- JMSB Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

John Marshall Bancorp (JMSB) DEF 14ADefinitive proxy

Filed: 6 May 22, 10:08am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

JOHN MARSHALL BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

JOHN MARSHALL BANCORP, INC.

May 6, 2022

Dear Fellow Shareholder:

The Board of Directors would like to extend to you a cordial invitation to attend the virtual Annual Meeting of Shareholders of John Marshall Bancorp, Inc. (the “Company”). The Annual Meeting will be held virtually on Wednesday, June 22, 2022, at 10:00 a.m., Eastern Time.

Details of the business to be conducted at our Annual Meeting are provided in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. On or about May 6, 2022, we mailed our shareholders a notice containing instructions on how to obtain the Proxy Statement and our Registration Statement on Form 10 and how to vote their shares over the Internet. You may read, print and download the Proxy Statement and our Registration Statement on Form 10 at https://www.astproxyportal.com/ast/26437. We encourage you to carefully read these materials.

Your vote is important. Please submit your proxy as soon as possible by Internet, telephone, or mail. Submitting your proxy by one of these methods will ensure your representation at the Annual Meeting regardless of whether you attend the virtual meeting. Instructions for your voting options can be found in the accompanying Proxy Statement.

Thank you for your ongoing support. We look forward to hearing from you at our Annual Meeting.

Sincerely,

|  | |

| Jonathan C. Kinney | Christopher W. Bergstrom | |

| Chairman of the Board | President and Chief Executive Officer |

1943 Isaac Newton Square East, Suite 100, Reston, Virginia 20190 – (703) 584-0840

JOHN MARSHALL BANCORP, INC.

1943 Isaac Newton Square East, Suite 100

Reston, Virginia 20190

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 22, 2022

NOTICE TO THE SHAREHOLDERS OF JOHN MARSHALL BANCORP, INC.:

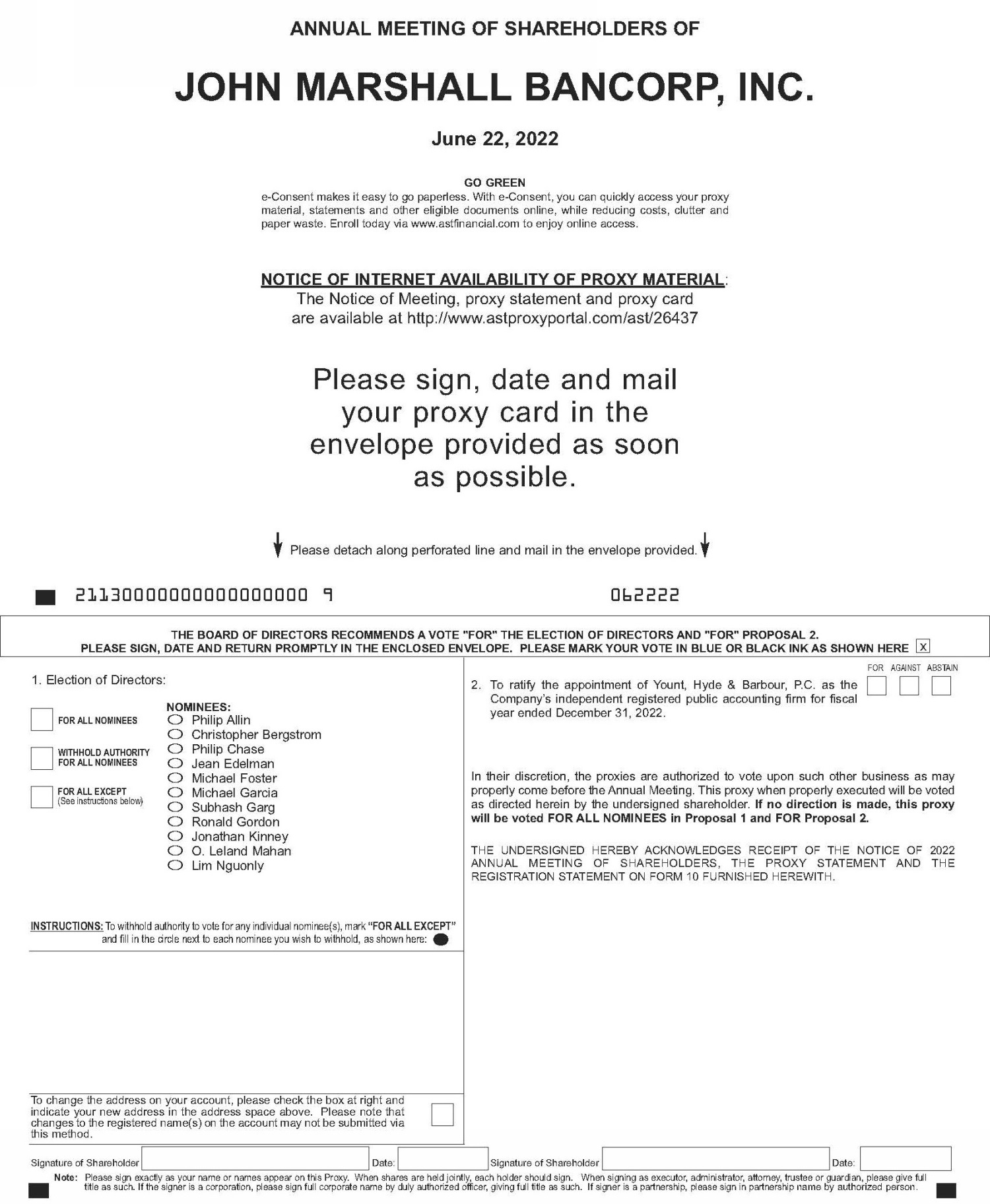

The 2022 Annual Meeting of Shareholders of John Marshall Bancorp, Inc. (the “Company”) will be conducted exclusively as a virtual meeting via online live webcast at https://web.lumiagm.com/206100865, on Wednesday, June 22, 2022, at 10:00 a.m., Eastern Time, for the following purposes:

| 1. | Election of Directors. To elect eleven directors to serve until the 2023 Annual Meeting of Shareholders and until their successors have been duly elected and qualified; |

| 2. | Ratification of the Appointment of Independent Public Accounting Firm. To ratify the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent public accounting firm for the fiscal year ending December 31, 2022. |

| 3. | Other Business. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Our Board of Directors recommends that you vote “FOR” the election of all 11 nominees named above to our Board of Directors, and “FOR” ratification of the appointment of Yount, Hyde & Barbour, P.C. as our independent public accounting firm for the fiscal year ending December 31, 2022.

Only shareholders of record at the close of business on April 29, 2022 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders

to be held on June 22, 2022.

This Proxy Statement and the Company’s Registration Statement on Form 10 are available online at

https://www.astproxyportal.com/ast/26437

YOUR VOTE IS VERY IMPORTANT. Even if you plan to attend the Annual Meeting virtually, please submit your proxy promptly by Internet, telephone, or mail, all as described in more detail in the Proxy Statement.

| By order of the Board of Directors | ||

| May 6, 2022 |  | |

| Jonathan C. Kinney | ||

| Chairman of the Board | ||

JOHN MARSHALL BANCORP, INC.

1943 Isaac Newton Square East, Suite 100

Reston, Virginia 20190

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held at 10:00 a.m., Eastern Time, Wednesday, June 22, 2022

INTRODUCTION

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors of John Marshall Bancorp, Inc., a Virginia corporation, for use at the 2022 Annual Meeting of Shareholders, which will be held on Wednesday, June 22, 2022 at 10:00 a.m., Eastern Time, and at any adjournments or postponements thereof.

Due to the COVID-19 pandemic and in support of the health of our shareholders, directors and employees, the Board of Directors has determined that the Annual Meeting will be conducted exclusively as a “virtual meeting” of shareholders via an online live webcast. There will be no physical location for the meeting. You will be able to attend and listen to the virtual meeting live, submit questions and vote online during the meeting by visiting https://web.lumiagm.com/206100865. To access the virtual Annual Meeting, you will need a connected device (computer, tablet or smart phone) and the control number included on your proxy card or voting form.

As a matter of convenience, in this Proxy Statement we refer to John Marshall Bancorp, Inc. as the “Company” or “we,” “us” or “our” and our 2022 Annual Meeting of Shareholders and any adjournments or postponement as the “Annual Meeting” or the “meeting”.

This Proxy Statement is being furnished to shareholders beginning on May 6, 2022. In accordance with Securities and Exchange Commission (“SEC”) rules, the Company is furnishing this Proxy Statement over the Internet to its shareholders. Most of the Company’s shareholders will not receive a printed copy of this Proxy Statement. Instead, most shareholders will receive a printed copy of the Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 22, 2022 (the “Notice of Internet Availability”), which contains instructions on how to access the proxy materials over the Internet and vote. The Notice of Internet Availability was first mailed to shareholders on or about May 6, 2022. By furnishing proxy materials over the Internet, the Company is able to reduce the printing and mailing costs of this solicitation and help conserve natural resources. If you receive the Notice of Internet Availability but would still like to receive printed copies of the proxy materials, please follow the instructions on the Notice of Internet Availability. Shareholders may vote over the Internet, by telephone, or by mail.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on June 22, 2022

A complete set of proxy materials relating to the Annual Meeting is available on the Internet. These materials, including the Proxy Statement and our Registration Statement on Form 10, may be viewed at https://www.astproxyportal.com/ast/26437.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE VIRTUAL ANNUAL MEETING, WE ENCOURAGE YOU TO READ THIS PROXY STATEMENT AND PROVIDE US WITH YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE.

Some shareholders may have their shares registered in different names or hold shares in different capacities. For example, a shareholder may have some shares registered in his or her name, individually, and others in his or her capacity as a custodian for minor children or as a trustee of a trust. If, in that event, you want all of your votes to be counted, please be sure to vote in each of those capacities.

Who May Vote?

If you were a holder of shares of our common stock on the records of the Company at the close of business on April 29, 2022 (the “Record Date”), you are entitled to notice of and may vote at the Annual Meeting.

1

How Many Votes Do I Have?

Each share of common stock outstanding at the close of business on the Record Date is entitled to one vote on each of the matters to be voted upon at the Annual Meeting. Shareholders do not have the right to cumulate votes in the election of directors.

On the Record Date, 13,988,945 shares of common stock were outstanding and entitled to vote at the Annual Meeting.

How Do I Vote?

Voting during the Virtual Annual Meeting. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, at the close of business on the Record Date, you are considered the shareholder of record with respect to those shares and you have the right to vote your shares online at the Annual Meeting. If your shares are held through a broker, bank or other nominee (that is, in “street name”) at the close of business on the Record Date, you are considered the “beneficial owner” of those shares and you may vote your shares online at the Annual Meeting only if you obtain a “legal proxy” from the bank, broker or other nominee that holds your shares, giving you the right to vote the shares online at the Annual Meeting.

Voting by Proxy for Shares Held by a Shareholder of Record. If you are a shareholder of record, you may direct how your shares are voted without attending the virtual Annual Meeting in one of the following ways:

| • | Voting on the Internet. You may vote on the Internet by accessing the website address and following the instructions printed on your proxy card. The deadline for voting on the Internet is June 21, 2022, at 11:59 P.M., Eastern Time. If you vote on the Internet, you do not need to return your proxy card. | |

| • | Voting by Telephone. You may vote by calling the toll-free telephone number and following the instructions printed on your proxy card. The deadline for voting by telephone is June 21, 2022, at 11:59 P.M., Eastern Time. If you vote by telephone, you do not need to return your proxy card. | |

| • | Voting by Mail. You may vote by completing, signing and returning your proxy card by mail. To vote in this manner, please mark, date and sign the proxy card and return it by mail in the accompanying postage-prepaid envelope. In order to assure that your shares will be voted, you should mail your signed proxy card in sufficient time for it to be received before the Annual Meeting. If your shares are registered in different names or you hold your shares in more than one capacity, you will receive more than one proxy card. In that case, if you choose to vote by mail and you want all of your shares voted, please complete each proxy card that you receive and return it in its own postage prepaid envelope. |

Even if you plan to attend the virtual Annual Meeting, we recommend that you submit your proxy in advance of the meeting as described above so that your vote will be counted if you later decide not to attend the virtual Annual Meeting. Submitting your proxy by Internet, telephone, or mail will not affect your right to vote during the virtual Annual Meeting. If you do attend and vote your shares during the Annual Meeting, after having voted by any of the methods described above, only your last vote will be counted.

Voting by Proxy for Shares Held In Street Name. If you are the beneficial owner of shares held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to instruct how your shares are to be voted at the Annual Meeting.

How Will The Board Vote My Proxy?

If you grant us your proxy to vote your shares (whether over the Internet or by telephone or by completing, signing and returning your proxy card by mail), and you do not revoke that proxy prior to the Annual Meeting, your shares will be voted as directed by you. If you grant us your proxy without providing any specific direction as to how your shares should be voted, your shares will be voted: “FOR” all of the 11 director nominees named in the Notice of Annual Meeting for election to the Board of Directors (Proposal No. 1), and “FOR” ratification of the appointment of Yount, Hyde & Barbour, P.C. as our independent public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 2).

If any other matter should be properly presented at the Annual Meeting upon which a vote may be taken, the shares represented by your proxy will be voted in accordance with the judgment of the holders of the proxy. Such persons also have discretionary authority to vote to adjourn the Annual Meeting, including for soliciting proxies to vote in accordance with the recommendations of the Board of Directors on any of the above items. However, if your shares are held in a brokerage account, please read the information below under the caption “Voting Shares Held by Brokers, Banks and Other Nominees” regarding how your shares may be voted.

2

Voting Shares Held by Brokers, Banks and Other Nominees

We ask brokers, banks and other nominee holders to obtain voting instructions from the beneficial owners of our common stock. Proxies that are returned to us by brokers, banks or other nominee holders on your behalf will count toward a quorum and will be voted in accordance with the voting instructions you have sent to your broker, bank or other nominee holder. If, however, you want to vote your shares during the Annual Meeting, you will need to obtain a legal proxy or broker’s proxy card from your broker, bank or other nominee holder and bring it with you to the Annual Meeting. If you fail to provide voting instructions to, or you attend the Annual Meeting virtually and do not obtain a legal proxy or broker’s proxy from, your broker, bank or other nominee, your shares will not be voted, except as provided below with respect to certain “routine” matters.

Under rules applicable to securities brokerage firms, a broker who holds shares in “street name” for a customer may generally vote your shares in its discretion on “routine” proposals, but does not have the authority to vote those shares on any “non-routine” proposal, except in accordance with your voting instructions. Under New York Stock Exchange (“NYSE”) rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization, or third parties acting on its behalf. If your broker does not receive voting instructions from you, but chooses to vote your shares on a routine matter, then your shares will be deemed to be present by proxy and will count toward a quorum at the Annual Meeting, but will not be counted as having been voted on, and as a result will be deemed to constitute “broker non-votes” with respect to, non-routine proposals.

Vote Required

Quorum Requirement. Our Bylaws require that a quorum (that is, the holders of a majority of all of the shares entitled to vote at the Annual Meeting) be present, by attendance at the Annual Meeting or by proxy, before any business may be transacted at the Annual Meeting (other than adjourning the Annual Meeting to a later date to allow time to obtain additional proxies to satisfy the quorum requirement).

Proposal No. 1 (Election of Directors). The 11 nominees for election to the Board shall be elected by a plurality of the votes cast at the meeting. As a result, shares voted “Withhold” and broker non-votes will not be counted in determining the outcome of the election. However, shares voted “Withhold” and broker non-votes will be considered present at the Annual Meeting for purposes of determining whether a quorum is present.

Proposal No. 2 (Ratification of the Appointment of Independent Public Accountants). If a quorum is present, approval of the ratification of the Company’s independent registered public accounting firm requires the affirmative vote of a majority of the votes cast on the matter. Votes may be cast in favor or against, or a shareholder may abstain. Abstentions will not be counted as votes cast on this proposal and will have no effect on whether such matter is approved. There should be no broker non-votes because this matter is considered “routine” under rules of the NYSE.

How You Can Revoke Your Proxy or Voting Instructions and Change Your Vote

If you are the record owner of your shares, you may revoke any proxy you may have submitted over the Internet or by telephone or any proxy you may have returned by mail, at any time before your proxy has been voted, by taking one of the following actions:

| • | By granting a later dated proxy with respect to the same shares; | |

| • | By sending written notice to the Corporate Secretary, at 1943 Isaac Newton Square East, Suite 100, Reston, Virginia 20190 so that it is received prior to the proxy being voted; or | |

| • | By voting online at the virtual meeting. |

However, if your shares are held by a broker, bank or other nominee holder, you will need to contact your broker, bank or the nominee holder if you wish to change or revoke any voting instructions that you previously gave to your broker, bank or other nominee holder.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of April 29, 2022 concerning the number and percentage of shares of the Company’s common stock beneficially owned by its directors, executive officers whose compensation is disclosed in this proxy statement, and by its directors and all executive officers as a group. Except as otherwise indicated, all shares are owned directly, and the named person possesses sole voting and sole investment power with respect to all such shares. The Company knows of no person or persons, who is a beneficial owner of more than 5% of the Company’s common stock as defined by Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| Name | Position | Common Stock Beneficially Owned(1) | Exercisable Options Included in Common Stock Beneficially Owned | Percentage(2) | ||||||||||

| Directors | ||||||||||||||

| Philip W. Allin | Director | 180,661 | (3) | 20,625 | 1.27 | % | ||||||||

| Christopher W. Bergstrom | Director, President and Chief Executive Officer | 64,252 | (3) | 15,000 | * | |||||||||

| Philip R. Chase | Director | 110,643 | (3) | 11,250 | * | |||||||||

| Jean M. Edelman | Director | 321,493 | (3), (4) | - | 2.26 | % | ||||||||

| Michael T. Foster | Director | 331,021 | (3) | 20,625 | 2.33 | % | ||||||||

| Michael A. Garcia | Director | 16,536 | (3) | - | * | |||||||||

| Subhash K. Garg | Director | 244,891 | (3), (5) | - | 1.73 | % | ||||||||

| Ronald J. Gordon | Director | 161,062 | (3) | 20,625 | 1.13 | % | ||||||||

| Jonathan C. Kinney | Chairman of the Board | 597,460 | (3), (6) | 11,250 | 4.21 | % | ||||||||

| O. Leland Mahan | Director | 114,754 | (3) | 10,250 | * | |||||||||

| Lim P. Nguonly | Director | 108,038 | (3), (7) | 20,625 | * | |||||||||

| Named Executive Officers who are not Directors | ||||||||||||||

| Carl E. Dodson | Senior Executive Vice President - Chief Operating Officer and Chief Risk Officer | 142,258 | 37,500 | 1.00 | % | |||||||||

| William J. Ridenour | Senior Executive Vice President – Chief Banking Officer | 169,932 | (8) | 37,500 | 1.20 | % | ||||||||

| All directors and executive officers of the Company as a group (15 persons) | 2,617,253 | (9) | 205,250 | 18.44 | % | |||||||||

* Percentage of ownership is less than one percent of the Company’s outstanding common stock.

| (1) | For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Exchange Act under which, in general, a person is deemed to be the beneficial owner of a security if he or she has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he or she has the right to acquire beneficial ownership of the security within 60 days. |

4

| (2) | Represents percentage of 13,988,945 shares issued and outstanding as of April 29, 2022, except with respect to individuals holding options exercisable within 60 days of said date, in which case represents percentage of shares issued and outstanding plus the number of shares with respect to which such person holds options exercisable within 60 days of April 29, 2022, and except with respect to all directors and executive officers of the Company as a group, in which case represents percentage of shares issued and outstanding plus the number of shares with respect to which all such person hold options exercisable within 60 days of April 29, 2022. | |

| (3) | Includes 2,786 shares of unvested restricted stock for each of Mr. Allin, Mr. Chase, Ms. Edelman, Mr. Foster, Mr. Garcia, Mr. Garg, Mr. Gordon, Mr. Kinney, Mr. Mahan and Mr. Nguonly. Includes 12,570 shares of unvested restricted stock for Mr. Bergstrom. These shares are subject to a vesting schedule, forfeiture risk and other restrictions. They may be voted at meetings of the Company’s shareholders. | |

| (4) | Includes 268,957 shares as to which Ms. Edelman shares voting and/or investment power with her spouse. | |

| (5) | Includes 89,940 shares held by a 401(k) plan for the benefit of Mr. Garg as to which he is co-trustee and shares voting and/or investment power; 3,610 shares held by an employee plan relating to an affiliated company of Mr. Garg as to which he is co-trustee and shares voting and/or investment power; 28,125 shares held by a trust as to which Mr. Garg is the sole beneficiary, serves as co-trustee and shares voting and/or investment power; 32,000 shares held by company as to which Mr. Garg shares voting and/or investment power; and 85,555 shares held by an affiliated company of Mr. Garg. Also includes 14,625 shares as to which Mr. Garg shares voting and/or investment power with his spouse. | |

| (6) | Includes 320,358 shares held by affiliated companies of Mr. Kinney. Also includes 5,624 shares owned by spouse. | |

| (7) | Includes 44,565 shares as to which Mr. Nguonly shares voting and/or investment power with his spouse. Also includes 762 shares owned by spouse. | |

| (8) | Includes 115,415 shares as to which Mr. Ridenour shares voting and/or investment power with his spouse. | |

| (9) | Includes 52,200 shares of unvested restricted stock. These shares are subject to a vesting schedule, forfeiture risk and other restrictions. They may be voted at meetings of the Company’s shareholders. |

5

ELECTION OF DIRECTORS

(Proposal No. 1)

At the Annual Meeting, shareholders will elect 11 directors to serve until our next annual meeting of shareholders. Our Bylaws provide that the authorized number of directors shall consist of not less than five nor more than 15 persons, the exact number within such minimum and maximum limits to be fixed and determined from time to time by the Articles of Incorporation, by resolution of a majority of the full Board or by resolution of the shareholders at any meeting thereof. The authorized number of directors is currently fixed at 11.

Vote Required and Recommendation of the Board of Directors

Under Virginia law and our Bylaws, the 11 nominees will be elected to serve as directors of the Company by a plurality of the votes cast at the meeting. As a result, any shares that are voted “Withhold” and broker non-votes will not be counted in determining the outcome of the election.

Unless otherwise instructed, the persons who are named as the proxy holders on the enclosed proxy card intend to vote the proxies received by them for the election of all 11 of the nominees. If, prior to the Annual Meeting, any of the nominees becomes unable or unwilling for good cause to serve as a director, the proxy holders will vote the proxies received by them for the election of any substitute nominee selected by the Board of Directors. The Company has no reason to believe that any of the nominees will become unable or unwilling to serve.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” ALL OF THE 11 NOMINEES NAMED BELOW FOR ELECTION TO THE BOARD OF DIRECTORS

Nominees

Our Board of Directors has nominated the 11 individuals named below for election to the Board for a term of one year ending at the 2023 Annual Meeting of Shareholders and until their respective successors are elected and qualify to serve. Each of the 11 nominees named below was nominated by the Board of Directors. Each nominee is currently a director of the Company as well as director of the Company’s subsidiary, John Marshall Bank (the “Bank”), and has consented to serve as a director, if elected at the upcoming Annual Meeting. The following table sets forth certain information about our directors, including their names, ages and years in which they began serving as directors (including service on the Board of Directors of the Bank prior to the Company becoming the bank holding company for the Bank in 2017).

| Name | Age | Position | Director Since | |||

| Philip W. Allin | 64 | Director | 2006 | |||

| Christopher W. Bergstrom | 62 | Director, President and Chief Executive Officer | 2018 | |||

| Philip R. Chase | 65 | Director | 2006 | |||

| Jean M. Edelman | 63 | Director | 2008 | |||

| Michael T. Foster | 60 | Director | 2008 | |||

| Michael A. Garcia | 62 | Director | 2018 | |||

| Subhash K. Garg | 71 | Director | 2008 | |||

| Ronald J. Gordon | 67 | Director | 2006 | |||

| Jonathan C. Kinney | 75 | Chairman of the Board | 2008 | |||

| O. Leland Mahan | 83 | Director | 2008 | |||

| Lim P. Nguonly | 61 | Director | 2008 |

The business experience of each of the directors is set forth below. No director has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or with any of our executive officers. There are no arrangements or understandings between any of the directors and any other person pursuant to which he or she was selected as a director.

6

Philip W. Allin is the Executive Vice President of Interiors by Guernsey, the furniture-focused division of Guernsey, Inc., a supplier of furniture and office products in the Mid-Atlantic. Prior to merging his company to create Interiors by Guernsey in 2017, Mr. Allin owned Systems Furniture Gallery, Inc., SEI Furniture and Design ~ Supplies Express, Inc. and Office Outfitters, Inc. Mr. Allin is an owner, Treasurer, and Principal in Barrel Oak Winery. Mr. Allin earned a Bachelor of Science degree in Business Administration and Finance from the University of Maryland, College Park. Since 2006, Mr. Allin has been Chairman of the Board of Fairfax Water, serving quality water to more than 2,000,000 residents and businesses in Northern Virginia. He has been on the Fairfax Water Board since 1992 and previously served as Vice-Chairman and Treasurer. Mr. Allin has been involved in several de novo banks in the Northern Virginia area. He is an organizer and founding shareholder of the Bank. Mr. Allin’s position as a member of the Board of Directors is supported by his educational background in the area of business administration and finance, and his professional experience as principal and senior executive of several local small businesses.

Christopher W. Bergstrom has been President and Chief Executive Officer of the Bank and Chief Executive Officer of the Company since April 2018. He has over 39 years of experience in the banking industry. Before joining John Marshall Bank, Mr. Bergstrom served in a variety of executive positions during 19 years with Cardinal Financial Corporation and Cardinal Bank (collectively “Cardinal”), most recently serving as President and Chief Executive Officer from October 2015 until United Bankshares, Inc.’s acquisition of Cardinal in April 2017. He was also President of United Bank from April 2017 to April 2018. Mr. Bergstrom received his Master of Science in Finance from Virginia Commonwealth University and a Bachelors of Business Administration degree from James Madison University. Mr. Bergstrom’s position as a member of the Board of Directors is supported by his professional experience of over 39 years in banking, including his prior experience in organizing and leading Cardinal Bank as its President and Chief Executive Officer.

Philip R. Chase retired from his position as Chief Financial Officer of NT Concepts, a leading technology firm that supports the U.S. Government with software engineering, geospatial, data analytics and investigative services solutions, in December 2019. He leads the Board’s Finance and Risk Committee. His prior engagements have included positions as Senior Vice President/Chief Financial Officer of a leading provider of mission-critical intelligence and cyber security services to the Armed Forces and the Federal Government, Vice President of Finance and Chief Financial Officer for an e-learning company primarily supporting the Office of Personnel Management, and Director of Corporate Operations at an information technology and professional services firm. Prior to that, Mr. Chase was an owner, Vice President, and Chief Financial Officer of CCI, Incorporated, a professional services government contractor acquired by Stanley Associates in 2002. Throughout his career, and currently, he has consulted as Owner/Principal at Synergis LLC, a management and business advisory firm which focuses on strategic planning and chief financial officer consulting support in the government contracting industry. He also previously worked in the banking industry in a lending and risk management capacity for approximately eight years. Mr. Chase’s position as a member of the Board of Directors is supported by his professional experience in the banking industry, and as principal of a local small business focusing on the government contracting industry, which is one of the Bank’s target markets.

Jean M. Edelman is a founder of Edelman Financial Engines, the largest independent financial planning and investment management firm in the nation, and the largest provider of financial advice and services to 401(k) plans in the country. She is a Trustee of Rowan University, and benefactor, along with her husband, of the Edelman Planetarium and Edelman Fossil Park at Rowan, as well as the Edelman Nursing Center at Inova Hospital and the Edelman Arena at the Northern Virginia Therapeutic Riding Program. Ms. Edelman is also on the Boards of NVTRP and the Wolf Trap Foundation for the Performing Arts, as well as Inova Hospital’s Holistic Nursing Council. Ms. Edelman’s position as a member of the Board of Directors is supported by her extensive professional experience in business management and the financial services industry.

Michael T. Foster, a Fellow of the American Institute of Architects, is the founder and president of MTFA Architecture, Inc., an award-winning architecture, interiors, historic preservation, and urban planning firm. MTFA Architecture is a regional leader in sustainable design and development for institutional, commercial, educational, and government buildings. Mr. Foster is active in the community having served on the Arlington Economic Development Commission, past Chair of the Arlington Planning Commission and past Chair of the Arlington Chamber of Commerce. He is currently appointed to the Arlington Board of Code Appeals, serves on The Virginia Hospital Center Foundation Board, The Virginia Tech College of Architecture Board, and is a mentor for the Urban Land Institute. He is active in numerous professional, civic, philanthropic, and arts organizations serving the community and the region. Mr. Foster’s position as a member of the Board of Directors is supported by his professional experience as founder and principal of a successful local business and his extensive civic and business contacts in the community.

Michael A. Garcia is president of Mike Garcia Construction Inc., a family-owned business. He established his Prince William County-based company in 1981, and during the past seven years, Mike Garcia Construction has been voted Best Builder of Prince William County by Prince William County residents. Mr. Garcia was a director of Cardinal Bank from 1999 and served on the Board’s loan committee until Cardinal’s acquisition by United Bank in 2017. Mr. Garcia currently is Chairman of the Prince William County Commercial Development Committee, lending his knowledge and experience in residential and commercial real estate development to support and guide business owners through the entire process of commercial real estate development projects. Mr. Garcia supports the community by exclusively hiring talent within Prince William County, and by supporting multiple community projects and youth organizations. He has received numerous awards over the years for his community service. Mr. Garcia’s position as a member of the Board of Directors is supported by his professional experience of a local small business and his extensive contacts in the local business community.

7

Subhash K. Garg is a co-founder and managing member of Wiener & Garg LLC, a certified public accounting firm in Rockville, Maryland. Since June 1978, Mr. Garg has been a member of the American Institute of Certified Public Accountants and the Virginia Society of Certified Public Accountants. Mr. Garg is involved with several non-profit organizations in the Washington, D.C. metropolitan area which are helping to bring and expand Indian sub-continent culture in the community. Mr. Garg’s position as a member of the Board of Directors is supported by his professional experience as founder and principal of a local certified public accounting firm and his extensive contacts in the local business community.

Ronald J. Gordon was the Chairman and CEO of ZGS Communications (“ZGS”), a Hispanic-owned Spanish-language media company with interests in television, radio and the internet. Founded in 1983 by Mr. Gordon, ZGS owned and operated Spanish-language television stations, representing the largest group of independent stations affiliated with the Telemundo television network. In 2017, ZGS entered into agreement to sell all its broadcast assets to Comcast/NBC Universal. The transaction closed in January 2018. Mr. Gordon serves on the Board of Trustees of WETA, the flagship PBS television station in the nation’s capital. Mr. Gordon’s position as a member of the Board of Directors is supported by his professional experience as founder and principal of a local small business, overseeing the operation of a national television network, and his extensive contacts in the local business community.

Jonathan C. Kinney is a shareholder at the law firm of Bean, Kinney and Korman, P.C. in Arlington, Virginia. Mr. Kinney serves as the President of the Arlington County Retirement Board, a Trustee Emeritus of the Arlington Community Foundation and Community Residence Foundation. For the last 45 years, he has been actively involved in Arlington civic matters including being the 2016 recipient of the Spirit Award by the Arlington Community Foundation. Mr. Kinney earned an undergraduate degree from Duke University and a Juris Doctor from the University of Chicago Law School. Mr. Kinney became the Chairman of the Board of Directors in 2019. Mr. Kinney’s position as the Chairman and a member of the Board of Directors is supported by his legal education, his professional experience as principal of a local law firm, and his extensive contacts in the local business community.

O. Leland Mahan has practiced law in Leesburg, Virginia, for over 53 years. Currently, he is a senior partner at the law firm of Hall, Monahan, Engle, Mahan & Mitchell in Leesburg, Virginia. His primary areas of practice have been litigation, business, land use, real estate, wills and estate administration. Mr. Mahan earned a B.S. degree from Virginia Tech in 1961, and a Juris Doctor from the University of Richmond School of Law in 1964. He served as President of the University of Richmond Law School Alumni Association from 1988 to 1990. He served as a Captain in the United States Air Force, serving in the Judge Advocate General’s Corp from 1964 to 1967. He is active in legal and community affairs, being a member of the Virginia Trial Lawyers Association, Virginia State Bar, Virginia Bar Association and past president of the Loudoun County Bar Association. Mr. Mahan served as a director and President of the Loudoun Small Business Development Center. He has served in leadership roles as a member of the Loudoun County Redistricting Committee and the Loudoun County Economic Development Committee. Mr. Mahan has served on the advisory Boards of Virginia National Bank (including as chairman from 1980 to 1984), NationsBank and George Mason Bank. Mr. Mahan’s position as a member of the Board of Directors is supported by his legal education, his professional experience as principal of a local law firm, and his extensive contacts in the local business community.

Lim P. Nguonly is the founder and President of Princess Jewelers. Since 1988, Princess Jewelers has built its reputation as a prominent Washington full-service quality jewelry store. Mr. Nguonly is an Alumnus of College de Valleyfield in Quebec, Canada and holds a Diamond Diploma from the Gemological Institute of America (G.I.A.). Mr. Nguonly is now actively involved with numerous real estate investments. Mr. Nguonly’s position as a member of the Board of Directors is supported by his professional experience as founder and partner of a local small business, and as a local commercial real estate investor.

8

THE BOARD OF DIRECTORS

The Role of the Board of Directors

In accordance with our Bylaws and Virginia law, the Board of Directors oversees the management of the business and affairs of the Company. The members of the Board also are members of the Board of Directors of the Bank, which accounts for substantially all of the Company’s consolidated operating results. The members of the Board keep informed about our business through discussions with senior management and other officers and managers of the Company and the Bank, by reviewing analyses and reports sent to them by management and outside consultants, and by participating in Board and in Board committee meetings.

During 2021, our Board of Directors held a total of 12 meetings and each director attended at least 75% of the total number of those meetings and the meetings of the Board committees on which they served during their term of office as a director in 2021. We encourage our directors to attend our annual meeting of shareholders. All of our then-current directors attended our 2021 annual meeting of shareholders.

Corporate Governance Principles and Board Matters

Our Board believes that sound governance policies and practices provide an important framework to assist it in fulfilling its duties to our shareholders. Our Board has adopted a number of policies and practices under which it has operated for some time with concepts based on the suggestions of various authorities in corporate governance and the requirements under the applicable Nasdaq Stock Market (“Nasdaq”) rules. Our Board members believe these policies and practices are essential to the performance of the Board’s oversight responsibilities and the maintenance of the Company’s integrity in the marketplace. The policies and practices include, among others, the following:

Code of Business and Ethical Conduct. We have adopted a Code of Business and Ethical Conduct for all representatives of the Company (“Code of Conduct”) that contains specific ethical policies and principles that apply to our principal executive officer, principal financial officer, principal accounting officer and other key accounting and financial personnel. The Code of Conduct constitutes our “code of ethics” for purposes of satisfying Nasdaq’s listing standards.

The Code of Conduct is available in the Investor Relations section of our website at www.johnmarshallbank.com. To the extent required by applicable SEC rules, Nasdaq’s listing standards or our Code of Conduct, we will disclose any waivers of the requirements of our Code of Conduct that may be granted to our executive officers, including our principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions on our website.

Related Party Transaction Procedures. The Company has procedures in place to identify, review, approve and disclose, if necessary, transactions between the Company and executive officers and directors of the Company and its subsidiaries, immediate family members of executive officers and directors, entities directly or indirectly controlled by a director or executive officer, and persons known by the Company to be beneficial owners of more than 5% of the Company’s common stock. As part of management’s related party transaction monitoring, each director and executive officer completes a questionnaire on an annual basis that is designed to elicit information about any potential related party transactions.

Board Leadership Structure. The Chairman of our Board is Jonathan C. Kinney. Our Board currently has separated the positions of Chairman and Chief Executive Officer because our Board believes that doing so provides the appropriate leadership structure for us at this time, particularly because the separation of those two positions enables our Chief Executive Officer to focus on the management of our business and the development and implementation of strategic initiatives, while the Chairman leads our Board in the performance of its management oversight and other responsibilities.

Director Independence. The Board of Directors annually evaluates the independence of its members based on the standards set forth in Nasdaq Rule 5605(a)(2). In addition, the Board of Directors annually evaluates the independence of its Audit Committee and Compensation Committee members based on the standards set forth in Nasdaq Rules 5605(c)(2) and (d)(2), respectively. The Board of Directors has concluded that all of the members of the Company’s Board of Directors are independent under the standards set forth in Nasdaq Rule 5605(a)(2) other than Christopher W. Bergstrom, the Company’s President and Chief Executive Officer. The Board of Directors has also concluded that (i) the members of the Audit Committee meet the independence standards set forth in Nasdaq Rule 5605(c)(2) and SEC Rule 10A-3, (ii) the members of the Compensation Committee meet the independence standards set forth in Nasdaq Rule 5605(d)(2), and (iii) the members of the Nominating Committee are independent under the standards set forth in Nasdaq Rule 5605(a)(2).

Committees of our Board of Directors

Our Board has two standing committees: an Audit Committee and a Compensation Committee. Beginning in June 2022, our Board will also have a standing Nominating Committee. The Board has adopted a written charter for all three of the committees, and copies of those charters are available on the Investor Relations section of our website at www.johnmarshallbank.com. In addition, from time to time, our Board may establish special committees to address specific issues when necessary.

9

The Audit Committee. Our Board has established a standing Audit Committee, the current members of which are Subhash K. Garg, its chairman, Philip W. Allin, Philip R. Chase, and Ronald J. Gordon. Our Board also has determined that Mr. Garg meets the definition of “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K issued by the Securities and Exchange Commission and satisfies the financial sophistication requirements of applicable rules of The Nasdaq Stock Market.

The Audit Committee’s responsibilities include:

| • | Overseeing the integrity of our financial statements and those of our subsidiary, including the financial reporting processes and systems of internal controls; | |

| • | Overseeing the independence, qualifications and performance of our independent auditors and internal audit function; | |

| • | Monitoring the open communication among the independent auditor, management, the internal audit function and the Board; | |

| • | Providing general oversight of the Company’s risk management function and, as appropriate, to discuss with members of management, the independent auditor or the internal auditor significant risks or exposures and assess the steps management has taken to minimize such risk to the Company; | |

| • | In its sole discretion, retaining and obtaining the advice and assistance of independent outside counsel and such other advisors as it deems necessary to fulfill its duties and responsibilities under its charter; the Committee sets the compensation, and oversees the work, of any outside counsel and other advisors; | |

| • | Reviewing and assessing the adequacy of its formal written charter on an annual basis; and | |

| • | Reporting the matters considered and actions taken by the Committee to the Board of Directors. |

The Audit Committee met six times during 2021.

The Compensation Committee. The Board has established a standing Compensation Committee that is currently comprised of Michael T. Foster, its chairman, Jean M. Edelman, O. Leland Mahan, and Lim P. Nguonly.

The Compensation Committee’s responsibilities include:

| • | Reviewing and evaluating the performance of the Chief Executive Officer and the other executive officers in light of goals and objectives set by the Board of Directors that include the Company’s financial performance and return to shareholders; | |

| • | Establishing the compensation of the Chief Executive Officer; | |

| • | Reviewing the compensation of the other executive officers upon recommendation from the Chief Executive Officer; | |

| • | Making recommendations to the Board of Directors with respect to employment and change in control agreements, annual incentive compensation plans, deferred compensation plans, executive retirement plans, and equity based plans; | |

| • | Reviewing, approving and overseeing any transaction between the Company and any related person and any other potential conflict of interest situations on an ongoing basis, in accordance with Company policies and procedures; | |

| • | Considering and making recommendations to the Board of Directors on matters relating to Board of Director compensation; | |

| • | Reviewing the Company’s incentive compensation programs, practices and policies to determine whether they encourage excessive or inappropriate risk taking; | |

| • | Reviewing and assessing the adequacy of its formal written charter on an annual basis; and | |

| • | Reporting the matters considered and actions taken by the Committee to the Board of Directors. |

10

The Compensation Committee met one time during 2021.

The Nominating Committee. During the February 15, 2022 Board meeting, the Board approved the formation of the Nominating Committee and passed a resolution whereby each of the current directors would stand for re-election at the annual meeting of shareholders. As part of the June 21, 2022 Board meeting, the initial chairman and members of the Nominating Committee will be named and approved.

The Nominating Committee’s responsibilities will include:

| • | Determining the qualifications, qualities, skills, expertise and other criteria required for selection of Board members, the chairman of the Board, and Board committee members; | |

| • | Identifying, evaluating, and recommending to the Board of Directors the persons to be appointed or stand for election to the Board of Directors; | |

| • | Reviewing the director independence standards of the Board of Directors and, if applicable, develop and recommend to the Board for approval independence standards in addition to those required by The Nasdaq Stock Market for determining whether a director has a relationship with the Company that would impair the director’s independence; | |

| • | Considering policies and procedures regarding the performance evaluation of the Board of Directors and its committees; | |

| • | Evaluating from time to time the Board of Directors and its committees, including the composition, organization, and size of the Board and its committees, the contributions and effectiveness of Board and committee members and the tenure and periodic rotation of directors and committee members; | |

| • | Making recommendations to the Board of Directors regarding the size and composition of each standing committee of the Board, including the identification of individuals qualified to serve as members of a committee, including the Nominating Committee, and to recommend individual directors to fill any vacancy that might occur on a committee, including the Nominating Committee; | |

| • | Reviewing and assessing the adequacy of its formal written charter on an annual basis; and | |

| • | Reporting the matters considered and actions taken by the Committee to the Board of Directors. |

The Nominating Committee will be formed in 2022, and as a result, did not hold any meetings during 2021.

The Board’s Role in Risk Oversight

The Board’s responsibilities in overseeing our management and business include oversight of the Company’s key risk and management processes and controls. Management, in turn, is responsible for the day-to-day management of risk and implementation of appropriate risk management controls and procedures.

The risk of incurring losses on the loans is an inherent feature of the banking business and, if not effectively managed, such risks can materially affect our results of operations. Accordingly, the Board, as a whole, exercises oversight responsibility over the processes that our management employs to manage this risk. The Board fulfills that oversight responsibility by:

| • | Monitoring trends in our loan portfolio and allowance for loan losses; | |

| • | Approving the underwriting guidelines for all loan products offered by the Bank; | |

| • | Monitoring the open communication among the independent auditor, management, the internal audit function and the Board; | |

| • | Overseeing our significant risk management activities; |

11

| • | Reviewing and discussing, at least quarterly and more frequently as the Board deems necessary, reports from the Bank’s Chief Credit Officer relating to such matters as (i) risks in our loan portfolio, (ii) economic conditions or trends that could reasonably be expected to affect (positively or negatively) the performance of the loan portfolio or require increases in the allowance for loan losses and (iii) specific loans that have been classified as “special mention,” “substandard” or “doubtful” and, therefore, require increased attention from management; | |

| • | Reviewing, at least quarterly, management’s determinations with respect to the adequacy of, and any provisions required to be made to replenish or increase, the allowance for loan losses; and | |

| • | Reviewing management reports regarding collection efforts with respect to nonperforming loans. |

Although risk oversight permeates many elements of the work of the full Board and its committees, the Audit Committee is responsible for overseeing any other significant risk management processes. The Audit Committee oversees these risk management processes, periodically reporting its findings and making it policy and other recommendations to the full Board.

Audit Committee Oversight Responsibilities. The Audit Committee’s responsibilities in overseeing risk management processes include:

| • | Oversight of the internal audit function, with the internal auditor reporting directly to the Audit Committee; | |

| • | Oversight of the Company’s independent public accounting firm; and | |

| • | Reviewing reports from management and the internal auditor regarding the adequacy and effectiveness of various internal controls. |

Selection and Nomination of Candidates for Election to the Board of Directors

Historically, nominations for the election of directors were made by the Board or by any shareholder entitled to vote in the election of directors generally. Starting June 21, 2022, our Board will delegate to the Nominating Committee the responsibility for developing and recommending to the Board, for its consideration and approval, the specific qualifications and criteria for prospective director candidates as its deems necessary or advisable. The Nominating Committee will also be charged with recommending to our Board specific candidates for election as directors. The Nominating Committee will consider nominees recommended by directors, officers, employees, shareholders and others using the same criteria to evaluate all candidates. In identifying prospective director candidates, the Nominating Committee charter establishes the following minimum qualifications: honesty; integrity; good judgment; positive reputation in and demonstrated commitment to the community; willingness to devote the necessary time to serve; willingness to invest in the Company; and willingness and ability to engage in meaningful and constructive discussion regarding Company issues. The Nominating Committee will also consider the following qualities, skills, expertise and other criteria: personality and thinking style; location of residence; potential conflicts of interest and independence; understanding of financial statements and issues; membership or influence in a particular geographic or business target market, or other relevant business experience; record, if any, of past service as a director of the Company, including overall engagement and contributions to community and business development initiatives; overall diversity of the board, encouraging fresh perspectives, and taking into consideration the rules and guidance of Nasdaq, the SEC, and bank regulatory agencies; and other factors it deems appropriate. The Nominating Committee is authorized to engage consultants or third party search firms to assist in identifying and evaluating potential nominees at our expense.

Any shareholder may submit, for consideration and nomination by the Nominating Committee any candidate or candidates for election to the Board at any annual meeting of the Company’s shareholders by following the notice procedures and providing the information required by our Bylaws. To nominate a candidate for election as a director at an annual meeting of shareholders, our Bylaws require a shareholder to provide us with written notice no later than 90 days prior to the anniversary date of the immediately preceding annual meeting. If the current year’s annual meeting is called for a date that is not within 30 days of the anniversary of the previous year’s annual meeting, the notice must be received not later than 10 days following the day on which public announcement of the date of the annual meeting is first made. Our Bylaws require that the nominating shareholder’s notice include information regarding the candidate for election as director, including (i) the name, age, business address and, if known, the residence address of each nominee proposed, (ii) the principal occupation or employment of each such nominee, (iii) the number of shares of each class of stock of the Company beneficially owned or directly or indirectly controlled by each such nominee, (iv) such other information regarding each such nominee as would be required to be included in a proxy statement soliciting proxies for the election of the proposed nominee pursuant to Regulation 14A under the Exchange Act, (v) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder and (vi) as to the shareholder making such nomination (y) his or her name and address as they appear on the stock transfer books of the Company, and (z) the number of shares of each class of stock of the Company beneficially owned or directly or indirectly controlled by such shareholder. Shareholders are advised to carefully review our Bylaws, which contain a description of the information required to be submitted, as well as the advance notice and other requirements that apply to nominations by shareholder of candidates for election to the Board.

12

Certain Relationships and Related Transactions

The Bank, during the normal course of business, has made loans and provided other banking services to the directors and executive officers of the Company, including their family members and businesses and professional organizations with which they are associated, and management expects that the Bank will continue to engage in such banking transactions in the future. Such loans and other banking services were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans and banking services with persons not related to the Company or the Bank, and did not involve more than the normal risk of collectability or present other features unfavorable to the Bank. Neither the Company nor the Bank has engaged in any transaction reportable pursuant to Item 404(d) of Regulation S-K during the periods specified therein.

The maximum aggregate amount of loans to executive officers, directors and affiliates of the Company during the year ended December 31, 2021, amounted to $12.0 million, representing approximately 5.8% of the Company’s total shareholders’ equity at December 31, 2021. On December 31, 2021, $12.0 million of loans were outstanding to individuals who, during 2021, were executive officers, directors or affiliates of the Company. None of such loans were classified as Substandard, Doubtful or Loss. In addition, the executive officers, directors, and affiliates of the Company had deposits totaling $35.4 million with the Bank as of December 31, 2021.

Board Diversity

The table below provides details regarding the diversity of the Board of Directors:

| Board Diversity Matrix (As of May 6, 2022) | ||

| Female | Male | |

| Total Number of Directors | 11 | |

| Part I: Gender Identity | ||

| Directors | 1 | 10 |

| Part II: Demographic Background | ||

| Asian | 2 | |

| Hispanic or Latinx | 1 | |

| White | 1 | 4 |

| Two or More Races or Ethnicities | 3 | |

Director Compensation

Our non-employee directors may receive both cash and equity compensation. Mr. Bergstrom does not receive additional compensation for his service on the Board of Directors. During the year ended December 31, 2021, directors received $3,000 for each Board of Directors’ meeting attended ($6,000 for the Chairman) and $600 for each Committee meeting attended ($900 for each Committee Chairman). In addition, as indicated in the table below, restricted stock awards were made to the directors in 2021 based on the Company’s performance, with each director receiving 1,786 shares.

13

The following table sets forth information regarding compensation paid to non-employee directors during the year ended December 31, 2021.

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | ||||||||||||||||||

| Directors | ||||||||||||||||||||||||

| Jonathan C. Kinney (Chairman) | $ | 99,000 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 134,006 | ||||||||||||

| Philip W. Allin | $ | 39,600 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 74,606 | ||||||||||||

| Philip R. Chase | $ | 57,000 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 92,006 | ||||||||||||

| Jean M. Edelman | $ | 30,600 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 65,606 | ||||||||||||

| Michael T. Foster | $ | 36,900 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 71,906 | ||||||||||||

| Michael A. Garcia | $ | 53,400 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 88,406 | ||||||||||||

| Subhash K. Garg | $ | 41,400 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 76,406 | ||||||||||||

| Ronald J. Gordon | $ | 33,000 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 68,006 | ||||||||||||

| O. Leland Mahan | $ | 54,600 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 89,606 | ||||||||||||

| Lim P. Nguonly | $ | 36,600 | $ | 35,006 | $ | — | $ | — | $ | — | $ | 71,606 | ||||||||||||

| (1) | Reflects aggregate grant date fair value of stock awards provided in 2021 based upon the stock price on the date of grant in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). The awards presented vest in two substantially equal annual installments beginning on the first anniversary of the grant date. At December 31, 2021, each non-employee director had outstanding unvested stock awards of 3,786 shares. |

Compensation Committee Interlocks and Insider Participation

In 2021, the Compensation Committee was comprised of four independent directors, including one Chair. No member of the Compensation Committee is a current, or during 2021 was a former, executive officer or employee of the Company or any of its subsidiaries. During 2021, no member of the Compensation Committee had a relationship that must be described under the SEC rules relating to disclosure of related person transactions. In 2021, none of our executive officers served on the Board of Directors or Compensation Committee of any entity that had one or more of its executive officers serving on our Board or its Compensation Committee.

Communications with the Board

Shareholders interested in communicating with members of the Board of Directors or the non-management directors as a group may do so by writing to the Chairman of the Board of Directors, c/o Corporate Secretary, John Marshall Bancorp, Inc., 1943 Isaac Newton Square East, Suite 100, Reston, Virginia 20190. The Corporate Secretary will promptly forward to the appropriate members of the Board all such correspondence to the indicated directors. Concerns relating to accounting, internal controls or auditing matters will be brought promptly to the attention of the Chairman of the Audit Committee and will be handled in accordance with procedures established by that committee.

14

EXECUTIVE OFFICERS

Executive officers are appointed by and serve at the discretion of the Board of Directors. The following table sets forth certain information regarding our executive officers, including their names, ages and positions as of May 6, 2022:

| Name | Age | Position | ||

| Christopher W. Bergstrom | 62 | President and Chief Executive Officer | ||

| Carl E. Dodson | 67 | Senior Executive Vice President - Chief Operating Officer and Chief Risk Officer | ||

| William J. Ridenour | 70 | Senior Executive Vice President – Chief Banking Officer | ||

| Kent D. Carstater | 54 | Executive Vice President – Chief Financial Officer | ||

| Andrew J. Peden | 44 | Executive Vice President – Chief Lending Officer |

The business experience of each of our executive officers, other than Mr. Bergstrom, is set forth below. No executive officer has any family relationship, as defined in Item 401 of Regulation S-K, with any other executive officer or any of our directors. There are no arrangements or understandings between any of the officers and any other person pursuant to which he was selected as an officer.

Carl E. Dodson is the Senior Executive Vice President – Chief Operating Officer and Chief Risk Officer of the Company and served as the Bank’s President from its initial organization until June 2008. Mr. Dodson has over 40 years of community banking experience in the Washington metropolitan area. Mr. Dodson was one of the original officers of Palmer National Bank in Washington, D.C., serving as Executive Vice President and senior commercial lender from 1983 to 1996. Following Palmer’s sale to George Mason Bankshares in 1996, he served as a Senior Vice President of George Mason Bank until 1998. In 1998, Mr. Dodson joined Cardinal Bank as Chief Credit Officer. In 2001, Mr. Dodson was named Executive Vice President and Chief Operating Officer of the parent company, Cardinal Financial Corporation. Mr. Dodson holds a Bachelor of Arts in Economics from the University of Virginia, and Masters of Business Administration from the Darden School of Business at the University of Virginia.

William J. Ridenour is the Senior Executive Vice President – Chief Banking Officer of the Company and was previously the President of the Bank from June 2008 through June 2019. Prior to joining the Company, Mr. Ridenour was Executive Vice President and Chief Lending Officer at James Monroe Bank from July 2003 until its sale to Mercantile in July 2006, and served with Mercantile and its acquirer, PNC Financial Services Group, until January 2008. Mr. Ridenour has over 46 years of community banking experience in the Northern Virginia/Washington, D.C. market. Mr. Ridenour holds a Bachelor of Arts in Economics from Thiel College, a Masters of Science in Finance from American University and is a graduate of the Commercial Lending Training Program of Chase Manhattan Bank.

Kent D. Carstater is the Executive Vice President – Chief Financial Officer of the Company and has been since June 2017. He has responsibility for accounting, administrative, financial, and risk management operations. Mr. Carstater also chairs the Company’s Asset/Liability management committee. He has over 23 years of financial services experience. He joined John Marshall Bank in July 2016 as Senior Vice President of Market Risk Management, overseeing the Bank’s liquidity, asset/liability, investment, capital planning and strategic planning functions. From 2012 to 2016, Mr. Carstater served as a Senior Vice President and Treasurer at the Bank of Georgetown. In that role, he was responsible for financial and risk management, investor relations, capital markets activities and strategic planning. Prior to becoming a commercial banker in 2012, he advised community bank executives on strategic matters as an investment banker and founded a private equity firm focused on investing in financial institutions. Mr. Carstater earned his Bachelors of Science from Virginia Tech in Finance and Masters of Business Administration from the Darden School of Business at the University of Virginia.

Andrew J. Peden is the Executive Vice President – Chief Lending Officer of the Company and has been since May 2018. He has over 20 years of banking experience. Prior to joining the Company, Mr. Peden spent one year at United Bank serving as a Market Executive. Prior to that, Mr. Peden spent 17 years with Cardinal Bank where he most recently served as Executive Vice President of Commercial Real Estate Lending. Mr. Peden earned his Bachelors of Science from the University of Richmond – Robins School of Business in Business. Mr. Peden is also very involved in the community, having served for 15 years on the steering committee of a fundraising event for the Inova Kellar Center and as a youth sports coach.

15

EXECUTIVE OFFICER COMPENSATION

Compensation Paid to Named Executive Officers

The following table sets forth an overview of the compensation for Christopher W. Bergstrom, President & Chief Executive Officer, Carl E. Dodson, Senior Executive Vice President, Chief Operating Officer & Chief Risk Officer, and William J. Ridenour, Senior Executive Vice President, Chief Banking Officer. Messrs. Bergstrom, Dodson and Ridenour collectively constitute our named executive officers for the year ended December 31, 2021. The compensation of the named executive officers is not necessarily indicative of how we will compensate our named executive officers in the future. Evaluation and changes, as needed, are made to our compensation structure to ensure compensation packages remain competitive and align with our compensation philosophy.

Summary Compensation Table

| Name and Principal Position | Year | Salary | Bonus | Stock Awards(1) | Nonqualified Deferred Compensation Earnings | All Other Compensation (2) | Total | |||||||||||||||||||||

| Christopher W. Bergstrom, President & Chief Executive Officer | 2021 | $ | 650,000 | $ | 685,000 | $ | 150,018 | $ | — | $ | 290,419 | $ | 1,775,437 | |||||||||||||||

| Carl E. Dodson, Senior Executive Vice President — Chief Operating Officer & Chief Risk Officer | 2021 | $ | 370,000 | $ | 250,000 | $ | — | $ | — | $ | 113,885 | $ | 733,885 | |||||||||||||||

| William J. Ridenour, Senior Executive Vice President – Chief Banking Officer | 2021 | $ | 370,000 | $ | 155,000 | $ | — | $ | — | $ | 186,263 | $ | 711,263 | |||||||||||||||

| (1) | The amounts represent the aggregate grant date fair value of restricted stock awards granted in 2021 calculated in accordance with FASB ASC . Topic 718. See Note 13 of Notes to the December 31, 2021, Consolidated Financial Statements, for additional information about the Company’s share-based compensation plans, including the assumptions made in the valuation of restricted stock awards. The awards vest ratably, including the grant date and the three years following the grant date. |

| (2) | The amounts include discretionary contributions made by the Company to its nonqualified deferred compensation plan for Messrs. Bergstrom, Dodson and Ridenour in the amounts of $250,000, $80,000 and $145,000, respectively. Each other perquisite and personal benefit received by the officer was less than $25,000. Please see “— Deferred Compensation Plan” and “— Employment Agreements” below for more information on the deferred compensation plan and perquisites and other personal benefits. |

Summary of Material Components of Compensation Program

Base Salary

We generally set annual base salaries for the executive officers based on the executive’s experience, individual performance for the prior year and our prior year financial results. We also consider comparative peer salary data and believe that base salaries are set at levels that enable us to hire and retain individuals in the banking/finance industry that can drive achievement of the Company’s overall objectives.

The Committee annually evaluates the performance of the Chief Executive Officer based on our financial performance, achievements in implementing our long-term strategy and the personal observations of the Chief Executive Officer’s performance by the members of the Committee and Board of Directors. For other executive officers, the Committee reviews with the Chief Executive Officer the performance evaluations for those executive officers, along with competitive salary data for the Company’s peers.

Effective January 1, 2022, Messrs. Bergstrom, Dodson and Ridenour were entitled to annual base salaries of $685,000, $382,000 and $382,000, respectively.

As part of the Company’s succession planning, effective June 1, 2022, both Messrs. Dodson and Ridenour will reduce their current duties and responsibilities and assume roles as advisors to the Chief Executive Officer. The current duties and responsibilities that Messrs. Dodson and Ridenour will not perform in their roles as advisors to the Chief Executive Officer are currently being transitioned to existing members of the Company’s executive management team. Effective June 1, 2022, Messrs. Dodson’s and Ridenour’s annual base salaries will each be reduced to $200,000. Their perquisites will be reduced or eliminated on or before June 1, 2023. See “— Employment Agreements” below.

16

Short-Term Incentive Compensation

We annually review the Company’s performance relative to internal goals and each executive officer’s individual performance and responsibility to assess the payment of short-term incentive compensation. The Committee makes a discretionary assessment of actual financial results compared to budget and non-financial performance metrics relative to strategic objectives, safety and soundness, effectiveness in managing risk, and status of our relationship with bank regulatory agencies. Financial measures such as return on average assets, return on average equity, efficiency ratio, credit quality, net income to budget, and total return to shareholder are considered but each measure is not assigned a specific weight or given a higher or lower position of importance relative to the other measures. The Committee believes that total compensation for executive officers (base salary, short-term and long-term compensation) should vary based on the Company’s performance and return to shareholders, and should be generally consistent relative to performance against the Company’s peers. These considerations are taken into account in determining the cash bonus, if any, for each executive officer.

Based on assessment of performance, the Committee approves at the end of each year an overall pool of discretionary cash bonuses to be awarded to all officers. The Committee determines the annual cash bonus for the Chief Executive Officer. The Chief Executive Officer determines and reviews with the Committee the annual cash bonuses for executive officers other than the Chief Executive Officer based upon actual Company and individual results compared to the targeted results. Certain members of the executive management team, along with the Chief Executive Officer, then allocate discretionary bonuses to all other employees, not including executive officers.

Long-Term Incentive Compensation – Equity Incentive Plan

Each year, the Committee also considers the desirability of granting long-term incentive equity awards under our 2015 Stock Incentive Plan (the “2015 Plan”). The 2015 Plan was approved by shareholders of the Bank and assumed by the Company in connection with the formation of the holding company, to attract, retain and motivate key employees and directors. We believe that equity awards focus our executive management on building long-term profitability and shareholder value by closely aligning the interests of management with those of our shareholders. As a result, it is our view that equity awards afford a desirable long-term compensation method.

Under the 2015 Plan, incentive stock options, non-qualified stock options, shares of restricted stock and restricted stock units may be awarded to such officers and employees as the Compensation Committee may designate, and non-qualified stock options, shares of restricted stock and restricted stock units may be awarded to directors. The Company’s previous share-based compensation plan, the 2006 Stock Option Plan (the “2006 Plan”), provided for the grant of share-based awards in the form of incentive stock options and non-qualified stock options to directors and employees. In April 2015, the 2006 Plan was terminated and replaced with the 2015 Plan.

The 2015 Plan is administered by the Committee, each member of which meets the definition of an “independent director” under the listing standards of The Nasdaq Stock Market. Subject to the terms of the 2015 Plan, the Committee has the authority to select participants and to grant options, shares of restricted stock and restricted stock units, to determine the terms of those awards, and otherwise to administer and interpret the 2015 Plan. Neither the Committee nor the Board of Directors may reprice any option unless the repricing is approved in advance by the shareholders of the Company. Upon a “change in control” (as defined in the 2015 Plan) of the Company, all awards are immediately exercisable and fully vested. At the time of a change in control, the Committee may cancel outstanding options and give the holder the right to receive a cash payment in an amount equal to the excess of the market value of the shares subject to the option over the exercise price of the option.

Under the 2015 Plan, of the 976,211 shares authorized, 318,907 shares were available for granting purposes as of December 31, 2021.

For 2021, the Committee determined to grant Mr. Bergstrom time-based restricted stock awards totaling 7,654 shares that vest ratably, including the grant date and the three years following the grant date.

Deferred Compensation Plan

We currently have in place the John Marshall Bancorp Deferred Compensation Plan (the “Nonqualified Plan”), which offers certain executive officers and directors the opportunity to voluntarily defer current compensation for retirement income and other significant future financial needs for themselves, their families and other dependents. The Nonqualified Plan is also designed to provide the Company with a vehicle to address limitations on our contributions under any tax-qualified defined contribution plan. Any of our officers holding the position of senior vice president or above may be eligible to participate in the Nonqualified Plan.