As filed with the Securities and Exchange Commission on June 27, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMS-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PARK-OHIO INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Ohio | | 3460 | | 34-6520107 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

6065 Parkland Blvd.

Cleveland, Ohio 44124

(440)947-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert D. Vilsack

Secretary and General Counsel

6065 Parkland Blvd.

Cleveland, Ohio 44124

(440)947-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael J. Solecki

Jones Day

901 Lakeside Avenue

Cleveland, Ohio 44114

Phone: (216)586-3939

Fax: (216)579-0212

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☒ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of each class of securities to be registered | | Amount

to be

registered | | Proposed

maximum

offering price

per unit(1) | | Proposed

maximum

aggregate offering price(1) | | Amount of registration fee |

6.625% Senior Notes due 2027 | | $350,000,000 | | 100% | | $350,000,000 | | $40,565.00 |

Guarantees of 6.625% Senior Notes due 2027 | | — | | — | | — | | — (2) |

|

|

| (1) | Calculated in accordance with Rule 457(f) under the Securities Act of 1933 solely for purposes of calculating the registration fee. |

| (2) | Pursuant to Rule 457(n) of the Securities Act of 1933, no separate fee is payable for the guarantees. |

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

| | | | | | |

Exact Name of Registrant as Specified in its Charter(1) | | State of

Incorporation

or Organization | | Primary Standard

Industrial

Classification

Code Number | | IRS Employer

Identification

Number |

Ajax Tocco Magnethermic Corporation | | Ohio | | 3567 | | 74-3062212 |

Apollo Aerospace Components LLC | | Ohio | | 5085 | | 11-3727316 |

ATBD, Inc. | | Ohio | | 3460 | | 34-1447432 |

Autoform Tool & Manufacturing, LLC | | Indiana | | 3714 | | 35-1978983 |

Bates Rubber, Inc. | | Ohio | | 3061 | | 90-0967326 |

Blue Falcon Travel, Inc. | | Alabama | | 3460 | | 63-1154367 |

Control Transformer, Inc. | | Ohio | | 3612 | | 34-1834375 |

Elastomeros Tecnicos Moldeados, Inc. | | Texas | | 3061 | | 20-2811933 |

EP Cleveland Holdings, Inc. | | Delaware | | 3061 | | 27-1311742 |

EP Realty Holdings, Inc. | | Delaware | | 3061 | | 27-1311691 |

Feco, Inc. | | Illinois | | 3567 | | 36-3738441 |

Fluid Routing Solutions, LLC | | Delaware | | 3714 | | 26-4196381 |

Gateway Industrial Supply LLC | | Ohio | | 3469 | | 34-1862827 |

General Aluminum Mfg. Company | | Ohio | | 3365 | | 34-0641582 |

Induction Management Services, LLC | | Michigan | | 3567 | | 35-2304890 |

Integrated Holding Company | | Ohio | | 5085 | | 34-1862827 |

Integrated Logistics Holding Company | | Ohio | | 5072 | | 34-1862827 |

Integrated Logistics Solutions, Inc. | | Ohio | | 5085 | | 34-1820111 |

Lewis & Park Screw & Bolt Company | | Ohio | | 3460 | | 34-1875683 |

Park-Ohio Forged & Machined Products LLC | | Ohio | | 3720 | | 34-6520107 |

Park-Ohio Products, Inc. | | Ohio | | 3061 | | 34-1799215 |

Pharmaceutical Logistics, Inc. | | Ohio | | 8741 | | 34-1878255 |

Pharmacy Wholesale Logistics, Inc. | | Ohio | | 5122 | | 34-1782668 |

P-O Realty LLC | | Ohio | | 3460 | | 34-6520187 |

POVI L.L.C. | | Ohio | | 3460 | | 34-1921968 |

Precision Machining Connection LLC | | Ohio | | 3541 | | 34-1447432 |

RB&W Ltd. | | Ohio | | 3460 | | 34-1862827 |

RB&W Manufacturing LLC | | Ohio | | 3452 | | 34-1862827 |

Red Bird, Inc. | | Ohio | | 3460 | | 34-1797914 |

Snow Dragon LLC | | Ohio | | 3569 | | 03-0562114 |

ST Holding Corp. | | Ohio | | 5085 | | 30-0459958 |

STMX, Inc. | | Ohio | | 5085 | | 80-0143260 |

Summerspace, Inc. | | Ohio | | 3460 | | 34-1820113 |

Supply Technologies LLC | | Ohio | | 5085 | | 34-1862827 |

Supply Technologies Procurement Company, Inc. | | Delaware | | 5085 | | 37-1797564 |

The Ajax Manufacturing Company | | Ohio | | 3542 | | 34-1808659 |

The Clancy Bing Company | | Pennsylvania | | 3460 | | 25-1645335 |

Tocco, Inc. | | Alabama | | 3567 | | 63-0677577 |

TW Manufacturing Co. | | Ohio | | 3365 | | 80-0167669 |

WB&R Acquisition Company, Inc. | | Pennsylvania | | 3460 | | 25-1781418 |

| (1) | The address and phone number of each Registrant Guarantor is c/o Park Ohio-Industries, Inc., 6065 Parkland Blvd., Cleveland, Ohio 44124, (440)947-2000. |

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state.

SUBJECT TO COMPLETION, DATED JUNE 27, 2017

$350,000,000

PARK-OHIO INDUSTRIES, INC.

OFFER TO EXCHANGE

UP TO $350,000,000 IN AGGREGATE PRINCIPAL AMOUNT OF NEWLY ISSUED 6.625%

SENIOR NOTES DUE 2027

FOR A LIKE PRINCIPAL AMOUNT OF OUTSTANDING RESTRICTED

6.625% NOTES DUE 2027 ISSUED ON APRIL 17, 2017

On April 17, 2017, we issued $350,000,000aggregate principal amount of restricted 6.625% Notes due 2027, which we refer to as the “Original Notes,” in a private placement.

We are offering to exchange up to $350,000,000 aggregate principal amount of new 6.625% Notes due 2027, which we refer to as the “Exchange Notes,” for outstanding Original Notes. We refer to this offer to exchange as the “Exchange Offer.” The terms of the Exchange Notes are substantially identical to the terms of the Original Notes, except that the Exchange Notes will be registered under the Securities Act of 1933, which we refer to as the “Securities Act,” and the transfer restrictions and registration rights and related special interest provisions applicable to the Original Notes will not apply to the Exchange Notes. The Exchange Notes will be part of the same series as the Original Notes and will be issued under the same indenture. The Exchange Notes will be exchanged for Original Notes in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. We will not receive any proceeds from the issuance of Exchange Notes in the Exchange Offer.

You may withdraw tenders of Original Notes at any time prior to the expiration of the Exchange Offer.

The Exchange Offer expires at 5:00 p.m. New York City time on unless extended, which we refer to as the “Expiration Date.”

We do not intend to list the Exchange Notes on any securities exchange or to seek approval through any automated quotation system, and no active public market for the Exchange Notes is anticipated.

You should consider carefully therisk factors beginning on page 14 of this prospectus before deciding whether to participate in the Exchange Offer.

Neither the Securities and Exchange Commission, or the “SEC,” nor any state securities commission has approved or disapproved of the Exchange Notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

Rather than repeat certain information in this prospectus that we have already included in reports filed with the SEC, this prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. We will provide this information to you at no charge upon written or oral request directed to: Park-Ohio Industries, Inc., 6065 Parkland Boulevard, Cleveland, Ohio 44124 Telephone: (440)947-2000, Attention: Secretary. In order to receive timely delivery of any requested documents in advance of the Expiration Date, you should make your request no later than , which is five full business days before you must make a decision regarding the Exchange Offer.

TABLE OF CONTENTS

This prospectus may only be used where it is legal to make the Exchange Offer and by a broker-dealer for resales of Exchange Notes acquired in the Exchange Offer where it is legal to do so.

This prospectus summarizes documents and other information in a manner we believe to be accurate, but we refer you to the actual documents for a more complete understanding of the information we discuss in this prospectus. In making an investment decision, you must rely on your own examination of such documents, our business and the terms of the offering and the Exchange Notes, including the merits and risks involved.

We make no representation to you that the Exchange Notes are a legal investment for you. You should not consider any information in this prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding an investment in the Exchange Notes. Neither the delivery of the prospectus nor any exchange made pursuant to this prospectus implies that any information set forth in this prospectus is correct as of any date after the date of this prospectus.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a prospectus in connection with any resale of Exchange Notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Original Notes where the Original Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period ending on the earlier of (i) 180 days from the date on which the registration statement of which this prospectus forms a part is declared effective and (ii) the date on which a broker-dealer is no longer required to deliver a prospectus in connection with market-making or other trading activities, we will make this prospectus available to any broker-dealer for use in connection with these resales. See “Plan of Distribution.”

i

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain statements that are “forward-looking statements.” The words “believes”, “anticipates”, “plans”, “expects”, “intends”, “estimates” and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors that could cause actual results to differ materially from expectations include, but are not limited to:

| | • | | our substantial indebtedness; |

| | • | | the uncertainty of the global economic environment; |

| | • | | general business conditions and competitive factors, including pricing pressures and product innovation; |

| | • | | demand for our products and services; |

| | • | | raw material availability and pricing; |

| | • | | fluctuations in energy costs; |

| | • | | component part availability and pricing; |

| | • | | changes in our relationships with customers and suppliers; |

| | • | | the financial condition of our customers, including the impact of any bankruptcies; |

| | • | | our ability to successfully integrate recent and future acquisitions into existing operations; |

| | • | | changes in general domestic economic conditions such as inflation rates, interest rates, tax rates, unemployment rates, higher labor and healthcare costs, recessions and changing government policies, laws and regulations, including those related to the current global uncertainties and crises; |

| | • | | adverse impacts to us, our suppliers and customers from acts of terrorism or hostilities; |

| | • | | our ability to meet various covenants, including financial covenants, contained in the agreements governing our indebtedness, including our credit facility and the notes; |

| | • | | disruptions, uncertainties or volatility in the credit markets that may limit our access to capital; |

| | • | | potential disruption due to a partial or complete reconfiguration of the European Union; |

| | • | | increasingly stringent domestic and foreign governmental regulations, including those affecting the environment or import and export controls and other trade barriers; |

| | • | | inherent uncertainties involved in assessing our potential liability for environmental remediation-related activities; |

| | • | | the outcome of pending and future litigation and other claims and disputes with customers; |

| | • | | the outcome of the review conducted by the special committee of our board of directors; |

| | • | | our dependence on the automotive and heavy-duty truck industries, which are highly cyclical; |

| | • | | the dependence of the automotive industry on consumer spending; |

| | • | | our ability to negotiate contracts with labor unions; |

ii

| | • | | our dependence on key management; |

| | • | | our dependence on information systems; |

| | • | | our ability to continue to pay cash dividends; and |

| | • | | other factors that we describe in this prospectus under the heading “Risk Factors.” |

All forward-looking statements included in this prospectus are based on information available to us on the date of this prospectus. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. In light of these and other uncertainties, the inclusion of a forward-looking statement herein should not be regarded as a representation by us that our plans and objectives will be achieved. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this prospectus.

MARKET AND INDUSTRY DATA

Industry and market data included in this prospectus, including market share and ranking data, were obtained from our own research, studies conducted by third parties and industry and general publications published by third parties and, in some cases, are management estimates based on industry and other knowledge. We do not make any representations as to the accuracy of such information. While we believe internal company estimates are reliable and market definitions are appropriate, they have not been verified by any independent sources, and we do not make any representations as to the accuracy of such estimates.

iii

SUMMARY

The following summary highlights selected information and does not contain all the information you should consider. Before deciding to exchange your Original Notes, you should carefully read the entire prospectus, including the section of this prospectus entitled “Risk Factors,” and our historic consolidated financial statements and related notes, which are included in this prospectus. In this prospectus, unless otherwise indicated or the context otherwise requires, the terms “we,” “us,” “our” and other similar terms refer to the consolidated businesses of Park-Ohio Industries, Inc. and all of its subsidiaries, but not its parent, Park-Ohio Holdings Corp. Our parent company does not have any independent material operations or assets. Unless otherwise indicated, “Refinancing Transactions” refer to the transactions described below under “The Refinancing Transactions.” Unless otherwise indicated or the context requires otherwise, all references in this prospectus to “Notes” mean collectively the Original Notes and the Exchange Notes.

The Company

We are a diversified international company providing world-class customers with a supply chain management outsourcing service, capital equipment used on their production lines, and manufactured components used to assemble their products. We operate through three reportable segments: Supply Technologies, Assembly Components and Engineered Products.

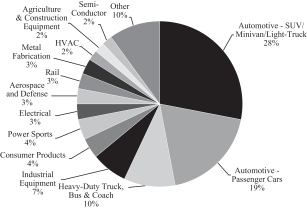

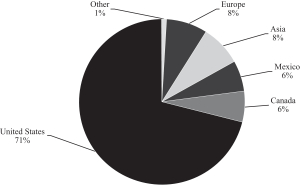

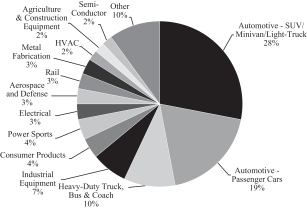

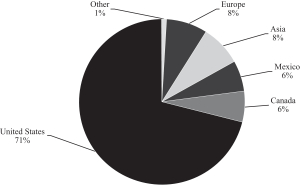

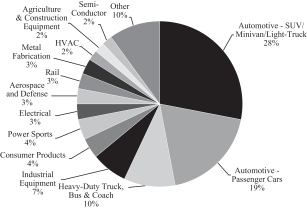

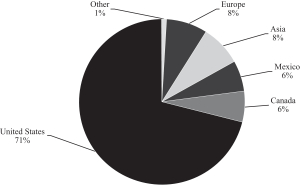

Supply Technologies provides our customers with Total Supply Management™, a proactive solutions approach that manages the efficiencies of every aspect of supplying production parts and materials to our customers’ manufacturing floor, from strategic planning to program implementation. Our Assembly Components business manufactures products oriented towards fuel efficiency and reduced emission standards, and our Engineered Products business utilizes proprietary technology and specializes in the engineering, construction, service and repair of induction heating and melting systems, primarily for the ferrous andnon-ferrous metals, silicon, coatings, forging, foundry, automotive and construction equipment industries. Our businesses are exposed to diverse and highly attractive geographic end markets, including the United States, Europe, Asia, Mexico, and Canada. For the year ended December 31, 2016, we generated net sales of $1,276.9 million and net income of $32.7 million.

| | |

| End Market Mix Year End 2016 | | Geographic Mix Year End 2016 |

| |

| |  |

-1-

The following table summarizes the key attributes of each of our business segments:

| | | | | | |

| | | Supply Technologies | | Assembly Components | | Engineered Products |

Net Sales(1) | | $502 million (39% of total) | | $529 million (42% of total) | | $245 million (19% of total) |

| | | |

Selected Products | | Sourcing, planning and procurement of over 190,000 production components, including: • Fasteners • Pins • Valves • Hoses • Wire harnesses • Clamps and fittings • Rubber and plastic components | | • Control arms • Knuckles • Injection molded rubber products • Turbo charging hose • Turbo coolant hose • Rubber and thermoplastic hose • Oil pans • Flywheel spacers • Steering racks • Fuel filler assemblies • Gasoline direct injection systems | | • Induction heating and melting systems • Pipe threading systems • Industrial oven systems • Forging presses • Forged steel and machined products |

| | | |

Selected Industries Served | | • Heavy-duty truck • Power sports and recreational equipment • Aerospace and defense • Electrical distribution and controls • Consumer electronics • Bus and coaches • Automotive • Agricultural and construction equipment • HVAC • Lawn and garden • Semiconductor equipment • Aerospace and defense | | • Automotive • Agricultural equipment • Construction equipment • Heavy-duty truck • Marine equipment | | • Ferrous andnon-ferrous metals • Coatings • Forging • Foundry • Heavy-duty truck • Construction equipment • Automotive • Oil and gas • Rail • Aerospace and defense |

| | | |

Selected Customers | | Applied Materials Black & Decker Eaton Ford Husqvarna IBM Invacare John Deere Lenovo NACCO Polaris Rockwell Trane Volvo/Mack Governments | | Bosch Chrysler Dayco Delphi Eaton Ford GM Hitachi Honda Linamar Toyota Yazaki YH America ZF | | Amstead/ASF Arcelor Mittal CAT EMD Goodrich Aerospace GKN GrafTech Messier Dowty Mitsubishi Rockwell Saudi Steel Pipe Trinity U.S. Steel Weatherford Yakazi |

| (1) | Results are for the year ended December 31, 2016. |

We believe that the diversity of our revenue base and end markets, as well as the significant breadth and overall quality of our products and services, enhances our business model, including our credit profile. Each of our three operating segments benefits from distinct demand cycles, and we have the ability to generate significant cash flow throughout economic cycles. We have established leading market positions across a variety of industries, and we believe we maintain a leading market position in products and services that represent a substantial portion of our net sales. We benefit from long-term, entrenched relationships with high-quality customers that include leading OEMs, and we derive a significant portion of our net sales from sole-source arrangements.

-2-

Supply Technologies

Our Supply Technologies business provides our customers with Total Supply Management™, a proactive solutions approach that manages the efficiencies of every aspect of supplying production parts and materials to our customers’ manufacturing floor, from strategic planning to program implementation. Total Supply Management™ includes such services as engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking,just-in-time andpoint-of-use delivery, electronic billing services and ongoing technical support. We operate 65 logistics service centers in the United States, Mexico, Canada, Puerto Rico, Scotland, Hungary, China, Taiwan, Singapore, India, England, France, Spain, Poland, Northern Ireland and Ireland as well as production sourcing and support centers in Asia. Through our supply chain management programs, we supply more than 190,000 globally-sourced production components, many of which are specialized and customized to meet individual customers’ needs.

Total Supply Management™ provides our customers with an expert partner in strategic planning, global sourcing, technical services, parts and materials, logistics, distribution and inventory management of production components. Some production components are characterized by low per unit supplier prices relative to the indirect costs of supplier management, quality assurance, inventory management and delivery to the production line. In addition, Supply Technologies delivers an increasingly broad range of higher-cost production components including valves, fuel hose assemblies, electro-mechanical hardware, labels, fittings, steering components and many others. Applications engineering specialists and the direct sales force work closely with the engineering staff of OEM customers to recommend the appropriate production components for a new product or to suggest alternative components that reduce overall production costs, streamline assembly or enhance the appearance or performance of the end product. As an additional service, Supply Technologies also provides spare parts and aftermarket products to end users of its customers’ products.

Total Supply Management™ services are typically provided to customers pursuant to sole-source arrangements. We believe our services distinguish us from traditional buy/sell distributors, as well as manufacturers who supply products directly to customers, because we outsource our customers’ high-volume production components supply chain management, providing processes customized to each customer’s needs and replacing numerous current suppliers with a sole-source relationship. Our highly-developed, customized, information systems provide global transparency and flexibility through the complete supply chain. This enables our customers to: (1) significantly reduce the direct and indirect cost of production component processes by outsourcing internal purchasing, quality assurance and inventory fulfillment responsibilities; (2) reduce the amount of working capital invested in inventory and floor space; (3) reduce component costs through purchasing efficiencies, including bulk buying and supplier consolidation; and (4) receive technical expertise in production component selection and design and engineering. Our sole source arrangements foster long-term, entrenched supply relationships with our customers and, as a result, the average tenure of service for our top 50 Supply Technologies clients exceeds seven years. Supply Technologies’ remaining sales are generated through the wholesale supply of industrial products to other manufacturers and distributors pursuant to master or authorized distributor relationships.

The Supply Technologies segment also engineers and manufactures precision cold formed and cold extruded products, including locknuts, SPAC® nuts and wheel hardware, which are principally used in applications where controlled tightening is required due to high vibration. Supply Technologies produces both standard items and specialty products to customer specifications, which are used in large volumes by customers in the automotive, heavy-duty truck and rail industries.

Assembly Components

Our Assembly Components business manufactures products oriented towards fuel efficiency and reduced emission standards. The Assembly Components segment designs, develops and manufactures aluminum products and highly efficient, high pressure Direct Fuel Injection fuel rails and pipes, fuel filler pipes that route fuel from the gas cap to the gas tank, as well as flexible multi-layer plastic and rubber assemblies used to transport fuel from the vehicle’s gas tank and then, at extreme high pressure, to the engine’s fuel injector nozzles. These advanced products, coupled with Turbo Enabled engines, make up large and growing engine architecture for all worldwide car manufacturers. The Assembly Components segment also designs and manufactures Turbo Charging hoses along with Turbo Coolant hoses that will be required as engines get downsized to three and four cylinders from six or eight cylinders. This engine downsizing increases efficiency, while dramatically decreasing pollution levels.

-3-

In addition, our Assembly Components segment operates what we believe is one of the few aluminum component suppliers that have the capability to provide a wide range of high-volume, high-quality products utilizing a broad range of processes including gravity and low pressure permanent mold,die-cast and lost-foam, as well as emerging alternative casting technologies. We also provide machining to our aluminum products customers.

Engineered Products

Our Engineered Products segment operates a diverse group of niche manufacturing businesses that design and manufacture a broad range of highly-engineered products, including induction heating and melting systems, pipe threading systems and forged and machined products. We manufacture these products in 13 domestic facilities throughout the United States and 22 international facilities in Canada, Mexico, the United Kingdom, Belgium, Germany, China, Italy, India, Japan, Spain and Brazil.

Our induction heating and melting business utilizes proprietary technology and specializes in the engineering, construction, service and repair of induction heating and melting systems, primarily for the ferrous andnon-ferrous metals, silicon, coatings, forging, foundry, automotive and construction equipment industries. Our induction heating and melting systems are engineered and built to customer specifications and are used primarily for melting, heating, and surface hardening of metals and curing of coatings. Approximately 51% of our induction heating and melting systems’ revenues are derived from the sale of replacement parts and provision of field service, primarily for the installed base of our own products. Our pipe threading business serves the oil and gas industry. We also engineer and install mechanical forging presses, sell spare parts and provide field service for the large existing base of mechanical forging presses and hammers in North America. We machine, induction harden and surface finish crankshafts and camshafts, used primarily in locomotives. We forge aerospace and defense structural components such as landing gears and struts, as well as rail products such as railcar center plates and draft lugs.

-4-

Competitive Strengths

Our competitive strengths include the following:

| | • | | Leading Market Positions in Attractive Niche Markets. In many cases, our businesses have achieved leading market positions as a result of our value-added services, high-quality products, superior customer service, expertise in applications and engineering, low costs and commitment to partnering with our customers. We believe we maintain a leading market position in products and services that represent a substantial portion of our sales, and that Supply Technologies is a leading provider of North American Production Parts Total Supply Management™. In addition, a significant portion of our net sales are sole-sourced. |

| | • | | Entrenched Relationships with High-Quality Customers. We have been successful in forming and maintaining long-term customer relationships, many of which have been in place for several years. The quality and value of our products and services and the strength of our relationships have allowed us to serve the majority of our significant customers across our three business segments on a sole-source basis. Supply Technologies’ customized supply chain management programs, delivery systems andon-site employees enhance the relationships with our customers, as well as create high switching costs. As a result, the average tenure of ongoing service to our top 50 Supply Technologies customers exceeds ten years. In addition, our Assembly Components and Engineered Products customers tend to maintain long-term, sole-source relationships with us because of the high-quality products that we provide to them as well as the high switching costs they face due toup-front tooling and engineering costs. |

| | • | | Highly Diversified Revenue Base and End Markets. We provide a significant breadth of proprietary, value-added solutions to our world-class customer base. Our products are sold to over 10,000 customers, and no customer represented more than 7% of our total net sales for the year ended December 31, 2016. We sell our products and services in a diverse set of end markets, including the automotive and vehicle parts, heavy-duty truck, industrial equipment, steel, rail, electrical distribution and controls, aerospace and defense, oil and gas, power sports and recreational equipment, HVAC, electrical components, appliance and semiconductor equipment industries. Over the past several years, we have focused on diversifying across attractive end markets and geographies, and as a result, have reduced our concentration in the U.S. market to 71%, with the remainder in Asia, Europe, Canada and Mexico. In the past three years, our international sales have grown by 18%. |

| | • | | Significant Cash Flow Generation throughout Economic Cycles. Each of our three operating segments benefits from distinct demand cycles and has differing cash flow characteristics, allowing us to generate significant cash flow throughout economic cycles. We believe we are well-positioned for growth during cyclical upturns, and have demonstrated our ability to quickly reduce variable costs and enhance profit and cash flows during cyclical downturns. Our ability to generate cash throughout economic cycles is enhanced by our streamlined cost structure, our limited capital expenditure requirements, our efficient working capital management and our financial discipline, which was demonstrated in 2016 when we delivered record operating cash flows of $71.5 million. Our sizable and scalable operating platform creates significant embedded operating leverage, leading to future potential cash flow generation. We believe we have sufficient borrowing capacity and free cash flow to support our currently contemplated growth plans. |

| | • | | Sophisticated Systems Infrastructure.We have made significant investments in Supply Technologies’ management information and communication systems to more efficiently plan, manage and deliver over 190,000 globally-sourced production components to our customers. Electronic data interchange capabilities provide an interactive order system to a majority of our customers. Supply Technologies’ customized systems enable us to provide customers withjust-in-time delivery ofbar-coded packages labeled for delivery to specific work stations. These systems also enhance fill rates by automatically searching alternative branches for products that are unavailable at a particular location and by routing those products for shipment where needed. These systems allow us to reduce our investment in working capital while meeting our customers’ demands and are scalable with moderate investment to support much larger volumes. Our highly-developed, customized, information systems provide transparency and flexibility through the complete supply chain. This enables our customers to: (1) significantly reduce the direct and indirect cost of production component processes by outsourcing internal purchasing, quality assurance and inventory fulfillment responsibilities; (2) reduce the amount of working capital invested in inventory and floor space; (3) reduce component costs through purchasing efficiencies, including bulk buying and supplier consolidation; and (4) receive technical expertise in production component selection and design and engineering. |

-5-

| | • | | Proven Management Team Executing Focused Strategy.We have an experienced, deep and stable management team led by Edward Crawford, our Chairman of the Board and Chief Executive Officer, and Matthew Crawford, our President and Chief Operating Officer, who, as of March 31, 2017, collectively beneficially owned approximately 29% of our parent company’s outstanding common stock. Our senior management team has an average of over 20 years of relevant industry experience and a proven track record of delivering profitable organic growth, generating cash flows, controlling costs, reducing debt, and successfully integrating value-creating acquisitions. Our operating units are managed on a decentralized basis by operating unit managers, while our corporate management team provides strategic direction and support. |

Business Strategy

Our overall goal is to be a leading global provider of integrated supply chain services and a leadinglow-cost manufacturer of highly-engineered products to a broad range of clients. Our business strategy includes the following:

| | • | | Capitalize on Favorable Market Trends. We intend to pursue opportunities created by attractive market trends in all of our business segments. Industrial OEMs are increasingly focusing on their core competencies and reducing costs and therefore continue to increase their reliance on key suppliers, such as Supply Technologies, for global production component procurement and global supply chain management. In our Assembly Components segment, automotive OEMs are increasingly seeking ways to reduce vehicle weights and lower emissions to satisfy increasing worldwide governmental standards and increasing global demand for fuel efficient and environmentally compliant vehicles. Our products, including fuel filler systems, gasoline direct injection products, and aluminum castings support our customers’ efforts to produce fuel efficient and low emission vehicles. Demand for induction hardening and melting products and forging expertise has become more global as many developed and emerging economies continue to repair and build much needed infrastructure which should result in strong long-term demand for products in our Engineered Products segment. |

| | • | | Leverage Existing Customer Relationships. We seek to enhance our customer relationships across all of our business segments by providing additional high-quality services, working with our customers to engineer products to meet specific application requirements, and continually broadening our design and engineering capabilities. We also leverage existing customer relationships by pursuing opportunities to expand the number and type of components we provide to our existing customers, increase the number of existing customers’ plants we serve, and capitalize on and assist with the global expansion of our core customers. |

| | • | | Extend Global Sourcing Network and Develop New Products.We have significantly expanded our global sourcing capabilities and product breadth. We source our products domestically as well as fromlow-cost regions such as Taiwan, China, South Korea and India. In Supply Technologies, we currently have in excess of 4,000 suppliers, and no single supplier accounted for more than $9.0 million of purchases for 2016. We intend to continue to deepen and broaden our foreign sourcing network to provide our customers with access to the lowest-cost components. We also continue to develop new products to meet our customers’ demands. We anticipate that by further broadening our global sourcing network and developing new technologies and products, we will be able to improve the range, quality and price of products that we offer our customers. |

| | • | | Expand Across Geographies. While we believe we can continue to penetrate within our current markets, we will continue to pursue and capitalize on global market opportunities within existing and new rapidly industrializing nations. |

| | • | | Selected Strategic Acquisitions. We will continue to pursue an acquisition strategy focused on acquiring leading businesses that are accretive to our earnings and immediately enhance our existing platform of leading businesses. We have a strong management team with a long history of acquiring and seamlessly integrating attractive assets into our existing business as evidenced by our most recent acquisitions. |

Refinancing Transactions

On April 17, 2017, we completed the sale of $350 million in aggregate principal amount of the Original Notes. The Original Notes bear an interest rate of 6.625% per annum and will be payable semi-annually in arrears on April 15 and October 15 of each year commencing on October 15, 2017. The Original Notes mature on April 17, 2027. In connection with the sale of the Original Notes, we entered into a seventh amended and restated credit agreement, which we refer to as the new revolving credit facility. The new revolving credit facility, among other things, provides an increased revolving credit facility up to $350 million, extends the maturity date of the borrowings under the revolving credit facility to April 17, 2022 and amends fee and pricing terms.

-6-

Furthermore, we have the option to increase the availability under the new revolving credit facility by $100 million. We also purchased all of our outstanding 8.125% senior notes due 2021 in aggregate principal amount of $250 million and repaid in full the term loan outstanding under our existing credit facility, as well as a portion of the borrowings outstanding under our revolving credit facility.

The term “Refinancing Transactions” refers to the offering of the Original Notes, our entry into the new revolving credit facility and the use of the proceeds from the offering of the Original Notes and borrowings under the new revolving credit facility to repurchase all of our outstanding 2021 senior notes and to repay in full the term loan outstanding under our existing credit facility, as well as a portion of the borrowings outstanding under our revolving credit facility.

Recent Developments

In December 2016, we acquired GH Electrotermia S.A. (“GH”), headquartered in Valencia, Spain, for $23.4 million in cash (net of $6.3 million cash acquired), plus the assumption of $13.9 million in debt. GH, which had 2016 revenues of approximately $46 million, is a global leader in the design, manufacturing and testing of induction heating equipment and heat treat solutions. GH, which operates through its locations in Spain, India, Germany, China and the United States, strengthens our position as the global leader of induction products and adds key technologies to our already diverse portfolio of induction hardening capabilities.

Information about Park-Ohio Industries, Inc.

We are a wholly owned subsidiary of Park-Ohio Holdings Corp. and were incorporated in Ohio in 1984. Our principal executive office is located at 6065 Parkland Boulevard, Cleveland, Ohio 44124, and our telephone number is (440)947-2000. Our parent company’s website address is http://www.pkoh.com. Information contained on our parent company’s website is not a part of this prospectus. Our parent company’s common shares are traded on the Nasdaq Global Select Market under the symbol “PKOH.”

-7-

The Exchange Offer

The following summary contains basic information about the Exchange Offer. It does not contain all of the information that may be important to you. For a more complete description of the terms of the Exchange Offer, see “The Exchange Offer.”

| | |

The Exchange Offer | | We are offering to exchange up to $350,000,000 aggregate principal amount of our registered 6.625% Notes due 2027, which we refer to as the “Exchange Notes,” for an equal principal amount of our outstanding restricted 6.625% Notes due 2027, which we refer to as the “Original Notes,” that were issued on April 17, 2017. The terms of the Exchange Notes are identical in all material respects to those of the Original Notes, except for transfer restrictions and registration rights and related special interest provisions relating to the Original Notes. Holders of Original Notes do not have any appraisal or dissenters’ rights in connection with the Exchange Offer. |

| |

Purposes of the Exchange Offer | | The Exchange Notes are being offered to satisfy our obligations under the registration rights agreement entered into at the time we issued and sold the Original Notes. |

| |

Expiration Date; withdrawal of tenders; return of Original Notes not accepted for exchange | | The Exchange Offer will expire at 5:00 p.m., New York City time, on , or on a later date and time to which we extend it. We refer to such time and date as the “Expiration Date.” Tenders of Original Notes in the Exchange Offer may be withdrawn at any time prior to the Expiration Date. We will exchange the Exchange Notes for validly tendered Original Notes promptly following the Expiration Date. Any Original Notes that are not accepted for exchange for any reason will be returned by us, at our expense, to the tendering holder promptly after the expiration or termination of the Exchange Offer. |

| |

Procedures for tendering Original Notes | | Each holder of Original Notes wishing to participate in the Exchange Offer must follow procedures of The Depository Trust Company’s, or “DTC,” Automated Tender Offer Program, or “ATOP,” subject to the terms and procedures of that program. The ATOP procedures require that the exchange agent receives, prior to the Expiration Date, a computer-generated message known as an “agent’s message” that is transmitted through ATOP and that DTC confirm that: |

| |

| | • DTC has received instructions to exchange your Original Notes; and • you agree to be bound by the terms of the letter of transmittal. |

| |

| | See “The Exchange Offer—Procedures for Tendering Original Notes.” |

| |

Consequences of failure to exchange Original Notes | | You will continue to hold Original Notes, which will remain subject to their existing transfer restrictions, if you do not validly tender your Original Notes or you tender your Original Notes and they are not accepted for exchange. With some limited exceptions, we will have no obligation to register the Original Notes after we consummate the Exchange Offer. See “The Exchange Offer—Terms of the Exchange Offer” and “The Exchange Offer—Consequences of Failure to Exchange.” |

-8-

| | |

Conditions to the Exchange Offer | | The Exchange Offer is not conditioned upon any minimum aggregate principal amount of Original Notes being tendered or accepted for exchange. The Exchange Offer is subject to customary conditions, which may be waived by us in our discretion. We currently expect that all of the conditions will be satisfied and that no waivers will be necessary. |

| |

Exchange agent | | Wells Fargo Bank, National Association. |

| |

Certain U.S. federal income tax considerations | | As described in “Certain U.S. Federal Income Tax Considerations,” the exchange of an Original Note for an Exchange Note pursuant to the Exchange Offer will not constitute a taxable exchange and will not result in any taxable income, gain or loss for U.S. federal income tax purposes, and immediately after the exchange a holder will have the same adjusted tax basis and holding period in each Exchange Note received as such holder had immediately prior to the exchange in the corresponding Original Note surrendered. |

| |

Risk Factors | | You should carefully read and consider the risk factors beginning on page 14 of this prospectus before deciding whether to participate in the Exchange Offer. |

-9-

The Exchange Notes

The following is a brief summary of the principal terms of the Exchange Notes and is provided solely for your convenience. It is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the Exchange Notes, see “Description of Notes.”

| | |

Issuer | | Park-Ohio Industries, Inc. |

| |

Securities Offered | | Up to $350,000,000 aggregate principal amount of 6.625% senior notes due 2027. |

| |

Maturity | | April 15, 2027. |

| |

Interest | | Interest on the Exchange Notes will accrue at a rate of 6.625% per annum, payable semi-annually in cash in arrears on April 15 and October 15 of each year. |

| |

Interest Payment Dates | | April 15 and October 15, commencing October 15, 2017. |

| |

Guarantee | | The Exchange Notes will be fully and unconditionally guaranteed on a senior basis by our existing and future material domestic subsidiaries that guarantee debt under our new revolving credit facility. Our foreign subsidiaries, subsidiaries and holding companies thereof, and our immaterial domestic subsidiaries will not guarantee the notes. See “Description of Notes—Ranking and Guarantee.” |

| |

| | Ournon-guarantor subsidiaries accounted for approximately 25% of our net sales for the three months ended March 31, 2017, and held approximately 36% of our consolidated assets as of March 31, 2017. |

| |

Ranking | | The Exchange Notes and the guarantees are unsecured, senior obligations. Accordingly, they will: |

| |

| | • rank equally in right of payment to all of our and the guarantors’ existing and future senior indebtedness, but will be effectively subordinated to any secured indebtedness, including indebtedness under our new revolving credit facility; |

| |

| | • be senior in right of payment to all of our and the guarantors’ existing and future subordinated indebtedness; and |

| |

| | • structurally subordinated to all obligations of ournon-guarantor subsidiaries. |

| |

| | As of March 31, 2017, after giving effect to the Refinancing Transactions, we and the guarantors would have had approximately $150.6 million of secured indebtedness outstanding, and an additional $187.6 million would have been available for borrowing under our new revolving credit facility, net of letters of credit. As of March 31, 2017, after giving effect to the Refinancing Transactions, the Exchange Notes would have been effectively junior to $47.6 million of liabilities (excluding trade payables) of ournon-guarantor subsidiaries. See “Description of Other Indebtedness” and our unaudited interim consolidated financial statements for the three months ended March 31, 2017, including the notes thereto, which are included in this prospectus. |

-10-

| | |

Optional Redemption | | We may redeem all or a part of the Notes on one or more occasions on or after April 15, 2022, at the redemption prices set forth in this prospectus under “Description of Notes—Optional Redemption,” plus accrued and unpaid interest and special interest, if any, to the date of redemption. In addition, on or prior to April 15, 2020, we may redeem on one or more occasions up to 40% of the aggregate principal amount of the Notes with the net cash proceeds of certain equity offerings by us, or our parent company that are contributed to us, at the redemption price set forth in this prospectus, plus accrued and unpaid interest, provided that at least 60% of the aggregate principal amount of the Notes issued remains outstanding after the redemption. We may also redeem all or a part of the Notes on one or more occasions prior to April 15, 2022, at a redemption price equal to 100% of the principal amount of the Notes plus a “make-whole” premium set forth in this Prospectus under “Description of Notes—Optional Redemption” and accrued and unpaid interest. |

| |

Change of Control | | If we experience a change of control or we or any of our restricted subsidiaries sell certain assets, we may be required to offer to purchase the Notes at the prices set forth under “Description of Notes—Repurchase at the Option of Holders—Change of Control” and “—Asset Sales.” |

| |

Covenants | | We will issue the Exchange Notes under the indenture dated as of April 17, 2017 among us, the guarantors and the trustee. The indenture will, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| |

| | • incur additional indebtedness and issue preferred stock; |

| |

| | • pay dividends or make restricted payments; |

| |

| | • make investments; |

| |

| | • sell assets; |

| |

| | • enter into transactions with affiliates; |

| |

| | • merge or consolidate with other entities; and |

| |

| | • create liens. |

| |

| | Each of the covenants is subject to a number of important exceptions and qualifications, including the suspension of certain covenants if the Notes achieve specified credit ratings and no default has occurred or is continuing. See “Description of Notes—Certain Covenants.” |

| |

Use of Proceeds | | We will not receive any cash proceeds from the issuance of the Exchange Notes. See “Use of Proceeds.” |

| |

Trustee | | Wells Fargo Bank, National Association. |

-11-

Summary Historical Consolidated Financial Information

The table below sets forth certain of our summary historical consolidated financial data as of and for each of the periods indicated. The consolidated historical financial information as of and for the fiscal years ended December 31, 2016, 2015 and 2014 is derived from our audited consolidated financial statements and the notes thereto. The consolidated historical financial information as of and for the three months ended March 31, 2017 and 2016 is derived from our unaudited interim consolidated financial statements. Our unaudited interim consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and include, in the opinion of management, all adjustments, consisting of normal and recurring adjustments, necessary to present fairly the data for such periods and may not necessarily be indicative of full-year results. Results of operations for the three month period ended March 31, 2017 are not necessarily indicative of results of operations that may be expected for the full fiscal year. The data below should be read in conjunction with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto, which are included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months

Ended March 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2017 | | | 2016 | |

| | | (Dollars in millions) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,276.9 | | | $ | 1,463.8 | | | $ | 1,378.7 | | | $ | 343.8 | | | $ | 328.0 | |

Cost of sales | | | 1,073.9 | | | | 1,228.6 | | | | 1,144.2 | | | | 288.3 | | | | 280.2 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 203.0 | | | | 235.2 | | | | 234.5 | | | | 55.5 | | | | 47.8 | |

Selling, general and administrative expenses | | | 128.9 | | | | 134.4 | | | | 135.6 | | | | 36.6 | | | | 32.4 | |

Asset impairment charge | | | 4.0 | | | | — | | | | — | | | | — | | | | 4.0 | |

Litigation judgment costs (settlement gain) | | | — | | | | 2.2 | | | | — | | | | (3.3 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 70.1 | | | | 98.6 | | | | 98.9 | | | | 22.2 | | | | 11.4 | |

Interest expense | | | 28.2 | | | | 27.9 | | | | 26.1 | | | | 7.4 | | | | 7.1 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 41.9 | | | | 70.7 | | | | 72.8 | | | | 14.8 | | | | 4.3 | |

Income tax expense | | | 9.2 | | | | 21.5 | | | | 25.2 | | | | 4.7 | | | | 1.6 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 32.7 | | | | 49.2 | | | | 47.6 | | | | 10.1 | | | | 2.7 | |

Net income attributable to noncontrolling interest | | | (0.5 | ) | | | (0.6 | ) | | | (1.3 | ) | | | (0.3 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to Park-Ohio common shareholder | | $ | 32.2 | | | $ | 48.6 | | | $ | 46.3 | | | $ | 9.8 | | | $ | 2.7 | |

| | | | | | | | | | | | | | | | | | | | |

-12-

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months

Ended March 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2017 | | | 2016 | |

| | | (Dollars in millions) | |

Balance Sheet Data (as of period end): | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 54.4 | | | $ | 48.4 | | | $ | 48.3 | | | $ | 57.9 | | | $ | 48.7 | |

Working capital | | | 305.4 | | | | 312.7 | | | | 304.5 | | | | 324.9 | | | | 314.0 | |

Property, plant and equipment | | | 169.6 | | | | 154.1 | | | | 141.0 | | | | 171.3 | | | | 152.5 | |

Total assets(1) | | | 979.6 | | | | 939.6 | | | | 958.8 | | | | 1,030.4 | | | | 960.1 | |

Total debt(2) | | | 475.0 | | | | 468.1 | | | | 443.8 | | | | 486.7 | | | | 465.4 | |

Shareholder’s equity | | | 231.7 | | | | 202.3 | | | | 177.9 | | | | 248.3 | | | | 210.3 | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 29.6 | | | | 27.9 | | | | 22.4 | | | | 7.8 | | | | 7.4 | |

Capital expenditures, net | | | 28.5 | | | | 36.5 | | | | 25.8 | | | | 6.1 | | | | 8.9 | |

Ratio of earnings to fixed charges(3) | | | 2.2x | | | | 3.0x | | | | 3.2x | | | | 2.6x | | | | 1.5x | |

Segment Data: | | | | | | | | | | | | | | | | | | | | |

Net Sales: | | | | | | | | | | | | | | | | | | | | |

Supply Technologies | | | 502.1 | | | | 578.7 | | | | 559.6 | | | | 133.2 | | | | 129.9 | |

Assembly Components | | | 529.4 | | | | 569.2 | | | | 490.5 | | | | 139.3 | | | | 131.7 | |

Engineered Products | | | 245.4 | | | | 315.9 | | | | 328.6 | | | | 71.3 | | | | 66.4 | |

Segment operating income: | | | | | | | | | | | | | | | | | | | | |

Supply Technologies | | | 40.0 | | | | 50.3 | | | | 42.5 | | | | 11.3 | | | | 10.2 | |

Assembly Components | | | 50.5 | | | | 57.9 | | | | 42.0 | | | | 12.5 | | | | 10.2 | |

Engineered Products | | | 10.6 | | | | 20.9 | | | | 42.7 | | | | 1.7 | | | | 1.4 | |

| (1) | Amounts for 2014 reflect reclassification of unamortized debt issuance costs from other long-term assets to long-term debt in accordance with ASU2015-03, which was adopted in 2016. |

| (2) | Excludes unamortized debt issuance costs. |

| (3) | Earnings consist of earnings before income taxes and fixed charges (excluding capitalized interest). Fixed charges consist of interest and the portion of rental expense deemed representative of the interest factor. |

-13-

RISK FACTORS

The terms of the Exchange Notes are identical in all material respects to those of the Original Notes, except for the transfer restrictions and registration rights and related special interest provisions relating to the Original Notes that will not apply to the Exchange Notes. You should carefully consider the risks described below and all of the information contained in this prospectus before making a decision on whether or not to participate in the Exchange Offer. If any of those risks actually occurs, our business, financial condition and results of operations could suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Disclosure Regarding Forward-Looking Statements” in this prospectus.

Risks Related to our Indebtedness and the Notes

Our substantial indebtedness could adversely affect our financial health and prevent us from fulfilling our obligations under the Notes.

We have now and, after the Exchange Offer concludes, will continue to have, a significant amount of indebtedness. Furthermore, we and our subsidiaries may be able to incur substantial additional indebtedness in the future because the terms of the indenture governing the Notes do not fully prohibit us or our subsidiaries from doing so. As of March 31, 2017, after giving effect to the Refinancing Transactions, we would have had total indebtedness of $500.6 million and an additional $187.6 million would have been available for borrowing under our new revolving credit facility, net of letters of credit.

Our substantial indebtedness could have important consequences to you. For example, it could:

| | • | | make it more difficult for us to satisfy our obligations with respect to the Notes; |

| | • | | increase our vulnerability to general adverse economic and industry conditions; |

| | • | | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes; |

| | • | | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate; |

| | • | | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| | • | | limit our ability to borrow additional funds. |

If we incur additional indebtedness in the future, these risks could intensify.

The agreements governing our debt will contain various covenants that limit our ability to take certain actions and also require us to meet financial maintenance tests, failure to comply with which could have a material adverse effect on us.

The indenture governing the Notes and the agreement governing the new revolving credit facility contain a number of significant covenants that, among other things, limit our ability to:

| | • | | consummate asset sales; |

| | • | | incur additional debt or liens; |

| | • | | consolidate or merge with any person or transfer or sell all or substantially all of our assets; |

| | • | | pay dividends or make certain other restricted payments; |

| | • | | make investments, including the repurchase or redemption of either capital stock or our Notes; |

| | • | | enter into transactions with affiliates; |

| | • | | create dividend or other payment restrictions with respect to subsidiaries; |

| | • | | make capital investments; and |

| | • | | alter the business we conduct. |

-14-

In addition, the new revolving credit facility requires us to comply with specific financial ratios and tests, under which we are required to achieve specific financial and operating results. Our ability to comply with these provisions may be affected by events beyond our control. A breach of any of these covenants would result in a default under the new revolving credit facility. In the event of any default, our lenders could elect to declare all amounts borrowed under our new revolving credit facility, together with accrued interest thereon, to be due and payable. We cannot assure you that we would have sufficient assets to pay debt then outstanding under the new revolving credit facility and the Notes. Any future refinancing of the new revolving credit facility is likely to contain similar restrictive covenants. See “Description of Other Indebtedness—New Revolving Credit Facility.”

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control.

Our ability to pay interest on the Notes and to satisfy our other debt obligations will depend in part upon the future financial and operating performance of our subsidiaries and upon our ability to renew or refinance borrowings. Prevailing economic conditions and financial, business, competitive, legislative, regulatory and other factors, many of which are beyond our control, will affect our ability to make these payments. While we believe that cash flow from our current level of operations, available cash and available borrowings under the new revolving credit facility will provide adequate sources of liquidity for at least the next twelve months, a significant drop in operating cash flow resulting from economic conditions, competition or other uncertainties beyond our control could create the need for alternative sources of liquidity. If we are unable to generate sufficient cash flow to meet our debt service obligations, we will have to pursue one or more alternatives, such as:

| | • | | reducing or delaying capital expenditures; |

| | • | | raising equity capital. |

We cannot assure you, however, that our business will generate sufficient cash flow from operations or that future borrowings will be available to us under the new revolving credit facility in an amount sufficient to enable us to pay our indebtedness, including the Notes, or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, including the Notes on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, including the new revolving credit facility and the Notes, on commercially reasonable terms or at all.

The Notes are subject to prior claims of any of our and the guarantors’ secured creditors, and if a default occurs we may not have sufficient funds to fulfill our obligations under the Notes. Further, your right to receive payments on the Notes could be adversely affected if any of ournon-guarantor subsidiaries declare bankruptcy, liquidate or reorganize.

The Notes and the subsidiary guarantees are our unsecured obligations, ranking equally with our and the guarantors’ existing and future senior unsecured indebtedness, but rank behind any secured indebtedness, including the indebtedness under and guarantees of our new revolving credit facility. The indenture governing the Notes permits us and the guarantors to incur additional secured debt under specified circumstances. Our assets and the assets of the guarantors will be subject to prior claims by our secured creditors. As a result, upon any distribution to our creditors or the creditors of the guarantors in bankruptcy, liquidation or reorganization or similar proceeding relating to us or the guarantors or our or their property, assets that secure debt will be available to pay obligations on the Notes only after all debt secured by those assets has been repaid in full. Holders of the Notes will participate in our remaining assets ratably with all of our unsecured and unsubordinated creditors.

If we incur any additional obligations that rank equally with the Notes, including trade payables, the holders of those obligations will be entitled to share ratably with the holders of the Notes in any proceeds distributed in the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to us or the guarantors or our or their property. We and the subsidiary guarantors may not have sufficient funds to pay all of our creditors and this may have the effect of reducing the amount of proceeds paid to you.

-15-

Not all of our subsidiaries will guarantee the Notes. In the event of a bankruptcy, liquidation or reorganization of any of ournon-guarantor subsidiaries, holders of its indebtedness and its trade creditors will generally be entitled to payment of their claims from the assets of such subsidiary before any assets are made available for distribution to us. As of March 31, 2017, after giving effect to the Refinancing Transactions, the Notes would have been effectively junior to $47.6 million of liabilities (excluding trade payables) of ournon-guarantor subsidiaries. Ournon-guarantor subsidiaries generated approximately 25% of our consolidated revenues in the three months ended March 31, 2017 and held approximately 36% of our consolidated assets as of March 31, 2017.

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture.

Upon the occurrence of certain specific change of control events, we will be required to offer to repurchase all outstanding Notes at 101% of the principal amount thereof plus accrued and unpaid interest and special interest, if any, to the date of repurchase. However, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of Notes or that restrictions in our new revolving credit facility will not allow such repurchases. In addition, certain important corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a “Change of Control” under the indenture. See “Description of Notes—Repurchase at the Option of Holders.”

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require note holders to return payments received from guarantors.

Under federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee could be voided, or claims in respect of a guarantee could be subordinated to all other debts of that guarantor if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

| | • | | received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee; |

| | • | | was insolvent or rendered insolvent by reason of such incurrence; |

| | • | | was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| | • | | intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

In addition, any payment by that guarantor pursuant to its guarantee could be voided and required to be returned to the guarantor, or to a fund for the benefit of the creditors of the guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a guarantor would be considered insolvent if:

| | • | | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; or |

| | • | | if the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| | • | | it could not pay its debts as they become due. |

On the basis of historical financial information, recent operating history and other factors, we believe that each guarantor, after giving effect to its guarantee of the Notes, will not be insolvent, will not have unreasonably small capital for the business in which it is engaged and will not have incurred debts beyond its ability to pay such debts as they mature. We cannot assure you, however, as to what standard a court would apply in making these determinations or that a court would agree with our conclusions in this regard.

Any adverse rating of the Notes may negatively affect the trading price and liquidity of the Notes.

A rating agency’s rating of the Notes is not a recommendation to purchase, sell or hold any particular security, including the Notes. Such ratings are limited in scope, and do not comment as to material risks relating to an investment in the Notes. If one or more rating agencies were to lower its rating of the Notes below the rating initially assigned to the Notes or otherwise announce its intention to put the Notes on credit watch, the trading price or liquidity of the Notes could decline.

-16-

Many of the covenants contained in the indenture governing the Notes will be suspended if and when the Notes of are rated investment grade by both Moody’s and S&P and no default or event of default has occurred and is continuing at that time.

Many of the covenants contained in the indenture governing the Notes will no longer apply to us during any period if and when the Notes are rated investment grade by both Moody’s and S&P and no default or event of default has occurred and is continuing at that time under the indenture governing the Notes. These covenants restrict, among other things, our ability to incur debt, make restricted payments, pay dividends and to enter into certain other transactions. We cannot predict whether the Notes will ever be rated investment grade, or that if they are rated investment grade, whether the Notes will maintain such ratings. However, the lack of these covenants would allow us to engage in certain actions that would not have been permitted while these covenants were in force. Any lowering, suspension or withdrawal of such ratings may have an adverse effect on the market price or marketability of the Notes. See “Description of Notes—Changes in Covenants When Notes Rated Investment Grade.”

If an active trading market does not develop for the Exchange Notes, you may not be able to resell them.

Prior to this Exchange Offer, there has been no public market for the Exchange Notes and we cannot assure you that an active trading market will develop for the Exchange Notes. We do not intend to apply for the listing of the Exchange Notes on any securities exchange or automated interdealer quotation system. If no active trading market develops, you may not be able to resell your Exchange Notes at their fair market value or at all. Future trading prices of the Exchange Notes will depend on many factors, including, among other things, prevailing interest rates, our operating results and the market for similar securities. Also, it is possible that the market for the Exchange Notes will be volatile. This volatility in price may affect your ability to resell your Exchange Notes or the timing of their sale.

We may redeem your Notes at our option, which may adversely affect your return.

We may redeem the Notes, in whole or in part, at our option at any time or from time to time at the applicable redemption prices described in this prospectus. Prevailing interest rates at the time we redeem the Notes may be lower than the interest rate on the Notes. As a result, you may not be able to reinvest the redemption proceeds in a comparable security at an interest rate equal to or higher than the interest rate on the Exchange Notes. See “Description of Notes—Optional Redemption” for a more detailed description of the conditions under which we may redeem the Exchange Notes.

If you do not exchange your outstanding Original Notes you may have difficulty in transferring them at a later time.

We will issue Exchange Notes in exchange for the Original Notes after the exchange agent receives your Original Notes, the letter of transmittal and all related documents. You should allow adequate time for delivery if you choose to tender your Original Notes for exchange. Original Notes that are not exchanged will remain subject to restrictions on transfer and will not have rights to registration.

If you do participate in the Exchange Offer for the purpose of participating in the distribution of the Exchange Notes, you must comply with the registration and prospectus delivery requirements of the Securities Act for any resale transaction. Each broker-dealer who holds Original Notes for its own account due to market-making or other trading activities and who receives Exchange Notes for its own account must acknowledge that it will deliver a prospectus in connection with any resale of the Exchange Notes. If any Original Notes are not tendered in the exchange or are tendered but not accepted, the trading market for such Original Notes could be negatively affected due to the limited amount expected to remain outstanding following the completion of the Exchange Offer.

Risks Relating to Our Business

The industries in which we operate are cyclical and are affected by the economy in general.

We sell products to customers in industries that experience cyclicality (expectancy of recurring periods of economic growth and slowdown) in demand for products and may experience substantial increases and decreases in business volume throughout economic cycles. Industries we serve, including the automotive and vehicle parts, heavy-duty truck, industrial equipment, steel, rail, oil and gas, electrical distribution and controls, aerospace and defense, recreational equipment, HVAC, electrical components, appliance and semiconductor equipment industries, are affected by consumer spending, general economic conditions and the impact of international trade. A downturn in any of the industries we serve could have a material adverse effect on our financial condition, liquidity and results of operations.

-17-

Adverse credit market conditions may significantly affect our access to capital, cost of capital and ability to meet liquidity needs.