Filed by Alps Electric Co., Ltd.

Pursuant to Rule 425 under the U.S. Securities Act of 1933

Subject Company: Alpine Electronics, Inc. (File Number: 132-02817)

Dated February 27, 2018

February 27, 2018

To all parties concerned

| Company name: | Alps Electric Co., Ltd. |

| Representative: | Toshihiro Kuriyama

Representative Director and President (Code: 6770, TSE 1st Section) |

| Inquiries to: | Junji Kobayashi, Senior Manager, Corporate Planning Office

TEL +81-3-5499-8026 (IR Direct) |

| | | |

| | Company name: | Alpine Electronics, Inc. |

| | Representative: | Nobuhiko Komeya

Representative Director and President (Code: 6816, TSE 1st Section) |

| | Inquiries to: | Shinji Yamazaki, Senior Manager, Finance and Public Relations Department TEL +81-3-5499-4391 (Finance and Public Relations Direct) |

Notice Regarding Change to the Transaction Structure of the Business Integration between Alps Electric Co., Ltd.

and Alpine Electronics, Inc. and Change of the Name of the Holding Company

(Partial Amendment to the Share Exchange Agreement between Alps Electric Co., Ltd. and Alpine Electronics, Inc.

(Simplified Share Exchange), Cancellation of the Company Split of Alps Electric Co., Ltd.,

Change of the Company Name and Partial Amendments to the Articles of Incorporation of Alps Electric Co., Ltd.)

With respect to the business integration (the “Business Integration”) that involves the reorganization into a holding company structure, which Alps Electric Co., Ltd. (“Alps Electric”) and Alpine Electronics, Inc. (“Alpine” and, together with Alps Electric, the “Companies”) announced in the press release dated July 27, 2017 titled “Notice Regarding Business Integration between Alps Electric Co., Ltd. and Alpine Electronics, Inc. (Execution of Share Exchange Agreement between Alps Electric Co., Ltd. and Alpine Electronics, Inc. (Simplified Share Exchange), Reorganization into a Holding Company Structure through the Company Split of Alps Electric Co., Ltd., Change of Company Name and Partial Amendments to the Articles of Incorporation of Alps Electric Co., Ltd.)” (the “Business Integration Press Release”), the Companies resolved at their respective board of directors meetings held today to partially amend the method of the Business Integration, and hereby announce as follows.

As announced in the Business Integration Press Release, based on a resolution of its board of directors dated July 27, 2017, Alps Electric had executed a memorandum of understanding with ALPS HD CO., LTD. (“Company Split Preparation Company”), its wholly owned subsidiary, concerning the implementation of an absorption-type company split (the “Absorption-type Company Split”), under which Alps Electric would have its rights and obligations concerning its businesses, other than those relating to group management and administration and the management of its assets, succeeded to by the Company Split Preparation Company. However, Alps Electric has decided at its board of directors meeting held today to cancel the Absorption-type Company Split, change the management structure following the Business Integration from a pure holding company structure to an operating holding company structure, and introduce an in-house company system (the “Changes”). The reorganization into an operating holding company structure and an in-house company system is scheduled for January 1, 2019 (the “Reorganization Date”). The Changes partially modify the method of the Business Integration; the intention of Alps Electric and Alpine to implement the Business Integration for their sustained growth and creation of synergies remains unchanged.

Alps Electric and Alpine have also executed, pursuant to the resolutions of their respective board of directors meetings held today, a memorandum of understanding (the “Share Exchange Agreement Amendment MOU”) concerning the amendments to the share exchange agreement executed between the Companies on July 27, 2017 (the “Share Exchange Agreement”) concerning a share exchange through which Alps Electric will be the wholly owning parent company and Alpine will become the wholly owned subsidiary (the “Share Exchange”) in order to implement the Changes. Except for the deletion of the provisions that assumed the implementation of the Absorption-type Company Split and the addition of provisions that confirm the Companies’ plan to implement a business integration that involves the reorganization into an operating holding company structure and to decide on basic matters concerning the Business Integration through good faith discussions between the Companies, the terms and conditions of the Share Exchange Agreement remain unchanged from those announced in the Business Integration Press Release.

As part of the Business Integration, Alps Electric resolved at its board of directors meeting on July 27, 2017 that it would submit a proposal at its 85th ordinary general meeting of shareholders scheduled to be held in late June 2018 to partially amend its articles of incorporation, including changing its company name to “ALPS HD CO., LTD.” on the condition that the Absorption-type Company Split would take effect (the “Amendments to the Articles of Incorporation”). However, in connection with the Changes, Alps Electric has resolved, at its board of directors meeting held today, to partially change the Amendments to the Articles of Incorporation to the effect that the Amendments to the Articles of Incorporation will be effected on the condition that the Share Exchange will have taken effect and its company name will be changed to “ALPS ALPINE CO., LTD.” after the Amendments to the Articles of Incorporation take effect. The Amendments to the Articles of Incorporation are scheduled to take effect on the Reorganization Date on the condition that the Share Exchange will have taken effect, subject to the approval at the 85th ordinary general meeting of shareholders of Alps Electric scheduled to be held in late June 2018.

A. Reason for the Changes

As announced in the Business Integration Press Release, the Companies decided on July 27, 2017 to implement the Business Integration based on the understanding that, in order to respond to a market environment that is expected to change dramatically and tackle business challenges of the Companies, it is vital, in addition to sharing management resources such as the Companies’ human resources and technologies, to exercise more efficient and agile management as the Alps Electric group as a whole, by growing the respective businesses of the Companies based on their prompt and agile decision making. After that, the Companies launched a business integration preparation committee and discussed the creation of synergy effects, and at the same time considered the details of the Absorption-type Company Split from the perspective of establishing a desirable management structure after the Business Integration. However, the Companies determined that it was necessary for them to continue such discussions and consideration. Therefore, as announced in the press release titled “Notice Regarding the Rescheduling of the Absorption-type Company Split Agreement” dated December 22, 2017, it was decided that the execution of the Absorption-type Company Split Agreement, which had been scheduled in late December 2017, be postponed. As such, the Companies have continued discussions.

In the course of considering the business plans of the holding company after the Business Integration, the optimal group structure, the timing when business integration synergies are to be realized and the methods for such realization, and other strategies for the sustainable growth of the Companies at the business integration preparation committee, it has been concluded that, in the current market environment that the Companies are facing, it is vital to realize steadily the synergy effects from the Business Integration and secure market competitiveness. The Companies believe that, in order to realize steadily the synergy effects from the Business Integration, it is best to first have the personnel in the administration departments, including the human resources, general affairs, accounting, and legal departments, as well as the planning departments responsible for management strategies and business strategies of each of the Companies, belong to one entity and thereby strengthen the business strategy function, and then strongly promote the integration of the Companies’ joint businesses to be operated in accordance with such business strategies. Based on such concept, while taking into consideration the importance of realizing a corporate governance structure in which, within one entity, management supervision and business execution are separated while at the same time securing autonomy of the businesses, the Companies have decided to adopt an operating holding company structure and introduce an in-house company system and a corporate officer system as the management structure after the Business Integration. In this regard, as the procedure for a company split is no longer necessary as a result of the Changes, the Companies decided to set the date of reorganization into a holding company structure earlier, from April 1, 2019 to January 1, 2019. In addition, in conjunction with the adoption of the operating holding company structure, the Companies believe it would be important to increase a sense of unity between the Companies and have decided to name the holding company “ALPS ALPINE CO., LTD.” after the Business Integration.

Today’s automotive industry has entered a phase of tremendous transformation that is said to occur only once every 100 years. In particular, the four domains which are referred to as CASE (Connected, Autonomous, Shared, Electric) are seeing, in a short period of time, major changes that are unparalleled by other industries such as a constant connection to the Internet (Connected), autonomous driving (Autonomous), automobile sharing services (Shared) and a shift to electric vehicles such as hybrid cars and electric vehicles (Electric). As represented by IT companies’ entries into the automobile industry, M&A and alliance activities beyond the framework of the automotive industry have been accelerating at an unprecedented pace. The Companies have continued conversations with their own automotive OEM customers even after the announcement of the Business Integration. In the course of such conversations with automotive OEM customers, the Companies have realized that the trend of concentrating management resources on the CASE domain will continue in fiscal 2018 and beyond, and that suppliers of human machine interfaces (HMIs) and other similar products like Alps Electric and Alpine are expected, even more than the Companies thought when they started considering the Business Integration, to not only supply mere electronic components and module products but also propose HMI systems used in the entire vehicle. In light of such a dramatically changing environment surrounding the automotive market, developing new products that integrate the Companies’ strengths and accelerating time-to-market has become a pressing issue for the Companies. The Companies believe that the acceleration of the Business Integration and the steady realization of the synergy effects will allow the Companies to promptly address those issues and meet customers’ expectations.

To that end, it is important for the Companies to distribute management resources efficiently, create new business domains, develop new technologies and implement other initiatives at an accelerated pace. It is particularly vital to provide customers with solutions centered on system integration products leveraging the Companies’ core device technologies, system design capabilities and software development capabilities. In order to steadily realize such result, it is essential to ensure a system that allows flexible and timely personnel transfers and clear reporting lines between the departments in charge of common functions of the Companies and the departments in charge of the Companies’ joint businesses. Accordingly, the Companies concluded that it would be desirable to adopt an operating holding company structure which enables the personnel involved in those departments to belong to a single entity. The Companies believe that, under the operating holding company structure after the Changes, it would be possible to retain the departments in charge of common functions of the Companies and the personnel of the departments in charge of the Companies’ joint businesses within the operating holding company, a single entity, and it would be possible to realize steadily the integration effects in the automotive businesses which currently belong to each of the Companies. Furthermore, the Companies also believe that the acceleration of the Business Integration will contribute to the steady establishment of new businesses in the EHII (Energy, Healthcare, Industry, and IoT (Internet of Things)) and other markets.

Meanwhile, the Companies believe that, while integrating the functions that need to be integrated, it is also important to ensure autonomy of the businesses of Alps Electric and Alpine, and to ensure prompt and strong-minded decision-making based on clear and fair procedures by separating the management supervision and business execution functions. To this end, the Companies have judged that it is desirable to adopt, under an operating holding company structure, an in-house company system to ensure the autonomy of the businesses, as well as a corporate officer system to separate the management supervision and business execution functions.

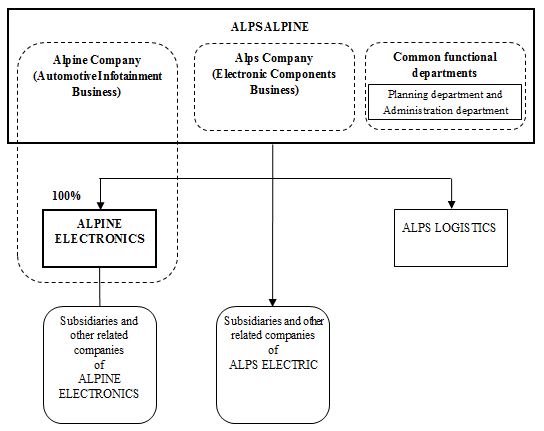

Specifically, under an operating holding company structure and an in-house company system, the Companies will concentrate their personnel in each of their respective administration departments (human resources, general affairs, accounting, and legal departments) and the departments in charge of strategy and planning, including the global business planning departments, in Alps Electric (the company name from the Reorganization Date, “ALPS ALPINE CO., LTD.”). At the same time, the Companies will establish ①”Alps Company,” which will mainly be engaged in the electronic components business, and ②”Alpine Company,” which will mainly be engaged in the automotive infotainment business, and promote the collaboration of the Companies. In addition, by transferring the personnel involved in the Companies’ joint businesses from Alpine to ALPS ALPINE CO., LTD., the Companies will promote the co-creation projects to develop new technology domains that the Companies are currently working on, and otherwise integrally operate the Companies’ businesses in which synergy effects are expected to be realized. The Companies also plan to take such measures as separating the management supervision and business execution functions by appointing some of the current directors of the Companies as the directors of ALPS ALPINE CO., LTD. to have them supervise the businesses of the entire Alps Electric group and also adopting a corporate officer system in ALPS ALPINE CO., LTD. to have the corporate officers operate Alps Company and Alpine Company, respectively. In addition, the Companies will establish a “integrated corporate officer committee” which will traverse across the two in-house companies and strengthen the business strategy functions of the Companies after the Business Integration.

The Companies had planned to adopt a pure holding company structure and name the holding company ALPS HD CO., LTD. after the Business Integration. However, in adopting an operating holding company structure, the Companies believed it would be important to put a better sense of unity in the company name for further growth and a new challenge, namely, the integration of the Companies’ strength and brand power, and started another series of discussions between them. As a result, the Companies decided to name the holding company, after the Amendments to the Articles of Incorporation, ALPS ALPINE CO., LTD. instead of ALPS HD CO., LTD.

As for the details of the functions to be integrated, the business integration preparation committee and ALPS ALPINE CO., LTD. after the Business Integration will consider ways to realize the mutual use of management resources and the efficient and prompt integration of the common functions and the joint businesses of the Companies, including the restructuring and integration of the Companies’ business systems and IT infrastructures, so as to accelerate the realization of the Business Integration and realize steadily the intended synergy effects. The Companies believe that these efforts will allow them to address the dramatically changing market environment and diverse customer needs in a prompt and flexible manner, and as a result the entire Alps Electric group will be able to steadily increase its enterprise value.

In addition, Alpine obtained on July 26, 2017 a written report (toshinsho) (“Original Written Report”) from a third-party committee consisting of three members, namely Mr. Hideo Kojima, a member of Alpine’s Audit and Supervisory Committee and outside director of Alpine who is registered with the TSE as an independent officer, as well as Mr. Shunsuke Teragaki, an attorney-at-law (Nexpert Law Office) and Mr. Toshikazu Nakazawa, a certified public accountant (Blest Partners Inc.), with each of the latter two being an external expert with no interests in either Alps Electric or Alpine, stating that the resolution by the board of directors of Alpine to approve the Share Exchange was not disadvantageous to the minority shareholders of Alpine. On February 2, 2018, the board of directors of Alpine re-established a third-party committee consisting of the above three members (the “Third-party Committee”) and asked the Third-party Committee whether there is any change to the content of its opinion expressed in the Original Written Report as a result of the Changes.

The Third-party Committee held a total of six (6) meetings between February 2, 2018 and February 26, 2018 and, together with considering the matters it was asked to consider as set forth in the “Notice Regarding the Results of the Examination of the Impact that the Financial Forecasts Reflecting the Revisions to Full-Year Earnings Forecasts for Fiscal Year Ending March 31, 2018 Have on the Calculation of the Share Exchange Ratio” dated February 27, 2018, carefully considered the above matters by, among others, collecting information and having discussions whenever necessary.

For the purpose of giving such consideration, the Third-party Committee received explanations from Alpine regarding such matters as the purpose of the Business Integration, environment currently surrounding the Companies, centering on the automotive market, and circumstances that lead to and reasons for the Changes. In addition, the Third-party Committee received explanations from SMBC Nikko Securities Inc., the financial advisor of Alpine, regarding such matters as the impact that the Changes have on the Share Exchange Ratio. The Third-party Committee also received explanations from TMI Associates, the legal advisor of Alpine, concerning such matters as the method and process of decision-making of the board of directors of Alpine with respect to the Changes. Under such circumstances, on the premise of those explanations and other materials they reviewed, the Third-party Committee submitted a written report to the board of directors of Alpine on February 26, 2018 substantially to the following effect.

(a) After confirming and examining the purpose of the Business Integration, environment surrounding the Companies centering on the automotive market, circumstances leading to and reasons for the Changes, it has been shown that the Share Exchange conditioned on the Changes will contribute to the increase of the enterprise value of Alpine;

(b) (i) in the financial forecasts of the Companies that were used as the basis for the calculation using the discounted cash flow analysis (“DCF Analysis”) in the financial analysis report dated July 26, 2017 concerning the Share Exchange Ratio that Alpine received from SMBC Nikko Securities Inc., a third -party financial advisor, the implementation of the Share Exchange was not assumed and (ii) after careful consideration, taking into account such matters as the calculation by DCF Analysis in the cases of other companies, it has been confirmed that the Changes do not have an impact on the Companies’ financial forecasts that were the basis for the calculation of the Share Exchange Ratio that was agreed in the Share Exchange Agreement;

(c) given that (i) in conducting the consideration, Alpine carefully considered various factors such as whether attention has been paid to the interests of the minority shareholders of Alpine through fair procedures while obtaining advice from SMBC Nikko (the financial advisor) and TMI Associates (the legal advisor), which are independent from both of Alps Electric and Alpine, and (ii) the Third-party Committee considered that, in the course of the consultations, considerations and negotiations concerning the Changes, there are no facts suggesting that the Alpine side had been affected by Alps Electric or a person with a special interest in Alps Electric, the Third-party Committee concluded that attention has been paid to the interests of the minority shareholders of Alpine through fair procedures with regard to the Changes; and

(d) in light of (a) to (c) above and other matters, the Third-party Committee concluded that the resolution by the board of directors of Alpine to execute the Share Exchange Agreement Amendment MOU is not disadvantageous to the minority shareholders of Alpine, and there is no change to the content of their opinion expressed in the Original Written Report.

| B. | Details of the Business Integration |

| 1. | Background and objectives of the Business Integration |

There is no change from the description in the Business Integration Press Release.

| 2. | Structure of the Business Integration and Change of the Company Name |

The Business Integration will be implemented in the following manner.

Alps Electric and Alpine will first conduct the Share Exchange, in which Alps Electric will become the wholly owning parent company and Alpine will become a wholly owned subsidiary. Through the Share Exchange, Alps Electric will acquire all Alpine common shares held by the shareholders (excluding Alps Electric) of Alpine common shares, and Alpine will become a wholly owned subsidiary of Alps Electric. Alps Electric as an operating holding company will introduce an in-house company system and establish “Alpine Company,” which will engage in the Automotive Infotainment Business, and “Alps Company,” which will engage in the Electronic Components Business, as in-house companies.

In connection with the Business Integration, Alps Electric will change its company name to “ALPS ALPINE CO., LTD.” Even after changing its company name to “ALPS ALPINE CO., LTD.,” Alps Electric plans on maintaining its listing status under its current stock code (6770).

In connection with the Share Exchange, the Alpine common shares are scheduled to be delisted from the First Section of the Tokyo Stock Exchange as of December 26, 2018 (with the last trading date scheduled for December 25, 2018), thus prior to the Effective Date of the Share Exchange (scheduled for January 1, 2019).

| (1) | Structure of the Business Integration |

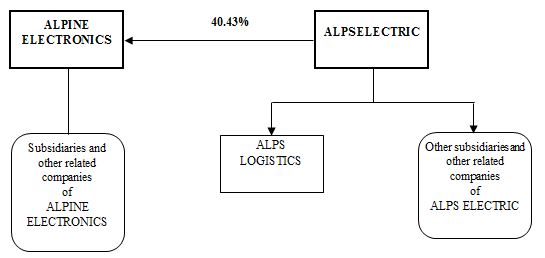

| ① | Current Structure (after the Company Split Preparation Company is established) (as of July 27, 2017) |

| (Note) | As of March 31, 2017, Alps Electric holds 46.6% of the total issued shares of Alps Logistics Co., Ltd. (“Alps Logistics”), and Alpine holds 2.2% of the same, respectively. |

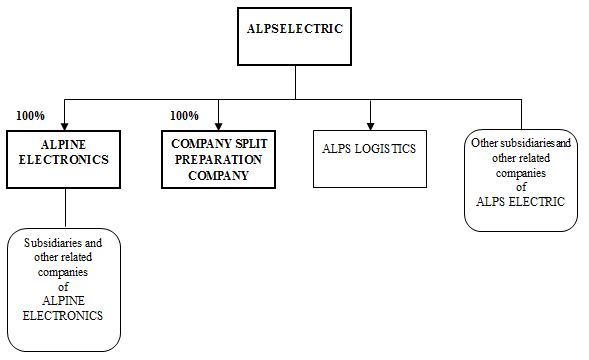

(Before the Changes)

② After the Share Exchange takes effect (scheduled for January 1, 2019)

③ Holding Company Structure after the Absorption-type Company Split takes effect (scheduled for April 1, 2019)

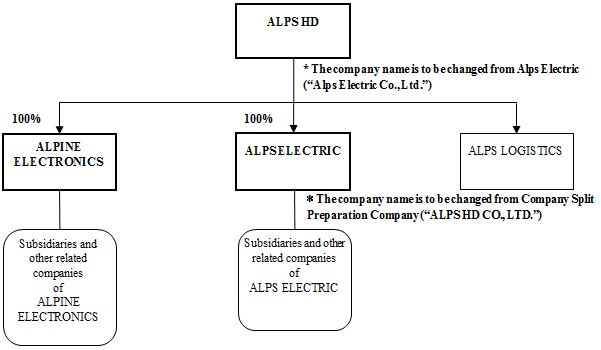

(After the Changes)

② After the Share Exchange takes effect (scheduled for January 1, 2019)

③ Holding Company Structure after the Reorganization Date (scheduled for January 1, 2019)

| (2) | Change of the Company Name and Partial Amendments to the Articles of Incorporation of Alps Electric |

On the condition that the Share Exchange has become effective, on the Reorganization Date, Alps Electric plans to partially amend its Articles of Incorporation to reflect changes, including a change of the company name to “ALPS ALPINE CO., LTD.,” changes to have its business purposes become suitable for a holding company, and additions and amendments to the provisions in connection with the introduction of the corporate officer system. To that end, Alps Electric plans to propose such amendments to its Articles of Incorporation at the 85th ordinary general meeting of shareholders scheduled to be held in late June 2018.

| (3) | Appointment of Directors |

The number of directors of Alps Electric (which is to be renamed “ALPS ALPINE CO., LTD.” on the Reorganization Date) on the Reorganization Date will be 11 (including 6 directors who are audit and supervisory committee members, of whom 4 are outside directors), and those candidates expected to become the directors of ALPS ALPINE CO., LTD. on the Reorganization Date, including Mr. Toshihiro Kuriyama, who is the current Representative Director and President of Alps Electric, will be elected after consultation between Alps Electric and Alpine. The candidates for directors will be announced as soon as they are determined.

| (4) | Capital Policy after the Business Integration |

There is no change from the description in the Business Integration Press Release.

3. Schedule of the Business Integration

| Meeting of Board of Directors relating to approval of the execution of the Share Exchange Agreement, the establishment of the Company Split Preparation Company and the execution of the Memorandum of Understanding on the Absorption-type Company Split (Alps Electric) | July 27, 2017 |

| Meeting of the Board of Director relating to approval of the execution of the Share Exchange Agreement (Alpine) |

| Execution of the Share Exchange Agreement (Alps Electric and Alpine) |

Establishment of the Company Split Preparation Company (Company Split Preparation Company) |

Decision by the Directors relating to approval of the execution of the Memorandum of Understanding on the Absorption-type Company Split (Company Split Preparation Company) |

| Execution of the Memorandum of Understanding on the Absorption-type Company Split (Alps Electric and Company Split Preparation Company) |

| Meeting of the Board of Directors relating to approval of the execution of the Share Exchange Agreement Amendment MOU and cancellation of the Absorption-type Company Split (Alps Electric) | February 27, 2018 |

| Decision by the Directors relating to the cancellation of the Absorption-type Company Split (Company Split Preparation Company) |

| Meeting of the Board of Directors relating to approval of the execution of the Share Exchange Agreement Amendment MOU (Alpine) |

Execution of the Share Exchange Agreement Amendment MOU (Alps Electric and Alpine) |

| The 85th ordinary general meeting of shareholders, at which the Amendments to the Articles of Incorporation are to be approved (Alps Electric) | Late June 2018 (scheduled) |

| Extraordinary general meeting of shareholders relating to approval of the Share Exchange Agreement (Alpine) | Mid-December 2018 (scheduled) |

| Last trading date (Alpine) | December 25, 2018 (scheduled) |

| Delisting date (Alpine) | December 26, 2018 (scheduled) |

| Effective date of the Share Exchange (Alps Electric and Alpine) | January 1, 2019 (scheduled) |

Change of the company name (Alps Electric) |

Reorganization Date (Alps Electric and Alpine) |

| (Note 1) | Alps Electric will consummate the Share Exchange by means of a simplified share exchange under Article 796, paragraph (2) of the Companies Act, which does not require an approval by shareholders at a shareholder’s meeting. |

| (Note 2) | The above schedule of the Business Integration is the plan at present. It may be changed in the course of carrying out the procedures described above due to such reasons as the filings made with the Japan Fair Trade Commission and other Japanese or foreign authorities, or the obtainment of permissions and approvals. In addition, Alps Electric and Alpine may change the above schedule after consulting with each other due to the need to do so in carrying out the procedures described above or other reasons. In the event that the above schedule is changed, the Companies will disclose the revised schedule promptly. |

1. Overview of the Share Exchange

There is no change from the description in the Business Integration Press Release.

2. Basis for the Calculation of the Share Exchange Ratio of the Share Exchange

There is no change from the description in the Business Integration Press Release.

3. Overview of the Parties to the Share Exchange

There is no change from the description in the Business Integration Press Release.

4. Status after the Share Exchange

| | Wholly Owning Parent Company |

| (1) | Company name | ALPS ALPINE CO., LTD. |

| (2) | Head office | 1-7, Yukigaya-otsukamachi, Ota-ku, Tokyo, Japan |

| (3) | Name and title of Representative | Toshihiro Kuriyama, Representative Director and President |

| (4) | Main business | Automotive Infotainment Business

Electronic Components Business

Logistics Business Group Management and Administration Business and Asset Management Business |

| (5) | Paid-in capital | 38,730 million yen |

| (6) | Fiscal year-end | March 31 |

| (7) | Net assets | Yet to be determined |

| (8) | Total assets | Yet to be determined |

| | (Note) | On January 1, 2019 (scheduled), on the condition that the Share Exchange will have taken effect, Alps Electric plans to partially amend its Articles of Incorporation to reflect changes, including a change of the company name to “ALPS ALPINE CO., LTD.” and changes to have its business purposes become suitable for a holding company. |

| 5. | Overview of Accounting Treatment |

There is no change from the description in the Business Integration Press Release.

Please see IV. 2 “Future Outlook” below.

| 7. | Matters concerning Transactions with Controlling Shareholders, etc. |

There is no change from the description in the Business Integration Press Release. In addition, on February 26, 2018, Alpine obtained a written report (toshinsho) from the Third-party Committee to the effect that, even if the Changes take place, the Share Exchange would not be disadvantageous to the minority shareholders of Alpine and that there is no change to its opinion expressed in the Original Written Report. For details, please see A. “Reason for the Changes.”

| III. | Change of the Company Name and Other Partial Amendments to the Articles of Incorporation |

| 1. | Reasons for the Amendments |

In connection with the reorganization into a holding company structure as part of the Business Integration, on the condition that the Share Exchange will have taken effect, the Articles of Incorporation of Alps Electric will be partially amended as of the Reorganization Date with respect to provisions such as the company name and the business purposes of Alps Electric as described below in 2. “Details of the Amendments to the Articles of Incorporation” and the Exhibit attached hereto.

| 2. | Details of the Amendments to the Articles of Incorporation |

The Articles of Incorporation will be amended as set forth in Exhibit. The main amendments are as follows.

| ① | Change of the company name to “ALPS ALPINE CO., LTD.” in connection with the reorganization into a holding company structure |

| ② | Change of business purposes in connection with the reorganization into a holding company structure |

| ③ | Reduction in the number of directors in connection with the reorganization into a holding company structure |

| ④ | Deletion of the provisions regarding directors with special titles and amendments to related provisions in connection with the reorganization into a holding company structure |

| ⑤ | Establishment of a new provision regarding the limitation of liability of directors |

| ⑥ | Establishment of a new provision regarding corporate officers in connection with the reorganization into a holding company structure |

| ⑦ | Other necessary changes in connection with the changes set forth in ① through ⑥ above |

| 3. | Scheduled Amendment Date |

January 1, 2019

| IV. | Status After the Business Integration |

| 1. | Status of Alps Electric after the Business Integration (scheduled) |

Please see II. 4. “Status after the Share Exchange.”

Alps Electric and Alpine have launched a business integration preparation committee consisting of the Representative Directors and Presidents and relevant officers of the Companies. The committee makes decisions concerning business plans of the holding company after the Business Integration, the optimal group structure, the timing when business integration synergies are to be realized and the methods for such realization, and other strategies for the sustainable growth of Alps Electric and Alpine. The management team for the Business Integration has a balanced composition of members from both Alps Electric and Alpine. If any new disclosure becomes necessary as a result of these initiatives, the Companies will make such disclosure promptly.

(Reference)

Alps Electric’s consolidated earnings forecast for the current fiscal year (announced on January 30, 2018) and consolidated earnings for the previous fiscal year

(Unit: millions of yen)

| | Consolidated net sales | Consolidated operating income | Consolidated ordinary income | Profit attributable to owners of parent |

Earnings forecast for the current fiscal year (Year ending March 2018) | 855,000 | 71,000 | 67,000 | 50,500 |

Earnings for the previous fiscal year (Year ended March 2017) | 753,262 | 44,373 | 42,725 | 34,920 |

Alpine’s consolidated earnings forecast for the current fiscal year (announced on January 30, 2018) and consolidated earnings for the previous fiscal year

(Unit: millions of yen)

| | Consolidated net sales | Consolidated operating income | Consolidated ordinary income | Profit attributable to owners of parent |

Earnings forecast for the current fiscal year (Year ending March 2018) | 270,000 | 11,000 | 10,200 | 6,000 |

Earnings for the previous fiscal year (Year ended March 2017) | 247,751 | 5,612 | 7,439 | 7,760 |

End

| (Exhibit) | Comparative Table of the Proposed Partial Amendment to the Articles of Incorporation of ALPS ELECTRIC CO., LTD. |

(The underlined portions indicate amendments.)

| Current Articles of Incorporation | After Amendments |

Article 1 (Trade Name) The name of the Company shall be Alps Denki Kabushiki Kaisha, and in English ALPS ELECTRIC CO., LTD. | Article 1 (Trade Name) The name of the Company shall be Alps Alpine Kabushiki Kaisha, and in English ALPS ALPINE CO., LTD. |

| | |

Article 2 (Purpose) The purpose of the Company shall be to engage in the following business activities: | Article 2 (Purposes) The purposes of the Company shall be to engage in the following business activities and to control and manage the business activities of the companies which engage in the following businesses and the business activities of foreign companies which engage in the businesses equivalent to the following business activities, through holding shares and equity in those companies: |

| 1. | Manufacture and sale of electronic and electrical machines and equipment as well as the components and materials therefor; | 1. | Manufacture and sale of electronic and electrical machines and equipment as well as the components and materials therefor; |

| 2. | Manufacture and sale of parts, components and materials used in information and communication equipment, business equipment, precision equipment, optical equipment, medical equipment, measurement equipment, control equipment, electrical equipment for power generation, power transmission and power distribution, and industrial electrical equipment; | 2. | Manufacture and sale of parts, components and materials used in information and communication equipment, business equipment, precision equipment, optical equipment, medical equipment, measurement equipment, control equipment, electrical equipment for power generation, power transmission and power distribution, and industrial electrical equipment; |

| 3. | Manufacture and sale of parts and components used in automobiles and other transportation equipment; | 3. | Manufacture and sale of parts and components used in automobiles and other transportation equipment; |

| 4. | Manufacture, sale and lease of manufacturing machines and equipment, manufacturing systems and manufacturing system plants which are incidental to those mentioned in the preceding items; | 4. | Manufacture and sale of sound and video recorders and reproducers and audio machines and equipment; |

| 5. | Provision of manufacturing technologies, processing technologies and other services which are incidental to those mentioned in the preceding items, and sale and licensing of intellectual properties related to those mentioned in the preceding items; | 5. | Manufacture and sale of applied electronic machines and equipment for automobiles and office equipment; |

| 6. | Investment, study, research and development, consulting, real property lease and management, worker dispatch business, fee-charging employment placement business and human resources development business which are incidental to those mentioned in the preceding items; and | 6. | Manufacture and sale of electrical machines and equipment for transmitting and receiving data; |

| 7. | All businesses which are incidental to those mentioned in the preceding items. | 7. | Development, sale, import and export of software, and provision of information processing services; |

| | | 8. | Manufacture, sale and lease of manufacturing machines and equipment, manufacturing systems and manufacturing system plants which are incidental to those mentioned in the preceding items; |

| | | 9. | Provision of manufacturing technologies, processing technologies and other services which are incidental to those mentioned in the preceding items, and sale and licensing of intellectual properties related to those mentioned in the preceding items; |

| | | 10. | Operation of facilities related to welfare, medical care, sport, cultural education and entertainment, and businesses related thereto; |

| | | 11. | Transportation and warehouse business and service business related thereto; |

| | | 12. | Investment, study, research and development, consulting, real property lease and management, worker dispatch business, fee-charging employment placement business and human resources development business which are incidental to those mentioned in the preceding items; and |

| | | 13. | All businesses which are incidental to those mentioned in the preceding items. |

Article 13 (Convocation) (Omitted) | Article 13 (Convocation) (No change) |

| ② | A general meeting of shareholders shall, except as otherwise provided by laws or ordinances, be convened by the director and chairman or the director and president in accordance with a resolution of the board of directors. | ② | A general meeting of shareholders shall, except as otherwise provided by laws or ordinances, be convened by the representative director in accordance with a resolution of the board of directors. |

| | |

| Article 14 (Chairman of Meetings) | Article 14 (Chairman of Meetings) |

| | The director and chairman or the director and president shall convene a general meeting of shareholders and act as the chairman thereof. If the director and chairman and the director and president are unable to so act, one of the other directors shall convene a general meeting of shareholders and act as the chairman thereof in accordance with the order of priority predetermined by a resolution of the board of directors. | | The representative director shall convene a general meeting of shareholders and act as the chairman thereof. If there is more than one representative director, one of them shall do so in accordance with the order of priority predetermined by a resolution of the board of directors. If all representative directors are unable to so act, one of the other directors shall convene a general meeting of shareholders and act as the chairman thereof in accordance with the order of priority predetermined by a resolution of the board of directors. |

| | |

| Article 19 (Number of Directors) | Article 19 (Number of Directors) |

The Company shall have no more than eighteen (18) directors (excluding directors who are audit and supervisory committee members). | The Company shall have no more than eight (8) directors (excluding directors who are audit and supervisory committee members). |

| | |

Article 23 (Convener and Chairman of the Board of Directors) (Omitted) | Article 23 (Convener and Chairman of the Board of Directors) (No change) |

| ② | The director and chairman or the director and president shall convene a meeting of the board of directors and act as the chairman thereof. If the director and chairman and the director and president are unable to so act, one of the other directors shall convene a meeting of the board of directors and act as the chairman thereof in accordance with the order of priority predetermined by a resolution of the board of directors. | ② | The representative director shall convene a meeting of the board of directors and act as the chairman thereof. If there is more than one representative director, one of them shall do so in accordance with the order of priority predetermined by a resolution of the board of directors. If all representative directors are unable to so act, one of the other directors shall convene a meeting of the board of directors and act as the chairman thereof in accordance with the order of priority predetermined by a resolution of the board of directors. |

| | |

Article 24 (Representative Directors and Directors with Special Titles) (Omitted) | Article 24 (Representative Director) (No change) |

| ② | The Company may, by a resolution of the board of directors, appoint one (1) director and chairman, director and deputy chairman, and director and president, respectively, and a few directors and deputy presidents, senior managing directors and managing directors. | (Deleted) |

Article 29 (Liability Limitation Agreement with Directors) | Article 29 (Limitation of Liability of Directors) |

| Pursuant to the provisions of Article 427, Paragraph (1) of the Companies Act, the Company may enter into a liability limitation agreement with directors (excluding directors who execute business of the Company), which will limit the maximum amount of their liabilities for damages under Article 423, Paragraph (1) of the Companies Act to the amount set forth by laws and ordinances. | 1. | Pursuant to the provisions of Article 426, Paragraph (1) of the Companies Act, the Company may, by a resolution of the board of directors, exempt directors (including former directors) from their liabilities for damages under Article 423, Paragraph (1) of the Companies Act to the extent permitted by laws and ordinances. |

| | | |

| | 2. | Pursuant to the provisions of Article 427, Paragraph (1) of the Companies Act, the Company may enter into a liability limitation agreement with directors (excluding directors who execute business of the Company), which will limit the maximum amount of their liabilities for damages under Article 423, Paragraph (1) of the Companies Act to the amount set forth by laws and ordinances. |

| | |

(Newly established) | CHAPTER V CORPORATE OFFICERS Article 30 (Corporate Officers) |

| | ① | The Company may, by a resolution of the board of directors, appoint corporate officers. |

| | ② | Matters concerning corporate officers shall be governed by the Regulations of the Corporate Officers established by the board of directors. |

| | | |

CHAPTER V AUDIT AND SUPERVISORY COMMITTEE Article 30 to Article 32 (Provisions omitted) | CHAPTER VI AUDIT AND SUPERVISORY COMMITTEE Article 31 to Article 33 (Same as the current provisions) |

| | |

CHAPTER VI FINANCIAL AUDITOR Article 33 to Article 34 (Provisions omitted) | CHAPTER VII FINANCIAL AUDITOR Article 34 to Article 35 (Same as the current provisions) |

| | |

CHAPTER VII ACCOUNTS Article 35 to Article 38 (Provisions omitted) | CHAPTER VIII ACCOUNTS Article 36 to Article 39 (Same as the current provisions) |

Alps Electric may file a registration statement on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the possible Share Exchange with Alpine. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of Alpine prior to the shareholders’ meeting at which the Share Exchange will be voted upon. The Form F-4 and prospectus (if a Form F-4 is filed) will contain important information about the Companies, the Share Exchange and related matters. U.S. shareholders of Alpine are urged to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the Share Exchange carefully before they make any decision at the shareholders’ meeting with respect to the Share Exchange. Any documents filed with the SEC in connection with the Share Exchange will be made available when filed, free of charge, on the SEC’s website at www.sec.gov. In addition, upon request, the documents will be mailed to shareholders for free of charge. To make a request, please refer to the following contact information.

Contacts for inquiries regarding the Business Integration

Company name: Alps Electric Co., Ltd. Address: 1-7, Yukigaya-otsukamachi, Ota-ku, Tokyo, Japan Department in charge: Junji Kobayashi, Senior Manager, Corporate Planning Office Telephone: +81-3-5499-8026 (IR Direct) | Company name: Alpine Electronics, Inc. Address: 1-7, Yukigaya-otsukamachi, Ota-ku, Tokyo, Japan Department in charge: Shinji Yamazaki, Senior Manager, Finance and Public Relations Department Telephone: +81-3-5499-4391 (IR Direct) |

Forward-Looking Statements

This document includes “forward-looking statements” that reflect the plans and expectations of Alps Electric and Alpine in relation to, and the benefits resulting from, their business integration described above. To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the Companies in light of the information currently available to them, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of one or both of the Companies (or the integrated group) to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements.

The Companies undertake no obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by the Companies (or the integrated group) in their subsequent domestic filings in Japan and filings with the U.S. Securities and Exchange Commission.

The risks, uncertainties and other factors referred to above include, but are not limited to:

| (1) | economic and business conditions in and outside Japan; |

| (2) | changes in demand for and material prices of automobiles, smart phones and consumer electrical equipment and machines, which are the main markets of the Companies’ products, and changes in exchange rates; |

| (3) | changes in the competitive landscape, including the changes in the competition environment and the relationship with major customers; |

| (4) | further intensified competition in the electronic components business, automotive infotainment business and logistics business; |

| (5) | increased instability of the supply system of certain important components; |

| (6) | change in the product strategies or other similar matters, cancellation of a large-quantity order, or bankruptcy, of the major customers; |

| (7) | costs and expenses, as well as adverse impact to the group’s reputation, resulting from any product defects; |

| (8) | suspension of licenses provided by other companies of material intellectual property rights; |

| (9) | changes in interest rates on loans and other indebtedness of the Companies, as well as changes in financial markets; |

| (10) | adverse impact to liquidity due to acceleration of indebtedness; |

| (11) | changes in the value of assets (including pension assets) such as securities and investment securities; |

| (12) | changes in laws and regulations (including environmental regulations) relating to the Companies’ business activities; |

| (13) | increases in tariffs, imposition of import controls and other developments in the Companies’ main overseas markets; |

| (14) | unfavorable political factors, terrorism, war and other social disorder; |

| (15) | interruptions in or restrictions on business activities due to natural disasters, accidents and other causes; |

| (16) | environmental pollution countermeasures costs; |

| (17) | violation of laws or regulations, or the filing of a lawsuit; |

| (18) | the Companies being unable to complete the Business Integration due to reasons such as the Companies not being able to implement the necessary procedures including approval of the agreement with regard to the Business Integration by the shareholders’ meetings of the Companies, and any other reasons; |

| (19) | delays in the review process by the relevant competition law authorities or the clearance of the relevant competition law authorities’ or other necessary approvals’ being unable to be obtained; and |

| (20) | inability or difficulty of realizing synergies or added values by the Business Integration by the integrated group. |

18