- LIN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Linde (LIN) DEF 14ADefinitive proxy

Filed: 2 May 22, 4:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

☒ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

|

CHECK THE APPROPRIATE BOX: | ||

☐ |

| Preliminary Proxy Statement |

☐ |

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

| Definitive Proxy Statement |

☐ |

| Definitive Additional Materials |

☐ |

| Soliciting Material Under Rule 14a-12 |

Linde plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | ||

☒ |

| No fee required. |

☐ |

| Fee paid previously with preliminary materials: |

☐ |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Making our world more productive Sustainable Growth Notice of 2022 Annual General Meeting of Shareholders and Proxy Statement

| A Message from Our Chairman |

On behalf of Linde’s entire Board of Directors, I am honored to write to you as the new Chairman of Linde plc (“Linde” or the “Company”). During the past year, there have been several corporate governance and leadership developments that culminated on March 1, 2022, which was effectively the third anniversary of the merger between Praxair and Linde AG.

Senior Executive Leadership Changes

In October 2021, the Board appointed me to succeed Wolfgang Reitzle as the new Chairman, and Sanjiv Lamba to become Linde’s new CEO, each effective March 1, 2022. Sanjiv previously served as the Chief Operating Officer since January 2021. This senior leadership transition was the result of a successful CEO succession planning process that the Board undertook starting in early 2020. I look forward to working with Sanjiv as he builds on the foundation of Linde’s success to drive results for all our stakeholders.

Director Retirements; New Director Recruitment

and Committee Changes

Director Retirements. Effective March 1, 2022, the following five Linde directors retired from the Board as required by the Board’s Director Retirement Policy: Wolfgang Reitzle (the former Chairman of the Board), Clemens Borsig (the former Chairman of the Audit Committee), Nance K. Dicciani, Franz Fehrenbach and Larry D. McVay. I want to thank these directors for their outstanding contributions to Linde’s success, and particularly to Wolfgang Reitzle for his leadership of the Board as the former Chairman.

New Directors. Beginning in 2020, the Governance and Nomination Committee began a comprehensive process to plan for the anticipated 2022 director retirements and to refresh the Board through the recruitment of new directors. This resulted in Linde adding two highly experienced directors who joined the Board effective November 1, 2021: Joe Kaeser, the former CEO and CFO of Siemens, AG, and Alberto Weisser, the former CEO and CFO of Bunge Limited.

Committee Changes. In connection with the director retirements, the Board reviewed and rotated committee assignments and appointed new committee Chairpersons as disclosed in the proxy statement. In addition, the Board added a new Sustainability Committee to focus on environmental matters and clean energy initiatives.

Board Oversight of Environmental, Social and

Governance Matters

The Board and its committees are actively involved in providing oversight and counsel to management regarding Environmental, Social and Governance (“ESG”) matters as discussed in the “Environmental, Social and Governance Highlights” section of the proxy statement. During 2021, the Board conducted a comprehensive review of its oversight of Linde’s ESG programs and practices and implemented several constructive enhancements, including (1) creating the new Sustainability Committee, (2) expanding the scope of and renaming the “Compensation Committee” to the “Human Capital Committee” and (3) revising the charters of certain committees to specify their oversight of ESG factors more clearly.

Other Key Board Actions

The Board and its committees undertook the other following key actions during the past year:

| • | Exercised oversight of the Company’s capital allocation strategy, with a focus on investment for future growth and appropriate shareholder distribution levels. This included a 10% increase in the 2022 cash dividend and a new $10 billion stock repurchase program (each approved in February 2022), and the approval of large capital projects that will provide future revenue streams. |

| • | Conducted the annual enterprise risk assessment and multiple strategic business reviews throughout the year. |

| • | Undertook talent reviews and senior management succession planning, and appointed Sanjiv Lamba as the Company’s new Chief Executive Officer. |

2022 AGM

I am pleased to invite you to the 2022 Annual General Meeting of Shareholders (“AGM”) of Linde plc. Due to health and safety considerations arising from the Covid-19 pandemic, we held the 2020 and 2021 AGMs primarily through an electronic online format. However, as many Covid-19 restrictions have eased, we are hopeful to return to an in-person meeting in London this year. We will continue to actively monitor ongoing developments, and health and safety protocols. Therefore, we may need to change the date, time and location of the 2022 AGM, including again holding the AGM primarily through electronic means. The accompanying Notice of the AGM and the proxy statement provide more details regarding potential contingencies and alternatives for the in-person AGM in London.

The Board thanks you for your continuing support and confidence in Linde.

Regards,

Stephen F. Angel

Table of Contents

Notice of 2022 Annual General Meeting of Shareholders

Dear Shareholder:

The Annual General Meeting (“AGM”) of Shareholders of Linde plc (“Linde” or the “Company”) will be held at 1:00 PM United Kingdom time (8:00 AM Eastern Daylight Time in the U.S.) on Monday, July 25, 2022, at the Corinthia Hotel, Whitehall Place, Westminster, London, SW1A 2BD, U.K., for the following purposes: (please see the notice below regarding possible changes to the meeting as a result of the COVID-19 pandemic)

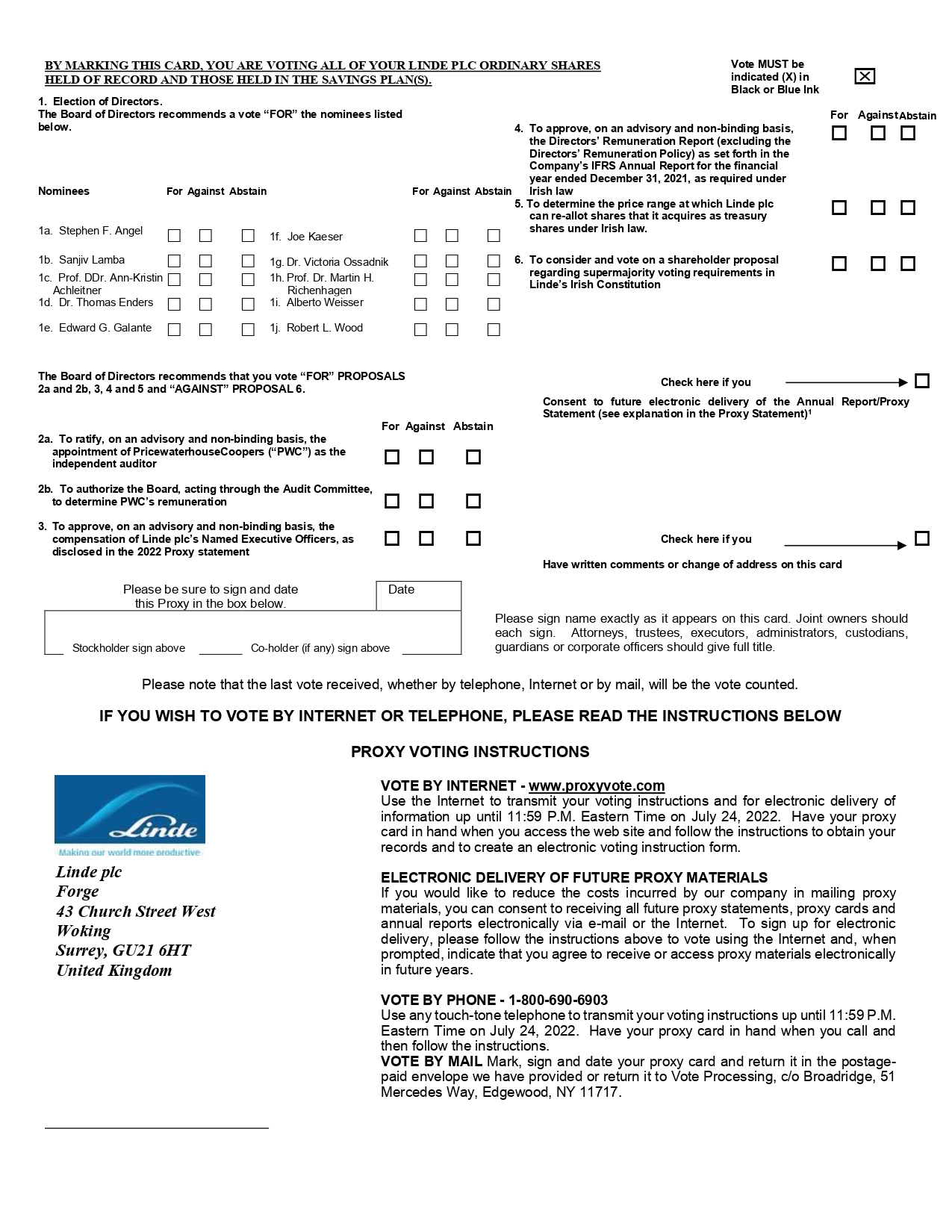

| 1. | By separate resolutions, to re-appoint the ten director nominees described in the proxy statement. |

| 2. | To (a) ratify, on an advisory and non-binding basis, the appointment of PricewaterhouseCoopers (“PwC”) as independent auditor of the Company and (b) to authorize the Board, acting through the Audit Committee, to determine PwC’s remuneration. |

|

| 3. | To approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers, as required under applicable U.S. law and U.S. Securities and Exchange Commission rules. |

| 4. | To approve, on an advisory and non-binding basis, the Directors’ Remuneration Report (excluding the Directors’ Remuneration Policy) as set forth in the Company’s IFRS Annual Report for the financial year ended December 31, 2021, as required under Irish law |

| 5. | To determine the price range at which the Company can re-allot shares that it acquires as treasury shares under Irish law. |

| 6. | To consider and vote on a shareholder proposal regarding supermajority voting requirements in Linde’s Irish Constitution. |

| 7. | To conduct such other business as may properly come before the meeting. |

Potential Impact of the COVID-19 Pandemic on the Annual General Meeting

Linde is monitoring coronavirus (COVID-19) developments and the related recommendations and protocols issued by public health authorities and governments. The health and well-being of Linde’s shareholders is a high priority. If the Company determines that it is not possible or advisable to hold the Annual General Meeting in person, Linde will announce alternative arrangements for the meeting, which may include a change in the date or time of the meeting, a change in the meeting location and/or holding the meeting primarily by means of remote electronic communication. Linde will announce any such change and the details on how to participate by press release, which will be available on Linde’s website at https://www.linde.com/news-media/press-releases and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to attend the meeting, please check the website prior to the meeting date.

Linde plc | 1

Shareholders may, by technological means, participate in the 2022 Annual General Meeting in Ireland in accordance with the section 176 of the Irish Companies Act 2014 by attending the offices of Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, DO2 T380, Ireland at the time of the meeting.

This Proxy Statement and a form of proxy are being distributed to shareholders on or about April 29, 2022. Only holders of record of Linde ordinary shares at the close of business on April 28, 2022, will be entitled to notice of the meeting or any adjournment or postponement thereof. Pursuant to section 1105(2) of the Irish Companies Act 2014, only holders of record of Linde ordinary shares at 1:00 p.m. Irish time on July 23, 2022, will be entitled to attend, speak, ask questions and vote at the meeting in respect of the number of shares registered in their name at that time.

It is important that your shares be represented and voted at the meeting. Any shareholder entitled to attend, speak, ask questions and vote at the meeting, may exercise his or her right to vote by appointing a proxy or proxies to attend and vote on his or her behalf. A shareholder may appoint the persons named in the proxy card provided or another person, who need not be a shareholder of the Company, as a proxy, by electronic means or in writing, to vote some or all of their shares. Appointment of a proxy does not preclude members from attending, speaking and asking questions at the meeting should they subsequently wish to do so. Please note that proxies may be required to provide identification to attend the meeting.

Whether or not you expect to attend the AGM in person, please promptly provide your proxy either online or by telephone, as further explained in the accompanying proxy statement, or by filling in, signing, dating and promptly mailing a proxy card. We recommend that you review the further information on the process for, and deadlines applicable to, voting, attending the meeting and appointing a proxy under “Information About the Annual General Meeting and Voting” on page 92 of the proxy statement.

Please be aware that, if you own shares in a brokerage account, you must instruct your broker on how to vote your shares. Without your instructions, New York Stock Exchange rules do not allow your broker to vote your shares on any of the proposals except those identified herein. Please exercise your right as a shareholder to vote on all proposals, including the re-appointment of the director nominees, by instructing your broker by proxy.

| By Order of The Board of Directors |

|

|

| Stephen F. Angel |

| Chairman of the Board |

April 29, 2022

2 | Linde plc

Proxy Statement Highlights

This summary highlights selected information in this Proxy Statement. Please review the entire document before voting.

Annual General Meeting of Shareholders of Linde plc

Date | Time | Location | Admission |

Monday, July 25, 2022 | 1:00 PM UK time (8:00 AM Eastern Daylight Time in the U.S.) | Corinthia Hotel Whitehall Place Westminster London, SW1A 2BD United Kingdom | See “Attending the Annual General Meeting” on page 93 for instructions. |

|

|

|

|

Please see the notice above regarding a potential change to the in-person meeting place and/or the cancellation of holding the in-person meeting format as a result of the COVID-19 pandemic.

Shareholders may, by technological means, participate in the 2022 Annual General Meeting in Ireland in accordance with the section 176 of the Irish Companies Act 2014 by attending the offices of Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, DO2 T380, Ireland at the time of the meeting.

Proposal | Board Voting Recommendation | Explanation of Proposal and Reason(s) for Board Recommendations | Further Information (page) | |

1. | By separate resolutions, to appoint the ten director nominees described in the proxy statement | FOR each nominee | Directors must be elected to the Board annually. Linde’s nominees are seasoned leaders who bring a mix of skills and qualifications to the Board. | 40 |

2. | (a) To ratify, on an advisory and non-binding basis, the appointment of PwC as the independent auditor of the Company and (b) to authorize the Board, acting through the Audit Committee, to determine PwC’s remuneration | FOR

FOR | Based on its recent evaluation, Linde’s Audit Committee believes that the retention of PricewaterhouseCoopers as the Auditor for 2022 is in the best interests of the Company and its shareholders. The Company requests shareholders’ non-binding ratification of the Auditor’s retention and the authorization for the Audit Committee to determine the Auditor’s remuneration. | 45 |

3. | To approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers as required under applicable U.S. law and SEC rules | FOR | Shareholders must vote annually on whether to approve the compensation paid to Linde’s five most highly compensated executive officers (“Say-On-Pay” vote). Linde’s executive compensation program reflects its commitment to paying for performance. This vote is required under applicable U.S. law and SEC rules. | 81 |

4. | To approve, on an advisory and non-binding basis, the Directors’ Remuneration Report for the financial year ended December 31, 2021, as required under Irish law | FOR | In accordance with European Union law as implemented in Ireland, Shareholders’ must vote annually on the Directors’ Remuneration Report. Linde’s Directors’ Remuneration Report for the year ended December 31, 2021, is included in the 2021 IFRS Annual Report and in Appendix 1 to this Proxy Statement. This vote is required under Irish law. As this Report applies to Linde Directors only, it is distinguished from our non-binding advisory vote in respect of the compensation for the Company’s named executive officers in voting item 3 as required under U.S. laws and SEC rules. | 82 |

Linde plc | 3

Proxy Statement Highlights

Proposals

5. | To determine the price range at which the Company can re-allot shares that it acquires as treasury shares under Irish law | FOR | The Board has authorized the Company’s share repurchase programs and believes that such programs enhance shareholder value as a means of returning capital to shareholders. Repurchased shares are held as treasury shares until they are either cancelled or used to fund employee and Director stock compensation awards. Irish law requires periodic shareholder approval of the price range at which treasury shares may be re-allotted for these purposes. | 83 |

6. | Shareholder Proposal regarding eliminating supermajority shareholder votes. | AGAINST | The proposal requests that the Board take steps to amend Linde’s Irish Constitution so that any shareholder vote requirement is a simple majority of the votes cast at a shareholder meeting and that any greater vote requirement (a “supermajority vote”) be reduced to a simple majority. The Board has considered the proposal and has concluded that it is not in shareholders’ best interest because of the 10 supermajority vote requirements in the Constitution: (1) five are mandated by Irish law and cannot be reduced, and (2) the other five provide shareholders with various protections under Irish law and the supermajority vote of four of these provisions simply reflect the default voting requirements provided under Irish law. | 84 |

How to Vote

Your vote is important. You are eligible to vote if you are a shareholder of record at 1:00 p.m. United Kingdom time on July 23, 2022. Even if you plan to attend the meeting, please vote as soon as possible using one of the following methods. In all cases, you should have your proxy card in hand.

Your Vote is Important | Online | By Phone | By Mail | In person |

|

|

|

|

|

| www.proxyvote.com

| 1-800-690-6903 | Fill out your proxy card and submit via mail | Attend in person at the above time and location. Please bring a photo ID. |

4 | Linde plc

Proxy Statement Highlights

2021 Business Performance Highlights

2021 Business Performance Highlights

2021 Year in Review

Linde employees once again demonstrated their steadfast commitment to supply products and services safely and reliably to millions of customers around the globe. With our dense network and high-performance culture, the company supplied critical industrial gases and engineering for world scale projects.

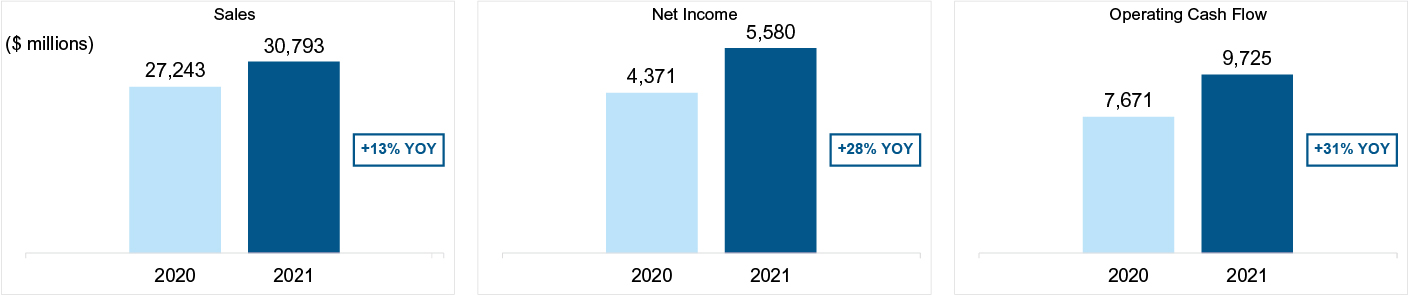

In 2020, Linde demonstrated the resiliency of the operating model and this year it proved its ability to leverage the economic recovery. Sales grew 13% to $31 billion, earnings per share grew 30% to $10.69, operating cash flow increased 31% to $9.7 billion and after-tax return on capital rose 430 basis points to 17.7%. Pricing actions coupled with productivity efforts globally enabled operating margins to expand 200 basis points, or 270 basis points excluding the effects of contractual energy cost pass through. Linde increased its dividend by another 10%, representing the 28th consecutive year of dividend increase. These results are a testament to Linde’s ability to outperform in any macro-economic environment.

Financial highlights

| • | Sales growth of 13% |

| • | Operating margin expanded by 200 basis points to 23.3%(a) |

| • | Earnings per share increased by 30%, following a 13% increase in 2020(a) |

| • | After-tax return on capital increased by 430 basis points to 17.7%(a) |

| • | Operating cash flow increased 31% to $9.7 billion |

Business highlights

| • | Record backlog providing a strong growth foundation for the next several years |

| • | Strong pipeline of new opportunities in Clean Energy, tracking approximately 300 projects with an estimated value of $5B |

| • | Reduced greenhouse gas intensity by 24%; on track to meet overall 35% reduction goal by 2028(b)(c) |

| • | Announced more ambitious medium and long-term greenhouse gas emission targets, including 35% absolute emissions reduction by 2035 and climate neutrality by 2050(c) |

| • | Included in the Dow Jones Sustainability World Index for 19th consecutive year |

| • | Awarded by CDP ‘A’ rating for Water Stewardship |

| • | Continued to prioritize diversity and inclusivity; at 28% gender diversity, on track to exceed gender diversity goal of 30% professional female employees by 2030 |

| • | Maintained best in class safety performance, despite challenging environment |

| (a) | Adjusted operating margin, earnings per share and after-tax return on capital are non-GAAP measures. Adjusted operating margin and earnings per share amounts are reconciled to reported amounts in the “Non-GAAP Financial Measures” Section in Item 7 of the Linde plc 2021 Form 10-K. For definition of after-tax return on capital and reconciliation to GAAP please see the “Non-GAAP Measures and Reconciliations” set forth in the financial tables that are included as an appendix to the 4th quarter and full year 2021 earnings press release that was furnished in the Linde plc Form 8-K filed on February 10, 2022. |

| (b) | Million tons of Co2 equivalent divided by adjusted EBITDA |

| (c) | GHG emission reduction targets relate to Linde’s Scope 1 and 2 emissions. |

Linde plc | 5

Proxy Statement Highlights

2021 Business Performance Highlights

|

Returned $6.8 billion to shareholders

| • | Dividend increased by 10% |

| • | Share repurchases, net of issuances, in the amount of $4.6 billion |

| • | Total shareholder return for 2021 was 33.4% |

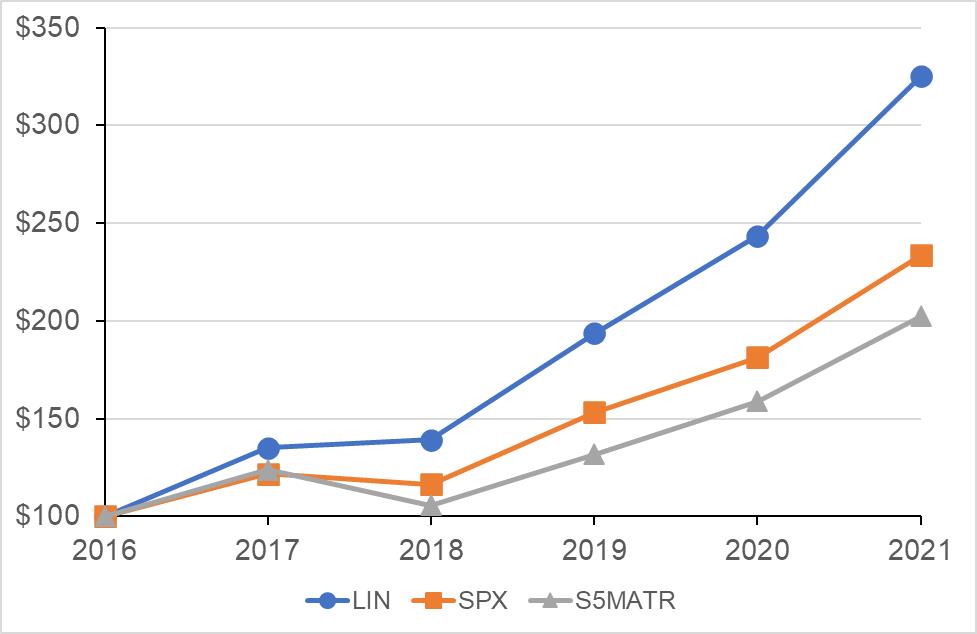

The graph below compares the most recent five-year cumulative returns of the common stock of Praxair, the Company's predecessor, through October 31, 2018 (the date of the closing of the Praxair-Linde AG Business Combination) and Linde's ordinary shares from October 31, 2018 through December 31, 2021 with those of the Standard & Poor’s 500 Index ("SPX") and the S5 Materials Index ("S5MATR") which covers 28 companies, including Linde. The figures assume an initial investment of $100 on December 31, 2016 and that all dividends have been reinvested.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

LIN | $100 | $135 | $139 | $194 | $244 | $325 |

SPX | $100 | $122 | $117 | $153 | $181 | $233 |

S5MATR | $100 | $124 | $106 | $132 | $159 | $202 |

6 | Linde plc

Proxy Statement Highlights

Board and Governance Highlights

Board and Governance Highlights

Corporate Governance Highlights

Linde plc has a strong corporate governance structure that compares favorably to that of other large public companies and to the standards of recognized governance organizations. A summary of the key aspects of Linde plc’s corporate governance structure is set forth below, followed by a more detailed discussion of certain governance matters.

Board and Governance Information | |||

Size of Board | 10 | Annual Board and Committee Evaluations | Yes |

Number of Independent Directors

| 8 80% | Limits service on other Boards for Directors Limits service on other Boards for CEO (2 other public company Boards) | Yes

Yes |

Split Chairman and CEO | Yes | Succession Planning Process | Yes |

Lead Independent Director | Yes |

|

|

Board Committees (Audit, Human Capital, Nomination and Governance, Sustainability and Executive) | 5 | Board Risk Oversight | Yes |

Board Meetings | 5 | Code of Conduct for Directors, Officers and Employees | Yes |

Annual Election of Directors | Yes | Stock Ownership Guidelines for Directors and Executive Officers | Yes |

Mandatory Retirement Age | 72 | Anti-Hedging and Pledging Policies | Yes |

Board Diversity – two women, one African American Director | Yes | Clawback Policy | Yes |

Average Director Age | 63.2 | Rights Agreement (Poison Pill) | No |

Average Director Tenure (Years) | 2.6 | Board Sustainability Oversight | Yes |

Majority Voting in Director Elections | Yes | Shareholders May Call Special Meetings | Yes |

Proxy Access | Yes |

|

|

Public Company Legal and Regulatory Framework

Linde plc is incorporated in Ireland and is subject to Irish corporate law pursuant to the Irish Companies Act 2014. In addition, Linde plc ordinary shares are listed and trade on the New York Stock Exchange (“NYSE”) and the Frankfurt Stock Exchange (“FSE”). Linde plc’s primary governance obligations arise from its designation as a domestic issuer for NYSE purposes and, as such, the Company is subject to the corporate governance rules of the NYSE, requiring it to adopt certain governance policies (which the Company has complied with), and to the reporting and other rules of the United States Securities and Exchange Commission (the “SEC”) requiring it to file Forms 10-K, 10-Q, 8-K, proxy statements and other public company reports. The Company is also subject to applicable laws of the European Union.

Linde plc | 7

Proxy Statement Highlights

Board and Governance Highlights

Board of Directors and Nominees

The following ten persons currently serve on the Board of Directors and have been nominated for re‑appointment to serve until the 2023 annual general meeting of shareholders and the election and qualification of their successors.

Name | Age | Director | Background | Independent | Current | Other Current Public | |

|

| Since |

| Yes | No | Committee Memberships (1) | Company Boards |

Stephen F. Angel | 66 | 2018 | Chairman of the Board of Linde plc; former Chief Executive Officer of Linde plc; former Chief Executive Officer and Chairman of the Board of Praxair, Inc. |

| X | EX | • General Electric Company • PPG Industries, Inc. |

Sanjiv Lamba | 57 | 2022 | Chief Executive Officer of Linde plc; former Chief Operating Officer of Linde plc |

| X | EX |

|

Prof. DDr. Ann-Kristin Achleitner | 56 | 2018 | Scientific Co-Director, Center for Entrepreneurial and Finance Studies, Technical University Munich, Germany | X |

| HC, SC | • Lazard Ltd. • Münchener Rückversicherungs-Gesellschaft AG

|

Dr. Thomas Enders | 63 | 2018 | Former Chief Executive Officer & Member of Executive Committee, Airbus SE | X |

| Chair of SC, AC, EX | • Knorr-Bremse AG • Lilium B.V. • Lufthansa Group

|

Edward G. Galante | 71 | 2018 | Former Senior Vice President and a member of the Management Committee of ExxonMobil Corporation | X |

| Chair of HC, NG | • Celanese Corporation • Clean Harbors, Inc. • Marathon Petroleum |

Joe Kaeser | 64 | 2021 | Former President and Chief Executive Officer of Siemens AG | X |

| Chair of NG, HC | • Daimler Truck Holding AG • NXP Semiconductors B.V. (until June 1, 2022) • Siemens Energy AG

|

Dr. Victoria E. Ossadnik | 53 | 2018 | Management Board member and Chief Operating Officer – Digital- E. ON SE | X |

| AC, NG | • E.ON SE

|

Prof. Dr. Martin H. Richenhagen | 69 | 2018 | Former Chief Executive Officer, President and Chairman of the Board of AGCO Corporation | X |

| Chair of AC, HC | • AXIOS Sustainable Growth Acquisition Corporation • Daimler Truck Holding AG • PPG Industries, Inc. |

Alberto Weisser | 66 | 2021 | Former Chairman and Chief Executive Officer of Bunge Limited | X |

| AC, SC | • Bayer AG • PepsiCo |

Robert L. Wood | 68 | 2018 | Lead Independent Director of Linde Plc; Partner, The McChrystal Group; Former Chairman, President & Chief Executive Officer of Chemtura Corporation | X |

| HC, SC, EX | • MRC Global Inc. • Univar Inc. |

(1) | Committees: AC means Audit Committee; HC means Human Capital Committee; EX means Executive Committee; NG means Nomination and Governance Committee; SC means Sustainability Committee |

8 | Linde plc

Proxy Statement Highlights

Compensation Highlights

Alignment of Executive Compensation Programs with Linde Business Objectives

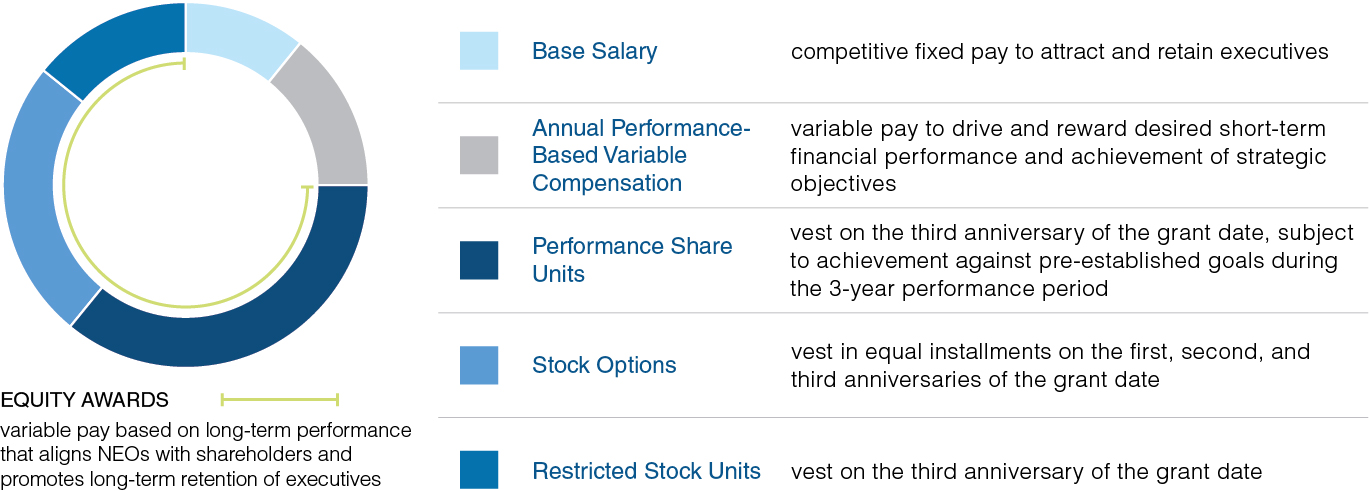

The Human Capital Committee seeks to achieve its executive compensation objectives by aligning the design of the Company’s executive compensation programs with the Company’s business objectives ensuring a balance between financial and strategic non-financial goals.

FINANCIAL BUSINESS OBJECTIVES: Achieve sustained profitable growth and shareholder return resulting in a robust cash flow to fund capital investment growth opportunities, dividend payments and share repurchases.

| • | Annual performance-based variable compensation earned by meeting or exceeding pre-established financial goals. |

| • | Annual grants of performance share units that vest based upon performance results over three years. |

| • | Annual grants of stock options, the value of which is directly linked to the growth in the Company’s stock price. |

| • | Annual grants of restricted stock units with three-year cliff vesting and value based on the Company’s stock price. |

STRATEGIC BUSINESS OBJECTIVES: Maintain world-class standards in safety, environmental responsibility, global compliance, strategic positioning, productivity, talent management, and financial controls.

| • | Annual payout of variable compensation is impacted by performance in these strategic and non-financial objectives. |

Attract and retain executives who thrive in a sustainable performance-driven culture.

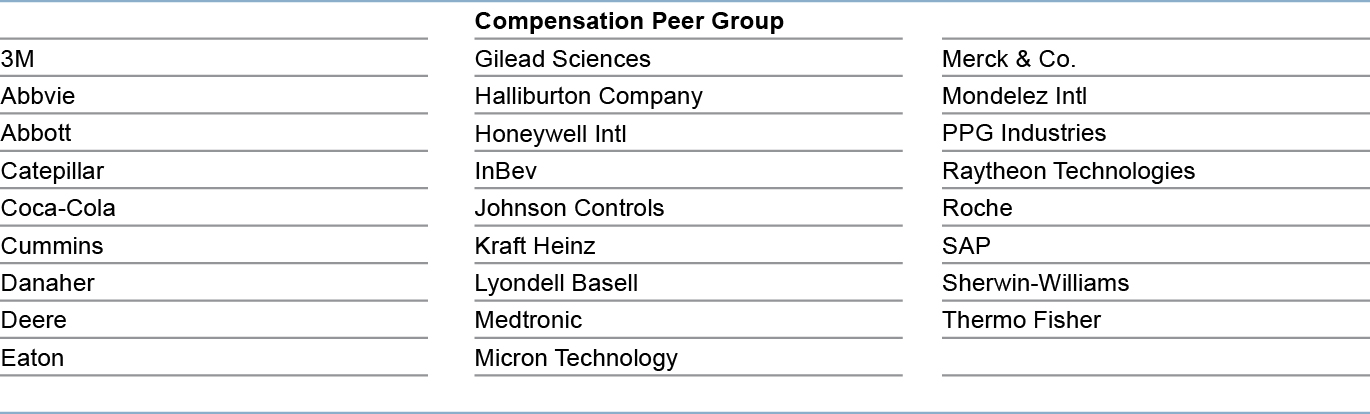

| • | A competitive compensation and benefits program regularly benchmarked against peer companies of similar size in market capitalization, revenue and other financial metrics and business attributes. |

| • | Realized compensation that varies with Company performance, with downside risk and upside opportunity. |

Annual Performance-Based Variable Compensation Program Design

In January 2022, in recognition of the importance of the Company’s standards for, and impacts from environmental, social and governance (ESG) considerations, the Human Capital Committee approved changes to the non-financial component of the annual variable compensation program, which will continue to be weighted 25% of the total payout.

The non-financial component will now be comprised of three pillars, each with their own weights: 1) reduction in absolute greenhouse gas emissions (weighted 20% of non-financial component), 2) ESG values: safety, health & environment; sustainability (excluding greenhouse gas emissions), compliance & integrity; and human capital (weighted 60%), and 3) the Company’s relative performance and strategic positioning (weighted 20%).

Linde plc | 9

Proxy Statement Highlights

Compensation Highlights

Best Practices Supporting Executive Compensation Objectives

What We Do: ✓Link a substantial portion of total compensation to Company performance: ✓Annual variable compensation awards based principally upon performance against objective, pre-established financial goals ✓Equity grants consisting largely of PSUs and stock options, focused on longer term shareholder value creation ✓Set compensation within competitive market ranges ✓Require substantial stock ownership and retention requirements for officers ✓Limit perquisites and personal benefits ✓Have a clawback (“recapture”) policy that applies to performance-based cash awards and equity grants, including gains realized through exercise or sale of equity securities |

| What We Do Not Do: X Guarantee bonuses for executive officers X Allow pledging or hedging of Company stock held by officers X Pay tax “gross-ups” on perquisites and personal benefits unless related to international assignment benefits that are available to employees generally X Include the same metrics in the short and long-term incentive programs X Allow backdating or repricing of stock option awards X Pay or accrue dividends or dividend equivalents on unvested PSU and RSU awards X Include an excise tax “gross-up” provision in the event of a change-in-control X Accelerate equity award vesting upon change-in-control |

10 | Linde plc

Proxy Statement Highlights

Environmental, Social and Governance Highlights

Environmental, Social and Governance Highlights

Commitment to Environmental, Social and Governance (“ESG”) Matters

Our core values – Safety, Inclusion, Accountability, Integrity and Community – combined with our mission of Making our World more Productive, underpin our commitment to the environment and social responsibility. From the oversight exercised by Linde’s Board of Directors to the culture of sustainability driven by our mission statement, our commitment to ESG matters is embedded in our company culture and operating rhythm.

Linde’s System of ESG management is focused on four priority pillars: Climate Change; Safety, Health & Environment; People & Community; and Integrity & Compliance. Details on these pillars are provided in our annual Sustainability Report which also describes our approach to ESG, including materiality assessment, determination of priorities, target setting, performance measurement, and continued surveillance and improvement.

Linde has two sets of targets, which coexist: SD 2028 Targets, which cover the period from 2018-2028, and recently announced targets for absolute GHG reduction by 2035 and climate neutrality ambition by 2050. We regularly review key actions and continue to report on progress toward the SD 2028 targets annually. Going forward we will include reporting on progress against the most recent climate change commitments. The Sustainable Development Report and other ESG information are available on our website https://www.linde.com/sustainable-development.

While we continue to work towards meeting or exceeding the goals across these priority pillars set forth in our Sustainable Development Report, the following are key actions undertaken in 2021:

| • | We announced our new absolute greenhouse gas reduction target of 35% by 2035 and our ambition to achieve climate neutrality by 2050. |

| • | We reaffirmed Linde’s commitment to global human rights through the release of our global human rights policy. |

Linde plc | 11

Proxy Statement Highlights

Environmental, Social and Governance Highlights

| • | We released Linde’s water position statement, confirming our commitment to water stewardship across the globe. |

| • | The Board of Directors performed a comprehensive review of and realigned and enhanced its oversight of ESG (see “Board Oversight of ESG Matters” below). |

| • | We incorporated a greenhouse gas reduction metrics as part of the non-financial factors considered in our Short-Term Incentive Plan compensation, with ESG factors comprising 20% of the payout. |

Our leadership and performance on sustainability and ESG received widespread external recognition in 2020-2021. These are listed on our website at https://www.linde.com/sustainable-development/awards-and-recognition. Examples include: :

Selected to Dow Jones Sustainability World Index For the 19th consecutive year |

| Included in S&P Global’s |

| Included as a FTSE4Good |

|

|

|

|

|

Recognized as one of the |

| Received ‘A’ rating for Water |

| Recognized as a Best Employer |

Board Oversight of ESG Matters

Overview; 2021 ESG Review and Changes to Board Structure

The Board’s oversight of ESG risks and opportunities is integral to our business strategy. The Board and its committees actively oversee Linde’s ESG strategy, programs and policies, which in turn are managed on a day-to-day basis by senior executives including the CEO and his direct reports.

In 2021, the Board, through the Nomination and Governance Committee, conducted a comprehensive review of its oversight of Linde’s ESG programs and practices to ensure that the Board or one of its committees has appropriate oversight responsibility. As a result of this review, the Board (1) created the new Sustainability Committee to focus on environmental matters, including climate change, decarbonization solutions, greenhouse gas emission reduction, and other key programs and initiatives; (2) expanded the scope of and renamed the “Compensation Committee” to the “Human Capital Committee” to reflect that committee's enhanced oversight of policies, practices and goals related to Linde's workforce generally, including diversity and inclusion, safety and community engagement; and (3) revised the charters of certain committees to more clearly specify the ESG programs and practices overseen by these committees. The Nominating and Governance Committee actively monitors the changing ESG landscape and recommends changes to Linde’s governance programs and practices. Below is a summary of the Board’s, its committees’ and senior management’s oversight of key ESG matters

12 | Linde plc

Proxy Statement Highlights

Environmental, Social and Governance Highlights

Linde plc | 13

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

Linde operates under Corporate Governance Guidelines which are posted at Linde’s public website, www.linde.com in the About Linde/Corporate Governance section. Consistent with those guidelines, the charters of the various Board committees and Linde’s Constitution, the Board has adopted the following policies and practices, among others:

Director Independence

The Board has adopted independence standards for service on Linde’s Board of Directors which are posted at Linde’s public website referenced above. The Board has applied these standards to all the directors and has determined that each qualifies as independent except for Mr. Angel, the Company’s Chairman of the Board and former Chief Executive Officer, and Mr. Lamba, the Company’s current Chief Executive Officer. The Board is not otherwise aware of any relationship with the Company or its management that could potentially impair the independent judgment of these directors. See also related information in this Proxy Statement under the caption “Certain Relationships and Transactions.”

Linde’s Corporate Governance Guidelines provide the Board with flexibility to determine the appropriate Board leadership structure from time to time. The Nomination and Governance Committee (consisting entirely of independent directors) regularly reviews the leadership structure, and considers many factors, including the specific needs of Linde and its businesses, corporate governance best practices, shareholder feedback and succession planning, as different structures may be appropriate in different circumstances. The Corporate Governance Guidelines also provide that the Board: (a) shall select a Chairman of the Board and determine his/her duties and responsibilities; and (b) If the Chairman of the Board has not been determined to be independent in accordance with the Board’s independence standards and those of the New York Stock Exchange and applicable law, then the Board may appoint a Lead Independent Director who has been determined to be independent under such standards and determine his/her responsibilities.

Given the recent leadership transition discussed below, the Board believes that the best leadership model for Linde at this time is that the position of the Chairman of the Board should continue to be separate from that of the Chief Executive Officer. In addition to assure effective independence in the Board’s oversight, advice and counsel of management, the Board believes that the appointment of a Lead Independent Director is appropriate.

2022 Leadership Transition and New Structure

Effective March 1, 2022, after the Board’s thorough and thoughtful Chief Executive Officer succession planning process, Sanjiv Lamba was appointed Linde’s new Chief Executive Officer (having served as the Chief Operating Officer since January 2021) and a member of the Board, succeeding Stephen F. Angel who served as CEO since 2018. The Board also elected Mr. Angel as the new Chairman of the Board to succeed Wolfgang Reitzle who retired from the Board. In addition, the Board appointed Robert L. Wood as the Lead Independent Director. The Board believes this new leadership structure is effective and appropriate and in the best interests of Linde and its shareholders. With Mr. Angel as Chairman of the Board, Linde continues to leverage his significant industry expertise, prior CEO experience and effective working relationship with the Board to lead the Board and focus its attention on strategic matters and facilitate effective communication between the Board and management. As the Lead Independent Director

14 | Linde plc

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

with clearly defined responsibilities, Mr. Wood ensures robust independent oversight of the Company by the Board.

Chairman of the Board Responsibilities

The Board believes that while the Chairman and CEO roles should be separate at this time, the Chairman should work collaboratively with the CEO who has the day-to-day familiarity with the business issues confronting the Company and an understanding of the specific areas in which management seeks advice and counsel from the Board. The designated responsibilities of the Chairman are set forth in the Board’s Corporate Governance Guidelines and include, among others:

| • | Serving as chairman of the meetings of the Board (other than meetings solely of the independent directors); |

| • | Having the authority to call meetings of the Board; |

| • | Serving as a liaison between the Board and the CEO; |

| • | Being available to consult with the CEO about the concerns of the Board; |

| • | Approving the Board meeting agendas and related information sent to the Board; |

| • | Approving the Board meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| • | Being available for consultation and direct communication with major shareholders if requested; and |

| • | Coordinating an annual performance review of the CEO with input from the Human Capital Committee and the Independent Directors. |

Lead Independent Director Responsibilities

The roles and responsibilities of the Lead Independent Director will be determined by the Board periodically and reviewed at least annually. It is the Board’s current policy that such duties include, among others, the following:

| • | Providing advice and assistance to the Chairman, as requested; |

| • | Consulting on and approving, in consultation with the Chairman, the agendas for and the scheduling of meetings of the Board; |

| • | Chairing meetings of the Board in the absence of the Chairman; |

| • | Serving as a liaison between the Chairman and the Independent Directors; |

| • | Calling and chairing executive sessions of the Independent Directors if required; |

| • | Reviewing in consultation with the Chairman, the quality, quantity, appropriateness, and timeliness of information provided to the Board; and |

| • | Communicating with shareholders and other stakeholders in consultation with the Chairman and Chief Executive Officer |

Linde plc | 15

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

At least annually, the Board reviews the Company’s risk identification, assessment and management processes and the guidelines and policies by which key risks are managed. As part of that review, the Board discusses (1) the key enterprise risks that management has identified, (2) management accountability for managing or mitigating each risk, (3) the steps being taken to manage each risk, and (4) which Board Committees will oversee each risk area on an ongoing basis.

The risk factors disclosed in Item 1A of the Company’s Form 10-K and Annual Report illustrate the range of the risks faced by a global industrial company and help explain the need for strong Board Committee oversight of the management of risks in specific subject areas. Each Committee’s calendar of recurring meeting agenda topics addresses risk areas pertinent to the Committee’s subject-matter responsibilities. These areas include: financing and currency exchange risks (Audit Committee); compensation risks, and executive development and retention (Human Capital Committee); regular

review of the Board’s governance practices (Nomination and Governance Committee); internal controls, investigations, and integrity standards compliance (Audit Committee); and risks related to climate change (Sustainability Committee). Other risk areas are regularly reviewed by the full Board. These include: safety (covered at each Board meeting), economic, market and competitive risk (part of business operating reports at each Board meeting, and the annual operating and strategic reviews), geopolitical risks, cyber security, and global compliance risks (supplementing reporting within the Audit Committee). In addition, risk identification and assessment is integrated into Board decision-making with respect to capital projects and acquisitions, entry into new markets, financings, and cash flow analysis, among other matters. In Committee meetings and full Board deliberations, each director brings his or her particular operating, financial, management development, and other experiences and expertise to bear in assessing management’s response to specific risks and in providing advice and counsel with respect to risk mitigation and management.

Board Oversight of Business Strategy

Each year, the Board conducts a comprehensive long-term strategic review of the Company’s outlook and business plans and provides advice and counsel to management regarding the Company’s strategic issues. This process involves engagement by all Board members and senior management. The Board performs a detailed review of management’s proposed strategy for each of the key business units, which is designed to drive profitable growth over the near-and long-term independent of the macro environment and drive long-term shareholder value creation.

Board Effectiveness Assessment

The Board assesses its effectiveness annually under a process determined by the Nomination and Governance Committee. Typically, this assessment includes each non-management director completing written questionnaires that are used to evaluate the Board’s effectiveness in the areas of Performance of Core Responsibilities, Decision-Making Support, the Quality of Deliberations, Director Performance, and Committee Functions, as well as consideration of additional Board practices and policies recommended as best practices by recognized governance authorities. Similarly, each Committee annually assesses its effectiveness in meeting its oversight responsibilities under its charter from the Board. The Nomination and Governance Committee reviews the results of the written assessments, provides the results to all Board members, and the Chairman may conduct a discussion of the results in an executive session of the non-management directors. Subsequently, the Nomination and Governance Committee may recommend certain actions be taken to enhance the operations and effectiveness of the Board and its committees.

16 | Linde plc

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

The Nomination and Governance Committee conducted the assessment process in 2021. The results were very favorable, and the Committee concluded that the Board and its committees are functioning properly and efficiently and are performing the core responsibilities of the Board generally and that the committees are meeting their key charter responsibilities.

In addition to leading the annual Board and Committee effectiveness assessment referred to above, the Nomination and Governance Committee annually reviews the Company’s governance practices (which may include an outside expert) and updates those practices as it deems appropriate. The Committee considers, among other things, the results of the Board and Committee effectiveness assessments, developments in Irish company law, federal laws and regulations promulgated by the SEC, applicable public company and related standards of the European Union (“EU”), and the views and standards of recognized governance authorities and institutional investors.

Succession Planning and Personnel Development

In addition to periodic senior management talent and succession reviews conducted by the Board, the Human Capital Committee conducts an annual Succession Planning and Personnel Development session to which all Board members are invited and at which executives are evaluated with respect to their potential for promotion into senior leadership positions, including that of the CEO. In addition, a variety of executives are introduced to the Board by way of Board and Committee presentations, and directors have unrestricted access to a broad cross-section of managers and high potential employees.

During 2021, the Board completed a thorough CEO succession planning process that resulted in the selection of Sanjiv Lamba as the Company’s new CEO to replace Stephen F. Angel upon his retirement as CEO effective March 1, 2022.

The Board’s policy is that a director who has attained the age of 72 may not stand for re-election at the next annual shareholders’ meeting. However, for the three-year period following the closing of the Praxair-Linde AG business

combination on October 31, 2018 (the “Integration Phase”), this retirement requirement did not apply to the directors (including their replacements) who began to serve on the Board in October 2018 to ensure continuity.

As required by this policy, the following five directors retired from the Board of Directors in 2022: Prof. Dr. Wolfgang Reitzle, Prof. Dr. Clemens Börsig, Dr. Nance K. Dicciani, Franz Fehrenbach and Larry D. McVay. Therefore, beginning in 2020, the Board, through the Nomination and Governance Committee, began a comprehensive review and planning process for such retirements and commenced new director recruitment (See “Director & Nominee Selection Criteria-Director Retirement and Recruitment” below). This resulted in the appointment of Joe Kaeser and Alberto Weisser as new directors, effective November 1, 2021.

Limits to Service on Other Boards

The Board’s policy is that a non-management director may not serve on more than four additional public company boards, and the CEO may not serve on more than two additional public company boards.

Also, a member of the Audit Committee may not serve on more than two additional public company audit committees unless the Board determines that such simultaneous service would not impair the ability of such member to effectively serve on the Audit Committee. If the Board so determines, it will disclose such determination in the Company’s annual proxy statement.

Linde plc | 17

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

Shareholder Outreach and Communications with the Board

The Company has a robust shareholder outreach program which ensures that the Board and management remain responsive to shareholder concerns. This includes ongoing interaction between Investor Relations and major institutional investors, as well as an extensive shareholder outreach program that is conducted annually. In addition, the Board has established procedures to enable a shareholder or other interested party to direct a communication to the Board of Directors. Such communications may be confidential or anonymous and may be communicated by mail, e-mail, or telephone. Information on how to submit communications, and how they will be handled, is included at www.linde.com in the About Linde/ Corporate Governance section.

Director Attendance at Board and Committee Meetings and the Annual Shareholders Meeting

Absent extenuating circumstances, each member of the Board is expected to attend all meetings of the Board, all meetings of each Committee of which he or she is a member, and the Annual General Meeting of Shareholders. Director meeting attendance is one of the factors that the Nomination and Governance Committee considers in determining whether to re-nominate an incumbent director for election at the Annual General Meeting.

All members of the Board attended the 2021 AGM.

Linde’s Board of Directors has adopted a Code of Business Integrity that is posted on Linde’s public website, www.linde.com, in the About Linde/Corporate Governance section and is available in print to any shareholder who requests it. This Code of Business Integrity applies to Linde’s directors and to all employees, including Linde’s CEO, CFO, Chief Accounting Officer and other officers.

Director Election by Majority Vote and Resignation Policy

Linde’s Constitution requires directors to be elected annually and that a director nominee must receive a majority of the votes cast at an annual general meeting in order to be elected (meaning a greater number of “for” votes than “against” votes) in an uncontested election of directors. The Board’s Tenure and Resignation Policy requires that any director nominee who is then serving as a director must tender his or her resignation if he or she fails to receive this majority vote. The Nomination and Governance Committee of the Board would then consider the resignation offer and recommend to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board would take action on the Committee’s recommendation within 90 days following certification of the vote, and promptly thereafter publicly disclose its decision and the reasons therefor.

Linde’s Constitution provides that a shareholder, or a group of up to 20 shareholders, who have owned at least 3% of the Company’s outstanding ordinary shares continually for at least three years, may nominate persons for election as directors and have these nominees included in the Company’s proxy statement. The shareholders or group must meet the requirements in the Company’s Constitution. The number of nominees is generally limited to the greater of two persons or 20% of the number of directors serving on the Board.

18 | Linde plc

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

The Company does not have a Shareholder Protection Rights Agreement (sometimes referred to as a “Poison Pill”). It is possible for Linde plc to adopt a shareholder rights agreement in certain circumstances. As Linde plc is an Irish public company with securities admitted to trading on NYSE and the Frankfurt Stock Exchange, it is subject to the Irish Takeover Panel Act, 1997 Takeover Rules 2013, which govern certain aspects of the manner in which a takeover offer can be made for shares in Linde plc. If an offer has been made or is deemed to be imminent, Linde plc is prevented from engaging in frustrating action. The adoption of a shareholder rights agreement would constitute frustrating action, meaning that it could only be adopted on a “clear day” where no such offer is anticipated.

Extraordinary General Meetings of Shareholders

Shareholders of the Company holding not less than 5% of the paid up share capital of the Company may call an extraordinary general meeting of shareholders in accordance with the provisions set forth in Linde’s Constitution.

Director Stock Ownership Guidelines

The Board’s policy is that non-management directors must acquire and hold the Company’s ordinary shares equal in value to at least five times the annual base compensation retainer awarded in the form of equity or equity-based awards. Directors have five years from their initial election to meet this guideline. All non-management directors have met this guideline or are within the five-year transition period afforded to them to do so. See the section titled “Information on Share Ownership” in this Proxy Statement.

Executive Stock Ownership and Shareholding Policy

The Board believes that it is important for executive officers to acquire a substantial ownership position in Linde. In this way, their interests are more closely aligned with those of shareholders. Significant stock ownership ensures that executives manage Linde as equity owners.

Accordingly, a stock ownership and shareholding policy has been established for the Company’s executive officers that requires them to own a minimum number of ordinary shares equal or greater in value to a multiple of their base salary, as set forth below. Individuals must meet the applicable ownership level within five years after first becoming subject to the guidelines by acquiring at least 20% of the required level of stock ownership each year. Until the stock ownership requirement is met, executive officers (i) may not sell, transfer or otherwise dispose of any of their Linde ordinary shares and (ii) must retain and hold all Linde ordinary shares acquired from all equity incentive awards, net of shares withheld for taxes and option exercise prices, including performance share unit awards, restricted stock unit awards and stock options.

Set forth below is the stock ownership required by the policy expressed as a multiple of base salary for each executive officer position. As of the date of this Proxy Statement, all covered individuals are in compliance with this policy. Stock ownership of the Named Executive Officers can be found in the table presented under the section titled “Information on Share Ownership.”

|

| Share ownership as a multiple of base salary |

Chief Executive Officer |

| 6X |

Chief Financial Officer |

| 3X |

Other Executive Officers |

| 3X |

Linde plc | 19

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

Hedging, Pledging and Similar Transactions Prohibited. The purpose of the Director and Executive Stock Ownership Policies is to ensure that directors and executive leaders will have a meaningful ownership stake in Linde so that their interests will be aligned with shareholder interests. Any investment activities intended to reduce or eliminate the economic risk that ordinarily accompanies such ownership would defeat this purpose. Therefore, directors and executive leaders may not engage in hedging transactions related to Linde’s stock that would have the effect of reducing the economic risk of their holding Linde stock. This prohibition applies to any Linde stock that a director or executive leader beneficially owns, regardless of whether he/she has fulfilled all or any part of the total stock ownership requirement as set forth above. For example, a director or executive leader may not purchase a “put option” on Linde stock or on certain derivative market instruments of which Linde is a significant component (more than 5%).

Directors and executive leaders also may not pledge or otherwise encumber Linde stock that they own.

Review, Approval or Ratification of Transactions with Related Persons

The Company’s Code of Business Integrity (“Ethics Policy”) prohibits employees, officers and Board members from having a personal, financial or family interest that could in any way prevent the individual from acting in the best interests of the Company (a “conflict of interest”) and provides that any conflict of interest waiver relating to Board members or executive officers may be made only after review and approval by the Board upon the recommendation of its Audit Committee. In addition, the Board’s Corporate Governance Guidelines require that any “related party transaction” by an executive officer or director be pre-approved by a committee of independent and disinterested directors. For this purpose, a “related party transaction” means any transaction or relationship that is reportable under Regulation S-K, Item 404, of the Securities and Exchange Commission (“SEC”) or that, in the case of a non-management director, would violate the Board’s independence standards.

Reporting and review procedures. To implement the foregoing policies, the Audit Committee has adopted a written procedure for the Handling of Potential Conflicts of Interests which specifies a process for the referral of potential conflicts of interests to the Board and standards for the Board’s evaluation of those matters. This policy applies to any transaction or relationship involving an executive officer, a member of the Board of Directors, a nominee for election as a director of the Company, or a family member of any of the foregoing which (1) could violate the Company’s Ethics Policy provisions regarding conflicts of interest, (2) would be reportable under the SEC’s disclosure rules, or (3) in the case of a non-management director, would violate the Board’s independence standards.

Under this procedure, potential conflicts of interest are reported to the Corporate Secretary for preliminary analysis to determine whether referral to the Audit Committee is appropriate. Potential conflicts of interest can be self-identified by the director or executive officer or may arise from internal audits, the integrity hotline or other referrals, or through periodic due diligence conducted by the Corporate Secretary’s office. The Audit Committee then examines the facts and circumstances of each matter referred to it and makes a final determination as to (1) whether the transaction or relationship would (or does) constitute a violation of the conflicts of interest provisions of the Company’s Ethics Policy, and (2) whether the transaction or relationship should be approved or ratified and the conditions, if any, of such approval or ratification. In determining whether a transaction or relationship constitutes a violation of the conflicts of interest provisions of the Company’s Ethics Policy, the Audit Committee considers, among other factors, the materiality of the transaction or relationship to the individual’s personal interest, whether the individual’s personal interest is materially adverse to or competitive with the interests of the Company, and whether the transaction or relationship materially interferes with the proper performance of the individual’s duties or loyalty to the Company. In determining whether to approve or ratify a transaction or relationship, the Audit Committee considers, among other factors, whether the matter would constitute a violation of the conflicts of interest provisions of the Company’s Ethics Policy, whether the matter would violate the NYSE listing standards, the expected practical impact of the transaction or relationship on the individual’s

20 I Linde Inc.

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

independence of judgment or ability to act in the best interests of the Company, the availability, practicality and effectiveness of mitigating controls or safeguards such as recusal, restricted access to information, reassignment etc., and the best interests of the Company and its shareholders generally.

Certain Relationships and Transactions

When determining whether any director or nominee is independent, the Board considers all facts and circumstances and any relationships that a director or nominee may have with the Company, directly or indirectly, other than in the capacity of serving as a director. To assist the Board in making independence determinations, it also applies the independence standards which are posted at Linde’s public website, www.linde.com in the About Linde/Corporate Governance section. In February 2022, the Board considered the following circumstances and relationships of those directors and nominees who then had any direct or indirect relationship with the Company. In the ordinary course of its business, Linde sells industrial gases to, and purchases certain goods or services from E. ON SE, of which Dr. Victoria Ossadnik is an executive officer; The 2021 consolidated revenues for each of Linde and E.ON SE were $31 billion and €77.4 billion, respectively. For the 2019, 2020 and 2021 fiscal years, the dollar value of Linde’s sales to, or purchases from, E.ON SE were $2.3 million, $0.1 million and $0.2 million in sales, respectively and $1.4 million, $2.0 million and $1.0 million of purchases, respectively. Such sale and purchase transactions were well below the limits set forth in the Board’s independence standards and were significantly less than 1% of the consolidated revenues of Linde or E.ON SE. Therefore, the Board has determined that such ordinary course business relationships are not material and do not otherwise impair the ability of Dr. Ossadnik to exercise independent judgment as a director.

Delinquent Section 16(a) Reports

Based solely upon a review of SEC Forms 3, 4 and 5 furnished to the Company and written representations from the Company’s executive officers and directors, the Company believes that those persons complied with all Section 16(a) filing requirements during 2021 with respect to transactions in the Company’s stock.

Director & Nominee Selection Criteria

The Nomination and Governance Committee will consider any candidate for election to the Board who is timely recommended by a shareholder and whose recommendation otherwise complies with the requirements under Linde’s Constitution. Recommendations should be sent to the Corporate Secretary of Linde and should include the candidate’s name and qualifications and a statement from the candidate that he or she consents to being named in the proxy statement and will serve as a director if elected. In order for any candidate to be considered by the Nomination and Governance Committee and, if nominated, to be included in the proxy statement, such recommendations must be received by the Corporate Secretary on or before the date specified in this Proxy Statement under the caption “Shareholder Proposals, Director Nominations and Other Business for the 2023 Annual General Meeting.”

The qualities and skills sought in director nominees are governed by the projected needs of the Board at the time the Nomination and Governance Committee considers adding a new director or renominating incumbent directors. Consistent with the Board’s Corporate Governance Guidelines, the Committee seeks to build and maintain a Board that contains a range of experiences, competencies, and perspectives that is well-suited for advice and counsel to, and oversight of, the Company’s business and operations. In doing so, the Committee takes into account a variety of factors, including:

(1) | the Company’s strategies and its market, geographic and regulatory environments, both current and projected, |

(2) | the mix of experiences, competencies, and perspectives (including gender, ethnic and |

Linde plc | 21

Corporate Governance and Board Matters

Linde’s Corporate Governance Framework

cultural diversity) currently represented on the Board, |

(3) |

(4) | the CEO’s views as to areas in which management would like to have additional advice and counsel from the Board, and |

(5) | with respect to the incumbent directors, meeting attendance, participation and contribution, and the director’s current independence status. |

The Committee also seeks in each director candidate a breadth of experience and background that (a) will allow the director to contribute to the full range of issues confronting a global industrial company and (b) will qualify the director to serve on, and contribute to, any of the Board’s standing committees. In addition, the Nomination and Governance Committee believes that every director nominee should demonstrate a

strong record of integrity and ethical conduct, an absence of conflicts that might interfere with the exercise of his or her independent judgment, and a willingness and ability to represent all shareholders of the Company.

When the need to recruit a director arises, the Nomination and Governance Committee will consult the Chairman and other directors, as well as the CEO, and may engage third party recruiting firms to identify potential candidates. The candidate evaluation process may include inquiries as to the candidate’s reputation and background, examination of the candidate’s experiences and skills in relation to the Board’s needs at the time, consideration of the candidate’s independence as measured by the Board’s independence standards, and other considerations that the Nomination and Governance Committee deems appropriate at the time. Prior to formal consideration by the Nomination and Governance Committee, any candidate who passes such screening would be interviewed by the Nomination and Governance Committee or its Chairman and by the Chairman of the Board and the CEO.

Additional information about the specific skills, qualifications and backgrounds of each of the director nominees is set forth in this Proxy Statement under the caption “Director Nominees.”

Proxy Access Nominees. The foregoing description applies only to the Nomination and Governance Committee’s consideration of director nominees who may be nominated by the Committee itself. It does not apply to persons nominated by eligible shareholders under the Company’s Proxy Access structure which has separate requirements that are set forth in Linde’s Constitution.

Director Retirement and Recruitment. Under the Board’s Director Retirement Policy, the following five directors retired from the Board effective March 1, 2022: Prof. Dr. Wolfgang Reitzle, Prof. Dr. Clemens Börsig, Dr. Nance K. Dicciani, Franz Fehrenbach and Larry D. McVay. Therefore, during 2020, the Governance and Nomination Committee began a comprehensive process to review the director retirements and to plan for Board refreshment by recruiting new directors to join the Board. The Committee engaged the services of reputable international recruitment firm and directed the search to include the key elements of Board diversity discussed above. This resulted in the recruitment and appointment of Alberto Weisser and Joe Kaeser as new directors, effective November 1, 2021. The Committee may continue the recruitment process to recruit additional directors if it is desirable.

22 | Linde plc

Corporate Governance and Board Matters

Board Committees

The Board currently has five standing committees as described below and each is comprised of only independent directors except for the Executive Committee of which the Chairman of the Board and the CEO are members. The Charters for each of these committees may be found on Linde’s public website, www.linde.com, in the About Linde/Corporate Governance section.

Board Director |

| Audit Committee |

| Human Capital Committee |

| Executive Committee |

| Nomination and Governance Committee |

| Sustainability Committee |

Stephen F. Angel (Chairman) |

|

|

|

|

| Chair |

|

|

|

|

Sanjiv Lamba (Chief Executive Officer) |

|

|

|

|

| • |

|

|

|

|

Prof. DDr. Ann-Kristin Achleitner |

|

|

| • |

|

|

|

|

| • |

Dr. Thomas Enders |

| • |

|

|

| • |

|

|

| Chair |

Edward G. Galante |

|

|

| Chair |

|

|

| • |

|

|

Dr. Victoria E. Ossadnik |

| • |

|

|

|

|

| • |

|

|

Joe Kaeser |

|

|

| • |

|

|

| Chair |

|

|

Prof. Dr. Martin H. Richenhagen |

| Chair |

| • |

|

|

|

|

|

|

Alberto Weisser |

| • |

|

|

|

|

|

|

| • |

Robert L. Wood |

|

|

| • |

| • |

|

|

| • |

Description of Key Committee Functions

Audit Committee | |||

Committee Chair Prof. Dr. Martin H. Richenhagen

Current Members: Dr. Thomas Enders Dr. Victoria E. Ossadnik Alberto Weisser Meetings in 2021 6 |

|

| The Audit Committee assists the Board in its oversight of (a) the independence, qualifications and performance of Linde’s independent auditor, (b) the integrity of Linde’s financial statements, (c) the performance of Linde’s internal audit function, and (d) Linde’s compliance with legal and regulatory requirements. In furtherance of these responsibilities, the Audit Committee, among other duties: (1) appoints the independent auditor to audit Linde’s financial statements, approves the fees and terms of such engagement, approves any non-audit engagements of the independent auditor, and meets regularly with, and receives various reports from, the independent auditor. The independent auditor reports directly to the Audit Committee; (2) reviews Linde’s principal policies for accounting and financial reporting and its disclosure controls and processes, and reviews with management and the independent auditor Linde’s financial statements prior to their publication; (3) reviews assessments of Linde’s internal controls, the performance of the Internal Audit function, the performance evaluations of the General Auditor and the Chief Compliance Officer, and the guidelines and policies by which Linde undertakes risk assessment and risk management; and (4) reviews the effectiveness of Linde’s compliance with laws, business conduct, integrity and ethics programs. |

| |||

Linde plc | 23

Corporate Governance and Board Matters

Board Committees

Human Capital Committee | |||

Committee Chair Edward G. Galante Current Members: Prof. DDr. Ann-Kristin Achleitner Joe Kaeser Prof. Dr. Martin H. Richenhagen Robert L. Wood Meetings in 2021 4 |

|

| The Human Capital Committee assists the Board in its oversight of (a) Linde’s compensation and incentive policies and programs, and (b) management development and succession, in both cases particularly as they apply to Linde’s executive officers. In furtherance of these responsibilities, the Human Capital Committee, among other duties: (1) determines Linde’s policies relating to the compensation of executive officers and assesses the competitiveness and appropriateness of their compensation and benefits; (2) determines the salaries, performance-based variable compensation, equity awards, terms of employment, retirement or severance, benefits, and perquisites of executive officers; (3) establishes the corporate goals relevant to the CEO’s compensation, evaluates the CEO’s performance in light of these goals and sets the CEO’s compensation accordingly; (4) reviews management’s long-range planning for executive development and succession, and develops a CEO succession plan; (5) assesses the design, administration and risk associated with Linde’s management incentive compensation and equity compensation plans; and (6) evaluates periodically the Company’s diversity policies and objectives, and programs to achieve those objectives. |

|

|

|

|

Certain Committee Processes for Determining Executive Compensation

Delegation and CEO Involvement. Except under limited circumstances, the Human Capital Committee may not delegate its executive compensation authority to any other persons. With respect to the allocation of compensation and awards to employees other than the executive officers, the Human Capital Committee may, and has, delegated authority to the CEO, subject to guidelines established by the Human Capital Committee. The CEO does not determine the compensation of any of the executive officers, but he does offer for the Human Capital Committee’s consideration his views on relevant matters, as described in more detail in this Proxy Statement in the CD&A section.

Compensation Risk Analysis. The Human Capital Committee considers whether the Company’s compensation policies and practices create incentives for risk-taking that could have a material adverse effect on the Company. Each year, the Human Capital Committee examines management’s review of the Company’s incentive compensation programs applicable to all employees, including executive officers, in order to evaluate whether they encourage excessive risk-taking through either the design of the executive and management incentive programs, or operational decision-making that could affect compensation payouts. The Human Capital Committee determines if (1) there exists sufficient operational controls, checks and balances that prevent or constrain compensation-driven decision-making that is inappropriate or excessively risky including, among others, frequent risk discussions with the Board, particularly in connection with capital project or acquisition proposals, (2) the Company uses highly leveraged short-term incentives that would tend to drive high short-term risk decisions or unsustainable gains, and (3) the Company’s executive stock ownership policy and the “recapture” policy described in the CD&A also serve as disincentives for unacceptable risk-taking.

24 | Linde plc

Corporate Governance and Board Matters

Board Committees

A more detailed description of how the Human Capital Committee considers and determines executive compensation is described in this Proxy Statement in the CD&A section.

Executive Committee | |||

Committee Chair Stephen F. Angel

Current Members: Sanjiv Lamba Dr. Thomas Enders Robert L. Wood

|

|

| The purpose of the Executive Committee is primarily to act on behalf of the entire Board with respect to certain matters that may arise in between regularly scheduled Board meetings, and act on certain other matters from time to time. In particular, the Executive Committee duties include, among others: (1) evaluating and approving any investments, acquisitions, partnerships or divestments requiring Board approval, that are within value thresholds specified by the Board; (2) evaluating and approving any financing or other capital markets transactions requiring Board approval, that are within value thresholds specified by the Board; and (3) acting upon any other such matters within the competencies of the Board, that are not reserved solely to the Board, that are within value thresholds specified by the Board and, in the opinion of the Chairman of the Board, should not be postponed until the next regularly scheduled Board meeting. |

|

|

|

|

Nomination and Governance Committee | |||

Committee Chair Joe Kaeser Current Members: Edward G. Galante Dr.Victoria E.Ossadnik

Meetings in 2021 5 |

|

| The Nomination and Governance Committee assists the Board in its oversight of (a) the selection, qualifications, compensation and performance of Linde’s directors, (b) Linde’s governance, including the practices and effectiveness of the Board, and (c) various important public policy concerns that affect the Company. In furtherance of these responsibilities, the Nomination and Governance Committee, among other duties: (1) recommends to the Board nominees for election as directors, and periodically reviews potential candidates, including incumbent directors; (2) reviews policies with respect to the composition, compensation, organization and practices of the Board, and developments in corporate governance matters generally; and (3) reviews Linde’s policies and responses to broad public policy issues such as social responsibility, corporate citizenship, charitable contributions, legislative issues, and important shareholder issues, including management and shareholder proposals offered for shareholder approval. |

|

|

|

|

Linde plc | 25

Corporate Governance and Board Matters

Board Committees

Sustainability Committee | |||