- GFS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

F-1 Filing

GLOBALFOUNDRIES (GFS) F-1Registration statement (foreign)

Filed: 4 Oct 21, 12:01pm

As filed with the Securities and Exchange Commission on October 4, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GLOBALFOUNDRIES Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Cayman Islands | 3674 | 98-0604079 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

400 Stonebreak Road Extension

Malta, NY 12020

(518) 305-9013

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Corporation Service Company

251 Little Falls Drive

Wilmington, DE 19808

(800) 927-9801

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

David Lopez, Esq. Gamal M. Abouali, Esq. Adam Fleisher, Esq. Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 | Tad J. Freese, Esq. Matthew T. Bush, Esq. Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 (650) 328-4600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

CALCULATION OF REGISTRATION FEE

| ||||

| Title Of Each Class Of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount Of Registration Fee | ||

Ordinary shares, par value US$0.02 per share | US$1,000,000,000 | US$92,700 | ||

| ||||

| ||||

| (1) | Includes shares that the underwriters may purchase, including pursuant to the option to purchase additional shares, if any. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor Mubadala may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2021

Ordinary Shares

GLOBALFOUNDRIES Inc.

This is an initial public offering of the ordinary shares, US$0.02 par value per share, of GLOBALFOUNDRIES Inc., or the company. We are offering of the ordinary shares to be sold in this offering. Mubadala Investment Company PJSC (“Mubadala”) is offering of the ordinary shares to be sold in the offering. We will not receive any proceeds from the sale of ordinary shares by Mubadala. Prior to this offering, there has been no public market for our ordinary shares. It is currently estimated that the initial public offering price per ordinary share will be between US$ and US$ . We have applied to list our ordinary shares on the Nasdaq under the symbol “GFS.”

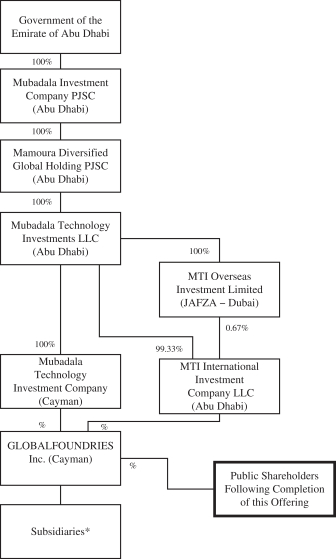

Following the completion of this offering, we will be a “controlled company” as defined under the Nasdaq corporate governance requirements. Our shareholder, Mubadala, through its wholly owned subsidiaries Mubadala Technology Investment Company (“MTIC”) and MTI International Investment Company LLC (“MTIIIC”), will beneficially own % of our issued and outstanding ordinary shares and control approximately % of the voting power of our issued and outstanding ordinary shares following this offering, assuming no exercise of the underwriters’ option to purchase additional ordinary shares. See “Principal and Selling Shareholder.”

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 20 of this prospectus.

Per Ordinary Share | Total | |||||||

Initial public offering price | US$ | US$ | ||||||

Underwriting discounts and commissions(1) | US$ | US$ | ||||||

Proceeds to us, before expenses | US$ | US$ | ||||||

Proceeds to Mubadala, before expenses | US$ | US$ | ||||||

| (1) | See “Underwriters” for additional information regarding total underwriter compensation. |

At our request, the underwriters have reserved up to ordinary shares, or up to % of the shares offered by us in this offering, for sale at the initial public offering price through a directed share program to certain employees and other related persons identified by us. See the section titled “Underwriters—Directed Share Program.”

Mubadala has granted an option to the underwriters, exercisable for 30 days after the date of this prospectus, to purchase up to additional ordinary shares at the public offering price, less the underwriting discount.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares against payment in New York, New York on or about , 2021, through the book-entry facility of The Depository Trust Company.

| MORGAN STANLEY | BofA SECURITIES | J.P. MORGAN | ||

| CITIGROUP | CREDIT SUISSE | |||

| DEUTSCHE BANK SECURITIES | HSBC | JEFFERIES | ||

| BAIRD | COWEN | NEEDHAM & COMPANY | RAYMOND JAMES | WEDBUSH SECURITIES | ||||

| DREXEL HAMILTON | SIEBERT WILLIAMS SHANK | IMI - INTESA SANPAOLO | ||||||

PROSPECTUS DATED , 2021

| Page | ||||

| 1 | ||||

| 20 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

Management’s Discussion and Analysis Of Financial Condition and Results of Operations | 62 | |||

| 89 | ||||

| 122 | ||||

| 132 | ||||

| Page | ||||

| 137 | ||||

| 142 | ||||

| 143 | ||||

| 159 | ||||

| 161 | ||||

| 165 | ||||

| 174 | ||||

| 175 | ||||

| 175 | ||||

| 177 | ||||

| 178 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and Mubadala have not, and the underwriters have not, authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and Mubadala take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and Mubadala are offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares. Our results of operations, financial condition, business and prospects may have changed since such date.

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in the ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside of the United States: neither we, Mubadala, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, observe any restrictions relating to, the offering of ordinary shares and this distribution of this prospectus outside of the United States.

i

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”), as adopted by the International Accounting Standards Board (“IASB”). Our financial statements were not prepared in accordance with generally accepted accounting principles in the United States. We present our consolidated financial statements in U.S. dollars. References in this prospectus to “US$” or “$” refer to U.S. dollars, the official currency of the United States.

Use of Non-IFRS Financial Measures

Certain parts of this prospectus contain the following non-IFRS financial measures: adjusted gross profit (loss), adjusted loss from operations, adjusted EBITDA, adjusted net loss from continuing operations and adjusted loss per share.

Adjusted gross profit (loss), adjusted loss from operations, adjusted EBITDA, adjusted net loss from continuing operations and adjusted loss per share are used by our management to monitor the underlying performance of the business and its operations. These measures are used by different companies for differing purposes and are often calculated in ways that reflect the circumstances of those companies. You should exercise caution in comparing these measures as reported by us to the same or similar measures as reported by other companies. Adjusted gross profit (loss), adjusted loss from operations, adjusted EBITDA, adjusted net loss from continuing operations and adjusted loss per share may not be comparable to similarly titled metrics of other companies. These measures are unaudited and have not been prepared in accordance with IFRS or any other generally accepted accounting principles.

Adjusted gross profit (loss), adjusted loss from operations, adjusted EBITDA, adjusted net loss from continuing operations and adjusted loss per share are not measurements of performance under IFRS or any other generally accepted accounting principles, and you should not consider them as an alternative to loss for the period, operating loss or other financial measures determined in accordance with IFRS or other generally accepted accounting principles. These measures have limitations as analytical tools, and you should not consider them in isolation.

ii

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “GF,” “the company,” “we,” “us” and “our” in this prospectus refer to GLOBALFOUNDRIES Inc. and its consolidated subsidiaries.

GLOBALFOUNDRIES INC.

Overview

We are one of the world’s leading semiconductor foundries. We manufacture complex, feature-rich integrated circuits (“ICs”) that enable billions of electronic devices that are pervasive throughout nearly every sector of the global economy. With our specialized foundry manufacturing processes, a library consisting of thousands of qualified circuit-building block designs (known as intellectual property (“IP”) titles or IP blocks), and differentiated transistor and device technology, we serve a broad range of customers, including the global leaders in IC design, and provide optimized solutions for the function, performance and power requirements of critical applications driving key secular growth end markets. As the only scaled pure-play foundry with a global footprint that is not based in China or Taiwan, we help customers mitigate geopolitical risk and provide greater supply chain certainty. We define a scaled pure-play foundry as a company that focuses on producing ICs for other companies, rather than those of its own design, with more than $2 billion of annual foundry revenue.

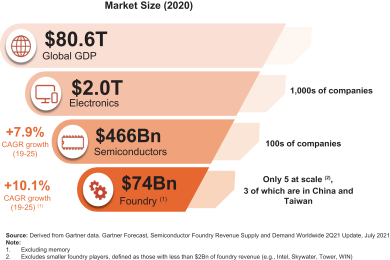

Technology megatrends including internet of things (“IoT”), 5G, cloud, artificial intelligence (“AI”) and next-generation automotive are reshaping the global economy and driving a new golden age for semiconductors—a market that is expected to grow to more than $1 trillion by the end of this decade, from close to $0.5 trillion in 2021, according to VLSI Research. Semiconductors have become ubiquitous, powering a broad range of applications from consumer devices to enterprise and industrial applications. Semiconductor innovation is essential to the growth and development of many parts of the technology ecosystem. This includes the software and AI revolution and data collection, transmission and processing at an unprecedented scale, as well as increasing use of advanced driver-assistance systems (“ADAS”) and electrification of automobiles, with electric vehicle penetration, consisting of hybrid-full, hybrid-mild and battery electric vehicle propulsion systems, expected to increase from 19% in 2021 to 55% in 2027, according to IHS Markit from July 2021. Semiconductor innovation is also essential for many industrial applications. As the manufacturing backbone of the semiconductor industry, foundries are the bedrock of the global technology ecosystem, and, by extension, the world economy. Foundries such as GF drive innovation by providing advances in process technologies, materials science and IC design IP within the global supply chain to enable customers to develop ICs, accelerate time-to-market and offer value-added services.

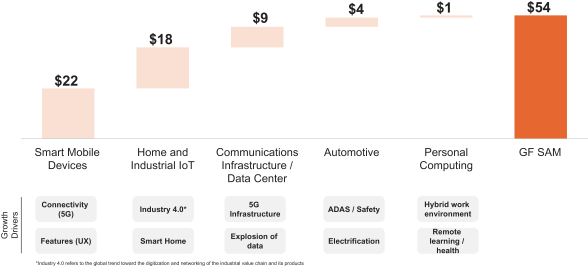

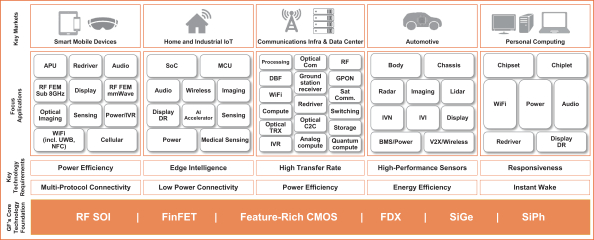

We provide differentiated foundry solutions that enable the era for data-centric, connected, intelligent and secure technologies. We are redefining the foundry model with feature-rich solutions that enable our customers to develop innovative products for an increasingly wide variety of applications across broad and pervasive markets. We unlock value for our customers by helping drive technology in multiple dimensions, making their products more intelligent and intuitive, more connected and secure, and more powerful and energy-efficient. Our objective is to be the global leader in feature-rich semiconductor manufacturing—the foundry of choice for the pervasive semiconductor market. We have a large and growing market opportunity with an estimated serviceable addressable market (“SAM”) of $54 billion in 2020, which reflects the sum of all foundry revenues excluding memory and revenues from <12nm wafers, as estimated by Gartner. Our SAM is supported by significant opportunities in our core markets of Smart Mobile Devices, Home and Industrial IoT, Communications Infrastructure & Datacenter, Automotive and Personal Computing.

1

Since our founding in 2009, we have invested over $23 billion in our company to build a global manufacturing footprint with multiple state-of-the-art facilities across three continents, offering customers the flexibility and security their supply chains require. As semiconductor technologies become more complex with advanced integration requirements, we are also able to offer comprehensive, state-of-the-art design solutions and services that provide our customers with a high-quality, cost-effective and faster path to market. We have over 50 ecosystem partners spanning IP, electronic design automation, outsourced assembly and test and design services. Building on an existing library of more than 4,000 IP titles, we currently have more than 950 IP titles in active development across 26 process nodes and 34 IP partners.

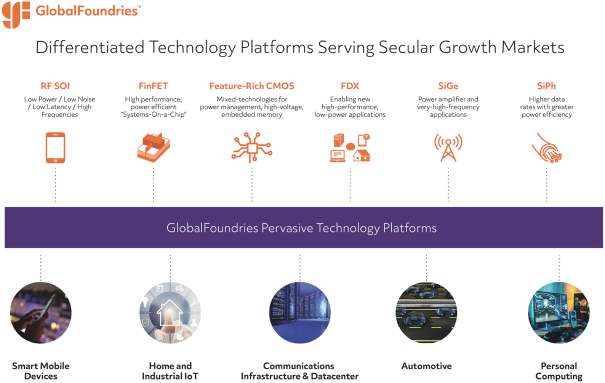

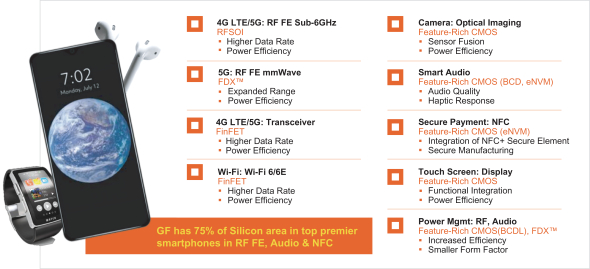

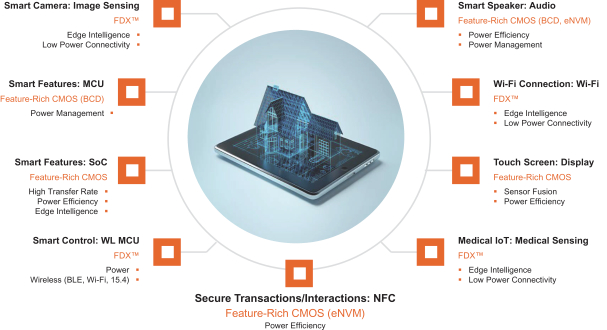

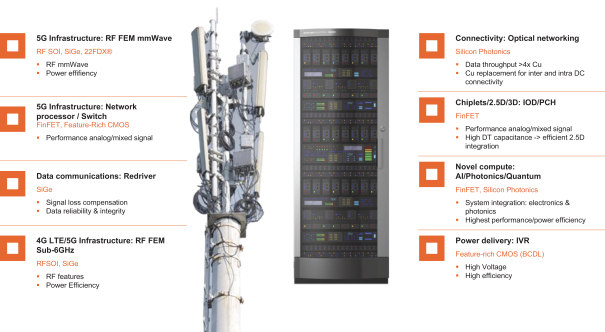

We focus on feature-rich devices that include digital, analog, mixed-signal, radio frequency (“RF”), ultra-low power and embedded memory solutions that connect, secure and process data, and efficiently power the digital world around us. As the semiconductor and technology industries become more complex, we expect to become an even more vital partner to fabless semiconductor design companies, integrated device manufacturers (“IDMs”) and original equipment manufacturers (“OEMs”), bringing their designs to life in physical hardware. Our core technology portfolio includes a range of differentiated technology platforms, including our industry-leading RF Silicon-on-Insulator (“SOI”) solutions, advanced high-performance Fin Field-Effect Transistor (“FinFET”), feature-rich Complementary Metal-Oxide Semiconductor (“CMOS”), our proprietary Fully-Depleted SOI (“FDXTM”), high-performance Silicon Germanium (“SiGe”) products and Silicon Photonics (“SiPh”), all of which can be purposely engineered, innovated and designed for a broad set of demanding applications. Customers depend on us for feature-rich solutions based on these differentiated technologies in a growing number of applications that require low power, real-time connectivity and on-board intelligence.

The combination of our highly-differentiated technology and our scaled manufacturing footprint enables us to attract a large share of single-sourced products and long-term supply agreements, providing a high degree of revenue visibility and significant operating leverage, resulting in improved financial performance and bottom line growth. As of the date of this prospectus, the aggregate lifetime revenue commitment reflected by these agreements amounted to more than $19.5 billion, including more than $10 billion during the period from 2022 through 2023 and approximately $2.5 billion in advanced payments and capacity reservation fees. These agreements include binding, multi-year, reciprocal annual (and, in some cases, quarterly) minimum purchase and supply commitments with wafer pricing and associated mechanics outlined for the contract term. Through an intense focus on collaboration, we have built deep strategic partnerships with a broad base of more than 200 customers as of December 31, 2020, many of whom are the global leaders in their field. In the first six months of 2021, our top ten customers, based on wafer shipment volume, included some of the largest semiconductor companies in the world: Qualcomm Inc. (“Qualcomm”), MediaTek Inc. (“MediaTek”), NXP Semiconductors N.V. (“NXP”), Qorvo, Inc. (“Qorvo”), Cirrus Logic, Inc. (“Cirrus Logic”), Advanced Micro Devices, Inc. (“AMD”), Skyworks Solutions, Inc. (“Skyworks”), Murata Manufacturing Co., Ltd. (“Murata”), Samsung Electronics Co., Ltd. (“Samsung”) and Broadcom Inc. (“Broadcom”). A key measure of our position as a strategic partner to our customers is the mix of our wafer shipment volume attributable to single-sourced business, which represented approximately 61% of wafer shipment volume in 2020, up from 47% in 2018. We define single-sourced products as those that we believe can only be manufactured with our technology and cannot be manufactured elsewhere without significant customer redesigns. Approximately 80% of our more than 350 design wins in 2020 were for single-sourced business, a record-breaking year in terms of number of design wins, up from 69% in 2018. We define a design win as the successful completion of the evaluation stage, where a customer has assessed our technology solution, verified that it meets its requirements, qualified it for their products and confirmed to us their selection.

In addition to our highly-differentiated technology platforms, our capital-efficient, scaled manufacturing footprint spanning three continents gives us the flexibility and agility to meet the dynamic needs of our customers around the globe, help them mitigate geopolitical risk and provide greater supply chain certainty. We are also one of the most advanced accredited foundry providers to the U.S. Department of Defense (“DoD”) and

2

have the ability to extend this high-assurance model to serve commercial customers and to enhance supply chain security and resilience at a time when they are becoming more critical to national and economic security. Since foundry production is concentrated in China and Taiwan, we believe our global manufacturing footprint is a key differentiator that makes us the ideal partner for local and regional government stakeholders at a time when many regions, in particular the United States and Europe, are contemplating significant funding to secure and grow domestic semiconductor manufacturing capabilities.

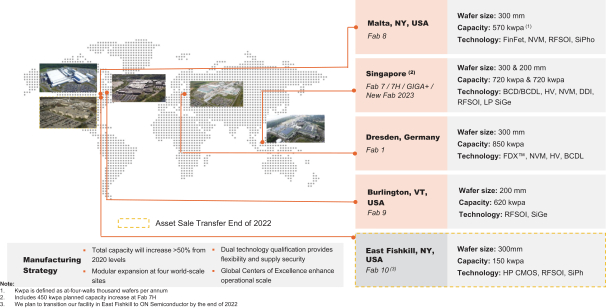

We currently operate five manufacturing sites in the following locations: Dresden, Germany; Singapore; Malta, New York; Burlington, Vermont; and East Fishkill, New York. Subsequent to our transfer of our East Fishkill facility (the “EFK facility”) (see “Business—Manufacturing and Operations”), we will have four world-class manufacturing sites on three continents, providing the scale, technology differentiation and geographic diversification that we believe are critically important to our customers’ success, with total 300mm equivalent capacity in 2020 of approximately 1,920 kilo wafers per annum (“kwpa”).

Industry Background

Technology Megatrends Are Reshaping the Global Economy

The global economy’s dependency on technology is greater today than ever before. Consumer devices played a significant role in technological advances over the last decade, triggering a wave of innovation in design and manufacturing, as evidenced by the evolution of the smartphone since the introduction of the iPhone in 2007. The number of connected devices worldwide increased from 13.3 billion in 2015 to 21.6 billion in 2020, according to IoT Analytics. The latest generations of smartphone devices have integrated and improved the functionality of dozens of applications, including the Global Positioning System (“GPS”), camera, camcorder, music player, recorder, measuring devices, remote controller, car keys and credit cards, which in turn has spawned increased innovation in myriad electronic devices across numerous markets. Several megatrends including IoT, 5G, cloud, AI and next-generation automotive are poised to lead the next decade of technology advances, redefining how we use electronic devices to live, work and interact as a global society. These megatrends are reshaping nearly every industry in the global economy and rely on advances in semiconductor technology across multiple innovation vectors.

A New Golden Age for Semiconductors

Semiconductors are the core building blocks of electronic devices and systems, including those used in mobile devices, automobiles, consumer electronics, wearables, smart home devices, 5G wireless infrastructure, robotics, personal computers (“PCs”), cloud computing, data networking and others. Historically, semiconductor innovation was driven by a few select compute-centric applications—initially PCs and later the internet and mobile phones. Mobile devices have evolved from a convenient communication appliance to a feature-rich, always-connected device, enabling users to do and control nearly everything in their lives. This has driven significant growth in semiconductor demand. According to Gartner, mobile phone semiconductor revenue in 2021, excluding memory, is expected to increase by approximately 16% from 2020, which is primarily attributable to the shift from 4G to 5G phones. Similarly, the use of semiconductors in automobiles is expected to dramatically increase from 2015 to 2025 as innovation in driver safety, electrical vehicles and infotainment applications increase.

Another significant driver of semiconductor demand has been, and we believe will continue to be, the tremendous growth in the deployment of intelligent software, which is increasingly transforming a wide variety of business functions across all sectors. Semiconductors enable the functionality that software delivers. With wide-scale adoption of mobile devices and software solutions, society has grown to expect high-speed connectivity, convenience and security in all applications, providing a catalyst for increased semiconductor content in nearly every industry.

3

Semiconductors have become mission-critical to the functionality, safety, transformation and success of many industries. As a result, the diversification of semiconductor demand across a wide range of industries has made the sector more foundational and central to the broader economy and in turn less vulnerable to cyclicality.

Foundries Are the Bedrock of the Technology Ecosystem

Semiconductor manufacturing is now a critical part of the electronics value chain by providing the foundation for innovation by fabless semiconductor design companies and OEMs, enabling broad-ranging products addressing almost every commercial sector. As a result, access to manufacturing has become a supply chain, economic and, ultimately, a national security concern.

Prior to the 1980s, the semiconductor industry was vertically integrated and semiconductor companies owned and operated their own manufacturing facilities. The market demand for continued electronics innovation, combined with the technical and financial barriers to entry in manufacturing, led to the proliferation of fabless semiconductor companies that outsourced manufacturing to foundry players. Over time, foundries, with their continued process technology innovation, coupled with the proliferation of product-focused fabless semiconductor companies, have been the engines driving the growth of the $0.5 trillion semiconductor market in 2021.

Today, it is increasingly difficult for IDMs to profitably scale manufacturing in-house, resulting in more outsourcing of manufacturing to foundries. In 2020, more than 33% of semiconductor manufacturing was outsourced to foundries, compared to approximately 9% in 2000, according to IC Insights. As manufacturing costs have continued to increase, only foundries have enough manufacturing volume to generate a return on the capital investment required, making outsourcing critical to any IDM’s strategy. Today, almost all of the remaining IDMs use foundry services for some of their products.

Geopolitical Environment and Growing Importance of Supply Security

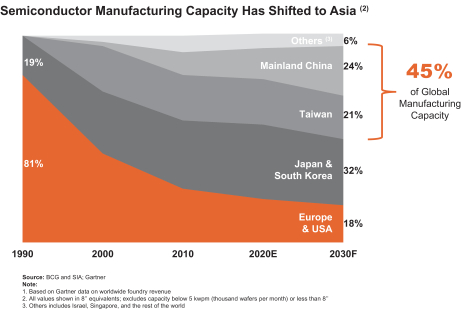

Over the past three decades, semiconductor manufacturing has shifted toward Asia. Since 1990, the share of global semiconductor manufacturing capacity produced in major commercial fabs using leading wafer sizes in the United States and Europe declined from 81% to 21% in 2020, according to the Boston Consulting Group (“BCG”) and the Semiconductor Industry Association (“SIA”). Over the same period, production capacity in China and Taiwan increased from close to zero to 37% of total global capacity, driven in large part by significant local government subsidies and support.

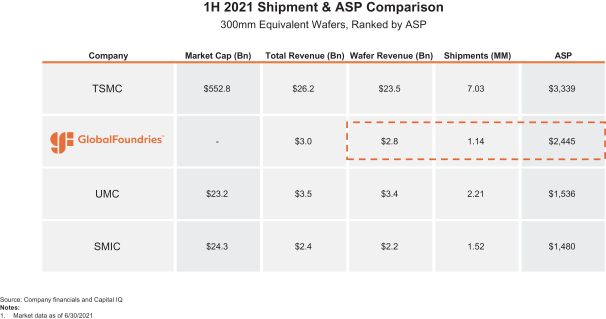

There are currently only five foundries of significant scale: GF, Samsung, Semiconductor Manufacturing International Corporation (“SMIC”), Taiwan Semiconductor Manufacturing Company, Limited (“TSMC”) and United Microelectronics Corporation (“UMC”). Collectively, these five foundries accounted for the vast majority of worldwide foundry revenue in 2020, according to a March 2021 Gartner Semiconductor Foundry Worldwide Market Share report. More importantly, approximately 77% of foundry revenue in 2020 was from wafers manufactured in Taiwan or China, with SMIC, TSMC and UMC accounting for approximately 72% of foundry revenue in 2020. These trends have not only created trade imbalances and disputes, but have also exposed global supply chains to significant risks, including geopolitical risks. The U.S. and European governments are increasingly focused on developing a semiconductor supply chain that is less dependent on manufacturing based in Taiwan or China.

In particular, the concentration of semiconductor production in countries such as Taiwan, a resource-constrained island susceptible to natural disasters and geopolitical tension, additionally exposes global supply chains to significant risk. Given the ubiquitous nature of semiconductor technology, these imbalances and associated risks are considered by countries to be a threat to economic and national security, with many industry experts equating the importance of semiconductor supply today to that of oil in the twentieth century.

4

The Global Semiconductor Supply Shortage

While technology megatrends have been driving increased semiconductor demand, the COVID-19 pandemic accelerated demand trends already underway, including remote work, learning and medicine, driving sustainable demand for electronic devices such as networking and infrastructure to maintain a distributed environment. As a result, demand has outstripped supply across most of the semiconductor industry. Meanwhile, other industries, such as the automotive sector, which were initially hard-hit by the pandemic, began to halt new purchases and depleted existing inventories of semiconductor chips. As some parts of the world have started to re-open, these impacted sectors have seen significant increases in new demand, which, when coupled with underlying megatrends not related to the COVID-19 pandemic, such as the electrification of vehicles, have resulted in a significant imbalance between demand and supply. Although the supply-demand imbalance is expected to improve over the medium-term, the semiconductor industry will require a significant increase in investment to keep up with demand, with total industry revenue expected to double over the next eight to ten years.

Government Incentives to Secure Supply

Against this backdrop, governments have been proposing bold new incentives to fund and secure their local semiconductor manufacturing industries. The United States Congress recently authorized the Creating Helpful Incentives to Produce Semiconductors for America (“CHIPS”) Act, which, when funded, as proposed by the United States Innovation and Competition Act, will provide for more than $52 billion in funding to the domestic semiconductor industry, with approximately two-thirds directed toward semiconductor manufacturing. In Europe, a program referred to as the Important Projects of Common European Interest (“IPCEI”) includes a large aid package to strengthen the European Union’s (“EU”) semiconductor industry. These programs are designed to bring back share in the semiconductor industry to the United States and Europe by encouraging manufacturers such as GF to increase their local capacities in these regions.

Similarly, we believe that foundry customers are increasingly seeking to diversify and secure their semiconductor supply chains, and are looking for foundry partners with manufacturing footprints in Europe, the United States and Asia, outside of China and Taiwan. Fabless companies and IDMs increasingly view their foundry relations as highly strategic and are looking to secure long-term capacity contracts by paying to access capacity expansions at their foundry partners. This trend has the potential to help balance the geographical distribution of manufacturing and drive increased long-term visibility and profitability of the foundry industry.

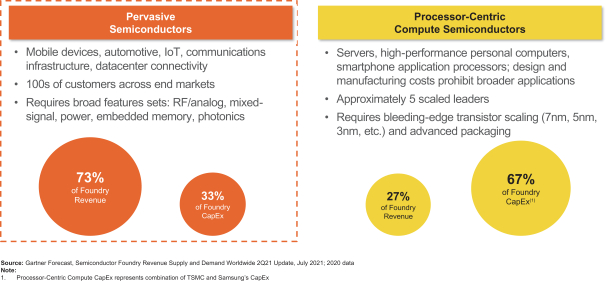

Evolution to Pervasive, Broadly Diversified End Markets

Historically, processor-centric compute was the foundation of the semiconductor industry, and technological innovation in end products was driven by an evolution to smaller feature sizes and greater processing capability per unit produced. This was appropriate when narrow application requirements were centered on raw processing power, and led to a cyclical industry predominantly focused on highly digital, compute-oriented verticals. Today, robust feature sets such as wireless connectivity, low power and thermal efficiency, human interfaces and security have become mission-critical to the functionality, safety, transformation, security and success of many industries. In addition, virtually all electronic systems require a combination of compute capability and features such as digital, analog, mixed-signal, RF and embedded memory to enable breakthrough functionality across wide-ranging end markets and applications. The ICs that serve these applications comprise the pervasive semiconductor market, consisting of feature-rich digital, analog and mixed-signal semiconductors. The market for, and manufacturing of, ICs for pervasive semiconductors is very different and less cyclical than the market for traditional processor-centric compute semiconductors, which have higher operating and capital costs and a narrower customer set.

The pervasive semiconductor market represented 73% of the total semiconductor foundry market, as well as 33% of the total semiconductor foundry capital expenditure in 2020, according to the Gartner Forecast,

5

Semiconductor Foundry Revenue Supply and Demand Worldwide 2Q21 Update, July 2021. The pervasive semiconductor market is driving breakthrough innovation across broad applications such as longer battery life for mobile devices, always-on access to connected devices, high data throughput for work from home, streaming, gaming and augmented reality / virtual reality (“AR/VR”), powerful sensing for safe and comfortable autonomous driving and embedded memory for secure cryptographic credentials. Unlike processor-centric compute devices, pervasive semiconductor performance is driven more by circuit design, specialty materials and specialized manufacturing processes. Innovation in pervasive ICs is measured in terms of precision, accuracy, bandwidth, efficiency and sensitivity. When combined with greater breadth and diversity of customers and end markets, these factors tend to result in more stable demand and pricing for pervasive semiconductors than processor-centric compute semiconductors.

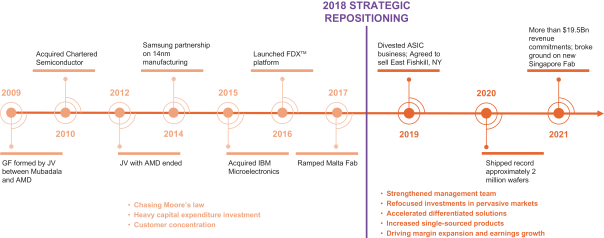

Our Journey

History

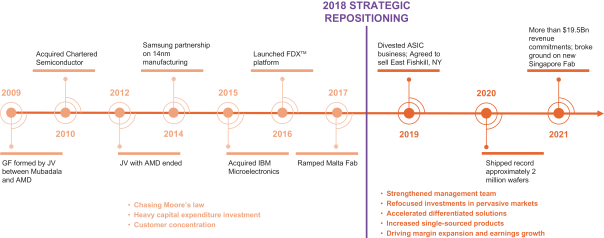

Since our inception, we have grown through a combination of acquisitions, greenfield expansions and strategic partnerships. We were established in 2009 when a subsidiary of Mubadala acquired AMD’s manufacturing operations in Dresden, Germany, and a fab project site in Malta, New York. In 2010, we combined with Chartered Semiconductor Manufacturing, the third-largest foundry by revenue at the time, forming the basis for our Singapore manufacturing hub. In 2015, we acquired International Business Machines Corporation’s (“IBM”) Microelectronics division with manufacturing facilities in New York and Vermont, adding distinctive technology capabilities, including more than 2,000 IBM engineers. By 2017, we had successfully ramped our most advanced manufacturing site in Malta, New York. Through our organic and strategic growth initiatives, we increased manufacturing capacity twelvefold from 2009 to 2020 and now have a global footprint with five manufacturing sites on three continents with approximately 15,000 employees and approximately 10,000 worldwide patents. In 2020, we shipped approximately 2 million 300mm equivalent semiconductor wafers. With this level of market presence and capability, our technologies are found across most semiconductor end markets in devices used on a daily basis.

Strategic Repositioning

Beginning in 2018, we embarked on a new strategy to significantly reposition our business to better align with our customers’ needs, drive margin expansion and accelerate value creation for our stakeholders. Today, we focus on and are growing sales of foundry solutions for the pervasive semiconductor market, where we are trusted to reliably innovate and deliver premium performance, functionality, efficiency and quality, rather than focusing merely on transistor density and processing speed.

Key elements of our strategy include:

| • | Focus on feature-rich solutions. In August 2018, we shifted our focus to address the pervasive foundry market opportunity and the growing demand for specialized process technologies in emerging high-growth markets. |

| • | Market-based customer engagement strategy. In order to better address and capture the pervasive semiconductor foundry market opportunity, we restructured our go-to-market organizations to better align with the growing opportunities in Smart Mobile Devices, Home and Industrial IoT, Communications Infrastructure & Datacenter, Automotive and Personal Computing. We supplemented our existing workforce with talented executives holding deep domain expertise in these growing markets. |

| • | Optimized portfolio. We took a number of steps to streamline and optimize our business and manufacturing footprint to improve our bottom line and return on capital. In 2019, we divested three assets that were not aligned with our strategic priorities. |

6

| • | Resized and refocused cost structure. We have realigned our engineering, sales and marketing organizations toward higher-margin, higher-return products and opportunities to drive our improved bottom line. |

| • | Disciplined, capital-efficient expansion strategy. Since our repositioning, we have focused on a capital-efficient expansion strategy that is based on long-term demand certainty and partnerships with our customers. In addition, by repositioning to focus on differentiated technologies, we have been able to efficiently add features to our existing platforms while significantly reducing overall capital expenditures. Additionally, this strategy provides us with the opportunity to pursue highly accretive investments to meet market demand. |

Our Market Opportunity

According to Gartner, the total addressable market (“TAM”) for the overall semiconductor device market was $466 billion in 2020, while the TAM for the foundry market, excluding memory, was $74 billion. Of this total, we estimate that our SAM represented $54 billion, which included $22 billion for Smart Mobile Devices, $18 billion for Home and Industrial IoT, $9 billion for Communications Infrastructure & Datacenter, $4 billion for Automotive and $1 billion for Personal Computing opportunities.

Smart Mobile Devices

According to Gartner, the smart mobile devices semiconductor market, excluding memory, is expected to grow at 6.3% compound annual growth rate (“CAGR”) from 2020 to 2025. By 2025, semiconductor devices for mobile applications, such as phones, tablets and wearables, are expected to account for approximately 28% of total semiconductor demand, excluding memory. Within smart mobile devices, we expect particularly rapid growth in mobile devices connected to phones, such as smart watches (with an expected CAGR of 22% from 2020 to 2025, according to Gartner). RF content in 5G mobile devices is also expected to be more than 700% higher than that of 4G devices by 2025, according to IDC. We anticipate rapid growth in wearables, such as smart watches, mesh sensors and tracking devices, as well as AR/VR headsets, as these technologies continue to mature. Our technology platforms are designed to capture this opportunity as they address key challenges that need to be solved to drive improved customer experience and adoption.

Home and Industrial IoT

According to Gartner, the home and industrial IoT semiconductor market is expected to grow at 7.6% CAGR, with industrial automation markets expected to grow at 11% CAGR from 2020 to 2025, excluding memory. Our Home and Industrial IoT opportunity consists of solutions for a wide variety of applications, including factory automation, test and measurement, smart city, healthcare, transportation, connected home and others. According to Gartner, IoT applications are expected to account for approximately 22% of total annual semiconductor demand in 2025, excluding memory. We are well-positioned to capture future growth in IoT applications, as we believe these applications will increasingly combine ultra-low power chips, a variety of sensors, improved displays and cameras, multi-sensor human-machine interfaces, connectivity and intelligence at the edge.

Communications Infrastructure & Datacenter

According to Gartner, the communications infrastructure & datacenter market is expected to grow at 5.4% CAGR, with wireless infrastructure and enterprise networking markets expected to grow at 12% CAGR, and 9% CAGR, respectively, from 2020 to 2025, excluding memory. Our Communications Infrastructure & Datacenter opportunity consists of solutions for wired and wireless network infrastructure, datacenter applications and satellite communications. We believe we are well-positioned in RF, switching, optical, compute and storage

7

solutions for these key end markets. Our leading capability in SiPh increases throughput and dramatically reduces power consumption through the use of light instead of electrons. Our millimeter wave (“mmWave”) technology serves the evolving needs of mobile networks, such as micro-cells for 5G mmWave, while our breadth of power applications enable our customers to design more efficient solutions for the RF networks of the future.

Automotive

According to Gartner, the automotive semiconductor devices, ADAS applications, and EV/HEV applications markets are expected to grow at 14.2% CAGR, 20% CAGR and 28% CAGR respectively, from 2020 to 2025, excluding memory. Many of the innovations underway in the automotive industry, such as electric and autonomous vehicles, advanced infotainment, connectivity and security, are driven by increased adoption of semiconductors in cars. Semiconductor content per vehicle is expected to increase dramatically in the coming years. The number of semiconductor devices per car is expected to double between 2016 and 2027, to over 2,000 ICs per car, according to IHS Markit from July 2021.

We expect the recent growth of semiconductor content in the automotive industry to continue, and we have been regularly evolving our technologies to serve these needs. We have developed many technologies that are well-positioned to be the semiconductor backbone of fully autonomous vehicles, such as our FDXTM platform for mmWave RADAR applications and SiGe for battery management.

Personal Computing

According to Gartner, the personal computing market is expected to grow at 2.5% CAGR from 2020 to 2025, excluding memory. Additionally, clamshell ultra-mobile devices and video game consoles are expected to grow at 9% CAGR and 12% CAGR, respectively, within that same time period, excluding memory. By 2025, semiconductor devices for personal computing, such as laptops and desktops are expected to account for approximately 16% of total semiconductor demand, excluding memory. In 2020 and 2021, the volume of personal computing devices has experienced strong growth, driven by work from home, remote learning and other trends related to the COVID-19 pandemic. We expect demand will continue to be sustained with the increasing use of compute in an increasing range of human activities (e.g., education and health), including in geographies that had limited access in the past.

While a large portion of the end market is driven by central processing units / graphics processing units (“CPU/GPUs”) that are progressively transitioning to technologies we do not serve following our pivot in 2018, we will continue to support our customers across a variety of applications where our technology platforms can provide meaningful differentiation for their devices. These devices include chipsets (e.g., platform controller hub (“PCH”) or I/O die (“IOD”)), Wi-Fi, power delivery, display drivers, re-drivers and audio amplifiers. Many of our technologies offer best-in-class performance for these applications, including FinFET, CMOS and BCDLiteTM.

Key Strengths

We have several distinct advantages that differentiate us from our peers:

| • | Scaled manufacturing capabilities. According to Gartner, in 2020, we were the third largest foundry in the world based on external sales. In 2020, we shipped approximately 2 million 300mm equivalent semiconductor wafers. We believe that our scaled global manufacturing footprint enables our customers to leverage the security of our fabrication facilities (“fabs”) and ensure a trusted supply of critical semiconductors. |

| • | Differentiated technology platforms and ecosystem. We deliver highly-differentiated solutions to meet customer demand for superior performance, lower power consumption and better thermal |

8

efficiency for mission-critical applications across IoT, 5G, cloud, AI, next-generation automotive and other secular growth markets that are driving the economy of the future. |

| • | Diversified and secure geographic footprint. Our scaled global manufacturing footprint helps mitigate geopolitical, natural disaster and competitive risks. We are the only U.S.-based scaled semiconductor foundry with a global footprint. We believe that this geographic diversification is critical to our customers as well as governments around the world as they look to secure semiconductor supply. Furthermore, a significant number of our technology platforms are qualified across our manufacturing footprint, providing our customers with a geographically diverse one-stop supply chain solution. |

| • | Market-centric solutions driving deep customer relationships. We are pioneering a new sustainable foundry relationship with fabless companies, IDMs and OEMs by partnering with customers to redefine the supply chain and economics for the entire value chain. The insights we gain through our market-centric approach enable us to focus on and invest in the markets and applications in which we believe we can achieve a clear leadership position. |

| • | High degree of revenue and earnings visibility. Our combination of highly-differentiated technology, significant number of single-sourced products and customer supply agreements provides a high degree of revenue and earnings visibility. |

| • | Capital-efficient model. Our focus on the pervasive semiconductor market results in lower capital requirements compared to foundries that focus on processor-centric compute semiconductors and are therefore obligated to invest significant capital to transition from node to node. Additionally, as the only scaled pure-play foundry with existing manufacturing capacity in the United States and Europe, we are well-positioned to benefit from government support, as governments around the world implement or contemplate large aid packages to encourage manufacturers such as us to increase their local capacities in these regions. |

| • | World-class team and focus on sustainability. We have a highly technically proficient, talented and experienced management team of executive officers and key employees with average industry experience of 25 years. We are dedicated to ethical and responsible business practices, the personal and social well-being of our diverse and highly-skilled employee base, and supply chain and environmental stewardship. As of December 31, 2020, we employed approximately 15,000 employees, and approximately 65% of our employees were engineers or technicians. |

Our Differentiated Technology Platforms

We offer a wide range of feature-rich solutions that can address the needs of mission-critical applications in Smart Mobile Devices, Home and Industrial IoT, Communications Infrastructure & Datacenter, Automotive and Personal Computing. To solve our customers’ most complex challenges, we have developed a broad range of sophisticated technology platforms that leverage our extensive patent portfolio and deep technical expertise in digital, analog, mixed-signal, RF and embedded memory.

We devote the majority of our research and development (“R&D”) efforts to our six primary differentiated technology platforms:

| • | RF SOI: Our industry-leading RF SOI technologies are utilized in high-growth, high-volume wireless and Wi-Fi markets and are optimized for low power, low noise and low latency/high frequency applications that enable longer battery life for mobile applications and high cellular signal quality. Our RF SOI technologies are found in almost all cellular handsets from major manufacturers and in cellular ground station transceivers. |

9

| • | FinFET: Our FinFET process technology is purpose-built for high-performance, power-efficient Systems-on-a-Chip (“SoCs”) in demanding, high-volume applications. Advanced features such as RF, automotive qualification, ultra-low power memory and logic provide a best-in-class (12 to 16 nanometer (“nm”)) combination of performance, power and area, and are well-suited for compute and AI, mobile/consumer and automotive processors, high-end IoT applications, high performance transceivers and wired/wireless networking applications. |

| • | Feature-Rich CMOS: Our CMOS platforms combined with foundational and complex IP and design enablement offer mixed-technology solutions on volume production-proven processes and are well-suited for a wide variety of applications. Technology features include Bipolar-CMOS-DMOS (“BCD”) for power management, high-voltage triple-gate oxide for display drivers, and embedded non-volatile memory for micro-controllers. |

| • | FDXTM: Our proprietary FDXTM process technology platform is especially well-suited for efficient single-chip integration of digital and analog signals delivering cost-effective performance for connected and low-power embedded applications. A full range of features, such as Ultra-Low Power (“ULP”), Ultra-Low Leakage (“ULL”), RF and mmWave, embedded Magnetoresistive Random Access Memory (“MRAM”) and automotive qualification, makes our FDXTM process technology platform especially well-matched for IoT/wireless, 5G (including mmWave), automotive radar, and satellite communications applications. |

| • | SiGe: Our SiGe Bipolar CMOS (“BiCMOS”) technologies are uniquely optimized for either power amplifier applications or very-high-frequency applications for optical and wireless networking, satellite communications and communications infrastructure. Our SiGe technologies are performance-competitive with more costly compound semiconductor technologies while taking full advantage of being integrated with conventional Silicon CMOS (“Si CMOS”). |

| • | SiPh: Our SiPh platforms address the increasing need for data centers to handle ever higher data rates and volumes with greater power efficiency, as conventional copper wire connections are becoming prohibitive from a power consumption perspective. Our SiPh platforms integrate photonics components with CMOS logic and RF to enable a fully integrated, monolithic electrical and optical computing and communications engine. Our SiPh technologies are also being extended to applications such as Light Detection and Ranging (“LiDAR”), quantum computing and consumer optical networks. |

Our Growth Strategies

Key elements of our growth strategies include:

| • | Deepen relationships with key customers. We operate a customer-focused partnership model in which we work closely with our customers to better understand their requirements in order to invest in and develop tailored solutions to suit their specific needs. We intend to expand our customer base and increase market share by leveraging our core IP, comprehensive portfolio, scale and flexibility to redefine the fabless-foundry model. |

| • | Expand portfolio of differentiated, feature-rich technologies. We believe that maintaining and enhancing our leadership position in differentiated technologies is critical to attracting and retaining customers, which increasingly rely on specific silicon features to differentiate their products. We will continue to invest in R&D across our six key technology platforms, which we believe provide room for continued innovation and growth within our addressable market for the foreseeable future. |

| • | Disciplined capacity expansion. We believe that we have a capital-efficient model that allows us to expand capacity in a disciplined and economically attractive manner. Our focus on the pervasive semiconductor market requires lower capital intensity than that of the compute-focused foundries to drive revenue growth. |

10

| • | Strengthen government partnerships. We intend to continue expanding our existing footprint by building on the strength of our public/private investment partnerships. As regions around the world work to establish domestic semiconductor supply, we believe governmental funding to secure local manufacturing will continue. |

| • | Continued operational excellence. We delivered more than $1 billion in cost savings from 2018 to 2020 through intensive management focus on operational efficiency and are continuing to implement additional efficiency measures aimed at expanding margins, improving our bottom line, and generating higher returns on investment. We expect our business model to provide significant bottom line benefits as revenue scales at each of our existing locations. |

RISK FACTORS SUMMARY

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks include the following:

Risks Related to our Business and Industry

| • | Global economic and political conditions could materially and adversely affect us. |

| • | We have long-term supply agreements with certain customers that obligate us to meet specific production requirements, which may expose us to liquidated and other damages, require us to return advanced payments, require us to provide products and services at reduced or negative margins and constrain our ability to reallocate our production capacity to serve new customers or otherwise. |

| • | Our strategy of securing and maintaining long-term supply contracts and expanding our production capacity may not be successful. |

| • | We depend on a small number of customers for a significant portion of our revenues and any loss of this or our other key customers, including potentially through further customer consolidation, could result in significant declines in our revenues. |

| • | We rely on a complex silicon supply chain and breakdowns in that chain could affect our ability to produce our products. |

| • | Reductions in demand and average selling prices for our customers’ end products (e.g., consumer electronics). |

| • | Our competitors have announced expansions and may continue to expand in the United States and Europe, which could materially and adversely affect our competitive position. |

| • | Sales to government entities and highly regulated organizations are subject to a number of challenges and added risks, and we could fail to comply with these heightened compliance requirements, or effectively manage these challenges or risks. |

Risks Related to Manufacturing, Operations and Expansion

| • | If we are unable to manage our capacity and production facilities effectively, our competitiveness may be weakened. |

| • | Our manufacturing processes are highly complex, costly and potentially vulnerable to impurities and other disruptions, and cost increases, that can significantly increase our costs and delay product shipments to our customers. |

11

| • | Our profit margin may substantially decline if we are unable to continually improve our manufacturing yields, maintain high shipment utilization or fail to optimize the process technology mix of our wafer production. |

| • | If we are unable to obtain adequate supplies of raw materials in a timely manner and at commercially reasonable prices our revenue and profitability may decline. |

Risks Related to Intellectual Property

| • | Any failure to obtain, maintain, protect or enforce our intellectual property and proprietary rights could impair our ability to protect our proprietary technology and our brand. |

| • | There is a risk that our trade secrets, know-how and other proprietary information will be stolen, used in an unauthorized manner, or compromised. |

| • | The laws of some foreign countries may not be as protective of intellectual property rights as those in the United States, and mechanisms for enforcement of intellectual property rights may be inadequate. |

| • | Our success depends, in part, on our ability to develop and commercialize our technology without infringing, misappropriating or otherwise violating the intellectual property rights of third parties and we may not be aware of such infringements, misappropriations or violations. |

| • | We may be unable to provide technology to our customers if we lose the support of our technology partners. |

| • | We have been and may continue to become subject to intellectual property disputes, which are costly and may subject us to significant liability and increased costs of doing business. |

Political, Regulatory and Legal Risks

| • | Environmental, health and safety laws and regulations expose us to liability and risk of non-compliance, and any such liability or non-compliance may adversely affect our business. |

| • | We are subject to governmental export and customs compliance requirements that could impair our ability to compete in international markets or subject us to liability if we violate the controls. |

| • | We are currently and may in the future become subject to litigation that could result in substantial costs, divert or continue to divert management’s attention and resources. |

Risks Related to Our Status as a Controlled Company and Foreign Private Issuer

| • | Mubadala will continue to have substantial control after this offering, which could limit your ability to influence the outcome of key transactions, including a change of control, and otherwise affect the prevailing market price of our ordinary shares. |

| • | We are a foreign private issuer and, as a result, are not subject to U.S. proxy rules but are subject to reporting obligations that, to some extent, are more lenient and less frequent than those of a U.S. issuer. |

12

CORPORATE INFORMATION

We are an exempted company incorporated in the Cayman Islands with limited liability on October 7, 2008 when a subsidiary of Mubadala acquired AMD’s manufacturing operations in Dresden, Germany. Our principal executive offices are located at 400 Stonebreak Road Extension, Malta, New York 12020, United States, and our telephone number is (518) 305-9013. Our website address is www.gf.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

The GF design logo, “GF” and our other registered or common law trademarks, service marks, or trade names appearing in this prospectus are the property of GLOBALFOUNDRIES Inc. Other trade names, trademarks and service marks used in this prospectus are the property of their respective owners.

13

OUR OFFERING

Ordinary shares offered by us | shares | |

Ordinary shares offered by Mubadala | shares (or shares if the underwriters exercise their over-allotment option in full) | |

Ordinary shares to be outstanding after this offering | shares (or shares if the underwriters exercise their over-allotment option in full) | |

Option to purchase additional shares | Mubadala has granted an option to the underwriters, exercisable for 30 days after the date of this prospectus, to purchase up to additional shares at the public offering price, less the underwriting discount. | |

Use of proceeds | We estimate that our net proceeds from this offering will be approximately $ million from the sale of the shares of ordinary shares offered by us in this offering, based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the anticipated net proceeds from this offering for capital expenditures and other general corporate purposes. We may use a portion of the net proceeds for acquisitions of technologies or businesses that complement our business, although we have no present commitments or agreements to enter into any such acquisitions or investments. See “Use of Proceeds” for additional information.

We will not receive any proceeds from the sale of ordinary shares by Mubadala in this offering. | |

Dividend policy | We currently intend to retain all available funds and any future earnings to fund the development and growth of our business. Therefore, we do not anticipate declaring or paying any cash dividends to our shareholders in the foreseeable future. See “Dividend Policy” for additional information. | |

Directed share program | At our request, the underwriters have reserved up to ordinary shares, or % of the shares offered by us in this offering, for sale at the initial public offering price through a directed share program to certain employees and other related persons identified by us. | |

14

The number of ordinary shares available for sale to the general public will be reduced to the extent that such persons purchase such reserved shares. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered by this prospectus. Morgan Stanley & Co. LLC will administer our directed share program.

See the sections titled “Certain Relationships and Related Party Transactions,” “Shares Eligible for Future Sale,” and “Underwriters—Directed Share Program.” | ||

Risk factors | You should read the section titled “Risk Factors” for a discussion of factors to consider carefully before deciding to invest in our shares. | |

Proposed Nasdaq symbol | “GFS” | |

The number of our ordinary shares to be outstanding after this offering is based on ordinary shares outstanding as of , 2021. Unless otherwise indicated, all information contained in this prospectus assumes no exercise of the option granted to the underwriters to purchase up to additional ordinary shares at the public offering price, less the underwriting discount.

The number of ordinary shares to be outstanding after this offering does not take into account an aggregate of ordinary shares available for future issuance under the 2017 LTIP, the 2018 Equity Plan, the Equity Plan and the ESPP (as defined under “Executive Compensation”) and ordinary shares subject to outstanding share option and restricted share unit (“RSU”) awards granted under the 2017 LTIP and 2018 Equity Plan.

In addition, except as otherwise noted, all information in this prospectus reflects our reverse share split, which was effective September 12, 2021, to reclassify:

| • | all 1,153,804,300, 1,000,000,000 and 1,000,000,000 of our ordinary shares outstanding as of December 31, 2018, 2019, and 2020 respectively, to 576,902,150, 500,000,000 and 500,000,000 ordinary shares, respectively; and |

| • | all 1,000,000,000 of our ordinary shares outstanding as of June 30, 2021 to 500,000,000 ordinary shares. |

15

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our historical consolidated financial data at the dates and for the periods indicated. We have derived our summary consolidated statements of operations data for the years ended December 31, 2018, 2019 and 2020, and for the six months ended June 30, 2020 and 2021, and our summary consolidated balance sheet data as of December 31, 2019 and 2020, and June 30, 2021 from our consolidated financial statements included elsewhere in this prospectus. We prepare our annual financial statements in accordance with IFRS, as adopted by the IASB. We prepare our unaudited interim condensed consolidated financial statements in accordance with International Financial Reporting Standard IAS No. 34 “Interim Financial Reporting,” or IAS 34. The financial information presented below may not be indicative of our future performance. The summary historical consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the accompanying notes included elsewhere in this prospectus.

| For the Years Ended December 31, | For the Six Months Ended June 30, | |||||||||||||||||||

| (dollars in millions, except for share amounts) | 2018 | 2019 | 2020 | 2020 | 2021 | |||||||||||||||

Consolidated Statement of Operations data | ||||||||||||||||||||

Net revenues(1) | $ | 6,196 | $ | 5,813 | $ | 4,851 | $ | 2,697 | $ | 3,038 | ||||||||||

Cost of revenues | (6,646 | ) | (6,345 | ) | (5,563 | ) | (3,058 | ) | (2,708 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross profit (loss)(2) | (450 | ) | (532 | ) | (713 | ) | (361 | ) | 330 | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Research and development expenses | (926 | ) | (583 | ) | (476 | ) | (243 | ) | (235 | ) | ||||||||||

Selling, general and administrative expenses | (453 | ) | (446 | ) | (445 | ) | (210 | ) | (293 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating expenses | (1,379 | ) | (1,029 | ) | (921 | ) | (453 | ) | (528 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Restructuring charges | (112 | ) | — | — | — | — | ||||||||||||||

Impairment charges | (582 | ) | (64 | ) | (23 | ) | 2 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Other operating charges | (694 | ) | (64 | ) | (23 | ) | 2 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss from operations(2) | (2,523 | ) | (1,625 | ) | (1,656 | ) | (815 | ) | (198 | ) | ||||||||||

Finance income | 10 | 11 | 3 | 2 | 3 | |||||||||||||||

Finance expenses | (165 | ) | (230 | ) | (154 | ) | (82 | ) | (58 | ) | ||||||||||

Share of profit of joint ventures and associates | 7 | 8 | 4 | 2 | 2 | |||||||||||||||

Gain on sale of a fabrication facility and application specific integrated circuit business | — | 615 | — |

| — |

|

| — |

| |||||||||||

Other income (expense), net | 61 | 74 | 440 | 395 | (20 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss before income taxes from continuing operations | (2,610 | ) | (1,147 | ) | (1,363 | ) | (498 | ) | (271 | ) | ||||||||||

Income tax (expense) benefit | (16 | ) | (224 | ) | 12 | (36 | ) | (30 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss from continuing operations | (2,626 | ) | (1,371 | ) | $ | (1,351 | ) | (534 | ) | (301 | ) | |||||||||

Discontinued operations | ||||||||||||||||||||

Loss from discontinued operations, net of tax $1 | (148 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss(2) | $ | (2,774 | ) | $ | (1,371 | ) | $ | (1,351 | ) | $ | (534 | ) | $ | (301 | ) | |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Attributable to: | ||||||||||||||||||||

Shareholder of GLOBALFOUNDRIES INC. | $ | (2,702 | ) | $ | (1,371 | ) | $ | (1,348 | ) | $ | (533 | ) | $ | (299 | ) | |||||

Non-controlling interest | (72 | ) | — | (3 | ) | (1 | ) | (2 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss for the period | $ | (2,774 | ) | $ | (1,371 | ) | $ | (1,351 | ) | $ | (534 | ) | $ | (301 | ) | |||||

Loss per share attributable to the equity holders of the company: | ||||||||||||||||||||

Basic and diluted loss per share: | ||||||||||||||||||||

From continuing operations | $ | (4.56 | ) | $ | (2.72 | ) | $ | (2.70 | ) | $ | (1.06 | ) | $ | (0.60 | ) | |||||

From discontinued operations | $ | (0.14 | ) | $ | — | $ | — | $ | — | $ | — | |||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss per share | $ | (4.70 | ) | $ | (2.72 | ) | $ | (2.70 | ) | $ | (1.06 | ) | $ | (0.60 | ) | |||||

16

| (1) | In 2020, the majority of our customer contractual terms were amended in a manner that resulted in moving from recognizing wafer revenue on a Percentage-of-Completion basis to recognizing revenue on a Wafer Shipment basis. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Revenue Recognition.” This resulted in a one-time, non-recurring reduction in net revenues recognized in 2020. Had the change in terms not occurred, our net revenues in 2020 would have been an estimated $810 million higher than reported results. In addition, we divested our Application Specific Integrated Circuit (“ASIC”) business, Avera Semiconductor, in 2019. This business generated $391 million of revenue in 2019 and $402 million in 2018. |

| (2) | The change in customer contract terms and associated revenue recognition also had a one-time impact on adjusted EBITDA, adjusted gross profit (loss), adjusted loss from operations, and adjusted net loss in 2020, estimated to be $176 million. |

| Years Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| (dollars in millions) | 2018 | 2019 | 2020 | 2020 | 2021 | |||||||||||||||

Consolidated Statement of Cash Flows data | ||||||||||||||||||||

Net cash provided by operating activities | $ | 279 | $ | 497 | $ | 1,006 | $ | 539 | $ | 582 | ||||||||||

Net cash provided by (used in) investing activities | (1,167 | ) | 344 | (366 | ) | (166 | ) | (462 | ) | |||||||||||

Net cash provided by (used in) financing activities | 1,132 | (684 | ) | (733 | ) | (99 | ) | (224 | ) | |||||||||||

| As of December 31, | As of June 30, 2021 | |||||||||||

| (dollars in millions) | 2019 | 2020 | ||||||||||

Consolidated Balance Sheet data | ||||||||||||

Cash and cash equivalents | $ | 997 | $ | 908 | $ | 805 | ||||||

Total current assets | 3,514 | 2,987 | 3,008 | |||||||||

Total assets | 14,498 | 12,322 | 12,397 | |||||||||

Total current liabilities | 2,336 | 1,896 | 2,146 | |||||||||

Total liabilities | 5,478 | 5,080 | 5,464 | |||||||||

Total stockholder’s equity | 9,019 | 7,242 | 6,932 | |||||||||

We use non-IFRS financial information and believe it is useful to investors as it provides additional information to facilitate comparisons of historical operating results, and identify trends in our underlying operating results, and it provides additional insight and transparency on how we evaluate the business. These non-IFRS measures are used by both our management and our board of directors, together with the comparable IFRS information, in evaluating our current performance and planning future business activities. We have detailed the non-IFRS adjustments that we make in our non-IFRS definitions below. The adjustments generally fall within the categories of non-cash items, acquisition and integration costs, business transformation initiatives and financing-related costs. We believe the non-IFRS measures should always be considered along with the related IFRS financial measures. We have provided the reconciliations between the IFRS and non-IFRS financial measures below. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

17

The following table reconciles gross profit (loss) to adjusted gross profit (loss) for the years ended December 31, 2018, 2019 and 2020, and the six months ended June 30, 2020 and 2021, respectively:

Adjusted gross profit (loss)

| For the Years Ended December 31, | For the Six Months Ended June 30, | |||||||||||||||||||

| (dollars in millions) | 2018 | 2019 | 2020 | 2020 | 2021 | |||||||||||||||

Gross profit (loss) for the period(1) | $ | (450 | ) | $ | (532 | ) | $ | (713 | ) | $ | (361 | ) | $ | 330 | ||||||

Share-based compensation | — | — | — | — | 36 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted gross profit (loss) | $ | (450 | ) | $ | (532 | ) | $ | (713 | ) | $ | (361 | ) | $ | 366 | ||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (1) | The change in customer contract terms and associated revenue recognition also had a one-time impact on adjusted EBITDA, adjusted gross profit (loss), adjusted loss from operations and adjusted net loss in 2020, estimated to be $176 million. |

The following table reconciles loss from operations to adjusted loss from operations for the years ended December 31, 2018, 2019 and 2020, and the six months ended June 30, 2020 and 2021, respectively:

Adjusted loss from operations

| For the Years Ended December 31, | For the Six Months Ended June 30, | |||||||||||||||||||

| (dollars in millions) | 2018 | 2019 | 2020 | 2020 | 2021 | |||||||||||||||

Loss from operations for the period(1) | $ | (2,523 | ) | $ | (1,625 | ) | $ | (1,656 | ) | $ | (815 | ) | $ | (198 | ) | |||||

Share-based compensation | 5 | — | 1 | 1 | 144 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted loss from operations | $ | (2,518 | ) | $ | (1,625 | ) | $ | (1,655 | ) | $ | (814 | ) | $ | (54 | ) | |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (1) | The change in customer contract terms and associated revenue recognition also had a one-time impact on adjusted EBITDA, adjusted gross profit (loss), adjusted loss from operations and adjusted net loss in 2020, estimated to be $176 million. |

The following table reconciles net loss from continuing operations to Adjusted EBITDA for the years ended December 31, 2018, 2019 and 2020, and for the six months ended June 30, 2020 and 2021, respectively:

Adjusted EBITDA

| For the Years Ended December 31, | For the Six Months Ended June 30, | |||||||||||||||||||

| (dollars in millions) | 2018 | 2019 | 2020 | 2020 | 2021 | |||||||||||||||

Net loss from continuing operations(1) | $ | (2,626 | ) | $ | (1,371 | ) | $ | (1,351 | ) | $ | (534 | ) | $ | (301 | ) | |||||

Adjustments to net loss from continuing operations: | ||||||||||||||||||||

Depreciation and amortization | 2,948 | 2,678 | 2,523 | 1,285 | 785 | |||||||||||||||

Finance expense | 165 | 230 | 154 | 82 | 58 | |||||||||||||||

Provision for income taxes | 16 | 224 | (12 | ) | 36 | 30 | ||||||||||||||

Share-based compensation | 5 | — | 1 | 1 | 144 | |||||||||||||||

Restructuring and corporate severance programs | 125 | — | 16 | 3 | 10 | |||||||||||||||

(Gain) on transactions, legal settlements and transaction expenses(2) | 21 | (607 | ) | (356 | ) | (339 | ) | 34 | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted EBITDA | $ | 654 | $ | 1,154 | $ | 976 | $ | 535 | $ | 760 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

18

| (1) | The change in customer contract terms and associated revenue recognition also had a one-time impact on adjusted EBITDA, adjusted gross profit (loss), adjusted loss from operations and adjusted net loss in 2020, estimated to be $176 million. |

| (2) | See the table below for the composition of (gain) on transactions, legal settlements and transaction expenses adjustment for each period presented: |

| For the Years Ended December 31, | For the Six Months Ended June 30, | |||||||||||||||||||

| (dollars in millions) | 2018 | 2019 | 2020 | 2020 | 2021 | |||||||||||||||

(Gain) on transactions(a) | $ | — | $ | (682 | ) | $ | (98 | ) | $ | (63 | ) | $ | — | |||||||

Legal settlements(b) | — | — | (294 | ) | (294 | ) | 34 | |||||||||||||

Transaction expenses(c) | 21 | 75 | 36 | 18 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total (gain) on transactions, legal settlements and transaction expenses | $ | 21 | $ | (607 | ) | $ | (356 | ) | $ | (339 | ) | $ | 34 | |||||||

|

|

|

|

|

|

|

|

|

| |||||||||||