ABS Investor Presentation O C T O B E R 1 7 - 1 8 , 2 0 2 2

Important Information 2 F ORWARD-LOOKING S TA TEMENTS This presentation contains forward-looking statements. These forward-looking statements include projections, estimates and assumptions about various matters such as our growth strategy and opportunities presented in our addressable market. In addition, words such as “estimate,” “believe,” “forecast,” “predict,” “project,” “intend,” “expect,” “should,” variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including, risks relating to the uncertainty of projected financial information and forecasts, the effects of competition on our business; our ability to attract and retain customers; global economic, market, financial, political or health conditions or events; our dependence on third-party lenders to provide the cash we need to fund our loans and our ability to affordably access third-party financing; our level of indebtedness; our ability to integrate acquired businesses; the impact of regulations on our business; our ability to protect our proprietary technology and analytics; disruption of our information technology systems; improper disclosure of customer personal data as well as other factors discussed in our filings with the Securities and Exchange Commission. The foregoing factors, as well as other existing risk factors and new risk factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. Furthermore, the Company undertakes no obligation to update, amend or clarify forward-looking statements. Non-GAAP Financial Measures In addition to the financial information prepared in conformity with U.S. GAAP, we provide certain “non-GAAP financial measures,” including: Adjusted Pre-Tax Income, (Income from continuing operations before income taxes minus certain non-cash and other adjusting items); Non- recourse debt (Debt related to funding loans); and Recourse debt (Debt not related to funding loans). Such measures are intended as a supplemental measure of our performance that are not required by, or presented in accordance with, GAAP. We present these non-GAAP financial measures because we believe that, when viewed with our GAAP results, such measures provide useful information for comparing our performance over various reporting periods as they remove from our operating results the impact of items that we believe do not reflect our core operating performance. These non-GAAP financial measures are not substitutes for any GAAP financial measure and there are limitations to using them. Although the Company believes that these non-GAAP financial measures can make an evaluation of our operating performance more consistent because they remove items that do not reflect our core operations, other companies in the Company’s industry may define their own non-GAAP financial measures differently or use different measures. As a result, it may be difficult to use any non-GAAP financial measure to compare the performance of other companies to our performance. The non-GAAP financial measures presented in these slides should not be considered as measures of the income generated by our business or discretionary cash available to us to invest in the growth of our business. Our management compensates for these limitations by reference to GAAP results and using these non-GAAP financial measures as supplemental measures. All product names, logos, brands, trademarks and registered trademarks are property of their respective owners.

CURO Company Overview 3 CURO is a tech-enabled, omni-channel consumer finance company serving a full spectrum of non-prime and prime consumers in the U.S. and Canada We operate in 13 states in the United States and eight provinces in Canada with retail locations and nine provinces online CURO operates in three business segments: US Direct Lending, Canada Direct Lending and Canada Point-of Sale Lending CURO is a publicly traded company: Initial public offering in 2017 Listed on the NYSE under the ticker symbol “CURO”

CURO Business Segments 4 CURO has the following business segments in the United States and Canada: US DIRECT LENDING Secured and unsecured installment loan products to near-prime and non-prime consumers as well as credit insurance and other ancillary financial products in over 500 branches across 13 states CANADA DIRECT LENDING Non-prime and open-end loans and payment protection insurance in over 200 branches and online in nine provinces CANADA POINT-OF-SALE LENDING Flexiti, Canada’s largest point-of-sale ("POS") lender, has a network of over 8,000 merchant locations and e-commerce sites.

CURO’s Strategic Transformation 5 CURO’s history began in the U.S. short-term lending industry but through investment and M&A we have repositioned the business to align with our go-forward strategy of offering longer term, higher balance and lower rate credit products Expansion of Canada Direct Lending Business Geographic and product expansion, developing non- prime customer base Acquisition of First Heritage Credit Expands <36% APR lending capabilities, adding strategic new geographies Sale of Legacy U.S. Direct Lending Business Accelerates transition from and reduces exposure to high APR loan products Acquisition of Flexiti Adds POS financing capabilities in Canada, as well as entrance into prime credit market Acquisition of Heights Entrance into the <36% APR loan market Secured first C$175M Warehouse Facility for CAN Direct Lending Refinanced and upsized Warehouse Facilities for Heights ($425M) and First Heritage ($225M) as part of the acquisitions Issued first C$526.5M Flexiti Securitization Facility, and refinanced and upsized C$535M Flexiti Warehouse Facility $750M Senior Notes Offering Refinanced Senior Notes and upsized issue to $1B 2018 2021 2022

CURO Company Highlights Publicly traded company with diversified funding sources Solid liquidity profile with staggered and/or long-term debt maturities North American footprint creates geographic and regulatory diversity Prime, near-prime and non-prime business units and asset classes create credit diversity Cycle-tested U.S. portfolio and management team with 150+ years combined industry experience Track record of sustainable, differentiated growth Advanced credit tools and analytics for underwriting and collections Large addressable market with market-leading brands Installment loans and open-end products with ability to quickly adjust to the credit environment 6

7 Joined CURO in 2012 Led CURO though its growth into the Canadian Market and transformation of its entire US business 30+ years of executive management experience in the consumer credit industry, including DFG Global Joined CURO in 2021, and oversees corporate development and strategy efforts 25+ years of experience working in consumer financial services, sourcing and leading complex transactions through business cycles, including eight years at Waterfall Asset Management and seven years at Goldman Sachs Don Gayhardt CEO Phil Gitler EVP & Chief Strategy Officer Rusty Foster SVP , Corporate Treasurer Peter Pittner AVP , Treasury Flexiti Joined CURO in 2013, and oversees Treasury and funding 23+ years of treasury management and capital markets experience within a variety of industries, including 10 years in financial services industry Joined Flexiti in 2021, and oversees Treasury and funding 16+ years of experience in financial services corporate planning, commercial banking, risk and international banking, including four years at Honda Canada Finance and nine years at Scotiabank CURO Management Team (in Attendance)

Public Company Discipline 8 PUBLIC COMPANY TRANSPARENCY Publicly available SEC filings and disclosures EXTERNAL AUDIT External financial statement and SOX audit performed by Deloitte COMPLIANCE AND RISK Experienced robust compliance team; CCO reports to the board Enterprise Risk Framework implemented 2020 utilizing COSO ERM Framework Enterprise risk committee reports to the board's Risk and Compliance Committee, which is chaired by independent board member INTERNAL AUDIT Robust eight-member internal audit team Performs risk-based financial, operational, compliance, technology audits in accordance with IIA (Institute of Internal Auditors) standards FRAUD DETECTION AND CYBERSECURITY Industry leading proprietary fraud detection framework Quarterly presentations to board, annual external penetration testing, social engineering tests and external PCI reviews INTERNAL CONTROLS SOX framework and controls in place since 2018, tested annually

As % of Loan Balances – Illustrative1 Interest Revenue 46% - 48% Ancillary Revenue 5% - 7% Total Revenue 51% - 55% Net Charge-Offs 11% - 13% Operating Expenses 25% - 29% Funding Costs as a % of debt balance 1 Mo. SOFR +4.25% Return on Assets % (Adj PTI/Avg Loan Balances) 7% - 10% 509 branches across 13 southern and midwestern states Near Prime Loans $1,000 - $10,000 18 - 60 month terms Secured or Unsecured Non-Prime Loans $250 - $1,500 5 - 12 month terms Unsecured Customary credit insurance and other financial products Approximately 50% of loans are <36% APR. P R O D U C T D E T A I L S 1 Metric ranges have been normalized to account for pandemic-related impacts Strong synergy potential through branch optimization, cost efficiencies and cross- selling opportunities Expand in-market branch presence and into new states to capitalize on the potential addition of millions of near- prime and non-prime customers G R O W T H S T R A T E G Y CURO Business Segments - US Direct Lending 9 $229 $293 $298 $166 $192 $197 $204 $230 $235 2020 2021 Jun-22 Heights Large Loan Heights Small Loan First Heritage $600 $730$715 L O A N B A L A N C E S 2 (Millions) 2 Excludes impacts of purchase accounting

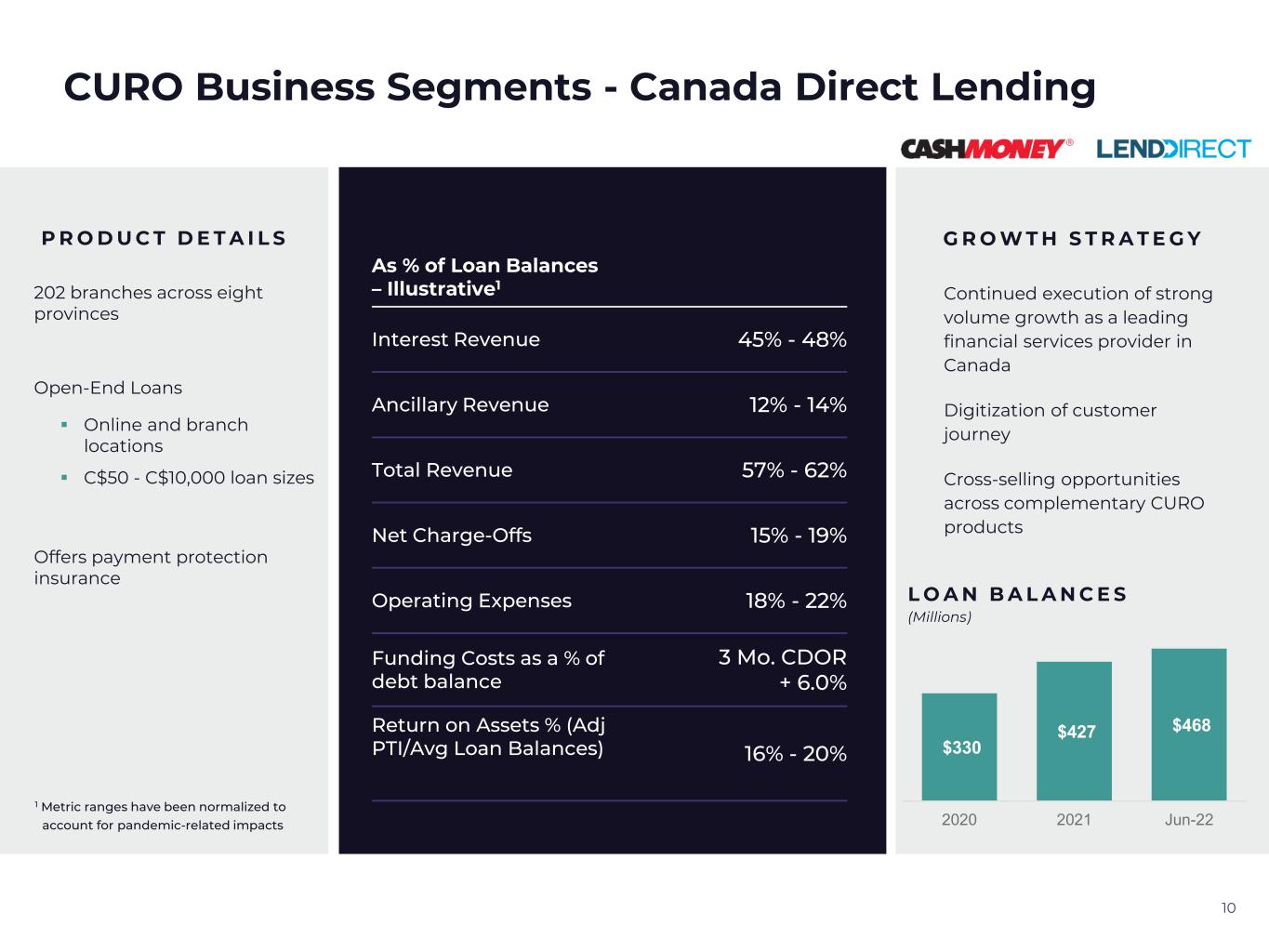

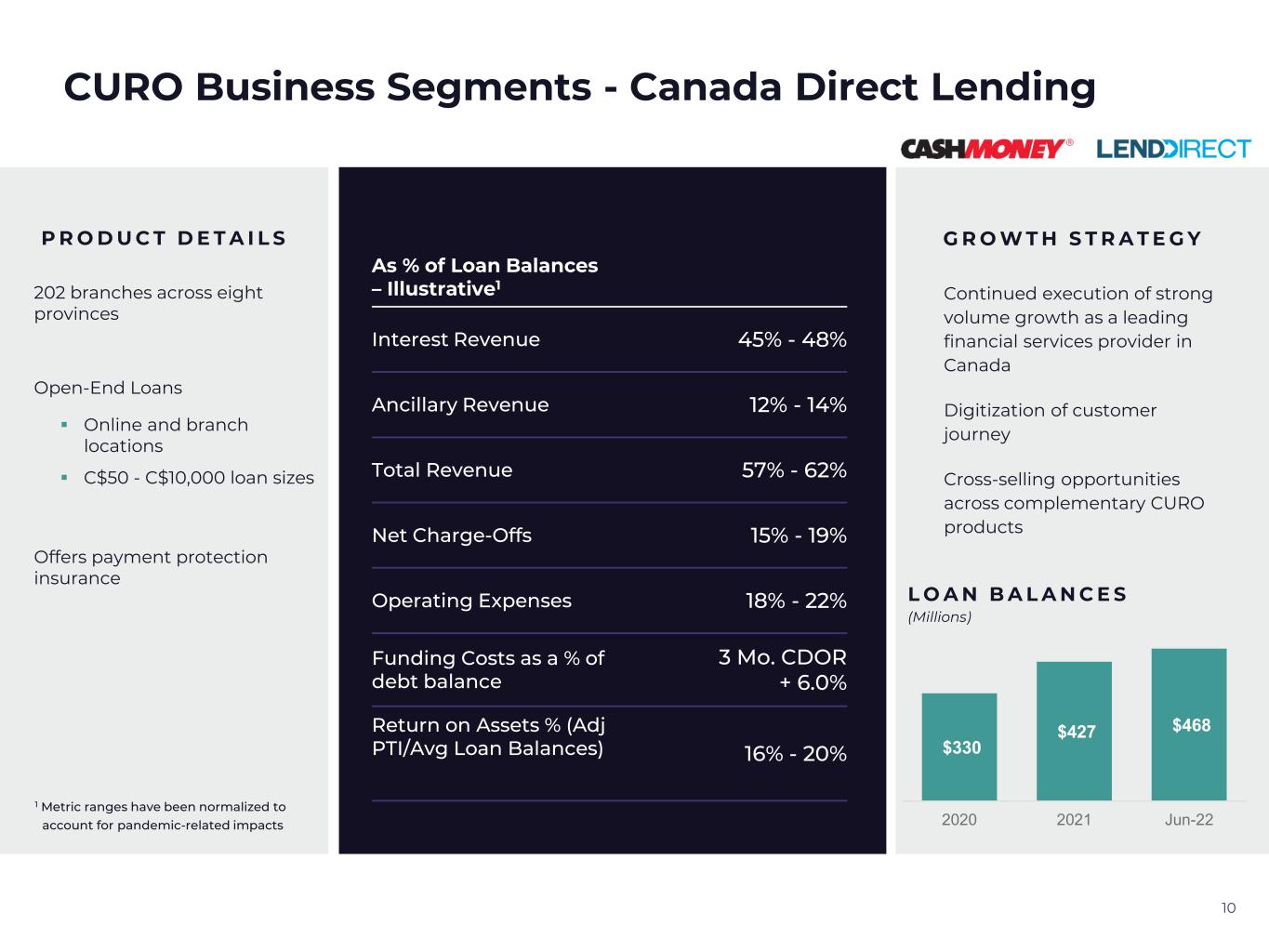

As % of Loan Balances – Illustrative1 Interest Revenue 45% - 48% Ancillary Revenue 12% - 14% Total Revenue 57% - 62% Net Charge-Offs 15% - 19% Operating Expenses 18% - 22% Funding Costs as a % of debt balance 3 Mo. CDOR + 6.0% Return on Assets % (Adj PTI/Avg Loan Balances) 16% - 20% 202 branches across eight provinces Open-End Loans Online and branch locations C$50 - C$10,000 loan sizes Offers payment protection insurance P R O D U C T D E T A I L S 1 Metric ranges have been normalized to account for pandemic-related impacts Continued execution of strong volume growth as a leading financial services provider in Canada Digitization of customer journey Cross-selling opportunities across complementary CURO products G R O W T H S T R A T E G Y CURO Business Segments - Canada Direct Lending 10 $330 $427 $468 2020 2021 Jun-22 L O A N B A L A N C E S (Millions)

As % of Loan Balances – Illustrative1 Interest Revenue 17% - 21% Ancillary Revenue 2% - 3% Total Revenue 19% - 24% Net Charge-Offs 4% - 5% Operating Expenses 4% - 6% Funding Costs as a % of debt balance 3 Mo. CDOR + 4.4% Return on Assets % (Adj PTI/Avg Loan Balances) 4% - 6% Big-ticket item POS financing C$1,760 average transaction size Revolving credit line for in-network at over 8,000 locations across merchant partners and e-commerce sites Gives customers the ability to split purchases into equal monthly installments P R O D U C T D E T A I L S 1 Metric ranges have been normalized to account for pandemic-related impacts Cross-sell opportunities across CURO’s range of products Addition of new merchant partners into the Flexiti network Expansion into non-prime product to provide incremental volume G R O W T H S T R A T E G Y CURO Business Segments - Canada Point-of-Sale 11 L O A N B A L A N C E S (Millions) $209 $459 $627 2020 2021 Jun-22

0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% 9.00% Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 SO FR & CDO R W AC D Historical Weighted-average Cost of Non-Recourse Debt (SPV) WACD SOFR CDOR 2022 2023 2024 2025 2026 2027 2028 2029 2030 Sr. Notes HFC SPV FHC SPV CDL SPV FLX SPV FLX 2021-1 US Revolver CN Revolver(1) Debt Maturities Diversified Funding Sources 12 CURO has proven access to diverse funding sources and sufficient liquidity to support future growth Through its strategic repositioning, CURO has been able to meaningfully reduce its cost of non-recourse debt Note 1: The Canada Revolver does not have a maturity date but is subject to an annual review - 50 100 150 200 250 300 350 400 450 500 HFC SPV FHC SPV CDL SPVFLX SPV FLX 2021-1 US Revolver CN Revolver Non-Recourse Commitments as of Sep-22

Heights Finance 13

Company Overview 14 Leading consumer finance company operating as Heights Finance and Southern Management Company in over 400 branch locations across 11 southern and mid-western U.S. states Heights Finance predominately underwrites large loans (>$2,500) with primarily <36% APR Southern Management Company (“SMC”) underwrites small loans (<$2,500) with primarily >36% APR Provides attractive, easy-to-understand secured and unsecured installment loan products to near- prime and non-prime consumers as well as credit insurance and other ancillary financial products CURO acquired Heights Finance in December 2021

Heights Finance Overview 15 Loan Product: Fixed Rate Installment Loan Repayment: Fully Amortizing Monthly P&I Average Term: 41 Months Average Loan Balance: $4,052 Average FICO: 619 Founded in 1953 (~70-year track record) Headquartered in Greenville, South Carolina Heights offers loans and related insurance products to consumers with limited access to traditional credit Installment Loans: Secured: Collateralized by assets with a NADA-verifiable value Unsecured: Includes loans collateralized by household goods in addition to signature loans Fee-Based Products: Insurance: Includes Credit Life and Disability, Involuntary Unemployment, Personal Property Collateral, Non-File and Collateral Protection Plans Other: Auto Security Plan provides various membership benefits B R A N C H L O C A T I O N S I L L U S T R A T I V E L A R G E L O A N T E R M S Branches 7 States144 >$335M Annual Originations Receivables ~$300M Customers ~90,000 Heights Large loan stats as of June 30, 2022 Heights Finance First Heritage

Heights Finance Management Team 16 Doug Clark President of North American Direct Lending Gary Fulk President Dan Niemiec Chief Risk Officer Dwayne Bryant Chief Legal Officer Joined Heights in 2020 16 years at Axcess Financial in both CEO role (2016-2020) and COO role (2004- 2016) 16 years at Chiquita Brands International in a variety of financial and operating roles Joined Heights in 2020 Previously SVP, Senior Managing Director at OneMain Financial (2 years), VP Director of Operations at OneMain Financial (2 years), Springleaf Financial Services (9 years), American General Finance (13 years) Joined Heights in 2020 Previously Managing Director and Senior Division Counsel at Womble Bond Dickinson; General Counsel at Guardian Building Products; Financial Advisor at Edward Jones; VP, GC and Secretary at BI-LO Joined Heights in 2019 Previously Deputy Chief Risk Officer at Regional Management, VP and Senior Portfolio Manager at JP Morgan

Heights Finance Company Highlights 70+ year track record in consumer lending Underwriting rigor rooted in bank standards from former bank owners and supplemented by CURO’s Risk Analytics Management team from OneMain, Axcess Financial, Regional Management Consistent growth and earnings generating portfolio Loyal customer base with average client relationship of four years 17 Deep compliance culture with benefit of CURO’s experienced compliance team

Average Years On Current Job Average Monthly Net Income Average Age Average FICO Home Ownership Heights Large Loan Typical Customer 8.4 $2,600 50 619 46% 18

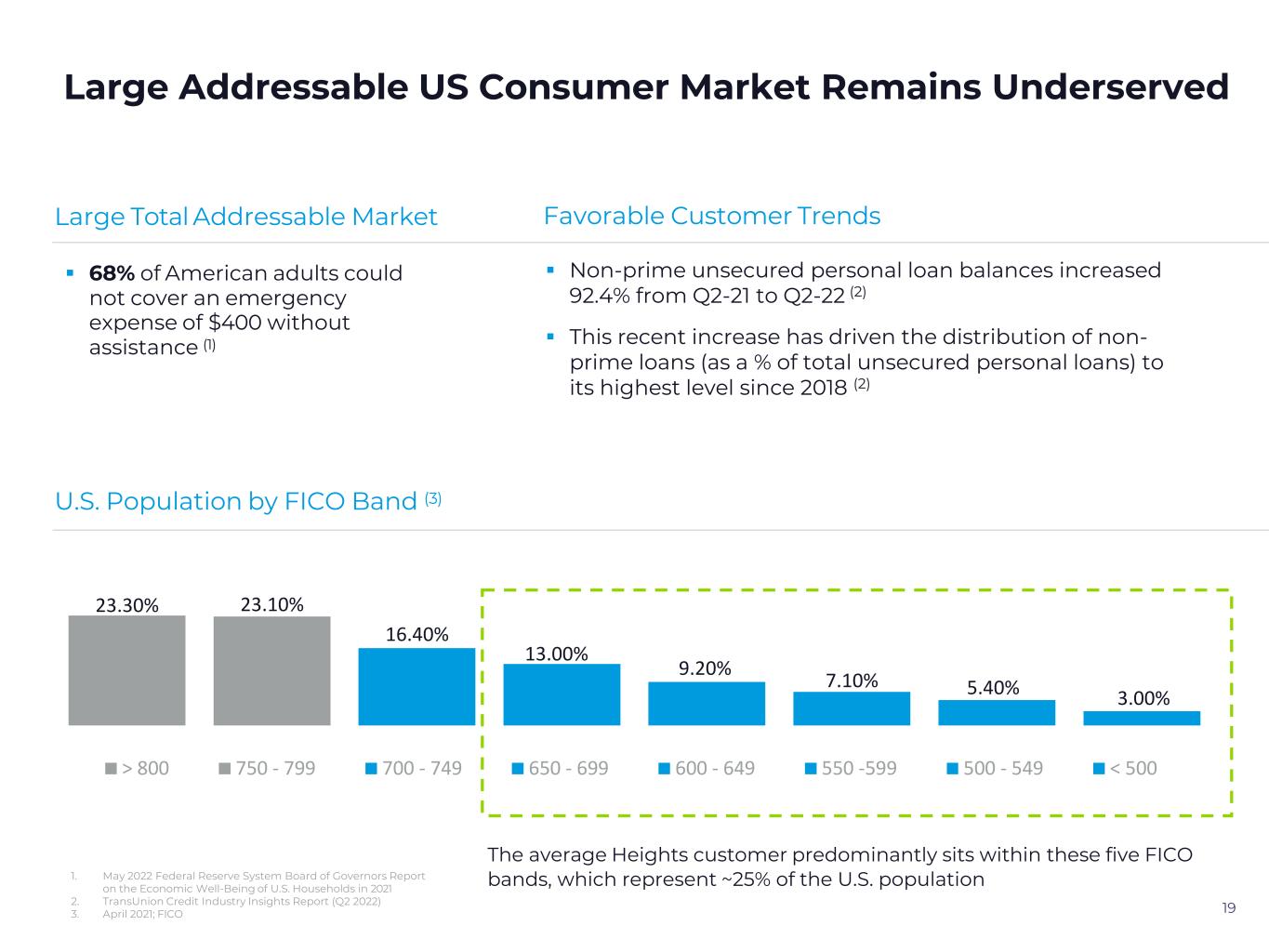

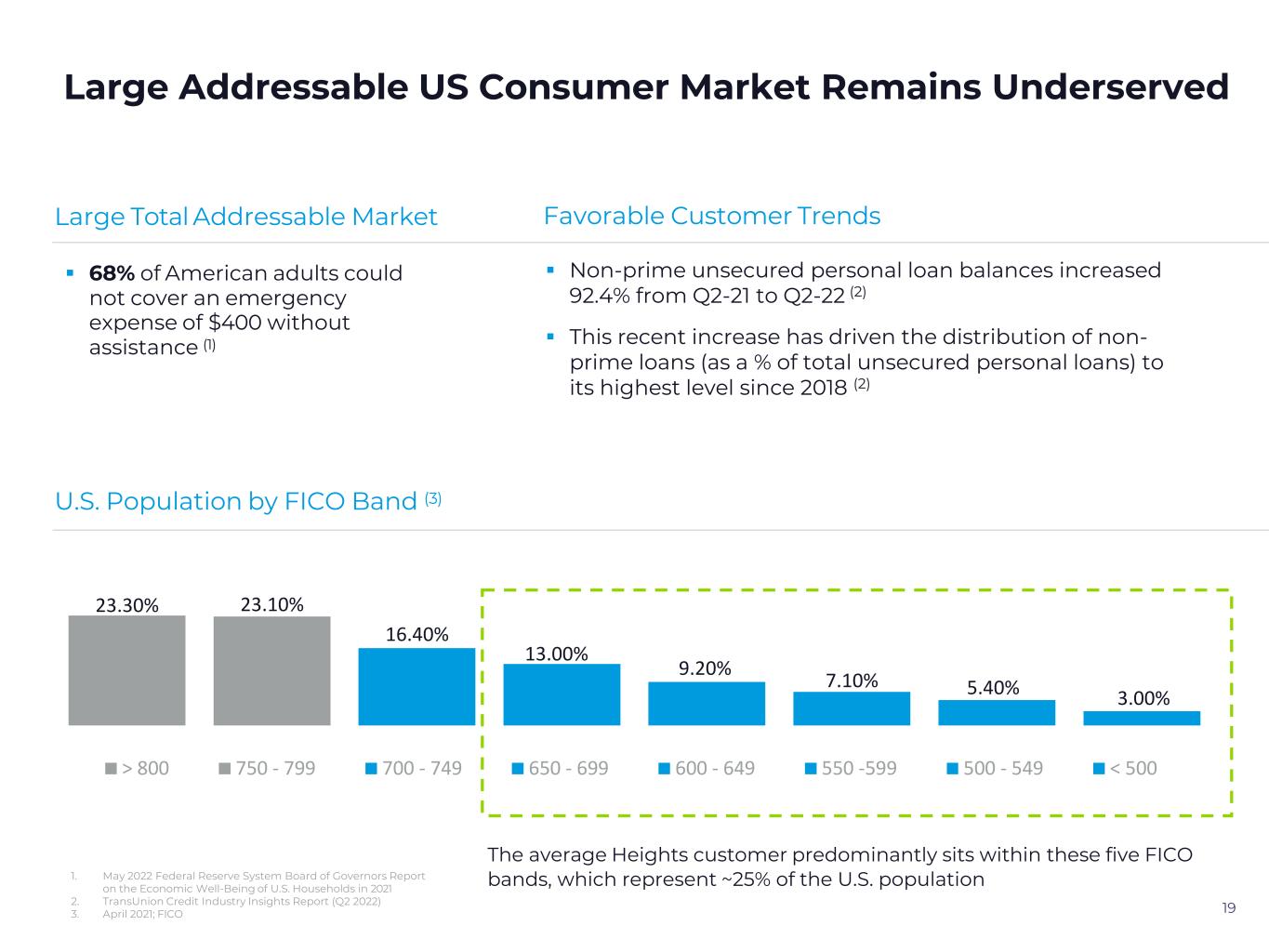

23.30% 23.10% 16.40% 13.00% 9.20% 7.10% 5.40% 3.00% > 800 750 - 799 700 - 749 650 - 699 600 - 649 550 -599 500 - 549 < 500 Large Addressable US Consumer Market Remains Underserved 19 Large Total Addressable Market Favorable Customer Trends 68% of American adults could not cover an emergency expense of $400 without assistance (1) Non-prime unsecured personal loan balances increased 92.4% from Q2-21 to Q2-22 (2) This recent increase has driven the distribution of non- prime loans (as a % of total unsecured personal loans) to its highest level since 2018 (2) U.S. Population by FICO Band (3) 1. May 2022 Federal Reserve System Board of Governors Report on the Economic Well-Being of U.S. Households in 2021 2. TransUnion Credit Industry Insights Report (Q2 2022) 3. April 2021; FICO The average Heights customer predominantly sits within these five FICO bands, which represent ~25% of the U.S. population

Origination & Underwriting Process Flow 20 Loan Approval Process (excluding Live Checks): Loan products are offered and priced based upon the risk profile of each customer including ability to repay Exceptions are handled by our Central Underwriting Team Application Process Review Collateral Options and Ability to Repay (Underwriting) Exceptions/High Risk Applications sent to Central Underwriting Decision/Loan Approval Loan Closing and Funding Branches Large Loan Only Large Loan Central Underwriting (for exceptions) Decision/Loan Approval Quality Control Reviews Review Collateral Options and Ability to Repay (Underwriting)

21 Johanna Underwriting Criterion Application Review Character Capacity Collateral Collateral Options Secured – Titled Unsecured (may include certain personal property) Verifications Identification Residence Employment Income Ability to Repay Net Disposable Income Underwriting Guidelines 21

Servicing Process 22 Ad Astra is CURO’s in-house collections and debt recovery provider for late-stage delinquencies Ad Astra was formerly CURO’s third-party collection service and was acquired by CURO in January 2020 Centralized ServicingBranch Servicing Charge Off Recovery180+906030Miss Pay 120 • Contact customer to make payment arrangements on past due account • Depending on circumstances, branches can offer customer assistance tools • Customer assistance tools are reviewed by Central Operations to ensure eligibility guidelines are followed • 100% of large loans 121+ days are serviced through a centralized environment with a predictive dialer • Depending on circumstances, branches can offer customer assistance tools • Customer assistance tools are reviewed by Central Operations to ensure eligibility guidelines are followed

23