Exhibit 99.3

PRO FORMA VALUATION REPORT

MUTUAL HOLDING COMPANY

STOCK OFFERING

Seneca Financial Corp.│Baldwinsville, New York

PROPOSED HOLDING COMPANY FOR:

Seneca Federal Savings and Loan Association│Baldwinsville New York

Dated as of May 12, 2017

1100 North Glebe Road Suite 600

Arlington, Virginia 22201

703.528.1700

rpfinancial.com

Board of Directors

Seneca Financial MHC

Seneca Financial Corp.

Seneca Federal Savings and Loan Association

35 Oswego Street

Baldwinsville, New York 13027

Members of the Board of Directors:

At your request, we have completed and hereby provide an independent appraisal ("Appraisal") of the estimated pro forma market value of the common stock which is to be issued in connection with the stock issuance transaction described below.

This Appraisal is furnished pursuant to the requirements stipulated in the Code of Federal Regulations and has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” (the “Valuation Guidelines”) of the Office of Thrift Supervision (“OTS”) and accepted by the Federal Reserve Board (“FRB”), the Office of the Comptroller of the Currency (“OCC”) and the Federal Deposit Insurance Corporation (“FDIC”), and applicable regulatory interpretations thereof.

Description of Plan of Reorganization and Stock Offering

On May 10, 2017, the Board of Directors of Seneca Federal Savings and Loan Association (“Seneca Federal” or the “Association”) adopted a plan of reorganization (the “Reorganization”) pursuant to which Seneca Federal will reorganize into a two-tier mutual holding company structure. After the Reorganization, Seneca Financial Corp. (“Seneca Financial” or the “Company”), a federal corporation, will be the mid-tier stock holding company and Seneca Financial MHC (the “MHC”), a federally chartered mutual holding company, will be the top-tier mutual holding company. The Reorganization will be completed as follows:

| (i) | Seneca Federal will organize an interim stock savings association as a wholly owned subsidiary ("Interim Bank"); |

| (ii) | After Interim Bank receives approval from the FDIC for insurance of accounts and the FDIC has issued it a certificate number, Seneca Federal will transfer pursuant to a purchase and assumption agreement all of its assets and liabilities, except $100,000 in cash, to Interim Bank, and Interim Bank will become the stock savings association resulting from the reorganization, including the purchase and assumption transaction pursuant to the plan (the "Stock Bank"); |

| (iii) | Seneca Federal will amend its charter and bylaws to read in the form of a federal mutual holding company to become Seneca Financial MHC; |

| | |

| Washington Headquarters | |

| Three Ballston Plaza | Telephone: (703) 528-1700 |

| 1100 North Glebe Road, Suite 600 | Fax No.: (703) 528-1788 |

| Arlington, VA 22201 | Toll-Free No.: (866) 723-0594 |

| www.rpfinancial.com | E-Mail: mail@rpfinancial.com |

Board of Directors

May 12, 2017

Page 2

| (iv) | Seneca Financial MHC will organize Seneca Financial Corp. as a wholly-owned subsidiary, and transfer $1,000 to Seneca Financial Corp. in exchange for 100 shares of Seneca Financial Corp. common stock; and |

| (v) | Seneca Financial MHC will transfer all of the initially issued stock of the Stock Bank to Seneca Financial Corp in exchange for additional shares of Seneca Financial Corp. common stock, and the Stock Bank will become a wholly-owned subsidiary of Seneca Financial Corp. |

Following the Reorganization, the new stock savings association will have the legal name Seneca Savings.

Concurrent with the Reorganization, Seneca Financial will issue a majority of its common stock to the MHC and sell a minority of its common stock to the public. At the completion of the public stock offering, the Company will retain up to 50% of the net stock proceeds. The MHC will own a controlling interest in the Company of at least 51%, and the Company will be the sole subsidiary of the MHC. The Company will own 100% of the Association’s outstanding stock. The Company’s initial activity will be ownership of its subsidiary, Seneca Federal, investment of the net cash proceeds retained at the holding company level and extending a loan to the employee stock ownership plan.

Seneca Financial will offer its common stock in a subscription offering to Eligible Account Holders, Tax-Qualified Employee Plans including Seneca Federal’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated community offering. At least 50% of the net proceeds from the stock offering will be invested in Seneca Federal and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of Seneca Federal, a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, Seneca Federal may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

RP® Financial, LC.

RP® Financial, LC. (“RP Financial”) is a financial consulting firm serving the financial services industry nationwide that, among other things, specializes in financial valuations and analyses of business enterprises and securities, including the pro forma valuation for savings institutions converting from mutual-to-stock form. The background and experience of RP Financial is detailed in Exhibit V-1. We believe that, except for the fee we will receive for the Appraisal, we are independent of the Company, the Association, the MHC and the other parties

Board of Directors

May 12, 2017

Page 3

engaged by the Association, the Company or the MHC to assist in the stock conversion process.

Valuation Methodology

In preparing our Appraisal, we have reviewed the regulatory applications of the Company, the Association and the MHC, including the prospectus as filed with the FRB, the OCC and the Securities and Exchange Commission (“SEC”). We have conducted a financial analysis of the Company, the Association and the MHC that has included a review of audited financial information for the years ended December 31, 2015 and December 31, 2016, a review of various unaudited information and internal financial reports through March 31, 2017, and due diligence related discussions with the Association’s management; Baker Tilly Virchow Krause, LLP, the Association’s independent auditor; Luse Gorman, PC, the Association’s counsel for the Reorganization and Raymond James Associates, Inc., the Association’s marketing advisor in connection with the stock offering. All assumptions and conclusions set forth in the Appraisal were reached independently from such discussions. In addition, where appropriate, we have considered information based on other available published sources that we believe are reliable. While we believe the information and data gathered from all these sources are reliable, we cannot guarantee the accuracy and completeness of such information.

We have investigated the competitive environment within which Seneca Federal operates and have assessed Seneca Federal’s relative strengths and weaknesses. We have kept abreast of the changing regulatory and legislative environment for financial institutions and analyzed the potential impact on Seneca Federal and the industry as a whole. We have analyzed the potential effects of the stock offering on Seneca Federal’s operating characteristics and financial performance as they relate to the pro forma market value of Seneca Financial. We have reviewed the economic and demographic characteristics of the Association’s primary market area. We have compared Seneca Federal’s financial performance and condition with selected publicly-traded thrifts in accordance with the Valuation Guidelines, as well as all publicly-traded thrifts and thrift holding companies. We have reviewed the current conditions in the securities markets in general and the market for thrift stocks in particular, including the market for existing thrift issues and initial public offerings by thrifts and thrift holding companies. We have excluded from such analyses thrifts subject to announced or rumored acquisition, and/or institutions that exhibit other unusual characteristics.

The Appraisal is based on Seneca Federal’s representation that the information contained in the regulatory applications and additional information furnished to us by Seneca Federal and its independent auditor, legal counsel and other authorized agents are truthful, accurate and complete. We did not independently verify the financial statements and other information provided by Seneca Federal, or its independent auditor, legal counsel and other authorized agents nor did we independently value the assets or liabilities of Seneca Federal. The valuation considers Seneca Federal only as a going concern and should not be considered as an indication of Seneca Federal’s liquidation value.

Our appraised value is predicated on a continuation of the current operating environment for Seneca Federal and for all thrifts and their holding companies. Changes in the local, state and national economy, the legislative and regulatory environment for financial institutions and mutual holding companies, the stock market, interest rates, and other external forces (such as

Board of Directors

May 12, 2017

Page 4

natural disasters or significant world events) may occur from time to time, often with great unpredictability and may materially impact the value of thrift stocks as a whole or the value of Seneca Federal’s stock alone. It is our understanding that there are no current plans for selling control of Seneca Federal following completion of the stock offering. To the extent that such factors can be foreseen, they have been factored into our analysis.

The estimated pro forma market value is defined as the price at which Seneca Financial’s common stock, immediately upon completion of the stock offering, would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

Valuation Conclusion

It is our opinion that, as of May 12, 2017, the estimated aggregate pro forma market value of the shares to be issued immediately following the offering, both shares issued publicly as well as to the MHC, was $15,000,000 at the midpoint, equal to 1,500,000 shares issued at a per share value of $10.00. Pursuant to conversion guidelines, the 15% offering range indicates a minimum value of $12,750,000 and a maximum value of $17,250,000. Based on the $10.00 per share offering price determined by the Board, this valuation range equates to total shares outstanding of 1,275,000 shares at the minimum of the valuation range and 1,725,000 total shares outstanding at the maximum of the valuation range. In the event that the appraised value is subject to an increase, the aggregate pro forma market value may be increased up to a super maximum value of $19,837,500 without a resolicitation. Based on the $10.00 per share offering price, the super maximum value would result in total shares outstanding of 1,983,750. The Board of Directors has established a public offering range such that the public ownership of the Company will constitute a 46.0% ownership interest of the Company. Accordingly, the offering range to the public of the minority stock will be $5,865,000 at the minimum, $6,900,000 at the midpoint, $7,935,000 at the maximum and $9,125,250 at the super maximum. Based on the public offering range, the MHC will own 54.0% of the shares.

Limiting Factors and Considerations

The valuation is not intended, and must not be construed, as a recommendation of any kind as to the advisability of purchasing shares of the common stock. Moreover, because such valuation is determined in accordance with applicable regulatory guidelines and is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the stock offering will thereafter be able to buy or sell such shares at prices related to the foregoing valuation of the estimated pro forma market value thereof. The appraisal reflects only a valuation range as of this date for the pro forma market value of Seneca Financial immediately upon issuance of the stock and does not take into account any trading activity with respect to the purchase and sale of common stock in the secondary market on the date of issuance of such securities or at anytime thereafter following the completion of the stock offering.

RP Financial’s valuation was based on the financial condition and operations of Seneca Federal as of March 31, 2017, the date of the financial data included in the prospectus.

Board of Directors

May 12, 2017

Page 5

RP Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by RP Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities. RP Financial maintains a policy which prohibits RP Financial, its principals or employees from purchasing stock of its client institutions.

This valuation will be updated as provided for in the conversion regulations and guidelines. These updates will consider, among other things, any developments or changes in the financial performance and condition of Seneca Federal, management policies, and current conditions in the equity markets for thrift shares, both existing issues and new issues. These updates may also consider changes in other external factors which impact value including, but not limited to: various changes in the legislative and regulatory environment for financial institutions, the stock market and the market for thrift stocks, and interest rates. Should any such new developments or changes be material, in our opinion, to the valuation of the shares, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in the update at the date of the release of the update. The valuation will also be updated at the completion of Seneca Financial’s stock offering.

| | Respectfully submitted, |

| | |

| | RP® FINANCIAL, LC. |

| | |

| |  |

| | |

| | James J. Oren |

| | Director |

| |  |

| | Gregory E. Dunn |

| | Director |

| RP® Financial, LC. | TABLE OF CONTENTS

i |

TABLE OF CONTENTS

SENECA FINANCIAL CORP.

SENECA FEDERAL SAVINGS AND LOAN ASSOCIATION

Baldwinsville, New York

| | | PAGE |

| DESCRIPTION | | NUMBER |

| | | |

| CHAPTER ONE | OVERVIEW AND FINANCIAL ANALYSIS |

| | | |

| Introduction | I.1 |

| Plan of Reorganization and Stock Offering | I.1 |

| Strategic Overview | I.3 |

| Balance Sheet Trends | I.5 |

| Income and Expense Trends | I.8 |

| Interest Rate Risk Management | I.11 |

| Lending Activities and Strategy | I.12 |

| Asset Quality | I.15 |

| Funding Composition and Strategy | I.15 |

| Financial Services Activities and Subsidiary | 1.16 |

| Legal Proceedings | I.17 |

| | | |

| CHAPTER TWO | MARKET AREA |

| | | |

| Introduction | II.1 |

| National Economic Factors | II.1 |

| Interest Rate Environment | II.3 |

| Market Area Demographics | II.4 |

| Market Area Regional Economy | II.4 |

| Unemployment Trends | II.7 |

| Market Area Deposit Characteristics and Competition | II.7 |

| | | |

| CHAPTER THREE | PEER GROUP ANALYSIS |

| | | |

| Peer Group Selection | III.1 |

| Financial Condition | III.5 |

| Income and Expense Components | III.8 |

| Loan Composition | III.11 |

| Interest Rate Risk | III.11 |

| Credit Risk | III.14 |

| Summary | III.16 |

| RP® Financial, LC. | TABLE OF CONTENTS

ii |

TABLE OF CONTENTS

SENECA FINANCIAL CORP.

SENECA FEDERAL SAVINGS AND LOAN ASSOCIATION

Baldwinsville, New York

(continued)

| | | PAGE |

| DESCRIPTION | | NUMBER |

| | | |

| CHAPTER FOUR | VALUATION ANALYSIS | |

| | | |

| Introduction | IV.1 |

| Appraisal Guidelines | IV.1 |

| RP Financial Approach to the Valuation | IV.1 |

| Valuation Analysis | IV.2 |

| 1. Financial Condition | IV.3 |

| 2. Profitability, Growth and Viability of Earnings | IV.4 |

| 3. Asset Growth | IV.6 |

| 4. Primary Market Area | IV.6 |

| 5. Dividends | IV.8 |

| 6. Liquidity of the Shares | IV.8 |

| 7. Marketing of the Issue | IV.9 |

| A. The Public Market | IV.9 |

| B. The New Issue Market | IV.13 |

| C. The Acquisition Market | IV.13 |

| 8. Management | IV.16 |

| 9. Effect of Government Regulation and Regulatory Reform | IV.17 |

| Summary of Adjustments | IV.17 |

| Valuation Approaches: Fully-Converted Basis | IV.18 |

| Basis of Valuation- Fully-Converted Pricing Ratios | IV.19 |

| 1. Price-to-Earnings ("P/E") | IV.19 |

| 2. Price-to-Book ("P/B") | IV.20 |

| 3. Price-to-Assets ("P/A") | IV.23 |

| Comparison to Publicly-Traded MHCs | IV.24 |

| Comparison to Recent MHC Offerings | IV.28 |

| Valuation Conclusion | IV.28 |

| RP® Financial, LC. | LIST OF TABLES

iii |

LIST OF TABLES

SENECA FINANCIAL CORP.

SENECA FEDERAL SAVINGS AND LOAN ASSOCIATION

Baldwinsville, New York

| TABLE | | | | |

| Number | | DESCRIPTION | | page |

| | | | | |

| 1.1 | | Historical Balance Sheets | | I.6 |

| 1.2 | | Historical Income Statements | | I.9 |

| | | | | |

| | | | | |

| 2.1 | | Summary Demographic Data | | II.5 |

| 2.2 | | Primary Market Area Employment Sectors | | II.6 |

| 2.3 | | Market Area Largest Employers | | II.6 |

| 2.4 | | Unemployment Trends | | II.7 |

| 2.5 | | Deposit Summary | | II.8 |

| 2.6 | | Market Area Deposit Competitors – As of June 30, 2016 | | II.9 |

| | | | | |

| | | | | |

| 3.1 | | Peer Group of Publicly-Traded Thrifts | | III.3 |

| 3.2 | | Balance Sheet Composition and Growth Rates | | III.6 |

| 3.3 | | Income as a Pct. of Avg. Assets and Yields, Costs, Spreads | | III.9 |

| 3.4 | | Loan Portfolio Composition and Related Information | | III.12 |

| 3.5 | | Interest Rate Risk Measures and Net Interest Income Volatility | | III.13 |

| 3.6 | | Credit Risk Measures and Related Information | | III.15 |

| | | | | |

| | | | | |

| 4.1 | | Market Area Unemployment Rates | | IV.7 |

| 4.2 | | Pricing Characteristics and After-Market Trends | | IV.14 |

| 4.3 | | Market Pricing Comparatives | | IV.15 |

| 4.4 | | Fully-Converted Market Pricing Versus Peer Group | | IV.21 |

| 4.5 | | MHC Market Pricing Versus Peer Group | | IV.22 |

| 4.6 | | Calculation of Implied Per Share Data- Incorporating MHC Second Step Conversion | | IV.26 |

| 4.7 | | MHC Institutions Implied Pricing Ratios, Full Conversion Basis | | IV.27 |

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.1 |

I. Overview and Financial Analysis

Introduction

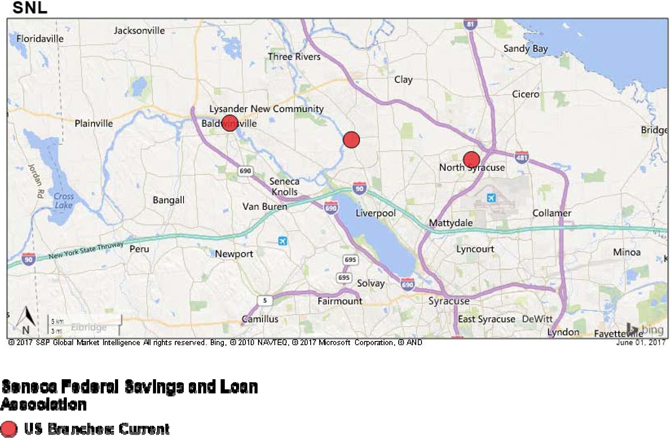

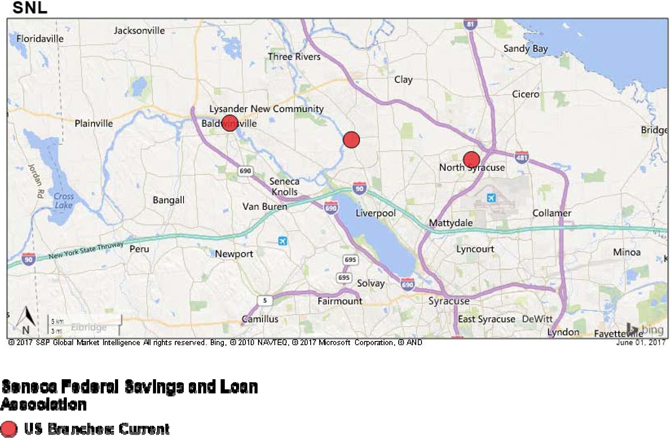

Seneca Federal Savings and Loan Association (“Seneca Federal” or the “Association”), established in 1928, is a federally-chartered mutual savings association headquartered in Baldwinsville, New York. The Association serves the Syracuse metropolitan area through its headquarters office and two full service branch offices. A map of the Association’s office locations is provided in Exhibit I-1. Seneca Federal is a member of the Federal Home Loan Bank (“FHLB”) system and its deposits are insured up to the maximum allowable amount by the Federal Deposit Insurance Corporation (“FDIC”). As of March 31, 2017, Seneca Federal had total assets of $167.3 million, total deposits of $132.3 million and total equity of 11.0 million equal to 6.57% of total assets. The Association’s audited financial statements are included by reference as Exhibit I-2.

Plan of Reorganization and Stock Offering

On May 10, 2017, the Board of Directors of Seneca Federal adopted a plan of reorganization (the “Reorganization”) pursuant to which Seneca Federal will reorganize into a two-tier mutual holding company structure. After the Reorganization, Seneca Financial Corp. (“Seneca Financial” or the “Company”), a federal corporation, will be the mid-tier stock holding company and Seneca Financial MHC (the “MHC”), a federally chartered mutual holding company, will be the top-tier mutual holding company. The Reorganization will be completed as follows:

| (i) | Seneca Federal will organize an interim stock savings association as a wholly owned subsidiary ("Interim Bank"); |

| (ii) | After Interim Bank receives approval from the FDIC for insurance of accounts and the FDIC has issued it a certificate number, Seneca Federal will transfer pursuant to a purchase and assumption agreement all of its assets and liabilities, except $100,000 in cash, to Interim Bank, and Interim Bank will become the stock savings association resulting from the reorganization, including the purchase and assumption transaction pursuant to the plan (the "Stock Bank"); |

| (iii) | Seneca Federal will amend its charter and bylaws to read in the form of a federal mutual holding company to become Seneca Financial MHC; |

| (iv) | Seneca Financial MHC will organize Seneca Financial Corp. as a wholly-owned |

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.2 |

subsidiary, and transfer $1,000 to Seneca Financial Corp. in exchange for 100 shares of Seneca Financial Corp. common stock; and

| (v) | Seneca Financial MHC will transfer all of the initially issued stock of the Stock Bank to Seneca Financial Corp in exchange for additional shares of Seneca Financial Corp. common stock, and the Stock Bank will become a wholly-owned subsidiary of Seneca Financial Corp. |

Following the Reorganization, the new stock savings association will have the legal name Seneca Savings.

Concurrent with the Reorganization, Seneca Financial will issue a majority of its common stock to the MHC and sell a minority of its common stock to the public. At the completion of the public stock offering, the Company will retain up to 50% of the net stock proceeds. The MHC will own a controlling interest in the Company of at least 51%, and the Company will be the sole subsidiary of the MHC. The Company will own 100% of the Association’s outstanding stock. The Company’s initial activity will be ownership of its subsidiary, Seneca Federal, investment of the net cash proceeds retained at the holding company level and extending a loan to the employee stock ownership plan.

Seneca Financial will offer its common stock in a subscription offering to Eligible Account Holders, Tax-Qualified Employee Plans including Seneca Federal’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated community offering. At least 50% of the net proceeds from the stock offering will be invested in Seneca Federal and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of Seneca Federal, a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, Seneca Financial may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.3 |

Strategic Overview

Seneca Federal maintains a local community banking emphasis, with a primary strategic objective of meeting the borrowing and savings needs of its local customer base. Historically, as a traditional thrift institution, the Association’s lending activities were concentrated in origination of 1-4 family permanent mortgage loans and such loans continue to comprise the largest concentration of the loan portfolio. In recent years, the Association has embarked on a new strategic direction designed to build a full service community banking franchise dedicated to meeting the banking needs of business and retail customers in the communities that are served by the Association. To facilitate implementation of new strategic initiatives, the Association added senior management infrastructure including the appointment of a new President and Chief Executive Officer in October 2013. Subsequently, the Association hired two additional executive offices for the positions of Executive President and Chief Financial Officer and Executive Vice President, Director of Retail Banking. In addition, following the Reorganization, the Association intends to hire a new commercial lender to help grow the portfolio. The Association’s objective is to fund asset growth primarily through deposit growth, emphasizing growth of lower cost core deposits. Core deposit growth is expected to be in part facilitated by growth of commercial lending relationships, pursuant to which the Association is seeking to establish a full service banking relationship with its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products.

Investments serve as a supplement to the Association’s lending activities and the investment portfolio is considered to be indicative of a low risk investment philosophy. Mortgage-backed securities that are guaranteed or insured by government sponsored enterprises constitute the largest portion of the Association’s investment portfolio, with other investments consisting of municipal bonds, corporate securities and U.S. government and agency securities.

Deposits have consistently served as the primary funding source for the Association, with supplemental funding provided by utilization of borrowings as an alternative funding source for purposes of managing funding costs and interest rate risk. Certificates of deposit (“CDs”) currently constitute the largest portion of the Association’s deposit base. Borrowings currently held by the Association consist of FHLB advances.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.4 |

Seneca Federal’s earnings base is largely dependent upon net interest income and operating expense levels. The Association has experienced some net interest margin compression since 2015, which has been primarily attributable to a more significant increase in interest-bearing funding costs relative to interest-earning assets yields. Operating expense ratios have trended lower since 2015, which was been facilitated by leveraging of operating expenses through a faster pace of asset growth. Non-interest operating income has been somewhat of a limited contributor to the Association’s earnings, reflecting limiting diversification into fee-based products and services. The amount of loan loss provisions established has increased in recent years, which has been largely attributable to growth of the loan portfolio including growth of higher risk types of loans. Non-operating gains generally have been a relatively modest factor in the Association’s earnings over the past five and one quarter years.

The post-offering business plan of the Association is expected to continue to focus on implementing strategic initiatives to develop and grow a full service community banking franchise. Accordingly, Seneca Federal will continue to be an independent full service community bank, with a commitment to meeting the retail and commercial banking needs of individuals and businesses in the Syracuse metropolitan area.

The Association’s Board of Directors has elected to complete a public stock offering to sustain growth strategies and facilitate implementation of its strategic plan. The capital realized from the stock offering will increase the Association’s operating flexibility and allow for additional growth of the balance sheet. The additional funds realized from the stock offering will provide an alternative funding source to deposits and borrowings in meeting the Association’s future funding needs, which may facilitate a reduction in Seneca Federal’s funding costs. Additionally, Seneca Federal’s higher equity-to-assets ratio will enable the Association to pursue expansion opportunities. Such expansion would most likely occur through the acquisition of other financial institutions and purchasing or establishing branches that would increase market penetration in the markets currently served by the Association or to gain a market presence into nearby complementary markets. At this time, the Association has no specific plans for expansion. The projected uses of proceeds are highlighted below.

| · | The Company. The Company is expected to retain up to 50% of the net offering proceeds. At present, funds at the Company level, net of the loan to the ESOP, are expected to be primarily invested initially into liquid funds held as a deposit at the Association. Over time, the funds may be utilized for various corporate purposes, possibly including acquisitions, infusing additional equity into the Association, repurchases of common stock and the payment of cash dividends. |

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.5 |

| · | The Association. At least 50% of the net conversion proceeds will be infused into the Association. Cash proceeds (i.e., net proceeds less deposits withdrawn to fund stock purchases) infused into the Association are anticipated to become part of general operating funds and are expected to be primarily utilized to fund loan growth over time. |

Overall, it is the Association’s objective to pursue controlled growth that will serve to increase returns, while continuing to emphasize management of the overall risk associated with Seneca Federal’s operations.

Balance Sheet Trends

Table 1.1 shows the Association’s historical balance sheet data for the past five and one-quarter years. From yearend 2012 through March 31, 2017, Seneca Federal’s assets increased at a 3.48% annual rate. Total assets trended lower from yearend 2012 through yearend 2014, which was followed by asset growth over the past two and one-quarter years. A decrease in cash and cash equivalents accounted for the Association’s asset shrinkage during 2013 and 2014, while asset growth over the past two and one-quarter years was primarily sustained by loan growth. Asset shrinkage and a slight increase in borrowings during 2013 funded deposit run-off from yearend 2012 through yearend 2014, while deposit growth and, to a lesser extent, borrowings funded asset growth over the past two and one-quarter years. A summary of Seneca Federal’s key operating ratios for the past two and one-quarter years is presented in Exhibit I-3.

Seneca Federal’s loans receivable portfolio increased at an 11.57% annual rate from yearend 2012 through March 31, 2017, in which the balance of loans receivable has trended steadily higher after declining in 2013. The most significant loan growth was realized during 2015 and 2016, which was primarily attributable to growth of 1-4 family permanent mortgage loans. The faster pace of loan growth relative to asset growth provided for an increase in the loans-to-assets ratio from 58.34% at yearend 2012 to 80.34% at March 31, 2017.

Trends in the Association’s loan portfolio composition over the past two and one-quarter years show that the concentration of 1-4 family permanent mortgage loans comprising total loans decreased from 71.55% at yearend 2015 to 69.89% at March 31, 2017. Commercial real estate loans and commercial business loans constitute the primary types of lending diversification for the Association, with both of those areas of lending diversification remaining fairly stable as a percent of total loans outstanding over the past two and one-quarter years.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.6 |

Table 1.1

Seneca Federal Savings and Loan Association

Historical Balance Sheets

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12/31/12- | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3/31/207 | |

| | | As of December 31, | | | As of March 31, | | | Annualized | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | Growth | |

| | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Pct | |

| | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | (%) | |

| Total Amount of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets | | $ | 144,709 | | | | 100.00 | % | | $ | 131,573 | | | | 100.00 | % | | $ | 130,285 | | | | 100.00 | % | | $ | 137,359 | | | | 100.00 | % | | $ | 161,411 | | | | 100.00 | % | | $ | 167,325 | | | | 100.00 | % | | | 3.48 | % |

| Loans Receivable (net) | | | 84,426 | | | | 58.34 | % | | | 79,234 | | | | 60.22 | % | | | 85,842 | | | | 65.89 | % | | | 105,257 | | | | 76.63 | % | | | 132,364 | | | | 82.00 | % | | | 134,424 | | | | 80.34 | % | | | 11.57 | % |

| Cash and Equivalents | | | 32,236 | | | | 22.28 | % | | | 19,346 | | | | 14.70 | % | | | 2,309 | | | | 1.77 | % | | | 4,045 | | | | 2.94 | % | | | 1,762 | | | | 1.09 | % | | | 5,784 | | | | 3.46 | % | | | -33.25 | % |

| Investment Securities | | | 24,601 | | | | 17.00 | % | | | 27,638 | | | | 21.01 | % | | | 36,283 | | | | 27.85 | % | | | 22,664 | | | | 16.50 | % | | | 19,450 | | | | 12.05 | % | | | 19,090 | | | | 11.41 | % | | | -5.79 | % |

| FHLB Stock | | | 1,066 | | | | 0.74 | % | | | 873 | | | | 0.66 | % | | | 1,056 | | | | 0.81 | % | | | 1,247 | | | | 0.91 | % | | | 2,090 | | | | 1.29 | % | | | 1,833 | | | | 1.10 | % | | | 13.60 | % |

| Bank Owned Life Insurance | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 2,141 | | | | 1.33 | % | | | 2,158 | | | | 1.29 | % | | | NM | |

| Deposits | | $ | 116,635 | | | | 80.60 | % | | $ | 107,134 | | | | 81.43 | % | | $ | 100,008 | | | | 76.76 | % | | $ | 108,672 | | | | 79.12 | % | | $ | 119,542 | | | | 74.06 | % | | $ | 132,338 | | | | 79.09 | % | | | 3.02 | % |

| Borrowings | | | 15,900 | | | | 10.99 | % | | | 11,800 | | | | 8.97 | % | | | 17,000 | | | | 13.05 | % | | | 15,500 | | | | 11.28 | % | | | 28,000 | | | | 17.35 | % | | | 21,000 | | | | 12.55 | % | | | 6.76 | % |

| Equity | | | 10,715 | | | | 7.40 | % | | | 10,640 | | | | 8.09 | % | | | 11,565 | | | | 8.88 | % | | | 10,096 | | | | 7.35 | % | | | 10,780 | | | | 6.68 | % | | | 10,985 | | | | 6.57 | % | | | 0.59 | % |

| Tangible Retained Earnings | | | 10,715 | | | | 7.40 | % | | | 10,640 | | | | 8.09 | % | | | 11,565 | | | | 8.88 | % | | | 10,096 | | | | 7.35 | % | | | 10,780 | | | | 6.68 | % | | | 10,985 | | | | 6.57 | % | | | 0.59 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AOCI | | $ | (1,889 | ) | | | -1.31 | % | | $ | (1,823 | ) | | | -1.39 | % | | $ | (1,078 | ) | | | -0.83 | % | | $ | (2,944 | ) | | | -2.14 | % | | $ | (2,787 | ) | | | -1.73 | % | | $ | (2,746 | ) | | | -1.64 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans/Deposits | | | 72.38 | % | | | | | | | 73.96 | % | | | | | | | 85.84 | % | | | | | | | 96.86 | % | | | | | | | 110.73 | % | | | | | | | 101.58 | % | | | | | | | | |

| Offices Open | | | 3 | | | | | | | | 3 | | | | | | | | 3 | | | | | | | | 3 | | | | | | | | 3 | | | | | | | | 3 | | | | | | | | | |

| (1) | Ratios are as a percent of ending assets. |

Sources: Seneca Federal's preliminary prospectus, audited financial reports and call reports.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.7 |

From yearend 2015 to March 31, 2017, commercial real estate loans increased from 13.38% of total loans to 14.70% of total loans and commercial business loans decreased from 6.96% of total loans to 6.35% of total loans. Other areas of lending diversification for the Association have been fairly limited, consisting primarily of home equity loans lines of credit and, to a lesser extent, construction loans and consumer loans. As of March 31, 2017, home equity loans and lines of credit equaled 4.46% of total loans, construction loans equaled 2.56% of total loans and consumer loans equaled 2.04% of total loans.

The intent of the Association’s investment policy is to provide adequate liquidity and to generate a favorable return within the context of supporting Seneca Federal’s overall credit and interest rate risk objectives. It is anticipated that proceeds retained at the holding company level will be invested into liquid funds held as a deposit at the Association. Since yearend 2012, the Association’s level of cash and investment securities (inclusive of FHLB stock) ranged from a low of 14.44% of assets at yearend 2016 to a high of 40.01% of assets at yearend 2012. The decrease in the balance of cash and investments since yearend 2012 was largely related to redeployment of those funds for purposes of funding loan growth and, to a lesser extent, to fund deposit run-off during 2013 and 2014. Mortgage-backed securities totaling $9.4 million comprised the most significant component of the Association’s investment portfolio at March 31, 2017. Other investments held by the Association at March 31, 2017 consisted of municipal bonds ($8.6 million), corporate securities ($814,000) and U.S. government and agency securities ($269,000). As of March 31, 2017, all investments were maintained as available for sale and reflected a net unrealized loss of $351,000. Exhibit I-4 provides historical detail of the Association’s investment portfolio. As of March 31, 2017, the Association also held $5.8 million of cash and cash equivalents and $1.8 million of FHLB stock.

The Association also maintains an investment in bank-owned life insurance (“BOLI”) policies, as a source of funding for employee benefit expenses. As of March 31, 2017, the cash surrender value of the Association’s BOLI equaled $2.2 million or 1.29% of assets.

Since yearend 2012, Seneca Federal’s funding needs have been addressed through a combination of deposits, borrowings and internal cash flows. From yearend 2012 through March 31, 2017, the Association’s deposits increased at a 3.02% annual rate. Deposits declined from yearend 2012 through yearend 2014, which was followed by deposit growth during the past two and one-quarter years. Overall, deposits as a percent of assets remained fairly stable over the past five and one-quarter years, equaling 80.60% of assets at yearend

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.8 |

2012 and 79.09% of assets at March 31, 2017. CDs account for the largest concentration of the Association’s deposits and comprised 49.23% of average deposits during first quarter of 2017.

Borrowings serve as an alternative funding source for the Association to address funding needs for growth and to support management of deposit costs and interest rate risk. From yearend 2012 through March 31, 2017, borrowings ranged from a low of $11.8 million or 8.97% of assets at yearend 2013 to a high of $28.0 million or 17.35% of assets at yearend 2016. As of March 31, 2017, the Association’s borrowings totaled $21.0 million or 12.55% of assets. Borrowing held by the Association at March 31, 2017 consisted of FHLB advances.

The Association’s equity increased at a 0.59% annual rate from yearend 2012 through March 31, 2017, as the retention of earning since yearend 2012 was largely offset by the net loss recorded in 2013 and an increase in the accumulated other comprehensive loss. The comparatively slower rate of equity growth relative to asset growth since yearend 2012 provided for a decrease in the Association’s equity-to-assets ratio from 7.40% at yearend 2012 to 6.57% at March 31, 2017. All of the Association’s capital is tangible capital, and the Association maintained capital surpluses relative to all of its regulatory capital requirements at March 31, 2017. The addition of stock proceeds will serve to strengthen the Association’s capital position, as well as support growth opportunities. At the same time, the increase in Seneca Federal’s pro forma capital position will initially depress its ROE.

Income and Expense Trends

Table 1.2 shows the Association’s historical income statements for the past five years and for the twelve months ended March 31, 2017. The Association’s reported earnings ranged from a net loss of $208,000 or 0.15% of average assets during 2013 to net income of $600,000 or 0.39% of average assets for the twelve months ended March 31, 2017. Net interest income and operating expenses represent the primary components of the Association’s recurring earnings, while non-operating income has been somewhat of a limited source of earnings for the Association. Loan loss provisions have had a varied impact on the Association’s earnings over the past five and one-quarter years. Gains and losses from the sale of investments and fixed assets have generally been a relatively minor factor in the Association’s earnings over the past five and one-quarter years.

During the period covered in Table 1.2, the Association’s net interest income to average assets ratio ranged from a low of 2.50% during 2013 to a high of 3.42% during 2015. For the

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.9 |

Table 1.2

Seneca Federal Savings and Loan Association

Historical Income Statements

| | | For the Fiscal Year Ended December 31, | | | 12 Months Ended, | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | March 31, 2017 | |

| | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | |

| | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Income | | $ | 5,472 | | | | 3.75 | % | | $ | 4,761 | | | | 3.45 | % | | $ | 4,844 | | | | 3.70 | % | | $ | 5,167 | | | | 3.94 | % | | $ | 5,844 | | | | 3.96 | % | | $ | 6,068 | | | | 3.95 | % |

| Interest Expense | | | (1,694 | ) | | | -1.16 | % | | | (1,311 | ) | | | -0.95 | % | | | (865 | ) | | | -0.66 | % | | | (681 | ) | | | -0.52 | % | | | (992 | ) | | | -0.67 | % | | | (1,085 | ) | | | -0.71 | % |

| Net Interest Income | | $ | 3,778 | | | | 2.59 | % | | $ | 3,450 | | | | 2.50 | % | | $ | 3,979 | | | | 3.04 | % | | $ | 4,486 | | | | 3.42 | % | | $ | 4,852 | | | | 3.29 | % | | $ | 4,983 | | | | 3.24 | % |

| Provision for Loan Losses | | | (239 | ) | | | -0.16 | % | | | 0 | | | | 0.00 | % | | | (20 | ) | | | -0.02 | % | | | (8 | ) | | | -0.01 | % | | | (247 | ) | | | -0.17 | % | | | (274 | ) | | | -0.18 | % |

| Net Interest Income after Provisions | | $ | 3,539 | | | | 2.43 | % | | $ | 3,450 | | | | 2.50 | % | | $ | 3,959 | | | | 3.02 | % | | $ | 4,478 | | | | 3.41 | % | | $ | 4,605 | | | | 3.12 | % | | $ | 4,709 | | | | 3.06 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain(Loss) on Sale of Loans | | $ | 85 | | | | 0.06 | % | | $ | 19 | | | | 0.01 | % | | $ | 5 | | | | 0.00 | % | | $ | 91 | | | | 0.07 | % | | $ | 105 | | | | 0.07 | % | | $ | 108 | | | | 0.07 | % |

| Other Income | | | 669 | | | | 0.46 | % | | | 593 | | | | 0.43 | % | | | 672 | | | | 0.51 | % | | | 584 | | | | 0.44 | % | | | 435 | | | | 0.30 | % | | | 427 | | | | 0.28 | % |

| Operating Expense | | | (4,103 | ) | | | -2.82 | % | | | (4,453 | ) | | | -3.22 | % | | | (4,441 | ) | | | -3.39 | % | | | (4,783 | ) | | | -3.64 | % | | | (4,808 | ) | | | -3.26 | % | | | (4,835 | ) | | | -3.14 | % |

| Net Operating Income | | $ | 190 | | | | 0.13 | % | | $ | (391 | ) | | | -0.28 | % | | $ | 195 | | | | 0.15 | % | | $ | 370 | | | | 0.28 | % | | $ | 337 | | | | 0.23 | % | | $ | 409 | | | | 0.27 | % |

| | | | | | | | | | | | | | | �� | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain(Loss) on Sale of Fixed Assets | | $ | 0 | | | | 0.00 | % | | $ | 0 | | | | 0.00 | % | | $ | 0 | | | | 0.00 | % | | $ | 0 | | | | 0.00 | % | | $ | 158 | | | | 0.11 | % | | $ | 158 | | | | 0.10 | % |

| Gain on Sale of Investments | | | 9 | | | | 0.01 | % | | | 34 | | | | 0.02 | % | | | 90 | | | | 0.07 | % | | | 48 | | | | 0.04 | % | | | 96 | | | | 0.07 | % | | | 90 | | | | 0.06 | % |

| Total Non-Operating Income (Exp.) | | $ | 9 | | | | 0.01 | % | | $ | 34 | | | | 0.02 | % | | $ | 90 | | | | 0.07 | % | | $ | 48 | | | | 0.04 | % | | $ | 254 | | | | 0.17 | % | | $ | 248 | | | | 0.16 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income Before Tax | | $ | 199 | | | | 0.14 | % | | $ | (357 | ) | | | -0.26 | % | | $ | 285 | | | | 0.22 | % | | $ | 418 | | | | 0.32 | % | | $ | 591 | | | | 0.40 | % | | $ | 657 | | | | 0.43 | % |

| Income Taxes | | | (24 | ) | | | -0.02 | % | | | 149 | | | | 0.11 | % | | | (104 | ) | | | -0.08 | % | | | (22 | ) | | | -0.02 | % | | | (64 | ) | | | -0.04 | % | | | (57 | ) | | | -0.04 | % |

| Net Income (Loss) | | $ | 175 | | | | 0.12 | % | | $ | (208 | ) | | | -0.15 | % | | $ | 181 | | | | 0.14 | % | | $ | 396 | | | | 0.30 | % | | $ | 527 | | | | 0.36 | % | | $ | 600 | | | | 0.39 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Earnings: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | | $ | 175 | | | | 0.12 | % | | $ | (208 | ) | | | -0.15 | % | | $ | 181 | | | | 0.14 | % | | $ | 396 | | | | 0.30 | % | | $ | 527 | | | | 0.36 | % | | $ | 600 | | | | 0.39 | % |

| Add(Deduct): Non-Operating (Inc)/Exp | | | (9 | ) | | | -0.01 | % | | | (34 | ) | | | -0.02 | % | | | (90 | ) | | | -0.07 | % | | | (48 | ) | | | -0.04 | % | | | (254 | ) | | | -0.17 | % | | | (248 | ) | | | -0.16 | % |

| Tax Effect | | | 3 | | | | 0.00 | % | | | 12 | | | | 0.01 | % | | | 31 | | | | 0.02 | % | | | 16 | | | | 0.01 | % | | | 86 | | | | 0.06 | % | | | 85 | | | | 0.06 | % |

| Adjusted Earnings: | | $ | 169 | | | | 0.12 | % | | $ | (230 | ) | | | -0.17 | % | | $ | 122 | | | | 0.09 | % | | $ | 364 | | | | 0.28 | % | | $ | 359 | | | | 0.24 | % | | $ | 437 | | | | 0.28 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Memo: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Efficiency Ratio (%) | | | 90.53 | % | | | | | | | 109.63 | % | | | | | | | 95.38 | % | | | | | | | 92.68 | % | | | | | | | 89.17 | % | | | | | | | 87.47 | % | | | | |

| (1) | Ratios are as a percent of average assets. |

Sources: Seneca Federal's preliminary prospectus, audited financial reports and call reports.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.10 |

twelve months ended March 31, 2017, the Association’s net interest income to average assets ratio equaled 3.24%. The increase in the Association’s net interest income ratio during 2013 and 2014 was facilitated by interest rate spread expansion, as the result of an increase in the average yield earned on interest-earning assets and a decrease in the average rate paid on interest-bearing liabilities. Comparatively, the decline in the Association’s net interest income ratio since 2014 has been largely attributable to interest rate spread compression that has resulted from a more significant increase in the Association’s cost of interest-bearing liabilities relative to the yield earned on interest-earnings assets. In fact, the Association’s yield earned on interest-earning assets during the first quarter of 2017 was down slightly compared to the year ago quarter (4.10% versus 4.18% for the first quarter of 2016). Partially offsetting decline in yield earned on interest-earning assets during the past two and one-quarter years has been a shift in the Association’s interest-earning asset composition towards a higher concentration of loans, which earn higher yields relative to investments and short-term liquid funds. Overall, during the two and one quarter years, the Association’s interest rate spread declined from 3.42% during 2015 to 3.23% during the first quarter of 2017 The Association’s net interest rate spreads and yields and costs for the past two and one-quarter years are set forth in Exhibit I-3 and Exhibit I-5.

Non-interest operating income has been somewhat of a limited contributor to the Association’s earnings over the past five and one-quarter years, reflecting the Association’s limited diversification into products and services that generate non-interest operating income. Revenues derived from non-interest income sources is also limited by the relatively high concentration of deposits maintained in CDs, as opposed to fee-based deposit products. Throughout the period shown in Table 1.2, non-interest operating income ranged from a low of $535,000 or 0.35% of average assets during the twelve months ended March 31, 2017 to a high of $754,000 or 0.52% of average assets during 2012. Service and other fee income, income from financial services activities and gains on the sale of 1-4 family loans constitute the major sources of the Association’s non-interest operating revenues.

Operating expenses represent the other major component of the Association’s earnings, ranging from a low of $4.103 million or 2.82% of average assets during 2012 to a high of $4.835 million or 3.14% of average assets during the twelve months ended March 31, 2017. In general, the Association has maintained a relatively high level of operating expenses, which can in part be attributed to certain inherent fixed operating costs Seneca Federal incurs as a regulated financial institution that are spread over a relatively small asset base. Further upward pressure

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.11 |

will be placed on the Association’s operating expense ratio following the stock offering, due to expenses associated with operating as a publicly-traded company, including expenses related to the stock benefit plans. At the same time, the increase in capital realized from the stock offering will increase the Association’s capacity to leverage operating expenses through pursuing a more aggressive growth strategy.

Overall, during the past five and one-quarter years, the Association’s expense coverage ratios (net interest income divided by operating expenses) ranged from a low of .78x during 2013 to a high of 1.03x during the twelve months ended March 31, 2017. Similarly, the Association’s efficiency ratio (operating expenses as a percent of the sum of net interest income and other operating income) reflected an upward trend in core earnings since 2013, based on efficiency ratios of 109.63% and 87.47% during 2013 and during the twelve months ended March 31, 2017, respectively.

During the period covered in Table 1.2, the amount of loan loss provisions established ranged from no loan loss provisions recorded during 2013 to a high of $274,000 or 0.18% of average assets during the twelve months ended March 31, 2017. The increase in loan loss provisions established during 2016 and the most recent twelve month period was related to loan growth, as opposed to deterioration in credit quality. As of March 31, 2017, the Association maintained loan loss allowances of $1.085 million, equal to 0.80% of total loans receivable and 114.45% of non-accruing loans. Exhibit I-6 sets forth the Association’s loan loss allowance activity for the past two and one-quarter years.

Over the past five and one-quarter years, the Association’s effective tax rate ranged from a tax benefit of 41.74% during 2013 to a tax expense of 36.49% during 2014 and equaled 8.68% during the twelve months ended March 31, 2017. As set forth in the prospectus, the Association’s marginal effective tax rate is 34.0%.

Interest Rate Risk Management

The Association’s balance sheet is liability-sensitive in the short-term (less than one year) and, thus, the net interest margin will typically be adversely affected during periods of rising and higher interest rates. Comparatively, the Association’s net interest margin generally benefits from a declining interest rate environment. As of March 31, 2017, an analysis of the Association’s Economic Value of Equity (“EVE”) indicatedthat a 2.0% instantaneous and

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.12 |

sustained parallel increase in the yield curve would result in a 23.0% decline in EVE (see Exhibit I-7).

The Association pursues a number of strategies to manage interest rate risk, particularly with respect to seeking to limit the repricing mismatch between interest rate sensitive assets and liabilities. The Association manages interest rate risk from the asset side of the balance sheet through maintaining the investment portfolio as available for sale, selling originations of longer term 1-4 family fixed rate loans and diversifying into other types of lending beyond 1-4 family permanent mortgage loans which consist primarily of adjustable rate or shorter term fixed rate loans. As of December 31, 2016, of the Association’s total loans due after December 31, 2017, adjustable rate loans comprised 25.42%% of total loans receivable (see Exhibit I-8). On the liability side of the balance sheet, management of interest rate risk has been pursued through emphasizing growth of lower costing and less interest rate sensitive transaction and savings accounts and utilizing fixed rate FHLB advances with terms of more than one year. Transaction and savings account deposits comprised 46.48% of the Association’s average total deposits during the three months ended March 31, 2017.

The infusion of stock proceeds will serve to further limit the Association’s interest rate risk exposure, as most of the net proceeds will be redeployed into interest-earning assets and the increase in the Association’s capital position will lessen the proportion of interest rate sensitive liabilities funding assets.

Lending Activities and Strategy

Historically, Seneca Federal’s lending activities have emphasized 1-4 family permanent mortgage loans and such loans continue to comprise the largest concentration of the Association’s loan portfolio composition. Pursuant to the Association’s strategic plan, the Association is pursuing a diversified lending strategy emphasizing commercial real estate loans and commercial business loans as the primary areas of targeted loan growth. Other areas of lending diversification for the Association include home equity loans and lines of credit, construction loans and consumer loans. Exhibit I-9 provides historical detail of Seneca Federal’s loan portfolio composition for the past two and one-quarter years and Exhibit I-10 provides the contractual maturity of the Association’s loan portfolio by loan type as of March 31, 2017.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.13 |

1-4 Family Residential Loans. Seneca Federal offers both fixed rate and ARM 1-4 family permanent mortgage loans with terms of up to 30 years. Loans are generally underwritten to secondary market guidelines, as the Association’s current philosophy has been to sell most originations of conforming fixed rate loans with terms of 20 years or more. Loans are generally sold on a servicing retained basis and without recourse. ARM loans and shorter-term fixed rate loan originations are retained for the Association’s loans portfolio. ARM loans offered by the Association have initial repricing terms of one, five, seven or ten years and then adjust annually thereafter. ARM loans are indexed to the average yield on U.S. Treasury securities, adjusted to a constant maturity of one year, as published weekly by the Federal Reserve Board. As of March 31, 2017, the Association’s outstanding balance of 1-4 family residential mortgage loans totaled $94.3 million or 69.89% of total loans outstanding and included $7.2 million of non-owner occupied loans.

Home Equity Loans and Lines of Credit. The Association’s 1-4 family lending activities include home equity loans and lines of credit, although the Association no longer originates home equity loans. Home equity lines of credit are tied to the prime rate as published inThe Wall Street Journal and are offered for terms of up to a ten year draw period followed by a 15 year repayment period. The Association will originate home equity lines of credit up to a maximum loan-to value (“LTV”) ratio of 80% (or 90% if Seneca Federal holds the first mortgage), inclusive of other liens on the property. As of March 31, 2017, the Association’s outstanding balance of home equity loans and lines of credit totaled $6.0 million or 4.46% of total loans outstanding and included $600,000 of home equity loans.

Construction Loans. The Association’s construction lending activities consist primarily of loans to individuals for the construction of their primary residence. On a more limited basis, construction loans are extended to contractors and builders of single-family homes. Construction loans are offered up to a maximum LTV ratio of 90% of the estimated appraised market value upon completion of the project and provide for the payment of interest only during the construction phase which is typically up to six months. At the end of the construction phase, the loan may convert to a permanent mortgage loan or the loan may be repaid in full. As of March 31, 2017, the Association’s outstanding balance of construction loans equaled $3.5 million or 2.56% of total loans receivable and all such loans were extended to individuals.

Commercial Real Estate Loans. Commercial real estate consist substantially of loans originated by the Association, which are collateralized by properties in the Association’s regional

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.14 |

lending area. Seneca Federal generally originates commercial real estate loans up to a LTV ratio of 80% (75% for non-owner occupied properties) and generally requires a minimum debt-coverage ratio of 1.2 times. Commercial real estate loans are originated with amortization terms of up to 20 years. Loan terms offered on commercial real estate loans generally consist of adjustable rate loans, which are indexed to the 5-year FHLB advance rate. Properties securing the commercial real estate loan portfolio include office buildings, industrial facilities, retail facilities, motels, apartments and other commercial properties. At March 31, 2017, the Association’s largest commercial real estate loan had an outstanding balance of $1.6 million and is secured by a hotel. At March 31, 2017, this loan was performing in accordance with its original terms. As of March 31, 2017, the Association’s outstanding balance of commercial real estate loans totaled $19.8 million equal to 14.70% of total loans outstanding and included $5.4 million of multi-family loans.

Commercial Business Loans. The commercial business loan portfolio is generated through extending loans to businesses operating in the local market area. Expansion of commercial business lending activities is a desired area of loan growth for the Association, pursuant to which the Association is seeking to become a full service community bank to its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products. Commercial business loans are made with either adjustable or fixed rates of interest and are indexed toThe Wall Street Journal prime rate. The commercial business loan portfolio consists substantially of loans secured by business assets such as accounts receivable, inventory, equipment and real estate. At March 31, 2017, the Association’s largest commercial business loan had an outstanding balance of $999,000 and is secured by building lots. At March 31, 2017, this loan was performing in accordance with its original terms. As of March 31, 2017, the Association’s outstanding balance of commercial business loans equaled $8.6 million or 6.35% of total loans receivable.

Consumer Loans. Consumer lending other than home equity loans and lines of credit has been somewhat of a limited area of lending diversification for the Association, with such loans consisting principally of loans extended to existing customers of the Association. The consumer loan portfolio includes loans secured by manufactured homes, deposit accounts, new and used automobiles and unsecured personal loans. As of March 31, 2017, the Association held $2.8 million of consumer loans equal to 2.04% of total loans receivable.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.15 |

The substantial portion of loans held in the Association’s loan portfolio were originated directory by the Association. The Association generally does not purchase loans from third parties. However, from time to time, the Association has purchased or sold participation interest in loans. Loan participation interests that are purchased by the Association are underwritten in accordance with the Association’s underwriting criteria and procedures. At March 31, 2017, the Association’s loan portfolio included $2.0 million of purchased loan participation interests and no loans for which the Association had sold participation interests.

Asset Quality

Historically, the Association’s lending emphasis on lending in local and familiar markets has generally supported maintenance of relatively favorable credit quality measures. Over the past two and one-quarter years, Seneca Federal’s balance of non-performing assets ranged from a high of $1.9 million or 1.35% of assets at yearend 2015 to a low of $1.1 million or 0.64% of assets at March 31, 2017. As shown in Exhibit I-11, non-performing assets at March 31, 2017 consisted of $948,000 of non-accruing loans and $130,000 of real estate owned. Non-accruing loans held by the Association at March 31, 2017 were concentrated in 1-4 family permanent mortgage loans totaling $929,000.

To track the Association’s asset quality and the adequacy of valuation allowances, the Association has established detailed asset classification policies and procedures which are consistent with regulatory guidelines. Classified assets are reviewed monthly by senior management and quarterly by the Board. Pursuant to these procedures, when needed, the Association establishes additional valuation allowances to cover anticipated losses in classified or non-classified assets. As of March 31, 2017, the Association maintained loan loss allowances of $1.1 million, equal to 0.80% of total loans receivable and 114.45% of non-performing loans.

Funding Composition and Strategy

Deposits have consistently served as the Association’s primary funding source and at March 31, 2017 deposits accounted for 86.30% of Seneca Federal’s combined balance of deposits and borrowings. Exhibit I-12 sets forth the Association’s deposit composition for the past two and one-quarter years and Exhibit I-13 provides the maturity composition of the Association’s jumbo CDs (CD deposits with balances of $100,000 or more) at March 31, 2017. CDs constitute the largest component of the Association’s deposit composition and the

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.16 |

concentration of CDs comprising total deposits has increased during the past two and one-quarter years, as the result of comparatively strong growth of CD deposits relative to growth of transaction and savings account deposits. For the three months ended March 31, 2017, the balance of CDs averaged $61.5 million or 49.23% of average deposits, versus comparable measures of $47.2 million and 45.42% of average deposits for 2015. As of March 31, 2017, jumbo CDs (CD accounts with balances of $100,000 or more) amounted to $42.2 million or 59.99% of total CDs. Jumbo CDs with scheduled maturities of one year or less comprised 50.19% of the Association’s jumbo’s CDs at March 31, 2017. The Association maintained $11.0 million of brokered deposit as of March 31, 2017.

Transaction and savings account deposits in total comprised 50.77% of average total deposits during the three months ended March 31, 2017, as compared to 54.58% of average total deposits during 2015. Savings account deposits comprised the largest concentration of the Association’s core deposits during the three months ended March 31, 2017, averaging $23.3 million or 36.67% of average core deposits.

Borrowings serve as an alternative funding source for the Association to facilitate management of funding costs and interest rate risk Borrowings totaled $21.0 million at March 31, 2017 and consisted entirely of FHLB advances. FHLB advances held by the Association at March 31, 2017 had fixed interest rates with ladder terms out to March 2021 and had a weighted average rate of 2.01%. Exhibit I-14 provides further detail of the Association’s borrowings activities during the past two and one-quarter years.

Financial Services Activities and Subsidiary

Financial Quest, a division of Seneca Federal, offers asset management, financial planning, insurance, annuities and other financial products in partnership with Centera Financial Services, a registered broker dealer. The Association has dedicated investment representatives that evaluates the needs of clients to determine suitable investment and insurance solutions to meet their short and long-term wealth management goals. At March 31, 2017, the Association had $43.0 million of assets held under management. Seneca Savings Agency Services, Inc., a wholly-owned subsidiary of the Association, collects fee income on fixed annuities and life insurance from legacy relationships. The Association is not actively using this subsidiary to generate new business.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS

I.17 |

Legal Proceedings

The Association is not currently party to any pending legal proceedings that the Association’s management believes would have a material adverse effect on the Association’s financial condition, results of operations or cash flows.

| RP® Financial, LC. | MARKET AREA

II.1 |

II. MARKET AREA ANALYSIS

Introduction

Seneca Federal serves the Syracuse Metropolitan Statistical Area (“MSA”) through the main office in Baldwinsville, New York and two branch offices in North Syracuse and Liverpool. All three offices are located in Onondaga County. Baldwinsville is approximately 20 miles northwest of the city of Syracuse. Exhibit II-1 provides information on the Association’s office properties.

The regional market area has a diversified economy, with education/healthcare/social services, services and wholesale/retail trade constituting the primary sectors of employment. With operations in a metropolitan area, the Association’s competitive environment includes a significant number of thrifts, commercial banks and other financial services companies, some of which have a regional or national presence and are larger than the Association in terms of deposits, loans, scope of operations, and number of branches. These institutions also have greater resources at their disposal than the Association. Within this region, community banking institutions remain a part of the banking industry.

Future business and growth opportunities will be partially influenced by economic and demographic characteristics of the markets served by the Association, particularly the future growth trends of the regional economy, demographic growth trends, and the nature and intensity of the competitive environment for financial institutions. These factors outlined herein have been accounted for in the determination of the Association’s pro forma market value.

National Economic Factors

The business potential of a financial institution is partially dependent on the future operating environment and growth opportunities for the financial services industry and the economy as a whole. Since the end of the “great recession” in 2009, the national economy has recorded modest growth rates, in terms of gross domestic product (“GDP”), ranging from a low of 1.5% in calendar year 2013 to a high of 2.8% in calendar year 2010. GDP growth was 2.6% for calendar years 2014 and 2015, 1.6% for calendar year 2016, and an annualized 0.9% for the three months ended March 31, 2017, indicating positive, yet modest growth for the US economy. As a result of the recession, approximately 8 million jobs were lost as consumers cut back on

| RP® Financial, LC. | MARKET AREA

II.2 |

spending, causing a reduction in the need for many products and services. Total personal wealth declined notably due to the housing crisis and the drop in real estate values. The economy has recorded slow, but steady job growth since reaching a low in early 2010, with approximately 2.7 million jobs added in 2015, 2.2 million jobs added in 2016, and a total of 527,000 jobs created for the three months ended March 31, 2017, or an annualized rate of 2.1 million jobs.

For the year ended December 2016 and the four months ended April 2017, the annualized national inflation rate was 1.3% and 2.5%, respectively, showing that inflation remains under control but has risen in recent periods. Indicating a level of continued improvement, the national unemployment rate equaled 4.1% as of April 2017, lower than the 4.7% rate as of April 2016. Future job growth is uncertain as the economy is approaching a full employment level nationally. The Federal Reserve has indicated that it will continue efforts to stimulate growth in the economy although market interest rates have been raised three times in the last year as a check on the rise in inflation and to avoid an overheating economy. Forecasts indicate modest economic growth through 2017, with GDP increasing by an estimated 2.3% in 2017.

Regarding factors that most directly impactthe banking and financial services industries, the residential real estate industry has recovered from the 2007-2009 housing crisis and recession. Following a relatively slow recovery through early 2012, in recent periods the number of housing foreclosures has remained modest, new and previously-owned home sales have increased, and residential housing prices have continued to trend upward in most metropolitan areas of the country. In certain areas, in particular metropolitan areas, there are supply shortages of housing stock. National home price indices have, to a large extent, recovered from the lows reached in 2009, with the national median home price reaching $236,400 in March 2017, versus $169,000 in March 2009.

According to the March 2017 housing forecast from the Mortgage Bankers Association (the “MBA”), existing home sales are projected to increase by approximately 1.6% and new home sales are expected to increase by 8.6% through the course of 2017. The MBA forecast also showed increases in the median sales prices for existing homes in 2017 and 2018 (5.6% in 2017 and 3.7% in 2018. Total mortgage production is forecasted to decrease in 2017 to $1.567 trillion compared to $1.941 trillion in 2016. The slowdown in 2017 originations is due to a 45% decrease in home refinance mortgage originations, with refinance lending forecasted to total $510 billion in 2017 (reflecting the recent rise in interest rates, with expectations for further increases in market interest rates). Comparatively, home purchase volumes are predicted to increase by 4.2% in

| RP® Financial, LC. | MARKET AREA

II.3 |

2017, with purchase volume forecasted to total $1.057 trillion in 2017. For 2018, refinancing volume is projected to further decline, while home purchase mortgage originations are projected to continue growing.

Based onthe consensus outlook of over 60 economists surveyed by The Wall Street Journal in April 2017, the U.S. economy is poised for stronger growth in 2017, with GDP growth forecasted at 2.2% for the year, along with a tighter job market and expectation of steady wage gains. The forecast reveals the U.S. economy should grow at a faster pace of 2.5% in 2018. Economists expect that the unemployment rate will continue to steadily decline, from 4.7% in December 2016 to 4.2% by December 2018 (although such rate has declined to 4.1% as of April 2017. On average, the economists expect the Federal Reserve to continue raising its target rate during 2017, and forecast an increase in 10-year Treasury yield to 2.79% by the end of 2017; thereafter increasing to 3.29% through December 2018. Inflation pressures were forecasted to remain below 2.2% through the end of 2017, increasing to 2.4% for calendar year 2018. The price of oil was expected to remain relatively stable, reaching $55 a barrel through the end of 2018.

Interest Rate Environment

The Federal Reserve manages interest rates in order to promote economic growth and to avoid inflationary periods. Amid increased indications of the economic downturn developing in 2007, the Fed began reducing market interest rates. The low interest rate environment was maintained as part of a strategy to stimulate the economy by keeping both personal and business borrowing costs as low as possible. The strategy has achieved its goals, as borrowing costs for residential housing have been at historical lows, and the prime rate of interest remains at a low level. Following an approximate 10-year period of historically low interest rates, the Fed has increased the targeted interest rates three times, by a total of 0.75%, through May 2017.

As of May 12, 2017, the bond equivalent yields for U.S. Treasury bonds with terms of one and ten years equaled 1.11% and 2.33%, respectively, versus comparable year ago yields of 0.54% and 1.75%. The overall low interest rates have had an unfavorable impact on the net interest margins of many financial institutions, as they rely on a spread between the yields on longer term assets and the costs of shorter term funding sources. Over the recent past, asset yields have continued to decline, while material reductions in liability costs have ceased, resulting a gradual reduction in yield/cost spreads for many institutions. In addition, institutions who

| RP® Financial, LC. | MARKET AREA

II.4 |

originate substantial volumes of prime-based loans have also given up yield as the prime rate has also remained relatively low. This low interest rate environment, along with continued competition in the industry for quality loans, has placed downward pressure on net interest margins. Historical interest rate trends are presented in Exhibit II-2.

Market Area Demographics

Key demographic and economic indicators for the Association’s market area include population, number of households and household/per capita income levels. Demographic data for Onondaga County, as well as comparative data for the Syracuse MSA, New York and the U.S., is provided in Table 2.1. In general, the demographics for Onondaga County were similar to the demographics for the Syracuse MSA. Onondaga County’s population showed a nominal increase from 2010 to 2017, versus comparable New York and U.S. annual population growth rates of 0.4% and 0.7%, respectively. Age distribution measures reflect that Onondaga County has a somewhat similarly-aged population relative to New York and the U.S. Similar to population growth trends, Onondaga County’s annual rate of household growth lagged the comparable New York and U.S. annual household growth rates over the past seven years. Projected five-year growth rates for Onondaga County showed increases in population and household growth rates, but remained below the comparable projected growth rates for New York and the U.S.

Onondaga County’s 2017 median household income of $56,285 was somewhat below the New York median of $62,222 and slightly below the U.S. median of $57,462. Similarly, per capita and household income distribution measures also generally reflected lower levels of income for Onondaga County relative to the comparable New York measures and were more consistent with the comparable U.S. measures. Over the next five years, Onondaga County is projected to experience slower growth rates in household and per capita income relative to the comparable projected New York and U.S. growth rates.

Market Area Regional Economy

Comparative employment data shown in Table 2.1 shows that employment in education/healthcare/social services constituted the major source of jobs in Onondaga County, as well as for the state of New York. Service jobs followed by wholesale/retail trade employment represented the second and third largest employment sectors in Onondaga County and the state

| RP® Financial, LC. | MARKET AREA

II.5 |

Table 2.1

Seneca Federal Savings and Loan Association

Summary Demographic Data

| | | Year | | | Growth Rate | |