4Q2024 Earnings Presentation January 27, 2025 FirstSun Capital Bancorp NASDAQ: FSUN

FirstSun Capital Bancorp | 2 Disclaimers Forward Looking Statements This presentation may contain forward-looking statements by FirstSun Capital Bancorp (the “Company”) within the meaning of the federal securities laws. Forward-looking statements expressing management’s current expectations, forecasts of future events or long-term goals may be based upon beliefs, expectations and assumptions of the Company’s management, and are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should”, “assumes”, “assumptions”, “beta”, and “outlook” or other similar expressions. In this presentation, forward-looking statements include our plans for additional branches in Southern California, our outlook for 2025 and the assumptions underlying our 2025 outlook. All statements in this presentation speak only as of the date they are made, and the Company undertakes no obligation to update any statement. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements. These factors include, without limitation: changes in interest rates (including anticipated Federal Reserve rate cuts that might not occur); failure to maintain our mortgage production flow to secondary markets; the inability of our infrastructure initiatives to reduce expenses; the inability to identify, close and successfully integrate attractive acquisition targets; the impact of inflation; increased deposit volatility; potential regulatory developments; and other general competitive, economic, business, market and political conditions. These risks and uncertainties should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements. Additional information concerning additional factors that could materially affect the forward-looking statements in this presentation can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and other documents subsequently filed by the Company with the Securities and Exchange Commission. Use of Non-GAAP Measures This presentation includes certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include certain operating performance measures that exclude merger-related and other charges that are not considered part of the Company’s recurring operations, such as “Adjusted Net Income”, “Adjusted ROAA”, “Adjusted ROATCE”, “Adjusted Diluted EPS”, “Adjusted PTPP ROAA” and “Adjusted Efficiency Ratio “. The Company believes these non-GAAP financial measures provide useful supplemental information for evaluating FirstSun’s performance trends. Further, the Company’s management uses these measures in managing and evaluating the Company’s business and intends to refer to them in discussions about FirstSun’s operations and performance. These measures should be viewed in addition to, and not as an alternative to substitute for measures that are determined in accordance with GAAP. Additionally, the non-GAAP financial measures used by the Company may differ from the similar measures presented by other companies. To the extent applicable, reconciliations of these non-GAAP measures to the most directly comparable GAAP measure are included in the Appendix to this presentation.

FirstSun Capital Bancorp | 3 Corporate Profile Operating in 5 of the Top 10 Fastest Growing MSAs1 # 1 Austin, TX 2 Dallas, TX 3 Orlando, FL 4 Charlotte, NC 5 Houston, TX 6 Tampa, FL 7 Nashville, TN 8 San Antonio, TX 9 Phoenix, AZ 10 Atlanta, GA With a Presence in 7 of the 10 Largest MSAs in the Southwest & Western US2 # 1 Southern CA (ex. San Diego & Ontario, CA) 3 2 Dallas, TX 3 Houston, TX 4 Phoenix, AZ 5 Ontario, CA 6 San Francisco, CA 7 Seattle, WA 8 Minneapolis, MN 9 San Diego, CA 10 Denver, CO 1,127 Employees 69 Licensed Branches 43 States with Mortgage Capabilities Headquarters: FirstSun: Denver, CO Sunflower Bank: Dallas, TX Key Facts and Statistics4 $1.1B $40.05 1.18x $33.94 12.80x Market Cap Price per Share Price / TBV TBV per Share Price / LTM Adjusted EPS KBRA Ratings5 FirstSun Capital Bancorp Sunflower Bank, N.A. Senior Unsecured Debt = BBB Deposit = BBB+ Subordinated Debt = BBB- Senior Unsecured Debt = BBB+ Short-Term Debt = K3 Short-Term Deposit = K2 Short-Term Debt = K2 Source: S&P Global Market Intelligence, Company documents. 1Defined as MSAs with population over 2 million. 2Defined as states west of the Mississippi River. 3The MSA of Southern California includes Los Angeles, Long Beach, and Anaheim; excludes San Diego and Ontario. 4As of Dec 31, 2024. 5As of Jan 15, 2025. $8.1B Total Assets $6.7B Total Deposits $6.4B Total Loans Franchise Footprint4

FirstSun Capital Bancorp | 4 Unique High Growth Franchise Universe Size Attractive Footprint3 Strong Fee Income Lending Focus Growth 42 Banks 1 Bank Banks West of the Mississippi River Banks with Total Assets $5B - $20B MRQ Fee Income / Rev. > 20% Specialized C&I Lending1 Loan Growth2 > 10% With scale in markets with leading projected population growth and household income Critical Mass in Key US Markets Durable & Growing Earnings Differentiated Platform Strong Growth Momentum Critical Mass in Key US Markets Attractive core deposit funded franchise with proven ability to deliver strong organic growth SCARCITY VALUE Source: S&P Global Market Intelligence; Financial data as of most recent quarter available 1Specialized C&I lending defined as C&I concentration of 30% or greater of total loan portfolio 2Loan Growth represents CAGR calculated from 12/31/2018 3MSA’s ranked by population size west of the Mississippi

FirstSun Capital Bancorp | 5 Investment Thesis — Focused Strategy Southwest & Western geography with a mix of metro and community markets C&I business focus with a disciplined and careful CRE exposure to core customers in our geography Vertical lending expertise provides true alternative to larger banks Core deposit funded franchise Financial service income at high end of peers Tenured management team

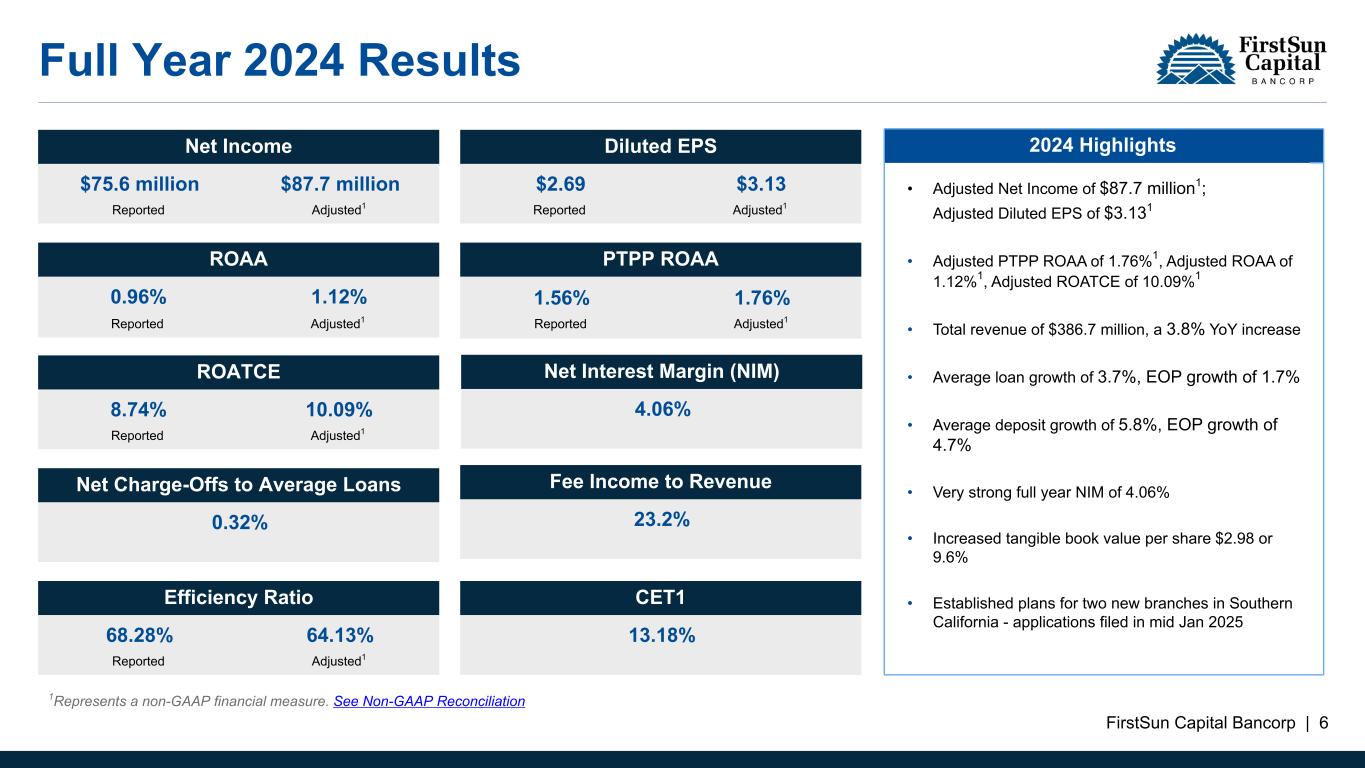

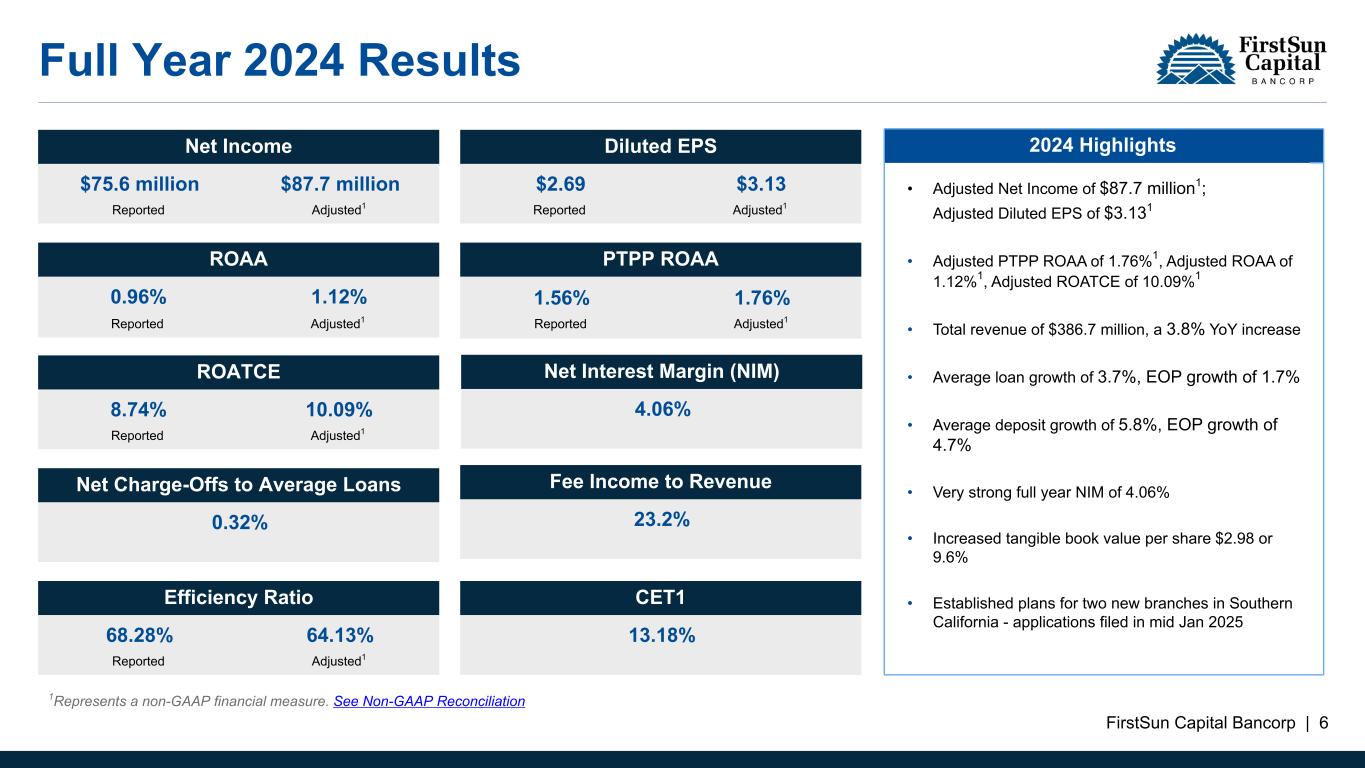

FirstSun Capital Bancorp | 6 Efficiency Ratio 68.28% 64.13% Reported Adjusted1 Full Year 2024 Results 2024 Highlights • Reported Net Income of $75.6 million, or diluted EPS of $2.69, on Revenue of $386.7 million • Strong adjusted PTPP ROAA of 1.56%, ROAA of 0.96%, ROTCE of 8.34% • Maintained a healthy full year NIM (FTE) of 4.12% • Increased tangible book value per share $2.98 or 9.63% • Maintained strong capital ratios with CET1 at 13.18% and TCE/ TA at 11.76% • Executed on organic growth opportunities across our franchise • Grew customers and deepened relationships • Plans for two new branch openings in southern California • KBRA Ratings Renewed • Confident positioning heading into 2025 Net Income $75.6 million $87.7 million Reported Adjusted1 Diluted EPS $2.69 $3.13 Reported Adjusted1 PTPP ROAA 1.56% 1.76% Reported Adjusted1 Net Charge-Offs to Average Loans 0.32% ROAA 0.96% 1.12% Reported Adjusted1 Fee Income to Revenue 23.2% ROATCE 8.74% 10.09% Reported Adjusted1 CET1 13.18% Net Interest Margin (NIM) 4.06% 2024 Highlights 1Represents a non-GAAP financial measure. See Non-GAAP Reconciliation • Adjusted Net Income of $87.7 million1; Adjusted Diluted EPS of $3.131 • Adjusted PTPP ROAA of 1.76%1, Adjusted ROAA of 1.12%1, Adjusted ROATCE of 10.09%1 • Total revenue of $386.7 million, a 3.8% YoY increase • Average loan growth of 3.7%, EOP growth of 1.7% • Average deposit growth of 5.8%, EOP growth of 4.7% • Very strong full year NIM of 4.06% • Increased tangible book value per share $2.98 or 9.6% • Established plans for two new branches in Southern California - applications filed in mid Jan 2025

FirstSun Capital Bancorp | 7 Fourth Quarter 2024 Highlights Q4 PerformanceNet Income $16.4 million $24.3 million Reported Adjusted1 Diluted EPS $0.58 $0.86 Reported Adjusted1 PTPP ROAA 1.24% 1.79% Reported Adjusted1 Fee Income to Revenue 21.9% ROAA 0.81% 1.21% Reported Adjusted1 Net Interest Margin (NIM) 4.11% ROATCE 7.40% 10.78% Reported Adjusted1 Net Recoveries to Average Loans (0.03)% Loan to Deposit Ratio 95.6% Annualized Average Deposit Growth 3.0% • Adjusted Net Income of $24.3 million1; Adjusted Diluted EPS of $0.861 • Adjusted PTPP ROAA of 1.79%1; Adjusted ROAA of 1.21%1; Adjusted ROATCE of 10.78%1 • Total revenue of $98.7 million, an increase of 0.5% • Average loan growth of 0.9%, annualized; EOP decline of 1.0% • Average deposit growth of 3.0%, annualized; EOP growth of 0.3% • Very strong quarterly NIM of 4.11% • Efficiency ratio: 74.66%; Adjusted efficiency ratio: 63.63%1 1Represents a non-GAAP financial measure. See Non-GAAP Reconciliation

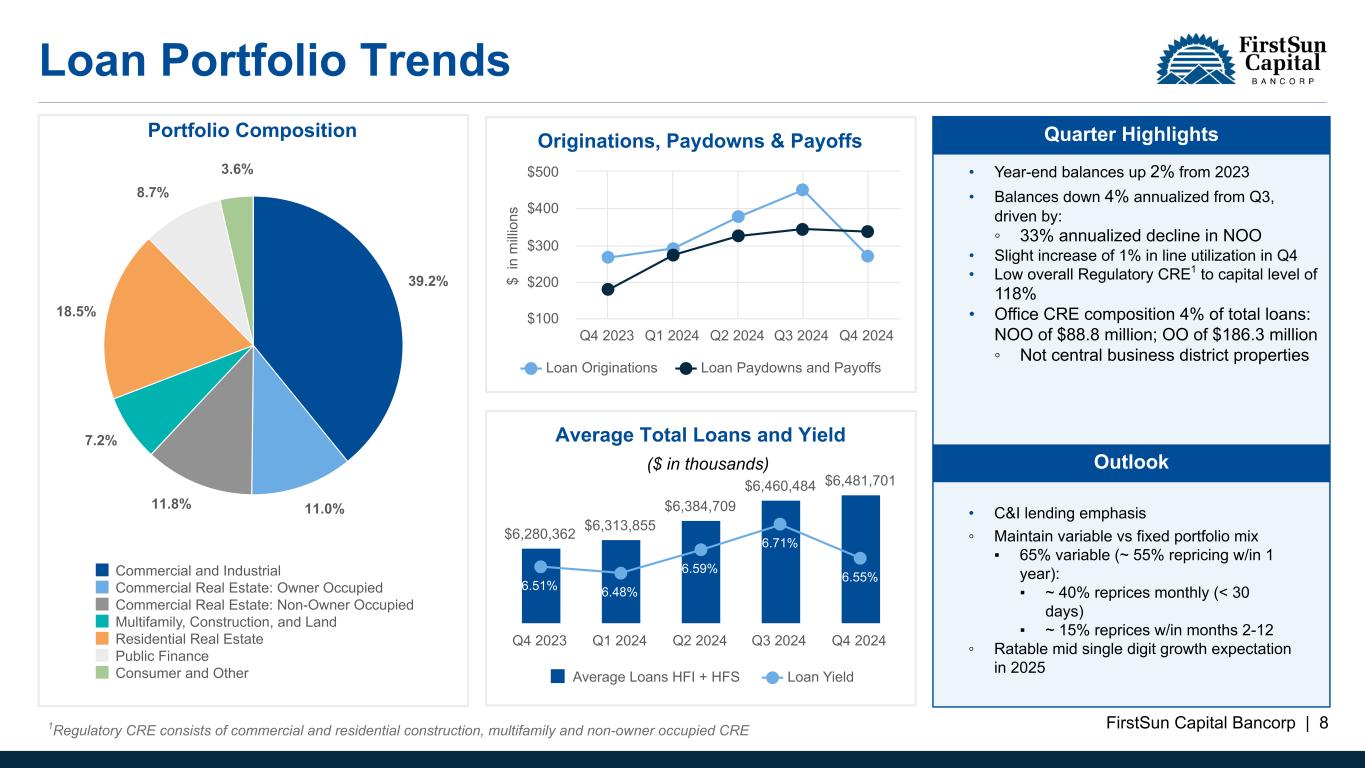

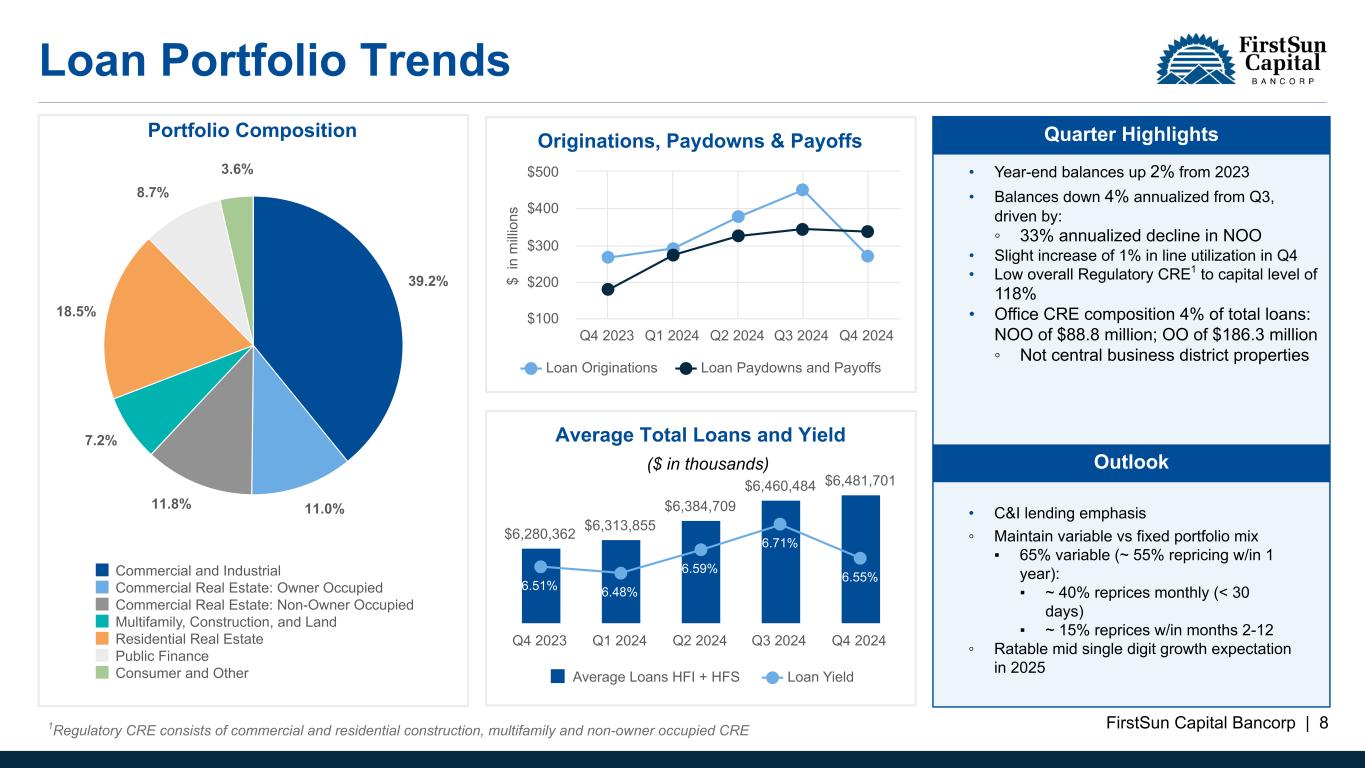

FirstSun Capital Bancorp | 8 Loan Portfolio Trends Portfolio Composition 39.2% 11.0%11.8% 7.2% 18.5% 8.7% 3.6% Commercial and Industrial Commercial Real Estate: Owner Occupied Commercial Real Estate: Non-Owner Occupied Multifamily, Construction, and Land Residential Real Estate Public Finance Consumer and Other $ in m ill io ns Originations, Paydowns & Payoffs Loan Originations Loan Paydowns and Payoffs Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $100 $200 $300 $400 $500 Average Total Loans and Yield $6,280,362 $6,313,855 $6,384,709 $6,460,484 $6,481,701 6.51% 6.48% 6.59% 6.71% 6.55% Average Loans HFI + HFS Loan Yield Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 1Regulatory CRE consists of commercial and residential construction, multifamily and non-owner occupied CRE ($ in thousands) • Year-end balances up 2% from 2023 • Balances down 4% annualized from Q3, driven by: ◦ 33% annualized decline in NOO • Slight increase of 1% in line utilization in Q4 • Low overall Regulatory CRE1 to capital level of 118% • Office CRE composition 4% of total loans: NOO of $88.8 million; OO of $186.3 million ◦ Not central business district properties • C&I lending emphasis ◦ Maintain variable vs fixed portfolio mix ▪ 65% variable (~ 55% repricing w/in 1 year): ▪ ~ 40% reprices monthly (< 30 days) ▪ ~ 15% reprices w/in months 2-12 ◦ Ratable mid single digit growth expectation in 2025 Quarter Highlights Outlook

FirstSun Capital Bancorp | 9 Deposit Trends Average Deposit Composition $6,627,469 $6,578,801 $6,468,574 $6,352,029 $6,455,041 Noninterest-Bearing Demand Deposit Accounts Interest-Bearing Demand Accounts Savings Accounts and Money Market Accounts NOW Accounts Certificate of Deposit Accounts Q4 2024 Q3 2024 Q2 2024 Q1 2024 Q4 2023 Cost of Deposits & Cost of Funds Int-bearing deposits Total Deposits Funds Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 2.00% 3.00% Loan to Deposit Ratio Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 95.00% 96.00% 97.00% 98.00% 99.00% ($ in thousands) • Year-end balances up 5% from 2023 • Year-end balances up 1% annualized from Q3 (up 3% on an avg balance basis annualized) • Continued mix shift ◦ Sav/MMDA increased to 42.5% from 39.2% ◦ CD’s decreased to 23.5% from 27.1% • Commercial business deposits represent 43% of total deposits and represent 73% of non-interest bearing • Ratable mid single digit growth expectation for 2025 • Continued mix shift ◦ Mid teen’s CD balance decline ◦ Mid single digit MMDA growth ◦ Mid to high single digit NIB growth Quarter Highlights Outlook 23.1% 10.3% 42.5% 23.5% 23.4% 9.7% 39.2% 27.1% 23.6% 8.1% 37.9% 29.8% 23.5% 8.4% 38.4% 29.1% 24.0% 8.4% 38.4% 28.3%

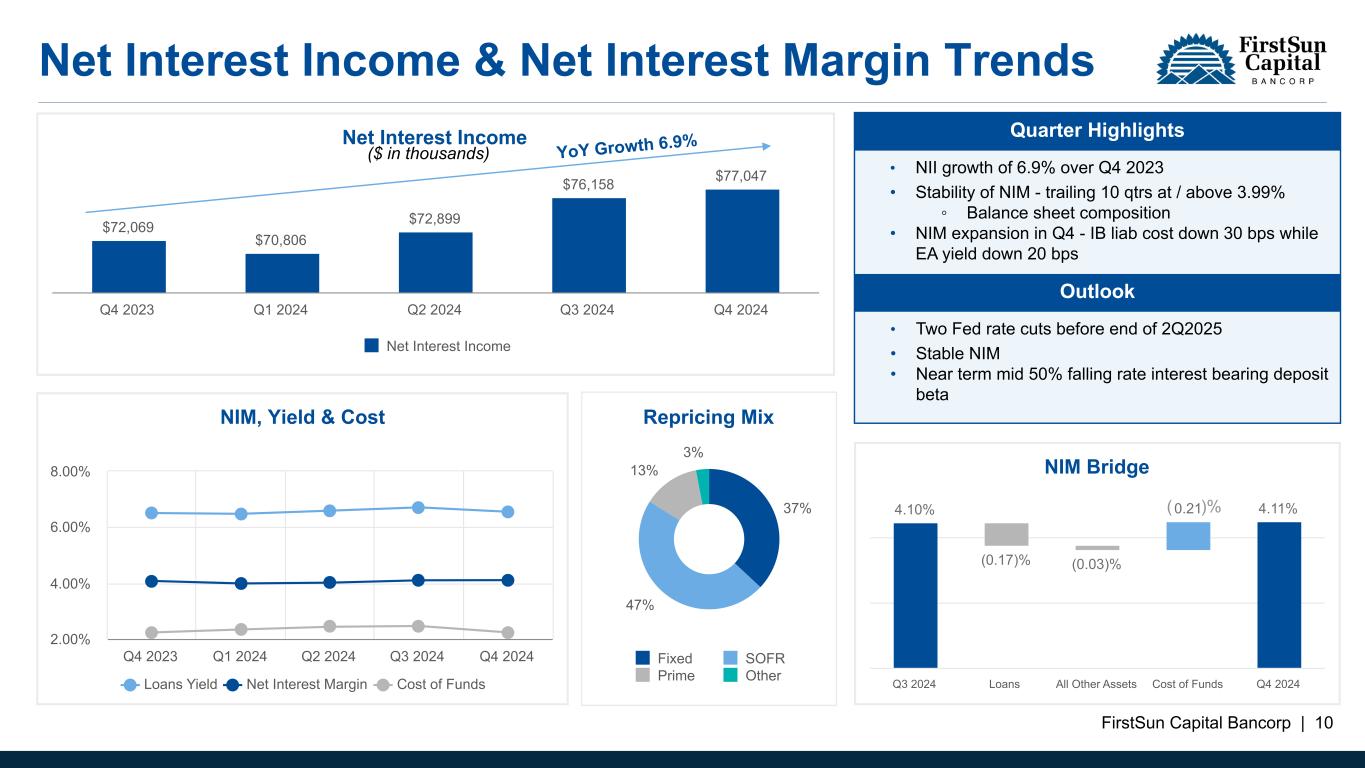

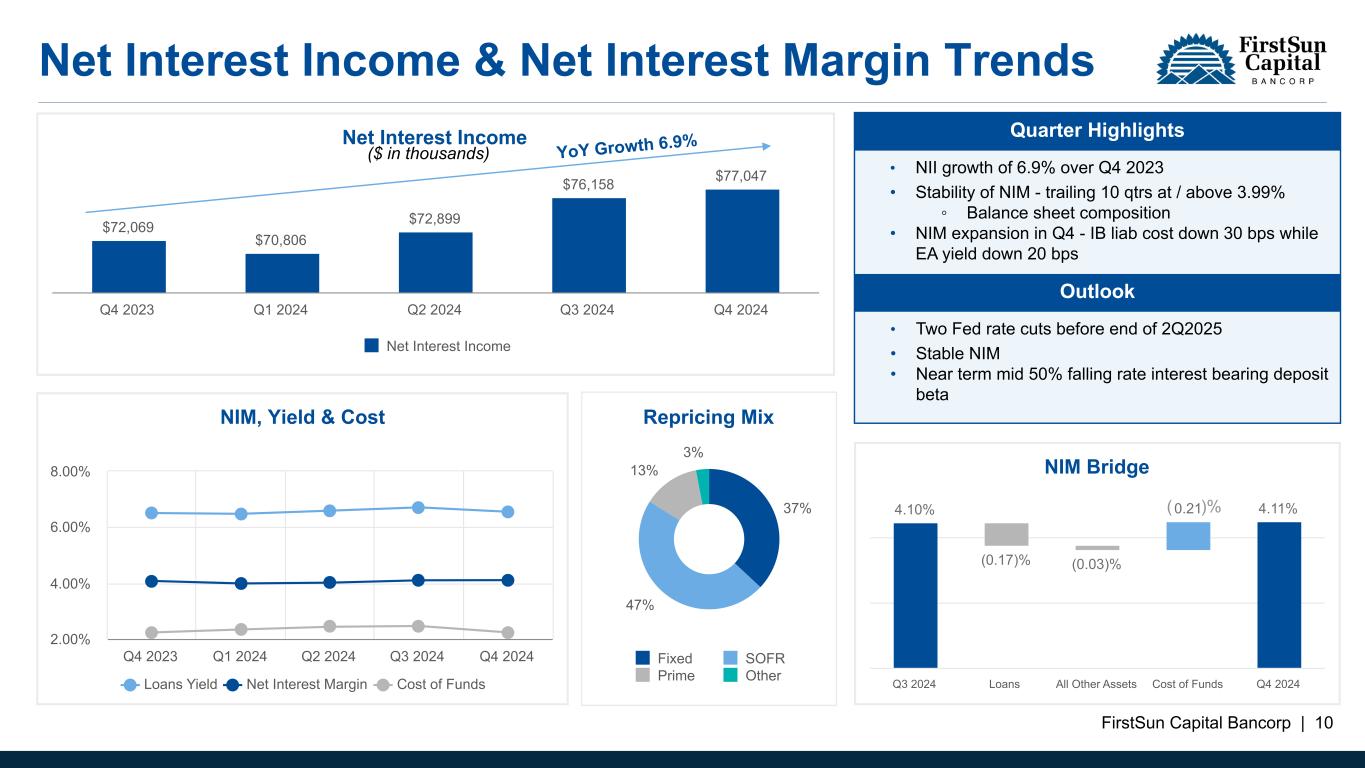

FirstSun Capital Bancorp | 10 NIM Bridge 4.10% (0.17)% (0.03)% 0.21 4.11% Q3 2024 Loans All Other Assets Cost of Funds Q4 2024 NIM, Yield & Cost Loans Yield Net Interest Margin Cost of Funds Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 2.00% 4.00% 6.00% 8.00% Net Interest Income $72,069 $70,806 $72,899 $76,158 $77,047 Net Interest Income Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Repricing Mix 37% 47% 13% 3% Fixed SOFR Prime Other Net Interest Income & Net Interest Margin Trends ($ in thousands) • NII growth of 6.9% over Q4 2023 • Stability of NIM - trailing 10 qtrs at / above 3.99% ◦ Balance sheet composition • NIM expansion in Q4 - IB liab cost down 30 bps while EA yield down 20 bps Quarter Highlights Outlook • Two Fed rate cuts before end of 2Q2025 • Stable NIM • Near term mid 50% falling rate interest bearing deposit beta ( )% YoY Growth 6.9%

FirstSun Capital Bancorp | 11 Noninterest Income Trends Service Fee Revenue Composition $21,635 $22,075 $23,274 $22,808 $17,221 $9,631 $8,838 $11,043 $9,502 $4,883 $3,982 $3,748 $3,631 $3,468 $3,075 $2,706 $2,738 $2,950 $2,759 $2,920 $2,219 $2,560 $2,372 $2,344 $2,468 $1,436 $1,395 $1,493 $1,463 $1,356 $1,661 $2,796 $1,785 $3,272 $2,519 Mortgage Banking Service Fee Revenue Treasury Management Service Fees Credit and Debit Card Service Fees Deposit Service Fees Wealth Management Service Fees Other Noninterest Income Q4 2024 Q3 2024 Q2 2024 Q1 2024 Q4 2023 Mortgage Volume Sold and Margin $278.3 $314.7 $282.5 $200.2 $154.0 2.72% 3.15% 3.07% 2.84% 2.76% Mortgage Volume Sold Margin Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 ($ in thousands) ($ in millions) • Diversified revenue base ~ 22% service fees to total revenue1 (~ 23% on full yr) • Treasury mgt service revenue (up 25% ann.) and mortgage banking service revenue (up 36% ann.) driving Q4 growth ◦ Mortgage banking revenue to total revenue ~ 10% ◦ Treasury management revenue to total revenue ~ 4% Quarter Highlights Outlook • Mid 20’s service fee revenue to total revenue • Mortgage banking, treasury management and loan syndication arrangement service revenues driving growth 1Total revenue is net interest income plus noninterest income

FirstSun Capital Bancorp | 12 Noninterest Expense Trends Noninterest Expense Composition $73,673 $64,664 $63,875 $61,828 $52,308 $38,498 $39,306 $39,828 $37,353 $30,158 $9,865 $9,121 $8,701 $8,595 $8,449 $8,010 $15,869 $13,953 $13,648 $12,576 $12,872 Salaries and Benefits Occupancy and Equipment Amortization of Intangible Assets Terminated Merger Related Expenses Other Noninterest Expenses Q4 2024 Q3 2024 Q2 2024 Q1 2024 Q4 2023 2024 Efficiency Ratio 58.58% 66.05% 66.42% 65.83% 74.66% 58.58% 63.39% 65.33% 64.16% 63.63% Adjusted Efficiency Ratio Efficiency Ratio Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Non-Recurring Expense Bridge $73.7 $(10.9) $62.8 Q4 2024 Non-Recurring Expenses Adjusted Q4 2024 ($ in millions) ($ in thousands) 1 1 1Represents a non-GAAP financial measure. See Non-GAAP Reconciliation • Adjusted noninterest expenses down slightly (1.5)%, annualized • Positive operating leverage on an adjusted basis for Q4 • Composition of non-recurring expense adjustments: ◦ Terminated merger related $8.0 million ◦ Selected ATM disposals $2.0 million ◦ Guardian Mortgage trade name write- off $0.8 million • Continued investment in building out franchise organically (sales force & infrastructure) ◦ Investing in growth markets • Mid 60’s efficiency ratio Quarter Highlights Outlook

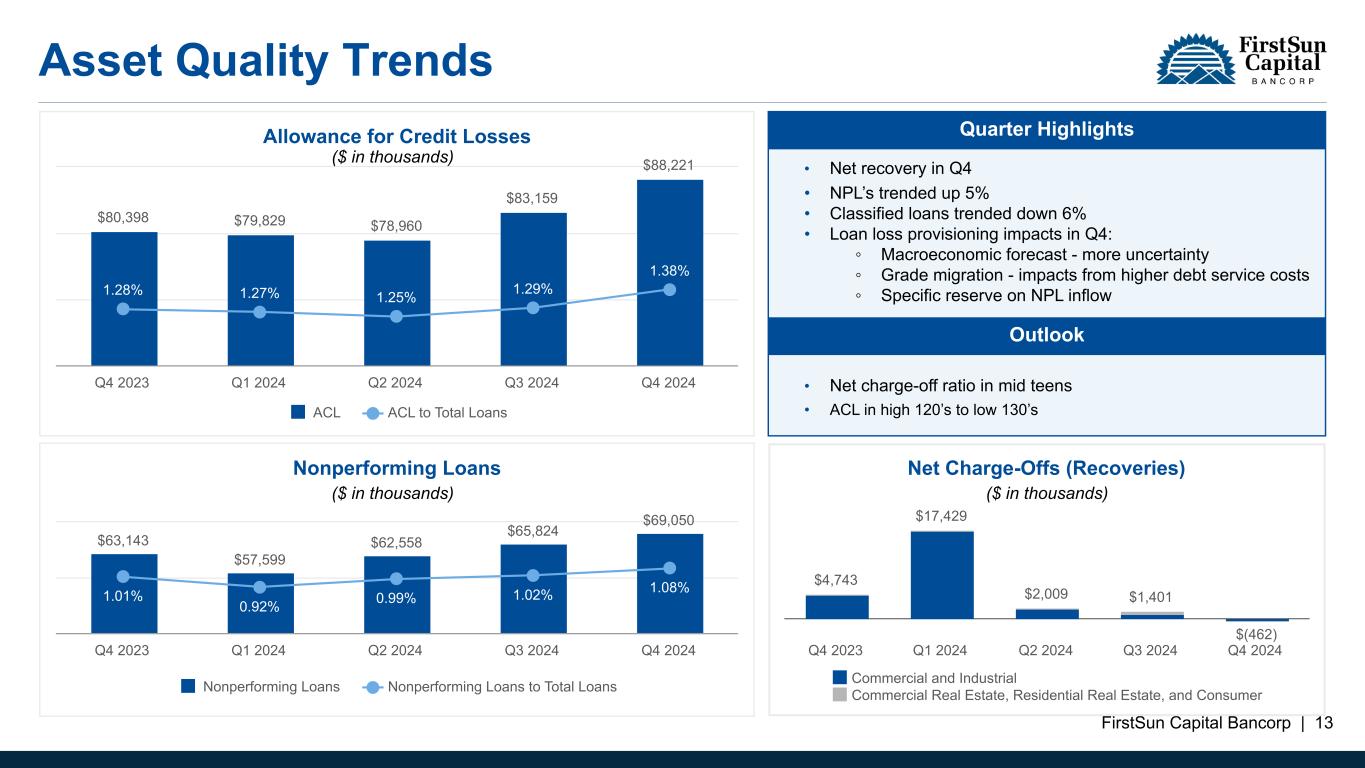

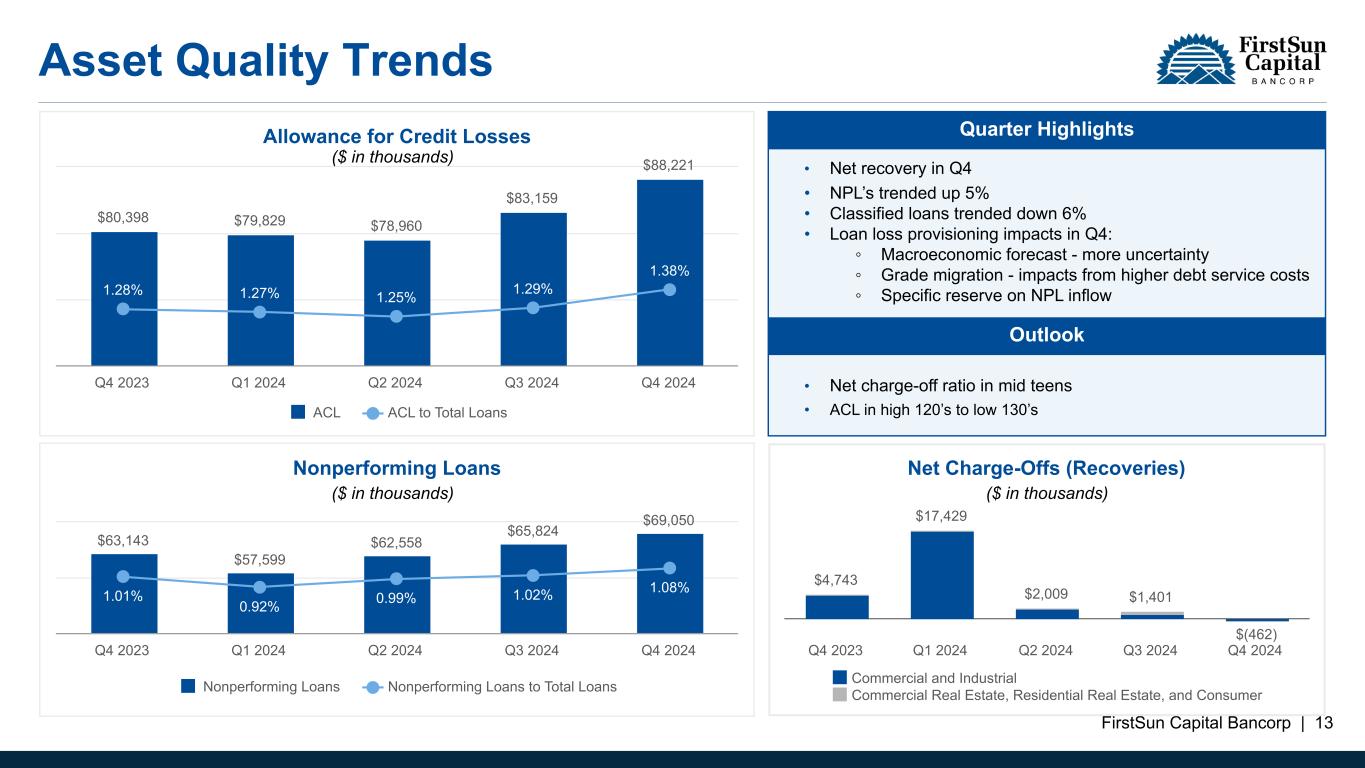

FirstSun Capital Bancorp | 13 Asset Quality Trends Net Charge-Offs (Recoveries) $4,743 $17,429 $2,009 $1,401 $(462) Commercial and Industrial Commercial Real Estate, Residential Real Estate, and Consumer Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Allowance for Credit Losses $80,398 $79,829 $78,960 $83,159 $88,221 1.28% 1.27% 1.25% 1.29% 1.38% ACL ACL to Total Loans Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Nonperforming Loans $63,143 $57,599 $62,558 $65,824 $69,050 1.01% 0.92% 0.99% 1.02% 1.08% Nonperforming Loans Nonperforming Loans to Total Loans Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 ($ in thousands) ($ in thousands)($ in thousands) • Net recovery in Q4 • NPL’s trended up 5% • Classified loans trended down 6% • Loan loss provisioning impacts in Q4: ◦ Macroeconomic forecast - more uncertainty ◦ Grade migration - impacts from higher debt service costs ◦ Specific reserve on NPL inflow Quarter Highlights Outlook • Net charge-off ratio in mid teens • ACL in high 120’s to low 130’s

FirstSun Capital Bancorp | 14 Capital and Liquidity Total Capital Ratio 13.25% 14.73% 14.95% 15.25% 15.42% Total Capital Ratio Capital Operating Threshold Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Common Equity Tier 1 Capital Ratio 11.10% 12.54% 12.80% 13.06% 13.18% CET1 Capital Operating Threshold Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Liquidity Ratios Wholesale Deposits and Borrowings to Total Liabilities TCE / TA TCE / TA, + Net Unrealized Losses on HTM Securities Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 7.50% 10.00% 12.50% ($ in thousands) • Wholesale funding reliance of 8% • Cash to total assets 8% • AOCI & HTM unrealized loss to total equity of (4)% • CET 1 of 13.18% Quarter Highlights Outlook • Liquidity & IRR ◦ Maintain historical solid liquidity positioning across multiple sources ◦ Maintain balance sheet strength and relative neutrality to downward/ upward rates (-/+ 100bps) • Capital ◦ Support organic growth thru earnings ◦ Opportunistic M&A $3.5B Immediate Borrowing Availability

FirstSun Capital Bancorp | 15 Consistent Long Term Strategy Key Southwest and Western Growth Markets C&I Focused Commercial Bank High Service Fee to Revenue Mix Core Deposit Franchise Operating Strategy Focused on Organic Loan and Deposit Growth in Targeted Markets Operating in 5 of 10 Fastest Growing MSA’s in US Robust Mix of Customer Relationships across Urban and Rural Communities Relationship Driven C&I Banking with Attractive Specialty Verticals Expansive Treasury Management Services Low CRE Concentration Revenue Diversification Emphasis Multiple Profitable Service Fee Income Lines of Business Best in Class Revenue Mix High Quality, Attractive Beta, Low Cost Deposits Balanced Distribution Across Deposit Rich Markets Advantageous Funding Solid Core Earnings Progression Sound Risk and Compliance Programs Opportunistic Acquisition Readiness 1 2 3 4 5

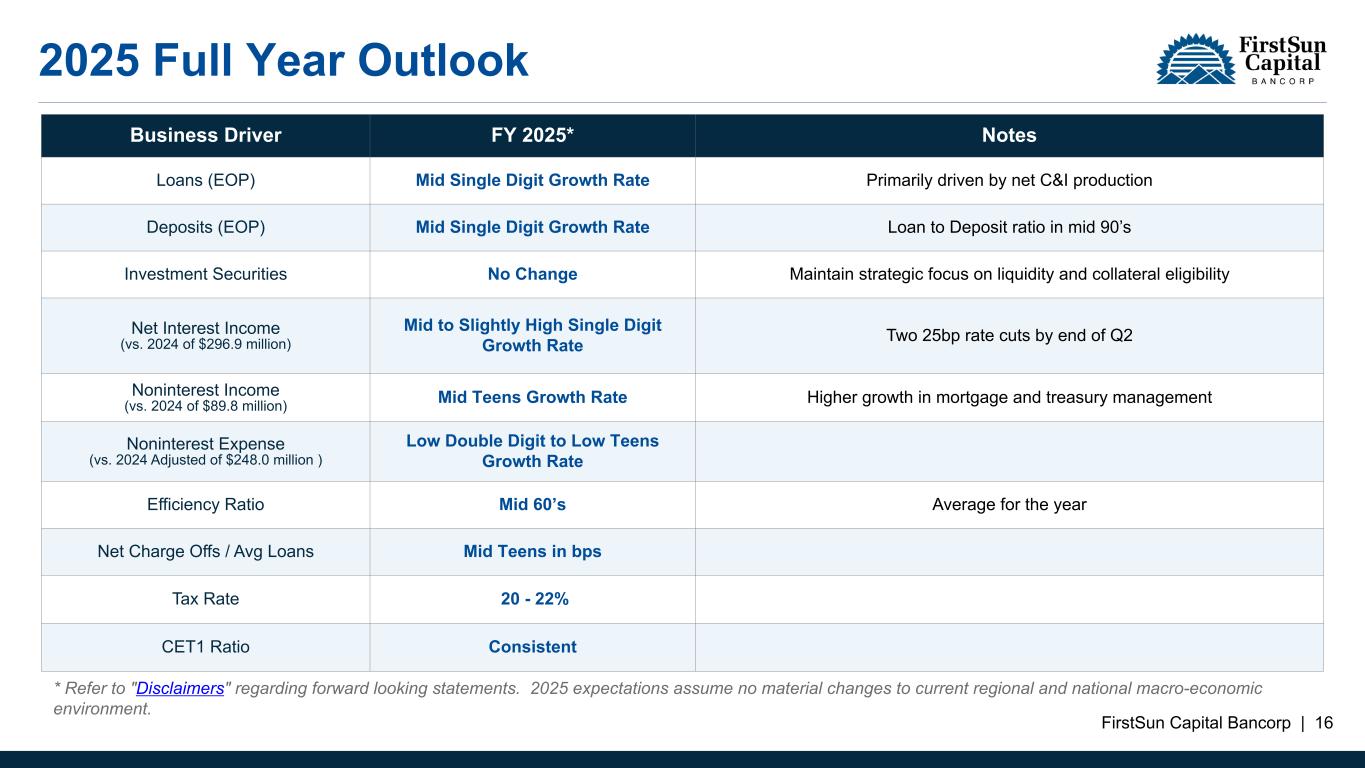

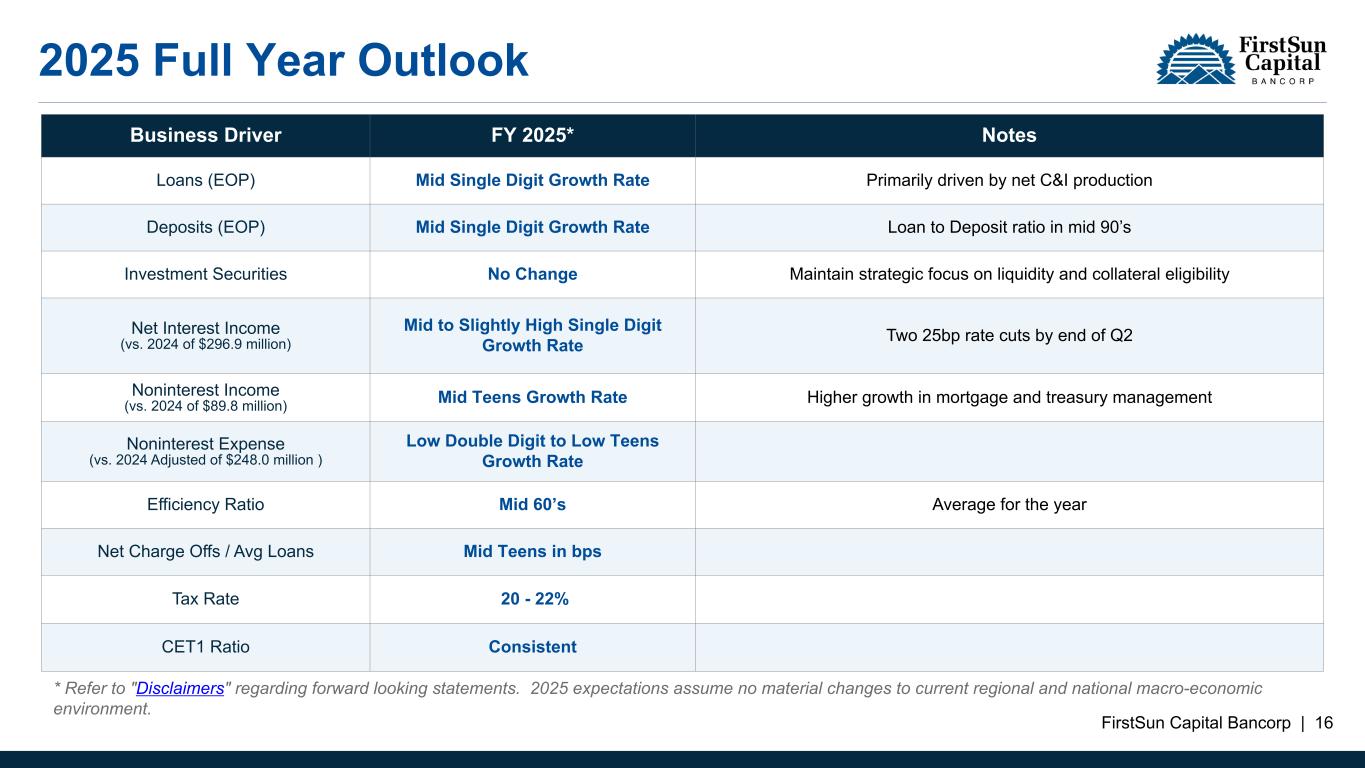

FirstSun Capital Bancorp | 16 2025 Full Year Outlook Business Driver FY 2025* Notes Loans (EOP) Mid Single Digit Growth Rate Primarily driven by net C&I production Deposits (EOP) Mid Single Digit Growth Rate Loan to Deposit ratio in mid 90’s Investment Securities No Change Maintain strategic focus on liquidity and collateral eligibility Net Interest Income (vs. 2024 of $296.9 million) Mid to Slightly High Single Digit Growth Rate Two 25bp rate cuts by end of Q2 Noninterest Income (vs. 2024 of $89.8 million) Mid Teens Growth Rate Higher growth in mortgage and treasury management Noninterest Expense (vs. 2024 Adjusted of $248.0 million ) Low Double Digit to Low Teens Growth Rate Efficiency Ratio Mid 60’s Average for the year Net Charge Offs / Avg Loans Mid Teens in bps Tax Rate 20 - 22% CET1 Ratio Consistent * Refer to "Disclaimers" regarding forward looking statements. 2025 expectations assume no material changes to current regional and national macro-economic environment.

FirstSun Capital Bancorp | 17 Appendix

FirstSun Capital Bancorp | 18 ~ 65%1 of Total Deposits are FDIC-Insured Granular Deposit Base Consumer Deposits - $3.4B as of December 31, 2024 Business Deposits - $2.8B as of December 31, 2024 Customer Base 135,628 Consumer Accounts Granular Deposit Base $25,000 Avg. Account Balance 69 Retail Branches Customer Base 13,589 Consumer Accounts Granular Deposit Base $209,000 Avg. Account Balance Example Total Return Performance Uninsured Consumer, 17.1% Uninsured Business, 82.9% Uninsured Consumer Uninsured Business Customer Base 135,600 Consumer Accounts Granular Deposit Base $25,000 Avg. Account Balance Customer Base 13,500 Commercial Business Accounts Granular Deposit Base $209,000 Avg. Account Balance $6.7 Billion Total Deposits as of December 31, 2024 Deposits by State2 $2.1B Texas $1.6B Kansas $1.2B New Mexico $0.8B Colorado $0.4B Arizona ~ 75%1 of Total Deposits are FDIC-Insured + Collateralized 1 Uninsured deposits and uninsured and uncollateralized deposits are reported for our wholly-owned subsidiary Sunflower Bank, N.A. and are estimated. 2Excludes wholesale and internal deposit accounts.

FirstSun Capital Bancorp | 19 Financial Summary As of and for the quarter ended ($ in thousands, except per share amounts) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Net interest income $ 77,047 $ 76,158 $ 72,899 $ 70,806 $ 72,069 Provision for credit losses 4,850 5,000 1,200 16,500 6,575 Noninterest income 21,635 22,075 23,274 22,808 17,221 Noninterest expense 73,673 64,664 63,875 61,828 52,308 Income before income taxes 20,159 28,569 31,098 15,286 30,407 Provision for income taxes 3,809 6,147 6,538 2,990 6,393 Net income 16,350 22,422 24,560 12,296 24,014 Adjusted net income (1) 24,316 23,655 25,181 14,592 24,014 Weighted average common shares outstanding, diluted 28,290,474 28,212,809 28,031,956 27,628,941 25,472,017 Diluted earnings per share $ 0.58 $ 0.79 $ 0.88 $ 0.45 $ 0.94 Adjusted diluted earnings per share (1) $ 0.86 $ 0.84 $ 0.90 $ 0.53 $ 0.94 Return on average total assets 0.81 % 1.13 % 1.26 % 0.64 % 1.26 % Adjusted return on average total assets (1) 1.21 % 1.19 % 1.29 % 0.76 % 1.26 % Pre-tax pre provision return on average assets (1) 1.24 % 1.69 % 1.66 % 1.66 % 1.94 % Adjusted pre-tax pre provision return on average assets (1) 1.79 % 1.77 % 1.71 % 1.79 % 1.94 % Return on average tangible stockholders' equity (1) 7.40 % 10.00 % 11.44 % 6.08 % 13.09 % Adjusted return on average tangible stockholders' equity (1) 10.78 % 10.54 % 11.73 % 7.16 % 13.09 % Net interest margin 4.11 % 4.10 % 4.02 % 3.99 % 4.08 % Efficiency ratio 74.66 % 65.83 % 66.42 % 66.05 % 58.58 % Adjusted efficiency ratio (1) 63.63 % 64.16 % 65.33 % 63.39 % 58.58 % Noninterest income to total revenue (2) 21.9 % 22.5 % 24.2 % 24.4 % 19.3 % Total assets $ 8,097,387 $ 8,138,487 $ 7,999,295 $ 7,781,601 $ 7,879,724 Total loans held-for-sale 61,825 72,247 66,571 56,813 54,212 Total loans held-for-investment 6,376,357 6,443,756 6,337,162 6,284,868 6,267,096 Total deposits 6,672,260 6,649,880 6,619,525 6,445,388 6,374,103 Total stockholders' equity 1,041,366 1,034,085 996,599 964,662 877,197 Loan to deposit ratio 95.6 % 96.9 % 95.7 % 97.5 % 98.3 % Period end common shares outstanding 27,709,679 27,665,918 27,443,246 27,442,943 24,960,639 Book value per share $ 37.58 $ 37.38 $ 36.31 $ 35.15 $ 35.14 Tangible book value per share (1) $ 33.94 $ 33.68 $ 32.56 $ 31.37 $ 30.96 (1) Represents a non-GAAP financial measure. See non-GAAP reconciliation (2) Total revenue is net interest income plus noninterest income.

FirstSun Capital Bancorp | 20 Non-GAAP Reconciliation As of and for the quarter ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Tangible stockholders’ equity to tangible assets: Total stockholders' equity (GAAP) $ 1,041,366 $ 1,034,085 $ 996,599 $ 964,662 $ 877,197 $ 1,041,366 $ 877,197 Less: Goodwill and other intangible assets: Goodwill (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) Other intangible assets (7,434) (8,866) (9,517) (10,168) (10,984) (7,434) (10,984) Tangible stockholders' equity (non-GAAP) $ 940,449 $ 931,736 $ 893,599 $ 861,011 $ 772,730 $ 940,449 $ 772,730 Total assets (GAAP) $ 8,097,387 $ 8,138,487 $ 7,999,295 $ 7,781,601 $ 7,879,724 $ 8,097,387 $ 7,879,724 Less: Goodwill and other intangible assets: Goodwill (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) Other intangible assets (7,434) (8,866) (9,517) (10,168) (10,984) (7,434) (10,984) Tangible assets (non-GAAP) $ 7,996,470 $ 8,036,138 $ 7,896,295 $ 7,677,950 $ 7,775,257 $ 7,996,470 $ 7,775,257 Total stockholders' equity to total assets (GAAP) 12.86 % 12.71 % 12.46 % 12.40 % 11.13 % 12.86 % 11.13 % Less: Impact of goodwill and other intangible assets (1.10) % (1.12) % (1.14) % (1.19) % (1.19) % (1.10) % (1.19) % Tangible stockholders' equity to tangible assets (non- GAAP) 11.76 % 11.59 % 11.32 % 11.21 % 9.94 % 11.76 % 9.94 % Tangible stockholers’ equity to tangible assets, reflecting net unrealized losses on HTM securities, net of tax: Tangible stockholders' equity (non-GAAP) $ 940,449 $ 931,736 $ 893,599 $ 861,011 $ 772,730 $ 940,449 $ 772,730 Less: Net unrealized losses on HTM securities, net of tax (4,292) (2,852) (3,949) (4,236) (3,629) (4,292) (3,629) Tangible stockholders’ equity less net unrealized losses on HTM securities, net of tax (non-GAAP) $ 936,157 $ 928,884 $ 889,650 $ 856,775 $ 769,101 $ 936,157 $ 769,101 Tangible assets (non-GAAP) $ 7,996,470 $ 8,036,138 $ 7,896,295 $ 7,677,950 $ 7,775,257 $ 7,996,470 $ 7,775,257 Less: Net unrealized losses on HTM securities, net of tax (4,292) (2,852) (3,949) (4,236) (3,629) (4,292) (3,629) Tangible assets less net unrealized losses on HTM securities, net of tax (non-GAAP) $ 7,992,178 $ 8,033,286 $ 7,892,346 $ 7,673,714 $ 7,771,628 $ 7,992,178 $ 7,771,628 Tangible stockholders’ equity to tangible assets (non-GAAP) 11.76 % 11.59 % 11.32 % 11.21 % 9.94 % 11.76 % 9.94 % Less: Net unrealized losses on HTM securities, net of tax (0.05) % (0.03) % (0.05) % (0.04) % (0.04) % (0.05) % (0.04) % Tangible stockholders’ equity to tangible assets reflecting net unrealized losses on HTM securities, net of tax (non- GAAP) 11.71 % 11.56 % 11.27 % 11.17 % 9.90 % 11.71 % 9.90 %

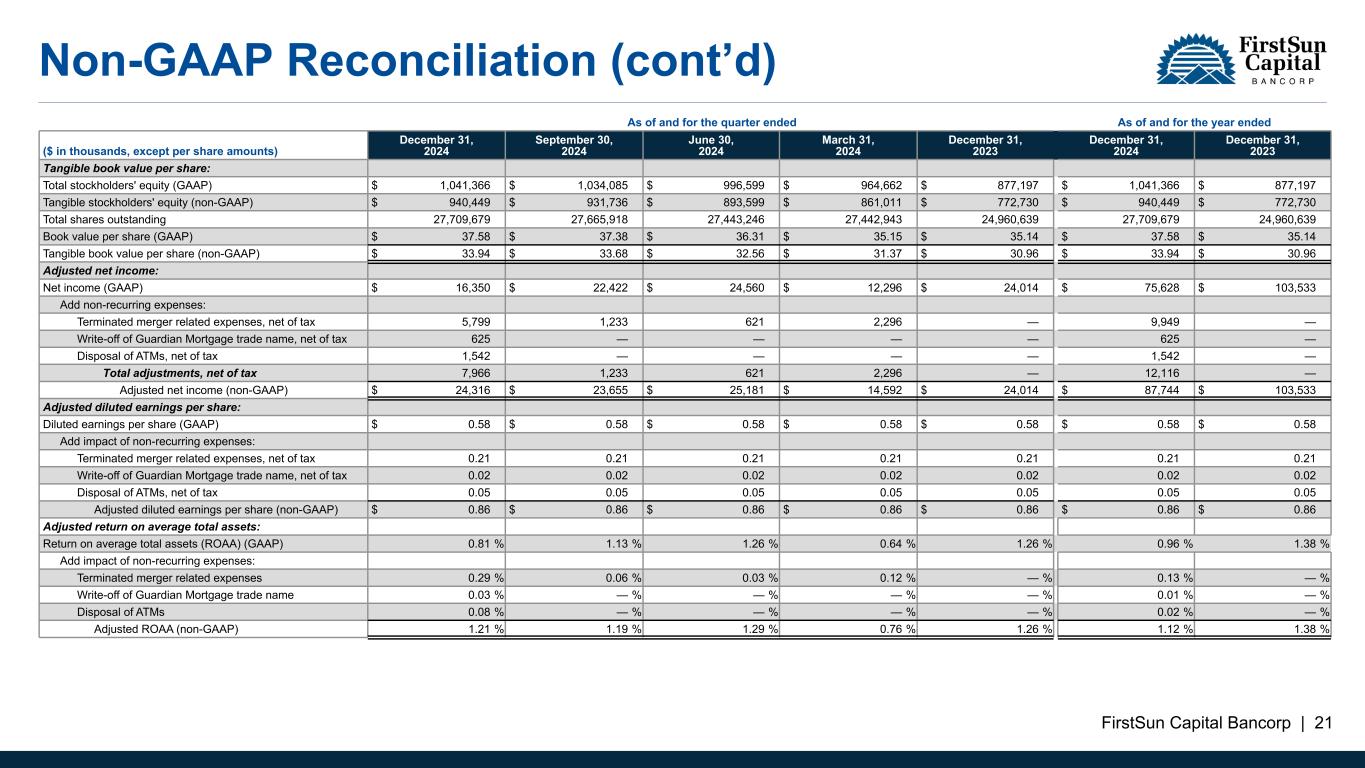

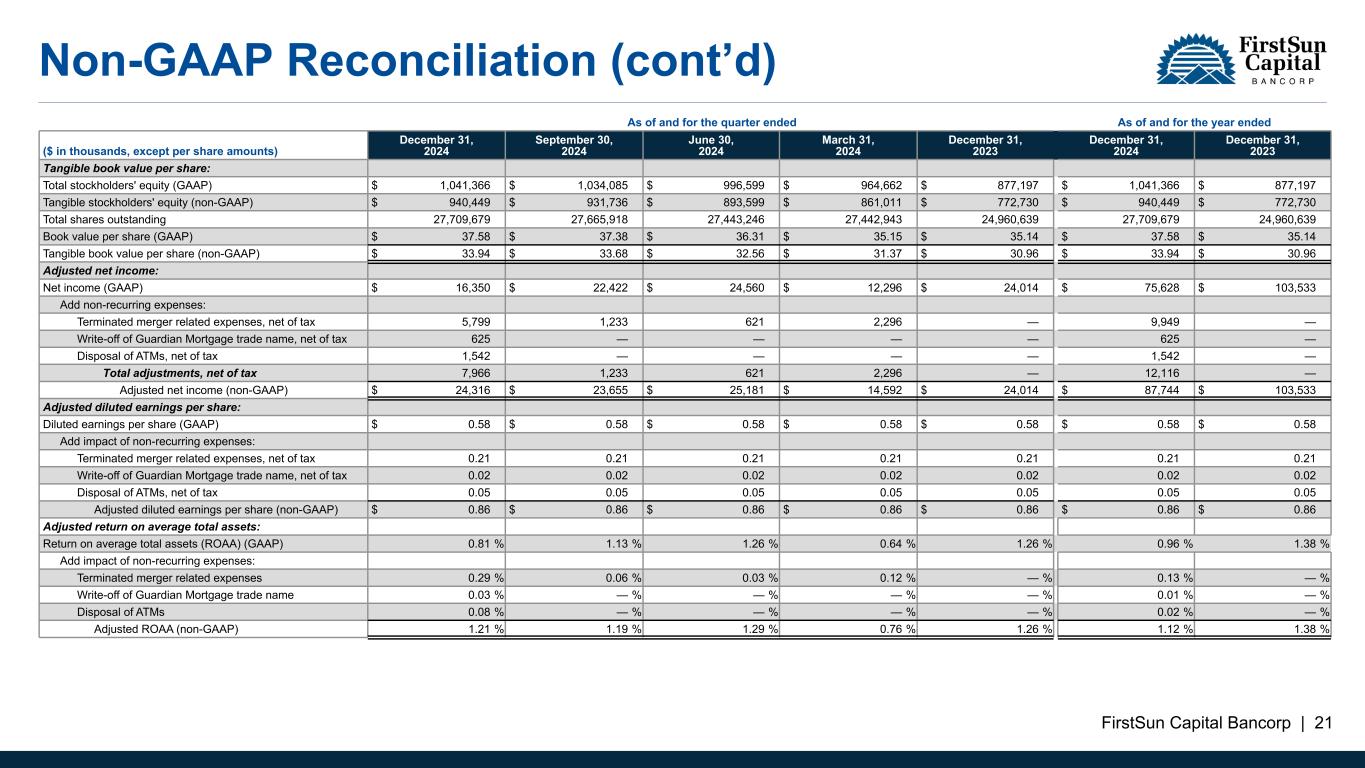

FirstSun Capital Bancorp | 21 Non-GAAP Reconciliation (cont’d) As of and for the quarter ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Tangible book value per share: Total stockholders' equity (GAAP) $ 1,041,366 $ 1,034,085 $ 996,599 $ 964,662 $ 877,197 $ 1,041,366 $ 877,197 Tangible stockholders' equity (non-GAAP) $ 940,449 $ 931,736 $ 893,599 $ 861,011 $ 772,730 $ 940,449 $ 772,730 Total shares outstanding 27,709,679 27,665,918 27,443,246 27,442,943 24,960,639 27,709,679 24,960,639 Book value per share (GAAP) $ 37.58 $ 37.38 $ 36.31 $ 35.15 $ 35.14 $ 37.58 $ 35.14 Tangible book value per share (non-GAAP) $ 33.94 $ 33.68 $ 32.56 $ 31.37 $ 30.96 $ 33.94 $ 30.96 Adjusted net income: Net income (GAAP) $ 16,350 $ 22,422 $ 24,560 $ 12,296 $ 24,014 $ 75,628 $ 103,533 Add non-recurring expenses: Terminated merger related expenses, net of tax 5,799 1,233 621 2,296 — 9,949 — Write-off of Guardian Mortgage trade name, net of tax 625 — — — — 625 — Disposal of ATMs, net of tax 1,542 — — — — 1,542 — Total adjustments, net of tax 7,966 1,233 621 2,296 — 12,116 — Adjusted net income (non-GAAP) $ 24,316 $ 23,655 $ 25,181 $ 14,592 $ 24,014 $ 87,744 $ 103,533 Adjusted diluted earnings per share: Diluted earnings per share (GAAP) $ 0.58 $ 0.58 $ 0.58 $ 0.58 $ 0.58 $ 0.58 $ 0.58 Add impact of non-recurring expenses: Terminated merger related expenses, net of tax 0.21 0.21 0.21 0.21 0.21 0.21 0.21 Write-off of Guardian Mortgage trade name, net of tax 0.02 0.02 0.02 0.02 0.02 0.02 0.02 Disposal of ATMs, net of tax 0.05 0.05 0.05 0.05 0.05 0.05 0.05 Adjusted diluted earnings per share (non-GAAP) $ 0.86 $ 0.86 $ 0.86 $ 0.86 $ 0.86 $ 0.86 $ 0.86 Adjusted return on average total assets: Return on average total assets (ROAA) (GAAP) 0.81 % 1.13 % 1.26 % 0.64 % 1.26 % 0.96 % 1.38 % Add impact of non-recurring expenses: Terminated merger related expenses 0.29 % 0.06 % 0.03 % 0.12 % — % 0.13 % — % Write-off of Guardian Mortgage trade name 0.03 % — % — % — % — % 0.01 % — % Disposal of ATMs 0.08 % — % — % — % — % 0.02 % — % Adjusted ROAA (non-GAAP) 1.21 % 1.19 % 1.29 % 0.76 % 1.26 % 1.12 % 1.38 %

FirstSun Capital Bancorp | 22 Non-GAAP Reconciliation (cont’d) As of and for the quarter ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Adjusted pre-tax pre provision return on average assets: Net income (GAAP) $ 16,350 $ 22,422 $ 24,560 $ 12,296 $ 24,014 $ 75,628 $ 103,533 Add: Income Taxes 3,809 6,147 6,538 2,990 6,393 19,484 27,950 Provision for Credit Losses 4,850 5,000 1,200 16,500 6,575 27,550 18,247 PTPP Net Income $ 25,009 $ 33,569 $ 32,298 $ 31,786 $ 36,982 $ 122,662 $ 149,730 Add: Merger related expenses 8,010 1,633 1,046 2,489 — 13,178 — Disposal of GMC tradename 828 — — — — 828 — Disposal of ATM's 2,042 — — — — 2,042 — Adjusted PTPP Net Income (non-GAAP) $ 35,889 $ 35,202 $ 33,344 $ 34,275 $ 36,982 $ 138,710 $ 149,730 Return on average total assets (ROAA) (GAAP) 0.81 % 1.13 % 1.26 % 0.64 % 1.26 % 0.96 % 1.38 % Add impact of non-recurring expenses: Income taxes 0.19 % 0.31 % 0.34 % 0.16 % 0.34 % 0.25 % 0.37 % Provision for credit losses 0.24 % 0.25 % 0.06 % 0.86 % 0.34 % 0.35 % 0.24 % PTPP ROAA (non-GAAP) 1.24 % 1.69 % 1.66 % 1.66 % 1.94 % 1.56 % 2.00 % Add impact of non-recurring expenses: Terminated merger related expenses 0.40 % 0.08 % 0.05 % 0.13 % — % 0.17 % — % Write-off of Guardian Mortgage trade name 0.04 % — % — % — % — % 0.01 % — % Disposal of ATMs 0.10 % — % — % — % — % 0.03 % — % Adjusted PTPP ROAA (non-GAAP) 1.79 % 1.77 % 1.71 % 1.79 % 1.94 % 1.76 % 2.00 % Adjusted return on average stockholders’ equity Return on average stockholders' equity (ROACE) (GAAP) 6.25 % 8.79 % 10.03 % 5.15 % 11.19 % 7.56 % 12.50 % Add impact of non-recurring expenses: Terminated merger related expenses 2.22 % 0.48 % 0.25 % 0.96 % — % 1.00 % — % Write-off of Guardian Mortgage trade name 0.24 % — % — % — % — % 0.06 % — % Disposal of ATMs 0.59 % — % — % — % — % 0.15 % — % Adjusted ROACE (non-GAAP) 9.30 % 9.27 % 10.28 % 6.11 % 11.19 % 8.77 % 12.50 %

FirstSun Capital Bancorp | 23 Non-GAAP Reconciliation (cont’d) As of and for the quarter ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Return on average tangible stockholders’ equity: Return on average stockholders’ equity (ROACE) 6.25 % 8.79 % 10.03 % 5.15 % 11.19 % 7.56 % 12.50 % Add: Impact from goodwill and other intangible assets: Goodwill 0.68 % 0.98 % 1.18 % 0.63 % 1.55 % 0.87 % 1.85 % Other intangible assets 0.47 % 0.23 % 0.23 % 0.30 % 0.35 % 0.31 % 0.53 % Return on average tangible stockholders’ equity (ROATCE) 7.40 % 10.00 % 11.44 % 6.08 % 13.09 % 8.74 % 14.88 % Adjusted return on average tangible stockholders’ equity: Return on average tangible stockholders' equity (ROATCE) 7.40 % 10.00 % 11.44 % 6.08 % 13.09 % 8.74 % 14.88 % Add impact of non-recurring expenses: Terminated merger related expenses 2.47 % 0.54 % 0.29 % 1.08 % — % 1.11 % — % Write-off of Guardian Mortgage trade name 0.26 % — % — % — % — % 0.07 % — % Disposal of ATMs 0.65 % — % — % — % — % 0.17 % — % Adjusted ROATCE (non-GAAP) 10.78 % 10.54 % 11.73 % 7.16 % 13.09 % 10.09 % 14.88 % Adjusted total noninterest expense: Total noninterest expense (GAAP) $ 73,673 $ 64,664 $ 63,875 $ 61,828 $ 52,308 $ 264,040 $ 222,793 Less non-recurring expenses: Terminated merger related expenses (8,010) (1,633) (1,046) (2,489) — (13,178) — Write-off of Guardian Mortgage trade name (828) — — — — (828) — Disposal of ATMs (2,042) — — — — (2,042) — Total adjustments, net of tax (10,880) (1,633) (1,046) (2,489) — (16,048) — Adjusted total noninterest expense (non-GAAP) $ 62,793 $ 63,031 $ 62,829 $ 59,339 $ 52,308 $ 247,992 $ 222,793 Adjusted efficiency ratio: Efficiency ratio (GAAP) 74.66 % 65.83 % 66.42 % 66.05 % 58.58 % 68.28 % 59.81 % Less impact of non-recurring expenses: Terminated merger related expenses (8.12) % (1.67) % (1.09) % (2.66) % — % (3.41) % — % Write-off of Guardian Mortgage trade name (0.84) % — % — % — % — % (0.21) % — % Disposal of ATMs (2.07) % — % — % — % — % (0.53) % — % Adjusted efficiency ratio (non-GAAP) 63.63 % 64.16 % 65.33 % 63.39 % 58.58 % 64.13 % 59.81 %