Exhibit 99.1

Transformative acquisition of Enovum Data Centers vertically integrates Bit Digital’s AI / HPC infrastructure offerings October 14, 2024

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward - looking statements described under “Risk Factors” in Item 3.D of our Annual Report on Form 20 - F for the fiscal year ended December 31, 2023. If any material risk was to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Future changes in the network - wide mining difficulty rate or digital asset hash rate may also materially affect the future performance of Bit Digital’s production of digital assets. See “Safe Harbor Statement” below. Safe Harbor Statement: This presentation may contain certain “forward - looking statements” relating to the business of Bit Digital, Inc. (the “Company”), and its subsidiaries. All statements, other than statements of historical fact included herein are “forward - looking statements.” These forward - looking statements are often identified by the use of forward - looking terminology such as “believes,” “expects,” or similar expressions, involving known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward - looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward - looking statements, which speak only as of the date of this presentation. The Company’s actual results could differ materially from those anticipated in these forward - looking statements as a result of a variety of factors, including those discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website at http://www.sec.gov. All forward - looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward - looking statements. Investor Notice 2

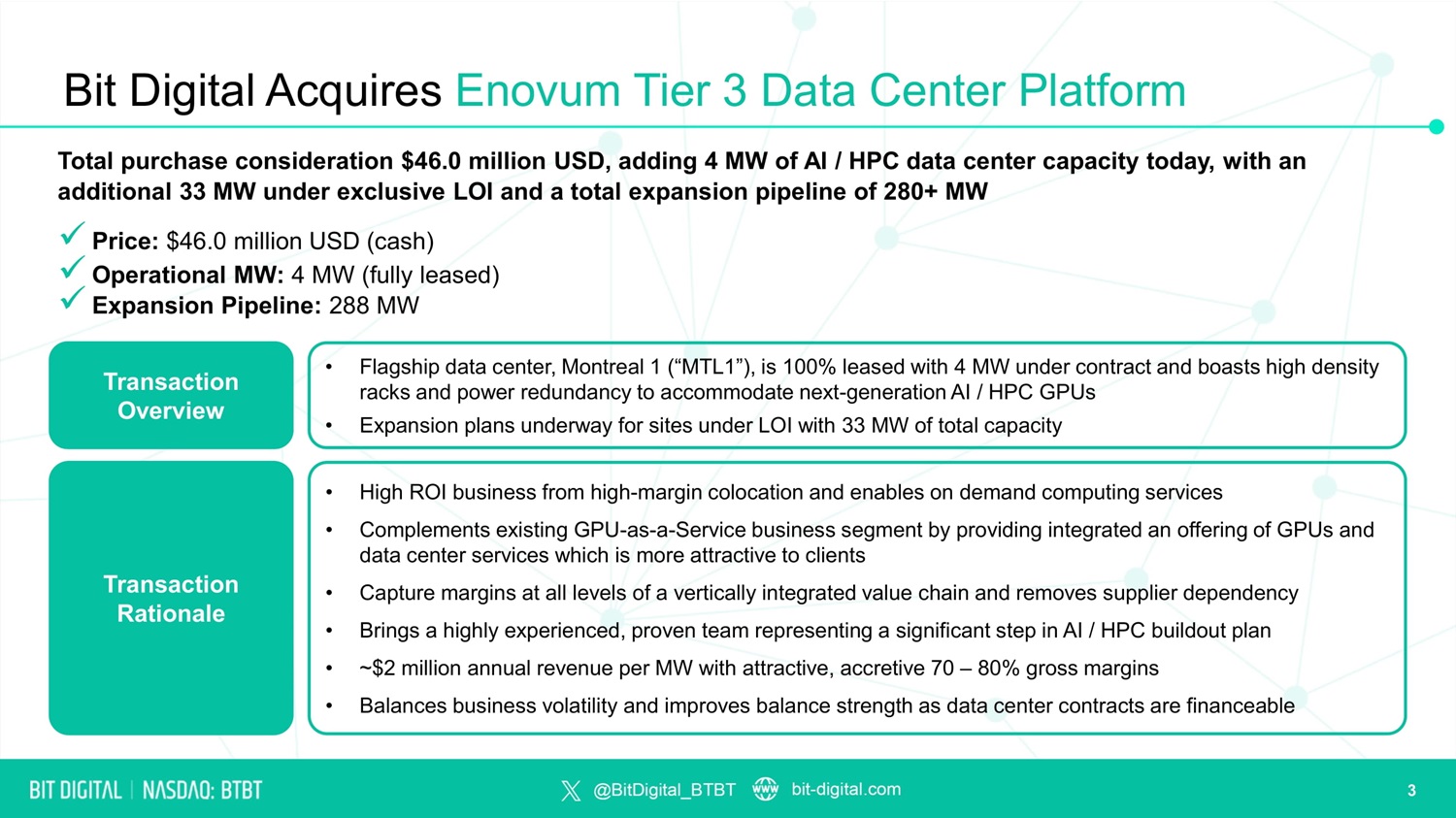

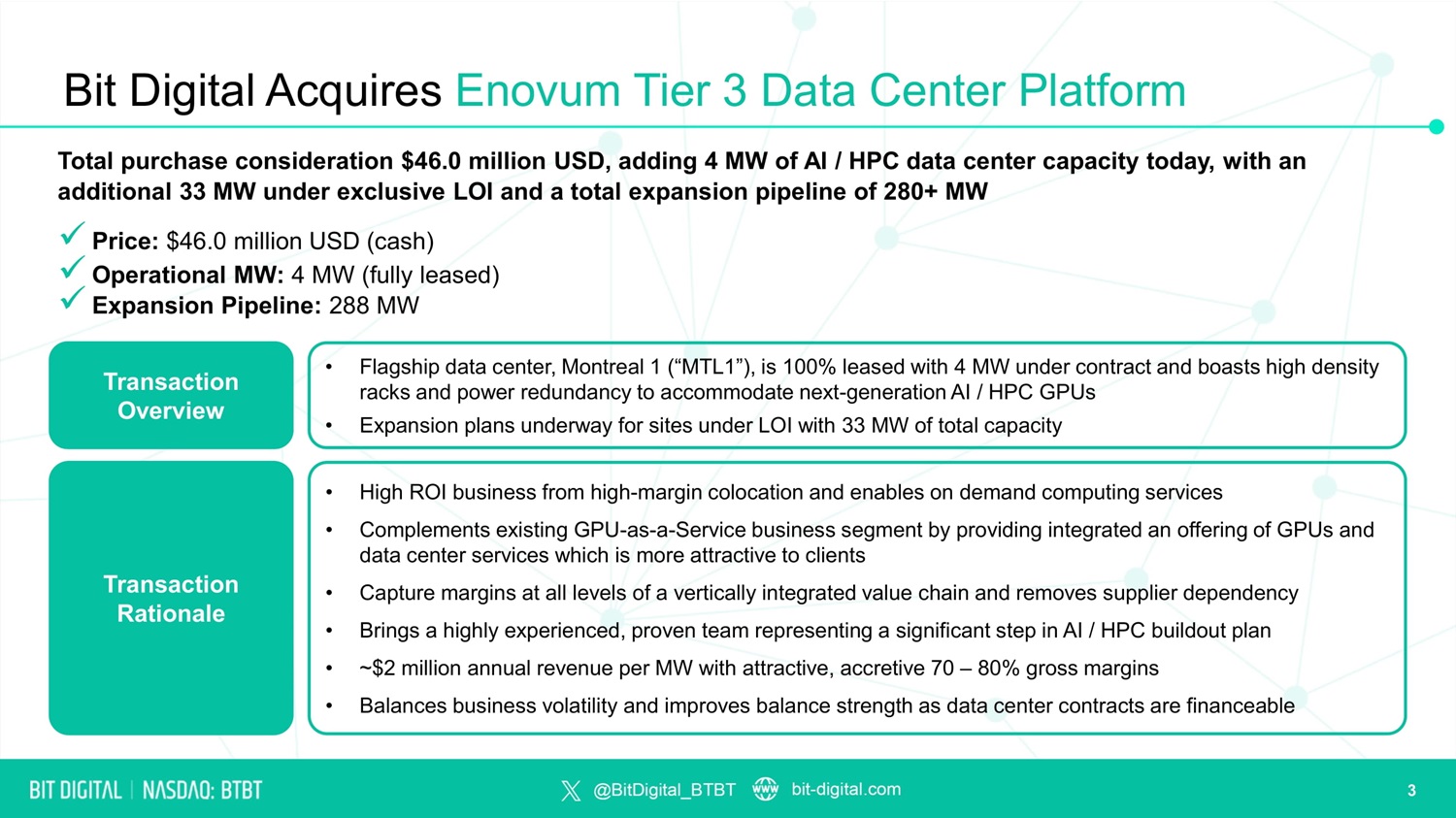

Bit Digital Acquires Enovum Tier 3 Data Center Platform Total purchase consideration $46.0 million USD, adding 4 MW of AI / HPC data center capacity today, with an additional 33 MW under exclusive LOI and a total expansion pipeline of 280+ MW x Price: $46.0 million USD (cash) x Operational MW: 4 MW (fully leased) x Expansion Pipeline: 288 MW Transaction Overview Transaction Rationale • High ROI business from high - margin colocation and enables on demand computing services • Complements existing GPU - as - a - Service business segment by providing integrated an offering of GPUs and data center services which is more attractive to clients • Capture margins at all levels of a vertically integrated value chain and removes supplier dependency • Brings a highly experienced, proven team representing a significant step in AI / HPC buildout plan • ~$2 million annual revenue per MW with attractive, accretive 70 – 80% gross margins • Balances business volatility and improves balance strength as data center contracts are financeable • Flagship data center, Montreal 1 (“MTL1”), is 100% leased with 4 MW under contract and boasts high density racks and power redundancy to accommodate next - generation AI / HPC GPUs • Expansion plans underway for sites under LOI with 33 MW of total capacity 3

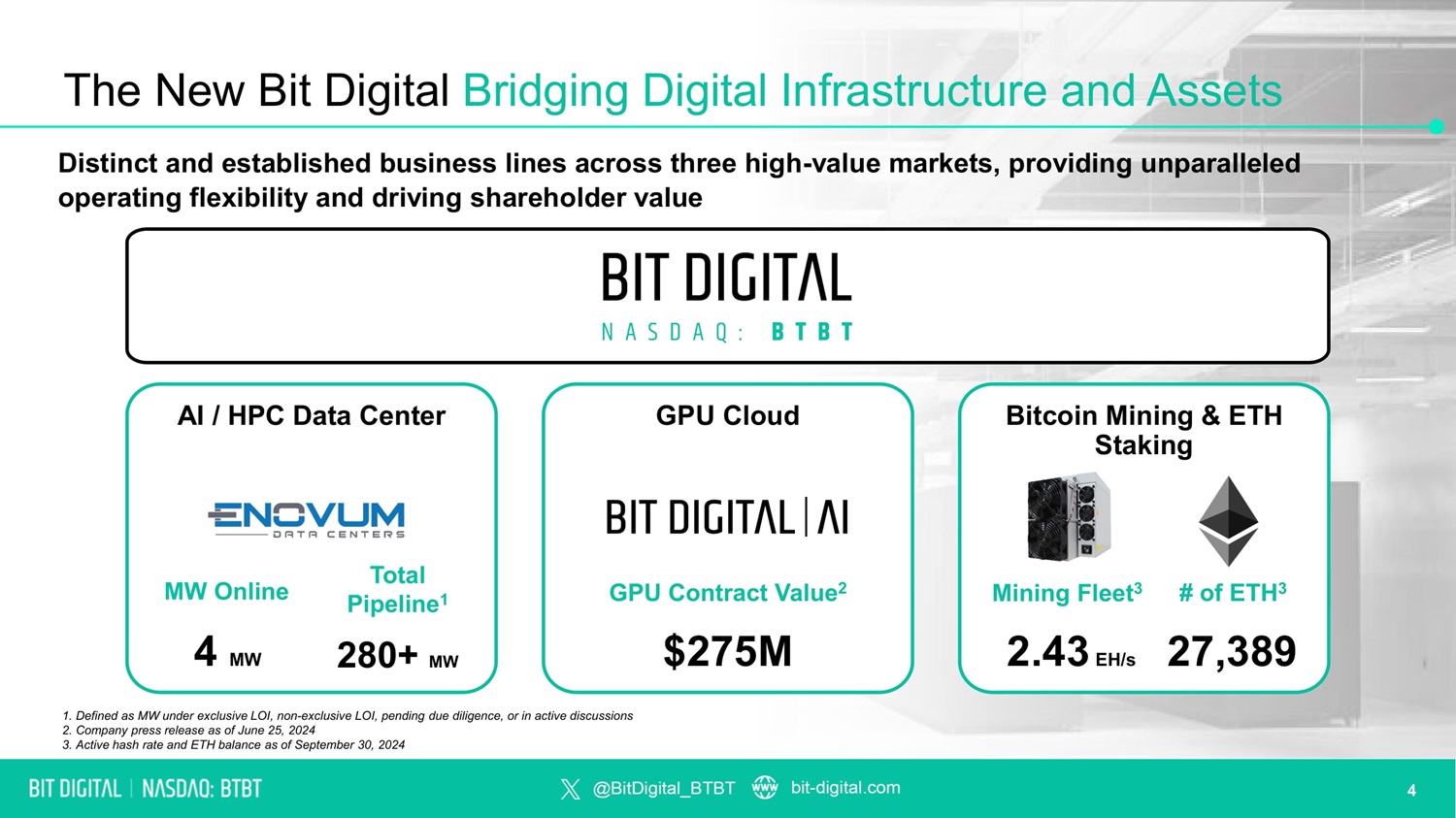

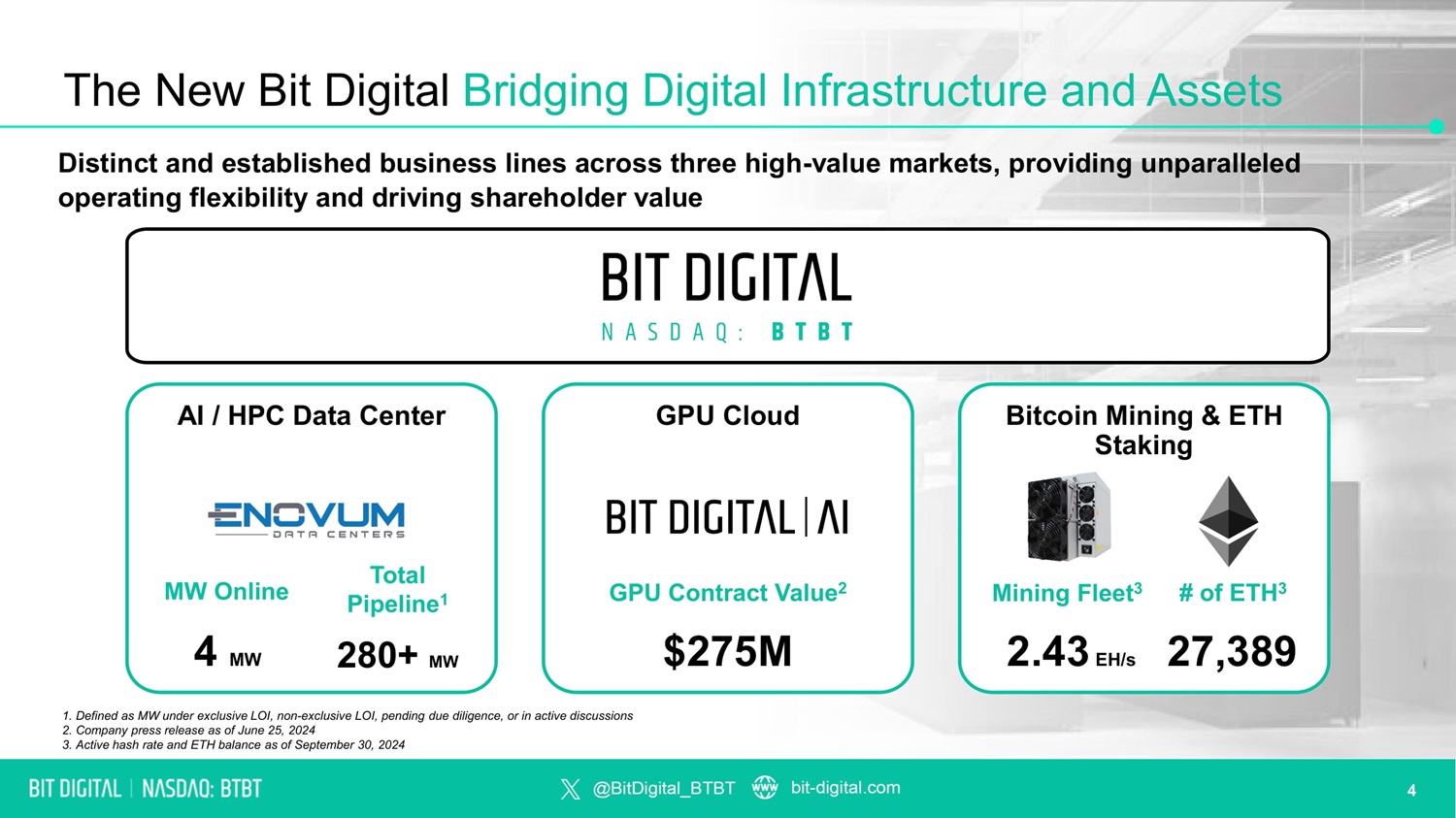

AI / HPC Data Center MW Online 4 MW Total Pipeline 1 280+ MW The New Bit Digital Bridging Digital Infrastructure and Assets GPU Cloud GPU Contract Value 2 $275M Bitcoin Mining & ETH Staking # of ETH 3 27,389 Mining Fleet 3 2.43 EH/s Distinct and established business lines across three high - value markets, providing unparalleled operating flexibility and driving shareholder value 1. Defined as MW under exclusive LOI, non - exclusive LOI, pending due diligence, or in active discussions 2. Company press release as of June 25, 2024 3. Active hash rate and ETH balance as of September 30, 2024 4

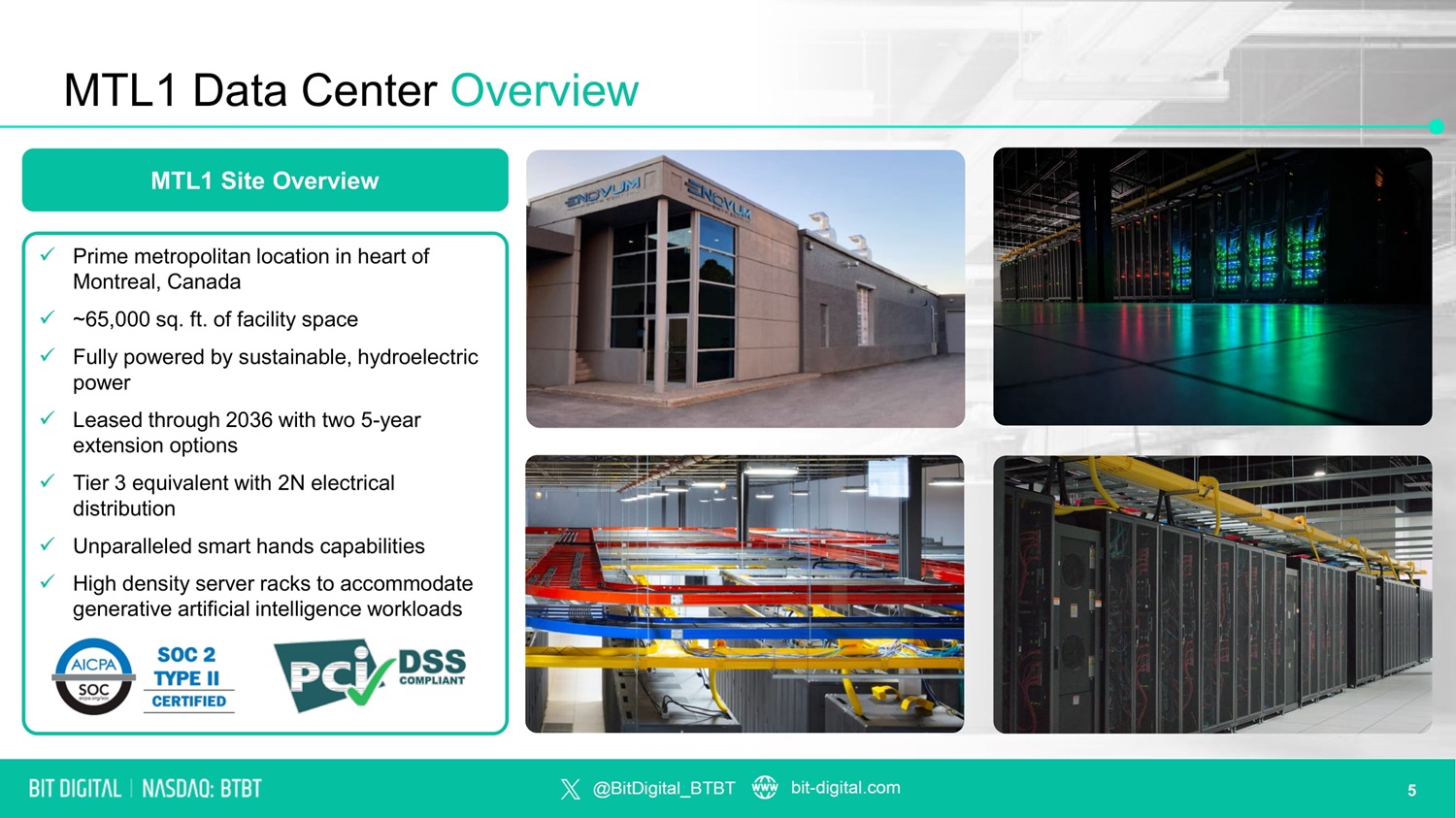

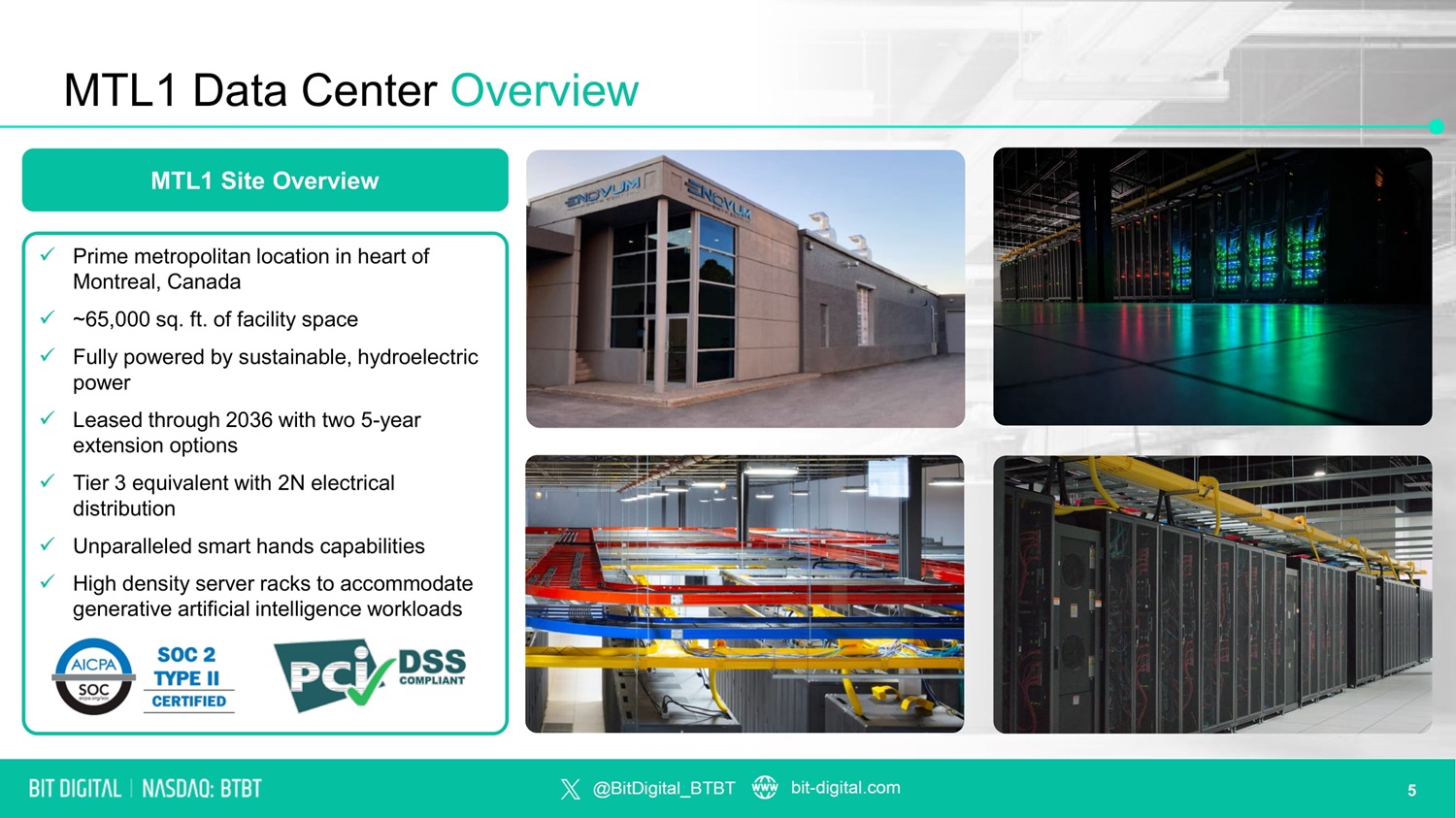

MTL1 Data Center Overview MTL1 Site Overview x Prime metropolitan location in heart of Montreal, Canada x ~65,000 sq. ft. of facility space x Fully powered by sustainable, hydroelectric power x Leased through 2036 with two 5 - year extension options x Tier 3 equivalent with 2N electrical distribution x Unparalleled smart hands capabilities x High density server racks to accommodate generative artificial intelligence workloads 5

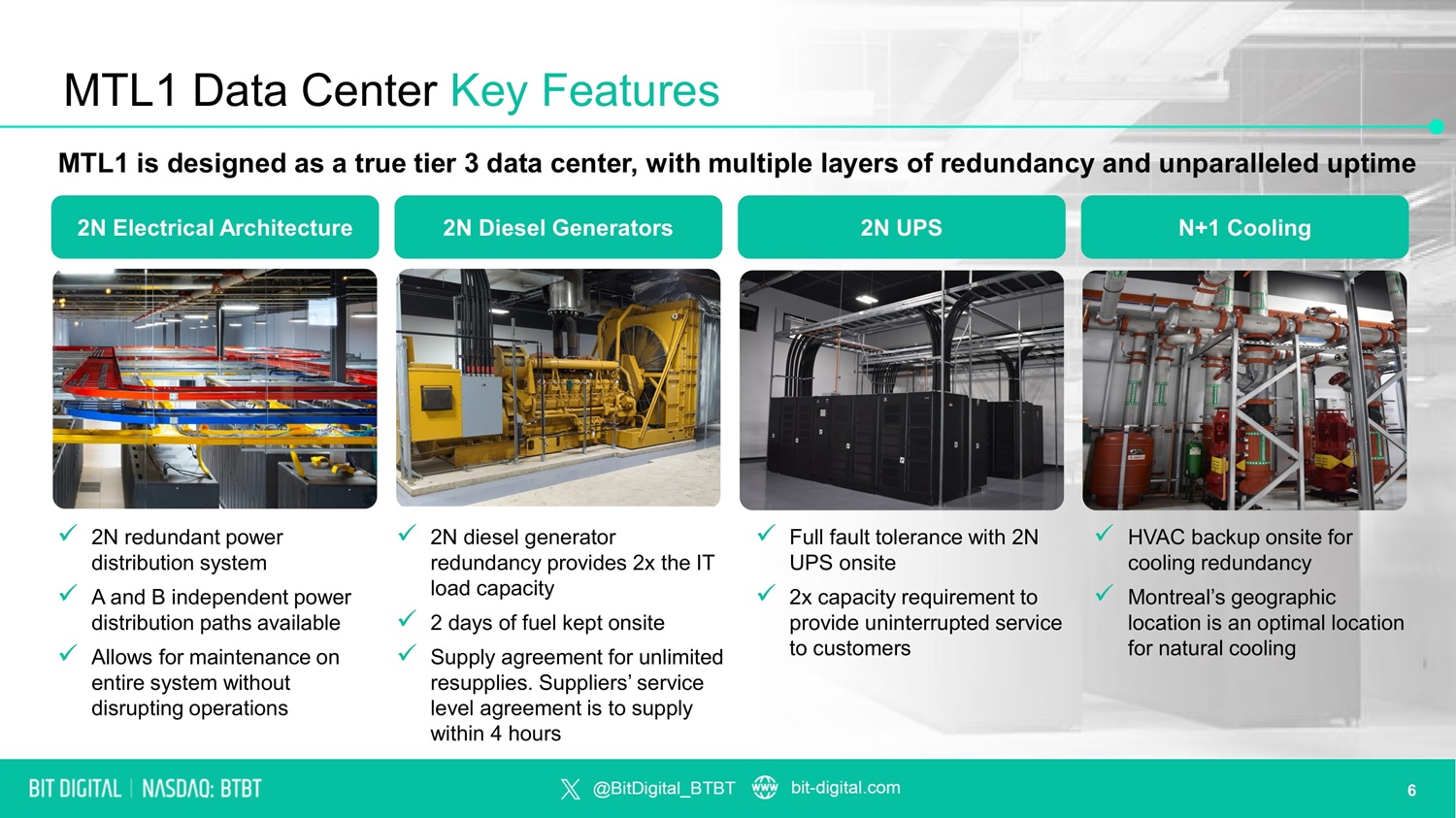

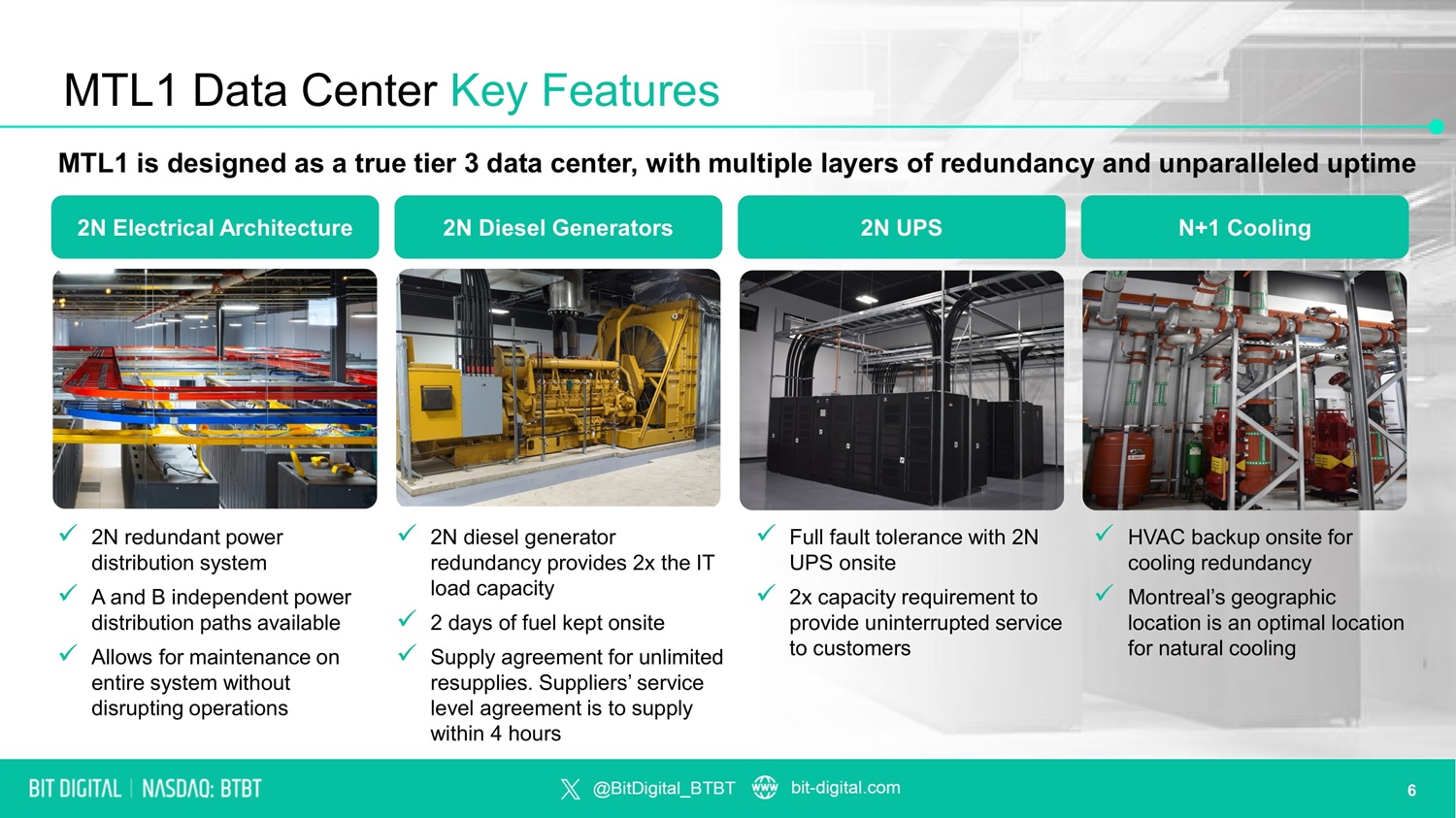

MTL1 Data Center Key Features x 2N diesel generator redundancy provides 2x the IT load capacity x 2 days of fuel kept onsite x Supply agreement for unlimited resupplies. Suppliers’ service level agreement is to supply within 4 hours x HVAC backup onsite for cooling redundancy x Montreal’s geographic location is an optimal location for natural cooling x 2N redundant power distribution system x A and B independent power distribution paths available x Allows for maintenance on entire system without disrupting operations x Full fault tolerance with 2N UPS onsite x 2x capacity requirement to provide uninterrupted service to customers MTL1 is designed as a true tier 3 data center, with multiple layers of redundancy and unparalleled uptime 2N Electrical Architecture 2N Diesel Generators 2N UPS N+1 Cooling 6

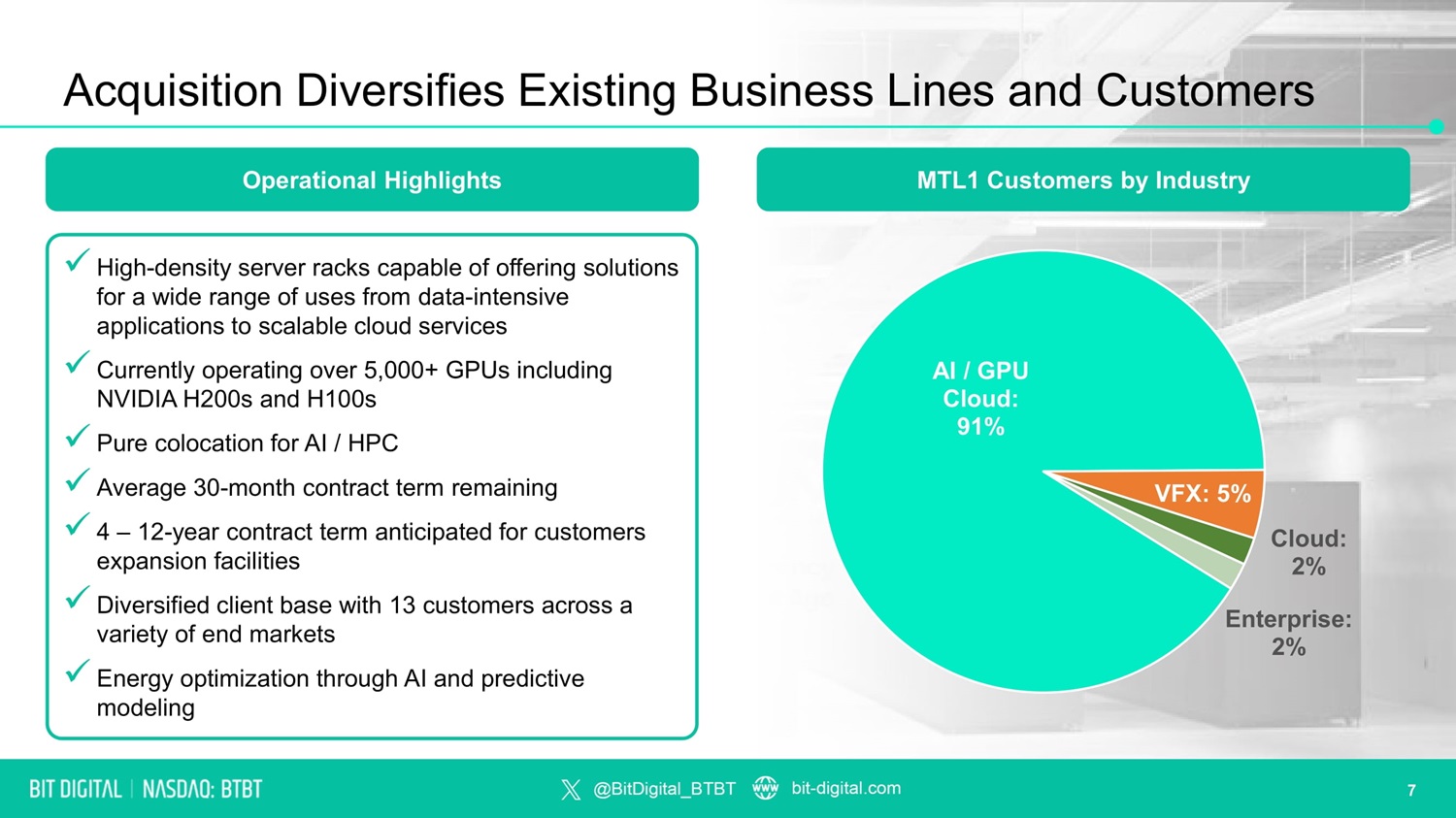

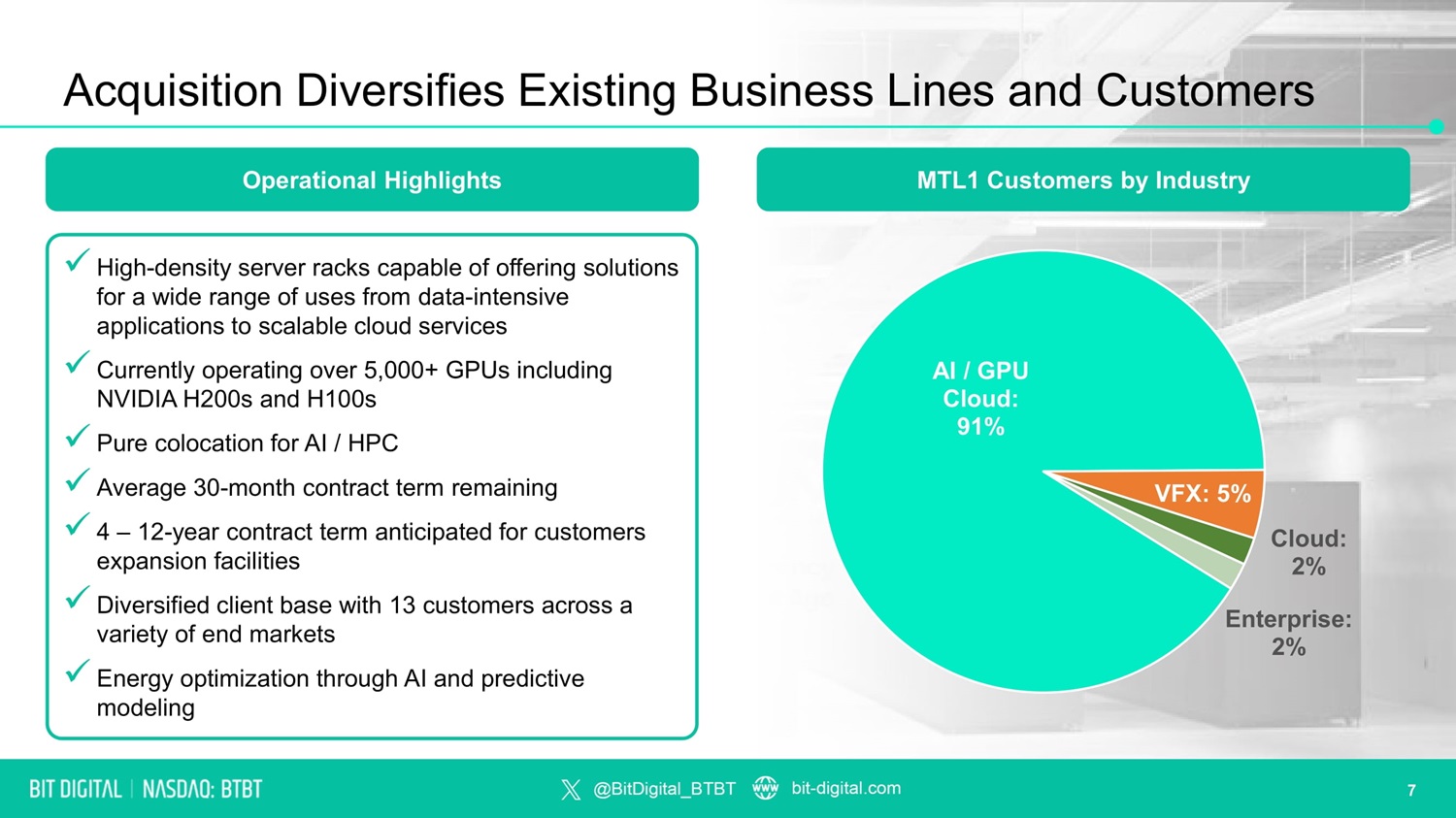

Acquisition Diversifies Existing Business Lines and Customers MTL1 Customers by Industry AI / GPU Cloud: 91% VFX: 5% Cloud: 2% Enterprise: 2% Operational Highlights x High - density server racks capable of offering solutions for a wide range of uses from data - intensive applications to scalable cloud services x Currently operating over 5,000+ GPUs including NVIDIA H200s and H100s x Pure colocation for AI / HPC x Average 30 - month contract term remaining x 4 – 12 - year contract term anticipated for customers expansion facilities x Diversified client base with 13 customers across a variety of end markets x Energy optimization through AI and predictive modeling 7

Customer Contract Term 4 – 12 years 2 – 5 years Annual Revenue per MW $2 million 1 dependent on location $14 – 19 million 2 Gross Margins 70 – 80% 65 – 75% Capex per MW ~$8.0 million $26 – 30 million 3 Financing Equity and Debt Equity and Debt Illustrative Economics Colocation & On Demand Computing ($ in USD) 1. Inclusive of energy expense 2. Assumes $2.00 - $2.75 per GPU hour for illustrative purposes 3. Assumes GPU capacity is 100% owned AI/HPC Colocation GPU - as - a - Service Enterprises, GPU compute providers Well funded startups, Enterprises The Enovum acquisition unlocks capital allocation optionality across our GPU - as - a - service and AI/HPC businesses, while maximizing growth potential and generating synergies 8

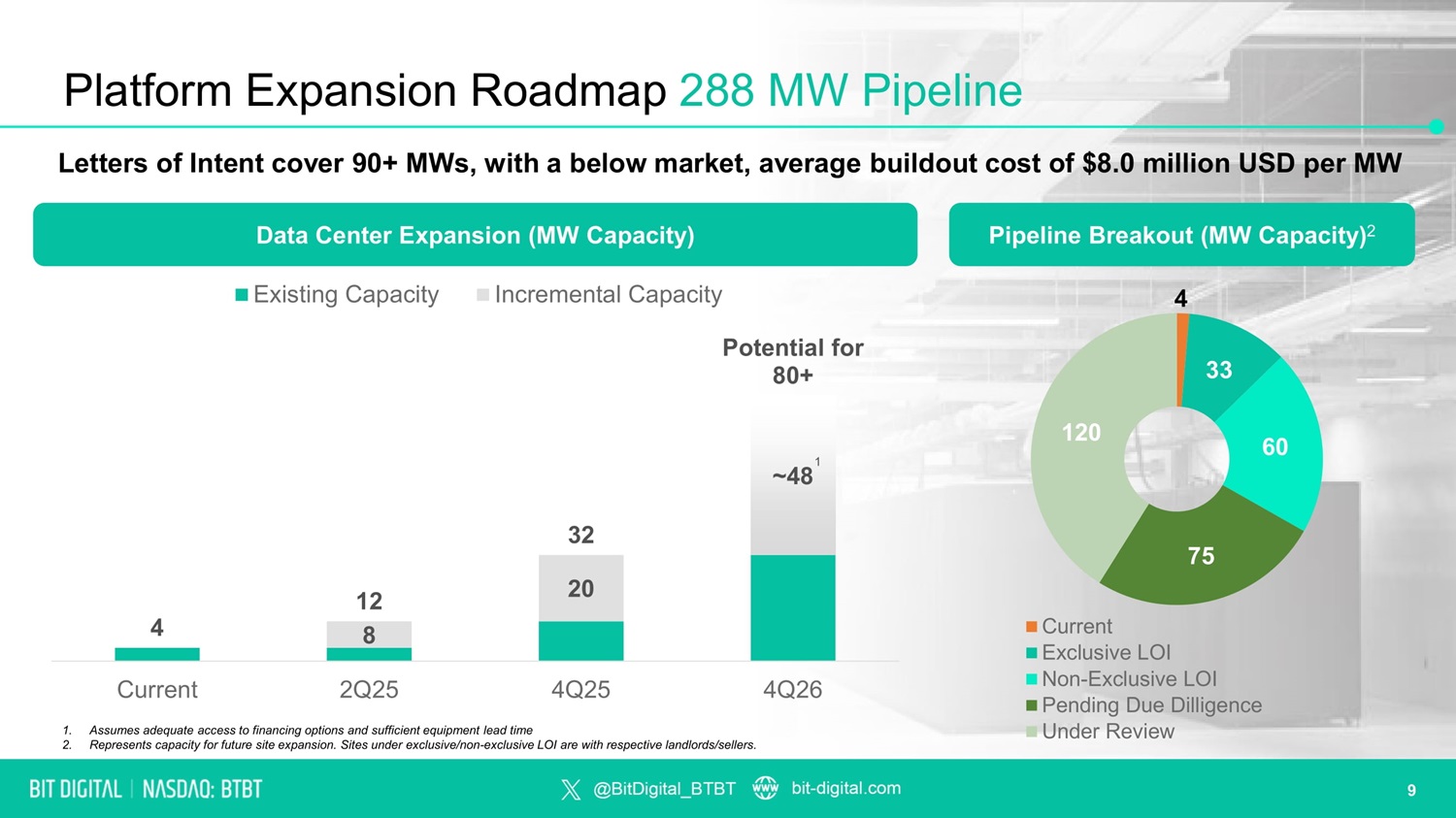

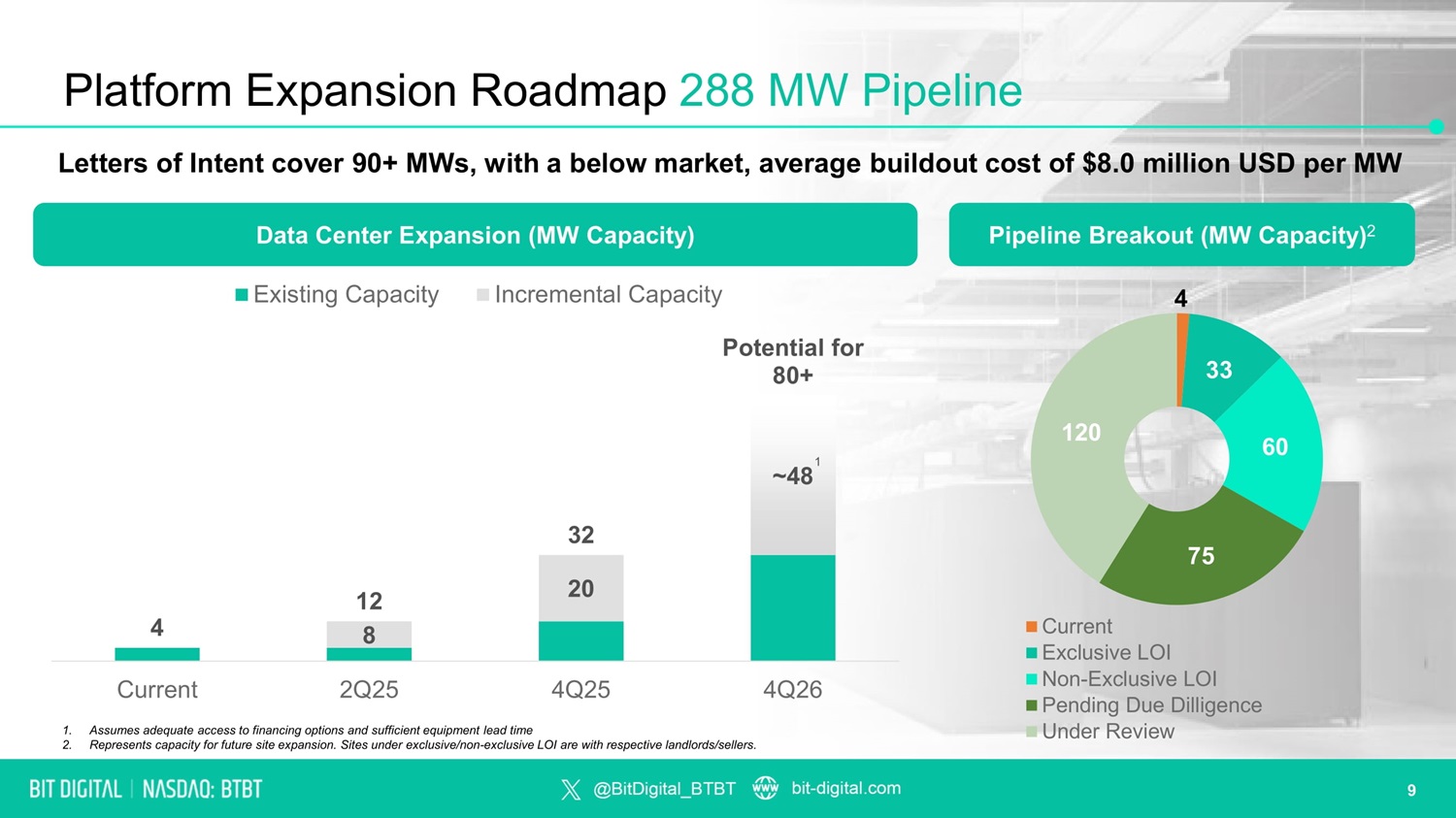

4 33 60 75 120 Current Exclusive LOI Non - Exclusive LOI Pending Due Dilligence Under Review 8 20 ~48 4 12 32 Potential for 80+ 4Q26 Existing Capacity Incremental Capacity Platform Expansion Roadmap 288 MW Pipeline Letters of Intent cover 90+ MWs, with a below market, average buildout cost of $8.0 million USD per MW Data Center Expansion (MW Capacity) Pipeline Breakout (MW Capacity) 2 9 Current 2Q25 4Q25 1. Assumes adequate access to financing options and sufficient equipment lead time 2. Represents capacity for future site expansion. Sites under exclusive/non - exclusive LOI are with respective landlords/sellers. 1

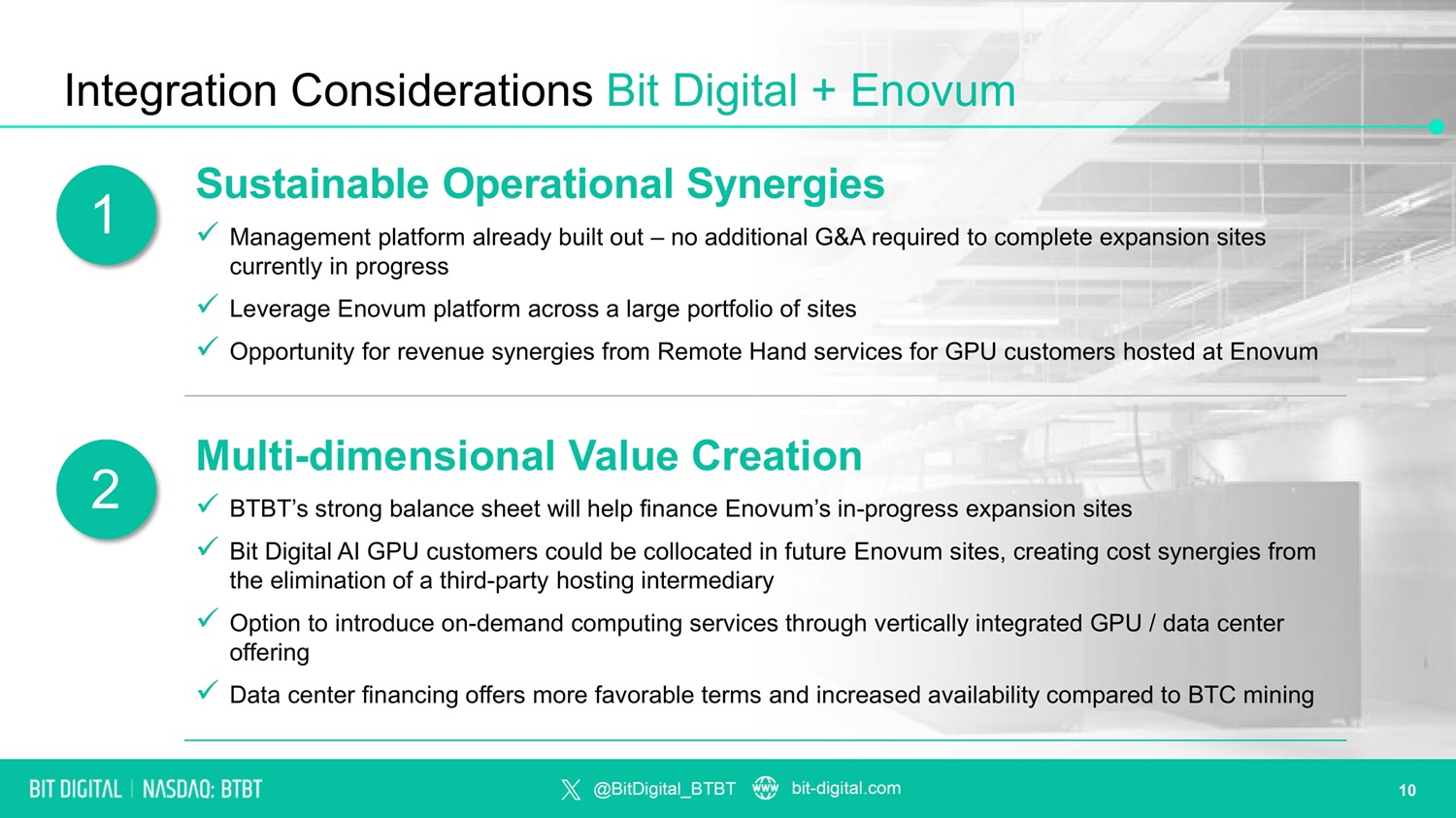

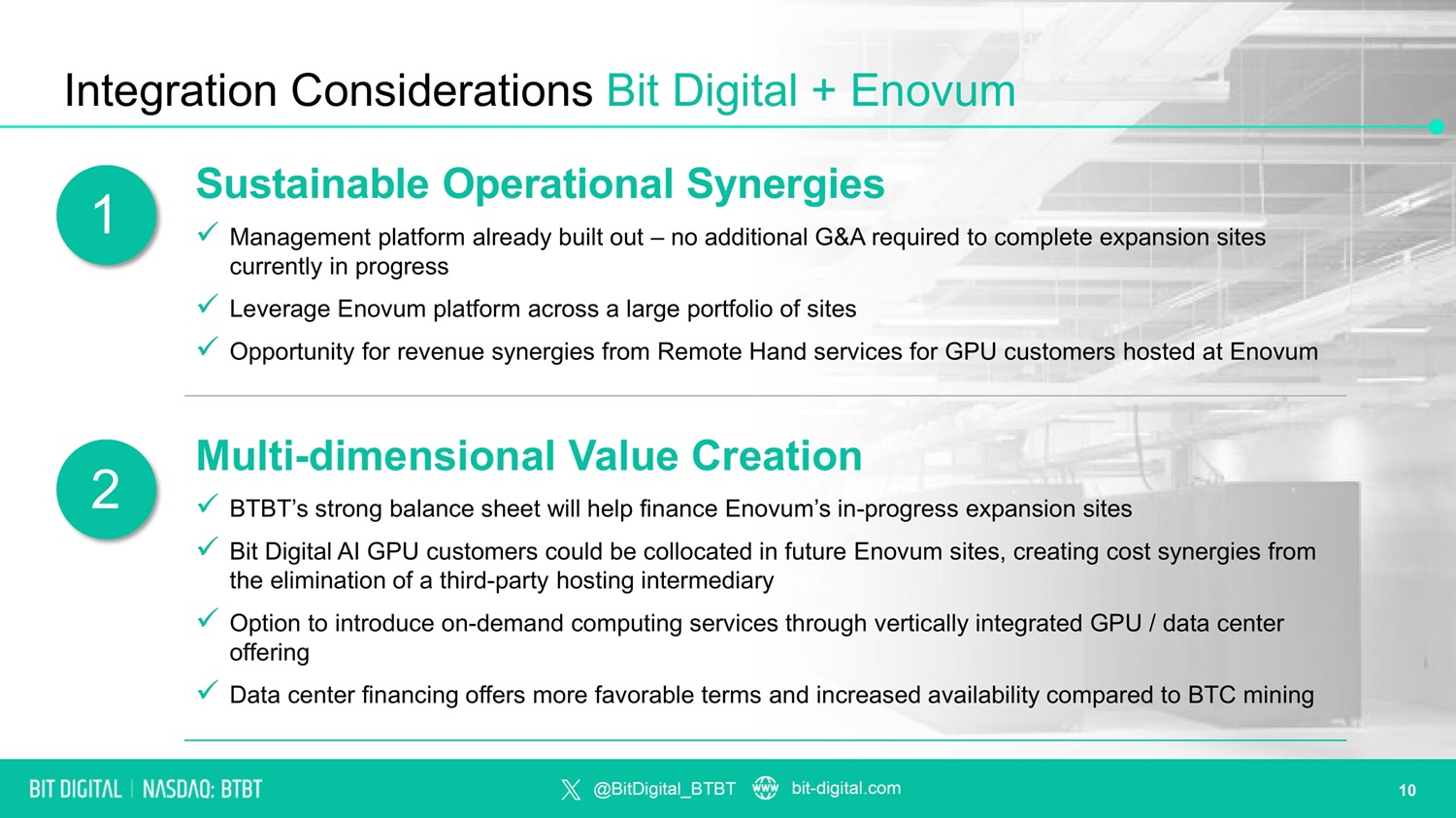

Integration Considerations Bit Digital + Enovum Sustainable Operational Synergies x Management platform already built out – no additional G&A required to complete expansion sites currently in progress x Leverage Enovum platform across a large portfolio of sites x Opportunity for revenue synergies from Remote Hand services for GPU customers hosted at Enovum Multi - dimensional Value Creation x BTBT’s strong balance sheet will help finance Enovum’s in - progress expansion sites x Bit Digital AI GPU customers could be collocated in future Enovum sites, creating cost synergies from the elimination of a third - party hosting intermediary x Option to introduce on - demand computing services through vertically integrated GPU / data center offering x Data center financing offers more favorable terms and increased availability compared to BTC mining 1 2 10

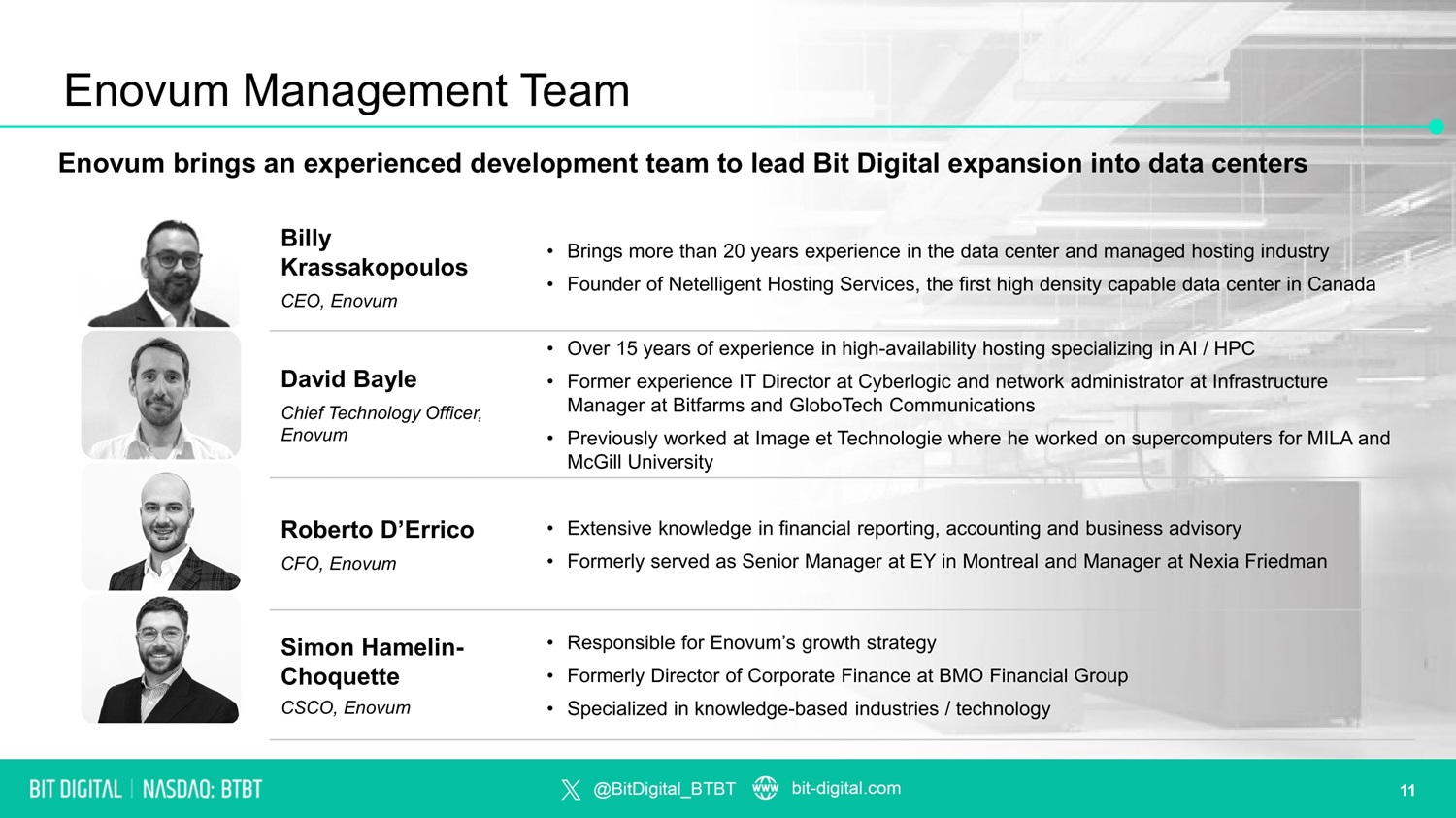

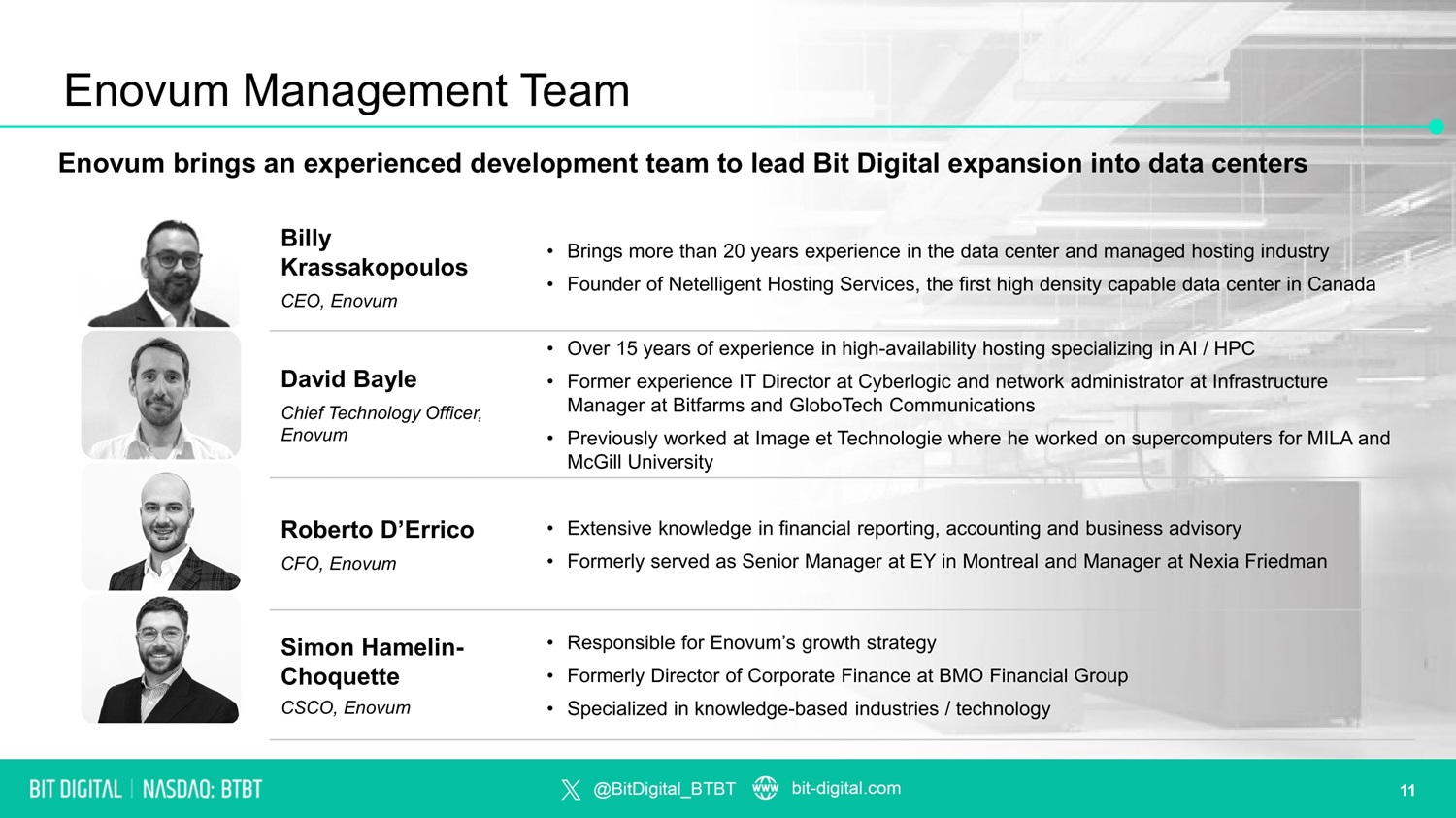

Enovum Management Team • Brings more than 20 years experience in the data center and managed hosting industry • Founder of Netelligent Hosting Services, the first high density capable data center in Canada Billy Krassakopoulos CEO, Enovum • Over 15 years of experience in high - availability hosting specializing in AI / HPC • Former experience IT Director at Cyberlogic and network administrator at Infrastructure Manager at Bitfarms and GloboTech Communications • Previously worked at Image et Technologie where he worked on supercomputers for MILA and McGill University David Bayle Chief Technology Officer, Enovum • Extensive knowledge in financial reporting, accounting and business advisory • Formerly served as Senior Manager at EY in Montreal and Manager at Nexia Friedman Roberto D’Errico CFO, Enovum • Responsible for Enovum’s growth strategy • Formerly Director of Corporate Finance at BMO Financial Group • Specialized in knowledge - based industries / technology Simon Hamelin - Choquette CSCO, Enovum Enovum brings an experienced development team to lead Bit Digital expansion into data centers 11

Expansion Strategies The Enovum team’s experience and unique market opportunity provide Bit Digital with a robust platform for significant expansion and growth Development Pipeline 90+ MW under exclusive or non - exclusive letters of intent with significant near - term actionability Target Criteria Actively targeting sub 20 MW sites with partial infrastructure in place and proximity to metro areas to reduce per MW buildout cost and allow for high speed to market “Modular” Build Strategy Allows for capital flexibility and diversification Sustainability Expansion sites are majority sustainable energy with special consideration paid to sites with existing heat recycling capabilities to garner government support Lease/Purchase Structure Lease agreements and outright purchase agreements are being negotiated in parallel for all expansion sites Customer Demand Growing demand from new and existing customers for HPC colocation services 12

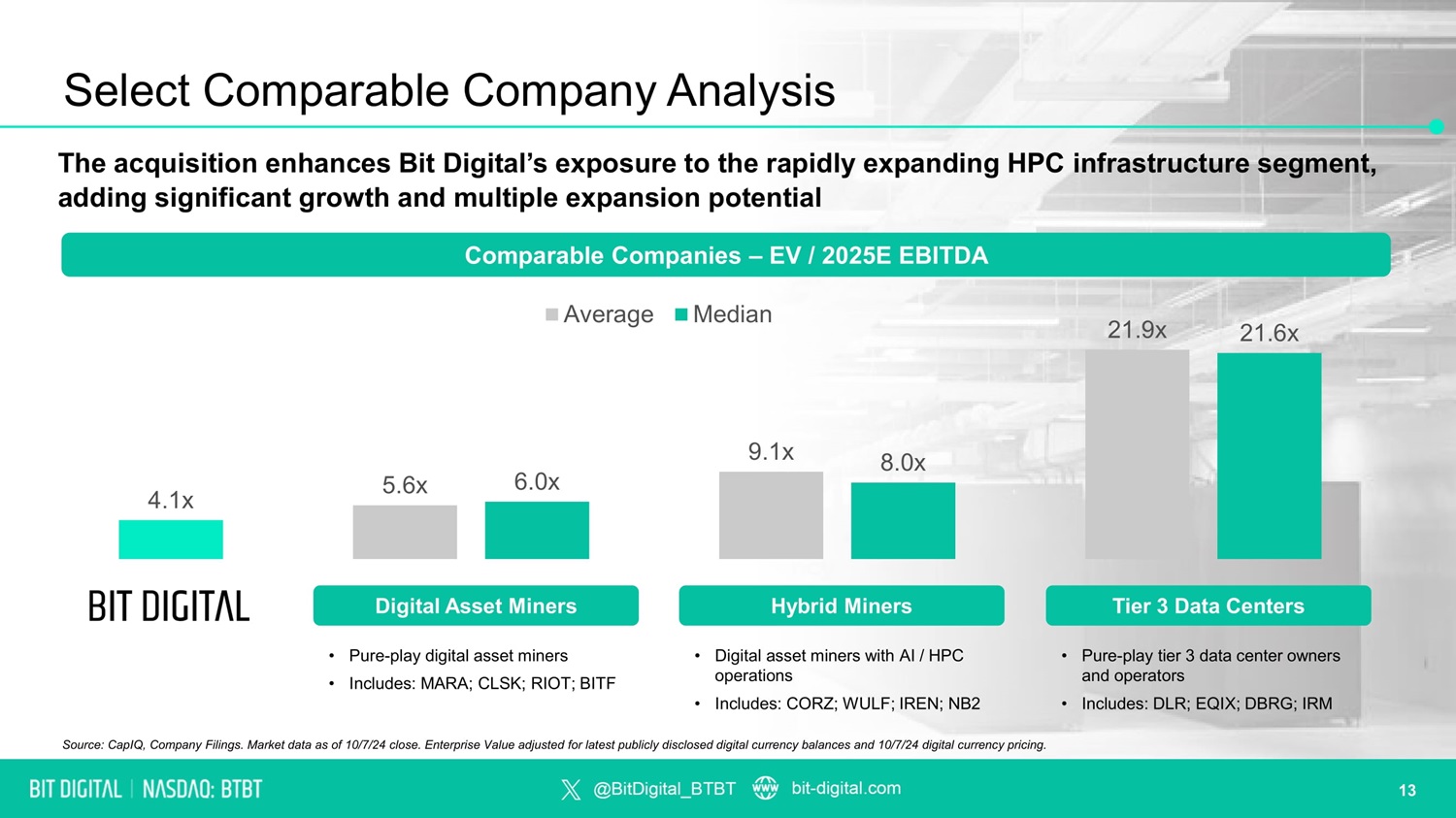

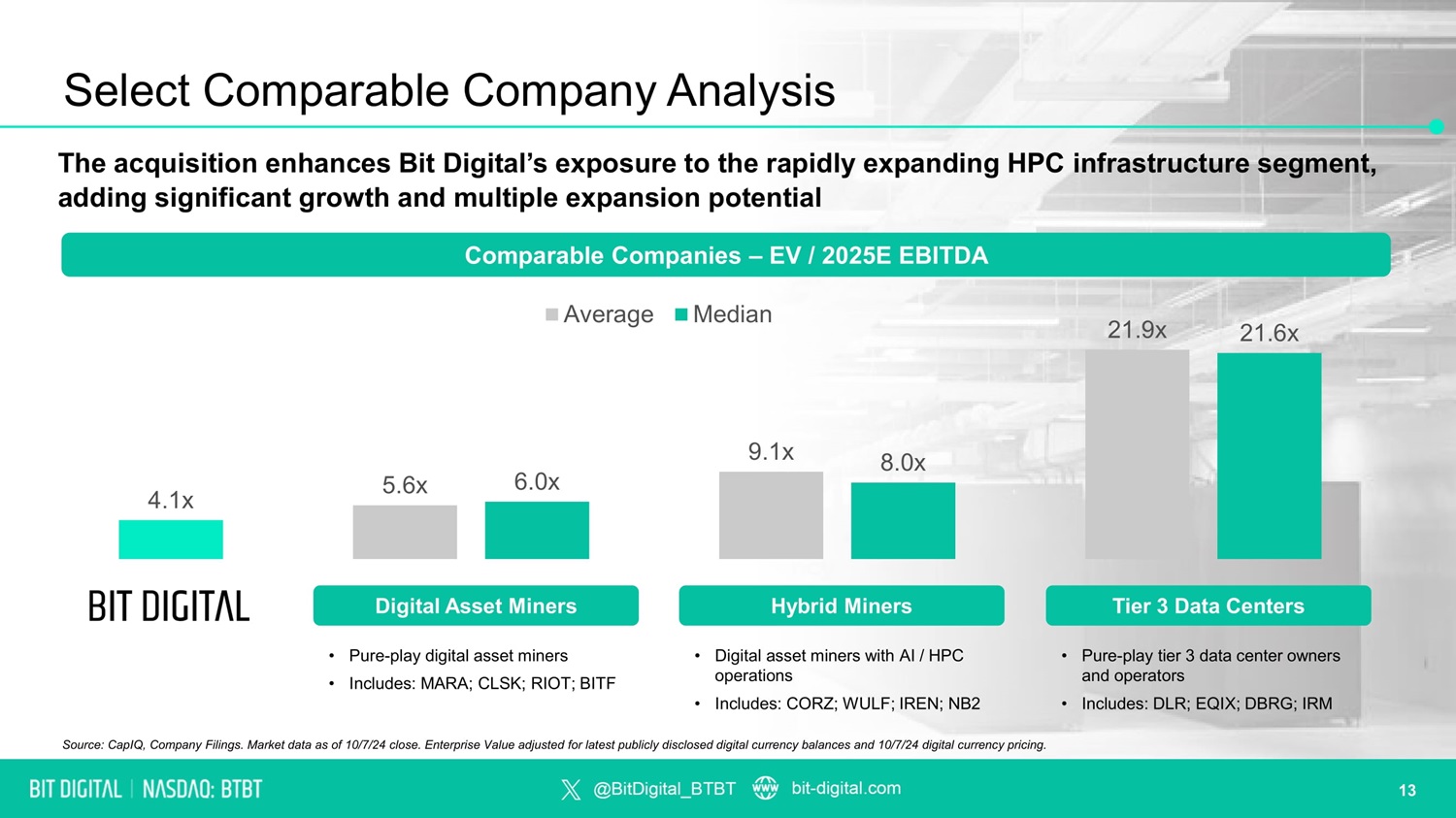

Select Comparable Company Analysis The acquisition enhances Bit Digital’s exposure to the rapidly expanding HPC infrastructure segment, adding significant growth and multiple expansion potential • Pure - play digital asset miners • Includes: MARA; CLSK; RIOT; BITF Digital Asset Miners • Digital asset miners with AI / HPC operations • Includes: CORZ; WULF; IREN; NB2 Hybrid Miners • Pure - play tier 3 data center owners and operators • Includes: DLR; EQIX; DBRG; IRM Tier 3 Data Centers Source: CapIQ, Company Filings. Market data as of 10/7/24 close. Enterprise Value adjusted for latest publicly disclosed digital currency balances and 10/7/24 digital currency pricing. 5.6x 9.1x 21.9x 4.1x 6.0x 8.0x 21.6x Comparable Companies – EV / 2025E EBITDA Average Median 13

31 Hudson Yards, Floor 11 New York, NY 10001 +1 212 463 5121 IR@bit - digital.com