- CNR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

DEF 14A Filing

Core Natural Resources (CNR) DEF 14ADefinitive proxy

Filed: 27 Mar 19, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

☑ Filed by the Registrant

| ☐ Filed by a Party other than the Registrant

|

Check the appropriate box: | ||

| ☐ |

Preliminary Proxy Statement | |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to ss.240.14a-12 | |

CONSOL ENERGY INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

☑

| No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) Title of each class of securities to which transaction applies:

| ||

(2) Aggregate number of securities to which transaction applies:

| ||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||

(4) Proposed maximum aggregate value of transaction:

| ||

(5) Total fee paid:

| ||

☐

| Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) Amount Previously Paid:

| ||

(2) Form, Schedule or Registration Statement No.:

| ||

(3) Filing Party:

| ||

(4) Date Filed:

| ||

ANNUAL MEETING OF STOCKHOLDERS — MAY 8, 2019

|

1000 CONSOL Energy Drive, Suite 100

Canonsburg, Pennsylvania 15317

Telephone (724)416-8300

Dear Fellow Stockholder:

On behalf of the entire Board of Directors of CONSOL Energy Inc. (CEIX), we invite you to attend CEIX’s second Annual Meeting of Stockholders. The Annual Meeting will be held on May 8, 2019, at 8:00 a.m. Eastern Time, at the Hyatt Regency Pittsburgh International Airport, Earhart Room (CD), 1111 Airport Boulevard, Pittsburgh, Pennsylvania 15231.

You will be asked to vote on several items at the Annual Meeting, including the election of our Class II directors, ratification of the appointment of our independent registered public accounting firm, and advisory approval of our 2018 executive compensation program. Detailed information about the director nominees, including their specific experience and qualifications, begins on page 10 of the proxy statement. Information about our independent registered public accounting firm begins on page 13 of the proxy statement. Our Compensation Discussion and Analysis, which explains our 2018 compensation decisions, begins on page 20 of the proxy statement. We encourage you to read the proxy statement carefully for more information.

During our first full calendar year as an independent publicly traded coal company, we adopted a new mission statement: To improve lives and communities by safely and compliantly producing affordable, reliable energy and profitably growing through innovative technology and perseverance. We achieved our key strategic and financial priorities of improving our balance sheet, returning capital to our stockholders, and improving our rate of returns through our disciplined capital allocation process. To do so, we capitalized on rising seaborne coal markets to secure a large multi-year export contract for our Pennsylvania Mining Complex (PAMC) as well as atake-or-pay contract at our CONSOL Marine Terminal (CMT). As domestic markets improved later in the year, we opportunistically secured several longer-term contracts with our keytop-performing power plant customers in the Northern Appalachian rail market. Our two operating assets, the PAMC and the CMT, both had record-breaking 2018 performance. The PAMC produced 27.6 million tons of coal, representing a new record and its third consecutive year of production growth, and the CMT achieved a new annual revenue record. We also made significant improvements on the safety front. On a year-over-year basis, we reduced our total recordable incident rate at the PAMC by 13.5% and reduced our total number of exceptions by 12.1%. The CMT continued its outstanding safety performance, with zero incidents and

a 100% compliance record during 2018. Overall, we generated $413.5 million in net cash provided by operations and $248 million in free cash flow net to CEIX stockholders*,de-levered the balance sheet by 0.7x, and allocated capital to a basket of higher-return areas to help boost ouryear-end 2018 return on capital employed to 15%.

Looking forward, our strategic priorities are very clear. We are focused on: (a) generating free cash flow, which will be used to reduce debt and increase equity value, (b) selectively pursuing growth opportunities that diversify our product mix and market reach and increase our value per share, (c) improving stockholder returns by being rate of return-driven in our capital allocation process, (d) returning capital to stockholders through dividends and buybacks and (e) embracing technology and other productivity-enhancing techniques to safely and compliantly increase our product margins. Our goal is to deliver strong and consistent financial performance for our stockholders throughout the commodity cycles via return-focused capital allocation and the safe, compliant operation of a well-capitalized portfolio of assets.

We are making our proxy materials for the Annual Meeting available to you via the Internet. We hope that this offers you convenience while allowing us to reduce the number of copies that we print.

Your vote is important to us. We hope that you will participate in the Annual Meeting, either by attending and voting in person or by voting as promptly as possible through the Internet, by telephone or by completing and mailing a proxy card (following the process as further described in the proxy statement). Detailed instructions on “How to Vote” begin on page 7.

If you plan to attend the Annual Meeting in person, please bring a valid government-issued photo identification. If your shares are held in the name of a bank, broker or other nominee, please also bring with you a letter (and a legal proxy if you wish to vote your shares) from your bank, broker or nominee confirming your ownership as of the record date.

Thank you for your investment in CEIX, and we hope you will be able to join us at this year’s Annual Meeting.

| * | See reconciliation of free cash flow net to CEIX stockholders(non-GAAP) to net cash provided by operations (GAAP) in Appendix A of the proxy statement. |

Sincerely,

| William P. Powell Chair of the Board

|

| James A. Brock President & CEO

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

DATE:

|

|

May 8, 2019

|

| |||||

TIME:

|

8:00 a.m. Eastern Time

| |||||||

PLACE:

|

Hyatt Regency Pittsburgh International Airport Earhart Room (CD) 1111 Airport Boulevard Pittsburgh, Pennsylvania 15231

| |||||||

AGENDA: |

1.

|

To elect two Class II directors for a three-year term; | ||||||

2. | To ratify the appointment of Ernst & Young LLP as CEIX’s independent registered public accounting firm for the fiscal year ending December 31, 2019;

| |||||||

3. | To approve, on an advisory basis, the compensation paid to our named executive officers in 2018, as reported in this Proxy Statement; and

| |||||||

4. | To transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.

| |||||||

RECORD DATE: |

By resolution of the Board of Directors, we have fixed the close of business on March 11, 2019 as the record date for determining the stockholders of CEIX entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

| |||||||

INFORMATION ABOUT THE MEETING: We are delivering our proxy materials to stockholders via the Internet. On March 27, 2019, we mailed a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to holders of record as of the record date, and posted our proxy materials on the website referenced in the Internet Notice. The Internet Notice explains how to access the proxy materials and our 2018 Annual Report, free of charge, through the website described in the Internet Notice. The Internet Notice and website also provide information regarding how you may request to receive proxy materials in printed form by mail or electronically bye-mail for this meeting and on an ongoing basis. You may vote in person or through any of the acceptable means described in the Proxy Statement. Instructions on how to vote begin on page 7.

March 27, 2019

Martha A. Wiegand General Counsel and Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

of Stockholders to be Held on May 8, 2019:

The Proxy Statement, 2018 Annual Report, Notice of Annual Meeting of Stockholders and related materials are available free of charge atwww.edocumentview.com/CEIX or may be obtained by contacting the Investor Relations department at the address and phone number on page 6 of the Proxy Statement.

|

– 2019 Proxy Statement – 2019 Proxy Statement |

|

This Proxy Summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. Please read the entire Proxy Statement carefully before voting. On March 27, 2019, we mailed the Internet Notice to holders of record as of the record date, and posted our proxy materials on the website in the Internet Notice.

2019 ANNUAL MEETING OF STOCKHOLDERS

DATE AND TIME: May 8, 2019 8:00 a.m. Eastern Time |

|

PLACE: Hyatt Regency Pittsburgh International Airport Earhart Room (CD) 1111 Airport Boulevard Pittsburgh, Pennsylvania 15231

|

| RECORD DATE: March 11, 2019 |

PROPOSALS REQUIRING YOUR VOTE

Stockholders are being asked to vote on the following proposals at the Annual Meeting. Your vote is very important to us. Please cast your vote immediately on all of the proposals to ensure that your shares are represented.

Item

| Proposal

| Board Recommendation | Page

| |||

1 |

Election of Class II Directors |

FOREACH NOMINEE | 9

| |||

The election of two Class II director nominees, each to be elected for a three-year term ending in 2022. | ||||||

2 |

Ratification of Appointment of Ernst & Young LLP |

FOR | 13

| |||

The Audit Committee appointed Ernst & Young LLP as CEIX’s independent registered public accounting firm for fiscal year 2019. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s appointment of the independent registered public accounting firm. | ||||||

3 |

Advisory Approval of 2018 Named Executive Officers’ Compensation Stockholders are being asked to approve, on an advisory basis, the compensation paid to CEIX’s named executive officers in 2018. CEIX’s executive compensation programs are designed to create a direct linkage between stockholder interests and management with incentives specifically tailored to the achievement of financial, operational and stock performance goals. |

FOR | 16

|

CURRENT BOARD OF DIRECTORS

The following table provides summary information about our current Board of Directors as of March 11, 2019. Both of our Class II directors, whose terms expire at the Annual Meeting, are nominees for election at the Annual Meeting, each for a three-year term ending in 2022.

Name | Age | Director Since | Occupation

| Class/ Term Expiring | Independent | Current Committee Memberships | ||||||||||

William P. Powell†

|

|

63

|

|

|

2017

|

|

Managing Partner of 535 Partners LLC

|

Class III 2020

|

Yes |

• AC • CC • HSE

| ||||||

Sophie Bergeron |

|

41 |

|

|

2019 |

|

Mine General Manager, Éléonore Mine of Goldcorp Inc. |

Class I 2021 |

Yes |

• NCG • HSE†† | ||||||

James A. Brock |

|

62 |

|

|

2017 |

|

President and Chief Executive Officer of CEIX |

Class I 2021 |

No |

• HSE | ||||||

John T. Mills |

|

71 |

|

|

2017 |

|

Former Chief Financial Officer of Marathon Oil Corporation |

Class III 2020 |

Yes |

• AC†† • CC • HSE | ||||||

Joseph P. Platt |

|

71 |

|

|

2017 |

|

General Partner of Thorn Partners LP |

Class II 2019 |

Yes |

• CC†† • NCG • HSE | ||||||

Edwin S. Roberson |

|

73 |

|

|

2017 |

|

Former Chief Executive Officer of Christ Community Health Services |

Class II 2019 |

Yes |

• AC • NCG†† • HSE | ||||||

AC | Audit Committee | |

CC | Compensation Committee | |

HSE | Health, Safety and Environmental Committee |

NCG | Nominating and Corporate Governance Committee | |

† | Chair of the Board | |

†† | Committee Chair |

– 2019 Proxy Statement – 2019 Proxy Statement | 1 |

BUSINESS/STRATEGIC 2018 HIGHLIGHTS

| • | The Right Team. We have an experienced and focused senior executive team and Board of Directors that can navigate and capitalize on the future opportunities in the mining space. |

| • | Strong Execution. |

| • | Remained committed to achievingbest-in-class safety and compliance results. |

| • | Achieved a safety incident rate 30% lower than the Mine Safety and Health Administration (MSHA) national average, and a Significant & Substantial (S&S) Citation Rate 62% lower than the MSHA national average. |

| • | As of February, 2019, we were greater than 95% contracted for 2019, 53% contracted for 2020 and 28% contracted for 2021, assuming an annual production rate of 27 million tons going forward. |

| • | With our excess cash, we repaid $56 million of debt in 2018, bought back $26 million of CEIX common stock and $3 million of common units of CONSOL Coal Resources LP, and still finished the fiscal year 2018 with approximately $236 million in cash on hand, net of $29 million in restricted cash. Also with excess cash from 2018, we prepaid approximately $110 million of debt under our Term Loan B Facility in the first quarter of 2019 pursuant to the terms of the related credit agreement. |

| • | Coal average revenue per ton sold increased by 8% to $49.28 per ton and coal average cash margins per ton sold increased by 21% to $19.99 per ton as a result of strong cost controls and rising coal price realizations.* |

| • | Record Output. |

| • | Produced a record level of coal at 27.6 million tons, the highest level in the Pennsylvania Mining Complex history. |

| • | Bottom Line.Generated net cash provided by operations of $413.5 million and $269.9 million of free cash flow.** |

| * | See reconciliation of average cash margins per ton sold(non-GAAP) to average revenue per ton sold (GAAP) in Appendix A to this Proxy Statement. |

| ** | See reconciliation of free cash flow(non-GAAP) to net cash provided by operations (GAAP) in Appendix A to this Proxy Statement. |

COMPENSATION HIGHLIGHTS

Independent Compensation Consultant | Continued use by our Compensation Committee of an independent compensation consultant that reports directly to the Compensation Committee. | |

| Governance Practices | Continued adherence to good governance practices, including but not limited to anti-hedging, recoupment, compensation risk assessment, and stock ownership/holding and equity grant practices. | |

| Say on Pay Results | Over 95% of the shares voted at our 2018 Annual Meeting of Stockholders approved our executive compensation program. | |

Compensation Program Design | Designed an overall compensation program with 73.8% of compensation for named executive officerscontingent on performance goals, reinforcing ourpay-for-performance culture, which aligns risk-taking with sustainability and the long-term financial health of our company. | |

| STIC Annual Performance | Exceeded financial and operational target performance goals by 200% under 2018 annual plan, resulting in the payment of cash incentives to named executive officers. | |

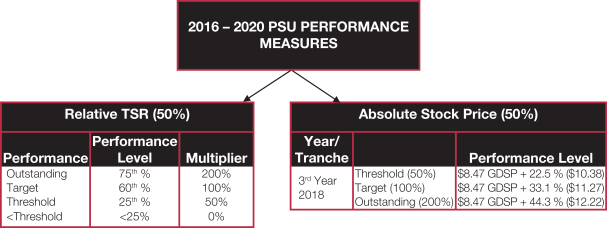

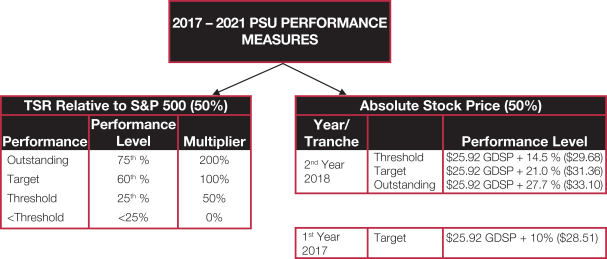

LTIC Performance-Based Restricted Stock Unit Awards “PSUs”) | Exceeded target performance goals for 2018 under three of our LTIC programs, resulting in the vesting of PSUs granted to the named executive officers under each LTIC program. | |

Discretionary Company Contribution to 401(k) Plan | Outstanding company performance during 2018 resulted in discretionary profit-sharing contribution to 401(k) savings plan for all participants including our named executive officers. | |

| Pay Ratio Results | Determined the ratio of the total annual compensation of our Chief Executive Officer (sometimes referred to as “CEO”), as compared to the total annual compensation of our median employee to be 36.9 to 1. | |

Board Size and Director Compensation | Maintained Board size andnon-employee director compensation at current levels with no increases. |

| 2 |  – 2019 Proxy Statement – 2019 Proxy Statement |

Proxy Summary

CORPORATE GOVERNANCE HIGHLIGHTS

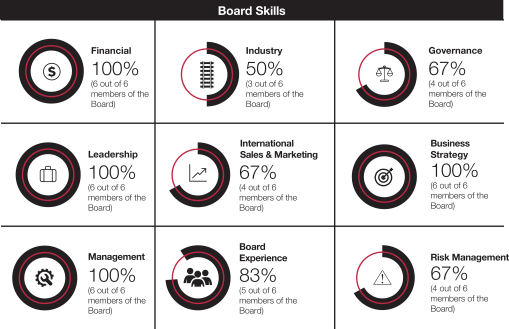

Our Board and management are committed to strong corporate governance, which promotes the long-term interests of stockholders, strengthens Board and management accountability and helps build public trust in our new public company. This Proxy Statement describes our governance framework, which includes the following highlights:

| • | Independent Directors.A majority of our directors must be independent. Currently, all of our directors other than our President and Chief Executive Officer, are independent, and our Audit, Nominating and Corporate Governance, and Compensation Committees consist exclusively of independent directors. |

| • | Majority Voting Requirement.Our Amended and Restated Bylaws (the “bylaws”) require that any nominee for election to the Board who does not receive a majority of the votes cast in favor of that director’s election to the Board in an uncontested election must tender his or her resignation to the Board. The Nominating and Corporate Governance Committee will make a recommendation on the tendered resignation, and the Board then will accept or reject the offer of resignation within 90 days. |

| • | Phase-Out of Classified Board.Our organizational documents include a plan tophase-out our classified Board structure by 2023. Starting in 2023, all of our directors will be subject to annualre-election to the Board. |

| • | Independent Chair; Lead Director.Currently, our Chair of the Board is independent of management. In addition, in the event that our Chief Executive Officer would also serve as the Chair, our corporate governance guidelines require a Lead Director position with specific responsibilities to ensure independent oversight of management. |

| • | Regular Meetings of Independent Directors.Our independent directors regularly meet in executive sessions with no members of management present. |

| • | Robust Strategy, Risk and Safety Oversight by Board and Committees.Our Board and committees have implemented a robust framework to actively oversee the strategy and risks relating to the operation and management of an independent, publicly traded coal company. In addition, our Board has a strong commitment to the safety of our workers and the environments in which we operate and has formed a separate Board level committee to oversee that value of CEIX. |

| • | Diversity on Board.We believe in diversity and value the benefits diversity can bring to our Board. In 2018, our Board adopted a policy regarding diversity of its members. Effective March 1, 2019, Sophie Bergeron was elected as a Class I director to fill the vacancy resulting from a retiring director. |

| • | Emphasis on Ethics Compliance.We believe strongly in our Code of Business Conduct and Ethics and training and awareness surrounding the CONSOL Ethics Compliance Hotline. As a result, effective January 1, 2019, we updated the Code to include more specificity around the hotline, implemented a training program in which 100% of our salaried workforce participated, and emphasized the importance of Code compliance and the hotline availability in our annual letter to our vendors. It is our policy to comply with all applicable laws and adhere to the highest level of ethical conduct, including anti-bribery laws, such as the U.S. Foreign Corrupt Practices Act (the FCPA) and similar laws in other jurisdictions. In that regard, in 2018 we adopted a Foreign Corrupt Practices Act Policy that has been distributed to all of our employees, directors and officers. In addition to these persons certifying compliance with the policy, we provide training on compliance with the FCPA and our policy.It is important that all of our business activities reflect our commitment to the highest standards of integrity and accountability. |

| • | Stock Ownership and Retention Guidelines.As further described beginning on page 32, our Board has adopted stock ownership and retention guidelines that apply to the Board and our executive officers. |

| • | Proactive Stockholder Outreach.Our management team spends a significant amount of time meeting and speaking to our stockholder base. We have initiated an integrated effort to interact and receive feedback from the proxy teams at our stockholder base to incorporate best governance, compensation, and oversight practices. |

| • | Sustainability. We provide transparency into our operations through the regular publishing of corporate sustainability reports. Through our former parent company, our operations have been covered in an annual Corporate Responsibility Report every year since 2012. Our first stand-alone Corporate Sustainability Report was published in February 2019 and is available on our website. Copies of our Corporate Sustainability Report will be available at the Annual Meeting. |

– 2019 Proxy Statement – 2019 Proxy Statement | 3 |

Proxy Summary

Proxy Summary

| • | Human Rights Policy. In February 2019, we adopted a human rights policy. This policy reinforces our commitment and responsibility to respect all human rights, including those of our employees, suppliers, vendors, subcontractors and other partners, and individuals in communities in which we operate. Our policy addresses promoting health and safety, eliminating compulsory labor and human trafficking, abolishing child labor, eliminating harassment and unlawful discrimination in the workplace and providing competitive compensation. |

| • | Strong Commitment to Robust Corporate Governance Practices.As a new public company, our Board is continuing to carefully work through and consider additional corporate governance practices to ensure that we have a strong corporate governance platform tailored to our company. |

LEARN MORE ABOUT OUR COMPANY

You can learn more about our company by visiting our website,www.consolenergy.com.

| 4 |  – 2019 Proxy Statement – 2019 Proxy Statement |

INFORMATION ABOUT THE ANNUAL MEETING

|

CONSOL Energy Inc.

1000 CONSOL Energy Drive, Suite 100

Canonsburg, Pennsylvania 15317

Telephone (724)416-8300

GENERAL:Proxies are being solicited by the Board to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 8, 2019, at 8:00 a.m., Eastern Time, at the Hyatt Regency Pittsburgh International Airport, Earhart Room (CD), 1111 Airport Boulevard, Pittsburgh, Pennsylvania 15231.

The specific proposals to be considered and voted upon at the Annual Meeting are summarized in the Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

PROPOSALS, BOARD RECOMMENDATION AND VOTE REQUIRED: Stockholders are being asked to vote on the following proposals at the Annual Meeting. The table below also outlines the Board’s recommendation on how to vote for each proposal and the vote required with respect to each proposal.

Item

| Proposal

|

Board

| Vote Required

| ||||||

1 |

Election of Class II Directors Election of two Class II director nominees, each for a three-year term ending in 2022. |

FOR EACH |

Plurality of the votes cast. Under this plurality vote standard, the director nominees who receive the highest number of “for” votes cast are elected as directors. Under our bylaws, if a director nominee does not receive a majority of the votes casts in favor of his or her election, then the director must tender his or her resignation to the Board. | ||||||

2 |

Ratification of Appointment of Ernst & Young LLP The Audit Committee appointed Ernst & Young LLP as CEIX’s independent registered public accounting firm for fiscal year 2019. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s appointment of the independent registered public accounting firm. |

FOR |

Affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote on the matter. | ||||||

3 |

Advisory Approval of 2018 Named Executive Officers’ Compensation Stockholders are being asked to approve, on an advisory basis, the compensation paid to CEIX’s named executive officers in 2018. CEIX’s executive compensation programs are designed to create a direct linkage between stockholder interests and management with incentives specifically tailored to the achievement of financial, operational and stock performance goals.

|

FOR |

Affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote on the matter. | ||||||

In tabulating the voting result for any particular proposal, votes that are withheld or shares that constitute brokernon-votes (described below) are not considered entitled to vote on that proposal and have no effect on the outcome. Abstentions have the same effect as votes against the matter, except in the case of Proposal No. 1, where abstentions would not have an effect on the outcome.

– 2019 Proxy Statement – 2019 Proxy Statement | 5 |

INFORMATION ABOUT THE ANNUAL MEETING

PROXY MATERIALS AND INFORMATION ABOUT THE MEETING:We mailed to all stockholders of record entitled to vote at the Annual Meeting the Internet Notice on or about March 27, 2019.

We are utilizing a Securities and Exchange Commission (“SEC”) rule that allows companies to furnish their proxy materials via the Internet rather than in paper form. This rule allows a company to send some or all of its stockholders the Internet Notice regarding Internet availability of proxy materials. The Internet Notice contains instructions on how to access the proxy materials over the Internet or how to request a paper copy of proxy materials.

An electronic copy of this Proxy Statement, the 2018 Annual Report and the Notice of Annual Meeting of Stockholders are available atwww.edocumentview.com/CEIX.

Copies of our 2018 Annual Report furnished to our stockholders do not contain copies of exhibits to our Annual Report on Form10-K for the year ended December 31, 2018. You can obtain copies of these exhibits electronically at the website of the SEC atwww.sec.gov or by mail from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. The exhibits are also available as part of theForm 10-K for the year ended December 31, 2018 which is available on CEIX’s corporate website atwww.consolenergy.com. Stockholders may also obtain copies of our Annual Report on Form10-K for the year ended December 31, 2018, or the exhibits thereto, without charge by contacting our Investor Relations department at CONSOL Energy Inc., Investor Relations department, 1000 CONSOL Energy Drive, Suite 100, Canonsburg, Pennsylvania 15317, Telephone (724)416-8300.

RECORD DATE AND QUORUM:The record date with respect to this solicitation is March 11, 2019. All holders of record of CEIX common stock as of the close of business on the record date are entitled to vote at the Annual Meeting and any adjournment or postponement thereof. As of the record date, CEIX had 27,607,517 shares of common stock outstanding. Each share of common stock is entitled to one vote for each matter to be voted on at the Annual Meeting. Stockholders do not have cumulative voting rights. In order to hold the Annual Meeting, a quorum representing the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting must be present in person or represented by proxy.

PROXIES AND VOTING: A proxy is your legal designation of another person to vote the CEIX common shares that you owned as of the record date. The person that you designate to vote your shares is called a “proxy” and when you designate someone to vote your shares in a written document, that document is also called a “proxy” or “proxy card”. The Board has appointed several officers of the company to serve as proxies on the proxy card.

If a proxy is properly executed and is not revoked by the stockholder, the shares it represents will be voted at the Annual Meeting in accordance with the instructions provided by the stockholder. If a proxy card is signed and returned without specifying choices, the shares will be voted in accordance with the recommendations of the Board. Accordingly, if no contrary instructions are given, the proxies named by the Board intend to vote the shares represented by such proxies as follows:

| • | in favor of the election of those persons nominated as set forth in this Proxy Statement to serve as Class II directors of CEIX (Proposal No. 1); |

| • | in favor of the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of CEIX for the fiscal year ending December 31, 2019 (Proposal No. 2); |

| • | in favor of approval, on an advisory basis, of the compensation paid to our named executive officers in 2018 (Proposal No. 3); and |

| • | in accordance with their judgment on any other matters which may properly come before the Annual Meeting. |

The Board does not know of any other business to be brought before the Annual Meeting other than as indicated in the Notice of Annual Meeting of Stockholders.

| 6 |  – 2019 Proxy Statement – 2019 Proxy Statement |

INFORMATION ABOUT THE ANNUAL MEETING

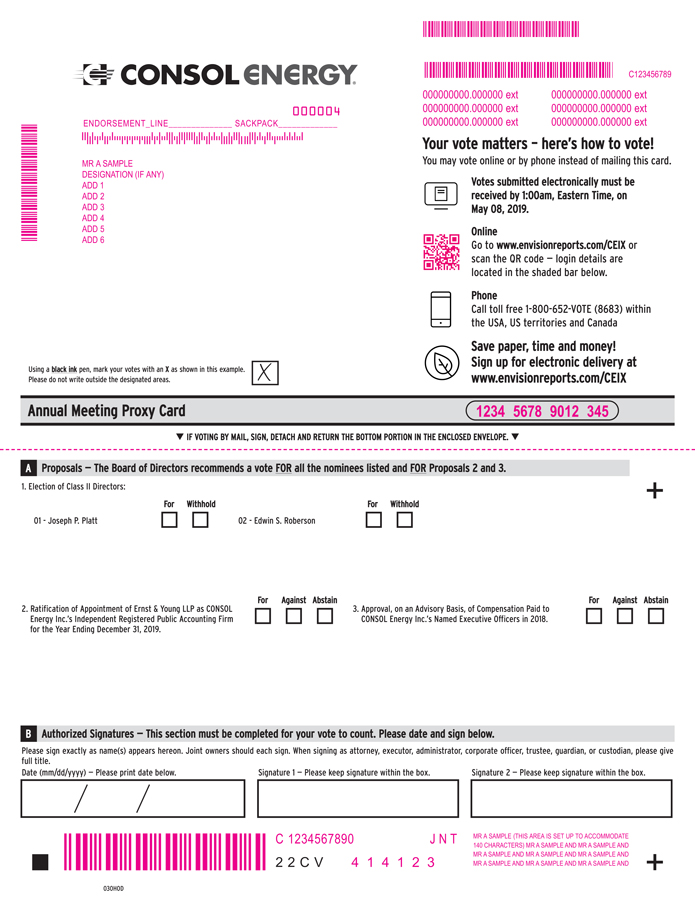

HOW TO VOTE: There are four ways for stockholders of record to vote:

| • | VIA THE INTERNET BY PROXY: Stockholders who have received the Internet Notice by mail may submit proxies over the Internet by following the instructions on the Internet Notice. Stockholders who received a voting instruction form by mail ore-mail from their bank, broker or other nominee may submit proxies over the Internet by following the instructions on the voting instruction form provided by their bank, broker or other nominee. |

| • | VIA TELEPHONE BY PROXY: Registered stockholders of record may submit proxies by telephone by calling1-800-652-8683 and following the instructions. Stockholders must have the15-digit control number that appears on their Internet Notice when voting. Stockholders who have received a voting instruction form by mail ore-mail from their bank, broker or other nominee should check the voting instruction form for telephone voting availability. If available, those stockholders may vote by phone by calling the number specified on the voting instruction form provided by the bank, broker or other nominee. |

| • | VIA MAIL BY PROXY: Stockholders who have received a paper copy of a proxy card or voting instruction form by mail may submit proxies by completing, signing and dating their proxy card or voting instruction form and mailing it in the accompanyingpre-addressed envelope. |

| • | IN PERSON AT ANNUAL MEETING: Stockholders of record may vote in person at the Annual Meeting. |

BENEFICIAL OWNERSHIP AND BROKERNON-VOTES:If you hold shares beneficially in street name, then you must provide your voting instructions to your bank, broker or other nominee. If you do not provide your bank, broker or other nominee with voting instructions, your shares may be treated as “brokernon-votes.”

Generally, brokernon-votes occur on a matter when a bank, broker or other nominee is not permitted to vote on that matter without instructions from the beneficial owner and such instructions are not given. Banks, brokers or other nominees that have not received voting instructions from their clients cannot vote on their clients’ behalf on“non-routine” proposals, such as Proposal Nos. 1 and 3, although they may vote their clients’ shares on “routine matters,” such as Proposal No. 2.

REVOCATION OF PROXY: If you are the stockholder of record of shares of our common stock as of the close of business on the record date, you can revoke your proxy at any time before its exercise by:

| • | sending a written notice to CEIX at 1000 CONSOL Energy Drive, Suite 100, Canonsburg, Pennsylvania 15317, attention: Secretary, bearing a date later than the date of the proxy, that is received prior to the Annual Meeting, stating that you revoke your proxy; |

| • | submitting your voting instructions again by telephone or over the Internet; |

| • | signing another valid proxy card bearing a later date than the proxy initially received and mailing it so that it is received by CEIX prior to the Annual Meeting; or |

| • | attending the Annual Meeting and voting in person. |

If you hold your shares through a bank, broker or other nominee, you must follow the instructions found on your voting instruction form, or contact your bank, broker or other nominee, in order to revoke your previously delivered proxy. Attendance at the Annual Meeting without a request to revoke a proxy will not by itself revoke a previously executed and delivered proxy.

ATTENDING THE MEETING IN PERSON: Subject to space availability, all stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting in person. Because seating is limited, admission to the meeting will be on a first come, first served basis.

Registration will begin at 7:30 a.m. Eastern Time. Stockholders who attend may be asked to present valid government-issued photo identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting. Please also note that if you hold your shares in “street name” (that is, through a bank, broker or other nominee), a copy of a brokerage statement reflecting your stock ownership as of the record date must be provided duringcheck-in at the registration desk at the Annual Meeting.

If you require directions to the Annual Meeting, please contact CEIX’s Investor Relations department at (724)416-8300.

– 2019 Proxy Statement – 2019 Proxy Statement | 7 |

INFORMATION ABOUT THE ANNUAL MEETING

PROXY SOLICITATION: All costs relating to the solicitation of proxies will be borne by CEIX. Georgeson LLC has been retained by CEIX to aid in the solicitation of proxies at an estimated cost of $9,000,plus reimbursement ofout-of-pocket expenses. Proxies may also be solicited by officers, directors and employees personally, by mail, or by telephone, facsimile transmission or other electronic means. None of these directors, officers or employees will receive any additional or special compensation for soliciting proxies. Upon request, CEIX will reimburse banks, brokers and other nominees for their reasonable expenses in sending proxy materials to their customers who are beneficial owners of CEIX’s common stock.

SECRECY IN VOTING: As a matter of policy, proxies, ballots and voting tabulations that identify individual stockholders are held confidentially by CEIX. Such documents are available for examination only by the inspectors of election and certain employees who assist in the tabulation of votes. The vote of any individual stockholder will not be disclosed except as may be necessary to meet applicable legal requirements.

| 8 |  – 2019 Proxy Statement – 2019 Proxy Statement |

PROPOSAL NO. 1 — ELECTION OF CLASS II DIRECTORS

|

The Nominating and Corporate Governance Committee has recommended, and the Board has nominated, our current Class II directors, Joseph P. Platt and Edwin S. Roberson, whose terms expire at the Annual Meeting, forre-election by the stockholders as Class II directors at the Annual Meeting. Upon election, each such director will serve until the 2022 annual meeting of stockholders or until his successor is elected and qualified, or his earlier death, resignation or removal.

To be elected, each nominee must receive a plurality of the votes cast (i.e., the director nominees who receive the highest number of “for” votes cast, up to the maximum number of directors to be elected, are elected as directors). If any nominee should for any reason become unable to serve, all shares represented by valid proxies will be voted for the election of such other person as the Board may designate, as recommended by the Nominating and Corporate Governance Committee. Alternatively, the Board may reduce the number of directors to eliminate the vacancy.

Our bylaws provide that if an incumbent director receives a greater number of votes “withheld” from his or her election than votes “for” such director nominee’s election, the director must tender his or her resignation promptly to the Board. The Nominating and Corporate Governance Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the Nominating and Corporate Governance Committee’s recommendation, and publicly disclose its decision and the underlying rationale in a press release, a filing with the SEC or other broadly disseminated means of communication within 90 days from the date of the certification of the election results.

The biographies included in this Proxy Statement below include information concerning the nominees for director and the continuing directors, including their recent employment, positions with CEIX, other directorships, board committee memberships and ages as of March 11, 2019.

– 2019 Proxy Statement – 2019 Proxy Statement | 9 |

PROPOSAL NO. 1—ELECTION OF CLASS II DIRECTORS | Biographies of Class II Director Nominees

Biographies of Class II Director Nominees

JOSEPH P. PLATT

| ||||

|

GENERAL PARTNER – THORN

Director Since: 2017 Age:71

|

Class II Director Term expires 2019

CEIX Committees: • Compensation (Chair) • Nominating and Corporate Governance • Health, Safety and Environmental | ||

BACKGROUND:

Joseph P. Platt joined the Board on November 28, 2017. He currently serves as a member of our Board’s Compensation Committee, which he chairs, Nominating and Corporate Governance Committee and Health, Safety and Environmental Committee. Mr. Platt previously served as a member of the board of directors of CNX Resources Corporation (“CNX”), CEIX’s former parent, from May 2016 until November 28, 2017, when CEIX separated from CNX. He is the general partner at Thorn Partners, LP, a family limited partnership, a position he has held since 1998. Mr. Platt’s career at Johnson and Higgins, a global insurance broker and employee benefits consultant (J&H), spanned 27 years until 1997, when J&H was sold to Marsh & McLennan Companies. At the time of the sale, Mr. Platt was an owner, director and executive vice president of J&H. Mr. Platt has served on the board of directors of Greenlight Capital Re, Ltd., a property and casualty reinsurer, since 2004 and has been its lead independent director since 2007, and also serves as an independent director of BlackRock’s Open End & Liquidity Funds and on the boards of various other nonpublic companies andnot-for-profit institutions.

QUALIFICATIONS:

Mr. Platt brings significant financial, compensation and risk management expertise to our Board. |

EDWIN S. ROBERSON

| ||||

|

FORMER CHIEF EXECUTIVE OFFICER – CHRIST COMMUNITY HEALTH SERVICES

Director Since: 2017 Age:73 |

Class II Director Term expires 2019

CEIX Committees: • Audit • Nominating and Corporate Governance (Chair) • Health, Safety and Environmental | ||

BACKGROUND:

Edwin S. Roberson joined the Board on November 28, 2017. He currently serves as a member of our Board’s Audit Committee, Nominating and Corporate Governance Committee, which he chairs, and Health, Safety and Environmental Committee. Mr. Roberson previously served as a member of the board of directors of CNX from May 2016 until November 28, 2017, when CEIX separated from CNX. From 2014 until his retirement on December 31, 2017, Mr. Roberson served as Chief Executive Officer of Christ Community Health Services, a health system of eight clinics providing high quality healthcare to the underserved in the Memphis, Tennessee community. Prior to that, Mr. Roberson served as Chief Executive Officer of various cancer research and biotech firms, and as President of Beacon Consulting, LLC, a business consulting firm, from 2006 to 2011. From 1991 to 2006, he worked at Conwood LLC, the nation’s second-largest manufacturer of smokeless tobacco products and a major seller and distributor of tobacco products manufactured by third parties, where he served in several roles, including Chief Financial Officer and, ultimately, President. After serving in the Army from 1969 to 1971, where he was awarded two Bronze Stars in Vietnam, Mr. Roberson, a certified public accountant, began his professional career at KPMG, an international accounting and consulting firm, where he was a tax partner until 1991. Mr. Roberson also served on the board of directors of Paragon National Bank, where he was chairman of the audit committee. Mr. Roberson currently serves on the board of directors of Infocare, Inc. (US), and on the boards of directors of several private companies.

QUALIFICATIONS:

Mr. Roberson brings to the Board significant leadership skills and financial, accounting and strategy expertise. Further, Mr. Roberson is a certified public accountant. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE

ABOVE-NAMED CLASS II DIRECTOR NOMINEES FOR THE BOARD OF DIRECTORS.

| 10 |  – 2019 Proxy Statement – 2019 Proxy Statement |

PROPOSAL NO. 1—ELECTION OF CLASS II DIRECTORS | Biographies of Continuing Class III Directors

Biographies of Continuing Class III Directors with Terms Expiring at the 2020 Annual Meeting of Stockholders

JOHN T. MILLS

| ||||

|

FORMER CHIEF FINANCIAL OFFICER – MARATHON OIL CORPORATION

Age:71 |

Class III Director Term expires 2020

CEIX Committees: • Audit (Chair) • Compensation • Health, Safety and Environmental | ||

BACKGROUND:

John T. Mills joined the Board on November 14, 2017. He currently serves as a member of our Board’s Audit Committee, which he chairs, Compensation Committee and Health, Safety and Environmental Committee. Mr. Mills previously served as a member of the board of directors of CNX from March 2006 until November 28, 2017, when CEIX separated from CNX. From December 2007 until August 2015, he served on the board of directors of Cal Dive International Inc., a marine contractor providing manned diving, derrick, pipelay and pipe burial services to the offshore oil and natural gas industry, where he served as lead independent director, and as a member of the audit, compensation, and corporate governance and nominating committees. From January 2008 through June 2010, Mr. Mills was a member of the board of directors and audit, conflicts and risk management committees of Regency GP, LLC, the general partner of Regency GP, LP, the general partner of Regency Energy Partners LP, a natural gas gathering, processing and transportation master limited partnership. Mr. Mills joined the board of directors of Horizon Offshore, Inc., a marine construction company, in June 2002 and served as the chairman of the board of directors from September 2004 until December 2007, when Horizon Offshore, Inc. was acquired by Cal Dive International, Inc. Mr. Mills was the Chief Financial Officer of Marathon Oil Corporation, an integrated energy company, from January 2002 until his retirement in December 2003. In 2011, Mr. Mills attended the Harvard Business School program “Making Corporate Boards More Effective.”

QUALIFICATIONS:

As a licensed attorney with over 40 years of business experience, including 16 years as an officer of Marathon Oil Corporation and U.S. Steel Corporation, Mr. Mills brings significant knowledge and experience to our Board. In particular, Mr. Mills brings anin-depth understanding of the evaluation of organic growth capital projects and acquisition and disposition opportunities, and the importance of maintaining a competitive capital structure and liquidity. In addition, having previously served as Senior Vice President, Finance and Administration, and later Chief Financial Officer of Marathon Oil Corporation, Mr. Mills has developed a wealth of financial knowledge with respect to the oversight of (i) the preparation of consolidated financial statements, (ii) internal audit functions, and (iii) public accountants, skills which are critical to our company and particularly our Audit Committee. |

WILLIAM P. POWELL

| ||||

|

MANAGING PARTNER – 535 PARTNERS LLC

Director Since: 2017 Age:63 |

Class III Director Term expires 2020

CEIX Committees: • Audit • Compensation • Health, Safety and Environmental | ||

BACKGROUND:

William P. Powell joined the Board on November 28, 2017 and has served as Chair of our Board since that time. He currently serves as a member of our Board’s Audit Committee, Compensation Committee and Health, Safety and Environmental Committee. Mr. Powell previously served as a member of the board of directors of CNX from January 2004 until November 28, 2017, when CEIX separated from CNX. Mr. Powell also previously was a director of Cytec Industries, a global specialty chemicals and materials company, from 1993 until its merger with Solvay SA in December 2015, where he served as lead independent director, as chair of the governance committee and as a member of the audit committee. From May 2001until May 2007, Mr. Powell was a Managing Director of William Street Advisors, a New York City-based merchant banking boutique. Mr. Powell resigned from William Street Advisors to establish a family office, 535 Partners LLC, where he has served as Managing Partner since May 2007. Prior to his time at William Street Advisors, he served as a Managing Director of UBS Warburg LLC and its predecessor Dillon, Read & Co. Inc. since 1991.

QUALIFICATIONS:

With an MBA degree and over 30 years of financial, management and investment experience, Mr. Powell brings a wealth of knowledge to our Board. Having served on multiple public company boards for over 20 years, Mr. Powell also has significant expertise in corporate governance matters. |

– 2019 Proxy Statement – 2019 Proxy Statement | 11 |

PROPOSAL NO. 1—ELECTION OF CLASS II DIRECTORS | Biographies of Continuing Class I Directors

Biographies of Continuing Class I Directors with Terms Expiring at the 2021 Annual Meeting of Stockholders

SOPHIE BERGERON

| ||||

|

MINE GENERAL MANAGER, ÉLÉONORE MINEOF GOLDCORP INC.

Age:41

|

Class I Director Term expires 2021

CEIX Committees: • Nominating and Corporate Governance • Health, Safety and Environmental (Chair)

| ||

BACKGROUND:

Sophie Bergeron joined the Board on March 1, 2019. She currently serves as a member of our Board’s Health, Safety and Environmental Committee, which she chairs, and Nominating and Corporate Governance Committee. Ms. Bergeron joined Goldcorp Inc., a gold production company headquartered in Vancouver British Columbia, Canada, in 2010 and has worked across the company’s project portfolio and mining operations in the Americas. She currently serves as the Mine General Manager for Goldcorp’s Éléonore Mine (James Bay, Québec), a position she has held since November 2017, and as the Project Manager for the Century Project (Timmins, Ontario), a position she has held since December 2016. Prior to that, Ms. Bergeron was the Operations Manager for Goldcorp’s Hoyle Pond Mine (Timmins, Ontario) from February 2015 to February 2016 and the Operations Manager for the MineRamp-Up (Cerro Negro, Argentina) from July 2014 to February 2015. Her other positions at Goldcorp included Director, Health and Safety from November 2012 to June 2014 and Senior Mining Manager from September 2010 to November 2012. Prior to joining Goldcorp in 2010, Ms. Bergeron held various positions with Xstrata Nickel (Xstrata), a nickel producer headquartered in Toronto, Canada. During her time at Xstrata, Ms. Bergeron rose to the position of Continuous Improvement Superintendent, completed her Six Sigma certification and earned a certificate in business optimization from Melbourne University in Australia. Ms. Bergeron is an active member of the Québec Mining Association and sits on its board of directors.

QUALIFICATIONS:

Through Ms. Bergeron’s education and experience, she has gained expertise in the mining sector, which provides significant value and insight to the Board, particularly with respect to operating and strategic issues. Ms. Bergeron has expertise in health and safety, mine operations management and continuous improvement. |

JAMES A. BROCK

| ||||

|

PRESIDENT & CHIEF EXECUTIVE

Director Since: 2017 Age:62 |

Class I Director Term expires 2021

CEIX Committees: • Health, Safety and Environmental

| ||

BACKGROUND:

James A. Brock has served as our Chief Executive Officer since June 21, 2017, and as our President since December 4, 2017, and he has been a member of our Board since November 28, 2017. He currently serves as a member of our Board’s Health, Safety and Environmental Committee. Mr. Brock previously served as the Chief Operating Officer-Coal of CNX from December 10, 2010 until November 28, 2017, when CEIX separated from CNX. Mr. Brock also currently serves as Chief Executive Officer and Chairman of the board of directors of the general partner of CONSOL Coal Resources LP, a position he has held since March 16, 2015. Previously, he served as Senior Vice President-Northern Appalachia-West Virginia Operations of CNX from 2007 to 2010, and as Vice President-Operations of CNX from 2006 to 2007. Mr. Brock began his career with CNX in 1979 at the Matthews Mine and since then has served at various locations in many positions including Section Foreman, Mine Longwall Coordinator, General Mine Foreman and Superintendent. Mr. Brock’s achievements in mining were recognized with his being named 2010 Coal Safety Leader of the Year in West Virginia and his induction into the West Virginia Coal Hall of Fame in 2016. Mr. Brock also currently serves as the Chairman of the Pennsylvania Coal Alliance board of directors, and as a member of the boards of directors of the National Coal Council, the American Coalition for Clean Coal Electricity (ACCCE) and the National Mining Association.

QUALIFICATIONS:

With a career in coal spanning five decades, we believe Mr. Brock’s extensive knowledge of our industry and our operations gained during his years of service with CNX, and now CEIX, provides our Board with valuable experience. |

| 12 |  – 2019 Proxy Statement – 2019 Proxy Statement |

PROPOSALNO. 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of CEIX’s independent registered public accounting firm. The Audit Committee has appointed Ernst & Young LLP as the independent registered public accounting firm for CEIX for the fiscal year ended December 31, 2019. The Board now recommends that CEIX’s stockholders ratify this appointment.

Neither CEIX’s governing documents nor the law require stockholder ratification of the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm. However, the Board is submitting the appointment of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain that firm. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of CEIX and its stockholders.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and will have an opportunity to address the meeting and respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019.

– 2019 Proxy Statement – 2019 Proxy Statement | 13 |

AUDIT COMMITTEE AND AUDIT FEES

|

The Audit Committee has reviewed and discussed with management and Ernst & Young LLP (“E&Y”), CEIX’s independent registered public accounting firm, the audited financial statements of CEIX for the fiscal year ended December 31, 2018 (the “Audited Financial Statements”). In addition, the Audit Committee has discussed with E&Y the matters required to be discussed under the auditing standards of the Public Company Accounting Oversight Board (“PCAOB”) (Auditing Standard No. 1301 –Communications with Audit Committees) relating to the conduct of the audit, including any difficulties encountered in the course of the audit work, any restrictions on the scope of the registered public accounting firm’s activities or access to requested information and any significant disagreements with management.

The Audit Committee also has received the written disclosures and letter from E&Y regarding E&Y’s independence required by PCAOB Ethics and Independence Rule 3526,Communication with Audit Committees Concerning Independence, and has discussed with the independent registered public accounting firm that firm’s independence from CEIX and its subsidiaries.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the Audited Financial Statements be included in CEIX’s Annual Report on Form10-K for the year ended December 31, 2018 for filing with the SEC.

Members of the Audit Committee:

John T. Mills, Chair

William P. Powell

Edwin S. Roberson

The foregoing Audit Committee Report does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing of CEIX under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that CEIX specifically incorporates the Report by reference therein.

| 14 |  – 2019 Proxy Statement – 2019 Proxy Statement |

AUDIT COMMITTEE AND AUDIT FEES | Independent Registered Public Accounting Firm

Independent Registered Public Accounting Firm

The following table presents fees billed for professional audit services rendered by E&Y in connection with its audits of CEIX’s annual financial statements for the years ended December 31, 2018 and 2017 and fees for other services rendered by E&Y during those periods, excluding the fees billed to CONSOL Coal Resources LP (“CCR”).

| 2018 (E&Y Fees) | 2017* (E&Y Fees) | |||||||||

Audit Fees | $ | 1,333,600 | $ | 420,600 | ||||||

Audit-Related Fees | $ | 540,000 | $ | — | ||||||

Tax Fees | $ | — | $ | — | ||||||

All Other Fees | $ | 7,200 | $ | 1,995 | ||||||

|

|

|

| |||||||

Total | $ | 1,880,800 | $ | 422,595 | ||||||

| * | Represents fees billed to CEIX following the separation of CEIX from CNX. |

As used in the table above, the following terms have the meanings set forth below.

Audit Fees

The fees for professional services rendered in connection with the audit of CEIX’s annual financial statements, for the review of the financial statements included in CEIX’s Quarterly Reports on Form10-Q, for the audit of certain financial statements included in CEIX’s Form 10 (for 2017 only) and for services that are normally provided by the accounting firm in connection with statutory and regulatory filings or engagements.

Audit-Related Fees

The professional services for audit-related fees in 2018 were for thepre-implementation assessment of our Oracle enterprise resource planning software that became our system of record on January 1, 2019. There were no professional services for audit-related fees in 2017.

Tax Fees

There were no professional services fortax-related work in 2018 or 2017.

All Other Fees

The fees for products and services provided, other than for the services reported under the headings “Audit Fees,” “Audit-Related Fees” and “Tax Fees.” These fees were for publications and online subscriptions.

Audit CommitteePre-Approval of Audit and PermissibleNon-Audit Services

The Audit Committee, or the Chair of the Audit Committee, must preapprove all audit andnon-audit services provided to CEIX by its independent registered public accounting firm. The Audit Committee must consider whether such services are consistent with SEC rules on auditor independence. All of the services performed by E&Y in 2018 werepre-approved by the Audit Committee.

– 2019 Proxy Statement – 2019 Proxy Statement | 15 |

PROPOSAL NO. 3 — ADVISORY APPROVAL OF EXECUTIVE COMPENSATION

|

Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), CEIX is required to provide its stockholders with the opportunity to cast anon-binding advisory vote on compensation paid to our named executive officers. Accordingly, we ask our stockholders to vote, on an advisory basis, “FOR” the compensation paid to our named executive officers in 2018, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC, and to adopt the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to CEIX’s named executive officers, as disclosed in this Proxy Statement, including the “Compensation Discussion and Analysis,” compensation tables and narrative discussion, is hereby APPROVED on an advisory basis.”

As described in detail in the “Compensation Discussion and Analysis,” our executive compensation program is designed to attract, motivate and retain key executives who drive our success and industry leadership. We achieve these objectives through compensation that:

| • | links a significant portion of total compensation to performance, which we believe will create long-term stockholder value; |

| • | includes stock-based compensation, which encourages our named executive officers to act as owners of CEIX; |

| • | is tied to overall corporate performance, and financial and operational goals (annual and long-term); |

| • | enhances retention in a highly competitive market by subjecting a significant portion of total compensation to multi-year vesting or performance conditions; |

| • | discourages unnecessary and excessive risk-taking; and |

| • | provides a competitive total pay opportunity. |

The Compensation Committee reviews the compensation programs for our executive officers to ensure they achieve the desired goal of aligning our executive compensation structure with our stockholders’ interests and current market practices. Please read “Compensation Discussion and Analysis” beginning on page 20, and the tabular compensation disclosures and accompanying narrative discussion beginning on page 34. The Compensation Discussion and Analysis discusses our executive compensation philosophy, programs and objectives, while the tabular compensation disclosures and accompanying narrative discussion provide detailed information on the compensation of our named executive officers.

We are asking our stockholders to indicate their support for the compensation paid to our named executive officers in 2018 as described in this Proxy Statement (including the Compensation Discussion and Analysis, the compensation tables and other related compensation disclosures required by RegulationS-K Item 402 and contained herein). This proposal is intended to give our stockholders the opportunity to express their views on the compensation paid to our named executive officers in 2018. This vote is not intended to address any specific item of compensation, but rather the overall compensation paid to our named executive officers, and the philosophy, policies and practices described in this Proxy Statement.

As an advisory vote, your vote will not be binding on CEIX, the Board or the Compensation Committee. However, our Board and our Compensation Committee, which are responsible for designing and administering CEIX’s executive compensation program, value the opinions of our stockholders and to the extent there is any significant vote against the compensation paid to our named executive officers in 2018, we will consider our stockholders’ concerns, if any, and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

After our stockholders voted in 2018, on an advisory basis, on the frequency of this advisory vote on compensation, the Company elected to hold future advisory votes on compensation on an annual basis until the next stockholder advisory vote on frequency, which we expect will be conducted at our annual meeting of stockholders in 2024.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS IN 2018, AS DISCLOSED IN THIS PROXY STATEMENT, PURSUANT TO THE COMPENSATION DISCLOSURE RULES OF THE SEC.

| 16 |  – 2019 Proxy Statement – 2019 Proxy Statement |

|

CEIX’s executive officers are listed below. Each officer is appointed by the Board and holds office for the term set forth in the officer’s written employment agreement or until the officer’s successor has been elected and qualified, or until such officer’s earlier death, resignation or removal.

Name | Age | Executive Since | Position | |||||||||

James A. Brock | 62 | 2017 | President and Chief Executive Officer | |||||||||

David M. Khani | 55 | 2017 | Executive Vice President, Chief Financial Officer and Treasurer | |||||||||

James J. McCaffrey | 62 | 2017 | Senior Vice President – Coal Marketing | |||||||||

John M. Rothka | 41 | 2017 | Chief Accounting Officer | |||||||||

Kurt R. Salvatori | 49 | 2017 | Chief Administrative Officer | |||||||||

Martha A. Wiegand | 48 | 2017 | General Counsel and Secretary | |||||||||

The biographical information for Mr. Brock is provided under the caption “Proposal No. 1 – Election of Class II Directors – Continuing Class I Directors with Terms Expiring at the 2021 Annual Meeting of Stockholders” on page 12.

|

David M. Khani

Mr. Khani has served as our Executive Vice President and Chief Financial Officer since August 2, 2017, and has served as our Treasurer since December 11, 2017. Mr. Khani previously served as the Executive Vice President and Chief Financial Officer at CNX from March 1, 2013 to August 2, 2017. Mr. Khani joined CNX in 2011 as Vice President of Finance, where he played a key role in the growth of CNX’s exploration and production business, and was integrally involved in the separation of CEIX from CNX. Prior to joining CNX, Mr. Khani was with FBR Capital Markets & Co., an investment banking and advisory firm, holding the positions of Director of Research (February 2007 to October 2010) andCo-Director of Research (November 2010 to August 2011). Mr. Khani also serves as Chief Financial Officer and as a director of the general partner of CONSOL Coal Resources LP and served in those same capacities with CONE Midstream Partners LP until January 3, 2018. He is a chartered financial analyst and a member of the CFA Society Pittsburgh.

| |

|

James J. McCaffrey

Mr. McCaffrey has served as our Senior Vice President—Coal Marketing since July 10, 2017 and acts as our functioning chief commercial officer.Mr. McCaffrey also has served as Senior Vice President—Sales of CONSOL Pennsylvania Coal Company, a wholly-owned subsidiary of CEIX, since June 2016. From January 2013 to June 2016, Mr. McCaffrey served as Senior Vice President—Energy Marketing for CONSOL Pennsylvania Coal Company, and from April 2003 to January 2013, he served as Senior Vice President of Coal Sales, Vice President of Materials & Supply Chain Management, Senior Vice President—CNX Land Resources, Vice President of Supply Chain and Vice President of Marketing Services in the coal operations group of CNX. Mr. McCaffrey, a certified mine foreman in Pennsylvania, started his career as a coal miner with CNX in 1976, and joined CNX’s management team as Vice President and General Manager of Consolidation Coal Mining Operations in March 2002.

|

– 2019 Proxy Statement – 2019 Proxy Statement | 17 |

EXECUTIVE OFFICERS

|

John M. Rothka

Mr. Rothka has served as our Chief Accounting Officer since November 22, 2017. Mr. Rothka also serves as the Chief Accounting Officer of the general partner of CONSOL Coal Resources LP, a position he has held since August 2, 2017. Prior to his appointment as the Chief Accounting Officer of the general partner of CONSOL Coal Resources LP and beginning in July 2015, Mr. Rothka served as the Controller of the general partner. Mr. Rothka joined the Accounting Department of CNX in September 2005, where he served in positions of increasing responsibility, and was promoted to Senior Manager in February 2012, a position he served in until July 2015. Prior to joining CNX, Mr. Rothka began his professional career at the accounting firm of Aronson LLC, where he served from September 1999 to November 2002, before joining Deloitte from November 2002 to September 2005, where he held several positions of increasing responsibility in the audit and assurance groups. Mr. Rothka is a certified public accountant.

| |

|

Kurt R. Salvatori

Mr. Salvatori has served as our Chief Administrative Officer since July 10, 2017. Mr. Salvatori has also served as Vice President- Administration of CONSOL Pennsylvania Coal Company since January 1, 2017. Previously, Mr. Salvatori served as Vice President Shared Services for CNX from July 2016 to December 2017, and prior to that as Vice President Human Resources for CNX from September 2011 to June 2016. Mr. Salvatori joined CNX in April 1992 and held numerous positions at CNX and CNX Gas Corporation, including Director of Human Resources from April 2006 to September 2011, Manager of Human Resources from January 2005 to April 2006, and Supervisor of Retirement and Investment Plans from April 2002 to January 2005. Active innon-profit organizations, Mr. Salvatori has served as a trustee of the Washington County Community Foundation since 2010 and as a trustee of the Monongahela Health System since 2014. Mr. Salvatori has also served as chairman of the CONSOL Energy Political Action Committee (PAC) since 2017.

| |

|

Martha A. Wiegand

Ms. Wiegand has served as our General Counsel and Secretary since July 10, 2017. Ms. Wiegand has also served as General Counsel and Secretary of the general partner of CONSOL Coal Resources LP since March 16, 2015. Ms. Wiegand joined the legal department of CNX in December 2008 as Senior Counsel and was promoted to Associate General Counsel of CNX effective in 2012, where she was responsible for a variety of legal matters, including coal and natural gas marketing and transportation, labor and employment, financing arrangements and certain corporate transactions. Prior to joining CNX, Ms. Wiegand worked for approximately 10 years for several large Pittsburgh-based law firms, where she handled financing and corporate transactions for clients in the banking and energy industries, among others. She is licensed to practice law in Pennsylvania and New Jersey and is a member of the American Bar Association, the Pennsylvania Bar Association and the Energy & Mineral Law Foundation. Ms. Wiegand has also served on the American Coalition for Clean Coal Electricity (ACCCE) Strategy & Policy Committee since 2018. |

| 18 |  – 2019 Proxy Statement – 2019 Proxy Statement |

EXECUTIVE COMPENSATION INFORMATION

|

Compensation Discussion and Analysis –

| 20 |

| ||

| 20 |

| ||

| 22 |

| ||

| 22 |

| ||

| 22 |

| ||

| 23 |

| ||

|

|

23 |

| |

|

|

24 |

| |

|

|

24 |

| |

|

|

24 |

| |

| 25 |

| ||

Increase in 2018 Base Salaries, 2018 STIC and LTIC Targets

|

|

25 |

| |

|

|

25 |

| |

|

|

25 |

| |

|

|

27 |

| |

|

|

27 |

| |

|

|

28 |

| |

Our Former Parent Long-Term Incentive Compensation Programs

|

|

29 |

| |

|

|

29 |

| |

|

|

30 |

| |

2018 Change in Control and CEO Employment Agreements

|

|

31 |

| |

|

|

31 |

| |

| 32 |

| ||

| 32 | |||

Stock Ownership Guidelines/Holding Requirements for NEOs

|

|

32 |

| |

|

|

33 |

| |

|

|

33 |

| |

|

|

33 |

| |

|

|

33 |

| |

|

|

33 |

| |

Named Executive Officers

| James A. Brock

| |

President and Chief Executive Officer

| ||

| David M. Khani

| |

Executive Vice President, Chief Financial Officer and Treasurer

| ||

| James J. McCaffrey

| |

Senior Vice President —Coal Marketing

| ||

| Martha A. Wiegand

| |

General Counsel and Secretary

| ||

| Kurt R. Salvatori

| |

Chief Administrative Officer

|

– 2019 Proxy Statement – 2019 Proxy Statement | 19 |

EXECUTIVE COMPENSATION INFORMATION | Compensation Discussion and Analysis

Compensation Discussion and Analysis

As one of the major producers ofhigh-Btu bituminous thermal and crossover metallurgical coal in the United States, we operate with a pay for performance philosophy in a challenging, highly competitive and rapidly evolving environment. This Compensation Discussion and Analysis (“CD&A”) discusses the compensation decisions made for the fiscal year 2018 with respect to our named executive officers (“NEOs”), who are listed below.

Our Named Executive Officers (NEOs)

Name | Title | |

James A. Brock | President and Chief Executive Officer | |

David M. Khani | Executive Vice President, Chief Financial Officer and Treasurer | |

James J. McCaffrey | Senior Vice President—Coal Marketing | |

Martha A. Wiegand | General Counsel and Secretary | |

Kurt R. Salvatori | Chief Administrative Officer |

| HOW DID WE PERFORM? |

✓ |

— Produced a record level of coal at 27.6 million tons, the highest level in the Pennsylvania Mining Complex history

| ||

| ✓ | — Increased our coal average revenue per ton sold by 8% to $49.28 per ton

| |||

| ✓ | — Increased our coal average cash margins per ton sold by 21% to $19.99 per ton*

| |||

| ✓ | — Exceeded thepre-established performance metrics related to our 2018 annual incentive plan, as well as thepre-established performance metrics associated with the 2018 tranches under our 2016, 2017 and 2018 performance-based long-term incentive programs

| |||

| ✓ | — Generated $413.5 million in net cash provided by operations, $248 million of free cash flow net to CEIX stockholders* and repaid $56 million of debt in 2018

| |||

q

| ||||

WHAT DID WE CHANGE FOR 2018? | ✓ | — Adopted and implemented a new compensation philosophy to recognize the highly competitive and regulated environment in which we operate to ensure that we continue to attract and retain key talent necessary to compete, incentivize our NEOs, and align risk-taking with the sustainability and the long-term financial health of our company

| ||

| ✓ | — Adjusted base salaries for three of our NEOs and also adjusted annual and long-term incentive targets for certain NEOs to reflect results of competitive compensation peer group data, general industry and internal pay equity of our NEOs |

| * | This CD&A, which relates to 2018 compensation determinations, contains references to one or more financial measures (indicated by *) that have not been calculated in accordance with GAAP. See reconciliation of these disclosed non-GAAP financial measures including average cash margins per ton sold, average operating margin per ton sold, free cash flow and free cash flow net to CEIX stockholders to the most directly comparable GAAP financial measures in Appendix A to this Proxy Statement. |

| 20 |  – 2019 Proxy Statement – 2019 Proxy Statement |

EXECUTIVE COMPENSATION INFORMATION | Compensation Discussion and Analysis

WHAT DID WE CHANGE FOR 2018? |

✓ |

— Implemented performance-based annual and long-term variable incentive compensation with goals tied to the achievement of operating margin and free cash flow net to CEIX stockholders annual targets, as well as relative total stockholder return and free cash flow long-term targets for our NEOs

| ||

| ✓ | — Approved our peer group, adopted double trigger change in control (“CIC”) andnon-CIC severance agreements for our NEOs (also including an employment agreement for our CEO)

|

q

| ||||

HOW DO WE DETERMINE PAY? |

✓ |

— Design competitive pay programs to reward executives for positive companypre-established financial and operational goals, mitigate material risks and align with stockholder interests’ equity-based long-term incentive awards

| ||

| ✓ | — Establish pay levels commensurate with performance and the need to retain high-quality talent, as well as to preserve internal equity among new NEOs

| |||

| ✓ | — Consider many factors, including the advice of our Compensation Committee’s independent compensation consultant, internal pay equity among executives and the alignment of total pay opportunity and pay outcomes with performance and external competitive market data relating to our peer group and general industry

| |||

q

| ||||

HOW DID WE PAY OUR NEOS? | ✓ | — Base salaries reflected each NEO’s role, responsibility, experience and market conditions

| ||

| ✓ | — Payouts under our annual program aligned with our fiscal 2018 performance

| |||

✓

✓ | — Annual cash incentive payouts up to 200% based on achievement of operating margin and free cash flow net to CEIX stockholders performance goals

— Vesting under our long-term programs aligned with performance of our stock as compared to our peers

| |||

| ✓ | — Long-term equity incentives granted at target levels delivered through a mix of performance-based restricted stock units (“PSUs”) (60%) and time-based restricted stock units (“RSUs”) (40%)

| |||

| ✓ | — Nooff-cycle equity awards or material perquisites for any of our NEOs

| |||

q

| ||||

HOW DO WE ADDRESS RISK AND GOVERNANCE? |

✓ |

— Provide an appropriate balance of short- and long-term compensation with payouts based on the company’s achievement ofpre-established financial and operational goals, including a focus on sustainability, environmental compliance and safety

| ||

| ✓ | — Follow practices that promote good governance and serve the interests of our stockholders, with threshold and maximum payout caps for annual cash incentives and long-term performance awards, and policies on clawbacks, anti-pledging, anti-hedging, insider trading, stock ownership and equity grant practices

| |||

| ✓ | — Solicit“say-on-pay” stockholder vote annually at stockholder meeting

| |||

| ✓ | — Conducts an annual risk assessment of our compensation policies and practices through our Compensation Committee, with the assistance of an independent compensation consultant

| |||

| ✓ | — Review our compensation program and practices with an independent compensation consultant that reports directly to our Compensation Committee |

– 2019 Proxy Statement – 2019 Proxy Statement | 21 |

EXECUTIVE COMPENSATION INFORMATION | Compensation Discussion and Analysis

q

| ||||

WHY YOU SHOULD APPROVE THE SAY-ON-PAY PROPOSAL |

✓ |

— Fiscal 2018 performance continued to support long-term stockholder value

| ||

| ✓ | — Fiscal 2018 annual and long-term incentive payouts for our NEOs aligned with company performance

| |||

| ✓ | — Our pay program is aligned with stockholder interests, emphasizing achievement of strategic objectives both annually and over the long term

| |||