Exhibit 99.2 TREMONT MORTGAGE TRUST TRMT Nasdaq Listed Second Quarter 2019 Supplemental Operating and Financial Data 1711 Caroline Street, Houston, TX $28.0 Million First Mortgage Whole Loan Closed May 2019 Tremont Mortgage Trust Confidential Supplemental Operating and Financial Data, June 30, 2019 All amounts in this report are unaudited 1

TABLE OF CONTENTS CORPORATE INFORMATION Page Company Profile 4 Investor Information 5 Research Coverage 6 Key Definitions 7 TABLE OF CONTENTS TABLE FINANCIALS Second Quarter 2019 Highlights 9 Condensed Consolidated Balance Sheets 10 Condensed Consolidated Statements of Operations 11 Condensed Consolidated Statements of Cash Flows 12 Debt Summary 14 Reconciliation of Net Income (Loss) to Core Earnings (Loss) 15 PORTFOLIO OVERVIEW Second Quarter 2019 Loan Originations and Portfolio Summary 17 Loan Investment Details 18 Loan Portfolio Diversification 19 Interest Rate Sensitivity 20 Capital Structure Overview 21 WARNING CONCERNING FORWARD-LOOKING STATEMENTS 22 Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 2

CORPORATE INFORMATION Barrington Business Center 1 Commerce Drive, Barrington, NJ $37.6 Million First Mortgage Whole Loan Closed May 2019 ‹#›

COMPANY PROFILE The Company: Tremont Mortgage Trust, or TRMT, we, our or us, is a real estate investment trust, or REIT, that focuses on originating and investing in floating Corporate Headquarters: rate first mortgage whole loans secured by middle market and transitional commercial real estate, or CRE. We define middle market CRE as Two Newton Place commercial properties that have values up to $75.0 million and transitional CRE as commercial properties subject to redevelopment or 255 Washington Street, Suite 300 repositioning activities that are expected to increase the value of the properties. Newton, MA 02458-1634 (617) 796-8317 Management: Our Manager, Tremont Realty Advisors LLC, is registered with the Securities and Exchange Commission, or SEC, as an investment adviser Stock Exchange Listing: and is owned by The RMR Group LLC, or RMR LLC, the operating subsidiary of The RMR Group Inc., or RMR Inc., a holding company listed Nasdaq COMPANY PROFILE COMPANY on The Nasdaq Stock Market LLC, or Nasdaq, under the symbol “RMR”. We collectively refer to RMR Inc. and its consolidated subsidiaries, including RMR LLC, as RMR. Trading Symbol: RMR is an alternative asset management company that was founded in 1986 to manage real estate companies and related businesses. RMR Common Shares: TRMT primarily provides management services to four publicly traded equity REITs and three real estate related operating businesses. In addition to managing TRMT, RMR manages Hospitality Properties Trust, a REIT that owns hotels and travel centers, Industrial Logistics Properties Trust, a REIT that owns industrial and logistics properties, Office Properties Income Trust, a REIT that owns buildings primarily leased to single tenants Key Data (as of and for the three months and those with high credit quality characteristics such as government entities, and Senior Housing Properties Trust, a REIT that primarily owns ended June 30, 2019): healthcare, senior living and medical office buildings. RMR also provides management services to Five Star Senior Living Inc., a publicly traded (dollars in 000s) operator of senior living communities, Sonesta International Hotels Corporation, a privately owned operator and franchisor of hotels and cruise ships, and TravelCenters of America LLC, a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway System Q2 2019 income from and restaurants. RMR also advises the RMR Real Estate Income Fund, a publicly traded closed end fund that invests in publicly traded securities investments, net $ 1,882 of real estate companies, through a wholly owned SEC registered investment advisory subsidiary, as well as manages the RMR Office Property Q2 2019 net income $ 894 Fund, a private, open end core plus fund focused on the acquisition, ownership and leasing of a diverse portfolio of multi-tenant office properties Q2 2019 Core Earnings (1) $ 1,079 throughout the U.S. As of June 30, 2019, RMR had $30.6 billion of real estate assets under management and the combined RMR managed companies had approximately $12 billion of annual revenues, over 1,500 properties and more than 50,000 employees. Loans held for investment, net $ 258,957 Total Assets $ 271,604 We believe our Manager’s relationship with RMR provides us with a depth of market knowledge that may allow us to identify more investment opportunities and to evaluate them more thoroughly than many of our competitors, including other commercial mortgage REITs. We also believe RMR’s broad platform provides us with access to RMR’s extensive network of real estate owners, operators, intermediaries, sponsors, financial institutions and other real estate related professionals and businesses with which RMR has historical relationships. We also believe that our Manager provides us with significant experience and expertise in investing in investments in middle market and transitional CRE. (1) See Key Definitions on page 7 for a definition of Core Earnings (Loss), a description of why we believe it's an appropriate supplemental measure and a description of how we use this measure. See page 15 for the calculation of Core Earnings (Loss) and a reconciliation of net income (loss) determined in accordance with U.S. generally accepted accounting principles, or GAAP, to this amount. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 4

INVESTOR INFORMATION Board of Trustees John L. Harrington Joseph L. Morea Jeffrey P. Somers Independent Trustee Independent Trustee Independent Trustee David M. Blackman Adam D. Portnoy Managing Trustee Managing Trustee INVESTOR INFORMATION INVESTOR Senior Management David M. Blackman G. Douglas Lanois President and Chief Executive Officer Chief Financial Officer and Treasurer Contact Information Investor Relations Inquiries Tremont Mortgage Trust Financial inquiries should be directed to Two Newton Place G. Douglas Lanois, Chief Financial Officer and Treasurer, 255 Washington Street, Suite 300 at (617) 658-0755 or dlanois@tremontadv.com Newton, MA 02458-1634 (617) 796-7651 Investor and media inquiries should be directed to cranjitkar@trmtreit.com Christopher Ranjitkar, Senior Director, Investor Relations, www.trmtreit.com at (617) 796-7651 or cranjitkar@trmtreit.com Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 5

RESEARCH COVERAGE Equity Research Coverage UBS Securities, LLC Citibank Global Markets, Inc Brock Vandervliet Arren Cyganovich, CFA RESEARCH COVERAGE (212) 713-2382 (212) 816-3733 brock.vandervliet@ubs.com arren.cyganovich@citi.com JMP Securities, LLC Steven C. Delaney (212) 906-3517 sdelaney@jmpsecurities.com TRMT is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding TRMT’s performance made by these analysts do not represent opinions, forecasts or predictions of TRMT or its management. TRMT does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 6

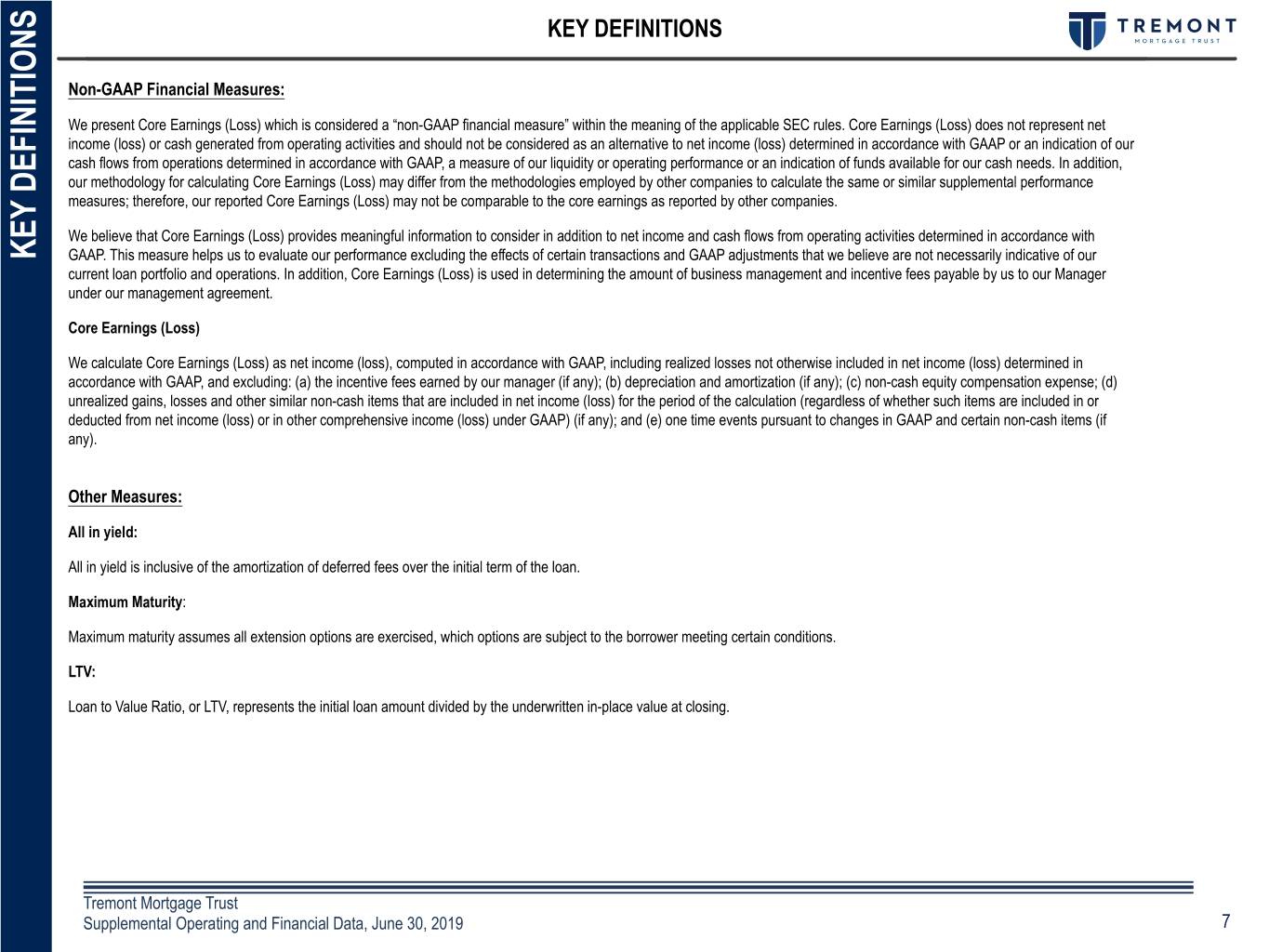

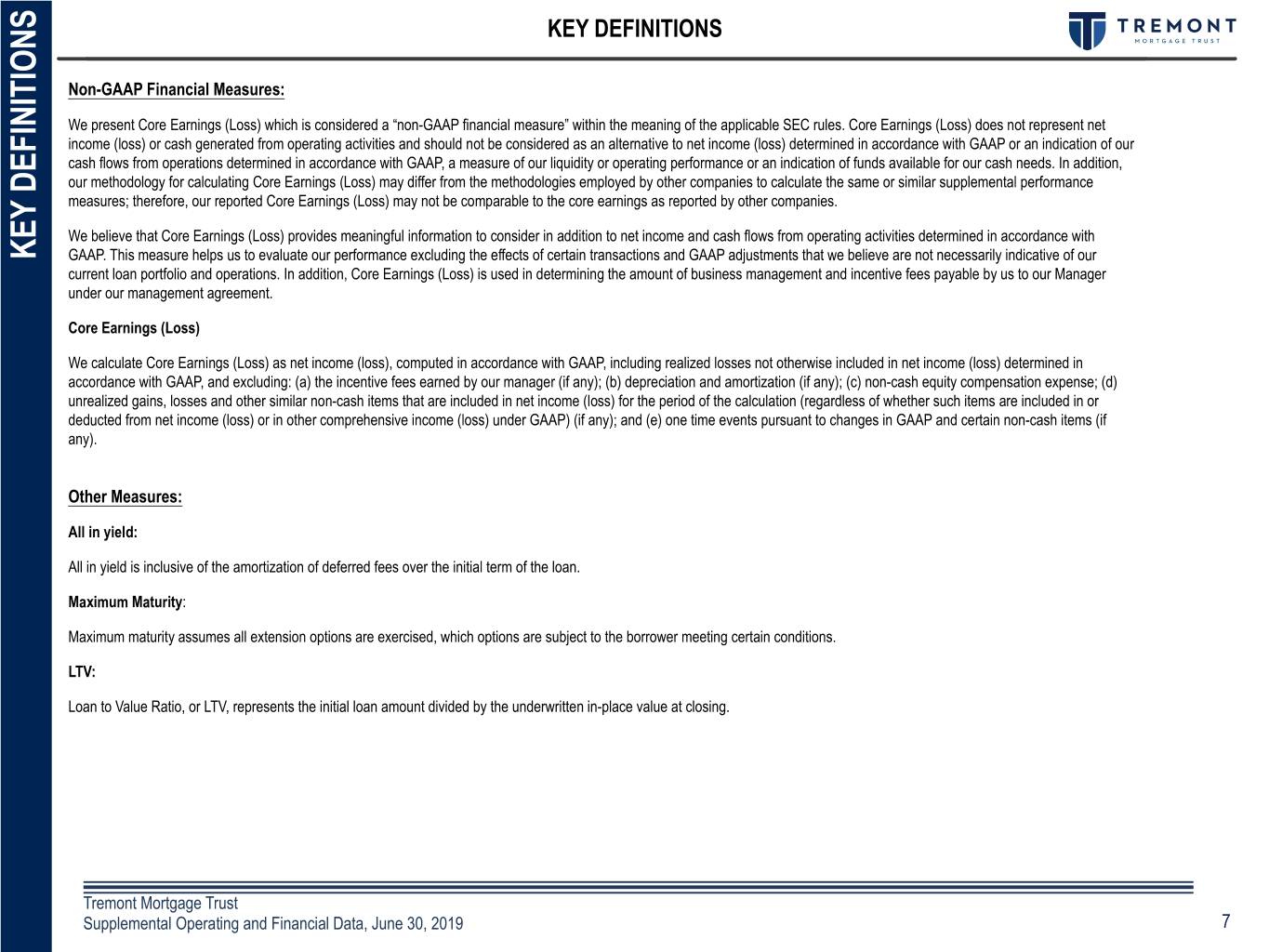

KEY DEFINITIONS Non-GAAP Financial Measures: We present Core Earnings (Loss) which is considered a “non-GAAP financial measure” within the meaning of the applicable SEC rules. Core Earnings (Loss) does not represent net income (loss) or cash generated from operating activities and should not be considered as an alternative to net income (loss) determined in accordance with GAAP or an indication of our cash flows from operations determined in accordance with GAAP, a measure of our liquidity or operating performance or an indication of funds available for our cash needs. In addition, our methodology for calculating Core Earnings (Loss) may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures; therefore, our reported Core Earnings (Loss) may not be comparable to the core earnings as reported by other companies. We believe that Core Earnings (Loss) provides meaningful information to consider in addition to net income and cash flows from operating activities determined in accordance with KEY DEFINITIONS KEY GAAP. This measure helps us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations. In addition, Core Earnings (Loss) is used in determining the amount of business management and incentive fees payable by us to our Manager under our management agreement. Core Earnings (Loss) We calculate Core Earnings (Loss) as net income (loss), computed in accordance with GAAP, including realized losses not otherwise included in net income (loss) determined in accordance with GAAP, and excluding: (a) the incentive fees earned by our manager (if any); (b) depreciation and amortization (if any); (c) non-cash equity compensation expense; (d) unrealized gains, losses and other similar non-cash items that are included in net income (loss) for the period of the calculation (regardless of whether such items are included in or deducted from net income (loss) or in other comprehensive income (loss) under GAAP) (if any); and (e) one time events pursuant to changes in GAAP and certain non-cash items (if any). Other Measures: All in yield: All in yield is inclusive of the amortization of deferred fees over the initial term of the loan. Maximum Maturity: Maximum maturity assumes all extension options are exercised, which options are subject to the borrower meeting certain conditions. LTV: Loan to Value Ratio, or LTV, represents the initial loan amount divided by the underwritten in-place value at closing. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 7

FINANCIALS West Park I, St. Louis, MO Part of West Park I, West Park II and Pine View Point Office Portfolio $29.5 Million First Mortgage Whole Loan Closed December 2018 ‹#›

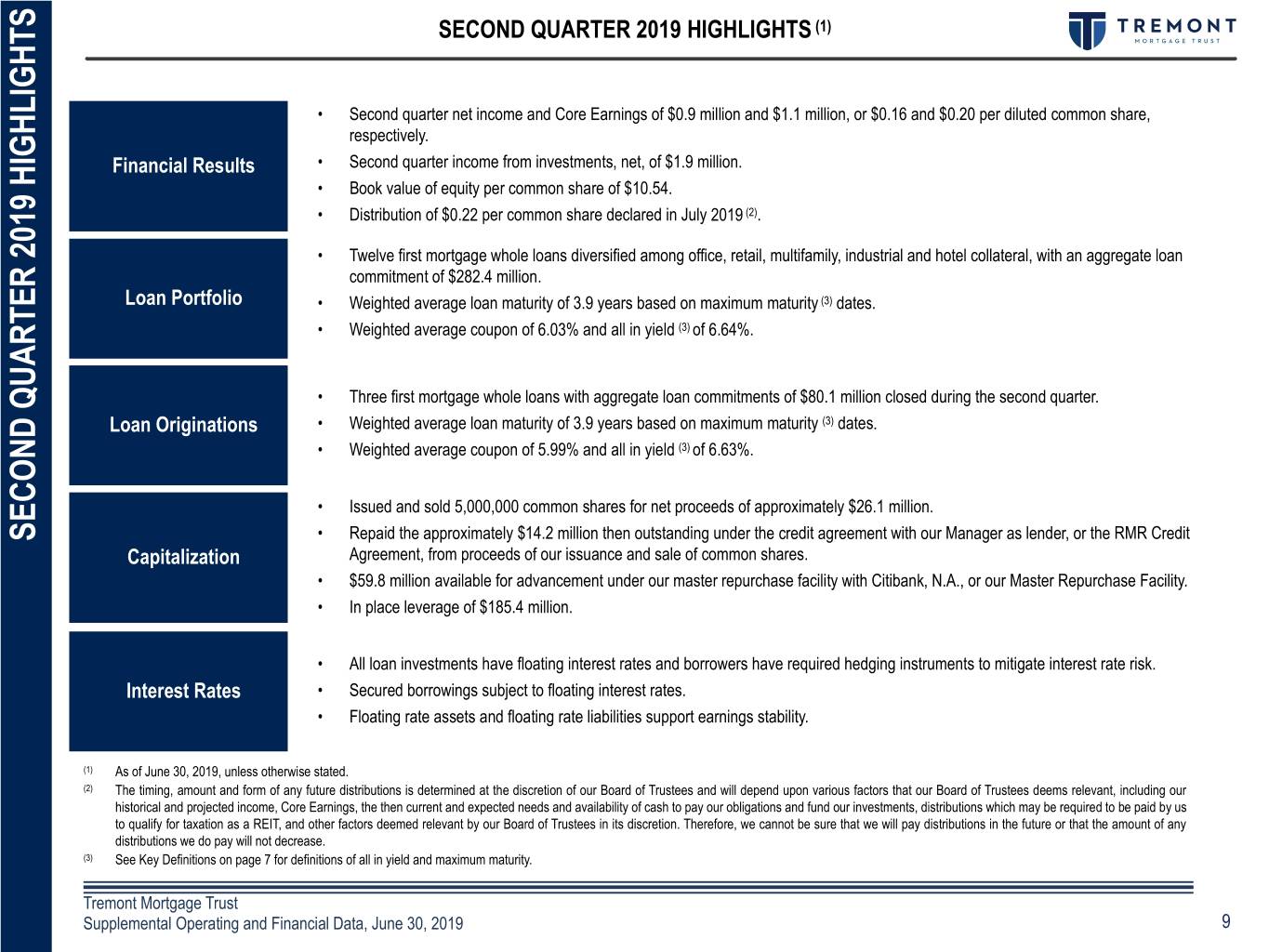

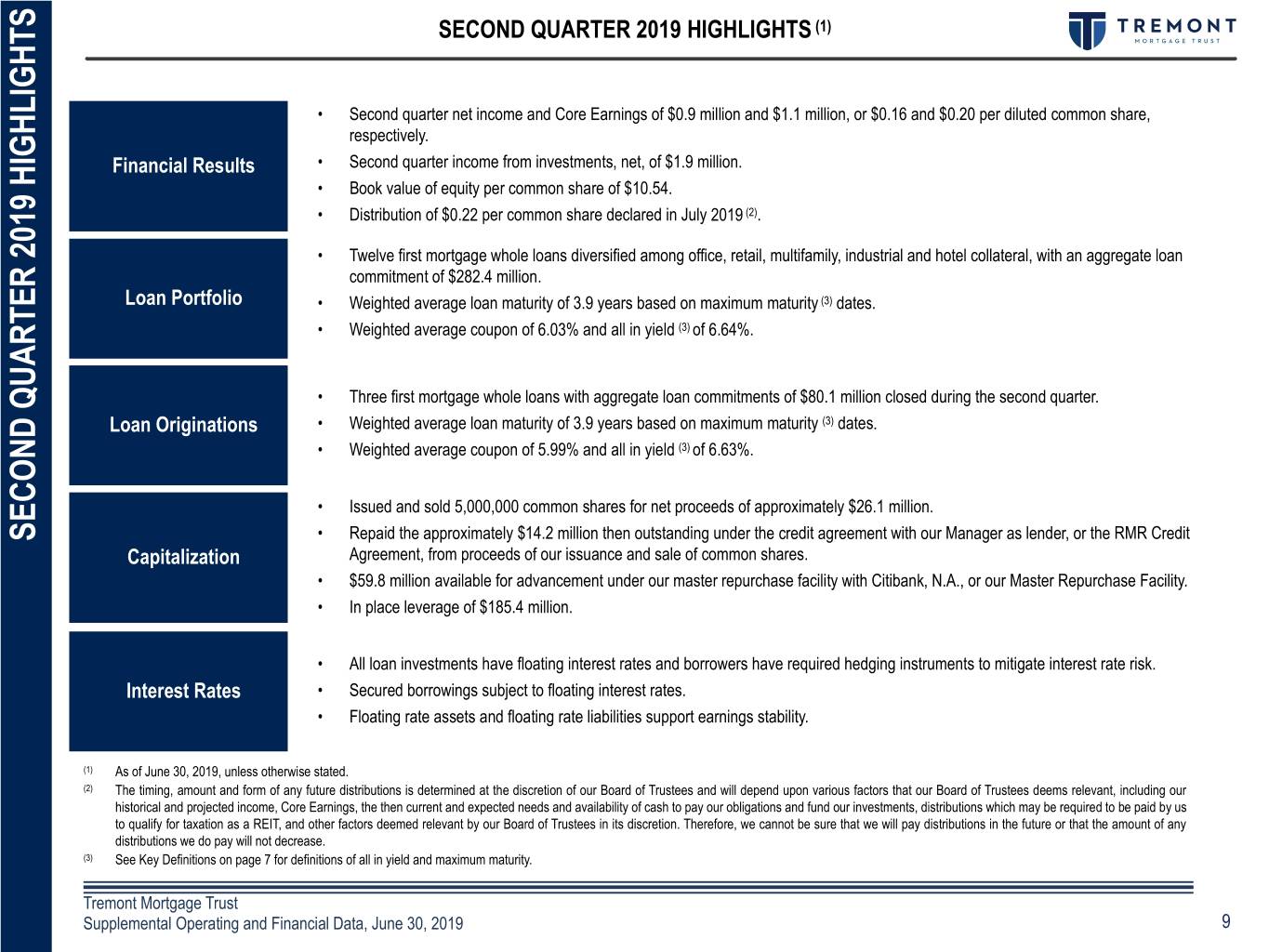

SECOND QUARTER 2019 HIGHLIGHTS (1) • Second quarter net income and Core Earnings of $0.9 million and $1.1 million, or $0.16 and $0.20 per diluted common share, respectively. Financial Results • Second quarter income from investments, net, of $1.9 million. • Book value of equity per common share of $10.54. • Distribution of $0.22 per common share declared in July 2019 (2). • Twelve first mortgage whole loans diversified among office, retail, multifamily, industrial and hotel collateral, with an aggregate loan commitment of $282.4 million. Loan Portfolio • Weighted average loan maturity of 3.9 years based on maximum maturity (3) dates. • Weighted average coupon of 6.03% and all in yield (3) of 6.64%. • Three first mortgage whole loans with aggregate loan commitments of $80.1 million closed during the second quarter. Loan Originations • Weighted average loan maturity of 3.9 years based on maximum maturity (3) dates. • Weighted average coupon of 5.99% and all in yield (3) of 6.63%. • Issued and sold 5,000,000 common shares for net proceeds of approximately $26.1 million. • Repaid the approximately $14.2 million then outstanding under the credit agreement with our Manager as lender, or the RMR Credit SECOND QUARTER 2019 HIGHLIGHTS Capitalization Agreement, from proceeds of our issuance and sale of common shares. • $59.8 million available for advancement under our master repurchase facility with Citibank, N.A., or our Master Repurchase Facility. • In place leverage of $185.4 million. • All loan investments have floating interest rates and borrowers have required hedging instruments to mitigate interest rate risk. Interest Rates • Secured borrowings subject to floating interest rates. • Floating rate assets and floating rate liabilities support earnings stability. (1) As of June 30, 2019, unless otherwise stated. (2) The timing, amount and form of any future distributions is determined at the discretion of our Board of Trustees and will depend upon various factors that our Board of Trustees deems relevant, including our historical and projected income, Core Earnings, the then current and expected needs and availability of cash to pay our obligations and fund our investments, distributions which may be required to be paid by us to qualify for taxation as a REIT, and other factors deemed relevant by our Board of Trustees in its discretion. Therefore, we cannot be sure that we will pay distributions in the future or that the amount of any distributions we do pay will not decrease. (3) See Key Definitions on page 7 for definitions of all in yield and maximum maturity. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 9

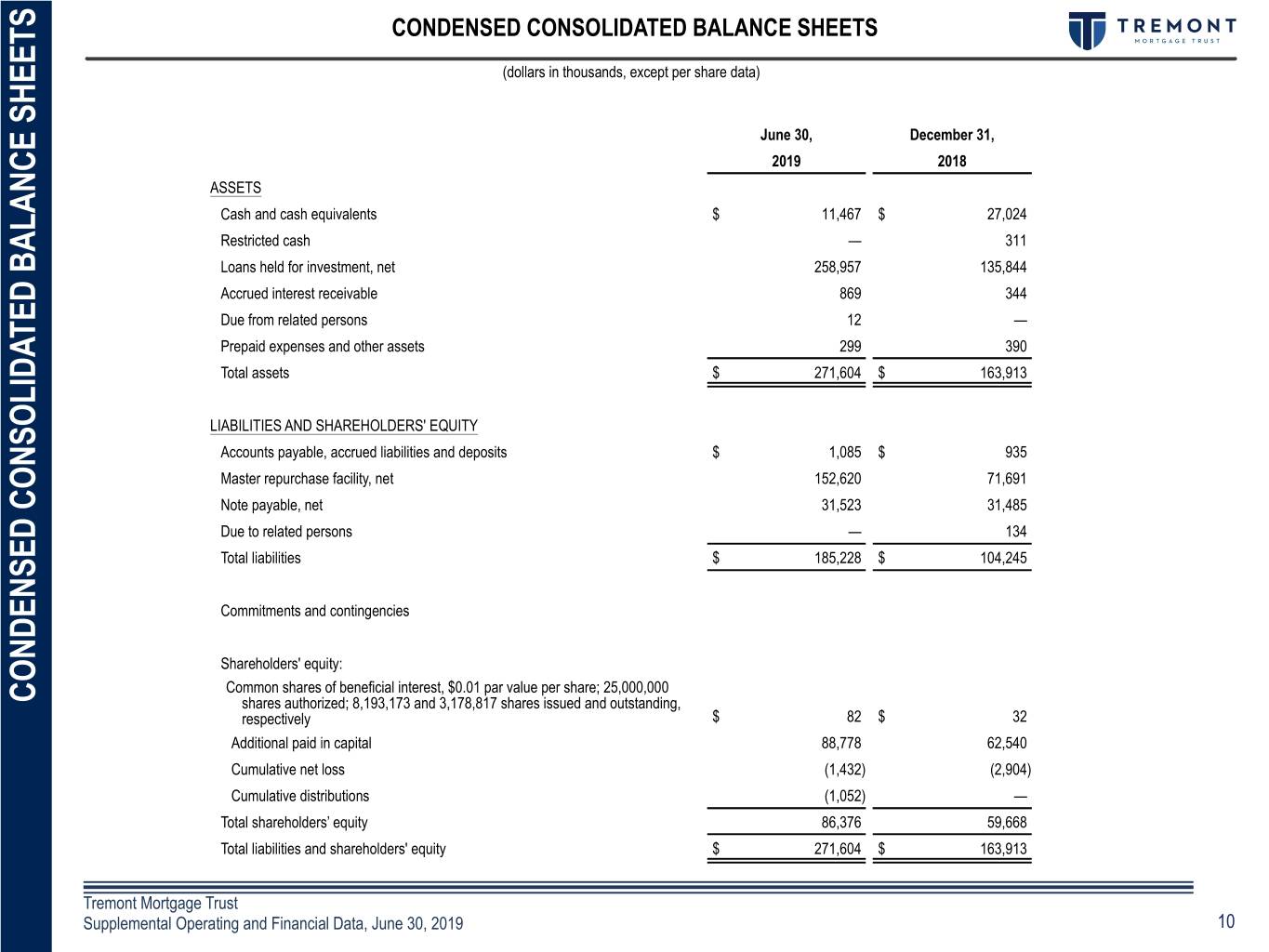

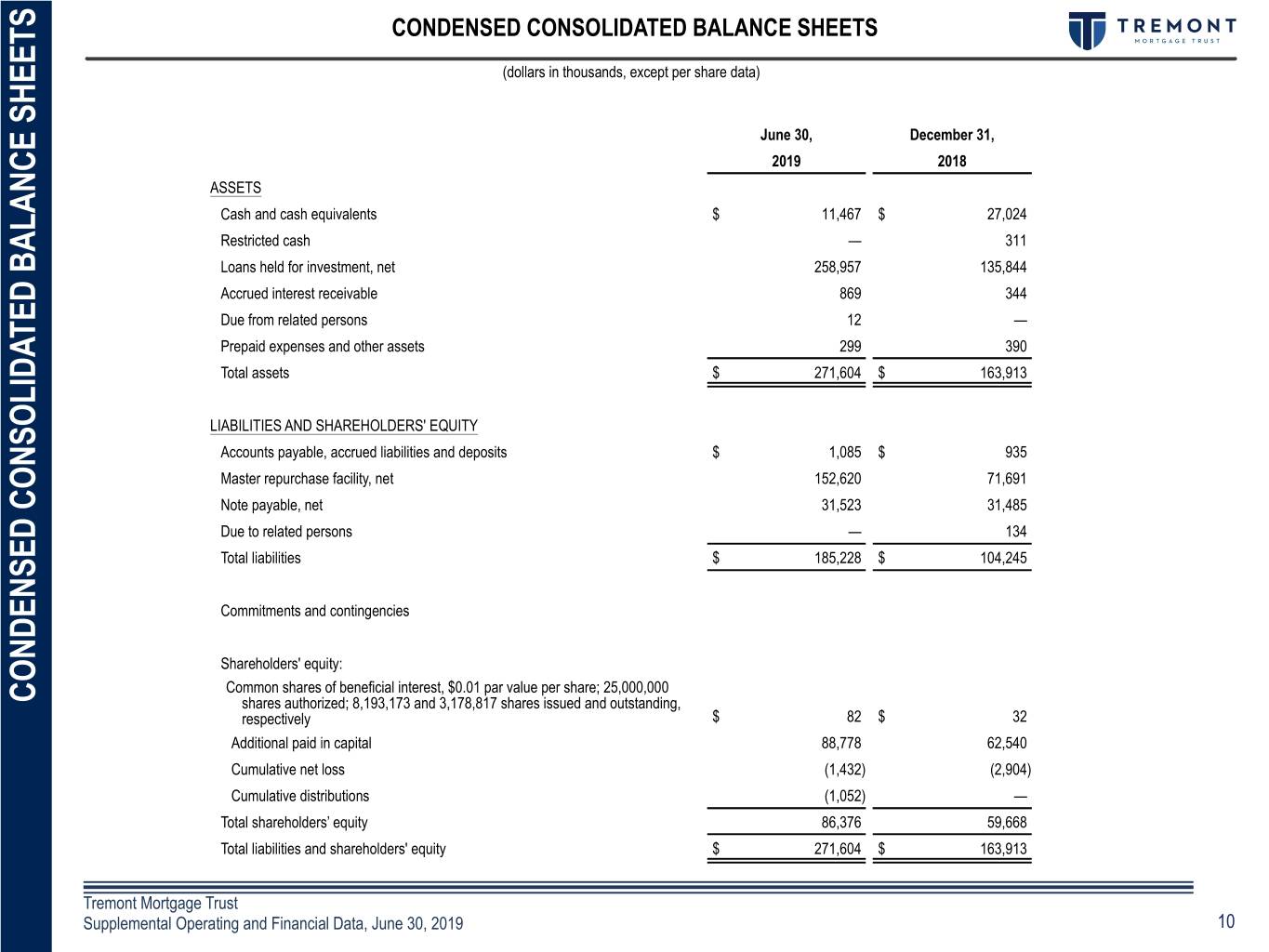

CONDENSED CONSOLIDATED BALANCE SHEETS (dollars in thousands, except per share data) June 30, December 31, 2019 2018 ASSETS Cash and cash equivalents $ 11,467 $ 27,024 Restricted cash — 311 Loans held for investment, net 258,957 135,844 Accrued interest receivable 869 344 Due from related persons 12 — Prepaid expenses and other assets 299 390 Total assets $ 271,604 $ 163,913 FinancialLIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable, accrued liabilities and deposits $ 1,085 $ 935 Master repurchase facility, net 152,620 71,691 SummaryNote payable, net 31,523 31,485 Due to related persons — 134 Total liabilities $ 185,228 $ 104,245 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $0.01 par value per share; 25,000,000 CONDENSED CONSOLIDATED BALANCE SHEETS CONDENSED CONSOLIDATED shares authorized; 8,193,173 and 3,178,817 shares issued and outstanding, respectively $ 82 $ 32 Additional paid in capital 88,778 62,540 Cumulative net loss (1,432) (2,904) Cumulative distributions (1,052) — Total shareholders��� equity 86,376 59,668 Total liabilities and shareholders' equity $ 271,604 $ 163,913 Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 10

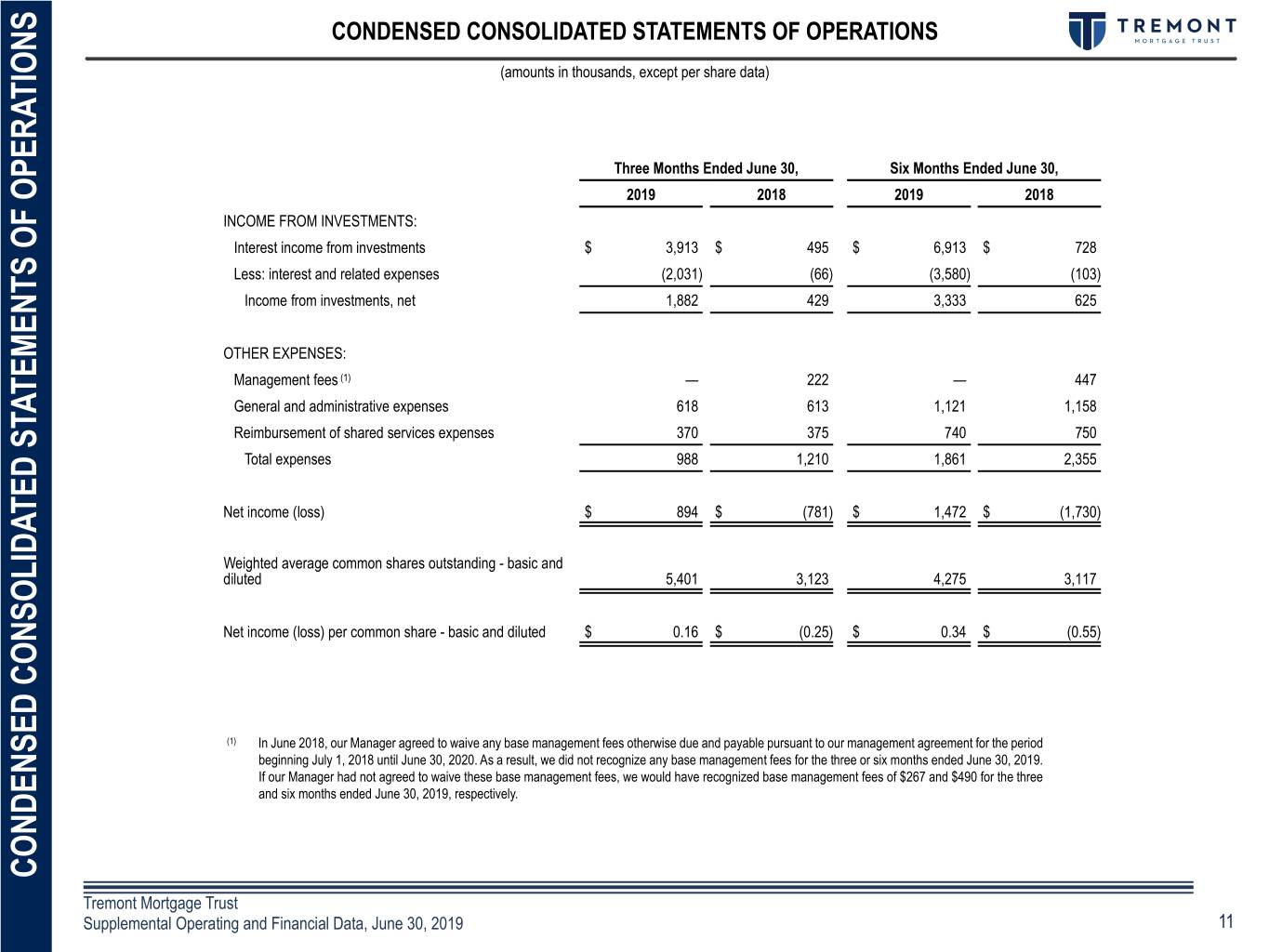

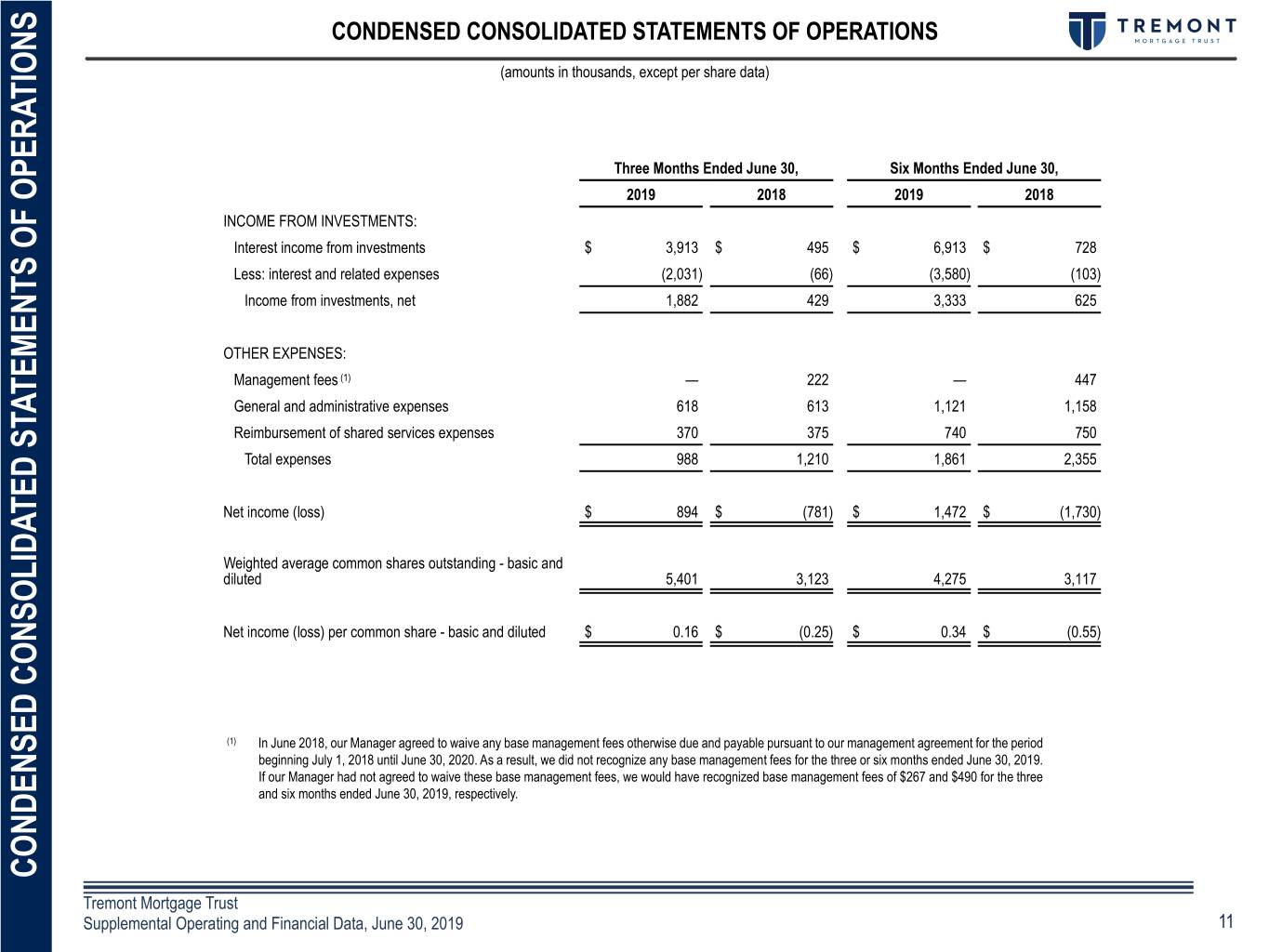

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in thousands, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 INCOME FROM INVESTMENTS: Interest income from investments $ 3,913 $ 495 $ 6,913 $ 728 Less: interest and related expenses (2,031) (66) (3,580) (103) Income from investments, net 1,882 429 3,333 625 OTHER EXPENSES: Management fees (1) — 222 — 447 General and administrative expenses 618 613 1,121 1,158 Reimbursement of shared services expenses 370 375 740 750 Total expenses 988 1,210 1,861 2,355 Net income (loss) $ 894 $ (781) $ 1,472 $ (1,730) Weighted average common shares outstanding - basic and diluted 5,401 3,123 4,275 3,117 Net income (loss) per common share - basic and diluted $ 0.16 $ (0.25) $ 0.34 $ (0.55) (1) In June 2018, our Manager agreed to waive any base management fees otherwise due and payable pursuant to our management agreement for the period beginning July 1, 2018 until June 30, 2020. As a result, we did not recognize any base management fees for the three or six months ended June 30, 2019. If our Manager had not agreed to waive these base management fees, we would have recognized base management fees of $267 and $490 for the three and six months ended June 30, 2019, respectively. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS STATEMENTS CONDENSED CONSOLIDATED Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 11

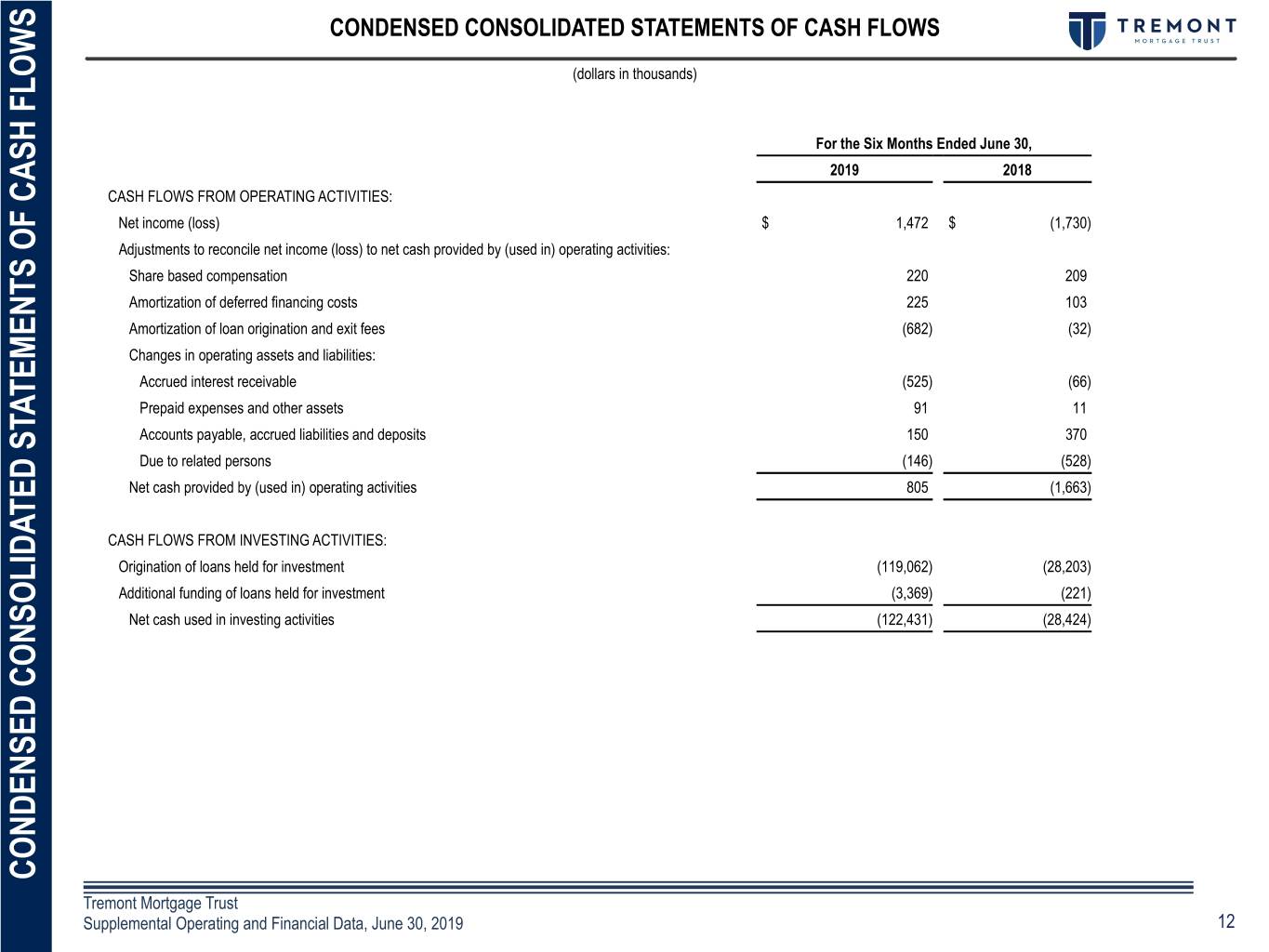

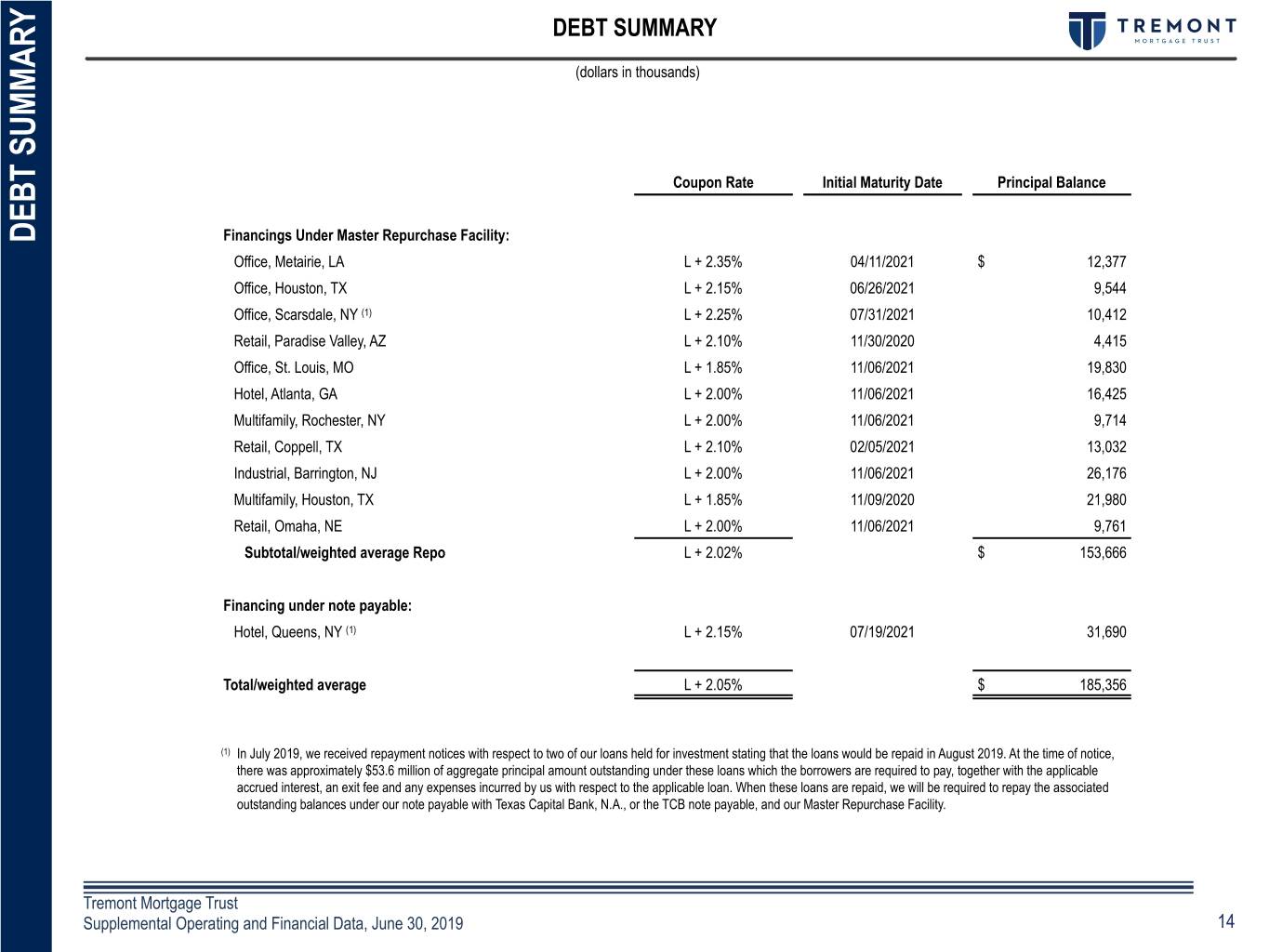

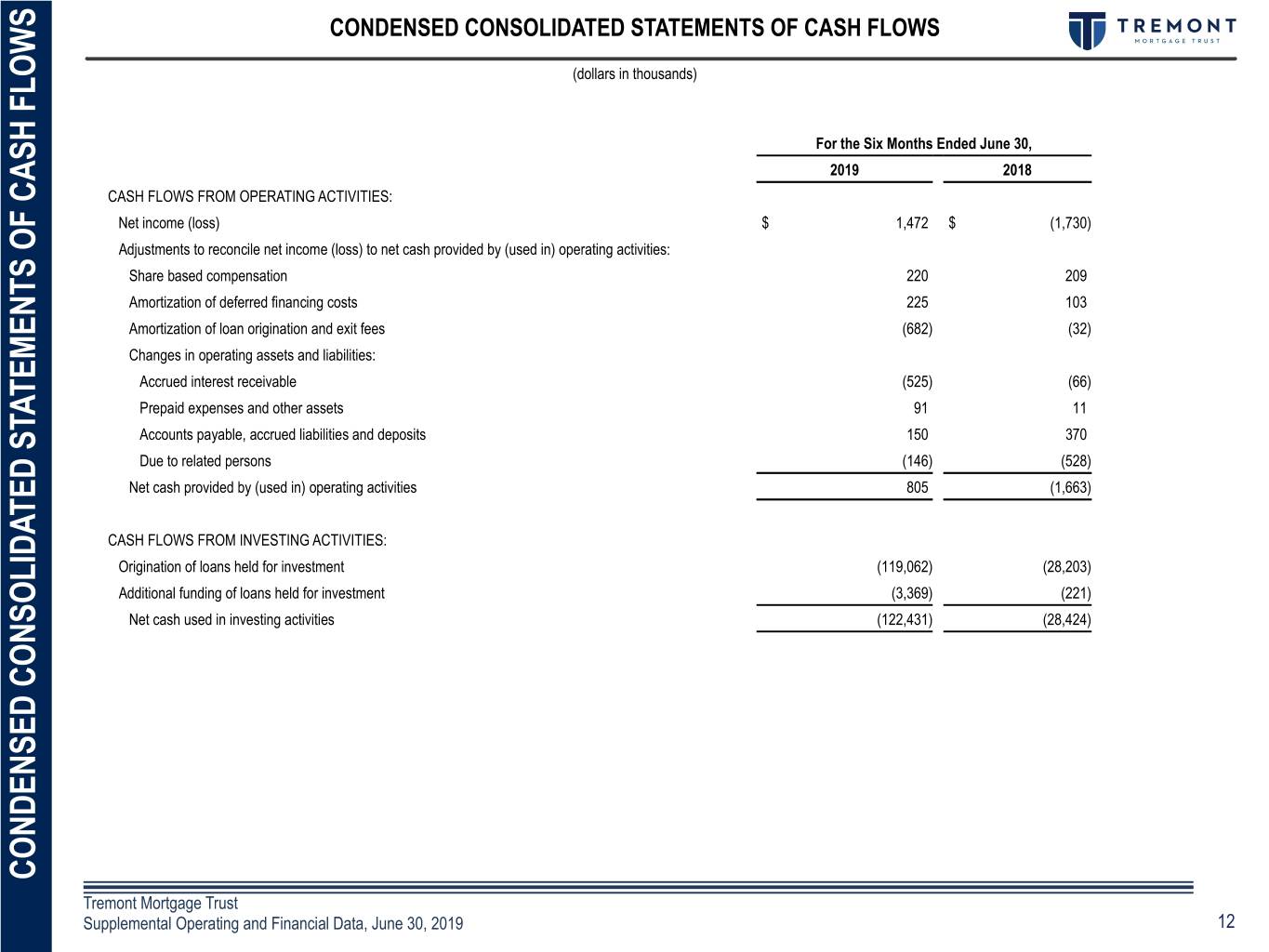

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in thousands) For the Six Months Ended June 30, 2019 2018 CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) $ 1,472 $ (1,730) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Share based compensation 220 209 Amortization of deferred financing costs 225 103 Amortization of loan origination and exit fees (682) (32) Changes in operating assets and liabilities: Accrued interest receivable (525) (66) Prepaid expenses and other assets 91 11 FinancialAccounts payable, accrued liabilities and deposits 150 370 Due to related persons (146) (528) SummaryNet cash provided by (used in) operating activities 805 (1,663) CASH FLOWS FROM INVESTING ACTIVITIES: Origination of loans held for investment (119,062) (28,203) Additional funding of loans held for investment (3,369) (221) Net cash used in investing activities (122,431) (28,424) CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS STATEMENTS CONDENSED CONSOLIDATED Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 12

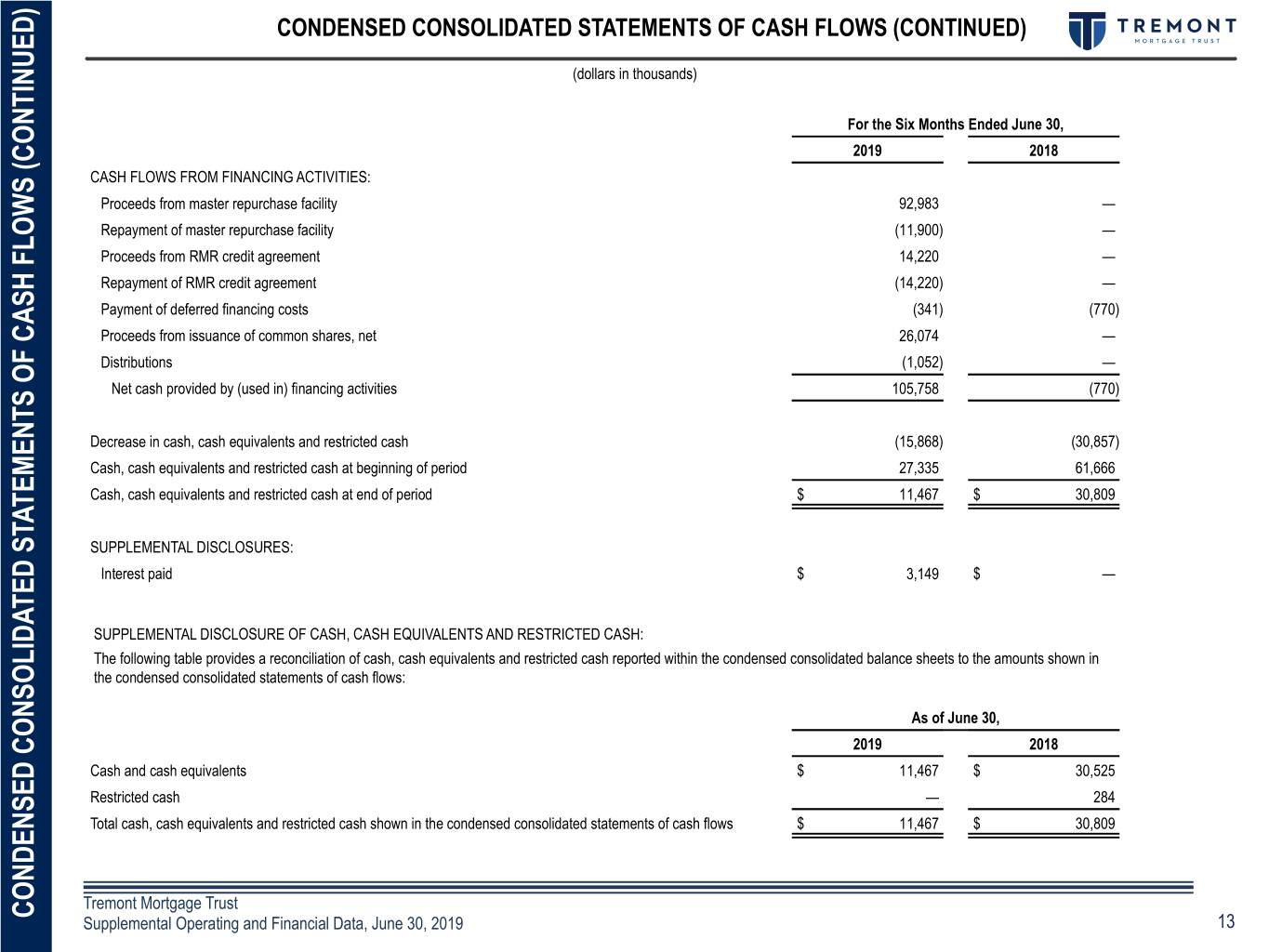

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) (dollars in thousands) For the Six Months Ended June 30, 2019 2018 CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from master repurchase facility 92,983 — Repayment of master repurchase facility (11,900) — Proceeds from RMR credit agreement 14,220 — Repayment of RMR credit agreement (14,220) — Payment of deferred financing costs (341) (770) Proceeds from issuance of common shares, net 26,074 — Distributions (1,052) — NetFinancial cash provided by (used in) financing activities 105,758 (770) Decrease in cash, cash equivalents and restricted cash (15,868) (30,857) Cash, cash equivalents and restricted cash at beginning of period 27,335 61,666 Cash,Summary cash equivalents and restricted cash at end of period $ 11,467 $ 30,809 SUPPLEMENTAL DISCLOSURES: Interest paid $ 3,149 $ — SUPPLEMENTAL DISCLOSURE OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH: The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets to the amounts shown in the condensed consolidated statements of cash flows: As of June 30, 2019 2018 Cash and cash equivalents $ 11,467 $ 30,525 Restricted cash — 284 Total cash, cash equivalents and restricted cash shown in the condensed consolidated statements of cash flows $ 11,467 $ 30,809 Tremont Mortgage Trust CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) STATEMENTS CONDENSED CONSOLIDATED ConfidentialSupplemental Operating and Financial Data, June 30, 2019 13

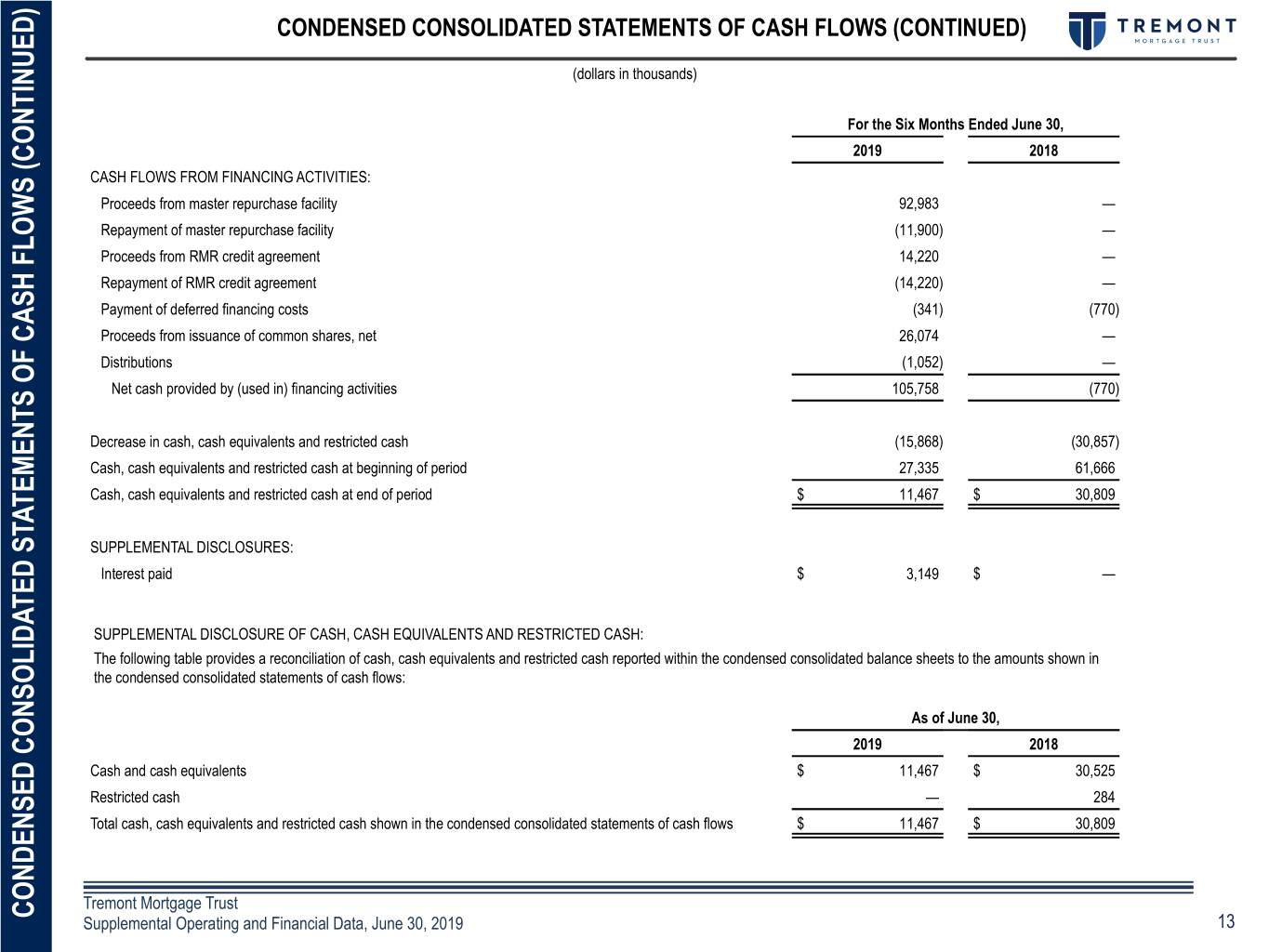

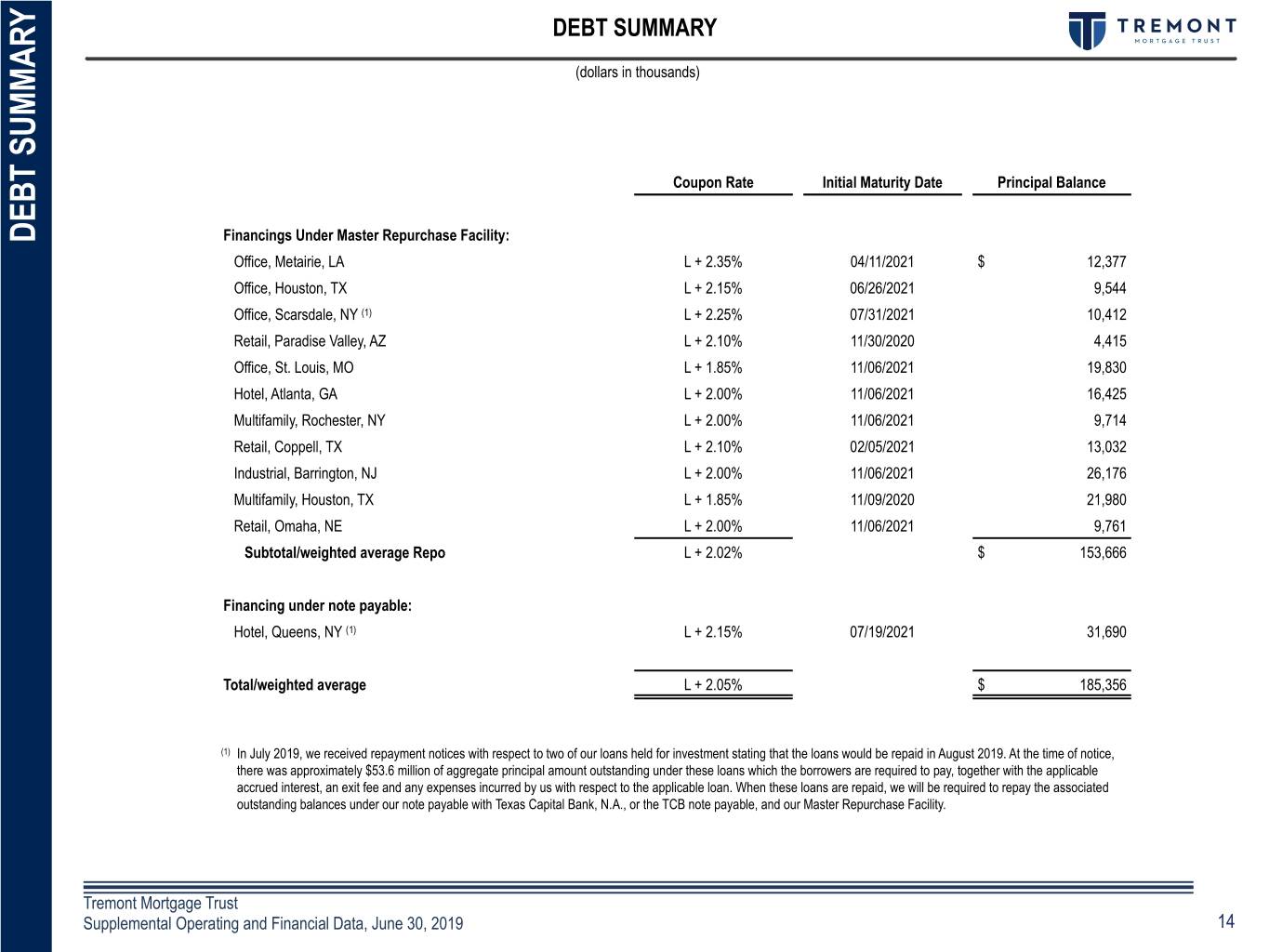

DEBT SUMMARY (dollars in thousands) Coupon Rate Initial Maturity Date Principal Balance DEBT SUMMARY Financings Under Master Repurchase Facility: Office, Metairie, LA L + 2.35% 04/11/2021 $ 12,377 Office, Houston, TX L + 2.15% 06/26/2021 9,544 Office, Scarsdale, NY (1) L + 2.25% 07/31/2021 10,412 Retail, Paradise Valley, AZ L + 2.10% 11/30/2020 4,415 Office, St. Louis, MO L + 1.85% 11/06/2021 19,830 Hotel, Atlanta, GA L + 2.00% 11/06/2021 16,425 Multifamily, Rochester, NY L + 2.00% 11/06/2021 9,714 Retail, Coppell, TX L + 2.10% 02/05/2021 13,032 Industrial, Barrington, NJ L + 2.00% 11/06/2021 26,176 Multifamily, Houston, TX L + 1.85% 11/09/2020 21,980 Retail, Omaha, NE L + 2.00% 11/06/2021 9,761 Subtotal/weighted average Repo L + 2.02% $ 153,666 Financing under note payable: Hotel, Queens, NY (1) L + 2.15% 07/19/2021 31,690 Total/weighted average L + 2.05% $ 185,356 (1) In July 2019, we received repayment notices with respect to two of our loans held for investment stating that the loans would be repaid in August 2019. At the time of notice, there was approximately $53.6 million of aggregate principal amount outstanding under these loans which the borrowers are required to pay, together with the applicable accrued interest, an exit fee and any expenses incurred by us with respect to the applicable loan. When these loans are repaid, we will be required to repay the associated outstanding balances under our note payable with Texas Capital Bank, N.A., or the TCB note payable, and our Master Repurchase Facility. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 14

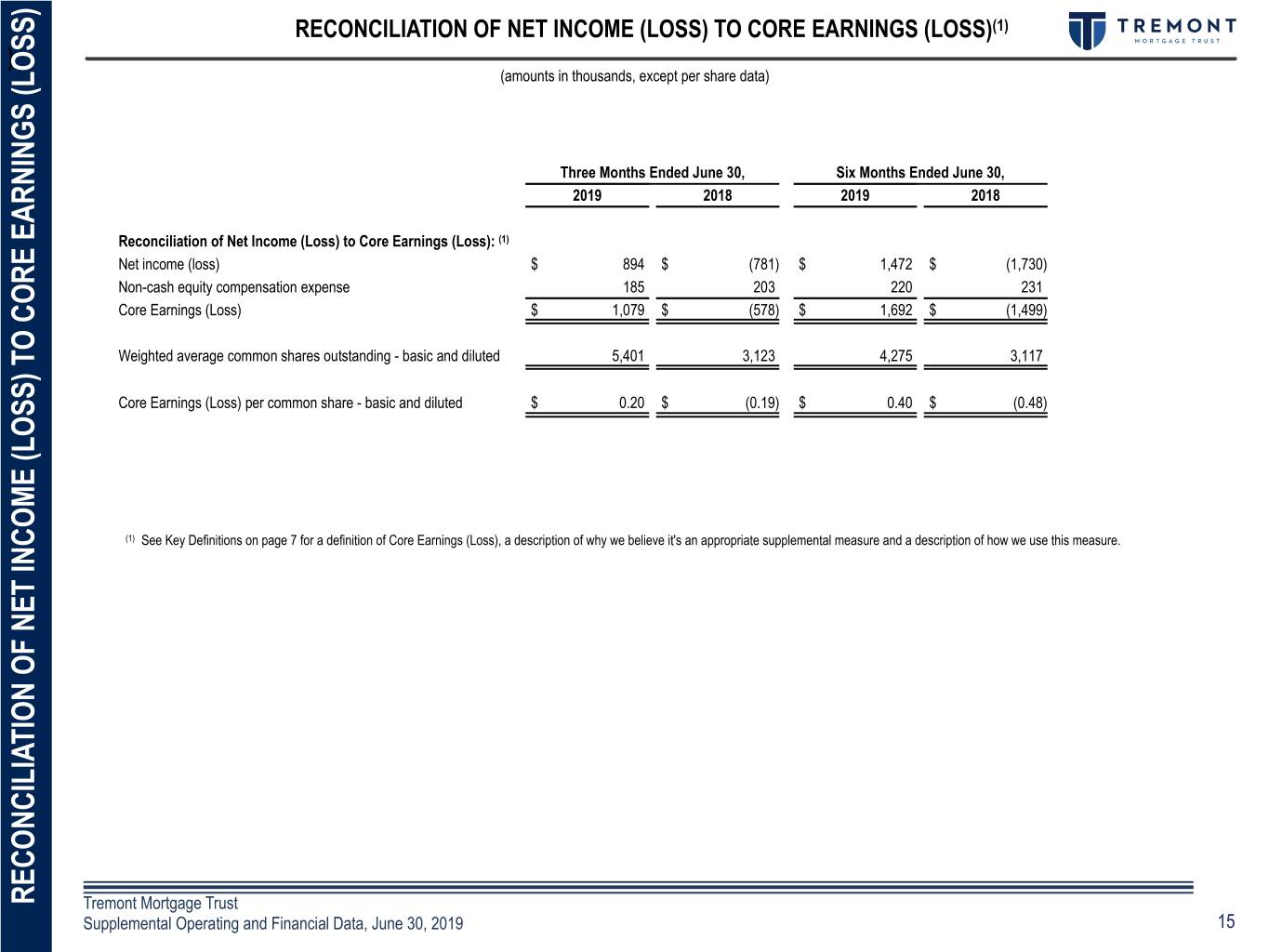

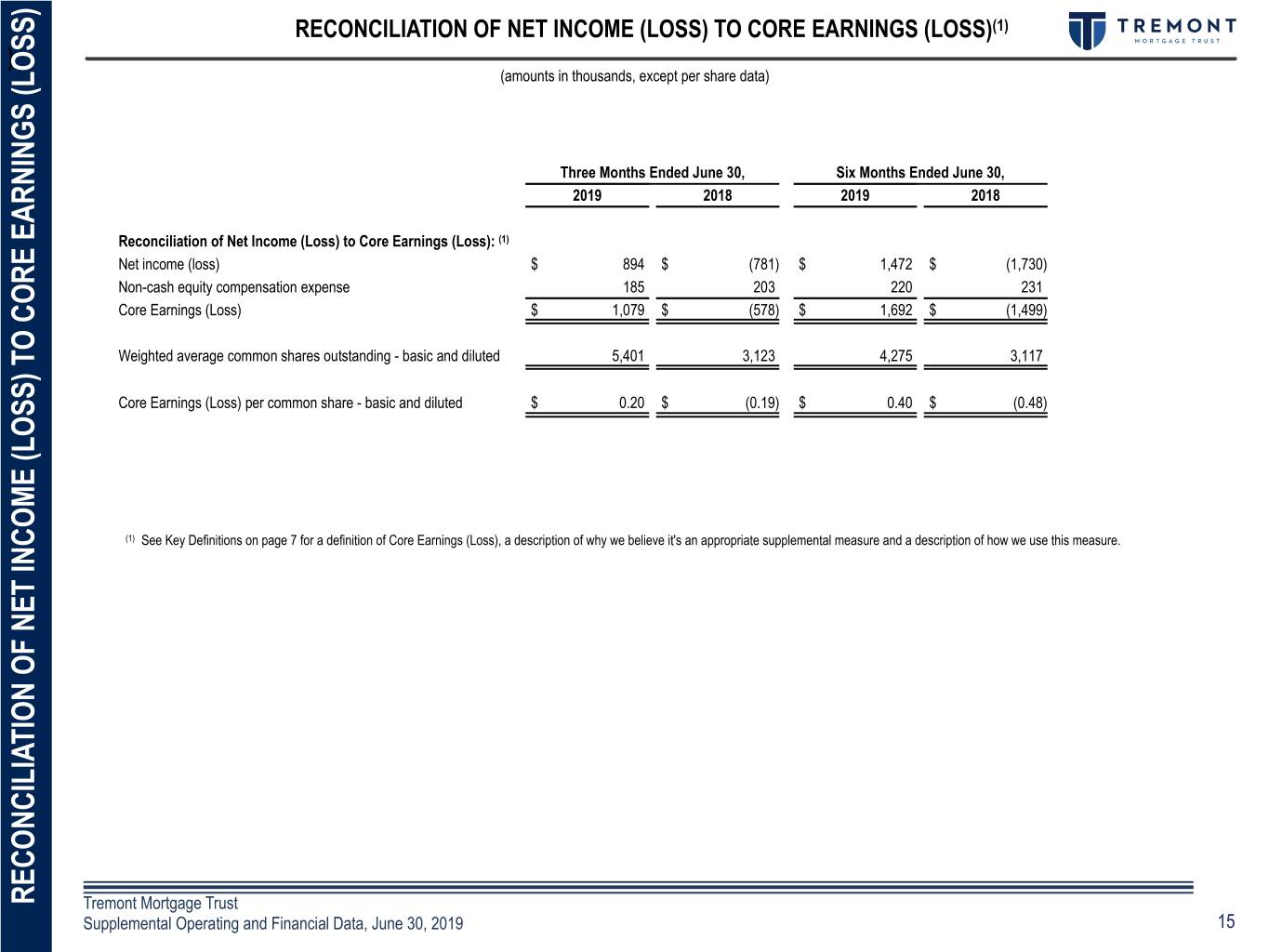

RECONCILIATION OF NET INCOME (LOSS) TO CORE EARNINGS (LOSS)(1) ) (amounts in thousands, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 Reconciliation of Net Income (Loss) to Core Earnings (Loss): (1) Net income (loss) $ 894 $ (781) $ 1,472 $ (1,730) Non-cash equity compensation expense 185 203 220 231 Core Earnings (Loss) $ 1,079 $ (578) $ 1,692 $ (1,499) Weighted average common shares outstanding - basic and diluted 5,401 3,123 4,275 3,117 Core Earnings (Loss) per common share - basic and diluted $ 0.20 $ (0.19) $ 0.40 $ (0.48) (1) See Key Definitions on page 7 for a definition of Core Earnings (Loss), a description of why we believe it's an appropriate supplemental measure and a description of how we use this measure. RECONCILIATION OF NET INCOME (LOSS) TO CORE EARNINGS (LOSS) OF NET INCOME (LOSS) TO RECONCILIATION Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 15

PORTFOLIO OVERVIEW West Park I, St. Louis, MO Part of West Park I, West Park II and Pine View Point Office Portfolio $29.5 Million First Mortgage Whole Loan Closed December 2018‹#›

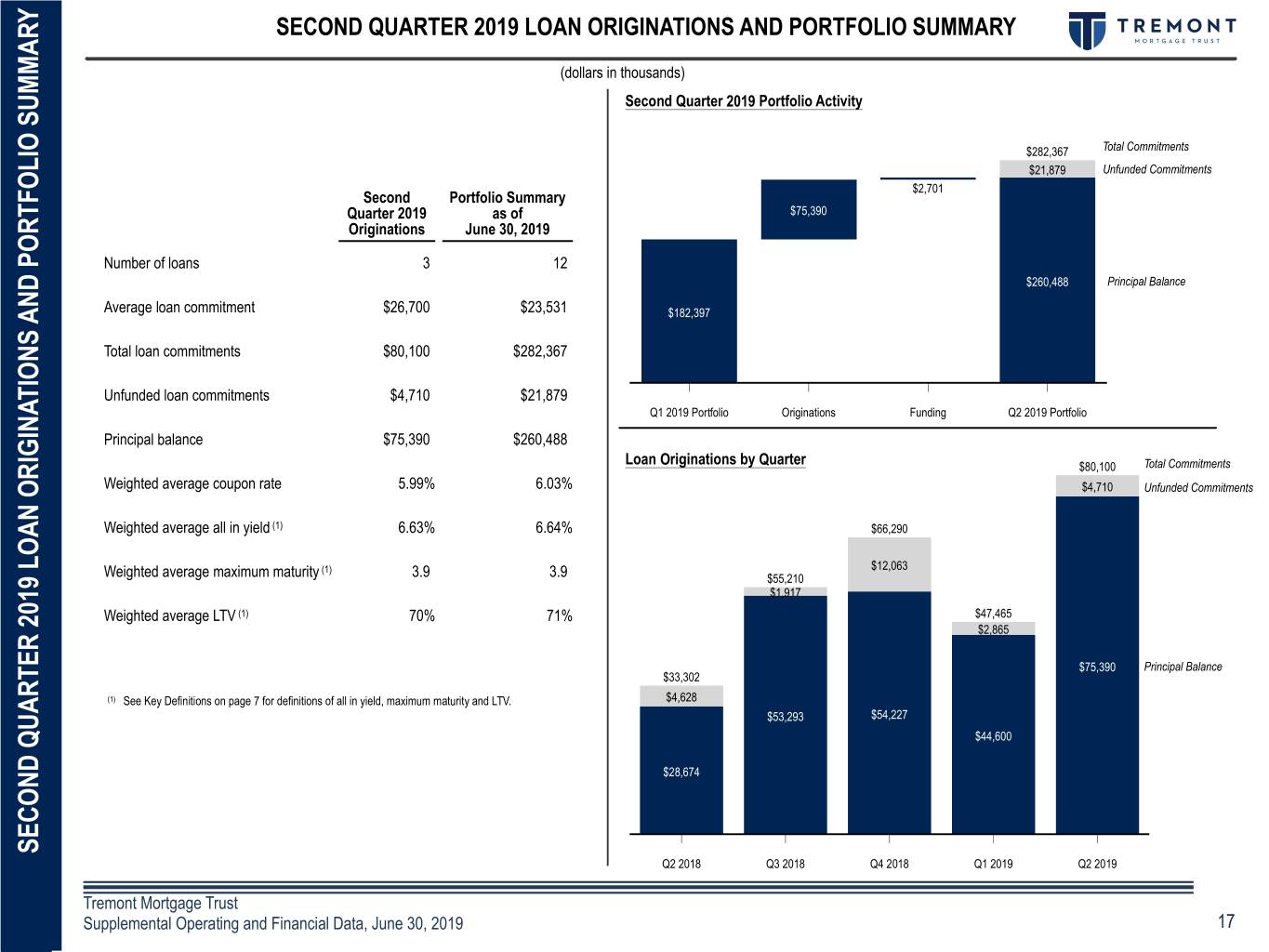

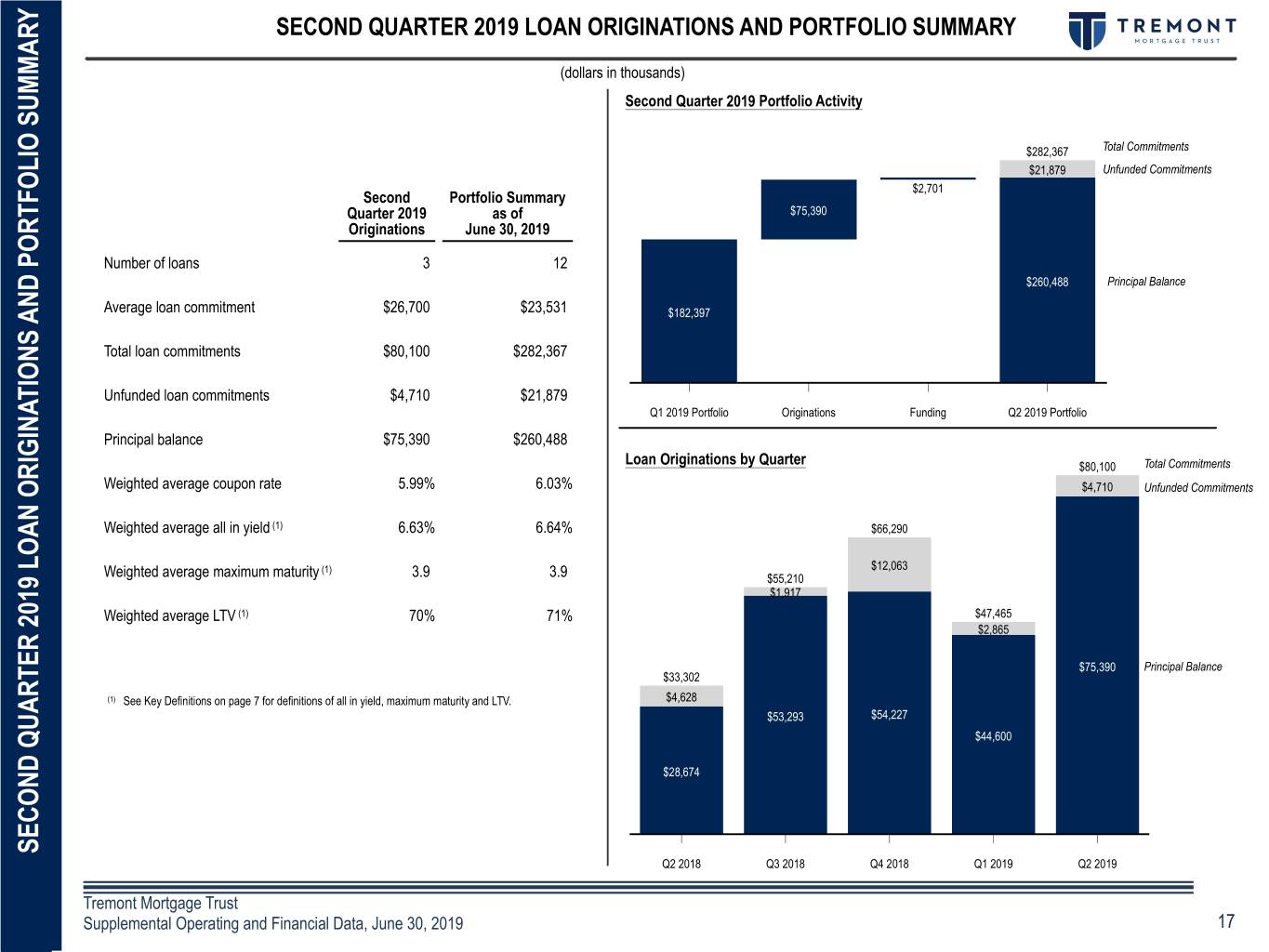

SECOND QUARTER 2019 LOAN ORIGINATIONS AND PORTFOLIO SUMMARY (dollars in thousands) Second Quarter 2019 Portfolio Activity $282,367 Total Commitments Unfunded Commitments $21,879 Unfunded Commitments $2,701 Second Portfolio Summary Quarter 2019 as of $75,390 Originations June 30, 2019 Number of loans 3 12 Principal Balance $260,488 Principal Balance Average loan commitment $26,700 $23,531 $182,397 Total loan commitments $80,100 $282,367 Unfunded loan commitments $4,710 $21,879 Q1 2019 Portfolio Originations Funding Q2 2019 Portfolio Principal balance $75,390 $260,488 Loan Originations by Quarter $80,100 Total Commitments Weighted average coupon rate 5.99% 6.03% $4,710 Unfunded Commitments Weighted average all in yield (1) 6.63% 6.64% $66,290 (1) $12,063 Weighted average maximum maturity 3.9 3.9 $55,210 $1,917 Weighted average LTV (1) 70% 71% $47,465 $2,865 $75,390 Principal Balance $33,302 (1) See Key Definitions on page 7 for definitions of all in yield, maximum maturity and LTV. $4,628 $53,293 $54,227 $44,600 $28,674 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 SECOND QUARTER 2019 LOAN ORIGINATIONS AND PORTFOLIO SUMMARY SECOND QUARTER 2019 LOAN ORIGINATIONS Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 17

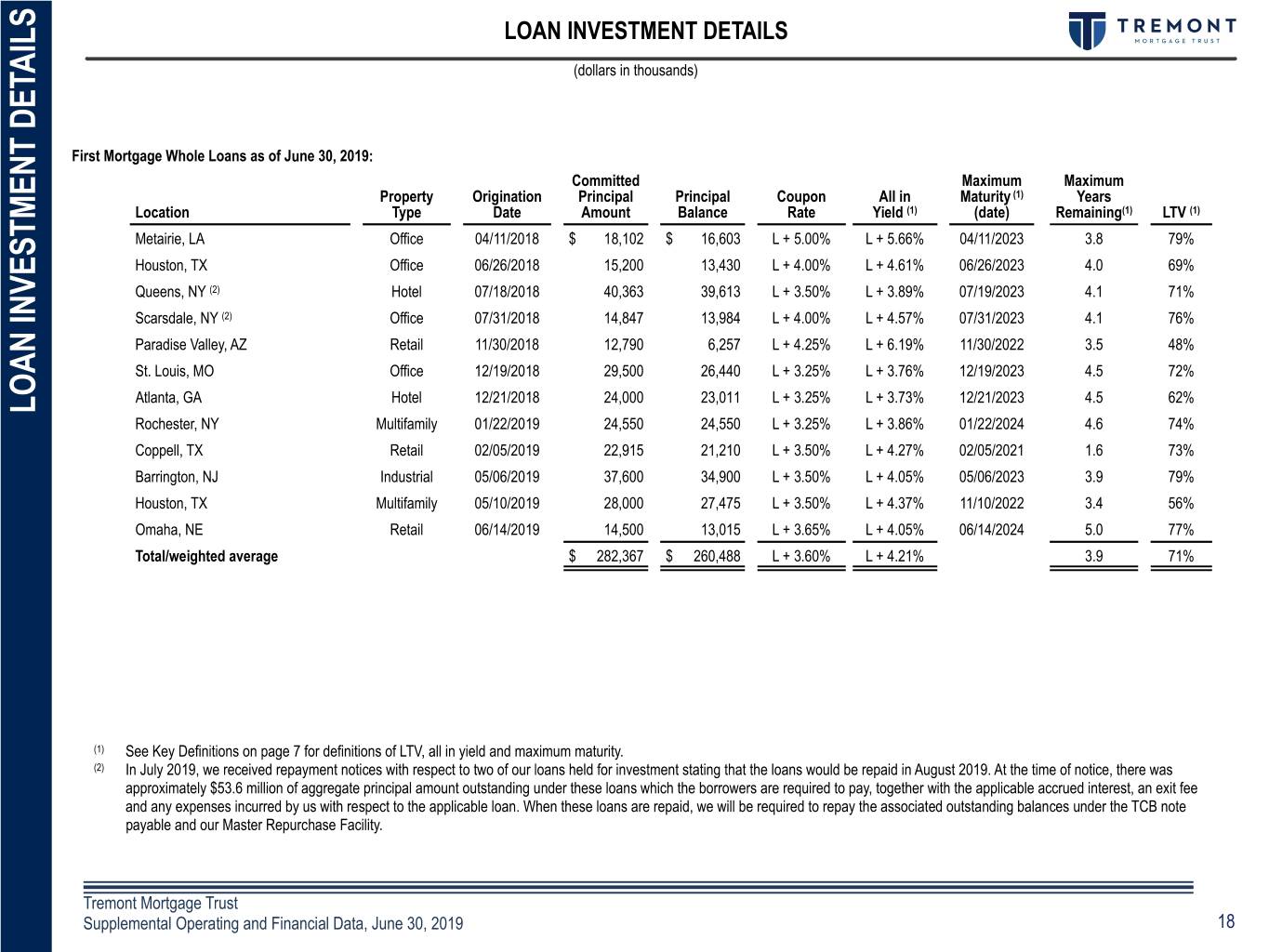

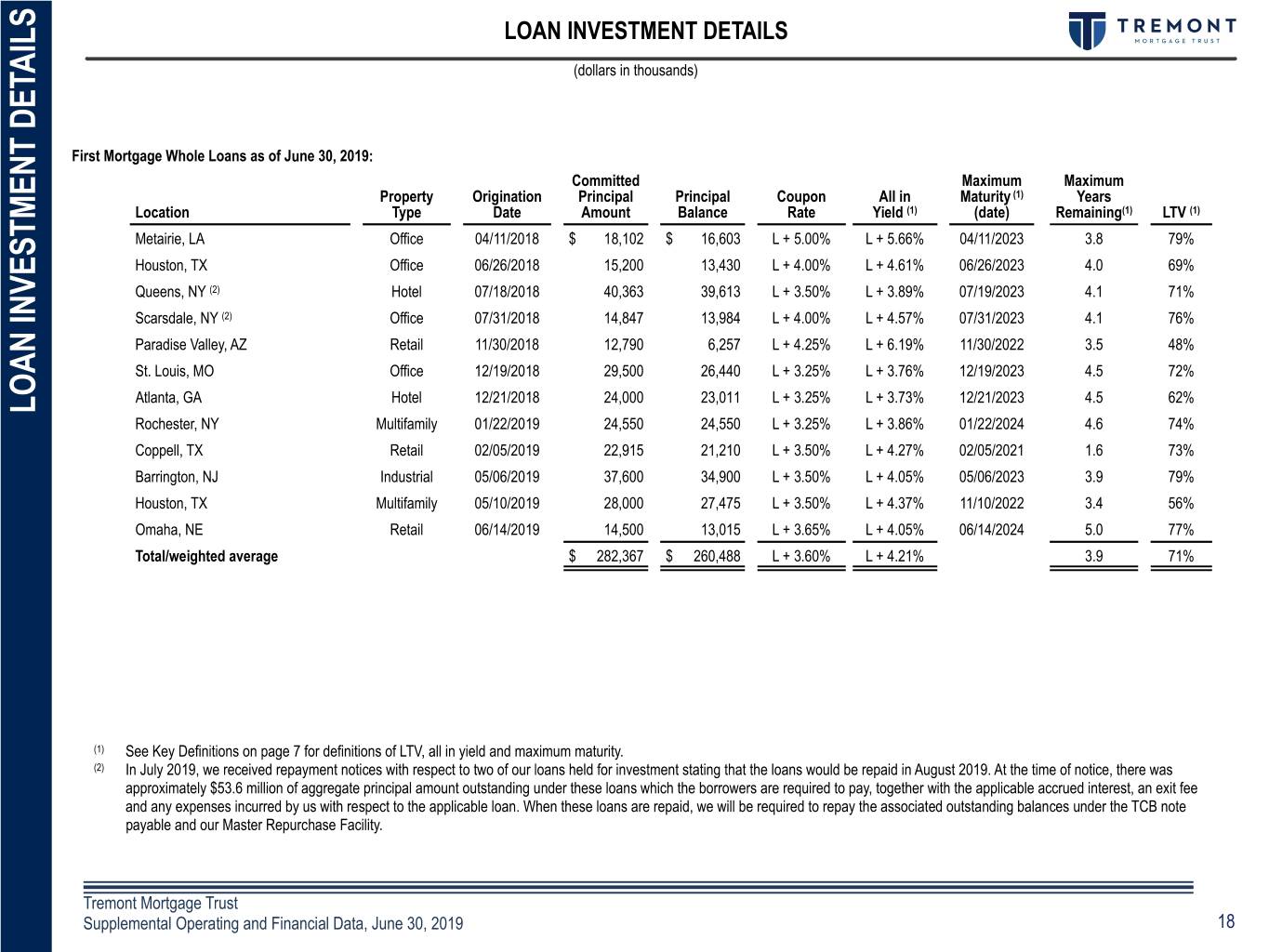

LOAN INVESTMENT DETAILS (dollars in thousands) First Mortgage Whole Loans as of June 30, 2019: Committed Maximum Maximum Property Origination Principal Principal Coupon All in Maturity (1) Years Location Type Date Amount Balance Rate Yield (1) (date) Remaining(1) LTV (1) Metairie, LA Office 04/11/2018 $ 18,102 $ 16,603 L + 5.00% L + 5.66% 04/11/2023 3.8 79% Houston, TX Office 06/26/2018 15,200 13,430 L + 4.00% L + 4.61% 06/26/2023 4.0 69% Queens, NY (2) Hotel 07/18/2018 40,363 39,613 L + 3.50% L + 3.89% 07/19/2023 4.1 71% Scarsdale, NY (2) Office 07/31/2018 14,847 13,984 L + 4.00% L + 4.57% 07/31/2023 4.1 76% Paradise Valley, AZ Retail 11/30/2018 12,790 6,257 L + 4.25% L + 6.19% 11/30/2022 3.5 48% St. Louis, MO Office 12/19/2018 29,500 26,440 L + 3.25% L + 3.76% 12/19/2023 4.5 72% Atlanta, GA Hotel 12/21/2018 24,000 23,011 L + 3.25% L + 3.73% 12/21/2023 4.5 62% LOAN INVESTMENT DETAILS Rochester, NY Multifamily 01/22/2019 24,550 24,550 L + 3.25% L + 3.86% 01/22/2024 4.6 74% Coppell, TX Retail 02/05/2019 22,915 21,210 L + 3.50% L + 4.27% 02/05/2021 1.6 73% Barrington, NJ Industrial 05/06/2019 37,600 34,900 L + 3.50% L + 4.05% 05/06/2023 3.9 79% Houston, TX Multifamily 05/10/2019 28,000 27,475 L + 3.50% L + 4.37% 11/10/2022 3.4 56% Omaha, NE Retail 06/14/2019 14,500 13,015 L + 3.65% L + 4.05% 06/14/2024 5.0 77% Total/weighted average $ 282,367 $ 260,488 L + 3.60% L + 4.21% 3.9 71% (1) See Key Definitions on page 7 for definitions of LTV, all in yield and maximum maturity. (2) In July 2019, we received repayment notices with respect to two of our loans held for investment stating that the loans would be repaid in August 2019. At the time of notice, there was approximately $53.6 million of aggregate principal amount outstanding under these loans which the borrowers are required to pay, together with the applicable accrued interest, an exit fee and any expenses incurred by us with respect to the applicable loan. When these loans are repaid, we will be required to repay the associated outstanding balances under the TCB note payable and our Master Repurchase Facility. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 18

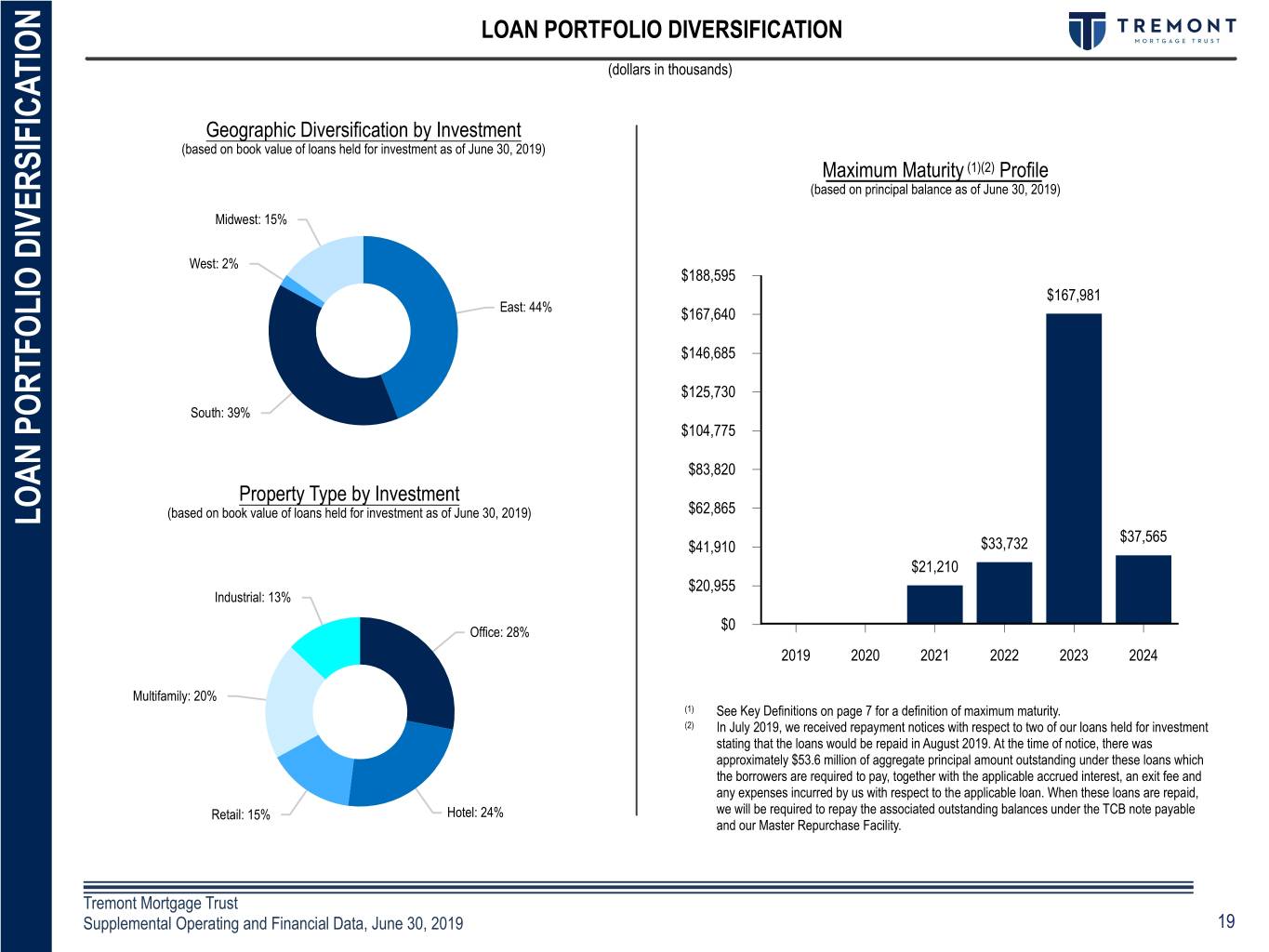

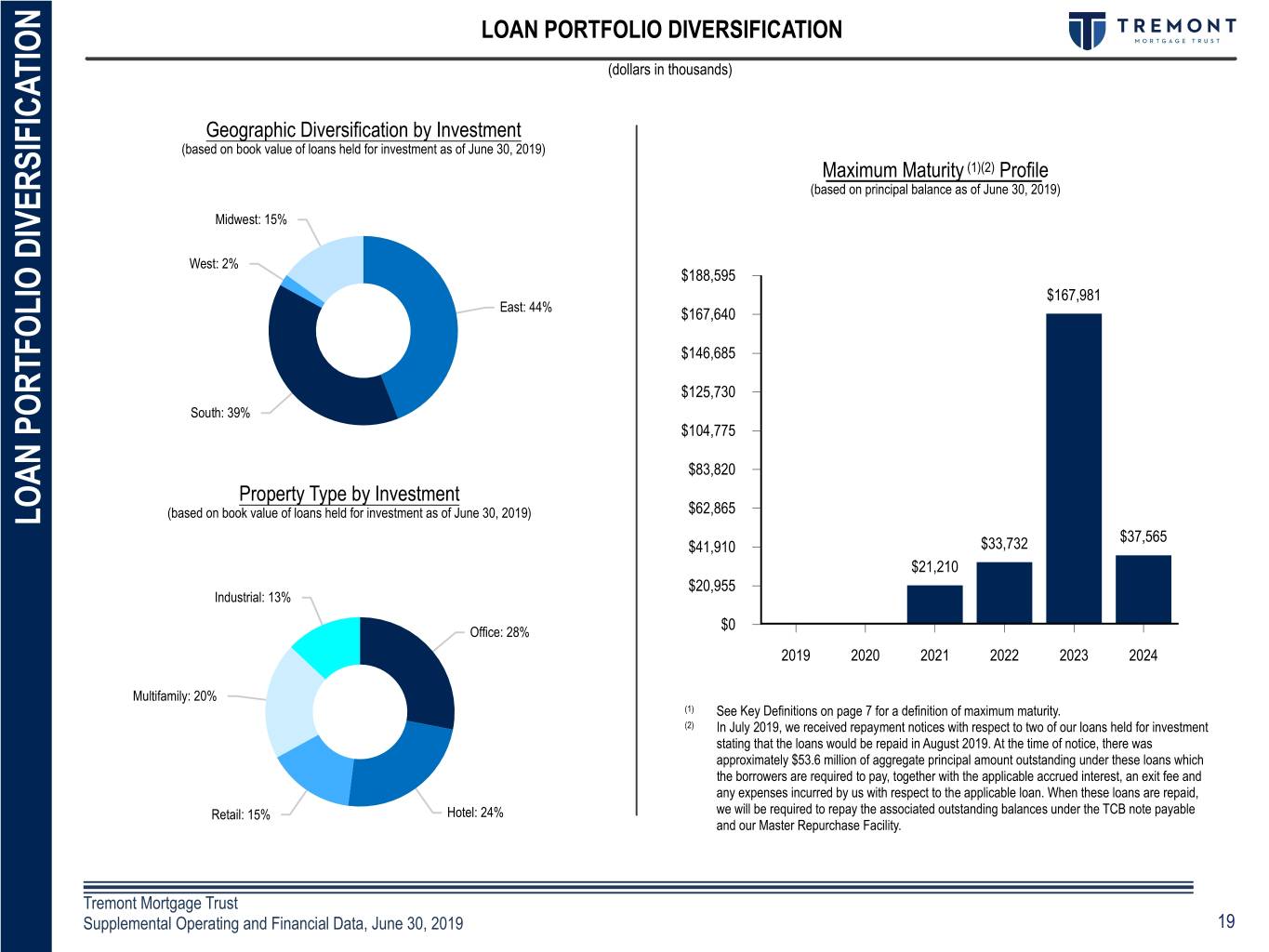

LOAN PORTFOLIO DIVERSIFICATION (dollars in thousands) Geographic Diversification by Investment (based on book value of loans held for investment as of June 30, 2019) Maximum Maturity (1)(2) Profile (based on principal balance as of June 30, 2019) Midwest: 15% West: 2% $188,595 $167,981 East: 44% $167,640 $146,685 $125,730 South: 39% $104,775 $83,820 Property Type by Investment (based on book value of loans held for investment as of June 30, 2019) $62,865 LOAN PORTFOLIO DIVERSIFICATION $37,565 Retail $41,910 $33,732 $21,210 $20,955 Industrial: 13% Office: 28% $0 2019 2020 2021 2022 2023 2024 Multifamily: 20% (1) See Key Definitions on page 7 for a definition of maximum maturity. (2) In July 2019, we received repayment notices with respect to two of our loans held for investment stating that the loans would be repaid in August 2019. At the time of notice, there was approximately $53.6 million of aggregate principal amount outstanding under these loans which the borrowers are required to pay, together with the applicable accrued interest, an exit fee and any expenses incurred by us with respect to the applicable loan. When these loans are repaid, Retail: 15% Hotel: 24% we will be required to repay the associated outstanding balances under the TCB note payable and our Master Repurchase Facility. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 19

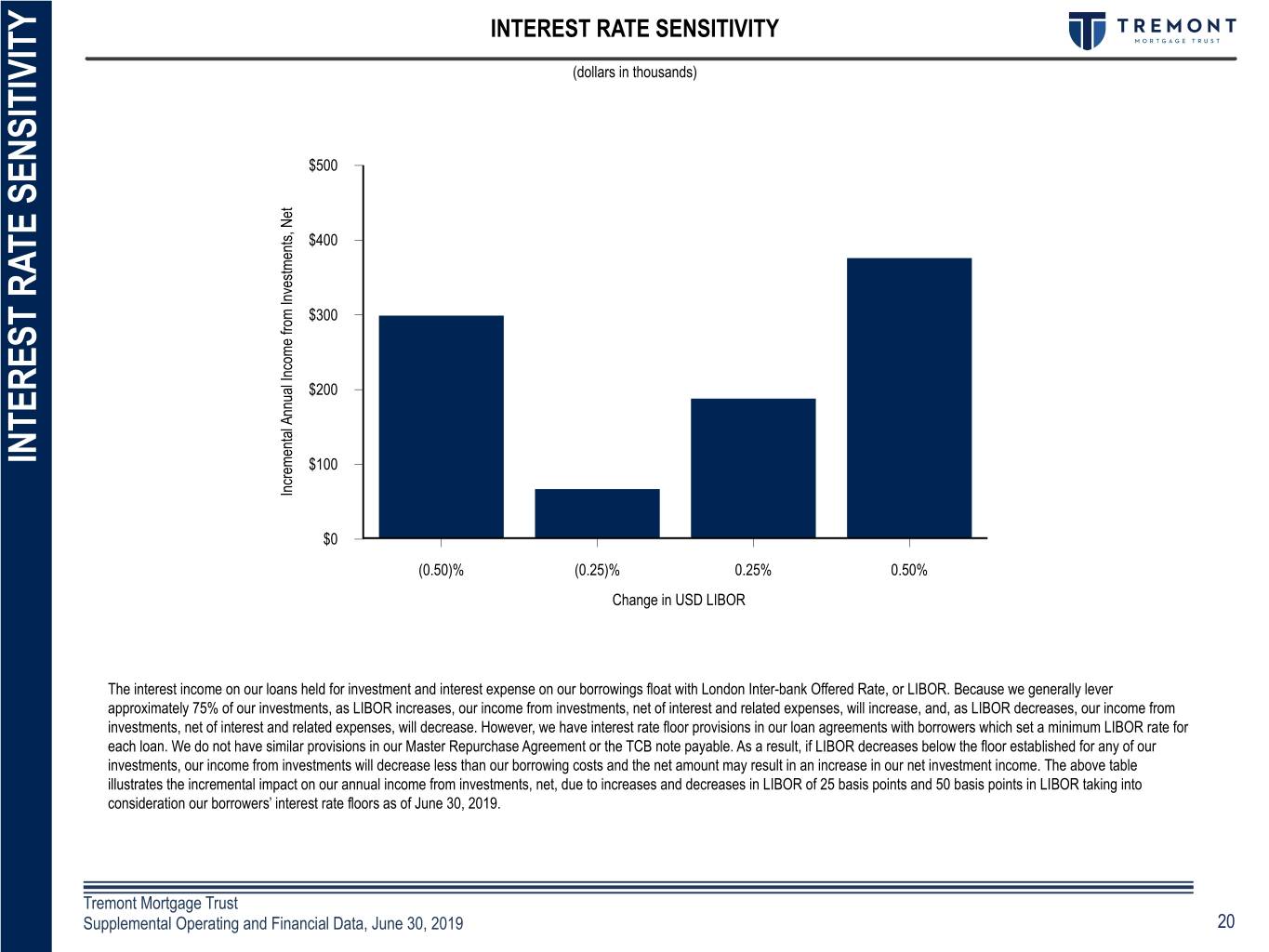

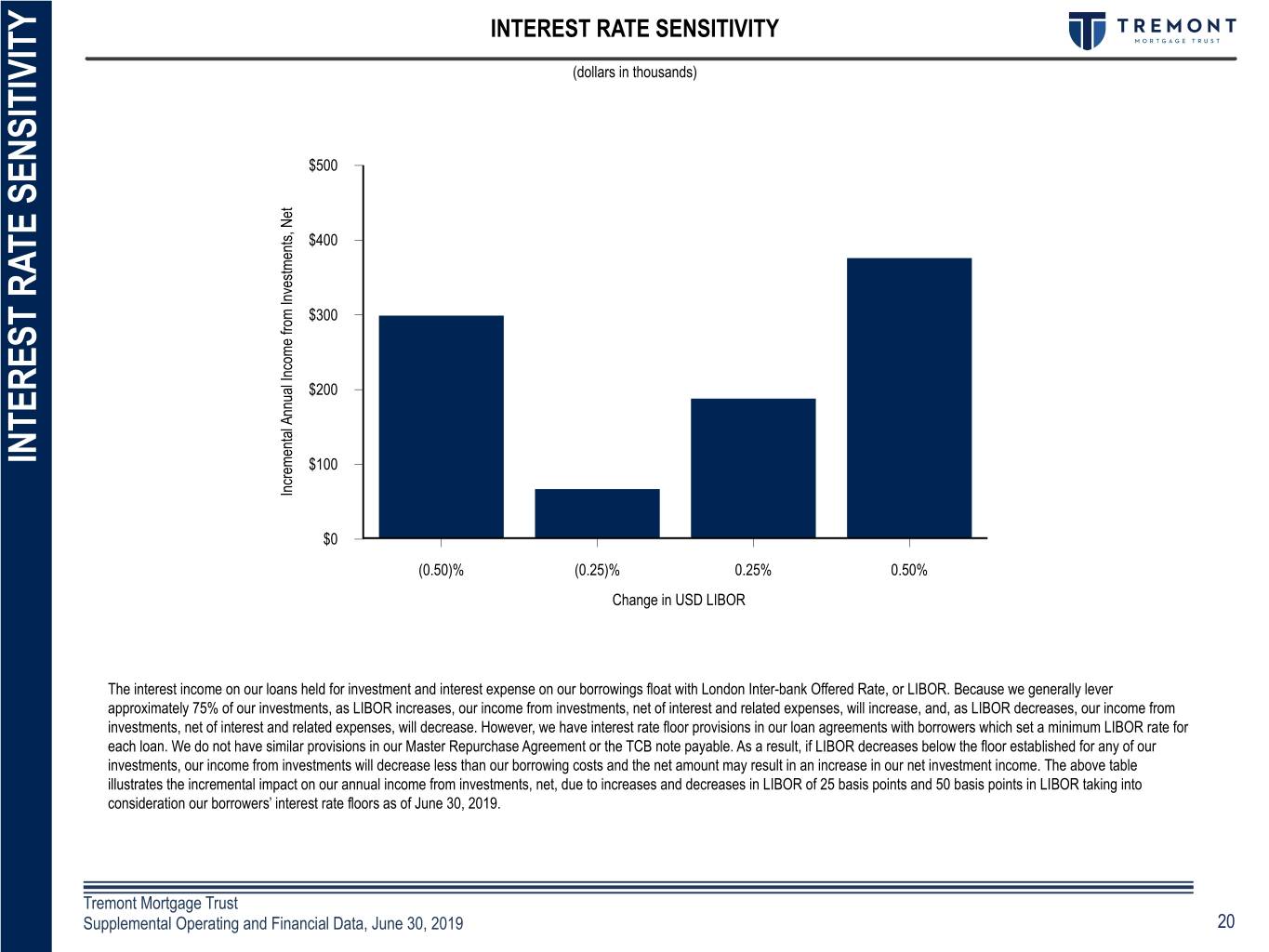

INTEREST RATE SENSITIVITY (dollars in thousands) $500 t e N , s t $400 n e m t s e v n I m $300 o r f e m o c n I l a $200 u n n A l a t n e INTEREST RATE SENSITIVITY INTEREST RATE m $100 e r c n I $0 (0.50)% (0.25)% 0.25% 0.50% Change in USD LIBOR The interest income on our loans held for investment and interest expense on our borrowings float with London Inter-bank Offered Rate, or LIBOR. Because we generally lever approximately 75% of our investments, as LIBOR increases, our income from investments, net of interest and related expenses, will increase, and, as LIBOR decreases, our income from investments, net of interest and related expenses, will decrease. However, we have interest rate floor provisions in our loan agreements with borrowers which set a minimum LIBOR rate for each loan. We do not have similar provisions in our Master Repurchase Agreement or the TCB note payable. As a result, if LIBOR decreases below the floor established for any of our investments, our income from investments will decrease less than our borrowing costs and the net amount may result in an increase in our net investment income. The above table illustrates the incremental impact on our annual income from investments, net, due to increases and decreases in LIBOR of 25 basis points and 50 basis points in LIBOR taking into consideration our borrowers’ interest rate floors as of June 30, 2019. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 20

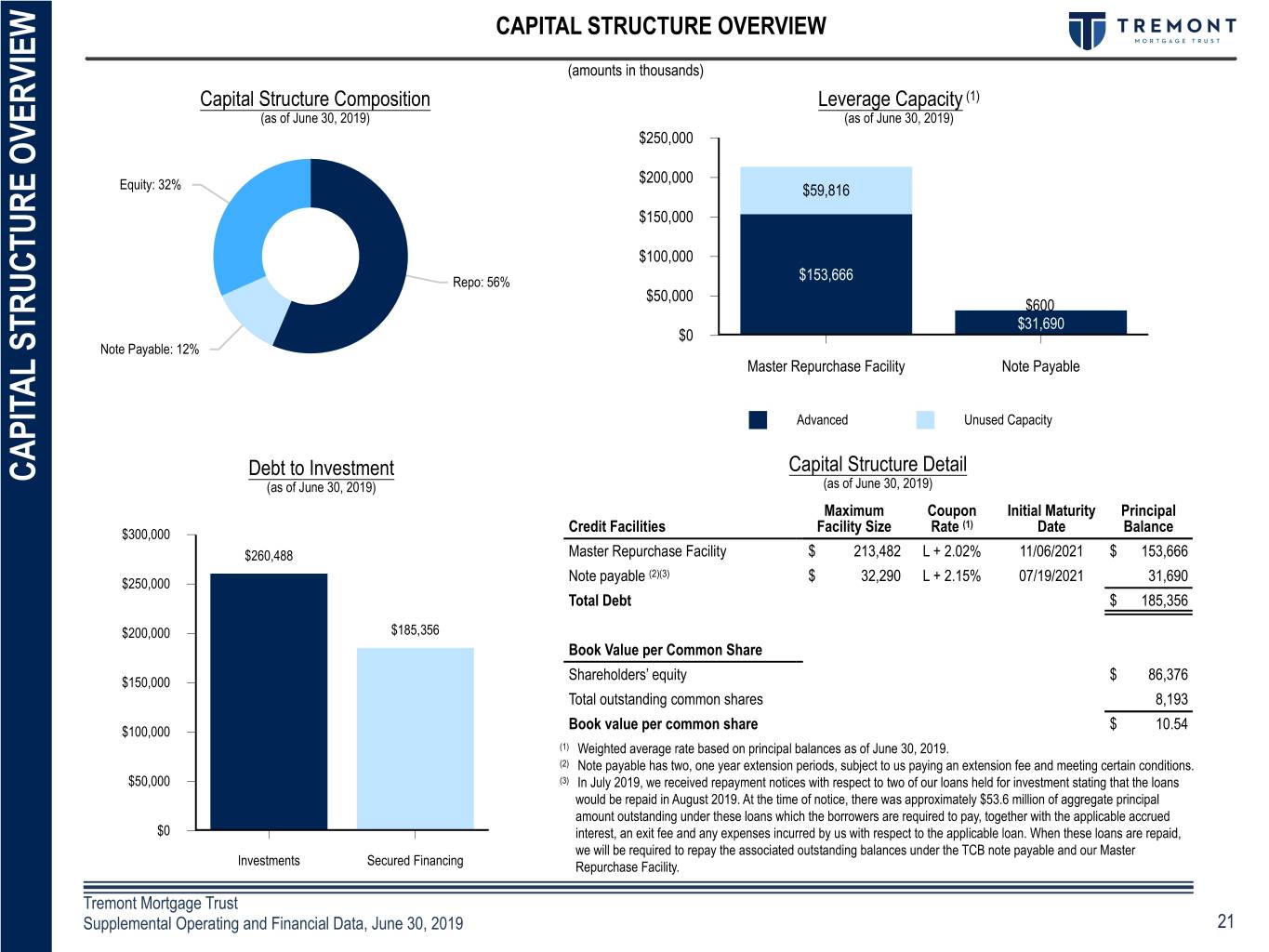

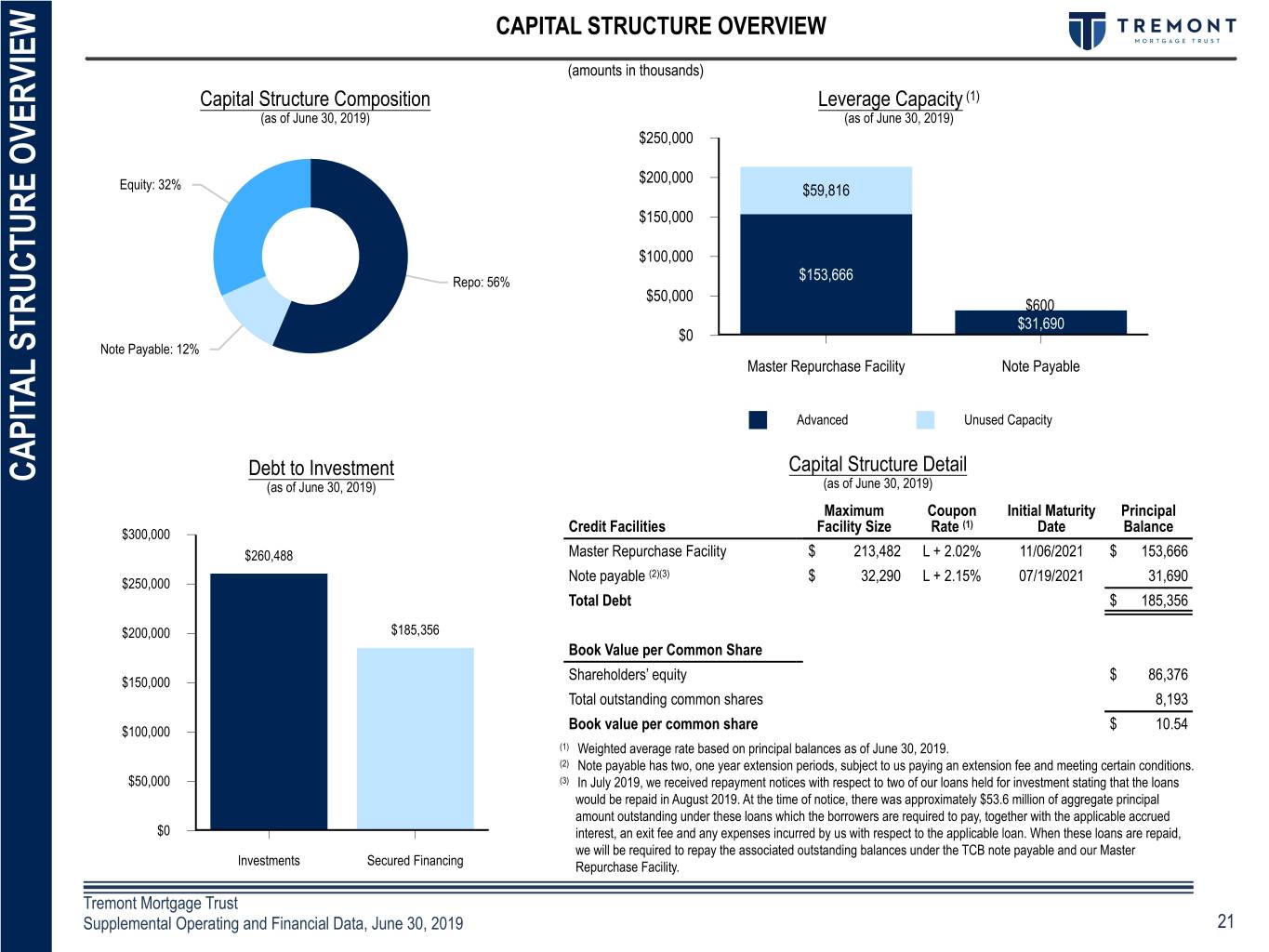

CAPITAL STRUCTURE OVERVIEW (amounts in thousands) Capital Structure Composition Leverage Capacity (1) (as of June 30, 2019) (as of June 30, 2019) $250,000 $200,000 Equity: 32% $59,816 $150,000 $100,000 Repo: 56% $153,666 $50,000 $600 $31,690 $0 Note Payable: 12% Master Repurchase Facility Note Payable Advanced Unused Capacity Debt to Investment Capital Structure Detail CAPITAL STRUCTURE OVERVIEW CAPITAL (as of June 30, 2019) (as of June 30, 2019) Maximum Coupon Initial Maturity Principal (1) $300,000 Credit Facilities Facility Size Rate Date Balance $260,488 Master Repurchase Facility $ 213,482 L + 2.02% 11/06/2021 $ 153,666 (2)(3) $ $250,000 Note payable 32,290 L + 2.15% 07/19/2021 31,690 Total Debt $ 185,356 $200,000 $185,356 Book Value per Common Share $ $150,000 Shareholders’ equity 86,376 Total outstanding common shares 8,193 $ $100,000 Book value per common share 10.54 (1) Weighted average rate based on principal balances as of June 30, 2019. (2) Note payable has two, one year extension periods, subject to us paying an extension fee and meeting certain conditions. $50,000 (3) In July 2019, we received repayment notices with respect to two of our loans held for investment stating that the loans would be repaid in August 2019. At the time of notice, there was approximately $53.6 million of aggregate principal amount outstanding under these loans which the borrowers are required to pay, together with the applicable accrued $0 interest, an exit fee and any expenses incurred by us with respect to the applicable loan. When these loans are repaid, we will be required to repay the associated outstanding balances under the TCB note payable and our Master Investments Secured Financing Repurchase Facility. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 21

WARNING CONCERNING FORWARD-LOOKING STATEMENTS This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Also, whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward- looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward- looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. WARNING CONCERNING FORWARD-LOOKING STATEMENTS CONCERNING FORWARD-LOOKING WARNING Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, June 30, 2019 22