Q3 2023 Earnings Presentation November 2, 2023

IMPORTANT: You must read the following information before continuing to the rest of the presentation, which is being provided to you for informational purposes only. Note: Current and prior period financial information is presented on a continuing operations basis, which excludes the results and positions of the Canada POS Lending segment due to the sale of Flexiti on August 31, 2023. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements include projections, estimates and assumptions about various matters such as our future financial and operational performance, including our fourth quarter 2023 and full year 2024 outlook, liquidity and capacity, various target ranges, NIM inflection points and the drivers of our long-term path to profitability. In addition, words such as “estimate,” “believe,” “forecast,” “predict,” “project,” “intend,” “should,” "expect" and variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including, risks relating to the uncertainty of projected financial information and forecasts, our level of indebtedness; our dependence on third-party lenders to provide the cash we need to fund our indebtedness and our ability to affordably access third-party financing; the impact of regulations on our business; the effects of competition on our business; our ability to attract and retain customers; global economic, market, financial, political or public health conditions or events; our ability to integrate acquired businesses; our ability to protect our proprietary technology and analytics; disruption of our information technology systems; improper disclosure of customer personal data, as well as other factors discussed in our filings with the Securities and Exchange Commission. The foregoing factors, as well as other existing risk factors and new risk factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. Furthermore, the Company undertakes no obligation to update, amend or clarify forward-looking statements. Non-GAAP Financial Measures In addition to the financial information prepared in conformity with U.S. GAAP, we provide certain “non-GAAP financial measures.” Such measures are intended as a supplemental measure of our performance that are not required by or presented in accordance with GAAP. We present these non-GAAP financial measures because we believe that, when viewed with our GAAP results and the accompanying reconciliation, such measures provide useful information for comparing our performance over various reporting periods as they remove from our operating results the impact of items that we believe do not reflect our core operating performance. These non-GAAP financial measures are not substitutes for any GAAP financial measure and there are limitations to using them. Although the Company believes that these non-GAAP financial measures can make an evaluation of our operating performance more consistent because they remove items that do not reflect our core operations, other companies in the Company’s industry may define their own non- GAAP financial measures differently or use different measures. As a result, it may be difficult to use any non-GAAP financial measure to compare the performance of other companies to our performance. The non-GAAP financial measures presented in these slides should not be considered as measures of the income generated by our business or discretionary cash available to us to invest in the growth of our business. Our management compensates for these limitations by reference to GAAP results and using these non- GAAP financial measures as supplemental measures. Reconciliation of non-GAAP metrics to the closest comparable GAAP metrics are included in the Appendix. NOTE: All dollar amounts for Canada in this presentation are in U.S. Dollars. Unless otherwise noted tables and charts may not sum due to rounding. Disclaimer 2

3Q23 Highlights Strengthen our Foundation Execute with ExcellenceGrow Responsibly 3 • Receivables growth of 2% sequentially ◦ 5% growth in the U.S. ◦ 2% growth in Canada on a constant currency basis • Converted U.S. operations to a single loan management system • Recurring operating expenses declined sequentially • Exclusively focused on our Direct Lending business following the sale of Flexiti • Liquidity and capacity of $264 million at the end of Q3

Direct Lending Gross Loans Receivable $1,204 $1,254 $1,210 $1,228 $1,254 739 773 715 719 752 465 481 495 509 503 U.S. Canada 3Q22 4Q22 1Q23 2Q23 3Q23 Continued responsible receivables growth 4 ($ Millions) Note: In 3Q23, Loans receivable in Canada grew 2% vs prior quarter on a constant currency basis

Total Direct Lending NCOs $55 $65 $65 $57 $55 18.4% 20.9% 21.5% 18.8% 17.7% 3Q22 4Q22 1Q23 2Q23 3Q23 Canada $28 $30 $28 $27 $27 23.6% 25.6% 24.1% 21.5% 21.3% 3Q22 4Q22 1Q23 2Q23 3Q23 U.S. $28 $35 $38 $30 $28 15.6% 18.4% 20.2% 16.9% 15.2% 3Q22 4Q22 1Q23 2Q23 3Q23 Credit quality improves year-over-year Highlights: • Net charge-offs improved sequentially and YTD primarily driven by credit tightening, servicing optimization and continued strategic mix shift to larger dollar, longer duration loans ($ Millions) Direct Lending NCOs by Geography 5 1 1Q23 NCOs excluding policy change. Including the change in charge-off policy, reported 1Q23 Direct Lending NCOs and NCO % were $47M and 15.6%, respectively, and $10M and 8.0%, respectively, in Canada 1 1

Canada $22 $19 $40 $42 $44 4.8% 4.0% 8.1% 8.3% 8.8% 3Q22 4Q22 1Q23 2Q23 3Q23 U.S. $78 $77 $60 $59 $63 10.5% 9.9% 8.4% 8.2% 8.3% 3Q22 4Q22 1Q23 2Q23 3Q23 Core delinquencies remain stable Highlights: • U.S. delinquency rates remained stable • Canadian increase primarily driven by installment and single pay loan products. Canadian open-end product remains stable on a sequential basis ($ Millions) Direct Lending 31+ DQs by Geography 6 1 Implemented change in charge-off policy in Canada during 1Q23 1 Total Direct Lending 31+ Days Past Due $100 $96 $100 $101 $107 8.3% 7.6% 8.3% 8.3% 8.5% 3Q22 4Q22 1Q23 2Q23 3Q23

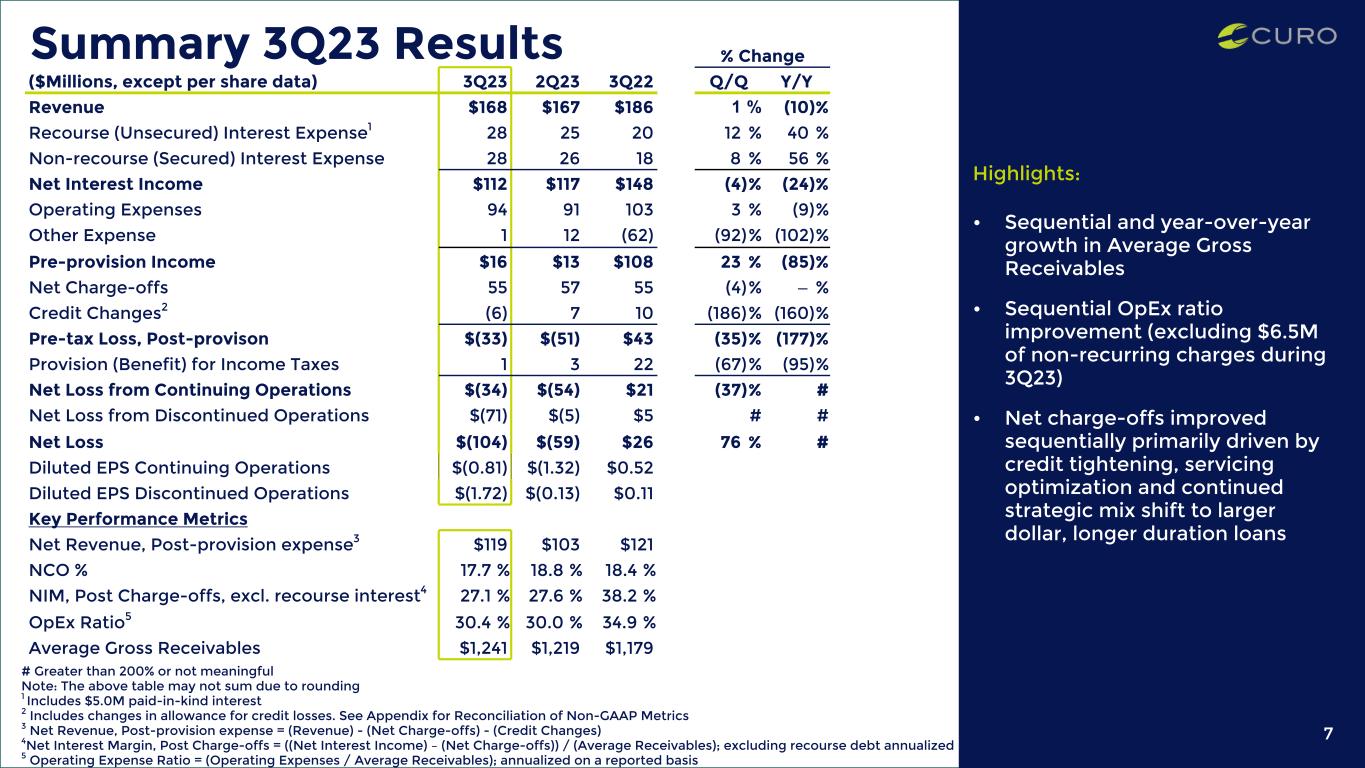

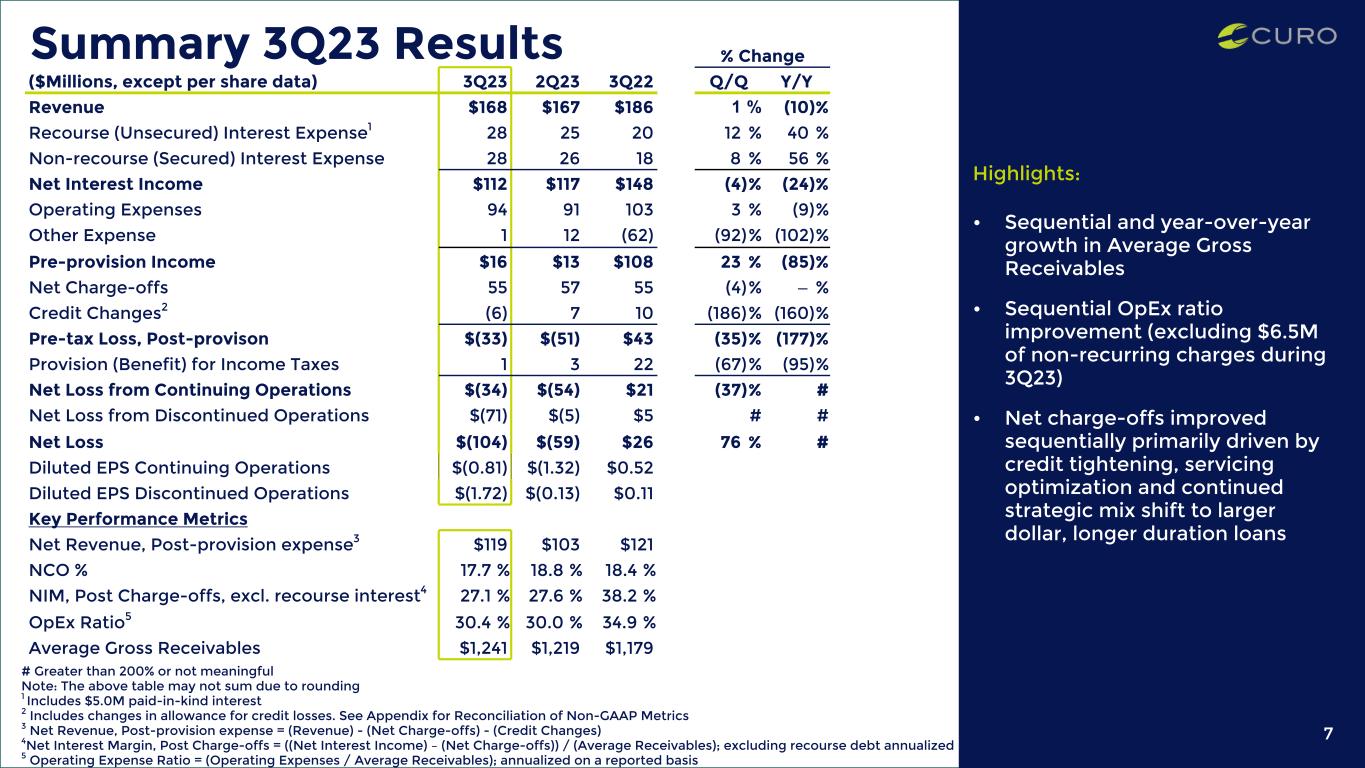

% Change ($Millions, except per share data) 3Q23 2Q23 3Q22 Q/Q Y/Y Revenue $168 $167 $186 1 % (10) % Recourse (Unsecured) Interest Expense1 28 25 20 12 % 40 % Non-recourse (Secured) Interest Expense 28 26 18 8 % 56 % Net Interest Income $112 $117 $148 (4) % (24) % Operating Expenses 94 91 103 3 % (9) % Other Expense 1 12 (62) (92) % (102) % Pre-provision Income $16 $13 $108 23 % (85) % Net Charge-offs 55 57 55 (4) % — % Credit Changes2 (6) 7 10 (186) % (160) % Pre-tax Loss, Post-provison $(33) $(51) $43 (35) % (177) % Provision (Benefit) for Income Taxes 1 3 22 (67) % (95) % Net Loss from Continuing Operations $(34) $(54) $21 (37) % # Net Loss from Discontinued Operations $(71) $(5) $5 # # Net Loss $(104) $(59) $26 76 % # Diluted EPS Continuing Operations $(0.81) $(1.32) $0.52 Diluted EPS Discontinued Operations $(1.72) $(0.13) $0.11 Key Performance Metrics Net Revenue, Post-provision expense3 $119 $103 $121 NCO % 17.7 % 18.8 % 18.4 % NIM, Post Charge-offs, excl. recourse interest4 27.1 % 27.6 % 38.2 % OpEx Ratio5 30.4 % 30.0 % 34.9 % Average Gross Receivables $1,241 $1,219 $1,179 Summary 3Q23 Results Highlights: • Sequential and year-over-year growth in Average Gross Receivables • Sequential OpEx ratio improvement (excluding $6.5M of non-recurring charges during 3Q23) • Net charge-offs improved sequentially primarily driven by credit tightening, servicing optimization and continued strategic mix shift to larger dollar, longer duration loans # Greater than 200% or not meaningful Note: The above table may not sum due to rounding 1 Includes $5.0M paid-in-kind interest 2 Includes changes in allowance for credit losses. See Appendix for Reconciliation of Non-GAAP Metrics 3 Net Revenue, Post-provision expense = (Revenue) - (Net Charge-offs) - (Credit Changes) 4Net Interest Margin, Post Charge-offs = ((Net Interest Income) – (Net Charge-offs)) / (Average Receivables); excluding recourse debt annualized 5 Operating Expense Ratio = (Operating Expenses / Average Receivables); annualized on a reported basis 7

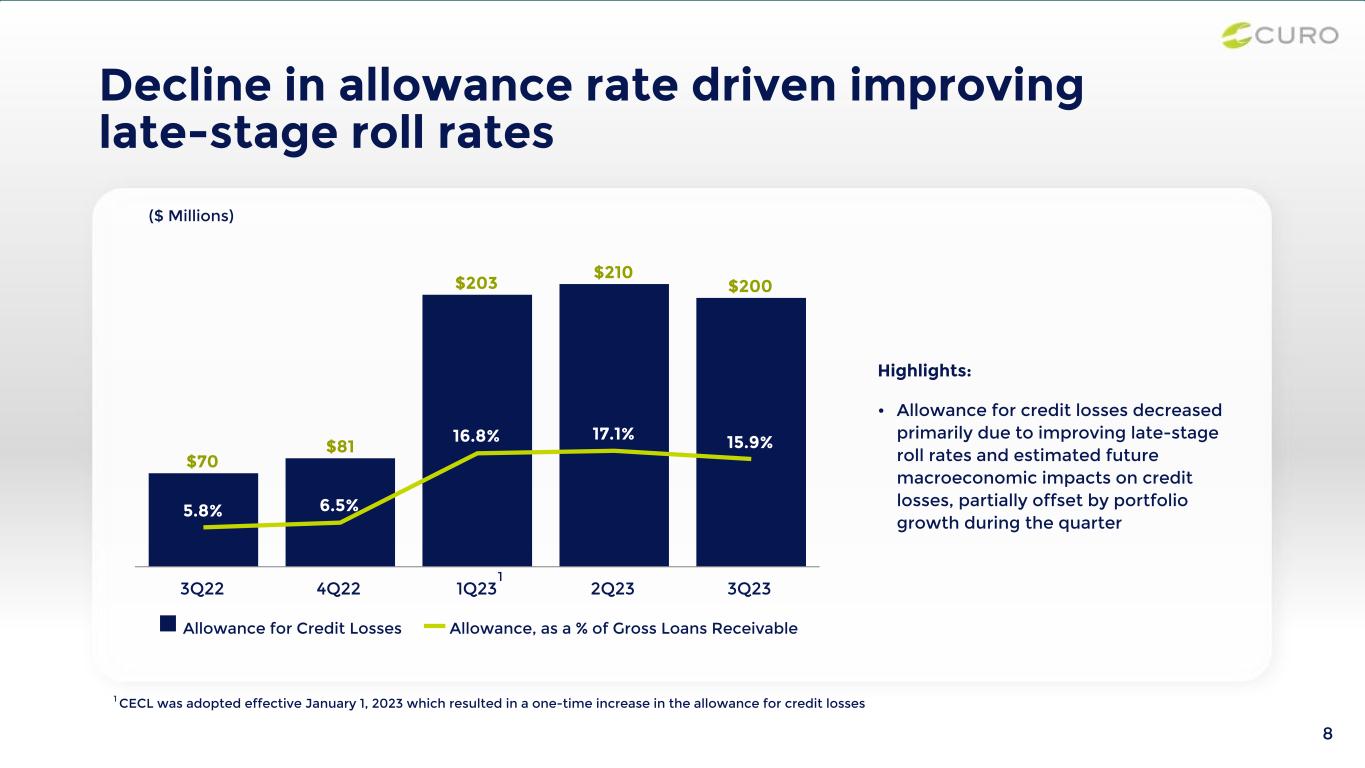

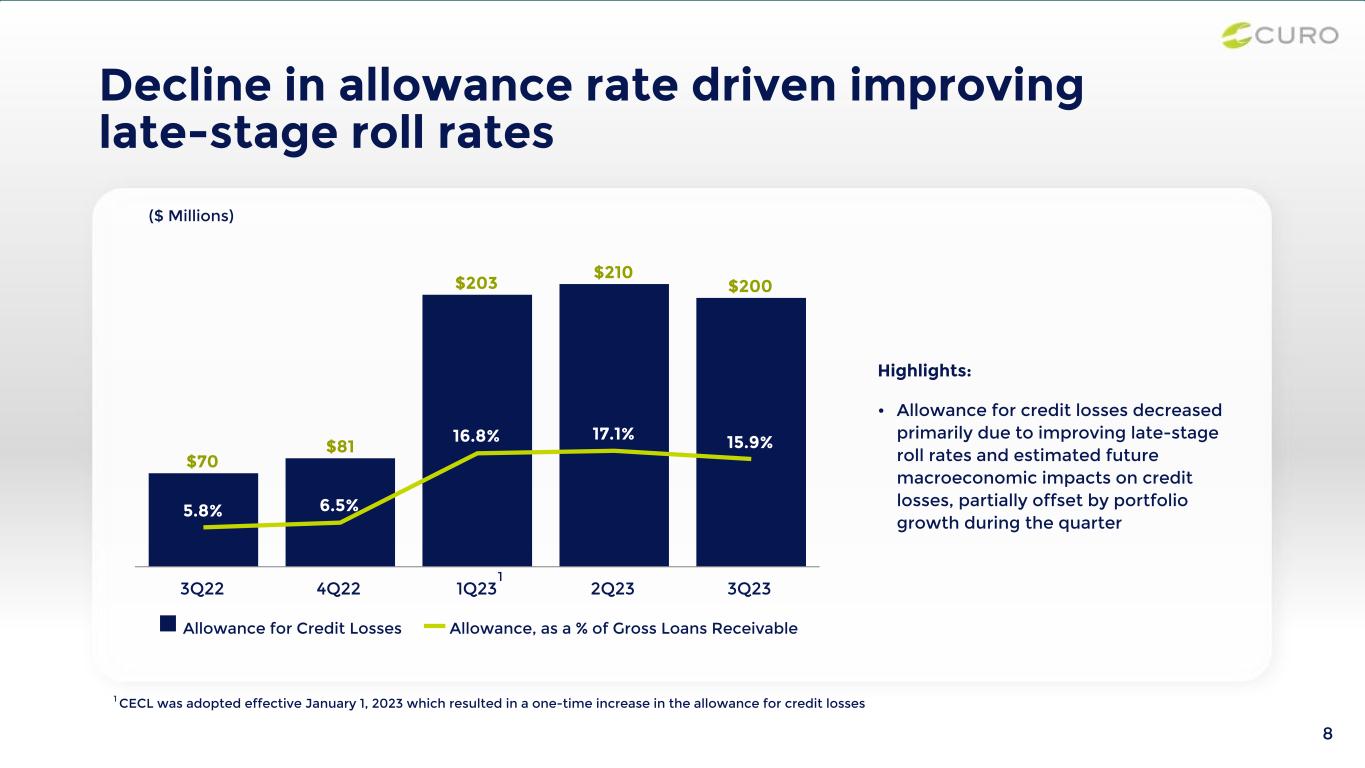

8 Decline in allowance rate driven improving late-stage roll rates Highlights: • Allowance for credit losses decreased primarily due to improving late-stage roll rates and estimated future macroeconomic impacts on credit losses, partially offset by portfolio growth during the quarter $70 $81 $203 $210 $200 5.8% 6.5% 16.8% 17.1% 15.9% Allowance for Credit Losses Allowance, as a % of Gross Loans Receivable 3Q22 4Q22 1Q23 2Q23 3Q23 ($ Millions) 1 CECL was adopted effective January 1, 2023 which resulted in a one-time increase in the allowance for credit losses 1

9 Net Interest Margin decreased slightly due to increased debt levels and higher rates $113 $96 $80 $84 $85 38.2% 30.9% 26.5% 27.6% 27.1% Net Interest Income, Post charge-offs, excluding Recourse Interest Expense Net Interest Margin, Post Charge-offs, excluding Recourse Interest Expense 3Q22 4Q22 1Q23 2Q23 3Q23 ($ Millions) Highlights: • Net interest margin, Post charge-offs, excluding Recourse Interest Expense decreased sequentially due to: ◦ Increased non-recourse debt levels and interest rates ◦ Decrease in yields due to continuing product mix shift to larger balance, longer duration loans ◦ All of which were partially offset by a decrease in net charge-offs Note: Net Interest Income, Post charge-offs, excl Recourse Interest Expense = (Revenue) - (Non-recourse Interest Expense)- (Net charge-offs) Net Interest Margin, Post Charge-offs, excl. Recourse Interest Expense = (Net Interest Income, Post charge-offs, excluding Recourse Interest Expense) / (Average Receivables); annualized 1 1Q23 excluding NCO policy change in Canada 1

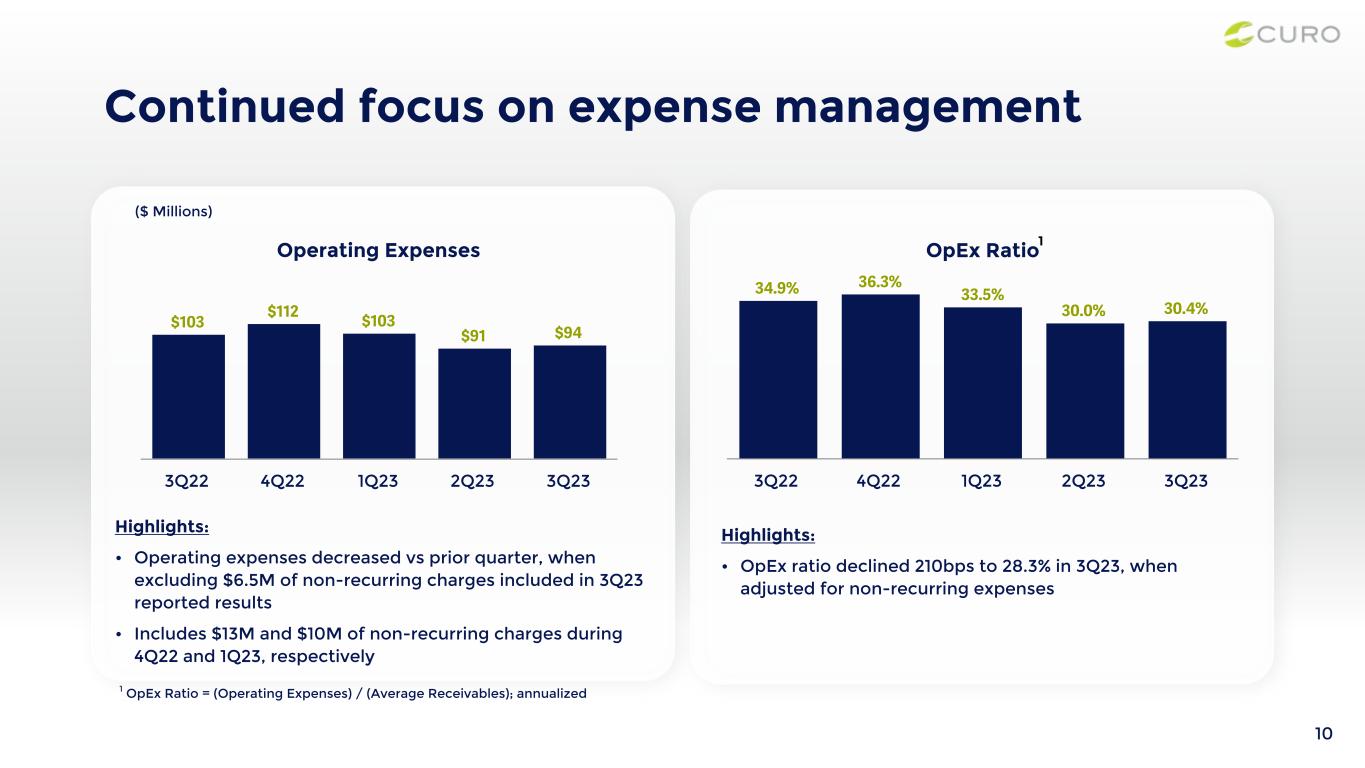

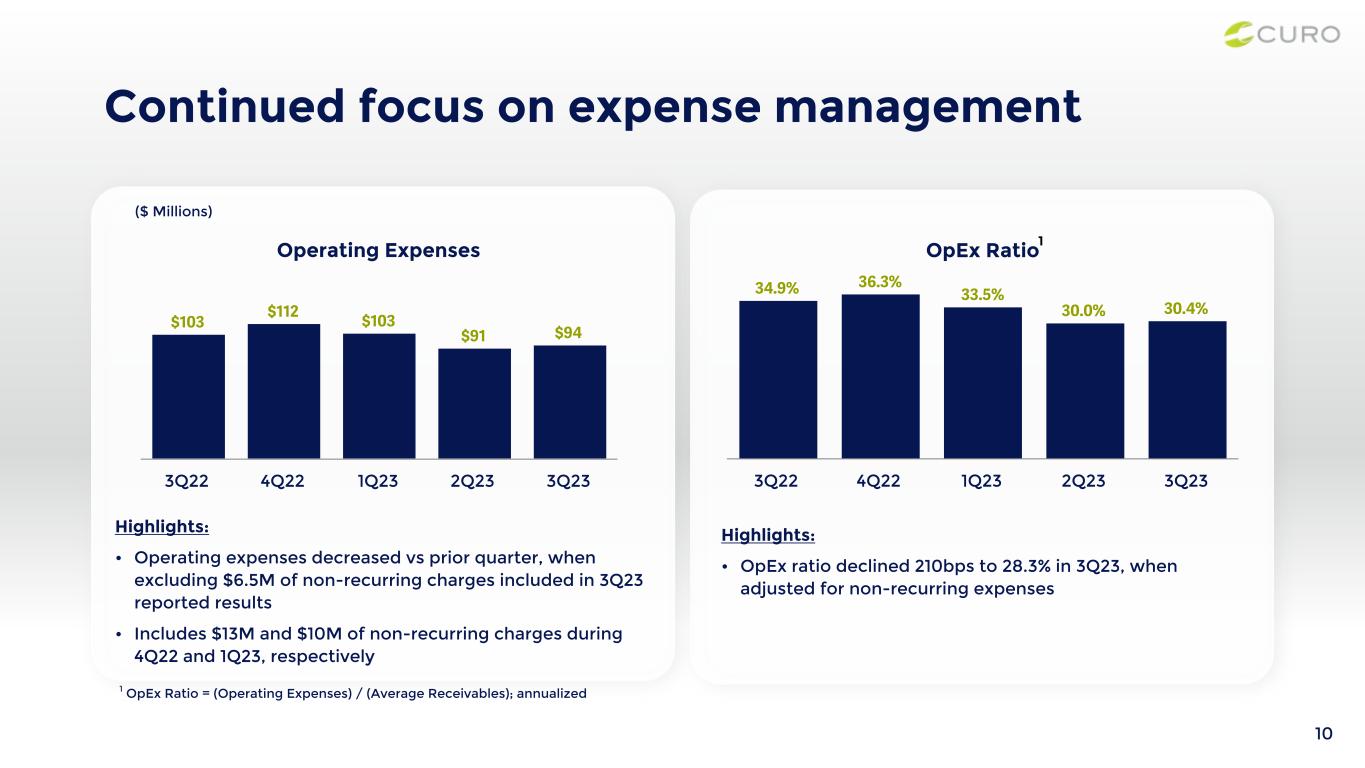

Continued focus on expense management Highlights: • Operating expenses decreased vs prior quarter, when excluding $6.5M of non-recurring charges included in 3Q23 reported results • Includes $13M and $10M of non-recurring charges during 4Q22 and 1Q23, respectively ($ Millions) 10 Operating Expenses $103 $112 $103 $91 $94 3Q22 4Q22 1Q23 2Q23 3Q23 OpEx Ratio 34.9% 36.3% 33.5% 30.0% 30.4% 3Q22 4Q22 1Q23 2Q23 3Q23 1 OpEx Ratio = (Operating Expenses) / (Average Receivables); annualized 1 Highlights: • OpEx ratio declined 210bps to 28.3% in 3Q23, when adjusted for non-recurring expenses

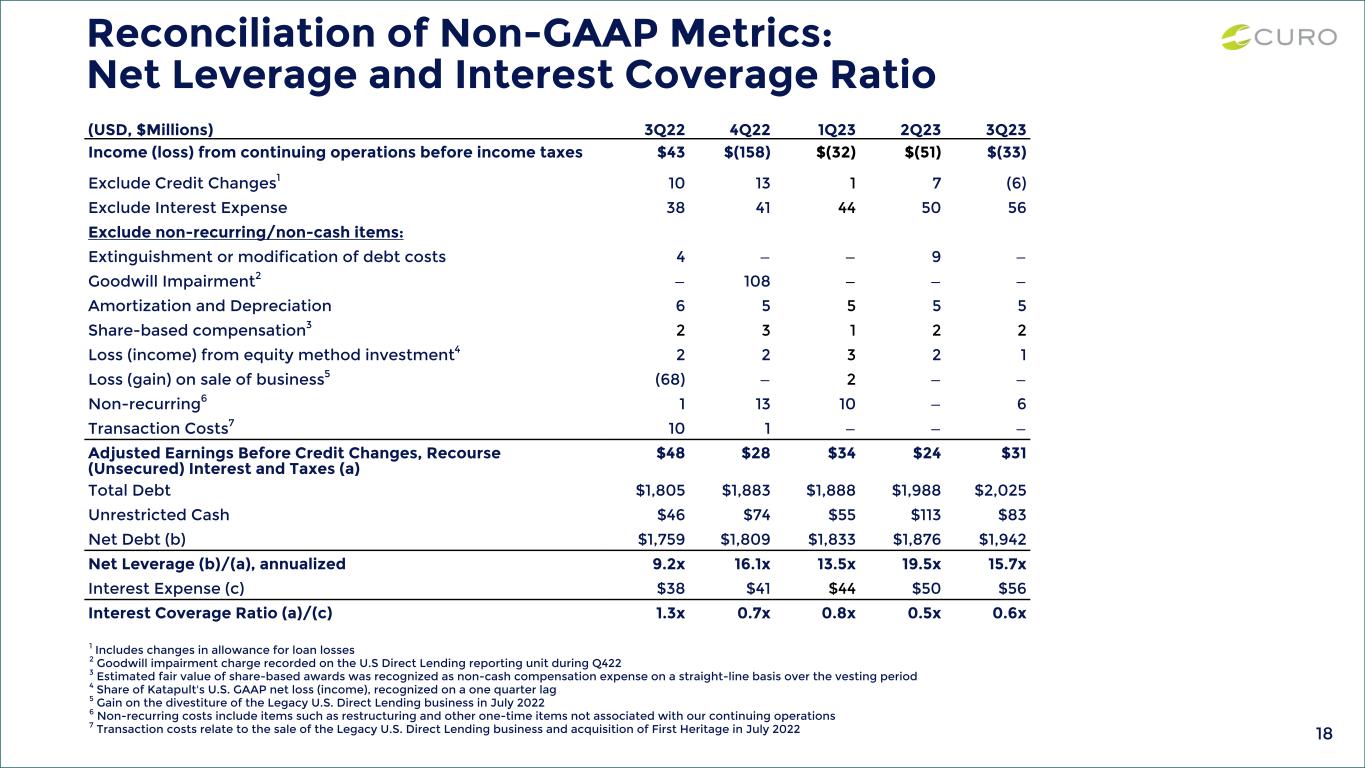

Net Leverage & Interest Coverage 9.2x 16.1x 13.5x 19.5x 15.7x 1.3x 0.7x 0.8x 0.5x 0.6x Net Leverage Interest Coverage Ratio 3Q22 4Q22 1Q23 2Q23 3Q23 Liquidity and Capacity 1 See Appendix for definition of Net Leverage and Interest Coverage, which are Non-GAAP financial measures 2 Represents facility commitments to support growth, less funded amounts Liquidity and Capacity $257 $187 $200 $343 $264 150 76 69 166 128 67 60 90 76 54 40 51 40 101 83 Unused Capacity for Growth Restricted Cash Unrestricted Cash 3Q22 4Q22 1Q23 2Q23 3Q23 2 11 1 ($ Millions) Highlights: • Year-end 2023 unrestricted cash is expected to be $90-$140M • $90-$140M quarterly unrestricted cash balance expected during 2024

Outlook Strengthen our Foundation Execute with ExcellenceGrow Responsibly Cost of funds: ~$60M $90-$140M of unrestricted cash 4Q23 Targets: EOP Receivables: $1.26-$1.28B Revenue: $165-$175M Net Charge-off %: 16.5-18.5% Operating Expenses: $85-$95M 12 $90-$140M quarterly unrestricted cash balance Full Year 20241 8-12% EOP receivables growth NIM, post charge-offs, excl. recourse interest2: 26-28% Maintain 4Q23 operating expense run rate 1 Based on management's expectations for business performance and current macro conditions; subject to change if macro conditions change 2Net Interest Margin, Post Charge-offs, excl. Recourse Interest Expense = (Net Interest Income, Post charge-offs, excluding Recourse Interest Expense) / (Average Receivables); annualized

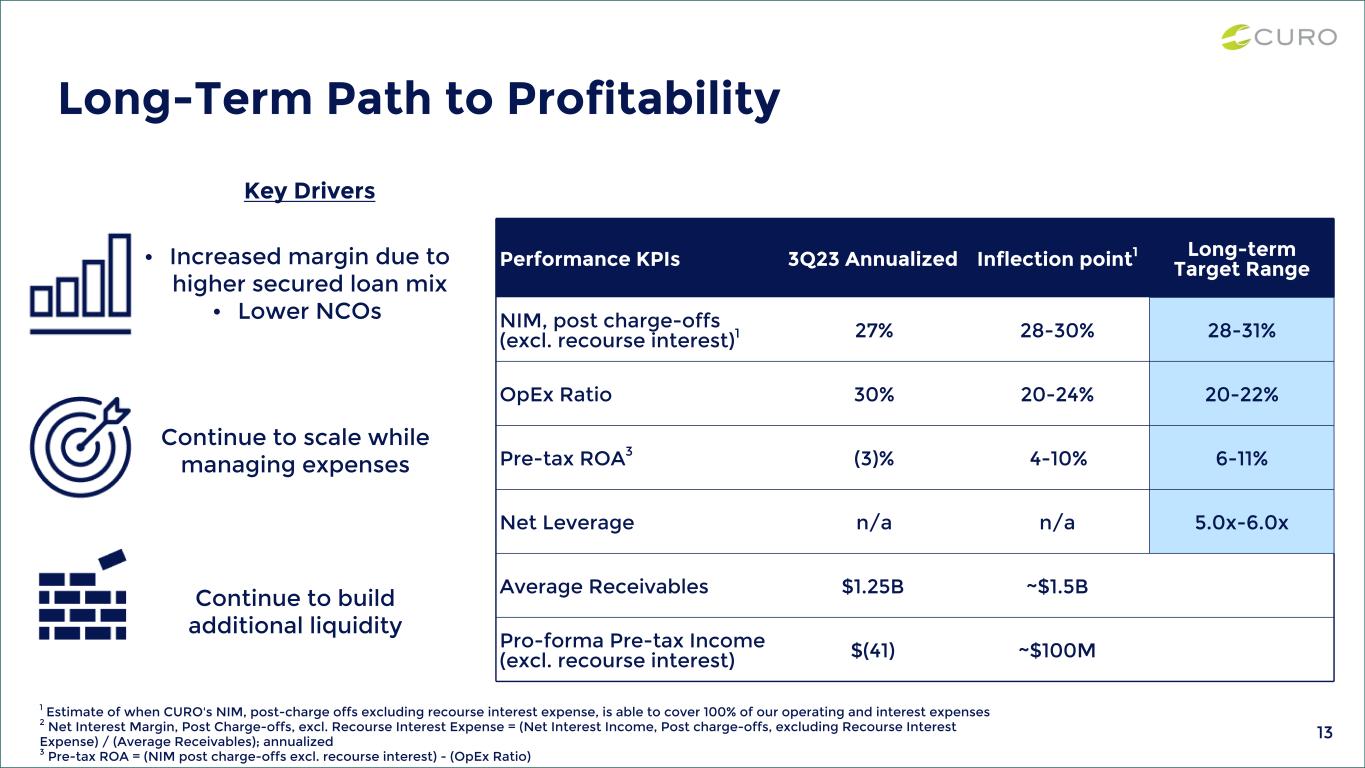

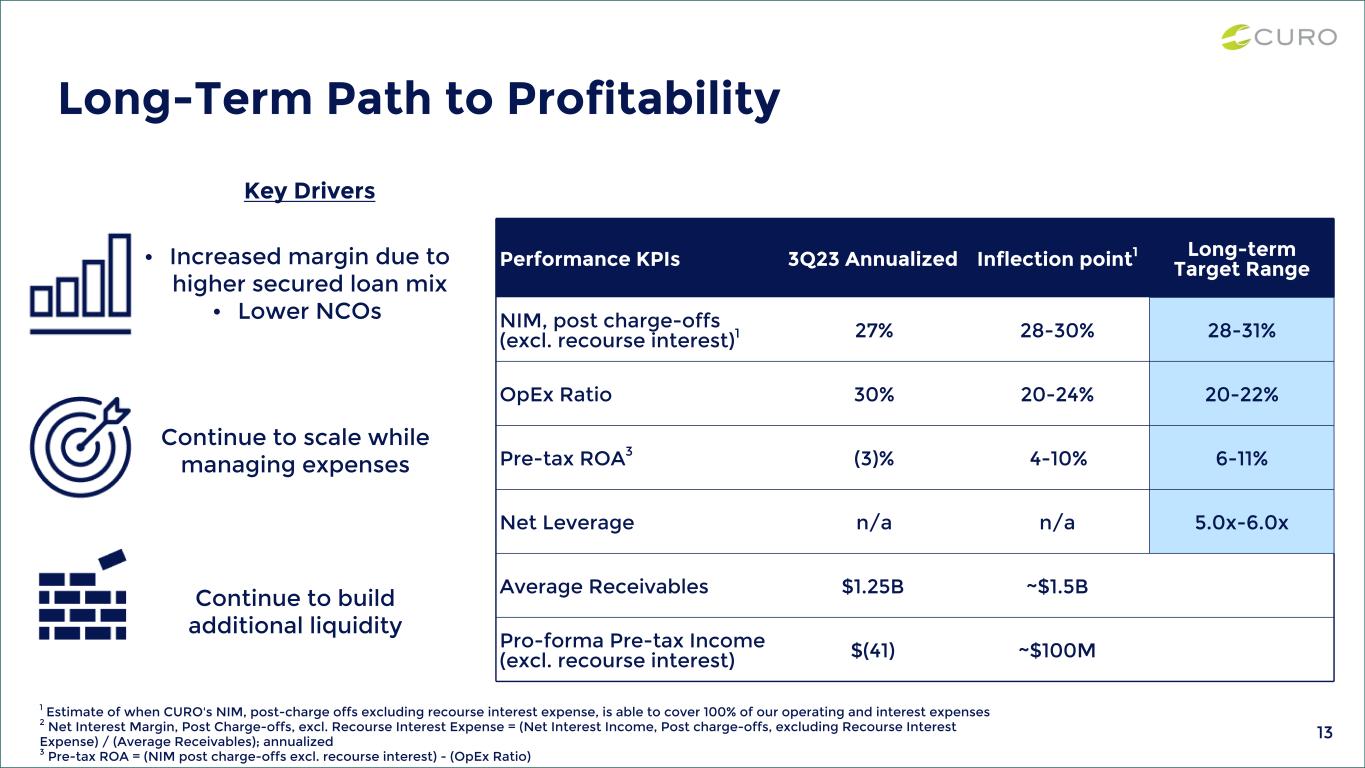

13 Performance KPIs 3Q23 Annualized Inflection point1 Long-term Target Range NIM, post charge-offs (excl. recourse interest)1 27% 28-30% 28-31% OpEx Ratio 30% 20-24% 20-22% Pre-tax ROA3 (3)% 4-10% 6-11% Net Leverage n/a n/a 5.0x-6.0x Average Receivables $1.25B ~$1.5B Pro-forma Pre-tax Income (excl. recourse interest) $(41) ~$100M Long-Term Path to Profitability • Increased margin due to higher secured loan mix • Lower NCOs Continue to scale while managing expenses Continue to build additional liquidity Key Drivers 1 Estimate of when CURO's NIM, post-charge offs excluding recourse interest expense, is able to cover 100% of our operating and interest expenses 2 Net Interest Margin, Post Charge-offs, excl. Recourse Interest Expense = (Net Interest Income, Post charge-offs, excluding Recourse Interest Expense) / (Average Receivables); annualized 3 Pre-tax ROA = (NIM post charge-offs excl. recourse interest) - (OpEx Ratio)

14 Appendix

15 Reconciliation of Non-GAAP Metrics: Credit Changes Net Charge-offs and Credit Changes ($Millions) 3Q22 4Q22 1Q23 2Q23 3Q23 Provision for Losses $65 $78 $48 $64 $49 Net Charge-offs $(55) $(65) $(47) $(57) $(55) Credit Changes $10 $13 $1 $7 $(6)

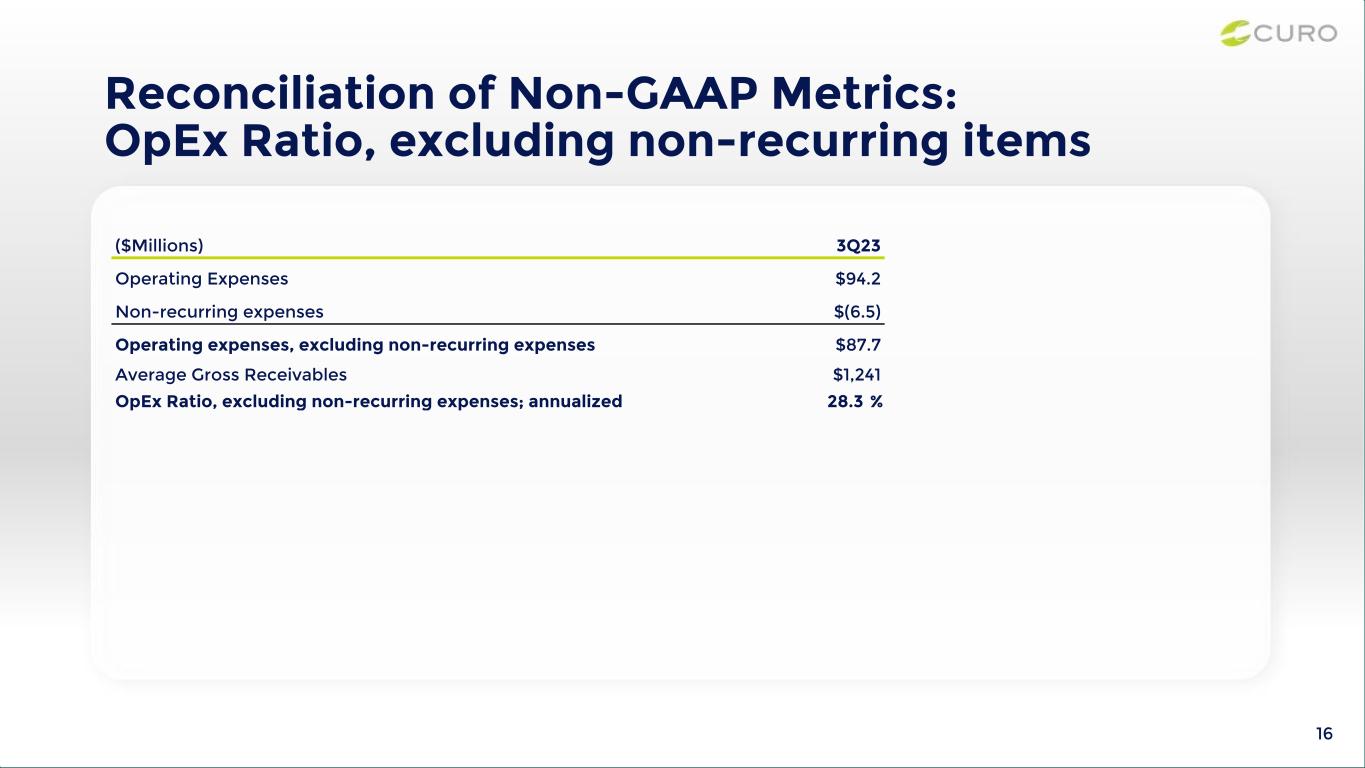

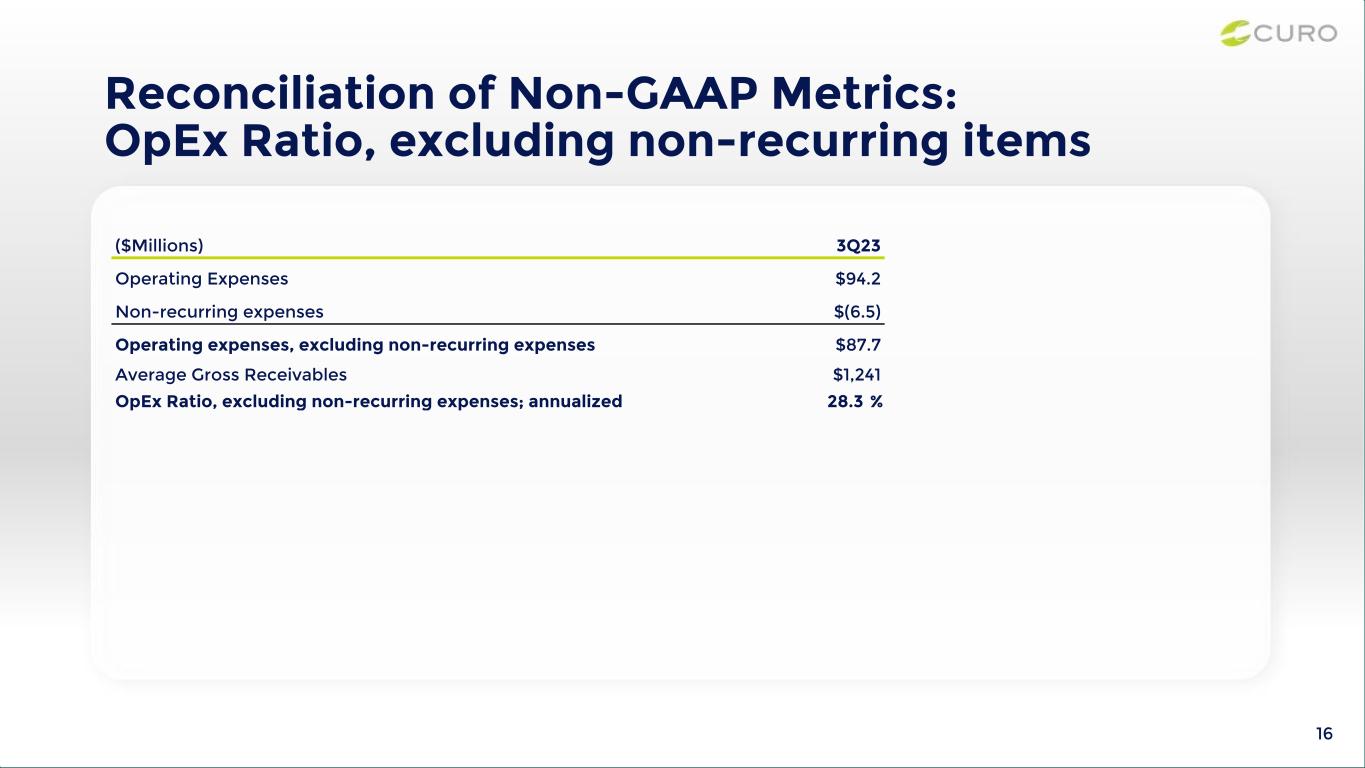

16 Reconciliation of Non-GAAP Metrics: OpEx Ratio, excluding non-recurring items ($Millions) 3Q23 Operating Expenses $94.2 Non-recurring expenses $(6.5) Operating expenses, excluding non-recurring expenses $87.7 Average Gross Receivables $1,241 OpEx Ratio, excluding non-recurring expenses; annualized 28.3 %

17 Direct Lending Revenue and Receivables by Geography Note: The above table may not sum due to rounding 3Q23 Direct Lending by Geography ($Millions) U.S. Canada Total Revenue $88 $80 $168 Less: Net Charge-offs 28 27 55 Less: Credit Changes (4) (2) (6) Net Revenue $64 $55 $119 Gross Loans Receivable $752 $503 $1,254

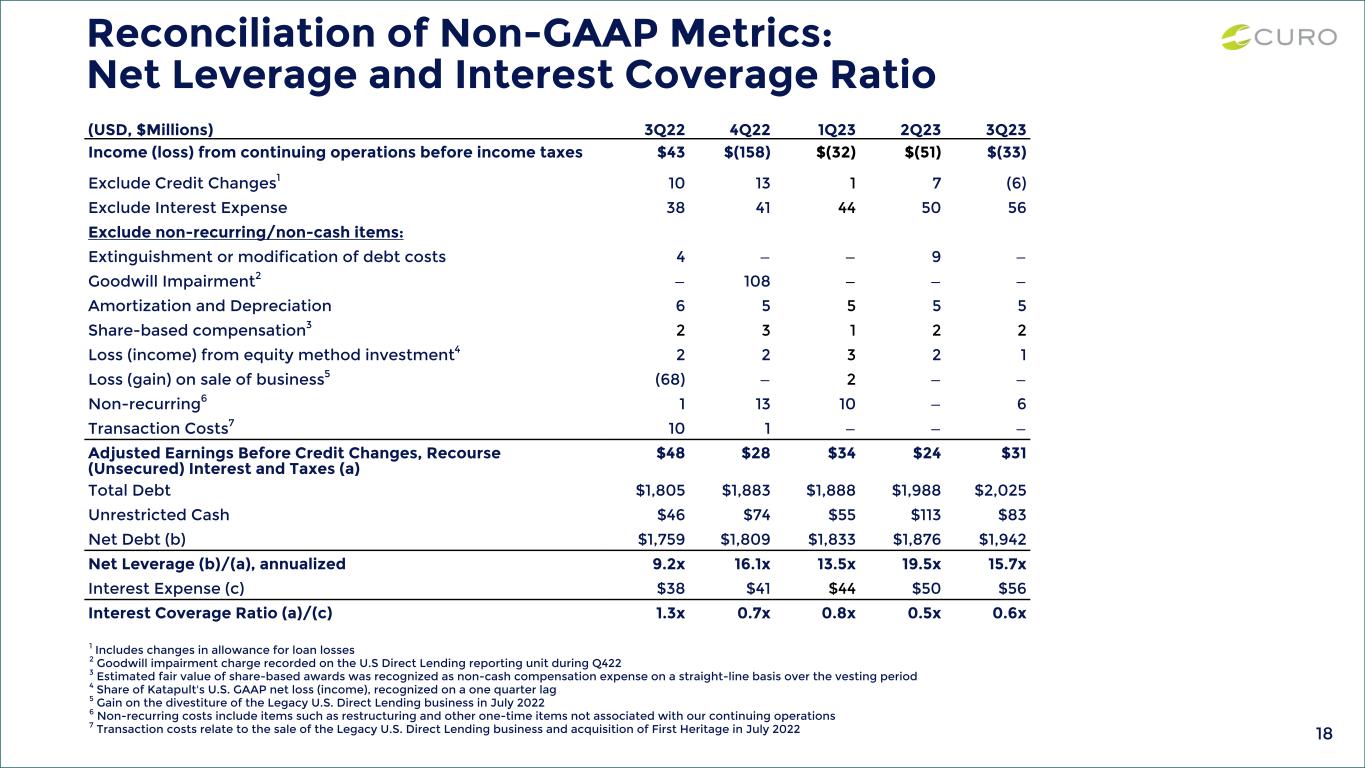

18 Reconciliation of Non-GAAP Metrics: Net Leverage and Interest Coverage Ratio 1 Includes changes in allowance for loan losses 2 Goodwill impairment charge recorded on the U.S Direct Lending reporting unit during Q422 3 Estimated fair value of share-based awards was recognized as non-cash compensation expense on a straight-line basis over the vesting period 4 Share of Katapult's U.S. GAAP net loss (income), recognized on a one quarter lag 5 Gain on the divestiture of the Legacy U.S. Direct Lending business in July 2022 6 Non-recurring costs include items such as restructuring and other one-time items not associated with our continuing operations 7 Transaction costs relate to the sale of the Legacy U.S. Direct Lending business and acquisition of First Heritage in July 2022 (USD, $Millions) 3Q22 4Q22 1Q23 2Q23 3Q23 Income (loss) from continuing operations before income taxes $43 $(158) $(32) $(51) $(33) Exclude Credit Changes1 10 13 1 7 (6) Exclude Interest Expense 38 41 44 50 56 Exclude non-recurring/non-cash items: Extinguishment or modification of debt costs 4 — — 9 — Goodwill Impairment2 — 108 — — — Amortization and Depreciation 6 5 5 5 5 Share-based compensation3 2 3 1 2 2 Loss (income) from equity method investment4 2 2 3 2 1 Loss (gain) on sale of business5 (68) — 2 — — Non-recurring6 1 13 10 — 6 Transaction Costs7 10 1 — — — Adjusted Earnings Before Credit Changes, Recourse (Unsecured) Interest and Taxes (a) $48 $28 $34 $24 $31 Total Debt $1,805 $1,883 $1,888 $1,988 $2,025 Unrestricted Cash $46 $74 $55 $113 $83 Net Debt (b) $1,759 $1,809 $1,833 $1,876 $1,942 Net Leverage (b)/(a), annualized 9.2x 16.1x 13.5x 19.5x 15.7x Interest Expense (c) $38 $41 $44 $50 $56 Interest Coverage Ratio (a)/(c) 1.3x 0.7x 0.8x 0.5x 0.6x

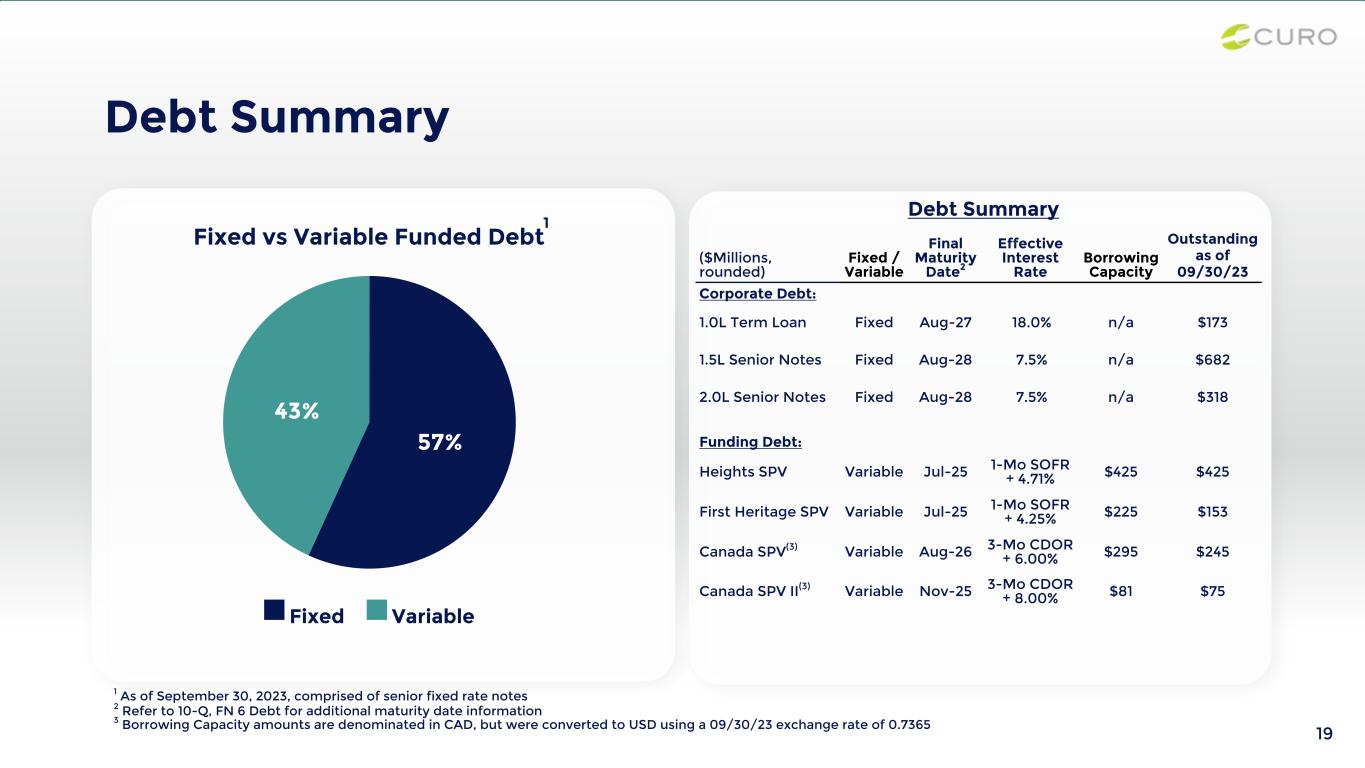

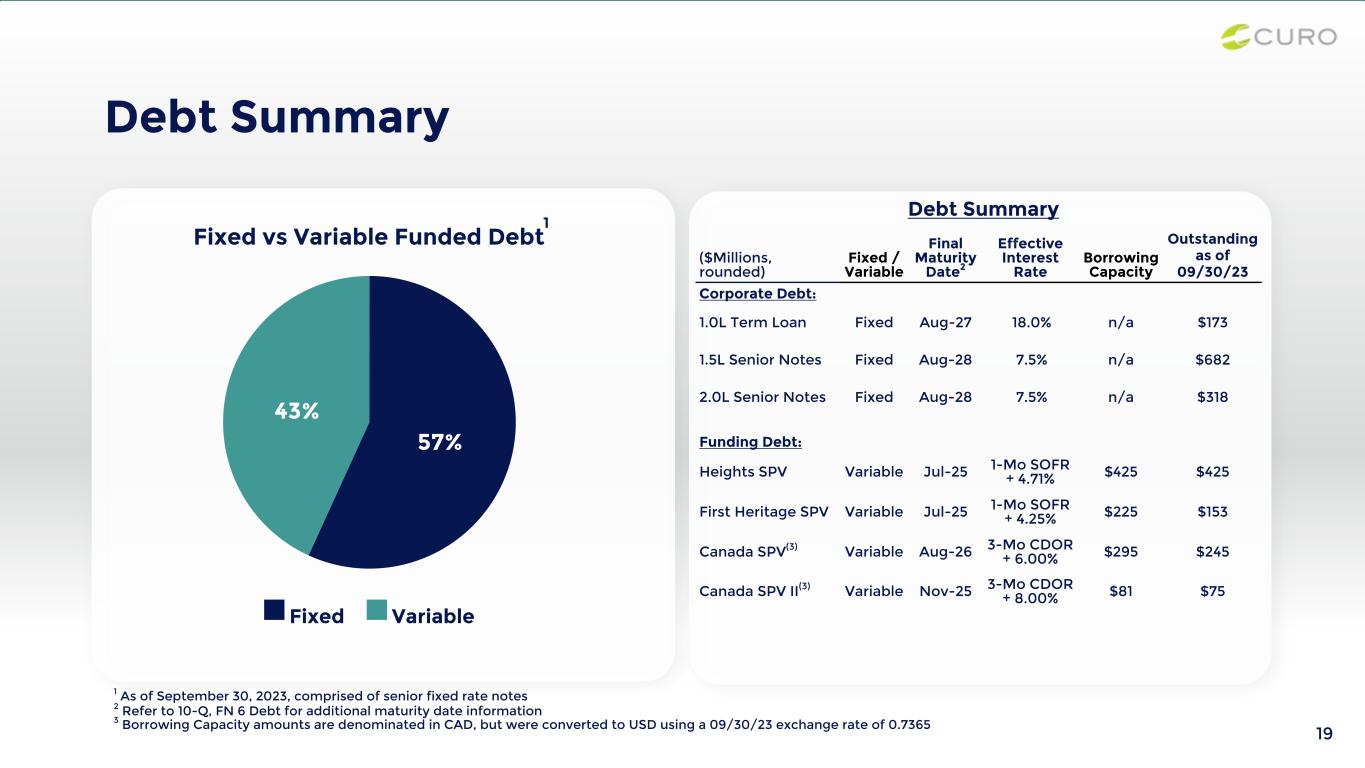

19 Debt Summary ($Millions, rounded) Fixed / Variable Final Maturity Date2 Effective Interest Rate Borrowing Capacity Outstanding as of 09/30/23 Corporate Debt: 1.0L Term Loan Fixed Aug-27 18.0% n/a $173 1.5L Senior Notes Fixed Aug-28 7.5% n/a $682 2.0L Senior Notes Fixed Aug-28 7.5% n/a $318 Funding Debt: Heights SPV Variable Jul-25 1-Mo SOFR + 4.71% $425 $425 First Heritage SPV Variable Jul-25 1-Mo SOFR + 4.25% $225 $153 Canada SPV(3) Variable Aug-26 3-Mo CDOR + 6.00% $295 $245 Canada SPV II(3) Variable Nov-25 3-Mo CDOR + 8.00% $81 $75 1 As of September 30, 2023, comprised of senior fixed rate notes 2 Refer to 10-Q, FN 6 Debt for additional maturity date information 3 Borrowing Capacity amounts are denominated in CAD, but were converted to USD using a 09/30/23 exchange rate of 0.7365 Debt Summary Fixed vs Variable Funded Debt 57% 43% Fixed Variable 1