UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

Liberty Latin America Ltd.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x No fee required.

¨ Fee paid previously with preliminary materials

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

l

LIBERTY LATIN AMERICA LTD.

Clarendon House,

2 Church Street,

Hamilton HM 11, Bermuda

(441) 295-5950 or (303) 925-6000

April 4, 2024

Dear Shareholder:

You are invited to attend the 2024 Annual General Meeting of Shareholders of Liberty Latin America Ltd. to be held at 4:00 p.m. Bermuda time (3:00 p.m. New York City time), on Tuesday, May 21, 2024, at the Rosewood Bermuda, 60 Tucker’s Point Drive, Hamilton Parish, HS 02 Bermuda, telephone number +1 (441) 298-4000. At the Annual General Meeting, you will be asked to consider and vote on the proposals described in the accompanying notice of Annual General Meeting and proxy statement, as well as on such other business as may properly come before the meeting.

Your vote is important, regardless of the number of shares you own. Whether or not you plan to attend the 2024 Annual General Meeting of Shareholders, please read the enclosed proxy materials and then promptly vote via the internet or telephone or, by completing, signing and returning by mail the enclosed proxy card. Doing so will not prevent you from later revoking your proxy or changing your vote at the meeting.

Thank you for your continued support and interest in Liberty Latin America Ltd.

Very truly yours,

| | |

|

|

| Michael T. Fries |

| Executive Chairman |

| Liberty Latin America Ltd. |

The Notice of Internet Availability of Proxy Materials relating to the Annual General Meeting is first being mailed on or about April 8, 2024, and the proxy materials relating to the Annual General Meeting will first be made available on or about the same date.

LIBERTY LATIN AMERICA LTD.

Clarendon House,

2 Church Street,

Hamilton HM 11, Bermuda

(441) 295-5950 or (303) 925-6000

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be Held on May 21, 2024

NOTICE IS HEREBY GIVEN of the 2024 Annual General Meeting of Shareholders (the AGM) of Liberty Latin America Ltd. (Liberty Latin America) to be held at 4:00 p.m. Bermuda time (3:00 p.m. New York City time), on Tuesday, May 21, 2024 at the Rosewood Bermuda, 60 Tucker’s Point Drive, Hamilton Parish, HS 02 Bermuda, telephone number +1 (441) 298-4000. At the Annual General Meeting, our shareholders will consider and vote on the following proposals:

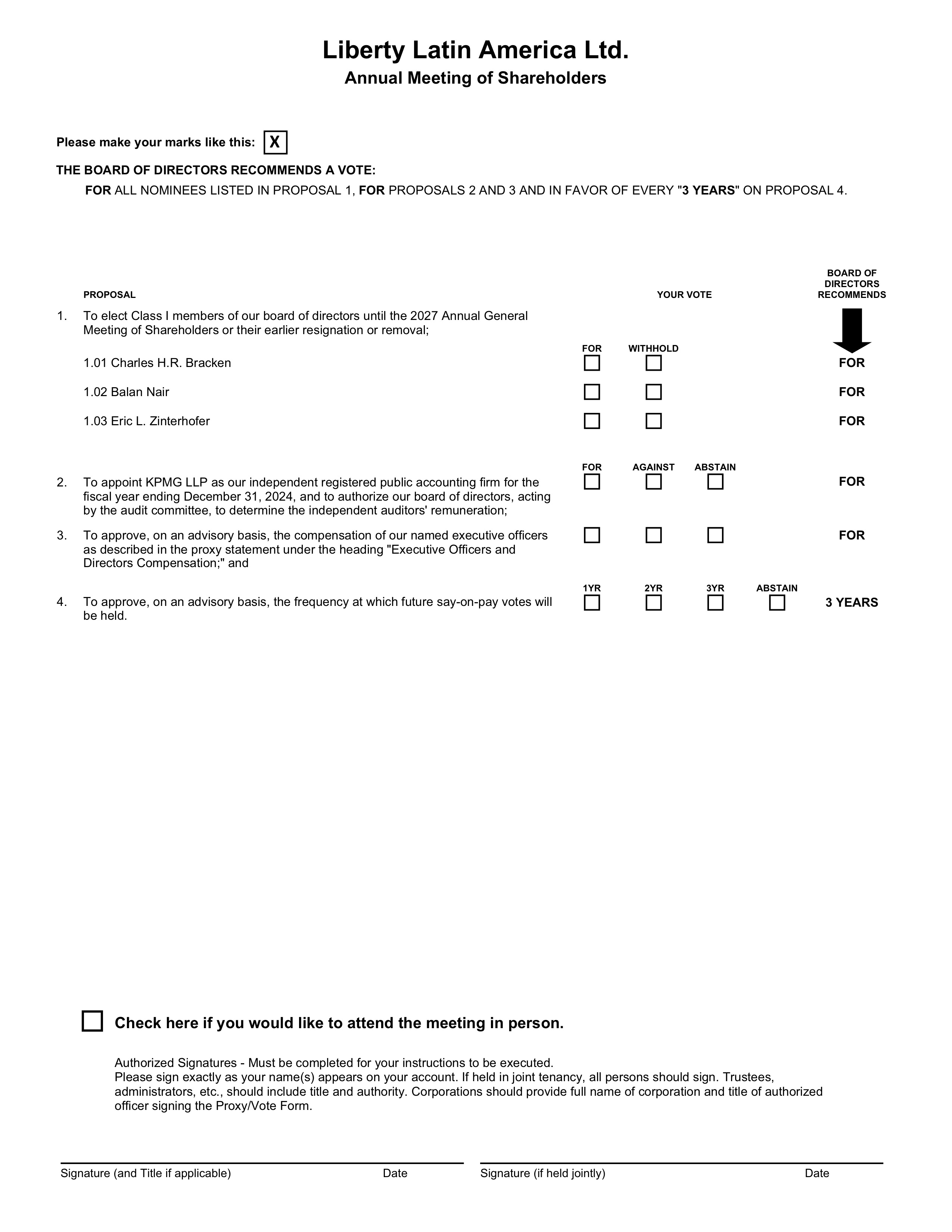

1. A proposal (which we refer to as the director election proposal) to elect Charles H.R. Bracken, Balan Nair and Eric L. Zinterhofer to serve as Class I members of our board of directors until the 2027 Annual General Meeting of Shareholders or their earlier resignation or removal;

2. A proposal (which we refer to as the auditors appointment proposal) to appoint KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and to authorize our board of directors, acting by the audit committee, to determine the independent auditors’ remuneration;

3. A proposal (which we refer to as the say-on-pay proposal) to approve, on an advisory basis, the compensation of our named executive officers as described in this proxy statement under the heading “Executive Officers and Directors Compensation;” and

4. A proposal (which we refer to as the say-on-frequency proposal) to approve, on an advisory basis, the frequency at which future say-on-pay votes will be held.

You may also be asked to consider and vote on such other business as may properly come before the AGM.

All shareholders of Liberty Latin America are cordially invited to attend the AGM. Holders of record of our Class A common shares, par value $0.01 per share, and Class B common shares, par value $0.01 per share, in each case, issued and outstanding as of 6:00 p.m. Bermuda time (5:00 p.m. New York City time), on March 25, 2024, the record date for the AGM, will be entitled to notice of the AGM and to vote at the AGM or any adjournment or postponement thereof. These holders will vote together as a single class on each proposal. A list of shareholders entitled to vote at the AGM will be available during regular business hours at our office at 1550 Wewatta Street, Suite 810, Denver, Colorado 80202, United States, for review by our shareholders for any purpose germane to the AGM, for at least 10 days prior to the AGM. The holders of record of our Class C common shares, par value $0.01 per share, are not entitled to any voting powers, except as required by applicable law, and may not vote on the proposals to be presented at the AGM. If you plan to attend the AGM in person, please notify our Investor Relations team via email to ir@lla.com.

We describe the proposals in more detail in the accompanying proxy statement. We encourage you to read the proxy statement in its entirety before voting.

Our board of directors has unanimously approved each proposal and recommends that you vote “FOR” the election of each director nominee and “FOR” each of the auditors appointment proposal and the say-on-pay proposal. Our board of

directors also recommends that you vote in favor of the “3 YEARS” frequency option with respect to the say-on-frequency proposal.

Votes may be cast in person at the AGM or by proxy prior to the AGM by telephone, via the internet or by mail.

YOUR VOTE IS IMPORTANT. Voting promptly, regardless of the number of shares you own, will aid us in reducing the expense of any further proxy solicitation in connection with the AGM.

| | |

|

By Order of the Board of Directors, |

|

|

| John M. Winter |

| Senior Vice President, Chief Legal Officer and Secretary |

Denver, Colorado

April 4, 2024

WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE AGM, PLEASE VOTE BY PROXY PROMPTLY VIA TELEPHONE OR ELECTRONICALLY VIA THE INTERNET. ALTERNATIVELY, IF YOU RECEIVED A PAPER PROXY CARD, PLEASE COMPLETE, SIGN AND RETURN BY MAIL THE ENCLOSED PAPER PROXY CARD.

| | | | | | | | |

| TABLE OF CONTENTS |

| Page |

| PROXY STATEMENT | |

| Notice and Access of Proxy Materials | |

| Voting Matters and Board Recommendations | |

| QUESTIONS AND ANSWERS ABOUT THE AGM AND VOTING | |

| CORPORATE GOVERNANCE | |

| Code of Conduct and Code of Ethics | |

| Director Independence | |

| Board Composition | |

| Board Leadership Structure | |

| Board Role in Risk Oversight | |

| EXECUTIVE OFFICERS | |

| BOARD AND COMMITTEES OF THE BOARD | |

| Board and Committees of the Board | |

| Shareholder Communication with Directors | |

| Executive Sessions | |

| Involvement in Certain Proceedings | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| Security Ownership of Certain Beneficial Owners | |

| Security Ownership of Management | |

| Change in Control | |

| PROPOSAL 1 - THE DIRECTOR ELECTION PROPOSAL | |

| The Board | |

| Vote and Recommendation | |

| Nominees for Election of Directors | |

| Directors Whose Term Expires in 2024 | |

| Directors Whose Term Expires in 2025 | |

| Directors Whose Term Expires in 2026 | |

| PROPOSAL 2 - THE AUDITORS APPOINTMENT PROPOSAL | |

| Vote and Recommendation | |

| Audit Fees and All Other Fees | |

| Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor | |

| PROPOSAL 3 - THE SAY-ON-PAY PROPOSAL | |

| Advisory Vote | |

| Vote and Recommendation | |

| PROPOSAL 4 - THE SAY-ON-FREQUENCY PROPOSAL | |

| Advisory Vote | |

| Vote and Recommendation | |

| EXECUTIVE OFFICERS AND DIRECTORS COMPENSATION | |

| Executive Summary | |

| Compensation Discussion and Analysis | |

| Compensation Committee Report | |

| | | | | | | | |

| TABLE OF CONTENTS |

| Page |

| Summary Compensation | |

| Grants of Plan-Based Awards | |

| Outstanding Equity Awards at Fiscal Year-End | |

| Option Exercises and Stock Vested | |

| Employment and Other Agreements | |

| Aircraft Policy | |

| Incentive Plans | |

| Nonqualified Deferred Compensation | |

| Potential Payments upon Termination or Change in Control | |

| Change in Control | |

| CEO Pay Ratio | |

| Pay versus Performance | |

| Director Compensation | |

| 2023 Compensation of Directors | |

| EQUITY COMPENSATION PLAN INFORMATION | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

| SHAREHOLDER PROPOSALS | |

| ADDITIONAL INFORMATION | |

LIBERTY LATIN AMERICA LTD.

a Bermuda exempted company

Clarendon House, 2 Church Street,

Hamilton HM 11, Bermuda

(441) 295-5950 or (303) 925-6000

PROXY STATEMENT FOR THE

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS

We are furnishing this proxy statement in connection with the board of directors’ solicitation of proxies for use at our 2024 Annual General Meeting of Shareholders (the AGM) to be held at 4:00 p.m. Bermuda time (3:00 p.m. New York City time), at the Rosewood Bermuda, 60 Tucker’s Point Drive, Hamilton Parish, HS 02 Bermuda on Tuesday, May 21, 2024, or at any adjournment or postponement of the AGM. At the AGM, we will ask you to consider and vote on the proposals described in the accompanying Notice of Annual General Meeting of Shareholders (the Meeting Notice). We are soliciting proxies from holders of record as of 6:00 p.m. Bermuda time (5:00 p.m. New York City time) on March 25, 2024, of our Class A common shares, par value $0.01 per share (LILA), and Class B common shares, par value $0.01 per share (LILAB). The holders of our Class C common shares, par value $0.01 per share (LILAK, together with LILA and LILAB, our common shares), are not entitled to any voting powers, except as required by applicable law, and may not vote on the proposals to be presented at the AGM. This proxy statement is also being made available to holders of LILAK.

Under Bermuda law, holders of a company’s common shares are referred to as “members,” but for convenience, they are referred to in this proxy statement as “shareholders.” In this proxy statement, the terms “we,” “our,” “our company,” “the company” and “us” refer, as the context requires, to Liberty Latin America Ltd. (Liberty Latin America) or collectively to Liberty Latin America and its subsidiaries.

Notice and Access of Proxy Materials

We have elected, in accordance with the Securities and Exchange Commission’s (the SEC) “Notice and Access” rule, to deliver a Notice of Internet Availability of Proxy Materials (the e-proxy notice) to our shareholders and to post our proxy statement and our annual report to our shareholders (collectively, the proxy materials) electronically. The e-proxy notice is first being mailed to our shareholders on or about April 8, 2024. The proxy materials will first be made available to our shareholders on or about the same date.

The e-proxy notice instructs you how to access and review the proxy materials and how to submit your proxy via the internet or by telephone. The e-proxy notice also instructs you how to request and receive a paper copy of the proxy materials, including a proxy card or voting instruction form, at no charge. We will not mail a paper copy of the proxy materials to you unless specifically requested to do so.

Voting Matters and Board Recommendations

The board of directors of Liberty Latin America (the Board) has unanimously approved each proposal and recommends that the holders of shares of LILA and LILAB (together, the voting shares):

1. Vote “FOR” the proposal (which we refer to as the director election proposal) to elect Charles H.R. Bracken, Balan Nair and Eric L. Zinterhofer to serve as Class I members of our board of directors until the 2027 Annual General Meeting of Shareholders or their earlier resignation or removal;

2. Vote “FOR” the proposal (which we refer to as the auditors appointment proposal) to appoint KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and to authorize the Board, acting by the audit committee, to determine the independent auditors’ remuneration;

3. Vote “FOR” the proposal (which we refer to as the say-on-pay proposal) to approve, on an advisory basis, the compensation of our named executive officers as described in this proxy statement under the heading “Executive Officers and Directors Compensation”; and

4. Vote in favor of the “3 YEARS” frequency option with respect to the proposal (which we refer to as the say-on-frequency proposal) to approve, on an advisory basis, the frequency at which future say-on-pay votes will be held.

The AGM may be adjourned to another date, time or place for proper purposes, including for the purpose of soliciting additional proxies to vote on proposals.

QUESTIONS AND ANSWERS ABOUT THE AGM AND VOTING

The questions and answers below highlight only selected information about the AGM and how to vote your shares. You should read carefully the entire proxy statement before voting.

When and where is the AGM?

The AGM will be held at 4:00 p.m. Bermuda time (3:00 p.m. New York City time), on May 21, 2024, at the Rosewood Bermuda, 60 Tucker’s Point Drive, Hamilton Parish, HS 02 Bermuda, telephone number +1 (441) 298-4000.

Who may vote at the AGM and what is the record date for the AGM?

Holders of shares of LILA and LILAB, as recorded in our share register as of 6:00 p.m. Bermuda time (5:00 p.m. New York City time), on March 25, 2024 (such date and time, the record date for the AGM), will be entitled to notice of the AGM and to vote at the AGM or any adjournment or postponement thereof (shareholders of record).

What is the purpose of the AGM?

At the AGM, you will be asked to consider and vote on each of the following:

1. the director election proposal, to elect Charles H.R. Bracken, Balan Nair and Eric L. Zinterhofer to serve as Class I members of our board of directors until the 2027 Annual General Meeting of Shareholders or their earlier resignation or removal;

2. the auditors appointment proposal, to appoint KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and to authorize the Board, acting by the audit committee, to determine the independent auditors’ remuneration;

3. the say-on-pay proposal, to approve, on an advisory basis, the compensation of our named executive officers as described in this proxy statement under the heading “Executive Officers and Directors Compensation”; and

4. the say-on-frequency proposal, to approve, on an advisory basis, the frequency at which future say-on-pay votes will be held.

You may also be asked to consider and vote on such other business as may properly come before the AGM, although we are not aware at this time of any other business that might come before the AGM.

What constitutes a quorum at the AGM?

In order to conduct the business of the AGM, a quorum must be present. A majority of the total voting power of the issued and outstanding shares entitled to vote at the AGM must be present or represented by proxy in order to constitute a quorum. For purposes of determining a quorum, your voting shares will be included as represented at the AGM even if you indicate on your proxy that you abstain from voting. If a broker, who is a record holder of voting shares, indicates on a form of proxy that the broker does not have discretionary authority to vote those voting shares on a particular proposal, or if those shares are voted in circumstances in which proxy authority is defective or has been withheld, those voting shares (broker non-votes) will nevertheless be treated as present for purposes of determining the presence of a quorum. See —What are ‘broker non-votes’ and how are they treated? below.

What are the requirements to elect the directors and approve each of the other proposals?

Each director nominee who receives a plurality of the combined voting power of the voting shares present in person or represented by proxy at the AGM and entitled to vote on the election of directors at the AGM, voting together as a single class, will be elected to office.

Approval of each of the auditors appointment proposal and the say-on-pay proposal requires the affirmative vote of the holders of a majority of the combined voting power of the issued and outstanding common shares that are present in person or represented by proxy at the AGM, and entitled to vote on the subject matter, voting together as a single class.

The say-on-frequency proposal provides for shareholders to vote for one of three potential frequencies (every one year, two years or three years) for future say-on-pay votes. Shareholders also have the option to abstain from such vote if they do not wish to express a preference. If (i) the combined total votes for all frequencies is equal to at least the affirmative vote of a majority of the combined voting power of the issued and outstanding common shares that are present in person or by proxy at the AGM, and entitled to vote on the subject matter, voting together as a single class, and (ii) any one frequency receives a majority of the affirmative votes cast on the say-on-frequency proposal by the holders of our issued and outstanding common shares that are present, in person or by proxy, and entitled to vote at the AGM, voting together as a single class, the frequency receiving such majority vote will be the frequency selected by the Board for future say-on-pay votes.

In the event that the auditors appointment proposal, say-on-pay proposal or say-on-frequency proposal fail to receive the required affirmative vote of the majority of those present in person or represented by proxy at the AGM solely by reason of broker non-votes or abstentions, the Board will nevertheless take note of the positive indication given by the receipt of an affirmative majority of the votes cast and proceed accordingly.

How does the Board recommend that I vote my shares?

The Board has unanimously approved each of the proposals and recommends that you vote “FOR” the election of each director nominee and “FOR” each of the auditors appointment proposal and the say-on-pay proposal. The Board also recommends that you vote in favor of the “3 YEARS” frequency option with respect to the say-on-frequency proposal.

How many votes do shareholders of record have at the AGM?

At the AGM, shareholders of record of LILA will have one vote per share and shareholders of record of LILAB will have 10 votes per share, in each case, that our records show are owned as of the record date. As of the record date, an aggregate of 40,023,720 shares of LILA and 2,398,784 shares of LILAB were issued and outstanding and entitled to vote at the AGM. There were, as of the record date, 10,730 and 19 shareholders of record of LILA and LILAB, respectively (which amounts do not include the number of shareholders whose shares were held of record by banks, brokers or other nominees, but include each such institution as one holder). Shares of LILAK are non-voting, except where otherwise required by applicable law and our Bye-laws.

What is the difference between a shareholder of record and a beneficial owner?

These terms describe how your common shares are held. If your common shares are registered directly in your name with Computershare, our transfer agent, you are a shareholder of record and the proxy materials are being sent directly to you by Liberty Latin America. If your common shares are held in the name of a broker, bank, or other nominee, you are a beneficial owner of the common shares held in street name and the proxy materials are being made available or forwarded to you by your broker, bank, or other nominee, who is treated as the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote your voting shares by following the instructions on the proxy card.

What do shareholders of record need to do to vote on the proposals?

Shareholders of record of our voting shares as of the record date may vote in person at the AGM, or by submitting a proxy vote by telephone, or through the internet prior to the AGM. Alternatively, if they received a paper proxy card, they may give a proxy by completing, signing, dating and returning the proxy card by mail. Instructions for proxy voting by using the telephone or the internet prior to the AGM are printed on the e-proxy notice or proxy card. In order to vote through the internet, holders should have their e-proxy notices or proxy cards available, so they can input the required information from the e-proxy notice or the proxy card, and log onto the internet website address shown on the e-proxy notice or the proxy card. When holders log onto the internet website address, they will receive instructions on how to vote their voting shares. The telephone and internet voting procedures are designed to authenticate votes cast by use of a personal identification number, which will be provided to each voting shareholder separately. Unless subsequently revoked, our voting shares represented by a proxy submitted as described herein and received at or before the AGM will be voted in accordance with the instructions on the proxy.

YOUR VOTE IS IMPORTANT. It is recommended that you vote by proxy even if you plan to attend the AGM. You may change your vote at the AGM.

If you submit a properly executed proxy, by proxy card or by telephone or through the internet, without indicating any voting instructions as to a proposal enumerated in the Meeting Notice, the shares represented by the proxy, or voted by telephone or through the internet, will be voted “FOR” the election of each director nominee, “FOR” each of the auditors appointment proposal and the say-on-pay proposal, and, in the case of the say-on-frequency proposal, will be voted in favor of the “3 YEARS” frequency option.

If you submit a proxy indicating that you “WITHHOLD” your vote, it will have no effect on the director election proposal. If you submit a proxy indicating that you abstain from voting as to the auditors appointment proposal, the say-on-pay proposal or the say-on-frequency proposal, it will have the same effect as a vote “AGAINST” such proposal.

If you do not submit a proxy or you do not vote in person at the AGM, your voting shares will not be counted as present and entitled to vote for purposes of determining a quorum, and your failure to vote will have no effect on determining whether any of the proposals are approved (if a quorum is present).

What do beneficial owners need to do to vote on the proposals?

If you hold your voting shares in the name of a broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee when voting your voting shares or to grant or revoke a proxy. The rules and regulations of the New York Stock Exchange and The Nasdaq Stock Market LLC (Nasdaq) prohibit brokers, banks and other nominees from voting shares on behalf of their clients with respect to numerous matters, including, in our case, all of the proposals described in this proxy statement other than the auditors appointment proposal. Accordingly, to ensure your voting shares held in street name are voted on these matters, we encourage you to promptly provide specific voting instructions to your broker, bank or other nominee.

What are “broker non-votes” and how are they treated?

A broker non-vote occurs when shares held by a broker, bank or other nominee are represented at the AGM, but the broker, bank or nominee has not received voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares on a particular proposal. Broker non-votes are counted as voting shares that are present and entitled to vote for purposes of determining a quorum. Broker non-votes will have no effect on the election of each director nominee because this proposal requires a plurality of the combined voting power of the voting shares present in person or represented by proxy at the AGM and a non-vote is not counted as a vote for this proposal. In addition, broker non-votes will have the same effect as a vote “AGAINST” each of the say-on-pay proposal and the say-on-frequency proposal, because each of these proposals requires an affirmative vote from a majority of the combined voting power of the issued and outstanding common shares that are present in person or by proxy at the AGM, and a non-vote is not counted as an affirmative vote. Brokers have discretion to direct the voting of shares on the auditors appointment proposal if it has not received voting instructions from the beneficial owner, and as a result, broker non-votes should not occur with respect to the auditors appointment proposal.

You should follow the directions your broker, bank or other nominee provides to you regarding how to vote your shares of LILA and LILAB or how to change your vote or revoke your proxy.

How do I vote any of my shares that are held in the Liberty Puerto Rico 401(k) Savings Plan or the Liberty Latin America 401(k) Savings Plan?

If you hold LILA shares through your account in the Liberty Puerto Rico 401(k) Savings Plan or the Liberty Latin America 401(k) Savings Plan, the trustees for the applicable plan are required to vote your LILA shares as you specify. To allow sufficient time for the trustees to vote your LILA shares, your voting instructions must be received by 6:00 p.m. Bermuda time (5:00 p.m. New York City time) on May 14, 2024. To vote such shares, please follow the instructions provided by the trustees for the applicable plan.

What if I respond and indicate that I am withholding my vote or abstaining from voting?

A properly submitted proxy marked “WITHHOLD” or “ABSTAIN” will be counted for purposes of determining whether there is a quorum and for purposes of determining the aggregate voting power and number of voting shares represented and entitled to vote at the AGM. However, a proxy marked “ABSTAIN” will not be treated as a vote cast at the AGM. Withheld votes will have no effect on the election of each director nominee. Abstentions will also have the same effect as a vote “AGAINST” each of the auditors appointment proposal, the say-on-pay proposal and the say-on-frequency proposal because these proposals require an affirmative vote from a majority of the combined voting power of the issued and

outstanding common shares that are present in person or represented by proxy at the AGM, and entitled to vote on the subject matter, voting together as a single class, and an abstention is not counted as an affirmative vote.

Can I change my vote?

Shareholders of record may change their vote any time before the polls close at the AGM, which can be done by voting in person at the AGM, voting via the Internet or by telephone, or by delivering a signed proxy revocation or a new signed proxy with a later date to Liberty Latin America Ltd., c/o Secretary, 1550 Wewatta Street, Suite 810, Denver, Colorado 80202, United States before the start of the AGM.

Your attendance at the AGM will not, by itself, revoke a prior vote or proxy from you.

If your voting shares are held in an account by a broker, bank or other nominee, you should contact your nominee to change your vote or revoke your proxy.

Who may attend, and who may vote at, the AGM?

All shareholders of Liberty Latin America may attend the AGM. Only shareholders of record (holders of record of our voting shares as of the record date, 6:00 p.m. Bermuda time (5:00 p.m. New York City time), on March 25, 2024) are entitled to vote at the AGM or any adjournment or postponement thereof. Holders of LILAK shares will not be entitled to vote on any of the proposals. If you plan to attend the AGM in person, please notify our Investor Relations team via email to ir@lla.com.

If you are a shareholder of record of our voting shares, you have the right to attend, speak and vote in person at the AGM. Any corporation that is a shareholder of record may by written instrument authorize one or more persons to act as its representative(s) at the AGM and the person(s) so authorized shall (on production of a certified copy of such written instrument at the AGM) be entitled to exercise these same powers on behalf of the corporation as that corporation could exercise if it were an individual shareholder of Liberty Latin America. If you are a beneficial owner, you may also attend and speak at the AGM. You may not, however, vote your shares held in street name unless you obtain a “proxy” from your broker, bank or other nominee that holds the shares, which gives you the right to vote the shares at the AGM.

Notwithstanding the foregoing, we recommend that you vote by proxy in advance of the AGM even if you plan to attend the AGM (note that you may change your vote at the AGM).

A list of shareholders entitled to vote at the AGM will be available during regular business hours at our office at 1550 Wewatta Street, Suite 810, Denver, Colorado 80202, United States, for review by our shareholders for any purpose germane to the AGM, for at least 10 days prior to the AGM.

How is Liberty Latin America soliciting proxies and who will pay the cost of soliciting proxies?

We are soliciting proxies by means of our proxy materials on behalf of the Board. In addition to this mailing, our employees may solicit proxies personally or by telephone. We pay the cost of soliciting these proxies. We also reimburse brokers and other nominees for their expenses in sending the e-proxy notices and, if requested, paper proxy materials to you and getting your voting instructions. We have also retained D.F. King to assist in the solicitation of proxies at a cost of $12,500, plus reasonable out of pocket expenses. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward soliciting material to the beneficial owners of common shares held of record by them and will be reimbursed for their reasonable expenses in connection therewith.

May I choose the method in which I receive future proxy materials?

Registered shareholders may elect to receive future notices and proxy materials by e-mail. To sign up for electronic delivery, go to www.computershare.com/investor. Shareholders who hold shares through a bank, brokerage firm or other nominee may sign up for electronic delivery when voting by internet at www.proxyvote.com by following the prompts. Also, shareholders who hold shares through a broker, bank or other nominee may sign up for electronic delivery by contacting their nominee. Once you sign up, you will not receive a printed copy of the notices and proxy materials, unless you request them. If you are a registered shareholder, you may suspend electronic delivery of the notices and proxy materials at any time by contacting our transfer agent, Computershare, at (877) 373-6374 (outside the United States +1 (781) 575-3100). Shareholders who hold shares through a bank, brokerage firm or other nominee should contact their nominee to suspend electronic delivery.

What is “householding”?

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” the proxy materials. This means that only one copy each of the proxy materials or e-proxy notice is being sent to multiple shareholders in your household. We will promptly deliver a separate copy of the proxy materials or e-proxy notice to you if

you call, email or mail our Investor Relations Department, +1 (303) 925-6000 or ir@lla.com or Liberty Latin America Ltd., Attention: Investor Relations Department, 1550 Wewatta Street, Suite 810, Denver, Colorado 80202, United States. If you prefer to receive separate copies of such documents in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee holder, or you may contact us at the above telephone number, email address or mailing address.

When will Liberty Latin America announce the voting results?

We will announce the preliminary voting results at the AGM. We will report the final results in a Current Report on Form 8-K that we will file with the SEC after the AGM.

What do I do if I have additional questions?

If you have any further questions about voting or attending the AGM, please call Liberty Latin America Investor Relations at +1 (303) 925-6000 or contact D.F. King, who is acting as proxy solicitation agent for the AGM, by telephone at (800) 769-4414 or by email at LILA@dfking.com. Banks and brokers may call collect at (212) 269-5550.

CORPORATE GOVERNANCE

Code of Conduct and Code of Ethics

We have adopted a code of conduct that applies to all of our employees, directors and officers. In addition, we have adopted a code of ethics for our senior executive officers and senior financial officers, which constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act. Both codes are available on our website at www.lla.com.

Director Independence

It is our policy that a majority of the members of the Board be independent of our management. For a director to be deemed independent, the Board must affirmatively determine that the director has no direct or indirect material relationship with our company other than in his or her capacity as a board member. To assist the Board in determining which of our directors qualify as independent for purposes of Nasdaq rules, as well as applicable rules and regulations adopted by the SEC, the nominating and corporate governance committee of the Board follows Nasdaq’s corporate governance rules on the criteria for director independence.

Board Composition

As described below under Proposal 1—The Director Election Proposal, the Board is comprised of directors with a broad range of backgrounds and skill sets, including in media and telecommunications, technology, venture capital, private equity, foreign relations, law, tax, real estate, finance, auditing, engineering and Latin American and Caribbean businesses. For more information on our policies with respect to board candidates, see Board and Committees of the Board—Committees of the Board—Nominating and Corporate Governance Committee.

Board Leadership Structure

The Board has separated the positions of Executive Chairman and Chief Executive Officer (principal executive officer). Michael T. Fries holds the position of Executive Chairman, leads the Board and board meetings and provides strategic guidance to our Chief Executive Officer. Balan Nair, our President, holds the position of Chief Executive Officer, leads our management team and is responsible for driving the performance of our company. We believe this division of responsibility effectively enables the Board to fulfill its duties.

Board Role in Risk Oversight

The Board as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant board committees. The audit committee oversees management of financial risks, risks relating to potential conflicts of interest, cybersecurity and information security risks, and our overall enterprise risk management program. The compensation committee oversees the management of risks relating to our compensation arrangements with senior officers. The nominating and corporate governance committee oversees risks associated with the independence of the Board. These committees then provide reports periodically to the full Board. The oversight responsibility of the Board and its committees is enabled by management reporting processes that are designed to provide visibility to the Board about the identification, assessment and management of critical risks. These areas of focus include strategic, operational, financial and reporting, succession and compensation, legal and compliance, and other risks, including cybersecurity and information security risks. Our management reporting processes include regular reports from our Chief Executive Officer, which are prepared with input from our senior management team, and also include input from our Internal Audit group.

EXECUTIVE OFFICERS

The following lists the executive officers of our company (other than Michael T. Fries and Balan Nair, Executive Chairman and our President and Chief Executive Officer (CEO), respectively, who also serve as directors of our company and who are listed under Proposal 1—The Director Election Proposal), their ages and a description of their business experience, including positions held with our company.

| | | | | | | | |

Name | | Positions |

Aamir Hussain

Age: 56 | | Mr. Hussain has served as the Chief Technology and Product Officer (CTO) and a Senior Vice President of our company since April 2022. In this capacity, he is responsible for Liberty Latin America’s Technology & Innovation (T&I) team, driving technology solutions including product development and network performance, and delivering an exceptional customer experience across the company’s multiple markets. Prior to joining Liberty Latin America, Mr. Hussain was Senior Vice President and Chief Product Officer at Verizon Communications from December 2019 to April 2022, Chief Executive Officer of Collinear Networks from February 2019 to December 2019, Executive Vice President, Chief Technology, Information and Product Development Officer at CenturyLink from October 2014 to November 2018 and has been a Venture Partner at Ridge Lane Limited Partners since July 2019. |

| | |

Christopher Noyes Age: 53 | | Mr. Noyes has served as the Chief Financial Officer and a Senior Vice President of our company since December 2017. In this capacity, he is responsible for Liberty Latin America’s finance and treasury operations, including commercial finance, tax and financial planning, accounting and external reporting matters, investor relations and strategic oversight for the financial performance of the company and its operations. Mr. Noyes became the Chief Financial Officer for Liberty Global plc’s (now known as Liberty Global Ltd. (Liberty Global)) Latin America operations in September 2014, which became the LiLAC Group of Liberty Global in July 2015. Prior to this, Mr. Noyes held multiple senior management positions with Liberty Global, including Managing Director, Investor Relations and Business Analysis. Mr. Noyes joined Liberty Global in June 2005 as Vice President, Investor Relations. Prior to joining Liberty Global, Mr. Noyes was an investment banker at Credit Suisse First Boston and Donaldson, Lufkin & Jenrette for over five years collectively. |

| | |

John M. Winter Age: 51 | | Mr. Winter has served as the Chief Legal Officer, Secretary and a Senior Vice President of our company since December 2017. In this capacity, he is responsible for oversight of all legal matters affecting Liberty Latin America and risk management within the company, including legal support for corporate governance, financial reporting, litigation, mergers and acquisitions, and commercial contracts, regulatory and general compliance. Mr. Winter also manages the government affairs and information security functions for our company. Prior to December 2017, Mr. Winter was a Managing Director, Legal for Liberty Global where he was responsible for various legal matters, including legal support for financial reporting, mergers and acquisitions, compliance and governance. Mr. Winter joined Liberty Global as a Vice President, Legal in July 2013. Prior to joining Liberty Global, Mr. Winter was with the law firm Baker Botts L.L.P. for more than five years, and most recently as a partner in the corporate department, specializing in public and private acquisitions, financings and financial reporting.

|

Our executive officers will serve in such capacities until their respective successors have been duly elected and have been qualified, or until their earlier death, resignation, disqualification or removal from office. There is no family relationship between any of our current executive officers or directors, by blood, marriage or adoption.

BOARD AND COMMITTEES OF THE BOARD

Board and Committees of the Board

Committee Membership

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Audit | | Compensation | | Nominating & Corporate Governance | | Executive Committee |

| Charles H.R. Bracken | | | | | | | | |

| Miranda Curtis | | l | | Chair | | l | | |

| Alfonso de Angoitia Noriega | | l | | | | | | |

| Michael T. Fries | | | | | | | | l |

| Paul A. Gould | | Chair | | l | | l | | |

| Roberta S. Jacobson | | | | | | l | | |

| Balan Nair | | | | | | | | l |

| Brendan Paddick | | l | | | | | | |

| Daniel E. Sanchez | | | | | | Chair | | |

| Eric L. Zinterhofer | | | | l | | | | |

Board and Committee Meetings

During 2023, we had six meetings of our full Board, six meetings of our audit committee, four meetings of the compensation committee, one meeting of our nominating and corporate governance committee, and two meetings of our executive committee. Each director attended, either in person or telephonically, at least 75% of the total number of meetings of our Board and each committee on which he or she served. Our Board encourages all members to attend each annual general meeting of our shareholders. Nine out of ten of our board members attended our 2023 AGM.

Executive Committee

The Board has established an executive committee, whose members are Michael T. Fries and Balan Nair. Subject to the limitations of Bermuda law, the executive committee may exercise all the powers and authority of the Board in the management of our business and affairs, including, but not limited to, the power and authority to issue any class of our shares.

Compensation Committee

The Board has established a compensation committee, whose chairman is Miranda Curtis and whose other members are Paul A. Gould and Eric L. Zinterhofer. See Corporate Governance—Director Independence above.

The compensation committee reviews and approves corporate goals and objectives relevant to the compensation of our CEO and our other executive officers. The compensation committee may also make recommendations to the Board with respect to our incentive compensation plans and equity based plans, and will administer such plans, with authority to make and modify grants under, and to approve or disapprove participation in, such plans. For a description of our current processes and policies for consideration and determination of executive compensation, including the role of our CEO and outside consultants in determining or recommending amounts and/or forms of compensation, see Executive Officers and Directors Compensation—Compensation Discussion and Analysis.

The Board has adopted a written charter for the compensation committee, which is available on our website at www.lla.com.

Compensation Committee Interlocks and Insider Participation

In 2023, the compensation committee of our Board consisted of Miranda Curtis, Paul A. Gould and Eric L. Zinterhofer during the entirety of the year. No member of the compensation committee is or has been an officer or employee of our company, or has engaged in any related party transaction in which our company was a participant.

Nominating and Corporate Governance Committee

The Board has established a nominating and corporate governance committee, whose chairman is Daniel E. Sanchez and whose other members are Miranda Curtis, Paul A. Gould and Roberta S. Jacobson, who joined the committee in May 2023. See Corporate Governance—Director Independence above.

The nominating and corporate governance committee identifies individuals qualified to become board members consistent with criteria established or approved by the Board from time to time, identifies director nominees for upcoming annual general meetings, develops corporate governance guidelines applicable to our company and oversees the evaluation of the Board and management.

The nominating and corporate governance committee will consider candidates for director recommended by any shareholder, provided that such recommendations are properly submitted. Eligible shareholders wishing to recommend a candidate for nomination as a director should send the recommendation in writing to the Secretary, Liberty Latin America Ltd., Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. Shareholder recommendations must be made in accordance with our Bye-Laws, as discussed under Shareholder Proposals in this proxy statement, and contain the following information:

• the name and address of the proposing shareholder and the beneficial owner, if any, on whose behalf the nomination is being made, as they appear on our share register, and documentation indicating the class or series and number of our common shares owned beneficially and of record by such person and the holder or holders of record of those shares, together with a statement that the proposing shareholder is recommending a candidate for nomination as a director;

• the candidate’s name, age, business and residence addresses, principal occupation or employment, business experience, educational background and any other information relevant in light of the factors considered by the nominating and corporate governance committee in making a determination of a candidate’s qualifications, as described below;

• a statement detailing any relationship, arrangement or understanding between the proposing shareholder and/or beneficial owner(s), if different, and any other person(s) (including their names) under which the proposing shareholder is making the nomination and any affiliates or associates (as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the Exchange Act)) of such proposing shareholder(s) or beneficial owner (each a Proposing Person);

• a statement detailing any relationship, arrangement or understanding that might affect the independence of the candidate as a member of the Board;

• any other information that would be required under SEC rules in a proxy statement soliciting proxies for the election of the candidate as a director;

• a representation as to whether the Proposing Person intends (or is part of a group that intends) to deliver any proxy materials or otherwise solicit proxies in support of the director nominee;

• a representation by each Proposing Person who is a holder of record of our common shares as to whether the notice is being given on behalf of the holder of record and/or one or more beneficial owners, the number of shares held by any beneficial owner along with evidence of such beneficial ownership and that such holder of record is entitled to vote at the annual general meeting of shareholders and intends to appear in person or by proxy at the annual general meeting of shareholders at which the person named in such notice is to stand for election;

• a written consent of the candidate to be named in the proxy statement and to serve as a director, if nominated and elected;

• a representation as to whether the Proposing Person has received any financial assistance, funding or other consideration from any other person regarding the nomination (a Shareholder Associated Person) (including the details of such assistance, funding or consideration); and

• a representation as to whether and the extent to which any hedging, derivative or other transaction has been entered into with respect to our company within the last six months by, or is in effect with respect to, the

Proposing Person, any person to be nominated by the Proposing Person or any Shareholder Associated Person, the effect or intent of which transaction is to mitigate loss to or manage risk or benefit of share price changes for, or increase or decrease the voting power of, the Proposing Person, its nominee, or any such Shareholder Associated Person.

In connection with its evaluation, the nominating and corporate governance committee may request additional information from the proposing shareholder and the candidate. The nominating and corporate governance committee has sole discretion to decide which individuals to recommend for nomination as directors.

To be nominated to serve as a director, a nominee need not meet any specific, minimum criteria; however, the nominating and corporate governance committee believes that nominees for director should possess the highest personal and professional ethics, integrity and values and judgment and should be committed to the long-term interests of our shareholders and our company. When evaluating a potential director nominee, including one recommended by a shareholder, the nominating and corporate governance committee will take into account a number of factors, including, but not limited to, the following:

• independence from management;

• his or her unique background, including education, financial, industry, regional and business experience and expertise, relevant skill sets and diversity of race, ethnicity, gender and sexual orientation;

• understanding of our business and the markets in which we operate;

• judgment, skill, integrity and reputation;

• existing commitments to other businesses as a director, executive or owner;

• personal conflicts of interest, if any; and

• the size and composition of our existing Board, including whether the potential director nominee would positively impact the composition of the Board by bringing a new perspective or viewpoint to the Board.

The nominating and corporate governance committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees.

The Board and the nominating and corporate governance committee believe that it is important that our Board members represent diverse viewpoints. Our corporate governance guidelines and the nominating and corporate governance committee’s charter provide that the nominating and corporate governance committee will consider diversity of race, ethnicity, gender and sexual orientation when evaluating nominees for the Board. We believe the composition of our Board, as reflected in the tables below, further demonstrates our commitment to board diversity.

| | | | | | | | |

| Board Diversity Matrix (as of 12/31/2023) |

| Total Number of Directors | 10 |

| Female | Male |

| Part I: Gender Identity | |

| Directors | 2 | 8 |

| Part II: Demographic Background | |

| Asian | | 1 |

| Hispanic or Latinx | | 2 |

| White | 1 | 6 |

| Two or More Races or Ethnicities | | 1 |

| Did Not Disclose Demographic Background | 1 |

When seeking candidates for director, the nominating and corporate governance committee may solicit suggestions from incumbent directors, management, shareholders and others. After conducting an initial evaluation of a prospective nominee, the nominating and corporate governance committee will interview that candidate if it believes the candidate might be suitable to be a director. The nominating and corporate governance committee may also ask the candidate to meet with

management. If the nominating and corporate governance committee believes a candidate would be a valuable addition to the Board, it may recommend to the full Board that candidate’s appointment or election.

Prior to nominating an incumbent director for re-election at an annual general meeting of shareholders, the nominating and corporate governance committee will consider, the director’s past attendance at, and participation in, meetings of the Board and its committees and the director’s formal and informal contributions to the various activities conducted by the Board and the Board committees of which such individual is a member.

The members of our nominating and corporate governance committee have determined that Messrs. Bracken, Nair and Zinterhofer, who are nominated for election at the AGM, continue to be qualified to serve as directors of our company and such nominations were approved by the entire Board.

The Board has adopted a written charter for the nominating and corporate governance committee. The charter is available on our website at www.lla.com.

Audit Committee

The Board has established an audit committee, whose chairman is Paul A. Gould and whose other members are Miranda Curtis, Alfonso de Angoitia Noriega, and Brendan Paddick. See Corporate Governance—Director Independence above.

The Board has determined that each member of the audit committee qualifies as an “audit committee financial expert” under applicable SEC rules and regulations. The audit committee reviews and monitors the corporate financial reporting and the internal and external audits of our company. The committee’s functions include, among other things:

• overseeing our management’s processes and activities relating to (i) maintaining the reliability and integrity of our accounting policies, financial reporting practices and financial statements, (ii) the independent auditor’s qualifications and independence, (iii) the performance of our internal audit function and independent auditor and (iv) compliance with applicable laws and stock exchange rules;

• the recommendation to our shareholders of the appointment, retention, termination and compensation of the independent auditor;

• oversight of the work of the independent auditor for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services;

• reviewing and preapproving all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed by the independent auditor, subject to a de minimus exception for non-audit services;

• reviewing any matters identified as critical audit matters by the independent auditor; and

• preparing a report for our annual proxy statement.

The Board has adopted a written charter for the audit committee, which is available on our website at www.lla.com.

Audit Committee Report

The audit committee reviews our financial reporting process on behalf of the Board. Management has primary responsibility for establishing and maintaining adequate internal controls, for preparing financial statements and for the public reporting process. Our independent registered public accounting firm, KPMG LLP, is responsible for expressing opinions on the conformity of our audited consolidated financial statements with U.S. generally accepted accounting principles and on the effectiveness of our internal control over financial reporting.

Our audit committee has reviewed and discussed with management and KPMG LLP our most recent audited consolidated financial statements, as well as management’s assessment of the effectiveness of our internal control over financial reporting and KPMG LLP’s evaluation of our internal control over financial reporting. Our audit committee has also discussed with KPMG LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC, including that firm’s judgment about the quality of our accounting principles, as applied in its financial reporting.

KPMG LLP has provided our audit committee with the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP’s communications with the audit committee concerning independence, and the audit committee has discussed with KPMG LLP that firm’s independence from the company and its subsidiaries.

Based on the reviews, discussions and other considerations referred to above, our audit committee recommended to the Board that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2023 (the 2023 Form 10-K), which was filed on February 22, 2024 with the SEC.

| | | | | |

| Submitted by the Members of the Audit Committee |

| Paul A. Gould (chairman) |

| Miranda Curtis |

| Brendan Paddick |

| Alfonso de Angoitia Noriega |

Other

The Board, by resolution, may from time to time establish other committees of the Board, consisting of one or more of our directors. Any committee so established will have the powers delegated to it by resolution of the Board, subject to applicable law.

Shareholder Communication with Directors

Our shareholders may send communications to the Board or to individual directors by mail addressed to the Board or to an individual director c/o Liberty Latin America Ltd., 1550 Wewatta Street, Suite 810, Denver, Colorado 80202, United States. All such communications from our shareholders will be forwarded to our directors on a timely basis.

Executive Sessions

Under the Nasdaq’s corporate governance rules, the independent directors are required to meet in regularly scheduled executive sessions, without management participation. In 2023, the independent directors had two such executive sessions. Any interested party who has a concern regarding any matter that it wishes to have addressed by our independent directors, as a group, at an upcoming executive session may send its concern in writing addressed to Independent Directors of Liberty Latin America Ltd., c/o Liberty Latin America Ltd., 1550 Wewatta Street, Suite 810, Denver, Colorado 80202, United States. The current independent directors of our company are Charles H.R. Bracken, Miranda Curtis, Alfonso de Angoitia Noriega, Paul A. Gould, Roberta S. Jacobson, Brendan Paddick, Daniel E. Sanchez and Eric L. Zinterhofer.

Involvement in Certain Proceedings

During the past 10 years, none of our directors or executive officers has had any involvement in such legal proceedings as would be material to an evaluation of his or her ability or integrity.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth information concerning our common shares beneficially owned by each person or entity known by us to own more than five percent of the outstanding shares of LILA and LILAB, which are our company’s voting securities. Beneficial ownership of our LILAK shares is set forth below only to the extent known by us or ascertainable from public filings. All of the information reported in the table below is based on publicly available filings.

The security ownership information is given as of February 29, 2024, and, in the case of percentage ownership information, is based upon (1) 40,853,386 shares of LILA, (2) 2,242,534 shares of LILAB and (3) 162,217,649 shares of LILAK, in each case, outstanding on that date. The percentage voting power is presented on an aggregate basis for all classes of our common shares. LILAK shares are, however, non-voting and, therefore, in the case of percentage voting power, are not included.

Our common shares that are issuable on or within 60 days after February 29, 2024 upon exercise of options, vesting of restricted share units (RSUs) and performance share units (PSUs), conversion of convertible securities or exchange of exchangeable securities, are deemed to be outstanding and to be beneficially owned by the person holding the options, RSUs, PSUs or convertible or exchangeable securities for the purpose of computing the percentage ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Share appreciation rights (SARs) are excluded from the table below because the exercise prices were below the closing prices of our common shares on February 29, 2024. For purposes of the following presentation, beneficial ownership of shares of LILAB, though convertible on a one-for-one basis into shares of LILA, is reported as beneficial ownership of shares of LILAB, and not as beneficial ownership of shares of LILA, but the voting power of shares of LILA and LILAB has been aggregated.

So far as is known to us, the persons or entities indicated below have sole voting and dispositive power with respect to the common shares indicated as beneficially owned by them, except as otherwise stated in the notes to the table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | | Title of Class | | Amount and Nature of Beneficial Ownership | | Percent of Class (%) | | Voting Power (%) |

| John C. Malone | | LILA | | 1,869,072 | | (1)(3)(4) | | 4.6 | | 27.2 |

| c/o Liberty Latin America Ltd. | | LILAB | | 1,535,757 | | (2) | | 68.5 | | |

| Clarendon House, 2 Church Street | | LILAK | | 9,658,381 | | (1)(3)(4) | | 6.0 | | |

| Hamilton HM 11, Bermuda | | | | | | | | | |

| | | | | | | | | |

| Michael T. Fries | | LILA | | 276,357 | | (5) | | * | | 3.2 |

| c/o Liberty Latin America Ltd. | | LILAB | | 175,867 | | (5) | | 7.8 | | |

| Clarendon House, 2 Church Street | | LILAK | | 538,197 | | (5) | | * | | |

| Hamilton HM 11, Bermuda | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Balan Nair | | LILA | | 954,979 | | (6) | | 2.3 | | 8.1 |

| c/o Liberty Latin America Ltd. | | LILAB | | 428,750 | | (6) | | 17.9 | | |

| Clarendon House, 2 Church Street | | LILAK | | 1,693,711 | | (6) | | 1.0 | | |

| Hamilton HM 11, Bermuda | | | | | | | | | |

| | | | | | | | | |

| Ashe Capital Management, LP | | LILA | | 3,832,760 | | (7) | | 9.4 | | 6.1 |

| 530 Sylvan Ave., Suite 101 | | LILAK | | 9,310,772 | | (7) | | 5.7 | | |

| Englewood Cliffs, NJ 07632 | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | | Title of Class | | Amount and Nature of Beneficial Ownership | | Percent of Class (%) | | Voting Power (%) |

| Berkshire Hathaway, Inc. | | LILA | | 2,630,792 | | (8) | | 6.4 | | 4.2 |

| 3555 Farnam Street | | | | | | | | | |

| Omaha, NE 68131 | | | | | | | | | |

| | | | | | | | | |

| BlackRock, Inc. | | LILA | | 3,194,839 | | (9) | | 7.8 | | 4.9 |

| 50 Hudson Yards | | LILAK | | 10,303,992 | | (9) | | 6.4 | | |

| New York, NY 10001 | | | | | | | | | |

| | | | | | | | | |

| Dimensional Fund Advisors LP | | LILA | | 2,711,559 | | (10) | | 6.6 | | 4.2 |

| 6300 Bee Cave Road, | | | | | | | | | |

| Building One | | | | | | | | | |

| Austin, TX 78746 | | | | | | | | | |

*Less than one percent.

(1)Includes 4,060 LILA shares and 8,119 LILAK shares that are subject to options, reported on a gross basis, which were exercisable as of, or will be exercisable within, 60 days of February 29, 2024.

(2)Based on information available to our company and the Schedule 13D of Mr. Malone filed with the SEC on January 8, 2018 (the Malone Schedule 13D). As disclosed in the Malone Schedule 13D, Mr. Fries, Mr. Malone and the Malone Trust (as defined below) entered into a letter agreement dated as of December 29, 2017 (the Letter Agreement) pursuant to which, under certain circumstances, Mr. Fries would have certain rights with respect to LILAB shares owned by a trust with respect to which Mr. Malone is a co-trustee and, with his wife, retains a unitrust interest (the Malone Trust). Pursuant to the terms of the Letter Agreement, for so long as Mr. Fries is employed as a principal executive officer of Liberty Latin America, (a) in the event the Malone Trust or any Permitted Transferee (as defined in the Letter Agreement) is not voting the LILAB shares owned by the Malone Trust, Mr. Fries will have the right to vote such LILAB shares and (b) in the event the Malone Trust or any Permitted Transferee determines to sell such LILAB shares, Mr. Fries (individually or through an entity he controls) will have an exclusive right to negotiate to purchase such shares, and if the parties fail to come to an agreement and the Malone Trust or any Permitted Transferee subsequently intends to enter into a sale transaction with a third-party, Mr. Fries (or an entity controlled by him) will have a right to match the offer made by such third-party.

(3)Includes 49,729 LILA shares and 266,574 LILAK shares held by Mr. Malone's spouse, as to which shares Mr. Malone has disclaimed beneficial ownership.

(4)Includes 19,249 LILAB shares and 5,179 LILAK shares held by two trusts managed by an independent trustee, of which the beneficiaries are Mr. Malone's adult children. Mr. Malone has no pecuniary interest in the trusts, but he retains the right to substitute the assets held by the trusts. Mr. Malone has disclaimed beneficial ownership of the shares held in the trusts. Also includes 1,516,508 LILAB shares and 2,011,791 LILAK shares held by the Malone Trust.

(5)Information with respect to our common shares beneficially owned by Mr. Fries, our Executive Chairman, is also set forth in —Security Ownership of Management.

(6)Based on information available to our company and an Amendment No. 1 to Schedule 13D filed by Mr. Nair, our President and CEO, with the SEC on March 14, 2024. Additional information with respect to our common shares beneficially owned by Mr. Nair is also set forth in —Security Ownership of Management.

(7)Based on two separate filings, each an Amendment No. 4 to Schedule 13G for the year ended December 31, 2023 and filed with the SEC on February 13, 2024 by Ashe Capital Management, LP (Ashe). Ashe is a registered investment advisor which holds LILA and LILAK shares in funds under its management and control, and in such capacity has voting and investment power over such securities. The principals of Ashe are William C. Crowley, William R. Harker and Stephen M. Blass. The filings reflect that Ashe has sole voting power and sole dispositive power over 3,832,760 LILA shares and 9,310,772 LILAK shares, respectively.

(8)Based on the Schedule 13G for the year ended December 31, 2020, filed with the SEC on February 16, 2021, by Warren E. Buffett on behalf of himself and Berkshire Hathaway Inc. (Berkshire), as well as on behalf of the following for the respective number of LILA shares indicated: National Indemnity Company (1,625,185), GEICO Corporation (1,625,185), Government Employees Insurance Company (1,517,798), GEICO Indemnity Company (107,387), BNSF Master Retirement Trust (368,829), Scott Fetzer Collective Investment Trust (54,907) and Berkshire Hathaway Consolidated Pension Plan Master Retirement Trust (581,871). Mr. Buffett (who may be deemed to control Berkshire), Berkshire and GEICO Corporation are each a parent holding company. National Indemnity Company, Government Employees Insurance Company and GEICO Indemnity Company are each an insurance company and the remaining reporting persons are each an employee benefit plan. Mr. Buffett, Berkshire and the other reporting persons share voting and dispositive power over the shares listed in the table.

(9)Based on two separate filings, each an Amendment No. 5 to Schedule 13G for the year ended December 31, 2023 and filed with the SEC on February 6, 2024 and February 2, 2024, by BlackRock, Inc. The filings reflect that BlackRock, Inc. has sole voting power over 3,074,284 LILA shares and 10,009,696 LILAK shares and sole dispositive power over 3,194,839 LILA shares and 10,303,992 LILAK shares. All shares covered by such filings are held by BlackRock, Inc. and/or its subsidiaries.

(10)Based on the Schedule 13G for the year ended December 31, 2023, filed with the SEC on February 9, 2024, by Dimensional Fund Advisors LP (Dimensional), which reflects that Dimensional has sole voting power over 2,663,120 LILA shares and sole dispositive power over 2,711,559 LILA shares. All shares covered by such filing are held by certain investment companies, commingled funds, group trusts and separate accounts for which Dimensional furnishes investment advice or serves as investment manager or sub-adviser.

Security Ownership of Management

The following table sets forth information with respect to the beneficial ownership by each of our directors and named executive officers as described below, and by all of our directors and executive officers as a group, of our common shares.

The security ownership information is given as of February 29, 2024, and, in the case of percentage ownership information, is based upon (1) 40,853,386 shares of LILA, (2) 2,242,534 shares of LILAB and (3) 162,217,649 shares of LILAK, in each case, outstanding on that date. The percentage voting power is presented on an aggregate basis for all classes of our common shares. LILAK shares are, however, non-voting and, therefore, in the case of percentage voting power, are not included.

Our common shares that are issuable on or within 60 days after February 29, 2024, upon exercise of options, vesting of RSUs and PSUs, conversion of convertible securities or exchange of exchangeable securities, are deemed to be outstanding and to be beneficially owned by the person holding the options, RSUs, PSUs or convertible or exchangeable securities for the purpose of computing the percentage ownership of that person and for the aggregate percentage owned by the directors and executive officers as a group, but are not treated as outstanding for the purpose of computing the percentage ownership of any other individual person. Because the exercise prices of our directors’ and executive officers’ SARs were below the closing prices of our common shares on February 29, 2024, their SARs are excluded from the table below. For purposes of the following presentation, beneficial ownership of LILAB, though convertible on a one-for-one basis into LILA, is reported as beneficial ownership of LILAB, and not as beneficial ownership of LILA, but the voting power of LILA and LILAB has been aggregated.

So far as is known to us, the persons indicated below have sole voting and dispositive power with respect to the common shares indicated as beneficially owned by them, except as otherwise stated in the notes to the table. With respect to certain of our executive officers and directors, the number of shares indicated as owned by them includes shares held by the Liberty Latin America 401(k) Savings Plan as of February 29, 2024, for their respective accounts.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Title of Class | | Amount and Nature of Beneficial Ownership | | Percent of Class (%) | | Voting Power (%) |

| Michael T. Fries | | LILA | | 276,357 | | (1)(2) | | * | | 3.2 |

| Executive Chairman | | LILAB | | 175,867 | | (3) | | 7.8 | | |

| | LILAK | | 538,197 | | (1)(2) | | * | | |

| | | | | | | | | | |

| Alfonso de Angoitia Noriega | | LILA | | 28,461 | | (2)(4) | | | * | | * |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 64,392 | | (2)(4) | | | * | | |

| | | | | | | | | | |

| Charles H.R. Bracken | | LILA | | 28,542 | | (2) | | * | | * |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 67,842 | | (2) | | * | | |

| | | | | | | | | | |

| Miranda Curtis | | LILA | | 25,172 | | (2)(5) | | * | | * |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 55,497 | | (2)(5) | | | * | | |

| | | | | | | | | | |

| Paul A. Gould | | LILA | | 160,945 | | (2)(4)(5) | | * | | * |

| Director | | LILAB | | 8,987 | | | | | * | | |

| | LILAK | | 323,169 | | (2)(4)(5) | | * | | |

| | | | | | | | | | |

| Roberta S. Jacobson | | LILA | | 10,628 | | (2) | | | * | | * |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 21,256 | | (2) | | * | | |

| | | | | | | | | | |

| Balan Nair | | LILA | | 954,979 | | (2) | | | 2.3 | | 8.1 |

| President, Chief Executive Officer & | | LILAB | | 428,750 | | (2) | | | 17.9 | | |

| Director | | LILAK | | 1,693,711 | | (2)(6)(7) | | | 1.0 | | |

| | | | | | | | | | |

| Brendan Paddick | | LILA | | 636,275 | | (2)(4) | | | 1.6 | | | 1.0 |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 1,886,706 | | (2)(4) | | | 1.2 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Daniel E. Sanchez | | LILA | | 15,688 | | (2) | | | * | | * |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 29,011 | | (2) | | | * | | |

| | | | | | | | | | |

| Eric L. Zinterhofer | | LILA | | 42,348 | | (2)(4)(8) | | * | | * |

| Director | | LILAB | | — | | | | | — | | | |

| | LILAK | | 14,287,937 | | (2)(4)(8) | | 8.8 | | | |

| | | | | | | | | | |

| Christopher Noyes | | LILA | | 245,225 | | (2)(7) | | | * | | * |

| Senior Vice President, Chief Financial | | LILAB | | 20,000 | | | | | * | | |

| Officer | | LILAK | | 562,601 | | (2)(6)(7) | | | * | | |

| | | | | | | | | | |

| Aamir Hussain | | LILA | | 89,678 | | (2) | | * | | * |

| Senior Vice President, Chief Technology | | LILAB | | — | | | | | — | | | |

| & Product Officer | | LILAK | | 139,357 | | (2) | | | * | | |

| | | | | | | | | | |

| Rocio Lorenzo | | LILA | | 95,439 | | (2) | | | * | | * |

Senior Vice President, General Manager of Cable & Wireless Panama S.A. (CWP) and Former Chief Customer Officer | | LILAB | | — | | | | | — | | | |

| LILAK | | 194,010 | | (2) | | | * | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Title of Class | | Amount and Nature of Beneficial Ownership | | Percent of Class (%) | | Voting Power (%) |

| John M. Winter | | LILA | | 111,924 | | (2) | | | * | | * |

| Senior Vice President, Chief Legal Officer | | LILAB | | 10,000 | | | | | * | | |

| & Secretary | | LILAK | | 359,565 | | (2)(6)(7) | | | * | | |

| | | | | | | | | | |

| All directors and executive officers as a group (13 persons) | | LILA | | 2,626,222 | | (1)(2)(4)(5)(7)(8) | | 6.4 | | | 13.9 | |

| LILAB | | 643,604 | | (2)(3) | | 26.8 | | | |

| LILAK | | 20,029,241 | | (1)(2)(4)(5)(6)(7) (8) | | 12.3 | | | |

| | | | | | | | | |

* Less than one percent

(1) Includes 8,115 LILA shares and 65,343 LILAK shares held by two trusts managed by an independent trustee, of which the beneficiaries are Mr. Fries’ children. Mr. Fries has no pecuniary interest in the trusts, but he retains the right to substitute the assets held by the trusts. Mr. Fries disclaims beneficial ownership with respect to these shares.

(2) Includes Mr. Nair’s LILAB PSU award and shares issued to our named executive officers in payment of our 2023 annual performance bonus program that, in each case, had been certified as earned by the compensation committee and our directors’ and named executive officers’ RSUs that will be settled in our common shares within 60 days of February 29, 2024, as follows:

| | | | | | | | | | | | | | | | | | | | |

| Owner | | LILA | | LILAB | | LILAK |

| Michael T. Fries | | 19,693 | | — | | | 39,386 |

| Alfonso de Angoitia Noriega | | 3,109 | | — | | | 6,219 |

| Charles H.R. Bracken | | 6,219 | | — | | | 12,438 |

| Miranda Curtis | | 6,219 | | — | | | 12,438 |

| Paul A. Gould | | 6,219 | | — | | | 12,438 |

| Roberta S. Jacobson | | 6,219 | | — | | | 12,438 |

| Balan Nair | | 178,565 | | 156,250 | | 357,132 |

| Brendan Paddick | | 6,219 | | — | | | 12,438 |

| Daniel Sanchez | | 6,219 | | — | | | 12,438 |

| Eric L. Zinterhofer | | 6,219 | | — | | | 12,438 |

| Christopher Noyes | | 64,339 | | — | | | 128,677 |

| Aamir Hussain | | 48,336 | | — | | | 96,671 |

| Rocio Lorenzo | | 41,147 | | — | | | 82,295 |

| John M. Winter | | 53,995 | | — | | | 107,991 |

(3) Information with respect to the Letter Agreement is set forth in —Security Ownership of Certain Beneficial Owners.

(4) Includes shares that the following directors have chosen to receive in lieu of their cash retainer for the quarter ended March 31, 2024:

| | | | | | | | | | | | | | |

| Owner | | LILA | | LILAK |

| Alfonso de Angoitia Noriega | | 564 | | 1,127 |

| Paul A. Gould | | 233 | | 465 |

| Brendan Paddick | | 1,181 | | 2,362 |

| Eric L. Zinterhofer | | 1,312 | | 2,625 |

(5) Includes shares that are subject to options which were exercisable as of, or will be exercisable within, 60 days of February 29, 2024, as follows:

| | | | | | | | | | | | | | |

| Owner | | LILA | | LILAK |

| Miranda Curtis | | 894 | | 1,788 |

| Paul A. Gould | | 894 | | 1,788 |

(6) Includes shares held in the Liberty Latin America 401(k) Savings Plan, as follows:

| | | | | | | | | | | | | | |

| Owner | | LILA | | LILAK |

| Balan Nair | | — | | | 11,849 |

| Christopher Noyes | | — | | | 11,759 |

| John M. Winter | | — | | | 11,572 |

(7) Includes shares held by each individual in an IRA, as follows:

| | | | | | | | | | | | | | |

| Owner | | LILA | | LILAK |

| Balan Nair | | — | | | 1,139 |

| Christopher Noyes | | 20,000 | | | 753 |

| John M. Winter | | — | | | 176 |