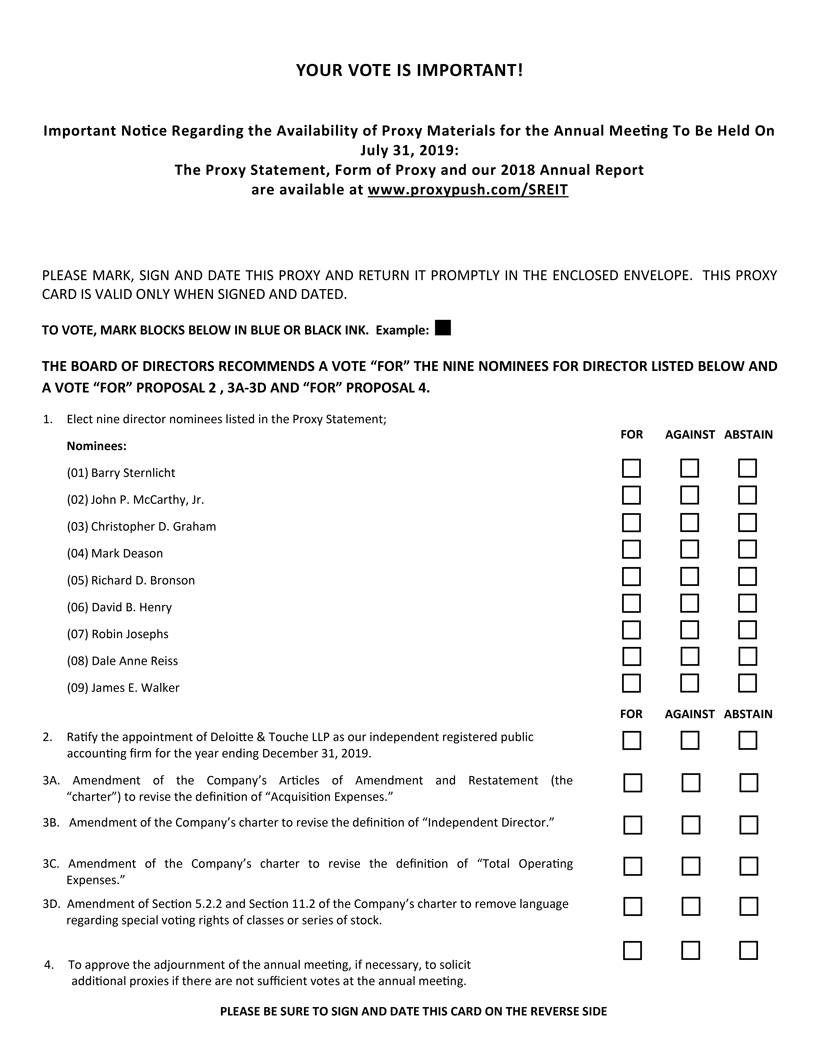

This amendment would cause our definition of “Acquisition Expenses” to more closely match that contained within the NASAA REITGuidelines. We do not expect this amendment to have a meaningful impact on us or our stockholders.

Proposal 3B — Proposal to amend definition of Independent Director

The second proposed charter amendment is to revise the definition of “Independent Director” in Article IV as follows:

“Independent Director” shall mean a Director who is not on the date of determination, and within the last two years from the date of determination has not been, directly or indirectly associated with the Sponsor or the Advisor by virtue of (i) ownership of an interest in the Sponsor, the Advisor or any of their Affiliates, other than an interest in the Corporation or an interest that is not material in any other Affiliatefor which the Director serves as a director, (ii) employment by the Sponsor, the Advisor or any of their Affiliates, (iii) service as an officer or director of the Sponsor, the Advisor or any of their Affiliates, (iv) performance of services, other than as a Director, for the Corporation, (v) service as a director or trustee of more than three REITs organized by the Sponsor or advised by the Advisor or (vi) maintenance of a material business or professional relationship with the Sponsor, the Advisor or any of their Affiliates. A business or professional relationship is considered “material” if the aggregate gross income derived by the Director from the Sponsor, the Advisor and their Affiliates exceeds 5% of either the Director’s annual gross income, derived from all sources, during either of the last two years or the Director’s net worth on a fair market value basis. An indirect association with the Sponsor or the Advisor shall include circumstances in which a Director’s spouse, parent, child, sibling, mother- orfather-in-law,son- ordaughter-in-law or brother- orsister-in-law is or has been associated with the Sponsor, the Advisor, any of their Affiliates or the Corporation.

The current definition of Independent Director in our charter has a variance from the language in the NASAA REITGuidelines whereby an interest in us or an interest that is not material in any other Affiliate (as defined in our charter) for which our director serves as a director will not prevent a person from being an Independent Director of our company. The proposed amendment would eliminate this variance. We do not expect this amendment to affect the current composition of our Board of Directors or have an impact on us or our stockholders.

Proposal 3C — Proposal to amend definition of Total Operating Expenses

The third proposed charter amendment is to revise the definition of “Total Operating Expenses” in Article IV as follows:

“Total Operating Expenses” shall mean all costs and expenses paid or incurred by the Corporation, as determined under generally accepted accounting principles, including advisory fees, but excluding: (i) the expenses of raising capital such as Organization and Offering Expenses, legal, audit, accounting, underwriting, brokerage, listing, registration and other fees, printing and other such expenses and taxes incurred in connection with the issuance, distribution, transfer, registration and Listing of the Shares, (ii) property level expenses incurred at each property, (iii) interest payments, (iv) taxes, (v)non-cash expenditures such as depreciation, amortization and bad debt reserves, (vi) incentive fees paid in compliance with Section 8.6, (vii) Acquisition Fees and Acquisition Expenses, (viii) real estate commissions on the Sale of Property and (ix) other fees and expenses connected with the acquisition, disposition, management and ownership of real estate interests, mortgage loans or other property (including the costs of foreclosure, insurance premiums, legal services, maintenance, repair and improvement of property).

This amendment would cause our definition of “Total Operating Expenses” to more closely match that contained within the NASAA REITGuidelines. We do not expect this amendment to have a meaningful impact on us or our stockholders.

38