As filed with the U.S. Securities and Exchange Commission on June 5, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMS-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Zamalight plc

(Exact name of registrant as specified in its charter)

| | | | |

| Ireland | | 2810 | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification No.) |

The Priestley Centre, 10 Priestley Road, The Surrey Research Park, Guildford, Surrey GU2 7XY, United Kingdom, +44 1483 242200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Corporation Service Company

251 Little Falls Drive

Wilmington, Delaware 19808-1674

1-800-927-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | | |

Keith A. Pagnani, Esq. Catherine M. Clarkin, Esq. Krishna Veeraraghavan, Esq. Sullivan & Cromwell LLP 125 Broad Street New York, New York 10004 +1 (212)558-4000 | | Guillermo Bichara Vice President, General Counsel and Corporate Secretary Praxair, Inc. 10 Riverview Drive Danbury, Connecticut 06810-5113 +1 (203)837-2000 | | Dr. Christoph Hammerl Head of Group Legal & Compliance Linde AG Klosterhofstraße 1 80331 Munich Germany +49 89 357571001 | | David Mercado, Esq. Richard Hall, Esq. Aaron M. Gruber, Esq. Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, New York 10019-7475 +1 (212)474-1000 |

Approximate date of commencement of proposed sale of the securities to the public:As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☒ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| | | |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange ActRule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange ActRule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☒

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities to Be Registered | | Amount to Be Registered (1) | | Proposed Maximum

Offering Price

Per Unit | | Proposed Maximum Aggregate Offering Price (2) | | Amount of

Registration Fee (3) |

Ordinary shares, nominal value €0.001 per share | | 577,750,769 | | N/A | | $73,521,557,267.33 | | $8,521,148.49 |

|

|

| (1) | The number of ordinary shares, nominal value €0.001 per share, of the registrant being registered is based upon the sum of (1) the product obtained by multiplying (a) 291,868,140 shares of common stock, par value $0.01 per share, of Praxair, Inc., or “Praxair shares,” estimated to be outstanding, on a fully diluted basis, immediately prior to the merger (as defined in the prospectus included in this Registration Statement) times (b) an exchange ratio of 1.000, and (2) the product obtained by multiplying (a) 185,638,071 ordinary shares of Linde AG, or “Linde shares,” estimated to be outstanding, on a fully diluted basis, immediately prior to the completion of the exchange offer (as defined in the prospectus included in this Registration Statement) times (b) an exchange ratio of 1.540. |

| (2) | Pursuant to Rule 457(c) and Rule 457(f) under the Securities Act of 1933, which we refer to as the “Securities Act,” and solely for the purpose of calculating the registration fee, the market value of the securities to be offered was calculated as the sum of (1) the product of (a) 291,868,140 Praxair shares, estimated to be outstanding, on a fully diluted basis, immediately prior to the merger times (b) the average of the high and low sales prices of Praxair shares on the New York Stock Exchange on May 31, 2017 and (2) the product of (a) 185,638,071 Linde shares estimated to be outstanding, on a fully diluted basis, immediately prior to the completion of the exchange offer times (b) the average of the high and low sales prices of Linde shares on the Frankfurt Stock Exchange on May 31, 2017 (converted into U.S. dollars on the basis of an exchange rate of $1.1170 equals €1.0000 (the noon buying rate as of May 26, 2017, the latest date on which the noon buying rate was available prior to the filing of this Registration Statement)). |

| (3) | Calculated by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0001159. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the “Securities Act”), or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two documents:

| | • | | a proxy statement/prospectus (which is herein referred to as the “proxy statement/prospectus”) that will be used in connection with the Praxair, Inc. special meeting of shareholders being held on [—], 2017 (which is herein referred to as the “Praxair special meeting”), to, among other things, vote to adopt the business combination agreement, dated as of June 1, 2017, by and among Praxair, Inc., Linde Aktiengesellschaft, Zamalight plc, Zamalight Holdco LLC and Zamalight Subco, Inc., and to approve the transactions contemplated thereby; and |

| | • | | a prospectus (which is herein referred to as the “exchange offer prospectus”) that will be used in connection with Linde plc’s offer to exchange each Linde share for 1.540 Linde plc shares. |

The proxy statement/prospectus and the exchange offer prospectus will be identical in all substantive respects, except that certain sections will be replaced as set forth in the comparison table below:

| | | | | | |

| Proxy Statement/Prospectus | | Exchange Offer Prospectus |

| | | |

Section | | Page | | Section | | Page |

Proxy Statement/Prospectus Cover Page | | Front

Cover | | Exchange Offer Prospectus Cover Page | | ALT-1 |

Notice of the Praxair Special Meeting | | Inside

Cover | | None | | — |

Questions and Answers — About the Praxair Special Meeting | | 3 | | Questions and Answers — About the Exchange Offer | | ALT-2 |

Summary | | 10 | | Summary of the Prospectus | | ALT-11 |

The Praxair Special Meeting | | 79 | | None | | — |

None | | — | | General Information — Responsibility for the Contents | | ALT-35 |

None | | — | | General Information — Subject Matter of this Prospectus | | ALT-36 |

Material Tax Considerations(1) | | 479 | | Material Tax Considerations(1) | | ALT-37 |

None | | — | | Draft Exchange Offer Document (2) | | ALT-57 |

| (1) | The section entitled “Material Tax Considerations” in the proxy statement/prospectus summarizes certain material tax considerations to holders of Praxair shares and the section entitled “Material Tax Considerations” in the exchange offer prospectus summarizes certain material tax considerations to holders of Linde shares. |

| (2) | The exchange offer document will form the main part of the exchange offer prospectus. The draft of the exchange offer document, which is included herein, does not constitute an offer and has not been and will not be reviewed or approved by the German Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht) (which is herein referred to as “BaFin”). |

The sections and captions in the exchange offer prospectus will be numbered in accordance with BaFin rules and regulations and the order of chapters and therefore the table of contents, cross-references, as well as the page numbers will be different.

Linde plc intends to file a German language exchange offer document with the BaFin (which is herein referred to as the “German exchange offer document”) that will include a German language prospectus as an annex.

The information contained in this document is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This document is not an offer to sell these securities and it is not soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

SUBJECT TO COMPLETION, DATED JUNE 5, 2017

| | |

PROXY STATEMENT OF PRAXAIR, INC.

| | PROSPECTUS OF ZAMALIGHT PLC |

Dear Praxair shareholder:

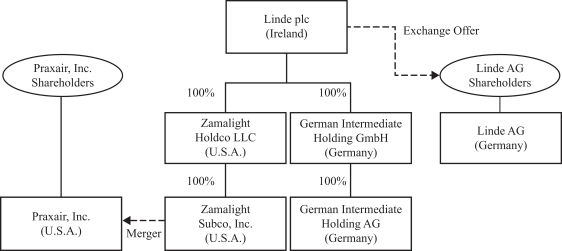

I am pleased to invite you to attend a special meeting of shareholders of Praxair, Inc. (which is herein referred to as “Praxair, Inc.,” and together with its subsidiaries, “Praxair”) to be held at [—] on [—], 2017, at [—], Eastern Standard Time. As previously announced, Praxair, Inc. and Linde Aktiengesellschaft (which is herein referred to as “Linde AG,” and together with its subsidiaries, “Linde”) have entered into an agreement providing for a combination of their businesses under a new Irish holding company, Zamalight plc, to be renamed Linde plc (which is herein referred to as “Linde plc”). Pursuant to this business combination agreement, Praxair’s business will be brought under the new holding company through a merger (which is herein referred to as the “merger”) and Linde’s business will be brought under the new holding company through an exchange offer (which is herein referred to as the “exchange offer,” and together with the merger, the “business combination”).

The merger will be subject to and occur immediately after settlement of the exchange offer. In the merger, each share of common stock of Praxair, Inc., par value $0.01 per share (which are herein referred to as “Praxair shares”), will be converted into the right to receive one ordinary share, nominal value €0.001 per share, of Linde plc (which are herein referred to as “Linde plc shares”). In the exchange offer, shareholders of Linde AG (which are herein referred to as “Linde shareholders”) will be offered to exchange each of their ordinary bearer shares, without par value, of Linde AG (which are herein referred to as “Linde shares”) for 1.540 Linde plc shares. Settlement of the exchange offer is subject to the satisfaction or, where permissible, waiver of certain conditions, including the minimum acceptance condition, the Praxair requisite vote condition, the regulatory condition, and the other conditions described in the section “The Exchange Offer — Conditions to the Exchange Offer.” Except for the regulatory condition, all conditions to the exchange offer must be satisfied on or prior to the expiration of the acceptance period on [—], 2017, 24:00 hours, Central European Summer Time, as extended (which is herein referred to as the “acceptance period”). The regulatory condition must be satisfied within twelve months following the end of the acceptance period,i.e., by [—], 2018, subject to any extension of the acceptance period. As a result, the exchange of Linde shares pursuant to the exchange offer and conversion of Praxair shares pursuant to the merger may be made on a date that is significantly later than the end of the acceptance period, or may not occur.

Upon completion of the business combination, and assuming that all of the outstanding Linde shares are exchanged in the exchange offer, former Praxair shareholders and former Linde shareholders will each own approximately 50% of the outstanding Linde plc shares. Linde plc will apply to list the Linde plc shares on the New York Stock Exchange (trading in U.S. dollars) and on the Frankfurt Stock Exchange (trading in euros). Praxair shares, which are listed on the New York Stock Exchange under the symbol “PX” will be delisted from the New York Stock Exchange upon or as soon as practicable after the completion of the business combination, as permitted by applicable law. We urge you to obtain current market quotations of each of the Praxair shares and the Linde shares prior to casting your vote.

In order for the business combination to be completed, the business combination agreement must be adopted by the Praxair, Inc. shareholders (which are herein referred to as “Praxair shareholders”). Accordingly, Praxair, Inc. will hold a special meeting of its shareholders on [—], 2017, at which, among other business to be considered by Praxair shareholders, Praxair shareholders will be asked to adopt the business combination agreement and approve the transactions contemplated thereby. Information about the Praxair special meeting, the business combination and other business to be considered by Praxair shareholders is contained in this document, which we urge you to read.In particular, see “Risk Factors” beginning on page 34.

Your vote is very important. Whether or not you plan to attend the Praxair special meeting, please take appropriate action to make sure your Praxair shares are represented at the Praxair special meeting. Your failure to vote will have the same effect as voting against the adoption of the business combination agreement.The board of directors of Praxair, Inc. (which is herein referred to as the “Praxair board of directors”) unanimously recommends that you vote FOR the adoption of the business combination agreement and approval of the transactions contemplated thereby and other related matters. We are not asking Linde shareholders for a proxy and Linde shareholders are requested not to send us a proxy.

Sincerely,

Stephen F. Angel

Chief Executive Officer and Chairman

Praxair, Inc.

Neither the U.S. Securities and Exchange Commission (which is herein referred to as the “SEC”) nor any state securities commission has approved or disapproved of the securities to be issued in connection with the business combination or passed upon the adequacy or accuracy of this document. Any representation to the contrary is a criminal offense.

This document is dated [—], 2017, and is first being mailed to Praxair shareholders on or about [—], 2017.

ADDITIONAL INFORMATION

This document incorporates important business and financial information about Praxair filed with the SEC that is not included in or delivered with this document. You can obtain any of the documents filed with the SEC by Praxair, Inc. at no cost from the SEC’s website at www.sec.gov. You may also request copies of these documents, including documents incorporated by reference into this document, at no cost, by contacting Praxair. Please see “General Information — Where You Can Find More Information; Documents Available for Inspection” for more details. In order to receive timely delivery of the documents in advance of the special meeting of Praxair shareholders, you should make your request to Praxair, Inc. at 10 Riverview Dr., Danbury, CT 06810, United States,1-800-772-9247 (U.S.) and1-716-879-4077 (outside the U.S.), no later than [—], 2017, or five trading days prior to the special meeting of Praxair shareholders.

No person is authorized to provide any information with respect to the matters that this document describes other than the information contained in this document, and, if provided, the information must not be relied upon as having been authorized by Linde plc, Praxair, or Linde. This document does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. Neither the delivery of this document nor any distribution of securities made under this document will, under any circumstances, create an implication that there has been no change in the affairs of Linde plc, Praxair, or Linde since the date of this document or that any information contained herein is correct as of any time subsequent to the date of this document.

Notice of Special Meeting of Shareholders

To Be Held on [—], 2017

Dear Praxair shareholder:

A special meeting of the shareholders of Praxair, Inc. will be held at [—] on [—], 2017, at [—], Eastern Standard Time. The purpose of the Praxair special meeting is for Praxair shareholders:

| | • | | to consider and vote on a proposal to adopt the business combination agreement, dated as of June 1, 2017, by and among Praxair, Inc., Linde AG, Linde plc, Zamalight Holdco LLC and Zamalight Subco, Inc., as the same may be amended from time to time, and to approve the transactions contemplated thereby (which is herein referred to as the “business combination proposal”), pursuant to which, among other things, Praxair, Inc. and Linde AG agreed to combine their businesses, through a merger and an exchange offer, respectively, and become subsidiaries of Linde plc; |

| | • | | to consider and vote on anon-binding advisory proposal to approve the reduction of the share premium account of Linde plc to allow for the creation of distributable reserves of Linde plc, which are generally required under Irish law in order to allow Linde plc to make distributions and to pay dividends and repurchase or redeem shares following completion of the business combination (which is herein referred to as the “distributable reserves creation proposal”); |

| | • | | to consider and vote on anon-binding advisory proposal to approve the compensation that may become payable to Praxair’s named executive officers in connection with the business combination (which is herein referred to as the “compensation proposal”); and |

| | • | | to consider and vote on any proposal that may be made by the chairman of the Praxair board of directors to adjourn or postpone the special meeting in order to (1) solicit additional proxies with respect to the above-mentioned proposals and/or (2) hold the special meeting on a date that is on or about the date of the expiration of the acceptance period, in the event that such date of expiration is extended (which is herein referred to as the “shareholder adjournment proposal”). |

The business combination proposal requires the affirmative vote of the holders of a majority of the Praxair shares outstanding and entitled to vote at the Praxair special meeting (which is herein referred to as the “Praxair requisite vote”). The business combination cannot be completed without approval of the business combination proposal. A failure to vote, a brokernon-vote, or an abstention will have the same effect as a vote “AGAINST” the business combination proposal. The distributable reserves creation proposal, the compensation proposal and the shareholder adjournment proposal each requires the affirmative vote of a majority of the Praxair shares present in person or by proxy and entitled to vote at the Praxair special meeting. An abstention will have the same effect as a vote “AGAINST” such proposals. A failure to vote and brokernon-votes will have no effect on the vote on any of the distributable reserves creation proposal, the compensation proposal or the shareholder adjournment proposal.The Praxair board of directors unanimously recommends that you vote FOR each of these proposals.

Only holders of record of Praxair shares at the close of business on [—], 2017, the record date for the Praxair special meeting, will be entitled to notice of, and to vote at, the Praxair special meeting or any adjournment or postponement thereof. A list of the Praxair shareholders of record as of [—], 2017, will be available for inspection during ordinary business hours at Praxair’s offices located at 10 Riverview Drive, Danbury, Connecticut 06810-5113, from [—], 2017, up to and including the date of the Praxair special meeting.

Please remember that your shares cannot be voted unless you cast your vote by one of the following methods: (1) sign and return a proxy card; (2) call the toll-free number listed on the proxy card; (3) vote through the internet as indicated on the proxy card; or (4) vote in person at the Praxair special meeting. You should NOT send documents representing Praxair shares with the proxy card.

Following the consummation of the business combination, you will receive information on how you will receive Linde plc shares for your Praxair shares.

BY ORDER OF THE BOARD OF DIRECTORS,

Guillermo Bichara

Vice President, General Counsel and

Corporate Secretary

[—], 2017

YOUR VOTE IS VERY IMPORTANT. PLEASE VOTE YOUR SHARES PROMPTLY, WHETHER OR NOT YOU EXPECT TO ATTEND THE PRAXAIR SPECIAL MEETING. YOU CAN FIND INSTRUCTIONS FOR VOTING ON THE ENCLOSED PROXY CARD. IF YOU ARE UNCERTAIN OF HOW YOU HOLD YOUR SHARES OR NEED ASSISTANCE IN VOTING YOUR SHARES, PLEASE CONTACT MORROW SODALI LLC, PRAXAIR’S PROXY SOLICITOR, AT (203)658-9400 (BANKS AND BROKERAGE FIRMS) AND (800)662-5200 (STOCKHOLDERS TOLL FREE), OR VIA EMAIL AT PX.INFO@MORROWSODALI.COM.

TABLE OF CONTENTS

-i-

-ii-

-iii-

-iv-

-v-

-vi-

QUESTIONS AND ANSWERS

The following questions and answers are intended to briefly address some commonly asked questions regarding the business combination. These questions and answers may not address all questions that may be important to you. You should carefully read this entire document, including its annexes and documents referred to herein, for a more complete understanding of the business combination agreement, the transactions contemplated by the business combination agreement, Linde plc, Praxair and Linde. You may obtain additional information without charge by following the instructions under “General Information — Where You Can Find More Information; Documents Available for Inspection.”

About the Business Combination

| Q: | What are Praxair and Linde proposing? |

| A: | On December 20, 2016, Praxair, Inc. and Linde AG announced their intention to combine their businesses to leverage the complementary strengths of each company, creating a leader in the industrial gas industry. The announcement was made after the parties entered into anon-binding term sheet on December 20, 2016. Following the announcement, Praxair, Inc., Linde AG, Zamalight plc, Zamalight Holdco LLC and Zamalight Subco, Inc. entered into a business combination agreement, dated June 1, 2017, pursuant to which, among other things, Praxair, Inc. and Linde AG agreed to combine their businesses, through the merger and the exchange offer, and become subsidiaries of a new Irish holding company, Zamalight plc, to be renamed Linde plc (which is herein referred to as “Linde plc”). This agreement is herein referred to as the “business combination agreement.” The merger and the exchange offer together are herein referred to as the “business combination.” |

Praxair, Inc. and Linde AG proposed the business combination because, among other reasons, the management and boards of both companies believe that the business combination will:

| | • | | leverage unique strengths of each company: Linde’s long-standing leadership in engineering and technology with Praxair’s operational excellence; |

| | • | | establish strong, complementary positions in key geographies and end-markets, and create a more diverse and balanced end-market portfolio; |

| | • | | create considerable value driven by approximately $1.2 billion (€1.1 billion) in annual synergies and cost reductions (see “The Business Combination — Certain Unaudited Forward-Looking Information — Certain Synergy and Cost Reduction Estimates”); and |

| | • | | create a combined company with revenues of approximately $29 billion (€27 billion) (based on 2016 revenues, see “Unaudited Pro Forma Condensed Combined Financial Information”) and combined market value in excess of $70 billion (€66 billion) as of May 31, 2017. |

| Q: | What will be the beneficial ownership of Linde plc immediately following the business combination? |

| A: | Former Praxair shareholders and former Linde shareholders are each expected to hold approximately 50% of all outstanding Linde plc shares following the business combination, assuming all Linde shareholders tender and do not withdraw their shares in the exchange offer. |

| Q: | When do you expect the business combination to be completed? |

| A: | The merger will be subject to and occur immediately after the settlement of the exchange offer. The exchange offer is subject to certain conditions, including the minimum acceptance condition, the Praxair requisite vote condition, the regulatory condition, and the other conditions described under “The Exchange Offer — Conditions to the Exchange Offer.” The timing for settlement of the exchange offer will depend on |

-1-

| | the satisfaction of such conditions. Under the terms of the exchange offer, all conditions to the exchange offer must be satisfied by the end of the acceptance period on [—], 2017, 24:00 hours, Central European Summer Time, as extended (which is herein referred to as the “acceptance period”), except for the regulatory condition. The regulatory condition must be satisfied within twelve months following the end of the acceptance period,i.e., by [—], 2018, subject to any extension of the acceptance period. If the regulatory condition is not satisfied by that date or if any other condition is not satisfied at the end of the acceptance period (unless any suchnon-satisfied condition has been waived at least one working day prior to the end of the acceptance period), the exchange offer will terminate and settlement will not occur. The parties currently expect regulatory approval to be finalized and the business combination to be completed in the second half of 2018 but in no event later than the date that is twelve months after the expiration of the acceptance period,i.e., [—], 2018, subject to any extension of the acceptance period.As a result, the exchange of Linde shares pursuant to the exchange offer and the conversion of Praxair shares pursuant to the merger may be made on a date that is significantly later than the end of the acceptance period, or may not occur. See “The Exchange Offer” for a more detailed discussion. |

| Q: | If the business combination is completed, will the Linde plc shares issued pursuant to the business combination agreement be listed for trading? |

| A: | Prior to the time of delivery of the Linde plc shares pursuant to the exchange offer and the merger, Linde plc will apply to admit its shares to listing and trading on the New York Stock Exchange (which is herein referred to as the “NYSE”), subject to official notice of issuance, and will apply to admit its shares to listing and trading on the regulated market (regulierter Markt) of the Frankfurt Stock Exchange and thesub-segment thereof with additional post-admission obligations (Prime Standard). The listings are intended to preserve current Praxair shareholders’ and Linde shareholders’ access to their historic trading markets in the United States and in Germany and may further improve liquidity in Linde plc shares and Linde plc’s access to additional equity financing sources. Nevertheless, as with listings on more than one stock exchange of certain other issuers, the liquidity in the market for Linde plc shares may be adversely affected if trading is split between two markets at least in the short term and could result in price differentials of Linde plc shares between the two exchanges. |

| Q: | What happens if the business combination is not completed? |

| A: | If Praxair shareholders do not approve the business combination proposal or if the business combination is not completed because any other conditions to the exchange offer, including the minimum acceptance condition or the regulatory condition, are not satisfied or waived, or for any other reason, Praxair and Linde will remain independent public companies. Praxair shares and Linde shares will continue to be listed and traded on the NYSE and the Frankfurt Stock Exchange, respectively, and the Linde shares will also continue trading on the stock exchanges in Berlin, Dusseldorf, Hamburg, Munich, Stuttgart, as well as on the TradegateExchange and on the open market (Freiverkehr) of the Hanover stock exchange, Germany. Praxair, Inc. will continue to have securities registered under the Securities Exchange Act of 1934, as amended (which is herein referred to as the “Exchange Act”) and will continue to be required to file periodic reports with the SEC. |

Praxair, Inc. and Linde AG have certain rights to terminate the business combination agreement or substantially all the covenants therein and one or the other may be required to pay a termination fee. For a summary of termination rights and the effects of a termination of the business combination agreement, including termination fees, see “The Business Combination Agreement — Termination — Termination Rights.”

| Q: | Who will lead the combined group? |

| A: | Pursuant to the business combination agreement, at the effective time of the merger, Mr. Stephen F. Angel, current Chairman and CEO of Praxair, Inc., will become CEO and a member of the board of directors of Linde plc, and Prof. Dr. Wolfgang Reitzle, current Chairman of the supervisory board of Linde AG, will become Chairman of the board of directors of Linde plc. |

-2-

| Q: | Who will comprise the board of directors of the new holding company? |

| A: | Upon completion of the business combination, the Linde plc board of directors will initially consist of twelve members, including Prof. Dr. Wolfgang Reitzle, Mr. Stephen F. Angel and tennon-executive directors, consisting of fivenon-executive directors to be designated for appointment by Praxair, Inc. and fivenon-executive directors to be designated for appointment by Linde AG. Under the constitution of Linde plc that will be in effect on completion of the business combination, directors will retire at each annual general meeting and may bere-elected by shareholders at that meeting. |

| Q: | Will my Linde plc shares acquired in the business combination receive dividends? |

| A: | The dividend policy for the combined group will be determined following completion of the business combination. Although Linde plc currently expects to pay dividends, any dividend paid or changes to dividend policy are within the discretion of the board of directors and will depend upon many factors, including distributions of earnings to Linde plc by its subsidiaries, the financial condition and results of operations of the combined group, legal requirements, including limitations imposed by Irish law, terms of any outstanding shares of preferred stock, restrictions in any debt agreements that limit its ability to pay dividends to shareholders, restrictions in any series of preferred stock and other factors the board of directors deems relevant. For a further discussion of the risks related to the payment of dividends after the business combination, see “Risk Factors — Risks Relating to Linde plc Shares” and “Risk Factors — Risks Relating to Tax Matters.” |

| Q: | Will there be Irish or U.K. withholding tax on future dividends, if any, by Linde plc? |

| A: | Linde plc is expected to be tax resident solely in the United Kingdom. As long as Linde plc remains resident for tax purposes outside Ireland, dividends paid by Linde plc will not be subject to Irish withholding tax. See “Material Tax Considerations — Material Irish Tax Considerations.” Under current U.K. law as of the date of this document, which may be subject to change, dividend payments may be made by Linde plc without withholding or deduction for or on account of U.K. income tax. See “Material Tax Considerations — Material U.K. Tax Considerations.” |

About the Praxair Special Meeting

| Q: | What are the proposals on which Praxair shareholders are being asked to vote? |

| A: | Praxair shareholders are being asked to consider and vote on a proposal to adopt the business combination agreement and to approve the transactions contemplated thereby. The business combination agreement provides for a combination of the businesses of Praxair and Linde under Linde plc. Linde’s business will be brought under Linde plc through the exchange offer and Praxair’s business will be brought under Linde plc through the merger. The merger is expected to occur immediately following the settlement of the exchange offer. |

Praxair shareholders are also being asked to consider and vote on anon-binding advisory proposal to approve the reduction of the share premium account of Linde plc to allow for the creation of distributable reserves of Linde plc, which are generally required under Irish law in order to allow Linde plc to make distributions and to pay dividends and repurchase or redeem shares following completion of the business combination. Under Irish law, dividends may only be paid (and share repurchases and redemptions must generally be funded) out of “distributable reserves,” which Linde plc will not have immediately following the business combination. In the event that distributable reserves of Linde plc are not created, no distributions by way of dividends, share repurchases or otherwise will be permitted under Irish law until Linde plc has created sufficient distributable reserves from its business activities.

Praxair shareholders are also being asked to consider and vote on anon-binding advisory proposal to approve the compensation that may become payable to Praxair’s named executive officers in connection

-3-

with the business combination. This proposal is being made in accordance with Section 14A of the Exchange Act and the applicable rules thereunder.

Finally, Praxair shareholders are being asked to approve any proposal that may be made by the chairman of the Praxair board of directors to adjourn or postpone the special meeting in order to (1) solicit additional proxies with respect to the above-mentioned proposals and/or (2) hold the special meeting on a date that is on or about the date of the expiration of the acceptance period, in the event that such date of expiration is extended.

The Praxair board of directors unanimously recommends that the Praxair shareholders vote “FOR” each of these proposals. For a discussion of the reasons for this recommendation, see “The Business Combination — Praxair’s Reasons for the Business Combination.”

| Q: | What are the most significant conditions to the merger? |

| A: | The only condition to the merger is that the exchange offer closes. The exchange offer is subject to the satisfaction or, where permissible, waiver of certain conditions, including the minimum acceptance condition, the Praxair requisite vote condition, the regulatory condition, and the other conditions described in the section “The Exchange Offer — Conditions to the Exchange Offer.” |

| Q: | What will I receive in the merger if I am a Praxair shareholder? |

| A: | In the merger, Praxair shareholders will be entitled to receive one Linde plc share for each of their Praxair shares. |

| Q: | What will happen to my Praxair, Inc. stock options, restricted stock units or performance-based stock units in the business combination? |

| A: | At the effective time of the merger, each option to purchase Praxair shares (which is herein referred to as a “Praxair stock option”) will be converted into an option to purchase Linde plc shares (which is herein referred to as a “Linde plc stock option”) on substantially the same terms and conditions as were applicable to such Praxair stock option immediately prior to the effective time of the merger. The number of Linde plc shares subject to each such Linde plc stock option will equal the number of Praxair shares subject to each Praxair stock option immediately prior to the effective time of the merger. Such Linde plc stock option will have the same exercise price per share as theper-share exercise price applicable to such Praxair stock option immediately prior to the effective time of the merger. If a holder of such Linde plc stock options experiences a qualifying termination of employment within two years following the effective time of the merger, such Linde plc stock options will vest in full. |

At the effective time of the merger, each restricted stock unit measured in Praxair shares (which is herein referred to as a “Praxair RSU”) will be converted into a restricted stock unit denominated in Linde plc shares (which is herein referred to as a “Linde plc RSU”) on substantially the same terms and conditions as were applicable to such Praxair RSU immediately prior to the effective time of the merger. The number of Linde plc shares subject to each such Linde plc RSU will equal the number of Praxair shares subject to each Praxair RSU immediately prior to the effective time of the merger. If a holder of such Linde plc RSUs experiences a qualifying termination of employment within two years following the effective time of the merger, such Linde plc RSUs will vest in full.

At the effective time of the merger, each performance share unit measured in Praxair shares (which is herein referred to as a “Praxair PSU”) will be converted into a Linde plc RSU on substantially the same terms and conditions as were applicable to such Praxair PSU immediately prior to the effective time of the merger, except that the Linde plc RSUs will be subject to service-vesting conditions only, not performance-vesting conditions. The number of Linde plc shares subject to each such Linde plc RSU will equal the greater of

-4-

(i) the target number of Praxair shares subject to such Praxair PSU and (ii) the number of Praxair shares subject to such Praxair PSU determined based on the achievement of the performance goals applicable to such Praxair PSU immediately prior to the effective time of the merger. If a holder of such Linde plc RSUs experiences a qualifying termination of employment within two years following the effective time of the merger, such Linde plc RSUs will vest in full.

| Q: | As a Praxair shareholder, will I have appraisal rights in connection with the merger? |

| A: | Under the Delaware General Corporation Law, which governs the merger, as well as under the Praxair, Inc. certificate of incorporation and bylaws, Praxair shareholders are not entitled to any appraisal rights in connection with the merger. See “The Business Combination — Appraisal Rights.” |

| Q: | Will Praxair shareholders be subject to taxation on the Linde plc shares received in the merger? |

| A | If a U.S. holder receives Linde plc shares with a fair market value in excess of the adjusted tax basis of such U.S. holder’s Praxair shares surrendered in the merger, such U.S. holder will recognize capital gain, if any, to the extent of the difference. A U.S. holder will not recognize any loss on Praxair shares surrendered in the merger. A U.S. holder who recognizes gain with respect to all of its Praxair shares surrendered in the merger will have an aggregate tax basis in the Linde plc shares received in the merger that is equal to the fair market value of the Linde plc shares as of the effective date of the merger. In the case of a U.S. holder who does not recognize gain with respect to any of its Praxair shares surrendered in the merger, the aggregate basis of the Linde plc shares received for Praxair shares in the merger will be equal to the basis of Praxair shares surrendered. The holding period of Linde plc shares received by a U.S. holder will include the holding period of the Praxair shares surrendered therefor. |

Anon-U.S. holder will not be subject to U.S. federal income tax on any gain recognized in the merger, unless (i) the gain is effectively connected with a U.S. trade or business of suchnon-U.S. holder (and, if required by an applicable income tax treaty, is attributable to a U.S. “permanent establishment”); or (ii) suchnon-U.S. holder is an individual who is present in the U.S. for 183 days or more in the taxable year of the merger, and certain other conditions are met.

For a further discussion of certain U.S. federal income tax consequences of the merger to Praxair shareholders, see “Material Tax Considerations — Material U.S. Federal Income Tax Considerations — Tax Consequences of the Merger to Holders of Praxair Shares.”

For a summary of certain U.K. tax consequences for certain Praxair shareholders who are resident and, in the case of an individual, domiciled exclusively in the U.K. for U.K. tax purposes, see “Material Tax Considerations — Material U.K. Tax Considerations — Merger — Taxation of Chargeable Gains” and “Material U.K. Tax Considerations — Merger — Stamp Duty and Stamp Duty Reserve Tax.”

Under Irish tax law, holders of Praxair shares who are not tax resident in Ireland and who do not have a branch or agency in Ireland through which a trade is carried on and to which the holding of such shares is attributable will not be subject to Irish tax as a result of the business combination. For a further discussion of certain Irish tax consequences of the merger to Praxair shareholders, see “Material Tax Considerations — Material Irish Tax Considerations.”

Tax matters are very complicated and the tax consequences of the merger to each U.S. holder of Praxair shares may depend on such shareholder’s particular facts and circumstances. Holders of Praxair shares are urged to consult their own tax advisors to understand fully the tax consequences to them of the merger.

| Q: | What is the recommendation of the Praxair board of directors as to each proposal that may be voted on at the Praxair special meeting? |

| A: | The Praxair board of directors has unanimously approved and declared advisable the business combination agreement, the business combination and all of the other transactions contemplated by the business |

-5-

| | combination agreement, declared that the transactions contemplated by the business combination agreement are fair to and in the best interests of Praxair, Inc. and its shareholders, directed that the adoption of the business combination agreement be submitted to a vote of Praxair shareholders at the Praxair special meeting and resolved to recommend that the Praxair shareholders vote to adopt the business combination agreement and approve the other matters submitted for approval in connection with the business combination agreement at the Praxair special meeting. |

Accordingly, the Praxair board of directors unanimously recommends that Praxair shareholders vote:

1. “FOR” the Business Combination Proposal;

2. “FOR” the Distributable Reserves Creation Proposal;

3. “FOR” the Compensation Proposal; and

4. “FOR” the Shareholder Adjournment Proposal.

| Q: | When and where is the Praxair special meeting? |

| A: | The Praxair special meeting will take place on [—], 2017, at [—] at [—], Eastern Standard Time. |

| Q: | Who is entitled to vote at the Praxair special meeting? |

| A: | Only holders of record of Praxair shares at the close of business on [—], 2017, the record date for the Praxair special meeting, will be entitled to notice of, and to vote at, the Praxair special meeting or any adjournment or postponement thereof. |

| Q: | Who is soliciting my proxy? |

| A: | The Praxair management, at the direction of the Praxair board of directors, is soliciting your proxy for use at the Praxair special meeting. It is expected that the solicitation will be primarily by mail or the internet, but proxies may also be solicited personally, by advertisement or by telephone, by directors, officers or employees of Praxair without special compensation or by Praxair, Inc.’s proxy solicitor, Morrow Sodali LLC. This document describes the voting procedures and the proposals to be voted on at the Praxair special meeting. |

| Q: | Who will solicit and pay the cost of soliciting proxies? |

| A: | Praxair, Inc. has engaged Morrow Sodali LLC to assist in the solicitation of proxies from shareholders at a fee of $48,000 plus reimbursement ofout-of-pocket expenses. Praxair also may reimburse banks, brokerage firms, other nominees or their respective agents for their expenses in forwarding proxy materials to beneficial owners of Praxair shares. Praxair’s directors, officers and employees also may solicit proxies by telephone, by facsimile, by mail, on the internet or in person. They will not be paid any additional amounts for soliciting proxies. |

| Q: | What is “householding”? |

| A: | A single proxy statement will be delivered to multiple shareholders sharing an address, unless contrary instructions have been received from an affected shareholder. Once you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and you prefer to receive a separate proxy statement, please notify your broker or contact Praxair, Inc.’s proxy solicitor, Morrow Sodali LLC at (203)658-9400 (banks and brokerage firms) and (800)662-5200 (stockholders toll free), or online at px.info@morrowsodali.com. Praxair shareholders who currently receive multiple copies of this document at their address and would like to request “householding” of their communications should contact their broker or bank. |

| Q: | How do I vote if I am a Praxair shareholder? |

| A: | If you are a Praxair shareholder and you hold your Praxair shares in your own name, you may submit your vote for or against the proposals submitted at the Praxair special meeting or your abstention in person or by |

-6-

| | proxy. Your vote is important. Because many shareholders cannot attend the special meeting in person, it is necessary that a large number be represented by proxy. Most shareholders have a choice of voting over the internet, by using a toll-free telephone number, or by completing a proxy card or voting instruction card, as described below: |

| | • | | Vote on the Internet. If you have internet access, you may submit your proxy or voting instructions by following the instructions provided with your proxy materials and on your proxy card or voting instruction card; |

| | • | | Vote by Telephone. You can also vote by telephone by following the instructions provided with your proxy materials and on your proxy card or voting instruction card.Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded; or |

| | • | | Vote by Mail.You may choose to vote by mail by marking your proxy card or voting instruction card, dating and signing it, and returning it in the postage-paid envelope provided. |

Information and applicable deadlines for using the proxy card, or voting by telephone or through the internet, are set forth in the enclosed proxy card instructions. Alternatively, you may vote in person at the Praxair special meeting by ballot.

If your Praxair shares are registered in the name of a broker, bank or other nominee (which is also known as being held in “street name”), that broker, bank or other nominee has enclosed or will provide a voting instruction card for you to direct the broker, bank or other nominee how to vote your shares. Praxair shareholders who hold shares in “street name” must return their instructions to their broker, bank or other nominee on how to vote their shares. If your Praxair shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record, to be able to vote in person at the special meeting.

You should be aware that, as of [—], 2017, Praxair, Inc. directors and executive officers and their affiliates owned and were entitled to vote approximately [—]% of the outstanding Praxair shares entitled to vote at the Praxair special meeting.

| Q: | If I am a Praxair shareholder, what vote is required to approve each proposal, and what happens if I do not vote or if I abstain from voting? |

| A: | The business combination cannot be completed without approval of the business combination proposal. The business combination proposal requires the affirmative vote of a majority of the outstanding Praxair shares entitled to vote at the Praxair special meeting. A failure to vote, a brokernon-vote or an abstention will have the same effect as a vote “AGAINST” the business combination proposal. |

The distributable reserves creation proposal, the compensation proposal and the shareholder adjournment proposal each requires the affirmative vote of a majority of the Praxair shares present in person or by proxy and entitled to vote at the Praxair special meeting. An abstention will have the same effect as a vote “AGAINST” such proposals. A failure to vote and brokernon-votes will have no effect on the vote on any of the distributable reserves creation proposal, the compensation proposal and the shareholder adjournment proposal.

The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote shall constitute a quorum. Praxair shares represented at the Praxair special meeting and entitled to vote but not voted, including Praxair shares represented by abstentions, will be considered present for quorum purposes. Broker non-votes will not be counted for purposes of determining whether a quorum is present.

| Q: | If I am a Praxair shareholder and my Praxair shares are held in “street name” by a broker, bank or other nominee, will my broker or bank vote my shares for me? |

| A: | If you hold your Praxair shares in “street name” and do not provide voting instructions to your broker, your Praxair shares will not be voted on any proposal on which your broker does not have discretionary authority |

-7-

| | to vote. Generally, your broker, bank or other nominee does not have discretionary authority to vote on the business combination proposal, the distributable reserves creation proposal, the compensation proposal or the shareholder adjournment proposal. Accordingly, your broker, bank or other nominee will vote your shares held by it in “street name” only if you provide voting instructions. You should follow the procedures that your broker, bank or other nominee provides. Shares that are not voted because you do not properly instruct your broker, bank or other nominee will have the same effect as a vote “AGAINST” the business combination proposal. Brokernon-votes are not considered shares entitled to vote on the distributable reserves creation proposal, the compensation proposal and the shareholder adjournment proposal and, therefore, will have no effect on the vote on any of such proposals. |

Alternatively, you can attend the Praxair special meeting and vote in person if your Praxair shares are held in the name of a bank, broker or other holder of record, by obtaining a proxy, executed in your favor, from the holder of record, to be able to vote at the special meeting.

| Q: | Can I change my vote after I have delivered my proxy? |

| A: | Yes. If you are a Praxair shareholder of record, there are three ways to change your vote after you have submitted a proxy: |

| | • | | you may send a later-dated, signed proxy card to the address indicated on the proxy card, which must be received prior to the Praxair special meeting; |

| | • | | you may attend the Praxair special meeting in person and vote; or |

| | • | | you may send a notice of revocation to the agent for Praxair, Inc., which notice must be received prior to the Praxair special meeting. |

Simply attending the Praxair special meeting without voting will not revoke your proxy. Praxair, Inc. proxy cards can be sent by mail to Morrow Sodali LLC, 470 West Avenue — 3rd floor, Stamford, CT 06902.

If your Praxair shares are held in an account at a broker, bank or other nominee and you have instructed your broker, bank or other nominee on how to vote your shares, you should follow the instructions provided by your broker, bank or other nominee to change your vote.

| Q: | What will happen if the proposals to be considered at the Praxair special meeting are not approved? |

| A: | Praxair, Inc., Linde AG, Zamalight Subco, Inc., Zamalight Holdco LLC and Linde plc will not be able to complete the business combination if Praxair shareholders do not approve the business combination proposal. The approval of the distributable reserves creation proposal, the compensation proposal or the shareholder adjournment proposal is not a condition to the completion of the business combination. |

| Q: | When should I submit my proxy? |

| A: | Whether or not you expect to attend the annual meeting in person, please promptly submit your proxy or voting instruction. Most shareholders have a choice of voting over the internet, by telephone or by using a traditional proxy card (including by mail). Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other nominee to see which voting methods are available to you. |

Please be aware that, if you own shares in a brokerage account, you must instruct your broker on how to vote your shares. Without your instructions, New York Stock Exchange rules do not allow your broker to vote your shares on any of the proposals. Please exercise your right as a shareholder to vote on all proposals, including the business combination proposal, by instructing your broker by proxy.

-8-

| Q: | Who can help answer my questions? |

| A: | The information provided above in the question and answer format is for your convenience only and is merely a summary of some of the information contained in this document. You should read carefully the entire document, including the information in the Annexes. See the section entitled “General Information — Where You Can Find More Information; Documents Available for Inspection.” If you are a Praxair shareholder and have any questions about the business combination, or how to submit your proxy, or if you need additional copies of this document or the enclosed proxy card, you should contact: |

Morrow Sodali LLC

470 West Avenue — 3rd floor

Stamford, CT 06902

Banks and Brokerage Firms Call: (203)658-9400

Stockholders Call Toll Free: (800)662-5200

Email: px.info@morrowsodali.com

-9-

SUMMARY

This summary highlights selected information in this document and may not contain all of the information that is important to you. You should carefully read this entire document, including its annexes and documents referred to herein, for a more complete understanding of the business combination agreement, the transactions contemplated by the business combination agreement, Praxair, Linde and Linde plc. You may obtain additional information without charge by following the instructions under “General Information — Where You Can Find More Information; Documents Available for Inspection.”

Information About the Companies (see page [—])

Linde plc

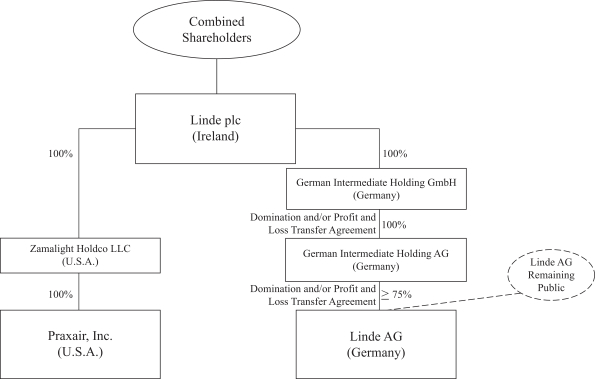

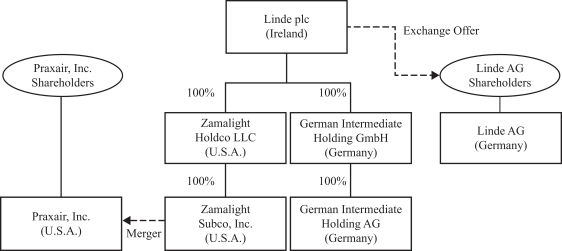

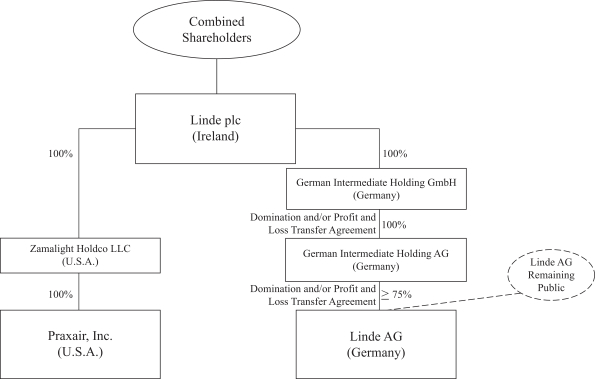

Zamalight plc, to be renamed Linde plc (which is herein referred to as “Linde plc”) prior to the commencement of the exchange offer, is a newly incorporated public limited company formed under the laws of Ireland on April 18, 2017, that will become the parent company of Praxair Inc. and Linde AG upon the completion of the business combination. To date, Linde plc has not conducted any material activities other than those incidental to its formation and the matters contemplated by the business combination agreement. On May 26, 2017, Linde plc formed Zamalight Holdco LLC, a Delaware limited liability company (which is herein referred to as “Zamalight Holdco”). Prior to the commencement of the exchange offer, Linde plc intends to form a German limited liability company (GmbH) domiciled in Germany (which is herein referred to as “German Intermediate Holding GmbH”), which in turn will form a German stock corporation (AG) domiciled in Germany (which is herein referred to as “German Intermediate Holding AG”) to facilitate the settlement of the exchange offer and a post-completion reorganization with respect to Linde.

Linde plc’s principal executive offices are located at The Priestley Centre, 10 Priestley Road, The Surrey Research Park, Guildford, Surrey GU2 7XY, United Kingdom, and its telephone number at that location is +44 1483 242200. Linde plc’s registered office is located at Ten Earlsfort Terrace, Dublin 2, D02 T380 Ireland.

Praxair, Inc.

Praxair, Inc., a Delaware corporation, was founded in 1907 and became an independent publicly traded company in 1992. Praxair is a leading industrial gas company in North and South America and one of the largest worldwide. It continues to be a major technological innovator in the industrial gases industry. Its primary products in its industrial gases business are atmospheric gases (oxygen, nitrogen, argon, rare gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, acetylene). Praxair serves a diverse group of industries including healthcare, petroleum refining, manufacturing, food, beverage carbonation, fiber-optics, steel making, aerospace, chemicals and water treatment. Praxair also designs, engineers, and builds equipment that produces industrial gases primarily for internal use. Praxair’s surface technologies segment supplies wear-resistant and high-temperature corrosion-resistant metallic and ceramic coatings and powders.

Praxair, Inc.’s principal executive offices are located at 10 Riverview Drive, Danbury, Connecticut 06810-6268, and its telephone number at that location is (203)837-2000. Its registered office in the State of Delaware is 1209 Orange Street, Wilmington, New Castle, and its common stock is listed on the NYSE under the symbol “PX” and ISIN US74005P1049.

Linde AG

Linde AG, a German stock corporation (Aktiengesellschaft), was founded in 1879. Linde is one of the largest gases and engineering companies worldwide. The Linde Group offers a wide range of compressed and

-10-

liquefied gases as well as chemicals and is a partner for a variety of industries. Linde gases, such as oxygen, nitrogen, hydrogen, helium and specialty gases, are used, for example, in the energy sector, steel production, chemical processing, environmental protection and welding, as well as in food processing, glass production, electronics and in the healthcare sector. Linde is also active in the sale of products in the field of medical technology, of pharmaceutical products and of other products in the healthcare area. Linde’s engineering business includes the technology, engineering, procurement, project management and construction of industrial plants. Linde plants are used in a wide variety of fields such as the petrochemical and chemical industries, refineries and fertilizer plants, to recover air gases, to produce hydrogen and synthesis gases and to treat natural gas.

Linde AG’s principal executive offices are located at Klosterhofstrasse 1, 80331 Munich, Germany and its telephone number at that location is +49 89 357571001. Its registered office is in Munich, Germany and its shares are listed on the regulated market of the Frankfurt Stock Exchange and the stock exchanges in Berlin, Dusseldorf, Hamburg, Munich and Stuttgart, are also traded on the TradegateExchange and the open market (Freiverkehr) of the Hanover stock exchange, in each case under the symbol “LIN” and ISIN DE0006483001.

Zamalight Holdco

Zamalight Holdco is a Delaware limited liability company and wholly-owned subsidiary of Linde plc that was formed on May 26, 2017, for the purposes of entering into the business combination agreement. To date, Zamalight Holdco has not conducted any material activities other than those incidental to its formation and the matters contemplated by the business combination agreement. Upon effectiveness of the merger, Praxair, Inc. will become a wholly-owned subsidiary of Zamalight Holdco.

Zamalight Holdco’s principal executive offices are located at 10 Riverview Drive, Danbury, Connecticut 06810-5113, and its telephone number at that location is +1 (203)837-2000. Its registered office in the State of Delaware is 2711 Centerville Road, Suite 400, in the City of Wilmington, County of New Castle, 19808.

Merger Sub

Zamalight Subco, Inc. (which is herein referred to as “Merger Sub”) is a Delaware corporation and wholly-owned subsidiary of Zamalight Holdco that was formed on May 26, 2017, solely for the purpose of effecting the merger. To date, Merger Sub has not conducted any material activities other than those incidental to its formation and the matters contemplated by the business combination agreement. Upon effectiveness of the merger, Merger Sub will merge with and into Praxair, Inc., with Praxair, Inc. surviving the merger as an indirect wholly-owned subsidiary of Linde plc.

Merger Sub’s principal executive offices are located at 10 Riverview Drive, Danbury, Connecticut 06810-5113, and its telephone number at that location is +1 (203)837-2000. Its registered office in the State of Delaware is 2711 Centerville Road, Suite 400, in the City of Wilmington, County of New Castle, 19808.

The Business Combination and the Business Combination Agreement (see page [—])

Pursuant to the business combination agreement, Praxair, Inc. and Linde AG have agreed to combine their businesses under Linde plc, a new Irish holding company. The effect of the business combination will be that Praxair, Inc. and Linde AG will become subsidiaries of Linde plc. Praxair, Inc. will become an indirect subsidiary of Linde plc through a merger of Merger Sub, a wholly-owned indirect subsidiary of Linde plc, with and into Praxair, Inc., with Praxair, Inc. surviving the merger, and Linde AG will become an indirect subsidiary of Linde plc through an exchange offer of Linde plc shares for Linde shares. The business combination agreement is more fully described in the section “The Business Combination Agreement” and a copy of the

-11-

business combination agreement is attached as Annex A to this document. We encourage you to read the business combination agreement carefully and in its entirety, as it is the legal document that governs the relationship between Praxair and Linde with respect to the business combination.

The Merger

The parties to the business combination agreement have agreed that, subject to and immediately after the settlement of the exchange offer, Merger Sub, a wholly-owned indirect subsidiary of Linde plc, will merge with and into Praxair, Inc., with Praxair, Inc. surviving the merger, as a result of which Praxair, Inc. will become a wholly-owned indirect subsidiary of Linde plc. The merger is discussed in more detail in the section “The Business Combination Agreement — The Merger.”

Merger Consideration

In the merger, each outstanding Praxair share will be converted into the right to receive one fully paid andnon-assessable Linde plc share (which is herein referred to as the “merger consideration”). This exchange ratio is fixed and will not be adjusted to reflect stock price changes prior to the completion of the merger.

Treatment of Praxair Equity Awards

Praxair Stock Options

At the effective time of the merger, each option to purchase Praxair shares (which is herein referred to as a “Praxair stock option”) will be converted into an option to purchase Linde plc shares (which is herein referred to as a “Linde plc stock option”) on substantially the same terms and conditions as were applicable to such Praxair stock option immediately prior to the effective time of the merger. The number of Linde plc shares subject to each such Linde plc stock option will equal the number of Praxair shares subject to each Praxair stock option immediately prior to the effective time of the merger. Such Linde plc stock option will have the same exercise price per share as theper-share exercise price applicable to such Praxair stock option immediately prior to the effective time of the merger. If a holder of such Linde plc stock options experiences a qualifying termination of employment within two years following the effective time of the merger, such Linde plc stock options will vest in full.

Praxair Restricted Stock Units

At the effective time of the merger, each restricted stock unit measured in Praxair shares (which is herein referred to as a “Praxair RSU”) will be converted into a restricted stock unit measured in Linde plc shares (which is herein referred to as a “Linde plc RSU”) on substantially the same terms and conditions as were applicable to such Praxair RSU immediately prior to the effective time of the merger. The number of Linde plc shares subject to each such Linde plc RSU will equal the number of Praxair shares subject to each Praxair RSU immediately prior to the effective time of the merger. If a holder of such Linde plc RSUs experiences a qualifying termination of employment within two years following the effective time of the merger, such Linde plc RSUs will vest in full.

Praxair Performance Share Units

At the effective time of the merger, each performance share unit measured in Praxair shares (which is herein referred to as a “Praxair PSU”) will be converted into a Linde plc RSU on substantially the same terms and conditions as were applicable to such Praxair PSU immediately prior to the effective time of the merger except that the Linde plc RSUs will be subject to service-vesting conditions only, not performance-vesting conditions.

-12-

The number of Linde plc shares subject to each such Linde plc RSU will equal the greater of (i) the target number of Praxair shares subject to such Praxair PSU and (ii) the number of Praxair shares subject to such Praxair PSU determined based on the achievement of the performance goals applicable to such Praxair PSU immediately prior to the effective time of the merger. If a holder of such Linde plc RSUs experiences a qualifying termination of employment within two years following the effective time of the merger, such Linde plc RSUs will vest in full.

Conditions to the Merger

The only condition to the merger is that the exchange offer closes.

Praxair Shareholders’ Appraisal Rights

Under the Delaware General Corporation Law, which governs the merger, as well as under the Praxair, Inc. certificate of incorporation and bylaws, Praxair shareholders are not entitled to any appraisal rights in connection with the merger. See “The Business Combination — Appraisal Rights.”

The Exchange Offer

In the exchange offer, Linde shareholders will be offered to exchange each of their Linde shares for 1.540 Linde plc shares. The American Depositary Receipts of Linde AG (which are herein referred to as “ADRs”), each representing the beneficial interest in one tenth of one Linde share, are not subject to the exchange offer. However, pursuant to the deposit agreement, holders of ADRs may exchange their ADRs for Linde shares and then tender such Linde shares in the exchange offer. The exchange offer is discussed in more detail in the section “The Exchange Offer.”

Assuming that all of the outstanding Linde shares are exchanged in the exchange offer, the aggregate number of Linde plc shares issued to the Linde shareholders will equal approximately 50% of the Linde plc shares outstanding at the completion of the business combination.

Acceptance Period; Additional Acceptance Period

The acceptance period for the exchange offer starts on [—], 2017, and will expire on [—], 2017, 24:00 hours, Central European Summer Time, unless extended. Withdrawal rights will cease at the time of the end of the acceptance period.

Following the end of the acceptance period, and if all conditions to the exchange offer (other than the regulatory condition which need not be satisfied until up to twelve months following the end of the acceptance period,i.e., until [—], 2018, subject to any extension of the acceptance period) have been satisfied or, where permissible, waived, the German Takeover Act provides an additional acceptance period of two weeks. The additional acceptance period will be an additionaltwo-week period of time beginning after the publication of the results of the acceptance period during which shareholders may tender, but not withdraw, their Linde shares. See “The Exchange Offer — Timetable.”

Conditions to the Exchange Offer

The exchange offer is subject to the satisfaction or, where permissible, waiver of certain conditions, including the minimum acceptance condition, the Praxair requisite vote condition, the regulatory condition, and the other conditions described in the section “The Exchange Offer — Conditions to the Exchange Offer.” Except for the regulatory condition, all conditions to the exchange offer must be satisfied on or prior to the end of the

-13-

acceptance period. The regulatory condition may remain outstanding for up to twelve months following the end of the acceptance period,i.e., subject to any extension of the acceptance period, until [—], 2018. As a result, the exchange of Linde shares pursuant to the exchange offer and conversion of Praxair shares pursuant to the merger may be made on a date that is significantly later than the end of the acceptance period, or may not occur. See “The Exchange Offer — Timetable” and “The Exchange Offer — Waiver of Conditions to the Exchange Offer.”

Settlement of the Exchange Offer

The Linde plc shares issued pursuant to the exchange offer to Linde shareholders who tendered, and did not withdraw, their Linde shares in the exchange offer, will be credited to DTC’s nominee, Cede & Co. (which is herein referred to as the “Nominee”), and then to the accounts of DTC’s participants, including Clearstream, who will in turn credit the securities custody accounts of the custodian banks maintained therein without undue delay and no later than seven business days following the later of (i) the publication of the results of the additional acceptance period or (ii) the satisfaction of the regulatory condition. Under the terms of the exchange offer, the regulatory condition may remain outstanding for up to twelve months following the end of the acceptance period,i.e., until [—], 2018, subject to any extension of the acceptance period. If the regulatory condition is not satisfied by that date (or waived at least one working day prior to the end of the acceptance period), the exchange offer will terminate and settlement will not occur. See “The Exchange Offer — Settlement of the Exchange Offer.” As used in this document, “business day” means any day other than a Saturday, Sunday or other day on which banks in Frankfurt am Main, Germany, or New York, New York, are generally closed, except when the context requires otherwise.

Treatment of Linde Equity Awards

Linde shall terminate the Linde Long Term Incentive Plan 2012 (which is herein referred to as the “Linde LTIP”) as follows (and such termination date is herein referred to as the “Linde LTIP termination time”): with respect to any holder who is a member of the executive board of Linde AG, the Linde LTIP termination time will occur upon the post-completion reorganization of Linde taking effect, provided that it occurs within 18 months after the consummation of the exchange offer, and with respect to any other holder of Linde equity awards, the Linde LTIP termination time will occur immediately after the consummation of the exchange offer.

At the Linde LTIP termination time, each option to purchase Linde shares (which is herein referred to as a “Linde stock option”) generally will be terminated in exchange for a cash payment determined in good faith (nach billigem Ermessen) by Linde considering certain criteria specified in the Linde LTIP conditions, including (i) the degree of the achievement of the performance targets set forth in the Linde LTIP at the time of consummation of the exchange offer, (ii) the elapsed time of the waiting period applicable for the respective Linde LTIP tranches up to the time of consummation of the exchange offer, and (iii) the market capitalization and the business prospects of Linde, as they were expected to develop without taking into consideration the exchange offer and its consummation. Similarly, each right to receive matching Linde shares (which is herein referred to as a “Linde matching share right”) generally will be terminated in exchange for a cash payment determined in good faith (nach billigem Ermessen) by Linde considering, to the extent applicable, the criteria specified in the Linde LTIP conditions with respect to Linde stock options.

Following the Linde LTIP termination time, Linde plc will grant to the former holders of Linde stock options and Linde matching share rights replacement equity awards in the form of (i) Linde plc stock options, in respect of terminated Linde stock options, and (ii) Linde plc RSUs, in respect of terminated Linde matching share rights. The number of Linde plc stock options and Linde plc RSUs awarded to a beneficiary will reflect (i) the number of equity awards of the relevant type outstanding as of closing of the exchange offer, (ii) multiplied by the exchange ratio, (iii) adjusted to reflect, on a prorated basis, the remaining portion of the respective four-year waiting period for each tranche and (iv) further adjusted to reflect Linde’s good faith

-14-

consideration of the criteria set forth in the Linde LTIP conditions (to the extent applicable) in determining the cash payments upon termination.

The Linde plc stock options will have an exercise price equal to the nominal value strike price that applied to the terminated Linde stock options, adjusted for the exchange ratio. The waiting period for each tranche of Linde plc stock options and Linde plc RSUs will correspond to the remainder of the respective original waiting period under the Linde LTIP and the exercise period in respect of the Linde plc stock options will be the same as the exercise period that applied to the terminated Linde stock options. Vesting of the Linde plc stock options and Linde plc RSUs will be conditioned on continued employment through the applicable waiting periods (subject to certain “good leaver” provisions). To become entitled to exercise Linde plc stock options and to earn Linde plc RSUs, each beneficiary who belonged to certain top management levels of the Linde remuneration system must hold a specified number of Linde plc shares until the expiry of the waiting periods applicable to the corresponding Linde plc RSUs. For all other beneficiaries, such holding of Linde plc shares is generally voluntary but required to earn Linde plc RSUs. The treatment of the Linde equity awards is discussed in more detail in the section “The Business Combination Agreement — The Exchange Offer — Consideration Offered to Linde Shareholders.”

Termination Fees

The business combination agreement requires Praxair, Inc. to pay Linde AG a termination fee of €250 million if:

| | • | | the business combination is terminated by Linde AG prior to the receipt of the Praxair requisite vote, because the Praxair board of directors changed its recommendation for the merger; |

| | • | | the business combination is terminated by either Praxair, Inc. or Linde AG prior to the expiration of the acceptance period, because the Praxair requisite vote has not been obtained after a vote of the Praxair shareholders has been taken and completed at the Praxair special meeting (and, at the time of such termination of the business combination agreement, Linde AG was entitled to terminate the business combination agreement because the Praxair board of directors changed its recommendation for the merger); or |