CORPORATE HISTORY AND STRUCTURE

Corporate History of RISE

In July 2013, Bain Capital Rise Education II Cayman Limited was incorporated as an exempted company under the laws of the Cayman Islands, and it was renamed as RISE Education Cayman Ltd in June 2017.

In July 2013, Rise IP (Cayman) Limited (“Rise IP”), was incorporated as an exempted company under the laws of the Cayman Islands. Subsequently, a number of RISE’s wholly owned subsidiaries were established to acquire Rise IP and certain operating assets and entered into a series of contractual arrangements with Beijing Step Ahead Education Technology Development Co., Ltd. (the “Rise VIE”), its schools and its shareholders. As a result, the RISE VIE and its subsidiaries and schools became RISE’s consolidated entities.

RISE listed the ADSs on the Nasdaq under the symbol “REDU” on October 20, 2017.

The Assets Sale

Prior to becoming a shell company, RISE Education Cayman Ltd was a holding company without substantive operations. RISE Education Cayman Ltd, primarily through its PRC subsidiary, Rise (Tianjin) Education Information Consulting Co., Ltd. (the “Rise WFOE”), and the Rise VIE, provided after-school English teaching and tutoring services to students aged three to 18 in China and was a leading service provider in the China market.

On December 1, 2021, Wuhan Xinsili Culture Development Co., Ltd. (the “Buyer SPV”), Rise WFOE, Rise VIE, RISE Education International Limited (“Rise HK”), Rise IP and RISE entered into a purchase agreement (the “WFOE Purchase Agreement”). Pursuant to the WFOE Purchase Agreement, RISE agreed to, through Rise HK, sell all of the equity interests in Rise WFOE to the Buyer SPV (the “WFOE Sale”), in consideration of the Buyer SPV (i) paying to Rise HK a consideration of RMB1, and (ii) assuming all liabilities of Rise WFOE and its subsidiaries. The Buyer SPV is a limited liability company controlled by a buyer consortium consisting of certain of RISE’s franchisees and an affiliate of RISE’s senior management, who are PRC nationals.

Also on December 1, 2021, Rise Education Cayman I Ltd, RISE’s wholly-owned indirect subsidiary (the “IP Seller”), Bain Capital Rise Education IV Cayman Limited, a major shareholder of RISE (the “Major Shareholder”), and RISE entered into a share purchase agreement (the “IP Holdco Purchase Agreement”, collectively with the WFOE Purchase Agreement, the “Purchase Agreements”). The IP Seller is also the borrower under the Facilities Agreement (defined below). Pursuant to the IP Holdco Purchase Agreement, the IP Seller and RISE agreed to sell all of the equity interests in Rise HK and Rise IP to the Major Shareholder in consideration of the Major Shareholder (i) paying US$2,500,000 to RISE, for the purposes of paying the Lenders in settlement of the Facilities Agreement, and (ii) causing Rise HK and Rise IP to grant Rise WFOE or entities designated by the Buyer SPV a royalty-free, perpetual, irrevocable and exclusive license over all intellectual property rights owned by or licensed to Rise HK and/or Rise IP (the “IP Sale”, and together with the WFOE Sale, the “Sale”).

In connection with the Sale, the IP Seller (being the borrower under the Facilities Agreement), WFOE, VIE and the Major Shareholder and certain other parties entered into a settlement agreement (the “Settlement Agreement”) with the Lenders on December 1, 2021. Under the Settlement Agreement, the Lenders agreed to (i) acknowledge and consent to the Sale, (ii) discharge and release all our liabilities and obligations and our subsidiaries under the Facilities Agreement in the amount of US$55,746,367.04; (iii) terminate, release and discharge all security interest, guarantee and indemnity created in connection with the Facilities Agreement; and (iv) waive, release and discharge all claims arising from or in connection with the Facilities Agreement, in exchange for (a) an aggregate amount of US$10,377,972.06, and (b) the transfer of all interest in certain business to a person nominated by the Lenders, amongst others (collectively, the “ “Settlement”).

In order for us to make the settlement payment under the Settlement Agreement, make an additional capital contribution to WFOE pursuant to the WFOE Purchase Agreement and pay for certain operating expenses, we entered into a convertible loan deed with the Major Shareholder on December 1, 2021 (the “Convertible Loan Deed”), pursuant to which the Major Shareholder agreed to provide an interest-free convertible loan of US$17 million to us. The loan was converted into 48,571,428 ordinary shares prior to the consummation of the Mergers.

The Sale was approved by a special resolution of shareholders of RISE at an extraordinary general meeting of shareholders held in Beijing on December 23, 2021. The Sale was consummated and the Settlement was entered into on December 30, 2021.

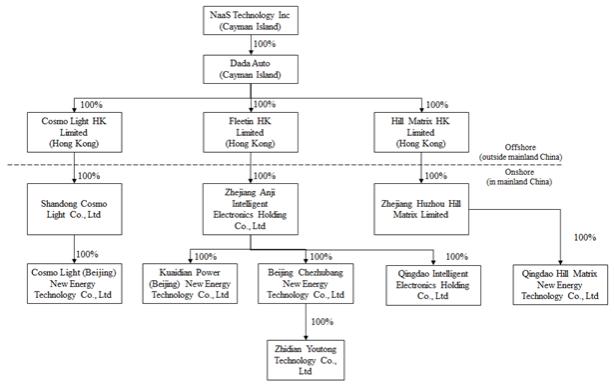

Corporate History of NaaS

NaaS launched its EV charging services in 2019 through Chezhubang (Beijing) Technology Co., Ltd. (“Chezhubang Technology”), and its subsidiaries Beijing Chezhubang New Energy Technology Co., Ltd. (“Beijing Chezhubang”) and Kuaidian Power (Beijing) New Energy Technology Co., Ltd. (“Kuaidian Power Beijing”), which were established by Chezhubang Technology in July 2018 and August 2019, respectively.

61