First Integrated Solution for Ultra- Sensitive Detection of Blood and Tissue Based Protein Biomarkers Uniquely positioned to speed up market development of new diagnostic testing solutions January 10, 2025

2 IMPORTANT ADDITIONAL INFORMATION In connection with the proposed transaction, Quanterix Corporation (“Quanterix” or “QTRX”) will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “registration statement”), which will contain a joint proxy statement of Quanterix and Akoya Biosciences, Inc. (“Akoya” or “AKYA”) and a prospectus of Quanterix (the “joint proxy statement/prospectus”), and each of Quanterix and Akoya may file with the SEC other relevant documents regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS CAREFULLY AND IN THEIR ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY QUANTERIX AND AKOYA, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT QUANTERIX, AKOYA AND THE PROPOSED TRANSACTION. A definitive copy of the joint proxy statement/prospectus will be mailed to Quanterix and Akoya stockholders when that document is final. Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus, as well as other filings containing information about Quanterix and Akoya, free of charge from Quanterix or Akoya or from the SEC’s website when they are filed. The documents filed by Quanterix with the SEC may be obtained free of charge at Quanterix’s website, at www.quanterix.com, or by requesting them by mail at Quanterix Investor Relations, 900 Middlesex Turnpike, Billerica, MA 01821. The documents filed by Akoya with the SEC may be obtained free of charge at Akoya’s website, at www.akoyabio.com, or by requesting them by mail at Akoya Investor Relations, 100 Campus Drive, 6th floor, Marlboro, MA 01752. PARTICIPANTS IN THE SOLICITATION Quanterix and Akoya and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Quanterix or Akoya in respect of the proposed transaction. Information about Quanterix’s directors and executive officers is available in Quanterix’s proxy statement dated April 15, 2024, for its 2024 Annual Meeting of Stockholders, and other documents filed by Quanterix with the SEC. Information about Akoya’s directors and executive officers is available in Akoya’s proxy statement dated April 23, 2024, for its 2024 Annual Meeting of Stockholders, and other documents filed by Akoya with the SEC. Other information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Quanterix or Akoya as indicated above. NO OFFER OR SOLICITATION This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger of Quanterix and Akoya, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Statements included in this presentation which are not historical in nature or do not relate to current facts are intended to be, and are hereby identified as, forward-looking statements for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on, among other things, projections as to the anticipated benefits of the proposed transaction as well as statements regarding the impact of the proposed transaction on Quanterix’s business and future financial and operating results, the amount and timing of synergies from the proposed transaction and the closing date for the proposed transaction. Words and phrases such as “may,” “approximately,” “continue,” “should,” “expects,” “projects,” “anticipates,” “is likely,” “look ahead,” “look forward,” “believes,” “will,” “intends,” “estimates,” “strategy,” “plan,” “could,” “potential,” “possible” and variations of such words and similar expressions are intended to identify such forward-looking statements. Quanterix and Akoya caution readers that forward-looking statements are subject to certain risks and uncertainties that are difficult to predict with regard to, among other things, timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks and uncertainties include, among others, the following possibilities: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement entered into between Quanterix and Akoya; the outcome of any legal proceedings that may be instituted against Quanterix or Akoya; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction) and stockholder approvals or to satisfy any of the other conditions to the proposed transaction on a timely basis or at all; the possibility that the anticipated benefits and synergies of the proposed transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Quanterix and Akoya do business; the possibility that the proposed transaction may be more expensive to complete than anticipated; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; changes in Quanterix’s share price before the closing of the proposed transaction; risks relating to the potential dilutive effect of shares of Quanterix common stock to be issued in the proposed transaction; and other factors that may affect future results of Quanterix, Akoya and the combined company. Additional factors that could cause results to differ materially from those described above can be found in Quanterix’s Annual Report on Form 10-K for the year ended December 31, 2023, as amended, Akoya’s Annual Report on Form 10-K for the year ended December 31, 2023, and in other documents Quanterix and Akoya file with the SEC, which are available on the SEC’s website at www.sec.gov. Legal Information

3 CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS (CONTD.) All forward-looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to herein. If one or more events related to these or other risks or uncertainties materialize, or if Quanterix’s or Akoya’s underlying assumptions prove to be incorrect, actual results may differ materially from what Quanterix and Akoya anticipate. Quanterix and Akoya caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and are based on information available at that time. Neither Quanterix nor Akoya assumes any obligation to update or otherwise revise any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. USE OF FINANCIAL PROJECTIONS This presentation contains projected financial information with respect to the combined company that will result from the proposed transaction, if consummated. Such projected financial information constitutes forward-looking information, is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. Actual results may differ materially from the results contemplated by the projected financial information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Neither Quanterix’s nor Akoya’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for purposes of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for purposes of this presentation. USE OF NON-GAAP FINANCIAL MEASURES To supplement Quanterix's preliminary financial information presented on a GAAP basis, Quanterix has provided certain non-GAAP financial measures, including non-GAAP gross margin. Management uses these non-GAAP measures to evaluate our operating performance in manner that allows for meaningful period-to-period comparison and analysis of trends in our business and our competitors. Management believes that presentation of these non-GAAP measures provides useful information to investors in assessing our operating performance within our industry and in order to allow comparability to the presentation of other companies in our industry. The non-GAAP financial information presented herein should be considered in conjunction with, and not as a substitute for, the financial information presented in accordance with GAAP. Unless otherwise specified, all information contained herein is provided as of September 30, 2024. Legal Information

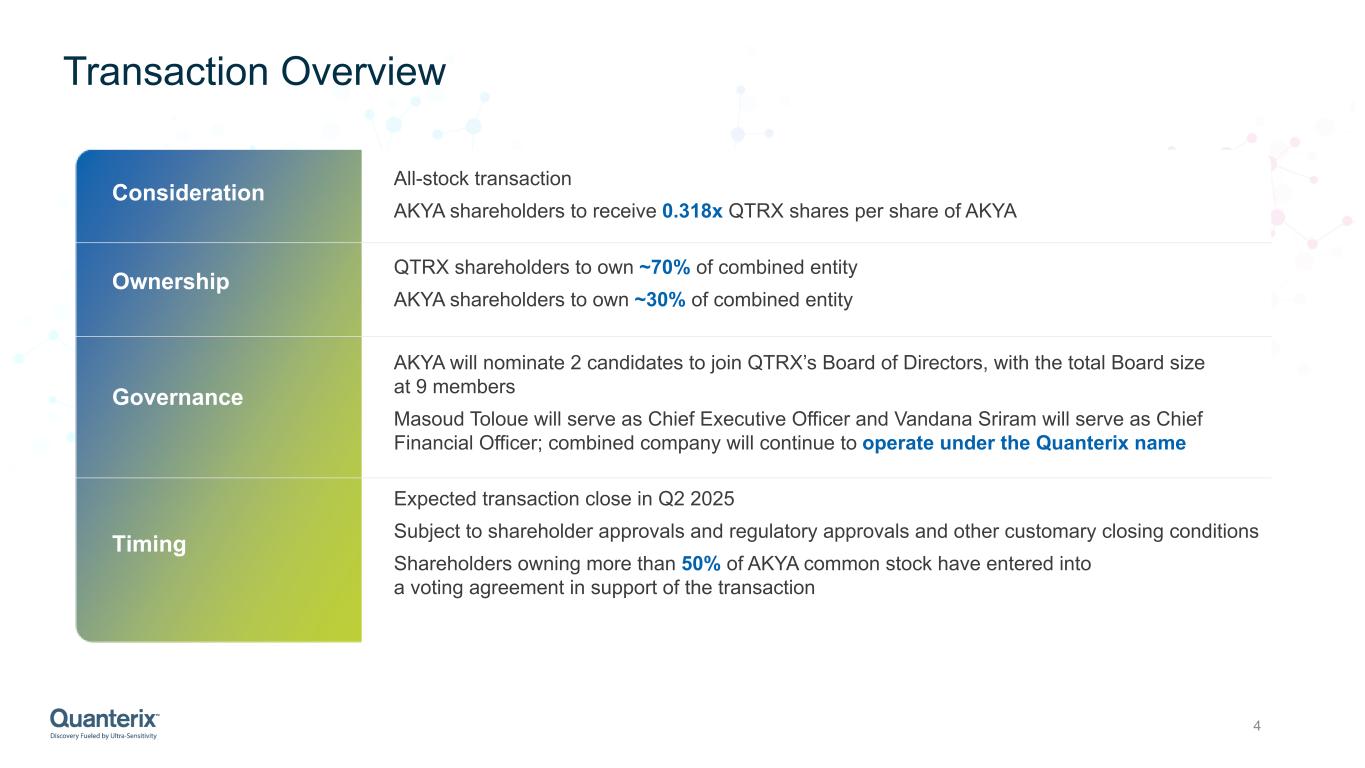

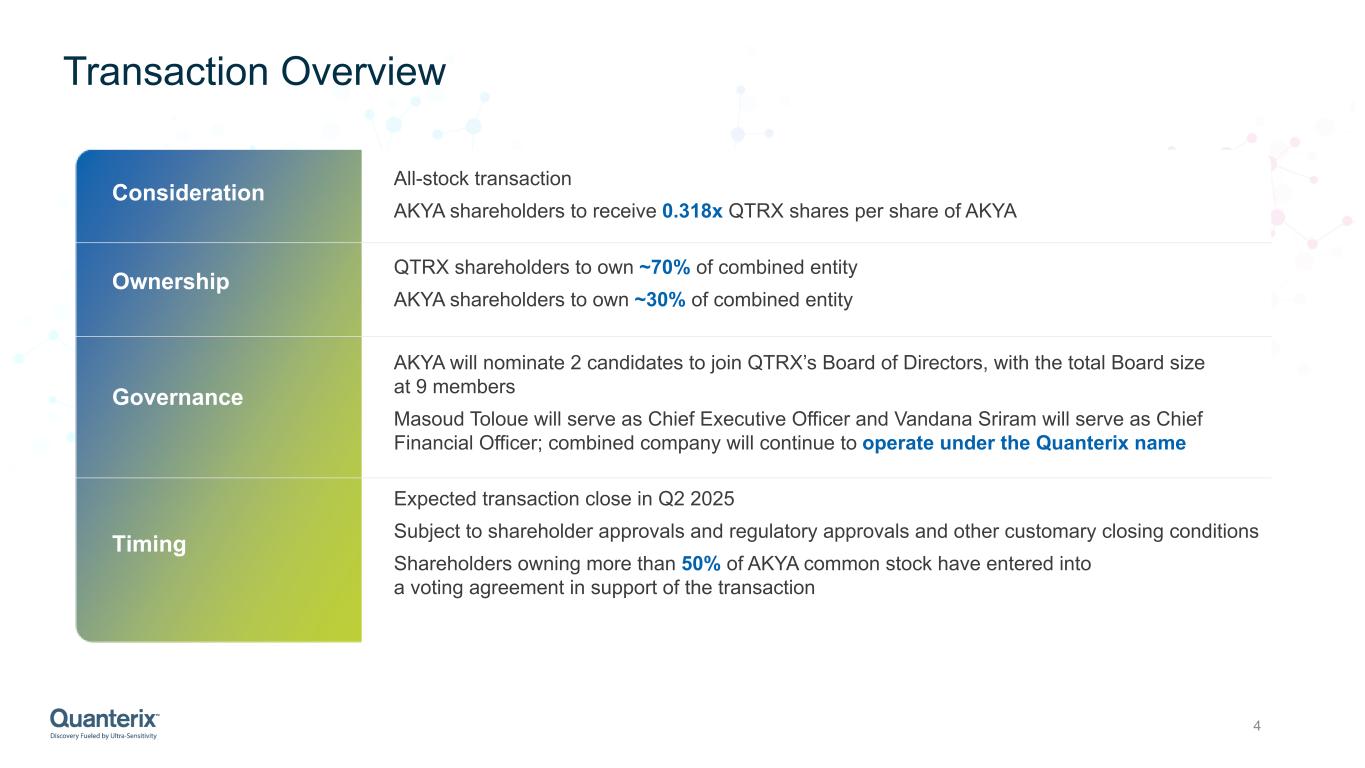

Transaction Overview 4 All-stock transaction AKYA shareholders to receive 0.318x QTRX shares per share of AKYA QTRX shareholders to own ~70% of combined entity AKYA shareholders to own ~30% of combined entity AKYA will nominate 2 candidates to join QTRX’s Board of Directors, with the total Board size at 9 members Masoud Toloue will serve as Chief Executive Officer and Vandana Sriram will serve as Chief Financial Officer; combined company will continue to operate under the Quanterix name Expected transaction close in Q2 2025 Subject to shareholder approvals and regulatory approvals and other customary closing conditions Shareholders owning more than 50% of AKYA common stock have entered into a voting agreement in support of the transaction Consideration Ownership Governance Timing

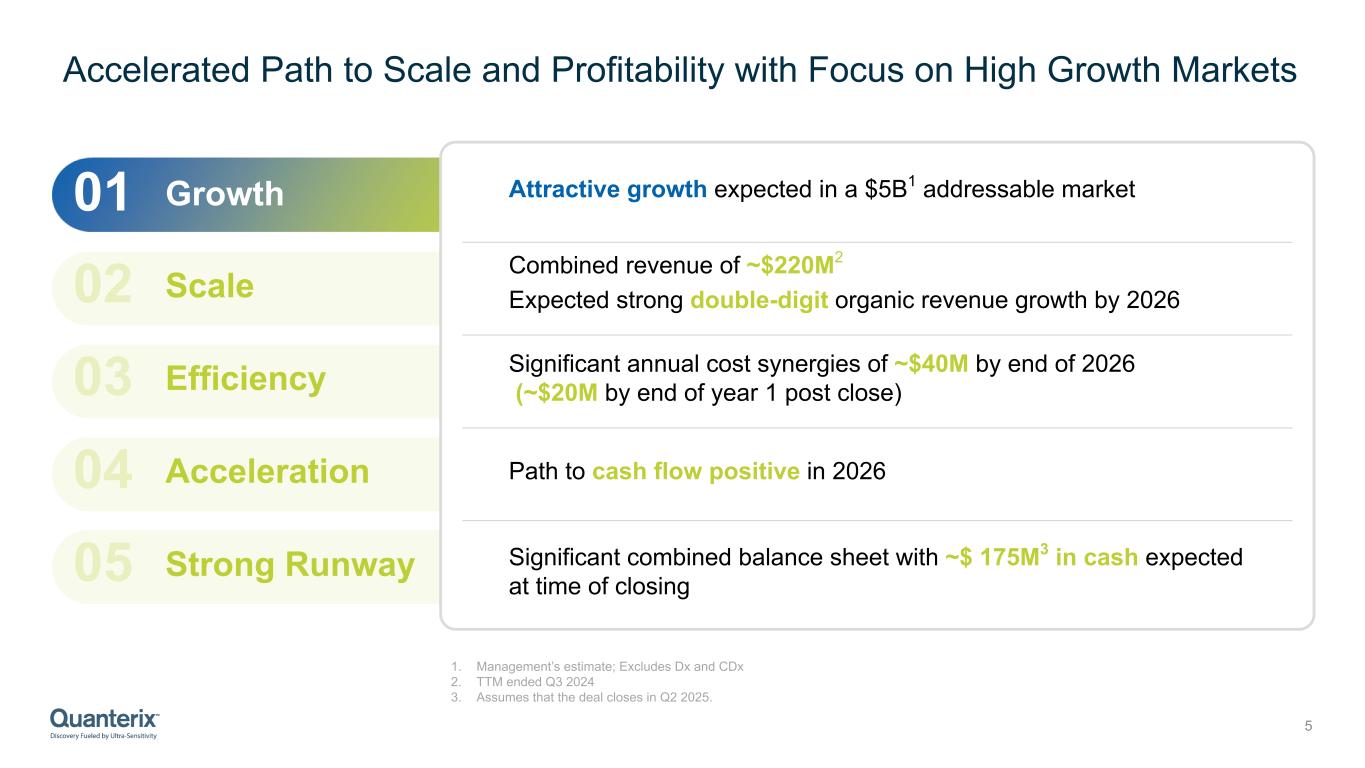

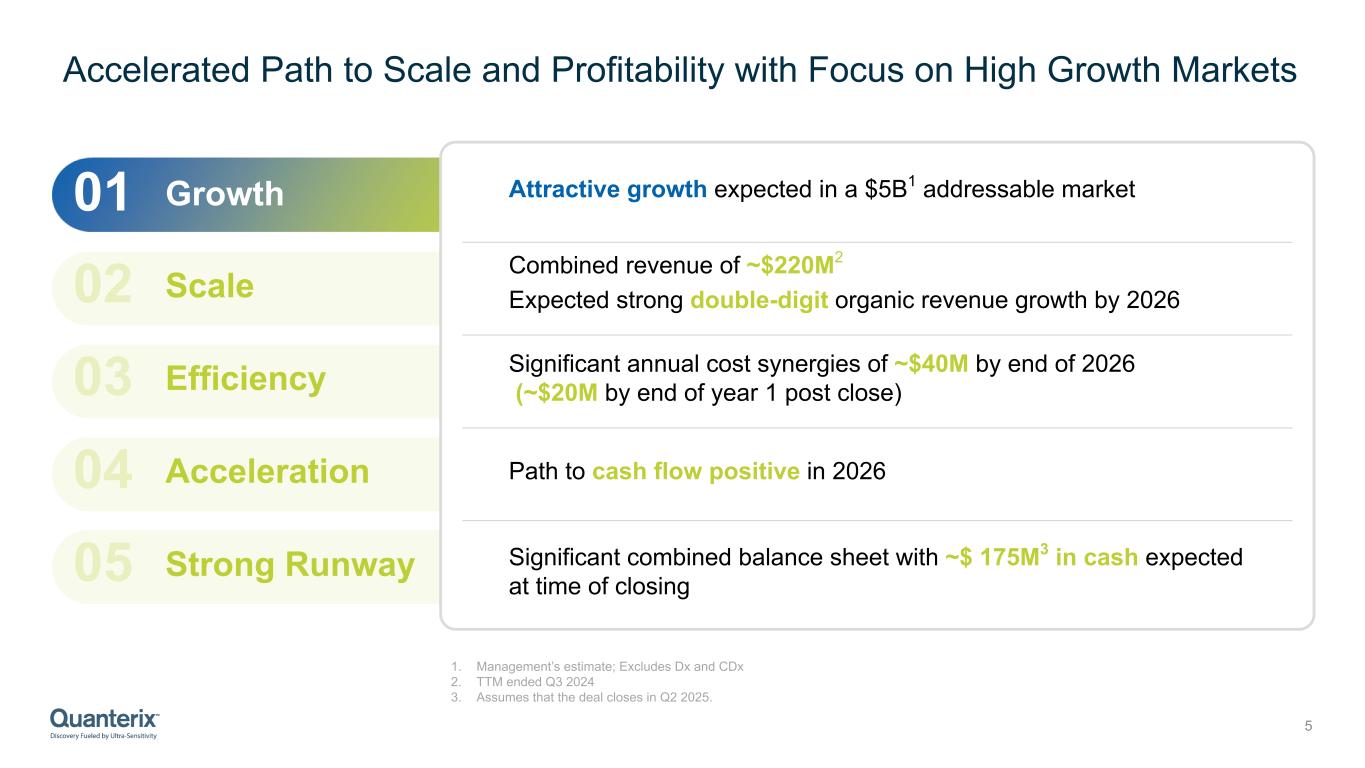

Accelerated Path to Scale and Profitability with Focus on High Growth Markets 5 01 Growth 02 Scale 03 Efficiency 04 Acceleration 05 Strong Runway Combined revenue of ~$220M2 Expected strong double-digit organic revenue growth by 2026 Significant annual cost synergies of ~$40M by end of 2026 (~$20M by end of year 1 post close) Path to cash flow positive in 2026 Significant combined balance sheet with ~$ 175M3 in cash expected at time of closing Attractive growth expected in a $5B1 addressable market 1. Management’s estimate; Excludes Dx and CDx 2. TTM ended Q3 2024 3. Assumes that the deal closes in Q2 2025.

Quanterix Today Leader in Ultra-Sensitive Biomarker Detection 1. Guidance as of November 12, 2024 2. GAAP gross margin guidance range of 57-61%. Projected GAAP gross margin does not include shipping and handling costs, which include freight and other activities costs associated with product shipments. Non-GAAP gross margin includes these shipping and handling costs. 6 Publications Installed Base2024 Revenue Guidance1 2024 Non-GAAP Gross Margin1 Guidance Unmatched Technology Proven track record of operating discipline Early penetration in multi-billion diagnostics CLIA lab running validated neuro LDTs North America: 65% | EMEA: 26% | APAC: 9% Revenue by Geography

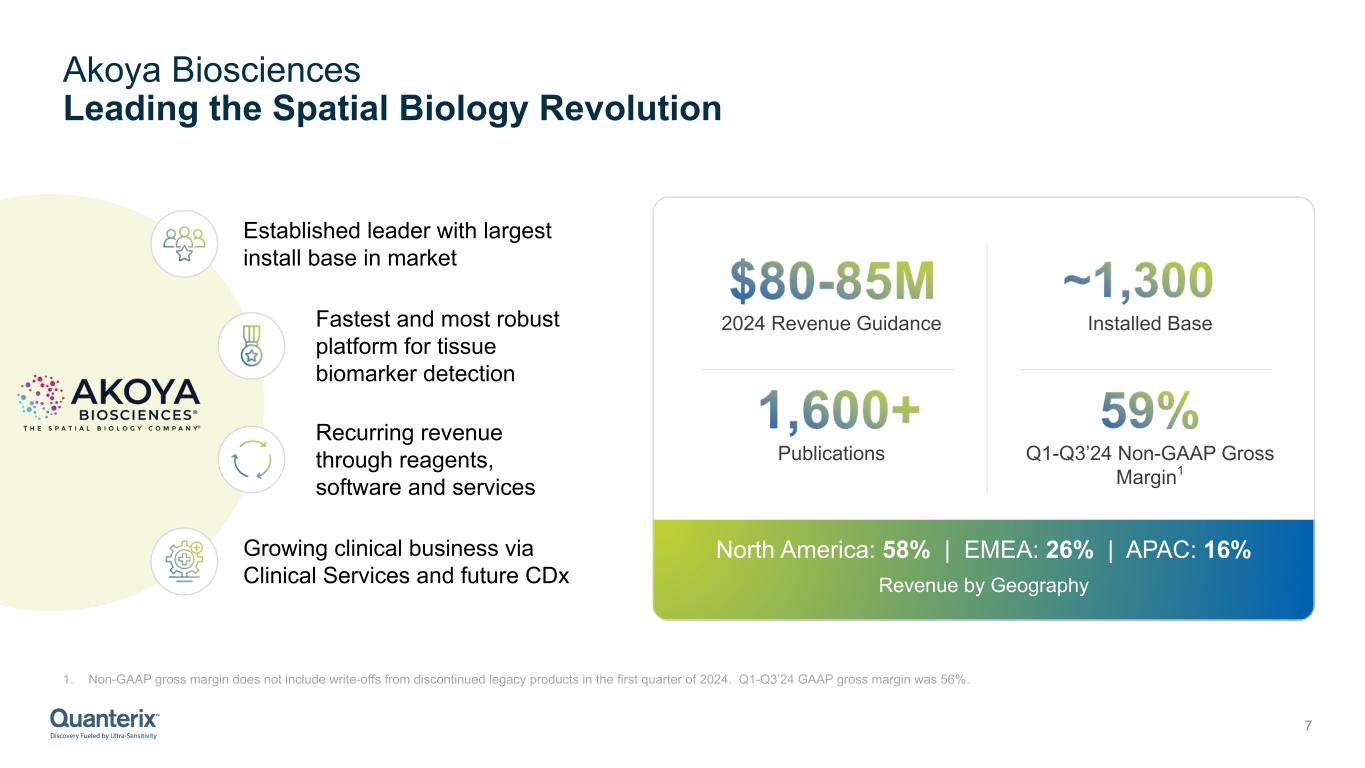

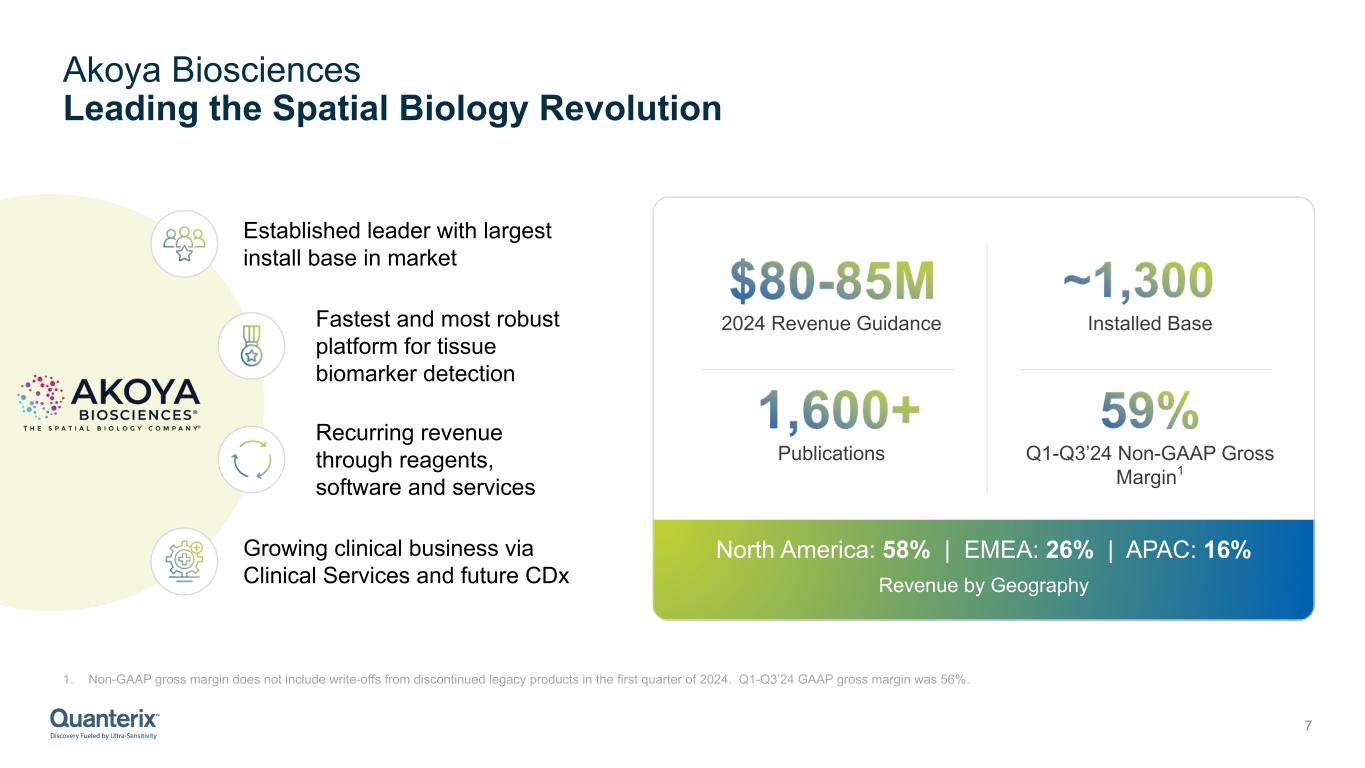

Akoya Biosciences Leading the Spatial Biology Revolution 7 Publications Installed Base2024 Revenue Guidance Q1-Q3’24 Non-GAAP Gross Margin1 Established leader with largest install base in market Fastest and most robust platform for tissue biomarker detection Recurring revenue through reagents, software and services Growing clinical business via Clinical Services and future CDx North America: 58% | EMEA: 26% | APAC: 16% Revenue by Geography 1. Non-GAAP gross margin does not include write-offs from discontinued legacy products in the first quarter of 2024. Q1-Q3’24 GAAP gross margin was 56%.

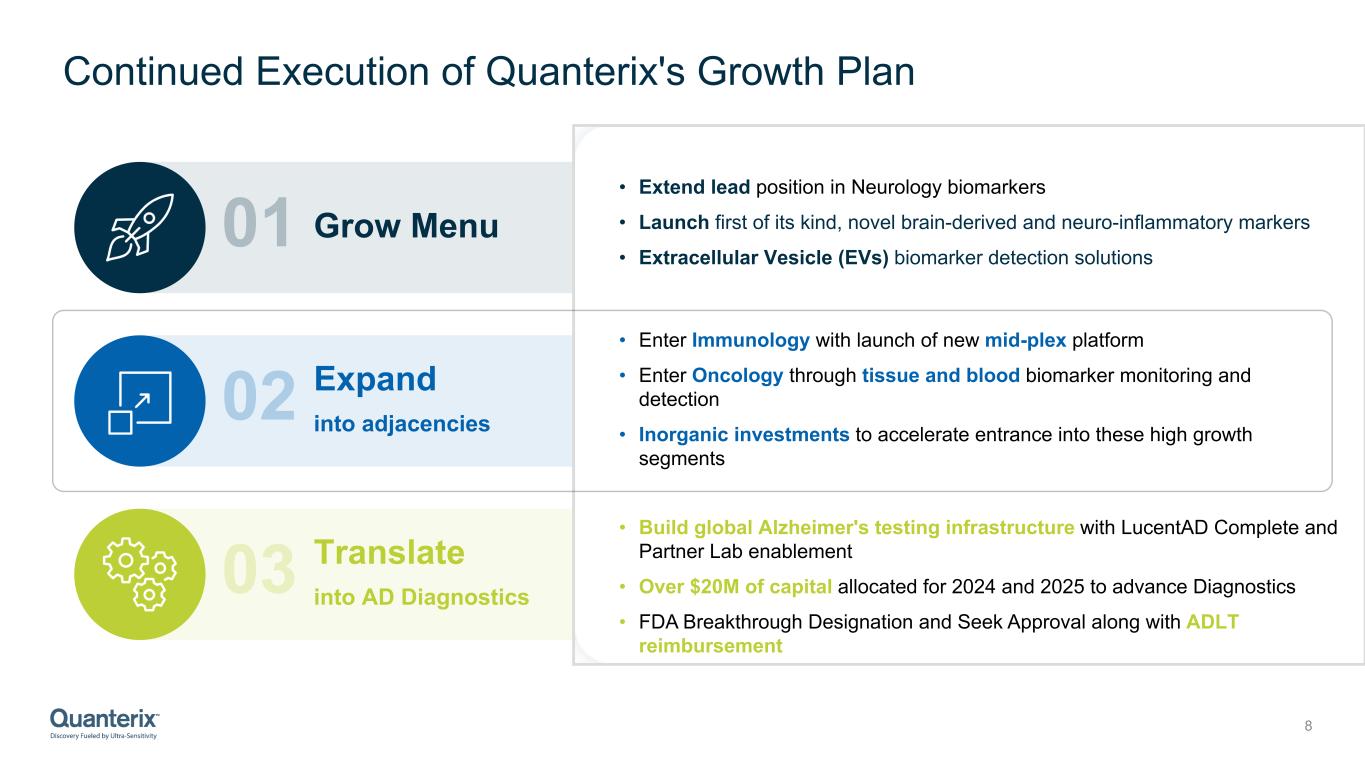

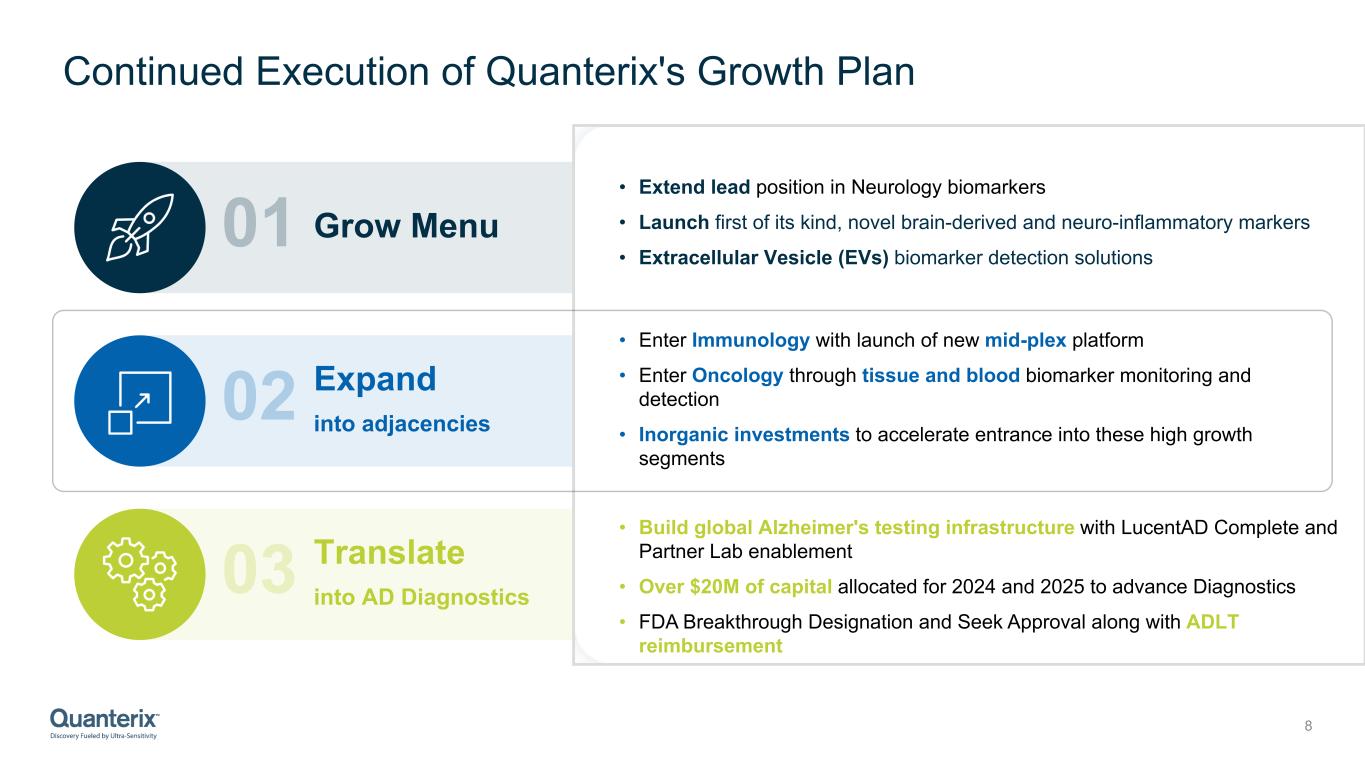

Continued Execution of Quanterix's Growth Plan 8 02 03 01 Grow Menu Expand into adjacencies Translate into AD Diagnostics • Extend lead position in Neurology biomarkers • Launch first of its kind, novel brain-derived and neuro-inflammatory markers • Extracellular Vesicle (EVs) biomarker detection solutions • Enter Immunology with launch of new mid-plex platform • Enter Oncology through tissue and blood biomarker monitoring and detection • Inorganic investments to accelerate entrance into these high growth segments • Build global Alzheimer's testing infrastructure with LucentAD Complete and Partner Lab enablement • Over $20M of capital allocated for 2024 and 2025 to advance Diagnostics • FDA Breakthrough Designation and Seek Approval along with ADLT reimbursement

Immediate Opportunity to Increase Serviceable Addressable Market * Management’s estimate; Excludes Dx and CDx 9 Addition of cutting-edge spatial biology capabilities Technology portfolio addresses customer needs in high growth markets in neurology, oncology and immunology Akoya’s position in oncology and immunology is complementary to Quanterix’s industry-leading position in neurology and launch of new mid-plex platform Combined commercial platform and cross-selling opportunities enable further market developmentCombined Instrument Installed-Base ~2,300 $3B* $5B* ~1,000 SIMOA installed base Launch of Quanterix’s new mid-plex platform + Immunology Mid-plex Segment + Tissue Spatial Biology solutions ~1,300 Akoya installed base with focus on oncology and immunology $1B*

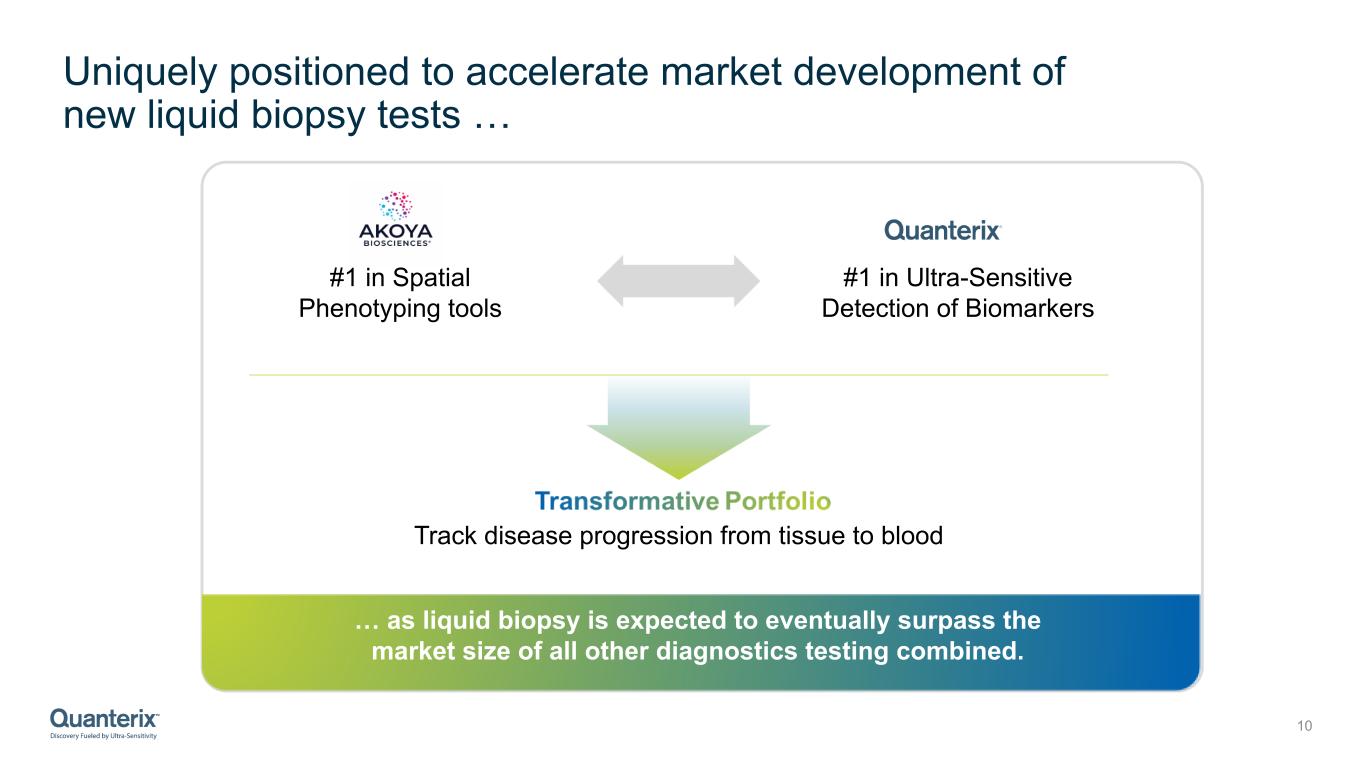

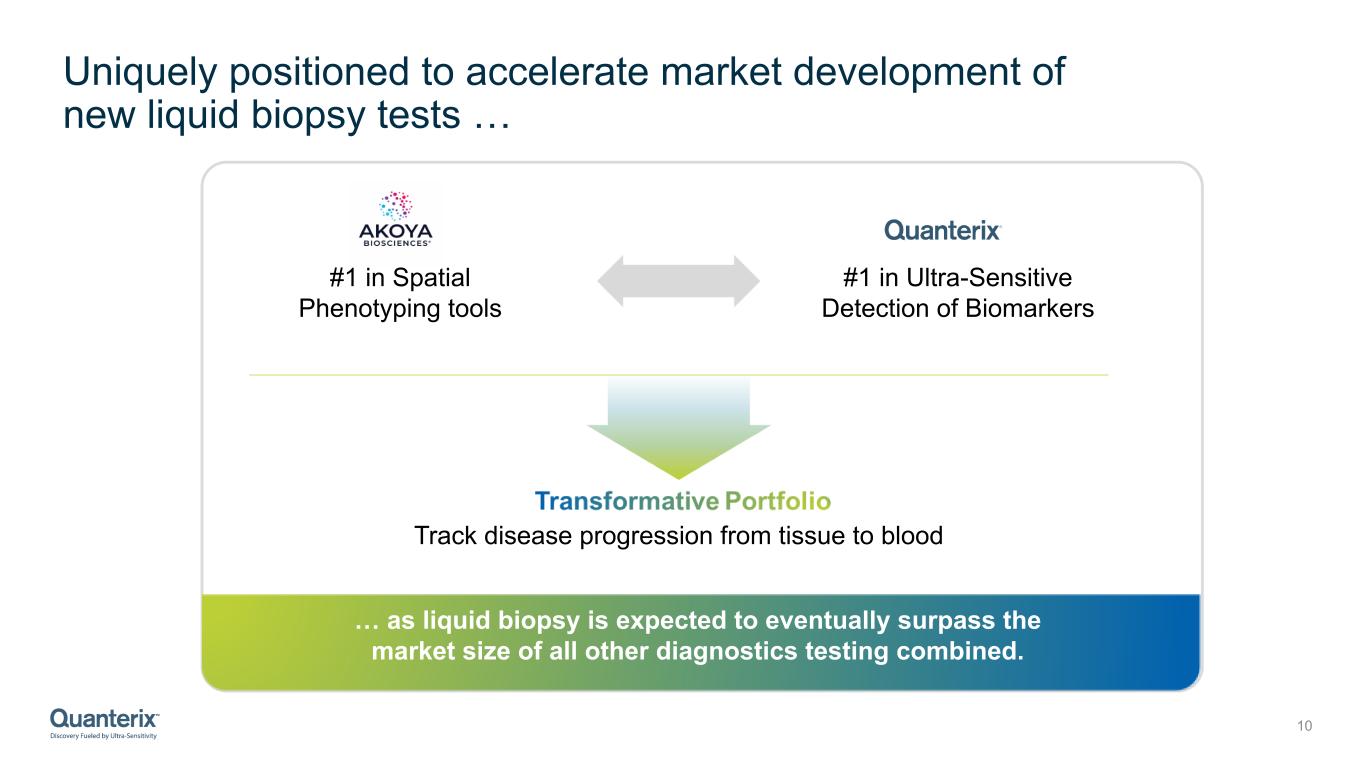

Uniquely positioned to accelerate market development of new liquid biopsy tests … 10 #1 in Ultra-Sensitive Detection of Biomarkers Track disease progression from tissue to blood #1 in Spatial Phenotyping tools … as liquid biopsy is expected to eventually surpass the market size of all other diagnostics testing combined.

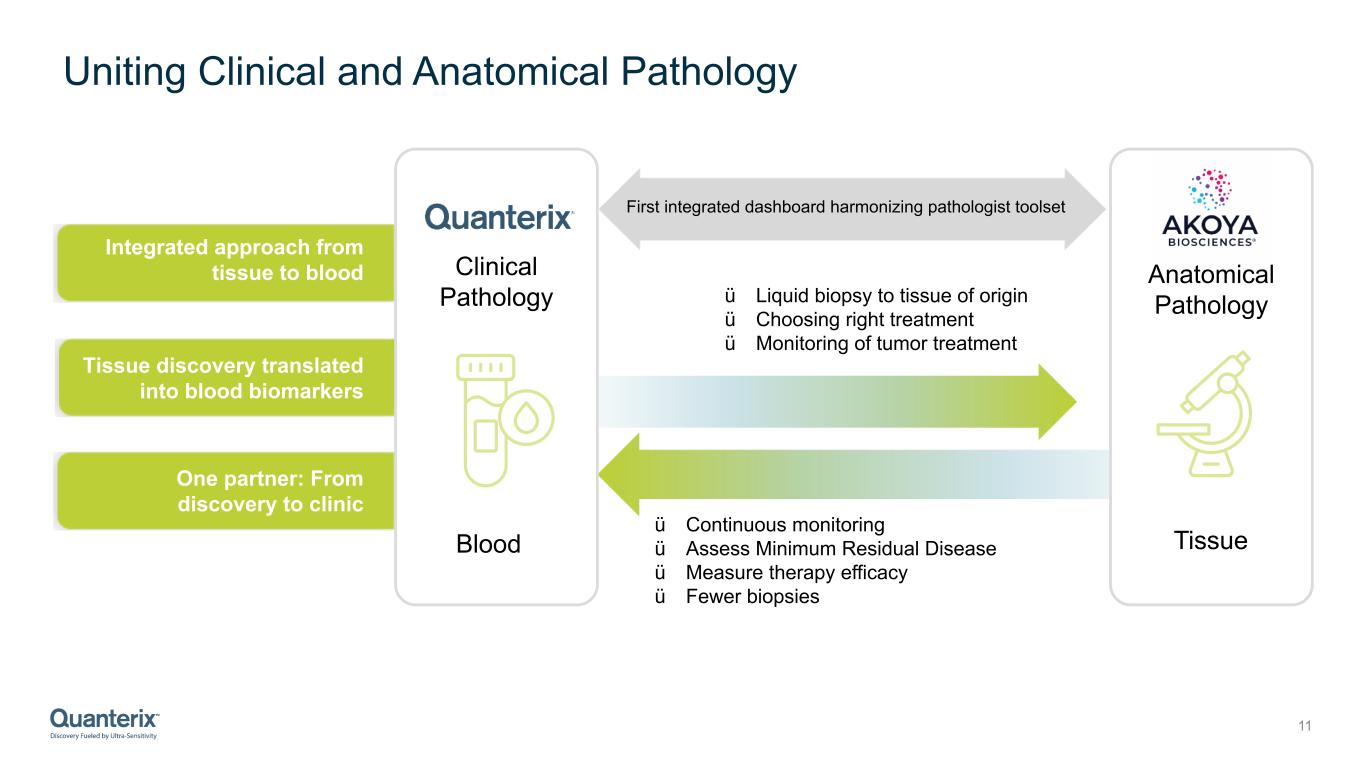

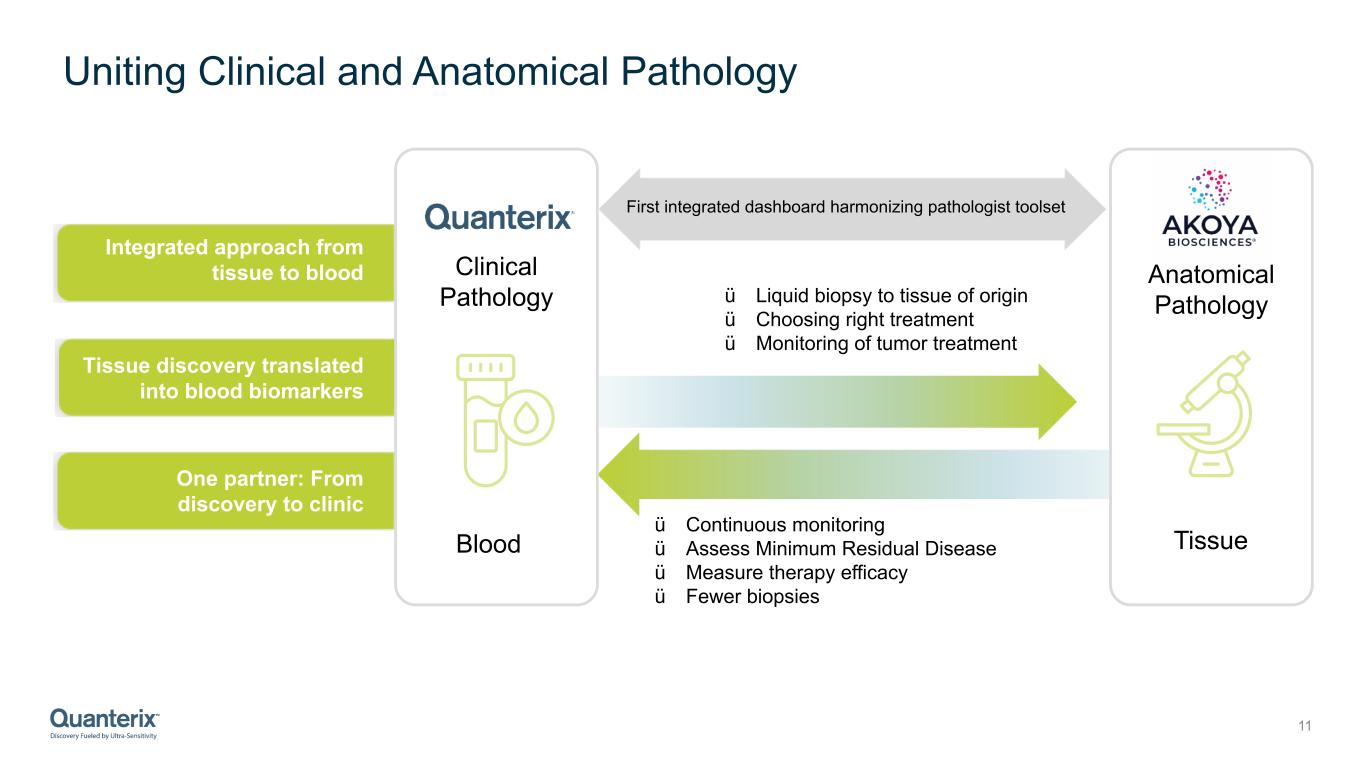

Uniting Clinical and Anatomical Pathology 11 ü Liquid biopsy to tissue of origin ü Choosing right treatment ü Monitoring of tumor treatment ü Continuous monitoring ü Assess Minimum Residual Disease ü Measure therapy efficacy ü Fewer biopsies First integrated dashboard harmonizing pathologist toolset Integrated approach from tissue to blood Tissue discovery translated into blood biomarkers One partner: From discovery to clinic Clinical Pathology Blood Tissue Anatomical Pathology

Complementary Technology and Service Offerings Expand Commercial Reach 12 Assay & ReagentsInstruments Lab Testing Services HD-X SR-X SP-X Ultra-sensitive SIMOA Instruments – Benchtop & Sample to Answer Catalog and custom assays in Single-plex and multiplex formats CLIA certified lab with wide menu of tests through Accelerator Laboratory Integrated end-to-end workflow and fastest whole-slide multispectral imaging system Low to Ultrahigh-plex protein and RNA panels; scalable to 100+ biomarkers CLIA certified lab offering custom assay development through Advanced Biopharma Solutions (ABS) Diagnostics +90% Broad Alzheimer’s Disease menu with multi-marker offering with plans to pursue IVD LucentAD Complete Ongoing Phase II Immunoprint assay in early-stage melanoma patients Ovarian, Endometrial & Bladder platinum resistant indicator Pipeline of Companion Diagnostics (CDx) commercialization potential Sensitivity, Specificity & Accuracy PhenoCycIer- Fusion 2.0 Phenolmager HT 2.0

Combined Company: Strong Double-Digit Organic Growth by 2026 13 Uniquely positioned to speed market development of new liquid biopsy tests Apply consumables product development engine to accelerate growth of new biomarker pairs across tissue and blood. Suite of synergistic biomarkers already in development. Over past 2 years, Quanterix grew reagents by 24%. Menu01 Replicate Quanterix’s Accelerator model to expand Akoya’s Tissue testing services portfolio. Over past 2 years, Quanterix's Accelerator services grew 33%Services02 Install base expansion creates new cross-selling opportunities. Combined install base of ~2,300 instruments Doubling of footprint03 With upside opportunity in a potential multi-billion Alzheimer’s and Companion Diagnostics segment

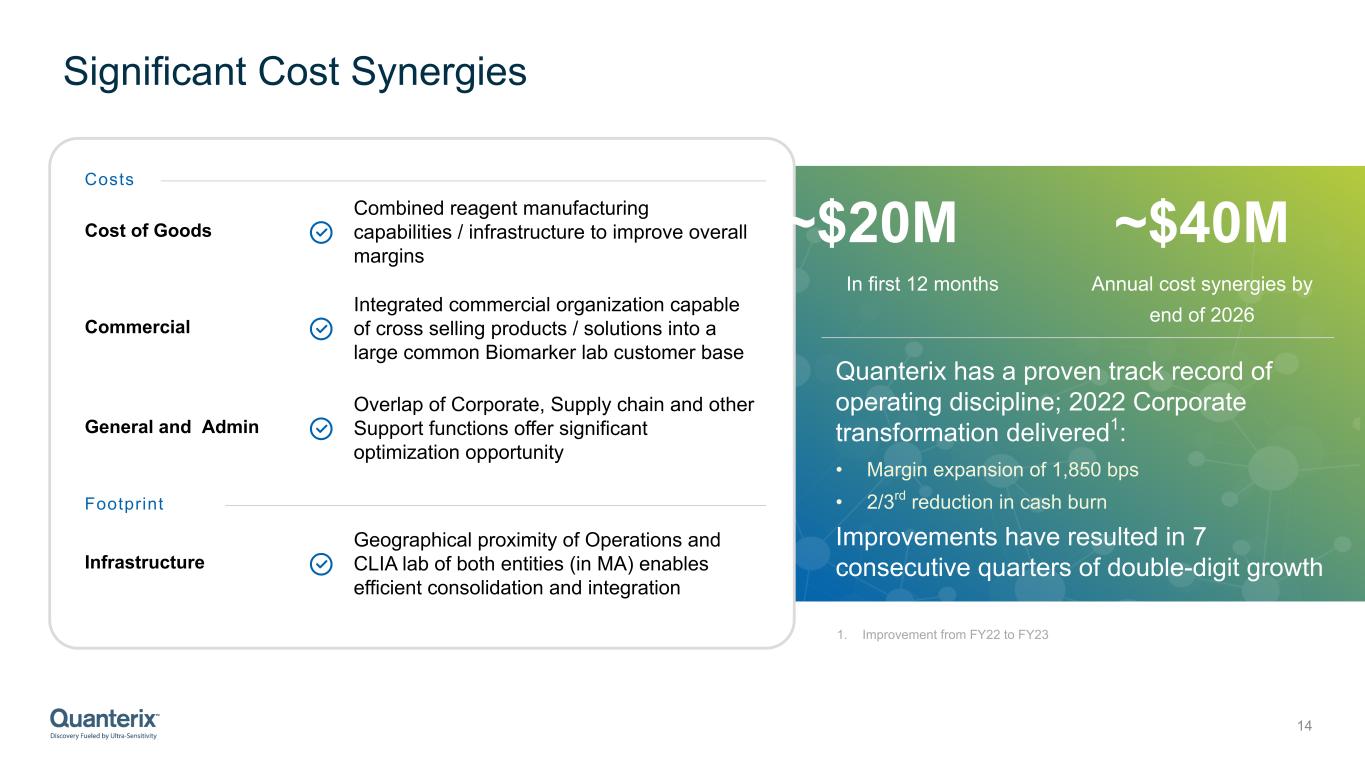

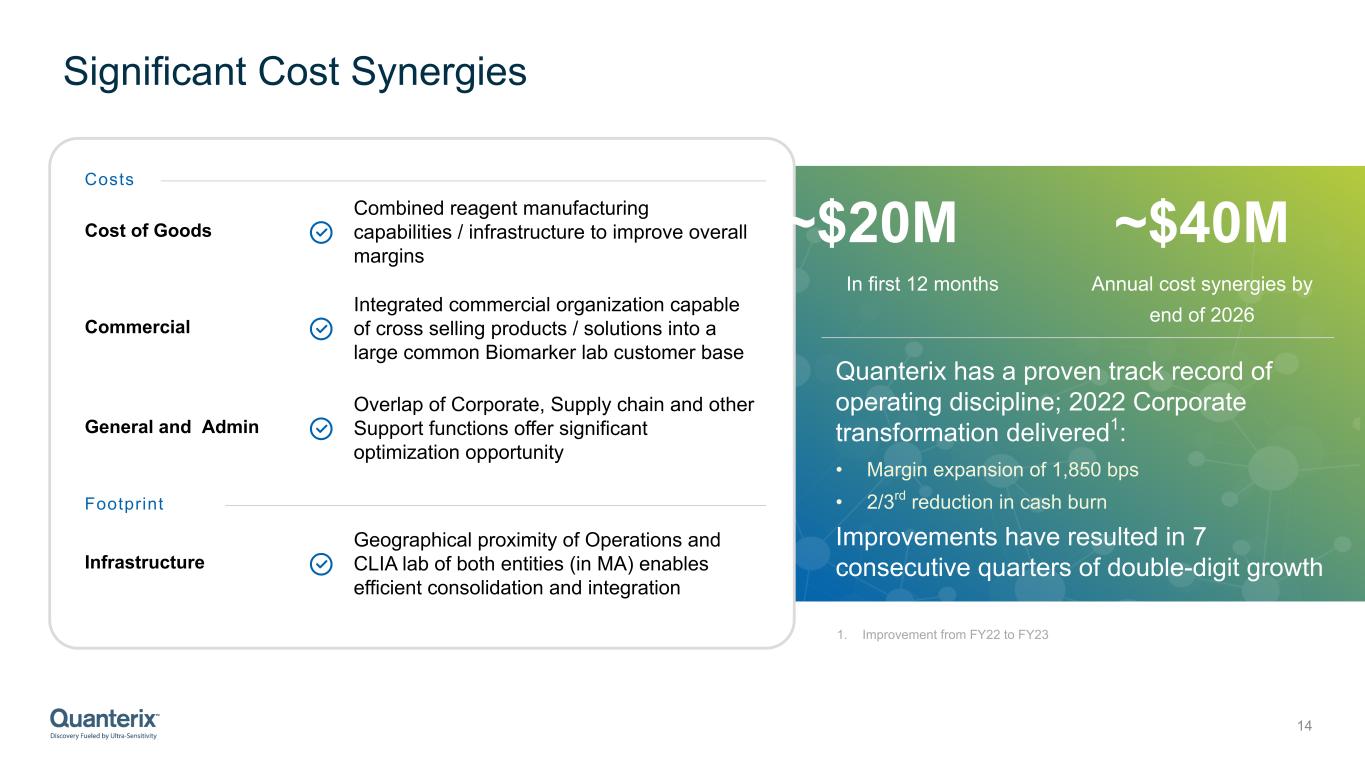

Significant Cost Synergies 14 General and Admin Costs Cost of Goods Combined reagent manufacturing capabilities / infrastructure to improve overall margins Overlap of Corporate, Supply chain and other Support functions offer significant optimization opportunity Footprint Infrastructure Geographical proximity of Operations and CLIA lab of both entities (in MA) enables efficient consolidation and integration Commercial Integrated commercial organization capable of cross selling products / solutions into a large common Biomarker lab customer base ~$40M Annual cost synergies by end of 2026 ~$20M In first 12 months Quanterix has a proven track record of operating discipline; 2022 Corporate transformation delivered1: • Margin expansion of 1,850 bps • 2/3rd reduction in cash burn Improvements have resulted in 7 consecutive quarters of double-digit growth 1. Improvement from FY22 to FY23

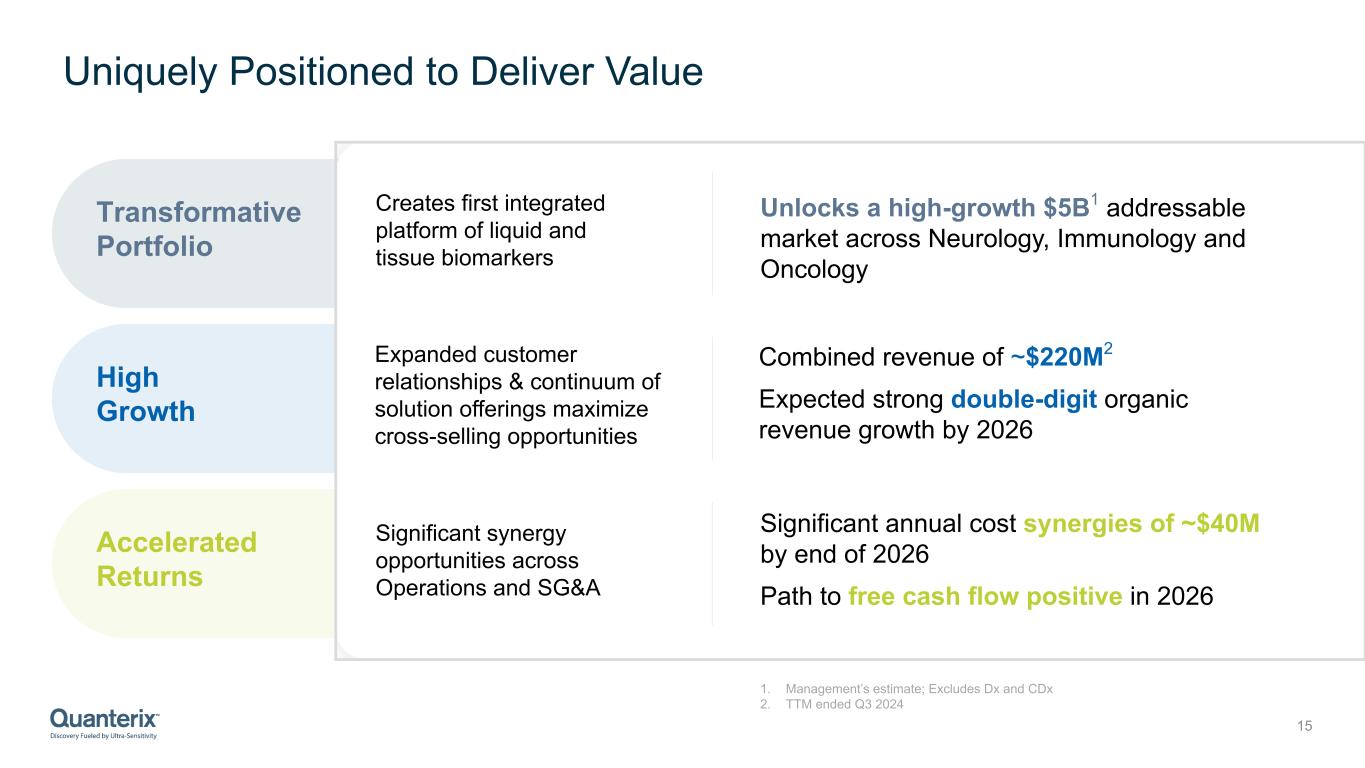

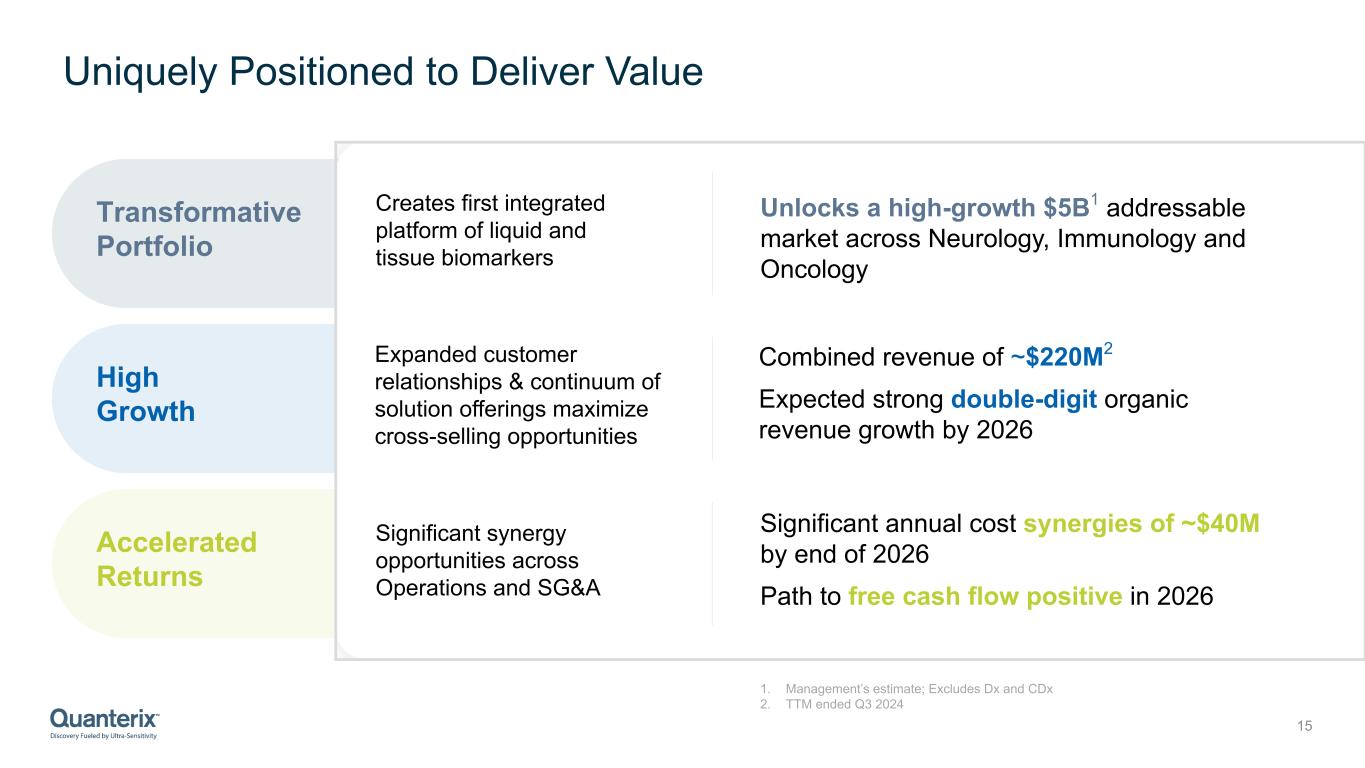

Uniquely Positioned to Deliver Value 15 Significant synergy opportunities across Operations and SG&A Expanded customer relationships & continuum of solution offerings maximize cross-selling opportunities Creates first integrated platform of liquid and tissue biomarkers Unlocks a high-growth $5B1 addressable market across Neurology, Immunology and Oncology Combined revenue of ~$220M2 Expected strong double-digit organic revenue growth by 2026 Significant annual cost synergies of ~$40M by end of 2026 Path to free cash flow positive in 2026 Transformative Portfolio High Growth Accelerated Returns 1. Management’s estimate; Excludes Dx and CDx 2. TTM ended Q3 2024