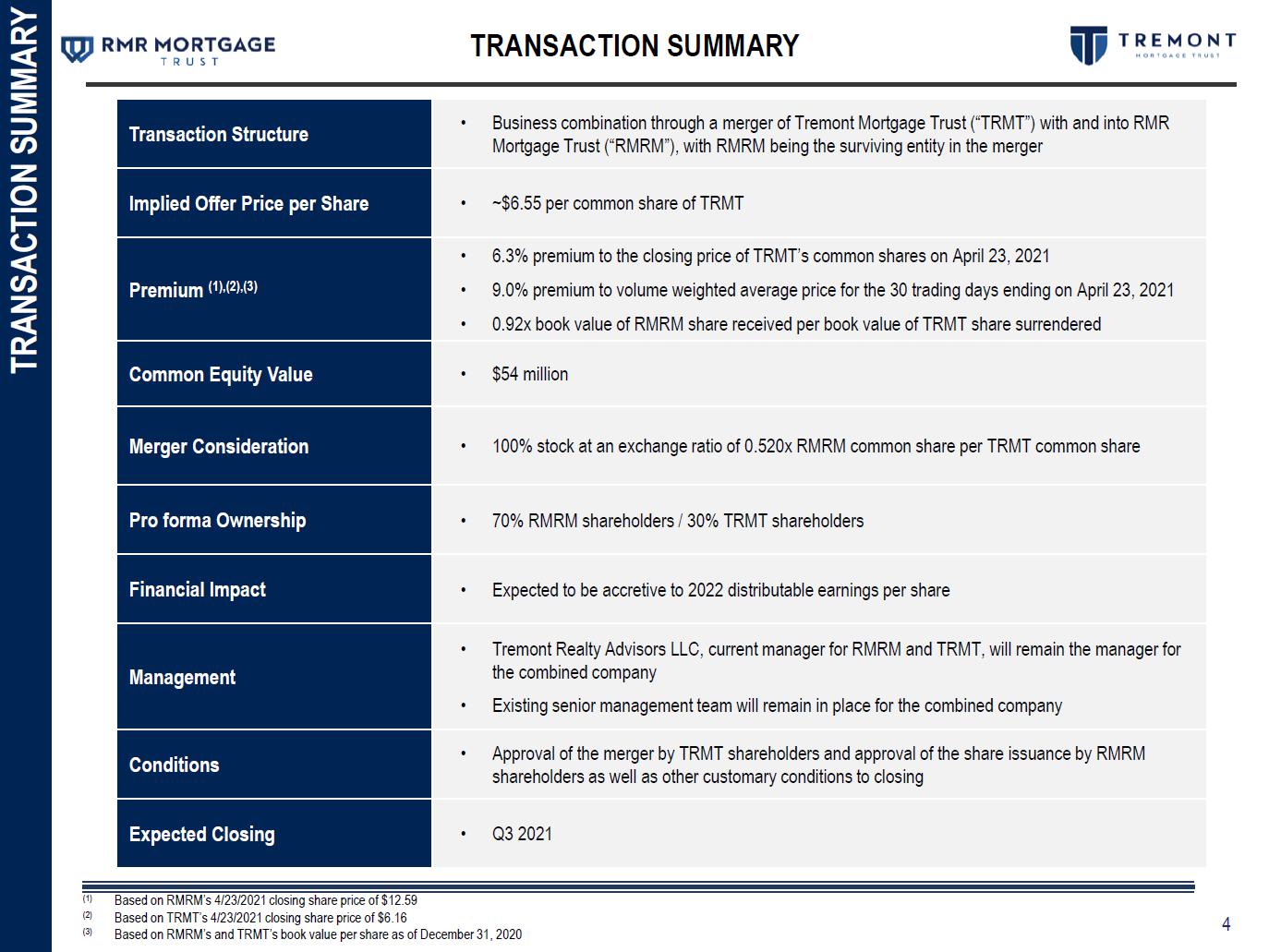

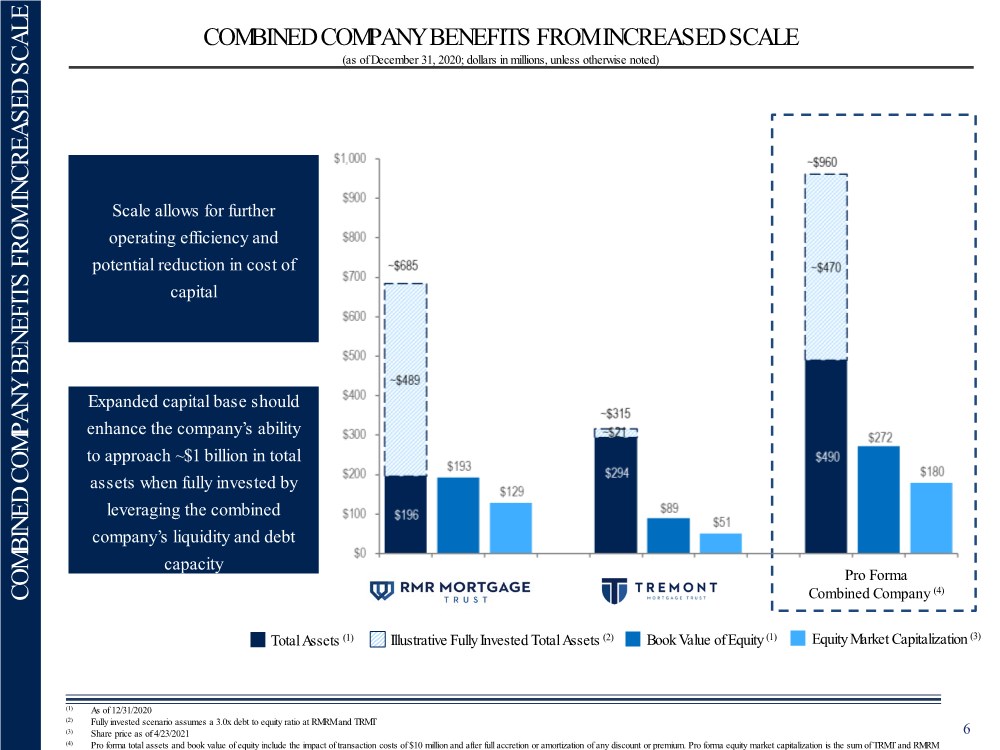

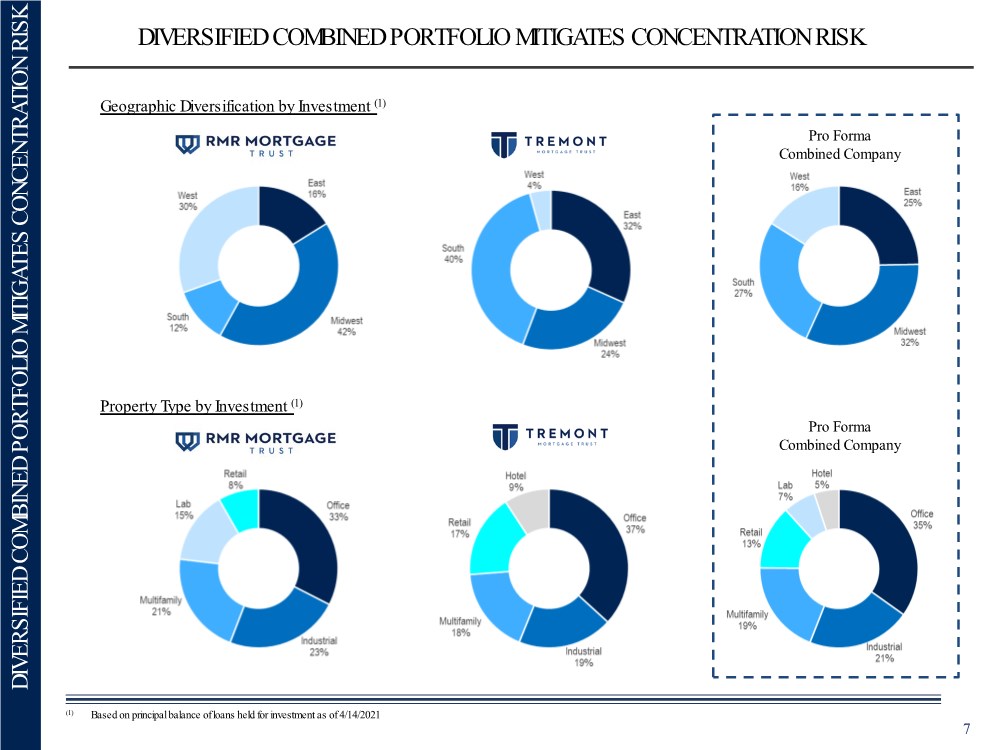

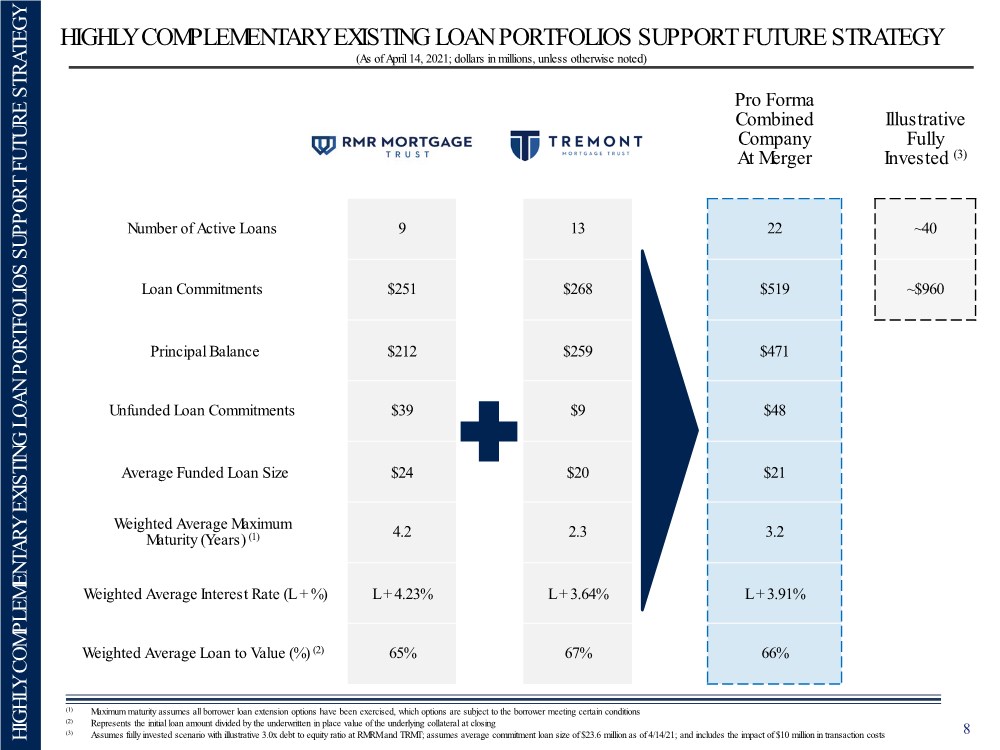

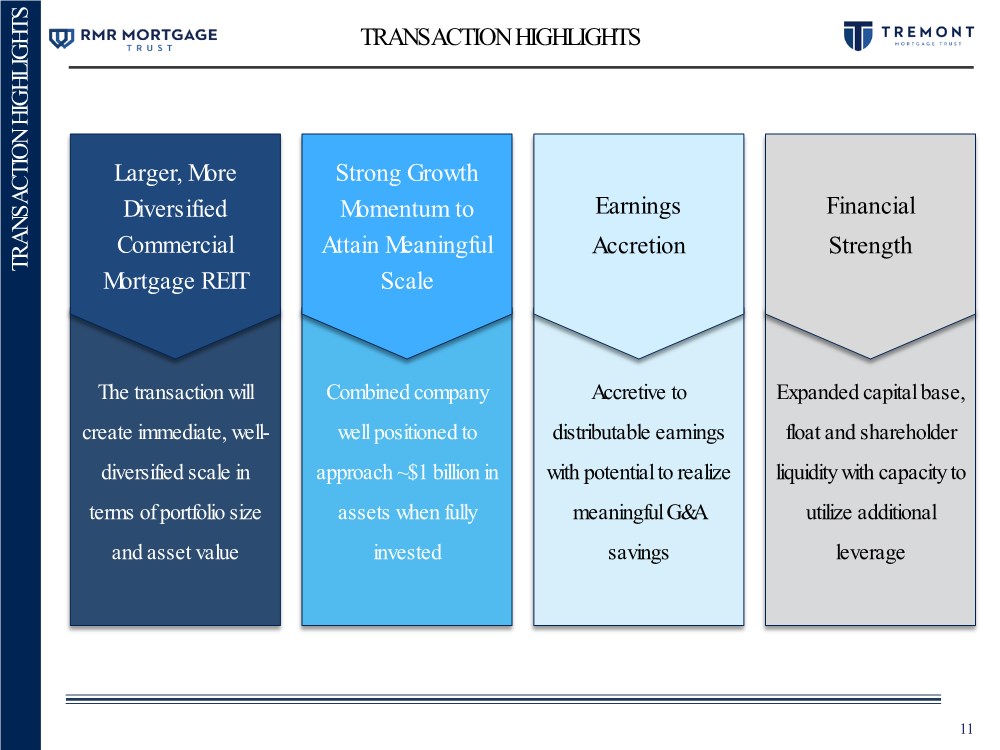

| 2 Confidential DISCLAIMERS DISCLAIMER This investor presentation is for informational purposes only and is subject to change. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or any other information contained herein. WARNING REGARDING FORWARD-LOOKING STATEMENTS This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever RMR Mortgage Trust (“RMRM”) or Tremont Mortgage Trust (“TRMT”) uses words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, they are making forward-looking statements. These forward-looking statements are based upon RMRM’s and TRMT’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by RMRM’s and TRMT’s forward‐looking statements as a result of various factors. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond RMRM’s and TRMT’s control. For example: • RMRM and TRMT have entered into a definitive agreement to merge. The merger is expected to close in the third quarter of 2021, subject to the satisfaction or waiver of closing conditions, including the receipt of the requisite approvals by RMRM and TRMT shareholders. RMRM and TRMT cannot be sure that these conditions will be satisfied or waived. Accordingly, the merger may not close by the end of the third quarter of 2021 or at all, or the terms contemplated by the merger agreement may change. • RMRM and TRMT expect to realize a number of benefits from the merger, including enhanced scale, earnings accretion, an expanded capital base, improved access to capital markets, increased portfolio diversification, greater market visibility and a seamless integration. These expectations are contingent upon the consummation of the merger and may not be realized as currently expected or at all. The information contained in RMRM’s “Summary of Principal Risk Factors” included in its Current Report on Form 8-K filed on March 24, 2021, and the information contained in TRMT’s filings with the Securities and Exchange Commission, or the SEC, including under “Risk Factors” in TRMT’s periodic reports or incorporated therein, identifies other important factors that could cause RMRM’s and TRMT’s actual results to differ materially from those stated in or implied by RMRM’s and TRMT’s forward-looking statements. RMRM’s and TRMT’s filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, neither RMRM nor TRMT intends to update or change any forward-looking statements as a result of new information, future events or otherwise. PRO FORMA FINANCIAL INFORMATION This presentation contains unaudited pro forma financial information related to the transactions discussed herein. The unaudited pro forma financial information reflect the impact of the transactions discussed herein on RMRM’s and TRMT’s consolidated financial statements. The unaudited pro forma financial information is based on the historical financial statements and accounting records of RMRM and TRMT, giving effect to the transactions discussed herein, related reclassifications and pro forma adjustments as described herein. The unaudited pro forma financial information is not necessarily indicative of RMRM’s and TRMT’s expected financial position or results of operations for any future period, including following the merger, if completed. Differences could result from numerous factors, including future changes in RMRM’s and TRMT’s portfolio of investments, capital structure, changes in interest rates and for other reasons. The unaudited pro forma financial information is provided for informational purposes only. Actual future results are likely to be different from amounts presented in the unaudited pro forma condensed consolidated financial statements and such differences could be significant. |