The Advisor will receive fees and compensation, payable monthly in arrears, in connection with the offering and ongoing management of the assets of the Company, as follows:

| | | | | | | | | | |

| | | Class T

Shares | | Class S

Shares | | Class D

Shares | | Class I

Shares | | Class N

Shares |

Advisory Fee (% of NAV) | | 1.25% | | 1.25% | | 1.25% | | 1.25% | | 0.65% |

As of September 30, 2021, the Company had accrued advisory fees of approximately $0.8 million, which has been included in Accounts Payable, Accrued Expenses, and Other Liabilities on the Company’s Consolidated Balance Sheets. For the three and nine months ended September 30, 2021, the Company incurred advisory fee expenses of $2.0 million and $4.2 million, respectively. For the three and nine months ended September 30, 2020, the Company had incurred advisory fee expenses of $0.8 million and $2.1 million, respectively.

The Company may retain certain of the Advisor’s affiliates for necessary services relating to the Company’s investments or its operations, including construction, special servicing, leasing, development, property oversight and other property management services, as well as services related to mortgage servicing, group purchasing, healthcare, consulting/brokerage, capital markets/credit origination, loan servicing, property, title and other types of insurance, management consulting and other similar operational matters.

During the year ended December 31, 2020, the Company engaged NexCore Companies LLC (“NexCore”), an affiliate of TIAA, to provide property management, accounting and leasing services for certain of its investments in healthcare properties. NexCore is a real estate development company focused exclusively on development, acquisition, and management of healthcare real estate. The Company paid approximately $30,000 and $0.1 million, respectively, in management fees to NexCore during the three and nine months ended September 30, 2021. The Company did not pay any management fees to NexCore during the three and nine months ended September 30, 2020.

Additionally, as part of this engagement, the Company may pay acquisition fees to NexCore for sourcing deals. The Company paid approximately $0.1 million and $0.2 million, respectively, in acquisition fees to NexCore during the three and nine months ended September 30, 2021. The Company did not pay any acquisition fees to NexCore during the three and nine months ended September 30, 2020. The Company may also enter into joint ventures with NexCore, and pursuant to the terms of the joint venture agreements, NexCore may receive a promote from the joint venture. The Company entered in three joint venture arrangements with NexCore during the nine months ended September 30, 2021, which have not incurred any promote payments. The Company did not enter into any joint venture arrangements with NexCore during the three and nine months ended September 30, 2020.

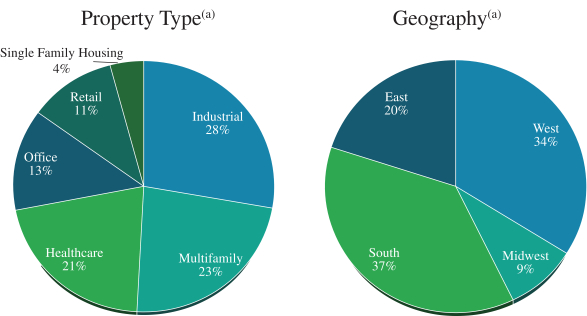

On July 27, 2021, the Company entered in an agreement with Imajn Homes Holdings (“Sparrow”), an affiliate of TIAA, to assist the Company in acquiring and managing single family housing in the United States. Sparrow is a vertically integrated company with acquisition, asset, property and construction management capabilities. As part of the joint venture arrangement with Sparrow, if certain internal rate of return hurdles are met, Sparrow will participate in the profits based on a set criteria at the crystallization event. Additionally, Sparrow has the ability to exercise the crystallization event between the fifth and sixth anniversaries from the effective date of the agreement. Subsequent to entering in the agreement, the Company committed $100.0 million to acquire single family rentals identified by Sparrow. The Company incurred approximately $5,500 and $1,700 in asset and property management fees, respectively, related to Sparrow during each of the three and nine months ended September 30, 2021.

On August 23, 2021, the Company entered into a master services agreement with Nuveen Real Estate Project Management Services, LLC (“Nuveen RE PMS”), an affiliate of the Advisor, for the purpose of Nuveen RE PMS providing professional services described below in connection with certain of our real estate investments (the “Agreement”).

26