UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 21, 2019 (March 15, 2019)

TARGET HOSPITALITY CORP.

(Exact name of registrant as specified in its charter)

Delaware | | 001-38343 | | 98-1378631 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

Target Hospitality Corp.

2170 Buckthorne Place, Suite 440

The Woodlands, TX 77380-1775

(Address, including zip code, of principal executive offices)

800-832-4242

(Registrant’s telephone number, including area code)

Platinum Eagle Acquisition Corp.

2121 Avenue of the Stars #2300

Los Angeles, California 90067

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Introductory Note

Unless the context otherwise requires, “we,” “us,” “our,” and the “Company” refer to Target Hospitality Corp., a Delaware corporation (“Target Hospitality”), and its consolidated subsidiaries. All references herein to the “Board” refer to the board of directors of Target Hospitality.

On March 15, 2019 (the “Closing Date”), Platinum Eagle Acquisition Corp., our predecessor company (“Platinum Eagle”), consummated the previously announced business combination (the “Business Combination”) pursuant to the terms of: (i) the agreement and plan of merger, dated as of November 13, 2018, as amended on January 4, 2019 (the “Signor Merger Agreement”), by and among Platinum Eagle, Signor Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Platinum Eagle and sister company to the Holdco Acquiror (as defined below) (“Signor Merger Sub”), Arrow Holdings S.a. r.l., a Luxembourg société à responsabilité limitée (the “Arrow Seller”) and Signor Parent (as defined below), and (ii) the agreement and plan of merger, dated as of November 13, 2018, as amended on January 4, 2019 (the “Target Merger Agreement” and, together with the Signor Merger Agreement, the “Merger Agreements”), by and among Platinum Eagle, Topaz Holdings LLC, a Delaware limited liability company (the “Holdco Acquiror”), Arrow Bidco, LLC, a Delaware limited liability company (“Arrow Bidco”), Algeco Investments B.V., a Netherlands besloten vennotschap (the “Algeco Seller”) and Target Parent (as defined below). Platinum Eagle, through its wholly-owned subsidiary, the Holdco Acquiror, acquired all of the issued and outstanding equity interests of Arrow Parent Corp., a Delaware corporation (“Signor Parent”), the owner Arrow BidCo and the owner of RL Signor Holdings, LLC, a Delaware limited liability company (“Signor”), from the Arrow Seller, and all of the issued and outstanding equity interests of Algeco US Holdings LLC, a Delaware limited liability company (“Target Parent”), the owner of Target Logistics Management, LLC, a Massachusetts limited liability company (“Target”), from the Algeco Seller. The Arrow Seller and the Algeco Seller are hereinafter referred to as the “Sellers.”

Immediately upon the completion of the Business Combination and the other transactions contemplated by the Merger Agreements (collectively, including the offering of the Notes (as defined herein) and entry into the New ABL Facility (as defined herein), the “Transactions”), Arrow Bidco became a direct wholly-owned subsidiary of the Holdco Acquiror and the direct parent of each of Target and Signor. In connection with the Business Combination, the Company changed its name to Target Hospitality.

Item 1.01. Entry into a Material Definitive Agreement

ABL Credit Agreement

On the Closing Date, in connection with the closing of the Business Combination, the Holdco Acquiror, Arrow Bidco, Target, Signor and each of their domestic subsidiaries (each a “Borrower” and collectively, the “Borrowers”) entered into an ABL credit agreement that provides for a senior secured asset based revolving credit facility in the aggregate principal amount of up to $125 million (the “New ABL Facility”). Approximately $40 million of proceeds from the New ABL Facility were used to finance a portion of the consideration payable and fees and expenses incurred in connection with the Business Combination. The New ABL Facility matures four and a half years after the Closing Date. Borrowings under the New ABL Facility, at the relevant Borrower’s option, bear interest either (1) an adjusted LIBOR or (2) a base rate, in each case plus an applicable margin. The applicable margin is 2.50% with respect to LIBOR borrowings and 1.50% with respect to base rate borrowings. Commencing at the completion of the first full fiscal quarter after the Closing Date, the applicable margin for borrowings under the New ABL Facility is subject to one step-down of 0.25% and one step-up of 0.25% based on excess availability levels with respect to the New ABL Facility.

The New ABL Facility provides borrowing availability of an amount equal to the lesser of (i) (a) $125 million and (b) the Borrowing Base (defined below) (the “Line Cap”).

The Borrowing Base is, at any time of determination, an amount (net of reserves) equal to the sum of:

· 85% of the net book value of the Borrowers’ eligible accounts receivable, plus

· the lesser of (i) 95% of the net book value of the Borrowers’ eligible rental equipment and (ii) 85% of the net orderly liquidation value of the Borrowers’ eligible rental equipment, minus

· customary reserves.

1

The New ABL Facility includes borrowing capacity available for letters of credit of up to $15 million and for “swingline” loan borrowings of up to $15 million. Any issuance of letters of credit or making of a swingline loan will reduce the amount available under the New ABL Facility.

In addition, the New ABL Facility provides the Borrowers with the option to increase commitments under the New ABL Facility in an aggregate amount not to exceed $75 million plus any voluntary prepayments that are accompanied by permanent commitment reductions under the New ABL Facility.

The obligations of the Borrowers under the New ABL Facility and certain of their obligations under hedging arrangements and cash management arrangements are unconditionally guaranteed by the Holdco Acquiror and each existing and subsequently acquired or organized direct or indirect wholly-owned US organized restricted subsidiary of Arrow BidCo (together with the Holdco Acquiror, the “ABL Guarantors”), other than certain excluded subsidiaries. The New ABL Facility is secured by (i) a first priority pledge of the equity interests of the Borrowers and of each direct, wholly-owned US organized restricted subsidiary of any Borrower or any ABL Guarantor, (ii) a first priority pledge of up to 65% of the voting equity interests in each non-US restricted subsidiary of any Borrower or ABL Guarantor and (iii) a first priority security interest in substantially all of the assets of the Borrowers and the ABL Guarantors (in each case, subject to customary exceptions).

The New ABL Facility requires the Borrowers to maintain a (i) minimum fixed charge coverage ratio of 1.00:1.00 and (ii) maximum total net leverage ratio of 4.00:1.00, at any time when the excess availability under the New ABL Facility is less than the greater of (a) $15.625 million and (b) 12.5% of the Line Cap.

The New ABL Facility also contains a number of customary negative covenants. Such covenants, among other things, limit or restrict the ability of each of the Borrowers, their restricted subsidiaries, and where applicable, the Holdco Acquiror, to:

· incur additional indebtedness, issue disqualified stock and make guarantees;

· incur liens on assets;

· engage in mergers or consolidations or fundamental changes;

· sell assets;

· pay dividends and distributions or repurchase capital stock;

· make investments, loans and advances, including acquisitions;

· amend organizational documents and master lease documents;

· enter into certain agreements that would restrict the ability to pay dividends;

· repay certain junior indebtedness; and

· change the conduct of its business.

The aforementioned restrictions are subject to certain exceptions including (i) the ability to incur additional indebtedness, liens, investments, dividends and distributions, and prepayments of junior indebtedness subject, in each case, to compliance with certain financial metrics and certain other conditions and (ii) a number of other traditional exceptions that grant the Borrowers continued flexibility to operate and develop their businesses. The New ABL Facility also contains certain customary representations and warranties, affirmative covenants and events of default.

The foregoing description of the New ABL Facility does not purport to be complete and is qualified in its entirety by the terms and conditions of the New ABL Facility, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Indenture

In connection with the closing of the Business Combination, Arrow Bidco issued $340,000,000 aggregate principal amount of 9.50% senior secured notes due 2024 (the “Notes”) under an indenture dated March 15, 2019 (the “Indenture”),

2

which was entered into by and among Arrow Bidco LLC, the guarantors named therein (the “Note Guarantors”), and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”) and as collateral agent (the “Collateral Agent”).

The Notes will mature on March 15, 2024. At any time and from time to time on and after March 15, 2021, Arrow Bidco, at its option, may redeem the Notes, in whole or in part, upon not less than 15 nor more than 60 days’ prior written notice to Holders and not less than 20 days’ prior written notice to the Trustee (or such shorter timeline as the Trustee may agree), at the redemption prices (expressed as percentages of the principal amount of the Notes to be redeemed) set forth below, plus accrued and unpaid interest, if any, to but not including the applicable redemption date (subject to the right of Holders on the relevant record date to receive interest due on an interest payment date falling on or prior to the redemption date), if redeemed during the 12-month period beginning on March 15 of each of the years set forth below.

Year | | Redemption

Price | |

2021 | | 104.750 | % |

2022 | | 102.375 | % |

2023 and thereafter | | 100.000 | % |

Arrow Bidco may redeem the Notes at any time before March 15, 2021 at a redemption price equal to 100% of the principal amount thereof, plus a customary make whole premium, plus accrued and unpaid interest, if any, to but not including the redemption date. At any time prior to March 15, 2021, Arrow Bidco may redeem up to 40% of the aggregate principal amount of the Notes at a price equal to 109.50% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to but not including the redemption date with the net proceeds of certain equity offerings. Arrow Bidco may redeem up to 10% of the aggregate principal amount of the Notes during each twelve month period commencing on the issue date and prior to March 15, 2021 at a redemption price equal to 103% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to but not including the redemption date. If Arrow Bidco undergoes a change of control or sells certain of its assets, Arrow Bidco may be required to offer to repurchase the Notes.

The Notes are unconditionally guaranteed by the Holdco Acquiror and each of Arrow Bidco’s direct and indirect wholly-owned domestic subsidiaries (collectively, the “Note Guarantors”). Target Hospitality is not an issuer or a guarantor of the Notes. The Note Guarantors are either borrowers or guarantors under the New ABL Facility. To the extent lenders under the New ABL Facility release the guarantee of any Note Guarantor, such Note Guarantor are also released from obligations under the Notes. These guarantees are secured by a second priority security interest in substantially all of the assets of Arrow Bidco and the Note Guarantors (subject to customary exclusions). The guarantees of the Notes by TLM Equipment, LLC, a Delaware limited liability company (“TLM Equipment”) which holds certain of Arrow Bidco’s assets, are subordinated to its obligations under the New ABL Facility.

The foregoing description of the Indenture and the Notes does not purport to be complete and is qualified in its entirety by the terms and conditions of the Indenture (including the form of note), which is attached hereto as Exhibit 4.4 and is incorporated herein by reference.

Earnout Agreement

On the Closing Date, in connection with the closing of the Business Combination, Harry E. Sloan, Jeff Sagansky and Eli Baker (together, the “Founder Group”) and Target Hospitality entered into an earnout agreement (the “Earnout Agreement”), pursuant to which, on the Closing Date, 5,015,898 Founder Shares were placed in escrow (the “Restricted Shares”), to be released at any time during the period of three years following the Closing Date upon the occurrence of the following triggering events: (i) fifty percent (50%) of the Restricted Shares will be released to the Founder Group if the closing price of the shares of Target Hospitality’s common stock as reported on Nasdaq exceeds $12.50 per share for twenty (20) of any thirty (30) consecutive trading days and (ii) the remaining fifty percent (50%) of the Restricted Shares will be released to the Founder Group if the closing price of the shares of Target Hospitality’s common stock as reported on Nasdaq exceeds $15.00 per share for twenty (20) of any thirty (30) consecutive trading days, in each case subject to certain notice mechanics.

The Earnout Agreement is subject to termination upon: (i) mutual written consent of the parties; (ii) termination of the Signor Merger Agreement; or (iii) the earlier of the expiration of the time periods set forth therein and the depletion of all of the Restricted Shares from the escrow account.

The foregoing description of the Earnout Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Earnout Agreement, which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

3

Escrow Agreement

On the Closing Date, pursuant to the terms and conditions of the Earnout Agreement described above, Target Hospitality, the Founder Group and Continental Stock Transfer & Trust Company, as escrow agent, entered into an escrow agreement (the “Escrow Agreement”) that provides for, among other things, holding the Restricted Shares in an escrow account until such time as the Restricted Shares are to be released by the escrow agent to the Founder Group upon the occurrence of certain triggering events as described above and as more specifically set forth in the Earnout Agreement. All voting rights and other shareholder rights with respect to the Restricted Shares shall be suspended until such Restricted Shares are released from the escrow account.

The Escrow Agreement will terminate on the earlier of the termination of the Earnout Agreement and five calendar days after all of the Restricted Shares have been released.

The foregoing description of the Escrow Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Escrow Agreement, which is attached hereto as Exhibit 10.3 and is incorporated herein by reference.

Amended and Restated Registration Rights Agreement

On the Closing Date, in connection with the closing of the Business Combination, Target Hospitality, the Arrow Seller, the Algeco Seller, and certain other parties named on the signature pages thereto, entered into an amended and restated registration rights agreement (the “Registration Rights Agreement”), that amends and restates that certain registration rights agreement, dated January 11, 2018 by and among Platinum Eagle and certain of its initial investors and provides such initial investors, the Arrow Seller and the Algeco Seller with certain demand, shelf and piggyback registration rights covering all shares of Target Hospitality common stock and warrants to purchase shares of Target Hospitality common stock owned by each holder, until such shares or warrants, as applicable, cease to be “Registrable Securities” as defined in the Registration Rights Agreement. The Registration Rights Agreement provides each of Arrow Seller, the Algeco Seller and certain of the initial investors (the “Initiating Holders”) the right to request an unlimited number of demands at any time following the Closing Date and customary shelf registration rights, subject to certain conditions. In addition, the agreement grants each of Arrow Seller, the Algeco Seller and the Initiating Holders piggyback registration rights with respect to registration statements filed subsequent to the Closing Date. Except for certain permitted transfers, none of the Arrow Seller, the Algeco Seller or any of their permitted transferees shall transfer any “Registrable Securities” beneficially owned by such holders until such date that is 180 days from the Closing Date. In addition, except for the Restricted Shares held in escrow, as described above, all “Registrable Securities” held by the Founder Group may not be transferred until the earlier of (1) such date that is one year from the Closing Date and (2) such date in which the common stock of Target Hospitality as reported on Nasdaq exceeds $12.00 per share for at least twenty (20) out of thirty (30) trading days commencing not earlier than 150 days following the Closing Date. The Company is responsible for all Registration Expenses (as defined in the Registration Rights Agreement) in connection with any demand, shelf or piggyback registration by any of the Initiating Holders. The registration rights under the Registration Rights Agreement are subject to customary lock-up provisions.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Registration Rights Agreement, which is attached hereto as Exhibit 10.4 and is incorporated herein by reference.

Indemnification Agreements

On the Closing Date, the Company entered into indemnification agreements with each of its directors and executive officers. Each indemnification agreement provides for indemnification and advancements by the Company of certain expenses and costs relating to claims, suits or proceedings arising from his or her service to the Company or, at our request, service to other entities, as officers or directors to the maximum extent permitted by applicable law.

The foregoing description of the indemnification agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the indemnification agreements, a form of which is attached hereto as Exhibit 10.6 and is incorporated herein by reference.

2019 Incentive Award Plan

Platinum Eagle’s board of directors approved the Target Hospitality Corp. 2019 Incentive Award Plan (the “Incentive

4

Plan”) on the Closing Date, and Platinum Eagle’s shareholders approved the Incentive Plan at the extraordinary general meeting of the shareholders of Platinum Eagle (the “Extraordinary General Meeting”) held on March 6, 2019.

A description of the Incentive Plan is included in the Proxy Statement/Prospectus for Extraordinary General Meeting of Platinum Eagle Acquisition Corp. (No. 333-228363), filed with the Securities and Exchange Commission (the “SEC”) on February 19, 2019 (the “Proxy”) by Platinum Eagle, under the heading “The Incentive Award Plan Proposal” beginning on page 124 and is incorporated herein by reference.

The foregoing description of the Incentive Plan does not purport to be complete and is qualified in its entirety by the full text of the Incentive Plan that is attached hereto as Exhibit 10.7 and is incorporated herein by reference.

Employment Agreement with James B. Archer

In connection with the Business Combination, Target entered into an employment agreement with Mr. Archer. The agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. Mr. Archer’s agreement provides for an annual base salary of $600,000, which he may elect to receive in whole in the form of restricted stock units under the incentive place. Mr. Archer’s agreement provides for an annual cash performance bonus target of 133% of annual base salary and a long term incentive annual equity award with a target grant value of $1,000,000. For the 2019 fiscal year, Mr. Archer will receive an equity award under the Incentive Plan of $1,000,000 — of 50% time-vested options and 50% restricted stock vesting ratably over four years. Mr. Archer’s agreement also includes a 12 month non-competition and non-solicitation provision.

If Mr. Archer’s employment is terminated other than for cause or with good reason, he will be entitled to 12 months base salary plus a pro-rata bonus for the year of termination, based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. If Mr. Archer’s employment is terminated other than for cause or by Mr. Archer, within the first year of his first annual long term incentive grant of $1,000,000, 25% of the respective grant will vest. In the event of a change of control, if Mr. Archer is terminated other than for cause or by Mr. Archer for good reason within 12 months of such change of control, he will be entitled to 150% of his base salary and his target annual bonus, as well as a lump sum payment of the costs that would be incurred by him for continued health insurance coverage during the severance period, and vesting of any unvested time-based equity awards.

The foregoing description of the employment agreement with Mr. Archer does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment agreement with Mr. Archer, which is attached hereto as Exhibit 10.8 and is incorporated herein by reference.

Employment Agreement with Andrew A. Aberdale

In connection with the Business Combination, Target entered into an employment agreement with Mr. Aberdale. The agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. Mr. Aberdale’s agreement provides for an annual base salary of $400,000, which he may elect to receive in whole in the form of restricted stock units under the Incentive Plan. Mr. Aberdale’s agreement provides for an annual cash performance bonus target of 75% of annual base salary and a long term incentive annual equity award with a target grant value of $500,000. For the 2019 fiscal year, Mr. Aberdale will receive an equity award under the Incentive Plan of $500,000 — of 50% time-vested options and 50% restricted stock vesting ratably over four years. Mr. Aberdale’s agreement also includes a 12 month non-competition and non-solicitation provision.

If Mr. Aberdale’s employment is terminated other than for cause or good reason, he will be entitled to 12 months base salary plus a pro-rata bonus for the year of termination, based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. If Mr. Aberdale’s employment is terminated other than for cause, within the first year of his first annual long term incentive grant of $500,000, 25% of the respective grant will vest. In the event of a change of control, if Mr. Aberdale is terminated other than for cause or by Mr. Aberdale for good reason within 12 months of such change of control, he will be entitled to 100% of his base salary and his target annual bonus, as well as a lump sum payment of the costs that would be incurred by him for continued health insurance coverage during the severance period, and vesting of any unvested time-based equity awards.

The foregoing description of the employment agreement with Mr. Aberdale does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment agreement with Mr. Aberdale, which is attached hereto

5

as Exhibit 10.9 and is incorporated herein by reference.

Employment Agreement with Heidi D. Lewis

In connection with the Business Combination, Target entered into an employment agreement with Ms. Lewis for the position of Executive Vice President, General Counsel and Secretary. The agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. The agreement provides for an annual base salary of $295,000, which, prior to the commencement of her second year of employment and each year thereafter, she may elect to receive in whole in the form of restricted stock units under the incentive plan. The agreement provides for an annual cash performance bonus target of 50% of annual base salary and a long term incentive annual equity award with a target grant value of $150,000. For the 2019 fiscal year, Ms. Lewis will receive an equity award under the incentive plan of $150,000—of 50% time-vested options and 50% restricted stock vesting ratably over four years. The agreement also includes a 12 month post-termination of employment non-solicitation provision.

If Ms. Lewis’s employment is terminated other than for cause or with good reason, she is entitled to 12 months base salary plus a pro-rata bonus for the year of termination, based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. If her employment is terminated other than for cause or by Ms. Lewis, within the first year of her first annual long term incentive grant of $150,000, 25% of the respective grant will vest. In the event of a change of control, if Ms. Lewis is terminated other than for cause or by Ms. Lewis for good reason within 12 months of such change of control, she will be entitled to 100% of her base salary and target annual bonus, as well as a lump sum payment of the costs that would be incurred by her for continued health insurance coverage during the severance period, and vesting of any unvested time-based equity awards.

The foregoing description of the employment agreement with Ms. Lewis does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment agreement with Ms. Lewis, which is attached hereto as Exhibit 10.10 and is incorporated herein by reference.

Employment Agreement with Troy Schrenk

In connection with the Business Combination, Target entered into an employment agreement with Mr. Schrenk. The agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. Mr. Schrenk’s agreement provides for an annual base salary of $200,000, which he may elect to receive in whole in the form of restricted stock units under the incentive place. Mr. Schrenk’s agreement provides for an annual cash performance bonus target of 75% of annual base salary and a long term incentive annual equity award with a target grant value of $200,000. For the 2019 fiscal year, Mr. Schrenk will receive an equity award under the Incentive Plan of $200,000 — of 50% time-vested options and 50% restricted stock vesting ratably over four years. Upon the occurrence of an initial public offering, Mr. Schrenk is entitled to certain additional benefits including a $500,000 one-time grant of 50% time-vested stock options and 50% restricted stock vesting ratably over 4 years at the closing of such offering. Mr. Schrenk’s agreement also includes a 12 month non-competition and non-solicitation provision.

If Mr. Schrenk’s employment is terminated other than for cause or good reason, he will be entitled to 12 months base salary plus a pro-rata bonus for the year of termination, based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. If Mr. Schrenk’s employment is terminated other than for cause, within the first year of either his initial public offering award of $500,000 or his first annual long term incentive grant of $200,000, 25% of the respective grant will vest. In the event of a change of control, if Mr. Schrenk is terminated other than for cause or by Mr. Schrenk with good reason within 12 months of such change of control, he will be entitled to 100% of his base salary and his target annual bonus, as well as a lump sum payment of the costs that would be incurred by him for continued health insurance coverage during the severance period, and vesting of any unvested time-based equity awards.

The foregoing description of the employment agreement with Mr. Schrenk does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment agreement with Mr. Schrenk, which is attached hereto as Exhibit 10.11 and is incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory Note” above is incorporated into this Item 2.01 by reference. On March 6, 2019, the Business Combination was approved by the shareholders of Platinum Eagle at an Extraordinary General Meeting.

6

The Business Combination was completed on March 15, 2019.

Consideration to Platinum Eagle Shareholders and Warrant Holders in the Business Combination

Prior to the Business Combination, Platinum Eagle had two classes of shares: Class A ordinary shares and Class B ordinary shares. The Class B ordinary shares were held by the Founder Group. Prior to and in connection with the Business Combination, Platinum Eagle domesticated as a Delaware corporation and the Class A ordinary shares and Class B ordinary shares automatically converted, by operation of law, into shares of Delaware Class A common stock and shares of Delaware Class B common stock, respectively. In connection with the domestication, Platinum Eagle replaced its amended and restated memorandum and articles of association with an interim certificate of incorporation of Platinum Eagle Delaware (the “Interim Domestication Charter”). Thereafter, on the Closing Date, Platinum Eagle was renamed Target Hospitality Corp. and, each currently issued and outstanding share of Platinum Eagle Delaware Class B common stock automatically converted on a one-for-one basis (subject to adjustment pursuant to the Interim Domestication Charter), into shares of Platinum Eagle Delaware Class A common stock, in accordance with the terms of the Interim Domestication Charter. Immediately thereafter, each currently issued and outstanding share of Platinum Eagle Delaware Class A common stock automatically converted by operation of law, on a one-for-one basis, into shares of the common stock of Target Hospitality.

Consideration to the Sellers in the Business Combination

As discussed above, in accordance with the terms and subject to the conditions of the Merger Agreements, upon completion of the Business Combination on March 15, 2019, the Holdco Acquiror purchased from the Sellers all of the issued and outstanding equity interests of Target Parent and Signor Parent. The total amount payable by the Holdco Acquiror under the Merger Agreements was $1.311 billion, of which $563,136,727.81 was Cash Consideration, and the remaining $747,863,272.19 was paid to the Sellers in the form of 49,100,000 shares of common stock of Target Hospitality to the Arrow Seller and 25,686,327 shares of common stock of Target Hospitality to the Algeco Seller as Stock Consideration.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for the post- combination business. Specifically, forward-looking statements may include statements relating to:

· operational, economic, political and regulatory risks;

· our ability to effectively compete in the specialty rental accommodations and hospitality services industry;

· effective management of our communities;

· natural disasters and other business disruptions;

· the effect of changes in state building codes on marketing our buildings;

· changes in demand within a number of key industry end-markets and geographic regions;

· our reliance on third party manufacturers and suppliers;

· failure to retain key personnel;

· increases in raw material and labor costs;

· the effect of impairment charges on our operating results;

· our inability to recognize deferred tax assets and tax loss carry forwards;

· our future operating results fluctuating, failing to match performance or to meet expectations;

7

· our exposure to various possible claims and the potential inadequacy of our insurance;

· unanticipated changes in our tax obligations;

· our obligations under various laws and regulations;

· the effect of litigation, judgments, orders or regulatory proceedings on our business;

· our ability to successfully acquire and integrate new operations;

· global or local economic movements;

· our ability to effectively manage our credit risk and collect on our accounts receivable;

· Target Hospitality’s ability to fulfill its public company obligations;

· any failure of our management information systems;

· our ability to meet our debt service requirements and obligations;

· risks related to Arrow Bidco’s obligations under the Notes; and

· other factors detailed under the section entitled “Risk Factors.”

These forward-looking statements are based on information available as of the date of this Current Report on Form 8-K and our management’s current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. The Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

The information presented in the sections “Risk Factors,” “Target Parent and Signor Parent’s Combined Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Target Parent’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” Signor’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business” below relates to the businesses and operations of Target and Signor on a combined basis, the entities purchased in the Business Combination. Until the consummation of the Business Combination on the Closing Date, the Company was a special purpose acquisition company with no operations of our own. As a result, our ongoing business is the combined businesses of Target and Signor as detailed below. References in this section to “we,” “us,” “our,” “Target Hospitality,” and the “Company” refer to the combined businesses of Target and Signor and their consolidated subsidiaries.

8

BUSINESS

Our Company

Overview

Our company, Target Hospitality, is the largest vertically integrated specialty rental and hospitality services company in the United States. We own an extensive network of geographically relocatable specialty rental accommodation units with approximately 12,000 beds across 20 sites. The majority of our revenues are generated under multi-year “take-or-pay” contracts which provide visibility to future earnings and cash flows. We believe our customers enter into contracts with us because of our differentiated scale and ability to deliver premier accommodations and in-house culinary and hospitality services across many key geographies in which they operate. Our specialty rental services, which include accommodations and ancillary services such as housekeeping and security, comprised 64% of our pro forma revenue for the year ended December 31, 2018. Our catering and other offerings provided the remaining 36% of pro forma revenue for the year ended December 31, 2018. For the year ended December 31, 2018, we generated pro forma revenues of $301.8 million.

Our company is comprised of two leading businesses in the sector, Target and Signor. Signor was founded in 1990, and Target, though initially founded in 1978, began operating as a specialty rental and hospitality services company in 2006. Our company operates across the U.S. and serves some of the country’s highest producing oil and gas basins. We also own and operate the largest family residential center in the U.S., serving asylum-seeking women and children. Using the “Design, Develop, Build, Own, Operate, and Maintain” (“DDBOOM”) business model, Target Hospitality provides comprehensive turnkey solutions to customers’ unique needs, from the initial planning stages through the full cycle of development and ongoing operations. We provide cost-effective and customized specialty rental accommodations, culinary services and hospitality solutions, including site design, construction, operations, security, housekeeping, catering, concierge services and health and recreation facilities. We deliver end-to-end essential facilities and hospitality services across several end markets in the U.S. and are known for high quality accommodations and vertically integrated hospitality services.

We operate in key oil producing regions in the U.S., which are some of the most active regions in the world. We have established a leadership position in providing a fully integrated service offering to our large customer base, which is comprised of major and independent oil producers, oilfield service companies, midstream companies, refineries, government and government service providers. Our company is built on the foundation of the following core values: safety, care, excellence, integrity and collaboration.

(1) Midstream pipeline lodges are customer-owned but operated by Target Hospitality and are excluded from our total lodge count.

Business Model

Our DDBOOM model allows our customers to focus their efforts and resources on their core businesses. This makes us an integral part of the planning and execution phases for all customers.

9

We provide a safe, comfortable, and healthy environment to our guests, employees and workers across the U.S. and anywhere our customers need our facilities and services. Under our “Target 12” service model, we provide benefits to our customers, delivering high quality food, rest, connection, wellness, community, and hospitality, which optimizes our customers’ engagement, performance, safety, loyalty, and productivity during work hours.

This facility and service model is provided directly by our employees, who deliver the essential services 24 hours per day for 365 days a year. We provide all of the hospitality services at our sites, and as a result, we believe we deliver more consistent and high-quality hospitality services at each community compared to our peers. Our company and employees are driven by our primary objective of helping our customers reach their full potential every day. Our professionally trained hospitality staff has the unique opportunity to live with our customers as most of our employees live on location at the communities where our customers reside. This allows our employees to develop powerful customer empathy, so we are better able to deliver consistent service quality and care through the Target 12 platform each day. Our employees are focused on “the other 12 hours”—the time our customers and their employees are not working—making sure we deliver a well fed, well rested, happier, loyal, safer and more productive employee every day. What we provide our customers “off the clock” optimizes their performance when they are “on the clock.” The investment our customers make in their employees “the other 12 hours” is an essential part of their strategy and overall business and operations execution plan.

Using our expansive community network, DDBOOM and Target 12 models, we provide specialty rental accommodations and hospitality services that span the lifecycle of our oil and gas customers’ projects. Our services cover the entire value chain of oil and gas projects, from the initial stages of exploration, resource delineation and drilling to the long-term production, pipeline transportation and final processing. Customers typically require accommodations and hospitality services at the onset of their projects as they assess the resource potential and determine how they will develop the resource. Our temporary accommodation assets are well-suited to support this exploratory stage where customers begin to execute their development and construction plans. As the resource development begins, we can serve customers’ needs with our specialty rental accommodation assets, and we are able to scale our facility size to meet customers’ growing needs. By providing infrastructure early in the project lifecycle, we are well-positioned to continue serving our customers throughout the full cycle of their projects, which can typically last for several decades.

Our integrated model provides value to our customers by reducing project timing and counterparty risks associated with projects. More broadly, our accommodations networks, combined with our integrated value-added hospitality and facilities services creates value for our customers by optimizing our customers’ engagement, performance, safety, loyalty, productivity, preparedness and profitability.

Summary of Value Added Services

We take great pride in the premium customer experience we offer across our range of community and hospitality services offerings. All of Target’s communities include in-house culinary and hospitality services. Our well-trained culinary and catering professionals serve more than 13,000,000 meals each year with fresh ingredients and many of our meals are made from scratch. Historically, over two-thirds of Signor’s legacy communities included culinary, hospitality and facilities management services, which were provided by a third party. Going forward, we plan to self-perform these services, which will provide us with greater control over service quality as well as incremental revenue and profit potential. Our communities are designed to promote rest and quality of life for our customers’ workforces and include amenities such as:

Summary of Amenities:

Facilities: | | Services: |

· New Innovative Modular Design | | · Media Lounges & WIFI Throughout |

· Single Occupancy Design | | · Individual Xbox/PSII Pods |

· Swimming Pool, Volleyball, Basketball | | · Flat-Screen TVs in Each Room |

· Commercial Kitchens | | · 40+ Premium TV Channel Line-up |

· Fast Food Lounges | | · Personal Laundry Service |

· Full & Self Service Dining Areas | | · Individually Controlled HVAC |

· TV Sports/Entertainment Lounges | | · Hotel Access Onity Lock Systems |

· Training/Conference Rooms | | · 24 Hour No-Limit Dining |

· Core Passive Recreation Areas | | · Free DVD Rentals |

· Active Fitness Centers | | · Self Dispensing Free Laundry |

· Lodge Reception Areas | | · Commercial Laundry |

· Locker/Storage/Boot-up Areas | | · Transportation to Project Site |

· Parking Areas | | · 24 Hour Gated & Guarded Security |

10

Facilities: | | Services: |

· Waste Water Treatment Facility | | · Daily Cleaning & Custodial Service |

· On-Site Commissary | | · Professional Uniformed Staff |

Our hospitality services and programming are designed to promote safety, security and rest, which in turn promote greater on-the-job productivity for our customers’ workforces. All of our communities strictly adhere to our community code of conduct, which prohibits alcohol, drugs, firearms, co-habitation and guests. We work closely with our customers to ensure that our communities are an extension of the safe environment and culture they aim to provide to their employees while they are on a project location. Our customer code of conduct is adopted by each corporate customer and enforced in conjunction with our customers through their documented health, safety and environmental policies, standards and customer management. We recognize that safety and security extends beyond the customers’ jobsite hours and is a 24-hour responsibility which requires 24-hour services by Target Hospitality and close collaboration with our customer partners.

History and Development

Target Hospitality’s legacy businesses of Signor and Target have grown and developed since they were created. The chart below sets out certain key milestones for each business.

1978-2010 | | 2010-Present | |

· 1978: Target Logistics was founded · 1990: Signor Farm and Ranch Real Estate was founded · Target awarded contracts for logistics services for Olympics in 1984 (Sarajevo), 1992 (Barcelona), 1996 (Atlanta), 2000 (Sydney), 2002 (Salt Lake City), 2004 (Athens), 2006 (Turin) and 2010 (Vancouver) · The Vancouver project consisted of a 1,600 bed facility, a portion of which was subsequently transferred to North Dakota and remains in use today · 2005: Target operated 1,100-bed cruise ship anchored in the Gulf of Mexico to support relief efforts during aftermath of Hurricane Katrina · In addition, built and managed 700-person modular camp in New Orleans with running water, electricity and on-site kitchen services · 2007: Target hired by Freeport-McMoRan to build and operate 425-bed facility in Morenci, AZ in support of copper mining operations (re-opening 10/2012) · 2008: Target provided catering/food services for 600 personnel in support of relief operations in aftermath of Hurricane Ike · 2009: Target provided housing and logistics services for 1,500 workers during a refurbishment of a refinery in St. Croix · 2009: Signor Lodging was formed · 2010: Target opened Williston Lodge, Muddy River, Tioga and Stanley Cabins in western North Dakota | | · 2011: Target expanded capacity in Williston, Stanley and Tioga with long-term customers Halliburton, Hess, ONEOK, Schlumberger, Superior Well Service, Key Energy Services and others · 2011: Signor Lodge opened in Midland, TX (84 rooms) · 2011: Signor Barnhart Lodge opened in Barnhart, TX (160 beds) · 2012: Target developed additional North Dakota facilities in Dunn County (Q1), Judson Lodge(Q3), Williams County (Q3) and Watford City (Q4) · 2012: Target expanded service into Texas with the opening of Pecos Lodge (90 beds) (Permian basin) in Q4 · 2013: Target awarded TCPL Keystone KXL pipeline project to house and feed over 6,000 workers · 2013: Algeco Scotsman acquired Target Logistics in Q1 · 2014: Target awarded lodge contract for new 200-bed community in the Permian · 2014: Target awarded contract and built 2,400-bed STRFC for U.S. federal government · 2015: Opened new community in Mentone, TX (Permian basin) in Q4 for Anadarko Petroleum Company · 2016: Signor expanded Midland Lodge several phased expansions 1,000 beds · 2016: Signor Kermit Lodge opens with 84 rooms · 2017: Signor opened Oria Lodge with 208 rooms · 2017: Target expanded Permian network with the expansion of both Wolf Lodge and Pecos Lodge (Permian basin) in Q2 · 2017: Target expanded presence in New Mexico (Permian basin) and West Texas with the acquisition of 1,000-room Iron Horse Ranch in Q3 | |

|

11

1978-2010 | | 2010-Present | |

| | · 2017: Signor opened El Reno Lodge with 345 rooms · 2017: Target expanded Permian presence with 280-room Blackgold Lodge in Q3 · 2018: Target Logistics rebranded as Target Lodging in March 2018 · 2018: Target opened new 600-room community in Mentone-Permian basin · 2018: Target added approximately 1,600 rooms across Permian basin network · 2018: Target expanded community network in Permian and Anadarko basins through Acquisition of Signor, adding 7 locations and approximately 4,500 beds to the network · 2019: Target announced new 400-bed community in the Permian basin | |

Industry Overview

We are one of the few vertically integrated specialty rental accommodations and hospitality services providers that service the entire value chain from site identification to long-term community development and facilities management. Our industry divides specialty rental accommodations into three primary types: communities, temporary worker lodges and mobile assets. We are principally focused on communities across several end markets, including oil and gas, energy infrastructure and government.

Communities typically contain a larger number of rooms and require more time and capital to develop. These facilities typically have commercial kitchens, dining areas, conference rooms, medical and dental services, recreational facilities, media lounges and landscaped grounds where climate permits. All of our communities are built and underpinned by multi-year take-or-pay contracts which often include exclusivity provisions. These facilities are designed to serve the long-term needs of customers regardless of the end markets they serve. All of our communities provide fully-integrated and value-added hospitality services, including but not limited to: catering and food services, housekeeping, recreation facilities, laundry services and facilities management, as well as water and wastewater treatment, power generation, communications and personnel logistics where required. In contrast, temporary lodges are usually smaller in number of rooms and generally do not include hospitality, catering, facilities services or other value-added on-site services and typically serve customers on a spot or short-term basis without long-term take-or-pay contracts. These temporary facilities are “open” for any customer who needs lodging services. Finally, mobile assets, or rig housing, are designed to follow customers’ activities and are generally used for drilling rig operators. They are often used to support conventional drilling crews and are contracted on a project-by-project, well-by-well or short-term basis.

Our specialty rental accommodations and hospitality services deliver the essential services and accommodations when and where there is a lack of sufficient accessible or cost-effective housing, infrastructure or local labor. Many of the geographic areas near the southern U.S. border lack sufficient temporary housing and infrastructure for asylum-seeking immigrants or may require additional infrastructure in the future. In the U.S. oil and gas sector, many of the largest unconventional and hydrocarbon reservoirs are in remote and expansive geographic locations, like the Permian and Bakken where limited infrastructure exists. Our industry supports the development of these natural resources by providing lodging, catering and food services, housekeeping, recreation facilities, laundry services and facilities management, as well as water and wastewater treatment, power generation, communications and personnel logistics where required. Our communities and integrated hospitality services allow our customers to outsource their accommodations needs to a single provider, optimizing employee morale, productivity, safety, and loyalty while focusing their investment on their core businesses and long term planning.

With our focus on large-scale community networks, large-scale stand-alone communities and hospitality services, our business model is a balanced combination of specialty rental assets and facilities services and is most similar to specialty rental companies like William Scotsman and Mobile Mini, and facilities services companies such as Aramark, Sodexo or Compass Group, and developers of lodging properties who are also owners or operators, such as Hyatt Hotels Corporation or Marriott International, Inc.

12

The U.S. specialty rental accommodations industry is segmented into competitors that serve components of the overall value chain, with very few integrated providers.

In the government sector, the GEO Group, Inc. is a fully integrated provider of immigration family residential centers. The family residential centers we own, operate, or manage, as well as those facilities we own but are managed by other operators, are subject to competition for residents from other private operators. We compete primarily on siting, cost, the quality and range of services offered, our experience in the design, construction, and management of facilities, and our reputation. We compete with government agencies that are responsible for correctional, detention and residential facilities and a number of companies, including, but not limited to, the GEO Group, Inc. and Management and Training Corporation. Government sector demand for facilities is affected by a number of factors, including the demand for beds, general economic conditions and the size of the immigration-seeking population.

In the U.S. oil and gas sector, Cotton Holdings and Civeo are the only other integrated accommodations and facilities services providers and make up less than 10% of the total U.S. integrated rental accommodations market, while private companies such as Aries and Permian Lodging primarily provide lodging only or offer optional catering services through a third-party catering company and also make up less than 10% of the market. Two public manufacturing and/or leasing firms also participate in the U.S. market—ATCO and Black Diamond. Those companies will primarily own and lease the units to customers, facility service companies or integrated providers. Facility service companies, such as Aramark, Sodexo and Compass Group manage third-party facilities, but do not invest in, or own, the accommodations assets.

Demand for accommodations and related services within our oil and gas end market is influenced by four primary factors: (i) available infrastructure, (ii) competition, (iii) workforce requirements, and (iv) commodity prices. Current commodity prices, and our customers’ expectations for future commodity prices as well as larger infrastructure requirements, influence customers’ spending on current productive assets, maintenance on current assets, expansion of existing assets and development of greenfield, brownfield or new assets. In addition to commodity prices, different types of customer activity require varying workforce sizes, influencing the demand for accommodations. Also, competing locations and services influence demand for our assets and services.

Demand within our government end market is primarily influenced by immigration, including the ongoing need to accommodate asylum seekers as well as federal governmental policy and budgets. Continued increases in asylum seeking activity may influence government spending on infrastructure in immigration-impacted regions and consequentially demand for accommodations and related services.

Another factor that influences demand for our rooms and services is the type of customer we are supporting. Generally, oil producer customers require larger workforces during construction and expansionary periods and therefore have a higher demand for accommodations. Due to the contiguous nature of their land positions, a “hub and spoke” model is utilized for producers. Oilfield service companies also require larger and more mobile workforces which, in many cases, consist of employees sourced from outside of the work areas. These employees, described as rotational workers, permanently reside in another region or state and commute to the Permian or Bakken on a rotational basis (often, two weeks on and one week off). Rotational workers are also sometimes described as a fly-in-fly-out (“FIFO”) or drive-in-drive-out (“DIDO”) commuter work force.

In addition, proximity to customer activities influences occupancy and demand. We have built, own and operate the two largest specialty rental and hospitality services networks available to oil and gas customers operating in the Permian and Bakken. These networks allow our customers to utilize one provider across a large and expansive geographic area. Our broad network often results in us having communities that are the closest to our customers’ job sites, which reduces commute times and costs, and improves the overall safety of our customers’ workforce. Generally, if a community is within a one hour drive of a customer’s work location, our contractual exclusivity provisions with our customers require the customers to have their crews lodge at one of our communities. Our communities provide customers with cost efficiencies, as they are able to jointly use our communities and related infrastructure (power, water, sewer and IT) services alongside other customers operating in the same vicinity.

Demand for our services is dependent upon activity levels, particularly our customers’ capital spending on exploration for, development, production and transportation of oil and natural gas and government immigration housing programs. Our customers’ spending plans generally are based on their view of commodity supply and demand dynamics, as well as the outlook for near-term and long-term commodity prices and annual government appropriations. Our current oil and gas footprint is strategically concentrated in the Permian, the largest basin in the world with approximately 140 billion barrels of oil equivalent (“bboe”) of recoverable oil while producing approximately 3.5 million barrels of oil equivalent (“mboe”) per day. The Permian stretches across the southeast corner of New Mexico and through a large swath of land in western Texas, encompassing hundreds of thousands of square miles and dozens of counties.

13

The Permian has experienced elevated drilling activity as the result of improved technologies that have driven down the cost of production. Additionally, the Permian is the lowest cost basin within the U.S., with a breakeven price below $40/bbl and multi-year drilling inventory economic at sub-$35 per barrel WTI prices in many areas, allowing operators focused in the Permian to continue drilling economic wells even at low commodity price levels. Technological improvements in recent years and the extensive oil and gas reserves support sustained activity in the Permian for the foreseeable future.

Business Strengths & Strategies

Strengths

· Market Leader in Strategically Located Geographies. We are the nation’s largest provider of turnkey specialty rental units with premium catering and hospitality services including 20 strategically located communities with approximately 12,000 beds primarily in the highest demand regions of the Permian and Bakken. Utilizing our large network of communities with the most bed capacity, particularly within the Permian and Bakken, we believe we are the only provider with the scale and regional density to serve all of our customers’ needs in these key basins. Additionally, our network and relocatable facility assets allow us to transfer the rental fleet to locations that meet our customer service needs. We leverage our scale and experience to deliver a comprehensive service offering of vertically integrated accommodations and hospitality services. Our complete end-to-end accommodations solution, including our premium amenities and experience, provides our customers with a compelling and unmatched value proposition.

(1) Midstream pipeline lodges are customer-owned but operated by Target Hospitality and are excluded from our total lodge count.

· Long-Standing Relationships with Diversified Blue-Chip Customers. We have long standing relationships with our diversified base of over 300 customers, which includes some of the largest blue-chip, investment grade oil and gas and integrated energy infrastructure companies in the U.S. We serve the full energy value chain, with customers spanning across the upstream, midstream, downstream and service sectors. We believe we have also established strong relationships in our U.S. government end market with our contract partner and the federal agency we serve. We initially won this large government contract in 2014 based upon our differentiated ability to develop and open the large facility on an accelerated timeline. This contract has already been renewed and extended once, demonstrating our successful execution and customer satisfaction. The relationships we have established over the past decade have been built on trust and credibility given our track record of performance and delivering value to our customers by providing a broad range of hospitality service offerings within a community atmosphere. Target’s customers’ desire and willingness to enter into multi-year “take-or-pay” contracts, and to renew them at a historical rate greater than 90%, demonstrates the strength of these long-standing relationships

14

· Multi-year Contracts and Exclusivity Produce Highly Visible, Recurring Revenue. The vast majority of our revenues are generated under multi-year contracts. Of those contracts, 93% contain take-or-pay clauses, pursuant to which our revenue generation is guaranteed regardless of utilization levels. Further, 95% of these take-or-pay contracts contain exclusivity provisions under which our customers agree to exclusively use our communities for all of their needs within the geographies we serve. Of our contracts that are not take-or-pay, approximately 83% have exclusivity. The weighted average term of our contracts is approximately 42 months and Target has maintained a contract renewal rate of at least 90% over the last six years. Many of our customers secure minimum capacity commitments with us to ensure sufficient accommodations and hospitality services are in place to properly care for their large workforces. Our multi-year take-or-pay customer agreements provide us with contracted recurring revenue and high visibility to future financial performance.

· Proven Performance and Resiliency Through the Cycle. Our business model is well insulated from economic and commodity cycles, as evidenced by our ability to increase revenue and EBITDA despite a significant and prolonged decline in oil and related commodity prices in recent years. In addition, in the fourth quarter of 2018, we secured contract renewals and extensions with four large oil and gas customers despite a greater than 35% decline in the spot price of oil (WTI) during the period. Our multi-year, take-or-pay contracts with blue-chip customers support stable performance through commodity and economic cycles. Further, we are able to efficiently move our rental assets and redeploy them, as warranted by customer demand. Our prior planning and strategic focus on the Permian further supports consistent performance as the region’s oil production continues to grow. The Permian is one of the largest basins in the world with high levels of sustained production expected to continue, further supported by the structural decline in breakeven prices in the region.

· Long-lived Assets Requiring Minimal Maintenance Capital Expenditures. Our long-lived specialty rental assets support robust cash flow generation. Our rental assets have an average life in excess of 20 years, and we typically recover our initial investment within the first contract, with a payback period of less than three years. We incur minimal maintenance capital expenditures, as cleaning and routine maintenance costs are included in day-to-day operating costs and recovered through the average daily rates that we charge our customers. This continual care of our assets supports extended asset lives and the ongoing ability to operate with only nominal maintenance capital expenditures. The investment profile of our rental assets underpins our industry leading unit economics, including internal rates of return on our fleet investments in excess of 35% based illustratively on a 500 bed community, requiring $25 million of total capital expenditures, an average daily rate of $95 per room per night and cost of goods sold of $35 per room per night. Our contract discipline underpins our investment decision making and spending on any new growth investments. We do not invest capital unless we can meet our internal returns thresholds. Due to the high revenue visibility from long-term contracts, we are poised to generate robust and stable cash flows driven by historical strategic growth investments and minimal future maintenance capital expenditure requirements.

Strategies

We believe that we can further develop our business by, among other things:

· Maintaining and Expanding Existing Customer Relationships. Ensuring we have and continue to have excellent relationships with our customers is very important to us. We work to fill existing bed capacity within our

15

communities, while optimizing our inventory for existing customer expansion and for new customers. Keeping this balance provides us with flexibility and a competitive advantage when pursuing new contract opportunities. We optimize our capacity, inventory and customers’ usage through data analytics, customer collaboration and forecasting demand. With the scale of our accommodations network, many of our customers are commercially exclusive to Target Hospitality as their primary and preferred provider of accommodations and hospitality throughout the U.S. or for a designated geographic area.

· Enhancing Contract Scope and Terms. A primary strategic focus for us is to enhance the scope and terms of our customer contracts. We intend to continue our historical track record of renewing and extending these contracts at favorable commercial and economic terms, while also providing additional value added services to our customers. A key near term priority is to add our vertically integrated suite of services, including catering, to the many legacy Signor contracts that included only accommodations. Replacing legacy third party providers allows us greater control over service quality and delivery and offers substantial incremental revenue potential. Additionally, we believe we have capacity to increase revenue within our existing communities without new growth capital expenditures through increased utilization rates and modest price increases over time.

· Disciplined Growth Capital Expenditures to Increase Capacity. We selectively pursue opportunities to expand existing communities and develop new communities to satisfy customer demand. We employ rigorous discipline to our capital expenditures to grow our business. Our investment strategy is to only deploy new capital with visibility—typically a contract—to revenue and returns to meet our internal return hurdles. We target payback on initial investment within three years. Due to the lower cost per bed, returns on investment are higher for the expansion of existing facilities.

· Growing and Pursuing New Customer/Contract Opportunities. We continually seek additional opportunities to lease our facilities to government, energy and natural resources, manufacturing, and other third-party owners or operators in need of specialty rental accommodation assets and integrated hospitality services. We have a proven track record of success in executing our DDBOOM specialty rental and facilities management model across several end markets for ongoing needs as well as major projects that have finite project life cycle durations. While special projects do not constitute a large portion of our business, it is typical for us to secure some special projects that can last anywhere from 1-5 years (or more). We have designated sales-related resources that focus on special finite life cycle projects and maintain a dynamic business pipeline which includes but is not limited to special projects across end markets.

· Expansion Through Acquisitions. We selectively pursue acquisitions and business combinations related to specialty rental accommodations and hospitality services in the markets we currently serve as well as those we do not. Leveraging our core competencies related to facilities management, culinary services, catering and site services, we can further scale this segment of our business and replicate it in other geographies and end markets. We continue to assess targeted acquisitions and business combinations that would be accretive to the Company.

Sales and Marketing

Target has a tenured in-house sales and marketing team that is responsible for acquiring new customers and managing the relationships of our existing customers across the U.S. Our sales approach is based on a consultative-empathy based value creation model. Our professionally trained sales organization is relentlessly focused on providing solutions to our customers’ challenges which has resulted in higher customer satisfaction and loyalty.

Business Operations

Target Hospitality provides specialty rental and hospitality services, temporary specialty rental and hospitality services solutions and facilities management services across the U.S. The company’s primary customers are investment grade oil, gas and energy companies, other workforce accommodation providers operating in the Permian and Bakken regions, and government contractors. The company’s specialty rental and hospitality services and management services are highly customizable and are tailored to each customer’s needs and requirements. Target Hospitality is also an approved general services administration (“GSA”) contract holder and offers a comprehensive range of housing, deployment, operations and management services through its GSA professional services schedule agreement. The GSA contract allows U.S. federal agencies to acquire our products and services directly from Target Hospitality which expedites the commercial procurement process often required by government agencies.

16

Target Hospitality operates its business in three key end markets: (i) government (“Government”), which includes the facilities, services and operations of its family residential center and the related support communities in Dilley, Texas (the “South Texas Family Residential Center”) provided under its lease and services agreement with CoreCivic; (ii) the Permian basin (the “Permian”), which includes the facilities and operations in the Permian region and the 14 communities located across Texas, New Mexico and (iii) the Bakken basin (the “Bakken”), which includes facilities and operations in the Bakken basin region and four communities in North Dakota.

17

The map below shows the company’s primary community locations in the Permian and the Bakken (including the Company’s one location in the Anadarko).

(1) Expected opening during the first half of 2019.

(2) Expected opening during the second half of 2019.

(3) Idled since November 2018.

The table below presents the Company’s lodges in the oil and gas end market.

Location | | Company | | Lodge Name | | Location | | Status | | Number of Beds | |

Permian | | Target | | Odessa East | | Odessa, TX | | Own/Operate | | 280 | |

Permian | | Target | | Odessa West | | Odessa, TX | | Own/Operate | | 805 | |

Permian | | Target | | Mentone | | Mentone, TX | | Own/Operate | | 530 | |

Permian | | Target | | Pecos South | | Pecos, TX | | Own/Operate | | 785 | |

Permian | | Target | | Skillman | | Mentone, TX | | Own/Operate | | 600 | |

Permian | | Target | | Carlsbad | | Carlsbad, NM | | Own/Operate | | 606 | |

Permian | | Target | | Carlsbad Lodge West(1) | | Carlsbad, NM | | Own/Operate | | 400 | |

Permian | | Target | | Orla North | | Orla, TX | | Operate Only | | 155 | |

Permian | | Target | | Orla South | | Orla, TX | | Operate Only | | 240 | |

Permian | | Signor | | Barnhart | | Barnhart, TX | | Own/Operate | | 192 | |

Permian | | Signor | | FTSI(2) | | Odessa, TX | | Own/Operate | | 212 | |

Permian | | Signor | | Jal | | Jal, NM | | Own/Operate | | 626 | |

Permian | | Signor | | Kermit | | Kermit, TX | | Own/Operate | | 126 | |

Permian | | Signor | | Midland | | Midland, TX | | Own/Operate | | 1,521 | |

Permian | | Signor | | Delaware | | Orla, TX | | Own/Operate | | 465 | |

Permian | | Signor | | Pecos North | | Pecos, TX | | Own/Operate | | 982 | |

Bakken | | Target | | Dunn(3) | | Dickinson, ND | | Own/Operate | | 596 | |

Bakken | | Target | | Stanley | | Stanley, ND | | Own/Operate | | 338 | |

Bakken | | Target | | Watford | | Watford City, ND | | Own/Operate | | 334 | |

Bakken | | Target | | Williams | | Williston, ND | | Own/Operate | | 300 | |

Bakken | | Target | | Judson | | Williston, ND | | Own/Operate | | 105 | |

Anadarko | | Signor | | El Reno | | El Reno, OK | | Own/Operate | | 458 | |

Total Number of Beds (U.S. oil and gas only) | | 10,060 | (4) |

(1) Expected opening during the second half of 2019.

18

(2) Expected opening during the first half of 2019.

(3) Idled since November 2018.

(4) Total bed count does not include Dunn.

Government

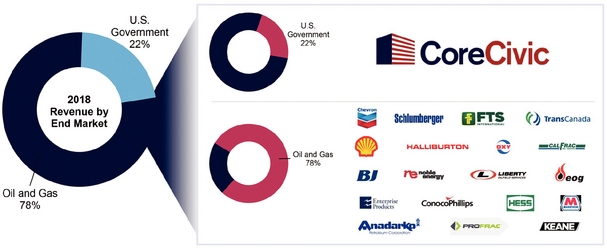

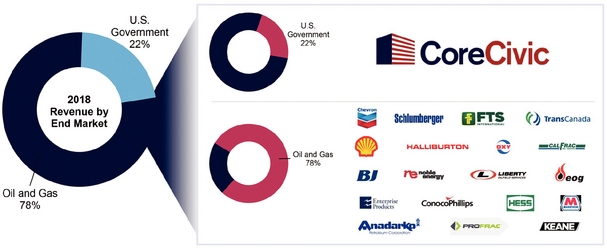

Historically, the Government segment has included, but is not limited to, two primary end markets which make up approximately 22% of our pro forma revenue for the year ended December 31, 2018:

· Residential Facilities. Residential facilities, including the South Texas Family Residential Center (discussed below), provide space and residential services in an open and safe environment to adult females with children who are seeking asylum and are awaiting the outcome of immigration hearings or the return to their countries of origin. Residential facilities offer services including, but not limited to, educational programs, medical care, recreational activities, counseling, and access to religious and legal services.

· Community Corrections. Community corrections/residential reentry facilities offer housing and programs to offenders who are serving the last portion of their sentence or who have been assigned to the facility in lieu of a jail or prison sentence, with a key focus on employment, job readiness, and life skills.

Target Hospitality built and currently leases and operates the South Texas Family Residential Center through a sub-lease and services agreement with CoreCivic, a government solutions company which provides correctional and detention management services. The company owns and operates the facility by providing on-site services including catering, culinary, management, janitorial and light maintenance. The South Texas Family Residential Center includes 524,000 square feet of building space including residential housing units with 2,400 beds, as well as classrooms, a library, chapels, an infirmary with full medical, dental, pharmaceutical and x-ray capabilities, a dining hall, offices and an industrial laundry center.

We look forward to expanding the products and services of our Government segment through our GSA designations, specifically our designation to maintain the professional services schedule (“PSS”) for logistics service solutions, which are designed to assist federal agencies in procuring comprehensive logistics solutions, including planning, consulting, management, and operational support when deploying supplies, equipment, materials and associated personnel. GSA’s PSS is a multiple award schedule (“MAS”) contract for innovative solutions, offered to federal, state and local governments, for their professional services needs. Having a PSS signifies that we have been vetted as a responsible supplier, our pricing has been determined to be fair and reasonable and we are in compliance with all applicable laws and regulations. PSS is one of the GSA’s schedule contracts, which are indefinite delivery, indefinite quantity (“IDIQ”), long-term contracts under the GSA MAS program. GSA schedule contracts were developed to assist federal employees in purchasing products and services and they contain pre-negotiated prices, delivery terms, warranties, and other terms and conditions which streamline the buying process.

The Government segment generated 22% or $66.7 million of the company’s pro forma revenue for the year ended December 31, 2018.

Permian