| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

References herein to “Starwood Real Estate Income Trust, Inc.”, “Company,” “we,” “us,” or “our” refer to Starwood Real Estate Income Trust, Inc. and its subsidiaries unless the context specifically requires otherwise.

The following discussion should be read in conjunction with the unaudited consolidated financial statements and notes thereto appearing elsewhere in this quarterly report on Form10-Q. In addition to historical data, this discussion contains forward-looking statements about our business, operations and financial performance based on current expectations that involve risks, uncertainties and assumptions. Our actual results may differ materially from those in this discussion as a result of various factors, including but not limited to those discussed under “Item 1A. Risk Factors” in our Annual Report on Form10-K filed with the SEC on March 28, 2019 and elsewhere in this Quarterly Report on Form10-Q. We do not undertake to revise or update any forward-looking statements.

Forward-Looking Statements

This Quarterly Report on Form10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include statements about our business, including, in particular, statements about our plans, strategies and objectives. Forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words. These statements include our plans and objectives for future operations, including plans and objectives relating to future growth and availability of funds, and are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to accurately predict and many of which are beyond our control.

Although we believe the assumptions underlying the forward-looking statements, and the forward-looking statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate and our actual results, performance and achievements may be materially different from that expressed or implied by these forward-looking statements. In light of the significant uncertainties inherent in these forward looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

You should carefully review Item 1A. Risk Factors in our Annual Report on Form10-K for the year ended December 31, 2018, and elsewhere in this Quarterly Report on Form10-Q for a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

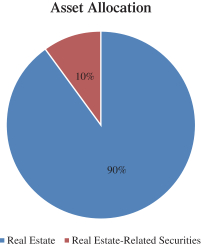

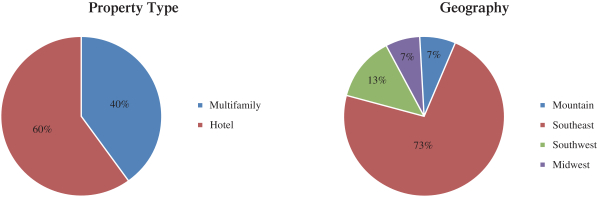

Starwood Real Estate Income Trust, Inc. was formed on June 22, 2017 as a Maryland corporation. We are an externally advised, perpetual-life real estate investment trust (“REIT”) and intend to qualify as a REIT for U.S. federal income tax purposes commencing with our taxable year ending December 31, 2019. We were formed to invest primarily in stabilized, income-oriented commercial real estate and debt secured by commercial real estate. Our portfolio is principally comprised of properties located in the United States, but may also be diversified on a global basis through investments in properties and debt secured by properties outside of the United States, with a focus on Europe. The Company is the sole general partner of Starwood REIT Operating

21