References herein to “Starwood Real Estate Income Trust,” “Company,” “we,” “us,” or “our” refer to Starwood Real Estate Income Trust, Inc., a Maryland corporation, and its subsidiaries unless the context specifically requires otherwise.

General Description of Business and Operations

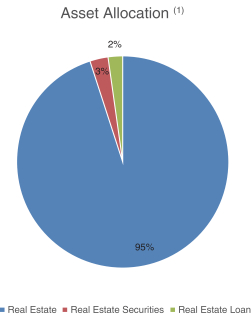

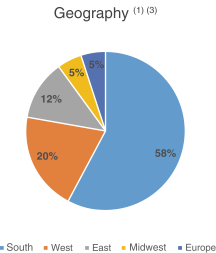

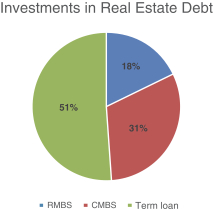

Starwood Real Estate Income Trust, Inc. (the “Company”) was formed on June 22, 2017 as a Maryland corporation and has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes commencing with the taxable year ended December 31, 2019. The Company was organized to invest primarily in stabilized, income-oriented commercial real estate and debt secured by commercial real estate. The Company’s portfolio is principally comprised of properties located in the United States. The Company may diversify its portfolio on a global basis through the acquisition of properties outside of the United States, with a focus on Europe. To a lesser extent, the Company invests in real estate debt, including loans secured by real estate and real estate-related securities. The Company is the sole general partner of Starwood REIT Operating Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”). Starwood REIT Special Limited Partner, L.L.C. (the “Special Limited Partner”), a wholly owned subsidiary of Starwood Capital Group Holdings, L.P. (the “Sponsor”), owns a special limited partner interest in the Operating Partnership. Substantially all of the Company’s business is conducted through the Operating Partnership. The Company and the Operating Partnership are externally managed by the Advisor, an affiliate of the Sponsor.

Our board of directors has at all times had oversight and policy-making authority over us, including responsibility for governance, financial controls, compliance and disclosure with respect to the Operating Partnership. Pursuant to an advisory agreement among the Advisor, the Operating Partnership and us (the “Advisory Agreement”), we have delegated to the Advisor the authority to source, evaluate and monitor our investment opportunities and make decisions related to the acquisition, management, financing and disposition of our assets, in accordance with our investment objectives, guidelines, policies and limitations, subject to oversight by our board of directors.

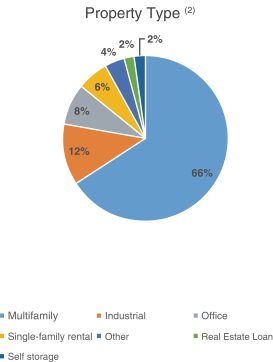

As of December 31, 2021, the Company owned 388 real estate properties, 2,595 single-family rental homes, one investment in an unconsolidated real-estate venture and 56 positions in real estate debt investments. The Company currently operates in nine reportable segments: Multifamily, Single-Family Rental, Hospitality, Industrial, Office, Self-Storage, Medical Office, Other and Investments in Real Estate Debt.

On December 27, 2017, the Company commenced its initial public offering of up to $5.0 billion in shares of common stock (the “Initial Public Offering”). On June 2, 2021, the Initial Public Offering terminated and the Company commenced a follow-on public offering of up to $10.0 billion in shares of common stock, consisting of up to $8.0 billion in shares in its primary offering and up to $2.0 billion in shares pursuant to its distribution reinvestment plan (the “Follow-on Public Offering”). On February 11, 2022, in accordance with the terms of the offering, we reallocated shares between the primary offering and distribution reinvestment plan. We reallocated $1,700,000,000 in shares from our distribution reinvestment plan to our primary offering, and as a result, we are now offering up to $9,700,000,000 in shares in our primary offering and up to $300,000,000 in shares pursuant to our distribution reinvestment plan. As of December 31, 2021, the Company had received aggregate net proceeds of $7.8 billion from the sale of shares of the Company’s common stock through the Company’s public offerings.

On February 8, 2022, the Company filed a registration statement on Form S-11 with the U.S. Securities and Exchange Commission (the “SEC”) for a second follow-on public offering of up to $18.0 billion in shares of its common stock, consisting of up to $16.0 billion in shares of common stock in its primary offering and up to $2.0 billion in shares of common stock pursuant to its distribution reinvestment plan. This offering has not yet been declared effective by the SEC.

As of March 28, 2022, we had received net proceeds of $9.8 billion from the sale of our common stock through our public offerings. We have contributed the net proceeds from our public offerings to the Operating Partnership

7