- HARP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Harpoon Therapeutics (HARP) DEF 14ADefinitive proxy

Filed: 17 Apr 20, 5:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

Harpoon Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

April 17, 2020

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Harpoon Therapeutics, Inc., a Delaware corporation (“Harpoon”). The meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/HARP2020 on Thursday, May 28, 2020 at 9:00 a.m. Pacific Time.

Details regarding admission to the Annual Meeting and the business to be conducted at the Annual Meeting are described in the accompanying Notice of 2020 Annual Meeting of Stockholders and proxy statement.

We have elected to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to our stockholders a notice instead of paper copies of this proxy statement and our 2019 Annual Report on Form10-K. The notice contains instructions on how to access those documents over the Internet. The notice also contains instructions on how stockholders can receive a paper copy of our proxy materials, including this proxy statement, our 2019 Annual Report on Form10-K and a form of proxy card or voting instruction form. We believe that providing our proxy materials over the Internet increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact and cost of our Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting online, we hope you will vote as soon as possible. You may vote over the Internet, by telephone or, if you receive a paper proxy card by mail, by completing and returning the proxy card or voting instruction form mailed to you. Please carefully review the instructions on each of your voting options described in this proxy statement, as well as in the notice you received in the mail.

On behalf of the Board of Directors and the employees of Harpoon, we thank you for your continued support.

Sincerely,

| /s/ Gerald McMahon |

| Gerald McMahon |

| President, Chief Executive Officer and Director |

HARPOON THERAPEUTICS, INC.

131 Oyster Point Boulevard, Suite 300

South San Francisco, California 94080

(650)443-7400

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

Time | 9:00 a.m. Pacific Time | |

Date | Thursday, May 28, 2020 | |

Place | Live audio webcast at www.virtualshareholdermeeting.com/HARP2020 | |

Purpose | (1) To elect the three nominees named in the attached proxy statement as directors to serve on the Board of Directors for a three-year term.

(2) To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020.

(3) To conduct any other business properly brought before the meeting or any adjournment or postponement thereof.

These items of business are more fully described in the proxy statement accompanying this Notice. Instructions on how to participate in the Annual Meeting and demonstrate proof of stock ownership are posted at www.virtualshareholdermeeting.com/HARP2020. The webcast of the Annual Meeting will be archived for one year after the date of the Annual Meeting at www.virtualshareholdermeeting.com/HARP2020. You will also be asked to transact such other business, if any, as may properly come before the 2020 Annual Meeting or any adjournment or postponement thereof. | |

Record Date | The record date for the Annual Meeting is April 9, 2020. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. A complete list of such stockholders will be available for examination by any stockholder for any purpose germane to the 2020 Annual Meeting beginning ten days prior to the meeting at our headquarters at 131 Oyster Point Boulevard, Suite 300. If you would like to view the list, please contact our Corporate Secretary to schedule an appointment by calling (650)443-7400 or writing to him at the address above. In addition, the list will be available for inspection by shareholders during the Annual Meeting at www.virtualshareholdermeeting.com/HARP2020. | |

Voting by Proxy | You are cordially invited to attend the Annual Meeting, which will be held virtually via the Internet. Whether or not you expect to attend the Annual Meeting, please vote by telephone or through the Internet, or, if you receive a paper proxy card by mail, by completing and returning the proxy card mailed to you, as promptly as possible in order to ensure your representation at the Annual Meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you receive a paper proxy card by mail, the instructions are printed on your proxy card and included in the accompanying Proxy Statement. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a brokerage firm, bank or other agent and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that agent in order to vote your shares that are held in such agent’s name and account. | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’

Meeting to Be Held on Thursday, May 28, 2020 at 9:00 a.m. Pacific Time via a live audio webcast at www.virtualshareholdermeeting.com/HARP2020.

The Annual Report onForm 10-K and the Proxy Statement for the Annual Meeting

are available at http://www.proxyvote.com.

By order of the Board of Directors,

/s/ Christopher Whitmore

Christopher Whitmore

Vice President, Finance and Secretary

South San Francisco, California

April 17, 2020

| Page | ||||

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | 1 | |||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

PROPOSAL 2—RATIFICATION OF THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 20 | |||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 34 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 44 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 45 | |||

| 48 | ||||

| 48 | ||||

| 49 | ||||

i

HARPOON THERAPEUTICS, INC.

131 Oyster Point Boulevard, Suite 300

South San Francisco, California 94080

(650)443-7400

PROXY STATEMENT

FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 28, 2020

AT 9:00 A.M. PACIFIC TIME

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

We are providing you with these Proxy Materials (as defined below) because the Board of Directors of Harpoon Therapeutics, Inc. (the “Board”) is soliciting your proxy to vote at the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Harpoon Therapeutics, Inc., including at any adjournments or postponements thereof, to be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/HARP2020 on Thursday, May 28, 2020 at 9:00 a.m. Pacific Time. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. You may vote by proxy over the Internet, telephone or by mail, and your vote will be cast on your behalf at the Annual Meeting. To submit your proxy, simply follow the instructions in this Proxy Statement. The Proxy Materials, including this Proxy Statement and our Annual Report onForm 10-K for the year ended December 31, 2019, are being made available on the Internet on or about April 17, 2020. As used in this Proxy Statement, references to “we,” “us,” “our” and the “Company” refer to Harpoon Therapeutics, Inc.

Why did I receivea Notice of Internet Availability of Proxy Materials on the internet instead of a full set of Proxy Materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our Proxy Materials over the Internet. Accordingly, on or about April 17, 2020, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) because the Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting. The Notice of 2020 Annual Meeting of Stockholders (“Notice of Annual Meeting”), this proxy statement, the proxy card or voting instruction form, and the Annual Report on Form10-K for the year ended December 31, 2019 (collectively, the “Proxy Materials”) are available to stockholders on the Internet.

The Notice of Internet Availability will provide instructions as to how stockholders may access and review the Proxy Materials on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the Proxy Materials, including a proxy card, be sent to them by mail or email. The Notice of Internet Availability will also provide voting instructions. Please note that, while our Proxy Materials are available at the website referenced in the Notice of Internet Availability, and our Notice of Annual Meeting, proxy statement and Annual Report onForm 10-K are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this document.

We intend to mail the Notice of Internet Availability on or about April 17, 2020 to all stockholders of record entitled to vote at the Annual Meeting. The Proxy Materials will be made available to stockholders on the Internet on the same date.

Will I receive any other Proxy Materials by mail?

You will not receive any additional Proxy Materials via mail unless (1) you request a printed copy of the Proxy Materials in accordance with the instructions set forth in the Notice or (2) we elect, in our discretion, to send you a proxy card and a second Notice of Internet Availability, which we may send on or after April 28, 2020.

1

When and where is the 2020 Annual Meeting?

The meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/HARP2020 on Thursday, May 28, 2020 at 9:00 a.m. Pacific Time.You will not be able to attend the 2020 Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/HARP2020. Our Board annually considers the appropriate format of our annual meeting and this year has decided to hold a virtual annual meeting due to theCOVID-19 global pandemic. In addition, we intend the virtual meeting format to provide stockholders a similar level of transparency to the traditionalin-person meeting format and will take steps to ensure such an experience. Our stockholders will be afforded the same rights and opportunities to participate at the virtual 2020 Annual Meeting as they would at anin-person annual meeting of stockholders, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting. At the end of the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of conduct, which will be posted on the virtual meeting web portal. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

If you attend the virtual meeting as described above, you will be deemed to be attending in person, as provided by Delaware law.

The 2020 Annual Meeting webcast will begin promptly at 9:00 a.m. Pacific Time. We encourage you to access the meeting webcast prior to the start time. Onlinecheck-in will begin, and stockholders may begin submitting written questions, at 8:45 a.m., Pacific Time, and you should allow ample time for thecheck-in procedures.

How do I attend the 2020 Annual Meeting?

You will need the16-digit control number included on your Notice of Internet Availability or your proxy card or voting instruction form (if you received a printed copy of the proxy materials) or included in the email to you if you received the proxy materials by email in order to be able to vote your shares or submit questions during the 2020 Annual Meeting. Beneficial owners who do not have a control number may gain access to the meeting by logging into their broker, brokerage firm, bank, or other nominee’s website and selecting the shareholder communications mailbox to link through to the annual meeting; instructions should also be provided on the voting instruction card provided by your broker, bank, or other nominee. Instructions on how to connect to the Annual Meeting and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/HARP2020. If you do not have your16-digit control number, you will be able to access and listen to the 2020 Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during thecheck-in or meeting time, please call the technical support number that will be posted on the virtual meeting web portal.

When is the record date for the Annual Meeting?

The Board has fixed the record date for the Annual Meeting as of the close of business on April 9, 2020.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 9, 2020 will be entitled to vote at the Annual Meeting. On this record date, there were of 25,009,020 shares of common stock outstanding and entitled to vote.

2

Stockholder of Record: Shares Registered in Your Name

If on April 9, 2020, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote online at the meeting, vote by proxy over the telephone or through the internet, or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If on April 9, 2020, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice of Internet Availability is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting.

What am I voting on?

At the 2020 Annual Meeting, there are two matters scheduled for a vote:

| • | Proposal 1: Election of three Class I directors to hold office until the 2023 Annual Meeting of Stockholders; and |

| • | Proposal 2: Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

In addition, you will also be asked to transact such other business, if any, as may properly come before the 2020 Annual Meeting or any adjournment or postponement thereof.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the proxies will vote as recommended by the Board or, if no recommendation is given, will vote on those matters in accordance with their best judgment.

How do I vote?

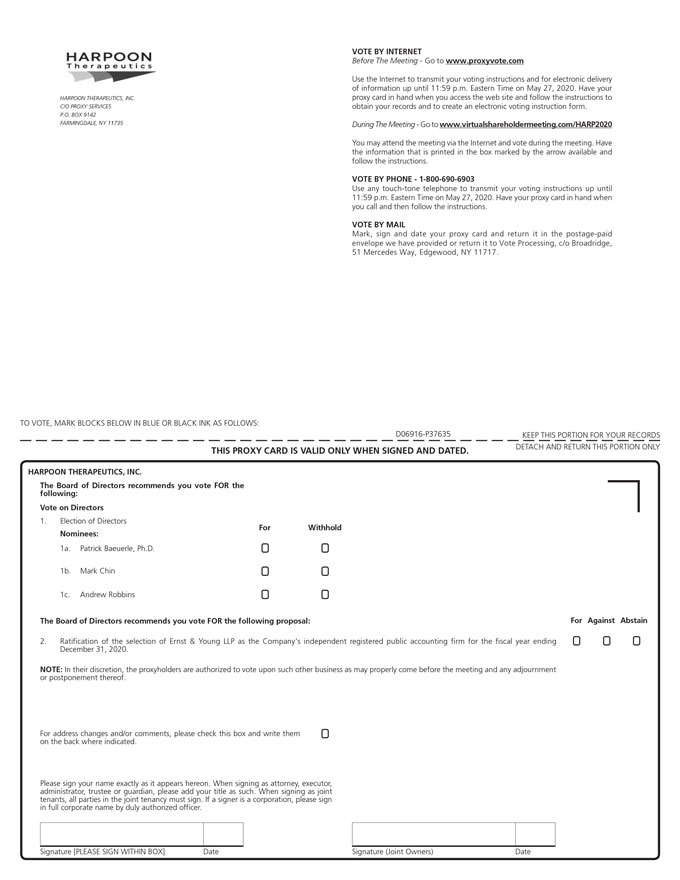

For the election of directors (Proposal 1), you may either vote “For” all nominees to the Board or you may “Withhold” your vote for any nominee you specify. For the ratification of the selection of our independent registered public accounting firm (Proposal 2), you may vote “For” or “Against” or abstain from voting.

Shareholders of Record: Shares Registered in Your Name

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

| • | By Internet |

Before the Meeting. To vote through the internet before the meeting, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice of Internet Availability. Your vote must be received by 11:59 p.m., Eastern time, on May 27, 2020 to be counted.

3

During the Annual Meeting. Attend the 2020 Annual Meeting by visiting www.virtualshareholdermeeting.com/HARP2020 and follow the instructions posted there. Please have your control number from the Notice of Internet Availability to join the 2020 Annual Meeting.

| • | By Telephone. Call (800)690-6903 toll-free from the U.S., U.S. territories and Canada, and follow the instructions on the Notice. You will be asked to provide your control number from the Notice of Internet Availability. Your telephone vote must be received by 11:59 p.m., Eastern time, on May 27, 2020 to be counted. |

| • | By Mail. Complete and mail the proxy card that may be requested and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct if we receive it prior to the Annual Meeting. |

| • | Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization |

If your shares of common stock are held in street name (i.e., held for your account by a broker, bank or other nominee), you should have received a notice containing voting instructions from that organization rather than from us. You should follow the instructions in the notice to ensure your vote is counted. To vote at the 2020 Annual Meeting, attend the 2020 Annual Meeting by visiting www.virtualshareholdermeeting.com/HARP2020 and follow the instructions posted there. Please have your16-digit control number to join the 2020 Annual Meeting.

Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 9, 2020.

What are the Board’s recommendations on how to vote my shares?

The Board recommends a vote:

| • | Proposal 1: FOR the election of the three Class I director nominees; and |

| • | Proposal 2: FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2020. |

Who pays the cost for soliciting proxies?

We will pay the entire cost of soliciting proxies. In addition to these Proxy Materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or by attending the Annual Meeting online, your shares will not be voted. If you return a signed and

4

dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of each of the three nominees for director and “For” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If your shares are held in street name, your bank, broker or other nominee may under certain circumstances vote your shares if you do not timely instruct your broker, bank or other nominee how to vote your shares. Banks, brokers and other nominees can vote your unvoted shares on routine matters, but cannot vote such shares onnon-routine matters. If you do not timely provide voting instructions to your bank, broker or other nominee to vote your shares, your bank, broker or other nominee may, on routine matters, either vote your shares or leave your shares unvoted. The election of directors (Proposal 1) is anon-routine matter. The ratification of the selection of our independent registered public accounting firm (Proposal 2) is a routine matter. We encourage you to provide voting instructions to your bank, broker or other nominee. This ensures that your shares will be voted at the Annual Meeting according to your instructions. You should receive directions from your bank, broker or other nominee about how to submit your proxy to them at the time you receive this proxy statement.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, youmust provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other nominee.

What does it mean if I receive more than one Notice of Internet Availability?

If you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. If you are the stockholder of record for your shares, you may revoke your proxy at any time before the final vote at the Annual Meeting in one of the following ways:

| • | by submitting a timely notice to our Secretary in writing at 131 Oyster Point Boulevard, Suite 300, South San Francisco, California 94080 that you are revoking your proxy; |

| • | by submitting another properly completed proxy with a later date; |

| • | by transmitting a subsequent vote over the Internet or by telephone prior to 11:59 p.m., Eastern time, on May 27, 2020; or |

| • | by attending the Annual Meeting, which will be held virtually via the Internet, and voting online. Simply attending the 2020 Annual Meeting will not, by itself, revoke your proxy. |

Your last vote, whether prior to or at the Annual Meeting, is the vote that we will count.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If your shares are held in street name, you must contact your broker or nominee for instructions as to how to change your vote.

5

How is a quorum reached?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting or represented by proxy. On the record date, there were 25,009,020 shares outstanding and entitled to vote. Thus, the holders of 12,504,511 shares must be present or represented by proxy at the Annual Meeting to have a quorum. As described above, stockholders attending the virtual meeting will be deemed to be attending in person, as provided by Delaware law, and their shares will be counted towards the quorum requirement.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the Annual Meeting. Abstentions andbroker non-votes, if any, will be counted towards the quorum requirement. If there is no quorum, the chairperson of the meeting or the holders of a majority of shares entitled to vote at the meeting and present or represented by proxy may adjourn the meeting to another date.

What are “brokernon-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be“non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “brokernon-votes.” Proposal 1 is considered to be“non-routine” and we therefore expect brokernon-votes to exist in connection with this proposal.

What vote is required to approve each item and how are votes counted?

Proposal 1: Election of Directors.Directors will be elected by a plurality of votes cast at the Annual Meeting by holders of shares present or represented by proxy and entitled to vote on the election of directors. The three nominees receiving the most “For” votes will be elected as directors. You may not vote your shares cumulatively for the election of directors.Abstentions and brokernon-votes will not affect the outcome of the election of directors.

Proposal 2: Ratification of the Selection of the Independent Registered Public Accounting Firm.To be approved, the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal year ending December 31, 2020 must receive “For” votes from the holders of a majority of shares present or represented by proxy and entitled to vote on the matter. Abstentions will have the same effect as an “Against” vote.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of each nominee for director and “For” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2020.

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at our Annual Meeting. We will publish final voting results in a Current Report on Form8-K that we expect to file no later than June 3, 2020. If final voting results are not available by June 3, 2020, we will disclose the preliminary results in the Current Report on Form8-K and, within four business days after the final voting results are known to us, file an amended Current Report on Form8-K to disclose the final voting results.

When are stockholder proposals due for the 2021 Annual Meeting of Stockholders?

If you wish to submit proposals for inclusion in our proxy statement for the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”), we must receive them on or before December 18, 2020. Nothing in

6

this paragraph shall require us to include in our proxy statement or proxy card for the 2021 Annual Meeting any stockholder proposal that does not meet the requirements of the SEC in effect at the time. Any such proposal will be subject to Rule14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

If you wish to nominate a director or submit a proposal for presentation at the 2021 Annual Meeting, without including such proposal in next year’s proxy statement, you must be a stockholder of record and provide timely notice in writing to our Secretary at c/o Harpoon Therapeutics, Inc., 131 Oyster Point Boulevard, Suite 300, South San Francisco, California 94080. To be timely, we must receive the notice not less than 90 days nor more than 120 days prior to the first anniversary of the Annual Meeting, that is, between January 28, 2021 and February 27, 2021;provided,however, that in the event that the date of the 2021 Annual Meeting is more than 30 days before or more than 30 days after such anniversary date, we must receive your notice (a) no earlier than the close of business on the 120th day prior to the currently proposed 2021 Annual Meeting and (b) no later than the close of business on the later of the 90th day prior to the 2021 Annual Meeting or the close of business on the 10th day following the day on which we first make a public announcement of the date of the 2021 Annual Meeting. Your written notice must contain specific information required in Section 5 of our amended and restated bylaws (the “Bylaws”). For additional information about our director nomination requirements, please see our Bylaws.

Who should I call if I have any additional questions?

If you are the stockholder of record for your shares, please call Christopher Whitmore, our Secretary, at (650)443-7400. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

7

PROPOSAL 1: ELECTION OF DIRECTORS

Our amended and restated certificate of incorporation provides for a classified Board consisting of three classes of directors. Class I and Class III each consist of three directors and Class II consists of four directors. Each class serves for a three-year term. Vacancies on our Board may be filled only by persons elected by a majority of the remaining directors. A director elected by our Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

Our Board currently is composed of ten directors. There are three directors whose term of office expires in 2020. Upon the recommendation of the Nominating and Corporate Governance Committee, our Board has nominated the three individuals listed in the table below for election as directors at the Annual Meeting. Dr. Baeuerle and Mr. Chin were each previously elected to our Board by our stockholders. Mr. Robbins was appointed to our Board in March 2020 by our directors to fill a newly created vacancy. If the nominees listed below are elected, they will each hold office until the annual meeting of stockholders in 2023 and until each of their successors has been duly elected and qualified or, if sooner, until the director’s death, resignation or removal. All nominees are currently serving on our Board and have consented to being named in this proxy statement and to serve if elected. It is our policy to encourage directors and nominees for director to attend the Annual Meeting.

The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills that led the Nominating and Corporate Governance Committee to believe that each director or nominee should serve on the Board. There are no family relationships among any of our executive officers or directors.

Nominees | Age(1) | Term Expires | Position(s) Held | Director Since | ||||||||||||

Patrick Baeuerle, Ph.D. | 62 | 2020 | Director | 2015 | ||||||||||||

Mark Chin | 38 | 2020 | Director | 2017 | ||||||||||||

Andrew Robbins | 44 | 2020 | Director | 2020 | ||||||||||||

| (1) | As of April 9, 2020 |

Class I Directors—Nominees for Election at the Annual Meeting

Patrick Baeuerle, Ph.D. co-founded our company and has served as a member of our Board since our inception in 2015. Dr. Baeuerle has been an executive partner of MPM Capital, an early-stage life-sciences venture investing firm, since April 2015. He has alsoco-founded numerous MPM capital portfolio companies such as iOmx Therapeutics, Maverick Therapeutics, Cullinan Oncology, Werewolf Therapeutics, and TCR2Therapeutics (Nasdaq: TCRR). Prior to MPM, Dr. Baeuerle served as Vice President of Research, and the General Manager at Amgen Research Munich GmbH, a biopharmaceutical company, from March 2012 to March 2015, where he oversaw the development of T cell engaging BiTE antibody Blincyto (blinatumomab), which was approved by the FDA for therapy of relapsed and refractory acute lymphoblastic leukemia. Prior to that, Dr. Baeuerle served as Chief Scientific Officer for Micromet, Inc., a biotechnology company, from October 1998 through its acquisition by Amgen in 2012. Dr. Baeuerle has served as a professor and the Chairman of Biochemistry at Freiburg University in Germany and is an honorary professor of immunology of the Medical Faculty at Munich University. Dr. Baeuerle serves on the board of directors for TCR2 Therapeutics, a biotechnology company. Dr. Baeuerle holds a B.S. from the University of Konstanz, Germany, and an M.S. and a Ph.D. in Biology from the University of Munich, and conducted post-doctoral research at the Whitehead Institute at the Massachusetts Institute of Technology. Our Board believes that Dr. Baeuerle’s perspective and experience asour co-founder, his scientific and professional expertise and his educational background provide him with the qualifications and skills to serve on our Board.

8

Mark Chin has served as a member of our Board since May 2017. Mr. Chin currently serves as a member of the Board of Directors of public companies Imara Inc. (Nasdaq: IMRA) and Iterum Therapeutics (Nasdaq: ITRM). Mr. Chin served as an investment director at Arix Bioscience, a biotechnology-focused venture capital firm, from July 2016 to April 2020. Prior to Arix Bioscience, he was a principal at Longitude Capital, a healthcare venture capital firm, from January 2012 to August 2018, where he focused on investments in both private and public biotechnology and medical technology companies. Prior to Longitude Capital, Mr. Chin was a consultant at the Boston Consulting Group, a global management consulting firm, from January 2011 to January 2012, where he managed strategy and corporate development projects for pharmaceutical and biotechnology companies, and prior to Boston Consulting Group, he worked in corporate development at Gilead Sciences, a biotechnology company, and in market planning at Genentech, a biotechnology company. Mr. Chin holds a B.S. in Management Science from the University of California at San Diego, an M.S. in Biotechnology from the University of Pennsylvania and an M.B.A. from The Wharton School at the University of Pennsylvania. Our Board believes that Mr. Chin’s expertise and experience in the life sciences industry, experience as a director of other companies in our industry and his educational background provide him with the qualifications and skills to serve on our Board.

Andrew Robbins has served as a member of our Board since March 2020. Mr. Robbins served as Chief Operating Officer at Array BioPharma Inc., a pharmaceutical company, from March 2015 through its acquisition by Pfizer Inc., a pharmaceutical company, in July 2019, after serving as its Senior Vice President, Commercial Operations from July 2012 to March 2015. From January 2007 to July 2012, Mr. Robbins held management positions at Hospira, Inc., a pharmaceutical and medical device company, including General Manager and Vice President of the U.S. Alternate Site business unit and Vice President of Corporate Development. Prior to Hospira, Mr. Robbins held commercial and leadership positions within Pfizer’s oncology unit. Mr. Robbins holds a B.A. from Swarthmore College and an M.B.A. from the Kellogg School of Management at Northwestern University. Our Board believes that Mr. Robbins’ expertise and experience in the life sciences industry provide him with the qualifications and skills to serve on our Board.

Directors are elected by a plurality of the votes of the holders of shares present or represented by proxy and entitled to vote at the Annual Meeting on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. You may not vote your shares cumulatively for the election of directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by our Board. The Board has no reason to believe that any of the nominees would prove unable to serve if elected. There are no arrangements or understandings between us and any director, or nominee for directorship, pursuant to which such person was selected as a director or nominee.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NAMED DIRECTOR NOMINEES.

9

Information About Our Continuing Directors

Set forth below are the names, ages and length of service of the remaining members of our Board whose terms continue beyond the Annual Meeting.

| Continuing Directors | Age(1) | Term Expires | Position(s) Held | Director Since | ||||||||||

Gerald McMahon, Ph.D. | 65 | 2022 | President, Chief Executive Officer and Director | 2016 | ||||||||||

Ron Hunt | 55 | 2021 | Chairman of our Board of Directors | 2017 | ||||||||||

Joseph Bailes, M.D. | 63 | 2021 | Director | 2020 | ||||||||||

Jonathan Drachman, M.D. | 58 | 2021 | Director | 2018 | ||||||||||

Julie Eastland | 56 | 2022 | Director | 2018 | ||||||||||

Luke Evnin, Ph.D. | 56 | 2021 | Director | 2015 | ||||||||||

Scott Myers | 53 | 2022 | Director | 2018 | ||||||||||

| (1) | As of April 9, 2020 |

The principal occupation, business experience and education of each continuing director are set forth below. Unless otherwise indicated, principal occupations shown for each director have extended for five or more years.

Class II Directors—Continuing in Office until the 2021 Annual Meeting of Stockholders

Joseph Bailes, M.D. has served as a member of our Board since March 2020. Dr. Bailes is a medical oncologist with experience in clinical practice, legislation, public policy and advocacy and has served as an industry consultant for the past decade. Industry companies with which Dr. Bailes has consulted include Kite Pharma, Inc. (a subsidiary of Gilead Sciences, Inc.), Eli Lilly and Company, G1 Therapeutics, Inc., and Telik, Inc. In addition, Dr. Bailes previously served in various executive leadership roles at the American Society of Clinical Oncology (ASCO) until 2010, including as President, Interim Executive Vice President, Chief Executive Officer, Chair of the Clinical Research Committee and Chair of the Government Relations Council. In addition, Dr. Bailes has many years of oncology practice experience in private sector as a former partner at Texas Oncology, P.A., an oncology practice group, and as a founding member of, and the President of Research overseeing clinical trials and drug development activities at Physician Reliance Network, LLC, a health care company and corporate predecessor of US Oncology, Inc., where he then served as Executive Vice President of Clinical Affairs. Dr. Bailes holds a B.A. from the University of Texas at Austin and an M.D. from the University of Texas Southwestern Medical School, Dallas. Dr. Bailes completed his internship and residency at the Parkland Memorial Hospital in Dallas and his Medical Oncology/Hematology Fellowship at the University of Texas Health Science Center in San Antonio, where he also served as a Clinical Assistant Professor. Our Board believes that Dr. Bailes’ medical expertise and experience in the biopharmaceutical industry provide him with the qualifications and skills to serve on our Board.

Jonathan Drachman, M.D. has served as a member of our Board since September 2018. Since January 2019, Dr. Drachman has been CEO and President of Neoleukin Therapeutics, Inc., a biotechnology company using computational algorithms to design de novo proteins for the treatment of cancer, inflammation and autoimmune diseases. Previously, Dr. Drachman served as the Chief Medical Officer and Executive Vice President, Research and Development of Seattle Genetics, a biotechnology company, from October 2013 until May 2018, after serving as their Senior Vice President, Research and Translational Medicine and various other positions of increasing authority since November 2004. Prior to Seattle Genetics, Dr. Drachman was Associate Professor in the Hematology Division, Department of Medicine at the University of Washington in Seattle, where he remains a Clinical Professor of Medicine. He also served as Senior Investigator in the Division of Research and Education and Medical Director of the Umbilical Cord Blood Program at the Puget Sound Blood Center. Dr. Drachman currently serves on the boards of two public companies: Calithera Biosciences, Inc. (Nasdaq: CALA) and Neoleukin Therapeutics, Inc. (Nasdaq: NLTX). Dr. Drachman holds a B.A. in Biochemistry from Harvard University and an M.D. from Harvard Medical School. He completed his residency in Internal Medicine

10

and fellowship in Medical Oncology at the University of Washington School of Medicine. Our Board believes that Dr. Drachman’s scientific and professional expertise and his educational background provide him with the qualifications and skills to serve on our Board.

Luke Evnin, Ph.D. co-founded our company and has served as a member of our Board since our inception in 2015, including as the Chairman of our Board from our inception through April 2020. From October 2017 to August 2019, Dr. Evnin served as the interim Chief Executive Officer of Werewolf. Priorto co-founding our company,Dr. Evnin co-founded MPM Capital, an early-stage life sciences venture investing firm, in 1997, where he is currently a Managing Director. Prior to MPM Capital, Dr. Evnin spent seven years as a venture capitalist at Accel Partners, a venture capital firm, including four years as general partner, where he focused on emerging healthcare companies. Dr. Evnin has previously served on the board of the companies Syndax Pharmaceuticals, Inc. (Nasdaq: SNDX), Enteromedics Inc, Epix Medical, Inc., Intercell AG, Metabasis Therapeutics, Inc. (acquired by Ligand Pharmaceuticals, Inc.), Oscient Pharmaceuticals Corp., Pacira Pharmaceuticals, Inc. (Nasdaq: PCRX), Restore Medical, Inc. (acquired by Medtronic, Inc.), Sonic Innovations, Inc. and Signal Pharmaceuticals, Inc. (acquired by Celgene Corporation). He also serves on a number of private company boards, including as the Chairman of the Board of Directors of Werewolf Therapeutics and Tizona Therapeutics, and of the Scleroderma Research Foundation, anot-for-profit organization. Dr. Evnin holds an A.B. in molecular biology from Princeton University and a Ph.D. in Biochemistry from the University of California, San Francisco. Our Board believes that Dr. Evnin’s perspective and experience asour co-founder, his depth and expertise in the life sciences and venture capital industries, and his educational background provide him with the qualifications and skills to serve on our Board.

Ron Hunt has served as the Chairman of our Board since April 2020 and as a member of our Board since May 2017.Mr. Hunt co-founded and has served as a Managing Director of New Leaf Venture Partners, a venture capital fund focused on biopharmaceuticals and other healthcare technologies, since 2005. From 1998 to 2005, Mr. Hunt was a venture capital investor and became a partner at the Sprout Group, an institutional venture capital firm. Prior to Sprout, Mr. Hunt was a consultant with The Health Care Group (a division of the Interpublic Group), a strategy consulting firm and a consultant within the pharmaceutical industry practice at Coopers & Lybrand Consulting, a consulting firm. Prior to these consulting positions, Mr. Hunt held a number of roles in the sales and marketing divisions of Johnson & Johnson and SmithKline Beecham Pharmaceuticals, both pharmaceutical companies. Mr. Hunt currently serves on the board of public company Iterum Therapeutics (Nasdaq: ITRM) and has previously served as a director for Relypsa, Inc. (Nasdaq: RLYP), Neuronetics, Inc. (Nasdaq: STIM) and Durata Therapeutics, Inc. (Nasdaq: DRTX). Mr. Hunt holds a B.S. from Cornell University and an M.B.A. from The Wharton School at the University of Pennsylvania. Our Board believes that Mr. Hunt’s expertise and experience in the venture capital and pharmaceutical industry, and his educational background provide him with the qualifications and skills to serve on our Board.

Class III Directors – Continuing in Office until the 2022 Annual Meeting of Stockholders

Julie Eastland has served as a member of our Board since October 2018. Since January 2020, Ms. Eastland has served as a consultant to Rainier Therapeutics, Inc., an oncology biotechnology company, after serving as its Chief Financial and Business Officer from August 2018 to January 2020. Prior to Rainier Therapeutics, Ms. Eastland served as Chief Business Officer and Chief Financial Officer for Cascadian Therapeutics, Inc., a biotechnology company, from September 2010 through its acquisition by Seattle Genetics in March 2018. Prior to Cascadian, Ms. Eastland served as the Chief Financial Officer and Vice President of Finance and Administration for VLST Corporation, a biotechnology company, from January 2006 to September 2010. Prior to VLST Corporation, Ms. Eastland was the Vice President of Strategic Planning at Dendreon Corporation, a biotechnology company, from October 2000 to October 2005. Prior to Dendreon, Ms. Eastland was the Controller at Amgen, a biopharmaceutical company, from March 1996 to April 1998. Ms. Eastland serves on the Board of Directors of theTSX-listed company Pascal Biosciences Inc. (TSX: PAS). Ms. Eastland holds a B.S. in

11

Finance from Colorado State University and an M.B.A. from Heriot-Watt University of the Edinburgh University in Scotland. Our Board believes that Ms. Eastland’s extensive professional experience and expertise provide her with the qualifications and skills to serve on our Board.

Gerald McMahon, Ph.D. has served as our President, Chief Executive Officer and a member of our Board since December 2016. From May 2012 to its acquisition by Celldex Therapeutics, Inc. in November 2016, Dr. McMahon was the President and Chief Executive Officer of Kolltan Pharmaceuticals, Inc., an oncology biologics company where he played a key role in the development of the business. From October 2010 to May 2012, he served as Senior Vice President of Oncology at MedImmune LLC, a subsidiary of AstraZeneca. Prior to MedImmune, he served as the Chairman and Chief Executive Officer of NeoRx Corporation, a pharmaceutical company, and as a venture partner at Bay City Capital, a venture capital firm, and in executive leadership roles at Poniard Pharmaceuticals and SUGEN (acquired by Pfizer), both biopharmaceutical companies, where he was a key player in the development and commercialization of innovative oncology drugs. Dr. McMahon earned a B.S. in Biology and a Ph.D. in Biochemistry from the Rensselaer Polytechnic Institute. He holds an academic appointment at the Yale Comprehensive Cancer Center at Yale University, and previously held post-graduate appointments at Tufts University School of Medicine, department of hematology and oncology at the New England Medical Center, and the Massachusetts Institute of Technology. Our Board believes that Dr. McMahon’s expertise and experience as our President and Chief Executive Officer, his depth and expertise in the life sciences industry, his experience in leadership, scientific innovation and creative deal-making and his educational background provide him with the qualifications and skills to serve on our Board.

Scott Myers has served as a member of our Board since August 2018. Mr. Myers has served as Chairman of the board of directors of Rainier Therapeutics, Inc., a private oncology biotechnology company since June 2018, and served as Chief Executive Officer from September 2018 to December 2019. Prior to Rainier, Mr. Myers served as Chief Executive Officer, President and Director for Cascadian Therapeutics, Inc., an oncology company, from April 2016 through its acquisition by Seattle Genetics in March 2018. Prior to Cascadian, Mr. Myers served as the Chief Executive Officer of Aerocrine AB, a Swedish medical device company from September 2011 through its acquisition by Circassia Pharmaceuticals plc in July 2015. Mr. Myers also serves on the Board of Directors of Selecta Biosciences (Nasdaq: SELB), a clinical-stage biotechnology company. Mr. Myers served as a director for Orexo AB, a pharmaceutical company, from April 2012 to April 2014. Mr. Myers holds a B.A. in Biology from Northwestern University and an M.B.A. from the Graduate School of Business at the University of Chicago. Our Board believes that Mr. Myers’ experience in the biotechnology industry and his extensive experience in the leadership of both commercial and development stage biopharmaceutical companies provide him with the qualifications and skills to serve on our Board.

12

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

As required under The Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board must qualify as “independent,” as affirmatively determined by the Board. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, our Board has affirmatively determined that all of our directors, except Dr. McMahon, by virtue of his position as President and Chief Executive Officer, and Dr. Baeuerle, by virtue of his consulting agreement with the Company, are independent directors within the meaning of the applicable Nasdaq listing standards. In making these determinations, our Board has determined, upon the recommendation of our Nominating and Corporate Governance Committee, that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. The Board also determined that each member of our Audit, Compensation and Nominating and Corporate Governance Committees satisfies the independence standards for such committees established by the SEC and the Nasdaq listing standards, as applicable.

Leadership Structure and Risk Oversight

The Board has an independent chair, Mr. Hunt, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chair has substantial ability to shape the work of the Board. The Company believes that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, the Company believes that having an independent Board Chair can enhance the effectiveness of the Board as a whole.

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss with management and the auditors, as appropriate, the Company’s guidelines and policies with respect to financial risk management and financial risk assessment, including the Company’s major financial risk exposures and the steps taken by management to monitor and control these exposures. In addition, the Audit Committee considers management risks relating to data privacy, technology and information security, including cyber security, andback-up of information systems and the steps the Company has taken to monitor and control such exposures as well as overseeing the performance of our internal audit function, as applicable. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, including risks related to executive compensation and overall compensation and benefit strategies, plans, arrangements, practices and policies. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. The Nominating and Corporate Governance Committee also oversees and reviews with management the Company’s major legal compliance risk exposures and the steps management has taken to monitor or mitigate

13

such exposures, including the Company’s procedures and any related policies with respect to risk assessment and risk management. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. In connection with its reviews of the operations and corporate functions of the Company, our Board addresses the primary risks associated with those operations and corporate functions. In addition, our Board reviews the risks associated with our company’s business strategies periodically throughout the year as part of its consideration of undertaking any such business strategies. While the Board and its committees oversee risk management strategy, management is responsible for implementing and supervisingday-to-day risk management processes and reporting to the Board and its committees on such matters.

Our Board held seven meetings during the fiscal year ended December 31, 2019. Each of the incumbent directors attended at least 75% of the total of the meetings of the Board and the meetings of the committees of the Board on which he served during the fiscal year ended December 31, 2019 (in each case, which were held during the period for which he was a director and/or a member of the applicable committee). It is our policy to encourage our directors to attend the Annual Meeting. We anticipate that a majority of the members of the Board will attend the Annual Meeting.

As required under applicable Nasdaq listing standards, in fiscal 2019, the Company’s independent,non-employee directors met two times in regularly scheduled executive sessions at which only independent directors were present.

Our Board has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The following table provides current membership information and the total number of meetings held during the year ended December 31, 2019 for each committee. Our committees were reconstituted in April 2020 to remove Mr. Chin from the Audit, Compensation and Nominating and Corporate Governance Committees, add Mr. Robbins to the Audit Committee and Compensation Committee and add Dr. Bailes to the Nominating and Corporate Governance Committee.

Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||

Joseph Bailes, M.D. | X | |||||

Jonathan Drachman, M.D. | X | |||||

Julie Eastland† | X* | X | ||||

Luke Evnin, Ph.D. | X | |||||

Ron Hunt | X* | |||||

Scott Myers† | X | X | X* | |||

Andrew Robbins† | X | X | ||||

|

|

| ||||

Total meetings held in 2019 | 4 | 4 | 0 |

| † | Audit Committee Financial Expert |

| * | Committee Chair |

Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company. Each of the committees operates pursuant to a written charter and each committee reviews and assesses the adequacy of its charter and submits its charter to the Board for

14

approval. The charters are all available in the “Investors/News–Corporate Governance” section of our website, www.harpoontx.com. The inclusion of our website address here and elsewhere in this proxy statement does not include or incorporate by reference the information on our website into this proxy statement.

Audit Committee

The Audit Committee of the Board was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee our corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions, including, among other things:

| • | evaluating the performance of and assessing the qualifications of the auditors; |

| • | determining whether to retain or terminate the engagement of the existing auditors or to appoint and engage new auditors; |

| • | determining and approving the engagement of the auditors; |

| • | determining and approving the engagement of the auditors to perform any proposed permissiblenon-audit services; |

| • | monitoring the rotation of partners of the auditors on the Company’s audit engagement team as required by applicable laws and rules; |

| • | assessing, at least annually, and taking appropriate action to oversee the independence of the auditors; |

| • | conferring with management and the auditors, as appropriate, regarding the scope, adequacy and effectiveness of internal control over financial reporting and disclosure controls and procedures; |

| • | establishing procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and |

| • | reviewing the Company’s annual audited financial statements, quarterly financial statements and disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s filings to be filed with the SEC with management and the auditors, as appropriate. |

Messrs. Myers and Robbins and Ms. Eastland serve as the current members of the Audit Committee, with Ms. Eastland serving as Chair of the committee. The Board also determined that Ms. Eastland and Messrs. Myers and Robbins are each an “audit committee financial expert” within the meaning of the SEC regulations and applicable listing standards of Nasdaq. Our Board has determined that each of the members of our Audit Committee satisfies the independence requirements under the listing standards of Nasdaq andRule 10A-3(b)(1) of the Exchange Act. The Audit Committee met four times during the fiscal year ended December 31, 2019.

Report of the Audit Committee of the Board of Directors*

The material in this report is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2019 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the

15

Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form10-K for the fiscal year ended December 31, 2019.

Harpoon Therapeutics, Inc.

Audit Committee

Julie Eastland, Chair

Mark Chin

Scott Myers

| * | This Audit Committee Report was approved by the Audit Committee on March 3, 2020 in connection with the Company’s Annual Report on Form10-K filed with the SEC on March 12, 2020, prior to when Andrew Robbins was appointed to the Company’s Board of Directors on March 28, 2020 and then appointed to the Audit Committee on April 14, 2020. |

Compensation Committee

The primary purpose of our Compensation Committee is to discharge the responsibilities of our Board in overseeing our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate. Specific responsibilities of our Compensation Committee include:

| • | determining the compensation and other terms of employment of our chief executive officer and our other executive officers and reviewing and approving corporate performance goals and objectives relevant to such compensation; |

| • | reviewing and recommending to our full Board the compensation of the members of our Board; |

| • | evaluating and administering the equity incentive plans, compensation plans and similar programs advisable for us, as well as reviewing and recommending to our Board the adoption, modification or termination of our plans and programs; |

| • | establishing policies with respect to equity compensation arrangements; |

| • | reviewing with management our disclosures under the caption “Compensation Discussion and Analysis” and recommending that our full Board its inclusion in our periodic reports to be filed with the SEC; and |

| • | reviewing and evaluating, at least annually, the performance of our Compensation Committee and the adequacy of its charter. |

Messrs. Hunt and Robbins and Dr. Evnin serve as the current members of the Compensation Committee, with Mr. Hunt serving as Chair of the committee. Our Board has determined that each of the members of our Compensation Committee is independent under the listing standards of Nasdaq anda “non-employee director” as defined inRule 16b-3 under the Exchange Act. The Compensation Committee met 4 times during the fiscal year ended December 31, 2019.

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with

16

our Chief Executive Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisers or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company. In addition, under the charter, the Compensation Committee has the authority to obtain, at our expense, advice and assistance from compensation consultants and internal and external legal, accounting or other advisers and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Compensation Committee. In particular, the Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, otherthan in-house legal counsel and certain other types of advisers, only after assessing the independence of such person in accordance with SEC and Nasdaq requirements that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

During the past fiscal year, after taking into consideration the six factors prescribed by the SEC and Nasdaq, the Compensation Committee engaged Compensia, Inc. (the “Consultant”), a compensation consulting firm, as a compensation consultant. The Compensation Committee has assessed the Consultant’s independence and determined that the Consultant had no conflicts of interest in connection with its provisions of services to the Compensation Committee. Specifically, the Compensation Committee engaged the Consultant to provide market data, peer group analysis and conduct an executive compensation assessment analyzing the current cash and equity compensation of our executive officers and directors against compensation for similarly situated executives at our peer group. Our management did not have the ability to direct the Consultant’s work.

Historically, our Compensation Committee has made most of the significant adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the first quarter of the year. However, our Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, our Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. For all executives and directors as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels, including analyses of executive and director compensation paid at a peer group of other companies approved by our Compensation Committee.

Nominating and Corporate Governance Committee

Specific responsibilities of our Nominating and Corporate Governance Committee include:

| • | reviewing periodically and evaluating director performance on our Board and its applicable committees, and recommending to our Board and management areas for improvement; |

17

| • | interviewing, evaluating, nominating and recommending individuals for membership on our Board; |

| • | reviewing and recommending to our Board any amendments to our corporate governance policies; and |

| • | reviewing and assessing, at least annually, the performance of our Nominating and Corporate Governance Committee and the adequacy of its charter. |

Mr. Myers, Drs. Bailes and Drachman and Ms. Eastland serve as the current members of the Nominating and Corporate Governance Committee, with Mr. Myers serving as Chair of the Committee. Our Board has determined that each member of our Nominating and Corporate Governance committee is independent under the applicable listing standards of Nasdaq. The Nominating and Corporate Governance Committee did not meet during the fiscal year ended December 31, 2019.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, understand the Company’s industry and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time, subject to Board approval. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Committee will take into account the results of the Board’s self-evaluation, conducted annually on a group and individual basis. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. Generally, our Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with management, using search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as the Nominating and Corporate Governance Committee deems to be helpful to identify candidates. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. The Nominating and Corporate Governance Committee may gather information about the candidates through interviews, questionnaires, background checks or any other means that the Nominating and Corporate Governance Committee deems to be appropriate in the evaluation process. We have no formal policy regarding board diversity. Our Nominating and Corporate Governance Committee’s priority in selecting board members is identification of persons who will further the interests of our company through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, and professional and personal experiences and expertise relevant to our growth strategy.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the

18

candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by providing timely notice in writing to our Secretary at c/o Harpoon Therapeutics, Inc., 131 Oyster Point Boulevard, Suite 300, South San Francisco, California 94080. To be timely, we must receive the notice not less than 90 days nor more than 120 days prior to the anniversary of the prior year’s annual meeting of stockholders; provided, however, that in the event that no annual meetings what held during the preceding year or the date of the annual meeting is more than 30 days before or more than 30 days after such anniversary date, we must receive the stockholder’s notice (i) no earlier than the close of business on the 120th day prior to the proposed date of the annual meeting and (ii) no later than the close of business on the later of the 90th day prior to the annual meeting or the 10th day following the day on which we first make a public announcement of the date of the annual meeting. Submissions must include the specific information required in Section 5 of our Bylaws. For additional information about our director nomination requirements, please see our Bylaws.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all employees, officers and directors, including our principal executive officer, principal financial officer and principal accounting officer or controller, or persons performing similar functions. The Code of Business Conduct and Ethics is available in the “Investors/Corporate Governance” section of our website, www.harpoontx.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website. The reference to our website does not constitute incorporation by reference of the information contained at or available through our website.

Corporate Governance Guidelines