- CNR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

DEF 14A Filing

Core Natural Resources (CNR) DEF 14ADefinitive proxy

Filed: 30 Mar 23, 7:31am

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

ANNUAL MEETING OF STOCKHOLDERS — APRIL 27, 2023

|

|

275 Technology Drive, Suite 101

Canonsburg, Pennsylvania 15317

Telephone (724) 416-8300

Dear Fellow Stockholder:

On behalf of the entire Board of Directors of CONSOL Energy Inc. (“CEIX”), we invite you to attend CEIX’s sixth Annual Meeting of Stockholders. The Annual Meeting will be held solely via live webcast at www.virtualshareholdermeeting.com/CEIX2023 on April 27, 2023, at 8:00 a.m. Eastern Time.

You will be asked to vote on the following items for the Annual Meeting: (i) the election of our directors, (ii) ratification of the appointment of our independent registered public accounting firm, and (iii) advisory approval of our 2022 executive compensation program. Detailed information about the director nominees, including their specific experience and qualifications, begins on page 13 of the proxy statement. Information about our independent registered public accounting firm begins on page 28 of the proxy statement. Our Compensation Discussion and Analysis, which explains our 2022 compensation decisions, begins on page 36 of the proxy statement. We encourage you to read the proxy statement carefully for more information.

During 2022, we celebrated our five-year anniversary as an independent publicly traded company and continued to build upon the momentum that we created in 2021 to achieve record performance on multiple fronts. This success was enabled in large part by our global market reach and reliable world-class mining and logistics operations, which allowed us to play a key role in supplying strained power generation markets in the U.S. and Europe, while at the same time continuing to serve growing demand from industrial and metallurgical customers in Asia, Africa, and South America, all while global supply of high-BTU and metallurgical coal remains tight. We exported 10.7 million tons of coal in 2022 and derived 53% of our coal revenue from export sales, up from 46% in 2021. Additionally, 43% of our revenues derived from contracts with customers came from sources other than sales to coal-fired power plants.

At our Pennsylvania Mining Complex (PAMC), we grew our coal revenue to $1,974 million for the year ended December 31, 2022, from $1,085 million for the year ended December 31, 2021. This resulted from a 53% improvement in our average realized coal revenue per ton sold* from $45.75 in 2021 to $69.89 in 2022. The market volatility contributed to a high inflationary environment and global supply chain difficulties, both of which influenced our total costs and expenses. These increased to $1,534 million for the year ended December 31, 2022, from $1,224 million for the year ended December 31, 2021. Our average cash cost of coal sold per ton* also followed suit and increased to $34.56 in 2022 from $28.25 in 2021, driven by inflationary pressures on supplies, maintenance and contract labor, as well as increased power prices and ongoing costs associated with our development of the fifth longwall at the PAMC. In spite of this challenging cost environment, we were able to grow our PAMC average cash margin per ton sold* to $35.33 in 2022 from $17.50 in 2021, a 102% year-on-year increase and a record result for our company. Our CONSOL Marine Terminal (CMT) also performed very well, transloading 13.7 million tons of CONSOL and third-party coal and achieving record financial performance, with $41 million of net income and $52 million of Adjusted EBITDA* attributable to the CMT segment for the year ended December 31, 2022. Our employees at the PAMC and CMT accomplished all of this while maintaining a Total Recordable Incident Rate 63% lower than the national average for underground bituminous coal mines at the PAMC (based on preliminary Mine Safety and Health Administration (MSHA) data) and achieving another year of zero safety exceptions at the CMT.

The continued success of our core business led to very strong financial results, which allowed us to fortify our balance sheet and execute on several strategic priorities. For the year ended December 31, 2022, we generated a record $651 million of net cash provided by operating activities and $501 million of free cash flow.* This enabled meaningful progress on our debt reduction goals, as we

made repayments of $175.7 million, $50.0 million, $41.3 million and $25.3 million on our Term Loan B, second lien notes, Term Loan A and equipment-financed and other debt, respectively. This brings our total debt payments and repurchases in the year to $292.3 million (excluding the premium paid on the second lien notes) and we ended the year with total long term debt of $355 million and a net debt level* of $57 million.

We also utilized organic cash generated in 2022 to invest in completing the restart of our fifth longwall at the PAMC and the development of our Itmann Mine project in southern West Virginia. The fifth longwall, which began operating in mid-December, will produce a relatively low-sulfur product that we expect will help expand our reach into quality-sensitive markets, including the crossover metallurgical market. It also is expected to allow us to grow our production at the PAMC from 23.9 million tons in 2022 to 25-27 million tons in 2023. The Itmann Mine project achieved a major milestone in 2022 with the commissioning of the preparation plant during the third quarter and subsequent shipment of nine trains of coal during the fourth quarter, a remarkable accomplishment considering the plant was purchased, disassembled, relocated, and reconstructed on our site in just over a year’s time. Despite short-term geological issues, supply chain delays, and a challenging labor market, ramp up of the Itmann Mining Complex to full production is expected in 2023. Once operating at full capacity, we expect the Itmann mine and preparation plant to produce approximately 900,000 tons annually of high-quality low-vol metallurgical coal for sale in the domestic and international markets. Finally, with our debt reduction accelerated and growth initiatives well-funded, we were excited to move forward with implementing an enhanced shareholder return program in 2022. This included paying $71.5 million in dividends and repurchasing 124.5 thousand shares at an average share price of $64.18 during the second half of 2022, while our share price also appreciated by 186% during the year. We see strong fundamentals carrying into 2023, as we stand near fully-contracted for 2023 PAMC sales at anticipated realizations that are improved compared to our 2022 results.

Looking ahead, we believe we have a continuing critical role to play in meeting global energy and resource needs as the energy transition plays out in the coming decades. According to the International Energy Agency, 2022 marked a record year for global coal demand, even as investments in new coal supply continued to decline. As such, we remain focused on leading the industry as a socially and environmentally responsible coal supplier, helping to ensure that global electricity, infrastructure, and basic human needs are met during these dynamic times. As a key part of our commitment, we continue to advance toward our voluntary goals of reducing our direct operating greenhouse gas emissions by 50% by 2026 and achieving net zero direct operating greenhouse gas emissions by 2040. We have approved capital expenditures of approximately $28 million in 2023-2026, including $9.5 million in 2023, toward achieving our 2026 goal. These efforts are described more fully alongside our broader sustainability initiatives as part of our sixth annual Corporate Sustainability Report, which was released earlier this month. We remain excited about our outlook and the role we play as a responsible supplier of crucial global resources, and we look forward to continuing to expand our capability to return value to our shareholders and create sustainable opportunities for our future.

Your vote is important to us. We hope that you will participate in the Annual Meeting, either by attending and voting at the meeting or by voting as promptly as possible through the Internet, by telephone or by completing and mailing a proxy card (following the process as further described in the proxy statement). Detailed instructions on “How to Vote” begin on page 10.

Thank you for your investment in CEIX, and we hope you will be able to join us at this year’s Annual Meeting.

Sincerely,

| ||||||

| William P. Powell Chair of the Board

|

| James A. Brock Chief Executive Officer

|

| * | See Appendix A to this Proxy Statement for a reconciliation of average realized coal revenue per ton sold (non-GAAP) to total coal revenue (GAAP), average cash cost of coal sold per ton (non-GAAP) to total costs and expenses (GAAP), average cash margin per ton sold (non-GAAP) to total coal revenue (GAAP), Adjusted EBITDA (non-GAAP) to net income (GAAP), free cash flow (non-GAAP) to net cash provided by operating activities (GAAP) and net debt level (non-GAAP) to total long-term debt (GAAP). |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

DATE:

|

|

April 27, 2023

|

| |||||||

TIME:

|

8:00 a.m. Eastern Time

| |||||||||

PLACE:

|

Solely via live webcast at www.virtualshareholdermeeting.com/CEIX2023 (the “CEIX Meeting Website”)

| |||||||||

AGENDA: | 1. | Elect directors for a one-year term;

| ||||||||

2. | Ratify the appointment of Ernst & Young LLP as CEIX’s independent registered public accounting firm for the fiscal year ending December 31, 2023;

| |||||||||

3. | Approve, on an advisory basis, the compensation paid to our named executive officers in 2022, as reported in this Proxy Statement;

| |||||||||

4. | Transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.

| |||||||||

RECORD DATE: |

By resolution of the Board of Directors, we have fixed the close of business on March 3, 2023 as the record date for determining the stockholders of CEIX entitled to this Notice of Annual Meeting of Stockholders (the “Notice”), and to vote at, the Annual Meeting and any adjournment or postponement thereof.

| |||||||||

MAILING DATE:

|

On or about March 30, 2023

| |||||||||

INFORMATION ABOUT THE MEETING:

We are mailing our proxy materials to stockholders entitled thereto via the full set delivery option. The approximate date on which the Proxy Statement and proxy card are intended to be first sent or given to the Company’s stockholders entitled thereto is March 30, 2023. This delivery will be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders entitled thereto, we must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website. These proxy materials include this Notice, the Proxy Statement, the proxy card and our 2022 Annual Report. These materials are available free of charge on our website at www.consolenergy.com by following the link for “Investors” and also at www.proxyvote.com. You may vote through any of the acceptable means described in the Proxy Statement. Instructions on how to vote begin on page 10.

Our annual meeting of stockholders (the “Annual Meeting”) will be held solely via live webcast on the CEIX Meeting Website and you will not be able to be physically present at the Annual Meeting. You will be able to participate virtually, vote your shares of CEIX Common Stock electronically, view the list of registered holders entitled to vote at the Annual Meeting and submit questions online during the Annual Meeting by logging on to the CEIX Meeting Website using the 16-digit control number included in your proxy card or vote instruction form you previously received and following the directions on the CEIX Meeting Website. If you are not eligible to participate in the Annual Meeting, you may listen to a webcast of the Annual Meeting by logging on to the CEIX Meeting Website as a guest. Guests will not be able to ask questions or vote at the Annual Meeting. We encourage you to log on 15 minutes prior to the start time of the Annual Meeting. If you have difficulty accessing the Annual Meeting through the CEIX Meeting Website, please call the technical support number provided.

March 30, 2023

Martha A. Wiegand General Counsel and Secretary

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING

OF STOCKHOLDERS TO BE HELD ON APRIL 27, 2023:

We have elected to utilize the full set delivery option and are delivering paper copies to all stockholders entitled thereto of all proxy materials, as well as providing access to those proxy materials on a publicly accessible website. The Proxy Statement, the proxy card, and our 2022 Annual Report are available free of charge at www.consolenergy.com by following the link for “Investors” and also at www.proxyvote.com.

TABLE OF CONTENTS

|

- 2023 Proxy Statement - 2023 Proxy Statement |

PROXY SUMMARY

|

This Proxy Summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. Please read the entire Proxy Statement carefully before voting. On or about March 30, 2023, we mailed the Proxy Statement, the proxy card, and our 2022 Annual Report to holders of record as of the record date, and posted our proxy materials on the websites referenced in the Notice.

2023 ANNUAL MEETING OF STOCKHOLDERS

TIME 8:00 a.m. Eastern Time |

|

DATE April 27, 2023

|

|

PLACE Solely via live webcast at www.virtualshareholdermeeting.com/CEIX2023

|

PROPOSALS REQUIRING YOUR VOTE

Stockholders are being asked to vote on the following proposals at the Annual Meeting. Your vote is very important to us. Please cast your vote immediately on all of the proposals to ensure that your shares are represented.

Item

| Proposal

| Board Recommendation | Page

| ||||||

1 | Election of Directors

|

FOR EACH | 12

| ||||||

2

| Ratification of Appointment of Ernst & Young LLP

|

FOR | 28

| ||||||

3 | Advisory Approval of 2022 Named Executive Officers’ Compensation

|

FOR | 31

| ||||||

- 2023 Proxy Statement - 2023 Proxy Statement | 1 |

PROXY SUMMARY

CURRENT BOARD OF DIRECTORS

The following table provides summary information about our current Board of Directors as of March 22, 2023. All of our directors whose terms expire at the Annual Meeting, are nominees for election at the Annual Meeting, each for a one-year term ending in 2024.

Name | Age | Director Since | Occupation | Independent | Committee Memberships | |||||||||||

| William P. Powell† | 67 | 2017 | Managing Partner of 535 Partners LLC | Yes | • AC • CC • HSE

| |||||||||||

| Valli Perera | 65 | 2023 | Former Partner of Deloitte LLP | Yes | • AC • NCG†† • HSE | |||||||||||

James A. Brock

|

| 66

|

|

| 2017

|

| Chief Executive Officer of CEIX

| No | • HSE

| |||||||

| John T. Mills | 75 | 2017 | Former Chief Financial Officer of Marathon Oil Corporation | Yes | • AC†† • CC • HSE | |||||||||||

| Joseph P. Platt | 75 | 2017 | General Partner of Thorn Partners LP | Yes | • CC†† • NCG • HSE

| |||||||||||

| Cassandra Pan | 64 | 2023 | Former President of Fenner Dunlop Americas | Yes | • NCG • HSE†† | |||||||||||

| AC | Audit Committee | |

| CC | Compensation Committee | |

| HSE | Health, Safety and Environmental Committee |

| NCG | Nominating and Corporate Governance Committee | |

| † | Chair of the Board | |

| †† | Committee Chair |

BUSINESS/STRATEGIC 2022 HIGHLIGHTS

| • | The Right Team. We have an experienced and focused senior executive team and Board of Directors that can navigate and capitalize on future opportunities in the mining and energy space. |

| • | Bottom Line. We generated a GAAP net income of $467.0 million in 2022 compared to $34.1 million in 2021. Notably, our Adjusted EBITDA for 2022 was $806.7 million* compared to $378.2 million* for 2021, representing a 113% improvement compared to 2021. |

| • | Strong Operational Performance. |

| • | Total PAMC coal shipments of 24.1 million tons in 2022 versus 23.7 million tons in 2021. |

| • | PAMC coal revenue of $1,974 million for 2022 compared to $1,085 million for 2021. |

| • | Average cash margin per ton sold of PAMC coal sales of $35.33* for 2022 versus $17.50* for 2021, a 102% improvement year-over-year. |

| • | Record annual terminal revenue of $78.9 million and adjusted EBITDA of $52.3 million* at the CONSOL Marine Terminal. |

| • | Our Bailey Preparation Plant and CONSOL Marine Terminal each had ZERO employee recordable incidents in 2022. Our Total Recordable Incident Rate at the PAMC was approximately 63% below the national average (based on preliminary MSHA data). |

| • | Net Cash Provided by Operating Activities of $651.0 million in 2022 compared to $305.6 million in 2021. |

| • | Generated free cash flow of $501.0 million* in 2022 compared to $186.4 million* in 2021, of which $292.3 million was used towards reducing consolidated indebtedness, including paying off our Term Loan A and significantly reducing both our Term Loan B and second lien notes. |

| 2 |  - 2023 Proxy Statement - 2023 Proxy Statement |

PROXY SUMMARY

| • | Positioning for the Future. |

| • | Committed to approximately $28 million in capital expenditures for 2023-2026, including $9.5 million in 2023, to advance our sustainability goals by mitigating methane emissions from our mines. These steps will advance us toward our goal of voluntarily reducing our scope 1 & 2 greenhouse gas emissions by 50% in 2026 compared to 2019 base levels. |

| • | Commissioned the Itmann preparation plant in late September 2022 and shipped the first train from the plant in October 2022. The Itmann Mining Complex, once operating at full capacity, is expected to produce approximately 900,000 tons/year of high-quality low-vol metallurgical coal for sale in the domestic and seaborne markets, with the capability to process up to 750 thousand to 1 million saleable tons of third-party metallurgical coal as well. Ramp-up to full capacity operation is expected in mid-2023. |

| • | Restarted our fifth longwall at the Pennsylvania Mining Complex in December 2022. This longwall is expected to expand our production capacity at the PAMC to 25-27 million tons in 2023, compared to 23.9 million tons of production in 2022, and it will produce a relatively low-sulfur product that is well-suited for sale in high-value and/or quality-sensitive markets such as the crossover metallurgical market. |

| • | Continued to focus on transitioning and diversifying our revenue mix. Derived 53% of our coal sales revenue from export sales, up from 46% in 2021. Additionally, 43% of our total revenues derived from contracts with customers came from sources other than sales to coal-fired power plants. |

| • | Initiated an enhanced shareholder return program in the third quarter of 2022, which returned approximately $80 million to shareholders during 2022 through dividends and share repurchases. This program is expected to continue in 2023, and we announced an update that will become effective in the first quarter of 2023 and return a planned aggregate range of approximately 35 to 50% of quarterly free cash flow*. |

| * | See reconciliation of average cash margin per ton sold (non-GAAP) to total coal revenue (GAAP), Adjusted EBITDA (non-GAAP) to net income (GAAP) and free cash flow (non-GAAP) to net cash provided by operating activities (GAAP) in Appendix A to this Proxy Statement. |

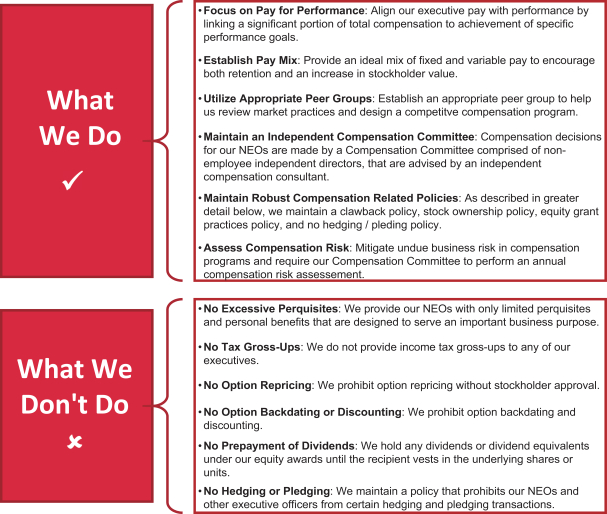

COMPENSATION HIGHLIGHTS

Independent Compensation Consultant | Continued use by our Compensation Committee of an independent compensation consultant that reports directly to the Compensation Committee. | |

Say on Pay Stockholder Engagement | Engaged in stockholder outreach regarding our compensation programs which informed the Compensation Committee’s decision-making for program changes for 2023 regarding our CEO’s employment agreement and long-term incentive awards for executives. | |

Compensation Program Design | Designed an overall compensation program with 84.6% of compensation for our CEO and 65.7% for named executive officers (“NEOs”) contingent on performance goals, reinforcing our pay-for-performance culture, which aligns risk-taking with sustainability and the long-term financial health of our company. | |

Short-Term Incentive Compensation (“STIC”) Annual Performance | Met and exceeded target performance level for 2022 STIC resulting in annual STIC payouts to our NEOs at approximately 125% of target performance. |

- 2023 Proxy Statement - 2023 Proxy Statement | 3 |

PROXY SUMMARY

Long-Term Incentive Compensation (“LTIC”) Performance-Based Restricted Stock Unit Awards (“PSUs”) | Met and exceeded target performance level for 2021 tranche resulting in the vesting of performance-based cash awards granted to the NEOs under the 2021-2023 LTIC program. | |

| Pay Ratio Results | Determined the ratio of the total annual compensation of our Chief Executive Officer (“CEO”), as compared to the total annual compensation of our median employee, to be 87:1. Based upon data collected by Mercer, our independent compensation consultant, in 2021 the average ratio of the compensation of the Chief Executive Officer to median employee of 482 of the companies included in the S&P 500 Index was 223 to 1 and among 68 companies that have reported such ratio as of March 1, 2023 with respect to 2022 compensation, the average ratio of Chief Executive Officer to median employee compensation was 353 to 1. | |

Board Size and Director Compensation | Maintained Board size and non-employee director compensation at current levels with no increases since the inception of the company in 2017. | |

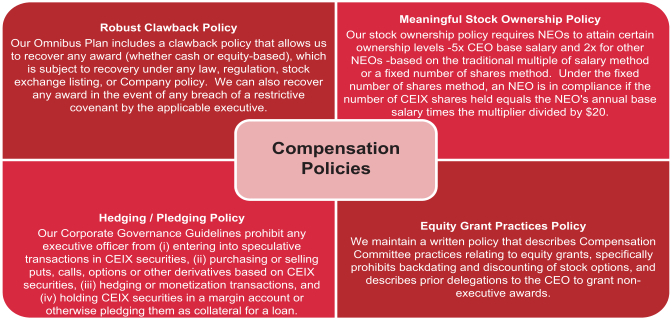

| Governance Practices | Continued adherence to good governance practices, including but not limited to, anti-hedging, recoupment, compensation risk assessment, and stock ownership/holding and equity grant practices. |

| 4 |  - 2023 Proxy Statement - 2023 Proxy Statement |

PROXY SUMMARY

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board and management are committed to strong corporate governance, which promotes the long-term interests of stockholders, strengthens Board and management accountability and helps build public trust in our company.

This Proxy Statement describes our governance framework, which includes the following highlights:

Page No. | Page No. | |||||||||

✓ All non-employee directors are independent | 17 | ✓ No Supermajority Vote Requirements | ||||||||

✓ Majority voting standard for uncontested director elections | 8 | ✓ Diversity in Board and Executive Management | 23 | |||||||

✓ Annual Election of Directors | 12 | ✓ Emphasis on Ethics Compliance | 25 | |||||||

✓ Three fully independent standing Board committees | 21 | ✓ Meaningful stock ownership and retention guidelines for the Board and executive officers | 27, 54 | |||||||

✓ Strong independent Chairman role reinforces effective independent leadership on the Board | 17 | ✓ Consistent Stockholder Outreach | 6 | |||||||

✓ Independent directors meet regularly in executive session | 17 | ✓ Annual corporate sustainability reports | 6 | |||||||

✓ Risk and safety oversight by the full Board and its committees | 18 | ✓ Human Rights Policy | 24 | |||||||

✓ Insider Trading Policy

| 55

| |||||||||

- 2023 Proxy Statement - 2023 Proxy Statement | 5 |

PROXY SUMMARY

2022 STOCKHOLDER ENGAGEMENT

CEIX has a very focused and dedicated investor relations program which handles our outreach to the analyst and investor community. We engage with our shareholders on a regular basis and provide access to our management team. Throughout the year, we attend multiple industry conferences, non-deal roadshows, one-on-one phone calls and regularly scheduled quarterly earnings calls. Each quarter we post refreshed investor marketing materials on our website to ensure transparency on the important aspects of our business. Our conversations with investors covers wide ranging topics including but not limited to business and financial updates, strategy, and ESG initiatives. These discussions also help management and the board in implementing certain strategies and programs that reflect investor preferences. For instance, in 2022, we sought feedback from investors on specific items such as executive compensation and shareholder return preferences.

Following the say-on-pay vote in 2022, which received approximately 36% support, the Compensation Committee and full Board took time to consider the feedback received. The Compensation Committee took the outcome of this vote seriously and was highly focused on gathering and responding to stockholder feedback, with the goal of incorporating key feedback themes into our executive compensation programs. We contacted 60% of our stockholders and engaged with stockholders representing 52% of our outstanding shares, of which 39% we held meetings with while the other 13% indicated no meeting was necessary because they were supportive of our compensation practices. All stockholders engaged were institutional investors. Independent directors led many of these meetings, with participation from members of our senior management team. We always consider our stockholders’ interests and feedback as part of the Board’s deliberations and decision-making.

The feedback we heard directly informed the Compensation Committee’s decision-making for program changes for 2023 regarding our CEO’s employment agreement and long-term incentive awards for executives.

| ||||

|

Where to find more information about our say-on-pay response See the letter from the Compensation Committee on page 36- 38 in the Compensation section of this Proxy Statement.

|

SUSTAINABILITY

At CEIX, we strive to be the most responsible coal company in the world. Excellence is our goal, and we endeavor to operate our business in a manner that meets or exceeds the expectations of our employees, communities, regulators and stockholders. Our approach to sustainability is underscored by our dedication to compliance, ethical business practices, and the communities where we live and work. We provide transparency into our operations through the regular publishing of corporate sustainability reports. Our Corporate Sustainability Report for 2022 has been posted to our website.

We believe long-term utilization of our high-Btu coal is essential in the quest to expand access to affordable and reliable electricity throughout the world. We are committed to employing technology and innovation across our operations that will further enhance employee safety, reduce our environmental footprint, increase operational efficiencies, and support continued coal production into the future.

LEARN MORE ABOUT OUR COMPANY

LEARN MORE ABOUT OUR COMPANY

You can learn more about our company by visiting our website, www.consolenergy.com.

| 6 |  - 2023 Proxy Statement - 2023 Proxy Statement |

INFORMATION ABOUT THE ANNUAL MEETING

|

CONSOL Energy Inc.

275 Technology Drive, Suite 101

Canonsburg, Pennsylvania 15317

Telephone (724) 416-8300

GENERAL: Proxies are being solicited by the Board to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on April 27, 2023, at 8:00 a.m., Eastern Time solely via live webcast at www.virtualshareholdermeeting.com/CEIX2023. The specific proposals to be considered and voted upon at the Annual Meeting are summarized in the Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

PROPOSALS, BOARD RECOMMENDATION AND VOTE REQUIRED: Stockholders are being asked to vote on the proposals discussed on the following page at the Annual Meeting. The table on the following page also outlines the Board’s recommendation on how to vote for each proposal and the vote required with respect to each proposal.

VOTE TABULATION: In accordance with our governing documents and applicable state law, in tabulating the voting result for any particular proposal, votes that are withheld or shares that constitute broker non-votes (described below) are not considered entitled to vote on that proposal and have no effect on the outcome. Abstentions have the same effect as votes against the matter, except in the case of Proposal No. 1, where abstentions would not have an effect on the outcome.

RECORD DATE AND QUORUM: The record date with respect to this solicitation is March 3, 2023. All holders of record of CEIX common stock as of the close of business on the record date are entitled to vote at the Annual Meeting and any adjournment or postponement thereof. As of the record date, CEIX had 34,460,537 shares of common stock outstanding. Each share of common stock is entitled to one vote for each matter to be voted on at the Annual Meeting. Stockholders do not have cumulative voting rights. In order to hold the Annual Meeting, a quorum representing the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting must be present in person or represented by proxy.

- 2023 Proxy Statement - 2023 Proxy Statement | 7 |

INFORMATION ABOUT THE ANNUAL MEETING

Item | Proposal |

Board Recommendation | Vote Required | |||

1 |

Election of Directors Election of director nominees for a one-year term ending at the Company’s annual meeting of stockholders in 2024. |

FOR EACH |

Plurality of the votes cast. Under this plurality vote standard, the director nominees who receive the highest number of “for” votes cast are elected as directors. Under our bylaws, if a director nominee receives a greater number of “withheld” votes for his or her election than votes cast in favor of his or her election, then the director must tender his or her resignation to the Board. | |||

2 |

Ratification of Appointment of Ernst & Young LLP The Audit Committee appointed Ernst & Young LLP as CEIX’s independent registered public accounting firm for fiscal year 2023. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s appointment of the independent registered public accounting firm. |

FOR |

Affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote on the matter. | |||

3 |

Advisory Approval of 2022 Named Executive Officers’ Compensation Stockholders are being asked to approve, on an advisory basis, the compensation paid to CEIX’s named executive officers in 2022. CEIX’s executive compensation programs are designed to create a direct linkage between stockholder interests and management with incentives specifically tailored to the achievement of financial, operational and stock performance goals.

|

FOR |

Affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote on the matter. | |||

| 8 |  - 2023 Proxy Statement - 2023 Proxy Statement |

INFORMATION ABOUT THE ANNUAL MEETING

PROXY MATERIALS AND INFORMATION ABOUT THE MEETING: We mailed to all stockholders of record entitled to vote at the Annual Meeting this Proxy Statement, the proxy card, and our 2022 Annual Report on or about March 30, 2023.

We are utilizing a Securities and Exchange Commission (“SEC”) rule that allows companies to mail all proxy materials to its stockholders. This delivery can be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders, the Company must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website. These proxy materials include this Proxy Statement, the proxy card, and our 2022 Annual Report and are available free of charge on CEIX’s corporate website at www.consolenergy.com by following the link for “Investors” and also at www.proxyvote.com.

Copies of our 2022 Annual Report furnished to our stockholders do not contain copies of exhibits to our Annual Report on Form 10-K for the year ended December 31, 2022. You can obtain copies of these exhibits electronically at the website of the SEC at www.sec.gov or by mail from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. The exhibits are also available as part of the Form 10-K for the year ended December 31, 2022, which is available on CEIX’s corporate website at www.consolenergy.com. Stockholders may also obtain copies of the exhibits without charge by contacting our Investor Relations department by telephone at (724) 416-8300 or by mail at CONSOL Energy Inc., Investor Relations department, 275 Technology Drive, Suite 101, Canonsburg, Pennsylvania 15317.

PROXIES AND VOTING: A proxy is your legal designation of another person to vote the CEIX common shares that you owned as of the record date. The person that you designate to vote your shares is called a “proxy” and when you designate someone to vote your shares in a written document, that document is also called a “proxy” or “proxy card”. The Board has appointed several officers of the company to serve as proxies on the proxy card.

If a proxy is properly executed and is not revoked by the stockholder, the shares it represents will be voted at the Annual Meeting in accordance with the instructions provided by the stockholder. If a proxy card is signed and returned without specifying choices, the shares will be voted in accordance with the recommendations of the Board. Accordingly, if no contrary instructions are given, the proxies named by the Board intend to vote the shares represented by such proxies as follows:

| • | in favor of the election of those persons nominated as set forth in this Proxy Statement to serve as directors of CEIX (Proposal No. 1); |

| • | in favor of the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of CEIX for the fiscal year ending December 31, 2023 (Proposal No. 2); |

| • | in favor of approval, on an advisory basis, of the compensation paid to our named executive officers in 2022 (Proposal No. 3); and |

| • | in accordance with their judgment on any other matters which may properly come before the Annual Meeting. |

The Board does not know of any other business to be brought before the Annual Meeting other than as indicated in the Notice of Annual Meeting of Stockholders.

- 2023 Proxy Statement - 2023 Proxy Statement | 9 |

INFORMATION ABOUT THE ANNUAL MEETING

HOW TO VOTE: There are four ways for stockholders of record to vote:

| VIA THE INTERNET BY PROXY: Stockholders who received a proxy card may still submit proxies over the Internet at www.proxyvote.com up until 11:59 p.m. Eastern Time on April 26, 2023. Stockholders who received a voting instruction form by mail or e-mail from their bank, broker or other nominee may submit proxies over the Internet by following the instructions on the voting instruction form provided by their bank, broker or other nominee. | |

| VIA TELEPHONE BY PROXY: Registered stockholders of record may submit proxies by telephone up until 11:59 p.m. Eastern Time on April 26, 2023 by calling 1-800-690-6903 and following the instructions. Stockholders must have the 16-digit control number that appears on their proxy card when voting. Stockholders who have received a voting instruction form by mail or e-mail from their bank, broker or other nominee should check the voting instruction form for telephone voting availability. If available, those stockholders may vote by phone by calling the number specified on the voting instruction form provided by the bank, broker or other nominee. | |

| VIA MAIL BY PROXY: Stockholders who have received a paper copy of a proxy card or voting instruction form by mail may submit proxies by completing, signing and dating their proxy card or voting instruction form and mailing it in the accompanying pre-addressed envelope. | |

| BY PARTICIPATING IN THE ANNUAL MEETING: Stockholders of record may vote by participating in the virtual Annual Meeting via the CEIX Meeting Website and voting electronically during the virtual Annual Meeting. | |

BENEFICIAL OWNERSHIP AND BROKER NON-VOTES: If you hold shares beneficially in street name, then you must provide your voting instructions to your bank, broker or other nominee. If you do not provide your bank, broker or other nominee with voting instructions, your shares may be treated as “broker non-votes.”

Generally, broker non-votes occur on a matter when a bank, broker or other nominee is not permitted to vote on that matter without instructions from the beneficial owner and such instructions are not given. Banks, brokers or other nominees that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals, such as Proposal Nos. 1 and 3, although they may vote their clients’ shares on “routine matters,” such as Proposal No. 2.

REVOCATION OF PROXY: If you are the stockholder of record of shares of our common stock as of the close of business on the record date, you can revoke your proxy at any time before its exercise by:

| • | sending a written notice to CEIX at 275 Technology Drive, Suite 101, Canonsburg, Pennsylvania 15317, attention: Secretary, bearing a date later than the date of the proxy, that is received prior to the Annual Meeting, stating that you revoke your proxy; |

| • | submitting your voting instructions again by telephone or over the Internet; |

| • | signing another valid proxy card bearing a later date than the proxy initially received and mailing it so that it is received by CEIX prior to the Annual Meeting; or |

| • | participating in and voting electronically via the CEIX Meeting Website during the virtual Annual Meeting. |

If you hold your shares through a bank, broker or other nominee, you must follow the instructions found on your voting instruction form, or contact your bank, broker or other nominee, in order to revoke your previously delivered proxy. Attendance at the Annual Meeting without a request to revoke a proxy will not by itself revoke a previously executed and delivered proxy.

| 10 |  - 2023 Proxy Statement - 2023 Proxy Statement |

INFORMATION ABOUT THE ANNUAL MEETING

ATTENDING THE MEETING: The Annual Meeting will be held solely via live webcast at www.virtualshareholdermeeting.com/CEIX2023 on April 27, 2023 at 8:00 a.m. Eastern Time and you will not be able to be physically present at the Annual Meeting. You will be able to participate virtually, vote your shares of CEIX common stock electronically and submit questions online during the Annual Meeting.

To participate in the virtual Annual Meeting, you will need the 16-digit control number included on your proxy card, vote instruction form or notice you previously received. The Annual Meeting webcast will begin promptly at 8:00 a.m. Eastern Time on April 27, 2023, and CEIX stockholders will be able to log in beginning at 7:45 a.m. Eastern Time. The virtual Annual Meeting platform is fully supported across browsers (Firefox, Chrome, Edge and Safari). Participants in the Annual Meeting should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the Annual Meeting. We encourage participants in the virtual Annual Meeting to log on to the CEIX Meeting Website 15 minutes prior to the start time of the Annual Meeting and ensure that they can hear streaming audio.

ASKING QUESTIONS DURING THE MEETING: During the live question and answer portion of the Annual Meeting, CEIX stockholders may submit questions, which will be answered as they come in, as time permits. If you wish to submit a question, you may do so by logging in to the CEIX Meeting Website, and under the “Ask a Question” heading, selecting a question topic in the question topic dropdown menu, typing your question in the field titled “Enter Question” and then clicking “Submit”. Only questions pertinent to Annual Meeting matters will be answered during the Annual Meeting, subject to time constraints.

TECHNICAL SUPPORT FOR ACCESSING THE MEETING: We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting via the CEIX Meeting Website. If you encounter any difficulties accessing the CEIX Meeting Website during the check-in or meeting time, please call the technical support number that will be posted on the CEIX Meeting Website log in page.

PROXY SOLICITATION: All costs relating to the solicitation of proxies will be borne by CEIX. Georgeson LLC has been retained by CEIX to aid in the solicitation of proxies at an estimated cost of $10,000, plus reimbursement of out-of-pocket expenses. Proxies may also be solicited by officers, directors and employees personally, by mail, or by telephone, facsimile transmission or other electronic means. None of these directors, officers or employees will receive any additional or special compensation for soliciting proxies. Upon request, CEIX will reimburse banks, brokers and other nominees for their reasonable expenses in sending proxy materials to their customers who are beneficial owners of CEIX’s common stock.

CONFIDENTIALITY IN VOTING: As a matter of policy, proxies, ballots and voting tabulations that identify individual stockholders are held confidentially by CEIX. Such documents are available for examination only by the inspectors of election and certain employees who assist in the tabulation of votes. The vote of any individual stockholder will not be disclosed except as may be necessary to meet applicable legal requirements.

- 2023 Proxy Statement - 2023 Proxy Statement | 11 |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

|

The Nominating and Corporate Governance Committee has recommended, and the Board has nominated James A. Brock, William P. Powell, John T. Mills, Joseph P. Platt, Cassandra Pan and Valli Perera, whose terms expire at the Annual Meeting, for election by the stockholders as directors at the Annual Meeting. Upon election, each such director will serve a one-year term until the 2024 annual meeting of stockholders or until his or her successor is elected and qualified, or his or her earlier death, resignation or removal.

To be elected, each nominee must receive a plurality of the votes cast (i.e., the director nominees who receive the highest number of “for” votes cast, up to the maximum number of directors to be elected, are elected as directors). If any nominee should for any reason become unable to serve, all shares represented by valid proxies will be voted for the election of such other person as the Board may designate, as recommended by the Nominating and Corporate Governance Committee. Alternatively, the Board may reduce the number of directors to eliminate the vacancy.

Our bylaws provide that if an incumbent director receives a greater number of votes “withheld” from his or her election than votes “for” such director nominee’s election, the director must tender his or her resignation promptly to the Board. The Nominating and Corporate Governance Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the Nominating and Corporate Governance Committee’s recommendation, and publicly disclose its decision and the underlying rationale in a press release, a filing with the SEC or other broadly disseminated means of communication within 90 days from the date of the certification of the election results.

The biographies included in this Proxy Statement below include information concerning the nominees for director, including their recent employment, positions with CEIX, other directorships, board committee memberships and ages as of March 22, 2023.

| 12 |  - 2023 Proxy Statement - 2023 Proxy Statement |

PROPOSAL NO. 1—ELECTION OF DIRECTORS | Biographies of Director Nominees

Biographies of Director Nominees

JAMES A. BROCK

| ||||

|

CHIEF EXECUTIVE OFFICER OF CEIX

Director Since: 2017 Age: 66 Term Expires: 2023 |

CEIX Committees: • Health, Safety and Environmental | ||

BACKGROUND:

James A. Brock has served as our Chief Executive Officer since June 2017, previously served as our President from December 2017 to January 2023, and he has been a member of our Board since November 28, 2017. He currently serves as a member of our Board’s Health, Safety and Environmental Committee. Mr. Brock previously served as the Chief Operating Officer-Coal of CNX Resources Corporation (“CNX”), CEIX’s former parent, from December 10, 2010 until November 28, 2017, when CEIX separated from CNX. Since May of 2015, Mr. Brock also served as Chief Executive Officer and Chairman of the board of directors of the general partner of PA Mining Complex LP (“PAMC LP”) (formerly known as CONSOL Coal Resources LP) during such time as PAMC LP was a publicly-traded master limited partnership and he continues to serve in such roles now that PAMC LP is a wholly-owned subsidiary of the Company. Previously, he served as Senior Vice President-Northern Appalachia-West Virginia Operations of CNX from 2007 to 2010, and as Vice President-Operations of CNX from 2006 to 2007. Mr. Brock began his career with CNX in 1979 at the Matthews Mine and since then has served at various locations in many positions including Section Foreman, Mine Longwall Coordinator, General Mine Foreman and Superintendent. Mr. Brock’s achievements in mining were recognized with him being named 2010 Coal Safety Leader of the Year in West Virginia and his induction into the West Virginia Coal Hall of Fame in 2016. Mr. Brock also currently serves as the Treasurer of the Pennsylvania Coal Alliance board of directors, as a member of the boards of directors of the National Coal Council and the American Coalition for Clean Coal Electricity and as an executive committee member and board of directors of the National Mining Association. Mr. Brock also serves on the board of directors of West Virginia Coal Association.

QUALIFICATIONS:

With a career in coal spanning five decades, we believe Mr. Brock’s extensive knowledge of our industry and our operations gained during his years of service with CNX, and now CEIX, provides our Board with valuable experience.

|

- 2023 Proxy Statement - 2023 Proxy Statement | 13 |

PROPOSAL NO. 1—ELECTION OF DIRECTORS | Biographies of Director Nominees

JOHN T. MILLS

| ||||

|

FORMER CHIEF FINANCIAL OFFICER—

Director Since: 2017 Age: 75 Term Expires: 2023 |

CEIX Committees: • Audit (Chair) • Compensation • Health, Safety and Environmental | ||

BACKGROUND:

John T. Mills joined the Board on November 14, 2017. He currently serves as a member of our Board’s Audit Committee, which he chairs, Compensation Committee and Health, Safety and Environmental Committee. Mr. Mills previously served as a member of the board of directors of CNX from March 2006 until November 28, 2017, when CEIX separated from CNX. From December 2007 until August 2015, he served on the board of directors of Cal Dive International Inc., a marine contractor providing manned diving, derrick, pipelay and pipe burial services to the offshore oil and natural gas industry, where he served as lead independent director, and as a member of the audit, compensation, and corporate governance and nominating committees. From January 2008 through June 2010, Mr. Mills was a member of the board of directors and audit, conflicts and risk management committees of Regency GP, LLC, the general partner of Regency GP, LP, the general partner of Regency Energy Partners LP, a natural gas gathering, processing and transportation master limited partnership. Mr. Mills joined the board of directors of Horizon Offshore, Inc., a marine construction company, in June 2002 and served as the chairman of the board of directors from September 2004 until December 2007, when Horizon Offshore, Inc. was acquired by Cal Dive International, Inc. Mr. Mills was the Chief Financial Officer of Marathon Oil Corporation, an integrated energy company, from January 2002 until his retirement in December 2003. In 2011, Mr. Mills attended the Harvard Business School program “Making Corporate Boards More Effective.”

QUALIFICATIONS:

As a licensed attorney with over 40 years of business experience, including 16 years as an officer of Marathon Oil Corporation and U.S. Steel Corporation, Mr. Mills brings significant knowledge and experience to our Board. In particular, Mr. Mills brings an in-depth understanding of the evaluation of organic growth capital projects and acquisition and disposition opportunities, and the importance of maintaining a competitive capital structure and liquidity. In addition, having previously served as Senior Vice President, Finance and Administration, and later Chief Financial Officer of Marathon Oil Corporation, Mr. Mills has developed a wealth of financial knowledge with respect to the oversight of (i) the preparation of consolidated financial statements, (ii) internal audit functions, and (iii) public accountants, skills which are critical to our company and particularly our Audit Committee.

|

WILLIAM P. POWELL

| ||||

|

MANAGING PARTNER—535 PARTNERS LLC

Director Since: 2017 Age: 67 Term Expires: 2023 |

CEIX Committees: • Audit • Compensation • Health, Safety and Environmental | ||

BACKGROUND:

William P. Powell joined the Board on November 28, 2017 and has served as Chair of our Board since that time. He currently serves as a member of our Board’s Audit Committee, Compensation Committee and Health, Safety and Environmental Committee. Mr. Powell previously served as a member of the board of directors of CNX from January 2004 until November 28, 2017, when CEIX separated from CNX. Mr. Powell also previously was a director of Cytec Industries, a global specialty chemicals and materials company, from 1993 until its merger with Solvay SA in December 2015, where he served as lead independent director, as chair of the governance committee and as a member of the audit committee. From May 2001 until May 2007, Mr. Powell was a Managing Director of William Street Advisors, a New York City-based merchant banking boutique. Mr. Powell resigned from William Street Advisors to establish a family office, 535 Partners LLC, where he has served as Managing Partner since May 2007. Prior to his time at William Street Advisors, he served as a Managing Director of UBS Warburg LLC and its predecessor Dillon, Read & Co. Inc. since 1991.

QUALIFICATIONS:

With an MBA degree and over 30 years of financial, management and investment experience, Mr. Powell brings a wealth of knowledge to our Board. Having served on multiple public company boards for over 20 years, Mr. Powell also has significant expertise in corporate governance matters.

|

| 14 |  - 2023 Proxy Statement - 2023 Proxy Statement |

PROPOSAL NO. 1—ELECTION OF DIRECTORS | Biographies of Director Nominees

JOSEPH P. PLATT

| ||||

|

GENERAL PARTNER—THORN

Director Since: 2017 Age: 75 Term Expires: 2023 |

CEIX Committees: • Compensation (Chair) • Nominating and Corporate Governance • Health, Safety and Environmental | ||

BACKGROUND:

Joseph P. Platt joined the Board on November 28, 2017. He currently serves as a member of our Board’s Compensation Committee, which he chairs, Nominating and Corporate Governance Committee and Health, Safety and Environmental Committee. Mr. Platt previously served as a member of the board of directors of CNX from May 2016 until November 28, 2017, when CEIX separated from CNX. He is the general partner at Thorn Partners LP, a family limited partnership, a position he has held since 1998. Mr. Platt’s career at Johnson and Higgins, a global insurance broker and employee benefits consultant (J&H), spanned 27 years until 1997, when J&H was sold to Marsh & McLennan Companies. At the time of the sale, Mr. Platt was an owner, director and executive vice president of J&H. Mr. Platt has served on the board of directors of Greenlight Capital Re, Ltd., a property and casualty reinsurer, since 2004 and has been its lead independent director since 2007. He serves on the boards of various other nonpublic companies and not-for-profit institutions.

QUALIFICATIONS:

Mr. Platt brings significant financial, compensation and risk management expertise to our Board.

|

VALLI PERERA

| ||||

|

FORMER PARTNER OF DELOITTE

Director Since: 2023 Age: 65 Term Expires: 2023 |

CEIX Committees: • Nominating and Corporate Governance (Chair) • Audit • Health, Safety and Environmental | ||

BACKGROUND:

Valli Perera joined the Board on March 22, 2023. She currently serves as a member of our Board’s Nominating and Corporate Governance Committee, which she chairs, Audit Committee and Health, Safety and Environmental Committee. Ms. Perera is a seasoned executive with over 40 years of professional services and corporate experience. She retired from Deloitte, as a senior partner in June 2019. During her tenure at Deloitte, Ms. Perera advised and led client service teams in areas of finance, mergers and acquisitions, technology transformation and business growth. She also worked with transitioning chief financial officers at Deloitte’s CFO Transition Lab program. Ms. Perera’s tenure at Deloitte spanned over 25 years, including: her elevation to the partnership in 1997, senior roles such as Managing Director for Global Services and Global Mergers & Acquisition, Deloitte’s Global and U.S. Service Innovation Board and the firm’s global digital transformation, talent and development, diversity and inclusion, and member firm standards and governance. Further, from 2014 to 2020, she served on the board of directors of Make-A-Wish® Illinois, a non-profit organization.

Ms. Perera currently serves on the board of directors for Midmark Corporation, a clinical environmental design private company, since 2020 and is a member of its audit and compensation committees. Moreover, since 2012, Ms. Perera has served on the board of directors for Communities In Schools of Chicago, a non-profit organization and is the Chair of its governance committee. She received a Master of Science degree in Taxation from Drexel University and a graduate degree in journalism from Northwestern University. Ms. Perera is credentialed by the Chartered Institute of Management Consultants, United Kingdom. Further, she is a retired Certified Public Accountant.

QUALIFICATIONS:

With an extensive tenure spanning over 40 years as a seasoned business leader partnering with executive teams of private and Fortune 500 publicly traded signature companies to define high-value strategies for top- and bottom-line growth and providing specialized services in finance, governance, and organizational development, as well as global insight and direct experience across several continents, skills in finance, accounting, tax, acquisitions, and technology and substantive board directorship experience, Ms. Perera brings significant expertise to the board of directors.

|

- 2023 Proxy Statement - 2023 Proxy Statement | 15 |

PROPOSAL NO. 1—ELECTION OF DIRECTORS | Biographies of Director Nominees

CASSANDRA PAN

| ||||

|

FORMER PRESIDENT OF FENNER DUNLOP AMERICAS

Director Since: 2023 Age: 64 Term Expires: 2023 |

CEIX Committees: • Health, Safety and Environmental (Chair) • Nominating and Corporate Governance | ||

BACKGROUND:

Cassandra Pan joined the Board on March 22, 2023. She currently serves as chair of our Board’s Health, Safety and Environmental Committee and on the Nominating and Corporate Governance Committee. Ms. Pan has extensive entrepreneurial and executive experience in North America, China and internationally. She is currently self-employed as a business consultant and strategic advisor. From 2009 to 2015 based in Pittsburgh, Pennsylvania, she was the President of Fenner Dunlop Americas (formerly a subsidiary of Fenner plc and now a part of the Michelin group of companies) where she led that company’s Engineered Conveyor Solutions business in North and South America. Prior to her elevation to President of the Americas, she served as Managing Director of Greater China at Fenner plc. from 1998 to 2009, where she oversaw Fenner’s wholly owned and joint venture investments in China relating to the manufacture of conveyor belting and specialty polymer businesses for use in the servicing of underground coal mines, construction equipment and in various automotive and industrial markets. Since 2016, Ms. Pan serves as a mentor at AlphaLab Gear, a hardware accelerator program of Innovation Works, a seed-stage investor. From 2010 to 2018, she served as a member of the Advisory Committee of International Center for Energy, Environment and Sustainability (InCEES) at Washington University in St. Louis, Missouri. Since 2015 she has served on the board of directors of WQED Multimedia, a not-for-profit education-focused public media organization, where she also serves as chair of the Audit Committee and a member of the Finance, Business & Operations Committee. She is a member of the International Women’s Forum, Pittsburgh Chapter since 2012.

QUALIFICATIONS:

With nearly two decades of experience in leading global engineering business units in Asia and the Americas for a publicly traded company specializing in helping clients in the underground and surface mining industries in China, North America and South America to meet their engineering and material handling requirements, Ms. Pan brings significant expertise to the board of directors. Her professional experience in addressing a variety of operational and strategic aspects relating to the business, finances, engineering challenges, health, safety and environmental risks, sales and marketing efforts and human resource matters of mining companies brings important and relevant competencies and skills to the board.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE ABOVE-NAMED DIRECTOR NOMINEES FOR RE-ELECTION TO THE BOARD OF DIRECTORS.

| 16 |  - 2023 Proxy Statement - 2023 Proxy Statement |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION

|

Board of Directors and Its Committees

Board of Directors

The business and affairs of CEIX are managed under the direction of our Board. Our Board currently consists of six directors. Under our Certificate of Incorporation all directors are subject to election annually.

We do not have a formal policy regarding directors’ attendance at our annual meetings of stockholders; however, all directors are encouraged to attend. All of CEIX’s directors attended the 2022 Annual Meeting of Stockholders, and all of the directors are expected to attend this year’s Annual Meeting.

Board Leadership Structure

Our Board is currently structured with separate Chair and Chief Executive Officer positions. Our Corporate Governance Guidelines provide that the Board will determine whether to have a joint Chair and Chief Executive Officer or separate these offices as part of the succession planning process when it elects a Chief Executive Officer or at other appropriate times. The Board believes that the most effective leadership structure for our company at this time is to have Mr. Powell serve as independent Chair and Mr. Brock to serve as Chief Executive Officer. The Board believes these separate positions can facilitate Mr. Brock’s focus on the operation of our company and implementation of our strategy and business plans, while ensuring effective oversight and focus by the Board on accountability of management, oversight and corporate governance matters. In addition, in the event that our Chief Executive Officer would also serve as the Chair, our corporate governance guidelines require a Lead Director position with specific responsibilities to ensure independent oversight of management.

Determination of Director Independence

The New York Stock Exchange (NYSE) listing standards require a majority of our directors and each member of our Audit, Compensation and Nominating and Corporate Governance Committees to be independent. In February 2023, our Board evaluated the relevant relationships between each director or director nominee (and his or her immediate family members and affiliates) and CEIX, and affirmatively determined that each of our directors, other than Mr. Brock (who is the Chief Executive Officer of CEIX), had no material relationship with CEIX and is “independent” under the corporate governance rules of the NYSE codified in Section 303A of the NYSE Listed Company Manual. In February 2023, the Board also determined that each member of the Audit Committee meets the independence standards required for audit committee members under the NYSE listing standards and the SEC rules, and considered the additional factors under the NYSE rules relating to members of the Compensation Committee before determining that each of them is independent. Effective March 22, 2023, Valli Perera and Cassandra Pan, who are both independent under the NYSE listing standards, replaced former independent directors Sophie Bergeron and Edwin S. Roberson on the Board.

Our independent directors regularly meet in executive sessions with no members of management present. Such executive sessions are presided over by our Chair of the Board.

- 2023 Proxy Statement - 2023 Proxy Statement | 17 |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

Robust Strategy, Risk and Safety Oversight by the Board and Committees

Our Board and committees have implemented a robust framework to actively oversee the strategy and risks relating to the operation and management of a publicly-traded coal company. In addition, our Board has a strong commitment to the safety of our workers and the environments in which we operate and has formed a separate Board level committee to oversee these core company values. See “Board’s Role in Risk Management” on page 20 for further information of the Board’s role in risk management.

Membership and Meetings of the Board of Directors and its Committees

In 2022, five of the six incumbent directors attended 100% of the meetings held by our Board and five of the six incumbent directors attended 100% of the meetings held by all Board committees on which he or she served. One incumbent director attended 90% of the meetings held by our Board and 80% of the meetings held by Board committees on which the incumbent director served.

Committee membership and the number of meetings held during 2022 by each committee, are shown in the following table:

| Board of Directors | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Health, Safety and Environmental Committee | ||||||

William P. Powell | Chair | ● | ● | ● | ||||||

Sophie Bergeron | ● | ● | Chair | |||||||

James A. Brock | ● | ● | ||||||||

John T. Mills | ● | Chair | ● | ● | ||||||

Joseph P. Platt | ● | Chair | ● | ● | ||||||

Edwin S. Roberson | ● | ● | Chair | ● | ||||||

No. of 2022 Meetings | 10 | 6 | 6 | 6 | 5 |

| 18 |  - 2023 Proxy Statement - 2023 Proxy Statement |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

Board Skills and Experience

The Nominating and Corporate Governance Committee seeks to cultivate a Board with the appropriate skill sets and diversity of experiences to discharge its responsibilities effectively. Each director possesses a unique background and, in the aggregate, we believe the Board encompasses the skills and experiences deemed important to effectively oversee our business.

The table below summarizes some of the key skills and experiences that the Nominating and Corporate Governance Committee currently believes should be represented on the Board, as well as the number of director nominees who possess each skill.

Skills, Experience and Demographics | Valli Perera

| James A.

| John T. Mills

| Cassandra

| Joseph

| William

| ||||||||

| Industry Experience |  |  |  |  |  | ||||||||

| Senior Leadership Experience |  |  |  |  |  |  | |||||||

| Financial Experience |  |  |  |  | |||||||||

| Public Company Board |  |  |  |  | |||||||||

| Operations/Environmental, Health & Safety (EH&S) |  |  |  | ||||||||||

| Risk Management |  |  |  |  |  |  | |||||||

| Sales and Marketing |  |  |  |  | |||||||||

| Strategy/M&A |  |  |  |  |  | ||||||||

| Human Capital Management |  |  |  |  |  | ||||||||

Race/Ethnicity | ||||||||||||||

African American | ||||||||||||||

Asian/Pacific Islander |  |  | ||||||||||||

White/Caucasian |

|  |

|

|  |  | ||||||||

Hispanic/Latino |

|

|

|

|

|

| ||||||||

Native American |

|

|

|

|

|

| ||||||||

Gender |

|

|

|

|

|

| ||||||||

Male |

|  |

|

|  |  | ||||||||

Female |  |

|

|  |

|

| ||||||||

- 2023 Proxy Statement - 2023 Proxy Statement | 19 |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

Board’s Role in Risk Management

|

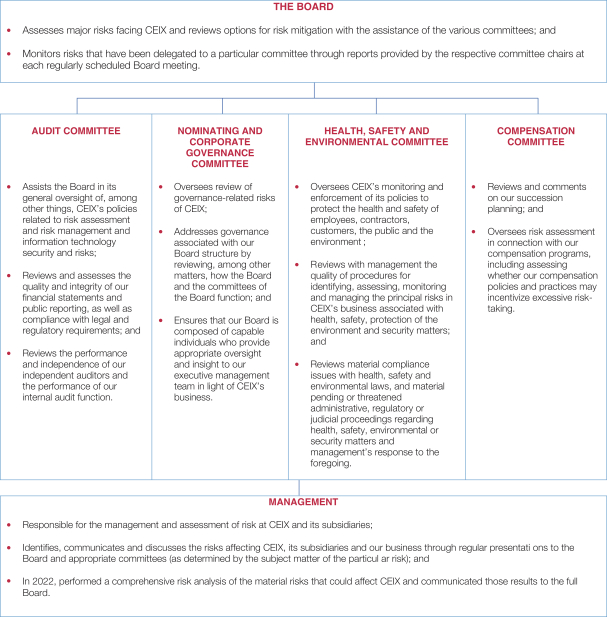

Among the Board’s most important functions is overseeing risk management. Our risk management framework fosters close interaction among the Board, its committees and our management.

The Company faces a variety of risks, including operational, financial, strategic, and reputational risks. The Board oversees the Company’s processes for assessing and managing these risks, through both the whole Board and its committees, while management is responsible for the day-to-day management of these risks. In furtherance of the Board’s oversight responsibilities and the Company’s day-to-day management of risk, CEIX representatives meet periodically with external advisors with respect to our risk management processes, as well as identified and emerging risks.

| 20 |  - 2023 Proxy Statement - 2023 Proxy Statement |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

Committees of the Board of Directors

Our Board has four standing committees: Audit, Compensation, Nominating and Corporate Governance, and Health, Safety and Environmental. Currently, all of our directors other than James A. Brock are independent, and our Audit, Nominating and Corporate Governance, and Compensation Committees consist exclusively of independent directors. Our committees regularly make recommendations and report on their activities to the entire Board. All members of each of the Audit, Compensation and Nominating and Corporate Governance Committees are independent under the current listing standards of the NYSE and other applicable regulatory requirements, as described above under “Determination of Director Independence”. Our Board, considering the recommendations of our Nominating and Corporate Governance Committee, reviews committee membership at least annually. The responsibilities of each of the four committees are summarized below.

Audit Committee

Three Independent Director Members |

• Assists our Board in its oversight of, among other things, the integrity of CEIX’s financial statements, CEIX’s compliance with legal and regulatory requirements, CEIX’s risk management policies and practices, and CEIX’s information technology security and risks;

• Oversees the appointment, compensation, and retention of CEIX’s independent auditor, and oversees the work done by CEIX’s independent auditor and any other registered public accounting firm hired to perform audit-related functions;

• Reviews and discusses with CEIX’s management and its independent auditor annual and quarterly financial statements, including those disclosures that appear under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in CEIX’s Form 10-Ks and Form 10-Qs;

• Provides general oversight over the accounting principles employed in CEIX’s financial reporting and the effectiveness of CEIX’s internal controls over financial reporting;

• Prepares any required Audit Committee Report; and

• Oversees CEIX’s internal audit function.

|

Our Audit Committee was established pursuant to Section 3(a)(58)(A) of the Exchange Act. Our Board has determined that all members of the Audit Committee are financially literate within the meaning of SEC rules and under the current listing standards of the NYSE. Our Board has also determined that each of the members of the Audit Committee qualify as an “audit committee financial expert.” A copy of the Audit Committee’s report for the 2022 fiscal year is included in this Proxy Statement.

Compensation Committee

Three Independent Director Members |

• Establishes and reviews CEIX’s compensation philosophies, policies, plans and programs, consistent with CEIX’s objectives and stockholder interests, for our non-employee directors and executive officers;

• Reviews executive officer compensation against peer group benchmark data and sets compensation levels for executive officers;

• Reviews the performance of our executive officers and awards incentive compensation;

• Reviews and discusses with management the Compensation Discussion and Analysis required to be included in our proxy statement;

• Oversees CEIX’s policies on structuring compensation programs for executive officers;

• Reviews and monitors our management development and succession plans and activities;

• Engages and oversees the outside compensation consultant;

• Reviews and oversees the risk assessment related to CEIX’s compensation programs; and

• Prepares the Compensation Committee Report for full Board review.

|

- 2023 Proxy Statement - 2023 Proxy Statement | 21 |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

Our Compensation Committee’s charter generally permits it to delegate its authority, duties and responsibilities or functions to one or more members of the Compensation Committee or to CEIX’s officers, except where otherwise prohibited by law or applicable listing standards. The terms of our Omnibus Performance Incentive Plan (the “Omnibus Plan”) also permit our Compensation Committee to delegate any power and authority granted to it by the Board under the Omnibus Plan to our officers.

Our Compensation Committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The Compensation Committee also periodically reports to the Board on how our non-employee director compensation practices compare with those of other similarly situated public corporations and, if the Compensation Committee deems it appropriate, recommends changes to our director compensation practices to our Board for approval.

For additional information regarding the Compensation Committee’s processes and procedures for reviewing and determining executive officer compensation, see starting on page 36 of the “Compensation Discussion and Analysis” section.

Nominating and Corporate Governance Committee

Three Independent Director Members |

• Identifies qualified individuals for nomination, election or appointment to the Board;

• Ensures appropriate Board and committee composition, and recommends appropriate Board structure and operations;

• Oversees and assesses CEIX’s corporate governance system, including the responsibilities of Board members and committees, and related policies and procedures;

• Oversees annual evaluation of the Board, committees and management;

• Recommends each director nominee to our Board for nomination for election at the annual meetings, taking into account candidates whose names are submitted by stockholders; and

• Annually reviews CEIX’s Corporate Governance Guidelines.

|

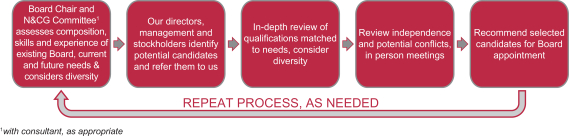

Director Nomination Process. The Nominating and Corporate Governance Committee annually reviews and assesses the Board’s membership needs, with the assistance of a consultant when appropriate. When assessing Board composition or identifying suitable candidates for appointment or re-election to the Board, the Nominating and Corporate Governance Committee will consider candidates based on the needs of the Board at the time, having due regard to the benefits of diversity. The Nominating and Corporate Governance Committee seeks to maintain a Board that is comprised of individuals who possess the following skills, experience and/or attributes:

| • | general industry knowledge; |

| • | accounting and finance; |

| • | ability to make sound business decisions; |

| • | management; |

| • | leadership; |

| • | knowledge of international markets; |

| • | business strategy; |

| • | crisis management; |

| • | innovation; |

| • | environmental, social and corporate governance concerns; |

| • | prior board experience; |

| • | diversity; and |

| • | risk management. |

| 22 |  - 2023 Proxy Statement - 2023 Proxy Statement |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

The Nominating and Corporate Governance Committee seeks to identify director candidates with leadership experience in positions with a high degree of responsibility. Director nominees are expected to be selected based upon contributions that they can make to CEIX.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders, although a formal policy has not been adopted with respect to consideration of such candidates because stockholder recommendations may be submitted and considered by the Nominating and Corporate Governance Committee under its charter. Director candidates recommended by stockholders will be evaluated by the Nominating and Corporate Governance Committee using the same criteria as candidates identified by the Board or the Nominating and Corporate Governance Committee for consideration. Stockholders may submit names of director candidates to Secretary, CONSOL Energy Inc., 275 Technology Drive, Suite 101, Canonsburg, Pennsylvania 15317. See “Additional Matters” on page 78 for more information on making director nominations.

Board Diversity and Inclusion. We believe in diversity and value the benefits diversity can bring to our Board and to the Company. The Board has adopted a policy regarding the diversity of its members, which is included in our Corporate Governance Guidelines.

For the purposes of Board composition, diversity includes, but is not limited to, business experience, geography, age, gender and ethnicity. Board diversity promotes the inclusion of different perspectives and ideas, and ensures that the Company has the opportunity to benefit from all available talent. The promotion of a diverse Board makes prudent business sense and makes for better corporate governance. Effective March 22, 2023, Cassandra Pan and Valli Perera were appointed to fill vacancies from retiring directors.

CEIX seeks to maintain a Board comprised of talented and dedicated directors with a diverse mix of expertise, experience, skills and background. The skills and backgrounds collectively represented on the Board should reflect the diverse nature of the business environment in which CEIX operates. CEIX will periodically assess the composition of the Board in light of the needs of the Board at the time, including the extent to which the current composition of the Board reflects a diverse mix of knowledge, experience, skills and backgrounds.

CEIX is committed to a Board composition that promotes a diverse and inclusive culture, that solicits multiple perspectives and views, and which is free of conscious or unconscious bias and discrimination. Additionally, we seek to promote diversity throughout our workforce by, among other things, emphasizing diversity among our executive management team.

Process for Board Assessment and Future Candidates. Set forth below is a summary of the process the Nominating and Corporate Governance Committee and Board intend to use in reviewing Board needs and future candidates.

- 2023 Proxy Statement - 2023 Proxy Statement | 23 |

BOARD OF DIRECTORS AND COMPENSATION INFORMATION | Board of Directors and Its Committees

Health, Safety and Environmental Committee

Six Director Members (Five Independent) |

• Oversees CEIX’s monitoring and enforcement of its policies to protect the health and safety of employees, contractors, customers, the public and the environment;

• Reviews CEIX’s strategy, including objectives and policies, relative to the protection of the safety and health of employees, contractors, customers, the public and the environment;

• Reviews material compliance issues or pending or threatened proceedings regarding health, safety or environmental matters, and management’s response to the same;