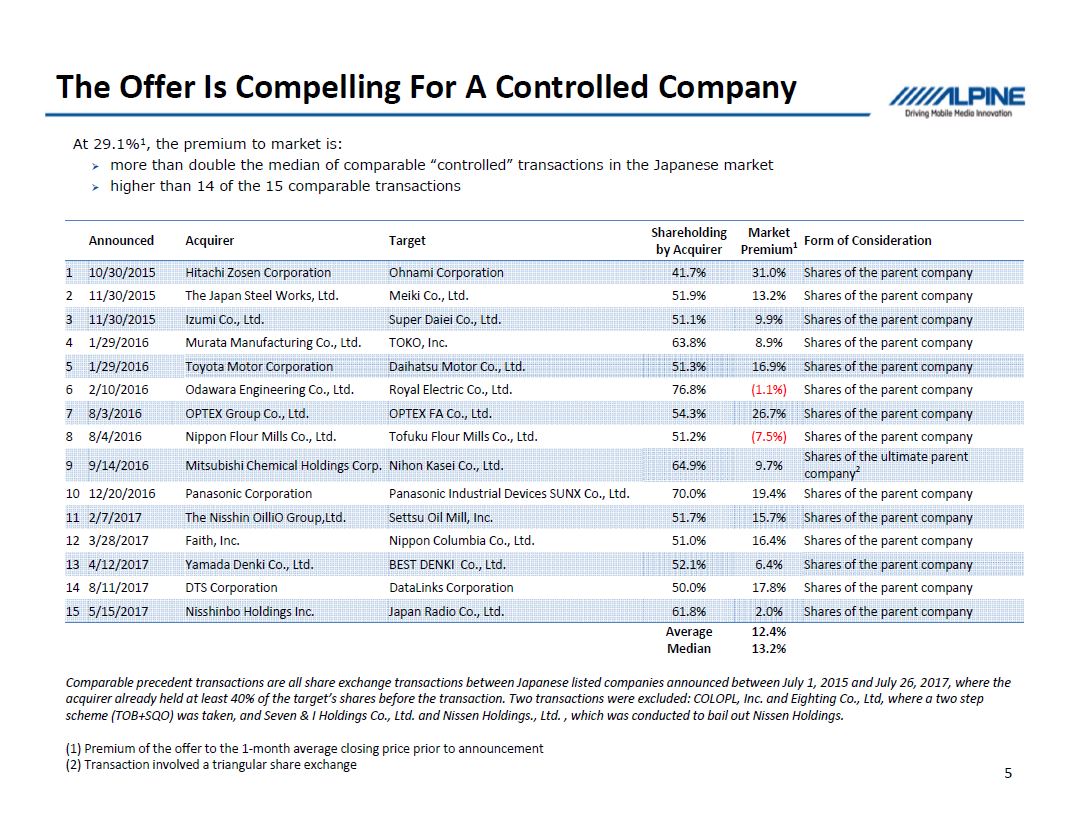

The Offer Is Compelling For A Controlled Company At 29.1%1, the premium to market is: more than double the median of comparable "controlled" transactions in the Japanese market higher than 14 of the 15 comparable transactions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Announced 10/30/2015 11/30/2015 11/30/2015 1/29/2016 1/29/2016 2/10/2016 8/3/2016 8/4/2016 9/14/2016 12/20/2016 2/7/2017 3/28/2017 4/12/2017 8/11/2017 5/15/2017 Acquirer Hitachi Zosen Corporation The Japan Steel Works, Ltd. Izumi Co., Ltd. Murata Manufacturing Co., Ltd. Toyota Motor Corporation Odawara Engineering Co., Ltd. OPTEX Group Co., Ltd. Nippon Flour Mills Co., Ltd. Mitsubishi Chemical Holdings Corp. Panasonic Corporation The Nisshin OilliO Group,Ltd. Faith, Inc. Yamada Denki Co., Ltd. DTS Corporation Nisshinbo Holdings Inc. Target Ohnami Corporation Meiki Co., Ltd. Super Daiei Co., Ltd. TOKO, Inc. Daihatsu Motor Co., Ltd. Royal Electric Co., Ltd. OPTEX FA Co., Ltd. Tofuku Flour Mills Co., Ltd. Nihon Kasei Co., Ltd. Panasonic Industrial Devices SUNX Co., Ltd. Settsu Oil Mill, Inc. Nippon Columbia Co., Ltd. BEST DENKI Co., Ltd. DataLinks Corporation Japan Radio Co., Ltd. Shareholding by Acquirer 41.7% 51.9% 51.1% 63.8% 51.3% 76.8% 54.3% 51.2% 64.9% 70.0% 51.7% 51.0% 52.1% 50.0% 61.8% Average Median Market Premium1 31.0% 13.2% 9.9% 8.9% 16.9% (1.1%) 26.7% (7.5%) 9.7% 19.4% 15.7% 16.4% 6.4% 17.8% 2.0% 12.4% 13.2% Form of Consideration Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the ultimate parent company2 Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Shares of the parent company Comparable precedent transactions are all share exchange transactions between Japanese listed companies announced between July 1, 2015 and July 26, 2017, where the acquirer already held at least 40% of the target's shares before the transaction. Two transactions were excluded: COLOPL, Inc. and Eighting Co., Ltd, where a two step scheme (TOB+SQO) was taken, and Seven & I Holdings Co., Ltd. and Nissen Holdings., Ltd. , which was conducted to bail out Nissen Holdings. (1) Premium of the offer to the 1-month average closing price prior to announcement (2) Transaction involved a triangular share exchange 5