Registration No. 333- 239759

(To Prospectus dated July 8, 2020)

| • | the timing, progress and results of clinical trials of IFX-1 and any other product candidates, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available, the costs of such trials and our research and development programs generally; |

| • | the timing and outcome of any discussions or submission of filings for regulatory approval of IFX-1 or any other product candidate, and the timing of and our ability to obtain and maintain regulatory approval of IFX-1 for any indication; |

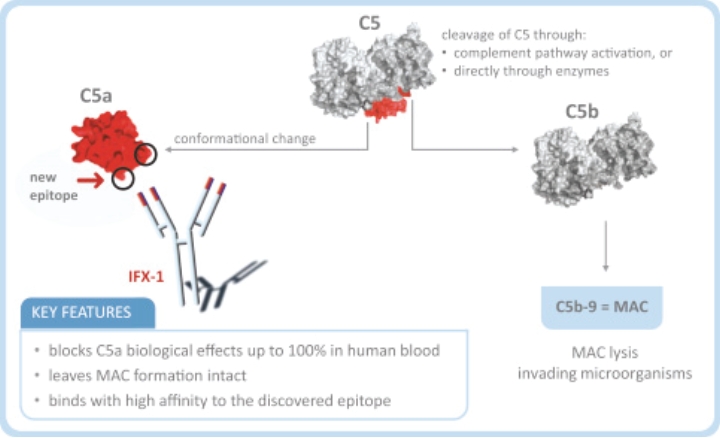

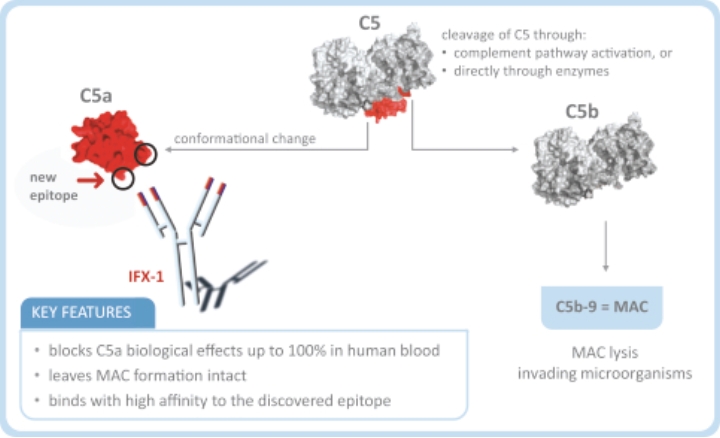

| • | our ability to leverage our proprietary anti-C5a technology to discover and develop therapies to treat complement-mediated autoimmune and inflammatory diseases; |

| • | our ability to protect, maintain and enforce our intellectual property protection for IFX-1 and any other product candidates, and the scope of such protection; |

| • | whether the Food and Drug Administration, European Medicines Agency or comparable foreign regulatory authority will accept or agree with the number, design, size, conduct or implementation of our clinical trials, including any proposed primary or secondary endpoints for such trials; |

| • | the success of our future clinical trials for IFX-1 and any other product candidates and whether such clinical results will reflect results seen in previously conducted preclinical studies and clinical trials; |

| • | our expectations regarding the size of the patient populations for, market opportunity for and clinical utility of IFX-1 or any other product candidates, if approved for commercial use; |

| • | our manufacturing capabilities and strategy, including the scalability and cost of our manufacturing methods and processes and the optimization of our manufacturing methods and processes, and our ability to continue to rely on our existing third-party manufacturers for our planned future clinical trials; |

| • | our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing; |

| • | our expectations regarding the scope of any approved indication for IFX-1; |

| • | our ability to defend against costly and damaging liability claims resulting from the testing of our product candidates in the clinic or, if, approved, any commercial sales; |

| • | our ability to commercialize IFX-1 or our other product candidates; |

| • | if any of our product candidates obtain regulatory approval, our ability to comply with and satisfy ongoing obligations and continued regulatory overview; |

| • | our ability to comply with enacted and future legislation in seeking marketing approval and commercialization; |

| • | our future growth and ability to compete, which depends on our retaining key personnel and recruiting additional qualified personnel; |

| • | our competitive position and the development of and projections relating to our competitors in the development of C5a inhibitors or our industry; |

| • | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act or a foreign private issuer; |

| • | the recent outbreak of the COVID-19, which may cause business disruptions and could adversely impact our business, including our supply chain, clinical trials and commercialization of our product candidates; and |

| • | other risk factors discussed herein under “Risk Factors” or incorporated herein by reference. |

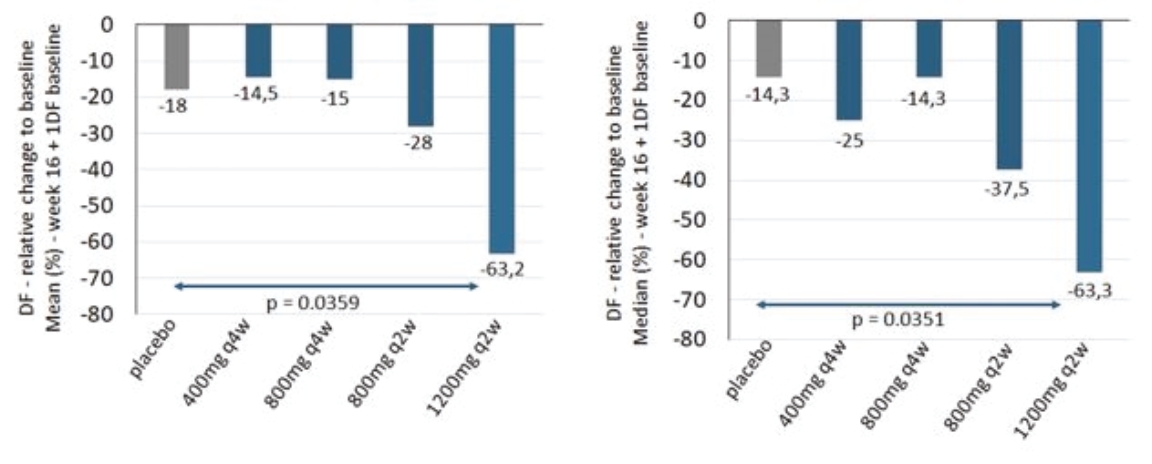

| | IFX-1 | | | Placebo | | |||||||||

| | Minimal dose | | | Low dose | | | Medium dose | | | High dose | | | | |

| | 400mg every 4 weeks (Q4W) | | | 800mg every 4 weeks (Q4W) | | | 800mg every 2 weeks (Q2W) | | | 1200mg every 2 weeks (Q2W) | | | placebo Q2W | |

| | 40.0% | | | 51.5% | | | 38.7% | | | 45.5% | | | 47.1% | |

| • | 70.6% of the responder group maintained their HiSCR response during the OLE, and |

| • | 41.8% of the non-responder group became responders at week 40. |

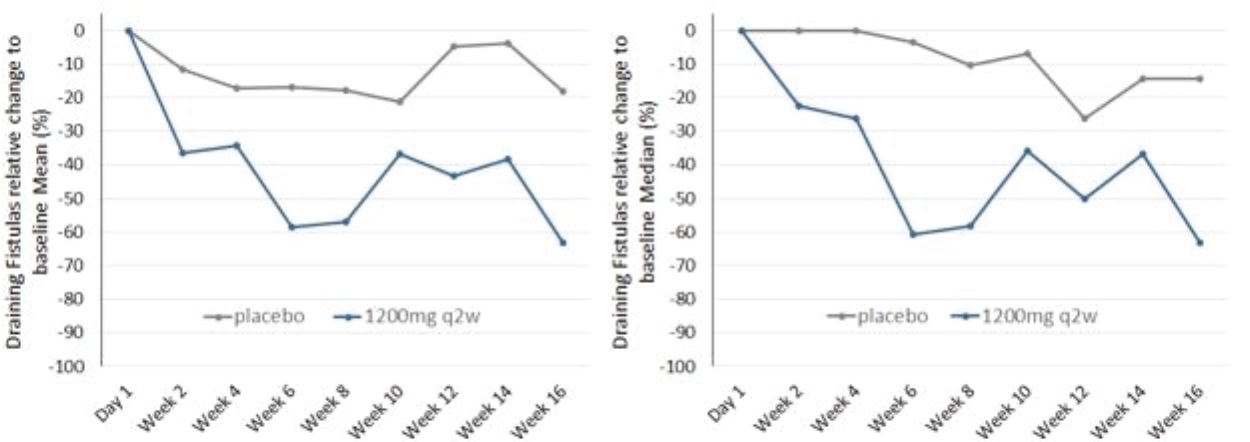

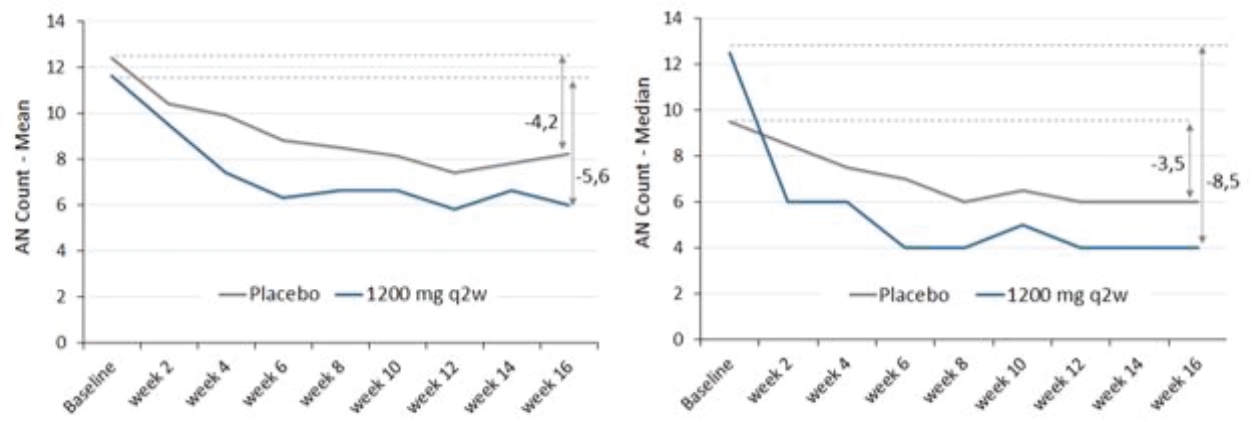

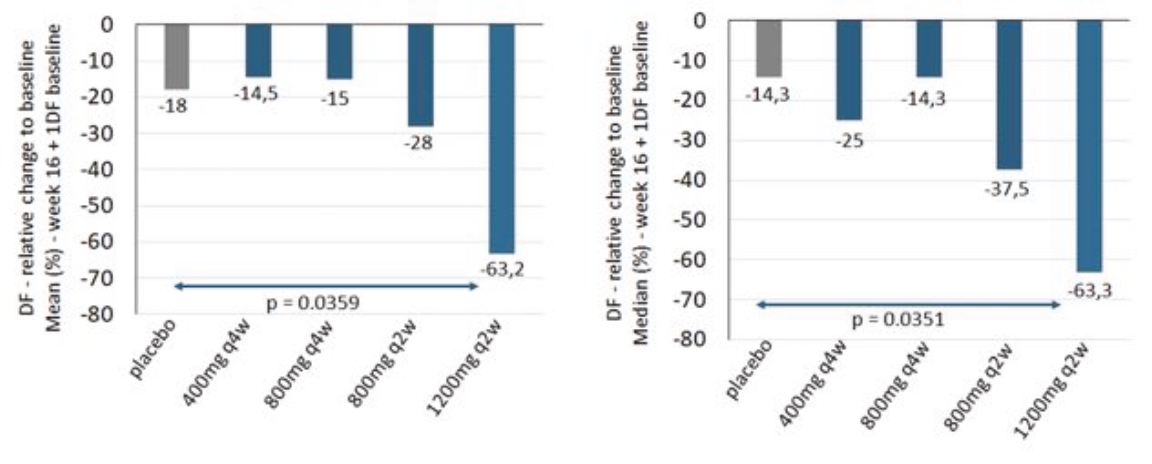

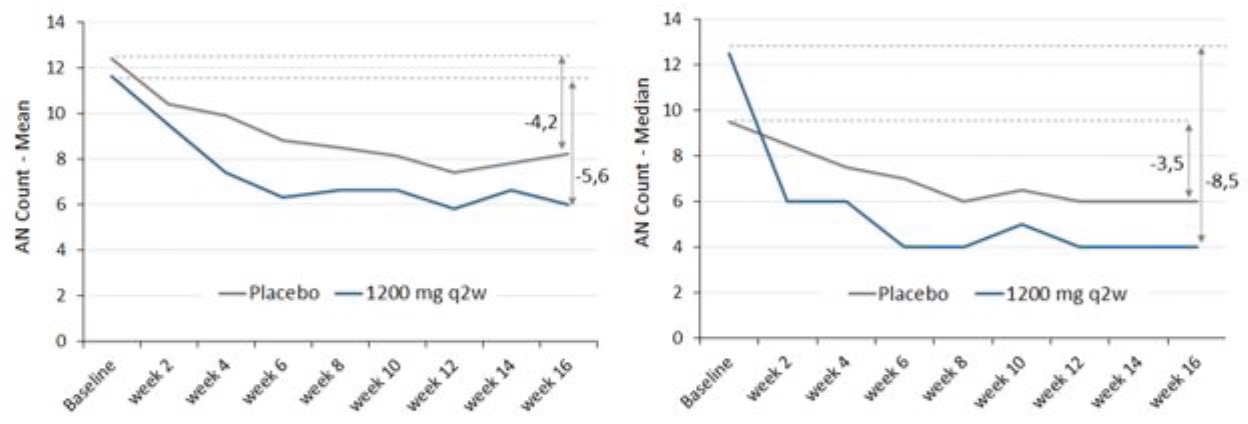

| • | AN count of -66.9% (mean) and -75.0% (median), and |

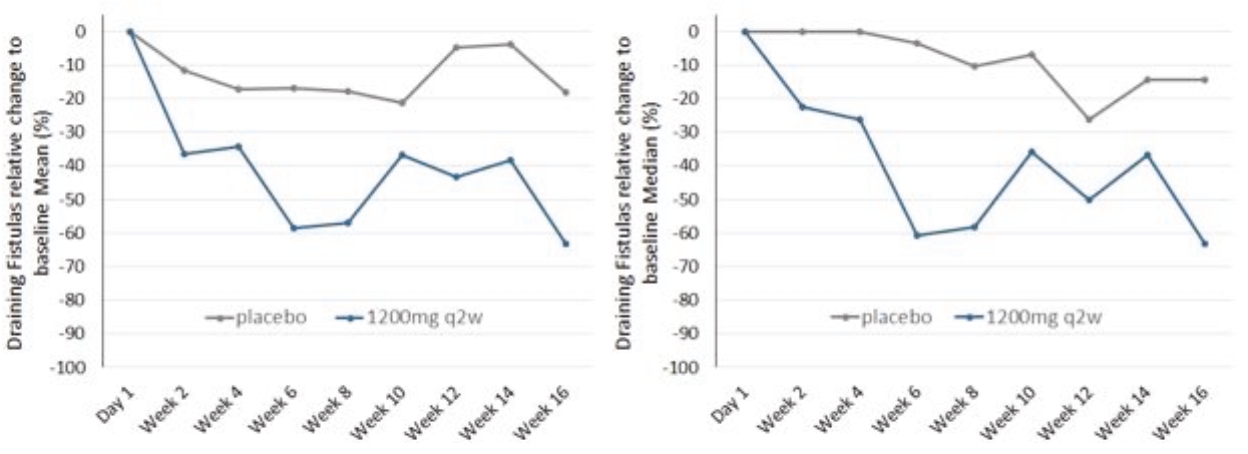

| • | draining fistula of -46.0% (mean) and -51.5% (median) |

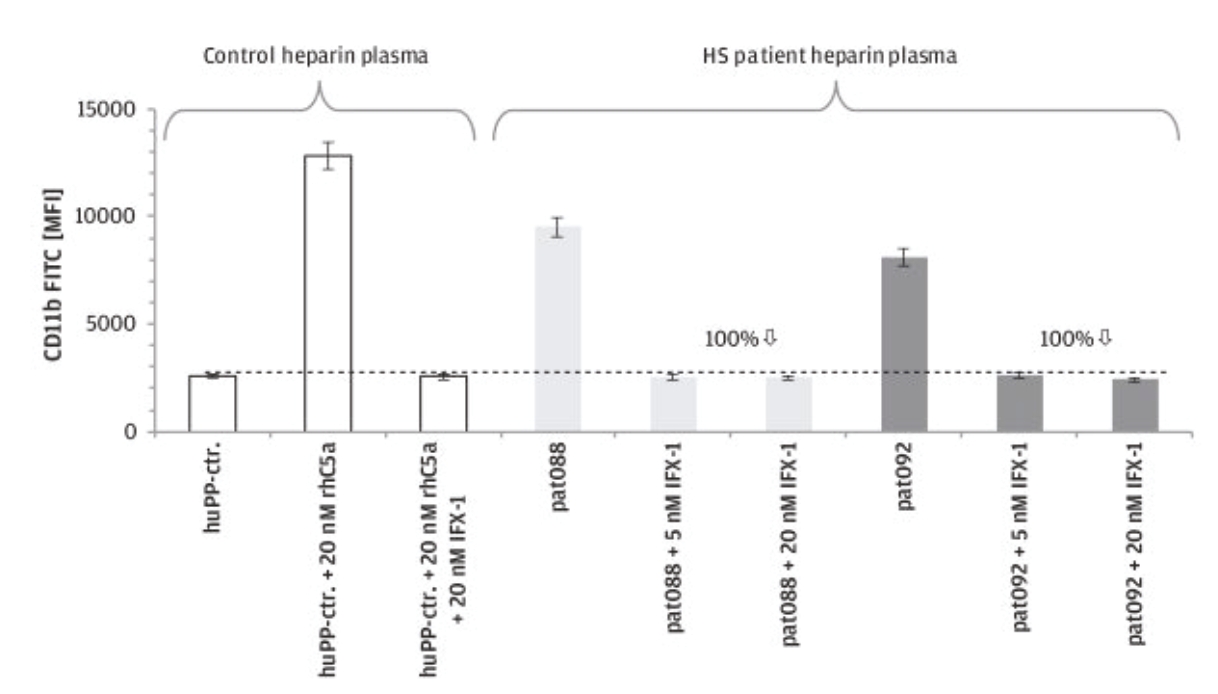

| • | Rapid onset of action: IFX-1 has fast onset of action such that after its intravenous administration, IFX-1 inhibits C5a-induced signaling completely, providing immediate protection from C5a induced priming and activation of neutrophils in this disease. This may result in a faster response rate and a potentially quicker induction of remission when compared to the currently available treatment options. |

| • | Potential potency advantages (over receptor inhibition): IFX-1 blocks the upstream ligand C5a, which inhibits signaling through both receptors, C5aR and C5L2; C5a pro-inflammatory MoA through both C5aR and C5L2 has been shown to be important for ANCA-primed and C5a-induced neutrophil degranulation as key disease-driving mechanism in AAV (published by Hao and Wang et al 2013, PloS ONE). |

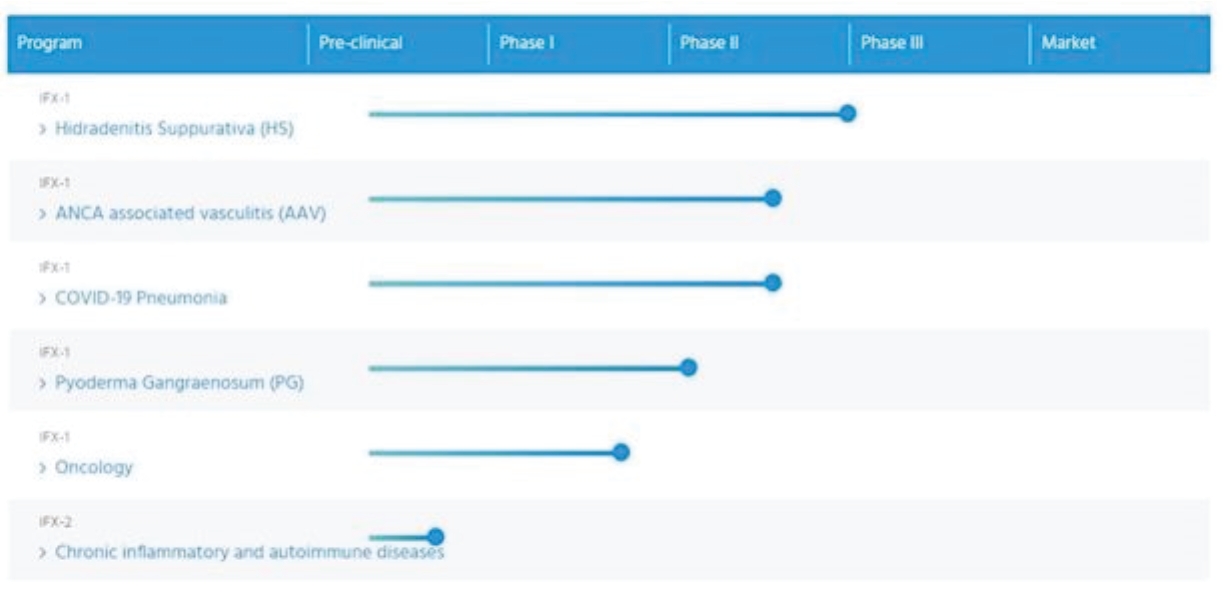

| • | advance our lead program IFX-1 for HS; |

| • | complete Phase II clinical development of IFX-1 for AAV, PG, oncological diseases and COVID-19-induced severe pneumonia and other complement-mediated autoimmune and inflammatory diseases; |

| • | pursue the clinical development of IFX-2 and continue to expand the breadth of our anti-C5a technology; |

| • | commercialize IFX-1, if approved, either independently or in collaboration with a partner; and |

| • | solidify our leadership position in the anti-C5a space by leveraging the full potential of our proprietary anti-C5a technology and expertise in complement and inflammation. |

| • | inclusion of only three years of audited financial statements with correspondingly reduced “Management’s discussion and analysis of financial condition and results of operations” disclosure in this prospectus; |

| • | an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| • | reduced disclosure about our executive compensation arrangements in our periodic reports and registration statements; and |

| • | exemptions from the requirements of holding non-binding advisory votes on executive compensation and golden parachute arrangements. |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Assumed public offering price per share | | | $5.47 |

Net tangible book value per share as of March 31, 2020 | | | $4.24 |

Increase per share attributable to new investors purchasing shares in this offering | | | $0.26 |

As adjusted net tangible book value per share after giving effect to this offering | | | $4.51 |

Dilution per share to new investors | | | $0.96 |

| • | 3,511,022 common shares issuable upon the exercise of options outstanding as of March 31, 2020, at a weighted-average exercise price of $3.27 per common share (€2.98 per common share); and |

| • | 159,992 common shares covered by awards available for issuance under our equity incentive plan as of March 31, 2020. |

| • | holders of our common shares if such holders, and in the case of individuals, such holder’s partner or certain of its relatives by blood or marriage in the direct line (including foster children), have a substantial interest (aanmerkelijk belang) or deemed substantial interest (fictief aanmerkelijk belang) in us under the Dutch Income Tax Act 2001 (Wet inkomstenbelasting 2001). Generally speaking, a holder of securities in a company is considered to hold a substantial interest in such company, if such holder alone or, in the case of individuals, together with such holder’s partner (as defined in the Dutch Income Tax Act 2001), directly or indirectly, holds (i) an interest of 5% or more of the total issued and outstanding capital of that company or of 5% or more of the issued and outstanding capital of a certain class of shares of that company; or (ii) rights to acquire, directly or indirectly, such interest; or (iii) certain profit sharing rights in that company that relate to 5% or more of the company’s annual profits or to 5% or more of the company’s liquidation proceeds. A deemed substantial interest may arise if a substantial interest (or part thereof) in a company has been disposed of, or is deemed to have been disposed of, on a non-recognition basis; |

| • | holders of our common shares, if the Shares held by such holders qualify or qualified as a participation (deelneming) for purposes of the Dutch Corporate Income Tax Act 1969 (Wet op de vennootschapsbelasting 1969). Generally, a holder's shareholding of 5% or more in a company's nominal paid-up share capital qualifies as a participation. A holder may also have a participation if such holder does not have a shareholding of 5% or more but a related entity (statutorily defined term) has a participation or if the company in which the shares are held is a related entity (statutorily defined term); |

| • | pension funds, investment institutions (fiscale beleggingsinstellingen), exempt investment institutions (vrijgestelde beleggingsinstellingen) (as defined in the Dutch Corporate Income Tax Act 1969) and other entities that are, in whole or in part, not subject to or exempt from Dutch corporate income tax as well as entities that are exempt from corporate income tax in their country of residence, such country of residence being another state of the European Union, Norway, Liechtenstein, Iceland or any other state with which the Netherlands has agreed to exchange information in line with international standards; and |

| • | holders of our common shares who are individuals for whom the common shares or any benefit derived from the common shares are a remuneration or deemed to be a remuneration for activities performed by such holders or certain individuals related to such holders (as defined in the Dutch Income Tax Act 2001). |

| • | distributions in cash or in kind, deemed and constructive distributions and repayments of paid-in capital not recognized for Dutch dividend withholding tax purposes; |

| • | liquidation proceeds, proceeds of redemption of common shares, or proceeds of the repurchase of common shares by us or one of our subsidiaries or other affiliated entities to the extent such proceeds exceed the average paid-in capital of those common shares as recognized for purposes of Dutch dividend withholding tax; |

| • | an amount equal to the par value of common shares issued or an increase of the par value of common shares, to the extent that it does not appear that a related contribution, recognized for purposes of Dutch dividend withholding tax, has been made or will be made; and |

| • | partial repayment of the paid-in capital, recognized for purposes of Dutch dividend withholding tax, if and to the extent that we have net profits (zuivere winst), unless (i) the general meeting has resolved in advance to make such repayment and (ii) the par value of the common shares concerned has been reduced by an equal amount by way of an amendment of our articles of association. |

| (i) | the common shares are attributable to an enterprise from which the holder of common shares derives a share of the profit, whether as an entrepreneur (ondernemer) or as a person who has a co-entitlement to the net worth (medegerechtigd tot het vermogen) of such enterprise without being a shareholder (as defined in the Dutch Income Tax Act 2001); or |

| (ii) | the holder of common shares is considered to perform activities with respect to the common shares that go beyond ordinary asset management (normaal, actief vermogensbeheer) or derives benefits from the common shares that are taxable as benefits from other activities (resultaat uit overige werkzaamheden). |

| (i) | such holder does not have an interest in an enterprise or deemed enterprise (as defined in the Dutch Income Tax Act 2001 and the Dutch Corporate Income Tax Act 1969) which, in whole or in part, is either effectively managed in the Netherlands or carried on through a permanent establishment, a deemed permanent establishment or a permanent representative in the Netherlands and to which enterprise or part of an enterprise the common shares are attributable; and |

| (ii) | in the event the holder is an individual, such holder does not carry out any activities in the Netherlands with respect to the common shares that go beyond ordinary asset management and does not derive benefits from the common shares that are taxable as benefits from other activities in the Netherlands. |

| (i) | in the case of a gift of common shares by an individual who at the date of the gift was neither resident nor deemed to be resident of the Netherlands, such individual dies within 180 days after the date of the gift, while being resident or deemed to be resident of the Netherlands; or |

| (ii) | the transfer is otherwise construed as a gift or inheritance made by, or on behalf of, a person who, at the time of the gift or death, is or is deemed to be resident of the Netherlands. |

| • | certain financial institutions; |

| • | dealers or traders in securities who use a mark-to-market method of tax accounting; |

| • | persons holding common shares as part of a hedging transaction, straddle, wash sale, conversion transaction or other integrated transaction or persons entering into a constructive sale with respect to the common shares; |

| • | persons whose functional currency for U.S. federal income tax purposes is not the U.S. dollar; |

| • | S corporations, entities or arrangements classified as partnerships for U.S. federal income tax purposes; |

| • | tax-exempt entities, including an “individual retirement account” or “Roth IRA”; |

| • | persons that own or are deemed to own ten percent or more of our shares (by vote or value); |

| • | persons who are subject to Section 451(b) of the Code; or |

| • | persons holding common shares in connection with a trade or business conducted outside of the United States. |

| • | a citizen or individual resident of the United States; |

| • | a corporation created or organized in or under the laws of the United States, any state therein or the District of Columbia; |

| • | an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| • | a trust if (1) a U.S. court can exercise primary supervision over the trust's administration and one or more U.S. persons are authorized to control all substantial decisions of the trust, or (2) the trust has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person. |

| (a) | to any legal entity which is a qualified investor as defined in the Prospectus Regulation; |

| (b) | to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Regulation), subject to obtaining the prior consent of the representatives for any such offer; or |

| (c) | in any other circumstances falling within Article 1(4) of the Prospectus Regulation, |

| • | our 2019 Annual Report on Form 20-F for the fiscal year ended December 31, 2019; |

| • |

| • | the description of our common shares contained in our registration statement on Form 8-A filed with the SEC on November 7, 2017, including any amendments or reports filed for the purpose of updating such description. |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| • | the timing, progress and results of clinical trials of IFX-1 and any other product candidates, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available, the costs of such trials and our research and development programs generally; |

| • | the timing and outcome of any discussions or submission of filings for regulatory approval of IFX-1 or any other product candidate, and the timing of and our ability to obtain and maintain regulatory approval of IFX-1 for any indication; |

| • | our ability to leverage our proprietary anti-C5a technology to discover and develop therapies to treat complement-mediated autoimmune and inflammatory diseases; |

| • | our ability to protect, maintain and enforce our intellectual property protection for IFX-1 and any other product candidates, and the scope of such protection; |

| • | whether the Food and Drug Administration, European Medicines Agency or comparable foreign regulatory authority will accept or agree with the number, design, size, conduct or implementation of our clinical trials, including any proposed primary or secondary endpoints for such trials; |

| • | the success of our future clinical trials for IFX-1 and any other product candidates and whether such clinical results will reflect results seen in previously conducted preclinical studies and clinical trials; |

| • | our expectations regarding the size of the patient populations for, market opportunity for and clinical utility of IFX-1 or any other product candidates, if approved for commercial use; |

| • | our manufacturing capabilities and strategy, including the scalability and cost of our manufacturing methods and processes and the optimization of our manufacturing methods and processes, and our ability to continue to rely on our existing third-party manufacturers for our planned future clinical trials; |

| • | our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional financing; |

| • | our expectations regarding the scope of any approved indication for IFX-1; |

| • | our ability to defend against costly and damaging liability claims resulting from the testing of our product candidates in the clinic or, if, approved, any commercial sales; |

| • | our ability to commercialize IFX-1 or our other product candidates; |

| • | if any of our product candidates obtain regulatory approval, our ability to comply with and satisfy ongoing obligations and continued regulatory overview; |

| • | our ability to comply with enacted and future legislation in seeking marketing approval and commercialization; |

| • | our future growth and ability to compete, which depends on our retaining key personnel and recruiting additional qualified personnel; |

| • | our competitive position and the development of and projections relating to our competitors in the development of C5a inhibitors or our industry; |

| • | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act or a foreign private issuer; |

| • | the recent outbreak of the COVID-19, which may cause business disruptions and could adversely impact our business, including our supply chain, clinical trials and commercialization of our product candidates; and |

| • | other risk factors discussed under “Risk Factors.” |

| | IFX-1 | | | Placebo | | |||||||||

| | Minimal dose | | | Low dose | | | Medium dose | | | High dose | | | placebo Q2W | |

| | 400mg every 4 weeks (Q4W) | | | 800mg every 4 weeks (Q4W) | | | 800mg every 2 weeks (Q2W) | | | 1200mg every 2 weeks (Q2W) | | |||

| | 40.0% | | | 51.5% | | | 38.7% | | | 45.5% | | | 47.1% | |

| • | 70.6% of the Responder Group maintained their HiSCR response during the OLE, and |

| • | 41.8% of the Non-responder Group became responders at week 40. |

| • | abscesses and inflammatory nodules (AN count) of -66.9% (mean) and -75.0% (median), and |

| • | draining fistula of -46.0% (mean) and -51.5% (median). |

| • | Rapid onset of action: IFX-1 has fast onset of action such that after its intravenous administration, IFX-1 inhibits C5a-induced signaling completely, providing immediate protection from C5a induced priming and activation of neutrophils in this disease. This may result in a faster response rate and a potentially quicker induction of remission when compared to the currently available treatment options. |

| • | Potential potency advantages (over receptor inhibition): IFX-1 blocks the upstream ligand C5a, which inhibits signaling through both receptors, C5aR and C5L2; C5a pro-inflammatory MoA through both C5aR and C5L2 has been shown to be important for ANCA-primed and C5a-induced neutrophil degranulation as key disease-driving mechanism in AAV (published by Hao and Wang et al 2013, PloS ONE). |

| • | Advance our lead program IFX-1 for HS. |

| • | Complete Phase II clinical development of IFX-1 for AAV, PG, oncological diseases and COVID-19 induced severe pneumonia and other complement-mediated autoimmune and inflammatory diseases. |

| • | Pursue the clinical development of IFX-2 and continue to expand the breadth of our anti-C5a technology. |

| • | Commercialize IFX-1, if approved, either independently or in collaboration with a partner. |

| • | Solidify our leadership position in the anti-C5a space by leveraging the full potential of our proprietary anti-C5a technology and expertise in complement and inflammation. |

| • | inclusion of only three years of audited financial statements with correspondingly reduced “Management’s discussion and analysis of financial condition and results of operations” disclosure in this prospectus; |

| • | an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| • | reduced disclosure about our executive compensation arrangements in our periodic reports and registration statements; and |

| • | exemptions from the requirements of holding non-binding advisory votes on executive compensation and golden parachute arrangements. |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

| • | to develop, license, manufacture and commercialize pharmaceutical products; |

| • | to develop and commercialize tests and analytical methods; |

| • | to participate in, to finance, to hold any other interest in and to conduct the management or supervision of other entities, companies, partnerships and businesses; |

| • | to acquire, administer, exploit, invest, encumber and dispose of assets and liabilities; |

| • | to furnish guarantees, to provide security, to warrant performance in any other way and to assume liability, whether jointly and severally or otherwise, in respect of obligations of group companies or other parties; and |

| • | to do anything which, in the widest sense, is connected with or may be conducive to the objectives described above. |

| • | Executive directors should be appointed for a maximum period of four years, without limiting the number of consecutive terms executive directors may serve. |

| • | Non-executive directors should be appointed for two consecutive periods of no more than four years. |

1 | NTD: Subject to ND review. |

| • | a director should report any potential conflict of interest in a transaction that is of material significance to the company and/or to such director to the other directors without delay, providing all relevant information in relation to the conflict; |

| • | the board of directors should then decide, outside the presence of the director concerned, whether there is a conflict of interest; |

| • | transactions in which there is a conflict of interest with a director should be agreed on arms’ length terms; and |

| • | a decision to enter into such a transaction in which there is a conflict of interest with a director that is of material significance to the company and/or to such director shall require the approval of the board of directors, and such transactions should be disclosed in the company’s annual board report. |

| • | the material facts as to the director’s relationship or interest are disclosed and a majority of disinterested directors consent; |

| • | the material facts are disclosed as to the director’s relationship or interest and a majority of shares entitled to vote thereon consent; or |

| • | the transaction is fair to the corporation at the time it is authorized by the board of directors, a committee of the board of directors or the stockholders. |

| • | options awarded to our executive directors as part of their compensation could (subject to the terms of the option awards) vest and become exercisable during the first three years after the date of grant; |

| • | our directors may generally sell our common shares held by them at any point in time, subject to applicable law, company policy and applicable lock-up arrangements; |

| • | our non-executive directors may be granted compensation in the form of shares, options and/or other equity-based compensation; and |

| • | our executive directors may be entitled to a severance payment in excess of their respective annual base salaries. |

| • | the authorization of a class of preferred shares that may be issued by our board of directors to the protective foundation, in such a manner as to dilute the interest of any potential acquirer; |

| • | the staggered multi-year terms of our directors (with subsequent terms as may be nominated by our board of directors and approved by our general meeting of shareholders), as a result of which only part of our directors may be subject to election or re-election in any one year; |

| • | a provision that our directors may only be removed at the general meeting of shareholders by a two-thirds majority of votes cast representing at least 50% of our outstanding share capital if such removal is not proposed by our board of directors; |

| • | our directors being appointed on the basis of a binding nomination by our board of directors, which can only be overruled by the general meeting of shareholders by a resolution adopted by at least a two-thirds majority of the votes cast, provided such majority represents more than half of the issued share capital (in which case the board of directors shall make a new nomination); |

| • | a provision allowing, among other matters, the former chairman of our board of directors or our former chief executive officer, as applicable, to manage our affairs if all of our directors are removed from office and to appoint others to be charged with the management and supervision of our affairs until new directors are appointed by the general meeting of shareholders on the basis of a binding nomination discussed above; and |

| • | requirements that certain matters, including an amendment of our Articles of Association, may only be brought to our shareholders for a vote upon a proposal by our board of directors. |

| • | the transaction that will cause the person to become an interested stockholder is approved by the board of directors of the target prior to the transactions; |

| • | after the completion of the transaction in which the person becomes an interested stockholder, the interested stockholder holds at least 85% of the voting stock of the corporation not including shares owned by persons who are directors and officers of interested stockholders and shares owned by specified employee benefit plans; or |

| • | after the person becomes an interested stockholder, the business combination is approved by the board of directors of the corporation and holders of at least 66.67% of the outstanding voting stock, excluding shares held by the interested stockholder. |

| • | a transfer of the business or virtually the entire business to a third party; |

| • | the entry into or termination of a long-term cooperation of the company or a subsidiary with another legal entity or company or as a fully liable partner in a limited partnership or general partnership, if such cooperation or termination is of a far-reaching significance for the company; and |

| • | the acquisition or divestment by the company or a subsidiary of a participating interest in the capital of a company having a value of at least one-third of the amount of its assets according to its balance sheet and explanatory notes or, if the company prepares a consolidated balance sheet, according to its consolidated balance sheet and explanatory notes in the last adopted annual accounts of the company. |

| • | classification as senior or subordinated debt securities; |

| • | ranking of the specific series of debt securities relative to other outstanding indebtedness, including subsidiaries’ debt; |

| • | if the debt securities are subordinated, the aggregate amount of outstanding indebtedness, as of a recent date, that is senior to the subordinated securities, and any limitation on the issuance of additional senior indebtedness; |

| • | the designation, aggregate principal amount and authorized denominations; |

| • | the date or dates on which the principal of the debt securities may be payable; |

| • | the rate or rates (which may be fixed or variable) per annum at which the debt securities shall bear interest, if any; |

| • | the date or dates from which such interest shall accrue, on which such interest shall be payable, and on which a record shall be taken for the determination of holders of the debt securities to whom interest is payable; |

| • | the place or places where the principal and interest shall be payable; |

| • | our right, if any, to redeem the debt securities, in whole or in part, at our option and the period or periods within which, the price or prices at which and any terms and conditions upon which such debt securities may be so redeemed, pursuant to any sinking fund or otherwise; |

| • | our obligation, if any, of the Company to redeem, purchase or repay any debt securities pursuant to any mandatory redemption, sinking fund or other provisions or at the option of a holder of the debt securities; |

| • | if other than denominations of $2,000 and any higher integral multiple of $1,000, the denominations in which the debt securities will be issuable; |

| • | if other than the currency of the United States, the currency or currencies, in which payment of the principal and interest shall be payable; |

| • | whether the debt securities will be issued in the form of global securities; |

| • | provisions, if any, for the defeasance of the debt securities; |

| • | any U.S. federal income tax consequences; and |

| • | other specific terms, including any deletions from, modifications of or additions to the events of default or covenants described below or in the applicable indenture. |

| • | subject to Dutch law, any insolvency or bankruptcy proceedings, or any receivership, dissolution, winding up, total or partial liquidation, reorganization or other similar proceedings in respect of us or a substantial part of our property, whether voluntary or involuntary; |

| • | (i) a default having occurred with respect to the payment of principal or interest on or other monetary amounts due and payable with respect to any senior indebtedness or (ii) an event of default (other than a default described in clause (i) above) having occurred with respect to any senior indebtedness that permits the holder or holders of such senior indebtedness to accelerate the maturity of such senior indebtedness. Such a default or event of default must have continued beyond the period of grace, if any, provided in respect of such default or event of default, and such a default or event of default shall not have been cured or waived or shall not have ceased to exist; and |

| • | the principal of, and accrued interest on, any series of the subordinated debt securities having been declared due and payable upon an event of default pursuant to the subordinated indenture. This declaration must not have been rescinded and annulled as provided in the subordinated indenture. |

| (1) | default in the payment of the principal on the debt securities when it becomes due and payable at maturity or otherwise; |

| (2) | default in the payment of interest on the debt securities when it becomes due and payable, and such default continues for a period of 30 days; |

| (3) | default in the performance, or breach, of any covenant in the indenture (other than defaults specified in clauses (1) or (2) above) and the default or breach continues for a period of 90 consecutive days or more after written notice to us by the trustee or to us and the trustee by the holders of 25% or more in aggregate principal amount of the outstanding debt securities of all series affected thereby; |

| (4) | the occurrence of certain events of bankruptcy, insolvency, or similar proceedings with respect to us or any substantial part of our property; or |

| (5) | any other Events of Default that may be set forth in the applicable prospectus supplement. |

| • | the rights of registration of transfer and exchange of debt securities, and our right of optional redemption, if any; |

| • | substitution of mutilated, defaced, destroyed, lost or stolen debt securities; |

| • | the rights of holders of the debt securities to receive payments of principal and interest; |

| • | the rights, obligations and immunities of the trustee; and |

| • | the rights of the holders of the debt securities as beneficiaries with respect to the property deposited with the trustee payable to them (as described below); |

| • | either: |

| • | all debt securities of any series issued that have been authenticated and delivered have been delivered by us to the trustee for cancellation; or |

| • | all the debt securities of any series issued that have not been delivered by us to the trustee for cancellation have become due and payable or will become due and payable within one year or are to be called for redemption within one year under arrangements satisfactory to the trustee for the giving of notice of redemption by such trustee in our name and at our expense, and we have irrevocably deposited or caused to be deposited with the trustee as trust funds the entire amount sufficient to pay at maturity or upon redemption all debt securities of such series not delivered to the trustee for cancellation, including principal and interest due or to become due on or prior to such date of maturity or redemption; |

| • | we have paid or caused to be paid all other sums then due and payable under such indenture; and |

| • | we have delivered to the trustee an officers’ certificate and an opinion of counsel, each stating that all conditions precedent under such indenture relating to the satisfaction and discharge of such indenture have been complied with. |

| • | we must irrevocably have deposited or caused to be deposited with the trustee as trust funds in trust for the purpose of making the following payments, specifically pledged as security for, and dedicated solely to the benefits of the holders of the debt securities of a series: |

| • | money in an amount; |

| • | U.S. government obligations; or |

| • | a combination of money and U.S. government obligations, |

| • | we have delivered to the trustee an opinion of counsel stating that, under then applicable U.S. federal income tax law, the holders of the debt securities of that series will not recognize gain or loss for U.S. federal income tax purposes as a result of the defeasance and will be subject to the same federal income tax as would be the case if the defeasance did not occur; |

| • | no default relating to bankruptcy or insolvency and, in the case of a covenant defeasance, no other default has occurred and is continuing at any time; |

| • | if at such time the debt securities of such series are listed on a national securities exchange, we have delivered to the trustee an opinion of counsel to the effect that the debt securities of such series will not be delisted as a result of such defeasance; and |

| • | we have delivered to the trustee an officers’ certificate and an opinion of counsel stating that all conditions precedent with respect to the defeasance have been complied with. |

| • | the title of the warrants; |

| • | the aggregate number of warrants offered; |

| • | the designation, number and terms of the debt securities, common shares or other securities purchasable upon exercise of the warrants and procedures by which those numbers may be adjusted; |

| • | the exercise price of the warrants; |

| • | the dates or periods during which the warrants are exercisable; |

| • | the designation and terms of any securities with which the warrants are issued; |

| • | if the warrants are issued as a unit with another security, the date on and after which the warrants and the other security will be separately transferable; |

| • | if the exercise price is not payable in U.S. dollars, the foreign currency, currency unit or composite currency in which the exercise price is denominated; |

| • | any minimum or maximum amount of warrants that may be exercised at any one time; |

| • | any terms relating to the modification of the warrants; |

| • | any terms, procedures and limitations relating to the transferability, exchange or exercise of the warrants; and |

| • | any other specific terms of the warrants. |

| • | the terms of the units and of the common shares, debt securities, warrants and/or purchase contracts comprising the units, including whether and under what circumstances the securities comprising the units may be traded separately; |

| • | a description of the terms of any unit agreement governing the units; and |

| • | a description of the provisions for the payment, settlement, transfer or exchange of the units. |

| • | through underwriters or dealers; |

| • | directly to a limited number of purchasers or to a single purchaser; |

| • | in “at-the-market” offerings, within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market on an exchange or otherwise; |

| • | through agents; or |

| • | through any other method permitted by applicable law and described in the applicable prospectus supplement. |

| • | the name or names of any underwriters, dealers or agents; |

| • | the purchase price of such securities and the proceeds to be received by us, if any; |

| • | any underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation; |

| • | any initial public offering price; |

| • | any discounts or concessions allowed or reallowed or paid to dealers; and |

| • | any securities exchanges on which the securities may be listed. |

| • | negotiated transactions; |

| • | at a fixed public offering price or prices, which may be changed; |

| • | at market prices prevailing at the time of sale; |

| • | at prices related to prevailing market prices; or |

| • | at negotiated prices. |

| • | our 2019 Annual Report on Form 20-F for the fiscal year ended December 31, 2019, or the Annual Report; |

| • |

| • | the description of our common shares contained in our registration statement on Form 8-A filed with the SEC on November 7, 2017, as updated by the description of our common shares filed as Exhibit 2.4 to the Annual Report, including any amendments or supplements thereto. |

| | | Amount To Be Paid | |

SEC registration fee | | | $25,960 |

FINRA filing fee | | | $225,500** |

Transfer agent’s fees | | | * |

Printing and engraving expenses | | | * |

Legal fees and expenses | | | * |

Accounting fees and expenses | | | * |

Miscellaneous | | | * |

Total | | | $25,960 |

| * | To be provided by a prospectus supplement or a Report on Form 6–K that is incorporated by reference into this prospectus. |

| ** | Previously paid in connection with the filing of the Registration Statement. |