UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23266

AIP ALTERNATIVE LENDING FUND P

(Exact name of Registrant as specified in Charter)

100 Front Street, Suite 400

West Conshohocken, Pennsylvania 19428-2881

(Address of principal executive offices)

Registrant’s Telephone Number, including Area Code: (800) 421-7572

Kara Fricke, Esq.

Morgan Stanley Investment Management Inc.

1633 Broadway

New York, New York 10019

(Name and address of agent for service)

COPY TO:

Allison M. Fumai, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036-6797

(212) 698-3500

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

ALTERNATIVE INVESTMENT PARTNERS | |

| |

| | AIP ALTERNATIVE LENDING FUND P

Financial Statements with Report of

Independent Registered Public Accounting Firm

For the Year Ended September 30, 2021 | |

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Financial Statements with Report of Independent Registered Public Accounting Firm

For the Year Ended September 30, 2021

Contents

Management Commentary (Unaudited) | | | 1 | | |

Report of Independent Registered Public Accounting Firm | | | 4 | | |

Audited Financial Statements | |

Statement of Assets and Liabilities | | | 5 | | |

Statement of Operations | | | 6 | | |

Statements of Changes of Net Assets | | | 7 | | |

Statement of Cash Flows | | | 8 | | |

Notes to Financial Statements | | | 9 | | |

Proxy Voting Policies and Procedures and Proxy Voting Record (Unaudited) | | | 17 | | |

Quarterly Portfolio Schedule (Unaudited) | | | 17 | | |

Information Concerning Trustees and Officers (Unaudited) | | | 18 | | |

Audited consolidated financial statements for AIP Alternative Lending Fund A for the year ended September 30, 2021 are attached to these financial statements and are an integral part thereof.

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Management Commentary

Investment Objective and Strategy Summary

AIP Alternative Lending Fund P's (the "Fund") investment objective is to seek to provide total return with an emphasis on current income.

The Fund, through the investment of substantially all of its assets in AIP Alternative Lending Fund A (the "Master Fund"), seeks to achieve its investment objective by investing in alternative lending securities that generate interest or other income streams that Morgan Stanley AIP GP LP, the Master Fund's investment adviser (the "Investment Adviser"), believes offer access to credit risk premium. Alternative lending securities are loans originated through non-traditional, or alternative, lending platforms or securities that provide the Master Fund with exposure to such instruments. The "credit risk premium" is the difference in return between obligations viewed as low risk, such as high-quality, short-term government debt securities, and securities issued by private entities or other entities which are subject to credit risk. The credit risk premium is positive when interest payments or other income streams received in connection with a pool of alternative lending securities, minus the principal losses experienced by the pool, exceed the rate of return for risk-free obligations. By investing in alternative lending securities, the Master Fund is accepting the risk that some borrowers will not repay their loans in exchange for the expected returns associated with the receipt of interest payments and repayment of principal by those that do. There is no assurance that the credit risk premium will be positive for the Master Fund's investments at any time or on average and over time. However, the Master Fund seeks to benefit over the long-term from the difference between the amount of interest and principal received and losses experienced.

The alternative lending securities in which the Master Fund may invest are sourced through various alternative lending platforms as determined by the Investment Adviser. The Master Fund may invest in a broad range of alternative lending securities, including, but not limited to, (1) consumer loans, inclusive of specialty offerings such as education loans and elective medical loans; (2) small business loans, receivables and/or merchant cash advances, inclusive of specialty offerings such as purchasing and financing of future payment streams or asset-based financing; (3) specialty finance loans, including, but not limited to, automobile purchases, equipment finance, transportation leasing or real estate financing; (4) tranches of alternative lending securitizations, including, but not limited to, residual interests and/or majority-owned affiliates (MOAs); and (5) to a lesser extent, fractional interests in alternative lending securities and other types of equity, debt or derivative instruments that the Investment Adviser believes are appropriate. The Master Fund may also invest in both rated senior classes of asset-backed securities as well as residual interests in pools of alternative lending loans or securitizations.

Performance Discussion

| | Average Annual Total Returns1 | |

| | One Year | | Since Inception2 | |

AIP Alternative Lending Fund P | | | 28.90 | % | | | 13.74 | % | |

1 Total returns assume reinvestment of all distributions and includes the impact of a sales load of 3% of an investor's subscription.

1

ALTERNATIVE INVESTMENT PARTNERS | |

| |

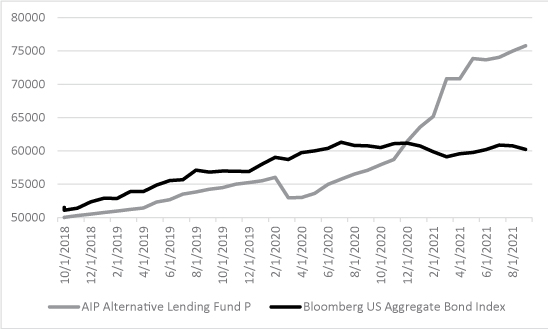

The chart below illustrates the growth of a hypothetical $50,000 investment in the Fund (net of a sales load of 3% of an investor's subscription) from its inception date of October 1, 2018 through September 30, 2021.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

During the twelve-month period ended September 30, 2021, the Fund returned 28.90% (including the impact of a sales load of 3% of an investor's subscription). The Fund, through its investment in the Master Fund, benefited from elevated performance in its portfolio of whole loans and asset-backed securities ("ABS"), strong gains in its platform equity investment in Upstart Holdings Inc. ("Upstart"), and profits generated from selling whole loans into securitizations.

The Master Fund's whole loan/ABS portfolio was the largest performance driver, extending a stretch of outperformance vs. ex-ante expectations that broadly commenced in May 2020 as U.S. employment began its rebound following the initial shock of the COVID-19 pandemic. Throughout the pandemic, household balance sheets that entered the crisis relatively well-positioned in aggregate supported consumer borrowers. Fiscal transfers, alongside short-term loan modification programs for struggling borrowers, buttressed consumers as the crisis progressed. The Master Fund's loan portfolio also benefited from exposure to borrowers with average credit scores and stated incomes that we believe were relatively less impacted by COVID-induced shutdowns, as compared to lower income and lower credit score borrowers. Additionally, loans acquired immediately after COVID shutdowns commenced generally provided tightened credit standards and/or enhanced interest rates for comparable borrower risk. Finally, we believe our active portfolio management of the Master Fund before and through the crisis added significant value for our investors.

Upstart common equity also significantly contributed. The Master Fund started acquiring Upstart equity securities ("Upstart shares") during the third quarter of 2019, while the company was still privately held. The Master Fund's pre-initial public offering ("IPO") total cost basis in Upstart shares was less than $6.3 million. Upstart went public during December 2020 (ticker: UPST), and the Master Fund sold a portion of its shares through the company's IPO and associated underwriter's option, fully recouping its cost basis while leaving the Master Fund with over 845,000 remaining shares. Remaining shares were subject to a 180-day post-IPO

2

ALTERNATIVE INVESTMENT PARTNERS | |

| |

lockup that expired in June 2021. While we remain excited by Upstart's long-term prospects, the Master Fund completed liquidation of its remaining Upstart shares in August 2021. Inclusive of all share sales, the Master Fund realized proceeds of over $122 million from its initial investment cost basis in Upstart shares of approximately $6.3 million. The remaining undistributed profits from Upstart share sales were distributed during September 2021 by the Master Fund to the Fund and ultimately to the Fund's shareholders of record on August 31, 2021. While realized Upstart shares gains had a significant positive impact on performance, we expect equity holdings to be a minor component of the Master Fund's investment strategy over time.

Finally, the Master Fund sold approximately $440,000,000 of whole loan principal into five securitizations during the fiscal year, while concurrently acquiring a portion of the residual interest in each transaction. Participation in securitization transactions provided further contribution to the Master Fund's overall positive returns.

Distributions

The Fund intends to declare and pay distributions of all or a portion of its net investment income on a quarterly basis and to distribute annually any realized capital gains. In addition, such distributions may include a return of capital.

Various factors will affect the level of the Fund's income, including the asset mix, the average maturity of the Master Fund's portfolio, the amount of leverage utilized by the Master Fund and the Master Fund's use of hedging. To permit the Fund to maintain a more stable quarterly distribution, the Fund may, from time to time, distribute less than the entire amount of income earned in a particular period. The undistributed income would be available to supplement future distributions. As a result, the distributions paid by the Fund for any particular quarterly period may be more or less than the amount of income actually earned by the Fund during that period. Undistributed income will add to the Fund's net asset value and, correspondingly, distributions from the Fund's income will reduce the Fund's net asset value.

Although there is no assurance that the Fund will be able to maintain a certain level of distributions, the Fund intends to declare and pay distributions of all or a portion of its net investment income on a quarterly basis and to distribute any realized capital gains at least annually. During the fiscal year, the Fund distributed $226.25 per share to shareholders, inclusive of $84.91 per share of realized gains.

Final Remarks

As a primarily consumer-focused private credit opportunity, during the past fiscal year alternative lending's yield, duration, and amortization characteristics continued to stand in stark contrast to most corporate debt. For these and other reasons, we believe that alternative lending could play an important role in investors' portfolios. While the 2021 fiscal year was an extraordinary period in which the Fund benefited from a confluence of factors, shareholders should not expect the outsized returns of 2021 to persist.

3

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of AIP Alternative Lending Fund P

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of AIP Alternative Lending Fund P (the "Fund"), as of September 30, 2021, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at September 30, 2021, the results of its operations and its cash flows for the year then ended, and the changes in its net assets for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund's internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of September 30, 2021, by correspondence with the transfer agent. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Morgan Stanley investment companies since 2000.

New York, New York

November 29, 2021

4

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Statement of Assets and Liabilities

September 30, 2021

Assets | |

Investment in AIP Alternative Lending Fund A, at fair value (cost $515,628,610) | | $ | 522,250,928 | | |

Cash and cash equivalents | | | 335,911 | | |

Distribution receivable from AIP Alternative Lending Fund A | | | 268,463 | | |

Redemption receivable from AIP Alternative Lending Fund A | | | 417,944 | | |

Total assets | | | 523,273,246 | | |

Liabilities | |

Shareholder servicing fees payable | | | 614,104 | | |

Payable for share repurchases | | | 417,944 | | |

Distribution payable | | | 268,463 | | |

Accrued expenses and other liabilities | | | 213,118 | | |

Total liabilities | | | 1,513,629 | | |

Net assets | | $ | 521,759,617 | | |

Net assets consist of: | |

Net capital | | $ | 514,250,724 | | |

Total distributable earnings (loss) | | | 7,508,893 | | |

Net assets | | $ | 521,759,617 | | |

Net asset value per share: | |

473,205.983 shares issued and outstanding, no par value,

1,000,000 registered shares | | $ | 1,102.61 | | |

Maximum offering price per share

($1,102.61 plus sales load of 3% of net asset value per share) | | $ | 1,135.69 | | |

See accompanying notes and attached consolidated financial statements for AIP Alternative Lending Fund A.

5

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Statement of Operations

For the Year Ended September 30, 2021

Investment Income | |

Dividends | | $ | 52,818,423 | | |

Expenses | |

Shareholder servicing fees | | | 2,359,451 | | |

Professional fees | | | 153,500 | | |

Transfer agent fees | | | 145,089 | | |

Accounting and administration fees | | | 19,750 | | |

Registration fees | | | 15,840 | | |

Custody fees | | | 5,698 | | |

Other expenses | | | 57,750 | | |

Total expenses | | | 2,757,078 | | |

Net investment income (loss) | | | 50,061,345 | | |

Realized and unrealized gain (loss) from investment in

AIP Alternative Lending Fund A | |

Net change in unrealized appreciation/depreciation on investment | |

in AIP Alternative Lending Fund A | | | 4,484,883 | | |

Realized gain (loss) on investment in AIP Alternative Lending Fund A | | | 792,008 | | |

Capital gain distributions from AIP Alternative Lending Fund A | | | 20,219,014 | | |

Net realized and unrealized gain (loss) from investments | | | 25,495,905 | | |

Net increase (decrease) in net assets resulting from operations | | $ | 75,557,250 | | |

See accompanying notes and attached consolidated financial statements for AIP Alternative Lending Fund A.

6

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Statements of Changes in Net Assets

For the Year Ended September 30, 2020 | |

Net increase (decrease) in net assets resulting from operations: | |

Net investment income (loss) | | $ | 8,328,920 | | |

Realized and unrealized gain (loss) from investment in AIP Alternative Lending

Fund A | | | 753,114 | | |

Net increase (decrease) in net assets resulting from operations | | | 9,082,034 | | |

Distributions to shareholders from: | |

Distributions resulting from operations | | | (8,631,974 | ) | |

Return of capital | | | (1,522,006 | ) | |

Total distributions | | | (10,153,980 | ) | |

Shareholder transactions: | |

Subscriptions (representing 65,385.780 shares) | | | 66,753,499 | | |

Distributions reinvested (representing 5,373.936 shares) | | | 5,348,726 | | |

Repurchases (representing 24,381.835 shares) | | | (24,579,087 | ) | |

Net increase (decrease) in net assets from shareholder transactions | | | 47,523,138 | | |

Total increase (decrease) in net assets | | | 46,451,192 | | |

Net assets, beginning of year (representing 134,653.810 shares) | | | 137,260,788 | | |

Net assets, end of year (representing 181,031.691 shares) | | $ | 183,711,980 | | |

For the Year Ended September 30, 2021 | |

Net increase (decrease) in net assets resulting from operations: | |

Net investment income (loss) | | $ | 50,061,345 | | |

Realized and unrealized gain (loss) from investment in AIP Alternative Lending

Fund A | | | 25,495,905 | | |

Net increase (decrease) in net assets resulting from operations | | | 75,557,250 | | |

Distributions to shareholders from: | |

Distributions resulting from operations | | | (70,140,656 | ) | |

Return of capital | | | — | | |

Total distributions | | | (70,140,656 | ) | |

Shareholder transactions: | |

Subscriptions (representing 268,438.693 shares) | | | 306,105,181 | | |

Distributions reinvested (representing 36,167.483 shares) | | | 39,742,896 | | |

Repurchases (representing 12,431.884 shares) | | | (13,217,034 | ) | |

Net increase (decrease) in net assets from shareholder transactions | | | 332,631,043 | | |

Total increase (decrease) in net assets | | | 338,047,637 | | |

Net assets, beginning of year (representing 181,031.691 shares) | | | 183,711,980 | | |

Net assets, end of year (representing 473,205.983 shares) | | $ | 521,759,617 | | |

See accompanying notes and attached consolidated financial statements for AIP Alternative Lending Fund A.

7

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Statement of Cash Flows

For the Year Ended September 30, 2021

Cash flows from operating activities | |

Net increase (decrease) in net assets resulting from operations | | $ | 75,557,250 | | |

Adjustments to reconcile net increase (decrease) in net assets resulting

from operations to net cash provided by (used in) operating activities: | |

Net change in unrealized appreciation/depreciation on investment in

AIP Alternative Lending Fund A | | | (4,484,883 | ) | |

Realized gain (loss) on investment in AIP Alternative Lending Fund A | | | (792,008 | ) | |

Purchase of investment in AIP Alternative Lending Fund A | | | (346,371,124 | ) | |

Sale of investment in AIP Alternative Lending Fund A | | | 13,217,034 | | |

(Increase) decrease in redemption receivable from AIP Alternative Lending Fund A | | | 12,607,580 | | |

(Increase) decrease in distribution receivable from AIP Alternative Lending Fund A | | | 1,361,658 | | |

(Increase) decrease in prepaid investment in AIP Alternative Lending Fund A | | | 1,000,000 | | |

Increase (decrease) in shareholder servicing fees payable | | | 368,487 | | |

(Increase) decrease in other assets | | | 1,851 | | |

Increase (decrease) in accrued expenses and other liabilities | | | 78,615 | | |

Net cash provided by (used in) operating activities | | | (247,455,540 | ) | |

Cash flows from financing activities | |

Subscriptions | | | 304,965,181 | | |

Distributions, net of reinvestments | | | (31,759,418 | ) | |

Repurchases, net of payable for share repurchases | | | (25,824,614 | ) | |

Net cash provided by (used in) financing activities | | | 247,381,149 | | |

Net change in cash and cash equivalents | | | (74,391 | ) | |

Cash and cash equivalents at beginning of year | | | 410,302 | | |

Cash and cash equivalents at end of year | | $ | 335,911 | | |

Supplemental disclosure of cash flow and non-cash information: | |

Distributions reinvested | | $ | 39,742,896 | | |

See accompanying notes and attached consolidated financial statements for AIP Alternative Lending Fund A.

8

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements

September 30, 2021

1. Organization

AIP Alternative Lending Fund P (the "Fund") was organized under the laws of the State of Delaware as a statutory trust on June 14, 2017. The Fund commenced operations on October 1, 2018 and operates pursuant to an Agreement and Declaration of Trust (the "Trust Deed"). The Fund is registered under the U.S. Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end, non-diversified management investment company. While non-diversified for 1940 Act purposes, the Fund intends to comply with the diversification requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"), as such requirements are described in Note 2. The Fund has no fixed termination date and will continue unless the Fund is otherwise terminated under the terms of the Trust Deed or unless and until required by law.

The Fund is a "Feeder" fund in a "Master-Feeder" structure whereby the Fund invests substantially all of its assets in AIP Alternative Lending Fund A (the "Master Fund"). The Master Fund is a statutory trust organized under the laws of the State of Delaware and is registered under the 1940 Act as a closed-end, non-diversified management investment company (notwithstanding its compliance with Subchapter M diversification requirements).

The Fund's investment objective is to seek to provide total return with an emphasis on current income. The Fund invests substantially all of its assets in the Master Fund, which has the same investment objective and strategies as the Fund. The Master Fund seeks to achieve its investment objective by investing, primarily through the Trust (as defined below), in alternative lending assets that generate interest or other income streams that the Adviser (as defined below) believes offer access to credit risk premium. Alternative lending assets include loans originated through non-traditional, or alternative, lending platforms ("Platforms") ("Loans") or alternative lending securities that provide the Master Fund with exposure to such instruments ("Securities"), collectively referred to as "Investments". Securities may include rated senior classes of asset- backed securities as well as unrated subordinated interests in pools of alternative lending securitizations and publicly or privately offered equity or debt securities, including warrants of Platforms or companies that own or operate Platforms.

As of September 30, 2021, the Fund had a 27.45% ownership interest in the Master Fund. The consolidated financial statements of the Master Fund, including the Consolidated Condensed Schedule of Investments, are attached to this report and should be read in conjunction with the Fund's financial statements.

The Master Fund generally invests in Loans through MPLI Capital Holdings (the "Trust"), a wholly-owned subsidiary trust of the Master Fund. The Trust was organized under the laws of the State of Delaware as a statutory trust on May 10, 2018. Wilmington Savings Fund Society, FSB, serves as the trustee of the Trust. The Trust operates pursuant to a trust agreement in order to achieve the Master Fund's investment objective, as described above.

Morgan Stanley AIP GP LP (the "Adviser") serves as the Master Fund's investment adviser. The Adviser is a limited partnership formed under the laws of the State of Delaware and is registered as an investment adviser

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

9

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

1. Organization (continued)

under the Investment Advisers Act of 1940, as amended. The Adviser is an affiliate of Morgan Stanley and is responsible for providing day-to-day investment management services to the Master Fund, subject to the supervision of the Master Fund's Board of Trustees (each member a "Trustee" and, collectively, the "Board"). The Fund's Adviser and Board are the same as the Master Fund's.

The Board has overall responsibility for monitoring and overseeing the Adviser's implementation of the Fund's operations and investment program. A majority of the Trustees are not "interested persons" (as defined by the 1940 Act) of the Fund or the Adviser. The same Trustees also serve as the Master Fund's Board.

2. Significant Accounting Policies

The following significant accounting policies are in conformity with U.S. generally accepted accounting principles ("US GAAP"). Such policies are consistently followed by the Fund in preparation of its financial statements. Management has determined that the Fund is an investment company in accordance with the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 946, "Financial Services – Investment Companies," for the purpose of financial reporting. The preparation of the financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases or decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund's financial statements are stated in United States dollars.

Investment in the Fund

The Fund offers on a continuous basis through Morgan Stanley Distribution, Inc. (the "Distributor") up to 1,000,000 shares of beneficial interest ("Shares"). The initial closing date ("Initial Closing Date") for the public offering of Shares was October 1, 2018. Shares were offered during an initial public offering period which ended on the Initial Closing Date at an initial offering price of $1,000 per Share and have been offered in a continuous offering thereafter at the Fund's then current net asset value per Share. The Distributor may enter into selected dealer agreements with various brokers and dealers (in such capacity, "Service Agents") that have agreed to participate in the distribution of the Fund's Shares. The Distributor is an affiliate of the Adviser and may be affiliated with one of more service agents. Shares may be purchased as of the first business day of each month at the Fund's then current net asset value ("NAV") per Share, plus any applicable sales load from the Distributor or Service Agent. Investors purchasing Shares in the Fund ("Shareholders") may be charged a sales load of up to 3% of the amount of the investor's purchase. The Distributor or Service Agent may, in its discretion, waive the sales load for certain investors.

Shares are to be sold only to investors that represent that they are "accredited investors" within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended. The Distributor and/or any Service Agent may impose additional eligibility requirements for investors who purchase shares through the Distributor or such Service Agent. The minimum initial investment in the Fund by any investor is $50,000 and the minimum additional investment in the Fund by any investor is $25,000. The minimum

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

10

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Investment in the Fund (continued)

initial and additional investments may be reduced by the Fund with respect to certain individual investors or classes of investors. Investors may only purchase their Shares through the Distributor or through a Service Agent.

The Fund may, from time to time, offer to repurchase Shares pursuant to written tenders by Shareholders, and each such repurchase offer will generally be conducted in parallel with similar repurchase offers made by the Master Fund with respect to shares of the Master Fund. Each such similar offer by the Master Fund with respect to shares of the Master Fund will generally apply to between 5% to 25% of the net assets of the Master Fund. Repurchases will be made at such times, in such amounts and on such terms as may be determined by the Board, in its sole discretion. In determining whether the Master Fund should offer to repurchase Shares, the Board will consider the recommendations of the Adviser as to the timing of such an offer, as well as a variety of operational, business and economic factors. The Adviser expects that, generally, it will recommend to the Board that the Master Fund offers to repurchase Shares from Shareholders quarterly, with such repurchases to occur as of each March 31, June 30, September 30 and December 31. Each repurchase offer will generally commence approximately 90 days prior to the applicable repurchase date.

Investment in the Master Fund

The Fund records its investment in the Master Fund at fair value, which is represented by the Fund's proportionate interest in the net assets of the Master Fund as of September 30, 2021. Valuation of Loans and Securities held by the Master Fund, including the Master Fund's disclosure of Investments under the three- tier hierarchy, is discussed in the notes to the Master Fund's consolidated financial statements. The performance of the Fund is directly affected by the performance of the Master Fund. The consolidated financial statements of the Master Fund, which are attached, are an integral part of these financial statements. Refer to the accounting policies disclosed in the consolidated financial statements of the Master Fund for additional information regarding significant accounting policies that affect the Fund.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash held on deposit and short-term highly liquid investments that are readily convertible to known amounts of cash and have maturities of three months or less. As of September 30, 2021, the Fund did not hold any cash equivalents.

Income Recognition and Expenses

The Fund recognizes income and records expenses on an accrual basis. Income, expenses, and realized and unrealized gains and losses are recorded monthly. The changes in fair value of the investment in the Master Fund are included in net change in unrealized appreciation/depreciation on investments in the Statement of Operations. Realized gain (loss) from investments in the Master Fund is calculated using specific identification.

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

11

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Income Taxes

The Fund intends to comply with the requirements of Subchapter M of the Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its Shareholders. Therefore, no provision for federal income tax is required. The Fund files tax returns with the U.S. Internal Revenue Service and various states. The Fund may be subject to taxes imposed by countries which it invests. Such taxes are generally based on income earned or gains realized or repatriated. Taxes are accrued and applied to net investment income, net realized capital gains and net realized appreciation, as applicable, as the income is earned or capital gains are recorded. The Fund has concluded there are no significant uncertain tax positions that would require recognition in the financial statements as of September 30, 2021. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in other expenses in the Statement of Operations. Generally, open tax years under potential examination vary by jurisdiction, but at least each of the tax years in the period from October 1, 2018 (commencement of operations) to September 30, 2021 remain subject to examination by major taxing authorities.

As of September 30, 2021, the cost and related gross unrealized appreciation and depreciation for tax purposes were as follows:

Cost of investments for tax purposes | | $ | 515,628,239 | | |

Gross tax unrealized appreciation | | | 6,622,689 | | |

Gross tax unrealized depreciation | | | — | | |

Net tax unrealized appreciation/depreciation on investments | | $ | 6,622,689 | | |

As of September 30, 2021, the components of distributable earnings for the Fund on a tax basis were as follows:

Undistributed ordinary income | | $ | 928,237 | | |

Undistributed long-term capital gains | | | — | | |

Total undistributed income and gains | | | 928,237 | | |

Net unrealized appreciation/depreciation | | | 6,622,689 | | |

Other Book/Tax differences | | | (41,662 | ) | |

Total accumulated gain/(loss) | | $ | 7,509,264 | | |

The difference between book-basis unrealized appreciation/depreciation (as shown in the Statement of Assets and Liabilities) and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to tax mark-to-market adjustments.

The tax character of distributions paid may differ from the character of distributions shown in the Statements of Changes in Net Assets due to short-term capital gains being treated as ordinary income for tax purposes.

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

12

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Income Taxes (continued)

The tax character of distributions paid during the year ended September 30, 2021 and 2020 was as follows:

| | | September 30, 2021 | | September 30, 2020 | |

Distributions paid from: | |

Net investment income | | $ | 49,129,634 | | | $ | 8,631,974 | | |

Capital gains | | | 21,011,022 | | | | — | | |

In excess of distributable earnings | | | — | | | | 1,522,006 | | |

Total | | $ | 70,140,656 | | | $ | 10,153,980 | | |

The amount and character of income and gains due to be distributed are determined in accordance with income tax regulations which may differ from US GAAP. These book/tax differences are either considered temporary or permanent in nature.

Temporary differences are primarily due to differing book and tax treatments in the timing of the recognition of gains (losses) on certain investment transactions and the timing of deductibility of certain expenses.

The Fund had no permanent differences resulting in reclassifications among the Fund's components of net assets for the year ended September 30, 2021.

Distribution of Income and Gains

The Fund declares and pays distributions of all or a portion of its net investment income on a quarterly basis. Net realized gains, if any, are distributed at least annually. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income for tax purposes.

The Master Fund intends to be treated as a dealer in securities within the meaning of Section 475 of the Code and anticipates marking to market eligible the Investments it holds at the close of each taxable year. Any gain or loss deemed realized under the mark to market rules will likely be ordinary.

In order to satisfy the diversification requirements under Subchapter M of the Code, the Fund generally invests its assets in the Master Fund, which invests in Investments that are treated as indebtedness for U.S. tax purposes. As such, the Fund expects that its distributions generally will be taxable as ordinary income to the Shareholders.

Pursuant to the dividend reinvestment plan established by the Fund (the "DRIP"), each Shareholder whose Shares are registered in its own name will automatically be a participant under the DRIP and have all income, dividends, and capital gains distributions automatically reinvested in additional Shares unless such Shareholder specifically elected to receive all income, dividends, and capital gain distributions in cash.

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

13

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

3. Subscriptions Received in Advance

Subscriptions received in advance represents cash proceeds received by the Fund prior to year-end related to Shareholder subscriptions to be made effective October 1, 2021. As of September 30, 2021, the Fund did not have any subscriptions received in advance.

4. Prepaid Investments

Prepaid investments in AIP Alternative Lending Fund A represents amounts transferred to the Master Fund prior to year-end related to the investments to be made effective October 1, 2021. As of September 30, 2021, the Fund did not have any prepaid investments.

5. Management Fee, Related Party Transactions and Other

The Fund bears all expenses incurred in the business of the Fund, as well as indirectly its pro rata portion of all expenses incurred by the Master Fund and certain ongoing costs associated with the Fund's continuous offering. The Fund does not pay the Adviser a management fee; however, as a holder of shares of the Master Fund, the Fund and its Shareholders are indirectly subject to the management fees to be charged to the Master Fund by the Adviser.

The Adviser has agreed to waive fees and/or reimburse the Master Fund to the extent that the ordinary operating expenses incurred by the Master Fund in any calendar year exceed 2.00% of the Master Fund's average annual Managed Assets (as defined below), calculated as of the end of each calendar month. Ordinary operating expenses exclude platform fees, borrowing costs, certain investment related expenses, and extraordinary expenses. "Managed Assets" means the total assets of the Master Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Master Fund's accrued liabilities (other than liabilities representing borrowings for investment purposes).

The Adviser has agreed to reimburse the Fund to the extent that the ordinary expenses incurred by the Fund in any calendar year exceed 1.00% of the Fund's average annual net assets, calculated as of the end of each calendar month. Ordinary expenses exclude (i) the Fund's proportionate share of the management fees paid to the Adviser by the Master Fund, (ii) the Fund's proportionate share of the other expenses of the Master Fund, and (iii) the Fund's extraordinary expenses (i.e. expenses incurred by the Fund outside the of the ordinary course of business, indemnification expenses, and expenses in connection with holding and/or soliciting proxies for a meeting of Shareholders, taking into account any expense waivers).

For the year ended September 30, 2021, the Adviser did not reimburse the Fund as the ordinary operating expenses were below 1.00% of the Fund's average annual net assets.

The Fund pays the Distributor, and the Distributor pays each Service Agent, a monthly distribution and shareholder servicing fee of up to 0.0625% (0.75% on an annualized basis) of the NAV of the outstanding Shares attributable to the clients of the Service Agent who are invested in the Fund through the Service Agent.

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

14

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

5. Management Fee, Related Party Transactions and Other (continued)

In exchange for this fee, the Service Agent provides distribution, marketing and/or sales support services. In addition, each Service Agent provides the shareholder services such as assisting in establishing and maintaining accounts and records relating to clients that invest in Shares, responding to client inquiries relating to the services performed by the Service Agent, responding to routine inquiries from clients concerning their investments in Shares, assisting clients in changing account designations and addresses, assisting in processing client repurchase requests and providing such other similar services as permitted under applicable statutes, rules and regulations. For the year ended September 30, 2021, the Fund incurred shareholder servicing fees of $2,359,451, of which $614,104 was payable as of September 30, 2021.

U.S. Bancorp Fund Services, LLC ("USBFS") provides accounting and administrative services to the Fund. Under an administrative services agreement, USBFS is paid an administrative fee, computed and payable monthly at an annual rate based on the aggregate monthly total assets of the Fund.

U.S. Bank National Association ("USB N.A.") serves as the custodian to the Fund. Under a custody services agreement, USB N.A. is paid a custody fee monthly based on the average daily market value of any securities and cash held in the portfolio.

UMB Fund Services, Inc. serves as the Fund's transfer agent. Transfer agent fees are payable monthly based on an annual base fee, annual per Shareholder account charges, and out-of-pocket expenses incurred by the transfer agent on the Fund's behalf.

6. Market Risk

Certain impacts to public health conditions particular to the coronavirus (COVID-19) outbreak could impact the operations and financial performance of certain of the Fund's investments. The extent of the impact to the financial performance of the Fund's investments will depend on future developments, including, (i) the duration and spread of the outbreak, (ii) the restrictions and advisories, (iii) the effects on the financial markets, and (iv) the effects on the economy overall, all of which are highly uncertain and cannot be predicted. If the financial performance of the Fund's investments is impacted because of these factors for an extended period, the Fund's investment results may be adversely affected.

7. Contractual Obligations

The Fund enters into contracts that contain a variety of indemnifications. The Fund's maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

15

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Notes to Financial Statements (continued)

8. Financial Highlights

The following represents per Share data, ratios to average net assets and other financial highlights information for Shareholders.

| | | For the Year

Ended

September 30,

2021 | | For the Year

Ended

September 30,

2020 | | For the Year

Ended

September 30,

2019 (f) | |

For a Share outstanding throughout the year: | |

Net asset value, beginning of year | | $ | 1,014.81 | | | $ | 1,019.36 | | | $ | 1,000.00 | | |

Net investment income (loss) (a) | | | 182.01 | | | | 46.27 | | | | 74.26 | | |

Net realized and unrealized gain (loss) from investments | | | 132.04 | | | | 5.07 | | | | 8.07 | | |

Net increase (decrease) resulting from operations | | | 314.05 | | | | 51.34 | | | | 82.33 | | |

Distributions paid from: | |

Net investment income | | | (141.34 | ) | | | (47.51 | ) | | | (62.97 | ) | |

Realized gain | | | (84.91 | ) | | | — | | | | — | | |

Return of capital | | | — | | | | (8.38 | ) | | | — | | |

Total distributions | | | (226.25 | ) | | | (55.89 | ) | | | (62.97 | ) | |

Net increase (decrease) in net asset value | | | 87.80 | | | | (4.55 | ) | | | 19.36 | | |

Net asset value, end of year | | $ | 1,102.61 | | | $ | 1,014.81 | | | $ | 1,019.36 | | |

Total return (b) | | | 32.76 | % | | | 5.24 | % | | | 8.49 | % | |

Ratio of total expenses before expense waivers and reimbursements (c) | | | 3.07 | % | | | 4.85 | % | | | 4.30 | % | |

Ratio of total expenses after expense waivers and reimbursements (c) | | | 3.07 | % | | | 4.85 | % | | | 4.21 | % | |

Ratio of net investment income (loss) (d) | | | 12.34 | % | | | 18.78 | % | | | 17.06 | % | |

Portfolio turnover (e) | | | 60.96 | % | | | 33.85 | % | | | 26.54 | % | |

Net assets, end of year (000s) | | $ | 521,760 | | | $ | 183,712 | | | $ | 137,261 | | |

(a) Calculated based on the average shares outstanding methodology, and excludes net investment income allocated from the Master Fund.

(b) Total return assumes a subscription of a Share to the Fund at the beginning of the year indicated and a repurchase of a Share on the last day of the year, assumes reinvestment of all distributions for the year, and does not reflect the impact of the sales load, if any, incurred when subscribing to the Fund.

(c) Includes net expenses of the Master Fund.

(d) Includes income and expenses of the Master Fund adjusted for distributions paid to the Fund.

(e) The portfolio turnover rate reflects investment activity of the Master Fund.

(f) The Fund commenced operations on October 1, 2018.

The above ratios and total returns have been calculated for the Shareholders taken as a whole. An individual Shareholder's return and ratios may vary from these returns and ratios due to the timing of Share transactions.

9. Subsequent Events

Unless otherwise stated throughout the Notes to the Financial Statements, the Fund noted no subsequent events that require disclosure in or adjustment to the financial statements through the date the financial statements were available to be issued.

See accompanying notes and attached audited consolidated financial statements for AIP Alternative Lending Fund A.

16

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

Proxy Voting Policies and Procedures and Proxy Voting Record (Unaudited)

If applicable, a copy of (1) the Fund's policies and procedures with respect to the voting of proxies relating to the Fund's investments; and (2) how the Fund voted proxies relating to Fund investments during the most recent period ended June 30, is available without charge, upon request, by calling the Fund at 1-888-322-4675. This information is also available on the Securities and Exchange Commission's website at http://www.sec.gov.

Quarterly Portfolio Schedule (Unaudited)

The Fund also files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the Fund's first and third fiscal quarters on Form N-PORT. The Fund's Forms N-PORT are available on the Securities and Exchange Commission's website at http://www.sec.gov and Morgan Stanley's public website, www.morganstanley.com/im/shareholderreports. Once filed, the most recent Form N-PORT will be available without charge, upon request, by calling the Fund at 1-888-322-4675.

Important Tax Information (Unaudited)

The Fund designates up to a maximum of $49,129,634 as interest-related dividends.

The Fund designates up to a maximum of $21,011,022 as long-term capital gain dividends.

The Fund designates up to a maximum of $49,129,634 as a dividend subject to 163(j).

17

ALTERNATIVE INVESTMENT PARTNERS | |

| |

Information Concerning Trustees and Officers (Unaudited)

Name, Address and

Birth Year of

Independent Trustee | | Position(s)

Held with

Registrant | | Length of

Time

Served* | | Principal Occupation(s) During

Past 5 Years and Other Relevant

Professional Experience | | Number of

Funds in

Fund Complex

Overseen by

Independent

Trustee | | Other Directorships Held by

Independent Trustee** | |

Frank L. Bowman

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1944 | | Trustee | | Since

August

2006 | | President, Strategic Decisions, LLC (consulting) (since February 2009); Director or Trustee of various Morgan Stanley Funds (since August 2006); Chairperson of the Compliance and Insurance Committee (since October 2015); formerly, Chairperson of the Insurance Sub-Committee of the Compliance and Insurance Committee (2007-2015); served as President and Chief Executive Officer of the Nuclear Energy Institute (policy organization) (February 2005-November 2008); retired as Admiral, U.S. Navy after serving over 38 years on active duty including 8 years as Director of the Naval Nuclear Propulsion Program in the Department of the Navy and the U.S. Department of Energy (1996-2004); served as Chief of Naval Personnel (July 1994- September 1996) and on the Joint Staff as Director of Political Military Affairs (June 1992-July 1994); knighted as Honorary Knight Commander of the Most Excellent Order of the British Empire; awarded the Officier de l'Orde National du Mérite by the French Government; elected to the National Academy of Engineering (2009). | | | 86 | | | Director of Naval and Nuclear Technologies LLP; Director Emeritus of the Armed Services YMCA; Member of the National Security Advisory Council of the Center for U.S. Global Engagement and a member of the CNA Military Advisory Board; Trustee of Fairhaven United Methodist Church; Member of the Board of Advisors of the Dolphin Scholarship Foundation; Director of other various nonprofit organizations; formerly, Director of BP, plc (November 2010-May 2019). | |

Kathleen A. Dennis

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1953 | | Trustee | | Since

August

2006 | | Chairperson of the Governance Committee (since January 2021), Chairperson of the Liquidity and Alternatives Sub-Committee of the Investment Committee (2006-2020) and Director or Trustee of various Morgan Stanley Funds (since August 2006); President, Cedarwood Associates (mutual fund and investment management consulting) (since July 2006); formerly, Senior Managing Director of Victory Capital Management (1993-2006). | | | 86 | | | Board Member, University of Albany Foundation (2012-present); Board Member, Mutual Funds Directors Forum (2014-present); Director of various non-profit organizations. | |

Nancy C. Everett

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1955 | | Trustee | | Since

January

2015 | | Chairperson of the Equity Investment Committee (since January 2021); Chief Executive Officer, Virginia Commonwealth University Investment Company (since November 2015); Owner, OBIR, LLC (institutional investment management consulting) (since June 2014); formerly, Managing Director, BlackRock, Inc. (February 2011-December 2013) and Chief Executive Officer, General Motors Asset Management (a/k/a Promark Global Advisors, Inc.) (June 2005-May 2010). | | | 87 | | | Formerly, Member of Virginia Commonwealth University School of Business Foundation (2005- 2016); Member of Virginia Commonwealth University Board of Visitors (2013-2015); Member of Committee on Directors for Emerging Markets Growth Fund, Inc. (2007-2010); Chairperson of Performance Equity Management, LLC (2006-2010); and Chairperson, GMAM Absolute Return Strategies Fund, LLC (2006-2010). | |

18

ALTERNATIVE INVESTMENT PARTNERS | |

| |

Information Concerning Trustees and Officers (Unaudited) (continued)

Name, Address and

Birth Year of

Independent Trustee | | Position(s)

Held with

Registrant | | Length of

Time

Served* | | Principal Occupation(s) During

Past 5 Years and Other Relevant

Professional Experience | | Number of

Funds in

Fund Complex

Overseen by

Independent

Trustee | | Other Directorships Held by

Independent Trustee** | |

Jakki L. Haussler

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1957 | | Trustee | | Since

January

2015 | | Director or Trustee of various Morgan Stanley Funds (since January 2015); Chairman, Opus Capital Group (since 1996); formerly, Chief Executive Officer, Opus Capital Group (1996-2019); Director, Capvest Venture Fund, LP (May 2000-December 2011); Partner, Adena Ventures, LP (July 1999-December 2010); Director, The Victory Funds (February 2005-July 2008). | | | 87 | | | Director of Cincinnati Bell Inc. and Member, Audit Committee and Chairman, Governance and Nominating Committee; Director of Service Corporation International and Member, Audit Committee and Investment Committee; Director of Northern Kentucky University Foundation and Member, Investment Committee; Member of Chase College of Law Transactional Law Practice Center Board of Advisors; Director of Best Transport; Director of Chase College of Law Board of Visitors; formerly, Member, University of Cincinnati Foundation Investment Committee; Member, Miami University Board of Visitors (2008-2011); Trustee of Victory Funds (2005-2008) and Chairman, Investment Committee (2007-2008) and Member, Service Provider Committee (2005-2008). | |

Dr. Manuel H. Johnson

c/o Johnson Smick

International, Inc.

220 I Street, NE

Suite 200

Washington, D.C.

20002

Birth Year: 1949 | | Trustee | | Since July

1991 | | Senior Partner, Johnson Smick International, Inc. (consulting firm); Chairperson of the Fixed Income, Liquidity and Alternatives Investment Committee (since January 2021), Chairperson of the Investment Committee (2006-2020) and Director or Trustee of various Morgan Stanley Funds (since July 1991); Co-Chairman and a founder of the Group of Seven Council (G7C) (international economic commission); formerly, Chairperson of the Audit Committee (July 1991-September 2006); Vice Chairman of the Board of Governors of the Federal Reserve System and Assistant Secretary of the U.S. Treasury. | | | 86 | | | Director of NVR, Inc. (home construction). | |

Joseph J. Kearns

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1942 | | Trustee | | Since

August

1994 | | Senior Adviser, Kearns & Associates LLC (investment consulting); Chairperson of the Audit Committee (since October 2006) and Director or Trustee of various Morgan Stanley Funds (since August 1994); formerly, Deputy Chairperson of the Audit Committee (July 2003-September 2006) and Chairperson of the Audit Committee of various Morgan Stanley Funds (since August 1994); CFO of the J. Paul Getty Trust (1982-1999). | | | 87 | | | Director, Rubicon Investments (since February 2019); Prior to August 2016, Director of Electro Rent Corporation (equipment leasing). Prior to December 31, 2013, Director of The Ford Family Foundation. | |

19

ALTERNATIVE INVESTMENT PARTNERS | |

| |

Information Concerning Trustees and Officers (Unaudited) (continued)

Name, Address and

Birth Year of

Independent Trustee | | Position(s)

Held with

Registrant | | Length of

Time

Served* | | Principal Occupation(s) During

Past 5 Years and Other Relevant

Professional Experience | | Number of

Funds in

Fund Complex

Overseen by

Independent

Trustee | | Other Directorships Held by

Independent Trustee** | |

Michael F. Klein

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1958 | | Trustee | | Since

August

2006 | | Chairperson of the Risk Committee (since January 2021);Managing Director, Aetos Alternatives Management, LP (since March 2000); Co-President, Aetos Alternatives Management, LP (since January 2004) and Co-Chief Executive Officer of Aetos Alternatives Management, LP (since August 2013); Chairperson of the Fixed Income Sub-Committee of the Investment Committee (2006-2020) and Director or Trustee of various Morgan Stanley Funds (since August 2006); formerly, Managing Director, Morgan Stanley & Co. Inc. and Morgan Stanley Dean Witter Investment Management and President, various Morgan Stanley Funds (June 1998-March 2000); Principal, Morgan Stanley & Co. Inc. and Morgan Stanley Dean Witter Investment Management (August 1997-December 1999). | | | 86 | | | Director of certain investment funds managed or sponsored by Aetos Alternatives Management, LP; Director of Sanitized AG and Sanitized Marketing AG (specialty chemicals). | |

Patricia Maleski

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1960 | | Trustee | | Since

January

2017 | | Director or Trustee of various Morgan Stanley Funds (since January 2017); Managing Director, JPMorgan Asset Management (2004-2016); Oversight and Control Head of Fiduciary and Conflicts of Interest Program (2015-2016); Chief Control Officer - Global Asset Management (2013-2015); President, JPMorgan Funds (2010- 2013); Chief Administrative Officer (2004-2013); various other positions including Treasurer and Board Liaison (since 2001). | | | 87 | | | None | |

W. Allen Reed

c/o Perkins Coie LLP

Counsel to the

Independent Trustees

1155 Avenue of

the Americas

22nd Floor

New York, NY

10036

Birth Year: 1947 | | Chair of the Board and Trustee | | Chair of the

Board since

August 2020

and Trustee

since

August 2006 | | Chair of the Boards of various Morgan Stanley Funds (since August 2020) and Director or Trustee of various Morgan Stanley Funds (since August 2006); formerly, Vice Chair of the Boards of various Morgan Stanley Funds (January 2020-August 2020); President and Chief Executive Officer of General Motors Asset Management; Chairman and Chief Executive Officer of the GM Trust Bank and Corporate Vice President of General Motors Corporation (August 1994-December 2005). | | | 86 | | | Formerly, Director of Legg Mason, Inc. (2006-2019); and Director of the Auburn University Foundation (2010-2015). | |

* This is the earliest date the Trustee began serving the Morgan Stanley Funds. Each Trustee serves an indefinite term, until his or her successor is elected.

** This includes any directorships at public companies and registered investment companies held by the Trustee at any time during the past five years.

20

ALTERNATIVE INVESTMENT PARTNERS | |

| |

Information Concerning Trustees and Officers (Unaudited) (continued)

Name, Address and

Birth Year

of Executive Officer | | Position(s)

Held with

Registrant | | Length of

Time

Served* | | Principal Occupation(s)

During Past 5 Years | |

John H. Gernon

522 Fifth Avenue

New York, NY 10036

Birth Year: 1963 | | President and

Principal

Executive

Officer | | Since

September 2013 | | President and Principal Executive Officer of the Equity and Fixed Income Funds and the Morgan Stanley AIP Funds (since September 2013) and the Liquidity Funds and various money market funds (since May 2014) in the Fund Complex; Managing Director of the Adviser; Head of Public Markets Product Development (since 2006). | |

Deidre A. Downes

1633 Broadway

New York, NY 10019

Birth Year: 1977 | | Chief

Compliance

Officer | | Since November

2021 | | Executive Director of the Adviser (since January 2021) and Chief Compliance officer of various Morgan Stanley Funds (since November 2021). Formerly, Vice President and Corporate Counsel at PGIM and Prudential Financial (October 2016-December 2020). | |

Francis J. Smith

522 Fifth Avenue

New York, NY 10036

Birth Year: 1965 | | Treasurer and

Principal Financial Officer | | Treasurer since

July 2003 and

Principal

Financial Officer since

September 2002 | | Managing Director of the Adviser and various entities affiliated with the Adviser; Treasurer (since July 2003) and Principal Financial Officer of various Morgan Stanley Funds (since September 2002). | |

Mary E. Mullin

1633 Broadway

New York, NY 10019

Birth Year: 1967 | | Secretary | | Since June 1999 | | Managing Director of the Adviser; Secretary of various Morgan Stanley Funds (since June 1999). | |

Michael J. Key

522 Fifth Avenue

New York, NY 10036

Birth Year: 1979 | | Vice President | | Since June 2017 | | Vice President of the Equity and Fixed Income Funds, Liquidity Funds, various money market funds and the Morgan Stanley AIP Funds in the Fund Complex (since June 2017); Executive Director of the Adviser; Head of Product Development for Equity and Fixed Income Funds (since August 2013). | |

* This is the earliest date the officer began serving the Morgan Stanley Funds. Each officer serves an indefinite term, until his or her successor is elected.

In addition, the following individuals who are officers of the Adviser or its affiliates serve as assistant secretaries of the Trust: Princess Kludjeson, Kristina B. Magolis, Francesca Mead and Jill R. Whitelaw.

21

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund P

100 Front Street, Suite 400

West Conshohocken, PA 19428

Trustees

W. Allen Reed, Chairperson of the Board and Trustee

Frank L. Bowman

Kathleen A. Dennis

Nancy C. Everett

Jakki L. Haussler

Dr. Manual H. Johnson

Joseph J. Kearns

Michael F. Klein

Patricia Maleski

Officers

John H. Gernon, President and Principal Executive Officer

Matthew Graver, Vice President

Michael J. Key, Vice President

Deidre Downes, Chief Compliance Officer

Francis J. Smith, Treasurer and Principal Financial Officer

Mary E. Mullin, Secretary

Master Fund's Investment Adviser

Morgan Stanley AIP GP LP

100 Front Street, Suite 400

West Conshohocken, PA 19428

Administrator and Fund Accounting Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

Custodian

U.S. Bank National Association

1555 North Rivercenter Drive, MK-WI-S302

Milwaukee, WI 53212

Transfer Agent

UMB Fund Services, Inc.

235 W Galena Street

Milwaukee, WI 53212

Independent Registered Public Accounting Firm

Ernst & Young LLP

One Manhattan West

New York, New York 10001-8604

Legal Counsel

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036

Counsel to the Independent Trustees

Perkins Coie LLP

1155 Avenue of the Americas

New York, NY 10036

22

ALTERNATIVE INVESTMENT PARTNERS | |

| |

| | AIP ALTERNATIVE LENDING FUND A

Consolidated Financial Statements with Report of Independent Registered Public Accounting Firm

For the Year Ended September 30, 2021 | |

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund A

Consolidated Financial Statements with Report of

Independent Registered Public Accounting Firm

For the Year Ended September 30, 2021

Contents

Management Commentary (Unaudited) | | | 1 | | |

Report of Independent Registered Public Accounting Firm | | | 4 | | |

Audited Consolidated Financial Statements | |

Consolidated Statement of Assets and Liabilities | | | 5 | | |

Consolidated Statement of Operations | | | 6 | | |

Consolidated Statements of Changes of Net Assets | | | 7 | | |

Consolidated Statement of Cash Flows | | | 8 | | |

Consolidated Condensed Schedule of Investments. | | | 9 | | |

Notes to Consolidated Financial Statements | | | 12 | | |

Investments Advisory Agreement Approval (Unaudited) | | | 24 | | |

Proxy Voting Policies and Procedures and Proxy Voting Record (Unaudited) | | | 27 | | |

Quarterly Portfolio Schedule (Unaudited) | | | 27 | | |

U.S. Privacy Policy (Unaudited) | | | 28 | | |

Information Concerning Trustees and Officers (Unaudited) | | | 31 | | |

ALTERNATIVE INVESTMENT PARTNERS | |

| |

AIP Alternative Lending Fund A

Management Commentary

Investment Objective and Strategy Summary

AIP Alternative Lending Fund A's (the "Fund") investment objective is to seek to provide total return with an emphasis on current income.

The Fund seeks to achieve its investment objective by investing in alternative lending securities that generate interest or other income streams that Morgan Stanley AIP GP LP (the "Investment Adviser") believes offer access to credit risk premium. Alternative lending securities are loans originated through non-traditional, or alternative, lending platforms or securities that provide the Fund with exposure to such instruments. The "credit risk premium" is the difference in return between obligations viewed as low risk, such as high-quality, short-term government debt securities, and securities issued by private entities or other entities which are subject to credit risk. The credit risk premium is positive when interest payments or other income streams received in connection with a pool of alternative lending securities, minus the principal losses experienced by the pool, exceed the rate of return for risk-free obligations. By investing in alternative lending securities, the Fund is accepting the risk that some borrowers will not repay their loans in exchange for the expected returns associated with the receipt of interest payments and repayment of principal by those that do. There is no assurance that the credit risk premium will be positive for the Fund's investments at any time or on average and over time. However, the Fund seeks to benefit over the long-term from the difference between the amount of interest and principal received and losses experienced.

The alternative lending securities in which the Fund may invest are sourced through various alternative lending platforms as determined by the Investment Adviser. The Fund may invest in a broad range of alternative lending securities, including, but not limited to, (1) consumer loans, inclusive of specialty offerings such as education loans and elective medical loans; (2) small business loans, receivables and/or merchant cash advances, inclusive of specialty offerings such as purchasing and financing of future payment streams or asset-based financing; (3) specialty finance loans, including, but not limited to, automobile purchases, equipment finance, transportation leasing or real estate financing; (4) tranches of alternative lending securitizations, including, but not limited to, residual interests and/or majority-owned affiliates (MOAs); and (5) to a lesser extent, fractional interests in alternative lending securities and other types of equity, debt or derivative instruments that the Investment Adviser believes are appropriate. The Fund may also invest in both rated senior classes of asset-backed securities as well as residual interests in pools of alternative lending loans or securitizations.

Performance Discussion

| | | Average Annual Total Returns1 | |

| | | One Year | | Since Inception2 | |

AIP Alternative Lending Fund A | | | 33.97 | % | | | 15.99 | % | |

1 Total returns assume reinvestment of all distributions.

2 The Fund commenced operations on October 1, 2018.

1

ALTERNATIVE INVESTMENT PARTNERS | |

| |

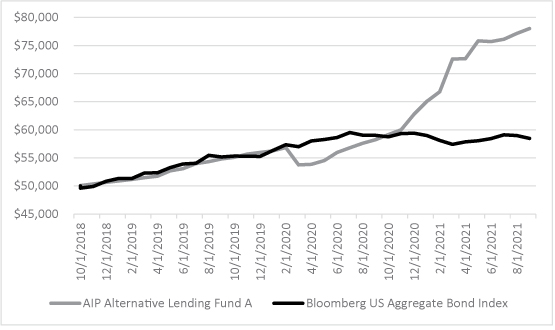

The chart below illustrates the growth of a hypothetical $50,000 investment in the Fund from its inception date of October 1, 2018 through September 30, 2021.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

During the twelve-month period ended September 30, 2021, the Fund returned 33.97%. The Fund benefited from elevated performance in its portfolio of whole loans and asset-backed securities ("ABS"), strong gains in its platform equity investment in Upstart Holdings Inc. ("Upstart"), and profits generated from selling whole loans into securitizations.

The Fund's whole loan/ABS portfolio was the largest performance driver, extending a stretch of outperformance vs. ex-ante expectations that broadly commenced in May 2020 as U.S. employment began its rebound following the initial shock of the COVID-19 pandemic. Throughout the pandemic, household balance sheets that entered the crisis relatively well-positioned in aggregate supported consumer borrowers. Fiscal transfers, alongside short-term loan modification programs for struggling borrowers, buttressed consumers as the crisis progressed. The Fund's loan portfolio also benefited from exposure to borrowers with average credit scores and stated incomes that we believe were relatively less impacted by COVID-induced shutdowns, as compared to lower income and lower credit score borrowers. Additionally, loans acquired immediately after COVID shutdowns commenced generally provided tightened credit standards and/or enhanced interest rates for comparable borrower risk. Finally, we believe our active portfolio management before and through the crisis added significant value for our investors.

Upstart common equity also significantly contributed. The Fund started acquiring Upstart equity securities ("Upstart shares") during the third quarter of 2019, while the company was still privately held. The Fund's pre-initial public offering ("IPO") total cost basis in Upstart shares was less than $6.3 million. Upstart went public during December 2020 (ticker: UPST), and the Fund sold a portion of its shares through the company's IPO and associated underwriter's option, fully recouping its cost basis while leaving the Fund with over 845,000 remaining shares. Remaining shares were subject to a 180-day post-IPO lockup that expired in

2

ALTERNATIVE INVESTMENT PARTNERS | |

| |

June 2021. While we remain excited by Upstart's long-term prospects, the Fund completed liquidation of its remaining Upstart shares in August 2021. Inclusive of all share sales, the Fund realized proceeds of over $122 million from its initial investment cost basis in Upstart shares of approximately $6.3 million. The remaining undistributed profits from Upstart share sales were distributed during September 2021 to shareholders of record on August 31, 2021. While realized Upstart shares gains had a significant positive impact on performance, we expect equity holdings to be a minor component of the Fund's investment strategy over time.

Finally, the Fund sold approximately $440,000,000 of whole loan principal into five securitizations during the fiscal year, while concurrently acquiring a portion of the residual interest in each transaction. Participation in securitization transactions provided further contribution to the Fund's overall positive returns.

Distributions

The Fund intends to declare and pay distributions of all or a portion of its net investment income on a quarterly basis and to distribute annually any realized capital gains. In addition, such distributions may include a return of capital.

Various factors will affect the level of the Fund's income, including the asset mix, the average maturity of the Fund's portfolio, the amount of leverage utilized by the Fund and the Fund's use of hedging. To permit the Fund to maintain a more stable quarterly distribution, the Fund may, from time to time, distribute less than the entire amount of income earned in a particular period. The undistributed income would be available to supplement future distributions. As a result, the distributions paid by the Fund for any particular quarterly period may be more or less than the amount of income actually earned by the Fund during that period. Undistributed income will add to the Fund's net asset value and, correspondingly, distributions from the Fund's income will reduce the Fund's net asset value.

Although there is no assurance that the Fund will be able to maintain a certain level of distributions, the Fund intends to declare and pay distributions of all or a portion of its net investment income on a quarterly basis and to distribute any realized capital gains at least annually. During the fiscal year, the Fund distributed $238.43 per share to shareholders, inclusive of $85.00 per share of realized gains.

Final Remarks

As a primarily consumer-focused private credit opportunity, during the past fiscal year alternative lending's yield, duration, and amortization characteristics continued to stand in stark contrast to most corporate debt. For these and other reasons, we believe that alternative lending could play an important role in investors' portfolios. While the 2021 fiscal year was an extraordinary period in which the Fund benefited from a confluence of factors, shareholders should not expect the outsized returns of 2021 to persist.

3

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of AIP Alternative Lending Fund A

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities of AIP Alternative Lending Fund A (the "Fund"), including the consolidated condensed schedule of investments, as of September 30, 2021, and the related consolidated statements of operations and cash flows for the year then ended, the consolidated statements of changes in net assets for each of the two years in the period then ended and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the consolidated financial position of the Fund at September 30, 2021, the consolidated results of its operations and its cash flows for the year then ended and the consolidated changes in its net assets for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.