February 2019 :: 20th Annual Financial Services Forum

Disclaimer IMPORTANT: You must read the following information before continuing to the rest of the presentation. This presentation has been prepared by CURO Group Holdings Corp. and its subsidiaries (collectively, “we,” “us” or the “Company”) and is being provided to you for informational purposes only. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements include statements related to our expectations regarding our significant and multiple growth opportunities and sustainable competitive advantages, our belief that market trends favor our business, our belief that our fourth quarter results in Canada provide excellent momentum heading into 2019 and our fiscal 2019 outlook. In addition, words such as “as “guidance,” “estimate,” “anticipate,” “believe,” “forecast,” “step,” “plan,” “predict,” “focused,” “project,” “is likely,” “expect,” “intend,” “should,” “will,” “confident,” variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions and judgments, including our ability to execute on our business strategy, our ability to capitalize on favorable market trends and our ability to accurately predict our future financial results. These assumptions and judgments may prove to be inaccurate in the future. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. There are important factors both within and outside of our control that could cause our actual results to differ materially from those in the forward-looking statements. These factors include our level of indebtedness; errors in our internal forecasts; our dependence on third-party lenders to provide the cash we need to fund our loans and our ability to affordably access third-party financing; actions of regulators and the negative impact of those actions on our business; our ability to protect our proprietary technology and analytics and keep up with that of our competitors; disruption of our information technology systems that adversely affect our business operations; ineffective pricing of the credit risk of our prospective or existing customers; inaccurate information supplied by customers or third parties would could lead to errors in judging customers’ qualifications to receive loans; improper disclosure of customer personal data; failure or third parties who provide products, services or support to us; any failure of third-party-lenders upon whom we rely to conduct business in certain states; disruption to our relationships with banks and other third-part electronic payment solutions providers; disruption caused by employee or third-party theft and errors in our stores as well as other factors discussed in our filings with the Securities and Exchange Commission. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. We undertake no obligation to update, amend or clarify any forward-looking statement for any reason. Non-GAAP Financial Measures In addition to the financial information prepared in conformity with U.S. GAAP, we provide in this presentation certain “non-GAAP financial measures,” including: Adjusted Net Income (Net Income minus certain non-cash and other adjusting items); Adjusted EBITDA (EBITDA plus or minus certain non-cash and other adjusting items); Gross Combined Loans Receivable (includes loans originated by third-party lenders through CSO programs which are not included in our consolidated financial statements); and Adjusted Return on Average Assets. Such measures are intended as a supplemental measure of the Company’s performance that are not required by, or presented in accordance with, GAAP. The Company presents Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets because it believes that, when viewed with the Company’s GAAP results and the accompanying reconciliation, such measures provide useful information for comparing the Company’s performance over various reporting periods as they remove from the Company’s operating results the impact of items that the Company believes do not reflect its core operating performance. Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets are not substitutes for net earnings, cash flows provided by operating activities or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets. Although the Company believes that Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets can make an evaluation of its operating performance more consistent because they remove items that do not reflect its core operations, other companies in the Company’s industry may define Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets differently than the Company does. As a result, it may be difficult to use Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets to compare the performance of those companies to the Company’s performance. Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets should not be considered as measures of the income generated by the Company’s business or discretionary cash available to it to invest in the growth of its business. The Company’s management compensates for these limitations by reference to its GAAP results and using Adjusted Net Income, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets as supplemental measures. Reconciliations of non-GAAP metrics utilized in this presentation to their closest GAAP measures can be found in slides 27 – 33. The presentation is confidential and may not be reproduced, redistributed, published or passed on to any other person, directly or indirectly, in whole or in part, for any purpose. This document may not be removed from the premises, and by accepting this document and attending the presentation, you agree to be bound by the foregoing limitations. If this document has been received in error it must be returned immediately to the Company. 2

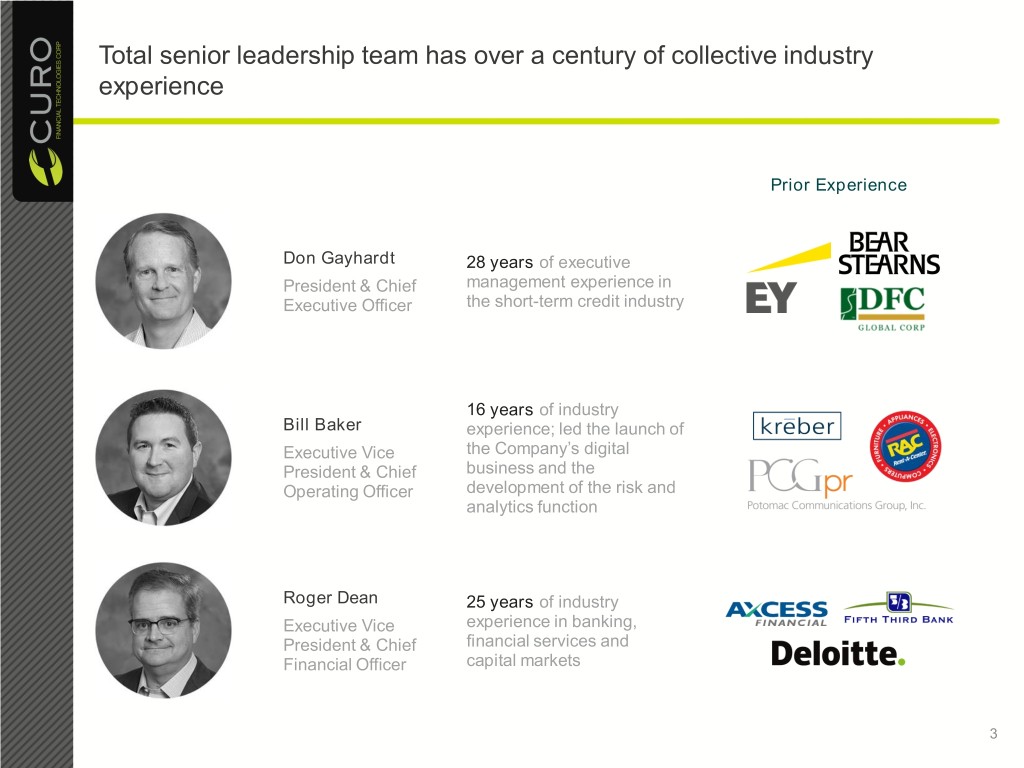

Total senior leadership team has over a century of collective industry experience Prior Experience Don Gayhardt 28 years of executive President & Chief management experience in Executive Officer the short-term credit industry 16 years of industry Bill Baker experience; led the launch of Executive Vice the Company’s digital President & Chief business and the Operating Officer development of the risk and analytics function Roger Dean 25 years of industry Executive Vice experience in banking, President & Chief financial services and Financial Officer capital markets 3

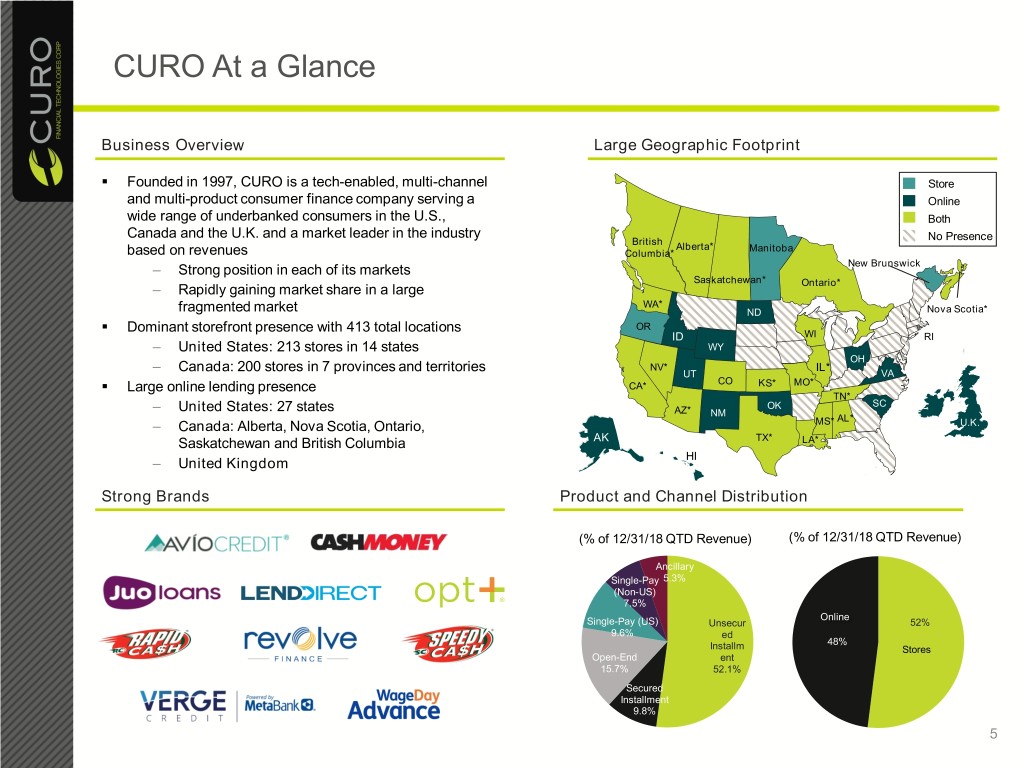

CURO At a Glance Business Overview Large Geographic Footprint . Founded in 1997, CURO is a tech-enabled, multi-channel Store and multi-product consumer finance company serving a Online wide range of underbanked consumers in the U.S., Both Canada and the U.K. and a market leader in the industry British No Presence Alberta* Manitoba based on revenues Columbia* – Strong position in each of its markets New Brunswick Saskatchewan* – Rapidly gaining market share in a large Ontario* WA* fragmented market ND Nova Scotia* . Dominant storefront presence with 413 total locations OR ID WI RI – United States: 213 stores in 14 states WY OH – Canada: 200 stores in 7 provinces and territories NV* IL* UT VA . Large online lending presence CA* CO KS* MO* TN* OK SC – United States: 27 states AZ* NM AL* – Canada: Alberta, Nova Scotia, Ontario, MS* U.K.* Saskatchewan and British Columbia AK TX* LA* HI – United Kingdom Strong Brands Product and Channel Distribution (% of 12/31/18 QTD Revenue) (% of 12/31/18 QTD Revenue) Ancillary Single-Pay 5.3% (Non-US) 7.5% Online Single-Pay (US) Unsecur 52% 9.6% ed 48% Installm Stores Open-End ent 15.7% 52.1% Secured Installment 9.8% 5

Key Investment Highlights Leading large scale lender to underbanked consumers with track record of profitability across credit cycles with over 20 years of history Omni-channel platform, geographic footprint and diverse revenue base drive profitability and performance of business Large and growing addressable market that is underserved by traditional finance companies and banks Dynamic marketing strategy and proprietary analytics fuel customer growth and optimize customer acquisition cost Significant growth opportunities with sustainable competitive advantages 5

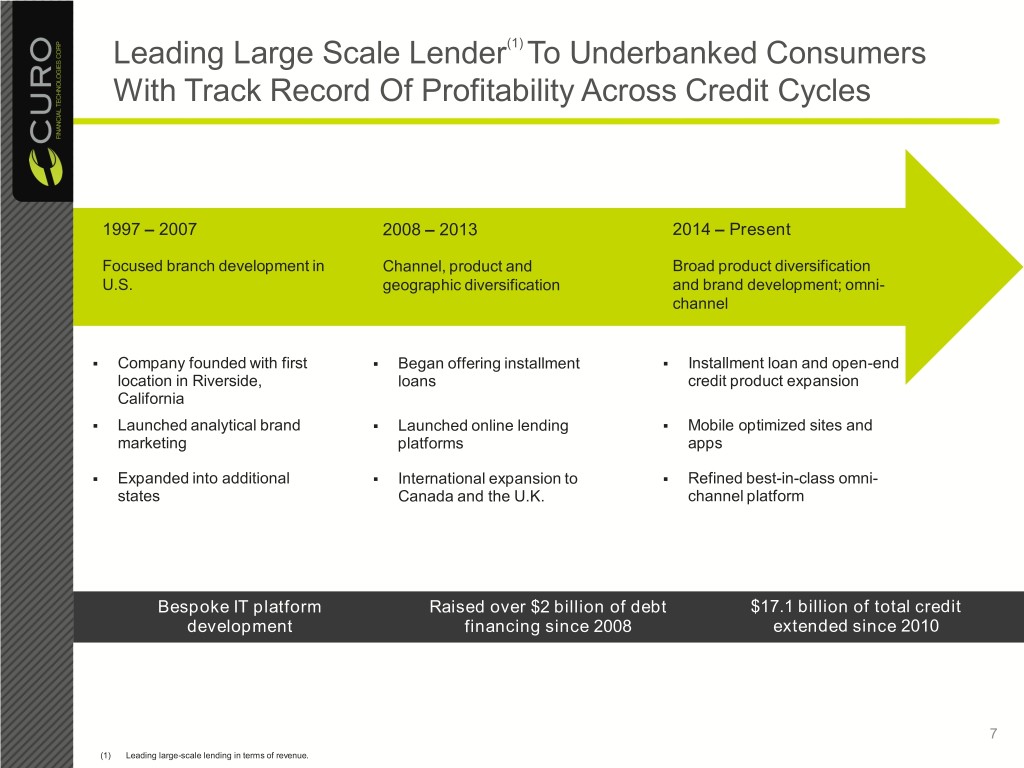

Leading Large Scale Lender(1) To Underbanked Consumers With Track Record Of Profitability Across Credit Cycles 1997 – 2007 2008 – 2013 2014 – Present Focused branch development in Channel, product and Broad product diversification U.S. geographic diversification and brand development; omni- channel . Company founded with first . Began offering installment . Installment loan and open-end location in Riverside, loans credit product expansion California . Launched analytical brand . Launched online lending . Mobile optimized sites and marketing platforms apps . Expanded into additional . International expansion to . Refined best-in-class omni- states Canada and the U.K. channel platform Bespoke IT platform Raised over $2 billion of debt $17.1 billion of total credit development financing since 2008 extended since 2010 7 (1) Leading large-scale lending in terms of revenue.

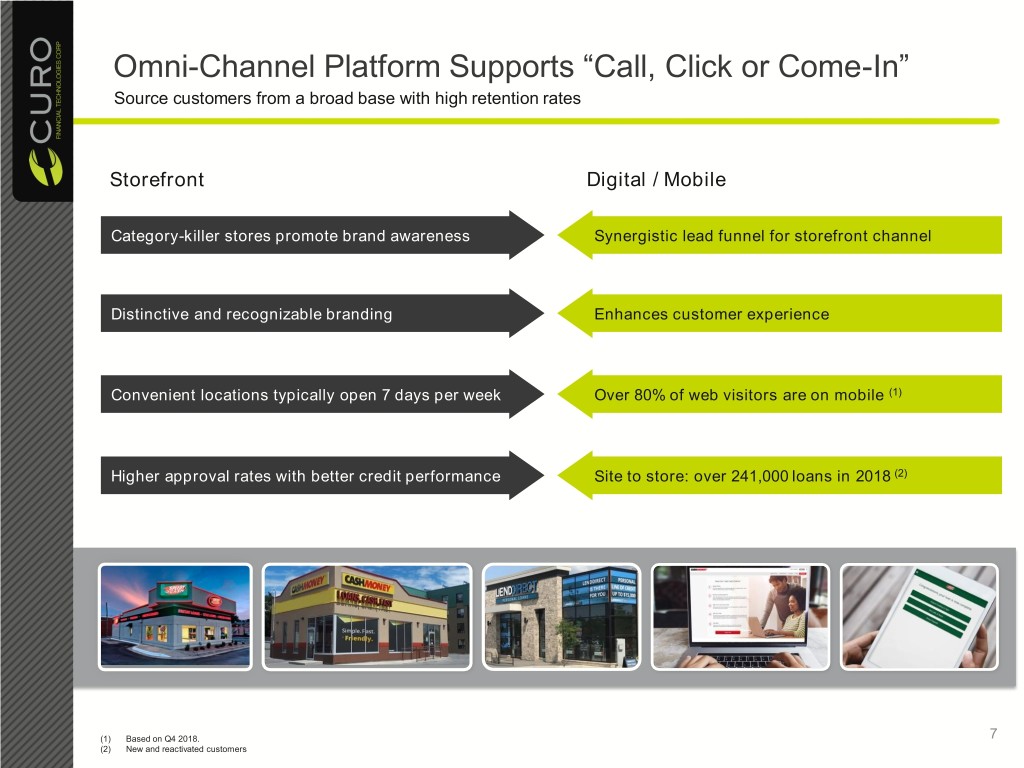

Omni-Channel Platform Supports “Call, Click or Come-In” Source customers from a broad base with high retention rates Storefront Digital / Mobile Category-killer stores promote brand awareness Synergistic lead funnel for storefront channel Distinctive and recognizable branding Enhances customer experience Convenient locations typically open 7 days per week Over 80% of web visitors are on mobile (1) Higher approval rates with better credit performance Site to store: over 241,000 loans in 2018 (2) (1) Based on Q4 2018. 7 (2) New and reactivated customers

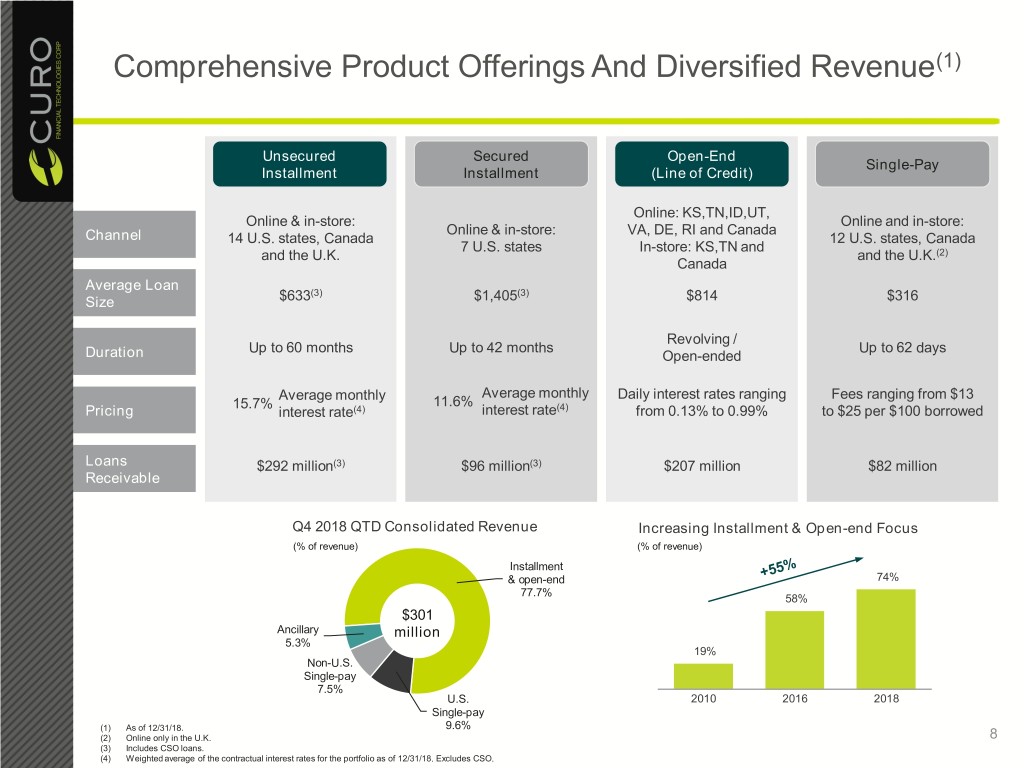

Comprehensive Product Offerings And Diversified Revenue(1) Unsecured Secured Open-End Single-Pay Installment Installment (Line of Credit) Online: KS,TN,ID,UT, Online & in-store: Online and in-store: Online & in-store: VA, DE, RI and Canada Channel 14 U.S. states, Canada 12 U.S. states, Canada 7 U.S. states In-store: KS,TN and and the U.K. and the U.K.(2) Canada Average Loan (3) (3) Size $633 $1,405 $814 $316 Revolving / Up to 60 months Up to 42 months Up to 62 days Duration Open-ended Average monthly Average monthly Daily interest rates ranging Fees ranging from $13 15.7% 11.6% Pricing interest rate(4) interest rate(4) from 0.13% to 0.99% to $25 per $100 borrowed Loans $292 million(3) $96 million(3) $207 million $82 million Receivable Q4 2018 QTD Consolidated Revenue Increasing Installment & Open-end Focus (% of revenue) (% of revenue) Installment & open-end 74% 77.7% 58% $301 Ancillary million 5.3% 19% Non-U.S. Single-pay 7.5% U.S. 2010 2016 2018 Single-pay (1) As of 12/31/18. 9.6% (2) Online only in the U.K. 8 (3) Includes CSO loans. (4) Weighted average of the contractual interest rates for the portfolio as of 12/31/18. Excludes CSO.

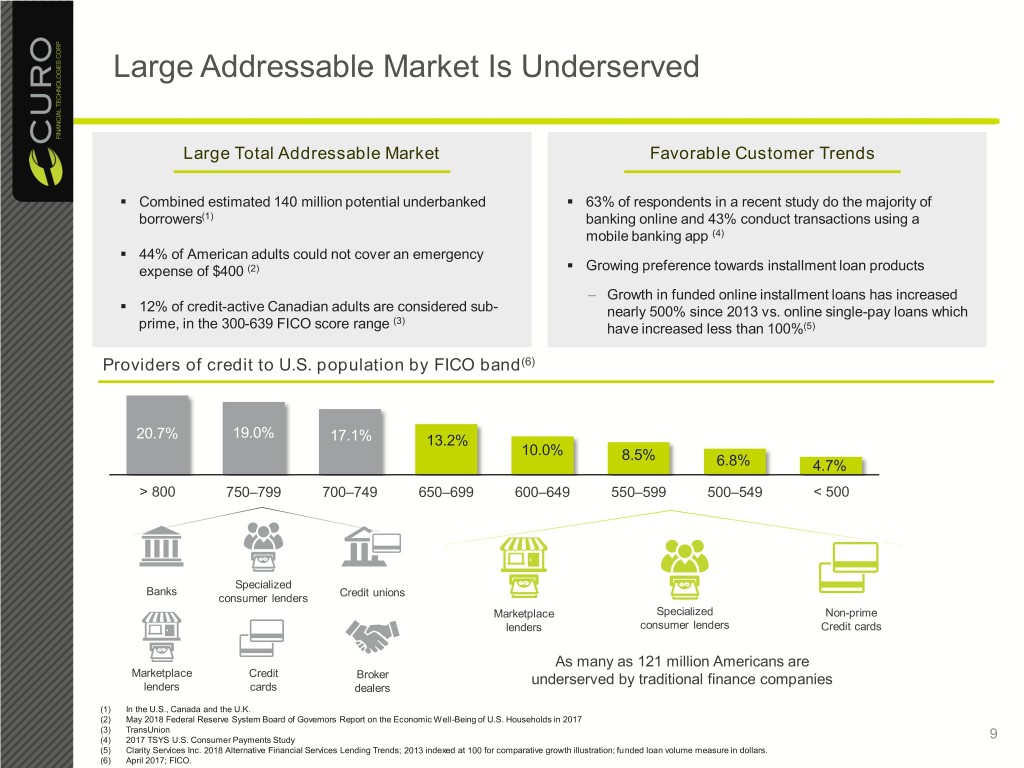

Large Addressable Market Is Underserved Large Total Addressable Market Favorable Customer Trends . Combined estimated 140 million potential underbanked . 63% of respondents in a recent study do the majority of borrowers(1) banking online and 43% conduct transactions using a mobile banking app (4) . 44% of American adults could not cover an emergency . expense of $400 (2) Growing preference towards installment loan products . – Growth in funded online installment loans has increased 12% of credit-active Canadian adults are considered sub- nearly 500% since 2013 vs. online single-pay loans which (3) prime, in the 300-639 FICO score range have increased less than 100%(5) Providers of credit to U.S. population by FICO band(6) 19.0% 20.7% 17.1% 13.2% 10.0% 8.5% 6.8% 4.7% > 800 750–799 700–749 650–699 600–649 550–599 500–549 < 500 Specialized Banks Credit unions consumer lenders Marketplace Specialized Non-prime lenders consumer lenders Credit cards As many as 121 million Americans are Marketplace Credit Broker underserved by traditional finance companies lenders cards dealers (1) In the U.S., Canada and the U.K. (2) May 2018 Federal Reserve System Board of Governors Report on the Economic Well-Being of U.S. Households in 2017 (3) TransUnion (4) 2017 TSYS U.S. Consumer Payments Study 9 (5) Clarity Services Inc. 2018 Alternative Financial Services Lending Trends; 2013 indexed at 100 for comparative growth illustration; funded loan volume measure in dollars. (6) April 2017; FICO.

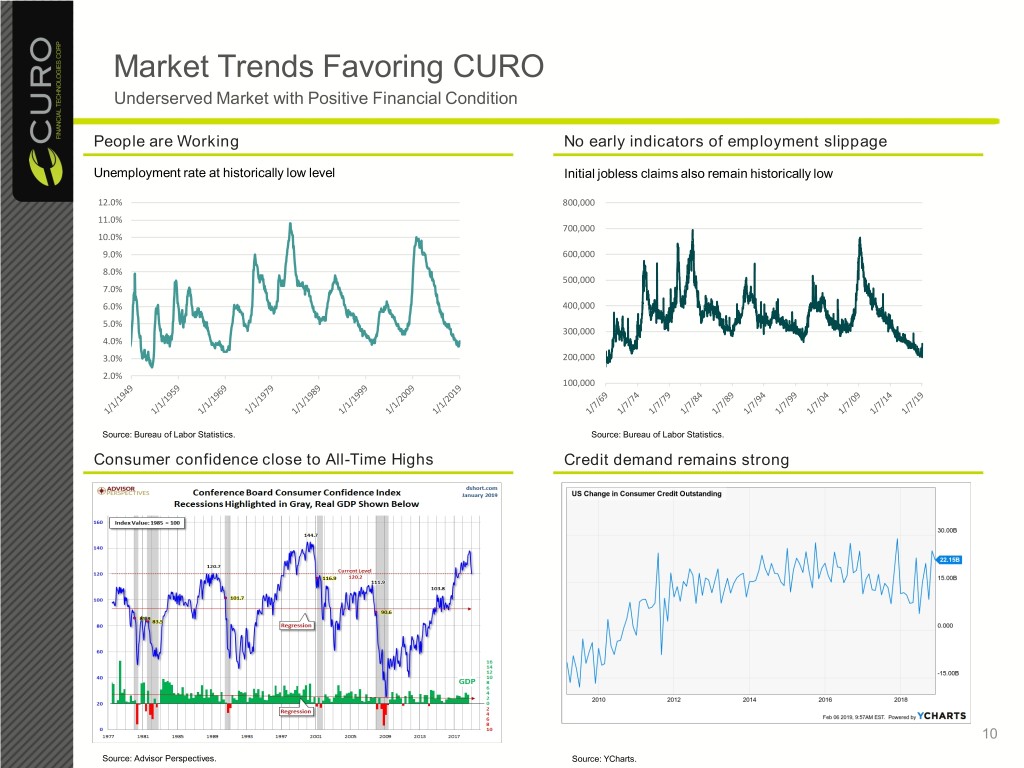

Market Trends Favoring CURO Underserved Market with Positive Financial Condition People are Working No early indicators of employment slippage Unemployment rate at historically low level Initial jobless claims also remain historically low 12.0% 800,000 11.0% 700,000 10.0% 9.0% 600,000 8.0% 500,000 7.0% 6.0% 400,000 5.0% 300,000 4.0% 3.0% 200,000 2.0% 100,000 Source: Bureau of Labor Statistics. Source: Bureau of Labor Statistics. Consumer confidence close to All-Time Highs Credit demand remains strong 10 Source: Advisor Perspectives. Source: YCharts.

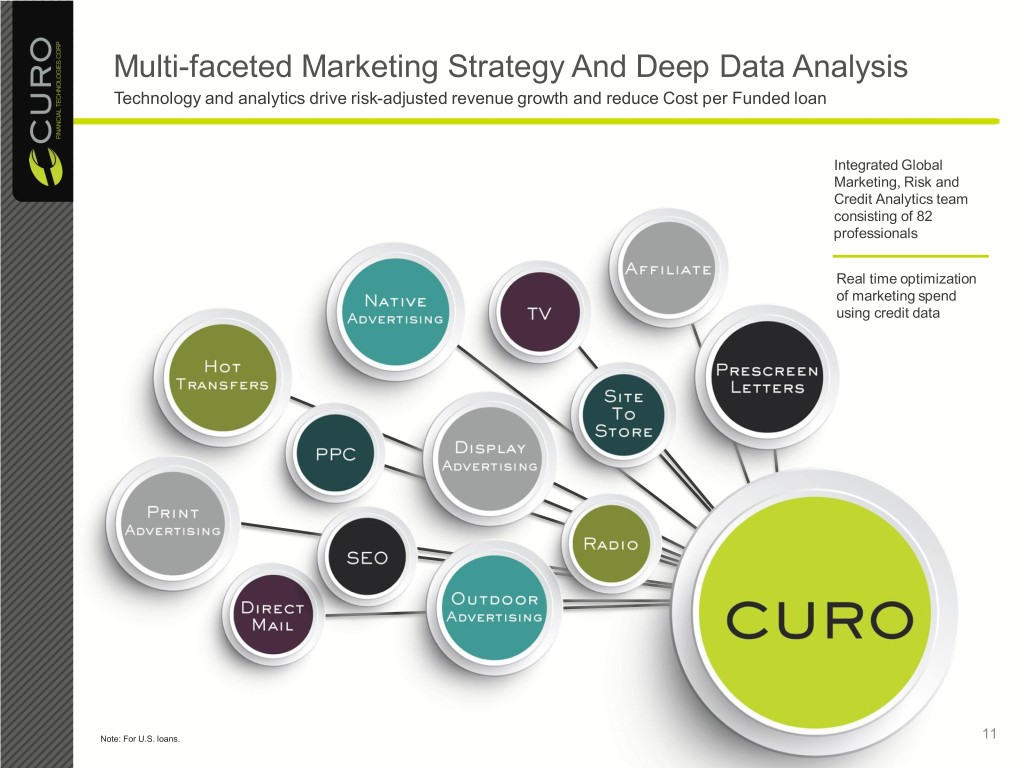

Multi-faceted Marketing Strategy And Deep Data Analysis Technology and analytics drive risk-adjusted revenue growth and reduce Cost per Funded loan Integrated Global Marketing, Risk and Credit Analytics team consisting of 82 professionals Real time optimization of marketing spend using credit data Note: For U.S. loans. 11

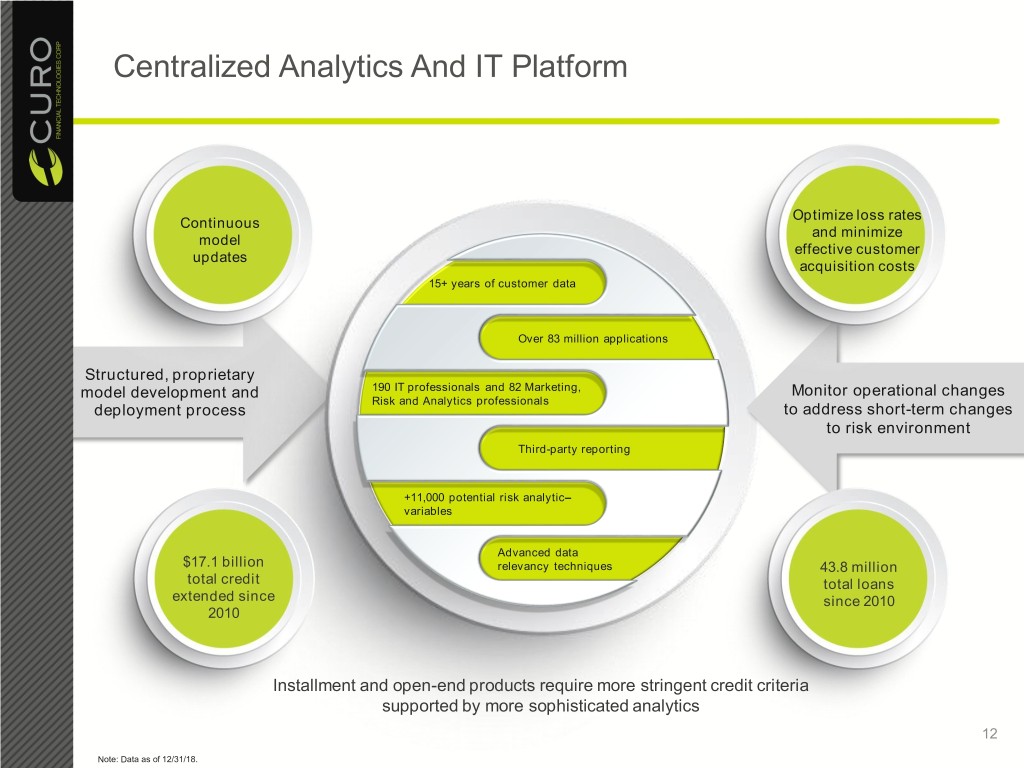

Centralized Analytics And IT Platform Optimize loss rates Continuous and minimize model effective customer updates acquisition costs 15+ years of customer data Over 83 million applications Structured, proprietary model development and 190 IT professionals and 82 Marketing, Monitor operational changes Risk and Analytics professionals deployment process to address short-term changes to risk environment Third-party reporting +11,000 potential risk analytic– variables Advanced data $17.1 billion relevancy techniques 43.8 million total credit total loans extended since since 2010 2010 Installment and open-end products require more stringent credit criteria supported by more sophisticated analytics 12 Note: Data as of 12/31/18.

Multiple Opportunities For Continued Significant Growth CURO has developed a growth-oriented financial technology platform Capital • August 2018 refinancing extended maturities and reduced interest expense positioned to capitalize on Structure • SPV Facility to finance growth of Open-end numerous growth Optimization loans in Canada opportunities • Expansion of Senior Revolver to $50 million • Optimize customer acquisition cost Operational • Improvement credit performance Enhancement • Further expand existing loan offerings in U.S. & Canada Geographic • Expansion of LendDirect in Canada; pilot stores opened Q4 2017 Expansion • Continue to explore opportunities in new high-growth markets New • New online installment loan brand, Avio Credit Product • Bank partner line of credit offerings in U.S. with MetaBank Offerings Efficient • Continue to drive more customer growth in existing products / geographies Customer • Data driven, cost-efficient acquisitions strategy Acquisition • Increase prescreen direct-mail program and add to affiliate network 13

Canada Open-End Transition 14

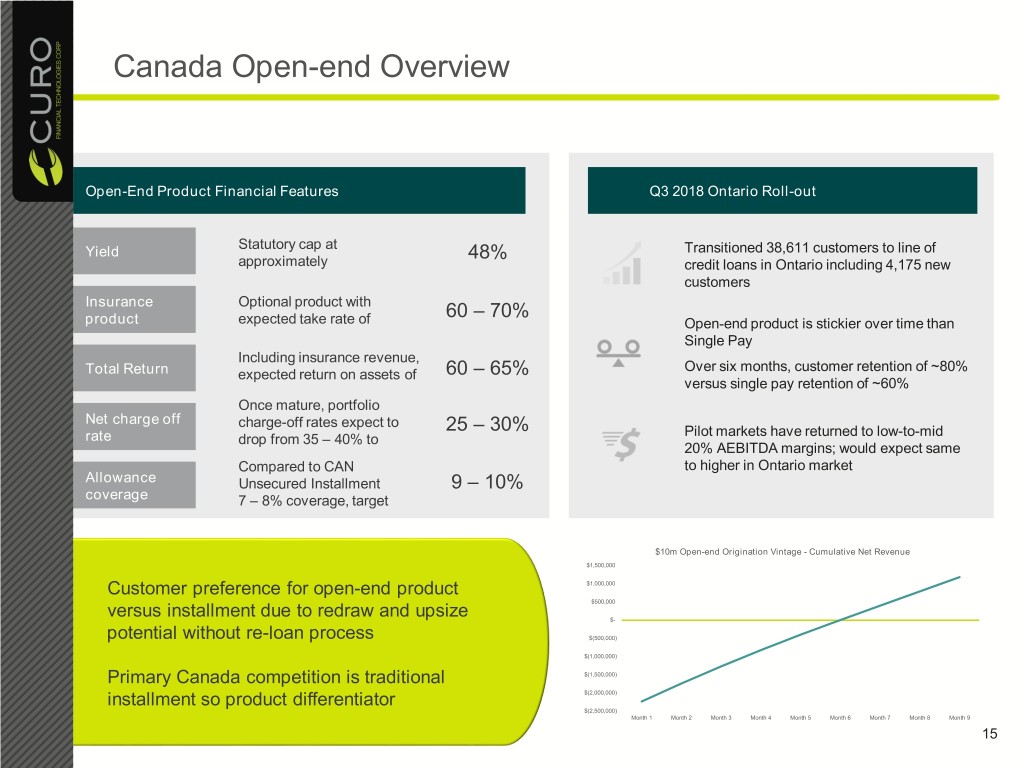

Canada Open-end Overview Open-End Product Financial Features Q3 2018 Ontario Roll-out Statutory cap at Yield 48% Transitioned 38,611 customers to line of approximately credit loans in Ontario including 4,175 new customers Insurance Optional product with 60 – 70% product expected take rate of Open-end product is stickier over time than Single Pay Including insurance revenue, Over six months, customer retention of ~80% Total Return expected return on assets of 60 – 65% versus single pay retention of ~60% Once mature, portfolio Net charge off charge-off rates expect to 25 – 30% Pilot markets have returned to low-to-mid rate drop from 35 – 40% to 20% AEBITDA margins; would expect same Compared to CAN to higher in Ontario market Allowance Unsecured Installment 9 – 10% coverage 7 – 8% coverage, target $10m Open-end Origination Vintage - Cumulative Net Revenue $1,500,000 Customer preference for open-end product $1,000,000 $500,000 versus installment due to redraw and upsize $- potential without re-loan process $(500,000) $(1,000,000) Primary Canada competition is traditional $(1,500,000) installment so product differentiator $(2,000,000) $(2,500,000) Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 15

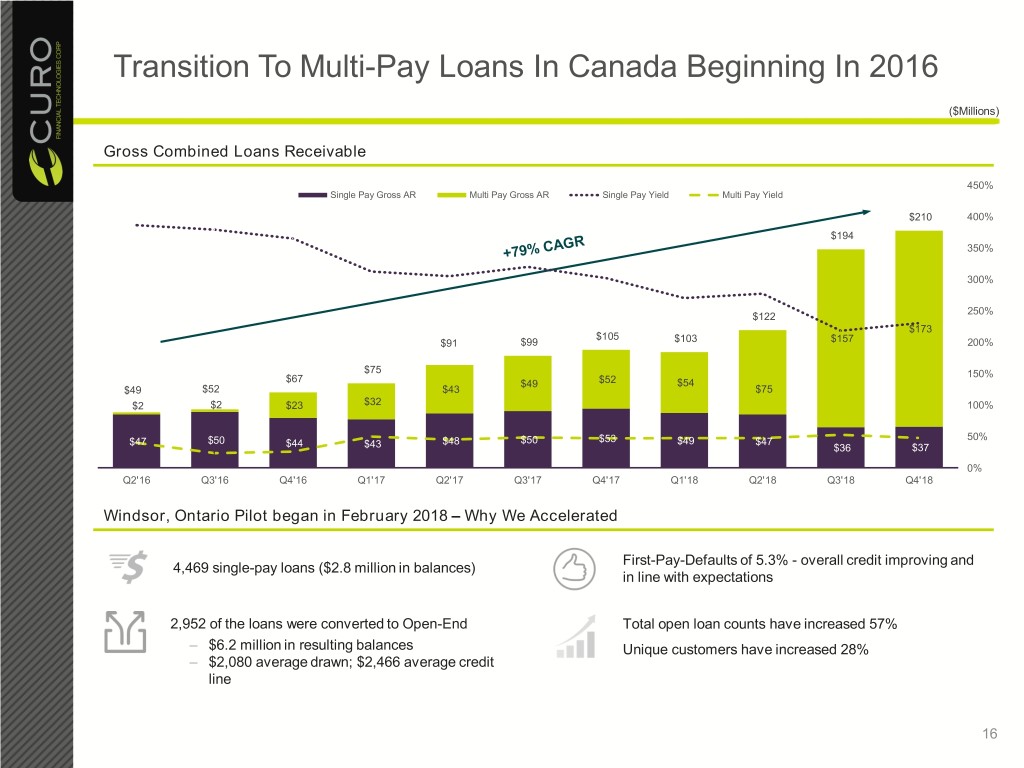

Transition To Multi-Pay Loans In Canada Beginning In 2016 ($Millions) Gross Combined Loans Receivable 450% Single Pay Gross AR Multi Pay Gross AR Single Pay Yield Multi Pay Yield $210 400% $194 350% 300% 250% $122 $173 $105 $91 $99 $103 $157 200% $75 150% $67 $49 $52 $54 $49 $52 $43 $75 $2 $2 $23 $32 100% $47 $50 $48 $50 $53 $49 $47 50% $44 $43 $36 $37 0% Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Windsor, Ontario Pilot began in February 2018 – Why We Accelerated First-Pay-Defaults of 5.3% - overall credit improving and 4,469 single-pay loans ($2.8 million in balances) in line with expectations 2,952 of the loans were converted to Open-End Total open loan counts have increased 57% – $6.2 million in resulting balances Unique customers have increased 28% – $2,080 average drawn; $2,466 average credit line 16

U.K. Redress Claims 17

The Challenge Facing the U.K. Business Curo Transatlantic Ltd (“CTL”), Curo Holdings Corp.’s U.K. subsidiary, is currently facing challenges arising from affordability complaints The U.K. payday lending industry faced a dramatic increase in affordability complaints over the course of 2018, accelerated by for-profit Claims Management Companies (“CMCs”) On October 15, 2018, the U.K.’s Financial Conduct Authority (“FCA”) issued a ‘Dear CEO’ letter to all High- Cost Short-Term Credit (“HCSTC”) firms, including CTL, stating that firms should take prompt actions to: ─ Assess their lending activity to determine whether creditworthiness assessments are compliant ─ If deficiencies were found, to take remedial action to ensure ongoing lending activity is compliant and consider whether proactive redress may be required ─ Inform the FCA if they are unable (now or in the future) to meet their financial commitments because of any remediation costs ─ Take account of recent determinations by the Financial Ombudsman Service (“FOS”) as part of their complaint procedures CTL has evaluated all in-scope claims and has determined potential ranges of cash compensation liabilities of a magnitude that would prevent profitable operation of the U.K. business. Therefore, CTL has evaluated two alternatives 18

Financial Summary 19

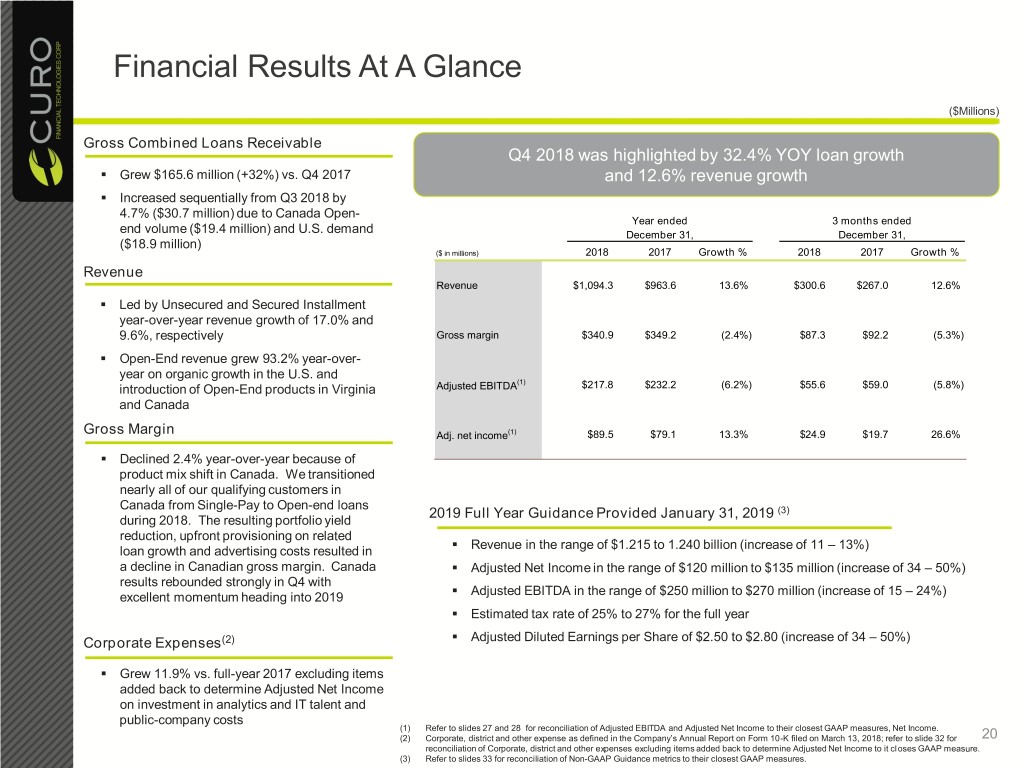

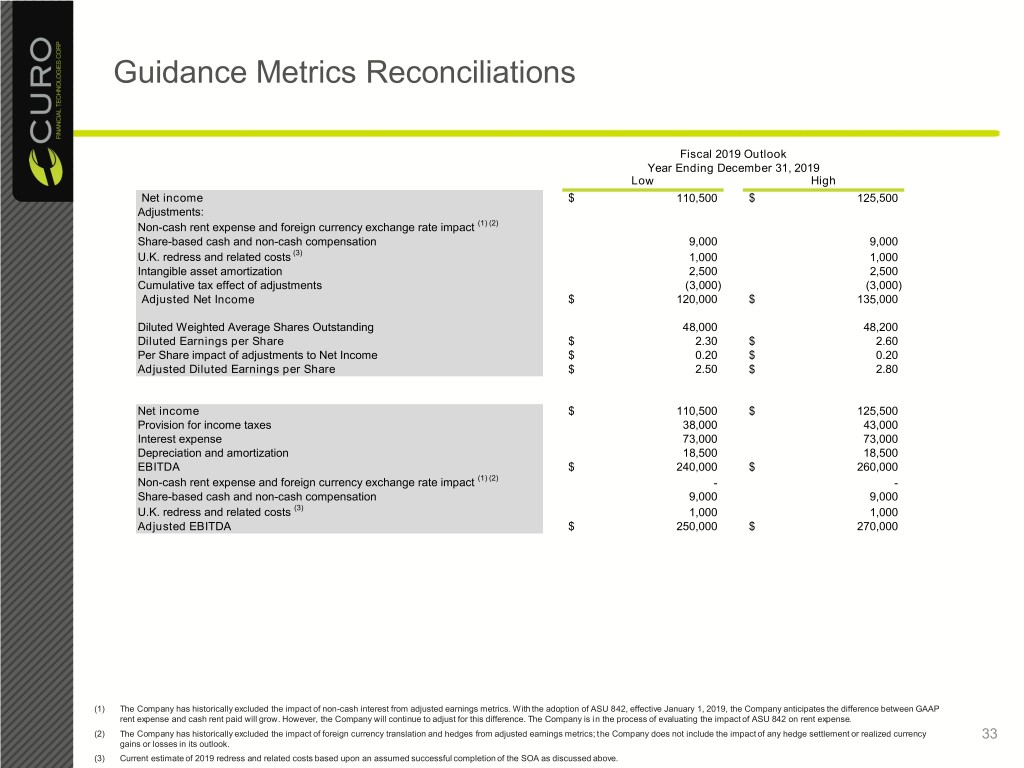

Financial Results At A Glance ($Millions) Gross Combined Loans Receivable Q4 2018 was highlighted by 32.4% YOY loan growth . Grew $165.6 million (+32%) vs. Q4 2017 and 12.6% revenue growth . Increased sequentially from Q3 2018 by 4.7% ($30.7 million) due to Canada Open- Year ended 3 months ended end volume ($19.4 million) and U.S. demand December 31, December 31, ($18.9 million) Q2 2018 YTD performance commentary ($ in millions) 2018 2017 Growth % 2018 2017 Growth % Revenue Revenue $1,094.3 $963.6 13.6% $300.6 $267.0 12.6% . Led by Unsecured and Secured Installment year-over-year revenue growth of 17.0% and 9.6%, respectively Gross margin $340.9 $349.2 (2.4%) $87.3 $92.2 (5.3%) . Open-End revenue grew 93.2% year-over- year on organic growth in the U.S. and (1) introduction of Open-End products in Virginia Adjusted EBITDA $217.8 $232.2 (6.2%) $55.6 $59.0 (5.8%) and Canada Gross Margin Adj. net income(1) $89.5 $79.1 13.3% $24.9 $19.7 26.6% . Declined 2.4% year-over-year because of product mix shift in Canada. We transitioned nearly all of our qualifying customers in Canada from Single-Pay to Open-end loans 2019 Full Year Guidance Provided January 31, 2019 (3) during 2018. The resulting portfolio yield reduction, upfront provisioning on related . Revenue in the range of $1.215 to 1.240 billion (increase of 11 – 13%) loan growth and advertising costs resulted in a decline in Canadian gross margin. Canada . Adjusted Net Income in the range of $120 million to $135 million (increase of 34 – 50%) results rebounded strongly in Q4 with . Adjusted EBITDA in the range of $250 million to $270 million (increase of 15 – 24%) excellent momentum heading into 2019 . Estimated tax rate of 25% to 27% for the full year . Corporate Expenses(2) Adjusted Diluted Earnings per Share of $2.50 to $2.80 (increase of 34 – 50%) . Grew 11.9% vs. full-year 2017 excluding items added back to determine Adjusted Net Income on investment in analytics and IT talent and public-company costs (1) Refer to slides 27 and 28 for reconciliation of Adjusted EBITDA and Adjusted Net Income to their closest GAAP measures, Net Income. (2) Corporate, district and other expense as defined in the Company’s Annual Report on Form 10-K filed on March 13, 2018; refer to slide 32 for 20 reconciliation of Corporate, district and other expenses excluding items added back to determine Adjusted Net Income to it closes GAAP measure. (3) Refer to slides 33 for reconciliation of Non-GAAP Guidance metrics to their closest GAAP measures.

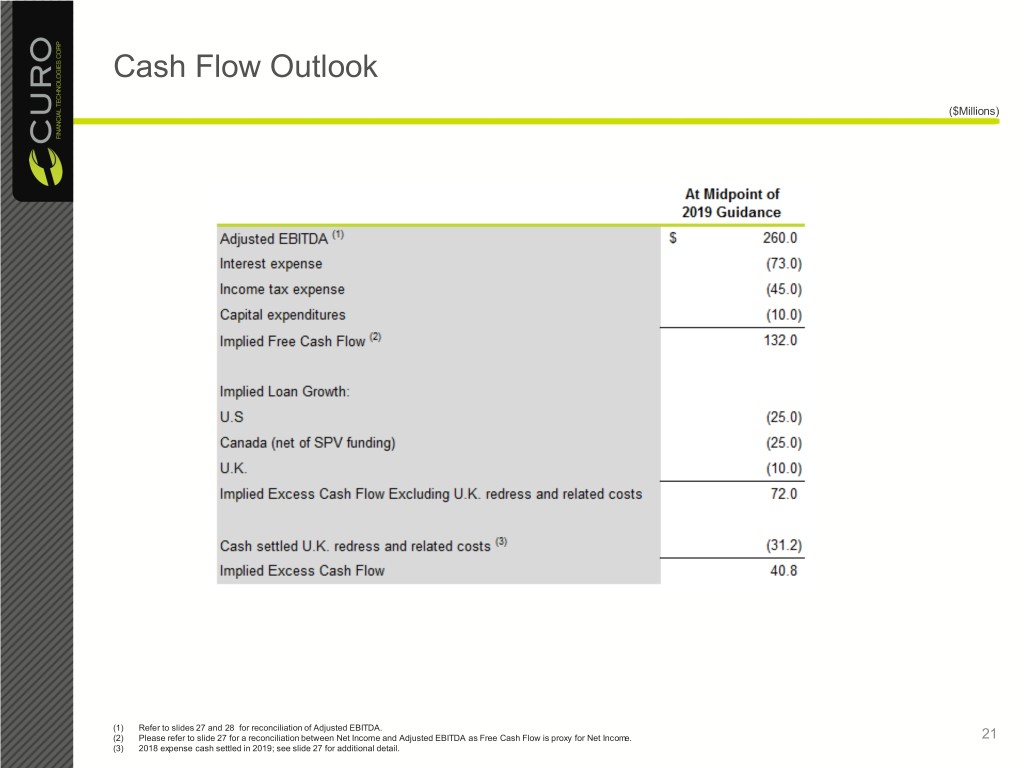

Cash Flow Outlook ($Millions) (1) Refer to slides 27 and 28 for reconciliation of Adjusted EBITDA. (2) Please refer to slide 27 for a reconciliation between Net Income and Adjusted EBITDA as Free Cash Flow is proxy for Net Income. 21 (3) 2018 expense cash settled in 2019; see slide 27 for additional detail.

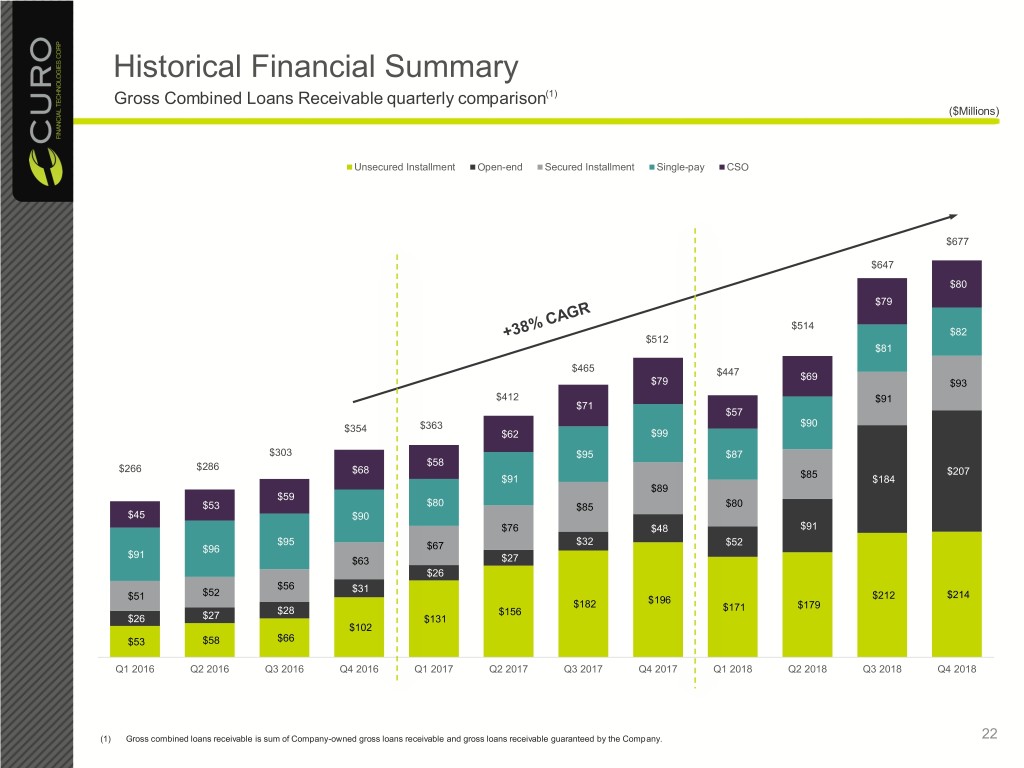

Historical Financial Summary Gross Combined Loans Receivable quarterly comparison(1) ($Millions) Unsecured Installment Open-end Secured Installment Single-pay CSO $677 $647 $80 $79 $514 $82 $512 $81 $465 $447 $69 $79 $93 $412 $91 $71 $57 $90 $354 $363 $62 $99 $303 $95 $87 $58 $266 $286 $68 $207 $91 $85 $184 $89 $59 $53 $80 $85 $80 $45 $90 $76 $48 $91 $95 $32 $52 $96 $67 $91 $63 $27 $26 $56 $31 $51 $52 $212 $214 $182 $196 $179 $28 $156 $171 $26 $27 $131 $102 $53 $58 $66 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 (1) Gross combined loans receivable is sum of Company-owned gross loans receivable and gross loans receivable guaranteed by the Company. 22

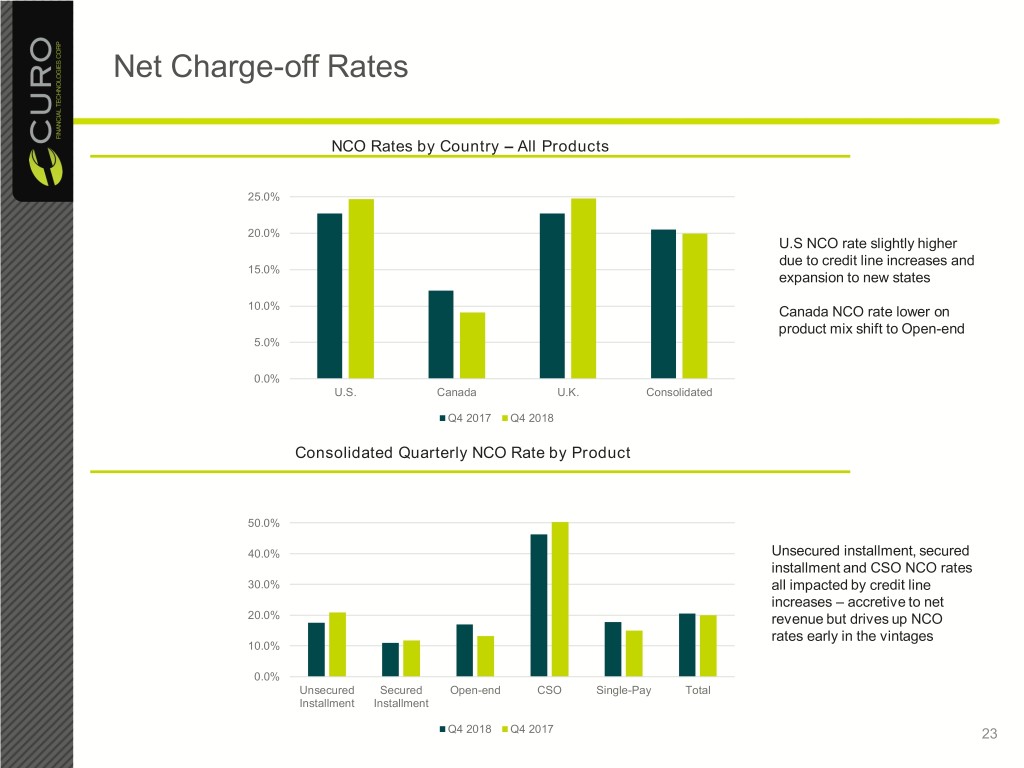

Net Charge-off Rates NCO Rates by Country – All Products 25.0% 20.0% U.S NCO rate slightly higher due to credit line increases and 15.0% expansion to new states 10.0% Canada NCO rate lower on product mix shift to Open-end 5.0% 0.0% U.S. Canada U.K. Consolidated Q4 2017 Q4 2018 Consolidated Quarterly NCO Rate by Product 50.0% 40.0% Unsecured installment, secured installment and CSO NCO rates 30.0% all impacted by credit line increases – accretive to net 20.0% revenue but drives up NCO rates early in the vintages 10.0% 0.0% Unsecured Secured Open-end CSO Single-Pay Total Installment Installment Q4 2018 Q4 2017 23

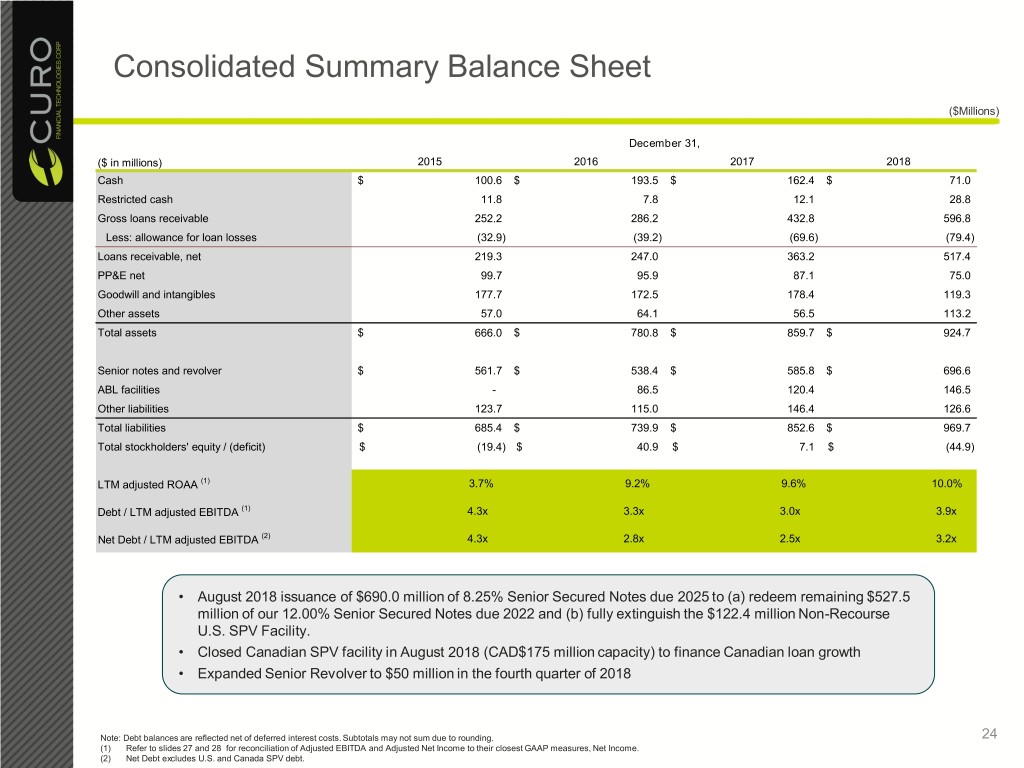

Consolidated Summary Balance Sheet ($Millions) December 31, ($ in millions) 2015 2016 2017 2018 Cash $ 100.6 $ 193.5 $ 162.4 $ 71.0 Restricted cash 11.8 7.8 12.1 28.8 Gross loans receivable 252.2 286.2 432.8 596.8 Less: allowance for loan losses (32.9) (39.2) (69.6) (79.4) Loans receivable, net 219.3 247.0 363.2 517.4 PP&E net 99.7 95.9 87.1 75.0 Goodwill and intangibles 177.7 172.5 178.4 119.3 Other assets 57.0 64.1 56.5 113.2 Total assets $ 666.0 $ 780.8 $ 859.7 $ 924.7 Senior notes and revolver $ 561.7 $ 538.4 $ 585.8 $ 696.6 ABL facilities - 86.5 120.4 146.5 Other liabilities 123.7 115.0 146.4 126.6 Total liabilities $ 685.4 $ 739.9 $ 852.6 $ 969.7 Total stockholders' equity / (deficit) $ (19.4) $ 40.9 $ 7.1 $ (44.9) LTM adjusted ROAA (1) 3.7% 9.2% 9.6% 10.0% Debt / LTM adjusted EBITDA (1) 4.3x 3.3x 3.0x 3.9x Net Debt / LTM adjusted EBITDA (2) 4.3x 2.8x 2.5x 3.2x • August 2018 issuance of $690.0 million of 8.25% Senior Secured Notes due 2025 to (a) redeem remaining $527.5 million of our 12.00% Senior Secured Notes due 2022 and (b) fully extinguish the $122.4 million Non-Recourse U.S. SPV Facility. • Closed Canadian SPV facility in August 2018 (CAD$175 million capacity) to finance Canadian loan growth • Expanded Senior Revolver to $50 million in the fourth quarter of 2018 Note: Debt balances are reflected net of deferred interest costs. Subtotals may not sum due to rounding. 24 (1) Refer to slides 27 and 28 for reconciliation of Adjusted EBITDA and Adjusted Net Income to their closest GAAP measures, Net Income. (2) Net Debt excludes U.S. and Canada SPV debt.

Key Investment Highlights Leading large scale lender to underbanked consumers with track record of profitability across credit cycles with over 20 years of history Omni-channel platform, geographic footprint and diverse revenue base drive profitability and performance of business Large and growing addressable market that is underserved by traditional finance companies and banks Dynamic marketing strategy and proprietary analytics fuel customer growth and optimize customer acquisition cost Significant growth opportunities with sustainable competitive advantages 25

Appendix 26

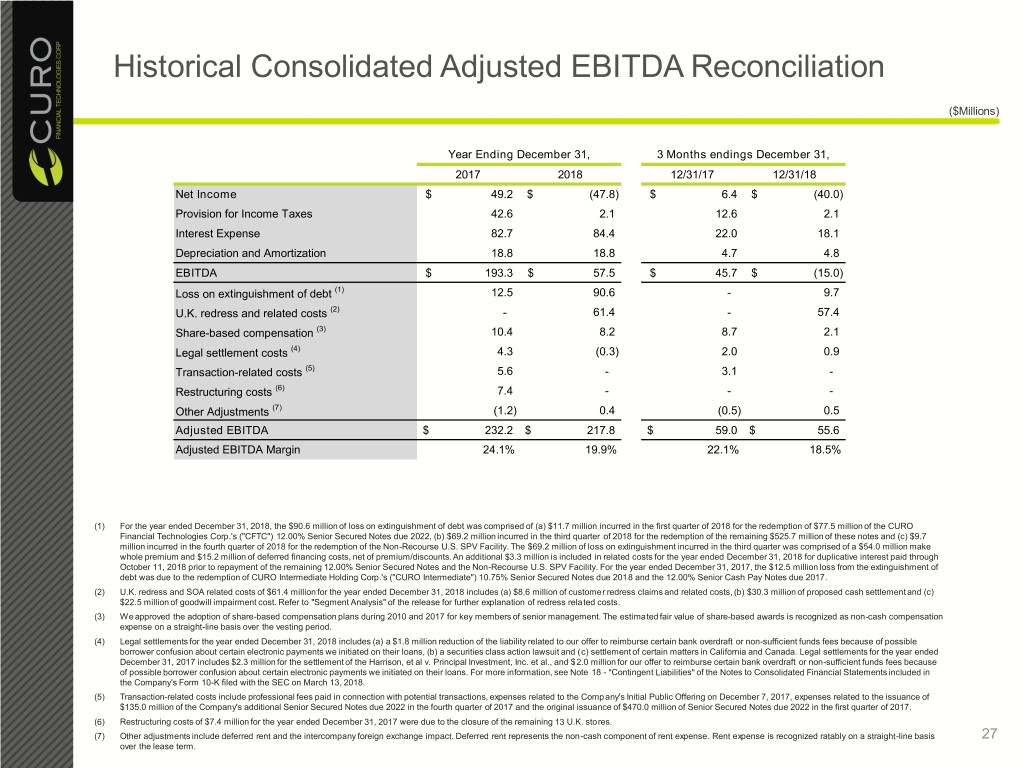

Historical Consolidated Adjusted EBITDA Reconciliation ($Millions) Year Ending December 31, 3 Months endings December 31, 2017 2018 12/31/17 12/31/18 Net Income $ 49.2 $ (47.8) $ 6.4 $ (40.0) Provision for Income Taxes 42.6 2.1 12.6 2.1 Interest Expense 82.7 84.4 22.0 18.1 Depreciation and Amortization 18.8 18.8 4.7 4.8 EBITDA $ 193.3 $ 57.5 $ 45.7 $ (15.0) Loss on extinguishment of debt (1) 12.5 90.6 - 9.7 U.K. redress and related costs (2) - 61.4 - 57.4 Share-based compensation (3) 10.4 8.2 8.7 2.1 Legal settlement costs (4) 4.3 (0.3) 2.0 0.9 Transaction-related costs (5) 5.6 - 3.1 - Restructuring costs (6) 7.4 - - - Other Adjustments (7) (1.2) 0.4 (0.5) 0.5 Adjusted EBITDA $ 232.2 $ 217.8 $ 59.0 $ 55.6 Adjusted EBITDA Margin 24.1% 19.9% 22.1% 18.5% (1) For the year ended December 31, 2018, the $90.6 million of loss on extinguishment of debt was comprised of (a) $11.7 million incurred in the first quarter of 2018 for the redemption of $77.5 million of the CURO Financial Technologies Corp.'s ("CFTC") 12.00% Senior Secured Notes due 2022, (b) $69.2 million incurred in the third quarter of 2018 for the redemption of the remaining $525.7 million of these notes and (c) $9.7 million incurred in the fourth quarter of 2018 for the redemption of the Non-Recourse U.S. SPV Facility. The $69.2 million of loss on extinguishment incurred in the third quarter was comprised of a $54.0 million make whole premium and $15.2 million of deferred financing costs, net of premium/discounts. An additional $3.3 million is included in related costs for the year ended December 31, 2018 for duplicative interest paid through October 11, 2018 prior to repayment of the remaining 12.00% Senior Secured Notes and the Non-Recourse U.S. SPV Facility. For the year ended December 31, 2017, the $12.5 million loss from the extinguishment of debt was due to the redemption of CURO Intermediate Holding Corp.'s ("CURO Intermediate") 10.75% Senior Secured Notes due 2018 and the 12.00% Senior Cash Pay Notes due 2017. (2) U.K. redress and SOA related costs of $61.4 million for the year ended December 31, 2018 includes (a) $8.6 million of customer redress claims and related costs, (b) $30.3 million of proposed cash settlement and (c) $22.5 million of goodwill impairment cost. Refer to "Segment Analysis" of the release for further explanation of redress related costs. (3) We approved the adoption of share-based compensation plans during 2010 and 2017 for key members of senior management. The estimated fair value of share-based awards is recognized as non-cash compensation expense on a straight-line basis over the vesting period. (4) Legal settlements for the year ended December 31, 2018 includes (a) a $1.8 million reduction of the liability related to our offer to reimburse certain bank overdraft or non-sufficient funds fees because of possible borrower confusion about certain electronic payments we initiated on their loans, (b) a securities class action lawsuit and (c) settlement of certain matters in California and Canada. Legal settlements for the year ended December 31, 2017 includes $2.3 million for the settlement of the Harrison, et al v. Principal Investment, Inc. et al., and $2.0 million for our offer to reimburse certain bank overdraft or non-sufficient funds fees because of possible borrower confusion about certain electronic payments we initiated on their loans. For more information, see Note 18 - "Contingent Liabilities" of the Notes to Consolidated Financial Statements included in the Company's Form 10-K filed with the SEC on March 13, 2018. (5) Transaction-related costs include professional fees paid in connection with potential transactions, expenses related to the Company's Initial Public Offering on December 7, 2017, expenses related to the issuance of $135.0 million of the Company's additional Senior Secured Notes due 2022 in the fourth quarter of 2017 and the original issuance of $470.0 million of Senior Secured Notes due 2022 in the first quarter of 2017. (6) Restructuring costs of $7.4 million for the year ended December 31, 2017 were due to the closure of the remaining 13 U.K. stores. (7) Other adjustments include deferred rent and the intercompany foreign exchange impact. Deferred rent represents the non-cash component of rent expense. Rent expense is recognized ratably on a straight-line basis 27 over the lease term.

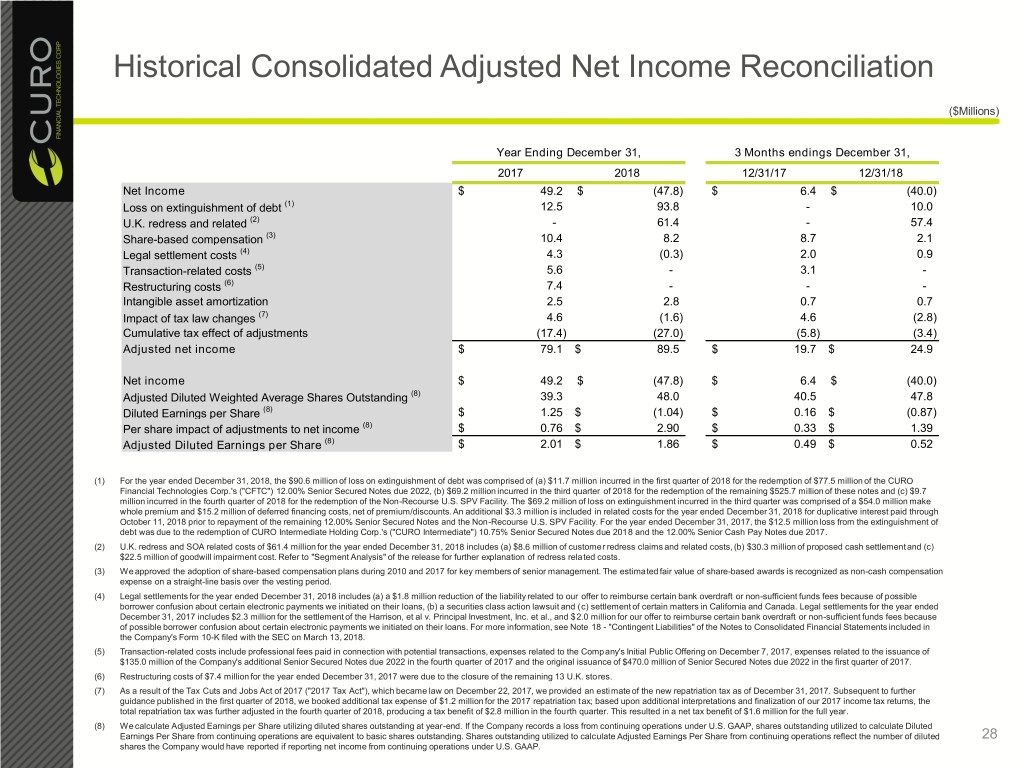

Historical Consolidated Adjusted Net Income Reconciliation ($Millions) Year Ending December 31, 3 Months endings December 31, 2017 2018 12/31/17 12/31/18 Net Income $ 49.2 $ (47.8) $ 6.4 $ (40.0) Loss on extinguishment of debt (1) 12.5 93.8 - 10.0 U.K. redress and related (2) - 61.4 - 57.4 Share-based compensation (3) 10.4 8.2 8.7 2.1 Legal settlement costs (4) 4.3 (0.3) 2.0 0.9 Transaction-related costs (5) 5.6 - 3.1 - Restructuring costs (6) 7.4 - - - Intangible asset amortization 2.5 2.8 0.7 0.7 Impact of tax law changes (7) 4.6 (1.6) 4.6 (2.8) Cumulative tax effect of adjustments (17.4) (27.0) (5.8) (3.4) Adjusted net income $ 79.1 $ 89.5 $ 19.7 $ 24.9 Net income $ 49.2 $ (47.8) $ 6.4 $ (40.0) Adjusted Diluted Weighted Average Shares Outstanding (8) 39.3 48.0 40.5 47.8 Diluted Earnings per Share (8) $ 1.25 $ (1.04) $ 0.16 $ (0.87) Per share impact of adjustments to net income (8) $ 0.76 $ 2.90 $ 0.33 $ 1.39 Adjusted Diluted Earnings per Share (8) $ 2.01 $ 1.86 $ 0.49 $ 0.52 (1) For the year ended December 31, 2018, the $90.6 million of loss on extinguishment of debt was comprised of (a) $11.7 million incurred in the first quarter of 2018 for the redemption of $77.5 million of the CURO Financial Technologies Corp.'s ("CFTC") 12.00% Senior Secured Notes due 2022, (b) $69.2 million incurred in the third quarter of 2018 for the redemption of the remaining $525.7 million of these notes and (c) $9.7 million incurred in the fourth quarter of 2018 for the redemption of the Non-Recourse U.S. SPV Facility. The $69.2 million of loss on extinguishment incurred in the third quarter was comprised of a $54.0 million make whole premium and $15.2 million of deferred financing costs, net of premium/discounts. An additional $3.3 million is included in related costs for the year ended December 31, 2018 for duplicative interest paid through October 11, 2018 prior to repayment of the remaining 12.00% Senior Secured Notes and the Non-Recourse U.S. SPV Facility. For the year ended December 31, 2017, the $12.5 million loss from the extinguishment of debt was due to the redemption of CURO Intermediate Holding Corp.'s ("CURO Intermediate") 10.75% Senior Secured Notes due 2018 and the 12.00% Senior Cash Pay Notes due 2017. (2) U.K. redress and SOA related costs of $61.4 million for the year ended December 31, 2018 includes (a) $8.6 million of customer redress claims and related costs, (b) $30.3 million of proposed cash settlement and (c) $22.5 million of goodwill impairment cost. Refer to "Segment Analysis" of the release for further explanation of redress related costs. (3) We approved the adoption of share-based compensation plans during 2010 and 2017 for key members of senior management. The estimated fair value of share-based awards is recognized as non-cash compensation expense on a straight-line basis over the vesting period. (4) Legal settlements for the year ended December 31, 2018 includes (a) a $1.8 million reduction of the liability related to our offer to reimburse certain bank overdraft or non-sufficient funds fees because of possible borrower confusion about certain electronic payments we initiated on their loans, (b) a securities class action lawsuit and (c) settlement of certain matters in California and Canada. Legal settlements for the year ended December 31, 2017 includes $2.3 million for the settlement of the Harrison, et al v. Principal Investment, Inc. et al., and $2.0 million for our offer to reimburse certain bank overdraft or non-sufficient funds fees because of possible borrower confusion about certain electronic payments we initiated on their loans. For more information, see Note 18 - "Contingent Liabilities" of the Notes to Consolidated Financial Statements included in the Company's Form 10-K filed with the SEC on March 13, 2018. (5) Transaction-related costs include professional fees paid in connection with potential transactions, expenses related to the Company's Initial Public Offering on December 7, 2017, expenses related to the issuance of $135.0 million of the Company's additional Senior Secured Notes due 2022 in the fourth quarter of 2017 and the original issuance of $470.0 million of Senior Secured Notes due 2022 in the first quarter of 2017. (6) Restructuring costs of $7.4 million for the year ended December 31, 2017 were due to the closure of the remaining 13 U.K. stores. (7) As a result of the Tax Cuts and Jobs Act of 2017 ("2017 Tax Act"), which became law on December 22, 2017, we provided an estimate of the new repatriation tax as of December 31, 2017. Subsequent to further guidance published in the first quarter of 2018, we booked additional tax expense of $1.2 million for the 2017 repatriation tax; based upon additional interpretations and finalization of our 2017 income tax returns, the total repatriation tax was further adjusted in the fourth quarter of 2018, producing a tax benefit of $2.8 million in the fourth quarter. This resulted in a net tax benefit of $1.6 million for the full year. (8) We calculate Adjusted Earnings per Share utilizing diluted shares outstanding at year-end. If the Company records a loss from continuing operations under U.S. GAAP, shares outstanding utilized to calculate Diluted Earnings Per Share from continuing operations are equivalent to basic shares outstanding. Shares outstanding utilized to calculate Adjusted Earnings Per Share from continuing operations reflect the number of diluted 28 shares the Company would have reported if reporting net income from continuing operations under U.S. GAAP.

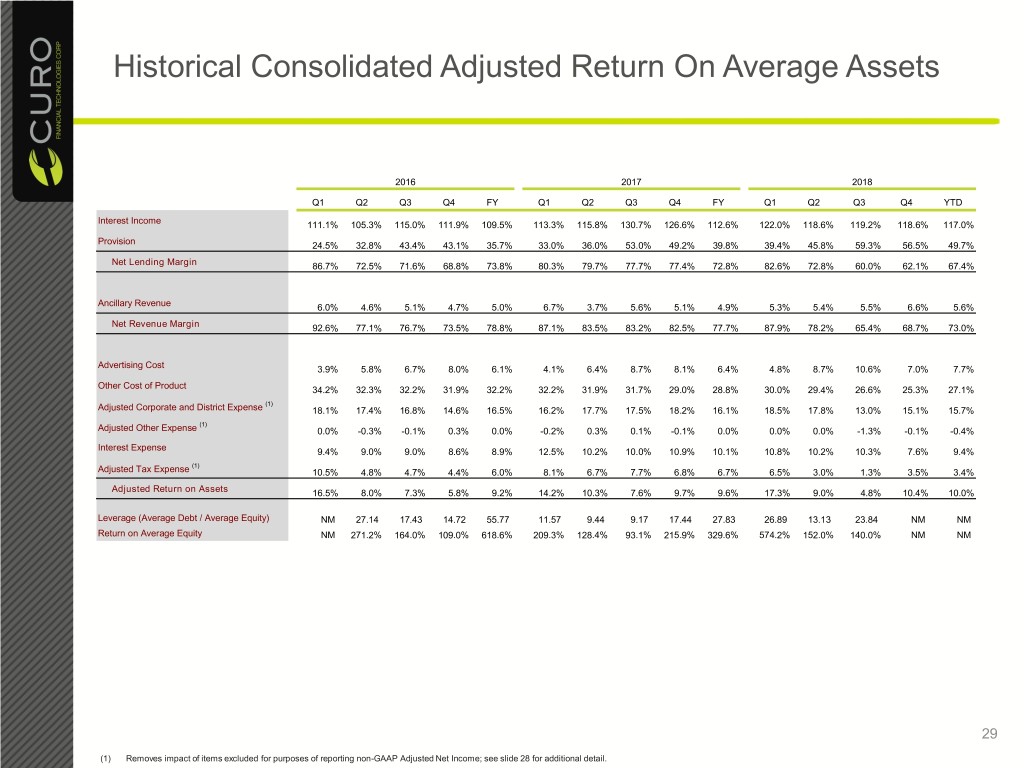

Historical Consolidated Adjusted Return On Average Assets 2016 2017 2018 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 YTD Interest Income 111.1% 105.3% 115.0% 111.9% 109.5% 113.3% 115.8% 130.7% 126.6% 112.6% 122.0% 118.6% 119.2% 118.6% 117.0% Provision 24.5% 32.8% 43.4% 43.1% 35.7% 33.0% 36.0% 53.0% 49.2% 39.8% 39.4% 45.8% 59.3% 56.5% 49.7% Net Lending Margin 86.7% 72.5% 71.6% 68.8% 73.8% 80.3% 79.7% 77.7% 77.4% 72.8% 82.6% 72.8% 60.0% 62.1% 67.4% Ancillary Revenue 6.0% 4.6% 5.1% 4.7% 5.0% 6.7% 3.7% 5.6% 5.1% 4.9% 5.3% 5.4% 5.5% 6.6% 5.6% Net Revenue Margin 92.6% 77.1% 76.7% 73.5% 78.8% 87.1% 83.5% 83.2% 82.5% 77.7% 87.9% 78.2% 65.4% 68.7% 73.0% Advertising Cost 3.9% 5.8% 6.7% 8.0% 6.1% 4.1% 6.4% 8.7% 8.1% 6.4% 4.8% 8.7% 10.6% 7.0% 7.7% Other Cost of Product 34.2% 32.3% 32.2% 31.9% 32.2% 32.2% 31.9% 31.7% 29.0% 28.8% 30.0% 29.4% 26.6% 25.3% 27.1% (1) Adjusted Corporate and District Expense 18.1% 17.4% 16.8% 14.6% 16.5% 16.2% 17.7% 17.5% 18.2% 16.1% 18.5% 17.8% 13.0% 15.1% 15.7% (1) Adjusted Other Expense 0.0% -0.3% -0.1% 0.3% 0.0% -0.2% 0.3% 0.1% -0.1% 0.0% 0.0% 0.0% -1.3% -0.1% -0.4% Interest Expense 9.4% 9.0% 9.0% 8.6% 8.9% 12.5% 10.2% 10.0% 10.9% 10.1% 10.8% 10.2% 10.3% 7.6% 9.4% (1) Adjusted Tax Expense 10.5% 4.8% 4.7% 4.4% 6.0% 8.1% 6.7% 7.7% 6.8% 6.7% 6.5% 3.0% 1.3% 3.5% 3.4% Adjusted Return on Assets 16.5% 8.0% 7.3% 5.8% 9.2% 14.2% 10.3% 7.6% 9.7% 9.6% 17.3% 9.0% 4.8% 10.4% 10.0% Leverage (Average Debt / Average Equity) NM 27.14 17.43 14.72 55.77 11.57 9.44 9.17 17.44 27.83 26.89 13.13 23.84 NM NM Return on Average Equity NM 271.2% 164.0% 109.0% 618.6% 209.3% 128.4% 93.1% 215.9% 329.6% 574.2% 152.0% 140.0% NM NM 29 (1) Removes impact of items excluded for purposes of reporting non-GAAP Adjusted Net Income; see slide 28 for additional detail.

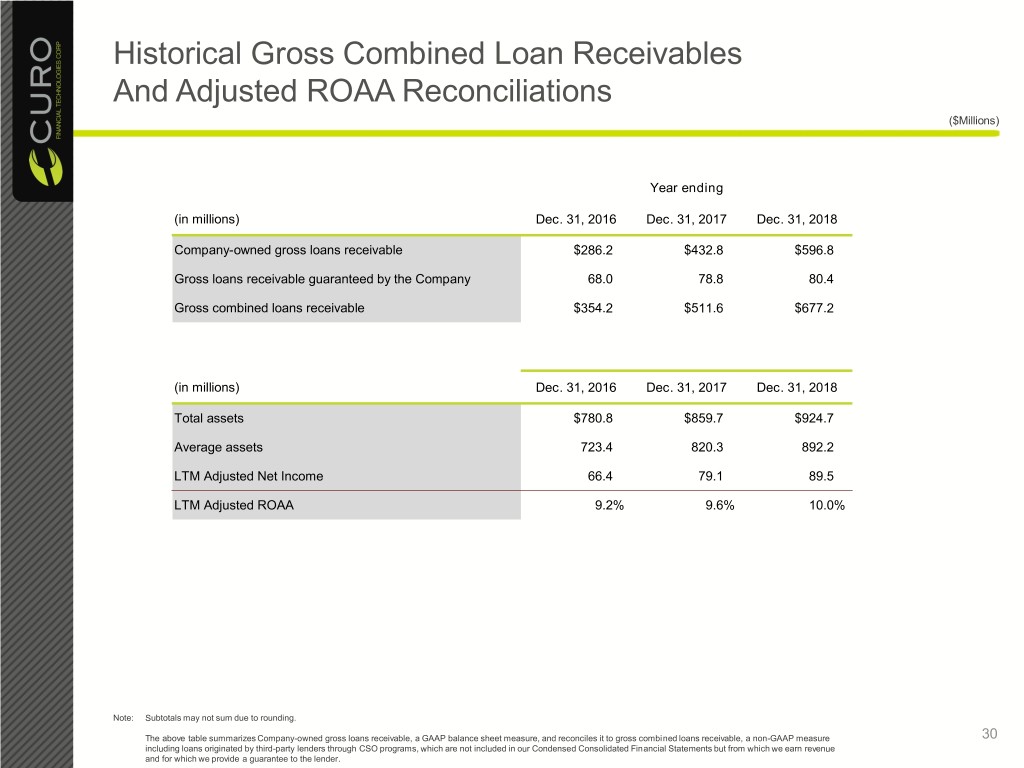

Historical Gross Combined Loan Receivables And Adjusted ROAA Reconciliations ($Millions) Year ending (in millions) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Company-owned gross loans receivable $286.2 $432.8 $596.8 Gross loans receivable guaranteed by the Company 68.0 78.8 80.4 Gross combined loans receivable $354.2 $511.6 $677.2 (in millions) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Total assets $780.8 $859.7 $924.7 Average assets 723.4 820.3 892.2 LTM Adjusted Net Income 66.4 79.1 89.5 LTM Adjusted ROAA 9.2% 9.6% 10.0% Note: Subtotals may not sum due to rounding. The above table summarizes Company-owned gross loans receivable, a GAAP balance sheet measure, and reconciles it to gross combined loans receivable, a non-GAAP measure 30 including loans originated by third-party lenders through CSO programs, which are not included in our Condensed Consolidated Financial Statements but from which we earn revenue and for which we provide a guarantee to the lender.

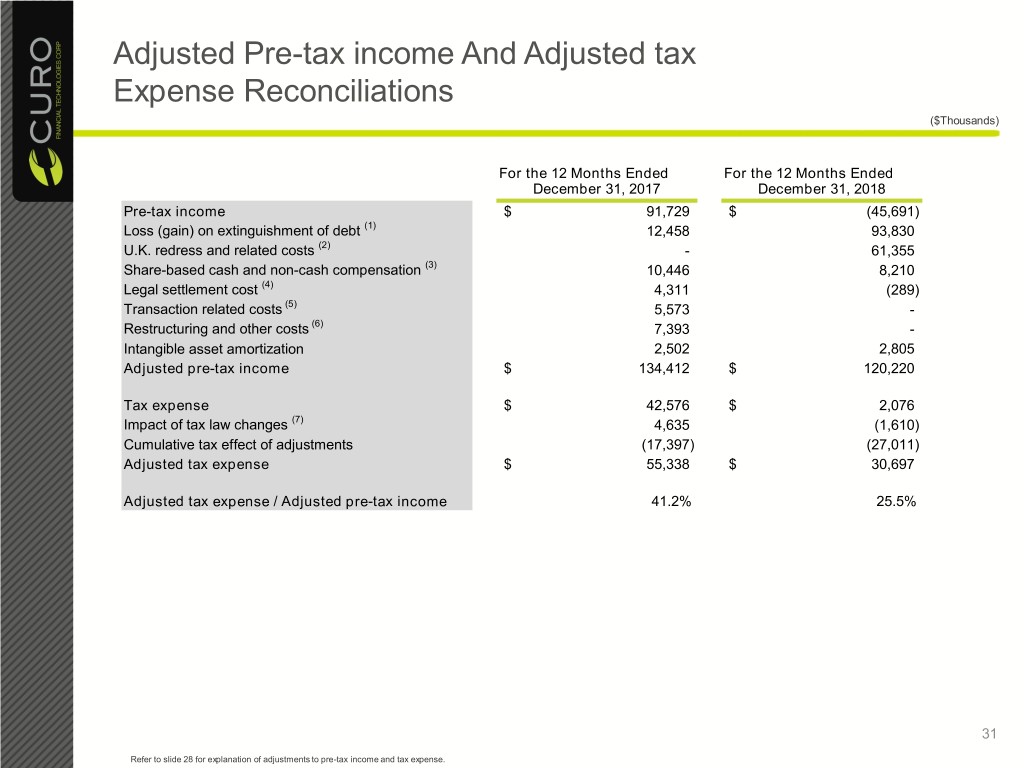

Adjusted Pre-tax income And Adjusted tax Expense Reconciliations ($Thousands) For the 12 Months Ended For the 12 Months Ended December 31, 2017 December 31, 2018 Pre-tax income $ 91,729 $ (45,691) Loss (gain) on extinguishment of debt (1) 12,458 93,830 U.K. redress and related costs (2) - 61,355 Share-based cash and non-cash compensation (3) 10,446 8,210 Legal settlement cost (4) 4,311 (289) Transaction related costs (5) 5,573 - Restructuring and other costs (6) 7,393 - Intangible asset amortization 2,502 2,805 Adjusted pre-tax income $ 134,412 $ 120,220 Tax expense $ 42,576 $ 2,076 Impact of tax law changes (7) 4,635 (1,610) Cumulative tax effect of adjustments (17,397) (27,011) Adjusted tax expense $ 55,338 $ 30,697 Adjusted tax expense / Adjusted pre-tax income 41.2% 25.5% 31 Refer to slide 28 for explanation of adjustments to pre-tax income and tax expense.

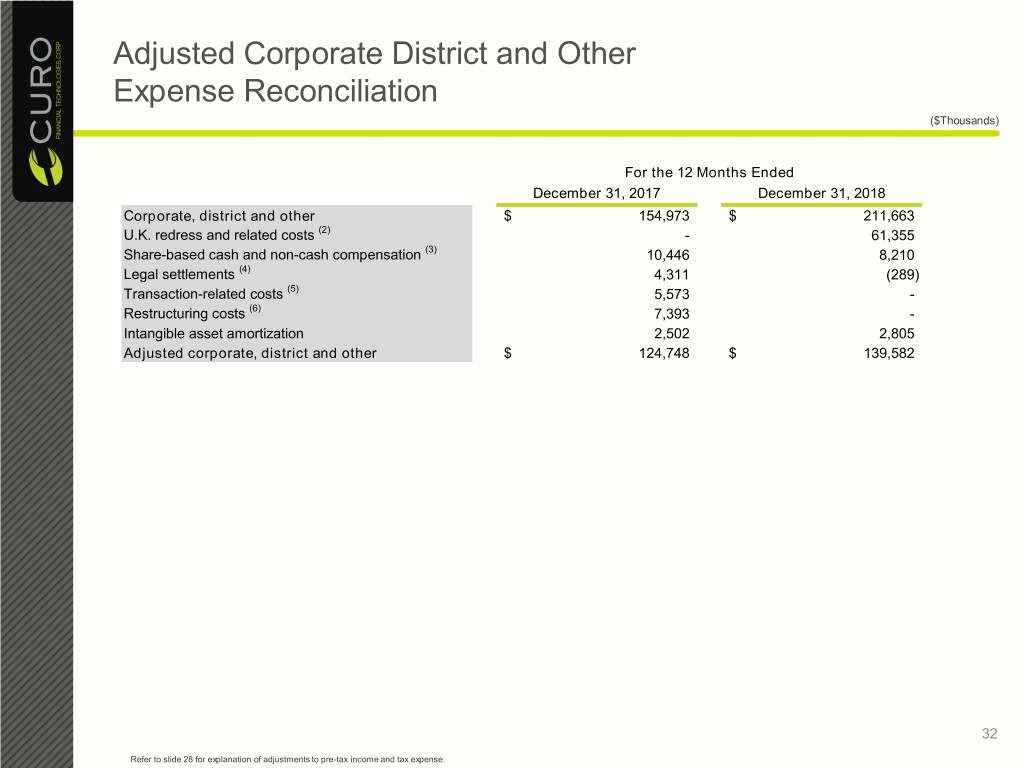

Adjusted Corporate District and Other Expense Reconciliation ($Thousands) For the 12 Months Ended December 31, 2017 December 31, 2018 Corporate, district and other $ 154,973 $ 211,663 U.K. redress and related costs (2) - 61,355 Share-based cash and non-cash compensation (3) 10,446 8,210 Legal settlements (4) 4,311 (289) Transaction-related costs (5) 5,573 - Restructuring costs (6) 7,393 - Intangible asset amortization 2,502 2,805 Adjusted corporate, district and other $ 124,748 $ 139,582 32 Refer to slide 28 for explanation of adjustments to pre-tax income and tax expense.

Guidance Metrics Reconciliations Fiscal 2019 Outlook Year Ending December 31, 2019 Low High Net income $ 110,500 $ 125,500 Adjustments: Non-cash rent expense and foreign currency exchange rate impact (1) (2) Share-based cash and non-cash compensation 9,000 9,000 U.K. redress and related costs (3) 1,000 1,000 Intangible asset amortization 2,500 2,500 Cumulative tax effect of adjustments (3,000) (3,000) Adjusted Net Income $ 120,000 $ 135,000 Diluted Weighted Average Shares Outstanding 48,000 48,200 Diluted Earnings per Share $ 2.30 $ 2.60 Per Share impact of adjustments to Net Income $ 0.20 $ 0.20 Adjusted Diluted Earnings per Share $ 2.50 $ 2.80 Net income $ 110,500 $ 125,500 Provision for income taxes 38,000 43,000 Interest expense 73,000 73,000 Depreciation and amortization 18,500 18,500 EBITDA $ 240,000 $ 260,000 Non-cash rent expense and foreign currency exchange rate impact (1) (2) - - Share-based cash and non-cash compensation 9,000 9,000 U.K. redress and related costs (3) 1,000 1,000 Adjusted EBITDA $ 250,000 $ 270,000 (1) The Company has historically excluded the impact of non-cash interest from adjusted earnings metrics. With the adoption of ASU 842, effective January 1, 2019, the Company anticipates the difference between GAAP rent expense and cash rent paid will grow. However, the Company will continue to adjust for this difference. The Company is in the process of evaluating the impact of ASU 842 on rent expense. (2) The Company has historically excluded the impact of foreign currency translation and hedges from adjusted earnings metrics; the Company does not include the impact of any hedge settlement or realized currency 33 gains or losses in its outlook. (3) Current estimate of 2019 redress and related costs based upon an assumed successful completion of the SOA as discussed above.