March 6, 2023

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Manufacturing

100 F Street, N.E.

Washington, D.C. 20549

Attn:

| Ken Schuler, Craig Arakawa, Mindy Hooker, Kevin Stertzel |

| Re: | Loma Negra Compañía Industrial Argentina Sociedad Anónima Amendment No. 1 to Form 20-F for the Year Ended December 31, 2021 File No. 1-38262 |

Ladies and Gentlemen:

Loma Negra Compañía Industrial Argentina Sociedad Anónima (the “Company”) is submitting this letter in response to the comment letter dated February 17, 2023 (the “Comment Letter”) issued by the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) with respect to the Form 20-F for the year ended December 31, 2021, as filed with the Commission on April 29, 2022 (the “Form 20-F”), and as amended by Amendment No. 1 as filed with the SEC on December 28, 2022 (“Amendment No. 1”).

To facilitate the Staff’s review, the text set forth below in bold-faced type, immediately following each paragraph number, is a reproduction of the comments included in the Comment Letter. Except as otherwise indicated, all references to page numbers and captions (other than those in the Staff’s comments) correspond to the page numbers and captions in the copy of Amendment No. 1. Capitalized terms used and not otherwise defined herein shall have the meanings set forth in Amendment No. 1.

Amendment No. 1 to Form 20-F for the Year Ended December 31, 2021

Overview of Mineral Reserves, page 4

| 1. | We reviewed your reserve disclosure and noted the sale price for your salable products, which serve as a basis of your reserve determination, was not disclosed in your filing as required the footnotes to Tables 1 and 2 of paragraph (b) for Item 1303 of Regulation S- K. In addition, the metallurgical recoveries were not disclosed for your material properties as required by Items 1304(d)(1) of Regulation S-K. Please modify your filing and include these modification factors for each of your properties with your reserve tables. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Location and History, page 5

| 2. | We note your individual material property disclosure beginning in this section. Please modify your filing and locate each of your material properties within one mile, using an easily recognizable coordinate system to comply with Item 1304(b)(1)(i) of Regulation S- K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Facilities, page 9

| 3. | Please modify your filing and include the book value for your material property as required by Item 1304(b)(2)(iii) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1

La Pampita y Entorno Quarry, page 8

| 4. | Please modify your filing to locate your property to within one-mile using an easily recognizable coordinate system. In addition, please enlarge your maps and illustrations to make them legible as required by Item 601(B)(96)(iii)(b)(3)(i) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1

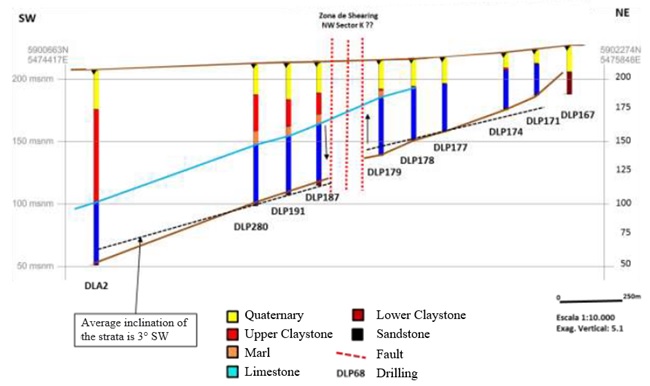

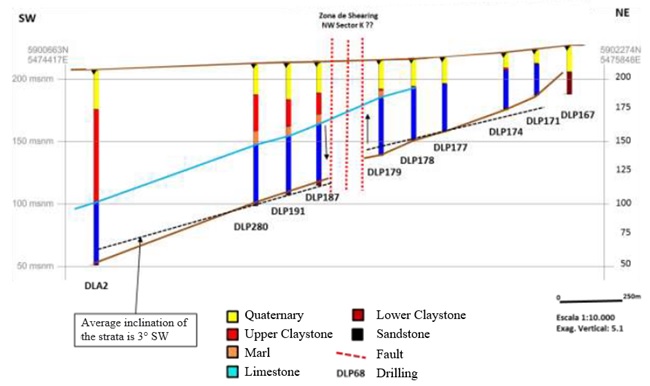

Geological Units involved in the project, page 14

| 5. | Please modify your filing to provide a cross-section of the local geology as required by Item 601(B)(96)(iii)(b)(6)(iii) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1

Adequacy of the Test Data, page 26

| 6. | We reviewed the mineral processing section of your technical report summary. Please modify your filing to include the QP’s opinion on the adequacy of the data and state the metallurgical recovery as required by Item 601(B)(96)(iii)(b)(10)(v) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1

Reserves Estimation, page 30

| 7. | We note you did not disclose a reserve price or metallurgical recovery for your reserve estimates. Please state the price and recovery used to determine your reserves and disclose, with particularity, the reasons this price was selected and any assumptions underlying this selection. See Item 601(B)(96)(iii)(b)(12)(iii) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1

Annual Production Rate, page 35

| 8. | Please modify your technical report to provide the annual Life of Mine (LOM) production schedule for your limestone and waste production as required by Item 601(B)(96)(iii)(b)(13) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1

Market Studies, page 40

| 9. | We note you did not disclose a commodity price forecast in the section. Please modify your technical report to disclose your cement price projections and the basis for your commodity price forecast as used in your economic evaluation as required by Item 601(B)(96)(iii)(b)(16) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1 A

Capital and Operating Costs, page 43

| 10. | We note you did not disclose an accuracy estimate with your capital and operating cost estimates as required by Item 601(B)(96)(iii)(b)(18)(i) of Regulation S-K. Please modify your filing to include your accuracy estimate and discuss how the annual operating costs in this section relate to the operating costs presented in the economic analysis. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

Exhibit 96.1 A

Economic Viability, page 44

| 11. | Please modify your technical report to include the annual mined material tonnage in your cash flow analysis as required by Item 601(B)(96)(iii)(b)(19) of Regulation S-K. |

The Company respectfully acknowledges the Staff’s comment and proposes to revise the disclosure as shown in the appendix to this letter in response.

* * *

We appreciate in advance your time and attention to our responses. Should you have any additional questions or concerns, please contact John Guzman of White & Case LLP at +55 11 3147 5607 or Scott Levi of White & Case LLP at +1 212 819 8320.

| Very truly yours, |

| |

| |

| |

| /s/ Marcos I. Gradin |

| Marcos I. Gradin |

| Chief Financial Officer |

| Loma Negra Compañía Industrial Argentina Sociedad Anónima |

cc: Sergio D. Faifman, Chief Executive Officer

Loma Negra Compañía Industrial Argentina Sociedad Anónima

John Guzman, Esq.

Scott Levi, Esq.

White & Case LLP

Appendix

Draft disclosure in response to comment 1.

Summary of our Mineral Reserves as of December 31, 2021

| | | | | | Probable mineral reserves | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | (Million Tonnes) | | | (% CaO) | | | (Million Tonnes) | | | (% CaO) | | | (Million Tonnes) | | | (% CaO) | |

| | | | | | | | | | | | | | | | | | | |

Limestone:* | | | | | | | | | | | | | | | | | | |

Doña Amalía

| | | 53.6 | | | | 43.96 | | | | 56.2 | | | | 44.6 | | | | 109.8 | | | | 44.2 | |

Piedras Blancas

| | | 0.3 | | | | 50.9 | | | | 0.3 | | | | 50.9 | | | | 0.6 | | | | 50.9 | |

| El Salitral y Cerro Bayo | | | 31.5 | | | | 44.1 | | | | 48.4 | | | | 43.7 | | | | 79.9 | | | | 43.8 | |

Barker

| | | 44.5 | | | | 46.4 | | | | 27 | | | | 46.1 | | | | 71.5 | | | | 46.2 | |

La Pampita y Entorno** (Don Gabino – Los Abriles – SASII) | | | 591.4 | | | | 47.4 | | | | 35.3 | | | | 47.1 | | | | 626.7 | | | | 47.4 | |

Cerro Soltero I

| | | - | | | | - | | | | 53.5 | | | | - | | | | 53.5 | | | | - | |

Cerro Soltero II

| | | - | | | | - | | | | 111.6 | | | | - | | | | 111.6 | | | | - | |

El Cerro

| | | - | | | | - | | | | 37.6 | | | | - | | | | 37.6 | | | | - | |

Granitic aggregates:* | | | | | | | | | | | | | | | | | | | | | | | | |

La Preferida

| | | 61.8 | | | | - | | | | 54.2 | | | | - | | | | 116 | | | | - | |

* The information (prices, costs and economic aspects) assumed for the Mineral Reserves estimation in the economic model can be found in the TRS set forth in Exhibits 96.1 to this annual report.

* The Company use an average price of US$93 per tonne for the economic analysis. Further detail can be found in the Technical Report Summary (TRS) set forth in Exhibit 96.1

** Limestone is used for cement and lime production. 100% of the limestone received at the plant is used.

Draft disclosure in response to comment 2.

L’Amalí and Olavarría Cement Plant

Right Image — Lower right margin: Latitude: 37° 3'12.12"S, Longitude: 60°14'58.06"W. Top left margin: Latitude: 36°58'42.59"S, Longitude: 60°19'58.69"W.

La Pampita y Entorno Mining Operations

Right Image — Lower right margin: Latitude: 37° 4'52.25"S, Longitude: 60° 6'33.87"W. Top left margin: Latitude: 36°50'41.71"S, Longitude: 60°21'49.94"W.

Draft disclosure in response to comment 3.

Facilities

The La Pampita y Entorno quarry has facilities such as offices, an electrical substation, a maintenance shop, a lubricant warehouse, a gas station, a oil tank, a guardhouse, a limestone field, a dining room, a laboratory, a truck scale, an ore belt, a loading tunnel, a meteorological station, a safety trench and a septic tank.

The total cost of the mining concession, mine development costs, land, buildings and other facilities, machinery and equipment, furniture and fixtures, transportation units, computer equipment and tools, quarry rehabilitation costs, capitalized interest and work in progress amounts to as of December 31, 2021.

The book value of L’Amalí and Olavarría cement plants and the La Pampita y Entorno quarry, taking into account all of the above factors, amounts to Ps. 59,186.85 million as of December 31, 2021.

Draft disclosure in response to comment 4.

L’Amalí and Olavarría Cement Plant

Right Image — Lower right margin: Latitude: 37° 3'12.12"S, Longitude: 60°14'58.06"W. Top left margin: Latitude: 36°58'42.59"S, Longitude: 60°19'58.69"W.

La Pampita y Entorno Mining Operations

Right Image — Lower right margin: Latitude: 37° 4'52.25"S, Longitude: 60° 6'33.87"W. Top left margin: Latitude: 36°50'41.71"S, Longitude: 60°21'49.94"W.

Right Image — Lower right margin: Latitude: 37° 4'52.25"S, Longitude: 60° 6'33.87"W. Top left margin: Latitude: 36°50'41.71"S, Longitude: 60°21'49.94"W.

Draft disclosure in response to comment 5.

Figure 11.2 Location of exploration drillings and cross section trace

[References: highlighted in yellow the exploration drillings. The red line is the trace of the cross section]

Figure 11.3 Cross Section of the local geology

Draft disclosure in response to comment 6.

10.4 Opinion of Qualified Person on Adequacy of Test Data

The QP, as part of Loma Negra’s geologist team, is satisfied with the preparation, review, issuance and control of test reports associated with cement production, and considers them to be reasonably valid. The QP’s opinion is that the test data that underlies assumptions about cement production in the associated test reports has been analyzed and collected appropriately and reasonably and is adequate to support the assumptions in this technical report.

Draft disclosure in response to comment 7.

10.2.Cement Manufacturing Test Results

The studies conducted in the Quality Control and Process area include reduction of the clinker/cement factor. The clinker/cement factor cements were 0.87 in 2021 (mostly influenced for the OPC cement type production) for L'Amali plant. In the case of Olavarría Plantplant, the factor in 2021 was 0.63. In the case of both L'Amali plant and Olavarría plant, due to the characteristics of the process, the rate of metallurgical recovery is 100%.

12.3.2 Reasonable Prospects of Economic Extraction

The mineral reserves evaluation has considered other modifying factors such as limestone production costs, cement sales prices, environmental and social viability at our operations. The price assumed for the mineral reserves evaluation is a price of 93 US dollars per ton of cement, averaged over a 63-year projection for the life of the quarry, at nominal values.

Draft disclosure in response to comment 8.

13.6 Life of Mine

A LOM (life of mine (“LOM”) of 134 years has been calculated for the quarry, based on the exploitation of the last five years (average 4.69 million tonnes per year). Considering the maximum capacity of the three plants supplied by the quarry (9.39 million tonnes per year), LOM would be 63 years.

Draft disclosure in response to comment 9.

Cement prices are strongly correlated with inflation and the variation in the exchange rate between the Argentine peso and the US dollar, as reflected by historical data for the five years.

Figure 26 Cement Price, CPI and Ps./US$ variations

*INDEC: Nation |

**YoY variation of Loma Negra's Net Revenue of cement, masonry and lime/Sales Volume of Cement, masonry and lime |

***Variation of the average exchange rate (Communication “A” 3500) reported by the Central Bank for U.S. dollars |

Source: INDEC, BCRA and the Company

Draft disclosure in response to comment 10.

Considering that the quarry production and cement plants will continue in the same geological deposit and using the same mining and industrial methods, there is limited risk associated with the estimation methods used for capital and production costs. An assessment of accuracy of estimation methods is reflected in the sensitivity analysis in Section 19. Forecasted capital and operating costs are estimated to an accuracy of +/- 25% with a contingency of 5%.

Draft disclosure in response to comment 11.

19.2 Economic Viability

Loma Negra has positive cash flow and La Pampita y Entorno quarry does not require a significant capital expenditure in the near future, therefore, payback and return on investment calculations are irrelevant. NPV was calculated using L’Amalí´s and Olavarría’s figures as the limestone obteind in La Pampita y Entorno quarry is exclusively used in the production of cement and lime. The NPV is US$597 million. The forecast horizon is considered to be consistent with the quarry’s life (63 years), which is calculated based on the total declared Reserves and the annual production of the quarry.

Table 31 Cash Flow of La Pampita y Entorno quarry, L’Amalí plant and Olavarría plant

Cash Flow (US$ million) | 2022e | 2023e | 2024e | 2025e | 2026e | 2027e | 2028e | 2029e | 2030e | 2031e | 2032e | 2033e | 2034e | 2035e | 2036e | 2037e | 2038e | 2039e | 2040e | 2041e | 2042e |

Limestone Mined used Tonnes (million) | 5.6 | 5.7 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 |

Cement Tonnes (million) | 4.0 | 4.1 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 |

| Revenue | 406 | 402 | 407 | 403 | 399 | 395 | 391 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 |

Operating Costs (-) | 223 | 218 | 221 | 220 | 220 | 220 | 221 | 222 | 223 | 224 | 226 | 227 | 228 | 229 | 229 | 229 | 230 | 230 | 230 | 230 | 230 |

SG&A (-) | 17 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 |

| EBITDA | 180 | 178 | 179 | 175 | 171 | 167 | 163 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 |

D&A (-) | 14 | 10 | 9 | 8 | 7 | 7 | 8 | 9 | 10 | 12 | 13 | 14 | 15 | 16 | 16 | 17 | 17 | 17 | 17 | 17 | 17 |

Taxable Income | 166 | 168 | 170 | 167 | 164 | 159 | 155 | 150 | 149 | 147 | 146 | 145 | 144 | 143 | 142 | 142 | 142 | 142 | 142 | 142 | 142 |

Income Tax (-) | 58 | 59 | 60 | 59 | 57 | 56 | 54 | 52 | 52 | 51 | 51 | 51 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 |

Working Capital (-) | 8 | 10 | 10 | 8 | 8 | 6 | 5 | 4 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

Capital Expenses (-) | 26 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 |

| Free Cash Flow | 88 | 82 | 82 | 81 | 78 | 78 | 76 | 75 | 76 | 78 | 78 | 79 | 79 | 79 | 79 | 80 | 80 | 80 | 80 | 80 | 80 |

Cash Flow (US$ million) | 2043e | 2044e | 2045e | 2046e | 2047e | 2048e | 2049e | 2050e | 2051e | 2052e | 2053e | 2054e | 2055e | 2056e | 2057e | 2058e | 2059e | 2060e | 2061e | 2062e | 2063e |

Limestone Mined usedTonnes (million) | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 |

Cement Tonnes (million) | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 |

| Revenue | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 |

Operating Costs (-) | 230 | 230 | 230 | 230 | 230 | 230 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 |

SG&A (-) | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 |

| EBITDA | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 |

D&A (-) | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 |

Taxable Income | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 |

Income Tax (-) | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 |

Working Capital (-) | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

Capital Expenses (-) | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 |

| Free Cash Flow | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 |

Cash Flow (US$ million) | 2064e | 2065e | 2066e | 2067e | 2068e | 2069e | 2070e | 2071e | 2072e | 2073e | 2074e | 2075e | 2076e | 2077e | 2078e | 2079e | 2080e | 2081e | 2082e | 2083e | 2084e |

Limestone Mined used Tonnes (million) | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 | 5.9 |

Cement Tonnes (million) | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 | 4.2 |

| Revenue | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 | 387 |

Operating Costs (-) | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 | 229 |

SG&A (-) | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 | 16 |

| EBITDA | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 |

D&A (-) | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 |

Taxable Income | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 | 142 |

Income Tax (-) | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 |

Working Capital (-) | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

Capital Expenses (-) | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 | 27 |

| Free Cash Flow | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 | 80 |

| NPV (US$ million) | 597 |

| Discount Rate | 13.4% |