO partners who provide Internal customized and dedicated Preclinical and resources to support analytical materials Capabilities for proof-of-concept advancement of Solid’s pre- Fully Integrated and studies and future Operational R&D/PD/AD clinical programs as well as pipeline products and Vector Core early-stage pipeline programs capabilities PD and GMP manufacturing services for gene therapy pipeline © 2022 Solid Biosciences 26

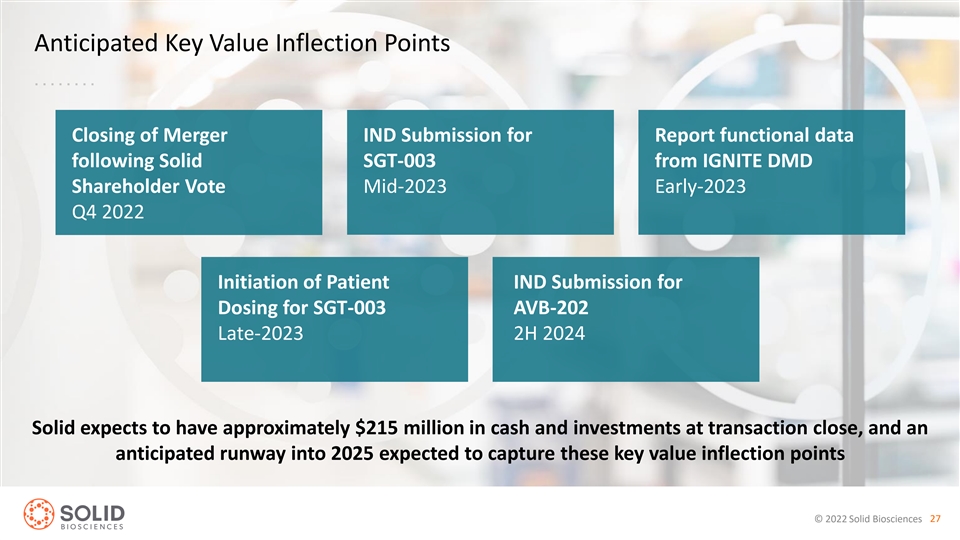

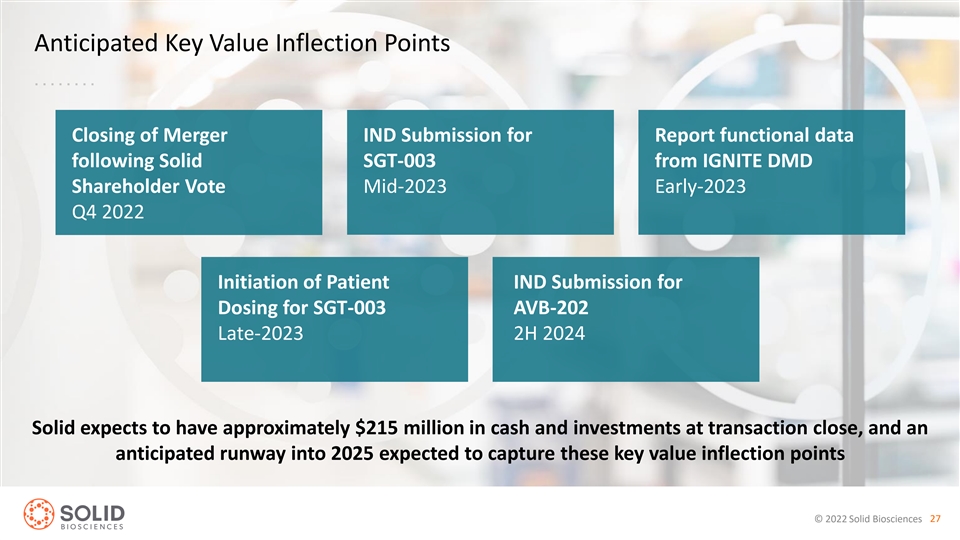

Anticipated Key Value Inflection Points Closing of Merger IND Submission for Report functional data following Solid SGT-003 from IGNITE DMD Shareholder Vote Mid-2023 Early-2023 Q4 2022 Initiation of Patient IND Submission for Dosing for SGT-003 AVB-202 Late-2023 2H 2024 Solid expects to have approximately $215 million in cash and investments at transaction close, and an anticipated runway into 2025 expected to capture these key value inflection points © 2022 Solid Biosciences 27

Q&A © 2022 Solid Biosciences 28

THANK YOU © 2022 Solid Biosciences 29

Risk Factors The list below of risk factors has been prepared solely for purposes of the proposed PIPE as part of the proposed Merger between Solid and AavantiBio, and solely for potential investors in the PIPE, and not for any other purpose. The risks presented below are certain of the general risks related to the proposed combined company following the Merger, the proposed Merger and proposed PIPE, and such list is not exhaustive. The list below is qualified in its entirety by disclosures contained in future documents filed or furnished by Solid with the U.S. Securities and Exchange Commission (the “SEC”), including the documents filed or furnished in connection with the proposed transactions between Solid and AavantiBio. The risks presented in such filings may differ significantly from and be more extensive than those presented below. Investing in the PIPE immediately following the consummation of the Merger involves a high degree of risk. Investors should carefully consider the risks and uncertainties inherent in an investment in the combined company, including those described below, before subscribing for the securities in the PIPE. If Solid or the combined company cannot address any of the following risks and uncertainties effectively, or any other risks and difficulties that may arise in the future, the combined company’s business, financial condition or results of operations could be materially and adversely affected. The risks described below are not the only ones that Solid faces. Additional risks that Solid currently does not know about or that Solid currently believes to be immaterial may also impair its business, financial condition or results of operations. You should review the investors’ presentation and perform your own due diligence, prior to making an investment in the combined company. Risks Related to the Merger • The consummation of the Merger will be subject to a number of closing conditions and if those closing conditions are not satisfied or waived, the proposed merger agreement may be terminated in accordance with its terms and the Merger may not be completed. • The ability to successfully effect the Merger and the combined company’s ability to successfully operate the business thereafter will be largely dependent upon the efforts of certain key personnel. The loss of such key personnel could negatively impact the operations and financial results of the combined business. • The combined company may not timely or successfully achieve the anticipated benefits of the Merger, and the combined company may experience unexpected costs, charges or expenses resulting from the Merger. • If the Merger’s benefits do not meet the expectations of investors or securities analysts, the market price of Solid’s common stock or, following the consummation of the Merger, the combined company’s common stock may decline. • There can be no assurance that, prior to the consummation of the Merger, Solid will regain compliance with Nasdaq’s minimum bid price requirement, and Solid may need to transfer to the Nasdaq Capital Market and/or effect a reverse stock split. There can be no assurance that the combined company’s securities will be able to comply with the continued listing standards of Nasdaq. • The issuance of shares of common stock as consideration in the Merger and any equity awards that may be issued in connection with the Merger will dilute substantially the voting power of the combined company’s stockholders. • Directors of each of Solid and AavantiBio may have potential conflicts of interest in recommending that their respective company’s stockholders vote in favor of the adoption of the Merger. • Bain, Perceptive Advisors and RA Capital have significant voting power in Solid and AavantiBio and may have interests in the Merger that are different from, or in addition to, the interests of other stockholders. • Solid stockholders and AavantiBio stockholders may not realize a benefit from the Merger commensurate with the ownership dilution they will experience in connection with the Merger. • Any future legal proceedings in connection with the Merger could delay or prevent the completion of the Merger. • Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect Solid’s and the combined company’s business, including Solid’s and the combined company’s ability to consummate the Merger, and results of operations. Risks Related to the Proposed PIPE • The closing of the PIPE will be contingent upon the closing of the Merger, which itself will be subject to a number of risks and uncertainties. • Solid may be unable to raise sufficient capital in the PIPE or otherwise obtain additional financing to fund the operations and growth of the combined company following the Merger. • The issuance of shares of common stock in the PIPE will dilute substantially the voting power of the combined company's stockholders. • The combined company may utilize the proceeds from the PIPE in ways that do not improve the combined company’s results of operations or enhance the value of the common stock. • Bain, Perceptive Advisor and RA Capital have aggregate indications of interest of $45 million in the PIPE, which will further increase their ownership in the combined company and may have interests in the PIPE that are different from, or in addition to, interests of other stockholders. • The securities issued in the PIPE will not initially be registered with the SEC, and prior to such registration cannot be transferred or resold except in a transaction exempt from or not subject to the registration requirements of the Securities Act and applicable state securities laws. • There can be no assurance that the PIPE shares will be approved for listing on Nasdaq or that we will be able to comply with Nasdaq's continued listing standards. © 2022 Solid Biosciences 30

Risk Factors Risks Related to the Proposed Combined Company • The combined company will incur net losses for the foreseeable future and may never achieve or maintain profitability. • The combined company will need additional funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force the combined company to delay, limit or terminate its product development efforts or other operations. • Neither Solid nor AavantiBio has generated revenue from product sales and the combined company does not expect to do so for the next several years, if ever. • The combined company’s limited operating history may make it difficult for stockholders to evaluate the success of the combined company’s business and to assess its future viability. • The ongoing COVID-19 pandemic may affect the combined company’s ability to initiate and complete current or future preclinical studies or clinical trials, disrupt regulatory activities or have other adverse effects on the combined company’s business and operations. • In November 2019, the FDA placed Solid’s IGNITE DMD clinical trial on a temporary clinical hold after Solid reported a serious adverse event in the clinical trial. We cannot guarantee that similar events will not happen in the combined company’s future clinical trials. • SGT-003 and AVB-202 are gene transfer candidates based on novel technology, which makes it difficult to predict the time and cost of development and of subsequently obtaining regulatory approval for such product candidates. • The combined company’s product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit their commercial potential or result in significant negative consequences following any potential marketing approval. • The combined company has never completed a clinical trial, and may be unable to do so for any product candidates it may develop, including SGT-003 and AVB-202 or other future product candidates. • Success in preclinical studies or early clinical trials, including Solid’s IGNITE DMD clinical trial, may not be indicative of results obtained in later trials. • Preliminary or interim data that the combined company announces or publishes from time to time may change as more data become available and are subject to audit and verification procedures that could result in material changes in the final data. • The combined company may encounter substantial delays in its clinical trials or may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities. • Even if the combined company completes the necessary clinical trials, we cannot predict when, or if, the combined company will obtain regulatory approval to commercialize SGT-003, AVB-202 or other future product candidates and any approval may be for a more narrow indication than we seek. • The combined company will face significant competition. • We have limited gene transfer manufacturing experience and the combined company could experience production problems and delays in obtaining regulatory approval of its manufacturing processes, which could result in delays in the development or commercialization of SGT-003, AVB-202 or other future product candidates. • The combined company expects to utilize third parties to conduct its product manufacturing for the foreseeable future. Therefore, the combined company will be subject to the risk that these third parties may not perform satisfactorily or meet regulatory requirements. • Negative public opinion and increased regulatory scrutiny of gene therapy may damage public perception of the safety of the combined company’s gene transfer product candidates and adversely affect the combined company’s ability to conduct its business or obtain regulatory approvals for its gene transfer product candidates. • The combined company will heavily rely on certain in-licensed patents and other intellectual property rights in connection with its development of SGT-003, AVB-202 and other future product candidates and may be required to acquire or license additional patents or other intellectual property rights to continue to develop and commercialize SGT-003, AVB-202 and other future product candidates. • If we are unable to obtain and maintain patent protection for the combined company’s product candidates, or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize products similar or identical to ours, and our ability to successfully commercialize our product candidates may be adversely affected. • If the combined company cannot comply with Nasdaq’s continued listing standards, its common stock could be delisted. • Bain, Perceptive Advisors and RA Capital will have significant ownership of the common stock of the combined company, and may have substantial control over our business and their interests may differ from the interests of other stockholders. © 2022 Solid Biosciences 31