- BTBT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

CORRESP Filing

Bit Digital (BTBT) CORRESPCorrespondence with SEC

Filed: 30 Aug 19, 12:00am

Golden Bull Limited

707 Zhang Yang Road, Sino Life Tower, F35

Pudong, Shanghai, China 200120

August 30, 2019

Via Edgar

Mr. John Spitz

Division of Corporation Finance

Office of Financial Services

U.S. Securities and Exchange Commission

| Re: | Golden Bull Limited |

| Form 20-F for Fiscal Year Ended December 31, 2018 | |

| Filed on April 30, 2019 | |

| File No. 001-38421 |

Dear Mr. Spitz:

This letter is in response to the letter dated July 17, 2019, from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) addressed to Golden Bull Limited (the “Company”, “we”, and “our”) regarding the Annual Report on Form 20-F (“Form 20-F”) previously filed on April 30, 2019. For ease of reference, we have recited the Commission’s comments in this response and numbered them accordingly.

Item 15. Controls and Procedures, page 105

1. We note your proposed revised disclosure in response to comment 4. Please ensure that your revised disclosure clearly identifies which of the listed items represented a material weakness that resulted in your determination that you did not maintain effective internal control over financial reporting as of December 31, 2018. Refer to Item 15(b)(3) of Form 20-F. Please also ensure the disclosure in your next Form 20-F clearly describes the changes in internal control over financial reporting that occurred during the year as part of your remediation activities and to clearly describe any remaining actions planned to remediate the identified material weaknesses.

��

Response: In response to the Staff’s comment, we have revised our disclosures accordingly below and will also do so in our future filings:

| Item 15 (b) | Management’s Report on Internal Control Over Financial Reporting |

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with international financial reporting standards (“IFRSs”). Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or because the degree of compliance with policies or procedures may deteriorate. Under the supervision and with the participation of our management, including our chief executive officer and chief financial officer, we conducted an assessment of the effectiveness of our internal control over financial reporting as of December 31, 2018. The assessment was based on criteria established in the framework Internal Control—Integrated Framework (2013), issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management determined that, as of December 31, 2018, we did not maintain effective internal control over financial reporting due to the existence of the following material weaknesses:

| o | Lack of sufficient full-time personnel with appropriate levels of accounting knowledge and experience to monitor the daily recording of transactions, address complex U.S. GAAP accounting issues, and prepare and review financial statements and related disclosures under U.S. GAAP, and as a result, the Company may not be able to identify and monitor significant accounting issues appropriately on a timely basis; |

| o | Lack of a functional internal audit department or personnel that monitors the consistencies of the preventive internal control procedures, and as a result, the Company may not be able to discover the existence of problems and prevent the problematic behavior in internal control; |

| o | Lack of adequate policies and procedures in internal audit function to ensure that the Company’s policies and procedures have been carried out as planned; and |

| o | Lack of well-structured IT general control policies and procedures for documentation of program changes, periodic transaction log reviews, control quality evaluations, backup restoration tests and centralized anti-virus detections, which may result in failure to accurately collect operational data to prepare the financial statements. |

| o | Lack of proper segregation of duties within accounting functions. |

| o | Significant deficiencies were also detected at Dianniu, one of our VIEs, which in the aggregate, constitute a material weakness and create a reasonable likelihood that a material misstatement of our annual and interim financial statements will not be prevented or detected on a timely basis. Such deficiencies include: (i) lack of reviewed documentation for management’s approval on aging analysis and as a result, the Company may not be able to accrue provision for bad debt appropriately on a timely basis; and (ii) lack of sufficient monitoring of the employee resignation procedure, which may result in an inaccurate number of employees in the annual report. |

As a company with limited resources, the Company does not have the resources to fund sufficient staff to ensure a complete segregation of responsibilities within the accounting function. However, management has carried out and is planning to undertake the following actions to remediate the material weakness described above:

| (1) | Recruiting qualified consultants with appropriate levels of knowledge and experience in U.S. GAAP reporting to assist in resolving accounting issues in non-routine or complex transactions; |

| (2) | Setting up an Internal Audit Department and establishing formal internal control policies and procedures, implementing an ongoing initiative and training to relevant personnel, |

| (3) | Providing continuous U.S. GAAP trainings to relevant employees; |

| (4) | Making quarterly aging analyses, which will be reviewed and confirmed by the CFO; |

| (5) | Further standardizing the employees’ resignation process; the resignation report of employees above the manager level (including managers) shall be approved by the CEO with approval records and signature; |

| (6) | Setting up IT strategic plans, annual plans and budgeting for it to be consistent with business development, maintaining IT meeting minutes and communicating through emails with relevant departments, setting up IT Best Practice Standards and evaluating the IT department performance annually, maintaining records for IT change authorizations, terminating user access rights the same day for any employees that leave the Company, standardizing and managing the anti-virus software with specific designated personnel, periodically reviewing the logs to identify any unusual transactions, performing restoration tests for backups regularly, evaluating third-party services annually, and terminating the ones with bad performance; |

2

Note 7 - Taxes, page F-19

2. We note your response to comment 6. Please address the following:

| ● | References to “taxable income” in your response appear to represent “Total operating revenues, net” as presented in your statement of operations on page F-4. Please revise your analysis to instead provide us historical and forecasted PRC taxable operating income/(loss) with appropriate detail of the significant revenue and expense line items. Please provide us your historical results by quarter if available. |

| ● | Please provide us your historical and forecasted US GAAP operating income/(loss) before taxes or taxable operating income/(loss) by country (i.e. PRC, Cayman Islands, etc.) and explain how historical income was generated for each country and ensure any differences in forecasted income/(loss) between countries is explained. |

| ● | In your accounting analysis you have forecasted revenue (21%) and expense (13%) growth based only on increases experienced from fiscal 2017 to fiscal 2018. Please tell us how you considered in your analysis the potential for ongoing PRC regulatory reform and planned changes to your business model (i.e. entrance into car leasing business, production and sales for Internet of Things technology and technical consulting) in support of these revenue and expense growth rates. |

| ● | You have also forecasted in your accounting analysis business consulting expenses and professional fees to decrease by 50% when compared to fiscal 2018 since you considered these expenses were mainly in relation to one-time IPO listing expenses. However, we note disclosure on pages 73-74 that business consulting expenses were due to the engagement of professional teams to monitor and provide business advice on your business in the area of human resource strategic management and business strategic management. Please update your analysis, based upon your changing business model, to explain in further detail how you have determined these significant expenses will reduce by 50% in future periods. |

Response: In response to the Staff’s comment, we have revised our analysis accordingly as below:

| ● | Please refer to “Taxable Income and Reconciling Items” attached hereto as Exhibit A which provides our historical and forecasted PRC taxable operating income/(loss) with appropriate details regarding significant revenue and expense line items. |

| ● | Please refer to “Operating and Forecasted Income by Country” attached hereto as Exhibit B which provides our historical and forecasted US GAAP operating income/(loss) before taxes or taxable operating income/(loss) by country. |

| ● | In our forecast, we used the growth rate of 21% in revenue because the Company’s revenue level has been gradually increasing since the fourth quarter of 2018. In the first quarter of 2019, the operating result was made available at the end of April 2019, right before the 2018 20-F was filed, and the Company’s revenue increased 101% over the fourth quarter of 2018. Therefore, the Company used the growth rate of 21% in revenue based on the fluctuation of loan volumes processed from fiscal year 2017 to fiscal year 2018, which appears to be achievable and conservative for the Company according to the positive performance in the first quarter of 2019. |

| ● | We have forecasted business consulting expenses and professional fees to decrease by 50% when compared to fiscal 2018, because these expenses were mainly attributable to consulting services in the area of human resource strategic management and business strategic management related to IPO. The original projection and accounting analysis we provided was largely based on the March 31, 2019 quarterly performance which was made available at the end of April 2019 right before the 2018 20-F was filed. However, the overall performance of the P2P industry has declined in the second quarter of 2019 due to the increasingly stricter regulations of the P2P industry by the Chinese government. As a P2P operator, we have also been affected, resulting in a sharp decline in the Company’s operations in the second quarter of 2019. Please refer to “New Forecast” attached hereto as Exhibit C which provides our revised forecast and accounting analysis. |

3

3. For each reconciling item in your effective tax rate reconciliation for 2017 and 2018 on page F-19, please clearly tell us and revise your future filings, to the extent material, to explain:

| ● | the nature of the reconciling item, and |

| ● | if the item represents income or expense and how the item is treated differently for taxes. |

Also, clearly explain to us why Cayman non-deductible expenses decrease your effective tax rate.

Response: In response to the Staff’s comment, please refer to our explanation in Exhibit A attached hereto and we will also revise our future filings accordingly

4. We note that 47% of your losses before taxes in 2018 is presented as foreign (i.e. non-PRC) on page F-19. Please tell us and revise future filings to clearly describe how income is generated in each geographic market as required by Item 4 and Item 5 of Form 20-F.

Response: In response to the Staff’s comment, we have revised our disclosures accordingly below and will also do so in our future filings:

| ● | All of our income from inception to 2018 is generated in China. We facilitate loans by connecting borrowers and lenders, preparing all necessary paperwork related to borrowers’ applications and assisting with securing collateral. Our primary sources of revenue consist of fees received for transactions through our platform and include transaction and management fees, which are described in further detail below: |

| o | Transaction Fees: Transaction fees are paid by borrowers to the Company for the work the Company performs through its platform. These fees are recognized as a component of operating revenue at the time of loan issuance. The amount of these fees is based upon the loan amount and other terms of the loan, including credit grade, maturity and other factors. These fees are non-refundable upon the issuance of loan. |

| o | Management Fees: Loan borrowers pay a management fee on each loan payment to compensate us for services provided in connection with facilitation of the loan transactions, including review of a borrower’s application with required supporting documentation, evaluation of such borrower’s credit, assessing and verification of collaterals as well as the maintenance of profiles in our system. The Company records management fees as a component of operating revenue at the time of loan issuance. The amount of these fees is based upon the loan amount and other terms of the loan, including credit grade, maturity and other factors. These fees are non-refundable upon the issuance of loan. |

We appreciate the assistance the Staff has provided with its comments. If you have any questions, please do not hesitate to call our counsel, Joan Wu, Esq., of Hunter Taubman Fischer & Li LLC, at (212) 530-2208.

Very truly yours,

| /s/ Erxin Zeng | ||

| Name: | Erxin Zeng | |

| Title: | Chief Executive Officer and Chairman of the Board of Directors | |

CC: Joan Wu, Esq. Hunter Taubman Fischer & Li LLC

Eddie Wong, Friedman LLP

4

Exhibit A

| For the years ended Dec 31, | ||||||||||||||

| 2018- dianniu per book | 2017- dianniu per book | 2016- dianniu per book | Note | |||||||||||

| OPERATING REVENUES | ||||||||||||||

| Transaction Fees | $ | 3,994,195 | $ | 3,307,984 | $ | 1,561,172 | ||||||||

| Management Fees | 4,399,578 | 4,037,700 | 2,264,241 | |||||||||||

| Sales taxes | (504,572 | ) | (391,927 | ) | (119,643 | ) | ||||||||

| Total operating revenues, net | 7,889,201 | 6,953,757 | 3,705,770 | |||||||||||

| OPERATING EXPENSES | ||||||||||||||

| Selling | (4,940,784 | ) | (3,910,646 | ) | (1,434,662 | ) | ||||||||

| General and administrative | (4,850,104 | ) | (3,647,862 | ) | (1,623,837 | ) | ||||||||

| Research and development | (447,884 | ) | (485,852 | ) | (417,901 | ) | ||||||||

| Total operating expenses | (10,238,772 | ) | (8,044,360 | ) | (3,476,400 | ) | ||||||||

| LOSS FROM OPERATIONS | (2,349,571 | ) | (1,090,603 | ) | 229,370 | |||||||||

| Adjustment item from Loss from operations to Taxable income/loss: | ||||||||||||||

| Non-deductable expense | 183,215 | Note 1 | ||||||||||||

| Non-taxbale income | (49,699 | ) | Note 2 | |||||||||||

| Temporary difference | 33,764 | (37,729 | ) | (9,620 | ) | Note 3 | ||||||||

| Taxable income/loss | (2,182,292 | ) | (1,128,332 | ) | 219,750 | |||||||||

| Note | There is no corporate income tax in Cayman and expenses occurred in Cayman are non-deductible in China. As a result, expenses occurred in Cayman are permanent tax differences and is not included in this sheet. |

There is no revenue but only expenses occurred in another three subsidiares in China,Baoxun,Youwang and Fuyu. As a result, the Company forcast there won’t be profit in the future in these three subsidiares,so expenses occurred in these three subsidiares is not included in this sheet.

| Note 1 | Business entertainment that exceed 5‰ of annual revenue is non-deductable according to Chinaese income tax law |

| Note 2 | Government subsidies are non-taxbale income according to Chinaese income tax law |

| Note 3 | 2018 Fees occured but invoice not yet received are non-deductable expense according to Chinaese income tax law |

2017 Deprication expense and renovation costs adjustment and defer revenue recognized in FY 2017

2016 Defer revenue recognized in FY 2016

5

| For the year ended | For the year ended | |||||||||||

| 31-Dec-18 | 31-Dec-17 | |||||||||||

| China income tax rate | 25 | % | 25 | % | ||||||||

| IPO costs | 0 | % | 7.7 | % | Note 4 | |||||||

| PRC – non-deductible expense | (1.7 | )% | Note 1 | (1.7 | )% | Note 5 | ||||||

| Cayman – non-deductible expense-consulting fee | (8.1 | )% | Note 2 | (9.6 | )% | Note 6 | ||||||

| Cayman – non-deductible expense-external service fee | (3.7 | )% | Note 3 | 0 | % | |||||||

| Effective tax rate | 11.5 | % | 21.4 | % | ||||||||

| Note 1 | PRC – non-deductible expense-dianniu | 167,279 | |||

| PRC – expense-Youwang&Fuyu&Baoxun | 4,386 | ||||

| PRC – US GAAP adjustment | 100,219 | ||||

| China income tax rate | 25 | % | |||

| Net income (loss) before taxes | -3,998,297 | ||||

| -1.7 | % |

There is no revenue but only expenses occurred in another three subsidiares in China,Baoxun,Youwang and Fuyu. As a result, the Company forcast there won’t be profit in the future in these three subsidiares,so expenses occurred in these three subsidiares is non-deductible.

| Note 2 | Cayman-consulting fee | 1,301,668 | |||

| China income tax rate | 25 | % | |||

| Net income (loss) before taxes | -3,998,297 | ||||

| -8.1 | % | ||||

| Note 3 | Foreign-external service fee | 584,886 | |||

| China income tax rate | 25 | % | |||

| Net income (loss) before taxes | -3,998,297 | ||||

| -3.7 | % | ||||

| Note 4 | IPO costs | -389,635 | |||

| China income tax rate | 25 | % | |||

| Net income (loss) before taxes | -1,268,366 | ||||

| 7.7 | % | ||||

| Note 5 | PRC – non-deductible expense | -37,729 | |||

| PRC – expense-Baoxun | - | ||||

| PRC – US GAAP adjustment | 123,978 | ||||

| China income tax rate | 25 | % | |||

| Net income (loss) before taxes | -1,268,366 | ||||

| -1.7 | % | ||||

| Note 6 | Cayman-consulting fee | 488,334 | |||

| China income tax rate | 25 | % | |||

| Net income (loss) before taxes | -1,268,366 | ||||

| -9.6 | % |

6

Exhibit B

| 2018 | 2018 | 2018 | 2017 | 2017 | 2017 | 2016 | 2016 | 2016 | ||||||||||||||||||||||||||||

| PRC-USGAAP | Cayman-USGAAP | Total-USGAAP | PRC-USGAAP | Cayman-USGAAP | Total-USGAAP | PRC-USGAAP | Cayman-USGAAP | Total-USGAAP | ||||||||||||||||||||||||||||

| USD | USD | USD | USD | USD | USD | USD | USD | USD | ||||||||||||||||||||||||||||

| OPERATING REVENUES | ||||||||||||||||||||||||||||||||||||

| Transaction Fees | 3,994,195 | - | 3,994,195 | 3,307,984 | - | 3,307,984 | 1,561,172 | - | 1,561,172 | |||||||||||||||||||||||||||

| Management Fees | 4,399,578 | - | 4,399,578 | 4,037,700 | - | 4,037,700 | 2,264,241 | - | 2,264,241 | |||||||||||||||||||||||||||

| Sales taxes | (504,572 | ) | - | (504,572 | ) | (391,927 | ) | - | (391,927 | ) | (119,643 | ) | - | (119,643 | ) | |||||||||||||||||||||

| Total operating revenues, net | 7,889,201 | - | 7,889,201 | 6,953,757 | - | 6,953,757 | 3,705,770 | - | 3,705,770 | |||||||||||||||||||||||||||

| OPERATING EXPENSES | ||||||||||||||||||||||||||||||||||||

| Selling | (4,940,784 | ) | - | (4,940,784 | ) | (3,910,646 | ) | - | (3,910,646 | ) | (1,434,662 | ) | - | (1,434,662 | ) | |||||||||||||||||||||

| General and administrative | (4,794,164 | ) | (1,891,213 | ) | (6,685,377 | ) | (3,428,402 | ) | (488,334 | ) | (3,916,736 | ) | (1,636,353 | ) | - | (1,636,353 | ) | |||||||||||||||||||

| Research and development | (447,884 | ) | - | (447,884 | ) | (485,852 | ) | - | (485,852 | ) | (417,901 | ) | - | (417,901 | ) | |||||||||||||||||||||

| Total operating expenses | (10,182,832 | ) | (1,891,213 | ) | (12,074,045 | ) | (7,824,900 | ) | (488,334 | ) | (8,313,234 | ) | (3,488,916 | ) | - | (3,488,916 | ) | |||||||||||||||||||

| INCOME(LOSS) FROM OPERATIONS | (2,293,631 | ) | (1,891,213 | ) | (4,184,844 | ) | (871,143 | ) | (488,334 | ) | (1,359,477 | ) | 216,854 | - | 216,854 | |||||||||||||||||||||

| Note | All of our income from inception to 2018 is generated in China because there is no business activities that can generate revenue in Cayman Golden Bull Limited was founded in 2017, so there are expenses occured since 2017. |

7

| 2019FORECAST-USGAAP | 2020FORECAST-USGAAP | 2021FORECAST-USGAAP | 2022FORECAST-USGAAP | 2023FORECAST-USGAAP | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PRC | Cayman | Total | PRC | Cayman | Total | PRC | Cayman | Total | PRC | Cayman | Total | PRC | Cayman | Total | ||||||||||||||||||||||||||||||||||||||||||||||

| USD | USD | USD | USD | USD | USD | USD | USD | USD | USD | USD | USD | USD | USD | USD | ||||||||||||||||||||||||||||||||||||||||||||||

| OPERATING REVENUES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction Fees | 4,333,654 | - | 4,333,654 | 5,227,260 | - | 5,227,260 | 6,305,130 | - | 6,305,130 | 7,605,257 | - | 7,605,257 | 9,173,473 | - | 9,173,473 | |||||||||||||||||||||||||||||||||||||||||||||

| Management Fees | 5,251,794 | - | 5,251,794 | 6,334,722 | - | 6,334,722 | 7,640,952 | - | 7,640,952 | 9,216,528 | - | 9,216,528 | 11,116,991 | - | 11,116,991 | |||||||||||||||||||||||||||||||||||||||||||||

| Sales taxes | (602,387 | ) | - | (602,387 | ) | (726,600 | ) | - | (726,600 | ) | (876,426 | ) | - | (876,426 | ) | (1,057,146 | ) | - | (1,057,146 | ) | (1,275,131 | ) | - | (1,275,131 | ) | |||||||||||||||||||||||||||||||||||

| Total operating revenues, net | 8,983,062 | - | 8,983,062 | 10,835,383 | - | 10,835,383 | 13,069,656 | - | 13,069,656 | 15,764,639 | - | 15,764,639 | 19,015,332 | - | 19,015,332 | |||||||||||||||||||||||||||||||||||||||||||||

| OPERATING EXPENSES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selling | (3,989,643 | ) | - | (3,989,643 | ) | (4,812,314 | ) | - | (4,812,314 | ) | (5,804,620 | ) | - | (5,804,620 | ) | (7,001,542 | ) | - | (7,001,542 | ) | (8,445,271 | ) | - | (8,445,271 | ) | |||||||||||||||||||||||||||||||||||

| General and administrative | (3,550,202 | ) | - | (3,550,202 | ) | (4,027,240 | ) | - | (4,027,240 | ) | (4,570,480 | ) | - | (4,570,480 | ) | (5,189,518 | ) | - | (5,189,518 | ) | (5,895,415 | ) | - | (5,895,415 | ) | |||||||||||||||||||||||||||||||||||

| Research and development | (623,749 | ) | - | (623,749 | ) | (702,416 | ) | - | (702,416 | ) | (791,005 | ) | - | (791,005 | ) | (890,767 | ) | - | (890,767 | ) | (1,003,111 | ) | - | (1,003,111 | ) | |||||||||||||||||||||||||||||||||||

| Total operating expenses | (8,163,594 | ) | - | (8,163,594 | ) | (9,541,970 | ) | - | (9,541,970 | ) | (11,166,106 | ) | - | (11,166,106 | ) | (13,081,827 | ) | - | (13,081,827 | ) | (15,343,796 | ) | - | (15,343,796 | ) | |||||||||||||||||||||||||||||||||||

| INCOME FROM OPERATIONS | 819,468 | - | 819,468 | 1,293,413 | - | 1,293,413 | 1,903,550 | - | 1,903,550 | 2,682,812 | - | 2,682,812 | 3,671,536 | - | 3,671,536 | |||||||||||||||||||||||||||||||||||||||||||||

| Note | Forecasted US GAAP operating income/(loss) before taxes or taxable operating income/(loss) is all for China. As all the expenses recorded in Cayman Islands are paid by its US dollar account and there is only $268,399 in the US dollar account at December,31,2018, the Company expects that there will not be significant expense in Cayman Islands in the future.Whatmore,there is no business activities that can generate revenue in Cayman |

8

Exhibit C

Due to the increasingly stricter regulations of the P2P industry by the Chinese government, the overall performance of the P2P industry has declined. As a P2P operator, we have also been affected, resulting in a sharp decline in the Company’s operations in the second quarter of 2019. The emergence of Defaulted Loans has resulted in decrease of investment and increase of defaulted loans. The lenders’ confidence in our platform was significantly affected and as a result, a significant amount of lenders decided not to invest on our platform. The Company used the decreased rate of approximately -35% based on the downturn situation. Sales tax and selling expenses are expected to decrease with the decrease revenue, -35% was therefore used for the projection of these items as well.

On July 22,2019, the Company shut down its office in Shanghai and relocated its principal operations in Chengdu, the monthly rental fee for new office is about $2,570 (RMB18,000). As a result, the decrease fluctuation percentage in Office space rental is 47% in 2019 and 85% in 2020. The Company made the redundancy in June, 2019 and only keeps about 20 staff since July, 2019. As a result, the decrease fluctuation percentage in salary is 30% in 2019 and 60% in 2020

| P&L projection - PBC | 2016 12 months | Fluctuation | 2017 12 months | Fluctuation | 2018 12 months | Project Fluctuation | 2019 12 months | Project Fluctuation | 2020 12 months | Project Fluctuation | 2021 12 months | Project Fluctuation | 2022 12 months | Project Fluctuation | 2023 12 months | |||||||||||||||||||||||||||||||||||||||||||||||||

| USD | USD | USD | USD | USD | USD | USD | USD | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan amount | 54,948,482 | 137 | % | 129,982,103 | 20 | % | 155,723,404 | -35 | % | 101,220,213 | -35 | % | 65,793,138 | -35 | % | 42,765,540 | -35 | % | 27,797,601 | -35 | % | 18,068,441 | ||||||||||||||||||||||||||||||||||||||||||

| Note 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction Fee | 1,561,172 | 112 | % | 3,307,984 | 9 | % | 3,592,811 | -35 | % | 2,335,327 | -35 | % | 1,517,963 | -35 | % | 986,676 | -35 | % | 641,339 | -35 | % | 416,870 | ||||||||||||||||||||||||||||||||||||||||||

| Management fees | 2,264,241 | 78 | % | 4,037,700 | 8 | % | 4,353,994 | -35 | % | 2,830,096 | -35 | % | 1,839,562 | -35 | % | 1,195,716 | -35 | % | 777,215 | -35 | % | 505,190 | ||||||||||||||||||||||||||||||||||||||||||

| Sales taxes | (119,643 | ) | 228 | % | (391,927 | ) | 27 | % | -499,408 | -35 | % | (324,615 | ) | -35 | % | (211,000 | ) | -35 | % | (137,150 | ) | -35 | % | (89,147 | ) | -35 | % | (57,946 | ) | |||||||||||||||||||||||||||||||||||

| Total gross revenue | 3,705,770 | 88 | % | 6,953,757 | 7 | % | 7,447,397 | -35 | % | 4,840,808 | -35 | % | 3,146,525 | -35 | % | 2,045,241 | -35 | % | 1,329,407 | -35 | % | 864,114 | 12,226,095 | |||||||||||||||||||||||||||||||||||||||||

| Advertisement | 373,525 | 248 | % | 1,299,450 | -31 | % | 898,312 | -35 | % | 583,903 | -35 | % | 379,537 | -35 | % | 246,699 | -35 | % | 160,354 | -35 | % | 104,230 | ||||||||||||||||||||||||||||||||||||||||||

| Brand promotion | 45,903 | 370 | % | 215,516 | 279 | % | 817,381 | -35 | % | 531,298 | -35 | % | 345,343 | -35 | % | 224,473 | -35 | % | 145,908 | -35 | % | 94,840 | ||||||||||||||||||||||||||||||||||||||||||

| Incentive | 503,238 | 198 | % | 1,497,279 | 6 | % | 1,591,916 | -35 | % | 1,034,745 | -35 | % | 672,585 | -35 | % | 437,180 | -35 | % | 284,167 | -35 | % | 184,709 | ||||||||||||||||||||||||||||||||||||||||||

| Servicing expenses | 105,386 | 95 | % | 205,604 | 47 | % | 303,180 | -35 | % | 197,067 | -35 | % | 128,094 | -35 | % | 83,261 | -35 | % | 54,120 | -35 | % | 35,178 | ||||||||||||||||||||||||||||||||||||||||||

| Office space rental | 359,448 | 11 | % | 399,569 | 1 | % | 405,373 | -47 | % | 214,848 | -85 | % | 32,227 | 0 | % | 32,227 | 0 | % | 32,227 | 0 | % | 32,227 | ||||||||||||||||||||||||||||||||||||||||||

| Salary | 215,418 | 89 | % | 408,133 | 22 | % | 499,470 | -30 | % | 349,629 | -60 | % | 139,852 | 0 | % | 139,852 | 0 | % | 139,852 | 0 | % | 139,852 | ||||||||||||||||||||||||||||||||||||||||||

| Business consulting | 530,636 | 225 | % | 1,721,932 | 57 | % | 2,706,930 | -35 | % | 1,759,505 | -35 | % | 1,143,678 | -35 | % | 743,391 | -35 | % | 483,204 | -35 | % | 314,083 | ||||||||||||||||||||||||||||||||||||||||||

| Professional fees | 46,238 | 1277 | % | 636,866 | 155 | % | 1,624,158 | -35 | % | 1,055,703 | -35 | % | 686,207 | -35 | % | 446,034 | -35 | % | 289,922 | -35 | % | 188,450 | ||||||||||||||||||||||||||||||||||||||||||

| R&D | 417,901 | 16 | % | 485,852 | 14 | % | 553,892 | -35 | % | 360,030 | -35 | % | 234,019 | -35 | % | 152,113 | -35 | % | 98,873 | -35 | % | 64,268 | ||||||||||||||||||||||||||||||||||||||||||

| Total expense | 2,597,693 | 164 | % | 6,870,201 | 37 | % | 9,400,612 | -35 | % | 6,086,727 | -38 | % | 3,761,541 | -33 | % | 2,505,229 | -33 | % | 1,688,627 | -31 | % | 1,157,835 | ||||||||||||||||||||||||||||||||||||||||||

| operation income | 1,108,077 | -92 | % | 83,556 | -2438 | % | -1,953,215 | -36 | % | (1,245,918 | ) | -51 | % | (615,016 | ) | -25 | % | (459,988 | ) | -22 | % | (359,220 | ) | -18 | % | (293,720 | ) | |||||||||||||||||||||||||||||||||||||

| CIT | 277,019 | 20,889 | 0 | 0 | 0 | 0 | 0 | 0 | total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net profit | 831,058 | 62,667 | (1,953,215 | ) | (1,245,918 | ) | (615,016 | ) | (459,988 | ) | (359,220 | ) | (293,720 | ) | (2,973,862 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

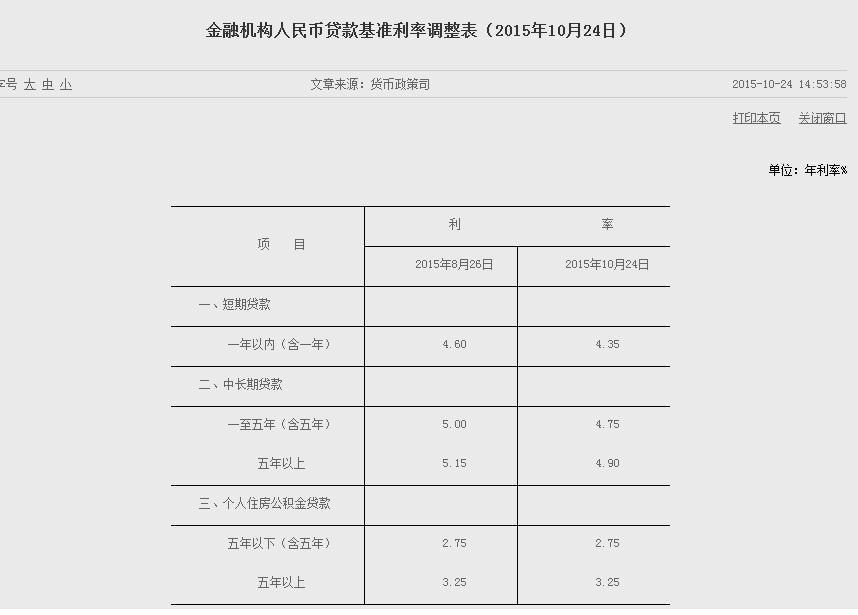

| discount rate | Note 2 interest rate - discount rate | 4.35 | % | 4.75 | % | 4.75 | % | 4.75 | % | 4.75 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| discount profit | (1,193,980 | ) | (560,503 | ) | (400,207 | ) | (298,362 | ) | (232,897 | ) | (2,685,950 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Note 1

Management assessment

1. decrease fluctuation percentage in Revenue - 35% in 2019 and 35% within the next four years after year 2019;

2. decrease fluctuation percentage in Selling expense - 35%;

3. decrease fluctuation percentage in Office space rental-47%

4. decrease fluctuation percentage in salary -30%

5. decrease fluctuation percentage in R&D expense and other general expense -35%

6. decrease fluctuation percentage in consulting and professional expense - 35% (See explanation above);

Note 2

Discount rate used for cash flows was based on the basic standard interest rates published by People’s Bank of China (Central Bank) for 1 year and for the period from 1 year to 5 years.

9

10

| 2018 B/S Ex rate | 0.145400 | |||||||||||||||||||

| 2018 I/S Ex rate | 0.151142 | |||||||||||||||||||

| 2019 Q1 actual | 2019 Q2 actual | 2019 Q1&Q2 actual | 2019 12 months forecasted | |||||||||||||||||

| Revenue-RMB | 26,838,376 | 4,803,252 | 31,641,628 | |||||||||||||||||

| Revenue-USD | 4,056,406 | 725,973 | 4,782,379 | 5,165,423 | 93 | % | ||||||||||||||

| Operating profit-RMB | 3,323,991 | -8,305,851 | -4,981,860 | |||||||||||||||||

| Operating profit-USD | 502,395 | -1,255,363 | -752,968 | -1,245,918 | 60 | % |

11